`Avino Silver´(ASM.V) besser als `Mines Management´(MGN)?

eröffnet am 22.12.04 21:46:10 von

neuester Beitrag 10.05.24 14:51:46 von

neuester Beitrag 10.05.24 14:51:46 von

Beiträge: 1.462

ID: 938.312

ID: 938.312

Aufrufe heute: 22

Gesamt: 133.409

Gesamt: 133.409

Aktive User: 0

ISIN: CA0539061030 · WKN: 862191 · Symbol: GV6

0,7520

EUR

+1,90 %

+0,0140 EUR

Letzter Kurs 10.05.24 Tradegate

Meistbewertete Beiträge

| Datum | Beiträge | Bewertungen |

|---|---|---|

| 18.04.24 |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +809,09 | |

| 8,0000 | +45,45 | |

| 11,000 | +19,57 | |

| 1,6640 | +16,04 | |

| 527,60 | +15,68 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,6800 | -8,94 | |

| 0,7000 | -10,26 | |

| 324,70 | -10,30 | |

| 8,1000 | -20,59 | |

| 0,6601 | -26,22 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 75.610.124 von altenman am 12.04.24 15:34:07

...kommt immer anders als man denkt.

Was geht...

Zitat von altenman: Bisschen schüchtern gerade unsere ASM. Traut dem Braten mit dem Silber wohl noch nicht. Vielleicht brauts die 30 $ für einen nächsten Schub.

...kommt immer anders als man denkt.

Avino Achieves Strong Production in Q1 2024

April 17, 2024

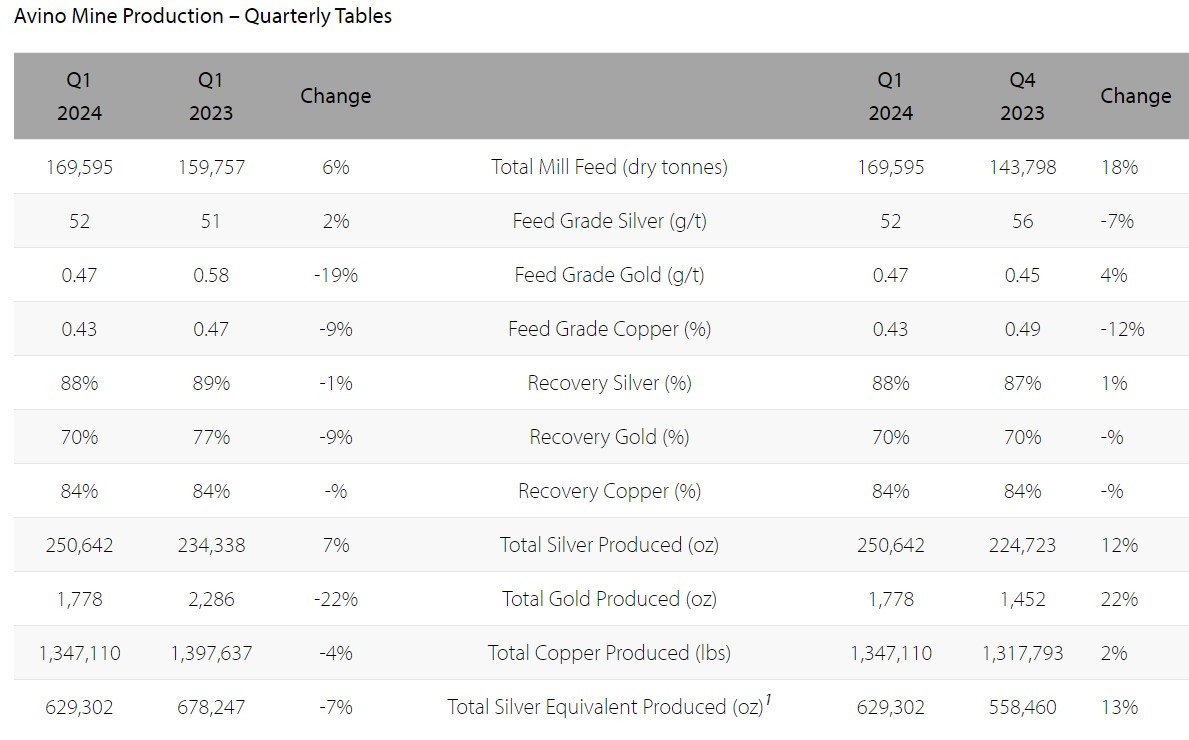

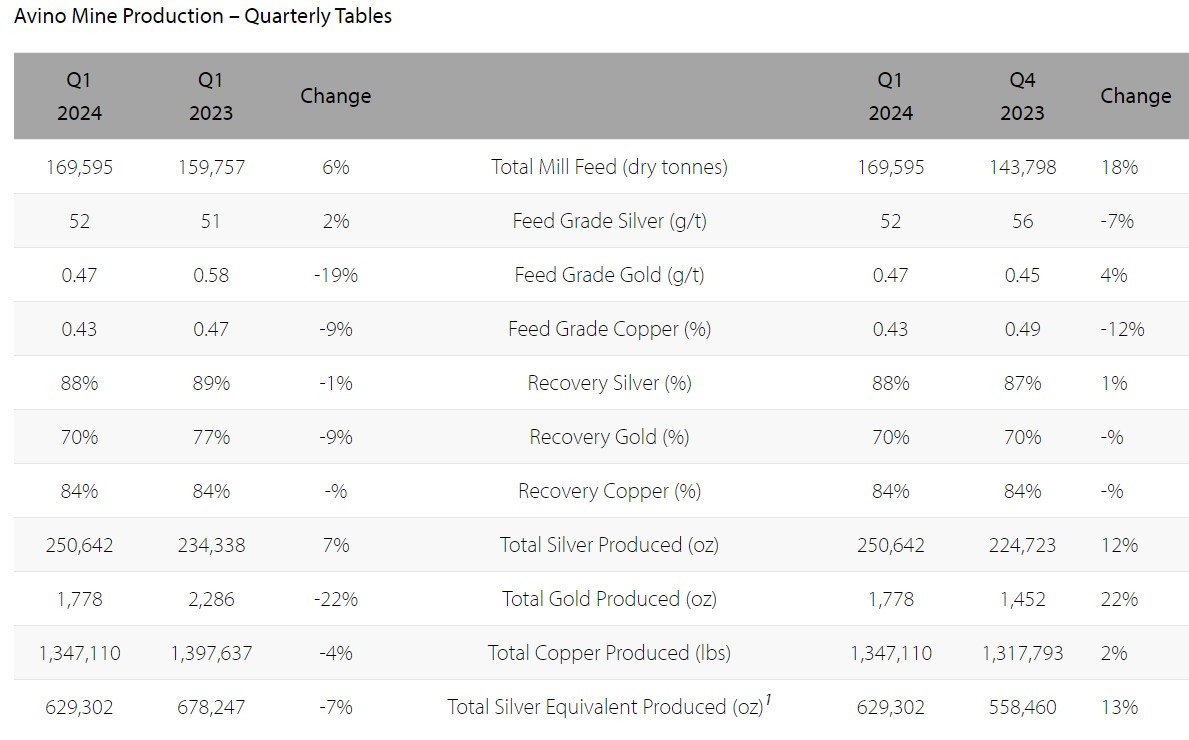

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE) a long-standing silver producer in Mexico, reports a strong first quarter start to the year with 629,302 silver equivalent ounces being produced.

Production Highlights – Q1 2024 (compared to Q4 2023)

- Silver equivalent production increased 13% to 629,302 oz

- Silver production increased 12% to 250,642 oz

- Copper production increased 2% to 1.35 million lbs

- Gold production increased 22% to 1,778 oz

- Mill throughput increased 18% to 169,595 tonnes

2024 First Quarter Highlights

- Production In line with Expectations: Silver equivalent production of 629,302 ounces is within our guidance range and the Company remains on track with our targeted full year production of 2.5M to 2.8M silver equivalent ounces.

- La Preciosa: On February 28, 2024, the Company provided an update on recently completed and ongoing work in connection with La Preciosa. Capital costs for 2024 are expected to be between US$3.0 – US$4.0 million and will include surface works and equipment procurement intended for the first phase of mine development for the Gloria and Abundancia veins. Avino already has the mining equipment necessary to commence operations at La Preciosa. The application for the Environmental Permit has been submitted by the Company to the relevant authorities. A further permit application will be submitted shortly after receipt of the Environmental Permit, which is required to commence the construction of the portal, haulage ramp, and the mining of the Gloria and Abundancia veins.

- Pre-Feasibility Study – Oxide Tailings Project: On February 5, 2024, the Company announced the completion of the Pre-Feasibility Study for its Oxide Tailings Project at the Avino Mine Operations. The completion of the PFS is a key milestone in our growth trajectory.

The study highlighted inaugural proven and probable Mineral Reserves, a first in Avino’s long history, 6.7 million tonnes at a silver and gold grade of 55 g/t and 0.47 g/t, respectively. The OTP is one of our 3 catalysts for gold and silver production growth.

- Avino Signed Community Agreement for La Preciosa: On January 9, 2024, Avino signed a long-term land-use agreement with a local community for the development of La Preciosa in Durango, Mexico. This achievement signaled the start of a new era for Avino and the communities adjacent to the mine as it meant another step closer to putting La Preciosa into production.

- Dry-Stack Tailings Facility Completed and Operational: With the rearrangement of our handling of tailings as a result of the completed dry-stack tailings facility, which has been in use for over a year, the prior method of wet tailings deposition is no longer in use. A tab is available on our website that provides further information on our tailings management system along with videos (in English and Spanish) that can be viewed. In addition, a selection of short videos of the facility in operation can be viewed on our Company website, under Videos and Media.

https://avino.com/news/2024/avino-achieves-strong-production…

April 17, 2024

Avino Silver & Gold Mines Ltd. (ASM: TSX/NYSE American, GV6: FSE) a long-standing silver producer in Mexico, reports a strong first quarter start to the year with 629,302 silver equivalent ounces being produced.

Production Highlights – Q1 2024 (compared to Q4 2023)

- Silver equivalent production increased 13% to 629,302 oz

- Silver production increased 12% to 250,642 oz

- Copper production increased 2% to 1.35 million lbs

- Gold production increased 22% to 1,778 oz

- Mill throughput increased 18% to 169,595 tonnes

2024 First Quarter Highlights

- Production In line with Expectations: Silver equivalent production of 629,302 ounces is within our guidance range and the Company remains on track with our targeted full year production of 2.5M to 2.8M silver equivalent ounces.

- La Preciosa: On February 28, 2024, the Company provided an update on recently completed and ongoing work in connection with La Preciosa. Capital costs for 2024 are expected to be between US$3.0 – US$4.0 million and will include surface works and equipment procurement intended for the first phase of mine development for the Gloria and Abundancia veins. Avino already has the mining equipment necessary to commence operations at La Preciosa. The application for the Environmental Permit has been submitted by the Company to the relevant authorities. A further permit application will be submitted shortly after receipt of the Environmental Permit, which is required to commence the construction of the portal, haulage ramp, and the mining of the Gloria and Abundancia veins.

- Pre-Feasibility Study – Oxide Tailings Project: On February 5, 2024, the Company announced the completion of the Pre-Feasibility Study for its Oxide Tailings Project at the Avino Mine Operations. The completion of the PFS is a key milestone in our growth trajectory.

The study highlighted inaugural proven and probable Mineral Reserves, a first in Avino’s long history, 6.7 million tonnes at a silver and gold grade of 55 g/t and 0.47 g/t, respectively. The OTP is one of our 3 catalysts for gold and silver production growth.

- Avino Signed Community Agreement for La Preciosa: On January 9, 2024, Avino signed a long-term land-use agreement with a local community for the development of La Preciosa in Durango, Mexico. This achievement signaled the start of a new era for Avino and the communities adjacent to the mine as it meant another step closer to putting La Preciosa into production.

- Dry-Stack Tailings Facility Completed and Operational: With the rearrangement of our handling of tailings as a result of the completed dry-stack tailings facility, which has been in use for over a year, the prior method of wet tailings deposition is no longer in use. A tab is available on our website that provides further information on our tailings management system along with videos (in English and Spanish) that can be viewed. In addition, a selection of short videos of the facility in operation can be viewed on our Company website, under Videos and Media.

https://avino.com/news/2024/avino-achieves-strong-production…

Antwort auf Beitrag Nr.: 75.610.124 von altenman am 12.04.24 15:34:07

Was geht...

... jetzt weißt du warum, hat sich gestern schon angekündigt. Die Verbrecherbande da drüben haben das Spiel gestern schon eröffnet und die Lemminge sind wieder darauf hereingefallen.

Bisschen schüchtern gerade unsere ASM. Traut dem Braten mit dem Silber wohl noch nicht. Vielleicht brauts die 30 $ für einen nächsten Schub.

Antwort auf Beitrag Nr.: 75.583.022 von elsifee am 08.04.24 14:14:00The limit up of SFE silver kept to the close, with 729,800 trades. All forward contracts have reached the limit up!

Was geht...

Läuft....

Was geht...

Augen auf im Stassenverkehr, habe geschrieben Silver X , ist eine Minenaktie.

Antwort auf Beitrag Nr.: 75.560.419 von elsifee am 03.04.24 19:46:14hi,

was denkst du warum Silver M. noch lahmt?

Probleme?

M.

was denkst du warum Silver M. noch lahmt?

Probleme?

M.

Antwort auf Beitrag Nr.: 75.560.419 von elsifee am 03.04.24 19:46:14Dito!

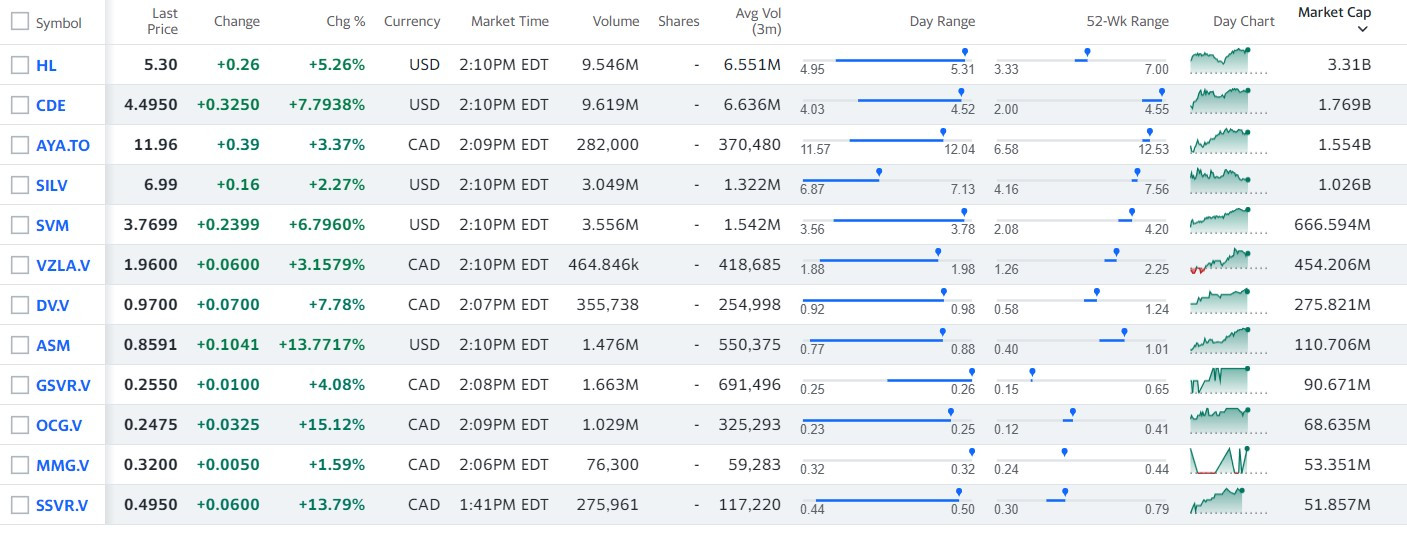

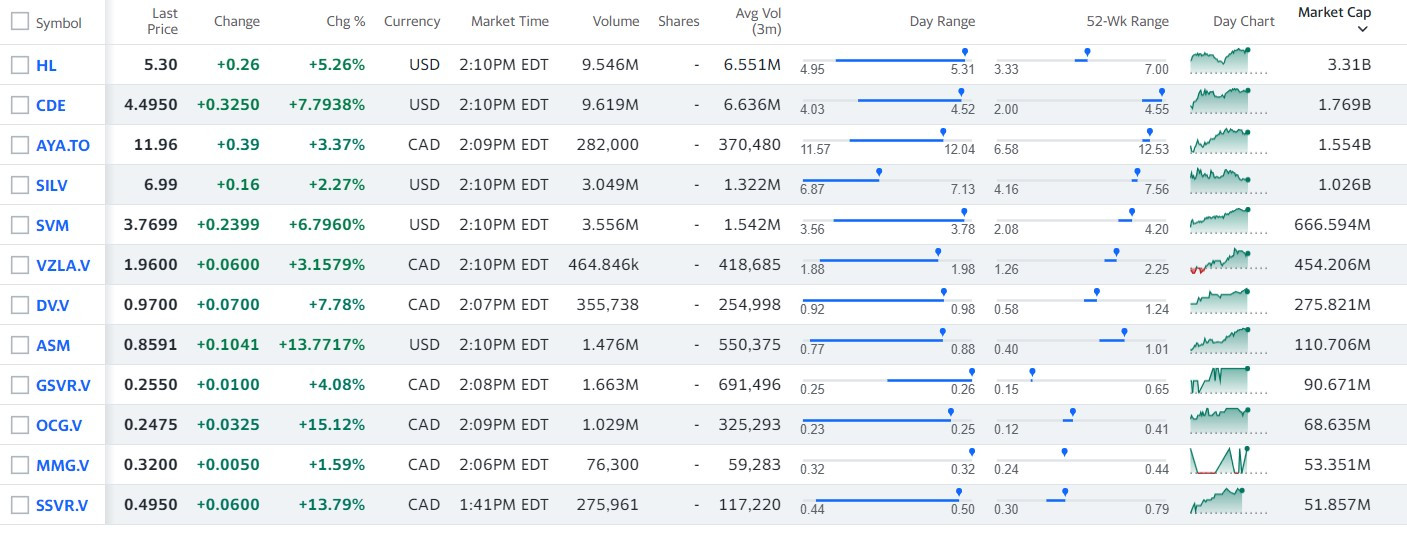

Man sieht auch sehr schön (außer bei Hecla), dass die Großen (sortiert nach MCap) schon langsam die Hochs der 52-Wk Range anpeilen, die Klitschen zuckeln hinterher.

Man sieht auch sehr schön (außer bei Hecla), dass die Großen (sortiert nach MCap) schon langsam die Hochs der 52-Wk Range anpeilen, die Klitschen zuckeln hinterher.