Rohstoff-Explorer: Research oder Neuvorstellung (Seite 1623)

eröffnet am 13.03.08 13:14:32 von

neuester Beitrag 01.05.24 21:08:23 von

neuester Beitrag 01.05.24 21:08:23 von

Beiträge: 29.536

ID: 1.139.490

ID: 1.139.490

Aufrufe heute: 14

Gesamt: 2.701.592

Gesamt: 2.701.592

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 6452 | |

| vor 1 Stunde | 3677 | |

| heute 11:14 | 3060 | |

| vor 1 Stunde | 2099 | |

| vor 1 Stunde | 2055 | |

| 01.05.24, 18:36 | 1761 | |

| vor 1 Stunde | 1492 | |

| vor 1 Stunde | 1322 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 2. | 18.120,49 | +0,54 | 203 | |||

| 2. | 1. | 173,22 | +2,98 | 97 | |||

| 3. | 9. | 10,280 | +5,98 | 49 | |||

| 4. | 10. | 1,3600 | +55,43 | 46 | |||

| 5. | Neu! | 87,85 | +1,91 | 23 | |||

| 6. | 5. | 0,1665 | +6,66 | 19 | |||

| 7. | 16. | 6,8920 | +0,38 | 19 | |||

| 8. | 4. | 2.330,98 | +1,27 | 18 |

Beitrag zu dieser Diskussion schreiben

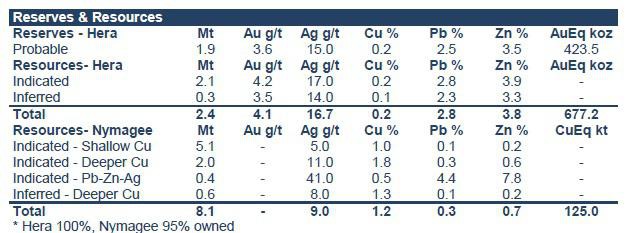

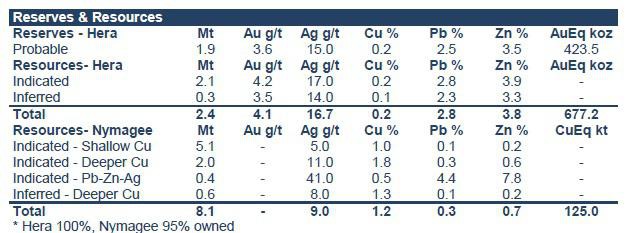

Ist hier noch jemand in Aurelia Metals investiert (früher YTC Resources) oder hat sich damit beschäftigt?

Die Hera-Mine soll noch in diesem Quartal in Produktion gehen.

Hatte die noch aus 2010 - den Verkauf in 2011 leider verpasst.

Sind stark gestiegen die letzten Wochen.

Hartley's hat ein 12-Monats-Kursziel von 0,62AUD (Aktuell 0,37AUD = 121M MarketCap).

Schwanke zwischen halten und verkaufen.

Verarbeitungsanlage Hera-Projekt

Die Hera-Mine soll noch in diesem Quartal in Produktion gehen.

Hatte die noch aus 2010 - den Verkauf in 2011 leider verpasst.

Sind stark gestiegen die letzten Wochen.

Hartley's hat ein 12-Monats-Kursziel von 0,62AUD (Aktuell 0,37AUD = 121M MarketCap).

Schwanke zwischen halten und verkaufen.

Verarbeitungsanlage Hera-Projekt

The onshore licencing round has provoked a divisive reaction in the UK. It has been welcomed by the industry at large, but rejected wholeheartedly by environmental groups. The awarding of exploration rights means that companies could begin the process of developing frac sites, which would lead to higher demand for associated minerals, but the stark opposition could spell delays.

http://www.indmin.com/Article/3366238/UK-fracking-licensing-…

http://www.indmin.com/Article/3366238/UK-fracking-licensing-…

Antwort auf Beitrag Nr.: 47.393.280 von stupidgame am 29.07.14 18:51:39klar, läuft ins dreieck... ob der ausbruch dann (ob up oder down) nachhaltig ist bezweifle ich. gold scheint mir noch ne weile um den dreh rum ganz gut aufgehoben zu sein...

tendenz bleibt weiter eher down als up.

tendenz bleibt weiter eher down als up.

Ordentliche 100 Mio Dollar Finanzierung

PETRO ONE ANNOUNCES DRILLING JOINT VENTURE

July 28, 2014 - Petro One Energy Corp. (TSX-V: POP) has entered into a Program Earning and Joint Venture Agreement (the “Agreement”) with Korea Myanmar Development Corporation (“KMDC”) which provides for a $4,000,000 private placement financing (“PP#1”) and a $14,000,000 funding (the “Phase 1 Funding”) to drill up to 11 oil wells on certain of the Company’s oil and natural gas leases in Saskatchewan and Manitoba (the “Program Lands”) plus a Lodgepole production test of the well previously drilled at South Reston (#SR1) by Petro One and Goldstrike Resources Ltd. (“Phase 1”). In addition, on completion of Phase 1, KMDC will have the option to provide additional funding (the “Phase 2 Funding”) in an amount between $42,000,000 and $82,000,000 to finance additional drilling, with the right to substitute equity funding (“PP#2”) for a portion of the Phase 2 Funding, as described in more detail below. KMDC will earn a 65% interest before payout and a 50% interest after payout in each oil well funded by it. All costs to payout for any well will be paid out of the drilling funds and revenue from production from that well.

Phase 1 Program

The Phase 1 Funding will be used to pay 100% of all drilling, completion and equipping costs as well as facility fees, any capping costs and a portion of abandonment costs (collectively “Program Costs”), for up to 11 horizontal oil wells at an estimated cost of $1,200,000 each plus production testing at South Reston at an estimated cost of ~$335,000. Phase 1 Funding will also be applied to pay the costs of acquiring oil and gas leases at Manor and Whitewater (~$95,000), property maintenance costs (including surface lease payments) and a 15% operator’s fee payable to Petro One, which will be the manager and operator of the Phase 1 Program. As operator, Petro One will have sole authority and discretion to select drilling locations for, and to make decisions relating to the Phase 1 program.

The Phase 1 Funding is scheduled to complete on November 5, 2014. If prior to November 5, 2014 Petro One uses any PP#1 proceeds to pay costs which would be Program Costs if incurred after the Phase 1 Funding is concluded, all of such costs will be deemed to be Program Costs (notwithstanding the fact that they are incurred prior to receipt of the Phase 1 Funding) and will be reimbursed to Petro One out of the Phase 1 Funding.

Phase 1 is currently proposed to commence with two wells at Milton (J5) and one well at each of Rosebank, Ingoldsby, Manor and Whitewater, plus production testing at South Reston. Additional Phase 1 wells will be selected according to the results from the initial wells and testing at South Reston.

Private Placement #1

PP#1 will consist of units (each a “PP#1 Unit”) to be issued at a price equal to the greater of $0.25 and the lowest "Discounted Market Price" (as defined in the Policies of the TSX Venture Exchange [the “TSXV”]) of Petro One shares occurring during the 20 day period following the second trading day after the date of this news release; provided that if the PP#1 Unit price as so determined is greater than $0.35, KMDC shall not be obligated to consummate PP#1. If KMDC elects not to complete PP#1 due to pricing above $0.35, the Phase 1 Funding obligation will increase from $14,000,000 to $18,000,000.

Each PP#1 Unit will be comprised of one common share and one transferrable purchase warrant (each a “PP#1 Warrant”) entitling the holder to purchase one additional common share at an exercise price equal to 150% of the PP#1 Unit price for a period of 24 months from the date of issue, subject to an acceleration provision stipulating that, in the event that the common shares trade at a closing price greater than $2.00 for a period of 10 consecutive trading days at any time following the date that is four months after the date of issue, Petro One may elect to have the PP#1 Warrants expire on 15 days notice.

The Agreement provides that KMDC or persons nominated by KMDC will subscribe for PP#1 Units. In the event that the lowest Discounted Market Price during the referenced 20-day period is greater than $0.35 and KMDC determines not to proceed with PP#1, KMDC shall still be obligated to provide the Phase 1 Funding. PP#1 is scheduled to complete on September 2, 2014. The Agreement provides that the proceeds from PP#1 will be used in part to pay drilling, completion and equipping costs for one horizontal well on Petro One’s “J5” Milton land, estimated at ~$1,200,000, but that such well and 100% of production from such well be belong to Petro One. The balance of the net proceeds from PP#1 will be available for use by Petro One for its general working capital purposes.

Phase 2 Program

The Agreement provides that KMDC will have 120 days after completion of Phase 1 to elect to proceed with the Phase 2 Funding and, optionally, PP#2. If it so elects, KMDC will notify Petro One of the amount of the Phase 2 Funding and the amount of PP#2, provided that the sum of the Phase 2 Funding and PP#2 shall not be less than $42,000,000 or more than $82,000,000. The Phase 2 Funding will be used to conduct further drilling and related activities on Program Lands.

Petro One will continue as manager and operator during Phase 2, but may be replaced as operator at any time during Phase 2 in accordance with the CAPL Operating Procedure; provided that in such event the new operator will be a person jointly selected by Petro One and KMDC and KMDC will be responsible for the payment of the new operator for its services from sources other than the Phase 2 Funding.

Private Placement #2

The Phase 2 Funding will be decreased by an amount equal to the amount of PP#2. Accordingly, the amount of PP#2 may not exceed the amount determined by the following formula:

5,000,000 + ( A / 40,000,000 x $5,000,000 ), where "A" = the amount by which the sum of the Phase 2 Advance and the PP#2 Subscription Amount exceeds $42,000,000

For example, if KMDC elects to set the sum of the Phase 2 Funding and PP#2 at $50,000,000, then PP#2 cannot be more than 5,000,000 + ( 8,000,000 / 40,000,000 x $5,000,000) = $6,000,000.

Each PP#2 Unit will be issued at a price equal to the lowest “Discounted Market Price” (as defined in the Policies of the TSXV) of Petro One shares occurring during the 20 day period following the first trading day after the date on which Petro One publicly announces the exercise of the Phase 2 Program Option, subject to the minimum price permitted by the TSXV. The purchase of PP#2 Units by KMDC and/or subscribers designated by KMDC will close on the second Business Day after the day POP receives written notice of final acceptance from the TSXV regarding PP#2. The proceeds from PP#2 will be used by POP at its sole discretion for its general working capital purposes.

Each PP#2 Unit will be comprised of one common share and one transferrable purchase warrant (each a “PP#2 Warrant”) entitling the holder to purchase one additional common share at an exercise price equal to 150% of the PP#2 Unit price for a period of 24 months from the date of issue, subject to an acceleration provision stipulating that, in the event that the common shares trade at a closing price greater than $6.00 for a period of 10 consecutive trading days at any time following the date that is four months after the date of issue, Petro One may elect to have the PP#2 Warrants expire on 15 days notice.

KMDC Earning Criteria

In the case of a well that is completed and equipped for the taking of petroleum substances in paying quantities, KMDC shall earn a 65% working interest in such well before payout and a 50% working interest in such well after payout, in each case based on Petro One’s current interest in such Program Lands and subject to applicable royalties; provided that notwithstanding the earned working interest of KMDC, 100% of all Program costs associated with each well will be funded from revenue from production from that Program Well and out of the Phase 1 Funding and/or Phase 2 Funding until economic production from such well is achieved. The Agreement defines “economic production” as the production of petroleum substances in paying quantities for a period of 90 consecutive days. Until that threshold is reached for any well, Petro One will be entitled to 35% of any net revenue from that well, but will not have any obligation to fund expenses. After 90 consecutive days of production in paying quantities from a well, any costs in excess of proceeds from the sale of production from such well shall be shared in accordance with the respective working interests of the parties.

If KMDC exercises its right to replace Petro One as operator during Phase 2, then KMDC shall earn a 100% interest in each well drilled by the new operator before payout subject to a 10% gross overriding royalty on production in favour or Petro One, which royalty may be converted by Petro One into a 50% working interest in such well.

Well #SR1 will be treated as a Phase 1 Program well for all purposes except that KMDC will earn a 50% Working Interest in Well #SR1 immediately upon completion of the proposed production test and no payout period shall apply (i.e. KMDC shall not be entitled to any reimbursement of Program Costs incurred in relation to Well #SR1 otherwise than out of its 50% share of net revenue. KMDC shall be responsible for 100% of abandonment costs related to any well that does not achieve economic production and for the first $50,000 of abandonment costs related to each well that does achieve economic production, with the balance of such costs being borne according to the parties’ respective working interests in such well.

Finders’ Fees and TSXV Acceptance

Petro One has agreed to pay a fee to a person at arm’s length from the Company equal to five percent (5%) of the Phase 1 funding and any Phase 2 Funding by issuing common shares of the Company at a deemed price equal to the greater of $0.25 and the closing price of the Company’s shares on the TSXV on the trading day immediately following the day on which completion of such funding is publicly announced.

Petro One has also agreed to pay a fee to Aberdeen Gould Capital Markets Ltd. in respect of PP#1 and PP#2 consisting of cash equal to 8% of the gross subscription proceeds and compensation warrants entitling Aberdeen to purchase that number of PP#1 Units or PP#2 Units which is equal to 8% of the number of PP#1 Units or PP#2 Units, as the case may be, in each case exercisable at the issue prices of such units for two years after completion of the applicable private placement, subject to acceleration on the same terms as the PP#1 Warrants and PP#2 Warrants.

The Agreement, PP#1, PP#2 and the finders’ fees are subject to acceptance of required filings by the TSXV. Further developments will be announced as they occur.

ON BEHALF OF THE BOARD

“Peter Bryant”

President & Director

For further information, please visit the company’s website at PetroOneEnergy.com, follow the Company’s tweets at Twitter.com/PetroOneEnergy and contact Jeff Stuart of King James Capital Corporation, handling Investor Relations for the Company, by telephone at (604) 805 0375 or by email at jstuart@kingjamescapital.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

PETRO ONE ANNOUNCES DRILLING JOINT VENTURE

July 28, 2014 - Petro One Energy Corp. (TSX-V: POP) has entered into a Program Earning and Joint Venture Agreement (the “Agreement”) with Korea Myanmar Development Corporation (“KMDC”) which provides for a $4,000,000 private placement financing (“PP#1”) and a $14,000,000 funding (the “Phase 1 Funding”) to drill up to 11 oil wells on certain of the Company’s oil and natural gas leases in Saskatchewan and Manitoba (the “Program Lands”) plus a Lodgepole production test of the well previously drilled at South Reston (#SR1) by Petro One and Goldstrike Resources Ltd. (“Phase 1”). In addition, on completion of Phase 1, KMDC will have the option to provide additional funding (the “Phase 2 Funding”) in an amount between $42,000,000 and $82,000,000 to finance additional drilling, with the right to substitute equity funding (“PP#2”) for a portion of the Phase 2 Funding, as described in more detail below. KMDC will earn a 65% interest before payout and a 50% interest after payout in each oil well funded by it. All costs to payout for any well will be paid out of the drilling funds and revenue from production from that well.

Phase 1 Program

The Phase 1 Funding will be used to pay 100% of all drilling, completion and equipping costs as well as facility fees, any capping costs and a portion of abandonment costs (collectively “Program Costs”), for up to 11 horizontal oil wells at an estimated cost of $1,200,000 each plus production testing at South Reston at an estimated cost of ~$335,000. Phase 1 Funding will also be applied to pay the costs of acquiring oil and gas leases at Manor and Whitewater (~$95,000), property maintenance costs (including surface lease payments) and a 15% operator’s fee payable to Petro One, which will be the manager and operator of the Phase 1 Program. As operator, Petro One will have sole authority and discretion to select drilling locations for, and to make decisions relating to the Phase 1 program.

The Phase 1 Funding is scheduled to complete on November 5, 2014. If prior to November 5, 2014 Petro One uses any PP#1 proceeds to pay costs which would be Program Costs if incurred after the Phase 1 Funding is concluded, all of such costs will be deemed to be Program Costs (notwithstanding the fact that they are incurred prior to receipt of the Phase 1 Funding) and will be reimbursed to Petro One out of the Phase 1 Funding.

Phase 1 is currently proposed to commence with two wells at Milton (J5) and one well at each of Rosebank, Ingoldsby, Manor and Whitewater, plus production testing at South Reston. Additional Phase 1 wells will be selected according to the results from the initial wells and testing at South Reston.

Private Placement #1

PP#1 will consist of units (each a “PP#1 Unit”) to be issued at a price equal to the greater of $0.25 and the lowest "Discounted Market Price" (as defined in the Policies of the TSX Venture Exchange [the “TSXV”]) of Petro One shares occurring during the 20 day period following the second trading day after the date of this news release; provided that if the PP#1 Unit price as so determined is greater than $0.35, KMDC shall not be obligated to consummate PP#1. If KMDC elects not to complete PP#1 due to pricing above $0.35, the Phase 1 Funding obligation will increase from $14,000,000 to $18,000,000.

Each PP#1 Unit will be comprised of one common share and one transferrable purchase warrant (each a “PP#1 Warrant”) entitling the holder to purchase one additional common share at an exercise price equal to 150% of the PP#1 Unit price for a period of 24 months from the date of issue, subject to an acceleration provision stipulating that, in the event that the common shares trade at a closing price greater than $2.00 for a period of 10 consecutive trading days at any time following the date that is four months after the date of issue, Petro One may elect to have the PP#1 Warrants expire on 15 days notice.

The Agreement provides that KMDC or persons nominated by KMDC will subscribe for PP#1 Units. In the event that the lowest Discounted Market Price during the referenced 20-day period is greater than $0.35 and KMDC determines not to proceed with PP#1, KMDC shall still be obligated to provide the Phase 1 Funding. PP#1 is scheduled to complete on September 2, 2014. The Agreement provides that the proceeds from PP#1 will be used in part to pay drilling, completion and equipping costs for one horizontal well on Petro One’s “J5” Milton land, estimated at ~$1,200,000, but that such well and 100% of production from such well be belong to Petro One. The balance of the net proceeds from PP#1 will be available for use by Petro One for its general working capital purposes.

Phase 2 Program

The Agreement provides that KMDC will have 120 days after completion of Phase 1 to elect to proceed with the Phase 2 Funding and, optionally, PP#2. If it so elects, KMDC will notify Petro One of the amount of the Phase 2 Funding and the amount of PP#2, provided that the sum of the Phase 2 Funding and PP#2 shall not be less than $42,000,000 or more than $82,000,000. The Phase 2 Funding will be used to conduct further drilling and related activities on Program Lands.

Petro One will continue as manager and operator during Phase 2, but may be replaced as operator at any time during Phase 2 in accordance with the CAPL Operating Procedure; provided that in such event the new operator will be a person jointly selected by Petro One and KMDC and KMDC will be responsible for the payment of the new operator for its services from sources other than the Phase 2 Funding.

Private Placement #2

The Phase 2 Funding will be decreased by an amount equal to the amount of PP#2. Accordingly, the amount of PP#2 may not exceed the amount determined by the following formula:

5,000,000 + ( A / 40,000,000 x $5,000,000 ), where "A" = the amount by which the sum of the Phase 2 Advance and the PP#2 Subscription Amount exceeds $42,000,000

For example, if KMDC elects to set the sum of the Phase 2 Funding and PP#2 at $50,000,000, then PP#2 cannot be more than 5,000,000 + ( 8,000,000 / 40,000,000 x $5,000,000) = $6,000,000.

Each PP#2 Unit will be issued at a price equal to the lowest “Discounted Market Price” (as defined in the Policies of the TSXV) of Petro One shares occurring during the 20 day period following the first trading day after the date on which Petro One publicly announces the exercise of the Phase 2 Program Option, subject to the minimum price permitted by the TSXV. The purchase of PP#2 Units by KMDC and/or subscribers designated by KMDC will close on the second Business Day after the day POP receives written notice of final acceptance from the TSXV regarding PP#2. The proceeds from PP#2 will be used by POP at its sole discretion for its general working capital purposes.

Each PP#2 Unit will be comprised of one common share and one transferrable purchase warrant (each a “PP#2 Warrant”) entitling the holder to purchase one additional common share at an exercise price equal to 150% of the PP#2 Unit price for a period of 24 months from the date of issue, subject to an acceleration provision stipulating that, in the event that the common shares trade at a closing price greater than $6.00 for a period of 10 consecutive trading days at any time following the date that is four months after the date of issue, Petro One may elect to have the PP#2 Warrants expire on 15 days notice.

KMDC Earning Criteria

In the case of a well that is completed and equipped for the taking of petroleum substances in paying quantities, KMDC shall earn a 65% working interest in such well before payout and a 50% working interest in such well after payout, in each case based on Petro One’s current interest in such Program Lands and subject to applicable royalties; provided that notwithstanding the earned working interest of KMDC, 100% of all Program costs associated with each well will be funded from revenue from production from that Program Well and out of the Phase 1 Funding and/or Phase 2 Funding until economic production from such well is achieved. The Agreement defines “economic production” as the production of petroleum substances in paying quantities for a period of 90 consecutive days. Until that threshold is reached for any well, Petro One will be entitled to 35% of any net revenue from that well, but will not have any obligation to fund expenses. After 90 consecutive days of production in paying quantities from a well, any costs in excess of proceeds from the sale of production from such well shall be shared in accordance with the respective working interests of the parties.

If KMDC exercises its right to replace Petro One as operator during Phase 2, then KMDC shall earn a 100% interest in each well drilled by the new operator before payout subject to a 10% gross overriding royalty on production in favour or Petro One, which royalty may be converted by Petro One into a 50% working interest in such well.

Well #SR1 will be treated as a Phase 1 Program well for all purposes except that KMDC will earn a 50% Working Interest in Well #SR1 immediately upon completion of the proposed production test and no payout period shall apply (i.e. KMDC shall not be entitled to any reimbursement of Program Costs incurred in relation to Well #SR1 otherwise than out of its 50% share of net revenue. KMDC shall be responsible for 100% of abandonment costs related to any well that does not achieve economic production and for the first $50,000 of abandonment costs related to each well that does achieve economic production, with the balance of such costs being borne according to the parties’ respective working interests in such well.

Finders’ Fees and TSXV Acceptance

Petro One has agreed to pay a fee to a person at arm’s length from the Company equal to five percent (5%) of the Phase 1 funding and any Phase 2 Funding by issuing common shares of the Company at a deemed price equal to the greater of $0.25 and the closing price of the Company’s shares on the TSXV on the trading day immediately following the day on which completion of such funding is publicly announced.

Petro One has also agreed to pay a fee to Aberdeen Gould Capital Markets Ltd. in respect of PP#1 and PP#2 consisting of cash equal to 8% of the gross subscription proceeds and compensation warrants entitling Aberdeen to purchase that number of PP#1 Units or PP#2 Units which is equal to 8% of the number of PP#1 Units or PP#2 Units, as the case may be, in each case exercisable at the issue prices of such units for two years after completion of the applicable private placement, subject to acceleration on the same terms as the PP#1 Warrants and PP#2 Warrants.

The Agreement, PP#1, PP#2 and the finders’ fees are subject to acceptance of required filings by the TSXV. Further developments will be announced as they occur.

ON BEHALF OF THE BOARD

“Peter Bryant”

President & Director

For further information, please visit the company’s website at PetroOneEnergy.com, follow the Company’s tweets at Twitter.com/PetroOneEnergy and contact Jeff Stuart of King James Capital Corporation, handling Investor Relations for the Company, by telephone at (604) 805 0375 or by email at jstuart@kingjamescapital.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Noch ein Chart - der Rogers auf 6-Monates Sicht

Hier übrigens mal der aktuelle Gold-Chart. Pendelt weiter um die Abwärtstrendlinie herum.

Zitat von likeshares: Was ist denn das BESONDERE an einem Explorer?

Nach welchen Daten suchst du für deine persönliche Bewertung?

Da muss schon einiges passen. Und deshalb ist es schon völlig unwahrscheinlich, das viele von den hier laufend im Forum - nicht hier im Thread - vorgestellten Explorer Treffer werden.

Ich habe heute früh gerade eine Studie gesehen, die z.B. einen relativ guten Eindruck macht. http://www.marketwatch.com/story/west-african-resources-limi…

Aber letzlich passt auch hier dann längst nicht alles. Der NPV ist nur noch mit 5% abdiskontiert. Fällt vielen vielleicht gar nicht auf, aber mir. Mag vielleicht angesichts der Niedrigzinsphase o.k. sein, aber ist natürlich mit den NPV10 nicht vergleichbar. Dann hat die Firma schon eine MK vonn 33m und ist natürlich noch nicht durchfinanziert. Das kommt also noch obendrauf - aber schon einen neuen Direktor einstellen, wo wir ja die Gehälter mittlerweile kennen...

Und last - auch hier wieder natürlich ein illiquider Börsenhandel.

Wenn ichs mal versuche, so knapp wie möglich auszudrücken:

Ein guter Explorer muss eine wettbewerbsfähige Kostenstruktur haben - weit besser als der Durchschnitt. Dann muss das Verhältnis Capex zu NPV natürlich stimmen. Also letztlich die Investitionskosten dürfen nur max. einen bestimmten Prozentsatz des zu erwartenden Ertrags ausmachen.

Die Aktie muss vernünftig handelbar sein, und v.a. die MK muss unter Einrechnung aller notwendigen Finanzierungen immer noch ausreichend Bewertungsluft nach oben lassen. Eine Firma darf zu Produktionsbeginn nicht schon eine Cap haben, die höher ist, als der gesamte Cashflow während der Minenlaufzeit - sowas ist nonsens.

Also so ungefähr.

Sierra Rutile hätte solch ein Fall sein können - da hat mir aber der Markt einen Strich durch die Rechnung gemacht, mit den extrem gefallenen HM-Preisen. Auch sowas muss man sehen, und dann rechtzeitig einen Schlussstrich machen.

s.

Zitat von stupidgame: Es ist ja nicht so, dass "man" nun gar nicht in den Markt geht. Selbst ich habe ab und zu mal eine Goldmine gekauft.

Dann brauchts dafür für mich aber auch eine sattelfeste Begründung, wie damals bei Oceana z.B. Und das funktioniert ja auch.

Aber MEIN Ding ist es nicht, irgendwas aufzupicken, was unten rumliegt, und also dann "billig" sein soll.

Ein optisch niedriger Kurs, oder ein Chart ganz unten heisst noch lange nicht automatisch "billig".

Und gefühlt 100-e von Explorern sind so dünn im Handel, dass es rein zufallsbedingte Kursentwicklungen gibt. DARAUF zu warten, ist absolut nicht mein Ding.

Kein Wunder, wenn hier im Forum laufend immer wieder neue Goldexplorer vorgestellt werden, die keiner kennt -und bei den meisten auch, ganz ehrlich, keiner kennen muss. Aber natürlich möchte ja jeder, das auf sein ganz persönliches Papier auch mal aufmerksam geworden wird.

Also es braucht für mich schon das BESONDERE an einem Explorer, warum gerade DER und kein anderer. Dafür reicht es mir sicher nicht, wenn der ne Property hat, 20km in der Nähe von Barrick, oder einen abgehalfterten Vorstand aus irgendeinem Major im MM. Da muss schon noch bischen mehr da sein.

Ansonsten ist man mit einem ETF sicher besser bedient.

Was ist denn das BESONDERE an einem Explorer?

Nach welchen Daten suchst du für deine persönliche Bewertung?

Zitat von donnerpower: Seltene Erden sind erstens nicht so selten wie man glaubt und zweitens wird in der Industrie weit weniger verbraucht als angenommen wird. Da geht es bei HREE um wenige 100kg im Jahr. Der große Hype wurde von den Exportbeschränkungen der Chinesen verursacht, der REE Markt kam 2011 in Hysterie. Inzwischen hat China die Exporte wieder gelockert und die westlichen Minen dürften Verluste schreiben.

Langfristig wäre z.B. Nora Karr (prod. 2017) eines der wenigen Deposites die Chancen haben dürften?

Jeder weiß das im Jahre 2020 die Nachfrage und der Preis gewaltig ansteigen wird !

Leider bin ich einer der Seltenen die das nicht wissen, bitte kläre mich auf warum? Wenn möglich mit Link zu Daten, keine Interpretationen davon!

Antwort auf Beitrag Nr.: 47.389.314 von Sweetbull am 29.07.14 10:11:09Emergings divergieren schon etwas von den westlichen Indizes, insb Dax.

Spannend wird, ob sich diese Woche jemand von den ZBs zu Leitzinsen äussert. Lt. Vartian hat England ja Neuseeland als Testballon "vorausgeschickt".

Heute mal etwas erfreuliches zu den Rohstoffpreisen:

http://de.investing.com/news/wirtschafts-indikatoren/deutsch…

So kann man das auch ausdrücken, dass wir mehr zahlen müssen.

Bitte achtet die Tage auf Öl, da kommt eine Entscheidung hopp oder topp.

Spannend wird, ob sich diese Woche jemand von den ZBs zu Leitzinsen äussert. Lt. Vartian hat England ja Neuseeland als Testballon "vorausgeschickt".

Heute mal etwas erfreuliches zu den Rohstoffpreisen:

http://de.investing.com/news/wirtschafts-indikatoren/deutsch…

So kann man das auch ausdrücken, dass wir mehr zahlen müssen.

Bitte achtet die Tage auf Öl, da kommt eine Entscheidung hopp oder topp.