Brazil court grants bankruptcy protection for retailer Americanas -- PwC?

eröffnet am 20.01.23 12:16:29 von

neuester Beitrag 16.11.23 15:14:31 von

neuester Beitrag 16.11.23 15:14:31 von

Beiträge: 9

ID: 1.366.299

ID: 1.366.299

Aufrufe heute: 0

Gesamt: 1.609

Gesamt: 1.609

Aktive User: 0

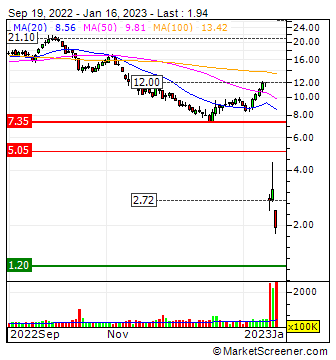

ISIN: US0305802037 · WKN: A3CVS8 · Symbol: BTOOQ

3,4500

USD

0,00 %

0,0000 USD

Letzter Kurs 12.05.23 Nasdaq OTC

Werte aus der Branche Einzelhandel

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,3500 | +27,00 | |

| 0,6500 | +24,16 | |

| 1,5000 | +23,97 | |

| 1,9650 | +22,43 | |

| 6,0900 | +21,07 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5500 | -15,38 | |

| 6,0000 | -19,35 | |

| 7.322,00 | -27,99 | |

| 0,7130 | -31,44 | |

| 47,56 | -58,74 |

Beitrag zu dieser Diskussion schreiben

16.11.

UPDATE 2-Brazil's Americanas revises results after accounting scandal

https://www.reuters.com/article/americanas-results/update-1-…

...

Brazilian retailer Americanas on Thursday disclosed revised financial results for 2021 and figures for 2022 after a multibillion-dollar accounting scandal was uncovered this year, leading it to file for bankruptcy.

Americanas said in a securities filing that its previously reported net income of 544 million reais ($111.9 million) in 2021 was revised to a net loss of 6.2 billion reais, and that in 2022 it registered a loss of 12.9 billion reais.

Those were the first financial figures released by one of Brazil’s largest retailers, backed by a billionaire trio that founded 3G Capital, since the accounting inconsistencies were revealed in January.

They are seen as a key step towards a successful bankruptcy and debt renegotiation plan.

...

UPDATE 2-Brazil's Americanas revises results after accounting scandal

https://www.reuters.com/article/americanas-results/update-1-…

...

Brazilian retailer Americanas on Thursday disclosed revised financial results for 2021 and figures for 2022 after a multibillion-dollar accounting scandal was uncovered this year, leading it to file for bankruptcy.

Americanas said in a securities filing that its previously reported net income of 544 million reais ($111.9 million) in 2021 was revised to a net loss of 6.2 billion reais, and that in 2022 it registered a loss of 12.9 billion reais.

Those were the first financial figures released by one of Brazil’s largest retailers, backed by a billionaire trio that founded 3G Capital, since the accounting inconsistencies were revealed in January.

They are seen as a key step towards a successful bankruptcy and debt renegotiation plan.

...

13.6.

Americanas Says Previous Management Team Committed Fraud

https://www.bnnbloomberg.ca/americanas-says-previous-managem…

...

The previous management team at Brazilian retailer Americanas SA carried out fraudulent accounting practices and hid them from investors and the board of directors, according to a filing on Tuesday and comments from the current chief executive officer.

The former executive team, led by then Chief Executive Officer Miguel Gutierrez, created false advertising contracts as a way to reduce costs on the balance sheet that ballooned to 21.7 billion reais ($4.5 billion) as of Sept. 30 2022, according to the filing that was based on information from an independent investigation. In addition, part of the money was shifted into suppliers accounts to cover the hole, the findings show.

Hours later, Leonardo Coelho, the current CEO, presented slides during a congressional hearing that allegedly show how the former executive team kept the real financial figures from the board, falsified letters and signatures and asked banks to remove references to supply chain financing operations. They also tried to sway the opinions of auditors, he said.

“The material fact today is that Americanas, for the first time, no longer calls this crisis ‘accounting inconsistencies”’, Coelho said. “It calls it ‘fraud.’”

The details are the clearest sign yet of what happened at the Rio de Janeiro-based retailer that was sunk into crisis in January after the incoming CEO Sergio Rial unveiled a massive accounting error that doubled its liabilities and forced it into bankruptcy protection to fend off creditors. The largest shareholders at Americanas, the trio of billionaire founders of buyout firm 3G Capital Inc., Jorge Paulo Lemann, Marcel Telles and Carlos Sicupira, have insisted that they were unaware of any fraudulent activity at the firm.

...

Americanas Says Previous Management Team Committed Fraud

https://www.bnnbloomberg.ca/americanas-says-previous-managem…

...

The previous management team at Brazilian retailer Americanas SA carried out fraudulent accounting practices and hid them from investors and the board of directors, according to a filing on Tuesday and comments from the current chief executive officer.

The former executive team, led by then Chief Executive Officer Miguel Gutierrez, created false advertising contracts as a way to reduce costs on the balance sheet that ballooned to 21.7 billion reais ($4.5 billion) as of Sept. 30 2022, according to the filing that was based on information from an independent investigation. In addition, part of the money was shifted into suppliers accounts to cover the hole, the findings show.

Hours later, Leonardo Coelho, the current CEO, presented slides during a congressional hearing that allegedly show how the former executive team kept the real financial figures from the board, falsified letters and signatures and asked banks to remove references to supply chain financing operations. They also tried to sway the opinions of auditors, he said.

“The material fact today is that Americanas, for the first time, no longer calls this crisis ‘accounting inconsistencies”’, Coelho said. “It calls it ‘fraud.’”

The details are the clearest sign yet of what happened at the Rio de Janeiro-based retailer that was sunk into crisis in January after the incoming CEO Sergio Rial unveiled a massive accounting error that doubled its liabilities and forced it into bankruptcy protection to fend off creditors. The largest shareholders at Americanas, the trio of billionaire founders of buyout firm 3G Capital Inc., Jorge Paulo Lemann, Marcel Telles and Carlos Sicupira, have insisted that they were unaware of any fraudulent activity at the firm.

...

5.6.2023

Ex-CEOs at Brazil's Americanas did not make proper accounting disclosures - regulator

https://sg.news.yahoo.com/ex-ceos-brazils-americanas-did-215…

...

Brazil's securities regulator has accused two former CEOs of retailer Americanas of failing to comply with information disclosure requirements following an investigation into the firm's accounting inconsistencies, the agency said.

According to a document from securities regulator CVM made public on Monday, the two ex-CEOs, Sergio Rial and Joao Guerra, also failed to meet other obligations on informing investors.

Rial and Guerra have yet to present their defenses, CVM said, adding that the case could lead to penalties such as a fine.

Americanas entered bankruptcy protection in January after uncovering around $4 billion in accounting inconsistencies. The firm is struggling to deal with a huge debt load as it looks to exit the bankruptcy process later this year.

Rial led the firm for less than two weeks and resigned after the accounting inconsistencies were unveiled, while Guerra, who was an acting CEO, left the top executive job in February and now heads human resources at the company.

Americanas said in a statement that it was monitoring the CVM investigation and hoped any irregularities would be "duly clarified".

The company did not mention the accusations against Guerra in its statement and he did not respond to a query via LinkedIn.

...

Ex-CEOs at Brazil's Americanas did not make proper accounting disclosures - regulator

https://sg.news.yahoo.com/ex-ceos-brazils-americanas-did-215…

...

Brazil's securities regulator has accused two former CEOs of retailer Americanas of failing to comply with information disclosure requirements following an investigation into the firm's accounting inconsistencies, the agency said.

According to a document from securities regulator CVM made public on Monday, the two ex-CEOs, Sergio Rial and Joao Guerra, also failed to meet other obligations on informing investors.

Rial and Guerra have yet to present their defenses, CVM said, adding that the case could lead to penalties such as a fine.

Americanas entered bankruptcy protection in January after uncovering around $4 billion in accounting inconsistencies. The firm is struggling to deal with a huge debt load as it looks to exit the bankruptcy process later this year.

Rial led the firm for less than two weeks and resigned after the accounting inconsistencies were unveiled, while Guerra, who was an acting CEO, left the top executive job in February and now heads human resources at the company.

Americanas said in a statement that it was monitoring the CVM investigation and hoped any irregularities would be "duly clarified".

The company did not mention the accusations against Guerra in its statement and he did not respond to a query via LinkedIn.

...

24.3.

Americanas Managers Presented Conflicting Information Over Debt

https://www.bnnbloomberg.ca/americanas-managers-presented-co…

...

The management team at Brazilian retailer Americanas SA told its external auditor and internal auditing committee as late as December 2022 that there were no supply-chain financing operations taking place at the firm.

At the same time, executives gave the securities regulator CVM conflicting information, and a central bank system showed the account registering supply chain financing at the firm had ballooned to almost 17 billion reais ($3.2 billion).

Just weeks later, a new chief executive officer unveiled massive accounting inconsistencies that led to a historic collapse for the Rio de Janeiro-based firm.

Documents seen by Bloomberg News provide the most detailed account yet of how Americanas’ debt expanded for years, outside of public view.

The materials were compiled by a court-appointed administrator, based on auditor reports and information coming from Americanas. The details show that Americanas executives were giving very different figures for the company’s supply-chain debt than the information that could have been available through the retailer’s bank accounts.

PricewaterhouseCoopers LLC, the most recent external auditor for the retailer, said it was told by management that there were no supply-chain financing transactions, according to the report. Written records from the internal auditing committee in May 2021 and December 2022 show executives saying the same. But documents sent by Americanas itself to the capital markets regulator CVM show the company started dabbling in this type of financing in 2015, with about 3.5 billion reais, ending 2022 with 15.9 billion reais, the administrator said.

...

Americanas said in a filing Friday that its 2022 earnings report, slated for release on March 29, won’t be published and didn’t provide a new date.

Americanas Managers Presented Conflicting Information Over Debt

https://www.bnnbloomberg.ca/americanas-managers-presented-co…

...

The management team at Brazilian retailer Americanas SA told its external auditor and internal auditing committee as late as December 2022 that there were no supply-chain financing operations taking place at the firm.

At the same time, executives gave the securities regulator CVM conflicting information, and a central bank system showed the account registering supply chain financing at the firm had ballooned to almost 17 billion reais ($3.2 billion).

Just weeks later, a new chief executive officer unveiled massive accounting inconsistencies that led to a historic collapse for the Rio de Janeiro-based firm.

Documents seen by Bloomberg News provide the most detailed account yet of how Americanas’ debt expanded for years, outside of public view.

The materials were compiled by a court-appointed administrator, based on auditor reports and information coming from Americanas. The details show that Americanas executives were giving very different figures for the company’s supply-chain debt than the information that could have been available through the retailer’s bank accounts.

PricewaterhouseCoopers LLC, the most recent external auditor for the retailer, said it was told by management that there were no supply-chain financing transactions, according to the report. Written records from the internal auditing committee in May 2021 and December 2022 show executives saying the same. But documents sent by Americanas itself to the capital markets regulator CVM show the company started dabbling in this type of financing in 2015, with about 3.5 billion reais, ending 2022 with 15.9 billion reais, the administrator said.

...

Americanas said in a filing Friday that its 2022 earnings report, slated for release on March 29, won’t be published and didn’t provide a new date.

6.2.

Hedge Fund Verde Says It Was Victim of Brazil’s ‘Biggest Fraud Ever’

https://finance.yahoo.com/news/hedge-fund-verde-says-victim-…

...

One of Brazil’s best-known hedge fund managers said it was stung by what it called the nation’s biggest case of corporate fraud on record with Americanas SA and joined banks in slamming the firm’s billionaire shareholders.

Verde Asset Management, which is run by industry veteran Luis Stuhlberger and whose flagship hedge fund is up over 21,800% after fees since its 1997 inception, says its exposure to local bonds of the Brazilian retailer brought a 14 basis-point loss last month, trimming gains to 2.7% in January.

“We were victims of a fraud,” Verde wrote in an investor note released Monday. Americanas had a vast track record, counted on three key shareholders considered to be “the country’s best business managers” and had its balance sheets audited by one of the sector’s top firms, the fund said.

...

Investors now want to know whether Americanas’ key shareholders — billionaires Jorge Paulo Lemann, Marcel Telles and Carlos Alberto Sicupira — will inject money into the distressed firm and appease creditors. The billionaire trio, which owns about a third of the company, “has been silent, but clearly chose the financial option,” the fund said.

Billionaire Sicupira Is Said in Talks With Americanas Creditors

While it’s expecting the bankruptcy protection process to be “lengthy” and “noisy,” Verde urged for a quick solution. “The longer it takes, the smaller the odds of any relevant recovery for the company (and its employees, suppliers, creditors and shareholders).”

...

Hedge Fund Verde Says It Was Victim of Brazil’s ‘Biggest Fraud Ever’

https://finance.yahoo.com/news/hedge-fund-verde-says-victim-…

...

One of Brazil’s best-known hedge fund managers said it was stung by what it called the nation’s biggest case of corporate fraud on record with Americanas SA and joined banks in slamming the firm’s billionaire shareholders.

Verde Asset Management, which is run by industry veteran Luis Stuhlberger and whose flagship hedge fund is up over 21,800% after fees since its 1997 inception, says its exposure to local bonds of the Brazilian retailer brought a 14 basis-point loss last month, trimming gains to 2.7% in January.

“We were victims of a fraud,” Verde wrote in an investor note released Monday. Americanas had a vast track record, counted on three key shareholders considered to be “the country’s best business managers” and had its balance sheets audited by one of the sector’s top firms, the fund said.

...

Investors now want to know whether Americanas’ key shareholders — billionaires Jorge Paulo Lemann, Marcel Telles and Carlos Alberto Sicupira — will inject money into the distressed firm and appease creditors. The billionaire trio, which owns about a third of the company, “has been silent, but clearly chose the financial option,” the fund said.

Billionaire Sicupira Is Said in Talks With Americanas Creditors

While it’s expecting the bankruptcy protection process to be “lengthy” and “noisy,” Verde urged for a quick solution. “The longer it takes, the smaller the odds of any relevant recovery for the company (and its employees, suppliers, creditors and shareholders).”

...

3.2.

3G Billionaires’ Personal Assets Targeted by Americanas Creditors

https://finance.yahoo.com/news/3g-billionaires-personal-asse…

...

Top Brazilian banks that are creditors of distressed retailer Americanas SA plan to go after personal assets of billionaires who are the firm’s biggest shareholders: Jorge Paulo Lemann, Marcel Telles and Carlos Sicupira.

The firms will make the move if the billionaires don’t rescue the company with combined capital injections of at least 15 billion reais ($3 billion), according to people familiar to the matter, who asked not to be identified because the decisions aren’t public. The billionaires have offered no more than 6 billion reais, the people said.

Creditors are trying to prove who was responsible for the $4 billion of “accounting inconsistencies” announced by Americanas, which doubled the retailer’s liabilities and made it collapse in one week. They say that the firm’s managers and main shareholders benefited from what they call fraud.

Representatives for Americanas and the billionaires didn’t immediately respond to messages requesting comment.

In a Jan. 22 filing, the three billionaires said they didn’t know about the accounting issues. “We never had any knowledge and would never have tolerated any maneuvers or accounting tricks in the company,” Lemann, Telles and Sicupira said. “Our action over decades has always been one of ethical and legal rigor.”

Bradesco SA, the biggest Americanas creditor and Brazil’s second-largest bank by market value, has said in a filing obtained by Bloomberg that it aims to go after the personal assets of shareholders. Other large banks have a similar view, but the people familiar with the matter asked not to identify them because it would reveal their legal strategy. A Bradesco spokesperson declined to comment.

...

3G Billionaires’ Personal Assets Targeted by Americanas Creditors

https://finance.yahoo.com/news/3g-billionaires-personal-asse…

...

Top Brazilian banks that are creditors of distressed retailer Americanas SA plan to go after personal assets of billionaires who are the firm’s biggest shareholders: Jorge Paulo Lemann, Marcel Telles and Carlos Sicupira.

The firms will make the move if the billionaires don’t rescue the company with combined capital injections of at least 15 billion reais ($3 billion), according to people familiar to the matter, who asked not to be identified because the decisions aren’t public. The billionaires have offered no more than 6 billion reais, the people said.

Creditors are trying to prove who was responsible for the $4 billion of “accounting inconsistencies” announced by Americanas, which doubled the retailer’s liabilities and made it collapse in one week. They say that the firm’s managers and main shareholders benefited from what they call fraud.

Representatives for Americanas and the billionaires didn’t immediately respond to messages requesting comment.

In a Jan. 22 filing, the three billionaires said they didn’t know about the accounting issues. “We never had any knowledge and would never have tolerated any maneuvers or accounting tricks in the company,” Lemann, Telles and Sicupira said. “Our action over decades has always been one of ethical and legal rigor.”

Bradesco SA, the biggest Americanas creditor and Brazil’s second-largest bank by market value, has said in a filing obtained by Bloomberg that it aims to go after the personal assets of shareholders. Other large banks have a similar view, but the people familiar with the matter asked not to identify them because it would reveal their legal strategy. A Bradesco spokesperson declined to comment.

...

25.1.

Brazilian Retailer Americanas Files for Chapter 15 Bankruptcy to Protect US Assets

https://finance.yahoo.com/news/brazilian-retailer-americanas…

...

Brazilian shopping chain Americanas SA filed for Chapter 15 bankruptcy, a move that protects its US assets while insolvency proceedings play out in its home country.

Representatives for Americanas filed the bankruptcy petition in Manhattan on Wednesday, court papers show. Chapter 15 bankruptcy filings stop creditors from seizing a company’s assets in the US.

The retailer nosedived in January after becoming mired in an accounting scandal. The firm, backed by billionaire Jorge Paulo Lemann, filed for bankruptcy at a court in Rio de Janeiro on Jan. 19.

In disclosures to investors, the firm implied it misreported numbers connected to some of its financing and wrongly deducted interest paid to lenders from its liabilities. In all, there were nearly $4 billion of accounting “inconsistencies,” according to a regulatory filing.

...

Brazilian Retailer Americanas Files for Chapter 15 Bankruptcy to Protect US Assets

https://finance.yahoo.com/news/brazilian-retailer-americanas…

...

Brazilian shopping chain Americanas SA filed for Chapter 15 bankruptcy, a move that protects its US assets while insolvency proceedings play out in its home country.

Representatives for Americanas filed the bankruptcy petition in Manhattan on Wednesday, court papers show. Chapter 15 bankruptcy filings stop creditors from seizing a company’s assets in the US.

The retailer nosedived in January after becoming mired in an accounting scandal. The firm, backed by billionaire Jorge Paulo Lemann, filed for bankruptcy at a court in Rio de Janeiro on Jan. 19.

In disclosures to investors, the firm implied it misreported numbers connected to some of its financing and wrongly deducted interest paid to lenders from its liabilities. In all, there were nearly $4 billion of accounting “inconsistencies,” according to a regulatory filing.

...

Antwort auf Beitrag Nr.: 73.129.776 von faultcode am 20.01.23 12:16:2919.1.

Brazil court grants bankruptcy protection for retailer Americanas

https://finance.yahoo.com/news/brazils-americanas-considerin…

...

Chief executive Sergio Rial resigned last week, less than two weeks after taking the job, citing the discovery of "accounting inconsistencies" totaling 20 billion reais.

Rial, the former head of Banco Santander's Brazilian arm, attributed the inconsistencies to differences in accounting for the financial cost of bank loans and debt with suppliers.

Chief financial officer Andre Covre, who had just joined Americanas as well, also left the firm, which has Brazilian billionaires Jorge Paulo Lemann, Carlos Alberto Sicupira and Marcel Telles as reference shareholders.

Americanas said the reference shareholders intended to maintain the company's liquidity at levels that allowed for a "good operation" of its stores, digital channel and other entities.

...

Brazil court grants bankruptcy protection for retailer Americanas

https://finance.yahoo.com/news/brazils-americanas-considerin…

...

Chief executive Sergio Rial resigned last week, less than two weeks after taking the job, citing the discovery of "accounting inconsistencies" totaling 20 billion reais.

Rial, the former head of Banco Santander's Brazilian arm, attributed the inconsistencies to differences in accounting for the financial cost of bank loans and debt with suppliers.

Chief financial officer Andre Covre, who had just joined Americanas as well, also left the firm, which has Brazilian billionaires Jorge Paulo Lemann, Carlos Alberto Sicupira and Marcel Telles as reference shareholders.

Americanas said the reference shareholders intended to maintain the company's liquidity at levels that allowed for a "good operation" of its stores, digital channel and other entities.

...

weiter von hier:

Zitat von faultcode: 17.1.

Americanas Crash Deepens as BTG Cites Fraud in Legal Battle

https://finance.yahoo.com/news/americanas-crash-deepens-btg-…

...

Americanas SA shares sank further after the Brazilian retailer, whose main backers include billionaire Jorge Paulo Lemann, obtained a decision that paves the way for a potential bankruptcy filing, sparking a legal reaction from creditors that accuse the company of fraud.

The Rio de Janeiro-based firm said on Friday a local court granted it protection against early debt maturity and asset-seizure for a 30-day period, after which Americanas could file for bankruptcy protection. The decision follows the surprise departure of the firm’s chief executive and financial officers last week due to “accounting inconsistencies” estimated at around 20 billion reais ($3.9 billion) tied to supply finance operations.

These inconsistencies will require adjustments that could impact the company’s past balance sheets and possibly breach covenants that could lead to early debt maturity of nearly 40 billion reais, the court decision reads. Americanas also told the court that some creditors moved to request some of its assets be frozen, including over 1.2 billion reais by Banco BTG Pactual SA.

BTG went to court trying to revert the decision and accused the company of fraud, according to a document obtained by Bloomberg. The judge denied the request, citing no urgency for the matter. BTG is planning to go to court again, according to people familiar with the matter.

...

=>