LYNAS - Faktenthread, Analysen, Querverweise u. Meldungen zum Unternehmen (Seite 70)

eröffnet am 25.04.07 13:15:18 von

neuester Beitrag 29.04.24 12:08:30 von

neuester Beitrag 29.04.24 12:08:30 von

Beiträge: 3.528

ID: 1.126.458

ID: 1.126.458

Aufrufe heute: 2

Gesamt: 784.860

Gesamt: 784.860

Aktive User: 0

ISIN: AU000000LYC6 · WKN: 871899

3,9570

EUR

-0,25 %

-0,0100 EUR

Letzter Kurs 02.05.24 Tradegate

Neuigkeiten

18.04.24 · Der Aktionär TV |

23.01.24 · kapitalerhoehungen.de |

22.01.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,1200 | +17,78 | |

| 9,8360 | +17,66 | |

| 85.089,50 | +16,19 | |

| 2,5900 | +13,85 | |

| 0,5340 | +12,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6865 | -6,92 | |

| 19,480 | -9,69 | |

| 183,20 | -19,30 | |

| 12,000 | -25,00 | |

| 46,60 | -97,97 |

Beitrag zu dieser Diskussion schreiben

LONDON Asian Metal 8 Feb 13 – Buying activity in European cerium oxide markets has gradually slowed this past week as end users temporarily suspend orders until the conclusion of the Chinese New Year Holiday period. According to sources familiar with the market, January saw marginal but gradual improvement in downstream demand as end users, facing sharply depleted stockpiles, returned to the market to place orders for necessary material. Nevertheless, sources explained that most end users are still reluctant to place large orders as they believe China may make important industry announcements following the conclusion of the Chinese

LONDON Asian Metal 8 Feb 13 – Despite a brief, though marginal, uptick in demand this January, buying activity in the European praseodymium oxide markets has slowly tapered off this week as consumers choose to delay further purchases until the conclusion of the Chinese New Year. Nevertheless, despite the temporary respite for demand, sources believe prices will hold stable as suppliers are likely to keep prices firm in anticipation of resumed increases following the conclusion of the Chinese Spring Festival holiday. According to sources familiar with the market, many end users are starting to run low on stock and production needs will soon require

PITTSBURGH Asian Metal 8 Feb 13 – Canada-based Focus Graphite announced that the company, along with its partner, SOQUEN Inc., has identified high grades of critical rare earth elements on the its Kwyjibo polymetallic property located in Quebec. The project, which is investigating iron ore, rare earths, copper, and other metals, returned high grades of up to 4.59% total rare earth oxides TREO in one subzone. The results were drawn from samples collected in the 2012 exploration program, which included surface and trench sampling. Other results were derived from...

http://www.marketoracle.co.uk/Category12-All.html

:::

:::

http://www.marketoracle.co.uk/Article38786.html

Stock Market Rally Should Boost Discounted Rare Earth and Uranium Miners

Commodities / Metals & MiningFeb 01, 2013 - 12:55 PM GMT

By: Jeb_Handwerger

I notice with interest that the popular media is ignoring the World Trade Organization case against China for restricting exports of critical materials (REMX). This reduction of supply of the critical metals has a significant impact on the global economy.

These critical metals are not only crucial for your iPads and smartphones, but for our top secret, most advanced weaponry. Looking for substitutes for rare earths has proven to be a poor return on investment. For 50 years, they have been trying to find alternatives, only to find out that the chemical characteristics of rare earths are inimitable.

have been a major proponent of advancing domestic strategic mines in the U.S. and Canada. Recently, the U.S. Department of Defense partnered with one of our rare earth recommendations to advance studies.

This move may show investors that the our national security is dependent on domestic critical rare earth production. I would not be surprised to see Canada make a similar move to support rare earth mining and development.

Recently during the quiet holiday season, China (FXI) announced that they were tightening exports again on critical materials. Rare earth export quotas for next year will drop again. China claims that they are cutting back because of the weak global economy.

Nevertheless, stealthily China continues to announce infrastructure plans within the country, and has been stockpiling these critical materials for their own domestic demand. For months, we have been predicting a rebound in China's economy as iron ore prices began rising.

Now we read headlines that China's exports are very strong, even with a rising yuan (CYB). Risk assets such as the rare earths miners and uranium miners (URA) should rally on this news. More smart money from the investment community is realizing that China is far from a hard landing. In fact, they may be in the midst of a powerful recovery.

Exports have jumped to a seven-month highs despite the debt issues in Europe and the United States. This rebound in China may be a spark for the undervalued junior miners (GDXJ), which have been in a downtrend for close to two years as economists predicted a Chinese hard landing.

Many investors have been concerned about the recent Fed minutes, which indicated some sort of exit plan from quantitative easing. These accommodative actions to expand the Fed's balance sheet to record levels have boosted bonds (TLT), the housing (XHB) and the financial markets (XLF) with easy money.

We may be witnessing capital flowing to growing economies such as China. All these actions over the past few years by Central Banks could be starting an inflationary cycle, which could boost the undervalued commodities such as uranium and industrial/strategic metals.

China's equity markets are up around 20% in the past six months, far outpacing equity markets in Europe and the United States. Many do not realize yet that not only is China the world's biggest supplier, but their own economy has grown to a point where they may become the largest consumer of these materials as major industries continue to move their factories to China.

China continues to control the rare earth industry despite attempts from companies like Molycorp (MCP) and Lynas (LYSCF.PK) to begin production. Both companies have been plagued by delays and obstacles. Mining and refining rare earths is not an easy ballgame, as it requires advanced metallurgy and favorable geopolitics.

For decades, the world has been relying on cheap rare earths from China. Nevertheless, this will change rapidly over the next few years. The Chinese are especially short on the critical rare earths needed for permanent magnets, wind turbines, guided missiles and lighting, as they are building their own facilities to manufacture these finished products.

Molycorp and Lynas should be able to supply a large amount of light rare earths after they work out their issues. However, Lynas is still dealing with protestors in Malaysia, and Molycorp is dealing with delays and rising costs to start production. The disappointing performance in these two equities has hurt the entire sector.

In 2011 and 2012, we experienced a decrease in the price of the entire industrial metal sector as QE2 expired and the U.S. and European debt crisis intensified. However, we may be at a turning point for the undervalued rare earth and uranium miners as China leads a rebound.

Large amounts of quantitative easing in the U.S. were announced in the second half of 2012. The new Japanese government is also devaluing the yen to boost the Nikkei, while restarting nuclear plants. China is rebounding quickly, announcing infrastructure projects and starting construction on nuclear reactors. China is leading the world with building new reactors.

China's decreasing rare earth exports, combined with declining production and rapidly depleting heavy rare earth resources, could cause an even greater supply shortfall in 2013. China is consolidating the rare earth industry and cutting down on critical metal smuggling. This will help the Chinese have greater control of their own domestic production.

I will closely follow in my free newsletter both the critical heavy rare earth space and the uranium sector as Asia rebounds, as these metals are crucial for China's domestic needs. These rare metals are vital for our latest high tech devices, and there are only a few viable companies that can get into production in a timely manner.

In the rare earth mining sector, geopolitical support and infrastructure is crucial. In the uranium space, rising geopolitical tensions in Africa and the Middle East with Al Qaeda could cause increased interest in junior uranium developers in the Western Hemisphere.

Two ways of investing in these sectors is through the Rare Earth ETF (REMX) and the Uranium Miners ETF (URA). Both of these metals are critical for China's clean energy initiatives and Middle Eastern energy independence. The ETFs were poor performers in 2012 as fears of a slowdown in China increased. Now, they may represent bottoming situations, which I will be following closely for my readers.

Now, they may represent bottoming situations, which I will be following closely for my readers.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

Google übersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

http://www.google.com/url?sa=t&rct=j&q=beijing%20asian%20met…

Rare Earth Industries:

Moving Malaysia’s Green Economy Forward

A Report by:

The Academy of Sciences Malaysia

&

The National Professors’ Council

AUGUST 2011

©Akademi Sains Malaysia 2011

All rights reserved. No part of this publication may be produced, stored in a retrieval system,

or transmitted in any form or by any means, electronic, mechanical, photocopying, recording,

or otherwise without the prior permission of the Copyright owner.

The views and opinions expressed or implied in this publication are those of the author and

do not necessarily reflect the views of the Academy of Sciences Malaysia.

Perpustakaan Negara Malaysia Cataloguing-in-Publication Data

Rare earth industries : moving Malaysia’s green economy forward /

a report by The Academy of Sciences Malaysia & The National Professors’ Council

Includes bibliographical references

ISBN 978-983-9445-69-5

1. Rare earth industries--Malaysia. 2. Rare earth industries--

Environmental aspects--Malaysia. 3. Rare earth industries--

Governmental policy--Malaysia. I. Akademi Sains Malaysia.

II. Majlis Profesor Negara.

338.4754641

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

v

PREFACE

When it was reported that the Australian company, Lynas Corporation, was proposing to

establish a rare-earth mineral processing plant in Gebeng, Kuantan, with ore imported from

its mine in Australia, there were many objections from Malaysians as to the management of

the radioactive waste. The objections prompted the Malaysian Government to invite the

International Atomic Energy Agency (IAEA) to conduct an independent Study to evaluate the

risks. IAEA undertook the evaluation and produced a report on the proposed plant.

The Academy of Sciences Malaysia (ASM), an independent science and technology “thinktank”,

and the National Professors Council (NPC), a body of more than 1,500 professors from

the public and private universities, decided that both organisations could jointly study the rare

earths issue holistically and comprehensively towards producing a report for the

Government’s consideration. We approached the issue from the view-point that, in the

subject of rare earths, there was much science, engineering and technology that would be

involved in their processing and development. ASM and NPC therefore initiated a

comprehensive Study on rare earth minerals, the rare earth industries (both upstream and

downstream) and their potential contribution to the Malaysian economy.

As far as risks and public safety is concerned we concur with the findings of the IAEA

Report.

Rare earths elements have found applications in high technology and in green technology

which is important to the development of Green Economy in Malaysia. The country’s

involvement in high technology is one of the required ingredients to become a high-income

nation. The report will definitely create awareness and interest in the rare earths industry. As

Malaysia is blessed with mineral resources, it is timely to revisit our mining industry to

embark on strategic elements used in high technology, such as rare earths, thorium, uranium

and others. MPN emphasises its continual support in research and development on rare earths

industry specifically and on other high technology industry generally.

The Study was undertaken by a Working Group, comprised ASM Fellows, NPC Professors

and others, which was charged to determine the economic potential of the Rare Earths

Industry and to assess their strategic importance to enhancing the green economy agenda of

the nation. This has been an enriching experience for all of us and hope that this would be

the template for future cooperation of scientific professionals, academia and technologists in

this country in trying to resolve challenges and issues impacting the nation from the S&T

point of view.

This Study Report, entitled “Rare Earths Industries: Moving Malaysia's Green Economy

Forward” is the culmination of the Working Group’s efforts and is yet another important

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

deliverable of the Academy of Sciences Malaysia. We are confident that the findings

contained therein would lead to taking concrete steps to developing potential rare earth

industries, both in the upstream and downstream sectors, in Malaysia towards realizing the

nation’s green technology agenda as a green growth area.

DATO’ DR. SAMSUDIN TUGIMAN PROF. DR. RADUAN BIN CHE ROSE

SECRETARY GENERAL SECRETARY

ACADEMY OF SCIENCES MALAYSIA MAJLIS PROFESOR NEGARA

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

PREFACE

The greatest risk facing humankind is global warming due to climate change. There will be no

habitable earth for our future generations if the adverse effects of global warming are not

mitigated starting now. Science, engineering and technology are able and ready. What is

lacking is collective global political will.

One of the most important drivers in propelling green technologies and economies to mitigate

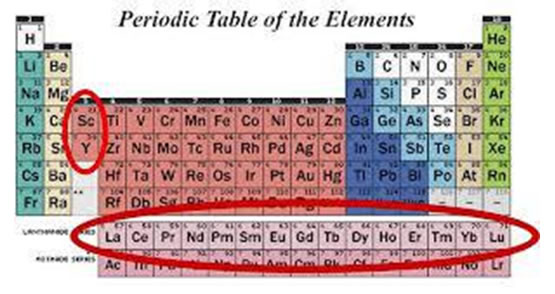

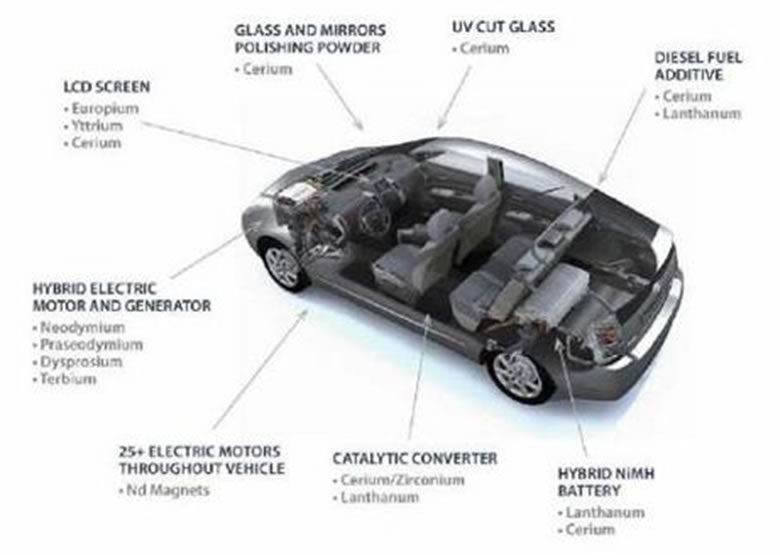

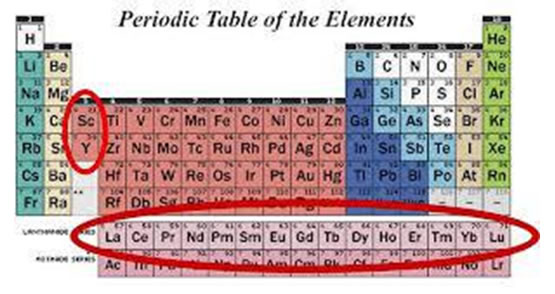

global warming is rare earths. Our study reaffirms the well known fact that rare earths are

strategic in all high technology and low carbon industries like aerospace, consumer electronics,

medical, military, automotive, renewable wind and solar energy and telecommunications etc.

Our study also emphasizes that the mining and processing of rare earths do pose certain risks

to health, safety and the environment. There are available technologies and systems to

manage such risks. However, it is crucial that up to date legislation, monitoring, surveillance

and enforcement are vigorously pursued throughout the life of all such rare earths facilities.

Currently China controls over 95 % of global rare earth supply, fuelling global concern on its

possible adverse consequences on the development of green technologies. The Lynas

Advance Material Plant in Gebeng, Pahang is the only alternative supply source in the short

term. Malaysia is therefore strategically placed to develop her green technology industries,

thus contributing to low carbon economies throughout the world and helping to assure a

sustainable earth for future generations.

ACADEMICIAN DATO’ IR. LEE YEE CHEONG F.A.Sc.

CHIEF SPOKESMAN, ASM-MPN WORKING GROUP

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

Executive Summary

Introduction

There is a famous saying, “Where there is risk, there is opportunity”. Rare earths present both

health and environmental risks as well as potential economic opportunities. However, the

risks are manageable thanks to improved technologies and a better understanding of the

implications on health and the environment. This explains why there is a rush by many

countries to reopen old mines and increase investment in the production of rare earths

concentrate and their high value downstream products. Why is there such a scramble to risk

money on rare earths? What have ignited global demand? Where are the opportunities? How

are the risks associated with rare earths managed? Can Malaysia benefit from this new

growth industry? What should be our strategies?

This report, produced by the joint Working Group of the Academy of Sciences Malaysia

(ASM) and the Majlis Profesor Negara (MPN), discusses the science of rare earths and their

business prospects; and proposes some strategic directions for Malaysia. The analysis is

based on information culled from various secondary sources as well as the group’s

engagement with experts from the Rare Earths Society of China.

Why Rare Earths?

Evidently, many factors contribute to the rush to invest in the unprecedented revival of rare

earths. One major reason has to do with the rapidly growing world demand. The other reason

relates to the attractive price of rare earths which is projected to stay strong in the coming

years. This is because supply is predicted to have difficulty keeping pace with demand.

Experts believe a major driver of global rare earths demand is the forecasted expansion in the

green economy.

Climate change is a major driver of the green economy. With climate change, there is

concern that the uncontrolled emission of the greenhouse gases, especially carbon dioxide,

can lead to catastrophic consequences for the world. This has been documented in countless

studies and reports.

Another important driver of the green economy is the growing shortfall in many resources.

The world is now experiencing declines in key resources to meet a growing global demand.

With more than 6 billion people now in the world and growing, the pressure exerted on

global resources including energy, water and food is a major concern. Recent demand surge

in China and India has dented the supply position of major world resources.

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

The much quoted Stern Report from the UK has warned that, unless immediate steps are

taken to reduce greenhouse gas emissions, it may be a costly exercise to undertake the

corrections later. Since energy use, especially fossil fuels, is a major contributor to climate

change, greener options are being sought. Add to that the fact that the fossil energy resources

of the world are declining, the need to seek alternatives becomes even more urgent. One

option is to change to renewable energy sources. These include such potentials as solar, wind

and biomass. Rare earths have somehow become a critical feature of the technologies in such

renewables.

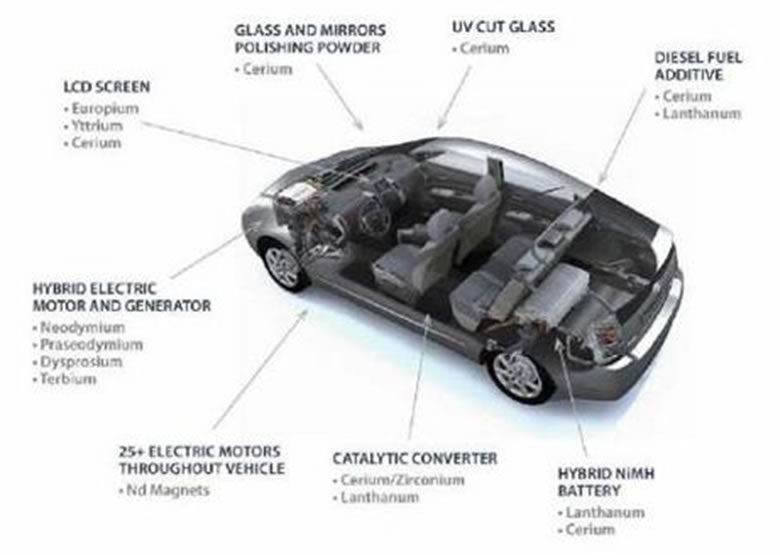

Another option is to improve the efficient use of energy in transport, buildings and all the

other energy intensive industries. Again the technologies in energy efficiency rely a lot on the

use of rare earths. These include applications in energy efficient lighting, new and more

reliable energy storage batteries as well as more efficient energy distribution mechanism.

The growing demand for more efficient communication systems, not only in the world of

business but also in defence and the military, is another significant driver of the global

demand for rare earths. Mobility and miniaturisation, which feature prominently in the

current specifications for telecommunications equipments, rely a lot on the deployment of

powerful and efficient magnetic technology. And rare earths have become a much sought

after material in the latest magnets used in mobile phones, defence equipments and computer

hardwares. With the rise in the global investments in smart cities and intelligent communities,

the demand for such communication products is destined to witness equally prolific

expansion. This would inadvertently translate into a rising demand for rare earths.

Rare Earth Business

The value chain of the rare earths business involves mining, extraction, processing, refining

and the manufacture of an extensive range of downstream products which find wide

applications in such industries including aerospace, consumer electronics, medical, military,

automotive, renewable wind and solar energy and telecommunications. In fact the entire

gamut of the high-tech industries depends on a sustainable supply of rare earths elements.

The explosive demand in mobile phones is an excellent illustration of the massive potential

that the rare earths business offers. In a matter of less than 20 years, the number of cell

phones worldwide has reached a staggering 5 billion. Soon, going by the report of their

growth in sales, the world demand for cell phones may even exceed the global population!

Admittedly, the rare earths business does pose certain risks. Top among the risks are the

health and safety risks. The mining, extraction and refining of rare earths produce residues

and wastes which carry health and safety risks. The residues from the extraction and refining

are radioactive, while their effluent waste streams do pose pollution risks to the receiving

rivers and waterways. But, as clearly elaborated in a recent report by IAEA experts, there are

technologies and systems available to efficiently mitigate such risks. The risks are

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

manageable. However, it is crucial that the risk and waste management procedures are strictly

followed and adhered to. This is where effective monitoring and surveillance throughout the

life of all such rare earths facilities is crucial. Fortunately, Malaysia’s regulatory standards on

rare earths follow international standards. In some areas, Malaysia’s regulatory regime is

even more stringent than the international guidelines.

Rare Earth Opportunities for Malaysia

Evidently, many reports cite Malaysia as having reasonably substantial amounts of rare earths

elements. In fact, based on the rare earths found in the residual tin deposits alone, Malaysia

has about 30,000 tonnes. This does not take into account unmapped deposits which experts

believe may offer more tonnages of rare earths. Brazil which is reported to have about 48,000

tonnes has announced plans to invest agressively in the rare earths business. China has on

record the largest reserves with about 36 million tonnes. This explains why China has

invested heavily in the entire value chain of the rare earths business. China’s committed

investment in rare earths started many years ago when the country’s foremost leaders

proclaimed the strategic position of rare earths in the world economy. That forecast is now a

reality where the rise in the green high-tech economy is seen driving global demand for rare

earths in a big way.

Malaysia needs to discover and venture into new economic growth areas. This will help fuel

the country’s drive to achieve a high income status by 2020 as articulated in the New

Economic Model (NEM) and the many supporting Economic Transformation Plans that the

Government has recently launched. Rare earths may be the new growth area for Malaysia.

However, the business opportunities should not just be confined to the mining, extraction and

production of rare earths elements alone if Malaysia is to maximise benefits from this

industry. The industry’s gold mine is in the downstream products. This is also the sector that

China wants to expand. Japan which now controls about 50% of the global market for

downstream rare earths-based high-tech components is desperately looking for partners to

grow their stake in the business. Malaysia needs to embark on the right strategies in order to

build the rare earths industry in the country.What are the strategies?

Rare Earth Strategies for Malaysia

Malaysia can take pride in the fact that the country has an illustrious history in the mining

business. The country was at one time a major player in tin and iron ore. In fact Malaysia was

a major contributor to the world tin market. It was only in recent years that mining has taken

a back seat to agriculture and manufacturing. Most of the country’s expertise in mining either

moved out into other sectors or joined the flourishing petroleum business. Any move to

venture into rare earths would not be difficult since mining is not entirely alien to the country.

It will be a revival of the mining business. And with the tin market now looking better thanks

:::

Seite 66/67/68/69/70/71

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

52

References

[1] http://en.wikipedia.org/wiki/Rare_earth_element

[2] http://www.geology.com

[3] http://minerals.usgs.gov/minerals/

[4] Dr. Doris Schüler, Dr. Matthias Buchert, Dipl.-Ing. Ran Liu, Dipl.-Geogr. Stefanie

Dittrich, Dipl.-Ing. Cornelia Merz, “Study on Rare Earths and Their Recycling”, Final

Report for The Greens/EFA Group in the European Parliament, Darmstadt, January 2011.

[5] Kingsnorth, D., IMCOA: “Rare Earths: Facing New Challenges in the New Decade”

presented by Clinton Cox SME Annual Meeting 2010, 28 Feb – 03 March 2010, Phoenix,

Arizona.

[6] Fairley, P.: Windkraft ohne Umwelt, Technology Review, 20.04.2010, download from

http://www.heise.de/tr/artikel/Windkraft-ohne-Umweg-985824.h…

[7] World Wind Energy Association (WWEA): Table “Wind Power Worldwide June 2010”,

published on http://www.wwindea.org/home/index.php, last access: 30.11.2010

[8] Oakdene Hollins Research & Consulting: Lanthanide Resources and Alternatives, A

report for Deparment for Transport and Department for Business, Innovation and Skills.

March 2010.

[9] Daily News, June 15, 2010: Stron Global Consumer Electronics Growth Forecast.

[10] den Daas, K.: Lighting: Building the future, New York, March 5, 2008.

[11] Press center of Trendforce Corp: LEDinside: Compound annual growth rate of LED

light source reaches 32 %. 14.01.2010, http://press.trendforce.com/en/node/373

[12] DisplaySearch 2010: Graphik on globale TV sales and forecast, cited in: Hevesi, M.:

DisplaySearch: LCD-TV-Markt wächst weiter, LED setzt sich 2011 durch, 0.10.2010,

PRAD Pro Adviser, http://www.prad.de/new/news/shownews_alg3719.html

[13] British Geological Survey: Rare Earth Elements, June 2010.

[14] Angerer, G., et al: Rohstoffe für Zukunftstechnologien, Fraunhofer Institut für Systemund

Innovationsforschung ISI, Karlsruhe in cooperation with Institut für Zukunftsstudien

und Technologiebewertung IZT gGmbH, Berlin; 15 May 2010, Stuttgart.

[15] Pillot, C.: Present and future market situation for batteries, Batteries 2009, Sep30th – Oct

2nd. 2009.

[16] The Economic Times: Toyota to launch lithium battery Prius in 2011. Reuters, 17 Apr

2010, download from http://economictimes.indiatimes.com/news/news-byindustry/

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

53

auto/automobiles/Toyota-to-launch-lithium-battery-Prius-in-2011

Report/articleshow/5823862.cms

[17] Avalon rare metals inc.: Rare metals information, download from

http://avalonraremetals.com/rare_earth_metal/rare_earths/, download in Nov 2010

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

54

Chapter 4:

Rare Earth Industries: Strategies for Malaysia

4.1 Introduction

If in the 70s and 80s, the concern over food security sparked the “green revolution” which

transformed global agriculture, it is clear now the world is undergoing another “green

transformation”. This time the concern is not about food security, but no less important is the

threat posed by a host of worrying global trends. These include, as elaborated earlier, the

changing climate, the depleting resources and the deteriorating natural support ecosystem.

Such trends threaten to not only derail global economic growth, but may also upset the social

fabric of human existence and sustainability.

It is clear from the evidence presented earlier; energy is arguably at the centre of this threat to

human survival. This is because use of fossil energy, especially coal, contributes the most to

the changing climate. Admittedly fossil energy is highly preferred because of its

comparatively lower cost. However, at the same time, the supply of fossil fuels is also fast

depleting. Unless new economic oil wells are discovered, very soon the world will run out of

petroleum. In Malaysia, experts predict that the country’s oil may soon run out by as early as

2019. Already Malaysia’s power system is dependent on imported coal to increase its power

generation capacity. Is this sustainable?

Over the last quarter of a century, the world economy has quadrupled, benefitting millions

whilst billions in developing countries are still left in abject poverty. At the same time, 60%

of the world’s major ecosystems have been degraded. This is because the economic growth of

recent decades has been achieved mainly through drawing down natural resources, without

allowing stocks to regenerate. This has led to widespread ecosystem degradation and loss.

Water is also becoming scarcer. Overconsumption and wastage are ascribed as the root cause.

And water stress is projected to increase due to climate change and global population

explosion.

This is what drives the green economy around the world. Green consumerism is now on the

uptrend. Green investment has suddenly become attractive. There is a rise in green financing.

New cleaner technologies have emerged through years of R&D. These include technologies

in renewable energy, cleaner production and more efficient energy storage, distribution and

consumption. The value of the global green economy is predicted to witness a boom in the

coming years. Countries which do not invest in green energy now may live to regret the day

when others are seen extracting dividends from their investment.

4.2 Rare Earths in Renewable Energy and Microelectronics

Among the many alternative sources of energy, a lot of attention has been focused on wind

and solar. Though much progress has been made, there are still major stumbling blocks in

their commercial development. One has to do with their prohibitive costs which have yet to

meet the lower costs offered by fossils. The current methodology in comparing investment of

electric power generation alternatives in fossil fuelled power plant against renewable power

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

55

plants overemphasizes the economy of scale whilst disregarding any cost penalties due to

carbon emission and resource depletion. Solar and wind power are intermittent, the former

cannot generate during darkness and the latter without wind. When deployed in big scale,

they can cause unacceptable power swings in the power grid lessening the reliability of power

supply. Effective energy storage technology needs to be developed for power grids to better

manage their large energy swings. Recent years have seen the recognition of the unique

attributes of rare earth elements in such applications. As a result, the global demand for rare

earths in magnets, batteries, superconductors and lasers, has witnessed a major surge. The

incorporation of rare earth elements in the electromagnets used in wind turbines would

significantly increase the conversion of wind into electricity. Consequently, the world

demand for rare earths has increased exponentially.

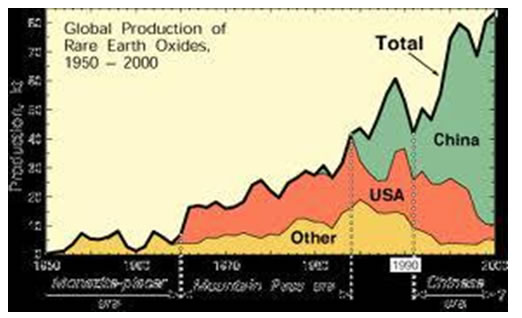

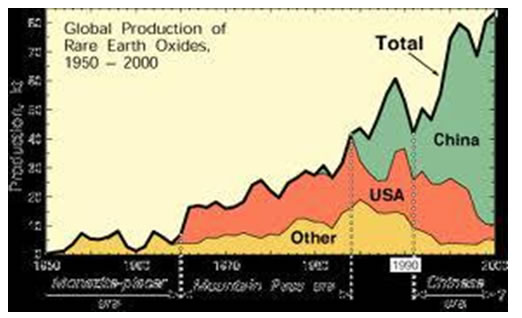

Although rare earth deposits are found in about 29 countries worldwide, China has emerged

as the only country which has given serious attention to rare earth mining and production. It

in fact started mining since the 1950s. It is now supplying 97% of the world’s demand for

rare earths. Now China has about 100 companies involved in the rare earth industry. It is

estimated that each year China produces more than 230,000 tonnes of rare earths. About 50%

are exported. The global market for rare earths is estimated at USD 1 billion. But the market

for the downstream products may run into tens of billions USD and are growing by the day.

Japan now dominates the downstream high value products made from rare earths. But China

is strategising to expand the downstream products business in rare earths.

4.3 Business Opportunities in Rare Earths

With the projected expansion in the green economy globally, the world demand for rare

earths and the associated green downstream products will further expand. As has been

demonstrated in Chapter 3, the deployment of green technology products in all spheres of

human activities are growing by leaps and bounds. Admittedly, there are environmental,

health and safety risks involved in the industry, especially in the mining, extraction,

processing and waste storage. However Chapter 2 has shown that the risks are manageable if

the right technologies and good management practices are deployed under a strict regulatory

regime.

In view of the near panic reaction generated worldwide due to the reduction of rare earths

export by China, what is certain is that the business opportunities in the rare earth industry

are destined to be even more lucrative in the coming years. Many countries have started to

seriously invest in the industry. Without rare earth products being available from outside

China, it appears inevitable that China with their massive investments in rare earths will

increasingly take charge of the key green technologies that will drive the global economy of

this century. With the Lynas rare earth plant in Gebeng, Malaysia will be in the strategic

position to be a key player in this vital industry.

4.4 Strategies for Malaysia: Development of Indigenous Rare

Earth Industries

Malaysia is stated to have some 0.03% of global world reserve of rare earth minerals. Chapter

2 presents a table of the rare earth elements present in samples of Xenotime and Monazite

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

56

from Perak. These two minerals have been extracted from tin placer deposits in Perak and

Selangor. It is worth noting that, prior to 1988, xenotime from Malaysia was the largest

source of yttrium in the world. Unfortunately with the down turn in the tin-mining industry,

the amounts produced of these two elements have declined. Some are present in the tailings

left by the tin mining industry. Apart from that, there are natural rare earth deposits in the

country which have yet to be developed.

We expect that Malaysia has more rare earth mineral deposits than the known global reserve

of 0.03%. There is an urgent need to undertake a mapping exercise to determine the locations

and quanta. Malaysia has led the world in tin mining expertise. We suggest that the

development of the rare earth mining and processing can be the renaissance of our mining

industry. The associated downstream green technology industries will make Malaysia a

competitive player in the increasingly strategic sector of the global economy.

Brazil is reported to have 0.05% of global rare earth reserve. It has attracted joint Japanese-

Korean investment in mining its rare earths. That will be the start of their indigenous rare

earth industry. It is worth remembering that Malaysia helped Brazil and many other

developing countries in tin mining expertise. However, going forward, we must allow rare

earths export only as a last resort.

The key determinants of the strongly recommended development of our indigenous rare

earth industry are: the skilled human capital, command of upstream and downstream

technologies, R&D, access to investment capital and access to world markets. We strongly

recommend that Government should lead in a Government-Industry-Academia-CSO

partnership. In fact, a 1Malaysia alliance to embrace the following broad strategies and action

plans:

• Undertake a national exercise to map the potential rare earth deposits and evaluate

their economic potential. This will be the start of a national enterprise for our mining

renaissance.

• Incentivise the upstream mining and extraction of rare earths through partnership

between local and global partners who have access to finance, technology and market.

• Incentivise the downstream manufacturing of rare earth-based products to substitute

imports and expand exports e.g. those components needed initially in those well

established industrial sectors like automotive industry, ICT, consumer/industrial

electronics, and palm oil; and in newly established industries like solar power,

biotechnology and nanotechnology etc.

• Build technologically competent human capital in Rare Earth Processing and Product

Manufacturing, starting with the Lynas facility in Gebeng as a test bed to establish a

world class R&D centre on rare earths through partnership of Universiti Malaysia

Pahang with foreign universities and R&D companies, in the immediate term from

China, and a Rare Earth Vocational Training Institute in Kuantan to man the small

and at medium enterprises that are bound to spring up to support our green

technology industry.

• Enhance the legal framework to monitor and support the effective functioning of the

rare earth industry without compromising on the safety and health of the people and

the environment. The AELB Independent Malaysian Regulatory Support Organisation

(TSO) is a good start.

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

57

• Enhance the environment, safety and health aspects of the management of the

industrial estates in the country. In line with the world movement in restoration of the

environs surrounding industrial estates, especially petrochemical complex, it is

recommended that a study be initiated with the Gebeng Industrial Estate. Again

Universiti Malaysia Pahang can play a significant part in this initiative.

• Undertake a comprehensive and continual public awareness program and pursue

regular engagement with the community on the risks and opportunities of new

technology-based business.

The Academy of Sciences Malaysia and the National Council of Professors stand ready to

offer our services to help realise the green technology aspirations of Malaysia through the

establishment of an indigenous Rare earth industry.

:::

Anschließend der..

IAEA Report

The ASM/NPC Working Group has reviewed the IAEA Report of the International

Review Mission on the Radiation Safety Aspects of a Proposed Rare earth processing

Facility (the Lynas Project), we are impressed by the comprehensive analysis of the

environmental, health and safety aspects of the Lynas Project. We fully support their

eleven recommendations:

:::

Bis Ende Februar in der Hoffnung die MODS lassen das Posting stehen denn das gehört IMHO zur Pflichtlektüre zu unserem Thema.

Grüsse JoJo

:::

:::

http://www.marketoracle.co.uk/Article38786.html

Stock Market Rally Should Boost Discounted Rare Earth and Uranium Miners

Commodities / Metals & MiningFeb 01, 2013 - 12:55 PM GMT

By: Jeb_Handwerger

I notice with interest that the popular media is ignoring the World Trade Organization case against China for restricting exports of critical materials (REMX). This reduction of supply of the critical metals has a significant impact on the global economy.

These critical metals are not only crucial for your iPads and smartphones, but for our top secret, most advanced weaponry. Looking for substitutes for rare earths has proven to be a poor return on investment. For 50 years, they have been trying to find alternatives, only to find out that the chemical characteristics of rare earths are inimitable.

have been a major proponent of advancing domestic strategic mines in the U.S. and Canada. Recently, the U.S. Department of Defense partnered with one of our rare earth recommendations to advance studies.

This move may show investors that the our national security is dependent on domestic critical rare earth production. I would not be surprised to see Canada make a similar move to support rare earth mining and development.

Recently during the quiet holiday season, China (FXI) announced that they were tightening exports again on critical materials. Rare earth export quotas for next year will drop again. China claims that they are cutting back because of the weak global economy.

Nevertheless, stealthily China continues to announce infrastructure plans within the country, and has been stockpiling these critical materials for their own domestic demand. For months, we have been predicting a rebound in China's economy as iron ore prices began rising.

Now we read headlines that China's exports are very strong, even with a rising yuan (CYB). Risk assets such as the rare earths miners and uranium miners (URA) should rally on this news. More smart money from the investment community is realizing that China is far from a hard landing. In fact, they may be in the midst of a powerful recovery.

Exports have jumped to a seven-month highs despite the debt issues in Europe and the United States. This rebound in China may be a spark for the undervalued junior miners (GDXJ), which have been in a downtrend for close to two years as economists predicted a Chinese hard landing.

Many investors have been concerned about the recent Fed minutes, which indicated some sort of exit plan from quantitative easing. These accommodative actions to expand the Fed's balance sheet to record levels have boosted bonds (TLT), the housing (XHB) and the financial markets (XLF) with easy money.

We may be witnessing capital flowing to growing economies such as China. All these actions over the past few years by Central Banks could be starting an inflationary cycle, which could boost the undervalued commodities such as uranium and industrial/strategic metals.

China's equity markets are up around 20% in the past six months, far outpacing equity markets in Europe and the United States. Many do not realize yet that not only is China the world's biggest supplier, but their own economy has grown to a point where they may become the largest consumer of these materials as major industries continue to move their factories to China.

China continues to control the rare earth industry despite attempts from companies like Molycorp (MCP) and Lynas (LYSCF.PK) to begin production. Both companies have been plagued by delays and obstacles. Mining and refining rare earths is not an easy ballgame, as it requires advanced metallurgy and favorable geopolitics.

For decades, the world has been relying on cheap rare earths from China. Nevertheless, this will change rapidly over the next few years. The Chinese are especially short on the critical rare earths needed for permanent magnets, wind turbines, guided missiles and lighting, as they are building their own facilities to manufacture these finished products.

Molycorp and Lynas should be able to supply a large amount of light rare earths after they work out their issues. However, Lynas is still dealing with protestors in Malaysia, and Molycorp is dealing with delays and rising costs to start production. The disappointing performance in these two equities has hurt the entire sector.

In 2011 and 2012, we experienced a decrease in the price of the entire industrial metal sector as QE2 expired and the U.S. and European debt crisis intensified. However, we may be at a turning point for the undervalued rare earth and uranium miners as China leads a rebound.

Large amounts of quantitative easing in the U.S. were announced in the second half of 2012. The new Japanese government is also devaluing the yen to boost the Nikkei, while restarting nuclear plants. China is rebounding quickly, announcing infrastructure projects and starting construction on nuclear reactors. China is leading the world with building new reactors.

China's decreasing rare earth exports, combined with declining production and rapidly depleting heavy rare earth resources, could cause an even greater supply shortfall in 2013. China is consolidating the rare earth industry and cutting down on critical metal smuggling. This will help the Chinese have greater control of their own domestic production.

I will closely follow in my free newsletter both the critical heavy rare earth space and the uranium sector as Asia rebounds, as these metals are crucial for China's domestic needs. These rare metals are vital for our latest high tech devices, and there are only a few viable companies that can get into production in a timely manner.

In the rare earth mining sector, geopolitical support and infrastructure is crucial. In the uranium space, rising geopolitical tensions in Africa and the Middle East with Al Qaeda could cause increased interest in junior uranium developers in the Western Hemisphere.

Two ways of investing in these sectors is through the Rare Earth ETF (REMX) and the Uranium Miners ETF (URA). Both of these metals are critical for China's clean energy initiatives and Middle Eastern energy independence. The ETFs were poor performers in 2012 as fears of a slowdown in China increased. Now, they may represent bottoming situations, which I will be following closely for my readers.

Now, they may represent bottoming situations, which I will be following closely for my readers.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

Google übersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

http://www.google.com/url?sa=t&rct=j&q=beijing%20asian%20met…

Rare Earth Industries:

Moving Malaysia’s Green Economy Forward

A Report by:

The Academy of Sciences Malaysia

&

The National Professors’ Council

AUGUST 2011

©Akademi Sains Malaysia 2011

All rights reserved. No part of this publication may be produced, stored in a retrieval system,

or transmitted in any form or by any means, electronic, mechanical, photocopying, recording,

or otherwise without the prior permission of the Copyright owner.

The views and opinions expressed or implied in this publication are those of the author and

do not necessarily reflect the views of the Academy of Sciences Malaysia.

Perpustakaan Negara Malaysia Cataloguing-in-Publication Data

Rare earth industries : moving Malaysia’s green economy forward /

a report by The Academy of Sciences Malaysia & The National Professors’ Council

Includes bibliographical references

ISBN 978-983-9445-69-5

1. Rare earth industries--Malaysia. 2. Rare earth industries--

Environmental aspects--Malaysia. 3. Rare earth industries--

Governmental policy--Malaysia. I. Akademi Sains Malaysia.

II. Majlis Profesor Negara.

338.4754641

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

v

PREFACE

When it was reported that the Australian company, Lynas Corporation, was proposing to

establish a rare-earth mineral processing plant in Gebeng, Kuantan, with ore imported from

its mine in Australia, there were many objections from Malaysians as to the management of

the radioactive waste. The objections prompted the Malaysian Government to invite the

International Atomic Energy Agency (IAEA) to conduct an independent Study to evaluate the

risks. IAEA undertook the evaluation and produced a report on the proposed plant.

The Academy of Sciences Malaysia (ASM), an independent science and technology “thinktank”,

and the National Professors Council (NPC), a body of more than 1,500 professors from

the public and private universities, decided that both organisations could jointly study the rare

earths issue holistically and comprehensively towards producing a report for the

Government’s consideration. We approached the issue from the view-point that, in the

subject of rare earths, there was much science, engineering and technology that would be

involved in their processing and development. ASM and NPC therefore initiated a

comprehensive Study on rare earth minerals, the rare earth industries (both upstream and

downstream) and their potential contribution to the Malaysian economy.

As far as risks and public safety is concerned we concur with the findings of the IAEA

Report.

Rare earths elements have found applications in high technology and in green technology

which is important to the development of Green Economy in Malaysia. The country’s

involvement in high technology is one of the required ingredients to become a high-income

nation. The report will definitely create awareness and interest in the rare earths industry. As

Malaysia is blessed with mineral resources, it is timely to revisit our mining industry to

embark on strategic elements used in high technology, such as rare earths, thorium, uranium

and others. MPN emphasises its continual support in research and development on rare earths

industry specifically and on other high technology industry generally.

The Study was undertaken by a Working Group, comprised ASM Fellows, NPC Professors

and others, which was charged to determine the economic potential of the Rare Earths

Industry and to assess their strategic importance to enhancing the green economy agenda of

the nation. This has been an enriching experience for all of us and hope that this would be

the template for future cooperation of scientific professionals, academia and technologists in

this country in trying to resolve challenges and issues impacting the nation from the S&T

point of view.

This Study Report, entitled “Rare Earths Industries: Moving Malaysia's Green Economy

Forward” is the culmination of the Working Group’s efforts and is yet another important

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

deliverable of the Academy of Sciences Malaysia. We are confident that the findings

contained therein would lead to taking concrete steps to developing potential rare earth

industries, both in the upstream and downstream sectors, in Malaysia towards realizing the

nation’s green technology agenda as a green growth area.

DATO’ DR. SAMSUDIN TUGIMAN PROF. DR. RADUAN BIN CHE ROSE

SECRETARY GENERAL SECRETARY

ACADEMY OF SCIENCES MALAYSIA MAJLIS PROFESOR NEGARA

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

PREFACE

The greatest risk facing humankind is global warming due to climate change. There will be no

habitable earth for our future generations if the adverse effects of global warming are not

mitigated starting now. Science, engineering and technology are able and ready. What is

lacking is collective global political will.

One of the most important drivers in propelling green technologies and economies to mitigate

global warming is rare earths. Our study reaffirms the well known fact that rare earths are

strategic in all high technology and low carbon industries like aerospace, consumer electronics,

medical, military, automotive, renewable wind and solar energy and telecommunications etc.

Our study also emphasizes that the mining and processing of rare earths do pose certain risks

to health, safety and the environment. There are available technologies and systems to

manage such risks. However, it is crucial that up to date legislation, monitoring, surveillance

and enforcement are vigorously pursued throughout the life of all such rare earths facilities.

Currently China controls over 95 % of global rare earth supply, fuelling global concern on its

possible adverse consequences on the development of green technologies. The Lynas

Advance Material Plant in Gebeng, Pahang is the only alternative supply source in the short

term. Malaysia is therefore strategically placed to develop her green technology industries,

thus contributing to low carbon economies throughout the world and helping to assure a

sustainable earth for future generations.

ACADEMICIAN DATO’ IR. LEE YEE CHEONG F.A.Sc.

CHIEF SPOKESMAN, ASM-MPN WORKING GROUP

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

Executive Summary

Introduction

There is a famous saying, “Where there is risk, there is opportunity”. Rare earths present both

health and environmental risks as well as potential economic opportunities. However, the

risks are manageable thanks to improved technologies and a better understanding of the

implications on health and the environment. This explains why there is a rush by many

countries to reopen old mines and increase investment in the production of rare earths

concentrate and their high value downstream products. Why is there such a scramble to risk

money on rare earths? What have ignited global demand? Where are the opportunities? How

are the risks associated with rare earths managed? Can Malaysia benefit from this new

growth industry? What should be our strategies?

This report, produced by the joint Working Group of the Academy of Sciences Malaysia

(ASM) and the Majlis Profesor Negara (MPN), discusses the science of rare earths and their

business prospects; and proposes some strategic directions for Malaysia. The analysis is

based on information culled from various secondary sources as well as the group’s

engagement with experts from the Rare Earths Society of China.

Why Rare Earths?

Evidently, many factors contribute to the rush to invest in the unprecedented revival of rare

earths. One major reason has to do with the rapidly growing world demand. The other reason

relates to the attractive price of rare earths which is projected to stay strong in the coming

years. This is because supply is predicted to have difficulty keeping pace with demand.

Experts believe a major driver of global rare earths demand is the forecasted expansion in the

green economy.

Climate change is a major driver of the green economy. With climate change, there is

concern that the uncontrolled emission of the greenhouse gases, especially carbon dioxide,

can lead to catastrophic consequences for the world. This has been documented in countless

studies and reports.

Another important driver of the green economy is the growing shortfall in many resources.

The world is now experiencing declines in key resources to meet a growing global demand.

With more than 6 billion people now in the world and growing, the pressure exerted on

global resources including energy, water and food is a major concern. Recent demand surge

in China and India has dented the supply position of major world resources.

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

The much quoted Stern Report from the UK has warned that, unless immediate steps are

taken to reduce greenhouse gas emissions, it may be a costly exercise to undertake the

corrections later. Since energy use, especially fossil fuels, is a major contributor to climate

change, greener options are being sought. Add to that the fact that the fossil energy resources

of the world are declining, the need to seek alternatives becomes even more urgent. One

option is to change to renewable energy sources. These include such potentials as solar, wind

and biomass. Rare earths have somehow become a critical feature of the technologies in such

renewables.

Another option is to improve the efficient use of energy in transport, buildings and all the

other energy intensive industries. Again the technologies in energy efficiency rely a lot on the

use of rare earths. These include applications in energy efficient lighting, new and more

reliable energy storage batteries as well as more efficient energy distribution mechanism.

The growing demand for more efficient communication systems, not only in the world of

business but also in defence and the military, is another significant driver of the global

demand for rare earths. Mobility and miniaturisation, which feature prominently in the

current specifications for telecommunications equipments, rely a lot on the deployment of

powerful and efficient magnetic technology. And rare earths have become a much sought

after material in the latest magnets used in mobile phones, defence equipments and computer

hardwares. With the rise in the global investments in smart cities and intelligent communities,

the demand for such communication products is destined to witness equally prolific

expansion. This would inadvertently translate into a rising demand for rare earths.

Rare Earth Business

The value chain of the rare earths business involves mining, extraction, processing, refining

and the manufacture of an extensive range of downstream products which find wide

applications in such industries including aerospace, consumer electronics, medical, military,

automotive, renewable wind and solar energy and telecommunications. In fact the entire

gamut of the high-tech industries depends on a sustainable supply of rare earths elements.

The explosive demand in mobile phones is an excellent illustration of the massive potential

that the rare earths business offers. In a matter of less than 20 years, the number of cell

phones worldwide has reached a staggering 5 billion. Soon, going by the report of their

growth in sales, the world demand for cell phones may even exceed the global population!

Admittedly, the rare earths business does pose certain risks. Top among the risks are the

health and safety risks. The mining, extraction and refining of rare earths produce residues

and wastes which carry health and safety risks. The residues from the extraction and refining

are radioactive, while their effluent waste streams do pose pollution risks to the receiving

rivers and waterways. But, as clearly elaborated in a recent report by IAEA experts, there are

technologies and systems available to efficiently mitigate such risks. The risks are

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

manageable. However, it is crucial that the risk and waste management procedures are strictly

followed and adhered to. This is where effective monitoring and surveillance throughout the

life of all such rare earths facilities is crucial. Fortunately, Malaysia’s regulatory standards on

rare earths follow international standards. In some areas, Malaysia’s regulatory regime is

even more stringent than the international guidelines.

Rare Earth Opportunities for Malaysia

Evidently, many reports cite Malaysia as having reasonably substantial amounts of rare earths

elements. In fact, based on the rare earths found in the residual tin deposits alone, Malaysia

has about 30,000 tonnes. This does not take into account unmapped deposits which experts

believe may offer more tonnages of rare earths. Brazil which is reported to have about 48,000

tonnes has announced plans to invest agressively in the rare earths business. China has on

record the largest reserves with about 36 million tonnes. This explains why China has

invested heavily in the entire value chain of the rare earths business. China’s committed

investment in rare earths started many years ago when the country’s foremost leaders

proclaimed the strategic position of rare earths in the world economy. That forecast is now a

reality where the rise in the green high-tech economy is seen driving global demand for rare

earths in a big way.

Malaysia needs to discover and venture into new economic growth areas. This will help fuel

the country’s drive to achieve a high income status by 2020 as articulated in the New

Economic Model (NEM) and the many supporting Economic Transformation Plans that the

Government has recently launched. Rare earths may be the new growth area for Malaysia.

However, the business opportunities should not just be confined to the mining, extraction and

production of rare earths elements alone if Malaysia is to maximise benefits from this

industry. The industry’s gold mine is in the downstream products. This is also the sector that

China wants to expand. Japan which now controls about 50% of the global market for

downstream rare earths-based high-tech components is desperately looking for partners to

grow their stake in the business. Malaysia needs to embark on the right strategies in order to

build the rare earths industry in the country.What are the strategies?

Rare Earth Strategies for Malaysia

Malaysia can take pride in the fact that the country has an illustrious history in the mining

business. The country was at one time a major player in tin and iron ore. In fact Malaysia was

a major contributor to the world tin market. It was only in recent years that mining has taken

a back seat to agriculture and manufacturing. Most of the country’s expertise in mining either

moved out into other sectors or joined the flourishing petroleum business. Any move to

venture into rare earths would not be difficult since mining is not entirely alien to the country.

It will be a revival of the mining business. And with the tin market now looking better thanks

:::

Seite 66/67/68/69/70/71

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

52

References

[1] http://en.wikipedia.org/wiki/Rare_earth_element

[2] http://www.geology.com

[3] http://minerals.usgs.gov/minerals/

[4] Dr. Doris Schüler, Dr. Matthias Buchert, Dipl.-Ing. Ran Liu, Dipl.-Geogr. Stefanie

Dittrich, Dipl.-Ing. Cornelia Merz, “Study on Rare Earths and Their Recycling”, Final

Report for The Greens/EFA Group in the European Parliament, Darmstadt, January 2011.

[5] Kingsnorth, D., IMCOA: “Rare Earths: Facing New Challenges in the New Decade”

presented by Clinton Cox SME Annual Meeting 2010, 28 Feb – 03 March 2010, Phoenix,

Arizona.

[6] Fairley, P.: Windkraft ohne Umwelt, Technology Review, 20.04.2010, download from

http://www.heise.de/tr/artikel/Windkraft-ohne-Umweg-985824.h…

[7] World Wind Energy Association (WWEA): Table “Wind Power Worldwide June 2010”,

published on http://www.wwindea.org/home/index.php, last access: 30.11.2010

[8] Oakdene Hollins Research & Consulting: Lanthanide Resources and Alternatives, A

report for Deparment for Transport and Department for Business, Innovation and Skills.

March 2010.

[9] Daily News, June 15, 2010: Stron Global Consumer Electronics Growth Forecast.

[10] den Daas, K.: Lighting: Building the future, New York, March 5, 2008.

[11] Press center of Trendforce Corp: LEDinside: Compound annual growth rate of LED

light source reaches 32 %. 14.01.2010, http://press.trendforce.com/en/node/373

[12] DisplaySearch 2010: Graphik on globale TV sales and forecast, cited in: Hevesi, M.:

DisplaySearch: LCD-TV-Markt wächst weiter, LED setzt sich 2011 durch, 0.10.2010,

PRAD Pro Adviser, http://www.prad.de/new/news/shownews_alg3719.html

[13] British Geological Survey: Rare Earth Elements, June 2010.

[14] Angerer, G., et al: Rohstoffe für Zukunftstechnologien, Fraunhofer Institut für Systemund

Innovationsforschung ISI, Karlsruhe in cooperation with Institut für Zukunftsstudien

und Technologiebewertung IZT gGmbH, Berlin; 15 May 2010, Stuttgart.

[15] Pillot, C.: Present and future market situation for batteries, Batteries 2009, Sep30th – Oct

2nd. 2009.

[16] The Economic Times: Toyota to launch lithium battery Prius in 2011. Reuters, 17 Apr

2010, download from http://economictimes.indiatimes.com/news/news-byindustry/

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

53

auto/automobiles/Toyota-to-launch-lithium-battery-Prius-in-2011

Report/articleshow/5823862.cms

[17] Avalon rare metals inc.: Rare metals information, download from

http://avalonraremetals.com/rare_earth_metal/rare_earths/, download in Nov 2010

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

54

Chapter 4:

Rare Earth Industries: Strategies for Malaysia

4.1 Introduction

If in the 70s and 80s, the concern over food security sparked the “green revolution” which

transformed global agriculture, it is clear now the world is undergoing another “green

transformation”. This time the concern is not about food security, but no less important is the

threat posed by a host of worrying global trends. These include, as elaborated earlier, the

changing climate, the depleting resources and the deteriorating natural support ecosystem.

Such trends threaten to not only derail global economic growth, but may also upset the social

fabric of human existence and sustainability.

It is clear from the evidence presented earlier; energy is arguably at the centre of this threat to

human survival. This is because use of fossil energy, especially coal, contributes the most to

the changing climate. Admittedly fossil energy is highly preferred because of its

comparatively lower cost. However, at the same time, the supply of fossil fuels is also fast

depleting. Unless new economic oil wells are discovered, very soon the world will run out of

petroleum. In Malaysia, experts predict that the country’s oil may soon run out by as early as

2019. Already Malaysia’s power system is dependent on imported coal to increase its power

generation capacity. Is this sustainable?

Over the last quarter of a century, the world economy has quadrupled, benefitting millions

whilst billions in developing countries are still left in abject poverty. At the same time, 60%

of the world’s major ecosystems have been degraded. This is because the economic growth of

recent decades has been achieved mainly through drawing down natural resources, without

allowing stocks to regenerate. This has led to widespread ecosystem degradation and loss.

Water is also becoming scarcer. Overconsumption and wastage are ascribed as the root cause.

And water stress is projected to increase due to climate change and global population

explosion.

This is what drives the green economy around the world. Green consumerism is now on the

uptrend. Green investment has suddenly become attractive. There is a rise in green financing.

New cleaner technologies have emerged through years of R&D. These include technologies

in renewable energy, cleaner production and more efficient energy storage, distribution and

consumption. The value of the global green economy is predicted to witness a boom in the

coming years. Countries which do not invest in green energy now may live to regret the day

when others are seen extracting dividends from their investment.

4.2 Rare Earths in Renewable Energy and Microelectronics

Among the many alternative sources of energy, a lot of attention has been focused on wind

and solar. Though much progress has been made, there are still major stumbling blocks in

their commercial development. One has to do with their prohibitive costs which have yet to

meet the lower costs offered by fossils. The current methodology in comparing investment of

electric power generation alternatives in fossil fuelled power plant against renewable power

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

55

plants overemphasizes the economy of scale whilst disregarding any cost penalties due to

carbon emission and resource depletion. Solar and wind power are intermittent, the former

cannot generate during darkness and the latter without wind. When deployed in big scale,

they can cause unacceptable power swings in the power grid lessening the reliability of power

supply. Effective energy storage technology needs to be developed for power grids to better

manage their large energy swings. Recent years have seen the recognition of the unique

attributes of rare earth elements in such applications. As a result, the global demand for rare

earths in magnets, batteries, superconductors and lasers, has witnessed a major surge. The

incorporation of rare earth elements in the electromagnets used in wind turbines would

significantly increase the conversion of wind into electricity. Consequently, the world

demand for rare earths has increased exponentially.

Although rare earth deposits are found in about 29 countries worldwide, China has emerged

as the only country which has given serious attention to rare earth mining and production. It

in fact started mining since the 1950s. It is now supplying 97% of the world’s demand for

rare earths. Now China has about 100 companies involved in the rare earth industry. It is

estimated that each year China produces more than 230,000 tonnes of rare earths. About 50%

are exported. The global market for rare earths is estimated at USD 1 billion. But the market

for the downstream products may run into tens of billions USD and are growing by the day.

Japan now dominates the downstream high value products made from rare earths. But China

is strategising to expand the downstream products business in rare earths.

4.3 Business Opportunities in Rare Earths

With the projected expansion in the green economy globally, the world demand for rare

earths and the associated green downstream products will further expand. As has been

demonstrated in Chapter 3, the deployment of green technology products in all spheres of

human activities are growing by leaps and bounds. Admittedly, there are environmental,

health and safety risks involved in the industry, especially in the mining, extraction,

processing and waste storage. However Chapter 2 has shown that the risks are manageable if

the right technologies and good management practices are deployed under a strict regulatory

regime.

In view of the near panic reaction generated worldwide due to the reduction of rare earths

export by China, what is certain is that the business opportunities in the rare earth industry

are destined to be even more lucrative in the coming years. Many countries have started to

seriously invest in the industry. Without rare earth products being available from outside

China, it appears inevitable that China with their massive investments in rare earths will

increasingly take charge of the key green technologies that will drive the global economy of

this century. With the Lynas rare earth plant in Gebeng, Malaysia will be in the strategic

position to be a key player in this vital industry.

4.4 Strategies for Malaysia: Development of Indigenous Rare

Earth Industries

Malaysia is stated to have some 0.03% of global world reserve of rare earth minerals. Chapter

2 presents a table of the rare earth elements present in samples of Xenotime and Monazite

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

56

from Perak. These two minerals have been extracted from tin placer deposits in Perak and

Selangor. It is worth noting that, prior to 1988, xenotime from Malaysia was the largest

source of yttrium in the world. Unfortunately with the down turn in the tin-mining industry,

the amounts produced of these two elements have declined. Some are present in the tailings

left by the tin mining industry. Apart from that, there are natural rare earth deposits in the

country which have yet to be developed.

We expect that Malaysia has more rare earth mineral deposits than the known global reserve

of 0.03%. There is an urgent need to undertake a mapping exercise to determine the locations

and quanta. Malaysia has led the world in tin mining expertise. We suggest that the

development of the rare earth mining and processing can be the renaissance of our mining

industry. The associated downstream green technology industries will make Malaysia a

competitive player in the increasingly strategic sector of the global economy.

Brazil is reported to have 0.05% of global rare earth reserve. It has attracted joint Japanese-

Korean investment in mining its rare earths. That will be the start of their indigenous rare

earth industry. It is worth remembering that Malaysia helped Brazil and many other

developing countries in tin mining expertise. However, going forward, we must allow rare

earths export only as a last resort.

The key determinants of the strongly recommended development of our indigenous rare

earth industry are: the skilled human capital, command of upstream and downstream

technologies, R&D, access to investment capital and access to world markets. We strongly

recommend that Government should lead in a Government-Industry-Academia-CSO

partnership. In fact, a 1Malaysia alliance to embrace the following broad strategies and action

plans:

• Undertake a national exercise to map the potential rare earth deposits and evaluate

their economic potential. This will be the start of a national enterprise for our mining

renaissance.

• Incentivise the upstream mining and extraction of rare earths through partnership

between local and global partners who have access to finance, technology and market.

• Incentivise the downstream manufacturing of rare earth-based products to substitute

imports and expand exports e.g. those components needed initially in those well

established industrial sectors like automotive industry, ICT, consumer/industrial

electronics, and palm oil; and in newly established industries like solar power,

biotechnology and nanotechnology etc.

• Build technologically competent human capital in Rare Earth Processing and Product

Manufacturing, starting with the Lynas facility in Gebeng as a test bed to establish a

world class R&D centre on rare earths through partnership of Universiti Malaysia

Pahang with foreign universities and R&D companies, in the immediate term from

China, and a Rare Earth Vocational Training Institute in Kuantan to man the small

and at medium enterprises that are bound to spring up to support our green

technology industry.

• Enhance the legal framework to monitor and support the effective functioning of the

rare earth industry without compromising on the safety and health of the people and

the environment. The AELB Independent Malaysian Regulatory Support Organisation

(TSO) is a good start.

Rare Earth Industries: Moving Malaysia’s Green Economy Forward

57

• Enhance the environment, safety and health aspects of the management of the

industrial estates in the country. In line with the world movement in restoration of the

environs surrounding industrial estates, especially petrochemical complex, it is

recommended that a study be initiated with the Gebeng Industrial Estate. Again

Universiti Malaysia Pahang can play a significant part in this initiative.

• Undertake a comprehensive and continual public awareness program and pursue

regular engagement with the community on the risks and opportunities of new

technology-based business.

The Academy of Sciences Malaysia and the National Council of Professors stand ready to

offer our services to help realise the green technology aspirations of Malaysia through the

establishment of an indigenous Rare earth industry.

:::

Anschließend der..

IAEA Report

The ASM/NPC Working Group has reviewed the IAEA Report of the International

Review Mission on the Radiation Safety Aspects of a Proposed Rare earth processing

Facility (the Lynas Project), we are impressed by the comprehensive analysis of the

environmental, health and safety aspects of the Lynas Project. We fully support their

eleven recommendations:

:::

Bis Ende Februar in der Hoffnung die MODS lassen das Posting stehen denn das gehört IMHO zur Pflichtlektüre zu unserem Thema.

Grüsse JoJo

07.02.2013

Umicore mit solider Gesamtjahresilanz