Keine Angst vom "schwarzen Schwan": Corona-Börsen: Ruhig bleiben und zukaufen, statt dem h | Diskussion im Forum

eröffnet am 26.02.20 20:01:23 von

neuester Beitrag 24.01.24 12:29:12 von

neuester Beitrag 24.01.24 12:29:12 von

Beiträge: 71

ID: 1.320.917

ID: 1.320.917

Aufrufe heute: 0

Gesamt: 6.375

Gesamt: 6.375

Aktive User: 0

ISIN: DE0008469008 · WKN: 846900

18.214,00

PKT

+0,86 %

+156,00 PKT

Letzter Kurs 22:22:12 Lang & Schwarz

Neuigkeiten

17:01 Uhr · wallstreetONLINE Redaktion |

18:48 Uhr · Markus Fugmann Anzeige |

18:30 Uhr · Roland Jegen Anzeige |

Beitrag zu dieser Diskussion schreiben

Qube Research & Technologies -- aktuell Deutschland's größter Leerverkäufer:

24.1.

Hedge Fund Qube Built a $1 Billion Short Bet Against Top German Companies

https://finance.yahoo.com/news/hedge-fund-qube-built-1-09003…

...

Qube Research & Technologies Ltd. has amassed a short bet of more than $1 billion against German companies amid a downturn in global demand that’s slowing Europe’s biggest economy.

The hedge fund added to wagers against the likes of automaker Volkswagen AG over the last two weeks, including disclosing a $131.8 million short against Deutsche Bank AG, according to data compiled by Bloomberg from regulatory filings. It’s the biggest disclosed short seller of the country’s stocks, the data show.

...

The hedge fund, spun out from Credit Suisse in 2018, managed about $11 billion last year and uses quantitative trading signals to take positions in equities, fixed income and commodities among other markets.

...

24.1.

Hedge Fund Qube Built a $1 Billion Short Bet Against Top German Companies

https://finance.yahoo.com/news/hedge-fund-qube-built-1-09003…

...

Qube Research & Technologies Ltd. has amassed a short bet of more than $1 billion against German companies amid a downturn in global demand that’s slowing Europe’s biggest economy.

The hedge fund added to wagers against the likes of automaker Volkswagen AG over the last two weeks, including disclosing a $131.8 million short against Deutsche Bank AG, according to data compiled by Bloomberg from regulatory filings. It’s the biggest disclosed short seller of the country’s stocks, the data show.

...

The hedge fund, spun out from Credit Suisse in 2018, managed about $11 billion last year and uses quantitative trading signals to take positions in equities, fixed income and commodities among other markets.

...

22.1.

Hedge Funds Cap a Bumper Year for Profits

https://finance.yahoo.com/news/hedge-funds-cap-bumper-profit…

...

Billionaire money managers Chris Hohn and Ken Griffin led hedge funds to deliver one of the best years for clients in 2023.

The industry produced combined gains worth $218 billion after fees, according to estimates by LCH Investments, a fund of hedge funds. Hohn’s TCI Fund Management made $12.9 billion to top LCH’s rankings, followed by Citadel, which made $8.1 billion.

The annual survey focuses on money managers with the most overall profits in absolute dollar terms since inception, and as a result the largest and oldest hedge funds typically tend to do best. The top 20 firms, which oversee less than a fifth of the industry’s assets, generated $67 billion or roughly a third of the gains last year.

As measured by a more traditional way of assessing returns, the top grouping gained 10.5% in 2023, outperforming the average hedge fund which returned 6.4%. Over the past three years, the top 20 have generated 83% of the absolute gains made by all hedge fund managers, the report found.

“In most cases this reflects an ability to limit the downside in adverse conditions and to make money when conditions are favourable, as they were toward the end of 2023,” Rick Sopher, chairman of LCH, said in a statement.

...

The report also shows the dominance of large multistrategy hedge funds that have been gobbling up assets, talent and leverage in recent years, causing unease among regulators, investors and traders.

...

“Firms of this type typically run with leverage levels far higher than the average hedge fund, which has helped boost their performance,” Sopher said. “Their strong net returns have been achieved after passing on substantial operating costs, which continue to be tolerated by their investors. The sustainability and acceptability to investors and regulators of the risks involved in these models is rightly coming under scrutiny.”

...

Hedge Funds Cap a Bumper Year for Profits

https://finance.yahoo.com/news/hedge-funds-cap-bumper-profit…

...

Billionaire money managers Chris Hohn and Ken Griffin led hedge funds to deliver one of the best years for clients in 2023.

The industry produced combined gains worth $218 billion after fees, according to estimates by LCH Investments, a fund of hedge funds. Hohn’s TCI Fund Management made $12.9 billion to top LCH’s rankings, followed by Citadel, which made $8.1 billion.

The annual survey focuses on money managers with the most overall profits in absolute dollar terms since inception, and as a result the largest and oldest hedge funds typically tend to do best. The top 20 firms, which oversee less than a fifth of the industry’s assets, generated $67 billion or roughly a third of the gains last year.

As measured by a more traditional way of assessing returns, the top grouping gained 10.5% in 2023, outperforming the average hedge fund which returned 6.4%. Over the past three years, the top 20 have generated 83% of the absolute gains made by all hedge fund managers, the report found.

“In most cases this reflects an ability to limit the downside in adverse conditions and to make money when conditions are favourable, as they were toward the end of 2023,” Rick Sopher, chairman of LCH, said in a statement.

...

The report also shows the dominance of large multistrategy hedge funds that have been gobbling up assets, talent and leverage in recent years, causing unease among regulators, investors and traders.

...

“Firms of this type typically run with leverage levels far higher than the average hedge fund, which has helped boost their performance,” Sopher said. “Their strong net returns have been achieved after passing on substantial operating costs, which continue to be tolerated by their investors. The sustainability and acceptability to investors and regulators of the risks involved in these models is rightly coming under scrutiny.”

...

17.1.

Ex-Millennium Trader Cowley’s Sandbar Shuts Down Hedge Fund

https://finance.yahoo.com/news/ex-millennium-trader-cowley-s…

...

The investment firm returned capital in Sandbar Master Fund last month saying the money pool never reached critical mass since its launch in 2018. The equities market-neutral fund managed $84 million, down from a peak of $150 million, and the cost to run it impacted returns, according to Sandbar Chief Executive Officer James Orme-Smith.

Once one of the fastest growing firms in London, Sandbar now solely focuses on running its Lumyna - Sandbar Global Equity Market Neutral UCITS Fund, a more liquid version of the fund that mimics the same investment strategy but allows investors daily access to their capital.

“Sandbar continues to manage almost $400 million in its flagship UCITS fund and is fully committed to growing its business,” Orme-Smith told Bloomberg News.

Equity-focused hedge funds have found it difficult to raise money following years of mediocre returns and investor shift toward multistrategy investment giants in search of stable returns. Clients pulled almost $51 billion from equity hedge funds through November last year, according to data compiled by eVestment.

Cowley ran an equity long-short money pool for billionaire Izzy Englander’s hedge fund Millennium Management before setting up Sandbar. His previous employers include Citadel.

...

Lumyna - Sandbar Global Equity Market Neutral UCITS Fund (ISIN LU2061570896): https://www.lumyna.com/

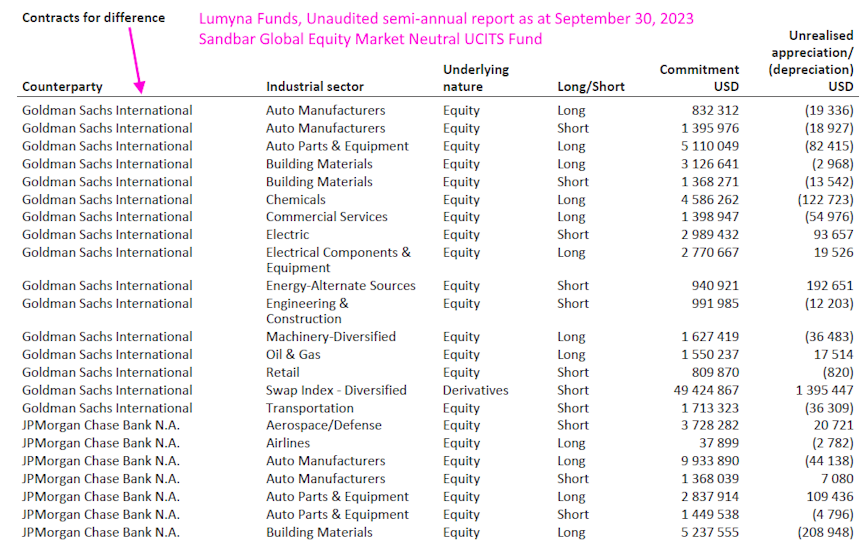

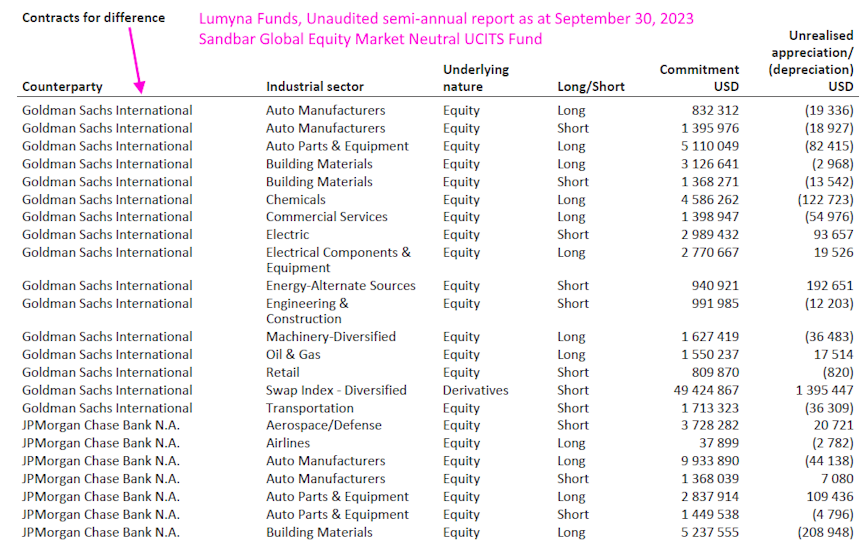

Das ist der erste EU-konforme (UCITS aus Luxemburg) Long/Short-Hedge fund, den ich sehe. Man sieht aber in den Berichten nicht die Namen der konkreten Aktien-Long/Short-Positionen, sondern nur den dazugehörigen Sektor:

=> man sieht, daß die das über CFD's mit Wall Street Primary dealers machen, die daran natürlich was verdienen wollen:

2.4 Valuation of contracts for difference

...

Contracts for differences are valued based on the closing market price of the underlying security, less any financing charges attributable to each contract.

...

Ich habe danach gesucht, ob CFD's allgemein auch eine gewisse Zinsempfindlichkeit aufweisen, habe aber nichts dazu gefunden.

Ex-Millennium Trader Cowley’s Sandbar Shuts Down Hedge Fund

https://finance.yahoo.com/news/ex-millennium-trader-cowley-s…

...

The investment firm returned capital in Sandbar Master Fund last month saying the money pool never reached critical mass since its launch in 2018. The equities market-neutral fund managed $84 million, down from a peak of $150 million, and the cost to run it impacted returns, according to Sandbar Chief Executive Officer James Orme-Smith.

Once one of the fastest growing firms in London, Sandbar now solely focuses on running its Lumyna - Sandbar Global Equity Market Neutral UCITS Fund, a more liquid version of the fund that mimics the same investment strategy but allows investors daily access to their capital.

“Sandbar continues to manage almost $400 million in its flagship UCITS fund and is fully committed to growing its business,” Orme-Smith told Bloomberg News.

Equity-focused hedge funds have found it difficult to raise money following years of mediocre returns and investor shift toward multistrategy investment giants in search of stable returns. Clients pulled almost $51 billion from equity hedge funds through November last year, according to data compiled by eVestment.

Cowley ran an equity long-short money pool for billionaire Izzy Englander’s hedge fund Millennium Management before setting up Sandbar. His previous employers include Citadel.

...

Lumyna - Sandbar Global Equity Market Neutral UCITS Fund (ISIN LU2061570896): https://www.lumyna.com/

Das ist der erste EU-konforme (UCITS aus Luxemburg) Long/Short-Hedge fund, den ich sehe. Man sieht aber in den Berichten nicht die Namen der konkreten Aktien-Long/Short-Positionen, sondern nur den dazugehörigen Sektor:

=> man sieht, daß die das über CFD's mit Wall Street Primary dealers machen, die daran natürlich was verdienen wollen:

2.4 Valuation of contracts for difference

...

Contracts for differences are valued based on the closing market price of the underlying security, less any financing charges attributable to each contract.

...

Ich habe danach gesucht, ob CFD's allgemein auch eine gewisse Zinsempfindlichkeit aufweisen, habe aber nichts dazu gefunden.

Antwort auf Beitrag Nr.: 75.060.597 von faultcode am 06.01.24 13:28:20noch ein paar Hedgies in 2023 (2):

5.12.

Haidar Overhauls Macro Hedge Fund Trades Amid Record 43% Plunge

https://finance.yahoo.com/news/haidar-overhauls-macro-hedge-…

...

His Haidar Jupiter fund slumped 43.5%, posting the biggest annual loss since it started trading more than two decades ago, according to an investor letter seen by Bloomberg News. The decline, which follows a record 193% surge just a year before, has forced Haidar to make sweeping changes to his portfolio.

Short bets on bonds — the reason behind most of his losses — have given way to long wagers on the securities as Haidar expects major global central banks to cut interest rates in the first half of this year, according to a person familiar with the fund’s positioning.

...

Haidar was one of the biggest losers amid the SVB debacle, slumping 32% to record its biggest-ever monthly decline in March.

...

6.12.

D1 Hedge Fund Stung by Big Venture Bets for Second Straight Year

https://www.bloomberg.com/news/articles/2024-01-06/d1-hedge-…

...

D1 Capital Partners’ big bets on venture capital and private equity weighed on its hedge fund returns for a second consecutive year as the firm marked down the value of 49 companies in 2023.

Before accounting for fees and adjusting for share classes with varying exposures to private investments, the hedge fund ended the year up just 0.8%, D1 founder Dan Sundheim wrote in an investor letter seen by Bloomberg. Markdowns of about 10% in the private book ate into the stock portfolio’s 21% gain.

...

5.12.

Haidar Overhauls Macro Hedge Fund Trades Amid Record 43% Plunge

https://finance.yahoo.com/news/haidar-overhauls-macro-hedge-…

...

His Haidar Jupiter fund slumped 43.5%, posting the biggest annual loss since it started trading more than two decades ago, according to an investor letter seen by Bloomberg News. The decline, which follows a record 193% surge just a year before, has forced Haidar to make sweeping changes to his portfolio.

Short bets on bonds — the reason behind most of his losses — have given way to long wagers on the securities as Haidar expects major global central banks to cut interest rates in the first half of this year, according to a person familiar with the fund’s positioning.

...

Haidar was one of the biggest losers amid the SVB debacle, slumping 32% to record its biggest-ever monthly decline in March.

...

6.12.

D1 Hedge Fund Stung by Big Venture Bets for Second Straight Year

https://www.bloomberg.com/news/articles/2024-01-06/d1-hedge-…

...

D1 Capital Partners’ big bets on venture capital and private equity weighed on its hedge fund returns for a second consecutive year as the firm marked down the value of 49 companies in 2023.

Before accounting for fees and adjusting for share classes with varying exposures to private investments, the hedge fund ended the year up just 0.8%, D1 founder Dan Sundheim wrote in an investor letter seen by Bloomberg. Markdowns of about 10% in the private book ate into the stock portfolio’s 21% gain.

...

Antwort auf Beitrag Nr.: 73.021.862 von faultcode am 04.01.23 14:07:47noch ein paar Hedgies in 2023 (1):

5.12., BlueCrest:

Michael Platt’s Winning Streak Extends With 20% Gain Last Year

https://finance.yahoo.com/news/michael-platt-winning-streak-…

...

Platt, one of Britain’s richest people, is known for using a heavy dose of leverage to supercharge returns at his firm and produce some of the best trading profits in the world.

...

5.12.

Peconic Hedge Fund Boosts Shorts After Scoring 31% Gain in 2023

https://financialpost.com/pmn/business-pmn/peconic-hedge-fun…

...

Bill Harnisch, whose $1.5 billion hedge fund delivered a market-beating 31% gain last year, is betting the recent bout of euphoric stock buying will peter out.

In the final days of December, the manager of the Peconic Partners increased wagers against the SPDR S&P 500 ETF Trust, while loading up short positions in expensive industrial stocks and shares of consumer-product makers that have raised prices aggressively.

...

For a fourth straight year, the New York-based fund beat the market. Over the stretch, it’s up 38% annually, three times as much as the S&P 500.

Harnisch, who started Peconic in 2004, envisions subdued upside in 2024, with the S&P 500 rising 10% at most at its peak. While profits are expected to recover, valuations particularly for stretched tech stocks will be under pressure from bond yields. At the same time, the downside risk will likely be limited, too, unless inflation picks up, he says.

...

Peconic focuses on discovering companies that will expand faster than the economy in the long run. The picks, the kernel of its portfolios, are usually held for seven to eight years. On the short side, the team builds hedges to offset the risk from the core holdings while looking for mispriced shares.

...

The rising dominance of passive investing is creating opportunities for stock pickers, according to Harnisch. The proliferation of exchange-traded funds has pushed the share of passive vehicles in the asset management industry to 53%, according to data compiled by BofA. That’s up from roughly 20% some 15 years ago.

...

5.12., BlueCrest:

Michael Platt’s Winning Streak Extends With 20% Gain Last Year

https://finance.yahoo.com/news/michael-platt-winning-streak-…

...

Platt, one of Britain’s richest people, is known for using a heavy dose of leverage to supercharge returns at his firm and produce some of the best trading profits in the world.

...

5.12.

Peconic Hedge Fund Boosts Shorts After Scoring 31% Gain in 2023

https://financialpost.com/pmn/business-pmn/peconic-hedge-fun…

...

Bill Harnisch, whose $1.5 billion hedge fund delivered a market-beating 31% gain last year, is betting the recent bout of euphoric stock buying will peter out.

In the final days of December, the manager of the Peconic Partners increased wagers against the SPDR S&P 500 ETF Trust, while loading up short positions in expensive industrial stocks and shares of consumer-product makers that have raised prices aggressively.

...

For a fourth straight year, the New York-based fund beat the market. Over the stretch, it’s up 38% annually, three times as much as the S&P 500.

Harnisch, who started Peconic in 2004, envisions subdued upside in 2024, with the S&P 500 rising 10% at most at its peak. While profits are expected to recover, valuations particularly for stretched tech stocks will be under pressure from bond yields. At the same time, the downside risk will likely be limited, too, unless inflation picks up, he says.

...

Peconic focuses on discovering companies that will expand faster than the economy in the long run. The picks, the kernel of its portfolios, are usually held for seven to eight years. On the short side, the team builds hedges to offset the risk from the core holdings while looking for mispriced shares.

...

The rising dominance of passive investing is creating opportunities for stock pickers, according to Harnisch. The proliferation of exchange-traded funds has pushed the share of passive vehicles in the asset management industry to 53%, according to data compiled by BofA. That’s up from roughly 20% some 15 years ago.

...

Antwort auf Beitrag Nr.: 74.931.664 von faultcode am 08.12.23 02:34:094.1.

Bridgewater’s Flagship Macro Fund Lost 7.6% Last Year

https://finance.yahoo.com/news/bridgewater-flagship-pure-alp…

...

Bridgewater Associates’s flagship hedge fund lost 7.6% last year, with all of the drop coming in the last two months of 2023, according to people familiar with its performance.

The losses for the world’s biggest hedge fund corresponded to the biggest two-month gain in global bonds since at least 1990 and a roughly 14% gain in US shares.

The Pure Alpha II fund was up 7.5% through October before dropping about 14% in the following two months.

The firm’s long-only All Weather fund returned 10.6% last year, one of the people said.

A Bridgewater spokesperson declined to comment.

This marked the second-straight instance that Bridgewater’s flagship fund gave up gains at year-end. Pure Alpha II tumbled in October and November 2022 after having been up 22%. It ended that year up 9.4%.

Last year’s market moves produced a wide range of returns for macro managers. Rob Citrone’s Discovery Capital Management made 48%, while Said Haidar’s macro fund fell about 50% through November.

Tekmerion Capital Management, another macro fund, gained 9.8% last year. The firm, run by former Bridgewater employees, won a case against their former employer in 2020, after the hedge fund giant accused them of misappropriating trade secrets, breach of contract and unfair competition.

...

Bridgewater’s Flagship Macro Fund Lost 7.6% Last Year

https://finance.yahoo.com/news/bridgewater-flagship-pure-alp…

...

Bridgewater Associates’s flagship hedge fund lost 7.6% last year, with all of the drop coming in the last two months of 2023, according to people familiar with its performance.

The losses for the world’s biggest hedge fund corresponded to the biggest two-month gain in global bonds since at least 1990 and a roughly 14% gain in US shares.

The Pure Alpha II fund was up 7.5% through October before dropping about 14% in the following two months.

The firm’s long-only All Weather fund returned 10.6% last year, one of the people said.

A Bridgewater spokesperson declined to comment.

This marked the second-straight instance that Bridgewater’s flagship fund gave up gains at year-end. Pure Alpha II tumbled in October and November 2022 after having been up 22%. It ended that year up 9.4%.

Last year’s market moves produced a wide range of returns for macro managers. Rob Citrone’s Discovery Capital Management made 48%, while Said Haidar’s macro fund fell about 50% through November.

Tekmerion Capital Management, another macro fund, gained 9.8% last year. The firm, run by former Bridgewater employees, won a case against their former employer in 2020, after the hedge fund giant accused them of misappropriating trade secrets, breach of contract and unfair competition.

...

3.1.

Discovery Capital’s macro hedge fund up 48% in 2023

https://www.hedgeweek.com/discovery-capitals-macro-hedge-fun…

...

Discovery Capital Management, the hedge fund firm led by ‘Tiger cub’ Rob Citrone, recorded a 48% return with its macro hedge fund in 2023, making it one of the top performers among funds betting on economic trends, according to a report by Bloomberg.

The report cites a person with knowledge of the matter as revealing that long wagers on Latin American equities and sovereign bonds, and US credit helped drive returns, as well as long and short bets on financial stocks.

The bumper returns came on the back of a 29% loss in the previous year.

According to data compiled by Bloomberg, macro funds were down by an average of 0.4% up to ten end of November last year following a year of volatile trading conditions as central banks hiked interest rates to tackle soaring inflation.

...

Discovery Capital’s macro hedge fund up 48% in 2023

https://www.hedgeweek.com/discovery-capitals-macro-hedge-fun…

...

Discovery Capital Management, the hedge fund firm led by ‘Tiger cub’ Rob Citrone, recorded a 48% return with its macro hedge fund in 2023, making it one of the top performers among funds betting on economic trends, according to a report by Bloomberg.

The report cites a person with knowledge of the matter as revealing that long wagers on Latin American equities and sovereign bonds, and US credit helped drive returns, as well as long and short bets on financial stocks.

The bumper returns came on the back of a 29% loss in the previous year.

According to data compiled by Bloomberg, macro funds were down by an average of 0.4% up to ten end of November last year following a year of volatile trading conditions as central banks hiked interest rates to tackle soaring inflation.

...

Antwort auf Beitrag Nr.: 73.499.455 von faultcode am 17.03.23 16:42:137.12.

Hedgefonds als Horrorhaus – was von Ray Dalio übrig bleibt

Ein Wall-Street-Reporter zerlegt die Hedgefonds-Legende Ray Dalio. Das Buch "The Fund" zertrümmert das Image des Bridgewater-Gründers.

https://www.manager-magazin.de/lifestyle/ray-dalio-und-bridg…

...

Copeland hat mit vielen (Ex-)Beschäftigten gesprochen, die der Chef nach diesem Schmerzverfahren belehrt hat. Sie erlebten seine Kultur eher als bizarren Kult: Alle bewerten ständig alle, nur für Dalio selbst ist die Bestnote faktisch garantiert; jedes Gespräch wird aufgezeichnet, manipulierte Clips gehen – als Lektion – schon mal an die gesamte Belegschaft.

Die totale Überwachung und Schnüffelei organisierte zeitweise James Comey, der anschließend FBI-Chef wurde. Copeland berichtet vom sadistischen Schauprozess Dalios gegen eine Topmanagerin. Oder von skurrilen Großkampagnen gegen Haustechniker: Ein schmierendes Whiteboard oder Pinkelflecken auf dem Klo habe der Meister wochenlang zur Chefsache gemacht, um die Schuldigen zu Selbstkritik und Perfektion zu zwingen.

...

Dalio hat seine CEO-Rolle 2017 inmitten von Kontroversen niedergelegt und sich im Herbst 2022 endgültig von allen Investitionsentscheidungen zurückgezogen. Derzeit erwäge er ein Comeback, das die neue Bridgewater-Führung jedoch vehement ablehne, berichtete Copeland jüngst in der "New York Times". Das Management ist längst auch auf Distanz zu den "Principles" gegangen.

...

Hedgefonds als Horrorhaus – was von Ray Dalio übrig bleibt

Ein Wall-Street-Reporter zerlegt die Hedgefonds-Legende Ray Dalio. Das Buch "The Fund" zertrümmert das Image des Bridgewater-Gründers.

https://www.manager-magazin.de/lifestyle/ray-dalio-und-bridg…

...

Copeland hat mit vielen (Ex-)Beschäftigten gesprochen, die der Chef nach diesem Schmerzverfahren belehrt hat. Sie erlebten seine Kultur eher als bizarren Kult: Alle bewerten ständig alle, nur für Dalio selbst ist die Bestnote faktisch garantiert; jedes Gespräch wird aufgezeichnet, manipulierte Clips gehen – als Lektion – schon mal an die gesamte Belegschaft.

Die totale Überwachung und Schnüffelei organisierte zeitweise James Comey, der anschließend FBI-Chef wurde. Copeland berichtet vom sadistischen Schauprozess Dalios gegen eine Topmanagerin. Oder von skurrilen Großkampagnen gegen Haustechniker: Ein schmierendes Whiteboard oder Pinkelflecken auf dem Klo habe der Meister wochenlang zur Chefsache gemacht, um die Schuldigen zu Selbstkritik und Perfektion zu zwingen.

...

Dalio hat seine CEO-Rolle 2017 inmitten von Kontroversen niedergelegt und sich im Herbst 2022 endgültig von allen Investitionsentscheidungen zurückgezogen. Derzeit erwäge er ein Comeback, das die neue Bridgewater-Führung jedoch vehement ablehne, berichtete Copeland jüngst in der "New York Times". Das Management ist längst auch auf Distanz zu den "Principles" gegangen.

...

30.11.

Citadel and Its Peers Are Piling Into the Same Trades. Regulators Are Taking Notice

https://finance.yahoo.com/news/citadel-peers-piling-same-tra…

...

Even with more assets and stiffer competition, Citadel continues to be among the most aggressive risk-takers.

While Griffin’s firm gets high marks from S&P Global Ratings for sound risk management, healthy cash levels and sticking to liquid investments, the credit-grading company called Citadel’s appetite for opportunistic, concentrated bets a negative, highlighting its big wagers on natural gas and power — sectors prone to large price swings — in 2021 and 2022.

Citadel gained 38% last year, with about $8 billion — half the profits of its main hedge fund — coming from commodities, according to people familiar with the matter.

With $62 billion of assets under management, Citadel is so big that its trades “could at times represent a high multiple of average daily trading volumes,” potentially limiting its ability to sell quickly without sending prices tumbling, S&P analyst Thierry Grunspan wrote in an April report.

“We are in the risk-taking business,” Citadel spokesman Matt Scully said in a statement. “Our investors expect us to deploy their capital against the most attractive opportunities we see in the market.” Citadel employees and principals are the firm’s largest investor group, accounting for 27% of the funds, he said.

Citadel gained 13.7% this year through October, while many other multistrats posted returns in the single digits.

“Our performance is driven by the extraordinarily talented people at Citadel,” Scully said. “We have the best investment team in the industry.”

...

Citadel and Its Peers Are Piling Into the Same Trades. Regulators Are Taking Notice

https://finance.yahoo.com/news/citadel-peers-piling-same-tra…

...

Even with more assets and stiffer competition, Citadel continues to be among the most aggressive risk-takers.

While Griffin’s firm gets high marks from S&P Global Ratings for sound risk management, healthy cash levels and sticking to liquid investments, the credit-grading company called Citadel’s appetite for opportunistic, concentrated bets a negative, highlighting its big wagers on natural gas and power — sectors prone to large price swings — in 2021 and 2022.

Citadel gained 38% last year, with about $8 billion — half the profits of its main hedge fund — coming from commodities, according to people familiar with the matter.

With $62 billion of assets under management, Citadel is so big that its trades “could at times represent a high multiple of average daily trading volumes,” potentially limiting its ability to sell quickly without sending prices tumbling, S&P analyst Thierry Grunspan wrote in an April report.

“We are in the risk-taking business,” Citadel spokesman Matt Scully said in a statement. “Our investors expect us to deploy their capital against the most attractive opportunities we see in the market.” Citadel employees and principals are the firm’s largest investor group, accounting for 27% of the funds, he said.

Citadel gained 13.7% this year through October, while many other multistrats posted returns in the single digits.

“Our performance is driven by the extraordinarily talented people at Citadel,” Scully said. “We have the best investment team in the industry.”

...

Antwort auf Beitrag Nr.: 73.021.862 von faultcode am 04.01.23 14:07:47

21.11.

JPMorgan Says ‘The Golden Year’ for Carry Trades Is Near Its End

https://finance.yahoo.com/news/jpmorgan-says-golden-carry-tr…

...

This year currency speculators piled into carry trades — in which they borrow low-yielding currencies in order to purchase higher-yielding alternatives — earning some of the strategy’s best returns in decades as global central banks continued an aggressive pace of rate hikes in the face of mounting inflation.

Looking into 2024, G-10 central banks are preparing to ease monetary policy, sending global yields tumbling with the highest yielders cutting deepest and dragging on carry returns in the process, JPMorgan strategists led by Meera Chandan wrote in the bank’s annual foreign exchange outlook released Tuesday.

“2023 will be a year remembered for many things, but for FX market participants it shall forever be known as the golden year for carry,” the report said. “2024 should be the beginning of the end as high-yielders cut most. Declining yields will make carry less attractive and a narrower theme.”

Between January and June of this year, the strategists wrote, a nominal carry basket of 27 currencies returned gains of more than 20%, the best half since 2003.

While carry strategies haven’t performed as well in the second half as US yields remained high while those in Latin America fell — the same basket has only returned 0.4% — the first-half surge was enough to confirm the importance of rate differentials in driving currency moves.

Next year, JPMorgan expects relative currency valuations to converge, reversing many of the trends seen in 2023. In both market downturns and rallies, the strategists wrote, “the trades which screen with the largest upside are involving rich or distressed G10 currencies.”

...

Zitat von faultcode: ...According to Berger, this is only the beginning of the end of the global carry trade, which aims to use low-yielding currencies such as the yen to buy something with higher returns.

...

21.11.

JPMorgan Says ‘The Golden Year’ for Carry Trades Is Near Its End

https://finance.yahoo.com/news/jpmorgan-says-golden-carry-tr…

...

This year currency speculators piled into carry trades — in which they borrow low-yielding currencies in order to purchase higher-yielding alternatives — earning some of the strategy’s best returns in decades as global central banks continued an aggressive pace of rate hikes in the face of mounting inflation.

Looking into 2024, G-10 central banks are preparing to ease monetary policy, sending global yields tumbling with the highest yielders cutting deepest and dragging on carry returns in the process, JPMorgan strategists led by Meera Chandan wrote in the bank’s annual foreign exchange outlook released Tuesday.

“2023 will be a year remembered for many things, but for FX market participants it shall forever be known as the golden year for carry,” the report said. “2024 should be the beginning of the end as high-yielders cut most. Declining yields will make carry less attractive and a narrower theme.”

Between January and June of this year, the strategists wrote, a nominal carry basket of 27 currencies returned gains of more than 20%, the best half since 2003.

While carry strategies haven’t performed as well in the second half as US yields remained high while those in Latin America fell — the same basket has only returned 0.4% — the first-half surge was enough to confirm the importance of rate differentials in driving currency moves.

Next year, JPMorgan expects relative currency valuations to converge, reversing many of the trends seen in 2023. In both market downturns and rallies, the strategists wrote, “the trades which screen with the largest upside are involving rich or distressed G10 currencies.”

...

18:48 Uhr · Markus Fugmann · DAXAnzeige |

18:30 Uhr · Roland Jegen · AmgenAnzeige |

18:20 Uhr · Robby's Elliottwellen · DAX |

18:05 Uhr · dpa-AFX · Borussia Dortmund |

18:00 Uhr · onemarkets Blog · DAXAnzeige |

17:01 Uhr · wallstreetONLINE Redaktion · DAX |

17:00 Uhr · BNP Paribas · AmazonAnzeige |

16:48 Uhr · dpa-AFX · DAX |

16:11 Uhr · dpa-AFX · Airbus |

15:20 Uhr · dpa-AFX · Adtran Networks |

| Zeit | Titel |

|---|---|

| 22:19 Uhr | |

| 22:15 Uhr | |

| 19:22 Uhr | |

| 18:17 Uhr | |

| 10:48 Uhr | |

| 09:50 Uhr | |

| 04.05.24 | |

| 03.05.24 | |

| 03.05.24 | |

| 03.05.24 |