Von 15.000 Dollar Umsatz (2004) auf 200 Millionen in 2006 - 500 Beiträge pro Seite (Seite 30)

eröffnet am 29.08.05 21:57:01 von

neuester Beitrag 30.12.11 10:02:50 von

neuester Beitrag 30.12.11 10:02:50 von

Beiträge: 14.836

ID: 1.003.354

ID: 1.003.354

Aufrufe heute: 40

Gesamt: 1.201.286

Gesamt: 1.201.286

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 21 Minuten | 6247 | |

| vor 27 Minuten | 5007 | |

| vor 29 Minuten | 4148 | |

| vor 35 Minuten | 3758 | |

| vor 21 Minuten | 2585 | |

| heute 14:53 | 1943 | |

| heute 15:18 | 1918 | |

| heute 13:07 | 1476 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.179,55 | +1,39 | 235 | |||

| 2. | 2. | 1,1100 | -19,57 | 118 | |||

| 3. | 3. | 0,1905 | +0,79 | 97 | |||

| 4. | 5. | 9,3500 | +1,14 | 63 | |||

| 5. | 4. | 171,58 | +0,82 | 54 | |||

| 6. | Neu! | 0,4250 | -1,16 | 39 | |||

| 7. | Neu! | 11,905 | +14,97 | 36 | |||

| 8. | Neu! | 4,7650 | +6,24 | 35 |

Lächerlich was manchmal an der Börse abgeht. Lug und Betrug...

Aber dann kaufe ich eben nach.... diese Preise sind fundamental unbegründet.

Aber dann kaufe ich eben nach.... diese Preise sind fundamental unbegründet.

Defense Security Cooperation Agency

NEWS RELEASE

On the web: http://www.dsca.mil Media/Public Contact: (703) 601-3859

Transmittal No. 10-22

United Kingdom – Mastiff/Mine Resistant Ambush Protected (MRAP) Vehicles

WASHINGTON, May 20, 2010 – The Defense Security Cooperation Agency notified Congress May 19 of a possible Foreign Military Sale to the United Kingdom of 102 Mastiff/MRAP Cougar Category II 6X6 modified vehicles and associated equipment, parts, and logistical support for an estimated cost of $122 million.

The Government of the United Kingdom has requested a possible sale of 102 Mastiff/MRAP Cougar Category II 6X6 modified vehicles, tools and test equipment, maintenance support, contractor technical and logistics personnel services, support equipment, spare and repair parts, and other related elements of logistics support. The estimated cost is $122 million.

The United Kingdom is a major political and economic power in NATO and a key democratic partner of the U.S. in ensuring peace and stability in this region and around the world.

The United Kingdom requests these capabilities to provide for the safety of its deployed troops in support of overseas contingency operations. This program will ensure the United Kingdom can effectively operate in hazardous areas in a safe, survivable vehicle, and enhance the United Kingdom’s interoperability with U.S. forces. The United Kingdom is a staunch supporter of the U.S. in Iraq and Afghanistan. The United Kingdom’s troops are deployed in Afghanistan, where United Kingdom and U.S. forces are currently utilizing Cougar Based MRAP vehicles. By acquiring these additional MRAP vehicles, the United Kingdom will be able to provide the same level of protection for its own forces as that provided by the United States for its forces. The United Kingdom will have no difficulty absorbing these vehicles into its Armed Forces.

The proposed sale of this equipment and support will not alter the basic military balance in the region.

The principal contractor will be Force Protection Industries, Inc., of Ladson, South Carolina. There are no known offset agreements proposed in connection with this potential sale.

The continued support of nine Field Service Representatives, currently providing in-theater maintenance support for the existing Mastiff vehicles until July 2010, will be extended until the UK can provide this support internally.

There will be no adverse impact on U.S. defense readiness as a result of this proposed sale.

This notice of a potential sale is required by law and does not mean the sale has been concluded.

NEWS RELEASE

On the web: http://www.dsca.mil Media/Public Contact: (703) 601-3859

Transmittal No. 10-22

United Kingdom – Mastiff/Mine Resistant Ambush Protected (MRAP) Vehicles

WASHINGTON, May 20, 2010 – The Defense Security Cooperation Agency notified Congress May 19 of a possible Foreign Military Sale to the United Kingdom of 102 Mastiff/MRAP Cougar Category II 6X6 modified vehicles and associated equipment, parts, and logistical support for an estimated cost of $122 million.

The Government of the United Kingdom has requested a possible sale of 102 Mastiff/MRAP Cougar Category II 6X6 modified vehicles, tools and test equipment, maintenance support, contractor technical and logistics personnel services, support equipment, spare and repair parts, and other related elements of logistics support. The estimated cost is $122 million.

The United Kingdom is a major political and economic power in NATO and a key democratic partner of the U.S. in ensuring peace and stability in this region and around the world.

The United Kingdom requests these capabilities to provide for the safety of its deployed troops in support of overseas contingency operations. This program will ensure the United Kingdom can effectively operate in hazardous areas in a safe, survivable vehicle, and enhance the United Kingdom’s interoperability with U.S. forces. The United Kingdom is a staunch supporter of the U.S. in Iraq and Afghanistan. The United Kingdom’s troops are deployed in Afghanistan, where United Kingdom and U.S. forces are currently utilizing Cougar Based MRAP vehicles. By acquiring these additional MRAP vehicles, the United Kingdom will be able to provide the same level of protection for its own forces as that provided by the United States for its forces. The United Kingdom will have no difficulty absorbing these vehicles into its Armed Forces.

The proposed sale of this equipment and support will not alter the basic military balance in the region.

The principal contractor will be Force Protection Industries, Inc., of Ladson, South Carolina. There are no known offset agreements proposed in connection with this potential sale.

The continued support of nine Field Service Representatives, currently providing in-theater maintenance support for the existing Mastiff vehicles until July 2010, will be extended until the UK can provide this support internally.

There will be no adverse impact on U.S. defense readiness as a result of this proposed sale.

This notice of a potential sale is required by law and does not mean the sale has been concluded.

Danke kyron, das ist doch Marmelade auf´s Brot...

ich habe auch noch einen:

U.K. Invites Force Protection, Supacat To Tender for Patrol Vehicle Buy

Looks like COO Hutcherson was right when he said tender invite from MOD was coming within 30 days.

U.K. Invites Force Protection, Supacat To Tender for Patrol Vehicle Buy

By ANDREW CHUTER

Published: 20 May 2010 12:16

LONDON - A competition to replace the British Army's Snatch Land Rover armored vehicle has approached the end game after the issue of an invitation to tender to the two companies vying to secure the deal.

Force Protection Europe with the Ocelot is head-to-head with the rival SPV400 vehicle offered by Supacat to supply an initial batch of 200 light protected patrol vehicles for troops operating in Afghanistan.

The winning vehicle, being supplied as an urgent operational requirement, will offer troops better protection and greater mobility than the much-maligned Snatch machine.

The invitations issued by the Ministry of Defence are scheduled to be returned in June, with a decision on a winning contractor expected in early autumn.

The previous Labour Party administration was widely criticized by parliamentarians, the media and some in the military over its failure to replace a vehicle that was unable to provide adequate protection against roadside bombs in Afghanistan and Iraq, and has been blamed for a large number of British fatalities.

A second batch of 200 vehicles is expected to be ordered once deliveries of the initial machines are under way. More orders may follow to replace other Land Rover variants in service with the British military.

The MoD recently completed an evaluation of the two new vehicle designs and subsequently purchased a pair of machines from both manufacturers to continue trials and testing.

Designed and built in the United Kingdom, the vehicles weigh about 7.5 tons, use extensive amounts of composite armor, carry a crew of six and have a turning circle not much worse than the fabled London taxi.

ich habe auch noch einen:

U.K. Invites Force Protection, Supacat To Tender for Patrol Vehicle Buy

Looks like COO Hutcherson was right when he said tender invite from MOD was coming within 30 days.

U.K. Invites Force Protection, Supacat To Tender for Patrol Vehicle Buy

By ANDREW CHUTER

Published: 20 May 2010 12:16

LONDON - A competition to replace the British Army's Snatch Land Rover armored vehicle has approached the end game after the issue of an invitation to tender to the two companies vying to secure the deal.

Force Protection Europe with the Ocelot is head-to-head with the rival SPV400 vehicle offered by Supacat to supply an initial batch of 200 light protected patrol vehicles for troops operating in Afghanistan.

The winning vehicle, being supplied as an urgent operational requirement, will offer troops better protection and greater mobility than the much-maligned Snatch machine.

The invitations issued by the Ministry of Defence are scheduled to be returned in June, with a decision on a winning contractor expected in early autumn.

The previous Labour Party administration was widely criticized by parliamentarians, the media and some in the military over its failure to replace a vehicle that was unable to provide adequate protection against roadside bombs in Afghanistan and Iraq, and has been blamed for a large number of British fatalities.

A second batch of 200 vehicles is expected to be ordered once deliveries of the initial machines are under way. More orders may follow to replace other Land Rover variants in service with the British military.

The MoD recently completed an evaluation of the two new vehicle designs and subsequently purchased a pair of machines from both manufacturers to continue trials and testing.

Designed and built in the United Kingdom, the vehicles weigh about 7.5 tons, use extensive amounts of composite armor, carry a crew of six and have a turning circle not much worse than the fabled London taxi.

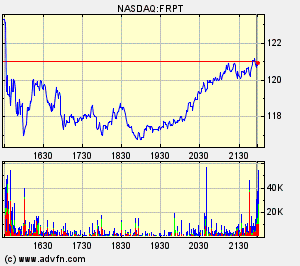

+10%. What the hell is going on?

Wow........

CommentsProvided by: $2.95 Flat-Rate Stock Trades at OptionsHouse. Why Pay More?

Shares of Force Protection (FRPT) Trading Higher on Benckmark Upgrade; Attractive Risk/Reward Ahead of Catalysts

More News related to FRPT

Shares of Force Protection (FRPT) Trading Higher on Benckmark Upgrade; Attractive Risk/Reward Ahead of Catalysts

Benchmark Upgrades Force Protection (FRPT) to Buy; Attractive Risk/Reward Ahead of Catalysts

Force Protection to Present at Stephens Inc. Spring Investment Conference on Wednesday, May 26, 2010

Force Protection (FRPT) Receives $62.4M Contract for 60 Buffalo MPCV from U.S. Army TACOM

Merriman Curhan Ford Maintains Buy On Force Protection (FRPT) Despite Q1 Miss

More News related to FRPT

More News related to Analyst Comments

Shares of Force Protection (FRPT) Trading Higher on Benckmark Upgrade; Attractive Risk/Reward Ahead of Catalysts

Morgan Stanley Adds Textron (TXT) to 'Research Tactical Idea' List; Stock Moving Higher

Deutsche Bank Adds Coke (KO) to Short-Term Buy List

Credit Suisse Cuts Estimates/Price Targets on Solar Stocks (TSL, FSLR, STP, SPWRA, JASO)

Broadpoint.AmTech Reiterates a 'Buy' on Marvell Technology (MRVL); New Products Sustain Growth

More News related to Analyst Comments

May 21, 2010 1:45 PM EDT

Shares of Force Protection Inc. (Nasdaq: FRPT) are getting a boost from today's Benckmark upgrade. The stock is currently up 8.51%. However, shares are trading around $4.60, at the low end of the 52wk Range: $4.03 - $10.03.

This morning, Benckmark raised its rating on Force Protection to 'Buy' and upped the price target to $6.

Benchmark analyst mentioned three potential catalysts:

1) The Defense Security Cooperation Agency notified Congress on May 19 of a possible Foreign Military Sales (FMS) to the U.K. for 102 Cougar vehicles worth approximately $122 million. The award could bring total Cougar vehicle sales to more than 170 units for FY10, higher than the Street’s expectation of 140-150 units.

2) Management expects another order for 50 Buffalo vehicles, following the recent order for 60 Buffaloes. In addition to the existing backlog of 34 vehicles, this could bring total FY10 Buffalo sales to more than 100 units for the year, also higher than the Street’s expectations.

3) Force has potential to install Oshkosh’s independent suspension on other vehicle OEM’s MRAP vehicles for Afghanistan , in our view. The company has a proven track record from its upgrade of the Cougar MRAPs. If successful, this could represent modernization revenue of $200+ million.

Benchmark analyst said in closing, "We are maintaining our FY10 revenue and EPS estimates of $650 million and $0.34. We believe the three potential catalysts discussed above will likely support a better than expected 2H and will update our model post Q2 results. Our current projections assume FY10 vehicle sales of 100 Buffaloes ($100 million) and 140 Cougars ($85 million), $250 million in modernization revenue and $215 million in spares and sustainment revenue."

To see all the upgrades/downgrades on shares of FRPT, visit our Analyst Ratings page.

Related Categories

Analyst Comments

Upgrades

Stocks Mentioned

FRPT 4.59

+0.36 +8.51%

Volume: 1,392,964

Track FRPT

CommentsProvided by: $2.95 Flat-Rate Stock Trades at OptionsHouse. Why Pay More?

Shares of Force Protection (FRPT) Trading Higher on Benckmark Upgrade; Attractive Risk/Reward Ahead of Catalysts

More News related to FRPT

Shares of Force Protection (FRPT) Trading Higher on Benckmark Upgrade; Attractive Risk/Reward Ahead of Catalysts

Benchmark Upgrades Force Protection (FRPT) to Buy; Attractive Risk/Reward Ahead of Catalysts

Force Protection to Present at Stephens Inc. Spring Investment Conference on Wednesday, May 26, 2010

Force Protection (FRPT) Receives $62.4M Contract for 60 Buffalo MPCV from U.S. Army TACOM

Merriman Curhan Ford Maintains Buy On Force Protection (FRPT) Despite Q1 Miss

More News related to FRPT

More News related to Analyst Comments

Shares of Force Protection (FRPT) Trading Higher on Benckmark Upgrade; Attractive Risk/Reward Ahead of Catalysts

Morgan Stanley Adds Textron (TXT) to 'Research Tactical Idea' List; Stock Moving Higher

Deutsche Bank Adds Coke (KO) to Short-Term Buy List

Credit Suisse Cuts Estimates/Price Targets on Solar Stocks (TSL, FSLR, STP, SPWRA, JASO)

Broadpoint.AmTech Reiterates a 'Buy' on Marvell Technology (MRVL); New Products Sustain Growth

More News related to Analyst Comments

May 21, 2010 1:45 PM EDT

Shares of Force Protection Inc. (Nasdaq: FRPT) are getting a boost from today's Benckmark upgrade. The stock is currently up 8.51%. However, shares are trading around $4.60, at the low end of the 52wk Range: $4.03 - $10.03.

This morning, Benckmark raised its rating on Force Protection to 'Buy' and upped the price target to $6.

Benchmark analyst mentioned three potential catalysts:

1) The Defense Security Cooperation Agency notified Congress on May 19 of a possible Foreign Military Sales (FMS) to the U.K. for 102 Cougar vehicles worth approximately $122 million. The award could bring total Cougar vehicle sales to more than 170 units for FY10, higher than the Street’s expectation of 140-150 units.

2) Management expects another order for 50 Buffalo vehicles, following the recent order for 60 Buffaloes. In addition to the existing backlog of 34 vehicles, this could bring total FY10 Buffalo sales to more than 100 units for the year, also higher than the Street’s expectations.

3) Force has potential to install Oshkosh’s independent suspension on other vehicle OEM’s MRAP vehicles for Afghanistan , in our view. The company has a proven track record from its upgrade of the Cougar MRAPs. If successful, this could represent modernization revenue of $200+ million.

Benchmark analyst said in closing, "We are maintaining our FY10 revenue and EPS estimates of $650 million and $0.34. We believe the three potential catalysts discussed above will likely support a better than expected 2H and will update our model post Q2 results. Our current projections assume FY10 vehicle sales of 100 Buffaloes ($100 million) and 140 Cougars ($85 million), $250 million in modernization revenue and $215 million in spares and sustainment revenue."

To see all the upgrades/downgrades on shares of FRPT, visit our Analyst Ratings page.

Related Categories

Analyst Comments

Upgrades

Stocks Mentioned

FRPT 4.59

+0.36 +8.51%

Volume: 1,392,964

Track FRPT

Es haben sich ja frühzeitig wieder Instis platziert.

http://www.j3sg.com/Reports/Stock-Insider/generate-Instituti…

Ich möchte zu gern wissen, wer sich vom 01.04 - bis heute eingekauft hat.

Ich glaube das wird auch eine ganze Menge sein.

FRPT wird in den nächsten Monaten ein Gewinner sein, da braucht man nur die Aufträge und die daraus resultierenden Umsätze sich anzusehen. Wenn das BoD so weiterarbeitet, werden auch die Margen sehr gut sein und wir wieder 8 - 10 Dollar sehen.

Ich habe nachgekauft.

http://www.j3sg.com/Reports/Stock-Insider/generate-Instituti…

Ich möchte zu gern wissen, wer sich vom 01.04 - bis heute eingekauft hat.

Ich glaube das wird auch eine ganze Menge sein.

FRPT wird in den nächsten Monaten ein Gewinner sein, da braucht man nur die Aufträge und die daraus resultierenden Umsätze sich anzusehen. Wenn das BoD so weiterarbeitet, werden auch die Margen sehr gut sein und wir wieder 8 - 10 Dollar sehen.

Ich habe nachgekauft.

Antwort auf Beitrag Nr.: 39.569.738 von coolrunning am 22.05.10 14:49:54Bitte weiter so mit den News.

Versüßt mir meinen Urlaub in Ägypten und Force soll so heiß gehandelt werden wie es hier ist - Schwitz

Versüßt mir meinen Urlaub in Ägypten und Force soll so heiß gehandelt werden wie es hier ist - Schwitz

-7%???????????????????ß

Das ist Börse - Lug und Betrug.

Wer jedoch gut informiert ist, weiß wann er nachkaufen oder sonstwie handeln muss.

Aus motley fool:

Now, 100% accuracy is obviously an anomaly. No one gets it all right, all the time. Eventually, I'm certain Benchmark will make a blunder, or even two or three. But not with Force Protection. Fools, Benchmark's right on the money with this one.

Buy the numbers

Why do I say that? After all, at first glance, Force Protection doesn't look like a screaming bargain. Hobbled by a truly miserable fiscal first quarter, trailing earnings at the company have sunk to just $23 million, while free cash flow has slowed to a trickle, just $14 million. This leaves the stock trading at 23 times free cash flow, and 14 times earnings. Extremely un-remarkable numbers.

But you don't have to dig very deep to uncover the hidden value in this company. With nearly half its market cap in cash, Benchmark points out that Force sells for a mere "3.4x FY10 EV/EBITDA, below the sector average of 9x." Benchmark suggests that despite Force's troubled history of winning (i.e. its remarkable skill at losing) major defense contracts, the stock could easily be worth six times EBITDA.

Granted, this seems somewhat an exercise in guesswork. Valuations in the defense space run all over the map -- from Oshkosh, which at an enterprise value/EBITDA of 3.3 mirrors Force's own undervaluation; to Force's historical partner General Dynamics (NYSE: GD), which sells for 6.4 times EBITDA; to Navistar (NYSE: NAV) and Textron (NYSE: TXT) at the other end of the scale, sporting EV/EBITDAs in the low-to-mid-double digits. With such a wide range of price tags in the defense sector, saying that the "sector average is 9x" may be accurate, but it's not particularly helpful.

Foolish takeaway

Instead of comparing Force to the industry average, I'd urge investors to focus on just two numbers specific to Force:

•Fully 50% of the company's market cap is made up of cash. With more cash pouring in the door every day, and Benchmark suggesting that the rate of cash influx will actually increase this year, the valuation proposition here seems obvious.

•The handful of analysts who follow the company, on average, predict profits at Force will grow at an astounding 43% per year over the next five years, fast enough to make even a 23 price-to-free cash flow ratio look cheap.

http://www.fool.com/investing/general/2010/05/24/this-just-i…

Ich habe gestern nachgelegt und weiß, das FRPT i.d. nächsten Monaten guten Gewinn erzielen wird, volle Auftragsbücher hat und eine hohe Cashrate.

Fazit: Nicht vom derzeitigen Kurs beeinflussen lassen, sondern die Fakten erkennen.

Wer jedoch gut informiert ist, weiß wann er nachkaufen oder sonstwie handeln muss.

Aus motley fool:

Now, 100% accuracy is obviously an anomaly. No one gets it all right, all the time. Eventually, I'm certain Benchmark will make a blunder, or even two or three. But not with Force Protection. Fools, Benchmark's right on the money with this one.

Buy the numbers

Why do I say that? After all, at first glance, Force Protection doesn't look like a screaming bargain. Hobbled by a truly miserable fiscal first quarter, trailing earnings at the company have sunk to just $23 million, while free cash flow has slowed to a trickle, just $14 million. This leaves the stock trading at 23 times free cash flow, and 14 times earnings. Extremely un-remarkable numbers.

But you don't have to dig very deep to uncover the hidden value in this company. With nearly half its market cap in cash, Benchmark points out that Force sells for a mere "3.4x FY10 EV/EBITDA, below the sector average of 9x." Benchmark suggests that despite Force's troubled history of winning (i.e. its remarkable skill at losing) major defense contracts, the stock could easily be worth six times EBITDA.

Granted, this seems somewhat an exercise in guesswork. Valuations in the defense space run all over the map -- from Oshkosh, which at an enterprise value/EBITDA of 3.3 mirrors Force's own undervaluation; to Force's historical partner General Dynamics (NYSE: GD), which sells for 6.4 times EBITDA; to Navistar (NYSE: NAV) and Textron (NYSE: TXT) at the other end of the scale, sporting EV/EBITDAs in the low-to-mid-double digits. With such a wide range of price tags in the defense sector, saying that the "sector average is 9x" may be accurate, but it's not particularly helpful.

Foolish takeaway

Instead of comparing Force to the industry average, I'd urge investors to focus on just two numbers specific to Force:

•Fully 50% of the company's market cap is made up of cash. With more cash pouring in the door every day, and Benchmark suggesting that the rate of cash influx will actually increase this year, the valuation proposition here seems obvious.

•The handful of analysts who follow the company, on average, predict profits at Force will grow at an astounding 43% per year over the next five years, fast enough to make even a 23 price-to-free cash flow ratio look cheap.

http://www.fool.com/investing/general/2010/05/24/this-just-i…

Ich habe gestern nachgelegt und weiß, das FRPT i.d. nächsten Monaten guten Gewinn erzielen wird, volle Auftragsbücher hat und eine hohe Cashrate.

Fazit: Nicht vom derzeitigen Kurs beeinflussen lassen, sondern die Fakten erkennen.

Team Ocelot receives Invitation to Tender for light protected patrol vehicle

Ocelot shows off its unique modular design.

11:48 GMT, May 25, 2010 Force Protection Europe has been invited by the UK MoD to tender for the Light Protected Patrol Vehicle Programme – Demonstration, Production and Support Phases.

The Invitation to Tender (ITT) follows a recently awarded contract placed with Force Protection Europe by the UK MoD for the supply of two Ocelot light protected patrol vehicles.

An all-new concept, Ocelot has been developed by Force Protection Europe and Ricardo to provide levels of survivability comparable with the Cougar family of Mine Resistant Ambush Protected (MRAP) vehicles, together with exceptional cross country mobility, flexibility and value for money.

Ocelot’s capabilities have been proven by a sustained programme of blast, ballistic, automotive and manoeuvrability tests conducted since the summer of 2009. The vehicle successfully completed another series of tests last week.

Ocelot can be maintained and repaired quickly out in the field to ensure maximum availability, while its unique modular design enables the vehicle to be reconfigured in theatre within two hours to meet a variety of different roles, such as patrol, fire support and protected logistics.

Force Protection Europe Managing Director, David Hind, said, “We firmly believe that Ocelot has defined the future for light protected patrol vehicles and are delighted to have received this invitation to tender from the MoD.”

Force Protection, Inc.

Company or Organisation Portrait:

Force Protection Europe Ltd (FPE) is a wholly owned subsidiary of Force Protection Industries, Inc. (FPII) - the world's leading provider of survivability solutions. FPII’s Cougar MPRAP vehicles (in service with the British Army as Mastiff, Ridgback and Wolfhound) are acknowledged globally as providing the highest levels of blast protection. FPE has been established to create a UK leader in the provision and sustainment of survivability solutions based on tactical wheeled vehicles.

With technical centres and offices in the UK, USA, Germany, the Czech Republic, France, Italy, Russia, China, Japan, India and Korea, Ricardo plc is a leading independent technology provider and strategic consultant to the world's transportation sector and clean energy industries. The company's engineering expertise ranges from vehicle systems integration, controls, electronics and software development, to the latest driveline and transmission systems and gasoline, diesel, hybrid and fuel cell powertrain technologies, as well as wind energy and tidal power systems. Ricardo is committed to excellence and industry leadership in people, technology and knowledge; approximately 70 percent of its employees are highly qualified multi-disciplined professional engineers and technicians. A public company, Ricardo plc posted sales of £178.8 million in financial year 2009 and is a constituent of the FTSE techMark 100 index - a group of innovative technology companies listed on the London Stock Exchange.

Company or Organisation Contact:

Force Protection Europe Ltd:

Victoria Bailey / Nick Johnstone

CMS Strategic

+44 (0)208 748 9797

info@cmsstrategic.com

Ricardo UK Ltd:

Anthony Smith

Ricardo Media Office

+44 (0)1273 382710

media@ricardo.com

Ocelot shows off its unique modular design.

11:48 GMT, May 25, 2010 Force Protection Europe has been invited by the UK MoD to tender for the Light Protected Patrol Vehicle Programme – Demonstration, Production and Support Phases.

The Invitation to Tender (ITT) follows a recently awarded contract placed with Force Protection Europe by the UK MoD for the supply of two Ocelot light protected patrol vehicles.

An all-new concept, Ocelot has been developed by Force Protection Europe and Ricardo to provide levels of survivability comparable with the Cougar family of Mine Resistant Ambush Protected (MRAP) vehicles, together with exceptional cross country mobility, flexibility and value for money.

Ocelot’s capabilities have been proven by a sustained programme of blast, ballistic, automotive and manoeuvrability tests conducted since the summer of 2009. The vehicle successfully completed another series of tests last week.

Ocelot can be maintained and repaired quickly out in the field to ensure maximum availability, while its unique modular design enables the vehicle to be reconfigured in theatre within two hours to meet a variety of different roles, such as patrol, fire support and protected logistics.

Force Protection Europe Managing Director, David Hind, said, “We firmly believe that Ocelot has defined the future for light protected patrol vehicles and are delighted to have received this invitation to tender from the MoD.”

Force Protection, Inc.

Company or Organisation Portrait:

Force Protection Europe Ltd (FPE) is a wholly owned subsidiary of Force Protection Industries, Inc. (FPII) - the world's leading provider of survivability solutions. FPII’s Cougar MPRAP vehicles (in service with the British Army as Mastiff, Ridgback and Wolfhound) are acknowledged globally as providing the highest levels of blast protection. FPE has been established to create a UK leader in the provision and sustainment of survivability solutions based on tactical wheeled vehicles.

With technical centres and offices in the UK, USA, Germany, the Czech Republic, France, Italy, Russia, China, Japan, India and Korea, Ricardo plc is a leading independent technology provider and strategic consultant to the world's transportation sector and clean energy industries. The company's engineering expertise ranges from vehicle systems integration, controls, electronics and software development, to the latest driveline and transmission systems and gasoline, diesel, hybrid and fuel cell powertrain technologies, as well as wind energy and tidal power systems. Ricardo is committed to excellence and industry leadership in people, technology and knowledge; approximately 70 percent of its employees are highly qualified multi-disciplined professional engineers and technicians. A public company, Ricardo plc posted sales of £178.8 million in financial year 2009 and is a constituent of the FTSE techMark 100 index - a group of innovative technology companies listed on the London Stock Exchange.

Company or Organisation Contact:

Force Protection Europe Ltd:

Victoria Bailey / Nick Johnstone

CMS Strategic

+44 (0)208 748 9797

info@cmsstrategic.com

Ricardo UK Ltd:

Anthony Smith

Ricardo Media Office

+44 (0)1273 382710

media@ricardo.com

195000 shares hat da jemand verkauft....

Sowas macht mir immer irgendwie Sorgen, denn oftmals sind es gut unterrichtete Kreise, bei diesen Größenordnungen...

Sowas macht mir immer irgendwie Sorgen, denn oftmals sind es gut unterrichtete Kreise, bei diesen Größenordnungen...

Antwort auf Beitrag Nr.: 39.576.771 von coolrunning am 25.05.10 08:51:19@coolrunning: wenn du hier im Gewinn bist, macht das Sinn. aber sobald deine Position im Verlust ist, passiert beim Halten genau dasselbe, was einmal Winston Chuchill sagte: in the long run, we are all dead.

Antwort auf Beitrag Nr.: 39.587.589 von coolrunning am 26.05.10 18:55:02Wieso verkauft. Ein Verkauf ist auch immer ein Kauf. Kommt darauf an wie man es betrachtet.

Press Release Source: Force Protection, Inc. On Wednesday May 26, 2010, 2:18 pm EDT

LADSON, S.C.--(BUSINESS WIRE)--Force Protection, Inc. (NASDAQ: FRPT - News), a leading designer, developer and manufacturer of survivability solutions and provider of total life cycle support for those products, today announced that its Ocelot light protected patrol vehicle has been down-selected by the Australian Government to compete in the Land 121 Phase 4 Project for the Protected Mobility Vehicle – Light (PMV-L) prototype. Ocelot was offered for the Land 121 competition through Force Protection’s subsidiary, Force Protection Europe, LTD.

In a press release issued earlier today in Australia, The Hon. Greg Combet, Minister for Defence Materiel and Science in the Australian Government, said, "Three Australian based companies will be awarded up to (AUD) $9 million each for the development of protected mobility vehicle prototypes, putting them in the running to land a manufacturing contract for up to 1300 vehicles."

The news from Australia comes on the heels of a decision by the United Kingdom Ministry of Defence (UK MoD) to issue Force Protection Europe with an Invitation to Tender (ITT) for the Light Protected Patrol Vehicle Programme – Demonstration, Production and Support phases. The issuing of the ITT follows a contract placed with Force Protection Europe by UK MoD for the supply of two Ocelot vehicles.

Commenting on these latest developments, David Hind, Managing Director at Force Protection Europe, said, "We are delighted at the way Ocelot is being received around the world and expect that our display of the Ocelot at the Eurosatory exhibition in Paris next month will generate still further interest in this important new vehicle."

About Force Protection, Inc.

Force Protection, Inc. is a leading designer, developer and manufacturer of survivability solutions, including blast- and ballistic-protected wheeled vehicles currently deployed by the U.S. military and its allies to support armed forces and security personnel in conflict zones. The Company’s specialty vehicles, including the Buffalo, Cougar and related variants, are designed specifically for reconnaissance and urban operations and to protect their occupants from landmines, hostile fire, and improvised explosive devices (IEDs, commonly referred to as roadside bombs). The Company also develops, manufactures, tests, delivers and supports products and services aimed at further enhancing the survivability of users against additional threats. In addition, the Company provides long-term life cycle support services of its vehicles that involve development of technical data packages, supply of spares, field and depot maintenance activities, assignment of highly-skilled field service representatives, and advanced on and off-road driver and maintenance training programs. For more information on Force Protection and its products and services, visit http://cts.businesswire.com/ct/CT?id=smartlink&url=http%3A%2…

Safe Harbor Statement

This press release contains forward looking statements that are not historical facts, including statements about our beliefs and expectations. These statements are based on beliefs and assumptions of Force Protection’s management, and on information currently available to management. These forward looking statements include, among other things: the growth, demand and interest and demand for Force Protection’s vehicles, including the Ocelot vehicle; expectations for future contracts for the Ocelot the benefits and suitability of the Ocelot; the rate at which the Company will be able to produce these vehicles; the ability to meet current and future requirements the Company’s execution of its business strategy and strategic transformation, including its opportunities to grow the business; and the Company’s expected financial and operating results, including its revenues, cash flow and gross margins, for future periods. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update any of them publicly in light of new information or future events. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Examples of these factors include, but are not limited to, ability to effectively manage the risks in the Company’s business; the ability to develop new technologies and products and the acceptance of these technologies and products; the other risk factors and cautionary statements listed in the Company’s periodic reports filed with the Securities and Exchange Commission, including the risks set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009 and as updated in the Quarterly Report on Form 10Q for the quarter ended March 31, 2010.

LADSON, S.C.--(BUSINESS WIRE)--Force Protection, Inc. (NASDAQ: FRPT - News), a leading designer, developer and manufacturer of survivability solutions and provider of total life cycle support for those products, today announced that its Ocelot light protected patrol vehicle has been down-selected by the Australian Government to compete in the Land 121 Phase 4 Project for the Protected Mobility Vehicle – Light (PMV-L) prototype. Ocelot was offered for the Land 121 competition through Force Protection’s subsidiary, Force Protection Europe, LTD.

In a press release issued earlier today in Australia, The Hon. Greg Combet, Minister for Defence Materiel and Science in the Australian Government, said, "Three Australian based companies will be awarded up to (AUD) $9 million each for the development of protected mobility vehicle prototypes, putting them in the running to land a manufacturing contract for up to 1300 vehicles."

The news from Australia comes on the heels of a decision by the United Kingdom Ministry of Defence (UK MoD) to issue Force Protection Europe with an Invitation to Tender (ITT) for the Light Protected Patrol Vehicle Programme – Demonstration, Production and Support phases. The issuing of the ITT follows a contract placed with Force Protection Europe by UK MoD for the supply of two Ocelot vehicles.

Commenting on these latest developments, David Hind, Managing Director at Force Protection Europe, said, "We are delighted at the way Ocelot is being received around the world and expect that our display of the Ocelot at the Eurosatory exhibition in Paris next month will generate still further interest in this important new vehicle."

About Force Protection, Inc.

Force Protection, Inc. is a leading designer, developer and manufacturer of survivability solutions, including blast- and ballistic-protected wheeled vehicles currently deployed by the U.S. military and its allies to support armed forces and security personnel in conflict zones. The Company’s specialty vehicles, including the Buffalo, Cougar and related variants, are designed specifically for reconnaissance and urban operations and to protect their occupants from landmines, hostile fire, and improvised explosive devices (IEDs, commonly referred to as roadside bombs). The Company also develops, manufactures, tests, delivers and supports products and services aimed at further enhancing the survivability of users against additional threats. In addition, the Company provides long-term life cycle support services of its vehicles that involve development of technical data packages, supply of spares, field and depot maintenance activities, assignment of highly-skilled field service representatives, and advanced on and off-road driver and maintenance training programs. For more information on Force Protection and its products and services, visit http://cts.businesswire.com/ct/CT?id=smartlink&url=http%3A%2…

Safe Harbor Statement

This press release contains forward looking statements that are not historical facts, including statements about our beliefs and expectations. These statements are based on beliefs and assumptions of Force Protection’s management, and on information currently available to management. These forward looking statements include, among other things: the growth, demand and interest and demand for Force Protection’s vehicles, including the Ocelot vehicle; expectations for future contracts for the Ocelot the benefits and suitability of the Ocelot; the rate at which the Company will be able to produce these vehicles; the ability to meet current and future requirements the Company’s execution of its business strategy and strategic transformation, including its opportunities to grow the business; and the Company’s expected financial and operating results, including its revenues, cash flow and gross margins, for future periods. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update any of them publicly in light of new information or future events. A number of important factors could cause actual results to differ materially from those contained in any forward-looking statements. Examples of these factors include, but are not limited to, ability to effectively manage the risks in the Company’s business; the ability to develop new technologies and products and the acceptance of these technologies and products; the other risk factors and cautionary statements listed in the Company’s periodic reports filed with the Securities and Exchange Commission, including the risks set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009 and as updated in the Quarterly Report on Form 10Q for the quarter ended March 31, 2010.

Merriman Curhan Maintains Positive Views on Force Protection (FRPT)

May 27, 2010 8:52 AM EDT

Merriman Curhan Ford reiterates a 'Buy' rating and valuation range of $7.00-$8.00 on Force Protection (Nasdaq: FRPT) after it was selected to provide two prototypes for test drive for the Australian Minister of Defense.

A Merriman Curhan Ford analyst states, "With high operational tempo in Afghanistan, and a large and growing backlog of modernization projects, we think there is good visibility for the rest of the year and upside. In addition, we have not built in potential international vehicle production wins, which could also drive estimates higher."

To see all the upgrades/downgrades on shares of FRPT, visit our Analyst Ratings page.

Force Protection, Inc., together with its subsidiaries, engages in the design, manufacture, testing, delivery, and support of blast and ballistic protected vehicles.

May 27, 2010 8:52 AM EDT

Merriman Curhan Ford reiterates a 'Buy' rating and valuation range of $7.00-$8.00 on Force Protection (Nasdaq: FRPT) after it was selected to provide two prototypes for test drive for the Australian Minister of Defense.

A Merriman Curhan Ford analyst states, "With high operational tempo in Afghanistan, and a large and growing backlog of modernization projects, we think there is good visibility for the rest of the year and upside. In addition, we have not built in potential international vehicle production wins, which could also drive estimates higher."

To see all the upgrades/downgrades on shares of FRPT, visit our Analyst Ratings page.

Force Protection, Inc., together with its subsidiaries, engages in the design, manufacture, testing, delivery, and support of blast and ballistic protected vehicles.

27.05.2010 16:13

Force Protection Provides Additional Information Concerning Its Participation in the Land 121 Competition

Force Protection, Inc. (NASDAQ: FRPT), a leading survivability solutions provider, today provided additional information related to the Australian Government's Land 121 Phase 4 Project for the Protected Mobility Vehicle - Light (PMV-L) prototype ("Land 121").

Yesterday the Company announced that its Ocelot light protected patrol vehicle has been down-selected by the Australian Government to compete in the Land 121 competition. Ocelot was offered for the competition through Force Protection's subsidiary, Force Protection Europe, LTD.

There are six entities remaining in the Land 121 competition, including Force Protection Europe, LTD. Three of the entities are from the current US Joint Light Tactical Vehicle program, which is also working on the development of protected mobility vehicle prototypes.

The Australian Government has announced the Land 121 competition could lead to a manufacturing contract for up to 1,300 vehicles. Force Protection currently expects a final decision from the Australian Government will come no earlier than 2011.

Force Protection Provides Additional Information Concerning Its Participation in the Land 121 Competition

Force Protection, Inc. (NASDAQ: FRPT), a leading survivability solutions provider, today provided additional information related to the Australian Government's Land 121 Phase 4 Project for the Protected Mobility Vehicle - Light (PMV-L) prototype ("Land 121").

Yesterday the Company announced that its Ocelot light protected patrol vehicle has been down-selected by the Australian Government to compete in the Land 121 competition. Ocelot was offered for the competition through Force Protection's subsidiary, Force Protection Europe, LTD.

There are six entities remaining in the Land 121 competition, including Force Protection Europe, LTD. Three of the entities are from the current US Joint Light Tactical Vehicle program, which is also working on the development of protected mobility vehicle prototypes.

The Australian Government has announced the Land 121 competition could lead to a manufacturing contract for up to 1,300 vehicles. Force Protection currently expects a final decision from the Australian Government will come no earlier than 2011.

On Thursday May 27, 2010, 4:55 pm

LADSON, S.C. (AP) -- Force Protection Inc. said Thursday its Ocelot light protected patrol vehicle has been selected by the Australian government to compete for a manufacturing contract for up to 1,300 vehicles.

Force Protection subsidiary Force Protection Europe LTD and five other manufacturers are vying for the contract.

The company expects a final decision from the Australian Government will come no earlier than next year.

Force Protection shares added 6 cents to close at $4.30

LADSON, S.C. (AP) -- Force Protection Inc. said Thursday its Ocelot light protected patrol vehicle has been selected by the Australian government to compete for a manufacturing contract for up to 1,300 vehicles.

Force Protection subsidiary Force Protection Europe LTD and five other manufacturers are vying for the contract.

The company expects a final decision from the Australian Government will come no earlier than next year.

Force Protection shares added 6 cents to close at $4.30

Force Protection Industries, Inc., Ladson, S.C., is being awarded a $46,102,093 firm-fixed-priced modification under contract (M67854-07-D-5031) delivery order #0018 for the purchase of 2,451 automatic fire extinguisher system kits to be installed on the Cougar Mine Resistant Ambush Protected vehicles. Work will be performed Sterling Heights, Mich., and is expected to be completed February 2011. Contract funds in the amount of $46,102,093 will expire at the end of the current fiscal year. This contract was not competitively procured. The Marine Corps Systems Command, Quantico, Va., is the contracting activity.

Ocelot Aims for World Markets at Eurosatory

http://www.forceprotection.net/news/news.html?id=349

Following a contract from the UK MOD for the supply of two vehicles for test purposes, Ocelot, the advanced new light protected patrol vehicle, will be the focus of the Force Protection display at Eurosatory (Stand K441).

An all-new concept, Ocelot has been developed by Force Protection Europe Ltd and Ricardo plc to provide levels of survivability comparable with the Cougar family of vehicles, together with exceptional cross country mobility, flexibility and value for money. Accordingly, Ocelot is equally effective in a range of diverse environments, including mountains, deserts and urban areas.

Ocelot can be maintained and repaired quickly out in the field to ensure maximum availability, while its unique modular design enables the vehicle to be reconfigured in theatre within two hours to meet a variety of different roles, such as patrol, fire support and protected logistics.

Ocelot’s capabilities have been proven by a sustained programme of blast, ballistic, automotive and manoeuvrability tests conducted since the summer of 2009. The vehicle is supported by a strong supply chain that includes QinetiQ, Sula Systems and Thales.

Force Protection Europe Ltd’s Managing Director, David Hind, said: ‘Ever since we launched Ocelot at last year’s DSEi (Defence Systems & Equipment International) the vehicle has been attracting serious interest from around the world resulting in being down-selected for two key programmes, including Australia’s Land 121 Phase 4 project. We firmly believe that Ocelot has defined the future for light protected patrol vehicles.’

Graeme Rumbol, Ricardo plc global vehicle product group director added: ‘Ocelot has proven itself though the extensive programme of development testing carried out since the first prototype was unveiled less than a year ago. It is a uniquely adaptable and innovative defence vehicle platform with unparalleled potential across a range of roles. We are extremely pleased to be working with Force Protection Europe to develop further opportunities for this truly class-leading vehicle on a global basis.’

Eurosatory 2010 takes place at Parc des Expositions, Paris, from June 14 – 18.

http://www.forceprotection.net/news/news.html?id=349

Following a contract from the UK MOD for the supply of two vehicles for test purposes, Ocelot, the advanced new light protected patrol vehicle, will be the focus of the Force Protection display at Eurosatory (Stand K441).

An all-new concept, Ocelot has been developed by Force Protection Europe Ltd and Ricardo plc to provide levels of survivability comparable with the Cougar family of vehicles, together with exceptional cross country mobility, flexibility and value for money. Accordingly, Ocelot is equally effective in a range of diverse environments, including mountains, deserts and urban areas.

Ocelot can be maintained and repaired quickly out in the field to ensure maximum availability, while its unique modular design enables the vehicle to be reconfigured in theatre within two hours to meet a variety of different roles, such as patrol, fire support and protected logistics.

Ocelot’s capabilities have been proven by a sustained programme of blast, ballistic, automotive and manoeuvrability tests conducted since the summer of 2009. The vehicle is supported by a strong supply chain that includes QinetiQ, Sula Systems and Thales.

Force Protection Europe Ltd’s Managing Director, David Hind, said: ‘Ever since we launched Ocelot at last year’s DSEi (Defence Systems & Equipment International) the vehicle has been attracting serious interest from around the world resulting in being down-selected for two key programmes, including Australia’s Land 121 Phase 4 project. We firmly believe that Ocelot has defined the future for light protected patrol vehicles.’

Graeme Rumbol, Ricardo plc global vehicle product group director added: ‘Ocelot has proven itself though the extensive programme of development testing carried out since the first prototype was unveiled less than a year ago. It is a uniquely adaptable and innovative defence vehicle platform with unparalleled potential across a range of roles. We are extremely pleased to be working with Force Protection Europe to develop further opportunities for this truly class-leading vehicle on a global basis.’

Eurosatory 2010 takes place at Parc des Expositions, Paris, from June 14 – 18.

Force Protection Industries, Inc., Ladson, S.C., is being awarded a $10,813,611 firm- fixed-priced modification under previously awarded contract (M67854-07-D-5031) delivery order #0018, to purchase 2,654 570 amp alternator modernization kits. These kits will be installed on the Cougar Mine Resistant Ambush Protected vehicle fleet supporting Operation Enduring Freedom and Operation Iraqi Freedom. Work will be performed in Ladson, S.C., and is expected to be completed by March 31, 2011. Contract funds in the amount of $1,937,510 will expire at the end of the current fiscal year. Marine Corps Systems Command, Quantico, Va., is the contracting activity.

http://www.defense.gov/contracts/contract.aspx?contractid=43…

http://www.defense.gov/contracts/contract.aspx?contractid=43…

13 new Mastiffs for UK?

http://www.independent.co.uk/news/world/asia/cameron-offers-…

Cameron offers cash – but not troops – to help fight the Taliban

By Kim Sengupta, Defence Correspondent

Friday, 11 June 2010

David Cameron offered extra funds to combat roadside bombs taking a relentless toll on British lives during his first visit to Afghanistan as Prime Minister yesterday, but ruled out sending any extra troops to help turn the tide of the war against the Taliban.

Mr Cameron's declaration that sending reinforcements was "not remotely" on the agenda and that the question should be "Can we go further, can we go faster?" on the date of withdrawing troops showed a desire to disengage from the conflict as soon as possible. In the meantime, however, he stated that a further £67m will be spent on countering IEDs (improvised explosive devices) on top of £150m pledged by Gordon Brown during his own visit to Afghanistan last year when he was still prime minister.

The issue of IEDs has been given added sensitivity following the resignation of Colonel Bob Seddon, the head of the Army's bomb disposal squads, last month, over concerns about the pressure being faced by his men in tackling what has become the insurgents' weapon of choice.

Related articles

The new funds will be spent on doubling the number of counter-IED teams to 20, up to 13 new Mastiff armoured vehicles and Dragon Runner robots used to track the bombs. In addition, £200m will be diverted from the existing international development budget for reconstruction work in Helmand. Other measures included an "information sharing" initiative under which the Foreign Secretary, William Hague, and the Defence Secretary, Liam Fox, will make quarterly "situation reports" to the Commons.

Mr Cameron arrived in Afghanistan the morning after a suicide bomber killed 40 people and injured 70 others at a wedding ceremony near Kandahar. He also came at a particularly bloody period in the conflict during which 29 Nato soldiers, including Britons, had died in a month.

Part of his Afghan tour was re-routed after the military intercepted calls suggesting insurgents planned to shoot down his helicopter, an aide said.

Mr Cameron had visited an agricultural college in Helmand and was scheduled to continue to the Shahzad military patrol base, but that excursion was called off by the Brigadier Richard Felton, the British commander. Still airborne, the Prime Minister's Chinook was diverted to the provincial capital of Lashkar Gah, where Mr Cameron had a barbecue with troops.

At a press conference in Kabul with the Afghan President Hamid Karzai, Mr Cameron was careful to highlight what he claimed to see as signs of progress after Dr Fox had described the country as a "broken 13th-century state". The Prime Minister stressed that Afghanistan was the "most important foreign policy issue, the most important national security issue facing our country, and it is that national security approach I want to stress here today".

But he also stressed that the focus should be on ending the deployment of the British force saying: "We should all the time be asking: can we go further, can we go faster? Nobody wants British troops to be in Afghanistan a moment longer than is necessary. The President doesn't, the Afghan people don't, the British people don't."

Mr Cameron stated there should be a political solution to the conflict, saying he welcomed last week's public meeting in Kabul at which Mr Karzai discussed proposals to encourage elements of the Taliban to rejoin the political mainstream. However, the overtures to the insurgents by the Afghan President, and the freeing of prisoners had alarmed a number of senior officials and human rights groups.

Mr Karzai's appeasement policy was said to be one of the main factors which drove Amrullah Saleh, the head of the intelligence service, the National Directorate of Security, and Hanif Atmar, the Interior Minister, to resign from the government. The departure of the two men, seen as honest and effective, is seen as a major blow by the West. The US Defence Secretary Robert Gates said during a visit to London that he "only hoped" that Mr Karzai would "replace them with equally able people". Mr Gates also warned that the public in the West would want to see discernible signs of progress by the end of year.

Eurosatory 2010: LPPV bids formalised

June 14, 2010

Supacat and Force Protection will submit their formal bids for the UK Ministry of Defence’s Light Protected Patrol Vehicle (LPPV) programme on Tuesday 15 June, according to company officials.

Speaking to Land Warfare International at Eurosatory in Paris on 14 June, both companies said a decision on a preferred partner could be made within six weeks as the MoD looks to roll out the vehicles to replace in-service and minimally protected Land Rover Snatch and Snatch Vixen vehicles as quickly as possible.

The MoD has released funding for an initial batch of around 200 vehicles under an Urgent Operational Requirement (UOR) with an in-service date in early 2011. However, with a total LPPV requirement comprising some 400 vehicles, industry sources stressed that procurement of the new fleet would be ‘completely unaffected’ by the government’s Strategic Defence Review (SDR), which is understood to have already begun.

‘Afghanistan is fundamental to what we do today and we cannot stop supporting what that operation is achieving,’ one source told LWI.

Supacat and NP Aerospace officially unveiled their SPV 400 participant for the LPPV programme on 13 April, followed shortly after by an offering from Team Ocelot- Force Protection’s joint venture with Ricardo.

The 4 x 4 Supacat Protected Vehicle 400 or SPV400, which includes a V-shaped hull, comprises a gross vehicle weight of 7.5 tonnes and is capable of carrying a 1.5 tonnes payload.

The Ocelot is a 7.5-tonne vehicle comprising a 1.5-tonne payload with a modular protected pod solution available in variants including load bearing; fire support; flat-bed; troop carrier; ambulance; and open-top vehicles.

http://www.shephard.co.uk/news/landwarfareintl/eurosatory-20…

June 14, 2010

Supacat and Force Protection will submit their formal bids for the UK Ministry of Defence’s Light Protected Patrol Vehicle (LPPV) programme on Tuesday 15 June, according to company officials.

Speaking to Land Warfare International at Eurosatory in Paris on 14 June, both companies said a decision on a preferred partner could be made within six weeks as the MoD looks to roll out the vehicles to replace in-service and minimally protected Land Rover Snatch and Snatch Vixen vehicles as quickly as possible.

The MoD has released funding for an initial batch of around 200 vehicles under an Urgent Operational Requirement (UOR) with an in-service date in early 2011. However, with a total LPPV requirement comprising some 400 vehicles, industry sources stressed that procurement of the new fleet would be ‘completely unaffected’ by the government’s Strategic Defence Review (SDR), which is understood to have already begun.

‘Afghanistan is fundamental to what we do today and we cannot stop supporting what that operation is achieving,’ one source told LWI.

Supacat and NP Aerospace officially unveiled their SPV 400 participant for the LPPV programme on 13 April, followed shortly after by an offering from Team Ocelot- Force Protection’s joint venture with Ricardo.

The 4 x 4 Supacat Protected Vehicle 400 or SPV400, which includes a V-shaped hull, comprises a gross vehicle weight of 7.5 tonnes and is capable of carrying a 1.5 tonnes payload.

The Ocelot is a 7.5-tonne vehicle comprising a 1.5-tonne payload with a modular protected pod solution available in variants including load bearing; fire support; flat-bed; troop carrier; ambulance; and open-top vehicles.

http://www.shephard.co.uk/news/landwarfareintl/eurosatory-20…

Ein Schelm wer Böses denkt. Kommt da was Bombastisches.

Pre-Market Charts | After Hours Charts Jun. 17, 2010 Market Close: $ 4.25 After Hours

Last: $ 4.25 After Hours

High: $ 4.2503

After Hours

Volume: 442,697 After Hours

Low: $ 4.22

Learn more about the After-Hours trading session. Trade Detail

After Hours

Time (ET) After Hours

Price After Hours

Share Volume

16:12 $ 4.25 500

16:12 $ 4.25 500

16:12 $ 4.25 4,000

16:12 $ 4.25 32,200

16:11 $ 4.2503 4,700

16:11 $ 4.25 3,500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 99,500

16:11 $ 4.25 94,500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 4,500

16:11 $ 4.25 99,000

16:11 $ 4.25 94,500

16:02 $ 4.25 597

16:00 $ 4.22 100

16:00 $ 4.22 100

Pre-Market Charts | After Hours Charts Jun. 17, 2010 Market Close: $ 4.25 After Hours

Last: $ 4.25 After Hours

High: $ 4.2503

After Hours

Volume: 442,697 After Hours

Low: $ 4.22

Learn more about the After-Hours trading session. Trade Detail

After Hours

Time (ET) After Hours

Price After Hours

Share Volume

16:12 $ 4.25 500

16:12 $ 4.25 500

16:12 $ 4.25 4,000

16:12 $ 4.25 32,200

16:11 $ 4.2503 4,700

16:11 $ 4.25 3,500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 99,500

16:11 $ 4.25 94,500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 500

16:11 $ 4.25 4,500

16:11 $ 4.25 99,000

16:11 $ 4.25 94,500

16:02 $ 4.25 597

16:00 $ 4.22 100

16:00 $ 4.22 100

Antwort auf Beitrag Nr.: 39.704.111 von kyron7htx am 18.06.10 12:06:05da covert wohl noch jemand schnell seine shorts

Force Protection Industries, Inc., Ladson, S.C., is being awarded a $15,431,971 firm-fixed-price modification under previously awarded contract (M67854-07-D-5031) delivery order #0015 for the purchase of 43 field service representatives to install spall-liner blanket kits and modernization safety kits, and conduct general maintenance to the Cougar Mine Resistant Ambush Protected vehicle fleet supporting Operation Enduring Freedom and Operation Iraqi Freedom. Work will be performed in Afghanistan and Iraq, and is expected to be completed by June 30, 2011. Contract funds in the amount of $15,431,971 will expire at the end of the current fiscal year. Marine Corps Systems Command, Quantico, Va., is the contracting activity.

http://www.defense.gov/contracts/contract.aspx?contractid=43…

http://www.defense.gov/contracts/contract.aspx?contractid=43…

U.K. To Add 28 Wolfhounds for Afghan Operations

By ANDREW CHUTER

Published: 22 Jun 2010 12:46

LONDON - British force protection capabilities in Afghanistan are being improved by a new order for additional Wolfhound armored vehicles, the Ministry of Defence has revealed.

An additional 28 Wolfhound armored support vehicles are being acquired from U.S. manufacturer Force Protection. The Wolfhound is a truck variant of the Mastiff mine-resistant vehicle. The Mastiff is the British Army version of the U.S. six-wheel-drive Cougar mine-resistant ambush protected vehicles.

The British also operate Force Protection's four-wheel-drive version of Cougar, known in the British Army as Ridgeback, and the heavyweight Buffalo machine.

The order could be among an expected raft of announcements June 23 when Peter Luff, the new minister for defense equipment, support and technology opens an MoD-organized vehicle and soldier technology event here.

The order for the Wolfhounds emerged as a result of a parliamentary answer to a question from the Labour opposition party about the number of vehicles the government had ordered since the general election in May.

Luff responded, saying the contract for the Wolfhound had been amended in early June 2010 to include an additional 28 vehicles.

About 97 Wolfhounds were originally ordered in April 2009 by the then-Labour administration as part of a 350 million pound tactical support vehicle program involving more than 400 machines of various categories.

The first of the vehicles are expected in theater this summer. The 2009 announcement by the MoD also included orders for Husky vehicles from the U.S. Navistar company and Coyote machines from local supplier Supacat.

The previous government tended to order vehicles for British forces fighting in Afghanistan in batches.

If the new Conservative led administration follows that trend its possible further orders could emerge over the next few days for Mastiff, Coyote, Husky and other types.

http://www.shephard.co.uk/news/landwarfareintl/uk-mod-announ…

...und sollten dann noch die 200 Ozelotfahrzeuge bestellt werden...

... dann geht der Kurs weiter runter, denn FRPT schreibt ja leider sehr gute Zahlen

Ich habe selten eine Firma erlebt, die so unterbewertet ist.

...und sollten dann noch die 200 Ozelotfahrzeuge bestellt werden...

... dann geht der Kurs weiter runter, denn FRPT schreibt ja leider sehr gute Zahlen

Ich habe selten eine Firma erlebt, die so unterbewertet ist.

Antwort auf Beitrag Nr.: 39.731.866 von coolrunning am 24.06.10 15:36:37Ich glaube mittlerweile, daß durch das naked short selling vor 2 Jahren, soviele Aktien im Überhang sind, daß der Kurs niemals wieder auf die Beine kommt, ausser man lässt durch eine evtl. Dividende herausfinden, wieviel Aktien tatsächlich existieren.

(Gibts eigentlich ein Kotz-Smiley?)

(Gibts eigentlich ein Kotz-Smiley?)

Force Protection Industries, Inc., Ladson, S.C., is being awarded a $19,644,010 firm-fixed-price modification under previously awarded contract (M67854-07-D-5031) delivery order #0012, for a three month extension of 216 field service representatives (FSR) to complete independent suspension system kit installation on the Cougar Mine Resistant Ambush Protected (MRAP) vehicle fleet at the MRAP sustainment facility in Kuwait and the associated life support required for the FSRs. Work will be performed in Kuwait, and is expected to be completed by Sept. 30, 2010. Contract funds in the amount of $19,644,010 will expire at the end of the current fiscal year. Marine Corps Systems Command, Quantico, Va., is the contracting activity.

http://www.defense.gov/contracts/contract.aspx?contractid=43…

http://www.defense.gov/contracts/contract.aspx?contractid=43…

Antwort auf Beitrag Nr.: 39.732.036 von HeinzBork am 24.06.10 16:04:23natürlich gibt es das,

aber warum sollte man das hier brauchen? Mit einem KGV von 12 ist hier doch nichts unterbewertet, außer in den Träumen derjenigen die immer noch auf die 40$ warten.

aber warum sollte man das hier brauchen? Mit einem KGV von 12 ist hier doch nichts unterbewertet, außer in den Träumen derjenigen die immer noch auf die 40$ warten.

USAF seeks special operations CSAR vehicle

June 24, 2010

The US Air Force Special Operations Command (USAFSOC) is expected to release a request for proposals (RfP) by the end of the year for a dedicated series of combat search and rescue (CSAR) vehicles.

Industry sources have informed Land Warfare International that a request for information (RfI) has already been released, with the RfP delayed by a few months due to various ‘reshaped’ requirements.

USAFSOC is understood to be seeking a 4x4, open-top and wheeled vehicle for ‘covert‘ missions, that is capable of being transported internally by V-22 Osprey. It is also seeking a larger variant which could be carried as an underslung load by CH-47 and CH-53 air frames. Other requirements include an all-up-weight of 7,000 pounds and maximum vehicle width of 60-inches.

Original requirements for the ‘Guardian Angel’ programme called for 90 internally transportable variants although this has been reduced to around 55 vehicles, sources said.

Speaking to LWI at the Defence Vehicles Dynamics exhibition in Millbrook, UK, Force Protection confirmed it would offer a variant of its Jamma (Joint All-Terrain Modular Mobility Asset) vehicle for the internally transportable vehicle (ITV) part of the requirement. The company also confirmed that it was in a position to offer up an open-top version of its Ocelot light protected patrol vehicle for the underslung version.

Force Protection’s chief operating officer, Randy Hutcherson, told LWI that the company was in the process of designing two prototypes which would be made available to USAFSOC this year.

‘We are improving mobility, protection and survivability to whatever extent we can do to meet customer requirements,’ he said while describing how the company was also considering command and control variants.

Other interested parties are understood to include General Dynamics and its Flyer II light strike vehicle and Raytheon’s HyDRA (Hybrid Defense Reconnaissance and Assault) system. Previously, Supacat had designed an ITV for V-22 but the company confirmed to LWI that it had yet to enter the race for the USAFSOC requirement.

Sources also told LWI that Lockheed Martin was considering a teaming agreement to bid for the contract, worth an undisclosed sum. Currently, NAVAIR (Naval Systems Air Command) has certified both Jamma and US Marine Corps Growler vehicles for internal transportation by V-22.

http://www.shephard.co.uk/news/landwarfareintl/usaf-seeks-sp…

June 24, 2010

The US Air Force Special Operations Command (USAFSOC) is expected to release a request for proposals (RfP) by the end of the year for a dedicated series of combat search and rescue (CSAR) vehicles.

Industry sources have informed Land Warfare International that a request for information (RfI) has already been released, with the RfP delayed by a few months due to various ‘reshaped’ requirements.

USAFSOC is understood to be seeking a 4x4, open-top and wheeled vehicle for ‘covert‘ missions, that is capable of being transported internally by V-22 Osprey. It is also seeking a larger variant which could be carried as an underslung load by CH-47 and CH-53 air frames. Other requirements include an all-up-weight of 7,000 pounds and maximum vehicle width of 60-inches.

Original requirements for the ‘Guardian Angel’ programme called for 90 internally transportable variants although this has been reduced to around 55 vehicles, sources said.

Speaking to LWI at the Defence Vehicles Dynamics exhibition in Millbrook, UK, Force Protection confirmed it would offer a variant of its Jamma (Joint All-Terrain Modular Mobility Asset) vehicle for the internally transportable vehicle (ITV) part of the requirement. The company also confirmed that it was in a position to offer up an open-top version of its Ocelot light protected patrol vehicle for the underslung version.

Force Protection’s chief operating officer, Randy Hutcherson, told LWI that the company was in the process of designing two prototypes which would be made available to USAFSOC this year.

‘We are improving mobility, protection and survivability to whatever extent we can do to meet customer requirements,’ he said while describing how the company was also considering command and control variants.

Other interested parties are understood to include General Dynamics and its Flyer II light strike vehicle and Raytheon’s HyDRA (Hybrid Defense Reconnaissance and Assault) system. Previously, Supacat had designed an ITV for V-22 but the company confirmed to LWI that it had yet to enter the race for the USAFSOC requirement.

Sources also told LWI that Lockheed Martin was considering a teaming agreement to bid for the contract, worth an undisclosed sum. Currently, NAVAIR (Naval Systems Air Command) has certified both Jamma and US Marine Corps Growler vehicles for internal transportation by V-22.

http://www.shephard.co.uk/news/landwarfareintl/usaf-seeks-sp…

und weiter gehts

U.K. Adds 37 Mastiffs To Army

By ANDREW CHUTER

Published: 25 Jun 2010 10:46

LONDON - British force protection capabilities will be boosted by an order for additional Mastiff mine resistant armored vehicles from U.S. builder Force Protection.

The Ministry of Defence has purchased a further 37 Mastiff machines to add to the fleet of 277 vehicles it has ordered from the MRAP builder since 2006. Most of the existing fleet is operational in Afghanistan, where it is protecting troops fighting the Taliban in southern Afghanistan.

The deal has not been officially announced by the Ministry of Defence, but a spokesman confirmed a contract for the vehicle was signed recently.

Mastiff is the British variant of the widely used six-wheel-drive Cougar vehicle. Force Protection produces the basic vehicle, with U.K. company NP Aerospace modifying the machine to local requirements.

The Mastiff deal is the second Force Protection success here in two days. On June 23, British defense procurement and technology minister Peter Luff announced the military was also acquiring a further 28 Wolfhound armored trucks from the firm.

Luff also announced an order for a further 140 Jackal patrol vehicles from Supacat in a deal worth 45 million pounds ($67.3 million). The contract takes Jackal numbers in the British Army beyond the 500 mark. The latest deal is for the 2A version of the off-road vehicle, which has a better protected cab area than earlier Jackals.

Some 97 Wolfhounds, the truck variant of the Mastiff, were originally ordered in April 2009 by the then-Labour administration as part of a 350 million pound tactical support vehicle program involving more than 400 machines of various categories.

Together, the new Wolfhound and Mastiff orders are probably worth about 40 million pounds.

Force Protection also supplies Britain with the four-wheel-drive version of the Cougar, known here as the Ridgback. A total of 154 Ridgbacks were ordered by the MoD and further vehicles are likely to be purchased later this year.

The first of the Wolfhounds are expected in theater this summer

U.K. Adds 37 Mastiffs To Army

By ANDREW CHUTER

Published: 25 Jun 2010 10:46

LONDON - British force protection capabilities will be boosted by an order for additional Mastiff mine resistant armored vehicles from U.S. builder Force Protection.

The Ministry of Defence has purchased a further 37 Mastiff machines to add to the fleet of 277 vehicles it has ordered from the MRAP builder since 2006. Most of the existing fleet is operational in Afghanistan, where it is protecting troops fighting the Taliban in southern Afghanistan.

The deal has not been officially announced by the Ministry of Defence, but a spokesman confirmed a contract for the vehicle was signed recently.

Mastiff is the British variant of the widely used six-wheel-drive Cougar vehicle. Force Protection produces the basic vehicle, with U.K. company NP Aerospace modifying the machine to local requirements.

The Mastiff deal is the second Force Protection success here in two days. On June 23, British defense procurement and technology minister Peter Luff announced the military was also acquiring a further 28 Wolfhound armored trucks from the firm.

Luff also announced an order for a further 140 Jackal patrol vehicles from Supacat in a deal worth 45 million pounds ($67.3 million). The contract takes Jackal numbers in the British Army beyond the 500 mark. The latest deal is for the 2A version of the off-road vehicle, which has a better protected cab area than earlier Jackals.

Some 97 Wolfhounds, the truck variant of the Mastiff, were originally ordered in April 2009 by the then-Labour administration as part of a 350 million pound tactical support vehicle program involving more than 400 machines of various categories.

Together, the new Wolfhound and Mastiff orders are probably worth about 40 million pounds.

Force Protection also supplies Britain with the four-wheel-drive version of the Cougar, known here as the Ridgback. A total of 154 Ridgbacks were ordered by the MoD and further vehicles are likely to be purchased later this year.

The first of the Wolfhounds are expected in theater this summer

Antwort auf Beitrag Nr.: 39.739.796 von Gexe006 am 25.06.10 20:10:19ach, hier noch der Link dazu

http://www.defensenews.com/story.php?i=4686440&c=ASI&s=LAN

http://www.defensenews.com/story.php?i=4686440&c=ASI&s=LAN

Jun. 25, 2010 Market Close: $ 4.51 After Hours Last:

Net / % Change $ 4.51

unch (unch) After Hours High: $ 4.56

After Hours Volume: 1,233,020 After Hours Low: $ 4.3186

Learn more about the After-Hours trading session. Trade Detail

After Hours

Time (ET) After Hours

Price After Hours

Share Volume

16:30 $ 4.51 526,679 !!!!!!

16:30 $ 4.51 526,679 !!!!!!

16:29 $ 4.5104 1,409

16:27 $ 4.51 5,765

16:23 $ 4.5117 4,600

16:22 $ 4.51 200

16:20 $ 4.46 1,500

16:18 $ 4.5127 3,060

16:17 $ 4.5091 80,821 !!!!!!

16:17 $ 4.5109 60,752 !!!!!!

16:10 $ 4.47 500

16:10 $ 4.46 14,255

16:07 $ 4.54 400

16:07 $ 4.53 800

16:05 $ 4.3186 100

16:00 $ 4.50 4,300

16:00 $ 4.51 100

16:00 $ 4.56 300

16:00 $ 4.55 400

16:00 $ 4.55 200

16:00 $ 4.56 100

16:00 $ 4.48 100

1

Read more: http://www.nasdaq.com/aspxcontent/ExtendedTradingTrades.aspx…

Net / % Change $ 4.51

unch (unch) After Hours High: $ 4.56

After Hours Volume: 1,233,020 After Hours Low: $ 4.3186

Learn more about the After-Hours trading session. Trade Detail

After Hours

Time (ET) After Hours

Price After Hours

Share Volume

16:30 $ 4.51 526,679 !!!!!!

16:30 $ 4.51 526,679 !!!!!!

16:29 $ 4.5104 1,409

16:27 $ 4.51 5,765

16:23 $ 4.5117 4,600

16:22 $ 4.51 200

16:20 $ 4.46 1,500

16:18 $ 4.5127 3,060

16:17 $ 4.5091 80,821 !!!!!!

16:17 $ 4.5109 60,752 !!!!!!

16:10 $ 4.47 500

16:10 $ 4.46 14,255

16:07 $ 4.54 400

16:07 $ 4.53 800

16:05 $ 4.3186 100

16:00 $ 4.50 4,300

16:00 $ 4.51 100

16:00 $ 4.56 300

16:00 $ 4.55 400

16:00 $ 4.55 200

16:00 $ 4.56 100

16:00 $ 4.48 100

1

Read more: http://www.nasdaq.com/aspxcontent/ExtendedTradingTrades.aspx…