Africa Oil Corp. - World-Class East Africa Oil Exploration (Seite 5)

eröffnet am 23.06.11 21:04:25 von

neuester Beitrag 23.04.24 11:17:43 von

neuester Beitrag 23.04.24 11:17:43 von

Beiträge: 4.120

ID: 1.167.139

ID: 1.167.139

Aufrufe heute: 4

Gesamt: 628.593

Gesamt: 628.593

Aktive User: 0

ISIN: CA00829Q1019 · WKN: A0MZJC · Symbol: AFZ

1,6470

EUR

+3,13 %

+0,0500 EUR

Letzter Kurs 25.04.24 Tradegate

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 75,38 | +19,99 | |

| 5,2000 | +9,47 | |

| 1,0600 | +8,16 | |

| 7,3300 | +7,79 | |

| 0,5300 | +7,72 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,000 | -13,39 | |

| 1,2501 | -15,25 | |

| 1,4000 | -18,13 | |

| 12,510 | -27,27 | |

| 9,3500 | -28,02 |

Beitrag zu dieser Diskussion schreiben

Ich schätze, das 3B/4B Orange Basin Konsortium in Süd Afrika wird die Bohrung für ein free carry an einen Major (Total, Shell, Chevron, Exxon ...?) ausfarmen. Deshalb besser wenn AOI einen möglichst hohen Anteil hat.

Antwort auf Beitrag Nr.: 75.104.034 von texas2 am 15.01.24 13:13:17Für relativ kleines Geld hat AOI seinen Anteil im südafrikanischen Orange Basin erhöht:

VANCOUVER, BC, Jan. 22, 2024 /CNW/ - (TSX: AOI) (Nasdaq-Stockholm: AOI)– Africa Oil Corp. ( "Africa Oil", or the "Company") is pleased to announce that it has received the final approval from the Government of the Republic of South Africa for the transfer of a 6.25% interest in Block3B/4B in the Orange Basin from Azinam Limited, a wholly-owned subsidiary of Eco (Atlantic) Oil & Gas Ltd. ("Eco"), to the Company as announced on July11, 2023. As per the terms of the Assignment and Transfer Agreement with Eco, the Company has made a payment of USD2.5million to Eco. View PDF version

Consequently, the Company now holds an operated 26.25% interest in Block3B/4B with Eco retaining a 20.00% interest and Ricocure (Pty) Ltd with a 53.75% interest.

Und Aktienrückkauf läuft weiter:

VANCOUVER, BC, Jan. 22, 2024 /CNW/ - (TSX: AOI) (Nasdaq-Stockholm: AOI) – Africa Oil Corp. ("Africa Oil", or the "Company") is pleased to announce that the Company repurchased a total of 1,298,784 Africa Oil common shares during the period of January15, 2024 to January19, 2024 under the previously announced share buyback program. View PDF version

Since December6, 2023, up to and including January19, 2024, a total of 1,820,784 Africa Oil common shares have been repurchased under the share repurchase program through the facilities of the TSX, Nasdaq Stockholm and/or alternative Canadian trading systems. A maximum of 38,654,702 Africa Oil common shares may be repurchased under the share buyback program through the facilities of the TS

VANCOUVER, BC, Jan. 22, 2024 /CNW/ - (TSX: AOI) (Nasdaq-Stockholm: AOI)– Africa Oil Corp. ( "Africa Oil", or the "Company") is pleased to announce that it has received the final approval from the Government of the Republic of South Africa for the transfer of a 6.25% interest in Block3B/4B in the Orange Basin from Azinam Limited, a wholly-owned subsidiary of Eco (Atlantic) Oil & Gas Ltd. ("Eco"), to the Company as announced on July11, 2023. As per the terms of the Assignment and Transfer Agreement with Eco, the Company has made a payment of USD2.5million to Eco. View PDF version

Consequently, the Company now holds an operated 26.25% interest in Block3B/4B with Eco retaining a 20.00% interest and Ricocure (Pty) Ltd with a 53.75% interest.

Und Aktienrückkauf läuft weiter:

VANCOUVER, BC, Jan. 22, 2024 /CNW/ - (TSX: AOI) (Nasdaq-Stockholm: AOI) – Africa Oil Corp. ("Africa Oil", or the "Company") is pleased to announce that the Company repurchased a total of 1,298,784 Africa Oil common shares during the period of January15, 2024 to January19, 2024 under the previously announced share buyback program. View PDF version

Since December6, 2023, up to and including January19, 2024, a total of 1,820,784 Africa Oil common shares have been repurchased under the share repurchase program through the facilities of the TSX, Nasdaq Stockholm and/or alternative Canadian trading systems. A maximum of 38,654,702 Africa Oil common shares may be repurchased under the share buyback program through the facilities of the TS

Antwort auf Beitrag Nr.: 75.094.905 von texas2 am 12.01.24 19:44:22Manghetti 1 ist nach wie vor hoffnungsvoll.

Und AOI kauft Aktien zurück, die getrichen werden:

AFRICA OIL ANNOUNCES RESULTS OF SHARE BUYBACK PROGRAM

VANCOUVER, BC, Jan. 15, 2024 /CNW/ - (TSX: AOI) (Nasdaq-Stockholm: AOI) – Africa Oil Corp. ("Africa Oil", or the "Company") is pleased to announce that the Company repurchased a total of 522,000 Africa Oil common shares during the period of January 11, 2024 to January 12, 2024 under the previously announced share buyback program. View PDF version.

Und AOI kauft Aktien zurück, die getrichen werden:

AFRICA OIL ANNOUNCES RESULTS OF SHARE BUYBACK PROGRAM

VANCOUVER, BC, Jan. 15, 2024 /CNW/ - (TSX: AOI) (Nasdaq-Stockholm: AOI) – Africa Oil Corp. ("Africa Oil", or the "Company") is pleased to announce that the Company repurchased a total of 522,000 Africa Oil common shares during the period of January 11, 2024 to January 12, 2024 under the previously announced share buyback program. View PDF version.

Hier könnten sich neue gute Nachrichten abzeichnen für AOI

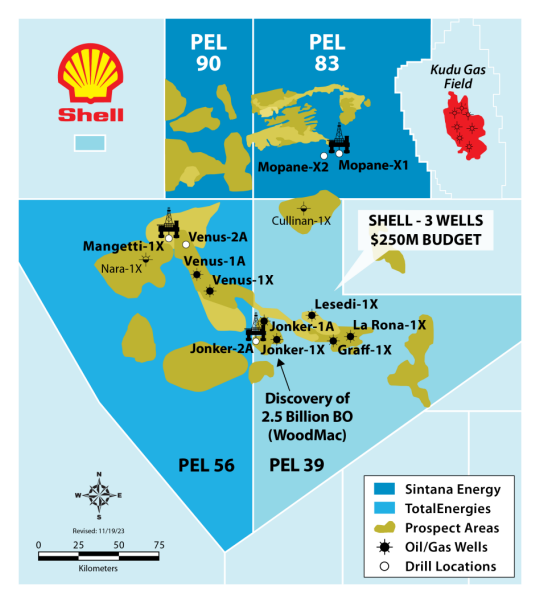

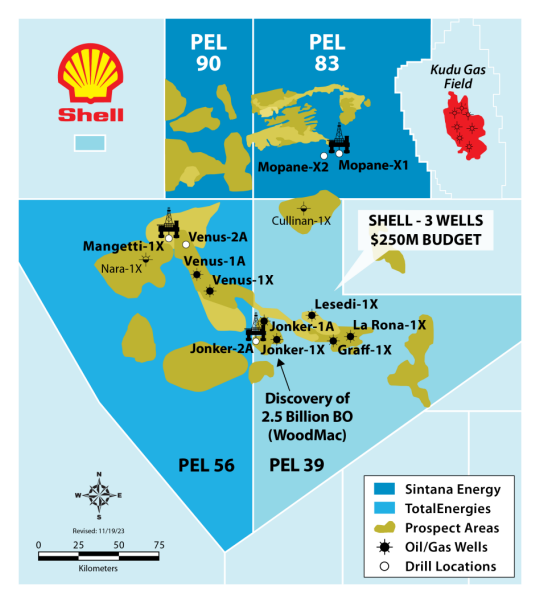

TotalEnergies’ latest Namibia well nears reservoir as excitement builds over other ‘Venus scale’ prospects

Mangetti-1X well closes in on target, as enthusiasm grows over two huge new Venus lookalikes in same block

12 January 2024 9:59 GMT UPDATED 12 January 2024 9:59 GMT

By Iain Esau in London

TotalEnergies will know within days if its closely watched Mangetti-1X exploration probe offshore Namibia is a success, although the company may keep the results from its latest Orange basin well under wraps until next month.

The French supermajor is also preparing to shoot 3D seismic data over two prospects that could be even bigger than Venus which, according to state oil company Namcor, holds about 5.1

https://www.upstreamonline.com/exploration/totalenergies-lat…

Mangetti ist der andere hellere braune Fleck/Prospekt nördlich von Venus

Allerdings denke ich dass AOI seine 3% zu billig an Total abgegeben hat. Wie kann man nur einen goldenen Block so billig hergeben. Noch dazu wurde der geologische Code in diesem goldenen Block gecrackt wo sich das Öl und Gas verstecken. So etwas darf man als AOI (bzw Impact) einfach nicht hergeben!!!

TotalEnergies’ latest Namibia well nears reservoir as excitement builds over other ‘Venus scale’ prospects

Mangetti-1X well closes in on target, as enthusiasm grows over two huge new Venus lookalikes in same block

12 January 2024 9:59 GMT UPDATED 12 January 2024 9:59 GMT

By Iain Esau in London

TotalEnergies will know within days if its closely watched Mangetti-1X exploration probe offshore Namibia is a success, although the company may keep the results from its latest Orange basin well under wraps until next month.

The French supermajor is also preparing to shoot 3D seismic data over two prospects that could be even bigger than Venus which, according to state oil company Namcor, holds about 5.1

https://www.upstreamonline.com/exploration/totalenergies-lat…

Mangetti ist der andere hellere braune Fleck/Prospekt nördlich von Venus

Allerdings denke ich dass AOI seine 3% zu billig an Total abgegeben hat. Wie kann man nur einen goldenen Block so billig hergeben. Noch dazu wurde der geologische Code in diesem goldenen Block gecrackt wo sich das Öl und Gas verstecken. So etwas darf man als AOI (bzw Impact) einfach nicht hergeben!!!

TOTAL steht offensichtlich auf die VENUS und glaubt daran.

Mir persönlich wäre es lieber gewesen wenn AOI seinen Anteil an der Venus über Impact erhöht hätte.

T.AOI | 2 hours ago

VANCOUVER, BC, Jan. 10, 2024 /CNW/ - (TSX: AOI) (Nasdaq-Stockholm: AOI) – Africa Oil Corp. ("Africa Oil", "AOC" or the "Company") is pleased to announce a significant value enhancing farmout transaction related to its offshore Namibia interests held through its investee company, Impact Oil and Gas Limited ("Impact"). On the closing of this transaction Impact will have a 9.5% interest in Blocks 2912 and 2913B (together, "the Blocks") that is fully carried for all joint venture costs, with no cap, through to first commercial production. Impact will also be cash reimbursed on closing for its share of the past costs incurred on the Blocks net to the farmout interests, which is estimated to be approximately USD 99 million. View PDF version

Impact Oil and Gas Namibia (Pty) Ltd., a wholly-owned subsidiary of Impact, has signed a farmout agreement ("Farmout Agreement") with TotalEnergies EP Namibia B.V., a wholly-owned subsidiary of TotalEnergies S.E. ("TotalEnergies"), for a share of Impact's interests in the Blocks. This Agreement provides Impact with carry loan over all of Impact's remaining development, appraisal and exploration costs on the Blocks from January 1st, 2024 ("Effective Date"), until the date on which Impact receives the first sales proceeds from oil production on the Blocks ("First Oil Date").

The carry is repayable to TotalEnergies from a share of Impact's after-tax cash flow and net of all joint venture costs, including capital expenditures, from production on the Blocks post the First Oil Date. During the repayment of the carry, Impact will pool its entitlement barrels with those of TotalEnergies for more regular off-takes and a more stable cashflow profile, and will also benefit from TotalEnergies' marketing and sales capabilities.

Completion of the transaction will be subject to customary third party approvals from the Namibian authorities and joint venture parties.

The Farmout Agreement provides Africa Oil with the opportunity to continue its participation in the world class Venus oil development project with no upfront costs, and to retain further upside in the highly prospective exploration and appraisal ("E&A") activities on the Blocks that have the potential to significantly grow the existing discovered resource base.

Africa Oil and Hosken Consolidated Investments Limited ("HCI"), the two largest shareholders in Impact with a combined shareholding of 81.0%, are fully aligned and support the Farmout Agreement having worked jointly with Impact's management to advance the negotiations with TotalEnergies.

Africa Oil President and CEO, Roger Tucker commented: "The Farmout Agreement allows Africa Oil to retain a very attractive growth opportunity in a major energy project, that is expected to add significant reserves and production to our portfolio from the late 2020s through the 2030s and beyond, without stretching our balance sheet or exposing ourselves to the execution risk on a large-scale deepwater project. It also reinforces our view of TotalEnergies' confidence in the development outlook for the Venus oil discovery and the follow-on prospectivity of the two blocks.

The successful collaboration of Impact management, the Company and Impact's other major shareholder, HCI, has played a pivotal role in navigating the complexities of this transaction which will enable Impact and its shareholders to retain the upside potential from the on-going exploration and appraisal campaign on Block 2913B with significant prospects scheduled to be drilled in 2024, with zero capital expenditure to Impact.

This Farmout Agreement delivers on Africa Oil's stated objective of focusing on and enhancing the value of its core assets. Also, with the funding secured for Impact's Namibian assets through to first commercial production and no further demand on our balance sheet, we can accelerate the work to consolidate our assets ownership, and to consider other capital allocation options including shareholder capital returns and other growth opportunities."

Block 2913B (PEL 56) and the Venus Discovery

Petroleum Exploration License 56, Block 2913B, is located offshore southern Namibia and covers approximately 8,215 km² in water depths between 2,450m and 3,250m. Impact currently holds a 20.0% interest in this block. TotalEnergies, the operator, holds a 40.0% interest, QatarEnergy holds a 30.0% interest, NAMCOR, the Namibian state oil company, holds a 10.0% interest. On the closing of the Farmout Agreement, Impact will hold a 9.5% interest in this block.

Block 2913B contains the world class Venus light oil and associated gas field that was discovered by the Venus-1X well drilled in 2022, which encountered high-quality light oil-bearing sandstone reservoir of Lower Cretaceous age. This well was re-entered, side-tracked and tested in in third quarter 2023, achieving positive test results. These results are being interpreted and incorporated into the development studies for the field.

Further appraisal of the Venus structure was undertaken with the drilling and testing of the Venus-1A appraisal well. A third appraisal well on the Venus structure, Venus-2A, is currently being drilled by the Deepsea Mira rig, and a second rig, Tungsten Explorer, is currently drilling the Mangetti-1X exploration well, targeting a prospect located in the northern part of Block 2913B. Mangetti-1X will then be deepened to appraise the northern area of the Venus structure.

In addition to the on-going drilling operations a 3D seismic acquisition program over the southern part of Block 2913B is currently under way. This program will cover an area where further follow-on prospectivity bas been identified from existing 2D seismic data sets. These include Damara and Damara South prospects.

Block 2912 (PEL 91)

Petroleum Exploration License 91, Block 2912 is adjacent and to the west of Block 2913B. It covers an area of approximately 7,884 km2 in water depths between 3,000m and 3,950m. Impact currently holds a 18.9% interest in this block. TotalEnergies, the operator, holds a 37.8% interest, QatarEnergy holds a 28.3% interest, NAMCOR, the Namibian state oil company, holds a 15.0% interest. On the closing of the Farmout Agreement, Impact will hold a 9.5% interest in this block.

Advisors

Evercore acted as sole financial advisor to Africa Oil in relation to this transaction.

Management Presentation

Senior management will host a presentation on the Farmout Agreement today, Wednesday January 10, 2024 at 09:00 (ET) / 14:00 (GMT) / 15:00 (CET). Participants should use the following link to register for the live webcast:

https://onlinexperiences.com/scripts/Server.nxp?LASCmd=AI:4;…

This landing page also has a link for the dial-in details to listen to the event via telephone

Mir persönlich wäre es lieber gewesen wenn AOI seinen Anteil an der Venus über Impact erhöht hätte.

T.AOI | 2 hours ago

VANCOUVER, BC, Jan. 10, 2024 /CNW/ - (TSX: AOI) (Nasdaq-Stockholm: AOI) – Africa Oil Corp. ("Africa Oil", "AOC" or the "Company") is pleased to announce a significant value enhancing farmout transaction related to its offshore Namibia interests held through its investee company, Impact Oil and Gas Limited ("Impact"). On the closing of this transaction Impact will have a 9.5% interest in Blocks 2912 and 2913B (together, "the Blocks") that is fully carried for all joint venture costs, with no cap, through to first commercial production. Impact will also be cash reimbursed on closing for its share of the past costs incurred on the Blocks net to the farmout interests, which is estimated to be approximately USD 99 million. View PDF version

Impact Oil and Gas Namibia (Pty) Ltd., a wholly-owned subsidiary of Impact, has signed a farmout agreement ("Farmout Agreement") with TotalEnergies EP Namibia B.V., a wholly-owned subsidiary of TotalEnergies S.E. ("TotalEnergies"), for a share of Impact's interests in the Blocks. This Agreement provides Impact with carry loan over all of Impact's remaining development, appraisal and exploration costs on the Blocks from January 1st, 2024 ("Effective Date"), until the date on which Impact receives the first sales proceeds from oil production on the Blocks ("First Oil Date").

The carry is repayable to TotalEnergies from a share of Impact's after-tax cash flow and net of all joint venture costs, including capital expenditures, from production on the Blocks post the First Oil Date. During the repayment of the carry, Impact will pool its entitlement barrels with those of TotalEnergies for more regular off-takes and a more stable cashflow profile, and will also benefit from TotalEnergies' marketing and sales capabilities.

Completion of the transaction will be subject to customary third party approvals from the Namibian authorities and joint venture parties.

The Farmout Agreement provides Africa Oil with the opportunity to continue its participation in the world class Venus oil development project with no upfront costs, and to retain further upside in the highly prospective exploration and appraisal ("E&A") activities on the Blocks that have the potential to significantly grow the existing discovered resource base.

Africa Oil and Hosken Consolidated Investments Limited ("HCI"), the two largest shareholders in Impact with a combined shareholding of 81.0%, are fully aligned and support the Farmout Agreement having worked jointly with Impact's management to advance the negotiations with TotalEnergies.

Africa Oil President and CEO, Roger Tucker commented: "The Farmout Agreement allows Africa Oil to retain a very attractive growth opportunity in a major energy project, that is expected to add significant reserves and production to our portfolio from the late 2020s through the 2030s and beyond, without stretching our balance sheet or exposing ourselves to the execution risk on a large-scale deepwater project. It also reinforces our view of TotalEnergies' confidence in the development outlook for the Venus oil discovery and the follow-on prospectivity of the two blocks.

The successful collaboration of Impact management, the Company and Impact's other major shareholder, HCI, has played a pivotal role in navigating the complexities of this transaction which will enable Impact and its shareholders to retain the upside potential from the on-going exploration and appraisal campaign on Block 2913B with significant prospects scheduled to be drilled in 2024, with zero capital expenditure to Impact.

This Farmout Agreement delivers on Africa Oil's stated objective of focusing on and enhancing the value of its core assets. Also, with the funding secured for Impact's Namibian assets through to first commercial production and no further demand on our balance sheet, we can accelerate the work to consolidate our assets ownership, and to consider other capital allocation options including shareholder capital returns and other growth opportunities."

Block 2913B (PEL 56) and the Venus Discovery

Petroleum Exploration License 56, Block 2913B, is located offshore southern Namibia and covers approximately 8,215 km² in water depths between 2,450m and 3,250m. Impact currently holds a 20.0% interest in this block. TotalEnergies, the operator, holds a 40.0% interest, QatarEnergy holds a 30.0% interest, NAMCOR, the Namibian state oil company, holds a 10.0% interest. On the closing of the Farmout Agreement, Impact will hold a 9.5% interest in this block.

Block 2913B contains the world class Venus light oil and associated gas field that was discovered by the Venus-1X well drilled in 2022, which encountered high-quality light oil-bearing sandstone reservoir of Lower Cretaceous age. This well was re-entered, side-tracked and tested in in third quarter 2023, achieving positive test results. These results are being interpreted and incorporated into the development studies for the field.

Further appraisal of the Venus structure was undertaken with the drilling and testing of the Venus-1A appraisal well. A third appraisal well on the Venus structure, Venus-2A, is currently being drilled by the Deepsea Mira rig, and a second rig, Tungsten Explorer, is currently drilling the Mangetti-1X exploration well, targeting a prospect located in the northern part of Block 2913B. Mangetti-1X will then be deepened to appraise the northern area of the Venus structure.

In addition to the on-going drilling operations a 3D seismic acquisition program over the southern part of Block 2913B is currently under way. This program will cover an area where further follow-on prospectivity bas been identified from existing 2D seismic data sets. These include Damara and Damara South prospects.

Block 2912 (PEL 91)

Petroleum Exploration License 91, Block 2912 is adjacent and to the west of Block 2913B. It covers an area of approximately 7,884 km2 in water depths between 3,000m and 3,950m. Impact currently holds a 18.9% interest in this block. TotalEnergies, the operator, holds a 37.8% interest, QatarEnergy holds a 28.3% interest, NAMCOR, the Namibian state oil company, holds a 15.0% interest. On the closing of the Farmout Agreement, Impact will hold a 9.5% interest in this block.

Advisors

Evercore acted as sole financial advisor to Africa Oil in relation to this transaction.

Management Presentation

Senior management will host a presentation on the Farmout Agreement today, Wednesday January 10, 2024 at 09:00 (ET) / 14:00 (GMT) / 15:00 (CET). Participants should use the following link to register for the live webcast:

https://onlinexperiences.com/scripts/Server.nxp?LASCmd=AI:4;…

This landing page also has a link for the dial-in details to listen to the event via telephone

AFRICA OIL

Africa Oil begins buyback of own shares (Finwire)

2023-12-04 08:08

Oil and gas company Africa Oil has been approved by the Toronto Stock Exchange to begin its proposed share buyback program. The company now has the opportunity to buy back up to the equivalent of 10 percent of the "public float".

The buybacks begin on Wednesday, December 6, and may extend over a year.

newsroom@finwire.se

News agency Finwire

Africa Oil begins buyback of own shares (Finwire)

2023-12-04 08:08

Oil and gas company Africa Oil has been approved by the Toronto Stock Exchange to begin its proposed share buyback program. The company now has the opportunity to buy back up to the equivalent of 10 percent of the "public float".

The buybacks begin on Wednesday, December 6, and may extend over a year.

newsroom@finwire.se

News agency Finwire

Three majors in last-minute dash to enter race for slice of Orange basin hotspot

Coveted South African exploration tract attracts more big suitors

RELATED NEWS

Supermajors eye prime Orange basin block

Exploration

25 August 2022 12:57 GMT

South Africa: Eco Atlantic boosts stake in ‘exciting’ Orange basin block where two probes could be drilled in 2023

Exploration

27 June 2022 11:10 GMT

Africa Oil eyes wildcat on red-hot Orange basin block in South Africa

Exploration

22 March 2022 10:23 GMT

What's next for Orange basin after Venus and Graff?

Exploration

25 February 2022 17:43 GMT

Azinam enters Shell, Equinor South Africa blocks after OK Energy deal

Exploration

25 February 2020 20:30 GMT

27 November 2023 13:12 GMT UPDATED 27 November 2023 15:58 GMT

By Iain Esau in London

A last-minute burst of interest by multiple supermajors in a sought-after exploration block in South Africa’s sector of the prolific Orange basin will delay the conclusion of a farm-out process.

Block 3B/4B — an asset that could host 4 billion barrels of recoverable resources — is operated by Stockholm-listed independent Africa Oil, which together with its two partners are keen to farm out a combined 55% stake in the deep-water acreage.

Operator boosts stake in high-profile Orange basin block as supermajors circle

Read more

A data room has been open for some months and there were expectations in the market that a farm-out deal could be struck soon, but an eleventh-hour flurry of interest means there will now be a delay.

“There is a high level of interest from major companies to come into this block and I anticipate that, certainly within 2024, we will have concluded a farm-in,” Africa Oil chief executive Roger Tucker told analysts recently.

Block 3B/4B is completely covered by 3D seismic data, studies of which have identified 24 prospects, many thought to be in the same Late Cretaceous play as the very big Jonker and Venus discoveries made by Shell and TotalEnergies’ on the Namibian side of this oil and gas rich basin.

“We have had significant discussions with one major already on that block,” Tucker told investors on 16 November, and he had hoped to wrap up a deal — which would likely involve drilling two exploration wells — sooner rather than later.

However, he pointed out that now, because “three other majors have asked to come in to” the data room, finalisation of a farm-out agreement will take a bit more time”.

“The [deal] is going to take a little bit longer. But I think it’s worth standing on the sidelines and not leaping at the first opportunity, because there has been this sudden uptick in the level of interest in the block,” he said.

Tucker said he wants to give these late arriving majors the time needed to study what is on offer in the data room, before a decision is made and a deal wrapped up.

He reckons an agreement could be clinched “towards the end of the first quarter” of next year.

Tucker did not name the interested parties, but it is thought they include Shell and TotalEnergies who already operate acreage elsewhere in South Africa’s Orange basin and could be keen to assess the potential of Block 3B/4B.

Africa Oil holds a 26.25% in the block, with Eco Atlantic holding 20% and privately owned South African player Ricocure on 53.75%

https://www.upstreamonline.com/exploration/three-majors-in-l…

Coveted South African exploration tract attracts more big suitors

RELATED NEWS

Supermajors eye prime Orange basin block

Exploration

25 August 2022 12:57 GMT

South Africa: Eco Atlantic boosts stake in ‘exciting’ Orange basin block where two probes could be drilled in 2023

Exploration

27 June 2022 11:10 GMT

Africa Oil eyes wildcat on red-hot Orange basin block in South Africa

Exploration

22 March 2022 10:23 GMT

What's next for Orange basin after Venus and Graff?

Exploration

25 February 2022 17:43 GMT

Azinam enters Shell, Equinor South Africa blocks after OK Energy deal

Exploration

25 February 2020 20:30 GMT

27 November 2023 13:12 GMT UPDATED 27 November 2023 15:58 GMT

By Iain Esau in London

A last-minute burst of interest by multiple supermajors in a sought-after exploration block in South Africa’s sector of the prolific Orange basin will delay the conclusion of a farm-out process.

Block 3B/4B — an asset that could host 4 billion barrels of recoverable resources — is operated by Stockholm-listed independent Africa Oil, which together with its two partners are keen to farm out a combined 55% stake in the deep-water acreage.

Operator boosts stake in high-profile Orange basin block as supermajors circle

Read more

A data room has been open for some months and there were expectations in the market that a farm-out deal could be struck soon, but an eleventh-hour flurry of interest means there will now be a delay.

“There is a high level of interest from major companies to come into this block and I anticipate that, certainly within 2024, we will have concluded a farm-in,” Africa Oil chief executive Roger Tucker told analysts recently.

Block 3B/4B is completely covered by 3D seismic data, studies of which have identified 24 prospects, many thought to be in the same Late Cretaceous play as the very big Jonker and Venus discoveries made by Shell and TotalEnergies’ on the Namibian side of this oil and gas rich basin.

“We have had significant discussions with one major already on that block,” Tucker told investors on 16 November, and he had hoped to wrap up a deal — which would likely involve drilling two exploration wells — sooner rather than later.

However, he pointed out that now, because “three other majors have asked to come in to” the data room, finalisation of a farm-out agreement will take a bit more time”.

“The [deal] is going to take a little bit longer. But I think it’s worth standing on the sidelines and not leaping at the first opportunity, because there has been this sudden uptick in the level of interest in the block,” he said.

Tucker said he wants to give these late arriving majors the time needed to study what is on offer in the data room, before a decision is made and a deal wrapped up.

He reckons an agreement could be clinched “towards the end of the first quarter” of next year.

Tucker did not name the interested parties, but it is thought they include Shell and TotalEnergies who already operate acreage elsewhere in South Africa’s Orange basin and could be keen to assess the potential of Block 3B/4B.

Africa Oil holds a 26.25% in the block, with Eco Atlantic holding 20% and privately owned South African player Ricocure on 53.75%

https://www.upstreamonline.com/exploration/three-majors-in-l…

Antwort auf Beitrag Nr.: 74.864.403 von texas2 am 26.11.23 10:04:35

'Staggering' industry interest in West Africa exploration block close to LNG plant

Africa Oil extends bid deadline for prime Equatorial Guinea acreage as data room overwhelmed

24 November 2023 12:07 GMT UPDATED 24 November 2023 13:57 GMT

By Iain Esau in London

Africa Oil has received “staggering” interest from oil companies keen to farm into an offshore exploration block near gas facilities in Equatorial Guinea, according to recently installed chief executive Roger Tucker.

As a result, the Toronto and Stockholm-listed independent has extended the bid submission deadline in order to give suitors more time in the data room.

Early this year, as part of a delayed licensing round, Africa Oil signed a production sharing contract for Block EG-31, which has generated such excitement.

“In terms of the level of interest in this block, frankly, it's been staggering,” Tucker told analysts late last week.

“We have a data room open in which we still have nine companies reviewing this opportunity - and they’re not all small independents.”

Tucker said the original aim was to ask for bids towards mid-December, but such has been the level of enthusiasm that if this schedule was not pushed back, there was little chance of every company getting enough time in the data room.

“We’ve just extended the deadline to 1 February … because there are too many people in there.”

What has whetted the appetite of suitors is that this block is a prime piece of exploration real estate just north of Marathon Oil’s Equatorial Guinea LNG plant on Bioko Island — which has spare capacity — as well Marathon’s Alba field which is the main supplier of gas to this liquefaction facility.

Staggered: Africa Oil chief executive Roger Tucker. Photo: AFRICA OIL

Some of Alba’s gas also feeds the US player’s methanol facility on the island, although Marathon’s current focus is on maximising LNG exports because of better market prices.

Tucker — speaking during Africa Oil’s third quarter webcast — described EG-31 as “an infrastructure-led exploration opportunity that it completely surrounds an energy facility which has got significant ullage within it”.

European independents strike amid renewed interest in Equatorial Guinea oil and gas exploration

Read more

As for exploration potential, he said “there are a whole series of what look like gas prospects with seismic anomalies, which would be very short tiebacks to existing infrastructure”.

The first exploration well is set to be drilled in 2025.

This shallow water block — which lies either side of the pipeline feeding Alba’s gas to EG LNG and is covered fully by 3D seismic — includes the 19-year old Gardenia gas discovery and a bunch of Cretaceous prospects including Whistler, Banff, Louise, Massif, Fernie, Marmot and Blackcomb.

RoyalGate gets EG block extension

Read more

Nigerian junior RoyalGate Energy previously held the block, but never drilled a well and claimed Gardenia holds an estimated 3.6 trillion cubic feet of gas and 25 million barrels of condensate.

Gardenia was originally discovered by Marathon and lies 17 kilometres south-west of Alba field in 320 feet of water.

The discovery well was drilled to a total measured depth of 15,175 feet and hit 150 feet of net gas and condensate pay in an Upper Isongo reservoir, which is also productive in the Alba field.

A 60-foot net pay interval was tested at a stabilised rate of 18.6 million cubic feet of gas and 1300 barrels of condensate per day.

Africa Oil has an 80% stake in EG-31, with the balance held by state-owned GePetrol which has an option to buy an additional 15% interest

Zitat von texas2: und weiter nördlich an der westküste von afrika

https://www.upstreamonline.com/exploration/staggering-indust…

'Staggering' industry interest in West Africa exploration block close to LNG plant

Africa Oil extends bid deadline for prime Equatorial Guinea acreage as data room overwhelmed

24 November 2023 12:07 GMT UPDATED 24 November 2023 13:57 GMT

By Iain Esau in London

Africa Oil has received “staggering” interest from oil companies keen to farm into an offshore exploration block near gas facilities in Equatorial Guinea, according to recently installed chief executive Roger Tucker.

As a result, the Toronto and Stockholm-listed independent has extended the bid submission deadline in order to give suitors more time in the data room.

Early this year, as part of a delayed licensing round, Africa Oil signed a production sharing contract for Block EG-31, which has generated such excitement.

“In terms of the level of interest in this block, frankly, it's been staggering,” Tucker told analysts late last week.

“We have a data room open in which we still have nine companies reviewing this opportunity - and they’re not all small independents.”

Tucker said the original aim was to ask for bids towards mid-December, but such has been the level of enthusiasm that if this schedule was not pushed back, there was little chance of every company getting enough time in the data room.

“We’ve just extended the deadline to 1 February … because there are too many people in there.”

What has whetted the appetite of suitors is that this block is a prime piece of exploration real estate just north of Marathon Oil’s Equatorial Guinea LNG plant on Bioko Island — which has spare capacity — as well Marathon’s Alba field which is the main supplier of gas to this liquefaction facility.

Staggered: Africa Oil chief executive Roger Tucker. Photo: AFRICA OIL

Some of Alba’s gas also feeds the US player’s methanol facility on the island, although Marathon’s current focus is on maximising LNG exports because of better market prices.

Tucker — speaking during Africa Oil’s third quarter webcast — described EG-31 as “an infrastructure-led exploration opportunity that it completely surrounds an energy facility which has got significant ullage within it”.

European independents strike amid renewed interest in Equatorial Guinea oil and gas exploration

Read more

As for exploration potential, he said “there are a whole series of what look like gas prospects with seismic anomalies, which would be very short tiebacks to existing infrastructure”.

The first exploration well is set to be drilled in 2025.

This shallow water block — which lies either side of the pipeline feeding Alba’s gas to EG LNG and is covered fully by 3D seismic — includes the 19-year old Gardenia gas discovery and a bunch of Cretaceous prospects including Whistler, Banff, Louise, Massif, Fernie, Marmot and Blackcomb.

RoyalGate gets EG block extension

Read more

Nigerian junior RoyalGate Energy previously held the block, but never drilled a well and claimed Gardenia holds an estimated 3.6 trillion cubic feet of gas and 25 million barrels of condensate.

Gardenia was originally discovered by Marathon and lies 17 kilometres south-west of Alba field in 320 feet of water.

The discovery well was drilled to a total measured depth of 15,175 feet and hit 150 feet of net gas and condensate pay in an Upper Isongo reservoir, which is also productive in the Alba field.

A 60-foot net pay interval was tested at a stabilised rate of 18.6 million cubic feet of gas and 1300 barrels of condensate per day.

Africa Oil has an 80% stake in EG-31, with the balance held by state-owned GePetrol which has an option to buy an additional 15% interest

und weiter nördlich an der westküste von afrika

https://www.upstreamonline.com/exploration/staggering-indust…

https://www.upstreamonline.com/exploration/staggering-indust…

Why have one when you can have two? The golden offshore block in Naibia (hoffe ich)

TotalEnergies' latest Namibia exploration probe targets two reservoirs

"Mangetti-1X well also appraising huge Venus discovery, with further probes and 3D seismic on radar.

TotalEnergies’ Mangetti-1X exploration well in Namibia’s prolific Orange basin will also appraise the supermajor’s Venus oil discovery in Block 2913B, confirming an earlier report by Upstream. Once this well has been completed, the supermajor might target a prospect further north before turning its attention to the southern part of the block where a 3D seismic shoot is due to kick off early next year.

Roger Tucker, chief executive of Africa Oil — a listed company with an indirect 6.2% stake in the two blocks through its 31.1% ownership of Impact Oil & Gas — said the exploration target for Mangetti-1X is a “higher fan than was encountered” at Venus, but stressed the well would also drill deeper to target the northern extension of Venus. He suggested Mangetti will likely go through both objectives between mid-December and the end of this year, but cautioned that results might only be released by the operator during its February capital markets day. Once this well has been completed by the Tungsten Explorer drillship, a new probe could be drilled in the northern part of the block, Pouyanne recently said.

At the same time, Tucker told analysts late last week that additional 3D seismic would be acquired over the southern part of 2913B to cover the promising Damara and South Damara structures. “It looks extremely attractive, and the 3D will be shot in the early part of 2024.” By this time, results should also be known from the ongoing Venus-1A appraisal well where the Deepsea Mira has been performing drill stem testing and multiple flares were recently seen on satellite data. “This is an asset we have to focus our attention on because it is material to a company of our size,” said Tucker. "It is a very, very large block and we have follow-on exploration prospectivity.”

https://www.upstreamonline.com/exploration/totalenergies-lat…

TotalEnergies' latest Namibia exploration probe targets two reservoirs

"Mangetti-1X well also appraising huge Venus discovery, with further probes and 3D seismic on radar.

TotalEnergies’ Mangetti-1X exploration well in Namibia’s prolific Orange basin will also appraise the supermajor’s Venus oil discovery in Block 2913B, confirming an earlier report by Upstream. Once this well has been completed, the supermajor might target a prospect further north before turning its attention to the southern part of the block where a 3D seismic shoot is due to kick off early next year.

Roger Tucker, chief executive of Africa Oil — a listed company with an indirect 6.2% stake in the two blocks through its 31.1% ownership of Impact Oil & Gas — said the exploration target for Mangetti-1X is a “higher fan than was encountered” at Venus, but stressed the well would also drill deeper to target the northern extension of Venus. He suggested Mangetti will likely go through both objectives between mid-December and the end of this year, but cautioned that results might only be released by the operator during its February capital markets day. Once this well has been completed by the Tungsten Explorer drillship, a new probe could be drilled in the northern part of the block, Pouyanne recently said.

At the same time, Tucker told analysts late last week that additional 3D seismic would be acquired over the southern part of 2913B to cover the promising Damara and South Damara structures. “It looks extremely attractive, and the 3D will be shot in the early part of 2024.” By this time, results should also be known from the ongoing Venus-1A appraisal well where the Deepsea Mira has been performing drill stem testing and multiple flares were recently seen on satellite data. “This is an asset we have to focus our attention on because it is material to a company of our size,” said Tucker. "It is a very, very large block and we have follow-on exploration prospectivity.”

https://www.upstreamonline.com/exploration/totalenergies-lat…