Keine Angst vom "schwarzen Schwan": Corona-Börsen: Ruhig bleiben und zukaufen, statt dem h (Seite 6) | Diskussion im Forum

eröffnet am 26.02.20 20:01:23 von

neuester Beitrag 24.01.24 12:29:12 von

neuester Beitrag 24.01.24 12:29:12 von

Beiträge: 71

ID: 1.320.917

ID: 1.320.917

Aufrufe heute: 0

Gesamt: 6.375

Gesamt: 6.375

Aktive User: 0

ISIN: DE0008469008 · WKN: 846900 · Symbol: DAX

18.188,00

PKT

-0,01 %

-2,00 PKT

Letzter Kurs 19:00:35 Lang & Schwarz

Neuigkeiten

19:37 Uhr · wallstreetONLINE Redaktion |

18:14 Uhr · Christoph Geyer |

16:46 Uhr · Andreas Bernstein |

Beitrag zu dieser Diskussion schreiben

so fängt das Hedge Fund-Elend oft an:

Ron Ozer’s vehicle was one of the world’s top performers last year

27.9.

Natural gas hedge fund Statar suffers $130m hit

https://www.ft.com/content/2b347fd8-0334-4f70-a8c1-46725643e…

...

A top-performing US hedge fund specialising in natural gas has suffered a large hit to its performance this month in a sign that even commodity experts are struggling to deal with soaring prices.

Miami-based Statar Capital, which manages $1.7bn in assets and is run by Ron Ozer, a former trader at Citadel and DE Shaw, made a hefty gain in the first 10 days of this month, according to a person familiar with its performance. But it suffered a pullback the following week, leaving it down about 7.7 per cent for September before fees, according to documentation seen by the Financial Times.

The reversal in fortunes wiped out gains made earlier in the month and left the fund with a loss of about $130m in the first two and a half weeks of the month. Statar declined to comment.

...

The “exodus of risk capital from the commodity markets” has exacerbated temporary market mispricings, while producers increasingly want to hedge, Statar says on its website. “This has provided the best opportunity set for natural gas trading in many years.”

Ozer, who studied at Massachusetts Institute of Technology, joined DE Shaw in 2008 and focused on trading natural gas futures and options, before moving to Citadel to become head portfolio manager for US natural gas. According to Statar’s website, he was promoted after his first year to report directly to the firm’s founder, Ken Griffin.

Ron Ozer’s vehicle was one of the world’s top performers last year

27.9.

Natural gas hedge fund Statar suffers $130m hit

https://www.ft.com/content/2b347fd8-0334-4f70-a8c1-46725643e…

...

A top-performing US hedge fund specialising in natural gas has suffered a large hit to its performance this month in a sign that even commodity experts are struggling to deal with soaring prices.

Miami-based Statar Capital, which manages $1.7bn in assets and is run by Ron Ozer, a former trader at Citadel and DE Shaw, made a hefty gain in the first 10 days of this month, according to a person familiar with its performance. But it suffered a pullback the following week, leaving it down about 7.7 per cent for September before fees, according to documentation seen by the Financial Times.

The reversal in fortunes wiped out gains made earlier in the month and left the fund with a loss of about $130m in the first two and a half weeks of the month. Statar declined to comment.

...

The “exodus of risk capital from the commodity markets” has exacerbated temporary market mispricings, while producers increasingly want to hedge, Statar says on its website. “This has provided the best opportunity set for natural gas trading in many years.”

Ozer, who studied at Massachusetts Institute of Technology, joined DE Shaw in 2008 and focused on trading natural gas futures and options, before moving to Citadel to become head portfolio manager for US natural gas. According to Statar’s website, he was promoted after his first year to report directly to the firm’s founder, Ken Griffin.

Antwort auf Beitrag Nr.: 69.238.419 von faultcode am 04.09.21 13:19:57Das WSJ schreibt, das es sich um die bislang höchste Steuernachzahlung in den USA handeln könnte: https://www.wsj.com/articles/james-simons-robert-mercer-othe…

PDF mit Executive Summary von 8 Seiten, auf das am Ende alles zurückging: https://t.co/SZphcL86d0?amp=1

JULY 22, 2014 HEARING

ABUSE OF STRUCTURED FINANCIAL PRODUCTS:

Misusing Basket Options to Avoid Taxes and Leverage Limits

...

=> man könnte fast sagen, so eine Art Cum-Ex-Skandal in den USA, denn ohne die Hilfe der zwei Banken ginge das so nicht, nicht zuletzt deshalb, weil die Hedge Funds mit Hilfe von bankeigenen Konten ihre Trades ausgeführt haben

Und Kredite haben sie dafür auch noch von den Banken bekommen.

I. EXECUTIVE SUMMARY

...

The basket option contracts examined by the Subcommittee investigation were used by at least 13 hedge funds to conduct over $100 billion in securities trades, most of which were short-term transactions and some of which lasted only seconds.

Yet the resulting short-term profits were frequently cast as long-term capital gains subject to a 20% tax rate (previously 15%) rather than the ordinary income tax rate (currently as high as 39%) that would otherwise apply to investors in hedge funds engaged in daily trading.

While the banks styled the trading arrangement as an “option” under which profits from short-term trades would be treated as long-term capital gains, in essence, the banks loaned the hedge funds money to finance their trading and allowed them to trade for themselves in highly leveraged positions in the banks’ proprietary accounts and reap the resulting profits.

The banks offering the “options” benefited from the financing, trading, and other fees charged to the hedge funds initiating the trades.

In the end, the trading conducted by the hedge funds using the basket option accounts was virtually indistinguishable from the trading conducted by hedge funds using their own brokerage accounts, and provided no justification for treating the resulting short-term trading profits as long-term capital gains.

...

zuvor:

This investigation offers yet another detailed case study of how two financial institutions – Deutsche Bank AG and Barclays Bank PLC – developed structured financial products called MAPS and COLT, two types of basket options, and sold them to one or more hedge funds, including Renaissance Technologies LLC and George Weiss Associates, that used them to avoid federal taxes and leverage limits on buying securities with borrowed funds.

PDF mit Executive Summary von 8 Seiten, auf das am Ende alles zurückging: https://t.co/SZphcL86d0?amp=1

JULY 22, 2014 HEARING

ABUSE OF STRUCTURED FINANCIAL PRODUCTS:

Misusing Basket Options to Avoid Taxes and Leverage Limits

...

=> man könnte fast sagen, so eine Art Cum-Ex-Skandal in den USA, denn ohne die Hilfe der zwei Banken ginge das so nicht, nicht zuletzt deshalb, weil die Hedge Funds mit Hilfe von bankeigenen Konten ihre Trades ausgeführt haben

Und Kredite haben sie dafür auch noch von den Banken bekommen.

I. EXECUTIVE SUMMARY

...

The basket option contracts examined by the Subcommittee investigation were used by at least 13 hedge funds to conduct over $100 billion in securities trades, most of which were short-term transactions and some of which lasted only seconds.

Yet the resulting short-term profits were frequently cast as long-term capital gains subject to a 20% tax rate (previously 15%) rather than the ordinary income tax rate (currently as high as 39%) that would otherwise apply to investors in hedge funds engaged in daily trading.

While the banks styled the trading arrangement as an “option” under which profits from short-term trades would be treated as long-term capital gains, in essence, the banks loaned the hedge funds money to finance their trading and allowed them to trade for themselves in highly leveraged positions in the banks’ proprietary accounts and reap the resulting profits.

The banks offering the “options” benefited from the financing, trading, and other fees charged to the hedge funds initiating the trades.

In the end, the trading conducted by the hedge funds using the basket option accounts was virtually indistinguishable from the trading conducted by hedge funds using their own brokerage accounts, and provided no justification for treating the resulting short-term trading profits as long-term capital gains.

...

zuvor:

This investigation offers yet another detailed case study of how two financial institutions – Deutsche Bank AG and Barclays Bank PLC – developed structured financial products called MAPS and COLT, two types of basket options, and sold them to one or more hedge funds, including Renaissance Technologies LLC and George Weiss Associates, that used them to avoid federal taxes and leverage limits on buying securities with borrowed funds.

Antwort auf Beitrag Nr.: 68.340.494 von faultcode am 28.05.21 20:25:18es gibt eine Vor-Steuer-Rendite und eine Nach-Steuer-Rendite:

3.9.

Jim Simons, RenTech Insiders to Pay Billions in Back Taxes

https://finance.yahoo.com/news/jim-simons-rentech-insiders-p…

...

Jim Simons, one of the world’s most successful investors, has just been handed a rare defeat.

The founder of quantitative hedge-fund manager Renaissance Technologies and his colleagues will pay billions of dollars in back taxes, interest and penalties to resolve one of the biggest tax disputes in U.S. history, under the terms of a deal reached by the firm and the Internal Revenue Service.

Renaissance Chief Executive Officer Peter Brown disclosed the agreement Thursday in a letter to investors seen by Bloomberg. While it doesn’t say how much money will be paid, U.S. Senate investigators in 2014 pegged potential unpaid taxes in the case at $6.8 billion, before interest and penalties.

The IRS has long contended that Renaissance mischaracterized profits from its flagship Medallion Fund, using a complex options arrangement to transform short-term capital gains into long-term gains, which are taxed at a lower rate.

Medallion is owned almost exclusively by current and former employees of the East Setauket, New York-based firm. Renaissance funds that are open to outsiders, such as the institutional equities fund, aren’t part of the tax dispute.

Under the terms of the deal, Simons and six other current and former members of Renaissance’s board will pay 100% of the additional tax that would have been due if they had characterized the gains as short-term, as the IRS said they should.

That group includes Brown as well as Robert Mercer, a former co-CEO and noted conservative political donor who was a prominent backer of former President Donald Trump. The board members will also pay unspecified interest and penalties.

Other Medallion investors will pay 80% of the additional tax for short-term gains, along with interest.

Simons, 83, who served as chairman of Renaissance during the period when the options were in use, paid an additional $670 million to the IRS, according to the letter. That resolves another problem that the agency identified with the options arrangements, involving dividend withholding tax.

The board opted for a settlement “rather than risking a worse outcome, including harsher terms and penalties, that could result from litigation,” Brown wrote. He said the firm spent years engaging with the IRS’s Office of Appeals. If a taxpayer can’t reach a resolution there, a dispute typically moves to U.S. Tax Court or another federal court.

A spokesman for the firm said Simons, Brown and Mercer weren’t available for comment.

Seven years ago, the Senate Permanent Subcommittee on Investigations revealed that, for more than a decade, Renaissance used options sold by Deutsche Bank AG and Barclays Plc to shelter some $34 billion of income in Medallion, cutting the rate paid by fund investors by as much as 20 percentage points.

Brown and other Renaissance executives defended the transactions at a hearing in Washington, arguing that the firm had entered into the deals for non-tax reasons and that they complied with the law.

The hearing “really knocked the IRS around and shook them up to start pursuing this more aggressively,” said Steven Rosenthal, a tax lawyer and senior fellow at the Urban-Brookings Tax Policy Center in Washington who also testified. “The IRS is so resource-strained that it often can’t pursue good cases, but here they nabbed one.”

Medallion is one of the best-performing funds in history, returning about 40% annualized since its formation in 1988. Simons has a net worth of $25.7 billion, according to the Bloomberg Billionaires Index.

...

3.9.

Jim Simons, RenTech Insiders to Pay Billions in Back Taxes

https://finance.yahoo.com/news/jim-simons-rentech-insiders-p…

...

Jim Simons, one of the world’s most successful investors, has just been handed a rare defeat.

The founder of quantitative hedge-fund manager Renaissance Technologies and his colleagues will pay billions of dollars in back taxes, interest and penalties to resolve one of the biggest tax disputes in U.S. history, under the terms of a deal reached by the firm and the Internal Revenue Service.

Renaissance Chief Executive Officer Peter Brown disclosed the agreement Thursday in a letter to investors seen by Bloomberg. While it doesn’t say how much money will be paid, U.S. Senate investigators in 2014 pegged potential unpaid taxes in the case at $6.8 billion, before interest and penalties.

The IRS has long contended that Renaissance mischaracterized profits from its flagship Medallion Fund, using a complex options arrangement to transform short-term capital gains into long-term gains, which are taxed at a lower rate.

Medallion is owned almost exclusively by current and former employees of the East Setauket, New York-based firm. Renaissance funds that are open to outsiders, such as the institutional equities fund, aren’t part of the tax dispute.

Under the terms of the deal, Simons and six other current and former members of Renaissance’s board will pay 100% of the additional tax that would have been due if they had characterized the gains as short-term, as the IRS said they should.

That group includes Brown as well as Robert Mercer, a former co-CEO and noted conservative political donor who was a prominent backer of former President Donald Trump. The board members will also pay unspecified interest and penalties.

Other Medallion investors will pay 80% of the additional tax for short-term gains, along with interest.

Simons, 83, who served as chairman of Renaissance during the period when the options were in use, paid an additional $670 million to the IRS, according to the letter. That resolves another problem that the agency identified with the options arrangements, involving dividend withholding tax.

The board opted for a settlement “rather than risking a worse outcome, including harsher terms and penalties, that could result from litigation,” Brown wrote. He said the firm spent years engaging with the IRS’s Office of Appeals. If a taxpayer can’t reach a resolution there, a dispute typically moves to U.S. Tax Court or another federal court.

A spokesman for the firm said Simons, Brown and Mercer weren’t available for comment.

Seven years ago, the Senate Permanent Subcommittee on Investigations revealed that, for more than a decade, Renaissance used options sold by Deutsche Bank AG and Barclays Plc to shelter some $34 billion of income in Medallion, cutting the rate paid by fund investors by as much as 20 percentage points.

Brown and other Renaissance executives defended the transactions at a hearing in Washington, arguing that the firm had entered into the deals for non-tax reasons and that they complied with the law.

The hearing “really knocked the IRS around and shook them up to start pursuing this more aggressively,” said Steven Rosenthal, a tax lawyer and senior fellow at the Urban-Brookings Tax Policy Center in Washington who also testified. “The IRS is so resource-strained that it often can’t pursue good cases, but here they nabbed one.”

Medallion is one of the best-performing funds in history, returning about 40% annualized since its formation in 1988. Simons has a net worth of $25.7 billion, according to the Bloomberg Billionaires Index.

...

einmal ist immer das erste Mal:

Alphadyne’s losses, the largest to be publicly revealed among macro hedge funds, are particularly surprising because its strategy has never had a down year since it started up in 2006.

3.8.

Hedge Fund Alphadyne Loses $1.5 Billion in Rates Short Squeeze

https://finance.yahoo.com/news/hedge-fund-alphadyne-loses-1-…

...

Alphadyne was founded by Khuong-Huu and Bart Broadman, who were colleagues at JPMorgan Chase & Co. Its investors include pensions, insurance companies and sovereign wealth funds, according to its website. In 2017, Alphadyne spun off its Asia team into Astignes Capital Asia Pte, which focuses on trading interest rate and currency instruments in the region. Broadman is now CIO of Singapore-based Astignes.

Khuong-Huu, who the New York Times described in a May article as a Frenchman of Vietnamese descent, was Goldman Sachs Group Inc.’s head of interest rates in the early 2000s before forming Alphadyne. During his time at the Wall Street bank, he overlapped with Glenn Hadden, who spent more than a decade there trading global government bonds and U.S. Treasuries before leaving in 2011 to run interest-rate trading at Morgan Stanley.

Hadden joined Alphadyne in 2014 and is considered one of its top portfolio managers, according to people familiar with his trading. That’s largely paid off -- Alphadyne posted double-digit gains in each of the previous four years.

...

Alphadyne’s losses, the largest to be publicly revealed among macro hedge funds, are particularly surprising because its strategy has never had a down year since it started up in 2006.

3.8.

Hedge Fund Alphadyne Loses $1.5 Billion in Rates Short Squeeze

https://finance.yahoo.com/news/hedge-fund-alphadyne-loses-1-…

...

Alphadyne was founded by Khuong-Huu and Bart Broadman, who were colleagues at JPMorgan Chase & Co. Its investors include pensions, insurance companies and sovereign wealth funds, according to its website. In 2017, Alphadyne spun off its Asia team into Astignes Capital Asia Pte, which focuses on trading interest rate and currency instruments in the region. Broadman is now CIO of Singapore-based Astignes.

Khuong-Huu, who the New York Times described in a May article as a Frenchman of Vietnamese descent, was Goldman Sachs Group Inc.’s head of interest rates in the early 2000s before forming Alphadyne. During his time at the Wall Street bank, he overlapped with Glenn Hadden, who spent more than a decade there trading global government bonds and U.S. Treasuries before leaving in 2011 to run interest-rate trading at Morgan Stanley.

Hadden joined Alphadyne in 2014 and is considered one of its top portfolio managers, according to people familiar with his trading. That’s largely paid off -- Alphadyne posted double-digit gains in each of the previous four years.

...

28.5.

Credit Suisse’s RenTech Fund Holds Back Some Client Withdrawals

https://finance.yahoo.com/news/credit-suisse-rentech-fund-ho…

...

Credit Suisse Group AG is temporarily barring clients from withdrawing all their cash from a fund that invests with Renaissance Technologies after the strategy tanked and investors rushed to exit.

The bank has invoked a so-called hold back clause, after assets in the CS Renaissance Alternative Access Fund slumped to about $250 million this month from approximately $700 million at the start of 2020, according to people with knowledge of the matter. While investors will receive 95% of their redemption requests after two months, the remaining 5% is expected to be paid out in January, after the fund’s year-end audit, the people said.

The fund lost about 32% last year, in line with the decline in the Renaissance Institutional Diversified Alpha Fund International fund that it invests into, the people said. Renaissance, regarded as one of the most successful quant investing firms in the world, was rocked by billion of dollars in redemptions earlier this year after unprecedented losses in 2020. Three of its funds open to external investors fell by double digits last year.

Credit Suisse and Renaissance declined to comment.

...

Credit Suisse’s RenTech Fund Holds Back Some Client Withdrawals

https://finance.yahoo.com/news/credit-suisse-rentech-fund-ho…

...

Credit Suisse Group AG is temporarily barring clients from withdrawing all their cash from a fund that invests with Renaissance Technologies after the strategy tanked and investors rushed to exit.

The bank has invoked a so-called hold back clause, after assets in the CS Renaissance Alternative Access Fund slumped to about $250 million this month from approximately $700 million at the start of 2020, according to people with knowledge of the matter. While investors will receive 95% of their redemption requests after two months, the remaining 5% is expected to be paid out in January, after the fund’s year-end audit, the people said.

The fund lost about 32% last year, in line with the decline in the Renaissance Institutional Diversified Alpha Fund International fund that it invests into, the people said. Renaissance, regarded as one of the most successful quant investing firms in the world, was rocked by billion of dollars in redemptions earlier this year after unprecedented losses in 2020. Three of its funds open to external investors fell by double digits last year.

Credit Suisse and Renaissance declined to comment.

...

22.4.

Hedge Fund IPM Shuts Doors After Losing $4 Billion in Pandemic

https://finance.yahoo.com/news/hedge-fund-ipm-shuts-doors-08…

...

Informed Portfolio Management, a Swedish hedge fund that had relied on statistical models to devise its strategies, is set to shut its doors and return investor capital after losing roughly $4 billion during the pandemic.

IPM, whose main owner is Stockholm-based investment firm Catella AB, had assets under

management of close to $5 billion in late 2019, before the pandemic hit. A year later, that amount had more than halved to $2 billion, with the investor exodus since then depleting assets to about $750 million.

“The recent investment market for systematic macro-funds has unfortunately been very challenging and IPM has had weak returns and large capital outflows,” Catella said in a statement on Thursday. “IPM will ensure that all investors are treated fairly. This includes that all investors will be able to redeem their capital in the coming months according to each fund’s specific liquidity rules.”

IPM had used quantitative strategies, which rely on mathematical models instead of on-the-ground analysis of portfolio assets. But the historical statistical models the fund built proved unequal to the task of predicting how markets would move during the volatility brought on by the coronavirus pandemic.

IPM joins a growing list of hedge funds shutting down in recent years as investors rethink their allocations to the industry. More hedge funds have closed than started in the last six years, with 770 of them shuttering in 2020, according to data compiled by Hedge Fund Research Inc.

Last year was particularly tough for computer-driven quant funds. Algorithms largely failed to decipher the impact of a rapidly moving virus and the response from central banks to contain economic damage. The market selloff in March last year and subsequent recovery humbled some of the most sophisticated of quants -- most notably behemoths such as Renaissance Technologies, Winton and Two Sigma.

IPM was founded over two decades ago. Catella had hoped to find a buyer for the troubled fund, and it recently even announced several new hires amid a plan to branch out into new strategies.

“Despite many promising dialogues during the spring, we have not been able to find a suitable buyer for IPM,” Catella said.

...

Hedge Fund IPM Shuts Doors After Losing $4 Billion in Pandemic

https://finance.yahoo.com/news/hedge-fund-ipm-shuts-doors-08…

...

Informed Portfolio Management, a Swedish hedge fund that had relied on statistical models to devise its strategies, is set to shut its doors and return investor capital after losing roughly $4 billion during the pandemic.

IPM, whose main owner is Stockholm-based investment firm Catella AB, had assets under

management of close to $5 billion in late 2019, before the pandemic hit. A year later, that amount had more than halved to $2 billion, with the investor exodus since then depleting assets to about $750 million.

“The recent investment market for systematic macro-funds has unfortunately been very challenging and IPM has had weak returns and large capital outflows,” Catella said in a statement on Thursday. “IPM will ensure that all investors are treated fairly. This includes that all investors will be able to redeem their capital in the coming months according to each fund’s specific liquidity rules.”

IPM had used quantitative strategies, which rely on mathematical models instead of on-the-ground analysis of portfolio assets. But the historical statistical models the fund built proved unequal to the task of predicting how markets would move during the volatility brought on by the coronavirus pandemic.

IPM joins a growing list of hedge funds shutting down in recent years as investors rethink their allocations to the industry. More hedge funds have closed than started in the last six years, with 770 of them shuttering in 2020, according to data compiled by Hedge Fund Research Inc.

Last year was particularly tough for computer-driven quant funds. Algorithms largely failed to decipher the impact of a rapidly moving virus and the response from central banks to contain economic damage. The market selloff in March last year and subsequent recovery humbled some of the most sophisticated of quants -- most notably behemoths such as Renaissance Technologies, Winton and Two Sigma.

IPM was founded over two decades ago. Catella had hoped to find a buyer for the troubled fund, and it recently even announced several new hires amid a plan to branch out into new strategies.

“Despite many promising dialogues during the spring, we have not been able to find a suitable buyer for IPM,” Catella said.

...

7.2.

Renaissance Hit With $5 Billion in Redemptions Since Dec. 1

https://finance.yahoo.com/news/renaissance-hit-5-billion-red…

...

Clients pulled a net $1.85 billion across the three hedge funds in December and requested a net $1.9 billion back in January, according to investor letters seen by Bloomberg. Investors are poised to yank another $1.65 billion this month, the letters show.

Those figures could be offset if there are any inflows in February or if investors decided to walk back any of their redemption requests.

...

Renaissance told clients in a September letter that its losses were due to being under-hedged during March’s collapse and then over-hedged in the rebound from April through June. That happened because its trading models “overcompensated” for the original trouble.

...

=> der Witz an der Sache ist, daß weniger AUM praktisch jedem Portfolio Manager das Leben leichter macht (außer man ist als großer/größerer Value-Investor unterwegs)

Also würde es mich nicht wundern, wenn Renaissance Technologies (RenTec) am Ende von 2021 ein recht gutes Jahr haben sollten

Renaissance Hit With $5 Billion in Redemptions Since Dec. 1

https://finance.yahoo.com/news/renaissance-hit-5-billion-red…

...

Clients pulled a net $1.85 billion across the three hedge funds in December and requested a net $1.9 billion back in January, according to investor letters seen by Bloomberg. Investors are poised to yank another $1.65 billion this month, the letters show.

Those figures could be offset if there are any inflows in February or if investors decided to walk back any of their redemption requests.

...

Renaissance told clients in a September letter that its losses were due to being under-hedged during March’s collapse and then over-hedged in the rebound from April through June. That happened because its trading models “overcompensated” for the original trouble.

...

=> der Witz an der Sache ist, daß weniger AUM praktisch jedem Portfolio Manager das Leben leichter macht (außer man ist als großer/größerer Value-Investor unterwegs)

Also würde es mich nicht wundern, wenn Renaissance Technologies (RenTec) am Ende von 2021 ein recht gutes Jahr haben sollten

Antwort auf Beitrag Nr.: 63.036.886 von faultcode am 17.03.20 13:28:47

...scheint aber zuletzt eher in die Hose gegangen zu sein:

24.7.

Bridgewater Associates Lays Off Several Dozen Employees

World’s largest hedge fund made cuts in its research department, client-services team, among recruiters

https://www.wsj.com/articles/bridgewater-associates-lays-off…

...

Zitat von faultcode: Der feine Herr Dalio wettet also gegen "coronavirus ridden countries":

...

...scheint aber zuletzt eher in die Hose gegangen zu sein:

24.7.

Bridgewater Associates Lays Off Several Dozen Employees

World’s largest hedge fund made cuts in its research department, client-services team, among recruiters

https://www.wsj.com/articles/bridgewater-associates-lays-off…

...

Antwort auf Beitrag Nr.: 63.036.076 von faultcode am 17.03.20 12:23:00

https://www.bloomberg.com/news/articles/2020-04-03/bridgewat…

--> darin werden Brevan Howard (Asset Management) erwähnt. Zumindest diesen beiden closed-end funds machten es richtig:

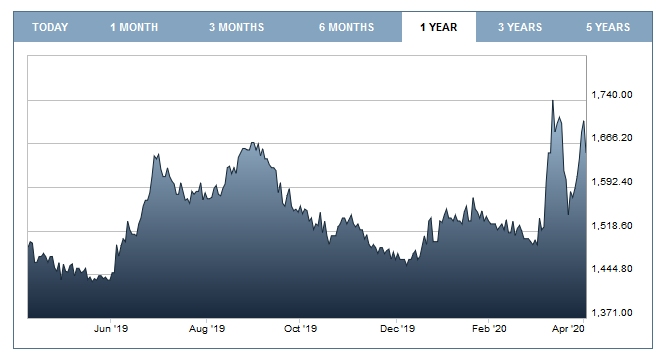

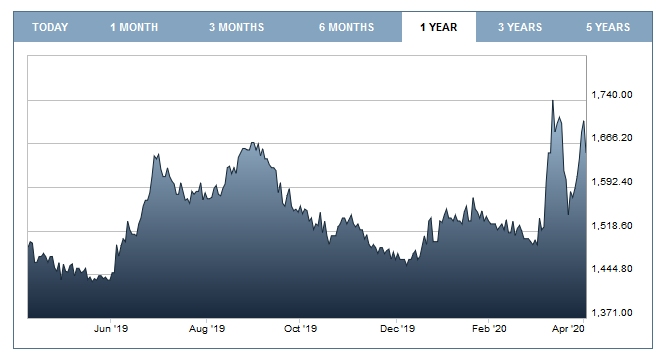

BHGG BH GLOBAL LD ORD NPV GBP

GG00B2QQPT96

https://www.londonstockexchange.com/exchange/prices-and-mark…

BHMG BH MACRO LD ORD NPV (GBP)

GG00B1NP5142

https://www.londonstockexchange.com/exchange/prices-and-mark…

https://www.bhglobal.com/reporting/monthly-shareholder-repor…

• die Monthly Shareholder Reports werden mit ~1 1/2 Monaten Verspätung effektiv veröffentlicht

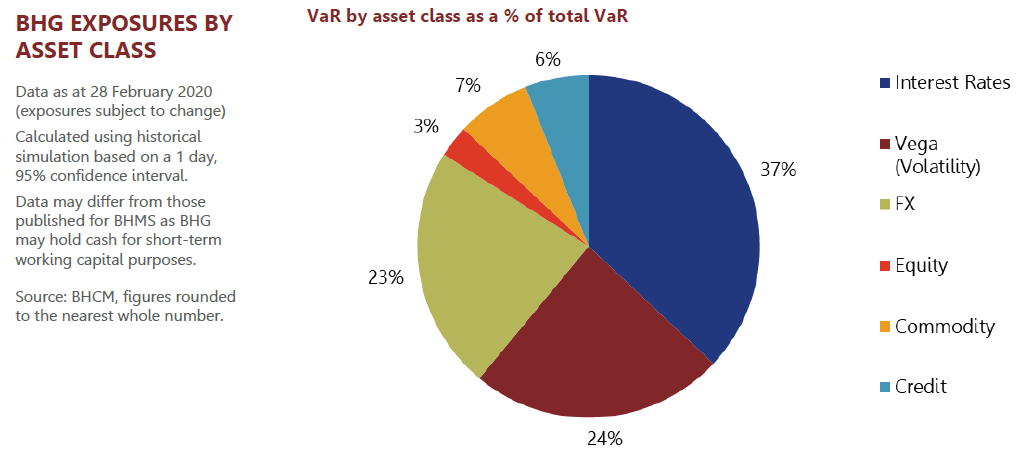

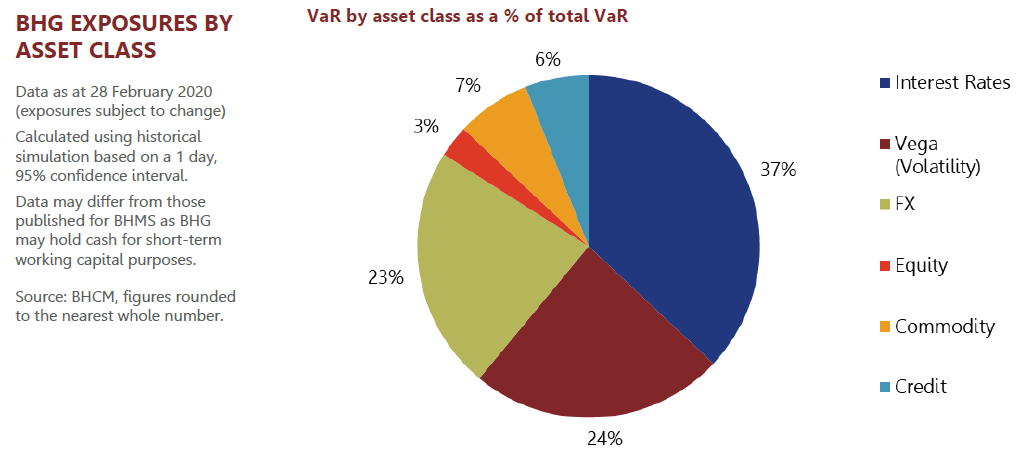

• das ist aus dem "BH GLOBAL LIMITED MONTHLY SHAREHOLDER REPORT FEBRUARY 2020":

--> fast alle Assets sind an Zinsen, Vola und FX gebunden:

<das PDF selber ist vom 1.4.2020>

BHCM = Brevan Howard Capital Management LP

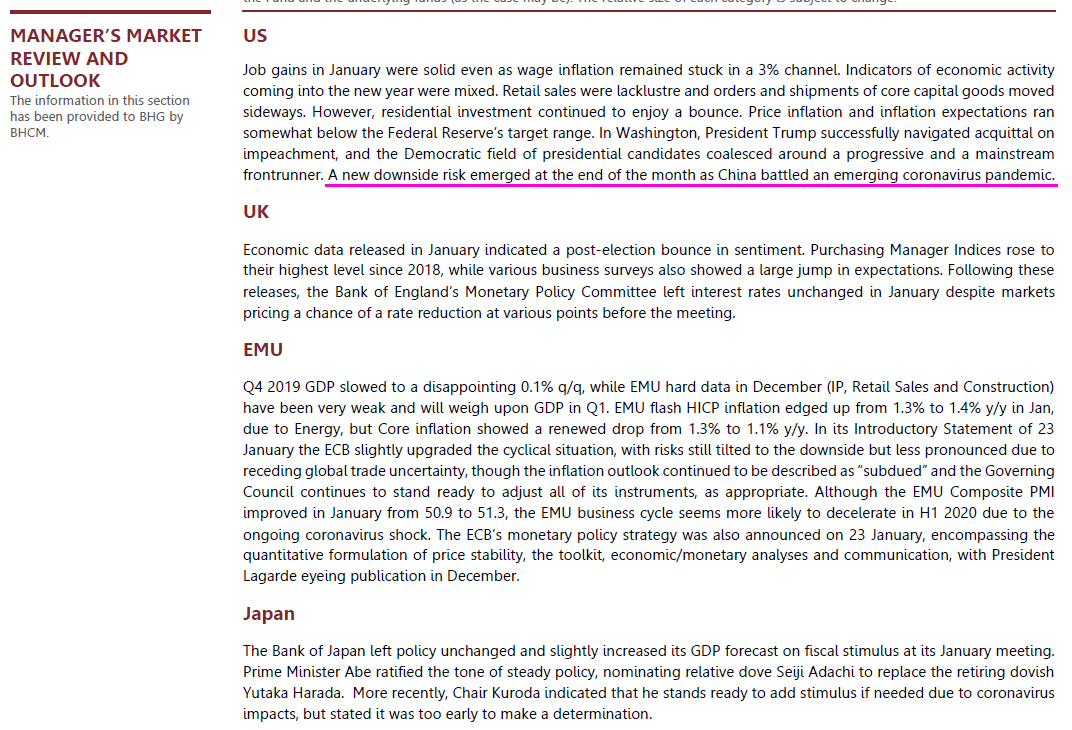

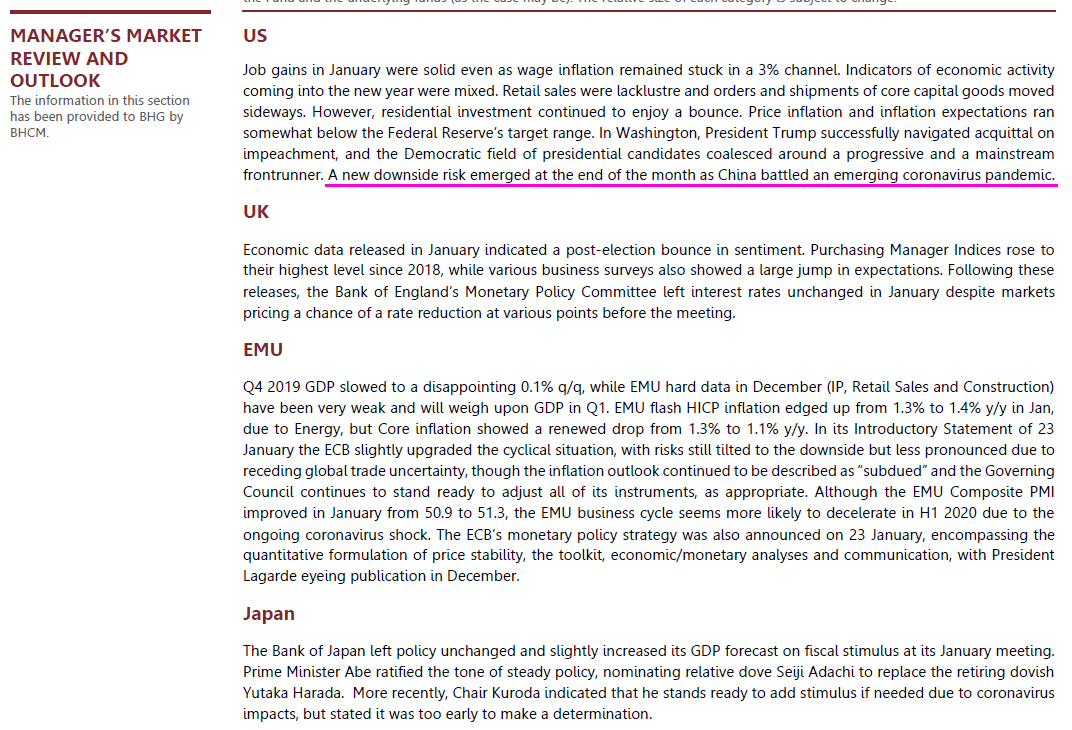

Im Februar tut sich bei beiden Fonds noch "nichts". Aber dann im März. Aus dem Januar-Brief vom 11.3.2020:

=> nur eine Andeutung zu COVID-19 (zu diesem Zeitpunkt, 11.3.2020, hat der DJIA bereits -19% seines Wertes verloren (*))

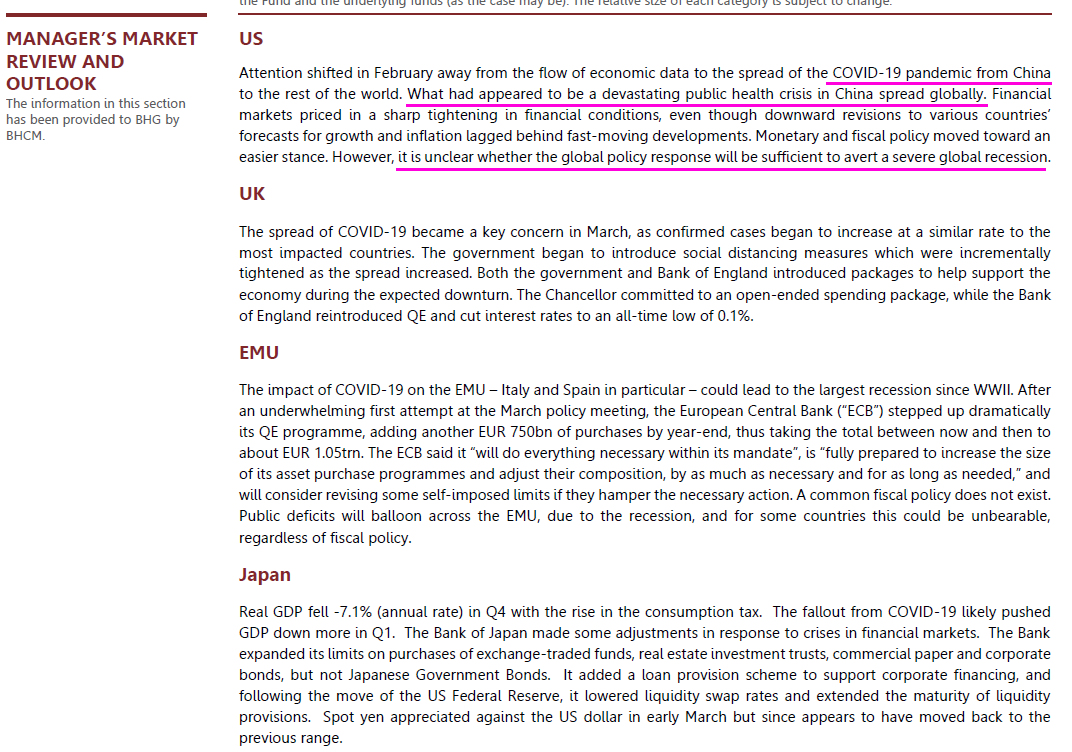

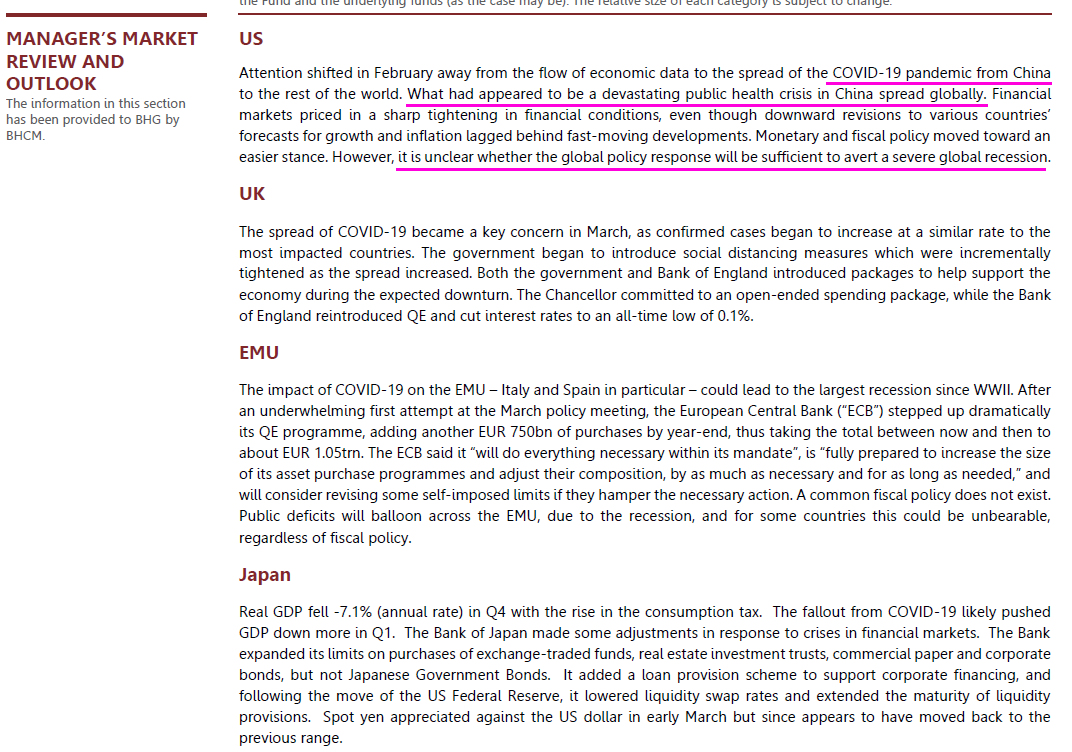

...und im Februar-Brief als globalen Rezessionstreiber beschrieben (1.4.2020):

=> irgendetwas müssen die sehr richtig gemacht haben (im Gegensatz zu Bridgewater). Aber man weiß halt nicht (ich zumindest nicht), wann der jeweilige MANAGER’S MARKET REVIEW AND OUTLOOK wirklich geschrieben wurde

Und lesen lohnt mMn nicht, da zu spät (*).

https://www.bloomberg.com/news/articles/2020-04-03/bridgewat…

--> darin werden Brevan Howard (Asset Management) erwähnt. Zumindest diesen beiden closed-end funds machten es richtig:

BHGG BH GLOBAL LD ORD NPV GBP

GG00B2QQPT96

https://www.londonstockexchange.com/exchange/prices-and-mark…

BHMG BH MACRO LD ORD NPV (GBP)

GG00B1NP5142

https://www.londonstockexchange.com/exchange/prices-and-mark…

https://www.bhglobal.com/reporting/monthly-shareholder-repor…

• die Monthly Shareholder Reports werden mit ~1 1/2 Monaten Verspätung effektiv veröffentlicht

• das ist aus dem "BH GLOBAL LIMITED MONTHLY SHAREHOLDER REPORT FEBRUARY 2020":

--> fast alle Assets sind an Zinsen, Vola und FX gebunden:

<das PDF selber ist vom 1.4.2020>

BHCM = Brevan Howard Capital Management LP

Im Februar tut sich bei beiden Fonds noch "nichts". Aber dann im März. Aus dem Januar-Brief vom 11.3.2020:

=> nur eine Andeutung zu COVID-19 (zu diesem Zeitpunkt, 11.3.2020, hat der DJIA bereits -19% seines Wertes verloren (*))

...und im Februar-Brief als globalen Rezessionstreiber beschrieben (1.4.2020):

=> irgendetwas müssen die sehr richtig gemacht haben (im Gegensatz zu Bridgewater). Aber man weiß halt nicht (ich zumindest nicht), wann der jeweilige MANAGER’S MARKET REVIEW AND OUTLOOK wirklich geschrieben wurde

Und lesen lohnt mMn nicht, da zu spät (*).

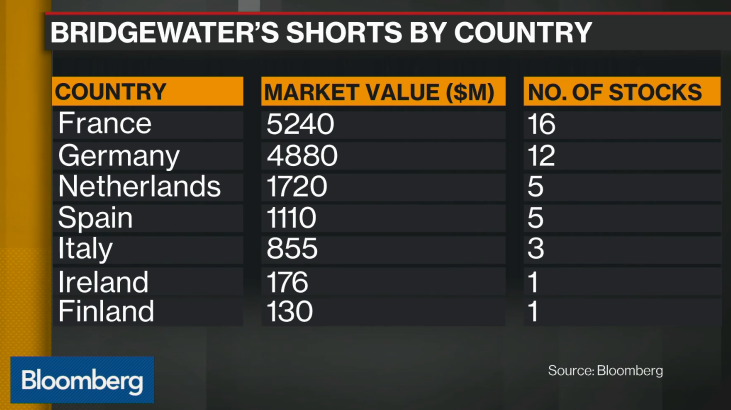

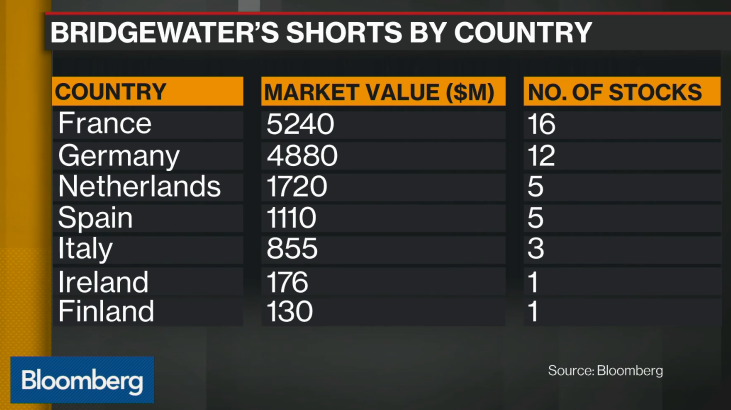

Antwort auf Beitrag Nr.: 63.036.076 von faultcode am 17.03.20 12:23:00Der feine Herr Dalio wettet also gegen "coronavirus ridden countries":

17.3.

Bridgewater's $14 Billion Bet Against European Stocks

https://www.bloomberg.com/news/videos/2020-03-17/bridgewater…

Bridgewater Associates, the world’s biggest hedge fund, has built up a $14 billion bet that shares in European companies will continue to sink amid the worsening coronavirus outbreak. Bloomberg's Sonali Basak has more on "Bloomberg Daybreak: Americas."

17.3.

Bridgewater's $14 Billion Bet Against European Stocks

https://www.bloomberg.com/news/videos/2020-03-17/bridgewater…

Bridgewater Associates, the world’s biggest hedge fund, has built up a $14 billion bet that shares in European companies will continue to sink amid the worsening coronavirus outbreak. Bloomberg's Sonali Basak has more on "Bloomberg Daybreak: Americas."

19:37 Uhr · wallstreetONLINE Redaktion · BMW |

18:14 Uhr · Christoph Geyer · DAX |

16:46 Uhr · Andreas Bernstein · DAX |

16:11 Uhr · BörsenNEWS.de · DAX |

15:00 Uhr · SG Zertifikate · DAXAnzeige |

14:16 Uhr · dpa-AFX · Münchener Rück |

08:05 Uhr · Sharedeals · DAX |

07:00 Uhr · SG Zertifikate · DAXAnzeige |

27.04.24 · Robby's Elliottwellen · DAX |

| Zeit | Titel |

|---|---|

| 22:12 Uhr | |

| 22:00 Uhr | |

| 12:20 Uhr | |

| 27.04.24 | |

| 27.04.24 | |

| 27.04.24 | |

| 26.04.24 | |

| 25.04.24 | |

| 25.04.24 | |

| 25.04.24 |