Carl Icahn: Kasse gemacht: Star-Investor stiegt vor Lyft-Börsengang aus (Seite 8) | Diskussion im Forum

eröffnet am 04.04.19 10:50:59 von

neuester Beitrag 14.02.24 15:57:49 von

neuester Beitrag 14.02.24 15:57:49 von

Beiträge: 86

ID: 1.301.322

ID: 1.301.322

Aufrufe heute: 0

Gesamt: 4.093

Gesamt: 4.093

Aktive User: 0

ISIN: US55087P1049 · WKN: A2PE38 · Symbol: LYFT

16,030

USD

+1,07 %

+0,170 USD

Letzter Kurs 12:05:07 Nasdaq

Neuigkeiten

24.04.24 · Markus Weingran |

18.04.24 · Business Wire (engl.) |

18.03.24 · Business Wire (engl.) |

14.03.24 · Business Wire (engl.) |

11.03.24 · Business Wire (engl.) |

Werte aus der Branche Informationstechnologie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0000 | +20,00 | |

| 1,6450 | +18,77 | |

| 9,6700 | +17,57 | |

| 0,8700 | +16,00 | |

| 1,0500 | +13,67 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,5700 | -13,97 | |

| 1,9400 | -14,12 | |

| 3,4500 | -16,87 | |

| 22,200 | -17,78 | |

| 4,5500 | -18,17 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 60.354.172 von faultcode am 14.04.19 23:32:49

14.4.

https://www.businessinsider.de/lyft-owned-citi-bike-pulling-…

=>

• Citi Bike, which is owned by Lyft, has removed its electric pedal-assisted bikes from circulation following reports of overly powerful brakes.

• Streetsblog New York reported the pedal-assisted bikes first began disappearing from the Citi Bike map over the weekend.

• DC's Capital Bikeshare and San Francisco's Ford GoBike, which are also both owned by Lyft, also pulled their electronic bikes, citing similar reasons.

Lyft-owned Citi Bike is pulling its electric bikes off the streets after brake complaints, ...

Einen hab ich noch:14.4.

https://www.businessinsider.de/lyft-owned-citi-bike-pulling-…

=>

• Citi Bike, which is owned by Lyft, has removed its electric pedal-assisted bikes from circulation following reports of overly powerful brakes.

• Streetsblog New York reported the pedal-assisted bikes first began disappearing from the Citi Bike map over the weekend.

• DC's Capital Bikeshare and San Francisco's Ford GoBike, which are also both owned by Lyft, also pulled their electronic bikes, citing similar reasons.

Antwort auf Beitrag Nr.: 60.354.160 von faultcode am 14.04.19 23:28:34..und als wenn das nicht schon genug Ärger wäre, kommt hier der nächste:

• der Arbeitsplatz bei solchen Ride sharing-Unternehmen

13.4.

Lyft Sued for Defective App Design Following Crash That Injured Pedestrian

https://news.yahoo.com/lyft-sued-defective-app-design-010008…

=>

...A South Florida lawsuit has accused ride-sharing company Lyft Inc. of operating an "unreasonably dangerous" app that puts the public at risk.

The complaint filed Thursday in Palm Beach Circuit Court names the San Francisco-based company as a defendant, alongside its subsidiary Lyft Florida Inc., Lyft driver Wilky Ilet and rental car company The Hertz Corp., which partners with Lyft.

The plaintiff is Palm Beach County resident Teresa Brookes, who suffered extensive injuries, including brain trauma, after the Lyft driver struck her as she crossed State Road A1A on Jan. 4.

According to plaintiffs counsel, Domnick Cunningham & Whalen shareholder Jeanmarie Whalen, Brookes was leaving work at The Breakers Palm Beach Resort at the time of the crash. Whalen said the incident was caused because the driver who hit Brookes was distracted by the Lyft app.

"These drivers are required to constantly monitor that app in order to obtain rides and generate revenue for Lyft, and in this instance, for Hertz as well," the Palm Beach Gardens attorney said.

The vehicle involved in the crash, a 2017 Kia Optima, was part of the Lyft Express Drive initiative. The program is a partnership between Hertz and Lyft, and allows Lyft drivers to rent vehicles to pick up passengers....

• der Arbeitsplatz bei solchen Ride sharing-Unternehmen

13.4.

Lyft Sued for Defective App Design Following Crash That Injured Pedestrian

https://news.yahoo.com/lyft-sued-defective-app-design-010008…

=>

...A South Florida lawsuit has accused ride-sharing company Lyft Inc. of operating an "unreasonably dangerous" app that puts the public at risk.

The complaint filed Thursday in Palm Beach Circuit Court names the San Francisco-based company as a defendant, alongside its subsidiary Lyft Florida Inc., Lyft driver Wilky Ilet and rental car company The Hertz Corp., which partners with Lyft.

The plaintiff is Palm Beach County resident Teresa Brookes, who suffered extensive injuries, including brain trauma, after the Lyft driver struck her as she crossed State Road A1A on Jan. 4.

According to plaintiffs counsel, Domnick Cunningham & Whalen shareholder Jeanmarie Whalen, Brookes was leaving work at The Breakers Palm Beach Resort at the time of the crash. Whalen said the incident was caused because the driver who hit Brookes was distracted by the Lyft app.

"These drivers are required to constantly monitor that app in order to obtain rides and generate revenue for Lyft, and in this instance, for Hertz as well," the Palm Beach Gardens attorney said.

The vehicle involved in the crash, a 2017 Kia Optima, was part of the Lyft Express Drive initiative. The program is a partnership between Hertz and Lyft, and allows Lyft drivers to rent vehicles to pick up passengers....

3 Reasons Why Lyft Stock Fell 20% Last Week --> Short selling, die Lock-up-Vereinbarungen umgehen??

14.4.https://www.fool.com/investing/2019/04/14/3-reasons-why-lyft…

=>

1/ Shorting

2/ Wall Street nicht begeistert

2/ Uber IPO

--> zu 1/:

6.4.

Lyft is threatening litigation against Morgan Stanley, accusing the firm of supporting short-selling

https://www.cnbc.com/2019/04/06/lyft-is-threatening-litigati…

=>

...Lyft has threatened litigation against Morgan Stanley, accusing the firm of supporting short-selling for investors who are subject to lock-up agreements.

In a letter sent to Morgan Stanley on April 2, Lyft questioned the firm about its alleged role in helping market certain products that would help pre-IPO investors bet against the stock.

...

The letter was prompted by reporting in the New York Post, which said Morgan Stanley had been selling a short product to pre-IPO investors and cited three sources close to the situation.

Lyft asked Morgan Stanley to go on record saying that they did not create such a product, and that they had engaged in the proper due diligence in marketing such a product.

The letter, which copied Lyft’s lead underwriters JP Morgan and Credit Suisse, also asks that if Morgan Stanley did engage in such activity that they stop immediately and turn over a list of shareholders who participated.

While the letter requested that Morgan Stanley respond by the end of the day on April 2, two source close to the matter said that as of late Friday, the firm had yet to do so formally. Both people asked for anonymity discussing private details involving the dispute.

However, a Morgan Stanley spokesperson provided a statement to CNBC, saying that the firm “did not market or execute, directly or indirectly, a sale, short sale, hedge, swap or transfer of risk or value associated with Lyft stock for any Lyft shareholder identified by the company or otherwise known to us to be the subject of a Lyft lock-up agreement.”....

=> wenn Morgan Stanley Recht haben sollte, sieht das Bild für Lyft noch schlechter aus

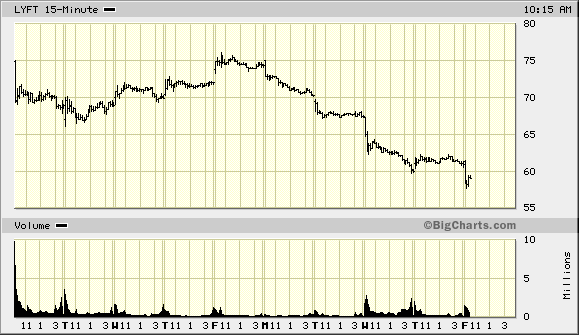

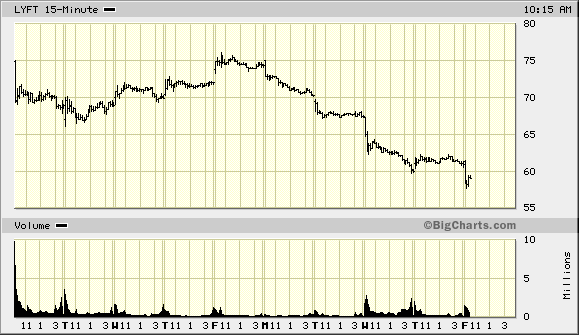

Antwort auf Beitrag Nr.: 60.327.442 von faultcode am 11.04.19 04:02:44..und auch heute - an einem leicht grünen NASDAQ-100-Tag - wird Lyft tiefergelegt:

Antwort auf Beitrag Nr.: 60.313.789 von faultcode am 09.04.19 15:42:53

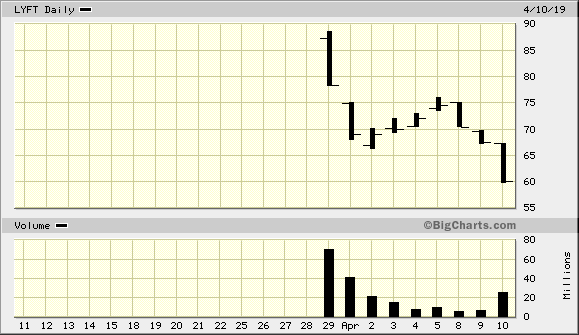

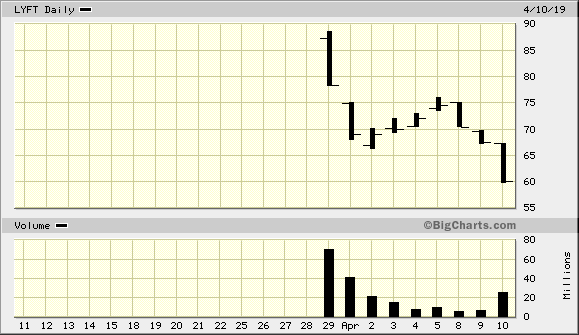

--> die Unicorn-IPO-Party ist vorbei, bevor sie eigentlich richtig angefangen hat

=> mMn eine Blaupause für den Uber-IPO (und airbnb). Nun sind alle gewarnt.

=> der Lyft-IPO hätte so aussehen sollen wie der (zeitgleiche) von Tradeweb Markets (TW) --> über den hier fast niemand spricht bezeichnenderweise: https://www.wallstreet-online.de/diskussion/1300736-1-10/tra…

Crash nach IPO

.

--> die Unicorn-IPO-Party ist vorbei, bevor sie eigentlich richtig angefangen hat

=> mMn eine Blaupause für den Uber-IPO (und airbnb). Nun sind alle gewarnt.

=> der Lyft-IPO hätte so aussehen sollen wie der (zeitgleiche) von Tradeweb Markets (TW) --> über den hier fast niemand spricht bezeichnenderweise: https://www.wallstreet-online.de/diskussion/1300736-1-10/tra…

Unicorns Like Lyft Have a Ton of ‘Restricted’ Stock. Here’s Why That Matters.

https://www.marketwatch.com/articles/lyft-restricted-stock-u…=>

...

Take Lyft for instance. Its stock is trading 1% below the $72 offering price and 18% below where the stock opened on its first day of trading. Lyft’s market value is currently $20 billion or $23 billion depending on how you treat its restricted stock units. A $3 billion spread is significant—it’s 15% of Lyft’s reported market capitalization.

How is that possible? Lyft told investors in its filings it would have about 284 million shares outstanding immediately after it sold stock to the public. It also told investors in the same filings it was excluding about 47 million restricted stock units when calculating its shares outstanding. That’s 16% of the 284 million figure, and it is the reason investors who say Lyft is worth $20 billion or $23 billion are both right.

Those 47 million restricted units are issued to individuals. They can’t be traded yet and their ultimate award is dependent on things like employee performance and tenure with the company. Not all the 47 million restricted shares will hit public markets some day, but a lot will...

Why legendary investor Roger McNamee says Lyft could merge with Uber

https://www.bnnbloomberg.ca/video/why-legendary-investor-rog…

https://www.bnnbloomberg.ca/video/why-legendary-investor-rog…

War ja echt das Gegenteil von einer originellen Idee gewesen, sich hier GEGEN Lyft zu positionieren, siehe die rekordverdächtigen Preise für die Leihe der Aktien:

https://seekingalpha.com/news/3448145-lyft-expensive-borrow-…

https://seekingalpha.com/news/3448145-lyft-expensive-borrow-…

Lyft's IPO is a good lesson for investors, says Quartz editor-in-chief

https://www.cnbc.com/video/2019/04/05/lyfts-ipo-is-a-good-le…

https://www.cnbc.com/video/2019/04/05/lyfts-ipo-is-a-good-le…

Antwort auf Beitrag Nr.: 60.288.282 von mindgames1001 am 05.04.19 14:36:14Oh danke. Keine Ahnung, wieso ich da nichts gefunden hatte.

Allerdings finde ich bei halbwegs lang laufenden (wenigstens über ein Jahr) nur ein paar Scheine von Vontobel und die sind mir viel zu teuer.

Allerdings finde ich bei halbwegs lang laufenden (wenigstens über ein Jahr) nur ein paar Scheine von Vontobel und die sind mir viel zu teuer.