Baidu.com - NASDAQ: BIDU crashed - dieses Jahr noch unter 30 US Dollar? (Seite 128)

eröffnet am 10.03.06 10:23:51 von

neuester Beitrag 09.05.24 18:42:49 von

neuester Beitrag 09.05.24 18:42:49 von

Beiträge: 1.963

ID: 1.046.404

ID: 1.046.404

Aufrufe heute: 31

Gesamt: 231.043

Gesamt: 231.043

Aktive User: 0

ISIN: US0567521085 · WKN: A0F5DE · Symbol: B1C

100,60

EUR

-1,57 %

-1,60 EUR

Letzter Kurs 20:43:53 Tradegate

Neuigkeiten

03.05.24 · Der Aktionär TV |

30.04.24 · wallstreetONLINE Redaktion |

30.04.24 · wallstreetONLINE Redaktion |

29.04.24 · Markus Weingran |

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 13,020 | +35,12 | |

| 3,7900 | +11,47 | |

| 2,5100 | +10,09 | |

| 5,2500 | +9,38 | |

| 11,350 | +9,13 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 84,87 | -10,32 | |

| 4,9000 | -12,50 | |

| 14,500 | -12,65 | |

| 5,9200 | -16,03 | |

| 1,9500 | -20,41 |

Beitrag zu dieser Diskussion schreiben

Nun, mann, hier gibt es Teilnehmer, sehen durchaus noch höhere Kurse als Du.

Baidu Going to $260?

by: Michael Bryant February 15, 2011 | about: BIDU

Baidu (BIDU) is a Chinese search monopoly garnering over 70% of the Chinese search market. And with Google (GOOG) forced out of the Chinese market do to regulation violations, this leaves clear sailing for BIDU.

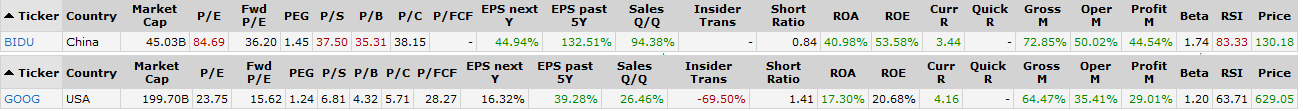

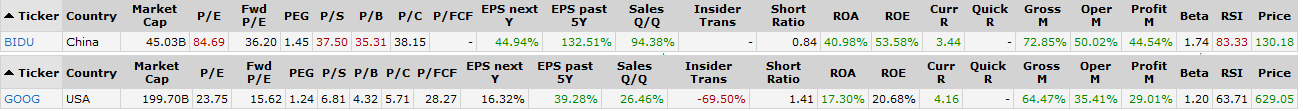

I agree that at first glance the stock looks pricy. The chart below compares BIDU against Google (GOOG) (click to enlarge images):

Source: Finviz.com

* P/S = Price/Sales

* P/B = Price/Book

* P/C = Price/Cash

* P/FCF = Price/Free cash flow

* EPS next Y = EPS growth next year

* EPS past 5Y = EPS growth last 5 years

* Insider Trans = Insider Transactions

* Sales Q/Q = Sales growth quarter over quarter

* ROA = Return on assets

* ROE = Return on equity

* Curr R = Current ratio, which “measures whether or not a firm has enough resources to pay its debts over the next 12 months.” A ratio of 1.25 means that “for every dollar the company owes it has $1.25 available in current assets.” (Source: Wikipedia)

* Quick R = Quick ratio

* Gross M = Gross margin

* Oper M = Operating margin

* Profit M = Profit margin

BIDU’s PE is 4 times that of Google. Forward PE is 2 times that of Google. However, PEG is about the same as that of Google. Quarter over quarter sales growth is about 4 times that of Google. And return on equity is over twice that of Google. So the pricey share price is compensated by the high growth of BIDU.

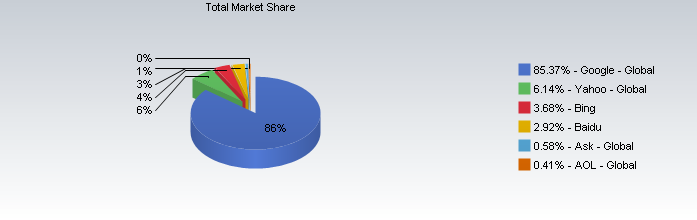

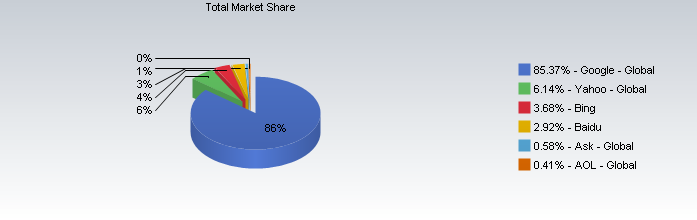

Google`s Global Market Share

Since Google is gone from competing with BIDU in China, it seems logical that BIDU will achieve the same or similar market share in China. This leaves another 10% or so of market share growth for BIDU.

And remember, China has about 1/5th of the world population. If China becomes like the US or Japan 50 years from now, which I think it very possible, that leaves a lot more potential growth for BIDU.

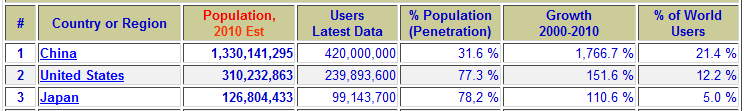

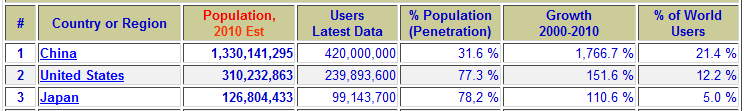

Number of Internet-Users

According to the chart above, the percentage of the Chinese population using the internet is still less than half that of the US and Japan. That means BIDU can at least double in share price from its current price of $128.

The graph below shows BIDU could head higher very quickly.

For each graph, top black line is overbought and bottom black line is oversold.

The stock seems to defy all technical indicators, let alone gravity. The MFI, RSI, W%R, and %K and %D are useless in predicting sell signals throughout the last year. As the first purple line illustrates, the stock did not fall when then indicators became overbought. As the second purple line indicates, it fell slightly when the indicators WERE NOT in overbought territory.

Thus, I would dismiss those technicals for now and concentrate on the support and resistance lines. The price is near support and will likely either follow the support line higher of move higher to the resistance line. Either way, it is going higher.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Baidu Going to $260?

by: Michael Bryant February 15, 2011 | about: BIDU

Baidu (BIDU) is a Chinese search monopoly garnering over 70% of the Chinese search market. And with Google (GOOG) forced out of the Chinese market do to regulation violations, this leaves clear sailing for BIDU.

I agree that at first glance the stock looks pricy. The chart below compares BIDU against Google (GOOG) (click to enlarge images):

Source: Finviz.com

* P/S = Price/Sales

* P/B = Price/Book

* P/C = Price/Cash

* P/FCF = Price/Free cash flow

* EPS next Y = EPS growth next year

* EPS past 5Y = EPS growth last 5 years

* Insider Trans = Insider Transactions

* Sales Q/Q = Sales growth quarter over quarter

* ROA = Return on assets

* ROE = Return on equity

* Curr R = Current ratio, which “measures whether or not a firm has enough resources to pay its debts over the next 12 months.” A ratio of 1.25 means that “for every dollar the company owes it has $1.25 available in current assets.” (Source: Wikipedia)

* Quick R = Quick ratio

* Gross M = Gross margin

* Oper M = Operating margin

* Profit M = Profit margin

BIDU’s PE is 4 times that of Google. Forward PE is 2 times that of Google. However, PEG is about the same as that of Google. Quarter over quarter sales growth is about 4 times that of Google. And return on equity is over twice that of Google. So the pricey share price is compensated by the high growth of BIDU.

Google`s Global Market Share

Since Google is gone from competing with BIDU in China, it seems logical that BIDU will achieve the same or similar market share in China. This leaves another 10% or so of market share growth for BIDU.

And remember, China has about 1/5th of the world population. If China becomes like the US or Japan 50 years from now, which I think it very possible, that leaves a lot more potential growth for BIDU.

Number of Internet-Users

According to the chart above, the percentage of the Chinese population using the internet is still less than half that of the US and Japan. That means BIDU can at least double in share price from its current price of $128.

The graph below shows BIDU could head higher very quickly.

For each graph, top black line is overbought and bottom black line is oversold.

The stock seems to defy all technical indicators, let alone gravity. The MFI, RSI, W%R, and %K and %D are useless in predicting sell signals throughout the last year. As the first purple line illustrates, the stock did not fall when then indicators became overbought. As the second purple line indicates, it fell slightly when the indicators WERE NOT in overbought territory.

Thus, I would dismiss those technicals for now and concentrate on the support and resistance lines. The price is near support and will likely either follow the support line higher of move higher to the resistance line. Either way, it is going higher.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Provideo Financial Analyst Suggests Chinese Internet Market Sectors To Watch In

2011

China’s internet population has become the largest single market in the world, and there are vast opportunities for both

businesses and investors. As proven by companies like Baidu.com (NASDAQ: BIDU) the Chinese internet market can

yield impressive returns. The Chinese internet search giant’s stock has nearly doubled in the past 6 months and gone

from $12 per share 2 years ago to over $120 today.

China’s internet industry today is the largest in the world and as well as one of the fastest growing. Baidu.com’s continued

success is evidence of this fact. In 2011 there will be plenty of industries and companies to watch that will take

advantage of the opportunities offered by the Chinese internet market’s boom.

Baidu’s online video company Qiyu is looking to make significant progress throughout 2011 and will likely be aiming at an

IPO sometime in 2012. According to Lee Jacobs, an analyst at Provideo Financial in Hong Kong, online video sites in

China will be a hot sector to watch over the next 24 months. “Much like the online video stocks in the U.S. were the

highlight of 2010 with companies like NetFlix dominating the spotlight, we are looking to companies including Qiyu,

Youku, and Tudou to file IPOs that could return big for investors.”

Social Networking will also be a hot sector to watch this year. Chinese social networking site Ren Ren will likely be the

next Chinese Social Networking IPO. With over 200 million users, and a growing user base, Ren Ren looks poised to

take on competitors in the Chinese market. Facebook also recently announced the opening of a new Hong Kong office.

Whether they intend to make an entry into the Chinese market or only focus on other Asian markets remains to be seen,

but Provideo Financial analysts believe that an attempted entry into the world’s largest market by the world’s dominant

social networking company is likely.

Overall, the Chinese internet market will likely have a very eventful year. Nobody can predict the future, but it is likely that

IPOs and stocks in the internet market sectors will capitalize on imminent online growth in 2011.

PR-USA.net

http:/

2011

China’s internet population has become the largest single market in the world, and there are vast opportunities for both

businesses and investors. As proven by companies like Baidu.com (NASDAQ: BIDU) the Chinese internet market can

yield impressive returns. The Chinese internet search giant’s stock has nearly doubled in the past 6 months and gone

from $12 per share 2 years ago to over $120 today.

China’s internet industry today is the largest in the world and as well as one of the fastest growing. Baidu.com’s continued

success is evidence of this fact. In 2011 there will be plenty of industries and companies to watch that will take

advantage of the opportunities offered by the Chinese internet market’s boom.

Baidu’s online video company Qiyu is looking to make significant progress throughout 2011 and will likely be aiming at an

IPO sometime in 2012. According to Lee Jacobs, an analyst at Provideo Financial in Hong Kong, online video sites in

China will be a hot sector to watch over the next 24 months. “Much like the online video stocks in the U.S. were the

highlight of 2010 with companies like NetFlix dominating the spotlight, we are looking to companies including Qiyu,

Youku, and Tudou to file IPOs that could return big for investors.”

Social Networking will also be a hot sector to watch this year. Chinese social networking site Ren Ren will likely be the

next Chinese Social Networking IPO. With over 200 million users, and a growing user base, Ren Ren looks poised to

take on competitors in the Chinese market. Facebook also recently announced the opening of a new Hong Kong office.

Whether they intend to make an entry into the Chinese market or only focus on other Asian markets remains to be seen,

but Provideo Financial analysts believe that an attempted entry into the world’s largest market by the world’s dominant

social networking company is likely.

Overall, the Chinese internet market will likely have a very eventful year. Nobody can predict the future, but it is likely that

IPOs and stocks in the internet market sectors will capitalize on imminent online growth in 2011.

PR-USA.net

http:/

Antwort auf Beitrag Nr.: 41.028.679 von fuger48 am 12.02.11 08:41:01hi

immer noch nur Beobachter

und das seit der "Geburt" und diese Aktie ist halt eine Perle - halt die Asiatische Google

immer noch nur Beobachter

und das seit der "Geburt" und diese Aktie ist halt eine Perle - halt die Asiatische Google

Antwort auf Beitrag Nr.: 41.027.207 von mann337 am 11.02.11 19:11:28Hey mann337,bist wieder dabei  ,oder nur Beobachter?

,oder nur Beobachter?

Gruß.

,oder nur Beobachter?

,oder nur Beobachter?Gruß.

Antwort auf Beitrag Nr.: 41.027.140 von Karlll am 11.02.11 19:03:03Guten Morgen!Ja klar,Rücksetzer hat es und wird es immer geben,ich nutze sie für mich.

Ach ja,Du bist BJ.55,ich BJ.54.Bin auch seit vielen Jahren an der Börse.Habe den Neuen Markt mitgemacht,mir auch die Finger verbrannt. Mein bester Deal war OS 725184 Stada

Mein bester Deal war OS 725184 Stada .War der einzige OS den ich je gekauft habe.Viel Erfolg weiterhin

.War der einzige OS den ich je gekauft habe.Viel Erfolg weiterhin

Gruß

Ach ja,Du bist BJ.55,ich BJ.54.Bin auch seit vielen Jahren an der Börse.Habe den Neuen Markt mitgemacht,mir auch die Finger verbrannt.

Mein bester Deal war OS 725184 Stada

Mein bester Deal war OS 725184 Stada .War der einzige OS den ich je gekauft habe.Viel Erfolg weiterhin

.War der einzige OS den ich je gekauft habe.Viel Erfolg weiterhinGruß

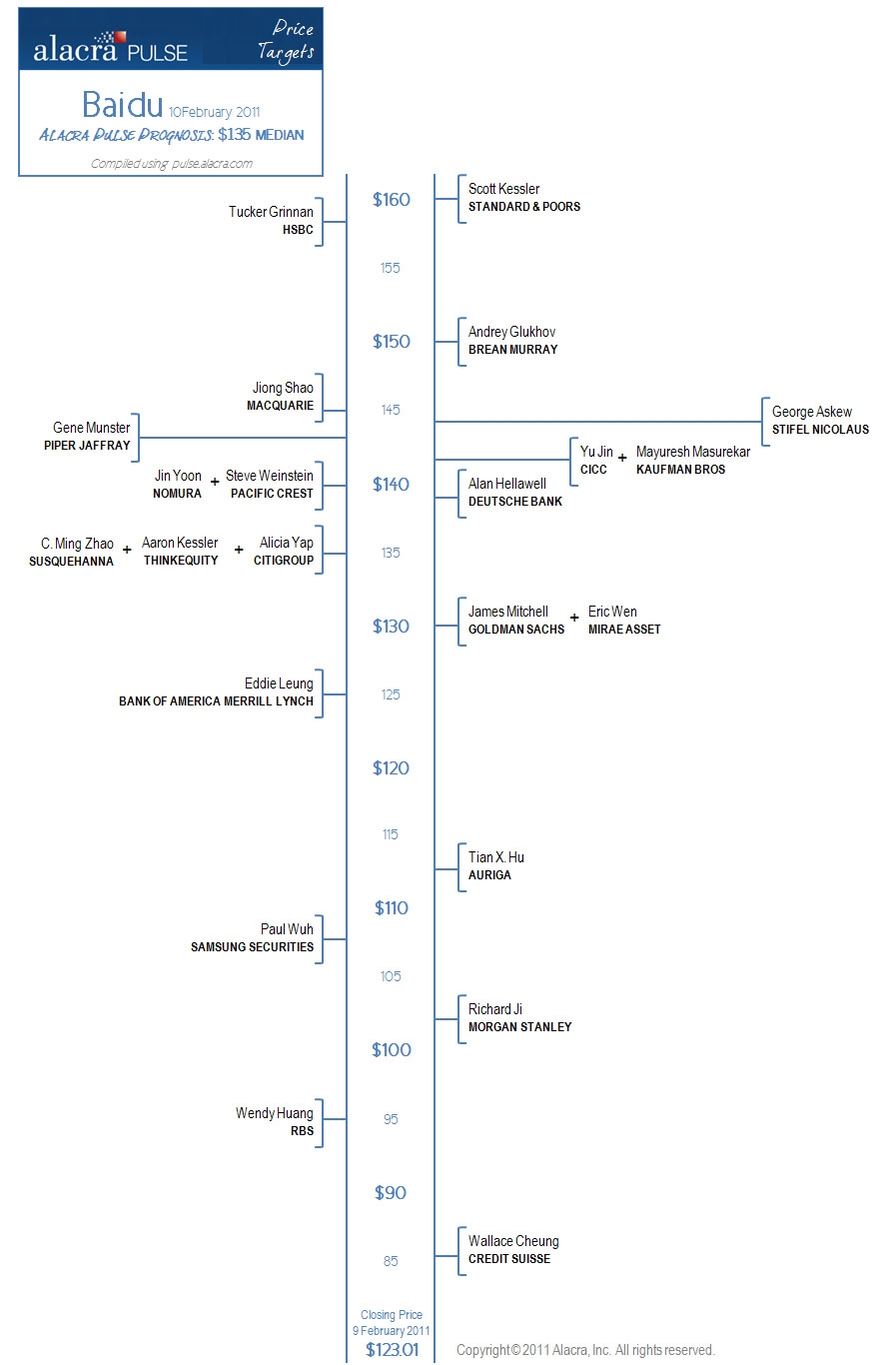

Baidu Impresses Analysts, But Valuation Starting to Look Rich?

by: Alacra Pulse Check Blog February 11, 2011

By Sheena Lee

Baidu (BIDU) last week posted earnings that more than doubled, leading many analysts to boost their price targets. However, some see the stock as overvalued, resulting in a wide range of targets. As China’s largest search engine, the company has gained steady market share, beating out foreign competitors like Google (GOOG), which has struggled with censorship rules in the country.

The median price based on the most recent 12-month targets of 23 sell-side and independent analysts tracked by Alacra Pulse is $135, up from $115 since our October prognosis. The mean target of $131.35 is 6.8% higher than Wednesday’s closing price of $123.01. Of these analysts, 17 are positive, three are neutral and three are negative.

Current 12-month price targets of selected sell-side and independent analysts.

Independent analysts rarely have the highest target price, but in this case Scott Kessler of Standard & Poor’s leads the pack with a $160 target and a Buy recommendation. “We think a premium is warranted, given what we perceive as BIDU’s entrenched category leadership and related ‘network effects,’ recent excellent execution (in our view), and a large and flexible balance sheet,” he wrote.

Among sell-side analysts, HSBC’s Tucker Grinnan upgraded Baidu to Overweight from Neutral and raised his 12-month target forecast to $158 from $116, saying “Baidu is and will remain the most profitable, lowest-risk blue chip Internet play in China.”

Macquarie Research analyst Jiong Shao initiated coverage of China’s top search engine last week with an Outperform rating and a price target of $145 on the firm, while Stifel Nicolaus analyst George Askew reiterated his Buy rating and $144 price target.

Kaufman Bros. analyst Mayuresh Masurekar increased his price target on Buy-rated Baidu to $142 from $118. Active advertisers grew 24% year-on-year and average revenue per customer grew 62% year-on-year, said Masurekar.

ThinkEquity analyst Aaron Kessler repeated his Buy rating on the Internet search firm and raised his price target to $135 from $130. Pacific Crest Securities analyst Steve Weinstein maintained an Outperform rating and $140 price target.

JP Morgan analyst Dick Wei kept his Overweight rating on Baidu and upped the firm’s stock target to $125 from $120. Deutsche Bank’s Alan Hellawell upgraded Baidu to Buy from Hold, and raised his target to $139 from $100.

Mizuho analysts initiated coverage of Baidu at a Buy with a $130 price target.

Baidu said that it is anticipating more spending by advertisers in the next quarter and that it is stepping up expansion into new businesses, including online video and e-commerce.

“The migration to Baidu from Google will continue this year, albeit at a reduced pace,” said Guotai Junan Securities analyst Jake Li, who rates Baidu shares at Accumulate. The company is bolstering its services, such as social networking and wireless search, he said.

Baidu’s CEO Robin Li told analysts and investors that social search products represent a significant portion of the company’s total traffic and it continues to grow at a rapid speed.

Motley Fool’s Rick Aristotle Munarriz said Baidu gained market share in 2010 at Google’s expense, and that “the year ahead won’t be as rich in low-lying fruit.” Analysts see revenue and earnings growing by a little better than 60% in 2011, justifying Baidu’s lofty price tag, said Munarriz. “Then again, seeing the way Wall Street routinely underestimates Baidu’s earnings power, the dot-com speedster may be even cheaper than you think.”

However, China’s internet landscape is seeing intensifying competition as other names like Sohu.com (SOHU), Alibaba Group (ALBCF.PK) and Tencent Holdings (TCEHY.PK) hope to take market share from leading player Baidu.

Leading the skeptics are Wallace Cheung of Credit Suisse, with a target of $85.20 and an Underperform rating. “Trading at 40x 2011 PER and 1.5x PEG, Baidu is not attractive in our view as new business has not materialized," he wrote. And Wendy Huang of RBS is “not sure Baidu can replicate Google’s historical high growth.” She reiterated a Sell recommendation while raising her target to $95 from $85.

Source: Alacra Pulse, Shanghai Daily, Bloomberg, Motley Fool, Street Insider, Reuters, China Analyst.

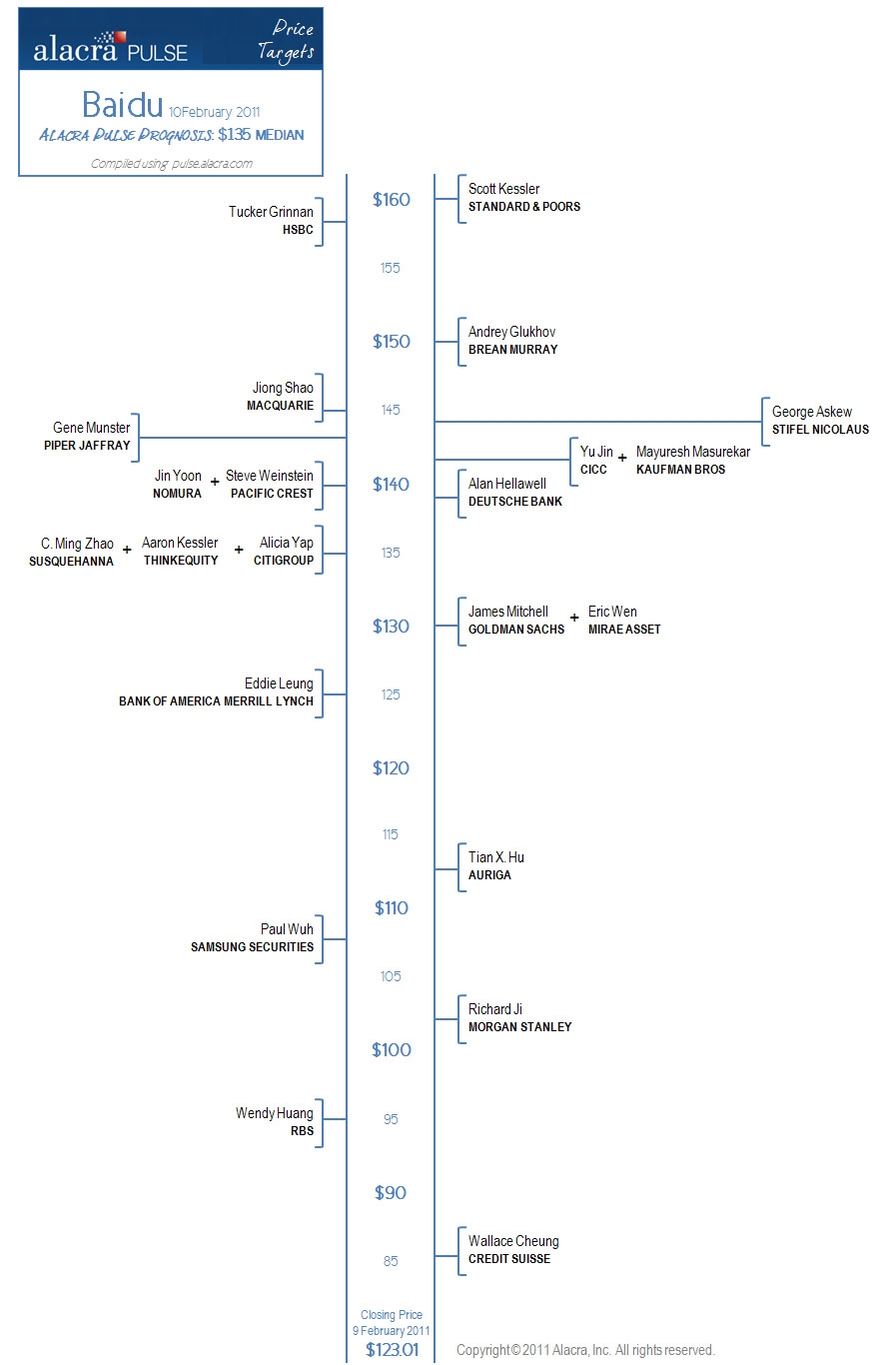

by: Alacra Pulse Check Blog February 11, 2011

By Sheena Lee

Baidu (BIDU) last week posted earnings that more than doubled, leading many analysts to boost their price targets. However, some see the stock as overvalued, resulting in a wide range of targets. As China’s largest search engine, the company has gained steady market share, beating out foreign competitors like Google (GOOG), which has struggled with censorship rules in the country.

The median price based on the most recent 12-month targets of 23 sell-side and independent analysts tracked by Alacra Pulse is $135, up from $115 since our October prognosis. The mean target of $131.35 is 6.8% higher than Wednesday’s closing price of $123.01. Of these analysts, 17 are positive, three are neutral and three are negative.

Current 12-month price targets of selected sell-side and independent analysts.

Independent analysts rarely have the highest target price, but in this case Scott Kessler of Standard & Poor’s leads the pack with a $160 target and a Buy recommendation. “We think a premium is warranted, given what we perceive as BIDU’s entrenched category leadership and related ‘network effects,’ recent excellent execution (in our view), and a large and flexible balance sheet,” he wrote.

Among sell-side analysts, HSBC’s Tucker Grinnan upgraded Baidu to Overweight from Neutral and raised his 12-month target forecast to $158 from $116, saying “Baidu is and will remain the most profitable, lowest-risk blue chip Internet play in China.”

Macquarie Research analyst Jiong Shao initiated coverage of China’s top search engine last week with an Outperform rating and a price target of $145 on the firm, while Stifel Nicolaus analyst George Askew reiterated his Buy rating and $144 price target.

Kaufman Bros. analyst Mayuresh Masurekar increased his price target on Buy-rated Baidu to $142 from $118. Active advertisers grew 24% year-on-year and average revenue per customer grew 62% year-on-year, said Masurekar.

ThinkEquity analyst Aaron Kessler repeated his Buy rating on the Internet search firm and raised his price target to $135 from $130. Pacific Crest Securities analyst Steve Weinstein maintained an Outperform rating and $140 price target.

JP Morgan analyst Dick Wei kept his Overweight rating on Baidu and upped the firm’s stock target to $125 from $120. Deutsche Bank’s Alan Hellawell upgraded Baidu to Buy from Hold, and raised his target to $139 from $100.

Mizuho analysts initiated coverage of Baidu at a Buy with a $130 price target.

Baidu said that it is anticipating more spending by advertisers in the next quarter and that it is stepping up expansion into new businesses, including online video and e-commerce.

“The migration to Baidu from Google will continue this year, albeit at a reduced pace,” said Guotai Junan Securities analyst Jake Li, who rates Baidu shares at Accumulate. The company is bolstering its services, such as social networking and wireless search, he said.

Baidu’s CEO Robin Li told analysts and investors that social search products represent a significant portion of the company’s total traffic and it continues to grow at a rapid speed.

Motley Fool’s Rick Aristotle Munarriz said Baidu gained market share in 2010 at Google’s expense, and that “the year ahead won’t be as rich in low-lying fruit.” Analysts see revenue and earnings growing by a little better than 60% in 2011, justifying Baidu’s lofty price tag, said Munarriz. “Then again, seeing the way Wall Street routinely underestimates Baidu’s earnings power, the dot-com speedster may be even cheaper than you think.”

However, China’s internet landscape is seeing intensifying competition as other names like Sohu.com (SOHU), Alibaba Group (ALBCF.PK) and Tencent Holdings (TCEHY.PK) hope to take market share from leading player Baidu.

Leading the skeptics are Wallace Cheung of Credit Suisse, with a target of $85.20 and an Underperform rating. “Trading at 40x 2011 PER and 1.5x PEG, Baidu is not attractive in our view as new business has not materialized," he wrote. And Wendy Huang of RBS is “not sure Baidu can replicate Google’s historical high growth.” She reiterated a Sell recommendation while raising her target to $95 from $85.

Source: Alacra Pulse, Shanghai Daily, Bloomberg, Motley Fool, Street Insider, Reuters, China Analyst.

seit Emmision 956 %

eine wahre Perle, mehr ist nicht zu sagen

Antwort auf Beitrag Nr.: 41.027.071 von fuger48 am 11.02.11 18:53:06Mußt natürlich, wenn Du aktuell eingestiegen bist, den Rücksetzer mit einkalkulieren.

Wir werden jüngst sicher noch Preise sehen, die auch unter diesem Level liegen, was aber

die Substanz von Baidu nicht schmälert, sondern einige Leutchen nehmen halt erstmal

wieder Geld vom Tisch.

Gruß Karlll

Wir werden jüngst sicher noch Preise sehen, die auch unter diesem Level liegen, was aber

die Substanz von Baidu nicht schmälert, sondern einige Leutchen nehmen halt erstmal

wieder Geld vom Tisch.

Gruß Karlll

Antwort auf Beitrag Nr.: 41.023.200 von fuger48 am 11.02.11 11:25:32

Gibts mehr zu sagen

Gibts mehr zu sagen

nein,daß Baby ist ein Traum.

nein,daß Baby ist ein Traum. @alleun schönes WE.

@alleun schönes WE.

Gibts mehr zu sagen

Gibts mehr zu sagen

nein,daß Baby ist ein Traum.

nein,daß Baby ist ein Traum. @alleun schönes WE.

@alleun schönes WE.

Baidu.com - NASDAQ: BIDU crashed - dieses Jahr noch unter 30 US Dollar?