ARK Invest: ARKK etc "active" ETF's: die "Disruptors"-Blase am US-Markt (Seite 35)

eröffnet am 16.12.20 13:08:27 von

neuester Beitrag 05.02.24 17:52:48 von

neuester Beitrag 05.02.24 17:52:48 von

Beiträge: 444

ID: 1.336.405

ID: 1.336.405

Aufrufe heute: 1

Gesamt: 25.999

Gesamt: 25.999

Aktive User: 0

ISIN: US00214Q1040 · WKN: A14Y8H

42,23

EUR

+0,79 %

+0,33 EUR

Letzter Kurs 03.05.24 Lang & Schwarz

Neuigkeiten

03.05.24 · wallstreetONLINE Redaktion |

Markt wird wieder bullisher: Tesla: Cathie Wood prognostiziert Kursverdreifachung – ohne Robotaxi! (3) 30.04.24 · wallstreetONLINE Redaktion |

Cathie Wood kauft den Dip: Tesla-Downgrade: "Der Investment Case der Aktie hat sich stark verändert" 19.04.24 · wallstreetONLINE Redaktion |

12.04.24 · wallstreetONLINE Redaktion |

08.04.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3500 | +33,66 | |

| 32,00 | +27,95 | |

| 2,5000 | +25,00 | |

| 0,5800 | +23,40 | |

| 6,1100 | +18,64 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,8775 | -14,17 | |

| 1,2600 | -16,00 | |

| 18,445 | -16,65 | |

| 1.138,25 | -16,86 | |

| 0,9150 | -21,79 |

Beitrag zu dieser Diskussion schreiben

"...roller-coaster ride produced by Wood's big bets."

Interessanter Forbes-Artikel zu ARK Invest, als es eben klein anfing:Dec 10, 2014

Are Transparent Managed ETFs The Future? Fund Manager Cathie Wood Is Betting On It

https://www.forbes.com/sites/samanthasharf/2014/12/10/are-tr…

...

The freewheeling discussions cover such holdings as Tesla, Netflix, Athenahealth, Autodesk, Illumina and Salesforce.com and is punctuated by Wood's characteristically out-there predictions. "I think Oracle is toast, I really do," she declares at one.

--> FC: Oracle vs QQQ:

=> das war für Oracle zwar nicht berauschend (oben ist ohne Dividende), aber "Oracle is toast" stimmt auch nicht. Im Gegenteil, auch hier riecht es nach Rotation in "Value" zuletzt:

...

Like other ETFs, Ark's must disclose their holdings daily instead of quarterly, as traditional mutual funds do. While BlackRock, the world's largest money manager, unsuccessfully sought Securities & Exchange Commission approval to run a managed ETF exempt from daily disclosure, Wood is happy to put her holdings out there. In fact, anyone can sign up to get an e-mail every time she makes a trade--usually a few times per week in each fund.

--> FC; genau das stimmt ja so nicht (siehe oben): es sind die Trades, die sie veröffentlicht, nicht die absoluten Holdings, die auch bei ihr nur aus den Quartalsmelduingen (13F) hervorgehen

...

Hier wird's schon interessanter mit einem US-Steuer-Wohlfühl-Faktor:

More important, ETFs avoid much of the tax drag of traditional mutual funds, which must pass through net realized gains to their holders annually. That's painful for investors who hold a fund outside of a tax-deferred retirement account.

...

As an undergraduate at the University of Southern California she found an early and lifelong mentor in supply-side economist Arthur Laffer, who sits on Ark's advisory board.

As a 25-year-old analyst she called the end of the 1970s bear market while most on Wall Street were still running scared, sending her employer, Jennison Associates, on a long run of outperformance. Later, as a newspaper stock analyst, she got a front-row view of an industry disrupted and decided she'd rather put her money on the disruptors.

After 18 years at Jennison, Wood ran her own hedge fund for three years before landing at AllianceBernstein in 2001. There, as chief investment officer for thematic portfolios, she managed nearly $6 billion at one point.

The idea for a family of actively managed ETFs came to Wood in August 2012, she says, when her three kids were all away and, amid the unfamiliar quiet, she got to thinking: "I have been watching disruptive innovation for my entire career--why don't I help my own sector along?"

Wood left AllianceBernstein in June 2013 on what she says were cordial terms after the firm passed on building out her ETF vision. While the firm won't comment, higher-ups there may have also tired of the roller-coaster ride produced by Wood's big bets.

Under her, AllianceBernstein's Strategic Research portfolios returned 45% in 2009, versus 26% for the S&P, but lost 14% in 2011, when the S&P returned 2%. During her 12 years at AllianceBernstein she produced an average annualized return of 5.6%, compared with the S&P 500's 4.2%, Morningstar reports.

Risk-adjusted return is obviously another matter. Even Wood acknowledges her style isn't for the faint of heart and shouldn't make up the core of a typical investor's portfolio. (She, on the other hand, has all of her personal stock holdings in her picks.)

Wood is unapologetic about her bold investing style. To the contrary, she argues that since the market crash of 2008 active managers have become too timid and obsessed with matching some benchmark index every year, guaranteeing that they'll underperform that index once their higher fees are taken into account. Only 16% of the assets in Ark Innovation overlap with the S&P 500--13% if you strip out Apple.

A fan of Clayton Christensen's idea of disruptive innovation, Wood looks for companies building new technologies or ways of thinking, including those that may, in her view, have "fallen through the cracks" because Wall Street stock analysts are organized by industry. Is Athenahealth a technology stock or a health care stock?, she asks rhetorically to demonstrate her point, and answers, "It's both." Is Tesla a battery manufacturer or an automaker? Is Amazon a technology firm or a retailer?

Wood latches on to themes and finds stocks she thinks will win big from them--regardless of current P/Es or industry. Example: She figures that 10% to 20% of the country's annual $3 trillion in health care spending is wasted or at least spent inefficiently. That creates a huge opening for Athenahealth, which puts medical health and billing records in the cloud. It has a P/E of 100 times forward earnings and is the largest holding in Ark's Web X.0 fund.

...

Google is a top-five holding in the Industrial Innovation fund, in part because she likes its driverless cars.

Yet despite her focus on new technologies, Wood paints herself as a stock-picking throwback. "We know the managements. We know the financial statements. We know how they are disrupting the world in some way, shape or form. We take a point of view," Wood explains. "It's classical investing. This is what the masters did when I first started in the business."

As for her own industry, Wood predicts that managed ETFs won't be a novelty for long. "As a student of disruption I always look at the tipping point. Certainly in any consumer product or service, if something heads toward 20%, it usually takes off," says Wood, pointing out that ETFs account for 12% of the $15.8 trillion mutual fund industry. "I think we are hitting a tipping point."

Whether those managed ETFs will be transparent, however, isn't yet clear. A few weeks after nixing BlackRock's plans, the SEC gave Eaton Vance approval to offer a new structure--exchange-traded managed funds, or ETMFs--without disclosing holdings. The SEC determined these hybrid funds did more than BlackRock's blind trust model to make sure funds traded near their underlying value.

Robert Goldsborough, a Morningstar analyst who covers primarily passive strategies, has been watching Wood and Ark with interest. "Not being concerned about the transparency, it makes her unique," he says. "It is safe to say that, assuming Cathie does her research right, there is a real opportunity for her, because there is no one else providing this kind of exposure."

https://twitter.com/cppinvest/status/1368210317369630723 - ein Thread

disingenuous = unaufrichtig

...

How does she play to retail? She used the word "FUD" about 30 times in her presentation. She also explicitly states that her fund caters to the retail investor because retail is unconstrained and more free-thinking.

...

Their holdings are only published quarterly in 13F's. She knows this. It's also important for the rest of you to note how ETF's are different from mutual funds. ETF's reflect underlying asset values minute by minute. Mutual funds ONLY at the end of each trading day.

...

So her nightly published "trade lists" are kind of nonsense. It creates the facade of transparency without being transparent.

...

...

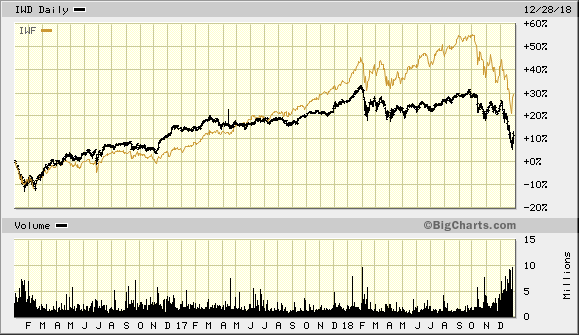

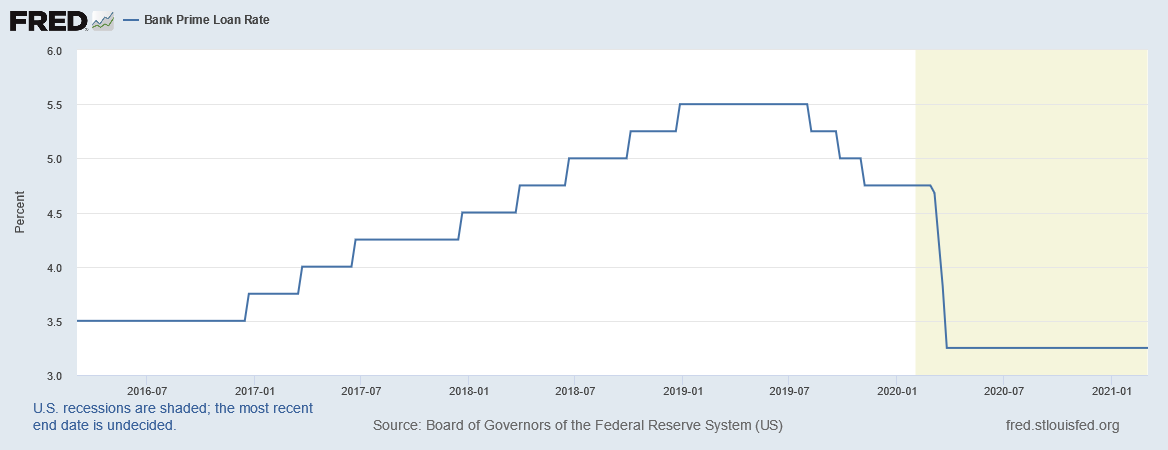

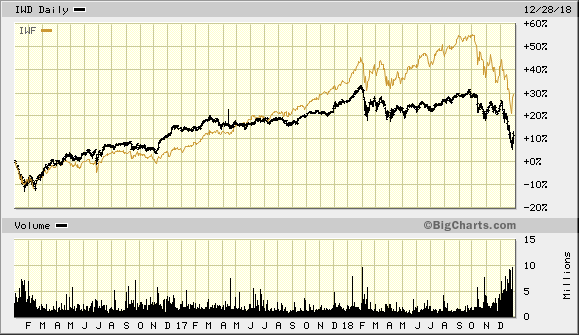

I did agree with her on one thing however: her views on rising rates not being a headwind now line up with mine. Rising rates didn't kill the 2018 small-cap rally like Gundlach wants everyone to think. It was more Trump's trade war with China that knocked growth investing flat. (*)

___

(*) das stimmt irgendwie: Growth (IWF) stieg zunächst auch weiterhin (gegenüber Value (IWD)), bevor es auch hier erst ab Oktober 2018 richtig bergab ging:

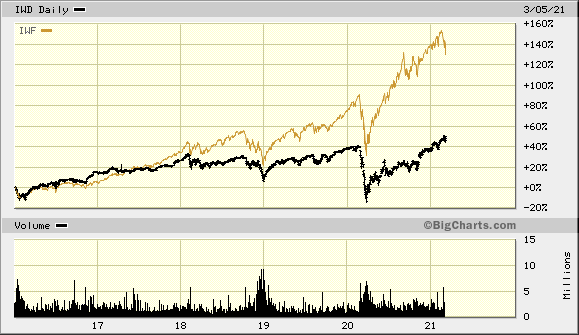

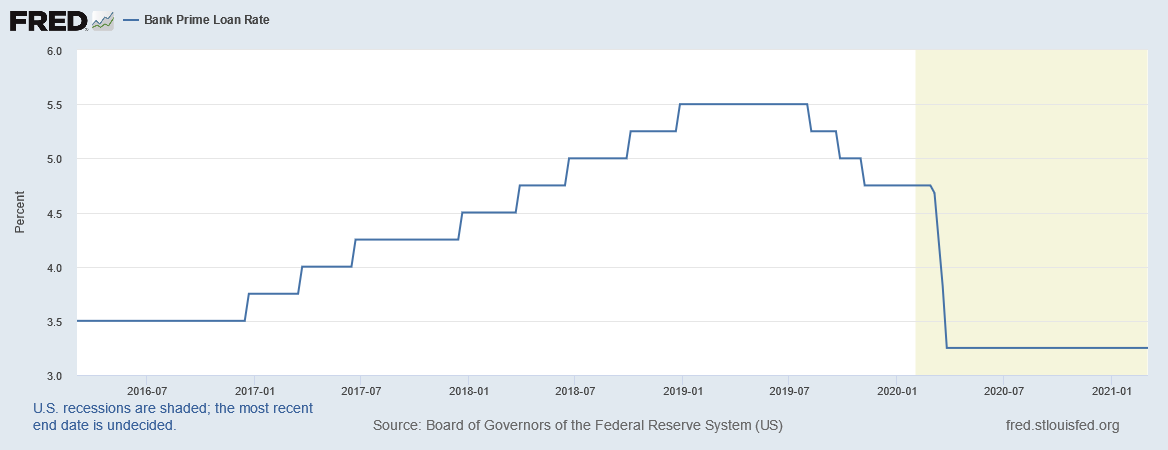

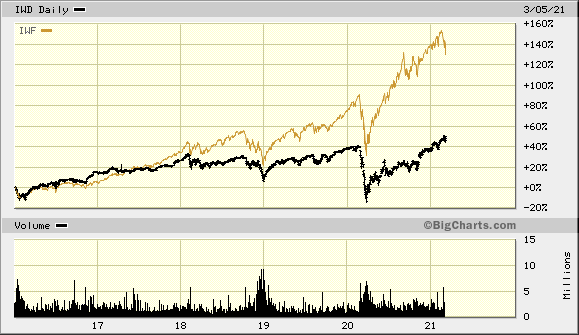

Und so ging es danach weiter:

=> man könnte darüber diskutieren, ob weniger ein Zinsniveau das Problem ist (solange es im "Rahmen" bleibt), als vielmehr die Dynamik der Zinsänderungen. Und die war zuletzt in den USA am langen Ende schon heftig.

disingenuous = unaufrichtig

...

How does she play to retail? She used the word "FUD" about 30 times in her presentation. She also explicitly states that her fund caters to the retail investor because retail is unconstrained and more free-thinking.

...

Their holdings are only published quarterly in 13F's. She knows this. It's also important for the rest of you to note how ETF's are different from mutual funds. ETF's reflect underlying asset values minute by minute. Mutual funds ONLY at the end of each trading day.

...

So her nightly published "trade lists" are kind of nonsense. It creates the facade of transparency without being transparent.

...

...

I did agree with her on one thing however: her views on rising rates not being a headwind now line up with mine. Rising rates didn't kill the 2018 small-cap rally like Gundlach wants everyone to think. It was more Trump's trade war with China that knocked growth investing flat. (*)

___

(*) das stimmt irgendwie: Growth (IWF) stieg zunächst auch weiterhin (gegenüber Value (IWD)), bevor es auch hier erst ab Oktober 2018 richtig bergab ging:

Und so ging es danach weiter:

=> man könnte darüber diskutieren, ob weniger ein Zinsniveau das Problem ist (solange es im "Rahmen" bleibt), als vielmehr die Dynamik der Zinsänderungen. Und die war zuletzt in den USA am langen Ende schon heftig.

Zitat von xwin: ...

ARK Invest: big stakes and a short swing

...

https://www.ft.com/content/3a3aa91c-4d1f-4005-80a4-fc8ae6e25…

...

hier ist mMn noch erwähnenswert, daß ARK Invest gegenüber der FT erklärte, daß sie sich mit ihren "aktiven ETF's" nicht als Insider entsprechend den angesprochenen Regularien - die Ausnahmen enthalten - sehen:

=> das heißt aber auch indirekt, daß ARK Invest überhaupt nicht vorhat, mögliche Trading-Gewinne, gemaß Sections 16(a) / 16(b) des Securities Exchange Act's, an die betroffenen Unternehmen abzuführen

=> aber, siehe am Schluss des Artikels:

Of course, this is all theoretical. But all it would take is one angry, litigious investor, perhaps jilted by losses, for this idea to come under some scrutiny.

Judging by the 20 per cent plus falls in several of these stocks over the past month, that moment might come sooner than later.

Und siehe oben: https://www.wallstreet-online.de/diskussion/1336405-81-90/ar…

=> nicht ohne Grund sucht ARK Invest mMn zur Zeit Compliance-Personal

https://cathiesark.com/ark-funds-combined/metrics

nebenbei:

• cathiesark.com ist eine ARK-Fan-Seite, keine Kritiker-Seite ("Cathie's Ark is not affiliated with Ark Invest or Cathie Wood")

Antwort auf Beitrag Nr.: 67.333.770 von faultcode am 05.03.21 19:27:27Cathie am Montag wieder auf CNBC

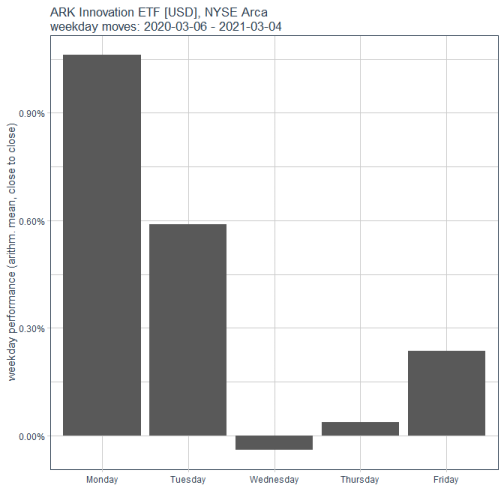

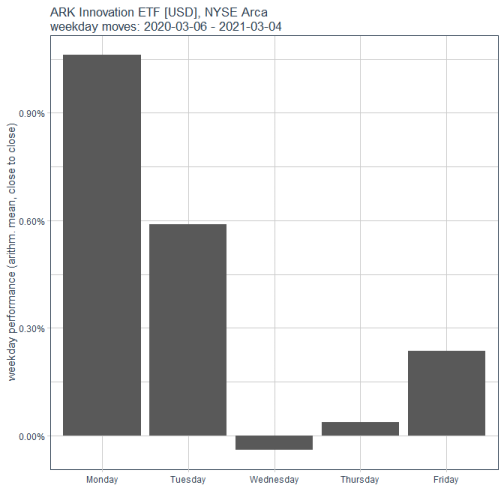

(Mo + Di werden mMn sowieso wieder in Tendenz gute Tage werden, auch für ARK (*))

https://twitter.com/rosemontseneca/status/136790419317712486…

(*)

(Mo + Di werden mMn sowieso wieder in Tendenz gute Tage werden, auch für ARK (*))

https://twitter.com/rosemontseneca/status/136790419317712486…

(*)

es ist Mittag in den USA.

Die Lemminge kaufen den "ARK-Dip".

Die Lemminge kaufen den "ARK-Dip".

Cathie Wood rechtfertigte sich gestern unter anderem damit, daß sie alleine dadurch eine Überperformance für ihre ETF's herausholen würde, indem sie ständig opportunistisch kauft und verkauft - auch in allgemeinen Down-Jahren wie 2018 mit dem Beispiel TSLA

(S&P 500 Annual Total Return 2018: -4.38% laut https://ycharts.com/indicators/sp_500_total_return_annual)

ab 2:00:

4.3.

Cathie Wood Responds to Jim Cramer's Criticism | #RazReport

Es fängt damit an, daß Jim Cramer sie auffordert, ihren Fonds zu schließen

Close your fund!

=> Cathie: "We trade all of our names!"

(S&P 500 Annual Total Return 2018: -4.38% laut https://ycharts.com/indicators/sp_500_total_return_annual)

ab 2:00:

4.3.

Cathie Wood Responds to Jim Cramer's Criticism | #RazReport

Es fängt damit an, daß Jim Cramer sie auffordert, ihren Fonds zu schließen

Close your fund!

=> Cathie: "We trade all of our names!"

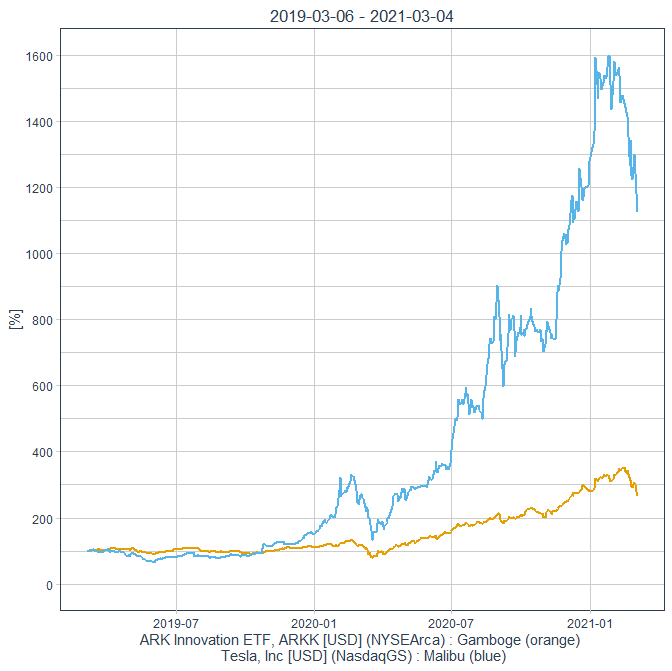

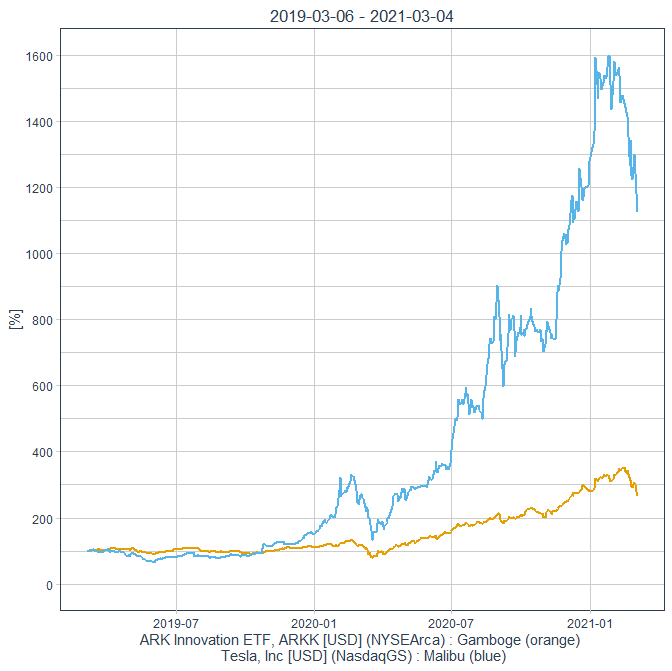

Antwort auf Beitrag Nr.: 67.317.831 von faultcode am 05.03.21 00:21:27jedes Mal denke ich, daß ich bei TSLA-Vergleichs-Charts einen Fehler mache (Yahoo finance, woher die Rohdaten sind, kommt zum selben Ergebnis, nur daß die bei null starten und ich bei 100%):

=> TSLA, neben den "Big 5"-Werten (Faceboook, Apple, Google, Amazon, Microsoft), bleibt mMn so lange die von ARK-Invest zu plündernde "Sparbüchse", wie der Bärenmarkt in vielen "Disruptive Innovation"-Werten anhält

Das hat aber mMn viel weniger Auswirkungen auf TSLA (so gut wie keine -- TSLA wird immer noch nur von den Big Boys/Long und Shorties maßgeblich bewegt), als auf den Rest des ARK-Portfolios.

=> TSLA, neben den "Big 5"-Werten (Faceboook, Apple, Google, Amazon, Microsoft), bleibt mMn so lange die von ARK-Invest zu plündernde "Sparbüchse", wie der Bärenmarkt in vielen "Disruptive Innovation"-Werten anhält

Das hat aber mMn viel weniger Auswirkungen auf TSLA (so gut wie keine -- TSLA wird immer noch nur von den Big Boys/Long und Shorties maßgeblich bewegt), als auf den Rest des ARK-Portfolios.

03.05.24 · wallstreetONLINE Redaktion · ARK Innovation |

Markt wird wieder bullisher: Tesla: Cathie Wood prognostiziert Kursverdreifachung – ohne Robotaxi! (3) 30.04.24 · wallstreetONLINE Redaktion · Tesla |

Cathie Wood kauft den Dip: Tesla-Downgrade: "Der Investment Case der Aktie hat sich stark verändert" 19.04.24 · wallstreetONLINE Redaktion · S&P 500 |

12.04.24 · wallstreetONLINE Redaktion · Microsoft |

08.04.24 · wallstreetONLINE Redaktion · Tesla |

07.04.24 · wallstreetONLINE Redaktion · Tesla |

02.04.24 · wallstreetONLINE Redaktion · ARK Next Generation Internet ETF |

27.03.24 · wallstreetONLINE Redaktion · S&P 500 |

05.03.24 · wallstreetONLINE Redaktion · ARK Innovation |

Enttäuschende Quartalszahlen: Der nächste Rückschlag für Cathie Wood: ARK-Aktie verliert 13 Prozent! 01.03.24 · wallstreetONLINE Redaktion · ARK Innovation |

| Zeit | Titel |

|---|---|

| 15.12.23 | |

| 01.12.23 | |

| 15.11.23 | |

| 12.10.23 | |

| 04.09.23 |