"Value" -- noch eine Zukunft? (Seite 2)

eröffnet am 10.12.20 22:33:18 von

neuester Beitrag 10.02.24 18:49:41 von

neuester Beitrag 10.02.24 18:49:41 von

Beiträge: 42

ID: 1.336.034

ID: 1.336.034

Aufrufe heute: 0

Gesamt: 9.515

Gesamt: 9.515

Aktive User: 0

ISIN: US78464A1280 · WKN: A1KA4J · Symbol: VLU

169,12

USD

+0,33 %

+0,56 USD

Letzter Kurs 16:02:55 NYSE Arca

Neuigkeiten

Werte aus der Branche Sonstige

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 28,87 | +3,61 | |

| 78,34 | +3,31 | |

| 40,86 | +3,21 | |

| 120,81 | +3,19 | |

| 29,55 | +2,82 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1.507,00 | -2,02 | |

| 2.565,25 | -2,24 | |

| 16,31 | -2,92 | |

| 633,49 | -3,96 | |

| 2,100 | -16,00 |

Beitrag zu dieser Diskussion schreiben

https://www.bloomberg.com/news/articles/2023-06-01/investors…

...

Smart-beta ETFs in US saw record $5.8 billion outflows in May

Value as a factor is ‘always disappointing,’ says BI analyst

...

...

Bloomberg Intelligence analysts expect S&P 500 earnings to have fallen 3.1% in the fourth quarter, compared with a year earlier.

The S&P 500 Pure Growth Index, which tracks firms in that sector, is projected to post an earnings drop of about 16%, while profits at its value counterpart likely rose 1.4%.

...

9.1.

Value Stocks to Lure Investors During Grim Earnings Season

https://uk.finance.yahoo.com/news/value-stocks-lure-investor…

Bloomberg Intelligence analysts expect S&P 500 earnings to have fallen 3.1% in the fourth quarter, compared with a year earlier.

The S&P 500 Pure Growth Index, which tracks firms in that sector, is projected to post an earnings drop of about 16%, while profits at its value counterpart likely rose 1.4%.

...

9.1.

Value Stocks to Lure Investors During Grim Earnings Season

https://uk.finance.yahoo.com/news/value-stocks-lure-investor…

6.1.

Goldman Strategists See Value Stocks Outperforming Again in 2023

https://finance.yahoo.com/news/goldman-strategists-see-value…

...

After years of lagging behind their growth peers, cheaper so-called value stocks outperformed in 2022 as major central banks hiked rates to tamp down surging inflation. “As big cap technology sees further margin pressure, commodity prices rise and real interest rates remain higher, we think this trend has further to go,” strategists led by Peter Oppenheimer wrote in a note Thursday.

The strategist is not alone in sounding cautious on technology and other growth stocks, which had led last year’s worst selloff on Wall Street since 2008. Bank of America Corp.’s Savita Subramanian said Wednesday investors should avoid crowded parts of the stock market, including big tech. Morgan Stanley strategist Michael Wilson — one of the most bearish voices on US stocks — also warned profit margins at tech companies are likely to take a hit this year.

Higher rates tend to particularly hurt growth stocks with the frothiest valuations, including technology, as they mean a bigger discount for the present value of future profits. Although valuations slumped last year, Goldman’s Oppenheimer said these sectors remain expensive, while financials and energy are relatively cheaper.

...

Antwort auf Beitrag Nr.: 70.085.975 von faultcode am 01.12.21 14:05:3501.12.2021

so ändern sich die Zeiten:

• mMn gibt es derzeit kurz vor Jahresende (in den USA) geradezu Druck, Value-Aktien im Portfolio (von profess. Vermögensverwaltern) zum 31.12.2022 vorzeigen zu können:

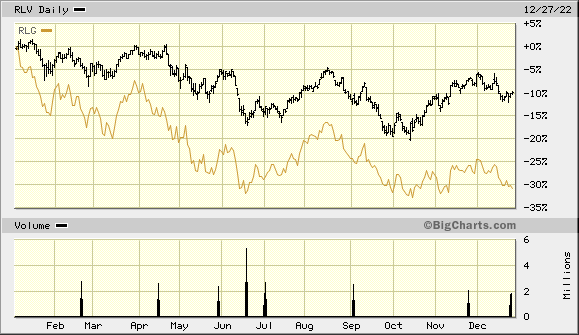

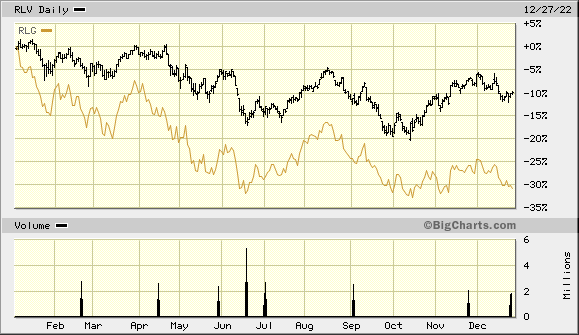

=> $RLV/Russell 1000 Value Index vs $RLG/Russell 1000 Growth Index:

..und auf den letzten Metern:

Denn wenn man sich mal die Bilanzen (2022Q3) z.B. mancher US-Aktien, die derzeit als "Value" gehandelt werden, genauer anschaut, könnte man mMn schon zum Ergebnis kommen, daß auch "Value" ein sehr dehnbarer Begriff ist

Zitat von faultcode: ... 30.11

Value Quant Trade Drops Near 1970s Lows in Covid Crash Echo

https://ca.finance.yahoo.com/news/value-quant-trade-drops-ne…

...

so ändern sich die Zeiten:

• mMn gibt es derzeit kurz vor Jahresende (in den USA) geradezu Druck, Value-Aktien im Portfolio (von profess. Vermögensverwaltern) zum 31.12.2022 vorzeigen zu können:

=> $RLV/Russell 1000 Value Index vs $RLG/Russell 1000 Growth Index:

..und auf den letzten Metern:

Denn wenn man sich mal die Bilanzen (2022Q3) z.B. mancher US-Aktien, die derzeit als "Value" gehandelt werden, genauer anschaut, könnte man mMn schon zum Ergebnis kommen, daß auch "Value" ein sehr dehnbarer Begriff ist

Value Investing ist so einfach (Mindset) und macht mir wirklich viel Spaß. Wenn jetzt die Zeit anbricht, in der Value Growth schlägt, dann umso besser. Aber Ende halte ich es da sowieso mit Graham: Spiel dein Spiel, nicht das der anderen. 🍻😇

7.1.

Hedge Funds Boost Value-Stock Exposure to the Highest in Four Years

https://finance.yahoo.com/news/hedge-funds-boost-value-stock…

...

Hedge funds are loading up on value shares and dumping expensive names, helping fuel the sharpest stock rotation since March as the Federal Reserve signals its intent to accelerate monetary tightening.

Long-short equity funds have raised their value exposure relative to growth to the highest in at least four years, data from JPMorgan Chase & Co.’s prime brokerage show. Among quantitative funds, bets on cheaper stocks have surged to the highest in months.

While hedge funds remain short on the factor overall, the fast-money shift mirrors moves in the broader market as the Fed resolves to tame price growth with higher rates. Inflation-adjusted bond yields are now spiking, driving investors toward cheap stocks that tend to offer more near-term cash flows.

A strategy that buys value shares and dumps pricey ones has gained 7% over the last five sessions, its sharpest rally in 10 months.

“Overall, it seems we’re starting off 2022 with more of a cyclical/value bias than we’ve seen in a while,” a JPMorgan team led by John Schlegel wrote in a Thursday note. “The ‘oversold’/low positioning in growth historically would suggest we could be due for a bounce, but the expectations for the Fed, yields, and the economy over the course of this year make this less clear.”

...

Hedge Funds Boost Value-Stock Exposure to the Highest in Four Years

https://finance.yahoo.com/news/hedge-funds-boost-value-stock…

...

Hedge funds are loading up on value shares and dumping expensive names, helping fuel the sharpest stock rotation since March as the Federal Reserve signals its intent to accelerate monetary tightening.

Long-short equity funds have raised their value exposure relative to growth to the highest in at least four years, data from JPMorgan Chase & Co.’s prime brokerage show. Among quantitative funds, bets on cheaper stocks have surged to the highest in months.

While hedge funds remain short on the factor overall, the fast-money shift mirrors moves in the broader market as the Fed resolves to tame price growth with higher rates. Inflation-adjusted bond yields are now spiking, driving investors toward cheap stocks that tend to offer more near-term cash flows.

A strategy that buys value shares and dumps pricey ones has gained 7% over the last five sessions, its sharpest rally in 10 months.

“Overall, it seems we’re starting off 2022 with more of a cyclical/value bias than we’ve seen in a while,” a JPMorgan team led by John Schlegel wrote in a Thursday note. “The ‘oversold’/low positioning in growth historically would suggest we could be due for a bounce, but the expectations for the Fed, yields, and the economy over the course of this year make this less clear.”

...

4.1.

Drubbing in Tech Stocks Marks Biggest Rotation to Value Since ’95

https://finance.yahoo.com/news/drubbing-tech-marks-biggest-s…

...

After five years of waiting for technology shares’ grip on the market to loosen, value investors are getting their hopes up at the start of 2022.

Software and internet stocks sold off Tuesday, driving the Russell 1000 Growth Index down 1.1%. Meanwhile, energy and financial shares surged, leading gains among those trading at lower multiples based on profits or book value.

The divergence was so wide that over the past two sessions, growth has trailed value by 1.5 percentage points. That’s the worst underperformance for growth to start a year since 1995.

This rotation came alongside a spike in Treasury yields on expectations that the Federal Reserve will raise interest rates this year to tame inflation. While the prospect of higher borrowing costs have prompted traders to rethink their affection for growth stocks -- particularly those fetching nose-bleed valuations -- rate hikes could signal an accelerating economy. This could be good for cyclical companies, many of which have been shunned.

“You could argue some of this rotation is the result of the higher real and nominal yields,” said Alon Rosin, Oppenheimer & Co.’s head of institutional equity derivatives. “This rotation is long overdue with large-cap tech holding up into year end. Now we have multiple compression concerns across all tech with the Fed’s liquidity spigot coming into the tightening drumbeat ahead.”

...

Despite the bleeding in the market’s largest industry, the S&P 500 stood firm, thanks to gains in economically sensitive shares. Energy producers and the KBW Bank Index each rallied more than 6% in the past two sessions, marking their best start for a year on record.

To many investors, the rotation was a welcome development in a bull run where in a handful of tech giants have increasingly dominated equity gains, leaving the market vulnerable to company-specific risks. Broader participation is also good news for active money managers, whose gravitation toward value has contributed to years of lackluster performance when measured against their benchmarks.

...

“Not many predictions for a blowout 2022, so many are allocating towards consistently profitable companies, and away from profitless,” said Larry Weiss, head of equity trading at Instinet LLC in New York. “It could be the value comeback we’ve been waiting for!”