Golar neue Chancen durch verstärkte Umwandlung von Gas in LNG (Seite 4)

eröffnet am 13.03.07 17:01:07 von

neuester Beitrag 21.10.23 14:03:24 von

neuester Beitrag 21.10.23 14:03:24 von

Beiträge: 601

ID: 1.118.311

ID: 1.118.311

Aufrufe heute: 0

Gesamt: 86.114

Gesamt: 86.114

Aktive User: 0

ISIN: BMG9456A1009 · WKN: 677102 · Symbol: G2O

22,920

EUR

-1,50 %

-0,350 EUR

Letzter Kurs 11:23:42 Tradegate

Neuigkeiten

25.04.24 · globenewswire |

28.03.24 · globenewswire |

12.03.24 · PR Newswire (engl.) |

29.02.24 · globenewswire |

29.02.24 · globenewswire |

Werte aus der Branche Verkehr

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0100 | +304,00 | |

| 0,7200 | +56,42 | |

| 0,7620 | +27,00 | |

| 9,6200 | +17,66 | |

| 72,15 | +13,35 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 23.400,00 | -10,00 | |

| 8,6500 | -10,08 | |

| 8,1400 | -14,32 | |

| 109,45 | -15,45 | |

| 8,2702 | -49,26 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 54.313.867 von R-BgO am 14.02.17 10:07:37Published: 15:20 CET 14-02-2017 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009

Golar LNG Limited Announces Pricing of $350 Million of 2.75% Convertible Senior Notes Due 2022

Hamilton, Bermuda, February 14, 2017 --

Golar LNG Limited (the "Company") (NASDAQ: GLNG) announces today the pricing of $350 million aggregate principal amount of its 2.75% Convertible Senior Notes due 2022 (the "Notes"), in a private placement to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"). The Company has also granted the initial purchasers of the Notes a 30-day option to purchase up to an additional $52.5 million aggregate principal amount of the Notes in connection with the offering, solely to cover overallotments. The offering is expected to close on February 17, 2017, subject to the satisfaction of certain customary closing conditions.

The Notes will be senior, unsecured obligations of the Company, bear interest at a rate of 2.75% per annum, payable semi-annually in arrears on February 15 and August 15 of each year, beginning on August 15, 2017, mature on February 15, 2022, and be convertible into the Company's common shares, cash, or a combination of shares and cash, at the Company's election. The conversion rate for the Notes will initially equal 26.5308 common shares per $1,000 principal amount of the Notes, which is equivalent to an initial conversion price of approximately $37.69 per common share, and is subject to adjustment.

The Company will use approximately $27.1 million of the net proceeds from the sale of the Notes to fund the cost of the initial capped call transactions described below and use the remaining funds for other general corporate purposes.

In connection with the offering of the Notes, the Company entered into capped call transactions with one or more of the initial purchasers of the Notes or their affiliates (the "option counterparties"). The capped call transactions have an initial strike price of approximately $37.69 per share and an initial cap price of $48.86 per share, subject to certain adjustments. The capped call transactions cover, subject to customary adjustments, approximately 9,285,780 common shares of the Company. The capped call transactions are expected to reduce the potential dilution to the Company's common shares upon and/or offset the cash payments the Company is required to make in excess of the principal amount of converted Notes, with such reduction and/or offset subject to a cap. If the initial purchasers exercise their option to purchase additional Notes, the Company may enter into additional capped call transactions with the option counterparties.

In connection with establishing their initial hedge of the capped call transactions, the Company expects that the option counterparties will enter into various derivative transactions with respect to the Company's common shares concurrently with or shortly after the pricing of the Notes and may unwind these various derivative transactions and purchase the Company's common shares in open market transactions shortly following the pricing of the Notes.

These activities could have the effect of increasing, or reducing the size of a decline in, the market price of the Company's common shares or Notes concurrently with, or shortly following, the pricing of the Notes. In addition, the option counterparties (and/or their respective affiliates) may modify their hedge positions by entering into or unwinding various derivatives with respect to the Company's common shares and/or purchasing or selling the Company's common shares or other securities of the Company in secondary market transactions following the pricing of the notes and prior to the maturity of the notes. Any of these activities could cause or avoid an increase or a decrease in the market price of the Company's common shares or the Notes.

Golar LNG Limited Announces Pricing of $350 Million of 2.75% Convertible Senior Notes Due 2022

Hamilton, Bermuda, February 14, 2017 --

Golar LNG Limited (the "Company") (NASDAQ: GLNG) announces today the pricing of $350 million aggregate principal amount of its 2.75% Convertible Senior Notes due 2022 (the "Notes"), in a private placement to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"). The Company has also granted the initial purchasers of the Notes a 30-day option to purchase up to an additional $52.5 million aggregate principal amount of the Notes in connection with the offering, solely to cover overallotments. The offering is expected to close on February 17, 2017, subject to the satisfaction of certain customary closing conditions.

The Notes will be senior, unsecured obligations of the Company, bear interest at a rate of 2.75% per annum, payable semi-annually in arrears on February 15 and August 15 of each year, beginning on August 15, 2017, mature on February 15, 2022, and be convertible into the Company's common shares, cash, or a combination of shares and cash, at the Company's election. The conversion rate for the Notes will initially equal 26.5308 common shares per $1,000 principal amount of the Notes, which is equivalent to an initial conversion price of approximately $37.69 per common share, and is subject to adjustment.

The Company will use approximately $27.1 million of the net proceeds from the sale of the Notes to fund the cost of the initial capped call transactions described below and use the remaining funds for other general corporate purposes.

In connection with the offering of the Notes, the Company entered into capped call transactions with one or more of the initial purchasers of the Notes or their affiliates (the "option counterparties"). The capped call transactions have an initial strike price of approximately $37.69 per share and an initial cap price of $48.86 per share, subject to certain adjustments. The capped call transactions cover, subject to customary adjustments, approximately 9,285,780 common shares of the Company. The capped call transactions are expected to reduce the potential dilution to the Company's common shares upon and/or offset the cash payments the Company is required to make in excess of the principal amount of converted Notes, with such reduction and/or offset subject to a cap. If the initial purchasers exercise their option to purchase additional Notes, the Company may enter into additional capped call transactions with the option counterparties.

In connection with establishing their initial hedge of the capped call transactions, the Company expects that the option counterparties will enter into various derivative transactions with respect to the Company's common shares concurrently with or shortly after the pricing of the Notes and may unwind these various derivative transactions and purchase the Company's common shares in open market transactions shortly following the pricing of the Notes.

These activities could have the effect of increasing, or reducing the size of a decline in, the market price of the Company's common shares or Notes concurrently with, or shortly following, the pricing of the Notes. In addition, the option counterparties (and/or their respective affiliates) may modify their hedge positions by entering into or unwinding various derivatives with respect to the Company's common shares and/or purchasing or selling the Company's common shares or other securities of the Company in secondary market transactions following the pricing of the notes and prior to the maturity of the notes. Any of these activities could cause or avoid an increase or a decrease in the market price of the Company's common shares or the Notes.

Published: 22:02 CET 13-02-2017 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009

Golar LNG Limited Announces Proposed Offering of $350 Million of Convertible Senior Notes due 2022

Hamilton, Bermuda - February 13, 2017-

Golar LNG Limited (the "Company") (NASDAQ:GLNG) announces today that it intends to offer, subject to market and other conditions, $350 million aggregate principal amount of Convertible Senior Notes due 2022 (the "Notes") in a private placement to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"). The Company also intends to grant the initial purchasers of the Notes a 30-day option to purchase up to an additional $52.5 million aggregate principal amount of the Notes in connection with the offering, solely to cover overallotments.

The Notes will be senior, unsecured obligations of the Company, pay interest semiannually in arrears on February 15 and August 15, mature on February 15, 2022, and be convertible into the Company's common shares, cash, or a combination of shares and cash, at the Company's election.

The Company intends to use a portion of the net proceeds from the sale of the Notes to fund the cost of the initial capped call transactions described below and use the remaining funds for other general corporate purposes.

Golar LNG Limited Announces Proposed Offering of $350 Million of Convertible Senior Notes due 2022

Hamilton, Bermuda - February 13, 2017-

Golar LNG Limited (the "Company") (NASDAQ:GLNG) announces today that it intends to offer, subject to market and other conditions, $350 million aggregate principal amount of Convertible Senior Notes due 2022 (the "Notes") in a private placement to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"). The Company also intends to grant the initial purchasers of the Notes a 30-day option to purchase up to an additional $52.5 million aggregate principal amount of the Notes in connection with the offering, solely to cover overallotments.

The Notes will be senior, unsecured obligations of the Company, pay interest semiannually in arrears on February 15 and August 15, mature on February 15, 2022, and be convertible into the Company's common shares, cash, or a combination of shares and cash, at the Company's election.

The Company intends to use a portion of the net proceeds from the sale of the Notes to fund the cost of the initial capped call transactions described below and use the remaining funds for other general corporate purposes.

Antwort auf Beitrag Nr.: 53.694.744 von R-BgO am 15.11.16 08:24:14Published: 17:22 CET 18-11-2016 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009

Golar LNG Limited Successfully Closes Upsized Public Follow-On Common Stock Offering

Hamilton, Bermuda - (November 18, 2016) - Golar LNG Limited (the "Company") (NASDAQ: GLNG) announced today that it has closed its upsized registered offering of 7,475,000 shares of its common stock, which included 975,000 common shares purchased pursuant to the underwriters' previously announced option to purchase additional common shares.

The proceeds of the offering are expected to be used to partly fund the settlement of the Company's outstanding convertible bonds and will augment a recently received commitment from Citibank N.A. to finance the remainder of the amounts outstanding under the Company's convertible bonds through a new term loan credit facility of up to $150 million.

Golar LNG Limited Successfully Closes Upsized Public Follow-On Common Stock Offering

Hamilton, Bermuda - (November 18, 2016) - Golar LNG Limited (the "Company") (NASDAQ: GLNG) announced today that it has closed its upsized registered offering of 7,475,000 shares of its common stock, which included 975,000 common shares purchased pursuant to the underwriters' previously announced option to purchase additional common shares.

The proceeds of the offering are expected to be used to partly fund the settlement of the Company's outstanding convertible bonds and will augment a recently received commitment from Citibank N.A. to finance the remainder of the amounts outstanding under the Company's convertible bonds through a new term loan credit facility of up to $150 million.

Published: 04:11 CET 15-11-2016 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009

Golar LNG Limited Announces Pricing of Upsized Public Follow-On Common Stock Offering

Hamilton, Bermuda - (November 14, 2016) -

Golar LNG Limited (the "Company") (NASDAQ: GLNG) announced today that it has increased the size of its previously announced registered offering by 800,000 shares to 6,500,000 shares of its common stock. In addition, the Company announced the pricing of the upsized offering, at a public offering price of $23.50 per share. As part of this offering, the underwriters are selling 212,765 common shares to a member of the Company's board of directors at the public offering price. The Company granted the underwriters a 30 day option to purchase up to an additional 975,000 common shares. The proceeds of the offering are expected to be used to partly fund the settlement of the Company's outstanding convertible bonds and will augment a recently received commitment from Citibank N.A. to finance the remainder of the amounts outstanding under the Company's convertible bonds through a new term loan credit facility of up to $150 million. The offering is scheduled to close on November 18, 2016.

Golar LNG Limited Announces Pricing of Upsized Public Follow-On Common Stock Offering

Hamilton, Bermuda - (November 14, 2016) -

Golar LNG Limited (the "Company") (NASDAQ: GLNG) announced today that it has increased the size of its previously announced registered offering by 800,000 shares to 6,500,000 shares of its common stock. In addition, the Company announced the pricing of the upsized offering, at a public offering price of $23.50 per share. As part of this offering, the underwriters are selling 212,765 common shares to a member of the Company's board of directors at the public offering price. The Company granted the underwriters a 30 day option to purchase up to an additional 975,000 common shares. The proceeds of the offering are expected to be used to partly fund the settlement of the Company's outstanding convertible bonds and will augment a recently received commitment from Citibank N.A. to finance the remainder of the amounts outstanding under the Company's convertible bonds through a new term loan credit facility of up to $150 million. The offering is scheduled to close on November 18, 2016.

Published: 08:00 CET 10-11-2016 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009

Ophir and OneLNG to form a Joint Operating Company to develop Fortuna FLNG Project

LONDON, November 10, 2016 -

Ophir Holdings & Ventures LTD ("Ophir"), a wholly owned subsidiary of Ophir Energy plc, and OneLNGSM, a joint venture between subsidiaries of Golar LNG Limited and Schlumberger, announce that they have signed a binding Shareholders' Agreement to establish a Joint Operating Company ("JOC") to develop the Fortuna project, in Block R, offshore Equatorial Guinea utilising Golar's FLNG technology.

OneLNG and Ophir will have 66.2% and 33.8% ownership of the JOC respectively (with economic entitlements materially consistent with the equity interest in the JOC1). The JOC will facilitate the financing, construction, development and operation of the integrated Fortuna project and, from Final Investment Decision ("FID"), will own Ophir's share of the Block R licence and the Gandria FLNG vessel. This innovative structure aligns investment across the value chain and provides a framework to promptly deliver a fully financed project.

The Shareholders' Agreement and FID are subject to, amongst other things:

-agreement of final terms and execution of documentation for the project debt financing

-approval by the shareholders of Ophir Energy plc

-approval by the government of Equatorial Guinea

FID is now expected to take place in 1H 2017 with first gas anticipated in 1H 2020. Initial offtake is expected to be 2.2-2.5 mtpa for a duration of between 15 and 20 years which will monetise around 2.6 Tcf of the discovered resource.

The expected total capital expenditure for the integrated project is approximately $2 billion to reach first gas. Approximately $1.2 billion is expected to be debt financed, with full drawdown by the start of commercial operations. Prior to FID, a decision will be taken as to the final offtake pricing mechanism. Shortlisted proposals from potential offtakers will be evaluated on the basis of value maximisation. At an assumed FOB gas price of $6/mmbtu the JOC will generate approximately $560 million in cash flow (pre debt service) per annum.

Nick Cooper, Chief Executive of Ophir, commented: "Formation of the Fortuna JOC provides the framework for FID and clear line of sight to first gas. This progress is due to the innovative partnering between OneLNG and Ophir, the quality of the resource base, the excellent project economics and support from the Government of Equatorial Guinea.

"Ophir's committed future expenditure to first gas will not exceed $150 million and certain other commercial exposures have been limited. We will now be able to advance the project while preserving our balance sheet strength."

Jeff Goodrich, CEO of OneLNG commented: "OneLNG was formed to provide an integrated approach to operators to reduce risk and costs and accelerate the time to monetize stranded gas reserves, and thereby transforming the economic viability of such projects. We are pleased to sign a shareholders' agreement with Ophir for the formation of the Fortuna JOC. We look forward to working with Ophir and all of the other stakeholders to deliver OneLNG's and Africa's first deep-water FLNG project."

Ophir and OneLNG to form a Joint Operating Company to develop Fortuna FLNG Project

LONDON, November 10, 2016 -

Ophir Holdings & Ventures LTD ("Ophir"), a wholly owned subsidiary of Ophir Energy plc, and OneLNGSM, a joint venture between subsidiaries of Golar LNG Limited and Schlumberger, announce that they have signed a binding Shareholders' Agreement to establish a Joint Operating Company ("JOC") to develop the Fortuna project, in Block R, offshore Equatorial Guinea utilising Golar's FLNG technology.

OneLNG and Ophir will have 66.2% and 33.8% ownership of the JOC respectively (with economic entitlements materially consistent with the equity interest in the JOC1). The JOC will facilitate the financing, construction, development and operation of the integrated Fortuna project and, from Final Investment Decision ("FID"), will own Ophir's share of the Block R licence and the Gandria FLNG vessel. This innovative structure aligns investment across the value chain and provides a framework to promptly deliver a fully financed project.

The Shareholders' Agreement and FID are subject to, amongst other things:

-agreement of final terms and execution of documentation for the project debt financing

-approval by the shareholders of Ophir Energy plc

-approval by the government of Equatorial Guinea

FID is now expected to take place in 1H 2017 with first gas anticipated in 1H 2020. Initial offtake is expected to be 2.2-2.5 mtpa for a duration of between 15 and 20 years which will monetise around 2.6 Tcf of the discovered resource.

The expected total capital expenditure for the integrated project is approximately $2 billion to reach first gas. Approximately $1.2 billion is expected to be debt financed, with full drawdown by the start of commercial operations. Prior to FID, a decision will be taken as to the final offtake pricing mechanism. Shortlisted proposals from potential offtakers will be evaluated on the basis of value maximisation. At an assumed FOB gas price of $6/mmbtu the JOC will generate approximately $560 million in cash flow (pre debt service) per annum.

Nick Cooper, Chief Executive of Ophir, commented: "Formation of the Fortuna JOC provides the framework for FID and clear line of sight to first gas. This progress is due to the innovative partnering between OneLNG and Ophir, the quality of the resource base, the excellent project economics and support from the Government of Equatorial Guinea.

"Ophir's committed future expenditure to first gas will not exceed $150 million and certain other commercial exposures have been limited. We will now be able to advance the project while preserving our balance sheet strength."

Jeff Goodrich, CEO of OneLNG commented: "OneLNG was formed to provide an integrated approach to operators to reduce risk and costs and accelerate the time to monetize stranded gas reserves, and thereby transforming the economic viability of such projects. We are pleased to sign a shareholders' agreement with Ophir for the formation of the Fortuna JOC. We look forward to working with Ophir and all of the other stakeholders to deliver OneLNG's and Africa's first deep-water FLNG project."

Antwort auf Beitrag Nr.: 52.654.535 von R-BgO am 20.06.16 14:14:07

=> spezifischer Preis für ein großes Gaskraftwerk: 1,3/1,5 = 87US-c/Watt

Golar Power reaches a Final Investment Decision on Sergipe Power Project and signs 25 year FSRU agreement

The board of Golar Power is pleased to announce that it has approved taking a Final Investment Decision on the Porto de Sergipe Project, thereby enabling CELSE, the project company, to enter into a lump sum turn-key EPC agreement with General Electric to build, maintain and operate a 1.5 GW combined cycle power plant in Brazil. The executed EPC contract with General Electric, which makes up approximately 80% of the project cost, has been structured on a non-recourse basis to the sponsors Golar Power and Ebrasil with all liabilities limited to the project level (CELSE).

Located near Aracaju, the state capital of Sergipe, the 1,516 megawatt power station will be the largest thermal power station in South America. The project will supplement hydropower during dry seasons and help to meet growing demand for electricity in the region. Capital expenditure for the power station and terminal including taxes and financing costs is estimated at BRL4.3 billion, equal to US$1.3 billion at current exchange rates. Scheduled to deliver power to 26 committed off-takers for 25 years from 2020 in accordance with previously executed PPA contracts awarded by the Brazilian government in 2015, the power project will generate a projected annual EBITDA of BRL1.1 billion based on no dispatch with further upside based on dispatch. Payments under the executed PPA are inflation indexed and provide for pass through changes in commodity prices to the PPA counterparties.

In connection with the Sergipe FID, Golar Power has entered into an Agreement to charter Golar Nanook, the November 2017 delivering new-build FSRU, for 25 years. The annual EBITDA contribution for Golar Power is currently projected to be US$39 million with upside potential for Golar Power from FSRU capacity not utilised by the Sergipe power plant.

Golar Power has also increased its ownership in the Sergipe Project from 25% to 50%. The final price to be paid for the shares will depend on the performance of the project and the structure includes an option, which if exercised, limits the price to US$50 million. As Golar Power had previously committed to finance the selling shareholders' equity contribution in the project, the ownership uplift is expected to have a limited cash impact on Golar Power during construction. The total equity funding from Golar Power remains unchanged at an expected US$165 million.

Golar LNG Limited has a 50% ownership interest in Golar Power. The remaining 50% is held by Stonepeak Infrastructure Partners. Golar Power will own 50% of the Sergipe project and 100% of the associated FSRU.

Golar Power CEO Eduardo Antonello commented "We are very enthusiastic with the FID of Porto de Sergipe and fully committed to deliver the plant and terminal in accordance with the original budget and schedule. The project shows very solid economics and provides a strong financial foundation for Golar Power. Through this project, Golar Power is developing a very robust and replicable structure to enable the most comprehensive, cost-efficient and flexible integrated gas-to-power solutions globally. We see a huge market to develop cheaper and cleaner energy solutions."

erster Deal:

Published: 14:26 CEST 17-10-2016 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009=> spezifischer Preis für ein großes Gaskraftwerk: 1,3/1,5 = 87US-c/Watt

Golar Power reaches a Final Investment Decision on Sergipe Power Project and signs 25 year FSRU agreement

The board of Golar Power is pleased to announce that it has approved taking a Final Investment Decision on the Porto de Sergipe Project, thereby enabling CELSE, the project company, to enter into a lump sum turn-key EPC agreement with General Electric to build, maintain and operate a 1.5 GW combined cycle power plant in Brazil. The executed EPC contract with General Electric, which makes up approximately 80% of the project cost, has been structured on a non-recourse basis to the sponsors Golar Power and Ebrasil with all liabilities limited to the project level (CELSE).

Located near Aracaju, the state capital of Sergipe, the 1,516 megawatt power station will be the largest thermal power station in South America. The project will supplement hydropower during dry seasons and help to meet growing demand for electricity in the region. Capital expenditure for the power station and terminal including taxes and financing costs is estimated at BRL4.3 billion, equal to US$1.3 billion at current exchange rates. Scheduled to deliver power to 26 committed off-takers for 25 years from 2020 in accordance with previously executed PPA contracts awarded by the Brazilian government in 2015, the power project will generate a projected annual EBITDA of BRL1.1 billion based on no dispatch with further upside based on dispatch. Payments under the executed PPA are inflation indexed and provide for pass through changes in commodity prices to the PPA counterparties.

In connection with the Sergipe FID, Golar Power has entered into an Agreement to charter Golar Nanook, the November 2017 delivering new-build FSRU, for 25 years. The annual EBITDA contribution for Golar Power is currently projected to be US$39 million with upside potential for Golar Power from FSRU capacity not utilised by the Sergipe power plant.

Golar Power has also increased its ownership in the Sergipe Project from 25% to 50%. The final price to be paid for the shares will depend on the performance of the project and the structure includes an option, which if exercised, limits the price to US$50 million. As Golar Power had previously committed to finance the selling shareholders' equity contribution in the project, the ownership uplift is expected to have a limited cash impact on Golar Power during construction. The total equity funding from Golar Power remains unchanged at an expected US$165 million.

Golar LNG Limited has a 50% ownership interest in Golar Power. The remaining 50% is held by Stonepeak Infrastructure Partners. Golar Power will own 50% of the Sergipe project and 100% of the associated FSRU.

Golar Power CEO Eduardo Antonello commented "We are very enthusiastic with the FID of Porto de Sergipe and fully committed to deliver the plant and terminal in accordance with the original budget and schedule. The project shows very solid economics and provides a strong financial foundation for Golar Power. Through this project, Golar Power is developing a very robust and replicable structure to enable the most comprehensive, cost-efficient and flexible integrated gas-to-power solutions globally. We see a huge market to develop cheaper and cleaner energy solutions."

Published: 14:33 CEST 14-10-2016 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009

Exchange of Golar LNG Partners LP Incentive Distribution Rights

Golar LNG Limited (NASDAQ: GLNG) and Golar GP LLC (collectively, "Golar") announced today that they have entered into an agreement with Golar LNG Partners L.P. ("Golar Partners" or "the Partnership") to exchange all of the existing incentive distribution rights ("Old IDRs") for (i) the issuance of a new class of incentive distribution rights ("New IDRs") and an aggregate of 2,994,364 common units and an aggregate of 61,109 general partner units on the closing date of the exchange (the "Closing") and (ii) an aggregate of up to 748,592 additional common units and up to 15,278 additional general partner units (collectively, the "Earn-Out Units") that may be issued subject to certain conditions described below (collectively, the "Transaction"). The Earn-Out Units represent an aggregate of 20% of the total units to be issued in connection with the Transaction. If the Partnership issues the Earn-Out Units, the Partnership will have issued to Golar an aggregate of 3,742,956 common units and 76,387 general partner units in connection with the Transaction.

The Partnership will issue to Golar 50% of the Earn-Out Units if the Partnership pays a distribution of available cash from operating surplus pursuant to the terms of the Partnership's agreement of limited partnership, as amended and restated in connection with the Transaction (the "Partnership Agreement"), on each of the outstanding common units of the Partnership (the "Common Units") equal to or greater than $0.5775 per Common Unit in respect of each of the quarterly periods ended December 31, 2016, March 31, 2017, June 30, 2017 and September 30, 2017. The Partnership will issue to Golar the remaining 50% of the Earn-Out Units if the Partnership has issued the first 50% of the Earn-Out Units and the Partnership pays a distribution of available cash from operating surplus pursuant to the terms of the Partnership Agreement on each of the outstanding Common Units equal to or greater than $0.5775 per Common Unit in respect of each of the quarterly periods ended December 31, 2017, March 31, 2018, June 30, 2018 and September 30, 2018.

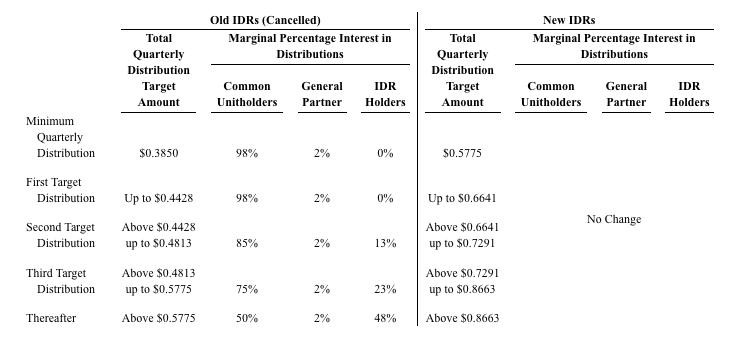

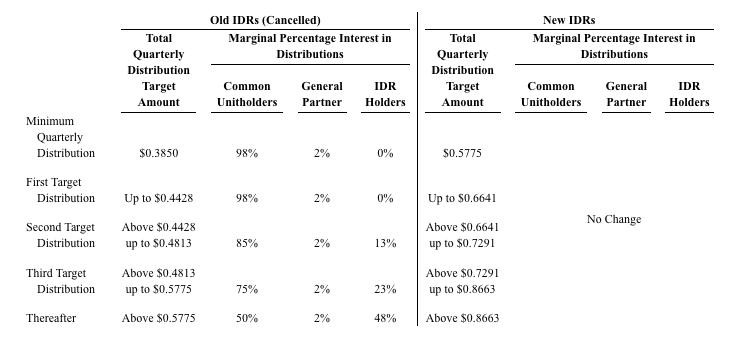

The terms of the New IDRs are effective with respect to the distribution for the quarter ended December 31, 2016, payable in February 2017. The New IDRs provide for distribution "splits" between the IDR holders and the holders of Common Units equal to those applicable to the Old IDRs, which have been cancelled. However, the New IDRs provide for higher target distribution levels, as set forth in the table below. In addition, in connection with the Transaction, the minimum quarterly distribution will be $0.5775 per common unit (or $2.31 per unit on an annualized basis).

The following table compares the target distribution levels and distribution splits between the general partner and the holders of Common Units under the Old IDRs and under the New IDRs:

After this reset Golar will have a total of 22,934,678 units including common and general partner units and including a total of 763,870 Earn-Out Units. Based on the October 13, 2016 closing price the value of this stake is in excess of $470 million. The common units and the associated annual distribution income receivable from Golar Partners of approximately of $49.9 million per annum, provides an attractive security package for a potential commercial bank refinancing of the whole or the major part of the convertible bond due in March 2017.

For the Partnership this Transaction reduces its cost of equity and better positions it to pursue acquisitions from Golar that add revenue backlog, reduce exposure to expiring time charters and grow its distribution capacity. As a holder of 33% of the common units in Golar Partners, Golar is likely to benefit from these developments.

Golar expects to enter into preliminary discussions with Golar Partners regarding the potential acquisition of an interest in the FLNG unit, the Golar Hilli, which is on schedule to commence its 8 year contract with Perenco Cameroon by September 30, 2017.

However, there can be no assurance that the Partnership will acquire an interest in the Golar Hilli. Any such acquisition would be dependent on the attractiveness of the overall financing package, including the pricing of any equity financing, and the approval of the boards of directors of the Partnership and Golar.

Exchange of Golar LNG Partners LP Incentive Distribution Rights

Golar LNG Limited (NASDAQ: GLNG) and Golar GP LLC (collectively, "Golar") announced today that they have entered into an agreement with Golar LNG Partners L.P. ("Golar Partners" or "the Partnership") to exchange all of the existing incentive distribution rights ("Old IDRs") for (i) the issuance of a new class of incentive distribution rights ("New IDRs") and an aggregate of 2,994,364 common units and an aggregate of 61,109 general partner units on the closing date of the exchange (the "Closing") and (ii) an aggregate of up to 748,592 additional common units and up to 15,278 additional general partner units (collectively, the "Earn-Out Units") that may be issued subject to certain conditions described below (collectively, the "Transaction"). The Earn-Out Units represent an aggregate of 20% of the total units to be issued in connection with the Transaction. If the Partnership issues the Earn-Out Units, the Partnership will have issued to Golar an aggregate of 3,742,956 common units and 76,387 general partner units in connection with the Transaction.

The Partnership will issue to Golar 50% of the Earn-Out Units if the Partnership pays a distribution of available cash from operating surplus pursuant to the terms of the Partnership's agreement of limited partnership, as amended and restated in connection with the Transaction (the "Partnership Agreement"), on each of the outstanding common units of the Partnership (the "Common Units") equal to or greater than $0.5775 per Common Unit in respect of each of the quarterly periods ended December 31, 2016, March 31, 2017, June 30, 2017 and September 30, 2017. The Partnership will issue to Golar the remaining 50% of the Earn-Out Units if the Partnership has issued the first 50% of the Earn-Out Units and the Partnership pays a distribution of available cash from operating surplus pursuant to the terms of the Partnership Agreement on each of the outstanding Common Units equal to or greater than $0.5775 per Common Unit in respect of each of the quarterly periods ended December 31, 2017, March 31, 2018, June 30, 2018 and September 30, 2018.

The terms of the New IDRs are effective with respect to the distribution for the quarter ended December 31, 2016, payable in February 2017. The New IDRs provide for distribution "splits" between the IDR holders and the holders of Common Units equal to those applicable to the Old IDRs, which have been cancelled. However, the New IDRs provide for higher target distribution levels, as set forth in the table below. In addition, in connection with the Transaction, the minimum quarterly distribution will be $0.5775 per common unit (or $2.31 per unit on an annualized basis).

The following table compares the target distribution levels and distribution splits between the general partner and the holders of Common Units under the Old IDRs and under the New IDRs:

After this reset Golar will have a total of 22,934,678 units including common and general partner units and including a total of 763,870 Earn-Out Units. Based on the October 13, 2016 closing price the value of this stake is in excess of $470 million. The common units and the associated annual distribution income receivable from Golar Partners of approximately of $49.9 million per annum, provides an attractive security package for a potential commercial bank refinancing of the whole or the major part of the convertible bond due in March 2017.

For the Partnership this Transaction reduces its cost of equity and better positions it to pursue acquisitions from Golar that add revenue backlog, reduce exposure to expiring time charters and grow its distribution capacity. As a holder of 33% of the common units in Golar Partners, Golar is likely to benefit from these developments.

Golar expects to enter into preliminary discussions with Golar Partners regarding the potential acquisition of an interest in the FLNG unit, the Golar Hilli, which is on schedule to commence its 8 year contract with Perenco Cameroon by September 30, 2017.

However, there can be no assurance that the Partnership will acquire an interest in the Golar Hilli. Any such acquisition would be dependent on the attractiveness of the overall financing package, including the pricing of any equity financing, and the approval of the boards of directors of the Partnership and Golar.

Antwort auf Beitrag Nr.: 51.558.291 von R-BgO am 22.01.16 15:44:34follow-up:

Published: 14:00 CEST 25-07-2016 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009

Golar and Schlumberger Form OneLNG Joint Venture: OneLNG targets development of low cost gas reserves to LNG

LONDON, July 25, 2016-Golar LNG Limited ("Golar") and Schlumberger today announced the creation of OneLNGSM, a joint venture to rapidly develop low cost gas reserves to LNG. The combination of Schlumberger reservoir knowledge, wellbore technologies and production management capabilities, with Golar's low cost FLNG (Floating LNG) solution, will offer gas resource owners a faster and lower cost development thereby increasing the net present value of the resources.

Golar and Schlumberger have 51/49 ownership of the joint venture. Golar and Schlumberger have agreed an initial investment commitment to cover the estimated equity needed to develop the first project. In addition, the parties will on a project-by-project basis discuss additional debt capital as required. This future financing will take into account Golar's FLNG intellectual property through an equitable contribution mechanism to be agreed between the parties.

Golar Vice Chairman, Tor Olav Troim said, "Our new venture with Schlumberger provides a powerful union of their oilfield services technology and production management business, and our low cost FLNG solution. It leverages Golar's LNG expertise, and builds upon our industry leading position as a midstream solutions provider."

Schlumberger, President Operations, Patrick Schorn commented, "This new joint venture is uniquely positioned to optimize the development of low cost gas reserves. The technology platform and production management capability that Schlumberger brings will enable a total system approach, leading to a simpler and fast-tracked FID process, and reliable operational execution for the benefit of the gas resource owners."

OneLNG will be the exclusive vehicle for all projects that involve the conversion of natural gas to LNG which require both Schlumberger Production Management services and Golar's FLNG expertise. After reviewing the current market opportunities where 40% of the world's gas reserves can be classified as stranded, both parties are excited at the future prospects of OneLNG and are confident that it would conclude 5 projects within the next 5 years.

Published: 14:00 CEST 25-07-2016 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009

Golar and Schlumberger Form OneLNG Joint Venture: OneLNG targets development of low cost gas reserves to LNG

LONDON, July 25, 2016-Golar LNG Limited ("Golar") and Schlumberger today announced the creation of OneLNGSM, a joint venture to rapidly develop low cost gas reserves to LNG. The combination of Schlumberger reservoir knowledge, wellbore technologies and production management capabilities, with Golar's low cost FLNG (Floating LNG) solution, will offer gas resource owners a faster and lower cost development thereby increasing the net present value of the resources.

Golar and Schlumberger have 51/49 ownership of the joint venture. Golar and Schlumberger have agreed an initial investment commitment to cover the estimated equity needed to develop the first project. In addition, the parties will on a project-by-project basis discuss additional debt capital as required. This future financing will take into account Golar's FLNG intellectual property through an equitable contribution mechanism to be agreed between the parties.

Golar Vice Chairman, Tor Olav Troim said, "Our new venture with Schlumberger provides a powerful union of their oilfield services technology and production management business, and our low cost FLNG solution. It leverages Golar's LNG expertise, and builds upon our industry leading position as a midstream solutions provider."

Schlumberger, President Operations, Patrick Schorn commented, "This new joint venture is uniquely positioned to optimize the development of low cost gas reserves. The technology platform and production management capability that Schlumberger brings will enable a total system approach, leading to a simpler and fast-tracked FID process, and reliable operational execution for the benefit of the gas resource owners."

OneLNG will be the exclusive vehicle for all projects that involve the conversion of natural gas to LNG which require both Schlumberger Production Management services and Golar's FLNG expertise. After reviewing the current market opportunities where 40% of the world's gas reserves can be classified as stranded, both parties are excited at the future prospects of OneLNG and are confident that it would conclude 5 projects within the next 5 years.

Antwort auf Beitrag Nr.: 52.654.535 von R-BgO am 20.06.16 14:14:07Published: 14:33 CEST 06-07-2016 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009

Golar Power transaction closes

We refer to the press release dated June 20, 2016 which announced the launch of Golar Power, a 50/50 partnership with Stonepeak Ltd.

The transaction completed on July 6. Golar Power has received the proceeds of a $100 million preferred note from Stonepeak and Golar LNG Limited has received $116 million in respect of its sale of 50% of the shares in Golar Power. After settlement of transaction related fees and Golar's contribution to the working capital of Golar Power, approximately $104 million will be added to Golar LNG Limited's liquidity.

Golar Power expects to execute contracts for the conversion of its first LNG carrier to a FSRU shortly.

Golar Power transaction closes

We refer to the press release dated June 20, 2016 which announced the launch of Golar Power, a 50/50 partnership with Stonepeak Ltd.

The transaction completed on July 6. Golar Power has received the proceeds of a $100 million preferred note from Stonepeak and Golar LNG Limited has received $116 million in respect of its sale of 50% of the shares in Golar Power. After settlement of transaction related fees and Golar's contribution to the working capital of Golar Power, approximately $104 million will be added to Golar LNG Limited's liquidity.

Golar Power expects to execute contracts for the conversion of its first LNG carrier to a FSRU shortly.

interessant - einfallsreich sind sie...

Published: 14:00 CEST 20-06-2016 /GlobeNewswire /Source: Golar LNG / : GOL /ISIN: BMG9456A1009Golar and Stonepeak launch Golar Power

Golar LNG Limited ("Golar" or "the Company") announces today that it has entered into a 50/50 joint venture with investment vehicles affiliated with private equity firm Stonepeak Infrastructure Partners ("Stonepeak"). The joint venture company, Golar Power Ltd ("Golar Power"), will offer integrated LNG based downstream solutions, through the ownership and operation of floating storage and regasification units ("FSRU"'s) and associated terminal and power generation infrastructure.

Stonepeak shares Golar's ambition to aggressively grow in the FSRU and LNG fueled power market and is committing $290 million in new equity to develop Golar Power.

Stonepeak Senior Managing Director, Luke Taylor, commented: "We are excited to partner with the leading player in the LNG downstream market and see compelling opportunities in this market to build and operate long term LNG and power infrastructure with high quality counterparties. While our initial commitment is $290 million we hope to invest up to $500 million in the coming years".

Golar comments: "By establishing this downstream entity with a strong financial partner that has extensive experience in the energy business Golar is able to accelerate the realization of its downstream ambitions and exploit the unprecedented number of opportunities in the current market".

Golar Power's initial asset base will comprise the FSRU currently being constructed at Samsung shipyard, two modern 160,000 cbm trifuel LNG carriers suited for conversion to FSRUs, and the right to invest in up to 25% of the Sergipe Power project. The Sergipe Power project is progressing well and is expected to take FID in the second half of 2016. Golar will also grant Golar Power a one year option to acquire from the Company a further two LNG carriers for conversion to FSRUs. Upon closing, Golar Power will immediately commence conversion of the first LNG carrier to a FSRU.

Subsequent to the formation of Golar Power and the contribution of the abovementioned assets, the Company has sold a 50% interest in Golar Power to Stonepeak. Stonepeak will acquire its 50% of Golar Power for $117 million in cash, subscribe to $100 million in preference shares on closing of the deal and commit to $75 million in additional equity. This, together with an additional $75 million funding commitment from Golar, in the period before Q1 2018, is expected to be sufficient including debt financing to fully finance the conversion of the two carriers to FSRUs, take delivery of the 2017 new-build FSRU and complete the financing of its share of the Sergipe Power project. Approximately $214 million in ship mortgage debt and $217 million of remaining newbuilding capex on the FSRU is projected to be transferred to Golar Power. The transaction will improve Golar's liquidity position.

LNG prices are at a significant discount to oil prices and Golar Power sees a range of potential LNG importers who would benefit from a rapid switch to gas. The first converted vessel is expected to be available within 16 months. There are only three unfixed FSRU newbuildings presently under construction and delivering within the next 28 - 30 months. Golar Power sees well in excess of three employment prospects that could be met within this window. The conversion model allows Golar Power to cost effectively and timeously address projects with bespoke requirements at a price that remains competitive with the all-in delivered cost of a newbuild equivalent. As the only company to have successfully converted LNG carriers to FSRUs, Golar expects that this partnership with Stonepeak will once again position it to aggressively exploit this competitive advantage.

Golar Power will also enter into an Omnibus Agreement with Golar LNG Partners L.P. ("the Partnership"). This agreement will govern the events upon which the Partnership will be able to acquire assets from Golar Power.

Clarksons Platou Securities AS acted as Sole Financial Advisor.

This transaction is subject to customary financial closing conditions.