Keine Angst vom "schwarzen Schwan": Corona-Börsen: Ruhig bleiben und zukaufen, statt dem h (Seite 4) | Diskussion im Forum

eröffnet am 26.02.20 20:01:23 von

neuester Beitrag 24.01.24 12:29:12 von

neuester Beitrag 24.01.24 12:29:12 von

Beiträge: 71

ID: 1.320.917

ID: 1.320.917

Aufrufe heute: 0

Gesamt: 6.375

Gesamt: 6.375

Aktive User: 0

ISIN: DE0008469008 · WKN: 846900

18.188,00

PKT

-0,01 %

-2,00 PKT

Letzter Kurs 28.04.24 Lang & Schwarz

Neuigkeiten

28.04.24 · wallstreetONLINE Redaktion |

28.04.24 · Christoph Geyer |

28.04.24 · Andreas Bernstein |

Beitrag zu dieser Diskussion schreiben

!

Dieser Beitrag wurde von FairMOD moderiert. Grund: auf eigenen Wunsch des Users

9.1.

AQR’s Longest-Running Fund Has a Record Year With 43.5% Gain

https://finance.yahoo.com/news/aqr-longest-running-fund-reco…

...

AQR Capital Management’s longest-running strategy had its best year since its inception in 1998, posting a gain of 43.5% net of fees, as a range of its funds achieved record performance.

...

It’s been a banner year for many macro funds, with traders including Said Haidar and Michael Platt producing some of the top returns.

Scott Bessent, a former Soros Fund Management investing chief, posted a 30% gain in his macro hedge fund, and Chris Rokos produced his best-ever gains last year in a dramatic change of fortunes for the hedge fund manager. The $15.5 billion Rokos Macro Fund he leads surged 51% in 2022, according to people with knowledge of the matter. The return was his best since 2015, when he began trading for his eponymous firm in London.

One exception has been Bridgewater Associates, the giant firm founded by Ray Dalio, which gave up much of its gains after losing money in October and November.

...

AQR’s Longest-Running Fund Has a Record Year With 43.5% Gain

https://finance.yahoo.com/news/aqr-longest-running-fund-reco…

...

AQR Capital Management’s longest-running strategy had its best year since its inception in 1998, posting a gain of 43.5% net of fees, as a range of its funds achieved record performance.

...

It’s been a banner year for many macro funds, with traders including Said Haidar and Michael Platt producing some of the top returns.

Scott Bessent, a former Soros Fund Management investing chief, posted a 30% gain in his macro hedge fund, and Chris Rokos produced his best-ever gains last year in a dramatic change of fortunes for the hedge fund manager. The $15.5 billion Rokos Macro Fund he leads surged 51% in 2022, according to people with knowledge of the matter. The return was his best since 2015, when he began trading for his eponymous firm in London.

One exception has been Bridgewater Associates, the giant firm founded by Ray Dalio, which gave up much of its gains after losing money in October and November.

...

4.1.

New Hedge Fund Soars 163% Betting Everything Is Going Down

https://finance.yahoo.com/news/hedge-fund-soars-163-betting-…

...

A veteran trader’s well-timed bet on the end of easy money has achieved triple-digit returns in his new hedge fund’s first full year.

After running Eagle’s View Capital Management as a fund of funds for 16 years, founder Neal Berger decided to add his own fund to the mix. The Contrarian Macro Fund launched initially with partner capital in April 2021 to load up on bets that the Federal Reserve would unwind a decade of stimulus — even as policy makers were describing inflation as “transitory.” By the time the Fed reversed course, Berger was starting to accept external money.

“The reason why I started the fund was that central bank flows were going to change 180 degrees. That key difference would be a headwind on all asset prices,” said Berger. “One had to believe that the prices we saw were, to use the academic term, wackadoodle.”

The wager proved prescient, delivering the new fund a return of about 163% in 2022, according to an investor document seen by Bloomberg. Berger declined to comment on the fund’s returns. New York-based Eagle’s View manages about $700 million in total, with $200 million in the Contrarian Macro Fund.

He joins a number of macro hedge fund managers, including Said Haider, Crispin Odey and Michael Platt’s BlueCrest Capital Management, who managed to use bets on the economy to multiply their money during the past year of turbulence that spelled lackluster returns at many other funds.

Berger said he’s using futures contracts to short stocks and bonds he saw as distorted by years of monetary stimulus.

“The $19 trillion of sovereign debt trading at negative yields, the SPAC boom, the crypto boom, private equity valuations and public equity valuations — they’re all stripes of the same zebra,” said Berger, whose prior macro trading experience includes Millennium Management, Chase Manhattan Bank and Fuji Bank. “The zebra being the ocean of liquidity, first in response to the Great Financial Crisis and then to Covid.”

The Contrarian Macro Fund mostly holds bearish bets on Europe and American assets, with hedges that pay off during more positive periods. After the Bank of Japan widened the upper limit for 10 year-yields, the fund also set up short positions against Japanese bonds and wagered that the yen would rise.

According to Berger, this is only the beginning of the end of the global carry trade, which aims to use low-yielding currencies such as the yen to buy something with higher returns.

Berger plans to keep his short positions for years. The pain isn’t over yet, and its end will only be clear after assets trade sideways for multiple months, he said.

“You have your variations, your rallies day-to-day, month-to-month,” he said. “But big picture, everything is going down. Price action is ultimately the bible.”

...

New Hedge Fund Soars 163% Betting Everything Is Going Down

https://finance.yahoo.com/news/hedge-fund-soars-163-betting-…

...

A veteran trader’s well-timed bet on the end of easy money has achieved triple-digit returns in his new hedge fund’s first full year.

After running Eagle’s View Capital Management as a fund of funds for 16 years, founder Neal Berger decided to add his own fund to the mix. The Contrarian Macro Fund launched initially with partner capital in April 2021 to load up on bets that the Federal Reserve would unwind a decade of stimulus — even as policy makers were describing inflation as “transitory.” By the time the Fed reversed course, Berger was starting to accept external money.

“The reason why I started the fund was that central bank flows were going to change 180 degrees. That key difference would be a headwind on all asset prices,” said Berger. “One had to believe that the prices we saw were, to use the academic term, wackadoodle.”

The wager proved prescient, delivering the new fund a return of about 163% in 2022, according to an investor document seen by Bloomberg. Berger declined to comment on the fund’s returns. New York-based Eagle’s View manages about $700 million in total, with $200 million in the Contrarian Macro Fund.

He joins a number of macro hedge fund managers, including Said Haider, Crispin Odey and Michael Platt’s BlueCrest Capital Management, who managed to use bets on the economy to multiply their money during the past year of turbulence that spelled lackluster returns at many other funds.

Berger said he’s using futures contracts to short stocks and bonds he saw as distorted by years of monetary stimulus.

“The $19 trillion of sovereign debt trading at negative yields, the SPAC boom, the crypto boom, private equity valuations and public equity valuations — they’re all stripes of the same zebra,” said Berger, whose prior macro trading experience includes Millennium Management, Chase Manhattan Bank and Fuji Bank. “The zebra being the ocean of liquidity, first in response to the Great Financial Crisis and then to Covid.”

The Contrarian Macro Fund mostly holds bearish bets on Europe and American assets, with hedges that pay off during more positive periods. After the Bank of Japan widened the upper limit for 10 year-yields, the fund also set up short positions against Japanese bonds and wagered that the yen would rise.

According to Berger, this is only the beginning of the end of the global carry trade, which aims to use low-yielding currencies such as the yen to buy something with higher returns.

Berger plans to keep his short positions for years. The pain isn’t over yet, and its end will only be clear after assets trade sideways for multiple months, he said.

“You have your variations, your rallies day-to-day, month-to-month,” he said. “But big picture, everything is going down. Price action is ultimately the bible.”

...

4.1.

Odey’s Hedge Fund Soars 152% in Best Ever Year on Inflation Bet

https://finance.yahoo.com/news/odey-hedge-fund-soars-152-102…

...

His flagship European Inc. hedge fund surged 152% last year, powered mainly by his highly leveraged short wagers on long-dated UK government bonds as inflation and political turmoil roiled the British economy, according to an investor document seen by Bloomberg.

A spokesman for London-based Odey Asset Management declined to comment.

The returns mark a stunning comeback for Odey, who has now fully recouped losses accumulated between 2015 and 2020 when his bearish wagers repeatedly failed to pay off. The fund was up as much as 193% last year but gave up some of the gains during the fourth quarter, another document shows.

The money manager joins a group of macro hedge funds, such as those managed by Said Haidar and Chris Rokos, seeing their fortunes turn as central banks roll back years of quantitative easing to control soaring inflation.

Odey had built up a huge short wager against UK government bonds mostly related to two U.K. government securities that mature in 2050 and 2061. At one point, the bet totaled almost 800% of the net asset value of his hedge fund.

The position turned in profits as inflationary pressures soared in the UK and around the world. The fund manager has since reduced the size of that trade to about 200% of the fund’s net asset value as of the end of November, according to the investor document. Macro hedge funds were up about 2% on average through November last year, according to data compiled by Bloomberg.

...

26.10.

Pimco Reloads Stock Shorts, Says Tech Is ‘Canary in Coal Mine’

https://finance.yahoo.com/news/pimco-reloads-stock-shorts-sa…

...

Pacific Investment Management Co. raised bearish stock wagers as the market bounced back, according to portfolio manager Erin Browne, who warns that the latest earnings woes from tech giants are a sign of what’s coming next for Wall Street.

“Over the last week or so, we’ve been resetting shorts at higher levels, taking that as an opportunity to get more underweight stocks,” Browne told Bloomberg TV. “I don’t think yet that we have received the all-clear signal,” she added. “What I think tech is highlighting now is they’re the canary in the coal mine for the broad market.”

Stocks have recovered after hitting their bear-market low earlier this month as speculation grew that the Federal Reserve will slow its aggressive monetary tightening amid a weakening economy. Despite disappointing results from Microsoft Corp. and Google parent Alphabet Inc., the S&P 500 erased earlier losses, rising 0.6% as of 11:50 a.m. in New York. The index has climbed about 8% this month.

Browne isn’t alone in her skepticism. Hedge funds tracked by JPMorgan Chase & Co., for instance, also sold stocks during last week’s bounce.

...

Pimco Reloads Stock Shorts, Says Tech Is ‘Canary in Coal Mine’

https://finance.yahoo.com/news/pimco-reloads-stock-shorts-sa…

...

Pacific Investment Management Co. raised bearish stock wagers as the market bounced back, according to portfolio manager Erin Browne, who warns that the latest earnings woes from tech giants are a sign of what’s coming next for Wall Street.

“Over the last week or so, we’ve been resetting shorts at higher levels, taking that as an opportunity to get more underweight stocks,” Browne told Bloomberg TV. “I don’t think yet that we have received the all-clear signal,” she added. “What I think tech is highlighting now is they’re the canary in the coal mine for the broad market.”

Stocks have recovered after hitting their bear-market low earlier this month as speculation grew that the Federal Reserve will slow its aggressive monetary tightening amid a weakening economy. Despite disappointing results from Microsoft Corp. and Google parent Alphabet Inc., the S&P 500 erased earlier losses, rising 0.6% as of 11:50 a.m. in New York. The index has climbed about 8% this month.

Browne isn’t alone in her skepticism. Hedge funds tracked by JPMorgan Chase & Co., for instance, also sold stocks during last week’s bounce.

...

aufpassen mit Leverage -- know what you have:

12.9.

https://uk.news.yahoo.com/fraga-backed-fund-faces-88-1817503…

Fraga-Backed Fund Faces 88% Drop as Leveraged Clarus Bet Sours

...

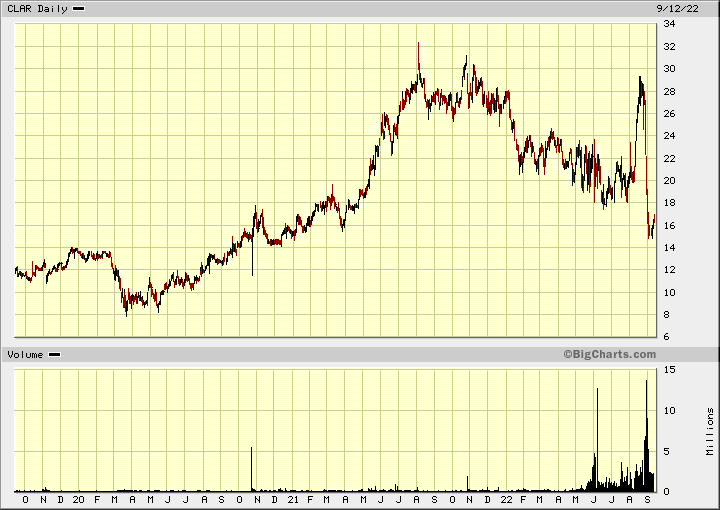

A small equity fund backed by former Brazilian central bank chief Arminio Fraga suffered an 88% rout after leveraged bets in American outdoor sports gear company Clarus Corp. went wrong.

The Rio de Janeiro-based asset manager TT Investimentos Ltda, which has two of Fraga’s nephews as founding partners, saw its TT Global Equities FIA IE fund shed about 73 million reais ($14 million) in assets after peaking in March of last year. Losses accelerated recently after the fund failed to meet a margin call and was forced by its custodian to liquidate its Clarus position, according to Arthur Fraga Bahia.

The trade consisted of selling put options and buying call options of Clarus. Fraga Bahia apologized to clients in an emailed message, adding that losses were “irreparable.”

Arminio Fraga, who lifted Brazil’s benchmark interest rates to 45% on his first day as central bank president in 1999, was the fund’s largest client. He had no involvement with the fund’s management activity and was solely an investor.

...

Clarus Corp:

12.9.

https://uk.news.yahoo.com/fraga-backed-fund-faces-88-1817503…

Fraga-Backed Fund Faces 88% Drop as Leveraged Clarus Bet Sours

...

A small equity fund backed by former Brazilian central bank chief Arminio Fraga suffered an 88% rout after leveraged bets in American outdoor sports gear company Clarus Corp. went wrong.

The Rio de Janeiro-based asset manager TT Investimentos Ltda, which has two of Fraga’s nephews as founding partners, saw its TT Global Equities FIA IE fund shed about 73 million reais ($14 million) in assets after peaking in March of last year. Losses accelerated recently after the fund failed to meet a margin call and was forced by its custodian to liquidate its Clarus position, according to Arthur Fraga Bahia.

The trade consisted of selling put options and buying call options of Clarus. Fraga Bahia apologized to clients in an emailed message, adding that losses were “irreparable.”

Arminio Fraga, who lifted Brazil’s benchmark interest rates to 45% on his first day as central bank president in 1999, was the fund’s largest client. He had no involvement with the fund’s management activity and was solely an investor.

...

Clarus Corp:

Antwort auf Beitrag Nr.: 72.062.030 von faultcode am 26.07.22 21:14:38..und wieder re-retour:

2.9.

Bridgewater again builds European shorts with €4bn bet on market plunge

Bridgewater at the end of August held short positions of at least 0.5% in 13 stocks in the Euro Stoxx 50 index

https://www.fnlondon.com/articles/bridgewater-shorts-euro-st…

...

Bridgewater Associates has once again made big bets on European stock declines as the hedge fund discloses huge short positions in European stocks.

On 31 August, Bridgewater disclosed that it held short positions in 13 companies that each made up at least 0.5% of their shares, according to research firm Breakout Point. The stock are all members of the Euro Stoxx 50 index. These short positions include French energy firm TotalEnergies, financial services firm Allianz, and pharmaceutical giant Bayer.

...

2.9.

Bridgewater again builds European shorts with €4bn bet on market plunge

Bridgewater at the end of August held short positions of at least 0.5% in 13 stocks in the Euro Stoxx 50 index

https://www.fnlondon.com/articles/bridgewater-shorts-euro-st…

...

Bridgewater Associates has once again made big bets on European stock declines as the hedge fund discloses huge short positions in European stocks.

On 31 August, Bridgewater disclosed that it held short positions in 13 companies that each made up at least 0.5% of their shares, according to research firm Breakout Point. The stock are all members of the Euro Stoxx 50 index. These short positions include French energy firm TotalEnergies, financial services firm Allianz, and pharmaceutical giant Bayer.

...

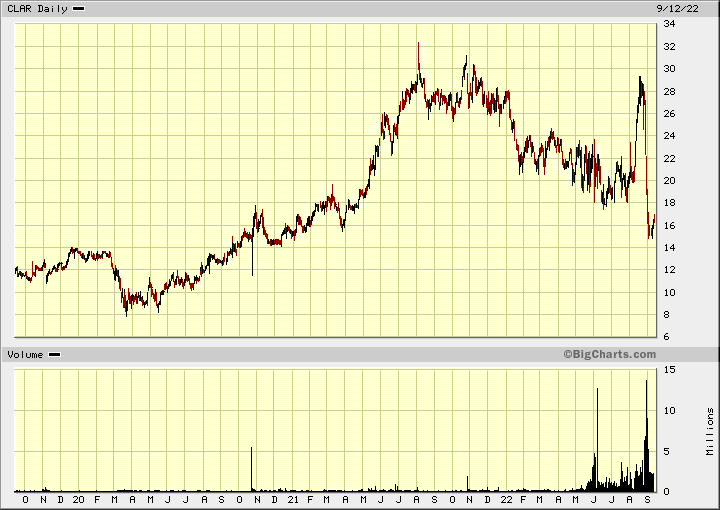

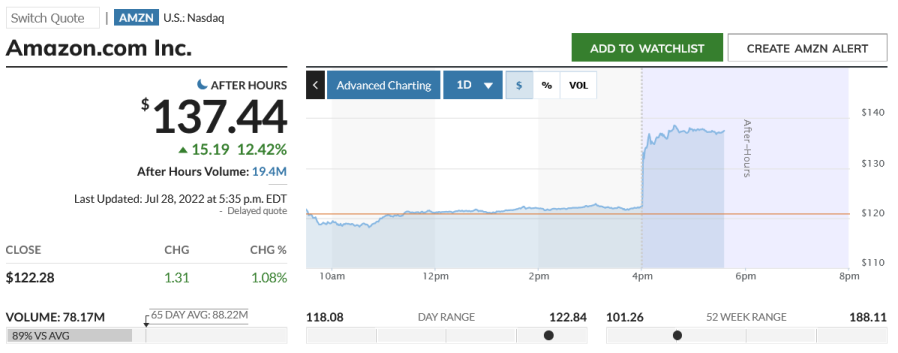

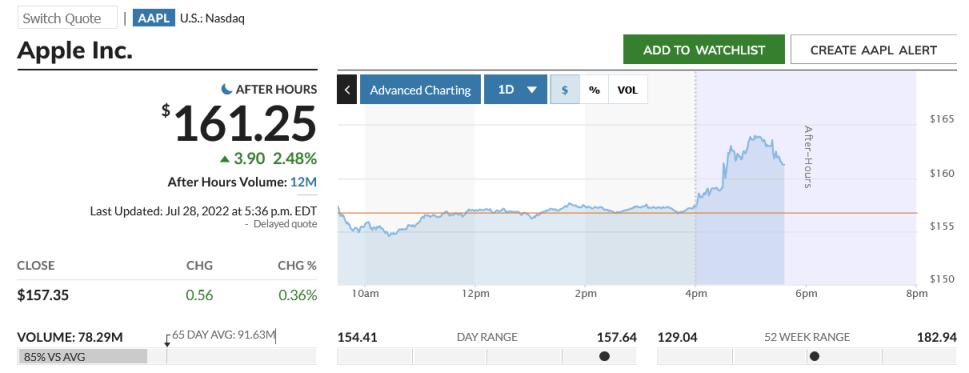

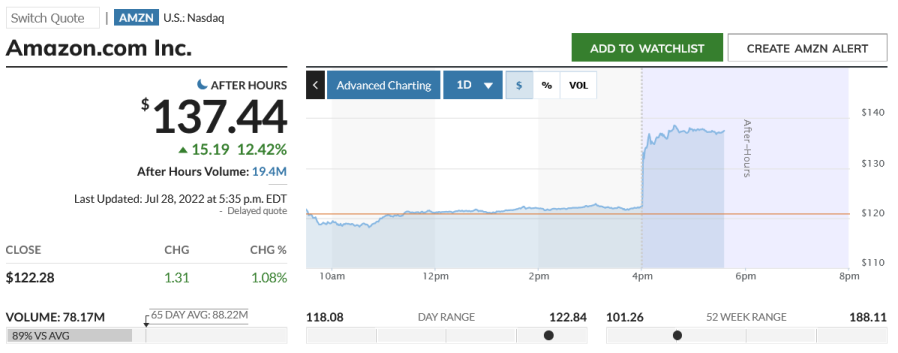

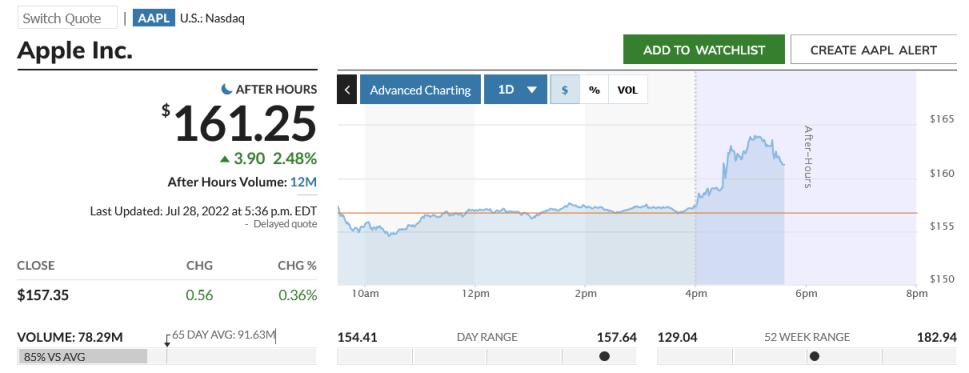

Jul 28, 2022 - 06:21 PM

Hedge Funds Massacred As "Most Hated" Tech Stocks Explode Higher

https://www.zerohedge.com/markets/hedge-funds-massacred-most…

https://twitter.com/zerohedge/status/1552764056192286720

...

=>

Hedge Funds Massacred As "Most Hated" Tech Stocks Explode Higher

https://www.zerohedge.com/markets/hedge-funds-massacred-most…

https://twitter.com/zerohedge/status/1552764056192286720

...

=>

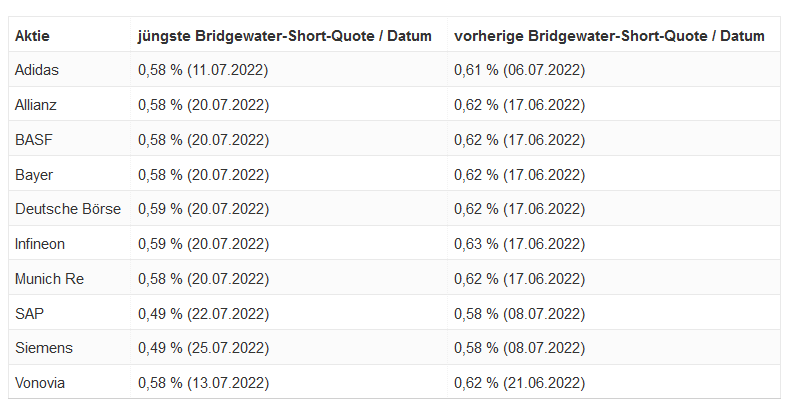

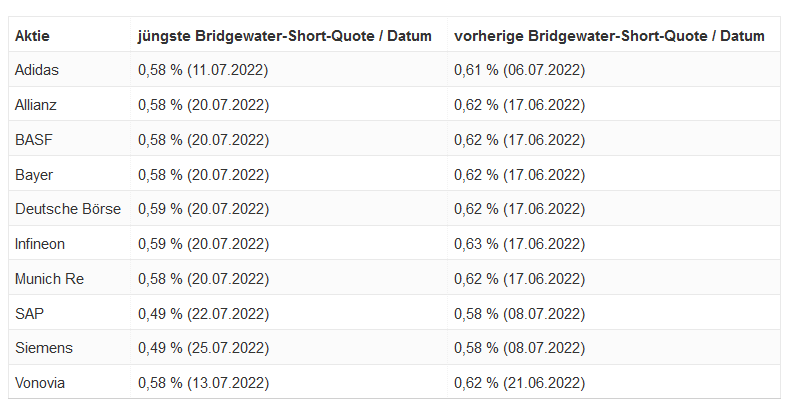

Antwort auf Beitrag Nr.: 71.988.979 von faultcode am 15.07.22 14:03:40..und wieder retour

26.7.

Bridgewater Associates baut Short-Positionen ab

Der weltgrößte Hedgefonds Bridgewater Associates von Starinvestor Ray Dalio ist im Juni milliardenschwere Short-Positionen auf zahlreiche deutsche sowie europäische Aktien eingegangen. Inzwischen baut Bridgewater seine Leerverkäufe aber langsam wieder ab, wie jüngste Meldungen aus dem Bundesanzeiger belegen.

https://www.godmode-trader.de/artikel/bridgewater-associates…

...

...

26.7.

Bridgewater Associates baut Short-Positionen ab

Der weltgrößte Hedgefonds Bridgewater Associates von Starinvestor Ray Dalio ist im Juni milliardenschwere Short-Positionen auf zahlreiche deutsche sowie europäische Aktien eingegangen. Inzwischen baut Bridgewater seine Leerverkäufe aber langsam wieder ab, wie jüngste Meldungen aus dem Bundesanzeiger belegen.

https://www.godmode-trader.de/artikel/bridgewater-associates…

...

...

Antwort auf Beitrag Nr.: 71.839.802 von faultcode am 23.06.22 12:41:0615.7.

Bridgewater’s Giant Bet Against Europe Stocks is Starting to Pay Off

https://ca.finance.yahoo.com/news/bridgewater-giant-bet-agai…

...

The world’s biggest hedge fund firm now has about $9.4 billion worth of wagers against 26 companies in Europe’s large-cap Euro Stoxx 50 index, according to data compiled by Bloomberg. Since Bridgewater’s initial bets were disclosed last month, the gauge has lagged major equity benchmarks in the US, the UK and Japan.

A protracted global equity selloff combined with a worsening economic outlook, exacerbated by an energy crisis and political turmoil, has created fertile ground for these bearish wagers in Europe. And Bridgewater’s call against the region’s largest companies is already bearing fruit.

The US firm has made large wagers against ASML Holding NV, TotalEnergies SE, SAP SE and Siemens AG, which have all underperformed the Euro Stoxx 50 over the past month, with Sanofi the only stock among its biggest shorts to rise.

...

Bridgewater’s Giant Bet Against Europe Stocks is Starting to Pay Off

https://ca.finance.yahoo.com/news/bridgewater-giant-bet-agai…

...

The world’s biggest hedge fund firm now has about $9.4 billion worth of wagers against 26 companies in Europe’s large-cap Euro Stoxx 50 index, according to data compiled by Bloomberg. Since Bridgewater’s initial bets were disclosed last month, the gauge has lagged major equity benchmarks in the US, the UK and Japan.

A protracted global equity selloff combined with a worsening economic outlook, exacerbated by an energy crisis and political turmoil, has created fertile ground for these bearish wagers in Europe. And Bridgewater’s call against the region’s largest companies is already bearing fruit.

The US firm has made large wagers against ASML Holding NV, TotalEnergies SE, SAP SE and Siemens AG, which have all underperformed the Euro Stoxx 50 over the past month, with Sanofi the only stock among its biggest shorts to rise.

...

28.04.24 · wallstreetONLINE Redaktion · BMW |

28.04.24 · Christoph Geyer · DAX |

28.04.24 · Andreas Bernstein · DAX |

28.04.24 · BörsenNEWS.de · DAX |

28.04.24 · dpa-AFX · Münchener Rück |

28.04.24 · Sharedeals · DAX |

27.04.24 · Robby's Elliottwellen · DAX |

| Zeit | Titel |

|---|---|

| 28.04.24 | |

| 28.04.24 | |

| 28.04.24 | |

| 27.04.24 | |

| 27.04.24 | |

| 27.04.24 | |

| 26.04.24 | |

| 25.04.24 | |

| 25.04.24 | |

| 25.04.24 |