Game-Aktien: Don´t stop the game - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 08.02.21 00:03:21 von

neuester Beitrag 02.10.23 20:58:54 von

neuester Beitrag 02.10.23 20:58:54 von

Beiträge: 22

ID: 1.341.635

ID: 1.341.635

Aufrufe heute: 15

Gesamt: 2.369

Gesamt: 2.369

Aktive User: 0

ISIN: US36467W1099 · WKN: A0HGDX · Symbol: GS2C

28,14

EUR

+75,89 %

+12,14 EUR

Letzter Kurs 21:59:09 Lang & Schwarz

Neuigkeiten

17:58 Uhr · wallstreetONLINE Redaktion |

19:56 Uhr · dpa-AFX |

18:37 Uhr · Markus Fugmann Anzeige |

17:30 Uhr · Markus Weingran |

Werte aus der Branche Unterhaltung

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8500 | +79,23 | |

| 28,01 | +72,79 | |

| 0,5540 | +62,94 | |

| 0,6050 | +21,00 | |

| 9,7300 | +13,14 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7850 | -9,25 | |

| 0,6150 | -12,14 | |

| 0,5200 | -13,33 | |

| 1,6900 | -13,78 | |

| 1,6440 | -14,38 |

Es handelt sich um einen automatisiert angelegten Thread zur Nachricht "Game-Aktien: Don´t stop the game" vom Autor Uwe Zimmer

Aktien des Computerspiele-Händlers GameStop wurde in den vergangenen Tagen zum Zocken benutzt. Nichts wert, aber an der Börse gehypt bis nichts mehr ging. Für die Ethik des Marktes kann man nur hoffen, dass sich diese Art des Spiels durchsetzt.

Lesen Sie den ganzen Artikel: Game-Aktien: Don´t stop the game

Aktien des Computerspiele-Händlers GameStop wurde in den vergangenen Tagen zum Zocken benutzt. Nichts wert, aber an der Börse gehypt bis nichts mehr ging. Für die Ethik des Marktes kann man nur hoffen, dass sich diese Art des Spiels durchsetzt.

Lesen Sie den ganzen Artikel: Game-Aktien: Don´t stop the game

<Platzhalter>

Antwort auf Beitrag Nr.: 66.871.331 von faultcode am 08.02.21 00:03:21

Antwort auf Beitrag Nr.: 66.871.337 von faultcode am 08.02.21 00:04:28

Antwort auf Beitrag Nr.: 66.871.349 von faultcode am 08.02.21 00:05:12Korrelation:

von Anzahl der täglichen Postings im Haupt-Thread -- zu -- letzter Schlusskurs an NYSE in USD (fortgeschrieben an Wochenenden, Feiertagen etc.; nur Tage mit Postings > 0 berücksichtigt)

• Pearson (linear): 79.3%

• Spearman (rank correlation): 67.5%

von Anzahl der täglichen Postings im Haupt-Thread -- zu -- letzter Schlusskurs an NYSE in USD (fortgeschrieben an Wochenenden, Feiertagen etc.; nur Tage mit Postings > 0 berücksichtigt)

• Pearson (linear): 79.3%

• Spearman (rank correlation): 67.5%

Antwort auf Beitrag Nr.: 66.871.349 von faultcode am 08.02.21 00:05:12

https://www.ft.com/content/04e6c524-389b-47fc-afaa-eb52c1e76…

https://www.ft.com/content/04e6c524-389b-47fc-afaa-eb52c1e76…

Antwort auf Beitrag Nr.: 66.917.597 von faultcode am 10.02.21 01:07:27

Wer solchen Plattformen glaubt, ist auch wirklich 🤯

Zitat von faultcode:

https://www.ft.com/content/04e6c524-389b-47fc-afaa-eb52c1e76…

Wer solchen Plattformen glaubt, ist auch wirklich 🤯

Antwort auf Beitrag Nr.: 66.917.597 von faultcode am 10.02.21 01:07:2719.2.

Billionaire investor Bill Gross made $10 million betting against GameStop - after he was down $15 million at one point

https://markets.businessinsider.com/news/stocks/bill-gross-m…

...

"I knew I had an advantage over Reddit and the boys," Gross said, highlighting his access to real-time options and volatility data on his Bloomberg terminal. However, he opened a bearish position on GameStop well before its shares peaked at north of $480 on January 28, and paid the price.

"I got in too early," he said. "I got short around $150 or $100 and at a decent size. I was losing millions of dollars and that's not a good feeling when you go to bed."

"Matter of fact, you wake up three or four times in the middle of the night and you check out GameStop on the black market," he continued.

While Gross admires Tesla CEO Elon Musk and views him as a "modern Thomas Edison," he didn't enjoy it when the executive tweeted "GameStonk!!" on January 26, throwing his weight behind the short squeeze.

"Musk is a little devil and he enjoys playing these games," Gross said. "He's just a frisky guy and so I didn't resent that, but it doubled the stock and that's when I lost the most sleep - it was after Musk did that."

"He probably should have known better, because that's close to yelling 'fire' in the theater," the investor added.

Gross thought about giving up and stomaching a loss, but he was confident that some of the day traders driving up the stock wouldn't be able to resist cashing out.

"I'm not regulated here like some of the hedge funds, and my broker's not calling me for margin and so on," he said. "At $400 I said, 'Hell no,' and so I doubled up to catch up, which was for me a very ballsy move."

Gross also analyzed the volatility of GameStop stock and determined that he was almost certain to come out ahead.

"It was one of those slam-dunk moments where yes, you could lose money, yes it could go to $1,000, but the volatility was priced so high that it was really hard to lose," he said.

"Risk-reward, it became one of those 'you're the casino,'" Gross continued. "That's when I doubled up, I sold more calls, and basically got out. I made a lot of money, maybe $10 million. But I was down $10 million and maybe down $15 million."

Gross felt vindicated that his assessments of the human nature and herd psychology at play, as well as the swings in the stock, were correct.

"It was a nice, intellectual, non-emotional moment for me in which I correctly analyzed the social aspects and the fact that people would turn on the group and sell before others thought they were gonna sell, and the volatility being so high priced that it was really hard to win," he said.

Regardless, Gross gave kudos to the Wall Street Bets community for their ingenuity.

"Their strategy to attack and squeeze shorts, certainly with GameStop, was a good one," he said. "I was really not expecting the stock to go through $10, $20, $30, $40, $100, $200, $300, $400 within the space of a few days."

However, the astounding stock rally was never going to last, he said in a research note on February 2. "Even without regulatory action, the plan was doomed from the beginning," he wrote.

Gross described the investors who bought options with 750% daily volatility as "fish at the poker table" in an earlier research note. He added that a "musical chair, me-first exit" from GameStop was inevitable and the price was bound to return to normal levels.

Billionaire investor Bill Gross made $10 million betting against GameStop - after he was down $15 million at one point

https://markets.businessinsider.com/news/stocks/bill-gross-m…

...

"I knew I had an advantage over Reddit and the boys," Gross said, highlighting his access to real-time options and volatility data on his Bloomberg terminal. However, he opened a bearish position on GameStop well before its shares peaked at north of $480 on January 28, and paid the price.

"I got in too early," he said. "I got short around $150 or $100 and at a decent size. I was losing millions of dollars and that's not a good feeling when you go to bed."

"Matter of fact, you wake up three or four times in the middle of the night and you check out GameStop on the black market," he continued.

While Gross admires Tesla CEO Elon Musk and views him as a "modern Thomas Edison," he didn't enjoy it when the executive tweeted "GameStonk!!" on January 26, throwing his weight behind the short squeeze.

"Musk is a little devil and he enjoys playing these games," Gross said. "He's just a frisky guy and so I didn't resent that, but it doubled the stock and that's when I lost the most sleep - it was after Musk did that."

"He probably should have known better, because that's close to yelling 'fire' in the theater," the investor added.

Gross thought about giving up and stomaching a loss, but he was confident that some of the day traders driving up the stock wouldn't be able to resist cashing out.

"I'm not regulated here like some of the hedge funds, and my broker's not calling me for margin and so on," he said. "At $400 I said, 'Hell no,' and so I doubled up to catch up, which was for me a very ballsy move."

Gross also analyzed the volatility of GameStop stock and determined that he was almost certain to come out ahead.

"It was one of those slam-dunk moments where yes, you could lose money, yes it could go to $1,000, but the volatility was priced so high that it was really hard to lose," he said.

"Risk-reward, it became one of those 'you're the casino,'" Gross continued. "That's when I doubled up, I sold more calls, and basically got out. I made a lot of money, maybe $10 million. But I was down $10 million and maybe down $15 million."

Gross felt vindicated that his assessments of the human nature and herd psychology at play, as well as the swings in the stock, were correct.

"It was a nice, intellectual, non-emotional moment for me in which I correctly analyzed the social aspects and the fact that people would turn on the group and sell before others thought they were gonna sell, and the volatility being so high priced that it was really hard to win," he said.

Regardless, Gross gave kudos to the Wall Street Bets community for their ingenuity.

"Their strategy to attack and squeeze shorts, certainly with GameStop, was a good one," he said. "I was really not expecting the stock to go through $10, $20, $30, $40, $100, $200, $300, $400 within the space of a few days."

However, the astounding stock rally was never going to last, he said in a research note on February 2. "Even without regulatory action, the plan was doomed from the beginning," he wrote.

Gross described the investors who bought options with 750% daily volatility as "fish at the poker table" in an earlier research note. He added that a "musical chair, me-first exit" from GameStop was inevitable and the price was bound to return to normal levels.

Antwort auf Beitrag Nr.: 67.104.645 von faultcode am 19.02.21 14:58:55Der hat also verbilligt und zugeguckt. Und ich dachte, ich wäre zu blöde zum Traden dieses Hypes. Um Himmels Willen.

The King is back!!!!

Keith hat zusätzliche 50K gekauft, besitz jetzt 100k. 😀 Es bleibt spannend!

Und bevor jetzt wieder Kursflutschi und seine Kids antworten... spart es euch, seit von den meisten Usern geblockt! Mit anderen Worten, keine Sau interessiert sich für eure Beiträge.

Und bevor jetzt wieder Kursflutschi und seine Kids antworten... spart es euch, seit von den meisten Usern geblockt! Mit anderen Worten, keine Sau interessiert sich für eure Beiträge.

Wie er das gesagt hat 😉

I like the stonk 😄😄😄😄😄

I like the stonk 😄😄😄😄😄

Hier mal was zum XRT Thema... Sehr interessant, wir ich finde.

https://www.nasdaq.com/articles/xrt-gme-mgni-ostk%3A-large-o…

https://www.nasdaq.com/articles/xrt-gme-mgni-ostk%3A-large-o…

Antwort auf Beitrag Nr.: 67.104.645 von faultcode am 19.02.21 14:58:559.11.

EU Set to Ban Trading Practice Helping Power Meme-Stock Mania

https://www.bnnbloomberg.ca/eu-set-to-ban-trading-practice-h…

...

The European Commission is planning to ban payment for order flow, paralleling potential U.S. moves to stem a practice that hit the headlines during the meme-stock mania.

A forthcoming review of the Markets in Financial Instruments Directive will include a ban amid other measures to increase transparency, such as a consolidated tape of information about transactions, people familiar with the matter said.

The U.S. Securities and Exchange Commission is separately weighing a ban on payment for order flow, in which trading firms pay retail brokerages to execute their trades. Regulators are concerned that video-game like prompts have encouraged excessive trading on app-based brokerages that fueled a explosive surge in value for GameStop Corp. and other stocks this year.

While the day-trading frenzy is far more muted in Europe than the U.S., the practice of zero-commission trading is starting to cross the Atlantic. That prompted the bloc’s markets watchdog to warn firms and investors in July of the risks arising from payment for order flow.

A spokesperson for the European Commission declined to comment.

Mairead McGuinness, the EU’s financial services commissioner, said this month regulators were “closely monitoring” payment for order flow. It was difficult to assess how problematic the practice is “because there is no consolidated view of all liquidity and prices of financial instruments traded across execution venues in the European markets.”

McGuinness said the payment for order flow “may lead to retail orders not being executed on terms most favorable to the client but instead on the terms most profitable to brokers,” according to a written response to a question from a European Union lawmaker.

“This would not be in line with the second Markets in Financial Instruments Directive,” she said. It’s also why regulators are “considering proposing legislation to facilitate a consolidated tape that provides all brokers and their clients with such a holistic view” of all liquidity and prices of financial instruments traded across execution venues in the European markets.

Consolidated Tape

The EU is planning to set a separate tape for each asset class, according to the people familiar. Details on delivery, specifications and speed would be set out later. There may be a tender process to choose the provider of a consolidated tape for an asset class.

The current draft notes a 15-minute delay to consolidate the data will remain acceptable, echoing current rules where exchanges should provide their data for free after 15 minutes. Those contributing data to the tape would share its revenue if the tape consolidates data in less than 15 minutes.

EU Set to Ban Trading Practice Helping Power Meme-Stock Mania

https://www.bnnbloomberg.ca/eu-set-to-ban-trading-practice-h…

...

The European Commission is planning to ban payment for order flow, paralleling potential U.S. moves to stem a practice that hit the headlines during the meme-stock mania.

A forthcoming review of the Markets in Financial Instruments Directive will include a ban amid other measures to increase transparency, such as a consolidated tape of information about transactions, people familiar with the matter said.

The U.S. Securities and Exchange Commission is separately weighing a ban on payment for order flow, in which trading firms pay retail brokerages to execute their trades. Regulators are concerned that video-game like prompts have encouraged excessive trading on app-based brokerages that fueled a explosive surge in value for GameStop Corp. and other stocks this year.

While the day-trading frenzy is far more muted in Europe than the U.S., the practice of zero-commission trading is starting to cross the Atlantic. That prompted the bloc’s markets watchdog to warn firms and investors in July of the risks arising from payment for order flow.

A spokesperson for the European Commission declined to comment.

Mairead McGuinness, the EU’s financial services commissioner, said this month regulators were “closely monitoring” payment for order flow. It was difficult to assess how problematic the practice is “because there is no consolidated view of all liquidity and prices of financial instruments traded across execution venues in the European markets.”

McGuinness said the payment for order flow “may lead to retail orders not being executed on terms most favorable to the client but instead on the terms most profitable to brokers,” according to a written response to a question from a European Union lawmaker.

“This would not be in line with the second Markets in Financial Instruments Directive,” she said. It’s also why regulators are “considering proposing legislation to facilitate a consolidated tape that provides all brokers and their clients with such a holistic view” of all liquidity and prices of financial instruments traded across execution venues in the European markets.

Consolidated Tape

The EU is planning to set a separate tape for each asset class, according to the people familiar. Details on delivery, specifications and speed would be set out later. There may be a tender process to choose the provider of a consolidated tape for an asset class.

The current draft notes a 15-minute delay to consolidate the data will remain acceptable, echoing current rules where exchanges should provide their data for free after 15 minutes. Those contributing data to the tape would share its revenue if the tape consolidates data in less than 15 minutes.

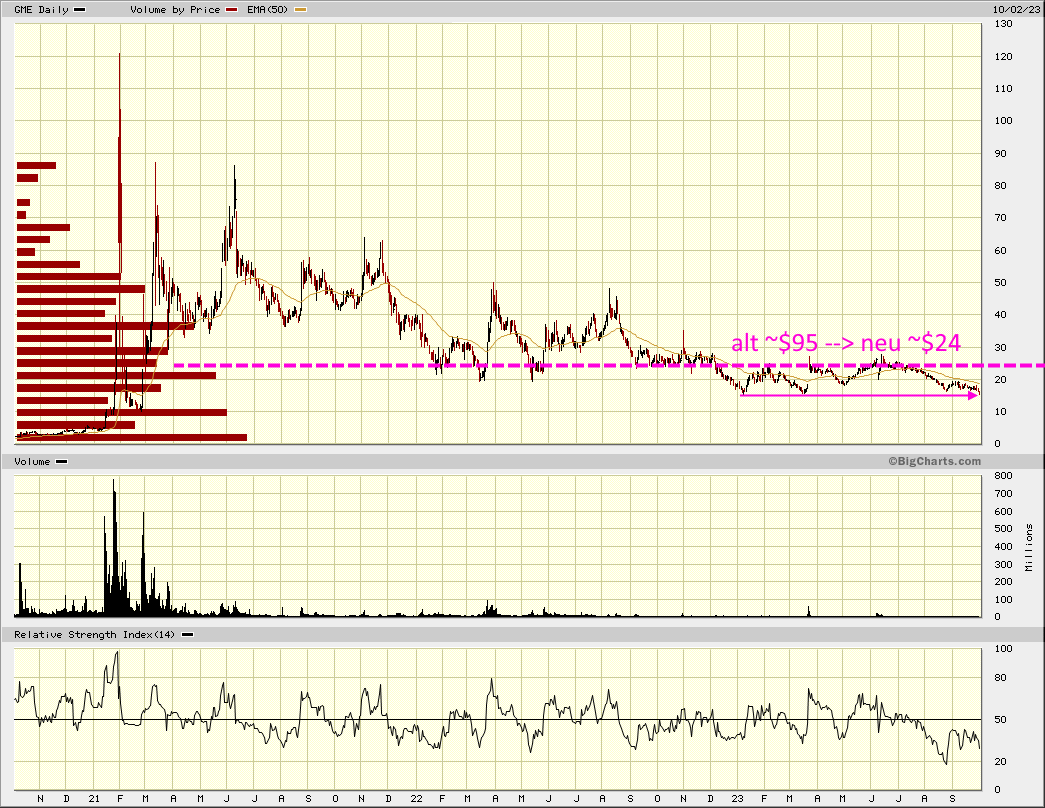

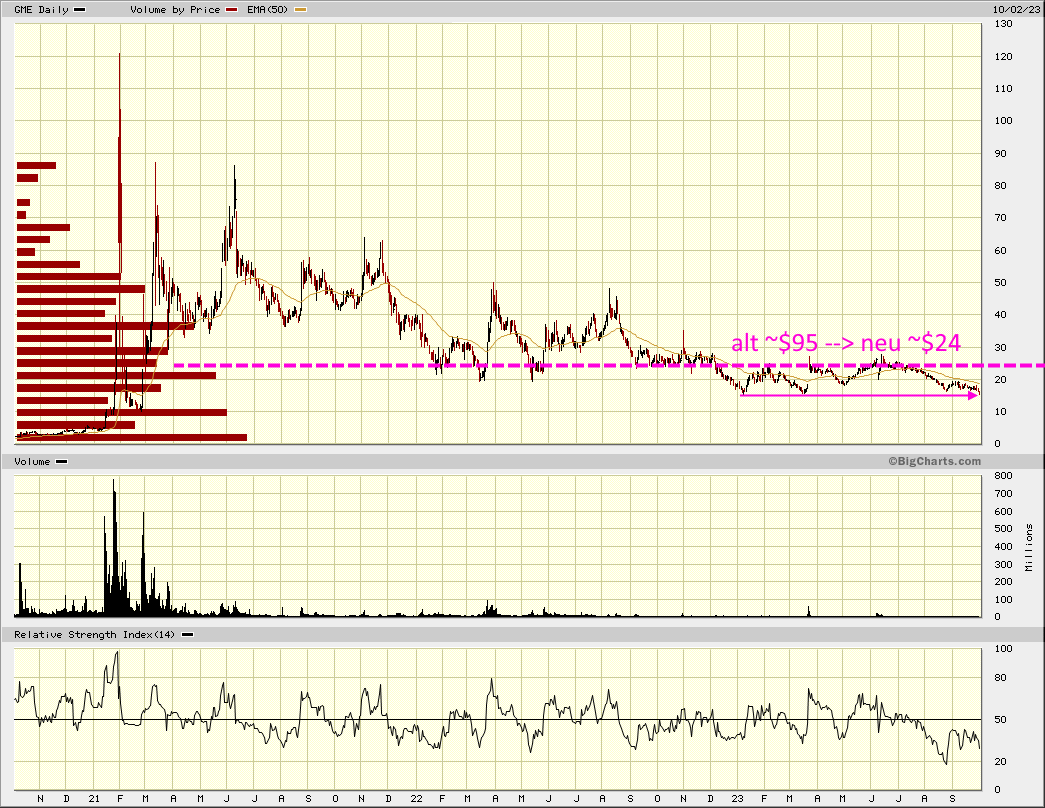

erst jetzt, über 13 Monaten nach dem einzigen und echten MOASS, ist die GameStop-Aktie in einen charttechnisch wirklich interessanten Bereich nach unten hin geraten:

der heutige Tag markiert mMn den Anfang bei der Umwandlung der Unterstützung bei ~USD95 in einen entsprechenden Widerstand. Alle möglichen Re-Tests dabei nicht ausgeschlossen.

Schon bei der vorherigen Marke von ~USD125 war das so.

der heutige Tag markiert mMn den Anfang bei der Umwandlung der Unterstützung bei ~USD95 in einen entsprechenden Widerstand. Alle möglichen Re-Tests dabei nicht ausgeschlossen.

Schon bei der vorherigen Marke von ~USD125 war das so.

Antwort auf Beitrag Nr.: 71.100.462 von faultcode am 14.03.22 18:27:56Das heißt? wann kann man wieder einsteigen, wo siehst du den Widerstand nach unten mit entsprechendem Wechsel in eine Aufwärtsbewegung? 50$?

Das GAME ist VORBEI ---> GAMESTOP 4 ALL

Kein Einstieg ist ab jetzt noch mehr rentabel!

Ab jetzt werden nur noch Fallen platziert....

Warten bis das weltweite anrollende Desater ein Ende nimmt Ende 2022....

Kein Einstieg ist ab jetzt noch mehr rentabel!

Ab jetzt werden nur noch Fallen platziert....

Warten bis das weltweite anrollende Desater ein Ende nimmt Ende 2022....

Antwort auf Beitrag Nr.: 71.101.008 von ManiacTrader am 14.03.22 19:17:04Ich habe heute nachgekauft.

Besser Loopring - LRC.X - kaufen

https://medium.loopring.io/gamestop-nft-marketplace-powered-…

https://stocktwits.com/symbol/LRC.X

https://medium.loopring.io/gamestop-nft-marketplace-powered-…

https://stocktwits.com/symbol/LRC.X

Antwort auf Beitrag Nr.: 71.172.298 von Charly_2 am 23.03.22 10:30:08GameStop NFT Marketplace, powered by Loopring L2

We’re thrilled to announce that the long-awaited GameStop NFT Marketplace (beta) is now LIVE, with the full NFT Marketplace coming shortly, built atop none other than Loopring L2!

It’s no secret that NFTs have become mainstream and are quickly becoming the next frontier of gaming, and the future of digital ownership for unique digital goods and property.

However, currently too many developers, gamers, and users are priced out due to high costs. In order to truly return Power to the Players, access to this new paradigm needs to be fast, cheap, and secure for the masses.

GameStop, in partnership with Loopring, has the opportunity to cement itself at the forefront of this new NFT + gaming paradigm and become THE destination for new global digital economies.

To accomplish this, the new GameStop NFT Marketplace is built atop the second layer of Ethereum, specifically Loopring L2, to ensure that users receive the strongest digital property rights, anchored by a secure, decentralized, and a credibly neutral environment, like Ethereum. Loopring L2 inherits Ethereum’s self-custodial security while abstracting away costly gas-fees, leaving no one priced out.

As showcased here, you can now mint NFTs directly on Loopring L2, with all of the security you get from Ethereum L1, for costs of under $1, compared to the prohibitive costs of minting directly on Ethereum L1, which are up to 100x higher.

GameStop choosing to build on L2 first, bypassing L1 altogether, marks a huge step forward for the future of NFTs and an important moment for Ethereum scaling.

Loopring has built the rails for creators to deliver high performance applications that rival the speeds and scalability of Web2, while also empowering users to receive provable ownership and control over their assets in Web3. These massive speed improvements and lower costs open up the design space to create all sorts of new use-cases for NFTs + gaming that were unimaginable prior.

We believe that today marks an important inflection point for the entire NFT space, and we are excited to be a part of building the next frontier in gaming, digital ownership, and new digital economies.

Get early beta access here, to set up your username + profile, make deposits and be prepared for the full launch of the official marketplace coming soon.

We’re thrilled to announce that the long-awaited GameStop NFT Marketplace (beta) is now LIVE, with the full NFT Marketplace coming shortly, built atop none other than Loopring L2!

It’s no secret that NFTs have become mainstream and are quickly becoming the next frontier of gaming, and the future of digital ownership for unique digital goods and property.

However, currently too many developers, gamers, and users are priced out due to high costs. In order to truly return Power to the Players, access to this new paradigm needs to be fast, cheap, and secure for the masses.

GameStop, in partnership with Loopring, has the opportunity to cement itself at the forefront of this new NFT + gaming paradigm and become THE destination for new global digital economies.

To accomplish this, the new GameStop NFT Marketplace is built atop the second layer of Ethereum, specifically Loopring L2, to ensure that users receive the strongest digital property rights, anchored by a secure, decentralized, and a credibly neutral environment, like Ethereum. Loopring L2 inherits Ethereum’s self-custodial security while abstracting away costly gas-fees, leaving no one priced out.

As showcased here, you can now mint NFTs directly on Loopring L2, with all of the security you get from Ethereum L1, for costs of under $1, compared to the prohibitive costs of minting directly on Ethereum L1, which are up to 100x higher.

GameStop choosing to build on L2 first, bypassing L1 altogether, marks a huge step forward for the future of NFTs and an important moment for Ethereum scaling.

Loopring has built the rails for creators to deliver high performance applications that rival the speeds and scalability of Web2, while also empowering users to receive provable ownership and control over their assets in Web3. These massive speed improvements and lower costs open up the design space to create all sorts of new use-cases for NFTs + gaming that were unimaginable prior.

We believe that today marks an important inflection point for the entire NFT space, and we are excited to be a part of building the next frontier in gaming, digital ownership, and new digital economies.

Get early beta access here, to set up your username + profile, make deposits and be prepared for the full launch of the official marketplace coming soon.

Antwort auf Beitrag Nr.: 71.100.462 von faultcode am 14.03.22 18:27:56 14.03.2022

nicht ganz: das MOASSen tobte hier noch bis Dezember 2022 -- und erst danach wurden aus den damaligen ~USD95 die heutigen ~USD24 (wegen Aktiensplit):

Zitat von faultcode: ...

der heutige Tag markiert mMn den Anfang bei der Umwandlung der Unterstützung bei ~USD95 in einen entsprechenden Widerstand. Alle möglichen Re-Tests dabei nicht ausgeschlossen.

Schon bei der vorherigen Marke von ~USD125 war das so.

nicht ganz: das MOASSen tobte hier noch bis Dezember 2022 -- und erst danach wurden aus den damaligen ~USD95 die heutigen ~USD24 (wegen Aktiensplit):

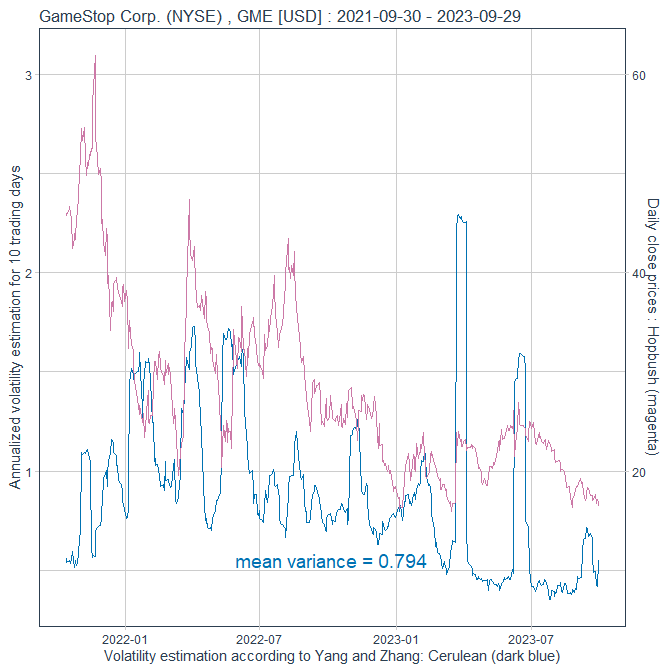

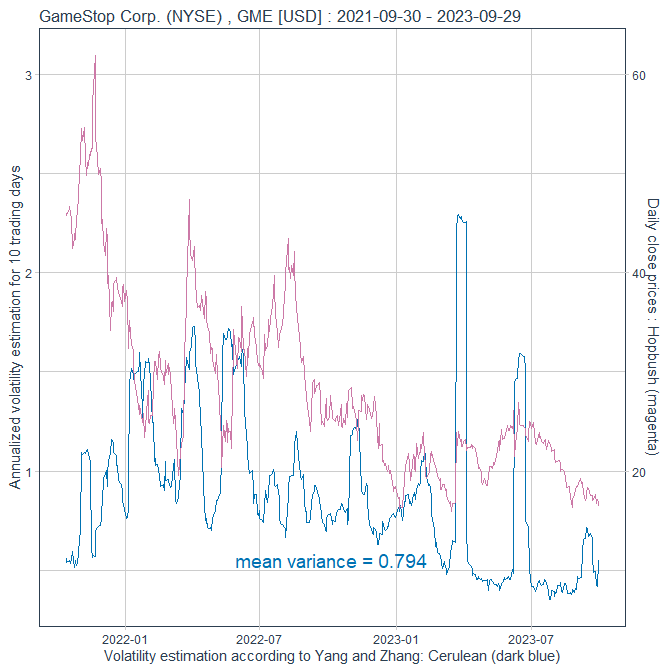

Antwort auf Beitrag Nr.: 74.575.064 von faultcode am 02.10.23 20:45:39nebenbei: die beiden Vola-Explosionen in 2023, mit einmal > 200%, sind beeindruckend:

Beitrag zu dieser Diskussion schreiben

Investoren beobachten auch:

| Wertpapier | Perf. % |

|---|---|

| -0,82 | |

| +1,88 | |

| +2,07 | |

| +12,48 | |

| +7,86 | |

| -1,43 | |

| +1,46 | |

| +6,68 | |

| +1,06 | |

| +82,61 |

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 153 | ||

| 88 | ||

| 74 | ||

| 64 | ||

| 60 | ||

| 47 | ||

| 40 | ||

| 39 | ||

| 38 | ||

| 33 |

19:56 Uhr · dpa-AFX · Apple |

18:37 Uhr · Markus Fugmann · GameStopAnzeige |

17:58 Uhr · wallstreetONLINE Redaktion · GameStop |

17:30 Uhr · Markus Weingran · Apple |

17:22 Uhr · dpa-AFX · Apple |

16:09 Uhr · Der Aktionär TV · Apple |

14:02 Uhr · inv3st.de · GameStopAnzeige |

10:13 Uhr · wallstreetONLINE Redaktion · GameStop |

11.05.24 · Sharedeals · GameStop |

10.05.24 · wallstreetONLINE Redaktion · GameStop |

| Zeit | Titel |

|---|---|

| 21:12 Uhr | |

| 08.05.24 |