Auferstanden aus Ruinen? – Welche Zukunft hat Bristol Meyers Squibb? - 500 Beiträge pro Seite

eröffnet am 24.08.12 16:26:47 von

neuester Beitrag 28.03.22 12:14:33 von

neuester Beitrag 28.03.22 12:14:33 von

Beiträge: 97

ID: 1.176.353

ID: 1.176.353

Aufrufe heute: 0

Gesamt: 18.665

Gesamt: 18.665

Aktive User: 0

ISIN: US1101221083 · WKN: 850501

41,24

EUR

0,00 %

0,00 EUR

Letzter Kurs 18:58:03 Lang & Schwarz

Neuigkeiten

10.05.24 · Business Wire (engl.) |

07.05.24 · Business Wire (engl.) |

06.05.24 · Business Wire (engl.) |

05.05.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Pharmaindustrie

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5700 | +55,23 | |

| 5,4500 | +41,56 | |

| 141,00 | +41,00 | |

| 1,1500 | +34,98 | |

| 1,0000 | +33,33 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,8700 | -12,62 | |

| 12,150 | -12,72 | |

| 35,69 | -13,71 | |

| 5,2500 | -19,23 | |

| 0,7300 | -19,34 |

Aus meiner Sicht lohnt es sich, BMS (Ticker: BMY, ISIN: US1101221083) zu beobachten und sogar dort zu investieren. Ende Juli stand die Aktie noch bei 36 Dollar und ist seit dem deutlich gefallen, weil ein Programm gegen Hepatitis-C in der klinischen Prüfung gescheitert ist. Ich habe darin die Chance zum Einstieg gesehen. Deshalb eröffne ich diesen Thread, um hier Nachrichten und Analysen zum Unternehmen zu sammeln. Tradingtips und „charttechnische“ Aussagen wird man hier von mir hingegen nicht zu lesen bekommen.

Bewertung

Am 24.08.2012 beträgt der Aktienkurs 32,15 Dollar, was eine Marktkapitalisierung von ca. 54 Milliarden Dollar bedeutet.

Es wird für 2012 ein Gewinn von 1,92 Dollar / Aktie erwartet, der 2013 auf 1,88 Dollar zurückgehen soll.

Das KGV liegt demnach bei ungefähr 17 für das laufende und das kommende Jahr.

Der Umsatz soll 2012 knappe 18 Milliarden Dollar betragen und dürfte 2013 auf etwas über 17 Milliarden Dollar fallen.

Bis 2015 dürften die Umsätze dann in etwa stagnieren, während der Gewinn ab 2014 wieder moderat steigen und im Jahr 2015 eventuell bei ca. 2,40 Dollar liegen könnte.

Die Jahresdividende liegt bei 1,36 Dollar, was eine Dividendenrendite von ca. 4% vor Steuern ergibt.

Bei BMS handelt es sich also derzeit um ein stagnierendes Pharmaunternehmen mittlerer Größe, das sich mehr und mehr zum Biotech wandelt.

Für den Beobachter stellen sich hier vermutlich zwei Fragen.

1.) Warum stagniert BMS?

2.) Was soll an diesem Unternehmen eigentlich spannend sein?

Stagnation bis 2015/2016 – das „Patentcliff“ bei BMS

BMS hat im letzten Jahr ca. 21 Milliarden Dollar Umsatz generiert.

Im Zeitraum 2012 bis 2015 verlieren indes 4 Medikamente ihren Patentschutz, die in 2011 zusammen für 12,3 Milliarden Dollar bzw. 58%(!) des Gesamtumsatzes standen. Allein Plavix (hemmt die Eigenschaft der Blutplättchen, verklumpen zu können und ist indiziert bspw. für Herzinfarkt- und Schlaganfallpatienten), kam im letzten Jahr auf einen Umsatz von 7 Milliarden Dollar.

Der Patentschutz ist in den USA mittlerweile ausgelaufen. In Europa wird dieses im Februar 2013 geschehen. Der Plavix-Umsatz wird damit bereits 2013 von 7 Milliarden Dollar noch in 2011 auf vielleicht 0,2 Milliarden Dollar einbrechen.

Die ehemals 12,3 Milliarden Dollar Umsatz der Medikamente, die bis 2015 den Patentschutz verlieren (Plavix, Avapro, Abilify und Sustiva) werden in 2016 fast vollständig ausradiert sein.

Stagnation als Erfolg

Wer sich dieses enorme Wegbrechen von Umsätzen vor Augen führt, muss zu dem Urteil kommen, dass es ein beachtlicher Erfolg des BMS-Managements ist, dass das Unternehmen dennoch in etwa seinen Umsatz halten können wird. Der Markt geht davon aus, dass das Umsatztief des Unternehmens schon 2013 mit etwas über 17 Milliarden Dollar erreicht sein wird und die Umsätze dann wieder wachsen. Erst langsam und dann, nach der Bereinigung um die Patentabläufe ab 2016 wieder schneller. Bereits 2015 wird man voraussichtlich wieder in etwa auf dem Niveau von 2011 sein. Dies hängt aber auch von einer Zulassung des Wirkstoffes Eliquis ab. Dies wird weiter unten näher ausgeführt.

Neue Produkte

BMS hat es verstanden, neue Produkte an den Markt zu bringen, deren Umsätze schnell wachsen und die dabei sind, Blockbuster zu werden.

Die beständig wachsenden Umsätze aus diesen neuen Produkten werden bis 2015 die wegfallenden Umsätze der Altprodukte kompensiert haben.

Zu diesen neuen Produkten gehören insbesondere:

- Onglyza (Diabetes), geschätzter Umsatz in 2012: 704 Millionen

- Orencia (Rheumatoide Arthritis), geschätzter Umsatz in 2012: 1 Milliarde

- Yervoy (Melanom), geschätzter Umsatz in 2012: 1 Milliarde

- Sprycel (Leukämie), geschätzter Umsatz in 2012: 650 Millionen

Besonders Yervoy und Sprycel wachsen schnell und könnten bis 2015 jeweils einen Umsatz von 2 Milliarden Dollar erzielen.

Ein Hoffnungsträger

Durch die eben erst erfolgte Übernahme von Amylin hat BMS nun deren Hoffnungsträger Bydureon (Diabetes) im Portfolio. Analysten halten für das erst in diesem Jahr zugelassene Produkt mittelfristig Milliardenumsätze für möglich. Es wird interessant und kursrelevant sein, wie gut die Vermarktung des Produktes in der Zusammenarbeit zwischen BMA und AstraZeneca funktionieren wird. Ende 2013 wird man hier ein erstes Fazit ziehen können.

Der neue König?

Die bisher beschriebenen Neuentwicklungen reichen wohl lediglich aus, um einen regelrechten Absturz bei BMS zu verhindern.

Für eine wirklich positive Entwicklung des Unternehmens und des Aktienkurses in den nächsten Jahren ist aber eine weitere Neuentwicklung entscheidend, nämlich Eliquis (apixaban), ein Ko-Entwicklung mit Pfizer.

Apixaban ist ein Wirkstoff aus der Gruppe der direkten Faktor-Xa-Inhibitoren. Es hemmt selektiv den Faktor Xa, ein Enzym, das in der Blutgerinnung eine zentrale Rolle spielt. Apixaban beugt der Entstehung von Thromben vor und wird zur Thromboseprophylaxe nach Knie- oder Hüftgelenksoperationen eingesetzt. Hierfür gibt es für den europäischen Markt bereits eine Zulassung.

Entscheidend ist aber, dass das Medikament bei Patienten mit Herzrhythmusstörungen (Vorhofflimmern) zum Einsatz kommen soll, um das erhöhte Schlaganfallrisiko der Patienten zu mindern.

Leider hat die amerikanische Zulassungsbehörde FDA im Juni den Zulassungsantrag für diesen Wirkstoff mit einem Complete Response Letter (CRL) zunächst auf das Abstellgleis geschoben.

Ein CRL ist zwar keine Ablehnung, kann aber im Einzelfall die Zulassung um Jahre verzögern oder letztlich zum Aus des Programms führen.

So schlimm dürfte es hier nicht kommen, denn die FDA hat wohl nicht verlangt, dass neue klinische Studien durchgeführt werden. Vielmehr wurde BMS und Pfizer „nur“ aufgegeben, weitere Angaben zum Datenmanagement des für die Zulassung entscheidenden „Aristoteles-Trials“ zu liefern. „Aristoteles“ umfasste 24.000 Patienten und hat Millionen von Datenpunkten generiert. Dass bei einem so komplexen Vorgang Klärungsbedarf zwischen Zulassungsbehörde und Antragsteller entstehen kann, sollte nicht zu kritisch gesehen werden.

Allerdings ist eines auch ganz klar: Die vollständige Zulassung von Eliquis ist essentiell für BMS, denn dem Wirkstoff wird langfristig ein Umsatzpotential wie Plavix zugetraut. Ein potentieller Mega-Blockbuster also.

Eine – wenn auch eher unwahrscheinliche – Ablehnung der Zulassung oder auch „nur“ die Notwendigkeit, zusätzliche Studien durchzuführen, wäre ein mittleres Desaster. In diesem Negativszenario wären Kurse über 25 Dollar für die nächsten 2 Jahre wohl nur schwer zu rechtfertigen.

Die Entscheidung über Eliquis wird aller Voraussicht nach bis spätestens Mitte 2013 gefallen sein. Mit sehr viel Glück könnte die Zulassung bereits Ende 2012 erfolgen. Wahrscheinlicher ist aber eine FDA-Entscheidung im Zeitraum Februar bis Mai 2013.

Persönlich gehe ich davon aus, dass das Mittel in 2013 die Zulassung erhalten wird und BMS dann sehr, sehr stark dastehen wird.

Sollte ich an diesem Punkt irren, werden zumindest die nächsten 2 oder 3 Jahre allerdings wirklich unschön.

Der kommende König der Könige? – Oder, was an BMS so spannend ist.

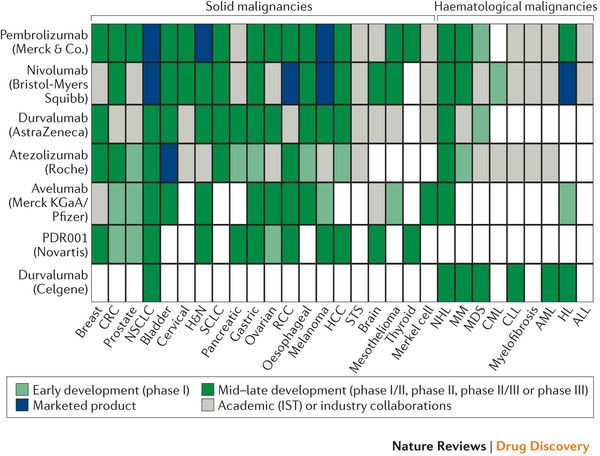

Während Eliquis auf die Indikation Herz-Kreislauferkrankungen zielt und damit die eine große Geisel der Menschheit adressiert, ist bei BMS noch ein weit weniger fortgeschrittenes Programm in der Entwicklung, das noch wenig bekannt ist, Fachleute aber elektrisiert hat. Es handelt sich um einen Antikörper gegen das Protein PD-1 (Programmed cell death protein 1). Das Programm trägt derzeit noch den Entwicklungsnamen „BMS-936558”.

Die – mittlerweile durch erste klinische Tests gestützte – Erwartung ist, dass durch die Blockade von PD-1 das Immunsystem in die Lage versetzt werden kann, selbst gegen Krebszellen vorzugehen (Immuntherapie).

In diesem Jahr tritt der Wirkstoff in die Phase III der klinischen Entwicklung ein, die um 2015 zu einer ersten Zulassung, möglicherweise bei Lungenkrebs, führen könnte. Tests in weiteren Krebsarten sind auf dem Weg oder werden demnächst beginnen.

Die bisher generierten Phase II-Daten waren überragend gut.

Ich will an dieser Stelle den Biotech-Analysten Ohad Hammer zitieren:

“The biggest news at this year’s ASCO came from BMS’ (BMY) PD-1 antibody, BMS-936558. This antibody belongs to a new class of antibodies that stimulate patients’ immune system to attack cancer. This approach has been recently validated with another BMS antibody, Yervoy, which was approved last year for melanoma.

Based on results presented at the meeting, BMS-936558 is superior to Yervoy by any measure. In fact, it is probably one of the most promising oncology drugs ever to be tested in humans. It induces tumor shrinkage in a substantial portion of patients, creates an immune response that keeps the disease under control for long periods and it does so with limited side effects. To make things even better, there might be a way to pre-select patients who are more likely to respond to this agent.”

Der Wirkstoff würde im Erfolgsfall mit Sicherheit ein Blockbuster, sehr wahrscheinlich ein Mega-Blockbuster, werden. Das Umsatzpotential liegt langfristig wohl deutlich jenseits der 5 Milliarden Dollar-Marke.

Ein Erfolg von BMS-936558 wäre für das Unternehmen transformativ. BMS hätte in diesem Falle viele Jahre eines schnellen Umsatz- und Gewinnwachstums vor sich, die das Unternehmen (und den Aktienkurs) in eine andere Liga führen würde.

Fazit

BMS macht derzeit aufgrund wichtiger Patentabläufe eine schwierige Phase der Unternehmensentwicklung durch.

Das Management hat das Unternehmen aber gut auf diese Zeit eingestellt und eine attraktive Pipeline aus neuen Produkten aufgebaut, die Stück für Stück die wegfallenden Umsätze ersetzen können.

Meine Kaufentscheidung beruhte im Wesentlichen aber auf meiner Erwartung, dass im nächsten Jahr Eliquis eine umfassende Zulassung erhalten und sich in der Folge zum Marktführer im Bereich der Antikoagulantien entwickeln und dass ab 2015/2016 die Zulassung von BMS-936558 das Unternehmen in eine neue Dimension führen wird.

Mit Eliquis und BMS-936558 hat BMS zwei potentielle Mega-Blockbuster in der Pipeline, die, falls sie beide zugelassen werden, ein Investment zu einem großen Erfolg werden lassen sollten. Ich schätze die Zulassungswahrscheinlichkeit für beide Wirkstoffe als überdurchschnittlich hoch ein, würde mir aber um Eliquis sogar etwas mehr Sorgen machen, als um BMS-936558.

Sollte nur einer dieser beiden Kandidaten die Zulassung erhalten, sollte sich ein Investment noch immer gut bezahlt machen, auch wenn, im Falle einer Nichtzulassung von Eliquis, die Jahre 2013/2014 recht bitter werden dürften.

Bewertung

Am 24.08.2012 beträgt der Aktienkurs 32,15 Dollar, was eine Marktkapitalisierung von ca. 54 Milliarden Dollar bedeutet.

Es wird für 2012 ein Gewinn von 1,92 Dollar / Aktie erwartet, der 2013 auf 1,88 Dollar zurückgehen soll.

Das KGV liegt demnach bei ungefähr 17 für das laufende und das kommende Jahr.

Der Umsatz soll 2012 knappe 18 Milliarden Dollar betragen und dürfte 2013 auf etwas über 17 Milliarden Dollar fallen.

Bis 2015 dürften die Umsätze dann in etwa stagnieren, während der Gewinn ab 2014 wieder moderat steigen und im Jahr 2015 eventuell bei ca. 2,40 Dollar liegen könnte.

Die Jahresdividende liegt bei 1,36 Dollar, was eine Dividendenrendite von ca. 4% vor Steuern ergibt.

Bei BMS handelt es sich also derzeit um ein stagnierendes Pharmaunternehmen mittlerer Größe, das sich mehr und mehr zum Biotech wandelt.

Für den Beobachter stellen sich hier vermutlich zwei Fragen.

1.) Warum stagniert BMS?

2.) Was soll an diesem Unternehmen eigentlich spannend sein?

Stagnation bis 2015/2016 – das „Patentcliff“ bei BMS

BMS hat im letzten Jahr ca. 21 Milliarden Dollar Umsatz generiert.

Im Zeitraum 2012 bis 2015 verlieren indes 4 Medikamente ihren Patentschutz, die in 2011 zusammen für 12,3 Milliarden Dollar bzw. 58%(!) des Gesamtumsatzes standen. Allein Plavix (hemmt die Eigenschaft der Blutplättchen, verklumpen zu können und ist indiziert bspw. für Herzinfarkt- und Schlaganfallpatienten), kam im letzten Jahr auf einen Umsatz von 7 Milliarden Dollar.

Der Patentschutz ist in den USA mittlerweile ausgelaufen. In Europa wird dieses im Februar 2013 geschehen. Der Plavix-Umsatz wird damit bereits 2013 von 7 Milliarden Dollar noch in 2011 auf vielleicht 0,2 Milliarden Dollar einbrechen.

Die ehemals 12,3 Milliarden Dollar Umsatz der Medikamente, die bis 2015 den Patentschutz verlieren (Plavix, Avapro, Abilify und Sustiva) werden in 2016 fast vollständig ausradiert sein.

Stagnation als Erfolg

Wer sich dieses enorme Wegbrechen von Umsätzen vor Augen führt, muss zu dem Urteil kommen, dass es ein beachtlicher Erfolg des BMS-Managements ist, dass das Unternehmen dennoch in etwa seinen Umsatz halten können wird. Der Markt geht davon aus, dass das Umsatztief des Unternehmens schon 2013 mit etwas über 17 Milliarden Dollar erreicht sein wird und die Umsätze dann wieder wachsen. Erst langsam und dann, nach der Bereinigung um die Patentabläufe ab 2016 wieder schneller. Bereits 2015 wird man voraussichtlich wieder in etwa auf dem Niveau von 2011 sein. Dies hängt aber auch von einer Zulassung des Wirkstoffes Eliquis ab. Dies wird weiter unten näher ausgeführt.

Neue Produkte

BMS hat es verstanden, neue Produkte an den Markt zu bringen, deren Umsätze schnell wachsen und die dabei sind, Blockbuster zu werden.

Die beständig wachsenden Umsätze aus diesen neuen Produkten werden bis 2015 die wegfallenden Umsätze der Altprodukte kompensiert haben.

Zu diesen neuen Produkten gehören insbesondere:

- Onglyza (Diabetes), geschätzter Umsatz in 2012: 704 Millionen

- Orencia (Rheumatoide Arthritis), geschätzter Umsatz in 2012: 1 Milliarde

- Yervoy (Melanom), geschätzter Umsatz in 2012: 1 Milliarde

- Sprycel (Leukämie), geschätzter Umsatz in 2012: 650 Millionen

Besonders Yervoy und Sprycel wachsen schnell und könnten bis 2015 jeweils einen Umsatz von 2 Milliarden Dollar erzielen.

Ein Hoffnungsträger

Durch die eben erst erfolgte Übernahme von Amylin hat BMS nun deren Hoffnungsträger Bydureon (Diabetes) im Portfolio. Analysten halten für das erst in diesem Jahr zugelassene Produkt mittelfristig Milliardenumsätze für möglich. Es wird interessant und kursrelevant sein, wie gut die Vermarktung des Produktes in der Zusammenarbeit zwischen BMA und AstraZeneca funktionieren wird. Ende 2013 wird man hier ein erstes Fazit ziehen können.

Der neue König?

Die bisher beschriebenen Neuentwicklungen reichen wohl lediglich aus, um einen regelrechten Absturz bei BMS zu verhindern.

Für eine wirklich positive Entwicklung des Unternehmens und des Aktienkurses in den nächsten Jahren ist aber eine weitere Neuentwicklung entscheidend, nämlich Eliquis (apixaban), ein Ko-Entwicklung mit Pfizer.

Apixaban ist ein Wirkstoff aus der Gruppe der direkten Faktor-Xa-Inhibitoren. Es hemmt selektiv den Faktor Xa, ein Enzym, das in der Blutgerinnung eine zentrale Rolle spielt. Apixaban beugt der Entstehung von Thromben vor und wird zur Thromboseprophylaxe nach Knie- oder Hüftgelenksoperationen eingesetzt. Hierfür gibt es für den europäischen Markt bereits eine Zulassung.

Entscheidend ist aber, dass das Medikament bei Patienten mit Herzrhythmusstörungen (Vorhofflimmern) zum Einsatz kommen soll, um das erhöhte Schlaganfallrisiko der Patienten zu mindern.

Leider hat die amerikanische Zulassungsbehörde FDA im Juni den Zulassungsantrag für diesen Wirkstoff mit einem Complete Response Letter (CRL) zunächst auf das Abstellgleis geschoben.

Ein CRL ist zwar keine Ablehnung, kann aber im Einzelfall die Zulassung um Jahre verzögern oder letztlich zum Aus des Programms führen.

So schlimm dürfte es hier nicht kommen, denn die FDA hat wohl nicht verlangt, dass neue klinische Studien durchgeführt werden. Vielmehr wurde BMS und Pfizer „nur“ aufgegeben, weitere Angaben zum Datenmanagement des für die Zulassung entscheidenden „Aristoteles-Trials“ zu liefern. „Aristoteles“ umfasste 24.000 Patienten und hat Millionen von Datenpunkten generiert. Dass bei einem so komplexen Vorgang Klärungsbedarf zwischen Zulassungsbehörde und Antragsteller entstehen kann, sollte nicht zu kritisch gesehen werden.

Allerdings ist eines auch ganz klar: Die vollständige Zulassung von Eliquis ist essentiell für BMS, denn dem Wirkstoff wird langfristig ein Umsatzpotential wie Plavix zugetraut. Ein potentieller Mega-Blockbuster also.

Eine – wenn auch eher unwahrscheinliche – Ablehnung der Zulassung oder auch „nur“ die Notwendigkeit, zusätzliche Studien durchzuführen, wäre ein mittleres Desaster. In diesem Negativszenario wären Kurse über 25 Dollar für die nächsten 2 Jahre wohl nur schwer zu rechtfertigen.

Die Entscheidung über Eliquis wird aller Voraussicht nach bis spätestens Mitte 2013 gefallen sein. Mit sehr viel Glück könnte die Zulassung bereits Ende 2012 erfolgen. Wahrscheinlicher ist aber eine FDA-Entscheidung im Zeitraum Februar bis Mai 2013.

Persönlich gehe ich davon aus, dass das Mittel in 2013 die Zulassung erhalten wird und BMS dann sehr, sehr stark dastehen wird.

Sollte ich an diesem Punkt irren, werden zumindest die nächsten 2 oder 3 Jahre allerdings wirklich unschön.

Der kommende König der Könige? – Oder, was an BMS so spannend ist.

Während Eliquis auf die Indikation Herz-Kreislauferkrankungen zielt und damit die eine große Geisel der Menschheit adressiert, ist bei BMS noch ein weit weniger fortgeschrittenes Programm in der Entwicklung, das noch wenig bekannt ist, Fachleute aber elektrisiert hat. Es handelt sich um einen Antikörper gegen das Protein PD-1 (Programmed cell death protein 1). Das Programm trägt derzeit noch den Entwicklungsnamen „BMS-936558”.

Die – mittlerweile durch erste klinische Tests gestützte – Erwartung ist, dass durch die Blockade von PD-1 das Immunsystem in die Lage versetzt werden kann, selbst gegen Krebszellen vorzugehen (Immuntherapie).

In diesem Jahr tritt der Wirkstoff in die Phase III der klinischen Entwicklung ein, die um 2015 zu einer ersten Zulassung, möglicherweise bei Lungenkrebs, führen könnte. Tests in weiteren Krebsarten sind auf dem Weg oder werden demnächst beginnen.

Die bisher generierten Phase II-Daten waren überragend gut.

Ich will an dieser Stelle den Biotech-Analysten Ohad Hammer zitieren:

“The biggest news at this year’s ASCO came from BMS’ (BMY) PD-1 antibody, BMS-936558. This antibody belongs to a new class of antibodies that stimulate patients’ immune system to attack cancer. This approach has been recently validated with another BMS antibody, Yervoy, which was approved last year for melanoma.

Based on results presented at the meeting, BMS-936558 is superior to Yervoy by any measure. In fact, it is probably one of the most promising oncology drugs ever to be tested in humans. It induces tumor shrinkage in a substantial portion of patients, creates an immune response that keeps the disease under control for long periods and it does so with limited side effects. To make things even better, there might be a way to pre-select patients who are more likely to respond to this agent.”

Der Wirkstoff würde im Erfolgsfall mit Sicherheit ein Blockbuster, sehr wahrscheinlich ein Mega-Blockbuster, werden. Das Umsatzpotential liegt langfristig wohl deutlich jenseits der 5 Milliarden Dollar-Marke.

Ein Erfolg von BMS-936558 wäre für das Unternehmen transformativ. BMS hätte in diesem Falle viele Jahre eines schnellen Umsatz- und Gewinnwachstums vor sich, die das Unternehmen (und den Aktienkurs) in eine andere Liga führen würde.

Fazit

BMS macht derzeit aufgrund wichtiger Patentabläufe eine schwierige Phase der Unternehmensentwicklung durch.

Das Management hat das Unternehmen aber gut auf diese Zeit eingestellt und eine attraktive Pipeline aus neuen Produkten aufgebaut, die Stück für Stück die wegfallenden Umsätze ersetzen können.

Meine Kaufentscheidung beruhte im Wesentlichen aber auf meiner Erwartung, dass im nächsten Jahr Eliquis eine umfassende Zulassung erhalten und sich in der Folge zum Marktführer im Bereich der Antikoagulantien entwickeln und dass ab 2015/2016 die Zulassung von BMS-936558 das Unternehmen in eine neue Dimension führen wird.

Mit Eliquis und BMS-936558 hat BMS zwei potentielle Mega-Blockbuster in der Pipeline, die, falls sie beide zugelassen werden, ein Investment zu einem großen Erfolg werden lassen sollten. Ich schätze die Zulassungswahrscheinlichkeit für beide Wirkstoffe als überdurchschnittlich hoch ein, würde mir aber um Eliquis sogar etwas mehr Sorgen machen, als um BMS-936558.

Sollte nur einer dieser beiden Kandidaten die Zulassung erhalten, sollte sich ein Investment noch immer gut bezahlt machen, auch wenn, im Falle einer Nichtzulassung von Eliquis, die Jahre 2013/2014 recht bitter werden dürften.

da gibt es nur eine lösung bei guten biotechs gute produkte einzukaufen!

vielleicht finden die auch berlin auf der landkarte

vielleicht finden die auch berlin auf der landkarte

BMS ist hoch spekulativ. In den USA und Europa verlieren sie die Blockbuster die aus dem Patent laufen, in Emerging Markets sind sie nicht stark aufgestellt.

Die Pipeline zeigt wenig hoffnungsvolle Kandidaten. Wie man hier von Koenig der Koenige sprechen kann ist schwer nachzuvollziehen.

Eliquis wird hoechstens im Premiumbereich Fuss fassen, Plavix und seine Nachahmer haben sich zum Golden Standard entwickelt. Bisher sehen die Daten auch noch nicht so gut aus.

Sollte sich BMS 936558 entwickeln wie geplant ergibt sich ein mittelfristiges Potential mit attraktiven Dimensionen.

Allerdings ist das wohl auch schon eingepreist (KGV).

Bei einem KGV ueber 17 wuerde ich jederzeit Roche, Sanofi und Novartis vorziehen. Alle drei stehen besser da, haben bessere Pipelines und eine gute Emerging Market Praesenz. Roche hat ebenso ein praesentes und potentielles Onkologieportfolio mit grossem Potential.

Ebenso sind alle drei dividendenstark.

Nur meine Meinung, keine Empfehlung.

Die Pipeline zeigt wenig hoffnungsvolle Kandidaten. Wie man hier von Koenig der Koenige sprechen kann ist schwer nachzuvollziehen.

Eliquis wird hoechstens im Premiumbereich Fuss fassen, Plavix und seine Nachahmer haben sich zum Golden Standard entwickelt. Bisher sehen die Daten auch noch nicht so gut aus.

Sollte sich BMS 936558 entwickeln wie geplant ergibt sich ein mittelfristiges Potential mit attraktiven Dimensionen.

Allerdings ist das wohl auch schon eingepreist (KGV).

Bei einem KGV ueber 17 wuerde ich jederzeit Roche, Sanofi und Novartis vorziehen. Alle drei stehen besser da, haben bessere Pipelines und eine gute Emerging Market Praesenz. Roche hat ebenso ein praesentes und potentielles Onkologieportfolio mit grossem Potential.

Ebenso sind alle drei dividendenstark.

Nur meine Meinung, keine Empfehlung.

Das Geld, das mir BMS für meine Medarex-Aktien gegeben hat, habe ich dann doch besser in den BMS-spin-off Mead Johnson investiert.

Offensichtlich wurde heute die Entwicklung von BMS986094 (Hepatitis C) eingestellt. Ein weiterer Megaverlust, das produkt war einlizensiert.

Ich werde diese Aktie nicht anfassen...

Ich werde diese Aktie nicht anfassen...

Antwort auf Beitrag Nr.: 43.532.366 von Norbi2 am 25.08.12 03:50:42Norbi, das ist richtig, das Hep-C-Programm ist jetzt offiziell tot und der goodwill aus der Inhibitex-Übernahme wird größtenteils abgeschrieben:

Biopharmaceutical company Bristol-Myers Squibb Co. (BMY:Quote) will take a charge of $1.8 billion in the third quarter related to the voluntarily discontinued development of an experimental hepatitis C drug. The New York-based drugmaker also "does not expect that the impairment charge will result in future cash expenditures."

The move comes just eight months after Bristol-Myers acquired the BMS-986094 drug through February's $2.5 billion all-cash acquisition of hepatitis C drug developer Inhibitex Inc.

Das kann man natürlich nur als Desaster bezeichnen. Klar war das schon seit dem 01.08.2012 als der Trial gestoppt wurde und einige Leute haben das schon lange vorher, nämlich bereits Anfang Mai, kommen sehen.

Siehe hier:

http://www.thestreet.com/story/11523381/1/bristol-myers-miss…

Das war sicher eine der schlechtesten Akquisitionen aller Zeiten. Eigentlich war da schon nach 3 oder 4 Monaten klar, dass das Geld in den Sand gesetzt worden war.

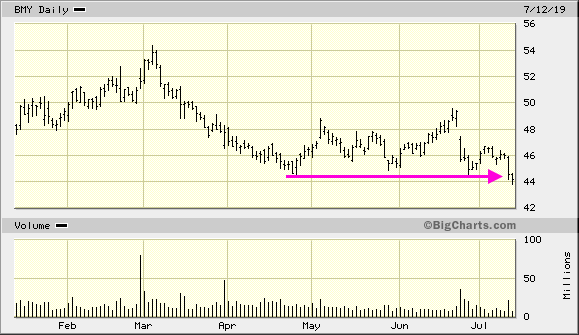

In der Folge hat es dann Anfang August den Kursrutsch von 36 Dollar auf 31,50 gegeben, den ich bei ungefähr 32 zum Einstieg genutzt habe.

Im Hep-C-Bereich ist Gilead nun der große Sieger.

Ich denke aber nicht, dass die Pipeline dadurch signifikant geschwächt ist und ich misstraue dem Hep-C-Hype generell etwas.

Ansonsten:

Zu Eliquis haben wir verschiedene Erwartungen, aber als eventuell kommenden "König der Könige" habe ich BMS 936558 bezeichnet.

Was das KGV angeht: Ich denke nicht, dass BMS 936558 eingepreist ist. Die bereits am Markt befindlichen Produkte + Eliquis haben jede Menge Wachstumspotential auch nach 2015.

Aus meiner Sicht hat BMS eine sehr gute Chance, nach 2015 dynamischer zu wachsen, als bspw. Pfizer oder J&J.

Kommt BMS 936558 noch hinzu, wird sich das natürlich noch viel klarer zeigen.

PS: Danke für die kritischen Kommentare. Ich ahnte schon, dass BMS ziemlich unbeliebt ist.

Mal sehen, ob ich hier recht behalte, mich gegen die allgemeine Meinung zu stellen.

Biopharmaceutical company Bristol-Myers Squibb Co. (BMY:Quote) will take a charge of $1.8 billion in the third quarter related to the voluntarily discontinued development of an experimental hepatitis C drug. The New York-based drugmaker also "does not expect that the impairment charge will result in future cash expenditures."

The move comes just eight months after Bristol-Myers acquired the BMS-986094 drug through February's $2.5 billion all-cash acquisition of hepatitis C drug developer Inhibitex Inc.

Das kann man natürlich nur als Desaster bezeichnen. Klar war das schon seit dem 01.08.2012 als der Trial gestoppt wurde und einige Leute haben das schon lange vorher, nämlich bereits Anfang Mai, kommen sehen.

Siehe hier:

http://www.thestreet.com/story/11523381/1/bristol-myers-miss…

Das war sicher eine der schlechtesten Akquisitionen aller Zeiten. Eigentlich war da schon nach 3 oder 4 Monaten klar, dass das Geld in den Sand gesetzt worden war.

In der Folge hat es dann Anfang August den Kursrutsch von 36 Dollar auf 31,50 gegeben, den ich bei ungefähr 32 zum Einstieg genutzt habe.

Im Hep-C-Bereich ist Gilead nun der große Sieger.

Ich denke aber nicht, dass die Pipeline dadurch signifikant geschwächt ist und ich misstraue dem Hep-C-Hype generell etwas.

Ansonsten:

Zu Eliquis haben wir verschiedene Erwartungen, aber als eventuell kommenden "König der Könige" habe ich BMS 936558 bezeichnet.

Was das KGV angeht: Ich denke nicht, dass BMS 936558 eingepreist ist. Die bereits am Markt befindlichen Produkte + Eliquis haben jede Menge Wachstumspotential auch nach 2015.

Aus meiner Sicht hat BMS eine sehr gute Chance, nach 2015 dynamischer zu wachsen, als bspw. Pfizer oder J&J.

Kommt BMS 936558 noch hinzu, wird sich das natürlich noch viel klarer zeigen.

PS: Danke für die kritischen Kommentare. Ich ahnte schon, dass BMS ziemlich unbeliebt ist.

Mal sehen, ob ich hier recht behalte, mich gegen die allgemeine Meinung zu stellen.

Antwort auf Beitrag Nr.: 43.530.408 von SLGramann am 24.08.12 16:26:47wieviel kaufkraft für biotech firmen sind da verfügbar?

gab es da einen großen lizensabschluss mit biotest?

gab es da einen großen lizensabschluss mit biotest?

SL,

BMS ist nicht unbeliebt. Darum geht es hier nicht. es ist einfach zur Zeit kein interessantes Investment. Ich habe Deinen Thread anfangs so verstanden dass Du relevante Informationen zur Aktie und zum Unternehmen zusammentragen wolltest und wollte Dir dabei helfen.

Nach Deinem PS (Danke für die kritischen Kommentare. Ich ahnte schon, dass BMS ziemlich unbeliebt ist.

Mal sehen, ob ich hier recht behalte, mich gegen die allgemeine Meinung zu stellen.) verstehe ich dass Du versuchen moechtestStimmen zu sammeln die Deine positive Einstellung wiederspiegeln.

Da kann ich Dir nun leider nicht helfen.

Viel Erfolg,

Norbi

BMS ist nicht unbeliebt. Darum geht es hier nicht. es ist einfach zur Zeit kein interessantes Investment. Ich habe Deinen Thread anfangs so verstanden dass Du relevante Informationen zur Aktie und zum Unternehmen zusammentragen wolltest und wollte Dir dabei helfen.

Nach Deinem PS (Danke für die kritischen Kommentare. Ich ahnte schon, dass BMS ziemlich unbeliebt ist.

Mal sehen, ob ich hier recht behalte, mich gegen die allgemeine Meinung zu stellen.) verstehe ich dass Du versuchen moechtestStimmen zu sammeln die Deine positive Einstellung wiederspiegeln.

Da kann ich Dir nun leider nicht helfen.

Viel Erfolg,

Norbi

hier gibt es noch ein paar (meiner Meinung nach brauchbare) Kommentare zu BMY von www.crosscurrentllc.com/Pharma_Research_JO05.html im Verlauf dieses Jahres...

www.crosscurrentllc.com/uploads/BMY_1-9-12_Must_Have_It.pdf

www.crosscurrentllc.com/uploads/BMY_1-26-12_HCV_Pipeline_Wil…

www.crosscurrentllc.com/uploads/BAYN_2-29-12_What_s_Real_and…

www.crosscurrentllc.com/uploads/BEP_1Q_2012_Part_1_Pharma.pd…

www.crosscurrentllc.com/uploads/BMY_4-26-12_HCV_Doesn_t_Seem…

www.crosscurrentllc.com/uploads/6-4-12_ASCO_Part_2_PD-1_T-DM…

www.crosscurrentllc.com/uploads/BMY_6-25-12_Eliquis.pdf

www.crosscurrentllc.com/uploads/BEP_7-13-12.pdf

www.crosscurrentllc.com/uploads/BMY_7-26-12_What_s_between_h…

www.crosscurrentllc.com/uploads/BMY_8-2-12_Oops.pdf

mfg ipollit

www.crosscurrentllc.com/uploads/BMY_1-9-12_Must_Have_It.pdf

www.crosscurrentllc.com/uploads/BMY_1-26-12_HCV_Pipeline_Wil…

www.crosscurrentllc.com/uploads/BAYN_2-29-12_What_s_Real_and…

www.crosscurrentllc.com/uploads/BEP_1Q_2012_Part_1_Pharma.pd…

www.crosscurrentllc.com/uploads/BMY_4-26-12_HCV_Doesn_t_Seem…

www.crosscurrentllc.com/uploads/6-4-12_ASCO_Part_2_PD-1_T-DM…

www.crosscurrentllc.com/uploads/BMY_6-25-12_Eliquis.pdf

www.crosscurrentllc.com/uploads/BEP_7-13-12.pdf

www.crosscurrentllc.com/uploads/BMY_7-26-12_What_s_between_h…

www.crosscurrentllc.com/uploads/BMY_8-2-12_Oops.pdf

mfg ipollit

Antwort auf Beitrag Nr.: 43.533.139 von Norbi2 am 25.08.12 15:12:28Norbi,

kritische Beiträge sind erwünscht.

Ich habe selbst versucht, auch die negativen Seiten darzustellen. Das allein durch Plavix dieses und nächstes Jahr 7 Milliarden Umsatz wegfällt, habe ich geschrieben.

Und dass dieses Jahr mit dem CRL bei Eliquis und dem Inhibitex-Desaster zwei echte Niederlagen kassiert worden, sehe ich ganz genauso.

Dennoch werde ich hier auch weiter die Chancen sehen.

Hallo ipollit,

danke für die Links.

Der Hinweis auf Elotuzumab war wichtig. Ein weiterer potentieller Blockbuster für den Zeitraum beginnend ab 2014/2015.

kritische Beiträge sind erwünscht.

Ich habe selbst versucht, auch die negativen Seiten darzustellen. Das allein durch Plavix dieses und nächstes Jahr 7 Milliarden Umsatz wegfällt, habe ich geschrieben.

Und dass dieses Jahr mit dem CRL bei Eliquis und dem Inhibitex-Desaster zwei echte Niederlagen kassiert worden, sehe ich ganz genauso.

Dennoch werde ich hier auch weiter die Chancen sehen.

Hallo ipollit,

danke für die Links.

Der Hinweis auf Elotuzumab war wichtig. Ein weiterer potentieller Blockbuster für den Zeitraum beginnend ab 2014/2015.

Weil hier bezweifelt wurde, dass Eliquis überhaupt ein wichtiges Produkt werden könnte, habe ich einige Überlegungen zu möglichen künftigen Umsätzen zusammengesucht:

Bernstein's Tim Anderson estimated that the treatment could grab peak sales of $3.7 billion by 2020 while Leerink Swann's Seamus Fernandez has estimated peak Eliquis sales at $4.2 billion in 2017.

The drug, aimed at patients with heart arrhythmia, would have $2.5 billion a year in sales by 2015 if approved, according to Tim Anderson, a Sanford C. Bernstein & Co. analyst in New York.

he drug: Eliquis (apixaban)

The disease: Cardiovascular

The developers: Pfizer and Bristol-Myers Squibb

Peak projections: $4 billion-$4.5 billion

Pfizer entered 2011 as the symbol for Big Pharma's often dysfunctional R&D efforts. However, it is beginning to look as if Pfizer won't end the year in the dog house. Eliquis--better known in research circles as apixaban--is one of the big reasons for the turnaround.

In August, investigators reported that the blood thinner performed extremely well in Phase III for patients suffering from atrial fibrillation. Not only were the outcomes significantly better than the warfarin arm, but the drug also reduced the risk of stroke or systemic embolism 21%, major bleeding 31% and mortality 11%.

One of the reasons why Pfizer looks so good here is that analysts have been forecasting a $9 billion market for a new wave of blood thinners, and a drug that fit apixaban's efficacy and safety profile could snatch half of that.

--------

Man darf natürlich trotzdem skeptisch sein, dass hier ein potentieller Mega-Blockbuster in der Warteschleife hängt, aber dann vertritt man eine Minderheitenposition und wäre eigentlich etwas stärker in der Begründungspflicht, würde ich meinen.

Fakt ist natürlich auch, dass die Zulassung durch die FDA eben noch fehlt und wahrscheinlich erst nächstes Jahr erfolgen kann.

Erfolgt sie nicht, haben wir den Kurs meines Erachtens bei 25 Dollar.

Hier besteht also durchaus ein echtes Risiko, aber eben gerade weil Eliquis so wichtig ist und eigentlich viel Potential hätte.

Eliquis gilt allgemein noch immer als best-in-class Produkt unter den neuen Antikoagulantien (Pradaxa, Xarelto, Eliquis), insbesondere was safety angeht.

Bernstein's Tim Anderson estimated that the treatment could grab peak sales of $3.7 billion by 2020 while Leerink Swann's Seamus Fernandez has estimated peak Eliquis sales at $4.2 billion in 2017.

The drug, aimed at patients with heart arrhythmia, would have $2.5 billion a year in sales by 2015 if approved, according to Tim Anderson, a Sanford C. Bernstein & Co. analyst in New York.

he drug: Eliquis (apixaban)

The disease: Cardiovascular

The developers: Pfizer and Bristol-Myers Squibb

Peak projections: $4 billion-$4.5 billion

Pfizer entered 2011 as the symbol for Big Pharma's often dysfunctional R&D efforts. However, it is beginning to look as if Pfizer won't end the year in the dog house. Eliquis--better known in research circles as apixaban--is one of the big reasons for the turnaround.

In August, investigators reported that the blood thinner performed extremely well in Phase III for patients suffering from atrial fibrillation. Not only were the outcomes significantly better than the warfarin arm, but the drug also reduced the risk of stroke or systemic embolism 21%, major bleeding 31% and mortality 11%.

One of the reasons why Pfizer looks so good here is that analysts have been forecasting a $9 billion market for a new wave of blood thinners, and a drug that fit apixaban's efficacy and safety profile could snatch half of that.

--------

Man darf natürlich trotzdem skeptisch sein, dass hier ein potentieller Mega-Blockbuster in der Warteschleife hängt, aber dann vertritt man eine Minderheitenposition und wäre eigentlich etwas stärker in der Begründungspflicht, würde ich meinen.

Fakt ist natürlich auch, dass die Zulassung durch die FDA eben noch fehlt und wahrscheinlich erst nächstes Jahr erfolgen kann.

Erfolgt sie nicht, haben wir den Kurs meines Erachtens bei 25 Dollar.

Hier besteht also durchaus ein echtes Risiko, aber eben gerade weil Eliquis so wichtig ist und eigentlich viel Potential hätte.

Eliquis gilt allgemein noch immer als best-in-class Produkt unter den neuen Antikoagulantien (Pradaxa, Xarelto, Eliquis), insbesondere was safety angeht.

Begruendungspflicht? Minderheitenmeinung?

Bist Du noch ganz dicht? Ich wollte Dir beim Argumentesammeln helfen und Du kommst mir mit Begruendungspflicht?

Der Markt bewertet die Aktie, nicht WO. DAS ist die Begruendung!

Bist Du noch ganz dicht? Ich wollte Dir beim Argumentesammeln helfen und Du kommst mir mit Begruendungspflicht?

Der Markt bewertet die Aktie, nicht WO. DAS ist die Begruendung!

Mal etwas Positives zu Eliquis. Das CHMP hat der EMA die Zulassung für die Vorsorge gegen Schlaganfall empfohlen.

Damit ist es sehr wahrscheinlich geworden, dass Eliquis Ende des Jahres in der EU die Zulassung für seine eigentliche Indikation erhalten wird und dass das Produkt in 2013 erstmals nennenswerte Umsätze generieren kann.

Weiter fraglich - und wichtiger - ist indes der Status in den USA. Ich hoffe, dass BMS/Pfizer noch in diesem Jahr den neu formulierten Antrag bei der FDA stellen werden.

Friday, September 21, 2012 7:46 am EDT

PRINCETON, N.J. & NEW YORK--(BUSINESS WIRE)--Bristol-Myers Squibb (NYSE: BMY) and Pfizer Inc. (NYSE: PFE) today announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) has adopted a positive opinion recommending that ELIQUIS® (apixaban) be granted approval for the prevention of stroke and systemic embolism in adult patients with nonvalvular atrial fibrillation (NVAF) and one or more risk factors for stroke. The CHMP's positive opinion will now be reviewed by the European Commission, which has the authority to approve medicines for the European Union. The final decision will be applicable to all 27 European Union member states plus Iceland and Norway.

The positive opinion was based on the pivotal ARISTOTLE and AVERROES studies. These clinical studies evaluated apixaban in approximately 24,000 patients with NVAF in the largest clinical trial program conducted to date in this patient population. The landmark ARISTOTLE trial compared apixaban to warfarin, the standard of care, in more than 18,000 NVAF patients, while AVERROES compared apixaban to aspirin in 5,598 NVAF patients who were unsuitable for vitamin K antagonist (VKA) therapy.

Damit ist es sehr wahrscheinlich geworden, dass Eliquis Ende des Jahres in der EU die Zulassung für seine eigentliche Indikation erhalten wird und dass das Produkt in 2013 erstmals nennenswerte Umsätze generieren kann.

Weiter fraglich - und wichtiger - ist indes der Status in den USA. Ich hoffe, dass BMS/Pfizer noch in diesem Jahr den neu formulierten Antrag bei der FDA stellen werden.

Friday, September 21, 2012 7:46 am EDT

PRINCETON, N.J. & NEW YORK--(BUSINESS WIRE)--Bristol-Myers Squibb (NYSE: BMY) and Pfizer Inc. (NYSE: PFE) today announced that the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) has adopted a positive opinion recommending that ELIQUIS® (apixaban) be granted approval for the prevention of stroke and systemic embolism in adult patients with nonvalvular atrial fibrillation (NVAF) and one or more risk factors for stroke. The CHMP's positive opinion will now be reviewed by the European Commission, which has the authority to approve medicines for the European Union. The final decision will be applicable to all 27 European Union member states plus Iceland and Norway.

The positive opinion was based on the pivotal ARISTOTLE and AVERROES studies. These clinical studies evaluated apixaban in approximately 24,000 patients with NVAF in the largest clinical trial program conducted to date in this patient population. The landmark ARISTOTLE trial compared apixaban to warfarin, the standard of care, in more than 18,000 NVAF patients, while AVERROES compared apixaban to aspirin in 5,598 NVAF patients who were unsuitable for vitamin K antagonist (VKA) therapy.

Antwort auf Beitrag Nr.: 43.635.380 von SLGramann am 23.09.12 09:34:15So, der Status von Eliquis in den USA ist nun auch klar. Die NDA wurde neu eingereicht. Am 17.03.2013 wird die Entscheidung fallen.

Die FDA unterzieht den Antrag offensichtlich einem "class II"-Review. Ich kann nicht beurteilen, ob hier überhaupt ein class I review denkbar gewesen wäre. Dass es class II ist, würde ich dennoch als leicht negativ beurteilen.

If new analysis of existing data is required, it could be a class II review and take six months to review. In the case of a Class I response the NDA could be approved as early as October or November of 2012 and a Class II response would extend approval until March or April of 2013.

Wednesday, September 26, 2012 5:01 pm EDT

PRINCETON, N.J. & NEW YORK--(BUSINESS WIRE)--Bristol-Myers Squibb Company(NYSE: BMY) and Pfizer Inc. (NYSE: PFE) today announced that the U.S. Food and Drug Administration (FDA) has acknowledged receipt of the New Drug Application (NDA) resubmission for ELIQUIS® (apixaban) to reduce the risk of stroke and systemic embolism in patients with nonvalvular atrial fibrillation (NVAF). The FDA assigned a new Prescription Drug User Fee Act (PDUFA) goal date of March 17, 2013. The FDA has deemed the resubmission a complete response to its June 22, 2012 Complete Response Letter that requested additional information on data management and verification from the ARISTOTLE trial.

Die FDA unterzieht den Antrag offensichtlich einem "class II"-Review. Ich kann nicht beurteilen, ob hier überhaupt ein class I review denkbar gewesen wäre. Dass es class II ist, würde ich dennoch als leicht negativ beurteilen.

If new analysis of existing data is required, it could be a class II review and take six months to review. In the case of a Class I response the NDA could be approved as early as October or November of 2012 and a Class II response would extend approval until March or April of 2013.

Wednesday, September 26, 2012 5:01 pm EDT

PRINCETON, N.J. & NEW YORK--(BUSINESS WIRE)--Bristol-Myers Squibb Company(NYSE: BMY) and Pfizer Inc. (NYSE: PFE) today announced that the U.S. Food and Drug Administration (FDA) has acknowledged receipt of the New Drug Application (NDA) resubmission for ELIQUIS® (apixaban) to reduce the risk of stroke and systemic embolism in patients with nonvalvular atrial fibrillation (NVAF). The FDA assigned a new Prescription Drug User Fee Act (PDUFA) goal date of March 17, 2013. The FDA has deemed the resubmission a complete response to its June 22, 2012 Complete Response Letter that requested additional information on data management and verification from the ARISTOTLE trial.

Antwort auf Beitrag Nr.: 43.534.231 von SLGramann am 26.08.12 10:14:51von Bloomberg:

Pfizer Inc. (PFE), the world’s largest drugmaker, and Bristol-Myers Squibb Co. (BMY) may have to wait until March for word on whether their experimental blood thinner Eliquis passes U.S. regulatory scrutiny.

The pill was rejected by the Food and Drug Administration in June after the agency said it needed more information from the companies’ existing trials. The two New York-based companies said in a statement today they had given the FDA all the data requested and were assigned a target decision date of March 17.

Revenue from Eliquis has the potential to peak at $4.7 billion if approved, Catherine Arnold, an analyst with Credit Suisse Group AG in New York, estimated in a note this month. The pill, which could replace the drug Warfarin as the standard of care, would also help make up for sales that the companies have lost from their own top-selling blockbusters.

Pfizer Inc. (PFE), the world’s largest drugmaker, and Bristol-Myers Squibb Co. (BMY) may have to wait until March for word on whether their experimental blood thinner Eliquis passes U.S. regulatory scrutiny.

The pill was rejected by the Food and Drug Administration in June after the agency said it needed more information from the companies’ existing trials. The two New York-based companies said in a statement today they had given the FDA all the data requested and were assigned a target decision date of March 17.

Revenue from Eliquis has the potential to peak at $4.7 billion if approved, Catherine Arnold, an analyst with Credit Suisse Group AG in New York, estimated in a note this month. The pill, which could replace the drug Warfarin as the standard of care, would also help make up for sales that the companies have lost from their own top-selling blockbusters.

Gestern hat BMS die Zahlen zum dritten Quartal gemeldet. Mit 41 Cent pro Aktien (non-GAAP) blieben sie leicht unter den Erwartungen des Marktes.

Insgesamt war das Quartal natürlich verheerend. Zum einen mussten 1,8 Milliarden wegen der gescheiterten Inhibitex-Übernahme abgeschrieben werden. Zum anderen ist Plavix nun endgültig Geschichte.

Nachdem der Hauptumsatzbringer von BMS faktisch ausradiert ist, macht es für mich Sinn zu schauen, ob und wie BMS den weggefallenen Umsatz langsam ersetzen kann.

Dazu vergleiche ich die beiden Altprodukte Avapro und Plavix, die in diesem Jahr ihren Patentschutz verloren haben, mit den aus meiner Sicht wichtigsten neuen Produkten auf Quartalsbasis.

Zunächst ist zu konstatieren, dass durch Avapro und Plavix seit dem Q1/2012 wahnsinnige 1,741 Milliarden Dollar Umsatz pro Quartal weggefallen sind.

Im Einzelnen:

Im Saldo sind damit nach dieser Rechnung von Q1 bis Q3/2012 auf Quartalsbasis immer noch 1,579 Milliarden Dollar Umsatzausfall zu beklagen.

Wahr ist aber eben auch, dass diese Zahl mit jedem weiteren Quartal kleiner werden wird – je nachdem, wie sich die „Hoffnungsträger“ tatsächlich entwickeln werden.

Der Tiefpunkt der Entwicklung ist jedenfalls mit dem dritten Quartal 2012 bereits durchschritten worden.

Aus der Übernahme von Amylin habe ich den Umsatz von Bydureon mit aufgenommen, den Umsatz mit Byetta (55 Mio.) hingegen unterschlagen. Dies deshalb, weil ich davon ausgehe, dass Bydureon in der Zukunft ohnehin zunächst auf Kosten von Byetta wachsen und die dortigen Umsätze kanibalisieren wird. Daher gehört Byetta für mich definitiv nicht zu den Hoffnungswerten, deren Beobachtung lohnt. Daher nehme ich Byetta von vornherein nicht in die Tabelle auf.

Wie schon mehrfach geschrieben, wäre die vollständige Zulassung von Eliquis extrem wichtig für ein dynamisches Wachstum durch die Hoffnungsträger. Die nächsten Monate werden insofern über die Dynamik der Entwicklung in 2013 und 2014 entscheiden.

Ich werde diese Tabelle künftig nach jedem Quartalsbericht aktualisieren.

Insgesamt war das Quartal natürlich verheerend. Zum einen mussten 1,8 Milliarden wegen der gescheiterten Inhibitex-Übernahme abgeschrieben werden. Zum anderen ist Plavix nun endgültig Geschichte.

Nachdem der Hauptumsatzbringer von BMS faktisch ausradiert ist, macht es für mich Sinn zu schauen, ob und wie BMS den weggefallenen Umsatz langsam ersetzen kann.

Dazu vergleiche ich die beiden Altprodukte Avapro und Plavix, die in diesem Jahr ihren Patentschutz verloren haben, mit den aus meiner Sicht wichtigsten neuen Produkten auf Quartalsbasis.

Zunächst ist zu konstatieren, dass durch Avapro und Plavix seit dem Q1/2012 wahnsinnige 1,741 Milliarden Dollar Umsatz pro Quartal weggefallen sind.

Im Einzelnen:

Q1/2012 Q2/2012 Q3/2012

Avapro 207 117 95

Plavix 1.693 741 64

Gesamt 1.900 858 159

Umsatzverlust durch Patentabläufe bis Q3/12: -1.741

Was konnte davon bisher durch „Hoffnungsträger“ kompensiert werden?

Q1/2012 Q2/2012 Q3/2012

Baraclude 325 357 346

Erbitux 179 179 173

Sprycel 231 244 263

Yveroy 154 162 179

Orencia 254 290 307

Onglyza 161 172 178

Eliquis 0 1 0

Bydureon 0 0 20

Gesamt 1.305 1.405 1.466

Umsatzgewinne durch “Hoffnungsträger” bis Q3/12: +162

Im Saldo sind damit nach dieser Rechnung von Q1 bis Q3/2012 auf Quartalsbasis immer noch 1,579 Milliarden Dollar Umsatzausfall zu beklagen.

Wahr ist aber eben auch, dass diese Zahl mit jedem weiteren Quartal kleiner werden wird – je nachdem, wie sich die „Hoffnungsträger“ tatsächlich entwickeln werden.

Der Tiefpunkt der Entwicklung ist jedenfalls mit dem dritten Quartal 2012 bereits durchschritten worden.

Aus der Übernahme von Amylin habe ich den Umsatz von Bydureon mit aufgenommen, den Umsatz mit Byetta (55 Mio.) hingegen unterschlagen. Dies deshalb, weil ich davon ausgehe, dass Bydureon in der Zukunft ohnehin zunächst auf Kosten von Byetta wachsen und die dortigen Umsätze kanibalisieren wird. Daher gehört Byetta für mich definitiv nicht zu den Hoffnungswerten, deren Beobachtung lohnt. Daher nehme ich Byetta von vornherein nicht in die Tabelle auf.

Wie schon mehrfach geschrieben, wäre die vollständige Zulassung von Eliquis extrem wichtig für ein dynamisches Wachstum durch die Hoffnungsträger. Die nächsten Monate werden insofern über die Dynamik der Entwicklung in 2013 und 2014 entscheiden.

Ich werde diese Tabelle künftig nach jedem Quartalsbericht aktualisieren.

Im CC, dessen Transcript bei seeking alpha zu finden ist, wurden einige interessante Dinge zur Pipeline gesagt.

Vielleicht am überraschendsten sind die sehr positiven Aussagen zu Forxiga. Von diesem Projekt halte ich eigentlich wenig und bin bisher nicht von einer Zulassung ausgegangen. Das Nebenwirkungsprofil erscheint nämlich sehr problematisch.

Sollten die Behörden aber dennoch eine Zulassung beschließen (EMA Ende 2012?, FDA irgendwann 2014?), muss das Programm natürlich in die Liste „Hoffnungswerte“ aufgenommen werden. Abwarten.

Das Jahr 2013 dürfte durch die erhoffte Zulassung von Eliquis geprägt werden. Hier bleibe ich nervös, auch wenn ich die Zulassungswahrscheinlichkeit für Europa bei 90% und für die USA bei 70% ansiedeln würde.

Ende 2014 dürfte dann der Zulassungsantrag für Elotuzumab folgen. Hier mache ich mir wenig Sorgen. Ich gehe von einem großen Erfolg für dieses Programm aus.

Spätestens ab 2015 wird BMS dann wohl durch die Daten des Anti-PD1 geprägt werden. Hier feuert man aus allen Rohren:

- Phase III Study of BMS-936558 Compared to Docetaxel in Previously Treated Advanced or Metastatic Non-squamous NSCLC

http://www.clinicaltrials.gov/ct2/show?term=BMS-936558&rank=…

Bisher 118 Studienstandorte angemeldet. 574 Patienten sind zu rekrutieren.

- Phase III Study of BMS-936558 Compared to Docetaxel in Previously Treated Advanced or Metastatic Squamous Cell Non-small Cell Lung Cancer (NSCLC)

http://www.clinicaltrials.gov/ct2/show?term=BMS-936558&rank=…

Bisher 118 Studienstandorte angemeldet. 264 Patienten sind zu rekrutieren.

- Phase III Study of BMS-936558 vs. Everolimus in Pre-Treated Advanced Or Metastatic Clear-cell RCC

http://www.clinicaltrials.gov/ct2/show?term=BMS-936558&rank=…

Bisher 147 Studienstandorte angemeldet. 844 Patienten sind zu rekrutieren.

Die Anzahl der Studien mit BMS-936558 (bisher 18) wird in den nächsten Jahren deutlich ansteigen, davon bin ich überzeugt.

Hier jetzt die Auszüge aus dem CC, die ich am wichtigsten fand:

Forxiga (dapagliflozin)

I'll take the dapagliflozin FORXIGA question. First, we, as Lamberto indicated, have had extensive discussions with the FDA in the last several months. Based on evolving data, clinical data of patients who've been treated following extensions, the FDA's benefit-risk profile assessment of dapagliflozin may have shifted in favor of the drug. Our discussions have, therefore, resulted in a well-defined path forward. We don't require starting any new clinical data, but we are planning to resubmit in the middle of 2013 with more clinical data from our extension of some studies, plus the results of some dedicated blood pressure studies with dapagliflozin. This medicine, as you know, offers the triad of potential benefits of glucose control, weight reduction and blood pressure reduction. And we do expect to have an advisory committee and a 6-month review. So resubmission of ongoing clinical studies, another look at the benefit-risk, including probably an advisory committee and a 6-month review. Meanwhile, in Europe, we are encouraged by the progress and do feel that we will have this drug approved in Europe by the end of the year.

Eliquis

Regarding ELIQUIS, we received a positive opinion from the CHMP in Europe, and we are expecting a decision by the end of the year. In Japan, our application is progressing and could lead to a decision by the end of the year. And in the U.S., we now have a new PDUFA date on March 17 from the FDA.

Tim, this is Elliott. On ELIQUIS, we do not expect nor have any indication there will be an advisory committee. As I mentioned on our last investor call at the end of July, we had a set of questions. We felt we could submit answers too. By mid-September, we did that. The official receipt by the FDA of those answers were -- was September 26. I am confident our answers addressed all the questions in front of the FDA. That submission date triggers a potential 6-month review. Therefore, we had announced the PDUFA date of March 17 of '13. I am personally hopeful that the decision can come earlier.

Elotuzumab

Yes, Tony, this is Elliott. I'll take the question on elotuzumab, which is our essentially another immuno-oncology approach, this time, focused on a specific antigen that's relevant to multiple myeloma. We are anxiously awaiting these trials. We're going to have to wait a little longer for the final Phase III, which should come in early 2014 in one study, maybe the second quarter of 2014 in the third study.

Anti PD1 (BMS-936558)

With regard to PD-1, we have a very significant, dedicated, intense team on this in development and with our commercial colleagues for advice and involvement in this. It's a very exciting area in specific and in general. We have just recently launched 3 Phase III studies, 2 are in lung studies. Those -- so patients have started to be dosed in second line squamous cells and second line non-squamous cell. A renal cell carcinoma study has also been started and soon, there will be a comprehensive Phase III program, covering all lines of therapy in melanoma probably to start before the end of the year.

Vielleicht am überraschendsten sind die sehr positiven Aussagen zu Forxiga. Von diesem Projekt halte ich eigentlich wenig und bin bisher nicht von einer Zulassung ausgegangen. Das Nebenwirkungsprofil erscheint nämlich sehr problematisch.

Sollten die Behörden aber dennoch eine Zulassung beschließen (EMA Ende 2012?, FDA irgendwann 2014?), muss das Programm natürlich in die Liste „Hoffnungswerte“ aufgenommen werden. Abwarten.

Das Jahr 2013 dürfte durch die erhoffte Zulassung von Eliquis geprägt werden. Hier bleibe ich nervös, auch wenn ich die Zulassungswahrscheinlichkeit für Europa bei 90% und für die USA bei 70% ansiedeln würde.

Ende 2014 dürfte dann der Zulassungsantrag für Elotuzumab folgen. Hier mache ich mir wenig Sorgen. Ich gehe von einem großen Erfolg für dieses Programm aus.

Spätestens ab 2015 wird BMS dann wohl durch die Daten des Anti-PD1 geprägt werden. Hier feuert man aus allen Rohren:

- Phase III Study of BMS-936558 Compared to Docetaxel in Previously Treated Advanced or Metastatic Non-squamous NSCLC

http://www.clinicaltrials.gov/ct2/show?term=BMS-936558&rank=…

Bisher 118 Studienstandorte angemeldet. 574 Patienten sind zu rekrutieren.

- Phase III Study of BMS-936558 Compared to Docetaxel in Previously Treated Advanced or Metastatic Squamous Cell Non-small Cell Lung Cancer (NSCLC)

http://www.clinicaltrials.gov/ct2/show?term=BMS-936558&rank=…

Bisher 118 Studienstandorte angemeldet. 264 Patienten sind zu rekrutieren.

- Phase III Study of BMS-936558 vs. Everolimus in Pre-Treated Advanced Or Metastatic Clear-cell RCC

http://www.clinicaltrials.gov/ct2/show?term=BMS-936558&rank=…

Bisher 147 Studienstandorte angemeldet. 844 Patienten sind zu rekrutieren.

Die Anzahl der Studien mit BMS-936558 (bisher 18) wird in den nächsten Jahren deutlich ansteigen, davon bin ich überzeugt.

Hier jetzt die Auszüge aus dem CC, die ich am wichtigsten fand:

Forxiga (dapagliflozin)

I'll take the dapagliflozin FORXIGA question. First, we, as Lamberto indicated, have had extensive discussions with the FDA in the last several months. Based on evolving data, clinical data of patients who've been treated following extensions, the FDA's benefit-risk profile assessment of dapagliflozin may have shifted in favor of the drug. Our discussions have, therefore, resulted in a well-defined path forward. We don't require starting any new clinical data, but we are planning to resubmit in the middle of 2013 with more clinical data from our extension of some studies, plus the results of some dedicated blood pressure studies with dapagliflozin. This medicine, as you know, offers the triad of potential benefits of glucose control, weight reduction and blood pressure reduction. And we do expect to have an advisory committee and a 6-month review. So resubmission of ongoing clinical studies, another look at the benefit-risk, including probably an advisory committee and a 6-month review. Meanwhile, in Europe, we are encouraged by the progress and do feel that we will have this drug approved in Europe by the end of the year.

Eliquis

Regarding ELIQUIS, we received a positive opinion from the CHMP in Europe, and we are expecting a decision by the end of the year. In Japan, our application is progressing and could lead to a decision by the end of the year. And in the U.S., we now have a new PDUFA date on March 17 from the FDA.

Tim, this is Elliott. On ELIQUIS, we do not expect nor have any indication there will be an advisory committee. As I mentioned on our last investor call at the end of July, we had a set of questions. We felt we could submit answers too. By mid-September, we did that. The official receipt by the FDA of those answers were -- was September 26. I am confident our answers addressed all the questions in front of the FDA. That submission date triggers a potential 6-month review. Therefore, we had announced the PDUFA date of March 17 of '13. I am personally hopeful that the decision can come earlier.

Elotuzumab

Yes, Tony, this is Elliott. I'll take the question on elotuzumab, which is our essentially another immuno-oncology approach, this time, focused on a specific antigen that's relevant to multiple myeloma. We are anxiously awaiting these trials. We're going to have to wait a little longer for the final Phase III, which should come in early 2014 in one study, maybe the second quarter of 2014 in the third study.

Anti PD1 (BMS-936558)

With regard to PD-1, we have a very significant, dedicated, intense team on this in development and with our commercial colleagues for advice and involvement in this. It's a very exciting area in specific and in general. We have just recently launched 3 Phase III studies, 2 are in lung studies. Those -- so patients have started to be dosed in second line squamous cells and second line non-squamous cell. A renal cell carcinoma study has also been started and soon, there will be a comprehensive Phase III program, covering all lines of therapy in melanoma probably to start before the end of the year.

Zulassung von Forxiga in der EU. Wie gesagt, ich mag den Wirkstoff nicht, aber er hat nun mal in Europa die Zulassung bekommen...

Wednesday, November 14, 2012 11:54 am EST

PRINCETON, N.J. and LONDON--(BUSINESS WIRE)--Bristol-Myers Squibb Company (NYSE: BMY) and AstraZeneca (NYSE: AZN) today announced that the European Commission has approved Forxiga™ (dapagliflozin) tablets for the treatment of type 2 diabetes in the European Union (EU). Forxiga is a selective and reversible inhibitor of sodium-glucose cotransporter 2 (SGLT2) that works independently of insulin to help remove excess glucose from the body, a unique mode of action not seen in any other currently available treatments for type 2 diabetes. This is the first medicine in the new SGLT2 class to gain regulatory approval for the treatment of type 2 diabetes, a disease in which high unmet medical need exists.

http://news.bms.com/press-release/rd-news/forxiga-dapagliflo…

Wednesday, November 14, 2012 11:54 am EST

PRINCETON, N.J. and LONDON--(BUSINESS WIRE)--Bristol-Myers Squibb Company (NYSE: BMY) and AstraZeneca (NYSE: AZN) today announced that the European Commission has approved Forxiga™ (dapagliflozin) tablets for the treatment of type 2 diabetes in the European Union (EU). Forxiga is a selective and reversible inhibitor of sodium-glucose cotransporter 2 (SGLT2) that works independently of insulin to help remove excess glucose from the body, a unique mode of action not seen in any other currently available treatments for type 2 diabetes. This is the first medicine in the new SGLT2 class to gain regulatory approval for the treatment of type 2 diabetes, a disease in which high unmet medical need exists.

http://news.bms.com/press-release/rd-news/forxiga-dapagliflo…

Antwort auf Beitrag Nr.: 43.825.656 von SLGramann am 14.11.12 21:47:55Eine Zusammenfassung von Fierce:

After FDA rejection, Bristol-AstraZeneca team wins EC OK for diabetes drug dapagliflozin

November 15, 2012 | By John Carroll

AstraZeneca ($AZN) and Bristol-Myers Squibb ($BMY) were stiff-armed by the FDA on their application for the SGLT2 diabetes drug dapagliflozin, but European regulators believe the benefits outweighed the risks that pushed the agency to reject the innovative therapy early this year.

The regulatory approval for dapagliflozin by the European Commission--which will soon hit the European market as Forxiga--clears the way for the first of several new sodium-glucose cotransporter 2 inhibitors, which spur the body to flush out glucose in urine, working independently of insulin. In the U.S., regulators and independent experts at the FDA turned thumbs down on dapagliflozin, demanding that the developers produce more data to prove that the cancer cases seen in drug studies didn't portend similar troubles if the drug is allowed to hit the huge and growing diabetes market.

This is good news for AstraZeneca, which has been struggling to overcome its reputation for one of the worst late-stage pipelines in the business. Bristol-Myers Squibb, which has had its own setbacks in the wake of a series of new drug approvals, has its own reasons to cheer the decision. The approval is also likely to raise the spirits of the development teams at Johnson & Johnson ($JNJ, developing canagliflozin), Pfizer ($PFE), a Lilly and Boehringer partnership, Lexicon and others which have their own SGLT2 inhibitors in development.

Analysts had projected peak sales of up to $700 million for dapagliflozin before the FDA handed out its complete response letter. But even with an approval from the European Commission, which came after regulators assessed and accepted the companies' risk management plans, a dark cloud is likely to remain over the drug's commercial prospects without a green light in the U.S.

The plan now is to head back to the FDA in mid-2013 with more data drawn from their drug studies.

"We are looking forward to getting approvals everywhere, and that includes with the FDA," Fred Fiedorek, cardiovascular head at Bristol-Myers, told Reuters.

"Diabetes is a progressive disease that requires a combination of treatment approaches over time," said Lamberto Andreotti, the CEO at Bristol-Myers Squibb. "Forxiga is the first of a new class of type 2 diabetes medication that works independently of insulin and represents a new treatment option for patients and physicians across Europe."

After FDA rejection, Bristol-AstraZeneca team wins EC OK for diabetes drug dapagliflozin

November 15, 2012 | By John Carroll

AstraZeneca ($AZN) and Bristol-Myers Squibb ($BMY) were stiff-armed by the FDA on their application for the SGLT2 diabetes drug dapagliflozin, but European regulators believe the benefits outweighed the risks that pushed the agency to reject the innovative therapy early this year.

The regulatory approval for dapagliflozin by the European Commission--which will soon hit the European market as Forxiga--clears the way for the first of several new sodium-glucose cotransporter 2 inhibitors, which spur the body to flush out glucose in urine, working independently of insulin. In the U.S., regulators and independent experts at the FDA turned thumbs down on dapagliflozin, demanding that the developers produce more data to prove that the cancer cases seen in drug studies didn't portend similar troubles if the drug is allowed to hit the huge and growing diabetes market.

This is good news for AstraZeneca, which has been struggling to overcome its reputation for one of the worst late-stage pipelines in the business. Bristol-Myers Squibb, which has had its own setbacks in the wake of a series of new drug approvals, has its own reasons to cheer the decision. The approval is also likely to raise the spirits of the development teams at Johnson & Johnson ($JNJ, developing canagliflozin), Pfizer ($PFE), a Lilly and Boehringer partnership, Lexicon and others which have their own SGLT2 inhibitors in development.

Analysts had projected peak sales of up to $700 million for dapagliflozin before the FDA handed out its complete response letter. But even with an approval from the European Commission, which came after regulators assessed and accepted the companies' risk management plans, a dark cloud is likely to remain over the drug's commercial prospects without a green light in the U.S.

The plan now is to head back to the FDA in mid-2013 with more data drawn from their drug studies.

"We are looking forward to getting approvals everywhere, and that includes with the FDA," Fred Fiedorek, cardiovascular head at Bristol-Myers, told Reuters.

"Diabetes is a progressive disease that requires a combination of treatment approaches over time," said Lamberto Andreotti, the CEO at Bristol-Myers Squibb. "Forxiga is the first of a new class of type 2 diabetes medication that works independently of insulin and represents a new treatment option for patients and physicians across Europe."

So, die Zulassung für Eliquis in der EU ist nun da.

Nächstes Jahr gehts dann natürlich noch um die wichtigere US-Zulassung.

Pfizer, Bristol get EU nod for blood clot preventer

Tue, Nov 20 2012

By Bill Berkrot

(Reuters) - European health regulators on Tuesday approved an eagerly anticipated blood thinner developed by Bristol-Myers Squibb Co and Pfizer Inc for preventing strokes and blood clots in patients with an irregular heartbeat known as atrial fibrillation, the companies said.

The drug Eliquis, also known as apixaban, is widely considered one of the most important new products for the two U.S. drugmakers, with multibillion-dollar annual sales potential.

The European approval was expected after an advisory panel this year recommended it for atrial fibrillation.

"It's not unexpected, but it's positive to finally get an afib approval under the belt for Eliquis," said MKM Partners analyst Jon Lecroy, who sees annual sales reaching $2 billion by about 2017. "We're looking for a March approval or earlier in the U.S. for the same indication," he added.

The U.S. Food and Drug Administration is expected to decide on the proposed use of the drug in the world's biggest market by March 17, after delaying a decision in June to review more information from clinical trials.

The European Commission approval marks the first regulatory approval for Eliquis for stroke prevention in atrial fibrillation patients in any market, the companies said.

Eliquis belongs to a new class of medicines designed to replace decades old warfarin for preventing blood clots in heart patients and after hip or knee replacement surgery.

It already was approved in 27 European Union countries for prevention of certain blood clots called venous thromboembelisms following elective hip or knee replacement surgery.

But atrial fibrillation, which greatly raises the risk of strokes, is considered by far the largest and most important use for the new drugs, that include Xarelto from Bayer and Johnson & Johnson, and Pradaxa from privately held Boehringer Ingelheim.

Eliquis, like Xarelto, works by inhibiting a protein called Factor Xa that plays a critical role in blood clotting. Pradaxa has a slightly different mechanism of action.

About 6 million people in Europe and another 5.8 million in the United States suffer from atrial fibrillation, the most common form of heart arrhythmia, or irregular heartbeat.

In clinical trials, Eliquis demonstrated superiority over warfarin in reducing the risk of strokes, major bleeding and death.

Warfarin, widely used for more than half a century, is inexpensive and works well, but requires close and regular patient monitoring as well as lifestyle and dietary changes that are not necessary with the newer medicines.

"Patients with atrial fibrillation have a five times greater risk of stroke and there remains a critical public health need for improved treatment options to reduce this risk," Lars Wallentin, director of cardiology at Uppsala Clinical Research Centre and University Hospital in Sweden, said in a statement.

He called Eliquis "an important new treatment option for health care professionals, who now have an oral anticoagulant with superior outcomes versus warfarin."

Wall Street analysts have said that, based on clinical efficacy and safety data, they believe Eliquis will become the dominant player in an estimated $10 billion market for the new blood thinners once it receives U.S. approval.

Pfizer Chief Executive Ian Read, in a statement, said he believes Eliquis "has the potential to transform the standard of care in stroke prevention in nonvalvular atrial fibrillation".

Pfizer shares were up 5 cents at $24.19 and Bristol-Myers shares were up 2 cents at $32.05, in afternoon trading on the New York Stock Exchange.

Nächstes Jahr gehts dann natürlich noch um die wichtigere US-Zulassung.

Pfizer, Bristol get EU nod for blood clot preventer

Tue, Nov 20 2012

By Bill Berkrot

(Reuters) - European health regulators on Tuesday approved an eagerly anticipated blood thinner developed by Bristol-Myers Squibb Co and Pfizer Inc for preventing strokes and blood clots in patients with an irregular heartbeat known as atrial fibrillation, the companies said.

The drug Eliquis, also known as apixaban, is widely considered one of the most important new products for the two U.S. drugmakers, with multibillion-dollar annual sales potential.

The European approval was expected after an advisory panel this year recommended it for atrial fibrillation.

"It's not unexpected, but it's positive to finally get an afib approval under the belt for Eliquis," said MKM Partners analyst Jon Lecroy, who sees annual sales reaching $2 billion by about 2017. "We're looking for a March approval or earlier in the U.S. for the same indication," he added.

The U.S. Food and Drug Administration is expected to decide on the proposed use of the drug in the world's biggest market by March 17, after delaying a decision in June to review more information from clinical trials.

The European Commission approval marks the first regulatory approval for Eliquis for stroke prevention in atrial fibrillation patients in any market, the companies said.

Eliquis belongs to a new class of medicines designed to replace decades old warfarin for preventing blood clots in heart patients and after hip or knee replacement surgery.

It already was approved in 27 European Union countries for prevention of certain blood clots called venous thromboembelisms following elective hip or knee replacement surgery.

But atrial fibrillation, which greatly raises the risk of strokes, is considered by far the largest and most important use for the new drugs, that include Xarelto from Bayer and Johnson & Johnson, and Pradaxa from privately held Boehringer Ingelheim.

Eliquis, like Xarelto, works by inhibiting a protein called Factor Xa that plays a critical role in blood clotting. Pradaxa has a slightly different mechanism of action.

About 6 million people in Europe and another 5.8 million in the United States suffer from atrial fibrillation, the most common form of heart arrhythmia, or irregular heartbeat.

In clinical trials, Eliquis demonstrated superiority over warfarin in reducing the risk of strokes, major bleeding and death.

Warfarin, widely used for more than half a century, is inexpensive and works well, but requires close and regular patient monitoring as well as lifestyle and dietary changes that are not necessary with the newer medicines.

"Patients with atrial fibrillation have a five times greater risk of stroke and there remains a critical public health need for improved treatment options to reduce this risk," Lars Wallentin, director of cardiology at Uppsala Clinical Research Centre and University Hospital in Sweden, said in a statement.

He called Eliquis "an important new treatment option for health care professionals, who now have an oral anticoagulant with superior outcomes versus warfarin."

Wall Street analysts have said that, based on clinical efficacy and safety data, they believe Eliquis will become the dominant player in an estimated $10 billion market for the new blood thinners once it receives U.S. approval.

Pfizer Chief Executive Ian Read, in a statement, said he believes Eliquis "has the potential to transform the standard of care in stroke prevention in nonvalvular atrial fibrillation".

Pfizer shares were up 5 cents at $24.19 and Bristol-Myers shares were up 2 cents at $32.05, in afternoon trading on the New York Stock Exchange.

Bei Seeking Alpha ist ein detailreicher Artikel erschienen, der Chancen und Potentiale von Eliquis auslotet.

Ich finde ihn sehr gut geschrieben und kopiere ihn hier deshalb vollständig rein.

Der Artikel geht mit der allgemeinen Auffassung konform, dass Eliquis seinen Konkurrenten Xarelto und Pradaxa überlegen ist.

Eliquis ist nach allem was man wissen kann "best in class".

Es wird auch klar, wie die Analysten zu ihren recht verschiedenen Umsatzschätzungen für Eliquis kommen (die Bandbreite schwankt ja zwischen 2 und 7 Milliarden Dollar Peak Sales).

Der Markt an sich ist riesig (bis zu 20 Milliarden). Die Frage ist aber, welchen Anteil die Faktor Xa-Hemmer erobern werden und welchen Anteil Eliquis in dieser Wirkstoffklasse erreichen wird.

Hier wird man einfach abwarten müssen. Sicher darf man nicht erwarten, dass die Ärzte jetzt sämtliche Patienten, die auf Warfarin eingestellt sind auf die neuen Präparate umstellen. Vor allem dort nicht, wo die Leute mit Warfarin recht gut zurecht kommen.

Ich gehe daher davon aus, dass die Eliquis-Umsätze verhältnismäßig langsam, dafür aber stetig wohl über die gesamte Patentlaufzeit hinweg immer weiter ansteigen werden.

(Eigentlich unnötig zu wiederholen: Für den großen Durchbruch ist die Zulassung durch die FDA unabdingbar - und daran fehlt es bisher. Im Q1/2013 wird sich insofern das Schicksal von Eliquis entscheiden.)

Eliquis (Apixaban) Approved In Europe - A Blockbuster Opportunity For Bristol-Myers, Pfizer

Yesterday, the European Medicine agency granted approval to Bristol-Myers (BMY) and Pfizer's (PFE) blood thinning drug - Eliquis for the prevention of stroke and systemic embolism in patients with non-valvular atrial fibrillation. Eliquis is still awaiting a US approval, the PDUFA data is set as March 17, 2013. Stroke prevention in atrial fibrillation (SPAF) is a large market and Eliquis is expected to take majority share by virtue of a superior profile compared to competing drugs.

Eliquis which belongs to a class of drugs called Factor Xa inhibitors is a new generation oral anticoagulant / blood thinning drug and is expected to replace warfarin the current gold standard treatment for stroke prevention in atrial fibrillation. Eliquis is to be taken twice daily. Besides Eliquis, two other new generation oral anticoagulants - Bayer's (BAYRY.PK) / Johnson and Johnson's (JNJ) Xarelto (approved in 2011) and Boehringer Ingelheim's Pradaxa (direct thrombin inhibitor, approved in 2010) are also on the market and are vying to replace warfarin.

The clinical data on Eliquis in atrial fibrillation is most impressive, when compared to Xarelto or Pradaxa and looks all set to grab majority market share. You can see a cross trial comparison of Pradaxa, Xarelto and Eliquis here

The Unmet Need in Stroke Prevention in Atrial Fibrillation

Warfarin - The current standard of care has several limitations and would be cannibalized by the new generation oral anti-coagulants which have demonstrated better efficacy and safety when compared to warfarin. A major limitation with warfarin is that patients taking warfarin need to be monitored frequently for their INR control. This is not the case with new generation oral anticoagulants - Pradaxa, Eliquis or Xarelto. The full form of INR is international normalized ratio. The higher the INR, the thinner the blood is. For warfarin to be effective and at the same time avoid bleeding risk, the INR should be between 2.0 and 3.0.