Freeport-McMoRan -- one of the cheapest companies in North America (Seite 3)

eröffnet am 29.05.07 06:45:54 von

neuester Beitrag 30.03.24 14:46:04 von

neuester Beitrag 30.03.24 14:46:04 von

Beiträge: 1.089

ID: 1.127.976

ID: 1.127.976

Aufrufe heute: 0

Gesamt: 112.079

Gesamt: 112.079

Aktive User: 0

ISIN: US35671D8570 · WKN: 896476 · Symbol: FCX

52,41

USD

+3,78 %

+1,91 USD

Letzter Kurs 01:00:00 NYSE

Neuigkeiten

26.04.24 · Business Wire (engl.) |

23.04.24 · wallstreetONLINE Redaktion |

Freeport-McMoRan First-Quarter 2024 Financial and Operating Results Release Available on Its Website 23.04.24 · Business Wire (engl.) |

17.04.24 · wallstreetONLINE Redaktion |

16.04.24 · Sharedeals |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4700 | +28,95 | |

| 1,3200 | +17,86 | |

| 1,0100 | +13,48 | |

| 0,5650 | +13,00 | |

| 0,8400 | +12,75 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7100 | -7,79 | |

| 3,3200 | -9,78 | |

| 3,9600 | -15,74 | |

| 12,000 | -25,00 | |

| 46,98 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 71.255.418 von faultcode am 01.04.22 14:54:2521.4.

Freeport-McMoRan stock pulls back, even as profit and revenue topped forecasts

https://www.marketwatch.com/story/freeport-mcmoran-stock-pul…

Shares of Freeport-McMoRan Inc. pulled back 3.2% in premarket trading Thursday, after the gold and copper miner reported first-quarter profit and revenue that beat expectations, while trimming its outlook for quarterly copper sales.

Net income more than doubled to $1.53 billion, or $1.04 a share, from $718 million, or 48 cents a share, in the year-ago period. Excluding nonrecurring items, adjusted earnings per share of $1.07 beat the FactSet consensus of 94 cents.

Revenue grew 36.1% to $6.60 billion, above the FactSet consensus of $6.44 billion, as copper sales rose 24.1% to 1.02 billion recoverable pounds and as gold sales increased 58.5% to 409,000 recoverable ounces. Average realized price per pound of copper rose 18.2% to $4.66 and the realized price per ounce of gold increased 12.1% to $1,920.

The company cut its copper sales outlook for the second quarter to 1.040 billion pounds from 1.075 billion pounds, for the third quarter to 1.095 billion pounds from 1.125 billion pounds and for the fourth quarter to 1.095 billion pounds from 1.130 billion pounds...

Freeport-McMoRan stock pulls back, even as profit and revenue topped forecasts

https://www.marketwatch.com/story/freeport-mcmoran-stock-pul…

Shares of Freeport-McMoRan Inc. pulled back 3.2% in premarket trading Thursday, after the gold and copper miner reported first-quarter profit and revenue that beat expectations, while trimming its outlook for quarterly copper sales.

Net income more than doubled to $1.53 billion, or $1.04 a share, from $718 million, or 48 cents a share, in the year-ago period. Excluding nonrecurring items, adjusted earnings per share of $1.07 beat the FactSet consensus of 94 cents.

Revenue grew 36.1% to $6.60 billion, above the FactSet consensus of $6.44 billion, as copper sales rose 24.1% to 1.02 billion recoverable pounds and as gold sales increased 58.5% to 409,000 recoverable ounces. Average realized price per pound of copper rose 18.2% to $4.66 and the realized price per ounce of gold increased 12.1% to $1,920.

The company cut its copper sales outlook for the second quarter to 1.040 billion pounds from 1.075 billion pounds, for the third quarter to 1.095 billion pounds from 1.125 billion pounds and for the fourth quarter to 1.095 billion pounds from 1.130 billion pounds...

31.3.

...

Goldman analyst Nicholas Snowdon told a copper conference Wednesday that current near-record prices need to go much higher in order to stimulate a supply response. The next day, Freeport boss Richard Adkerson said market tightness “is far beyond a price issue.”

So while copper companies like Freeport, the top publicly trader producer, are raking in the cash, there’s not much they can do to significantly accelerate projects given a deterioration of deposit quality and more demanding operating environments, Adkerson said in an interview. That’s a problem, with copper demand set to surge in the clean energy transition.

“Even if the price of copper were to double overnight it would still be years before we had significant incremental production coming on,” he said. “The market is going to need it far faster than companies like ours can produce it.”

Asked about the impact of China’s recent Covid lockdowns, Adkerson said copper demand from the Asian nation “has remained remarkably strong,” with the company not seeing any issues selling its material to smelters there.

Russia’s invasion of Ukraine has less of an impact on copper than other commodities given Russia accounts for less than 5% of global supply. Still, any meaningful disruption can be felt in the current tight market, he said.

The big unanswered question is how the war will affect the global economy, and therefore copper demand, going forward. “Nobody has a clear idea right now,” Adkerson said.

...

Copper Tightness ‘Is Far Beyond a Price Issue,’ Freeport CEO Says

https://finance.yahoo.com/news/copper-tightness-far-beyond-p…

...

Goldman analyst Nicholas Snowdon told a copper conference Wednesday that current near-record prices need to go much higher in order to stimulate a supply response. The next day, Freeport boss Richard Adkerson said market tightness “is far beyond a price issue.”

So while copper companies like Freeport, the top publicly trader producer, are raking in the cash, there’s not much they can do to significantly accelerate projects given a deterioration of deposit quality and more demanding operating environments, Adkerson said in an interview. That’s a problem, with copper demand set to surge in the clean energy transition.

“Even if the price of copper were to double overnight it would still be years before we had significant incremental production coming on,” he said. “The market is going to need it far faster than companies like ours can produce it.”

Asked about the impact of China’s recent Covid lockdowns, Adkerson said copper demand from the Asian nation “has remained remarkably strong,” with the company not seeing any issues selling its material to smelters there.

Russia’s invasion of Ukraine has less of an impact on copper than other commodities given Russia accounts for less than 5% of global supply. Still, any meaningful disruption can be felt in the current tight market, he said.

The big unanswered question is how the war will affect the global economy, and therefore copper demand, going forward. “Nobody has a clear idea right now,” Adkerson said.

...

Copper Tightness ‘Is Far Beyond a Price Issue,’ Freeport CEO Says

https://finance.yahoo.com/news/copper-tightness-far-beyond-p…

C.Vogt von Krisensicher investieren empfiehlt die Aktie zum kauf

Antwort auf Beitrag Nr.: 71.030.687 von faultcode am 06.03.22 17:52:47

Position bleibt so, wie sie ist!

Das halte ich genau so.

Antwort auf Beitrag Nr.: 65.865.456 von faultcode am 27.11.20 14:17:59 27.11.2020

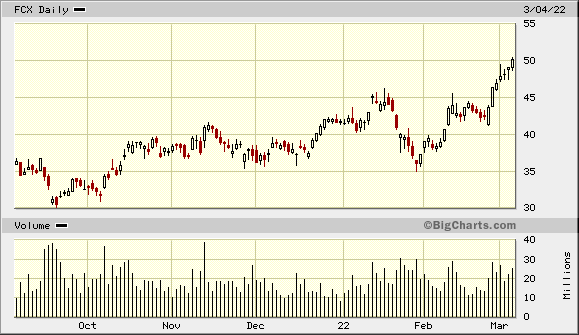

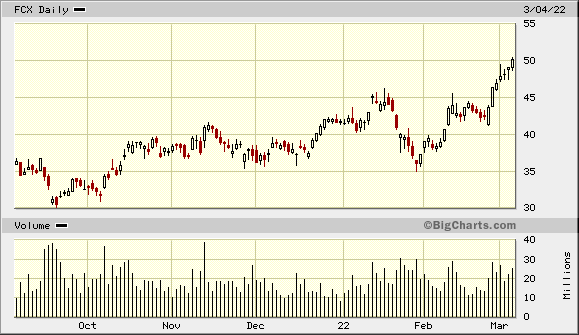

USD50 sind nun erreicht:

Position bleibt so wie sie ist

Zitat von faultcode: ...

ich denke über eine Teilgewinn-Mitnahme nach, um den Rest bis auf wahnwitzige ~USD50 laufen zu lassen (als Plan):

...

USD50 sind nun erreicht:

Position bleibt so wie sie ist

Gordon Reid discusses Freeport-McMoRan

https://www.bnnbloomberg.ca/video/gordon-reid-discusses-free…

https://www.bnnbloomberg.ca/video/gordon-reid-discusses-free…

Antwort auf Beitrag Nr.: 69.663.831 von faultcode am 21.10.21 16:17:14Q4: https://investors.fcx.com/investors/news-releases/news-rele…

...

• ..Capital expenditures for the year 2022 are expected to approximate $4.7 billion ($3.3 billion excluding the Indonesia smelter projects), including $2.0 billion for major mining projects.

• ...In November 2021, FCX's Board of Directors (Board) approved a new share repurchase program authorizing repurchases of up to $3.0 billion of FCX's common stock (through January 25, 2022, FCX has acquired 15.4 million shares for a total cost of $599.9 million, $39.03 per share) and approved an increase in common stock dividends. The combined annual rate of the base dividend and the variable dividend approved by the Board is expected to total $0.60 per share in 2022

• ...At December 31, 2021, consolidated debt totaled $9.5 billion and consolidated cash and cash equivalents totaled $8.1 billion, resulting in net debt of $1.4 billion

• ...Consolidated sales for the year 2022 are expected to approximate 4.3 billion pounds of copper, 1.6 million ounces of gold and 80 million pounds of molybdenum, including 970 million pounds of copper, 380 thousand ounces of gold and 20 million pounds of molybdenum in first-quarter 2022

...

...

• ..Capital expenditures for the year 2022 are expected to approximate $4.7 billion ($3.3 billion excluding the Indonesia smelter projects), including $2.0 billion for major mining projects.

• ...In November 2021, FCX's Board of Directors (Board) approved a new share repurchase program authorizing repurchases of up to $3.0 billion of FCX's common stock (through January 25, 2022, FCX has acquired 15.4 million shares for a total cost of $599.9 million, $39.03 per share) and approved an increase in common stock dividends. The combined annual rate of the base dividend and the variable dividend approved by the Board is expected to total $0.60 per share in 2022

• ...At December 31, 2021, consolidated debt totaled $9.5 billion and consolidated cash and cash equivalents totaled $8.1 billion, resulting in net debt of $1.4 billion

• ...Consolidated sales for the year 2022 are expected to approximate 4.3 billion pounds of copper, 1.6 million ounces of gold and 80 million pounds of molybdenum, including 970 million pounds of copper, 380 thousand ounces of gold and 20 million pounds of molybdenum in first-quarter 2022

...

Wir sind wieder bei der 39 USD. Mal schauen, ob wir sie jetzt nachhaltig überwinden können.

aber kaufe ich in drei Tranchen

Heute wieder erste Tranche fürs Langfristdepots gekauft. hatte ich schon mal, aber wieder verkauft. Jetzt wird wieder aufgebaut.

23.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

17.04.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |

16.04.24 · Sharedeals · Freeport-McMoRan |

16.04.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |

04.04.24 · dpa-AFX · Freeport-McMoRan |

29.03.24 · wallstreetONLINE Redaktion · Freeport-McMoRan |