$$$.........RSG hat den sprung in eine neue LIGA geschafft !!!! - 500 Beiträge pro Seite (Seite 2)

eröffnet am 14.03.07 00:31:28 von

neuester Beitrag 31.01.12 23:37:32 von

neuester Beitrag 31.01.12 23:37:32 von

Beiträge: 787

ID: 1.118.367

ID: 1.118.367

Aufrufe heute: 0

Gesamt: 37.570

Gesamt: 37.570

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 25.04.24, 13:40 | 476 | |

| vor 1 Stunde | 178 | |

| 30.04.24, 22:31 | 132 | |

| vor 1 Stunde | 110 | |

| 30.04.24, 19:23 | 101 | |

| 30.04.24, 23:28 | 80 | |

| 30.04.24, 23:55 | 79 | |

| vor 1 Stunde | 79 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 8,2900 | +4,94 | 228 | |||

| 2. | 2. | 17.899,00 | -1,43 | 204 | |||

| 3. | 3. | 2.291,30 | +0,24 | 73 | |||

| 4. | 4. | 0,9650 | +16,27 | 71 | |||

| 5. | 5. | 67,66 | +1,00 | 67 | |||

| 6. | 6. | 181,25 | -6,60 | 60 | |||

| 7. | 12. | 3,6925 | +0,27 | 27 | |||

| 8. | 8. | 13,988 | +4,74 | 27 |

Antwort auf Beitrag Nr.: 32.033.720 von Scheich2000 am 16.10.07 21:20:51

hi scheich, durchweg ein berechtigter gedanke, angesichts

des dortigen vol. auch den schwertpunkt des tradens

nach CAN zu verlegen.........allerdings muß auch der

kosten- aspekt dabei berücksichtigt werden......und die sind

bei CAN- trades nicht zu unterschätzen, soweit ICH es

beurteilen kann ( zb via CONSORS, NORDNET!!! )

aber bin seeeehr empfänglich für günstigere optionen !!!

hi scheich, durchweg ein berechtigter gedanke, angesichts

des dortigen vol. auch den schwertpunkt des tradens

nach CAN zu verlegen.........allerdings muß auch der

kosten- aspekt dabei berücksichtigt werden......und die sind

bei CAN- trades nicht zu unterschätzen, soweit ICH es

beurteilen kann ( zb via CONSORS, NORDNET!!! )

aber bin seeeehr empfänglich für günstigere optionen !!!

Jungs was machen die Cannis heut????

Antwort auf Beitrag Nr.: 32.048.708 von Bebibu am 17.10.07 15:54:20

....eröffnen jedenfalls mal ganz anständig.......

Time Price Shares $ Change Buyer Seller

09:59 0.300 3,000 +0.000 TD Securities Penson

09:59 0.300 3,500 +0.000 TD Securities Penson

09:52 0.300 25,000 +0.000 TD Securities CIBC

09:50 0.300 8,500 +0.000 TD Securities Anonymous

09:50 0.300 1,500 +0.000 CIBC Anonymous

09:47 0.300 10,000 +0.000 CIBC E*TRADE Sec.

09:42 0.300 20,000 +0.000 CIBC BMO Nesbitt

09:39 0.300 3,000 +0.000 CIBC RBC

09:39 0.300 10,000 +0.000 CIBC CIBC

09:38 0.300 10,000 +0.000 CIBC RBC

....eröffnen jedenfalls mal ganz anständig.......

Time Price Shares $ Change Buyer Seller

09:59 0.300 3,000 +0.000 TD Securities Penson

09:59 0.300 3,500 +0.000 TD Securities Penson

09:52 0.300 25,000 +0.000 TD Securities CIBC

09:50 0.300 8,500 +0.000 TD Securities Anonymous

09:50 0.300 1,500 +0.000 CIBC Anonymous

09:47 0.300 10,000 +0.000 CIBC E*TRADE Sec.

09:42 0.300 20,000 +0.000 CIBC BMO Nesbitt

09:39 0.300 3,000 +0.000 CIBC RBC

09:39 0.300 10,000 +0.000 CIBC CIBC

09:38 0.300 10,000 +0.000 CIBC RBC

Eröffnung war ganz okay, aber jetzt doch wieder deutlich im Minus.

Die Frage ist nur warum?

Die Frage ist nur warum?

Antwort auf Beitrag Nr.: 32.056.507 von Scheich2000 am 17.10.07 20:56:48

.....don´t worry - ganz normale seitwärts- bewegung

um 0,30 ......

Time Price Shares $ Change Buyer Seller

14:58 0.290 500 -0.010 Penson TD Securities

14:57 0.275 10,000 -0.025 RBC Research Cap.

14:53 0.290 9,500 -0.010 BMO Nesbitt TD Securities

14:53 0.280 5,000 -0.020 BMO Nesbitt Ntl. Bank Fin.

14:49 0.275 16,500 -0.025 RBC Bolder

14:49 0.275 7,000 -0.025 RBC RBC

14:47 0.275 20,000 -0.025 RBC Ntl. Bank Fin.

14:46 0.280 8,500 -0.020 Questrade Bolder

14:45 0.280 20,000 -0.020 TD Securities Bolder

14:45 0.280 5,000 -0.020 TD Securities Bolder

.....don´t worry - ganz normale seitwärts- bewegung

um 0,30 ......

Time Price Shares $ Change Buyer Seller

14:58 0.290 500 -0.010 Penson TD Securities

14:57 0.275 10,000 -0.025 RBC Research Cap.

14:53 0.290 9,500 -0.010 BMO Nesbitt TD Securities

14:53 0.280 5,000 -0.020 BMO Nesbitt Ntl. Bank Fin.

14:49 0.275 16,500 -0.025 RBC Bolder

14:49 0.275 7,000 -0.025 RBC RBC

14:47 0.275 20,000 -0.025 RBC Ntl. Bank Fin.

14:46 0.280 8,500 -0.020 Questrade Bolder

14:45 0.280 20,000 -0.020 TD Securities Bolder

14:45 0.280 5,000 -0.020 TD Securities Bolder

Antwort auf Beitrag Nr.: 32.057.064 von hbg55 am 17.10.07 21:30:13

.....mit folg. LAST TRADES...

Time Price Shares $ Change Buyer Seller

15:55 0.295 3,000 -0.005 BMO Nesbitt RBC

15:54 0.295 1,000 -0.005 TD Securities TD Securities

15:52 0.290 6,500 -0.010 Union RBC

15:50 0.290 13,500 -0.010 CIBC RBC

15:50 0.290 8,500 -0.010 CIBC Questrade

15:50 0.290 11,000 -0.010 CIBC E*TRADE Sec.

15:40 0.290 13,000 -0.010 Ntl. Bank Fin. E*TRADE Sec.

15:30 0.280 10,000 -0.020 Union TD Securities

15:16 0.290 5,000 -0.010 TD Securities TD Securities

15:16 0.290 1,000 -0.010 TD Securities E*TRADE Sec.

.....mit folg. LAST TRADES...

Time Price Shares $ Change Buyer Seller

15:55 0.295 3,000 -0.005 BMO Nesbitt RBC

15:54 0.295 1,000 -0.005 TD Securities TD Securities

15:52 0.290 6,500 -0.010 Union RBC

15:50 0.290 13,500 -0.010 CIBC RBC

15:50 0.290 8,500 -0.010 CIBC Questrade

15:50 0.290 11,000 -0.010 CIBC E*TRADE Sec.

15:40 0.290 13,000 -0.010 Ntl. Bank Fin. E*TRADE Sec.

15:30 0.280 10,000 -0.020 Union TD Securities

15:16 0.290 5,000 -0.010 TD Securities TD Securities

15:16 0.290 1,000 -0.010 TD Securities E*TRADE Sec.

gleiches bild wie gestern - knapp behauptet gehts

in den handel in CAN.........

Time Price Shares $ Change Buyer Seller

09:57 0.280 1,000 -0.015 CIBC Desjardins

09:56 0.280 29,500 -0.015 CIBC Canaccord

09:56 0.280 6,500 -0.015 RBC Canaccord

09:55 0.280 13,500 -0.015 RBC Scotia

09:55 0.280 6,500 -0.015 Scotia Scotia

09:53 0.280 4,000 -0.015 TD Securities TD Securities

09:48 0.280 20,000 -0.015 TD Securities TD Securities

09:46 0.280 1,000 -0.015 Scotia Desjardins

09:45 0.280 8,500 -0.015 TD Securities TD Securities

09:45 0.280 11,500 -0.015 Scotia TD Securities

in den handel in CAN.........

Time Price Shares $ Change Buyer Seller

09:57 0.280 1,000 -0.015 CIBC Desjardins

09:56 0.280 29,500 -0.015 CIBC Canaccord

09:56 0.280 6,500 -0.015 RBC Canaccord

09:55 0.280 13,500 -0.015 RBC Scotia

09:55 0.280 6,500 -0.015 Scotia Scotia

09:53 0.280 4,000 -0.015 TD Securities TD Securities

09:48 0.280 20,000 -0.015 TD Securities TD Securities

09:46 0.280 1,000 -0.015 Scotia Desjardins

09:45 0.280 8,500 -0.015 TD Securities TD Securities

09:45 0.280 11,500 -0.015 Scotia TD Securities

ja so ist es.

ruhig blut bewahren. alles in ordnung. alle warten auf die bohrergebnisse.

bis die nicht heraussen sind, wird sich am sp nicht viel ändern.

schö tag noch

ruhig blut bewahren. alles in ordnung. alle warten auf die bohrergebnisse.

bis die nicht heraussen sind, wird sich am sp nicht viel ändern.

schö tag noch

......angescihts des schwachen börsenumfeld

trennen sich vereinzelt inv. von ihren bestände -

allerdings bei niedrigem vol. von bislang

erst knapp 400k .....

knapp 400k .....

Time Price Shares $ Change Buyer Seller

10:41 0.270 13,000 -0.020 E*TRADE Sec. E*TRADE Sec.

10:41 0.270 5,000 -0.020 TD Securities Desjardins

10:41 0.275 10,000 -0.015 TD Securities Desjardins

10:40 0.275 6,000 -0.015 RBC TD Securities

10:37 0.275 2,000 -0.015 Anonymous TD Securities

10:37 0.275 7,500 -0.015 BMO Nesbitt TD Securities

10:37 0.275 20,000 -0.015 RBC TD Securities

10:37 0.275 18,000 -0.015 RBC TD Securities

10:26 0.275 3,000 -0.015 RBC Canaccord

10:26 0.275 7,000 -0.015 Anonymous Canaccord

trennen sich vereinzelt inv. von ihren bestände -

allerdings bei niedrigem vol. von bislang

erst

knapp 400k .....

knapp 400k .....Time Price Shares $ Change Buyer Seller

10:41 0.270 13,000 -0.020 E*TRADE Sec. E*TRADE Sec.

10:41 0.270 5,000 -0.020 TD Securities Desjardins

10:41 0.275 10,000 -0.015 TD Securities Desjardins

10:40 0.275 6,000 -0.015 RBC TD Securities

10:37 0.275 2,000 -0.015 Anonymous TD Securities

10:37 0.275 7,500 -0.015 BMO Nesbitt TD Securities

10:37 0.275 20,000 -0.015 RBC TD Securities

10:37 0.275 18,000 -0.015 RBC TD Securities

10:26 0.275 3,000 -0.015 RBC Canaccord

10:26 0.275 7,000 -0.015 Anonymous Canaccord

Schon lustig, wie man mit knapp 700€ den Kurs

in FFM um 22% steigen lassen kann!

Gruß aaahhh

in FFM um 22% steigen lassen kann!

Gruß aaahhh

....nach tief bei 0,255 gehts in CAN wieder

auf die 0,30 zu.......

Time Price Shares $ Change Buyer Seller

11:09 0.275 5,000 +0.000 Scotia Scotia

11:06 0.275 5,000 +0.000 Scotia Scotia

11:01 0.275 10,000 +0.000 E*TRADE Sec. E*TRADE Sec.

11:01 0.275 15,000 +0.000 E*TRADE Sec. Scotia

11:01 0.275 10,000 +0.000 E*TRADE Sec. TD Securities

11:01 0.270 15,000 -0.005 E*TRADE Sec. RBC

10:54 0.270 5,000 -0.005 Scotia RBC

10:54 0.265 23,500 -0.010 Desjardins TD Securities

10:54 0.265 16,500 -0.010 Leede TD Securities

10:49 0.265 23,500 -0.010 Leede RBC

auf die 0,30 zu.......

Time Price Shares $ Change Buyer Seller

11:09 0.275 5,000 +0.000 Scotia Scotia

11:06 0.275 5,000 +0.000 Scotia Scotia

11:01 0.275 10,000 +0.000 E*TRADE Sec. E*TRADE Sec.

11:01 0.275 15,000 +0.000 E*TRADE Sec. Scotia

11:01 0.275 10,000 +0.000 E*TRADE Sec. TD Securities

11:01 0.270 15,000 -0.005 E*TRADE Sec. RBC

10:54 0.270 5,000 -0.005 Scotia RBC

10:54 0.265 23,500 -0.010 Desjardins TD Securities

10:54 0.265 16,500 -0.010 Leede TD Securities

10:49 0.265 23,500 -0.010 Leede RBC

Antwort auf Beitrag Nr.: 32.110.813 von hbg55 am 22.10.07 17:33:31Na, ist mittlerweile ´n bisserl mehr als Lieschen Müller ...

Gruß

sdtm

Gruß

sdtm

Antwort auf Beitrag Nr.: 32.110.813 von hbg55 am 22.10.07 17:33:31

...inzwischen haben wir die 0,30 hinter uns gelassen

und sind mit schönem vol. auf 0,325 gesprungen........

Time Price Shares $ Change Buyer Seller

12:16 0.320 2,500 +0.045 Ntl. Bank Fin. TD Securities

12:15 0.320 1,500 +0.045 Ntl. Bank Fin. TD Securities

12:15 0.320 18,500 +0.045 Penson TD Securities

12:15 0.320 15,000 +0.045 Penson Anonymous

12:15 0.325 5,000 +0.050 Desjardins Penson

12:15 0.325 5,000 +0.050 Desjardins E*TRADE Sec.

12:15 0.325 5,000 +0.050 Desjardins Desjardins

12:15 0.320 4,000 +0.045 Penson TD Securities

12:15 0.320 2,500 +0.045 Penson Anonymous

12:15 0.320 10,000 +0.045 CIBC Anonymous

...inzwischen haben wir die 0,30 hinter uns gelassen

und sind mit schönem vol. auf 0,325 gesprungen........

Time Price Shares $ Change Buyer Seller

12:16 0.320 2,500 +0.045 Ntl. Bank Fin. TD Securities

12:15 0.320 1,500 +0.045 Ntl. Bank Fin. TD Securities

12:15 0.320 18,500 +0.045 Penson TD Securities

12:15 0.320 15,000 +0.045 Penson Anonymous

12:15 0.325 5,000 +0.050 Desjardins Penson

12:15 0.325 5,000 +0.050 Desjardins E*TRADE Sec.

12:15 0.325 5,000 +0.050 Desjardins Desjardins

12:15 0.320 4,000 +0.045 Penson TD Securities

12:15 0.320 2,500 +0.045 Penson Anonymous

12:15 0.320 10,000 +0.045 CIBC Anonymous

Antwort auf Beitrag Nr.: 32.111.646 von hbg55 am 22.10.07 18:33:54

....zum schluß sahen wir ein ord. vol. von

2,6 mio. St. und nem SK knapp unter TH.......

Time Price Shares $ Change Buyer Seller

15:49 0.315 6,000 +0.040 Desjardins Ntl. Bank Fin.

15:49 0.315 4,000 +0.040 Desjardins TD Securities

15:46 0.305 10,000 +0.030 Questrade RBC

15:42 0.315 5,000 +0.040 RBC RBC

15:42 0.310 5,000 +0.035 Ntl. Bank Fin. Anonymous

15:39 0.310 10,000 +0.035 Desjardins Scotia

15:30 0.315 3,000 +0.040 Scotia TD Securities

15:30 0.310 2,000 +0.035 Scotia Anonymous

15:29 0.310 4,000 +0.035 Scotia Anonymous

15:29 0.310 1,000 +0.035 Scotia TD Securities

....zum schluß sahen wir ein ord. vol. von

2,6 mio. St. und nem SK knapp unter TH.......

Time Price Shares $ Change Buyer Seller

15:49 0.315 6,000 +0.040 Desjardins Ntl. Bank Fin.

15:49 0.315 4,000 +0.040 Desjardins TD Securities

15:46 0.305 10,000 +0.030 Questrade RBC

15:42 0.315 5,000 +0.040 RBC RBC

15:42 0.310 5,000 +0.035 Ntl. Bank Fin. Anonymous

15:39 0.310 10,000 +0.035 Desjardins Scotia

15:30 0.315 3,000 +0.040 Scotia TD Securities

15:30 0.310 2,000 +0.035 Scotia Anonymous

15:29 0.310 4,000 +0.035 Scotia Anonymous

15:29 0.310 1,000 +0.035 Scotia TD Securities

Antwort auf Beitrag Nr.: 32.114.593 von hbg55 am 22.10.07 22:29:28Erinnert mich stark an das Geschehen vor den letzten News!

Nur gehts diesmal von einem höheren Niveau los! Dann lassen

wir das Spiel erneut beginnen.

Gruß aaahhh

Nur gehts diesmal von einem höheren Niveau los! Dann lassen

wir das Spiel erneut beginnen.

Gruß aaahhh

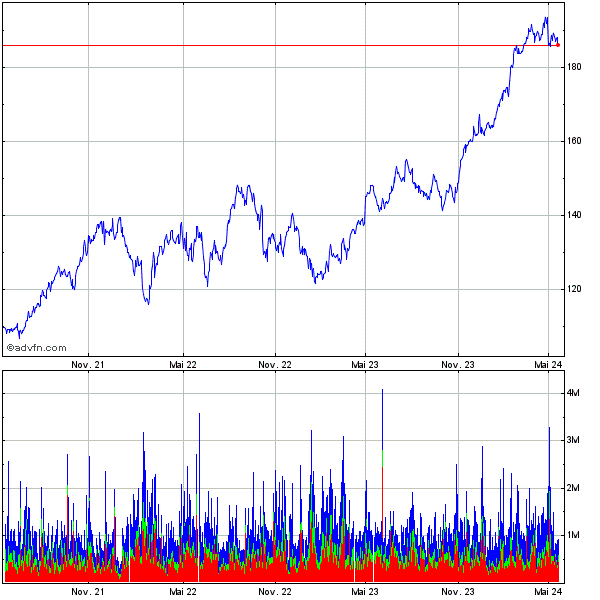

g. morgen,

das war mal wieder ein handelstag in canada; da sind doch wohl einige zu niedrigstwerten ausgestoppt worden

schicke mal zwei grafiken mit; beim ersten mit stochastischen wert, der übrigens nicht so schlecht aussieht.

macd; trend sieht soweit meiner meinung nach ok aus. auffallend auch schon die 2,5 mio gehandelte stückzahl sowie das positive candle von gestern.

kann mir vorstellen dass es heute oder morgen zum neuerlichen showdown kommt

das war mal wieder ein handelstag in canada; da sind doch wohl einige zu niedrigstwerten ausgestoppt worden

schicke mal zwei grafiken mit; beim ersten mit stochastischen wert, der übrigens nicht so schlecht aussieht.

macd; trend sieht soweit meiner meinung nach ok aus. auffallend auch schon die 2,5 mio gehandelte stückzahl sowie das positive candle von gestern.

kann mir vorstellen dass es heute oder morgen zum neuerlichen showdown kommt

leider immer noch k e i n e weiteren news, so

daß wir weiterhin um die 0,30 pendeln.......

Time Price Shares $ Change Buyer Seller

10:48 0.315 23,000 +0.000 Leede CIBC

10:47 0.310 2,500 -0.005 Ntl. Bank Fin. Ntl. Bank Fin.

10:46 0.310 2,500 -0.005 TD Securities Ntl. Bank Fin.

10:46 0.310 10,000 -0.005 TD Securities CIBC

10:46 0.310 500 -0.005 TD Securities RBC

10:41 0.310 19,500 -0.005 BMO Nesbitt RBC

10:37 0.310 5,000 -0.005 BMO Nesbitt TD Securities

10:37 0.310 3,000 -0.005 BMO Nesbitt Penson

10:37 0.310 10,000 -0.005 BMO Nesbitt BMO Nesbitt

10:37 0.310 12,500 -0.005 BMO Nesbitt Canaccord

daß wir weiterhin um die 0,30 pendeln.......

Time Price Shares $ Change Buyer Seller

10:48 0.315 23,000 +0.000 Leede CIBC

10:47 0.310 2,500 -0.005 Ntl. Bank Fin. Ntl. Bank Fin.

10:46 0.310 2,500 -0.005 TD Securities Ntl. Bank Fin.

10:46 0.310 10,000 -0.005 TD Securities CIBC

10:46 0.310 500 -0.005 TD Securities RBC

10:41 0.310 19,500 -0.005 BMO Nesbitt RBC

10:37 0.310 5,000 -0.005 BMO Nesbitt TD Securities

10:37 0.310 3,000 -0.005 BMO Nesbitt Penson

10:37 0.310 10,000 -0.005 BMO Nesbitt BMO Nesbitt

10:37 0.310 12,500 -0.005 BMO Nesbitt Canaccord

Ja, aber immerhin bei über 0,30. Wäre schon mal gut wenn wir uns auf diesem Niveau halten könnten.

Und endlich auch mal wieder ein paar Umsätze in Deutschland.

Und endlich auch mal wieder ein paar Umsätze in Deutschland.

so ist es.

Umsätze in Deutschland sind mal wichtig, auch wenn es nur geringe sind.

Etwas Geduld, denn die Ergebnisse werden kommen und damit auch wieder die Umsätze.

Wer will schon bei diesen Aussichten und diesem Kurs verkaufen?

Umsätze in Deutschland sind mal wichtig, auch wenn es nur geringe sind.

Etwas Geduld, denn die Ergebnisse werden kommen und damit auch wieder die Umsätze.

Wer will schon bei diesen Aussichten und diesem Kurs verkaufen?

Ich schon mal nicht.

Brauche mal wieder eine Aktie die steigt!

Brauche mal wieder eine Aktie die steigt!

zwar knapp 1 mio. St. vol., aber sonst

dümpelte RSG im sog des neg. umfelds so dahin........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:15 V 0.285 -0.02 500 1 Anonymous 7 TD Sec K

15:58:02 V 0.285 -0.02 9,500 9 BMO Nesbitt 7 TD Sec K

15:58:02 V 0.285 -0.02 500 9 BMO Nesbitt 1 Anonymous K

15:55:11 V 0.285 -0.02 9,500 19 Desjardins 1 Anonymous K

15:55:11 V 0.285 -0.02 500 19 Desjardins 2 RBC K

15:53:05 V 0.28 -0.025 1,500 88 E-TRADE 54 Global K

15:45:40 V 0.28 -0.025 1,000 88 E-TRADE 7 TD Sec K

15:28:52 V 0.28 -0.025 2,000 88 E-TRADE 80 National Bank K

15:24:38 V 0.285 -0.02 1,500 7 TD Sec 2 RBC K

15:24:38 V 0.285 -0.02 3,500 7 TD Sec 1 Anonymous K

dümpelte RSG im sog des neg. umfelds so dahin........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:15 V 0.285 -0.02 500 1 Anonymous 7 TD Sec K

15:58:02 V 0.285 -0.02 9,500 9 BMO Nesbitt 7 TD Sec K

15:58:02 V 0.285 -0.02 500 9 BMO Nesbitt 1 Anonymous K

15:55:11 V 0.285 -0.02 9,500 19 Desjardins 1 Anonymous K

15:55:11 V 0.285 -0.02 500 19 Desjardins 2 RBC K

15:53:05 V 0.28 -0.025 1,500 88 E-TRADE 54 Global K

15:45:40 V 0.28 -0.025 1,000 88 E-TRADE 7 TD Sec K

15:28:52 V 0.28 -0.025 2,000 88 E-TRADE 80 National Bank K

15:24:38 V 0.285 -0.02 1,500 7 TD Sec 2 RBC K

15:24:38 V 0.285 -0.02 3,500 7 TD Sec 1 Anonymous K

...nach kurzer ruhepause fängt RSG wieder das laufen an.......

Time Price Shares $ Change Buyer Seller

11:01 0.310 14,000 +0.030 CIBC Anonymous

11:00 0.310 1,000 +0.030 CIBC Anonymous

11:00 0.310 1,000 +0.030 RBC Anonymous

11:00 0.310 20,000 +0.030 RBC Anonymous

10:59 0.310 6,500 +0.030 RBC Desjardins

10:59 0.310 5,000 +0.030 RBC Anonymous

10:59 0.310 38,000 +0.030 RBC TD Securities

10:59 0.310 10,000 +0.030 RBC TD Securities

10:59 0.310 10,000 +0.030 RBC TD Securities

10:59 0.310 9,500 +0.030 RBC Desjardins

schon erstaunlich, so kurz vorm WE solch rally

zu sehen.......

Time Price Shares $ Change Buyer Seller

12:21 0.320 7,500 +0.040 TD Securities TD Securities

12:21 0.320 6,500 +0.040 TD Securities TD Securities

12:21 0.315 9,000 +0.035 TD Securities TD Securities

12:16 0.310 9,000 +0.030 TD Securities Bolder

12:03 0.310 2,000 +0.030 Interactive Bolder

12:03 0.310 8,000 +0.030 BMO Nesbitt Bolder

12:01 0.310 1,000 +0.030 TD Securities Bolder

12:00 0.310 10,000 +0.030 BMO Nesbitt Bolder

12:00 0.310 20,000 +0.030 TD Securities Bolder

11:54 0.320 2,000 +0.040 TD Securities TD Securities

inzwischen schon vol. von über 1,3 mio St.

zu sehen.......

Time Price Shares $ Change Buyer Seller

12:21 0.320 7,500 +0.040 TD Securities TD Securities

12:21 0.320 6,500 +0.040 TD Securities TD Securities

12:21 0.315 9,000 +0.035 TD Securities TD Securities

12:16 0.310 9,000 +0.030 TD Securities Bolder

12:03 0.310 2,000 +0.030 Interactive Bolder

12:03 0.310 8,000 +0.030 BMO Nesbitt Bolder

12:01 0.310 1,000 +0.030 TD Securities Bolder

12:00 0.310 10,000 +0.030 BMO Nesbitt Bolder

12:00 0.310 20,000 +0.030 TD Securities Bolder

11:54 0.320 2,000 +0.040 TD Securities TD Securities

inzwischen schon vol. von über 1,3 mio St.

Antwort auf Beitrag Nr.: 32.167.003 von hbg55 am 26.10.07 18:45:25Ja schon gut, nur leider jetzt wieder auf dem Rückzug.

Aber bin mal wieder zufrieden, wenn wir über 0,30 Can$ schließen und dann endlich mal auf die 0,35 zusteuern würden.

Aber bin mal wieder zufrieden, wenn wir über 0,30 Can$ schließen und dann endlich mal auf die 0,35 zusteuern würden.

Time Price Shares $ Change Buyer Seller

09:48 0.320 23,000 +0.020 RBC BMO Nesbitt

09:48 0.320 2,500 +0.020 RBC CIBC

09:48 0.315 4,500 +0.015 RBC Bolder

09:46 0.315 30,000 +0.015 RBC Bolder

09:43 0.315 500 +0.015 Interactive Bolder

09:43 0.305 500 +0.005 Interactive Scotia

09:43 0.310 4,500 +0.010 BMO Nesbitt Scotia

09:40 0.310 5,000 +0.010 BMO Nesbitt Desjardins

09:39 0.320 5,000 +0.020 Desjardins CIBC

09:39 0.310 500 +0.010 BMO Nesbitt Desjardins

09:48 0.320 23,000 +0.020 RBC BMO Nesbitt

09:48 0.320 2,500 +0.020 RBC CIBC

09:48 0.315 4,500 +0.015 RBC Bolder

09:46 0.315 30,000 +0.015 RBC Bolder

09:43 0.315 500 +0.015 Interactive Bolder

09:43 0.305 500 +0.005 Interactive Scotia

09:43 0.310 4,500 +0.010 BMO Nesbitt Scotia

09:40 0.310 5,000 +0.010 BMO Nesbitt Desjardins

09:39 0.320 5,000 +0.020 Desjardins CIBC

09:39 0.310 500 +0.010 BMO Nesbitt Desjardins

Antwort auf Beitrag Nr.: 32.189.584 von hbg55 am 29.10.07 15:16:21Also ich bin jedesmal gespannt, wenn ich abend heim komm und nach unserer Searchgold schau,

Und was denn wieder keine Ergebnisse der restlichen Bohrlöcher.

Lang kanns ja nemmer dauern bin aber 100% überzeugt von RSG.

Wenn wir dann auch so abheben wie NFX in den letzten Tagen na dann .

.

Grüße Bebibu

Und was denn wieder keine Ergebnisse der restlichen Bohrlöcher.

Lang kanns ja nemmer dauern bin aber 100% überzeugt von RSG.

Wenn wir dann auch so abheben wie NFX in den letzten Tagen na dann

.

.Grüße Bebibu

auch wenn heute keine news kommen sollten (was ich aber nicht glaube), rechne ich mit erhöhtem umsatz.

beruhigend sind die insidertrades, welche allesamt käufe sind

Searchgold Resources Inc. (RSG)

As of October 28th, 2007

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Sep 12/07 Sep 04/07 Nannan, Jean Direct Ownership Options 50 - Grant of options 200,000 $0.150

Sep 12/07 Sep 04/07 Baril, Florent Direct Ownership Options 50 - Grant of options 100,000 $0.150

Sep 12/07 Sep 04/07 Goossens, Pierre J. Direct Ownership Options 50 - Grant of options 100,000 $0.150

Sep 12/07 Feb 28/07 Goossens, Pierre J. Direct Ownership Options 00 - Opening Balance-Initial SEDI Report

Sep 12/07 Sep 04/07 Tremblay, Denis Direct Ownership Options 50 - Grant of options 500,000 $0.150

Sep 12/07 Sep 04/07 Giaro, Philippe Direct Ownership Options 50 - Grant of options 1,000,000 $0.150

Sep 12/07 Sep 10/07 Giaro, Philippe Direct Ownership Common Shares 10 - Acquisition in the public market 30,000 $0.165

Aug 15/07 Aug 15/07 Tremblay, Denis Indirect Ownership Common Shares 10 - Acquisition in the public market 6,000 $0.125

Aug 15/07 Aug 15/07 Tremblay, Denis Indirect Ownership Common Shares 10 - Acquisition in the public market 4,000 $0.120

Aug 14/07 Aug 09/07 Tremblay, Denis Indirect Ownership Common Shares 10 - Acquisition in the public market 9,000 $0.155

beruhigend sind die insidertrades, welche allesamt käufe sind

Searchgold Resources Inc. (RSG)

As of October 28th, 2007

Filing Date Transaction Date Insider Name Ownership Type Securities Nature of transaction # or value acquired or disposed of Unit Price

Sep 12/07 Sep 04/07 Nannan, Jean Direct Ownership Options 50 - Grant of options 200,000 $0.150

Sep 12/07 Sep 04/07 Baril, Florent Direct Ownership Options 50 - Grant of options 100,000 $0.150

Sep 12/07 Sep 04/07 Goossens, Pierre J. Direct Ownership Options 50 - Grant of options 100,000 $0.150

Sep 12/07 Feb 28/07 Goossens, Pierre J. Direct Ownership Options 00 - Opening Balance-Initial SEDI Report

Sep 12/07 Sep 04/07 Tremblay, Denis Direct Ownership Options 50 - Grant of options 500,000 $0.150

Sep 12/07 Sep 04/07 Giaro, Philippe Direct Ownership Options 50 - Grant of options 1,000,000 $0.150

Sep 12/07 Sep 10/07 Giaro, Philippe Direct Ownership Common Shares 10 - Acquisition in the public market 30,000 $0.165

Aug 15/07 Aug 15/07 Tremblay, Denis Indirect Ownership Common Shares 10 - Acquisition in the public market 6,000 $0.125

Aug 15/07 Aug 15/07 Tremblay, Denis Indirect Ownership Common Shares 10 - Acquisition in the public market 4,000 $0.120

Aug 14/07 Aug 09/07 Tremblay, Denis Indirect Ownership Common Shares 10 - Acquisition in the public market 9,000 $0.155

Das mit den Insiderkäufen sehe ich im Moment eher skeptisch.

Es handelt sich hiebei um Aktienoptionen, die Ende August/Anfang September an die Boardmitglieder ausgegeben wurden.

Haltefrist 4 Monate - also Ausübung Anfang 2008, sollte es also zu steigenden Kursen durch News etc. zum Jahresende kommen und daraufhin zu massiven Insiderverkäufen zu Jahresbeginn würde ich mir ziemlich vera... vorkommen. Ich hoffe das dem nicht so ist. Der Kursverlauf und die Nachrichtenlage ist im Moment allerdings enttäuschend, andere Juniorminers erleben gerade den Durchbruch (NFX).

Es handelt sich hiebei um Aktienoptionen, die Ende August/Anfang September an die Boardmitglieder ausgegeben wurden.

Haltefrist 4 Monate - also Ausübung Anfang 2008, sollte es also zu steigenden Kursen durch News etc. zum Jahresende kommen und daraufhin zu massiven Insiderverkäufen zu Jahresbeginn würde ich mir ziemlich vera... vorkommen. Ich hoffe das dem nicht so ist. Der Kursverlauf und die Nachrichtenlage ist im Moment allerdings enttäuschend, andere Juniorminers erleben gerade den Durchbruch (NFX).

leichtgrün gings auch gestern bei RSG ausm handel ........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:50:44 V 0.30 +0.01 5,000 1 Anonymous 1 Anonymous K

15:50:44 V 0.295 +0.005 5,000 1 Anonymous 1 Anonymous K

15:49:19 V 0.29 - 5,000 1 Anonymous 5 Penson K

15:48:30 V 0.29 - 3,500 80 National Bank 7 TD Sec K

15:48:11 V 0.27 - 300 36 Latimer 2 RBC E

15:48:11 V 0.29 - 1,000 80 National Bank 2 RBC K

15:48:02 V 0.29 - 500 80 National Bank 1 Anonymous K

15:47:34 V 0.265 -0.005 200 36 Latimer 2 RBC E

15:47:34 V 0.285 -0.005 1,000 2 RBC 2 RBC K

15:47:34 V 0.29 - 500 19 Desjardins 2 RBC K

und wird hoff. heute weiter ausgebaut !!

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:50:44 V 0.30 +0.01 5,000 1 Anonymous 1 Anonymous K

15:50:44 V 0.295 +0.005 5,000 1 Anonymous 1 Anonymous K

15:49:19 V 0.29 - 5,000 1 Anonymous 5 Penson K

15:48:30 V 0.29 - 3,500 80 National Bank 7 TD Sec K

15:48:11 V 0.27 - 300 36 Latimer 2 RBC E

15:48:11 V 0.29 - 1,000 80 National Bank 2 RBC K

15:48:02 V 0.29 - 500 80 National Bank 1 Anonymous K

15:47:34 V 0.265 -0.005 200 36 Latimer 2 RBC E

15:47:34 V 0.285 -0.005 1,000 2 RBC 2 RBC K

15:47:34 V 0.29 - 500 19 Desjardins 2 RBC K

und wird hoff. heute weiter ausgebaut !!

........der kampf um die 0,30 hält unvermindert an

Und wieder sind wir bei 0,30 angelangt.

Diese Woche wirds wohl nix mehr mit News.

Weiß jemand was die Candis in ihren Foren so über RSG schreiben?

Hoffentlich geht bei uns auch bald mal die Post ab.

Grüße Bebibu

Diese Woche wirds wohl nix mehr mit News.

Weiß jemand was die Candis in ihren Foren so über RSG schreiben?

Hoffentlich geht bei uns auch bald mal die Post ab.

Grüße Bebibu

SearchGold Resources Inc.

TSX VENTURE: RSG

FRANKFURT: S1O

Other Recent News

November 1, 2007

SearchGold to Create a New Mining Vehicle for Gold in Canada and to Distribute Shares of Golden Share Mining Corporation to SearchGold Shareholders

MONTREAL, QUEBEC--(Marketwire - Nov. 1, 2007) - NOT FOR DISTRIBUTION ON U.S. NEWSWIRE SERVICES OF FOR DISSEMINATION IN THE UNITED STATES.

SearchGold Resources Inc. (TSX VENTURE:RSG)(FRANKFURT:S1O) is pleased to announce that its Board of Directors has approved the distribution by SearchGold to its shareholders of common shares of Golden Share Mining Corporation ("Golden Share") held by SearchGold. Golden Share is currently a wholly-owned subsidiary of SearchGold.

The purpose of the distribution is to make Golden Share a public company. Golden Share will focus on exploration principally for gold in Canada, while SearchGold will continue to focus on the development of its African projects. Golden Share's initial property portfolio will comprise six properties. The Lac Fortune West and Belleterre Project properties (Lac Chevrier and Blondeau-Guillet) will be acquired by Golden Share from SearchGold as part of the spin-off business plan. Moreover, Golden Share has acquired three new properties; the Forsan, Elwood and Malartic Lakeshore properties. A brief description of these three latest properties is given in the current press release.

Philippe Giaro, President and CEO of SearchGold, stated, "This gold spin-off, combined with the recent gold intersection of 16.39 g/t Au over 49.50 m from 133.00 m to 182.50 m in hole BA-06-36 on our Bakoudou Gold Project, as announced in a press release dated September 19th 2007, are important steps in SearchGold's growth strategy. We are very pleased with this decision as it will allow SearchGold to focus on the advancement of the Bakoudou Gold Project in partnership with Managem in Gabon as well as on its other African Projects."

The distribution by SearchGold of a portion of its Golden Share shares will be effected by way of dividend to SearchGold's shareholders and will not affect SearchGold's issued and outstanding shares. SearchGold should set a record date for the distribution shortly. SearchGold's shareholders of record at the close of business on the distribution record date will be entitled to receive Golden Share shares. SearchGold will issue a press release announcing the dividend record date and distribution date once they are determined. Each SearchGold shareholder will receive approximately one common share of Golden Share for every twenty shares of SearchGold held. This distribution ratio could change as a function of eventual additional SearchGold share emissions between now and the Golden Share dividend distribution date. There are currently 125,850,171 common shares of SearchGold issued and outstanding.

Golden Share intends to file a prospectus with a number of Canadian provincial securities commissions in order to raise somewhere between 2.5 and 4.5 million dollars and to qualify the distribution of the shares to SearchGold's shareholders under securities laws. Canaccord Capital Corporation will be the agent for the initial public offering. The prospectus will provide a full description of Golden Share, including its management, properties and proposed exploration program. Golden Share also intends to raise funds through one or more private financings.

The distribution of the Golden Share shares to SearchGold's shareholders is subject to regulatory approval.

Golden Share will be an exploration mining company focused primarily on gold in Canada. As a spin-off of SearchGold, Golden Share will beneficiate from SearchGold's expertise at the corporate, technical and promotional level. The Company's initial property portfolio will comprise six properties as presented below.

Forsan Property

The Forsan property is located 45 km east of the town of Val d'Or, Quebec, Canada. It consists in 50 claims for a total property surface area of 800 hectares. As of October 5th 2007, Golden Share holds an option to acquire a 100% interest over 3 years by paying the Vendor a total of $125,000; issuing 1,200,000 shares and incurring a total of $500,000 in exploration expenditures. An additional 800,000 shares can be issued at any time in the event that measured and indicated resources representing a metal content of 500,000 ounces of gold or more can be defined; a first tranche of 400,000 shares would be issued when a first threshold of 250,000 ounces of gold is achieved.

The gold mineralization is directly associated with quartz veins and the principal showing is the Forsan mineralized occurrence which is hosted by the contact between a mafic agglomerate unit and a porphyry dyke in the vicinity of northeast trending diabase dyke.

The property has been the object of sufficient work to establish an historical resource estimate that stands at 282,605 metric tonnes at a grade of 4.42 g/t Au (Exploration Norwood Inc, Exploration Oz Inc., Exxeter Resources Corp., Rapport de travaux d'exploration 1987-88, Projet Exxeter #459., Perron. L, Morin R., 1988). This estimate dates from 1988, prior to the introduction of National Instrument 43-101, and should therefore be treated as historical data. Golden Share will perform additional drilling to establish a NI 43-101 compliant resource estimate. In addition, Golden Share will target sub-vertical auriferous shears zones and auriferous disseminated sulfides that have not been systematically evaluated as most of the historical work centered on low angle quartz veins. Finally, Golden Share will also target additional porphyry bodies elsewhere on the property that have not been properly investigated in the light of the specific relationship between the gold mineralization and this particular lithology.

Elwood Property

The Elwood property is located 70 km west of the city of Thunder Bay, Ontario, Canada. It consists in 21 mining titles covering 2,208 hectares. As of October 5th 2007, Golden Share holds an option to acquire a 100% interest over 4 years by paying the Vendors a total of $230,000; issuing a number of shares representing an equivalent value of $210,000 according to market price at the time of each of the three installments and by incurring a total of $150,000 in exploration expenditures before December 31st 2008. In addition Golden Share will issue 1,440,000 shares to a private company that initially secured the Elwood option.

The Elwood property shows several important, undeveloped gold showings associated with granodiorite dykes and/or sills hosted in a typical volcanic sequence. A rock competency contrast resulted in the brittle behavior of the granodiorite and the development of important quartz stockwork and veins arrays where important surface gold grades of up to 180.62 g/t Au were obtained from punctual surface rock sampling (AFRI 52B09SE0031, Fournier E., 1995).

The main previous operator was INCO which followed upon previous gold discoveries (Penziwol Af-U area) and discovered additional auriferous occurrences. Limited exploration has been performed and a thorough systematic approach will be implemented by Golden Share with the two foremost objectives being to fully delineate the high grade gold stockwork zones as well as assess the bulk tonnage potential of the granodiorite.

Malartic Lakeshore Property

The Malartic Lakeshore property is located 20 km west of the town of Val d'Or, Quebec, Canada. It consists in 22 claims for a total property surface area of 962 hectares. As of October 5th 2007, Golden Share holds an option to acquire a 100% interest over 3 years by paying the Vendors a total of $30,000; issuing 450,000 shares and incurring a total of $250,000 in exploration expenditures. An additional 300,000 shares can be issued at any time in the event that measured and indicated resources representing a metal content of 500,000 ounces of gold or more can be defined; a first tranche of 150,000 shares would be issued when a first threshold of 250,000 ounces of gold is achieved.

The property is strategically located between Agnico Eagle's new Lapa mine, located 5 km to the west, and the past producing Norlartic and Marban mines located 6 km to the east. The Lapa mine is now under construction with initial production expected in late 2008. Osisko's Canadian Malartic project is located 6 km due south of the Malartic Lakeshore property.

The gold mineralization is found in quartz-carbonate veins associated with a major shear zone hosted in the mafic and ultramafic units of the Dubuisson Formation. Two of the numerous veins present on the property were the object of more intense work and intersections of 9.60 g/t Au over 4.57 m and 8.10 g/t Au over 2.13 m were obtained in previous drilling programs (Rapport de travaux 2003, Propriete Malartic, Geologica Inc., Beauregard A.J., Gaudreault D., 2003). Given the number of recorded shear zones and veins, a thorough systematic approach will be implemented to fully develop the potential of the property.

Lac Fortune West and Belleterre Project properties

The Lac Fortune West and Belleterre Project properties (Lac Chevrier and Blondeau-Guillet) will be acquired by Golden Share from SearchGold as part of the spin-off business plan.

Source of information and verification

Each of the three properties recently acquired by Golden Share (Forsan, Elwood and Malartic Lakeshore) were visited and evaluated by Philippe Giaro, P. Geol., President of Golden Share. Recent 43-101 technical reports dated October 6 and 8, 2007 have been executed for Golden Share on all three properties by Jeannot Theberge, P. Geol. and qualified person with respect to each of the properties in accordance with NI 43-101. All technical information contained in the present release was obtained form such NI 43-101 technical reports and was verified by either Jeannot Theberge (Forsan and Elwood properties) or Philippe Giaro (Malartic Lakeshore property).

Philippe Giaro, P.Geol., President of Golden Share and qualified person for Golden Share, has reviewed and approved the content of this release.

About SearchGold Resources Inc.

SearchGold Resources is a Canadian-based mining exploration company whose primary mission is to target, explore and develop gold deposits in Africa and in Canada. The expansion strategy executed in 2006 set the stage for the Company's development in 2007 that involves increasing activity on the new blue-sky properties and the advanced projects as well as some potential acquisitions.

Forward-looking Statements

This news release contains certain forward-looking statements, including statements about the distribution by SearchGold of the shares of Golden Share. These forward-looking statements are subject to a variety of risks and uncertainties beyond the ability of SearchGold and Golden Share to control or predict, which could cause actual events or results to differ materially from those anticipated in such forward-looking statements, including risks relating to the parties' ability to complete the transaction and to obtain the necessary approvals, and other risks disclosed in filings with the Canadian securities regulators made by SearchGold. Accordingly, readers should not place undue reliance on forward-looking statements.

If you would like to receive press releases via e-mail please contact: info@SearchGold.ca

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

CONTACT INFORMATION:

SearchGold Resources Inc.

Philippe Giaro

President & CEO

32-473-52-30-29

phgiaro@skynet.be

or

SearchGold Resources Inc.

Denis Tremblay

Vice-President

514-866-4224

info@SearchGold.ca

http://www.SearchGold.ca

or

CHF Investor Relations

Alison Tullis, Account Manager

416-868-1079 x233

alison@chfir.com

INDUSTRY: Manufacturing and Production - Mining and Metals

TSX VENTURE: RSG

FRANKFURT: S1O

Other Recent News

November 1, 2007

SearchGold to Create a New Mining Vehicle for Gold in Canada and to Distribute Shares of Golden Share Mining Corporation to SearchGold Shareholders

MONTREAL, QUEBEC--(Marketwire - Nov. 1, 2007) - NOT FOR DISTRIBUTION ON U.S. NEWSWIRE SERVICES OF FOR DISSEMINATION IN THE UNITED STATES.

SearchGold Resources Inc. (TSX VENTURE:RSG)(FRANKFURT:S1O) is pleased to announce that its Board of Directors has approved the distribution by SearchGold to its shareholders of common shares of Golden Share Mining Corporation ("Golden Share") held by SearchGold. Golden Share is currently a wholly-owned subsidiary of SearchGold.

The purpose of the distribution is to make Golden Share a public company. Golden Share will focus on exploration principally for gold in Canada, while SearchGold will continue to focus on the development of its African projects. Golden Share's initial property portfolio will comprise six properties. The Lac Fortune West and Belleterre Project properties (Lac Chevrier and Blondeau-Guillet) will be acquired by Golden Share from SearchGold as part of the spin-off business plan. Moreover, Golden Share has acquired three new properties; the Forsan, Elwood and Malartic Lakeshore properties. A brief description of these three latest properties is given in the current press release.

Philippe Giaro, President and CEO of SearchGold, stated, "This gold spin-off, combined with the recent gold intersection of 16.39 g/t Au over 49.50 m from 133.00 m to 182.50 m in hole BA-06-36 on our Bakoudou Gold Project, as announced in a press release dated September 19th 2007, are important steps in SearchGold's growth strategy. We are very pleased with this decision as it will allow SearchGold to focus on the advancement of the Bakoudou Gold Project in partnership with Managem in Gabon as well as on its other African Projects."

The distribution by SearchGold of a portion of its Golden Share shares will be effected by way of dividend to SearchGold's shareholders and will not affect SearchGold's issued and outstanding shares. SearchGold should set a record date for the distribution shortly. SearchGold's shareholders of record at the close of business on the distribution record date will be entitled to receive Golden Share shares. SearchGold will issue a press release announcing the dividend record date and distribution date once they are determined. Each SearchGold shareholder will receive approximately one common share of Golden Share for every twenty shares of SearchGold held. This distribution ratio could change as a function of eventual additional SearchGold share emissions between now and the Golden Share dividend distribution date. There are currently 125,850,171 common shares of SearchGold issued and outstanding.

Golden Share intends to file a prospectus with a number of Canadian provincial securities commissions in order to raise somewhere between 2.5 and 4.5 million dollars and to qualify the distribution of the shares to SearchGold's shareholders under securities laws. Canaccord Capital Corporation will be the agent for the initial public offering. The prospectus will provide a full description of Golden Share, including its management, properties and proposed exploration program. Golden Share also intends to raise funds through one or more private financings.

The distribution of the Golden Share shares to SearchGold's shareholders is subject to regulatory approval.

Golden Share will be an exploration mining company focused primarily on gold in Canada. As a spin-off of SearchGold, Golden Share will beneficiate from SearchGold's expertise at the corporate, technical and promotional level. The Company's initial property portfolio will comprise six properties as presented below.

Forsan Property

The Forsan property is located 45 km east of the town of Val d'Or, Quebec, Canada. It consists in 50 claims for a total property surface area of 800 hectares. As of October 5th 2007, Golden Share holds an option to acquire a 100% interest over 3 years by paying the Vendor a total of $125,000; issuing 1,200,000 shares and incurring a total of $500,000 in exploration expenditures. An additional 800,000 shares can be issued at any time in the event that measured and indicated resources representing a metal content of 500,000 ounces of gold or more can be defined; a first tranche of 400,000 shares would be issued when a first threshold of 250,000 ounces of gold is achieved.

The gold mineralization is directly associated with quartz veins and the principal showing is the Forsan mineralized occurrence which is hosted by the contact between a mafic agglomerate unit and a porphyry dyke in the vicinity of northeast trending diabase dyke.

The property has been the object of sufficient work to establish an historical resource estimate that stands at 282,605 metric tonnes at a grade of 4.42 g/t Au (Exploration Norwood Inc, Exploration Oz Inc., Exxeter Resources Corp., Rapport de travaux d'exploration 1987-88, Projet Exxeter #459., Perron. L, Morin R., 1988). This estimate dates from 1988, prior to the introduction of National Instrument 43-101, and should therefore be treated as historical data. Golden Share will perform additional drilling to establish a NI 43-101 compliant resource estimate. In addition, Golden Share will target sub-vertical auriferous shears zones and auriferous disseminated sulfides that have not been systematically evaluated as most of the historical work centered on low angle quartz veins. Finally, Golden Share will also target additional porphyry bodies elsewhere on the property that have not been properly investigated in the light of the specific relationship between the gold mineralization and this particular lithology.

Elwood Property

The Elwood property is located 70 km west of the city of Thunder Bay, Ontario, Canada. It consists in 21 mining titles covering 2,208 hectares. As of October 5th 2007, Golden Share holds an option to acquire a 100% interest over 4 years by paying the Vendors a total of $230,000; issuing a number of shares representing an equivalent value of $210,000 according to market price at the time of each of the three installments and by incurring a total of $150,000 in exploration expenditures before December 31st 2008. In addition Golden Share will issue 1,440,000 shares to a private company that initially secured the Elwood option.

The Elwood property shows several important, undeveloped gold showings associated with granodiorite dykes and/or sills hosted in a typical volcanic sequence. A rock competency contrast resulted in the brittle behavior of the granodiorite and the development of important quartz stockwork and veins arrays where important surface gold grades of up to 180.62 g/t Au were obtained from punctual surface rock sampling (AFRI 52B09SE0031, Fournier E., 1995).

The main previous operator was INCO which followed upon previous gold discoveries (Penziwol Af-U area) and discovered additional auriferous occurrences. Limited exploration has been performed and a thorough systematic approach will be implemented by Golden Share with the two foremost objectives being to fully delineate the high grade gold stockwork zones as well as assess the bulk tonnage potential of the granodiorite.

Malartic Lakeshore Property

The Malartic Lakeshore property is located 20 km west of the town of Val d'Or, Quebec, Canada. It consists in 22 claims for a total property surface area of 962 hectares. As of October 5th 2007, Golden Share holds an option to acquire a 100% interest over 3 years by paying the Vendors a total of $30,000; issuing 450,000 shares and incurring a total of $250,000 in exploration expenditures. An additional 300,000 shares can be issued at any time in the event that measured and indicated resources representing a metal content of 500,000 ounces of gold or more can be defined; a first tranche of 150,000 shares would be issued when a first threshold of 250,000 ounces of gold is achieved.

The property is strategically located between Agnico Eagle's new Lapa mine, located 5 km to the west, and the past producing Norlartic and Marban mines located 6 km to the east. The Lapa mine is now under construction with initial production expected in late 2008. Osisko's Canadian Malartic project is located 6 km due south of the Malartic Lakeshore property.

The gold mineralization is found in quartz-carbonate veins associated with a major shear zone hosted in the mafic and ultramafic units of the Dubuisson Formation. Two of the numerous veins present on the property were the object of more intense work and intersections of 9.60 g/t Au over 4.57 m and 8.10 g/t Au over 2.13 m were obtained in previous drilling programs (Rapport de travaux 2003, Propriete Malartic, Geologica Inc., Beauregard A.J., Gaudreault D., 2003). Given the number of recorded shear zones and veins, a thorough systematic approach will be implemented to fully develop the potential of the property.

Lac Fortune West and Belleterre Project properties

The Lac Fortune West and Belleterre Project properties (Lac Chevrier and Blondeau-Guillet) will be acquired by Golden Share from SearchGold as part of the spin-off business plan.

Source of information and verification

Each of the three properties recently acquired by Golden Share (Forsan, Elwood and Malartic Lakeshore) were visited and evaluated by Philippe Giaro, P. Geol., President of Golden Share. Recent 43-101 technical reports dated October 6 and 8, 2007 have been executed for Golden Share on all three properties by Jeannot Theberge, P. Geol. and qualified person with respect to each of the properties in accordance with NI 43-101. All technical information contained in the present release was obtained form such NI 43-101 technical reports and was verified by either Jeannot Theberge (Forsan and Elwood properties) or Philippe Giaro (Malartic Lakeshore property).

Philippe Giaro, P.Geol., President of Golden Share and qualified person for Golden Share, has reviewed and approved the content of this release.

About SearchGold Resources Inc.

SearchGold Resources is a Canadian-based mining exploration company whose primary mission is to target, explore and develop gold deposits in Africa and in Canada. The expansion strategy executed in 2006 set the stage for the Company's development in 2007 that involves increasing activity on the new blue-sky properties and the advanced projects as well as some potential acquisitions.

Forward-looking Statements

This news release contains certain forward-looking statements, including statements about the distribution by SearchGold of the shares of Golden Share. These forward-looking statements are subject to a variety of risks and uncertainties beyond the ability of SearchGold and Golden Share to control or predict, which could cause actual events or results to differ materially from those anticipated in such forward-looking statements, including risks relating to the parties' ability to complete the transaction and to obtain the necessary approvals, and other risks disclosed in filings with the Canadian securities regulators made by SearchGold. Accordingly, readers should not place undue reliance on forward-looking statements.

If you would like to receive press releases via e-mail please contact: info@SearchGold.ca

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

CONTACT INFORMATION:

SearchGold Resources Inc.

Philippe Giaro

President & CEO

32-473-52-30-29

phgiaro@skynet.be

or

SearchGold Resources Inc.

Denis Tremblay

Vice-President

514-866-4224

info@SearchGold.ca

http://www.SearchGold.ca

or

CHF Investor Relations

Alison Tullis, Account Manager

416-868-1079 x233

alison@chfir.com

INDUSTRY: Manufacturing and Production - Mining and Metals

Antwort auf Beitrag Nr.: 32.247.137 von Bebibu am 02.11.07 06:11:11

thx BEBIBU

infos beinhalten zwar nicht die ersehnten

bohr- ergeb. jedoch eine WACHRÜTTELNDE info

des geplanten spin-offs von GOLDEN SHARE MIN.

im verhältnis 20: 1 !!!

kann dem mehr pos. denn neg. abgewinnen und

vernehme in ersten reaktionen in CAN ähnliches.

aber bekanntlich entscheiden ja ´die märkte´

darüber und bis zur eröffnung sollten wir

noch int. stunden sehen !!

thx BEBIBU

infos beinhalten zwar nicht die ersehnten

bohr- ergeb. jedoch eine WACHRÜTTELNDE info

des geplanten spin-offs von GOLDEN SHARE MIN.

im verhältnis 20: 1 !!!

kann dem mehr pos. denn neg. abgewinnen und

vernehme in ersten reaktionen in CAN ähnliches.

aber bekanntlich entscheiden ja ´die märkte´

darüber und bis zur eröffnung sollten wir

noch int. stunden sehen !!

mal sehen wie der markt reagiert. denke aber dass es nicht wirklich viel am sp ändert.

jedoch ist jetzt klar dass sie mit dem spin off die letzte zeit sehr beschäftigt waren. das könnte auch erklären, warum die bohrergebnisse sich verzögern. möchte noch einen interessanten stockhouse beitrag mitschicken:

I got a reply to my questions and they are proceeding with drilling on Zone A as we wait for drill results. I was hoping that they would be proceeding to drill the sh*t out of it knowing they got something.

Hi Doug,

In response to your questions,

1) Yes they are drilling the area;

2) 2 drills are operating

3) An update press release will follow on Mandiana

4) Managem has to provide us with a feasibility Study by year-end, we should mine gold within the next 12 to 15 months

Thank you for your interest in SearchGold

Denis Tremblay

VP

jedoch ist jetzt klar dass sie mit dem spin off die letzte zeit sehr beschäftigt waren. das könnte auch erklären, warum die bohrergebnisse sich verzögern. möchte noch einen interessanten stockhouse beitrag mitschicken:

I got a reply to my questions and they are proceeding with drilling on Zone A as we wait for drill results. I was hoping that they would be proceeding to drill the sh*t out of it knowing they got something.

Hi Doug,

In response to your questions,

1) Yes they are drilling the area;

2) 2 drills are operating

3) An update press release will follow on Mandiana

4) Managem has to provide us with a feasibility Study by year-end, we should mine gold within the next 12 to 15 months

Thank you for your interest in SearchGold

Denis Tremblay

VP

Antwort auf Beitrag Nr.: 32.249.517 von hbg55 am 02.11.07 09:40:22

.....nunja, wie soll man heutige reaktion

der inv. deuten......würde sagen unentschlossen

und zurückhaltend..........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:16 V 0.285 -0.015 500 88 E-TRADE 7 TD Sec K

15:59:16 V 0.285 -0.015 500 1 Anonymous 7 TD Sec K

15:49:05 V 0.29 -0.01 2,500 79 CIBC 19 Desjardins K

15:40:17 V 0.295 -0.005 500 1 Anonymous 7 TD Sec K

15:40:06 V 0.29 -0.01 2,000 79 CIBC 33 Canaccord K

15:39:37 V 0.315 -0.005 400 7 TD Sec 36 Latimer E

15:39:37 V 0.295 -0.005 2,500 7 TD Sec 7 TD Sec K

15:37:39 V 0.29 -0.01 5,500 79 CIBC 33 Canaccord K

15:37:39 V 0.29 -0.01 8,000 19 Desjardins 33 Canaccord K

15:32:04 V 0.29 -0.01 5,000 19 Desjardins 2 RBC K

......die next week wird dann deff. klarheit verschaffen !!!

da kommt das WE jetzt grad ganz gelegen

.....nunja, wie soll man heutige reaktion

der inv. deuten......würde sagen unentschlossen

und zurückhaltend..........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:16 V 0.285 -0.015 500 88 E-TRADE 7 TD Sec K

15:59:16 V 0.285 -0.015 500 1 Anonymous 7 TD Sec K

15:49:05 V 0.29 -0.01 2,500 79 CIBC 19 Desjardins K

15:40:17 V 0.295 -0.005 500 1 Anonymous 7 TD Sec K

15:40:06 V 0.29 -0.01 2,000 79 CIBC 33 Canaccord K

15:39:37 V 0.315 -0.005 400 7 TD Sec 36 Latimer E

15:39:37 V 0.295 -0.005 2,500 7 TD Sec 7 TD Sec K

15:37:39 V 0.29 -0.01 5,500 79 CIBC 33 Canaccord K

15:37:39 V 0.29 -0.01 8,000 19 Desjardins 33 Canaccord K

15:32:04 V 0.29 -0.01 5,000 19 Desjardins 2 RBC K

......die next week wird dann deff. klarheit verschaffen !!!

da kommt das WE jetzt grad ganz gelegen

wers noch abissl techn. aufbereitet haben möchte, dem

sei nachfolg. interpr. eines CAN- users empfohlen....

Nee das glaub ich jetzt kaum mit 50St um 19,5%

mit 50St um 19,5%

hochgetaxt in FFM

Gruß aaahhh

mit 50St um 19,5%

mit 50St um 19,5%hochgetaxt in FFM

Gruß aaahhh

12 Euro Umsatz "WOW"  - das lässt das Depot "glänzen".

- das lässt das Depot "glänzen".

Die Cans haben's auch schon gesehen und freuen sich über einen 20%-Jump

- das lässt das Depot "glänzen".

- das lässt das Depot "glänzen".Die Cans haben's auch schon gesehen und freuen sich über einen 20%-Jump

Antwort auf Beitrag Nr.: 32.290.271 von roycalero am 05.11.07 13:39:10

jaaaa herrlich - HEUTE legen wir mal schöööön vor

jaaaa herrlich - HEUTE legen wir mal schöööön vor

Antwort auf Beitrag Nr.: 32.290.803 von hbg55 am 05.11.07 14:06:12sorry, konnte einfach nicht widerstehen, mit ein paar Oiro Umsatz

die Performance hochzuziehen...

Gruss

Beuer

die Performance hochzuziehen...

Gruss

Beuer

Time Ex Price Change Volume Buyer Seller Markers

15:30:15 V 0.29 +0.005 3,000 7 TD Sec 80 National Bank K

15:24:20 V 0.29 +0.005 4,500 2 RBC 1 Anonymous K

15:11:34 V 0.29 +0.005 2,000 7 TD Sec 1 Anonymous K

15:08:51 V 0.29 +0.005 3,500 9 BMO Nesbitt 1 Anonymous K

15:08:51 V 0.29 +0.005 2,500 9 BMO Nesbitt 7 TD Sec K

14:59:02 V 0.285 - 8,000 1 Anonymous 7 TD Sec K

14:22:42 V 0.285 - 5,500 1 Anonymous 79 CIBC K

14:22:42 V 0.285 - 4,500 7 TD Sec 79 CIBC K

14:20:43 V 0.29 +0.005 7,500 85 Scotia 7 TD Sec K

13:53:15 V 0.285 - 10,000 7 TD Sec 9 BMO Nesbitt K

15:30:15 V 0.29 +0.005 3,000 7 TD Sec 80 National Bank K

15:24:20 V 0.29 +0.005 4,500 2 RBC 1 Anonymous K

15:11:34 V 0.29 +0.005 2,000 7 TD Sec 1 Anonymous K

15:08:51 V 0.29 +0.005 3,500 9 BMO Nesbitt 1 Anonymous K

15:08:51 V 0.29 +0.005 2,500 9 BMO Nesbitt 7 TD Sec K

14:59:02 V 0.285 - 8,000 1 Anonymous 7 TD Sec K

14:22:42 V 0.285 - 5,500 1 Anonymous 79 CIBC K

14:22:42 V 0.285 - 4,500 7 TD Sec 79 CIBC K

14:20:43 V 0.29 +0.005 7,500 85 Scotia 7 TD Sec K

13:53:15 V 0.285 - 10,000 7 TD Sec 9 BMO Nesbitt K

Antwort auf Beitrag Nr.: 32.302.998 von hbg55 am 06.11.07 08:20:14Hast Du eine Vorstellung, wann die nächsten BE kommen

könnten, nach der letzten News zu urteilen, müßte es

doch bald soweit sein

Gruß aaahhh

könnten, nach der letzten News zu urteilen, müßte es

doch bald soweit sein

Gruß aaahhh

Keiner mehr eine Meinung zum aktuellen Geschehen?

Ist ja auch eher zum vergessen, absolutes Trauerspiel!

Gruß aaahhh

Ist ja auch eher zum vergessen, absolutes Trauerspiel!

Gruß aaahhh

was willst du wissen ???

die antwort hast du doch schon erhalten; nämlich dass es keiner so richtig weiss. damit steigt auch die unsicherheit und einige in canada schaffen es tatsächlich den kurs wieder voll zu drücken. die psychologische wirkung ist schon extrem.

entscheidend ist jedoch, dass wir welche erhalten werden. und eines kann ich dir sagen: BALD !!!!!! und dann will doch jeder dabei sein. also entweder mitspielen an die story glauben oder aussteigen.

ich bleib sicher drinnen.

die antwort hast du doch schon erhalten; nämlich dass es keiner so richtig weiss. damit steigt auch die unsicherheit und einige in canada schaffen es tatsächlich den kurs wieder voll zu drücken. die psychologische wirkung ist schon extrem.

entscheidend ist jedoch, dass wir welche erhalten werden. und eines kann ich dir sagen: BALD !!!!!! und dann will doch jeder dabei sein. also entweder mitspielen an die story glauben oder aussteigen.

ich bleib sicher drinnen.

Antwort auf Beitrag Nr.: 32.356.777 von tonyjaa am 09.11.07 09:30:57An welche News denkst Du? Wann ist eigentlich mit Produktionsstart zu rechnen? Ich bin zufällig auf Searchgold aufmerksam geworden, weiss aber nicht recht, was ich von diesem Unternehmen halten soll. Die News bisher waren ja immer eher dürftig, bzw. die Reaktion auf die scheinbar gut aussehenden Meldungen ??? Danke.

ich ewarte weitere bohrergebnisse zu bakoudou!!!!

die letzten waren ja schon ein hammer. 49,50 m mit 16.39g /t!!!!!!

in dem bericht steht auch:

Two additional drill holes, BA-06-37 and BA-06-38, have intersected the mineralized structure south of the east-north-east trending fault and visible gold has also been observed in both instances. Samples of the mineralized zones intersected in these two holes are presently being analyzed.

weiters wird es ein spinoff von den canadischen liegenschaften geben:

Philippe Giaro, President and CEO of SearchGold, stated, "This gold spin-off, combined with the recent gold intersection of 16.39 g/t Au over 49.50 m from 133.00 m to 182.50 m in hole BA-06-36 on our Bakoudou Gold Project, as announced in a press release dated September 19th 2007, are important steps in SearchGold's growth strategy. We are very pleased with this decision as it will allow SearchGold to focus on the advancement of the Bakoudou Gold Project in partnership with Managem in Gabon as well as on its other African Projects."

und ein schönes mail von denis (aus dem stockhouse board)

Here's what you're looking for:

Here is an email a share holder received from Denis confirming a few things:

Dear Wil,

This selling is certainly uncalled for, I agree with you. This looks like capitulation selling to me, which in technical terms means that we are near the bottom ($0,20 ?). Panic selling is a sure way to lose money and don’t advise that you do that. I was just talking to one of our board member, Pierre J. Goossens, who was involved in the Mouria discovery in Mali which now holds 10,000,000 ounces of gold (RanGold) and he finds these results FANTASTIC! He said they didn’t have grades like that at the beginning. This is not the end of Mandiana, this is the Begining! We have more news in the pipeline, drilling results from Bakoudou should come out soon, we’re waiting for an update from Managem, our partner, on this. The last results from Bakoudou announced in March returned very solid grades :

the highlights of this recent round of drilling include:

36.94 grams per tonne gold over 1.65 metres;

15.82 grams per tonne gold over 2.60 metres;

15.40 grams per tonne gold over 2.95 metres;

8.77 grams per tonne gold over 16.05 metres;

7.65 grams per tonne gold over 12.10 metres;

3.35 grams per tonne gold over 14.25 metres;

2.10 grams per tonne gold over 17.00 metres; and

1.74 grams per tonne gold over 12.65 metres.

We’re confident that grades like that CAN be repeated. Bakoudou is going to be a producing mine within 12 months and I have not seen a stock with gold production, trading under $1.

Plus, we have other acquisitions in the pipeline and we have 2 M $ in the bank. We are building a $200 M Market Cap company and the last week did not change anything of that. This is the same company that traded at $0.43 5 weeks ago, that now trades at $0.22 with the same fundamentals.

We appreciate your support, feel free to write us again.

Best regards,

Denis Tremblay

VP-Searchgold

514-866-4224

das hier ist keine empfehlung. aber der kurs ist nach wie vor günstig !

gruss

tonyjaa

die letzten waren ja schon ein hammer. 49,50 m mit 16.39g /t!!!!!!

in dem bericht steht auch:

Two additional drill holes, BA-06-37 and BA-06-38, have intersected the mineralized structure south of the east-north-east trending fault and visible gold has also been observed in both instances. Samples of the mineralized zones intersected in these two holes are presently being analyzed.

weiters wird es ein spinoff von den canadischen liegenschaften geben:

Philippe Giaro, President and CEO of SearchGold, stated, "This gold spin-off, combined with the recent gold intersection of 16.39 g/t Au over 49.50 m from 133.00 m to 182.50 m in hole BA-06-36 on our Bakoudou Gold Project, as announced in a press release dated September 19th 2007, are important steps in SearchGold's growth strategy. We are very pleased with this decision as it will allow SearchGold to focus on the advancement of the Bakoudou Gold Project in partnership with Managem in Gabon as well as on its other African Projects."

und ein schönes mail von denis (aus dem stockhouse board)

Here's what you're looking for:

Here is an email a share holder received from Denis confirming a few things:

Dear Wil,

This selling is certainly uncalled for, I agree with you. This looks like capitulation selling to me, which in technical terms means that we are near the bottom ($0,20 ?). Panic selling is a sure way to lose money and don’t advise that you do that. I was just talking to one of our board member, Pierre J. Goossens, who was involved in the Mouria discovery in Mali which now holds 10,000,000 ounces of gold (RanGold) and he finds these results FANTASTIC! He said they didn’t have grades like that at the beginning. This is not the end of Mandiana, this is the Begining! We have more news in the pipeline, drilling results from Bakoudou should come out soon, we’re waiting for an update from Managem, our partner, on this. The last results from Bakoudou announced in March returned very solid grades :

the highlights of this recent round of drilling include:

36.94 grams per tonne gold over 1.65 metres;

15.82 grams per tonne gold over 2.60 metres;

15.40 grams per tonne gold over 2.95 metres;

8.77 grams per tonne gold over 16.05 metres;

7.65 grams per tonne gold over 12.10 metres;

3.35 grams per tonne gold over 14.25 metres;

2.10 grams per tonne gold over 17.00 metres; and

1.74 grams per tonne gold over 12.65 metres.

We’re confident that grades like that CAN be repeated. Bakoudou is going to be a producing mine within 12 months and I have not seen a stock with gold production, trading under $1.

Plus, we have other acquisitions in the pipeline and we have 2 M $ in the bank. We are building a $200 M Market Cap company and the last week did not change anything of that. This is the same company that traded at $0.43 5 weeks ago, that now trades at $0.22 with the same fundamentals.

We appreciate your support, feel free to write us again.

Best regards,

Denis Tremblay

VP-Searchgold

514-866-4224

das hier ist keine empfehlung. aber der kurs ist nach wie vor günstig !

gruss

tonyjaa

Antwort auf Beitrag Nr.: 32.357.419 von tonyjaa am 09.11.07 10:10:17Lieben Dank, na da schauen wir mal. Ich habe nämlich auch mal direkt zu denen gemailt. Bisher aber keine Antwort erhalten. Das finde ich nicht so angenehm.  . Charttechnisch ist es erstmal wieder schwierig.

. Charttechnisch ist es erstmal wieder schwierig.

. Charttechnisch ist es erstmal wieder schwierig.

. Charttechnisch ist es erstmal wieder schwierig.

moin RSG-lers........so lange wir keine news bekommen

stimme ich der einschätzung nachfolg. CAN- users zu:

SUBJECT: RE: TA AND CHART FOR RSG Posted By: techanal

Post Time: 11/8/2007 01:05

« Previous Message Next Message »

I don't usually disagree with what you say Zeta but the current chart is not very rosy. The RSI has broken below 50 and is heading down. The MACD is heading down. The Slow Stochastic, not shown, is heading down. The 20 day EMA was broken and is rolling over. We hit the 50 day EMA at .26 and if we break that we are heading to the 100 day EMA at .23. The only positive is the OBV, not shown, is holding fairly flat since the run up in late September. I don't like to knock a stock I own but I said 2 days ago we need news NOW, we didn't get it so this chart weakness is the result of no news. JMO

TA

.....fazit: RSG zzt spielball von techn. orientierten inv. - DENEN,

die an die story glauben, wie ich auch, bieten sich momentan kaum

vorgestellte nachleg- chancen !!!

stimme ich der einschätzung nachfolg. CAN- users zu:

SUBJECT: RE: TA AND CHART FOR RSG Posted By: techanal

Post Time: 11/8/2007 01:05

« Previous Message Next Message »

I don't usually disagree with what you say Zeta but the current chart is not very rosy. The RSI has broken below 50 and is heading down. The MACD is heading down. The Slow Stochastic, not shown, is heading down. The 20 day EMA was broken and is rolling over. We hit the 50 day EMA at .26 and if we break that we are heading to the 100 day EMA at .23. The only positive is the OBV, not shown, is holding fairly flat since the run up in late September. I don't like to knock a stock I own but I said 2 days ago we need news NOW, we didn't get it so this chart weakness is the result of no news. JMO

TA

.....fazit: RSG zzt spielball von techn. orientierten inv. - DENEN,

die an die story glauben, wie ich auch, bieten sich momentan kaum

vorgestellte nachleg- chancen !!!

hi hbg,

sehe das auch ähnlich. jedoch weiss man nie, wenn der sp anzieht. da sind doch wohl grössere fische am werk, denke ich

sehe das auch ähnlich. jedoch weiss man nie, wenn der sp anzieht. da sind doch wohl grössere fische am werk, denke ich

gibt offenbar doch mehrere investoren, die an die

RSG- story glauben.........wenn ich mir so den

heutigen kursverlauf betrachte mit SK von 0,265

seeehr nah am TH

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:59 V 0.265 +0.02 28,000 7 TD Sec 19 Desjardins K

15:57:26 V 0.27 +0.025 1,000 2 RBC 7 TD Sec K

15:51:43 V 0.26 +0.015 5,000 7 TD Sec 33 Canaccord K

15:38:15 V 0.27 +0.025 4,500 19 Desjardins 7 TD Sec K

15:38:15 V 0.27 +0.025 7,000 19 Desjardins 58 Qtrade K

15:38:15 V 0.27 +0.025 17,000 19 Desjardins 19 Desjardins K

15:38:15 V 0.27 +0.025 1,500 19 Desjardins 2 RBC K

15:38:15 V 0.265 +0.02 10,000 19 Desjardins 7 TD Sec K

15:38:15 V 0.265 +0.02 20,000 19 Desjardins 2 RBC K

15:36:22 V 0.255 +0.01 5,000 19 Desjardins 85 Scotia K

Ja aber der Kurs macht mir so keine Freude.

Auch die Geld - Brief Spannen in Frankfurt sind mir zu weit auseinander.

Auch die Geld - Brief Spannen in Frankfurt sind mir zu weit auseinander.

heute - 33 Prozent!!!

was geht denn jetzt bitte hier ab?

was geht denn jetzt bitte hier ab?

Antwort auf Beitrag Nr.: 32.412.601 von Scheich2000 am 13.11.07 18:33:10

.....k e i n e panik, scheich - bei diesen

spreads ist so was leider nicht auszuschließen, noch

bei solch engem wert !!!

wenn du dir mal den handel in CAN anschaust, sollte

auch dir bewußt werden, daß wir zurück in die spur

kommen..........

Time Price Shares $ Change Buyer Seller

15:30 0.275 20,000 +0.015 TD Securities Canaccord

15:26 0.300 300 OLT Desjardins W.D. Latimer

15:26 0.280 1,000 +0.020 Desjardins Desjardins

15:25 0.275 25,000 +0.015 Ntl. Bank Fin. TD Securities

15:22 0.275 20,000 +0.015 Ntl. Bank Fin. RBC

15:15 0.275 10,000 +0.015 Ntl. Bank Fin. Qtrade

15:15 0.275 10,000 +0.015 Ntl. Bank Fin. Ntl. Bank Fin.

14:53 0.270 37,500 +0.010 CIBC RBC

14:51 0.270 8,000 +0.010 CIBC TD Securities

14:51 0.270 20,000 +0.010 CIBC Questrade

.....k e i n e panik, scheich - bei diesen

spreads ist so was leider nicht auszuschließen, noch

bei solch engem wert !!!

wenn du dir mal den handel in CAN anschaust, sollte

auch dir bewußt werden, daß wir zurück in die spur

kommen..........

Time Price Shares $ Change Buyer Seller

15:30 0.275 20,000 +0.015 TD Securities Canaccord

15:26 0.300 300 OLT Desjardins W.D. Latimer

15:26 0.280 1,000 +0.020 Desjardins Desjardins

15:25 0.275 25,000 +0.015 Ntl. Bank Fin. TD Securities

15:22 0.275 20,000 +0.015 Ntl. Bank Fin. RBC

15:15 0.275 10,000 +0.015 Ntl. Bank Fin. Qtrade

15:15 0.275 10,000 +0.015 Ntl. Bank Fin. Ntl. Bank Fin.

14:53 0.270 37,500 +0.010 CIBC RBC

14:51 0.270 8,000 +0.010 CIBC TD Securities

14:51 0.270 20,000 +0.010 CIBC Questrade

Antwort auf Beitrag Nr.: 32.415.888 von hbg55 am 13.11.07 21:53:24

.......und mit TH gings dann sogar ausm

handel........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:33 V 0.28 +0.02 2,000 19 Desjardins 19 Desjardins K

15:59:28 V 0.28 +0.02 11,500 79 CIBC 7 TD Sec K

15:56:38 V 0.275 +0.015 10,000 2 RBC 7 TD Sec K

15:55:43 V 0.275 +0.015 20,000 2 RBC 7 TD Sec K

15:53:57 V 0.28 +0.02 2,000 2 RBC 7 TD Sec K

15:53:57 V 0.28 +0.02 9,000 2 RBC 79 CIBC K

15:53:57 V 0.28 +0.02 2,500 2 RBC 9 BMO Nesbitt K

15:53:57 V 0.275 +0.015 6,500 2 RBC 9 BMO Nesbitt K

15:48:30 V 0.275 +0.015 2,000 19 Desjardins 9 BMO Nesbitt K

15:48:30 V 0.275 +0.015 9,000 19 Desjardins 1 Anonymous K

.......und mit TH gings dann sogar ausm

handel........

Recent Trades - Last 10

Time Ex Price Change Volume Buyer Seller Markers

15:59:33 V 0.28 +0.02 2,000 19 Desjardins 19 Desjardins K

15:59:28 V 0.28 +0.02 11,500 79 CIBC 7 TD Sec K

15:56:38 V 0.275 +0.015 10,000 2 RBC 7 TD Sec K

15:55:43 V 0.275 +0.015 20,000 2 RBC 7 TD Sec K

15:53:57 V 0.28 +0.02 2,000 2 RBC 7 TD Sec K

15:53:57 V 0.28 +0.02 9,000 2 RBC 79 CIBC K

15:53:57 V 0.28 +0.02 2,500 2 RBC 9 BMO Nesbitt K

15:53:57 V 0.275 +0.015 6,500 2 RBC 9 BMO Nesbitt K

15:48:30 V 0.275 +0.015 2,000 19 Desjardins 9 BMO Nesbitt K

15:48:30 V 0.275 +0.015 9,000 19 Desjardins 1 Anonymous K

November 13, 2007

SearchGold Resources Inc. Announces the Filing of a Preliminary Prospectus by Golden Share Mining Corporation

MONTREAL, QUEBEC--(Marketwire - Nov. 13, 2007) - Searchgold Resources Inc. (TSX VENTURE:RSG)(FRANKFURT:S1O) is pleased to announce that Golden Share Mining Corporation has filed, on November 12, 2007, with the securities regulatory authorities in each of the provinces of Canada, a preliminary prospectus for an initial public offering of a minimum of 1,330 units A and 490 units B and a maximum of 2,190 units A and 1,470 units B (together the "Units") for total maximum gross proceeds of $3,722,250.

Each Unit A consists of: (i) 2,300 "flow-through" common shares at a price of $0.35 per share; and (ii) 700 common shares at a price of $0.30 per share. Each Unit B consists of: (i) 3,400 common shares at a price of $0.30 per share; and (ii) 3,400 common share purchase warrants with each warrant entitling the holder to acquire one additional common share of Golden Share at a price of $0.35 per share for a period of two years from the closing of the offering.

Canaccord Capital Corporation will act as lead agent in connection with the initial public offering. The distribution by Searchgold of a portion of its Golden Share shares will be effected by way of dividend to Searchgold's shareholders, and will not affect Searchgold's issued and outstanding shares. Searchgold's shareholders of record at the close of business on the distribution record date will be entitled to receive Golden Share shares. Searchgold will issue a press release announcing the dividend record date and distribution date once they are determined.

The purpose of the distribution is to make Golden Share a public company. Golden Share will focus on exploration for gold in Canada, while Searchgold will devote itself to the developments of its African projects. Proceeds from the IPO will be used by Golden Share to finance the exploration programs on the Forsan and Malartic Lakeshore properties and for working capital purposes.

About Searchgold Resources Inc.

Searchgold Resources is a Canadian-based mining exploration company whose primary mission is to target, explore and develop gold deposits in Africa. The expansion strategy executed in 2006 set the stage for the Company's development in 2007 that involves increasing activity on the new blue-sky properties and the advanced projects as well as some potential acquisitions.

Forward-looking Statements

This news release contains certain forward-looking statements. These forward-looking statements are subject to a variety of risks and uncertainties beyond the ability of Searchgold to control or predict, which could cause actual events or results to differ materially from those anticipated in such forward-looking statements, including risks disclosed in filings with the Canadian securities regulators made by Searchgold. Accordingly, readers should not place undue reliance on forward-looking statements.

If you would like to receive press releases via e-mail please contact: info@searchgold.ca

The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

CONTACT INFORMATION:

Searchgold Resources Inc.

Philippe Giaro

President & CEO

32-473-5229

phgiaro@skynet.be

or

Searchgold Resources Inc.

Denis Tremblay

Vice-President

514-866-4224

info@searchgold.ca

www.searchgold.ca

or

CHF Investor Relations

Alison Tullis

Account Manager

416-868-1079 x233

alison@chfir.com

INDUSTRY

SearchGold Resources Inc. Announces the Filing of a Preliminary Prospectus by Golden Share Mining Corporation

MONTREAL, QUEBEC--(Marketwire - Nov. 13, 2007) - Searchgold Resources Inc. (TSX VENTURE:RSG)(FRANKFURT:S1O) is pleased to announce that Golden Share Mining Corporation has filed, on November 12, 2007, with the securities regulatory authorities in each of the provinces of Canada, a preliminary prospectus for an initial public offering of a minimum of 1,330 units A and 490 units B and a maximum of 2,190 units A and 1,470 units B (together the "Units") for total maximum gross proceeds of $3,722,250.