Ölpreise überverkauft: Gründe für den Absturz der Öl-Notierungen - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 24.10.14 09:14:10 von

neuester Beitrag 22.08.19 09:53:05 von

neuester Beitrag 22.08.19 09:53:05 von

Beiträge: 241

ID: 1.201.166

ID: 1.201.166

Aufrufe heute: 0

Gesamt: 111.198

Gesamt: 111.198

Aktive User: 0

ISIN: XC0009677409 · WKN: 967740

82,73

USD

0,00 %

0,00 USD

Letzter Kurs 11.05.24 Lang & Schwarz

Neuigkeiten

10.05.24 · wallstreetONLINE Redaktion |

10.05.24 · dpa-AFX |

10.05.24 · dpa-AFX |

10.05.24 · Shareribs Anzeige |

10.05.24 · BNP Paribas Anzeige |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,2000 | +29,03 | |

| 246,02 | +21,37 | |

| 13,000 | +10,26 | |

| 4,5500 | +9,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,510 | -12,21 | |

| 0,8850 | -14,90 | |

| 0,960 | -15,04 | |

| 12,14 | -16,28 | |

| 5,9460 | -75,48 |

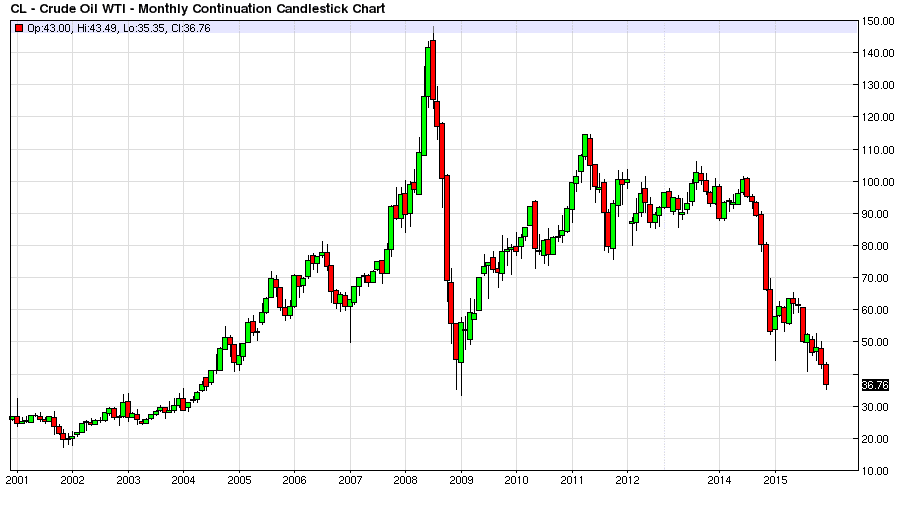

Ein derartiger Kursrutsch bei den Ölpreisen, wie wir ihn aktuell gesehen haben, ist fundamental eigentlich kaum zu begründen, auch wenn die Internationale Energie Agentur (IEA) in ihrem Ölmarktbericht für den Oktober, der am Dienstag herauskam, …

Lesen sie den ganzen Artikel: Ölpreise überverkauft: Gründe für den Absturz der Öl-Notierungen

Lesen sie den ganzen Artikel: Ölpreise überverkauft: Gründe für den Absturz der Öl-Notierungen

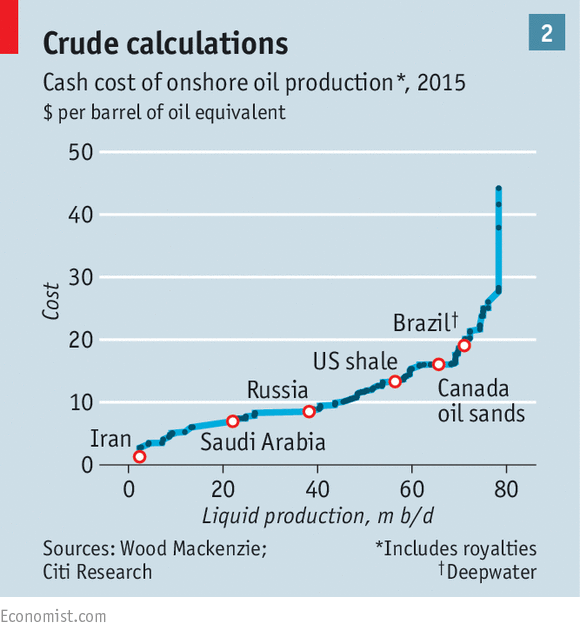

Rohölförderung kostet durchschnittlich 7,70 Dollar pro Barrel

Nach Berechnung der Deutschen Bank könnte der Ölpreis unter 20 Dollar je Barrel fallen, bevor die Ölproduktion in Ländern außerhalb der OPEC in großem Stil nachlassen würde. Die Deutsche Bank hat eine Analyse durchgeführt, um festzustellen, wie sich die Wirtschaftskrise kurz und mittelfristig auf das Ölangebot auswirken könnte. Die Analysten berechneten, bei welchem Rohölpreis neue Projekte, zum Beispiel in großen Wassertiefen vor Angola, Brasilien, Nigeria und im Golf von Mexiko, noch wirtschaftlich sein könnten. Das Ergebnis war erstaunlich: Die reinen Förderkosten (ohne staatliche Förderabgaben an die Förderländer) sind auch in solchen Gebieten relativ gering.

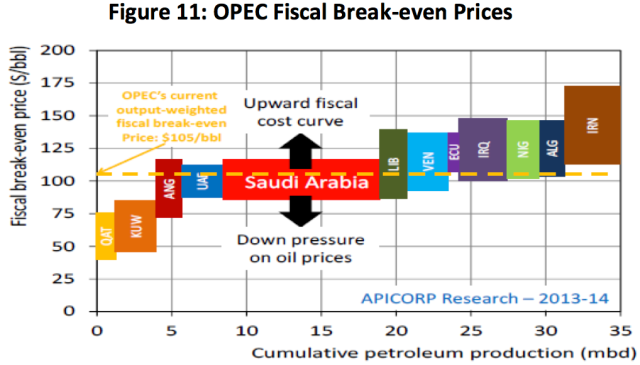

In Russland, der Nordsee und Alaska bewegen sich die Förderkosten um die 15 Dollar je Barrel und liegen damit noch deutlich unter den gegenwärtigen Ölpreisen. Nur bei den kanadischen Ölsanden kam die Deutsche Bank auf Förderkosten von 28 Dollar je Barrel. Sinkt der Ölpreis unter 30 Dollar je Barrel, würde die Förderung von 35 Millionen Tonnen Rohöl unwirtschaftlich, wobei von dieser Menge fast 60 Prozent auf Kanadas Ölsande entfallen würden. Erst bei 20 Dollar je Barrel Förderkosten würden 175 Millionen Tonnen Ölproduktion im Jahr in die roten Zahlen geraten. Nach Berechnungen der Deutschen Bank betragen die durchschnittlichen, reinen Förderkosten, ohne Verzinsung des eingesetzten Kapitals und der staatlichen Abgaben, in den Förderländern 7,70 Dollar je Barrel. Unter diesem Wert liegen die Länder in Nahost, wie die Vereinigten Emirate, Kuwait, Saudi Arabien, Iran, Libyen, Algerien, Irak und Venezuela. Am höchsten sind die Förderkosten in der Nordsee, Alaska, Russland, China und bei den Ölsanden in Kanada.

Nach Berechnung der Deutschen Bank könnte der Ölpreis unter 20 Dollar je Barrel fallen, bevor die Ölproduktion in Ländern außerhalb der OPEC in großem Stil nachlassen würde. Die Deutsche Bank hat eine Analyse durchgeführt, um festzustellen, wie sich die Wirtschaftskrise kurz und mittelfristig auf das Ölangebot auswirken könnte. Die Analysten berechneten, bei welchem Rohölpreis neue Projekte, zum Beispiel in großen Wassertiefen vor Angola, Brasilien, Nigeria und im Golf von Mexiko, noch wirtschaftlich sein könnten. Das Ergebnis war erstaunlich: Die reinen Förderkosten (ohne staatliche Förderabgaben an die Förderländer) sind auch in solchen Gebieten relativ gering.

In Russland, der Nordsee und Alaska bewegen sich die Förderkosten um die 15 Dollar je Barrel und liegen damit noch deutlich unter den gegenwärtigen Ölpreisen. Nur bei den kanadischen Ölsanden kam die Deutsche Bank auf Förderkosten von 28 Dollar je Barrel. Sinkt der Ölpreis unter 30 Dollar je Barrel, würde die Förderung von 35 Millionen Tonnen Rohöl unwirtschaftlich, wobei von dieser Menge fast 60 Prozent auf Kanadas Ölsande entfallen würden. Erst bei 20 Dollar je Barrel Förderkosten würden 175 Millionen Tonnen Ölproduktion im Jahr in die roten Zahlen geraten. Nach Berechnungen der Deutschen Bank betragen die durchschnittlichen, reinen Förderkosten, ohne Verzinsung des eingesetzten Kapitals und der staatlichen Abgaben, in den Förderländern 7,70 Dollar je Barrel. Unter diesem Wert liegen die Länder in Nahost, wie die Vereinigten Emirate, Kuwait, Saudi Arabien, Iran, Libyen, Algerien, Irak und Venezuela. Am höchsten sind die Förderkosten in der Nordsee, Alaska, Russland, China und bei den Ölsanden in Kanada.

Antwort auf Beitrag Nr.: 48.120.896 von conny220 am 24.10.14 09:14:10kannst Du einen Link zu der Quelle geben?

Antwort auf Beitrag Nr.: 48.148.796 von R-BgO am 28.10.14 09:44:52http://www.ed-info.de/edplus/ArtikelAnsichtArc.php?newsId=15…

ps:

Der Artikel ist von 2009 und summiert sich dann womöglich sogar aus noch etwas älteren Daten.

ps:

Der Artikel ist von 2009 und summiert sich dann womöglich sogar aus noch etwas älteren Daten.

Antwort auf Beitrag Nr.: 48.149.447 von Ruehrwerk am 28.10.14 10:38:10Danke, den hatte ich auch gefunden...

Zumindest eine gute Gelegenheit, mal über die Kosten-Struktur nachzudenken.

Zumindest eine gute Gelegenheit, mal über die Kosten-Struktur nachzudenken.

DON'T EXPECT A SIGNIFICANT REDUCTION IN US SHALE PRODUCTION GROWTH

http://www.rystadenergy.com/AboutUs/NewsCenter/PressReleases…October 15, 2014

Author: Bjornar Tonhaugen, VP Oil & Gas Markets

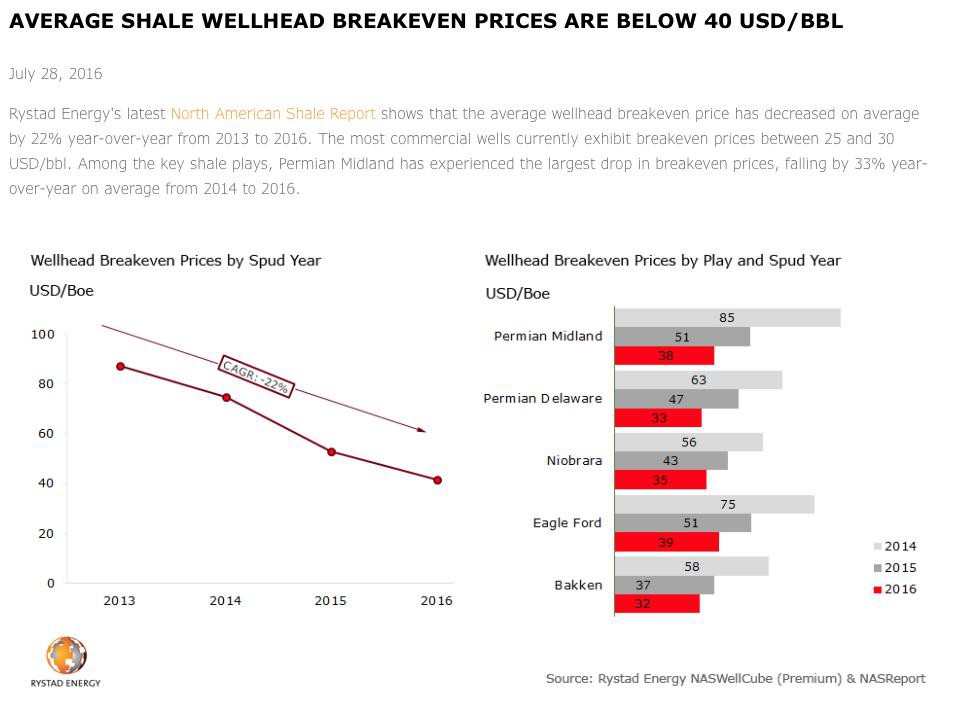

As oil prices are plummeting, the oil market is looking for clues about how low prices can go before we see a response on the supply side. The market’s attention is naturally turning towards OPEC and North American (NAm) shale production, but Rystad Energy’s latest analysis shows that a significant reduction in shale volumes at current prices should not be expected. NAm shale oil output will respond very slowly to a drop in oil prices. Recent history, such as outages in Libya, shows that supply shocks of up to 500 kbbld could be needed to move global oil prices 10 USD/bbl. Rystad Energy’s well-by-well database shows that even if the Brent price drops to 50 USD/bbl, it could take up to 12 months before NAm shale output would drop as much as 500 kbbld. In order to maintain production levels in 2015 at expected exit-2014 levels of 6.4m b/d, Brent-equivalent oil prices can fall to as low as USD 60-65 per barrel (Exhibit 1).

The most robust plays are Eagle Ford and Bakken with no significant volumes at risk with current levels of realized prices. In the Permian however, where supply growth has been the strongest this year, we see that merely about 100 kbbld could be at risk over the next 12 months at current WTI Midland prices (Exhibit 2). The Permian oil-price-spread to Cushing and Brent/LLS has narrowed to -7 USD/bbl with the recent opening of the BridgeTex pipeline. The BridgeTex moves 300 kbbld from Mitchell County to Houston and additional take-away capacity is expected to come online next year. Our analysis shows that NAm shale liquids output has passed 6 MMbbld (including 1.5MMbbld of NGLs) during the third quarter of this year and it grows with a staggering rate of 1.5 MMbbld year-on-year in 2014 and 2015. This growth rate is surprisingly insensitive to oil price fluctuations at current price levels.

In today’s IEA Oil Market Report for October, the call-on-OPEC crude production to theoretically balance the oil market next year was lowered to 29.3 MMbbld vs. September 2014 OPEC crude production of 30.6 MMbbld. Downwards revised world oil demand growth of 1.1 MMbbld year-on-year compares with the UCube supply growth of 1.8 MMbbld for 2015 (Exhibit 3). In other words, markets may be even more oversupplied next year than previously thought. Either oil prices will come down further or a significant cut in supplies to the market has to be made, with the ball now firmly in OPEC’s court.

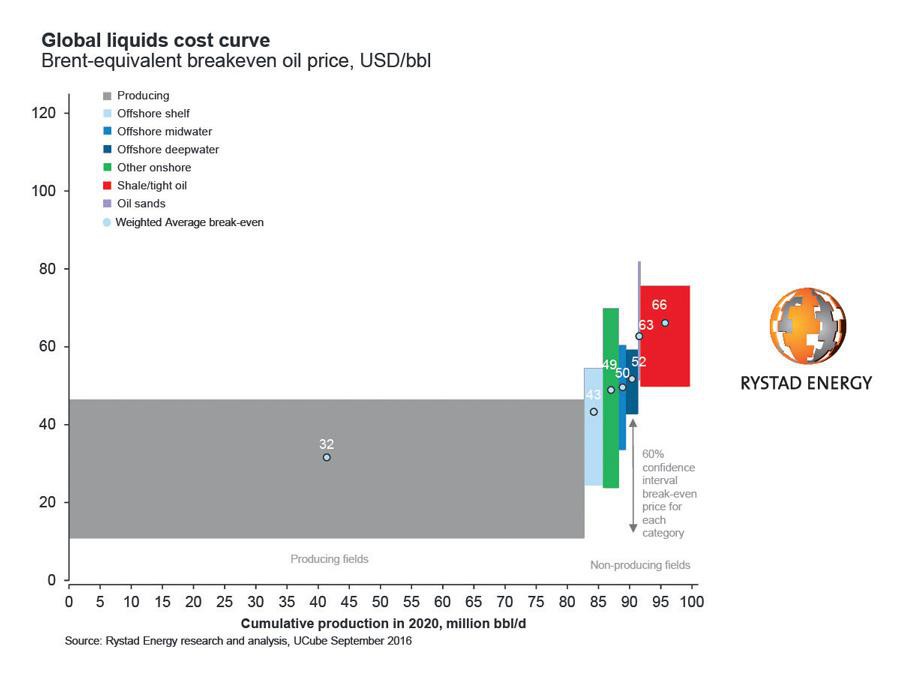

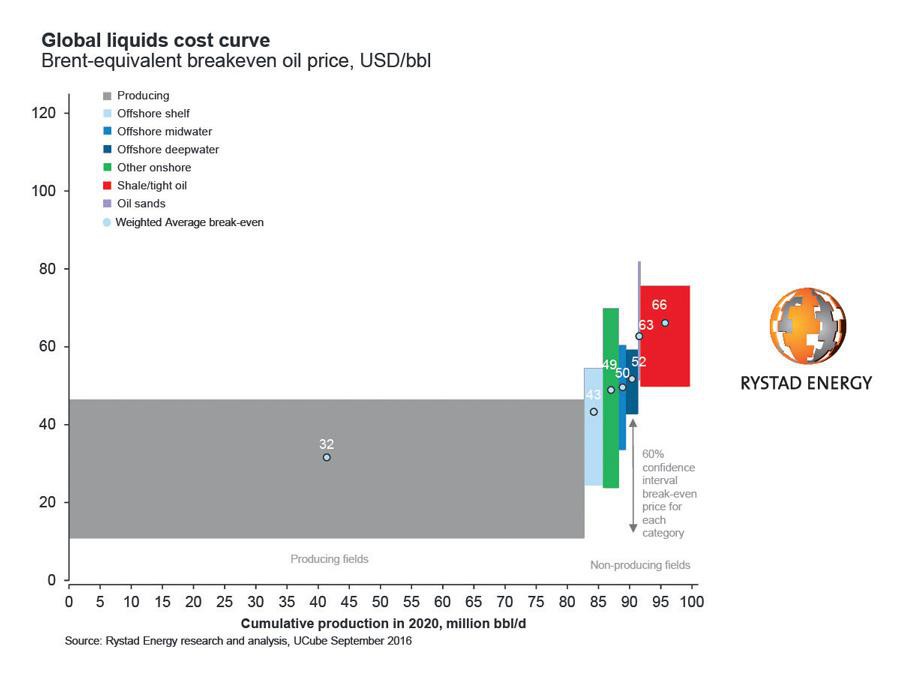

von Rystad kommt auch die cost-curve, die im Moment von allen präsentiert wird:

.GLOBAL LIQUIDS COST CURVE: SHALE IS PUSHING OUT OIL SANDS AND ARCTIC, OFFSHORE IS STILL IN THE RACE June 12, 2014

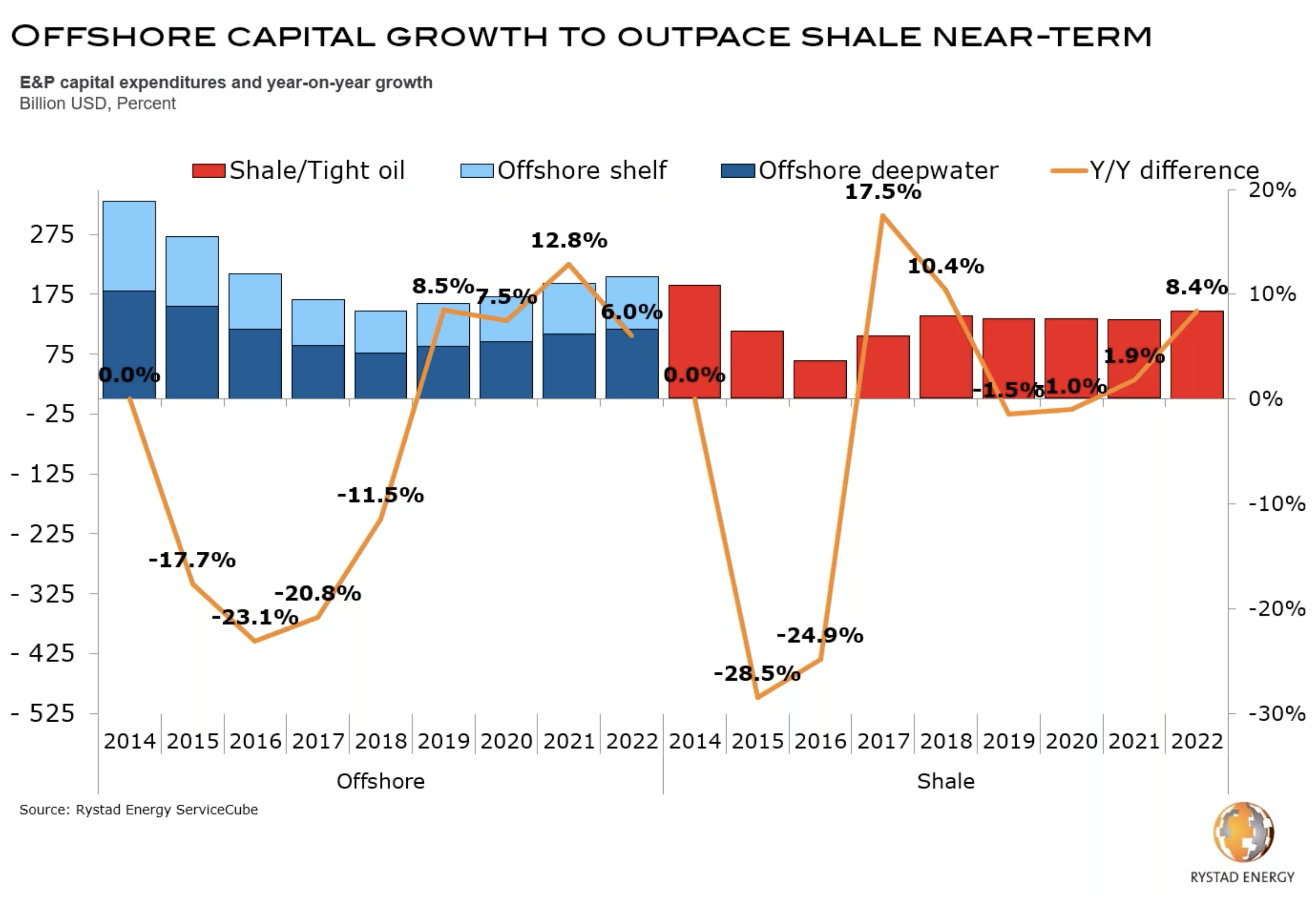

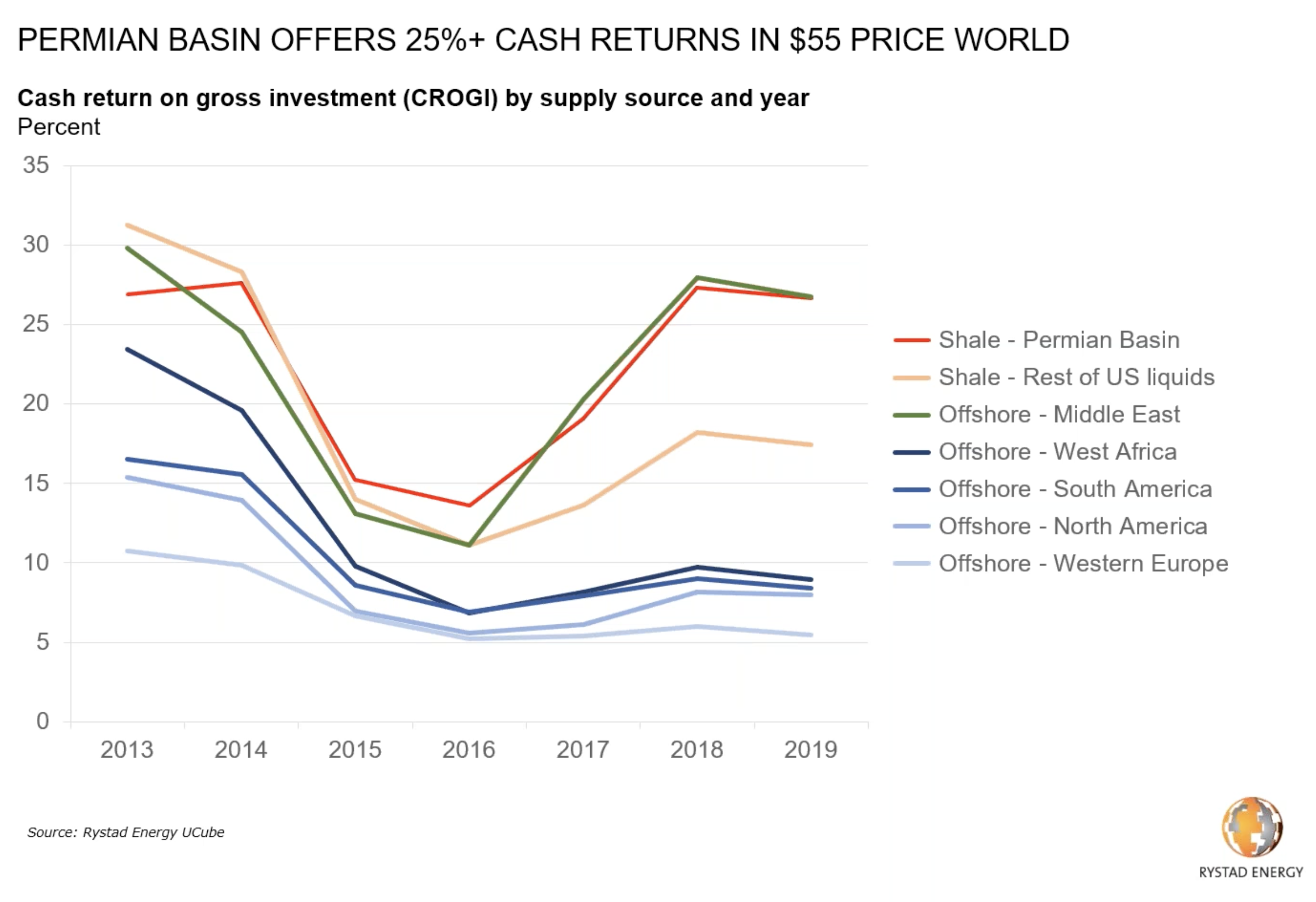

Rystad Energy estimates that oil sands and the Arctic continue to be the most expensive resources, with an average breakeven price of 75-80 $/boe. The attractiveness of the resources has declined over the past years, mainly as a result of the introduction of North American shale. The break-even price of NA shale is estimated at an average of 60-70 $/boe.

Offshore is still in the race with lower break-even prices than U.S. and Canadian shale developments (ultra-deepwater at 55-60 $/boe; deepwater at 50-55 $/boe and offshore shelf at 40-45$/boe).

“Though offshore projects have recently experienced a slowdown in investment levels, this decline is part of a natural cycle, and activity levels are expected to increase again. Both Deepwater and Ultradeepwater are necessary to develop in order to meet our demand outlook of around 100 million boe/d in 2020,” says Espen Erlingsen, Senior Analyst at Rystad Energy.

Rystad Energy’s demand outlook is just above IEA’s demand outlook of 98 million boe/d in 2020.

OIL MARKETS: INCREASING RISK OF OVERSUPPLY DESPITE SUSTAINED ISSUES AROUND OPEC SUPPLY June 18, 2014

IEA on June 17 released its Medium-Term Oil Market Report. Rystad Energy has compared the revised IEA demand outlook with own supply estimates deriving from its global upstream database UCube. The estimates are based on Rystad Energy’s bottom-up analysis of 30,000 fields and 2,500 oil companies in 150 countries.Analysis shows that oil markets have gradually been tightening over the last two years while the outlook indicates a possible inflection point early 2015 and an increasing downward pressure on oil prices for the coming two-three years. The recent geopolitical outages of oil production from the Middle East and North Africa has until now been perfectly balanced by the increased supply of unconventional tight oil from the United States. This predicted easing of the oil markets is partly driven by an assumption of gradual return over the next two years of oil from Libya, Iran, Iraq and Sudan, while US drillers are continuing their activities with unchanged intensity and increased efficiency.

Rystad Energy now forecasts North American tight liquids production to pass 10 million barrels before 2020 making North America a net exporter of seaborne crude and petroleum products within three years from now.

Wenn man die Rystad-Berichte zeitnah gelesen und danach gehandelt hätte, wäre man recht gut gefahren...

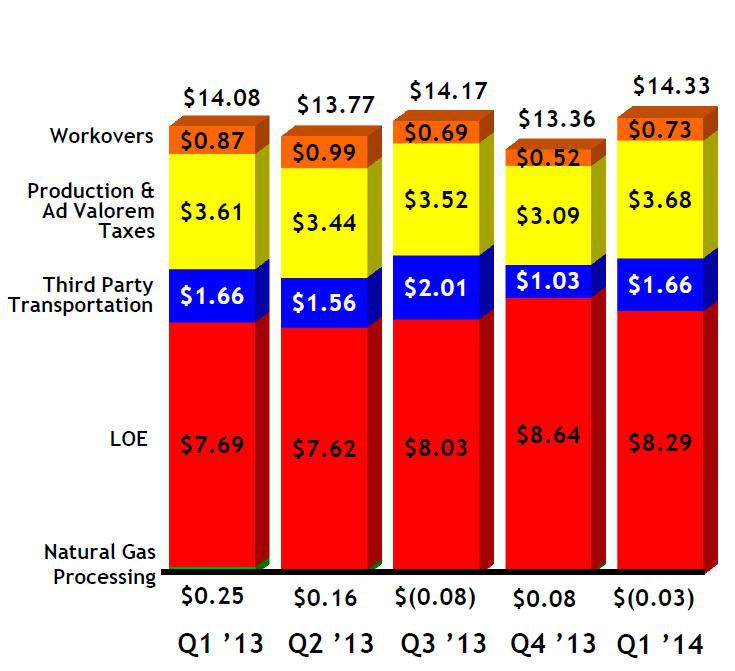

es ist nicht einfach, was über cash-costs zu finden, aber so langsam gelingt es:

z.B. bei Tullow Oil

http://www.tullowoil.com/index.asp?pageid=113

z.B. bei Tullow Oil

http://www.tullowoil.com/index.asp?pageid=113

und von der EIA, allerdings etwas älter

http://www.eia.gov/tools/faqs/faq.cfm?id=367&t=6

Und hier noch eine längere Abhandlung zu break-even, cash-cost, etc.: http://cdn2.hubspot.net/hub/312313/file-374680987-pdf/Whitep…

Versuche mal, ein Zwischenfazit zu ziehen - feed-back welcome:

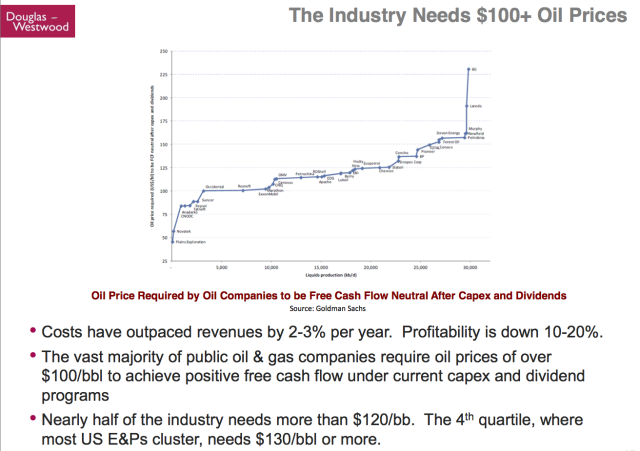

1) der durchschnittliche break-even der Ölproduktion läuft langfristig weiter kontinuierlich nach oben; billlgeres Öl erschöpft sich und wird durch teureres ersetzt (#7)

2) kurzfristig wirkt sich der shale-oil boom in den USA so aus, dass a) die Produktion sehr stark gestiegen ist (#6), wobei die break-even Kosten für nennenswert weiteres Wachstum von heute aus oberhalb von 60$ liegen; erst unter 60$ wird es keinen starken weiteren Ausbau geben

3) die shale-oil Angebotsausweitung hat den Ölmarkt aus dem Gleichgewicht gebracht UND das wird sich möglicherweise 2015-17 noch verschärfen (#8)

4) nochmals verschärfend kommt hinzu, dass -ebenfalls kurz- und evtl. sogar mittelfristig- die break-even Kosten gar nicht so entscheidend sind, sondern die cash-Kosten (so etwas ähnliches habe ich schon im PV-Sektor erlebt): solange man mit der Produktion mehr einnimmt, als die cash-Kosten, verschlechtert sich die Bilanz weniger stark, als wenn man aufgibt. D.h. wenn es ein Überangebot gibt, dann muss der Preis soweit runter, dass die Jungs am oberen Ende der cash-cost-curve das Handtuch werfen, solange bis Angebot und Nachfrage wieder im Gleichgewicht sind.

5) da die cash-costs SEHR viel niedriger (#10, #11) zu sein scheinen, als die break-even costs (was plausibel ist, angesichts der gigantischen CapEx) bedeutet das, dass die Anpassung primär über unterlassene Produktionsausweitung (=gestrichene Investitionen) erfolgen muss; gemildert werden kann das über stärker als erwartet steigende Nachfrage

=> in Summe für mich mal wieder ein klassischer Fall für "markets are made at the margin", mit gewalttätigen Schweinezyklusattributen

bin gespannt, wer lang genug lebt, um den nächsten Boom wieder zu ereichen

Versuche mal, ein Zwischenfazit zu ziehen - feed-back welcome:

1) der durchschnittliche break-even der Ölproduktion läuft langfristig weiter kontinuierlich nach oben; billlgeres Öl erschöpft sich und wird durch teureres ersetzt (#7)

2) kurzfristig wirkt sich der shale-oil boom in den USA so aus, dass a) die Produktion sehr stark gestiegen ist (#6), wobei die break-even Kosten für nennenswert weiteres Wachstum von heute aus oberhalb von 60$ liegen; erst unter 60$ wird es keinen starken weiteren Ausbau geben

3) die shale-oil Angebotsausweitung hat den Ölmarkt aus dem Gleichgewicht gebracht UND das wird sich möglicherweise 2015-17 noch verschärfen (#8)

4) nochmals verschärfend kommt hinzu, dass -ebenfalls kurz- und evtl. sogar mittelfristig- die break-even Kosten gar nicht so entscheidend sind, sondern die cash-Kosten (so etwas ähnliches habe ich schon im PV-Sektor erlebt): solange man mit der Produktion mehr einnimmt, als die cash-Kosten, verschlechtert sich die Bilanz weniger stark, als wenn man aufgibt. D.h. wenn es ein Überangebot gibt, dann muss der Preis soweit runter, dass die Jungs am oberen Ende der cash-cost-curve das Handtuch werfen, solange bis Angebot und Nachfrage wieder im Gleichgewicht sind.

5) da die cash-costs SEHR viel niedriger (#10, #11) zu sein scheinen, als die break-even costs (was plausibel ist, angesichts der gigantischen CapEx) bedeutet das, dass die Anpassung primär über unterlassene Produktionsausweitung (=gestrichene Investitionen) erfolgen muss; gemildert werden kann das über stärker als erwartet steigende Nachfrage

=> in Summe für mich mal wieder ein klassischer Fall für "markets are made at the margin", mit gewalttätigen Schweinezyklusattributen

bin gespannt, wer lang genug lebt, um den nächsten Boom wieder zu ereichen

Schwer zu sagen, ich schätze aber mal der hier möchte u.A. einen Aufschwung der Energiepreise schon noch erleben und wenn an den Gerüchten was dran ist hat er eventuell nicht mehr allzu viel Zeit seinen Patriotismus "bestmöglich" umzusetzen.Wenn´s wahr ist fände man darin auch womöglich aus psychologischer Sicht heraus eine Teilerklärung für verstärkt drängendes unnachgiebiges Vorgehen.

http://www.focus.de/politik/ausland/geruechte-verdichten-sic…

http://www.focus.de/politik/ausland/geruechte-verdichten-sic…

Antwort auf Beitrag Nr.: 48.176.218 von Ruehrwerk am 30.10.14 16:35:46und was soll "der hier" an den Marktverhältnissen machen können?

die russische Förderung einstellen, um denn Markt zu beruhigen?

die russische Förderung einstellen, um denn Markt zu beruhigen?

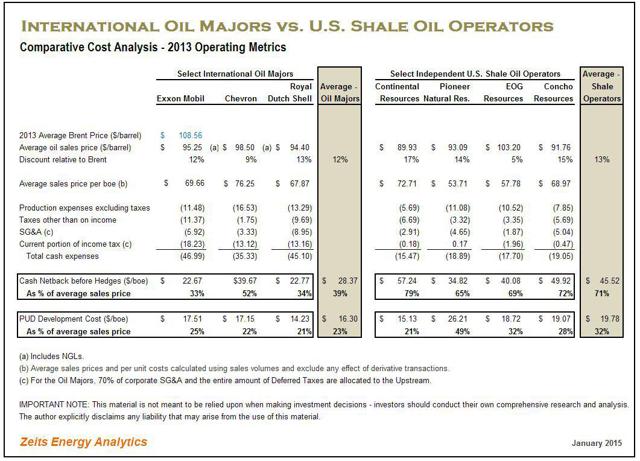

auf der letzten Seite der in #12 verlinkten Quelle findet sich eine Kostenabschätzung für die majors, derzufolge:

production cost rund 15$ per barrel

finding & development cost rund 35$ per barrel

betragen;

stützt die These, dass Marktgleichgewicht über unterlassene Investitionen herzustellen ist

production cost rund 15$ per barrel

finding & development cost rund 35$ per barrel

betragen;

stützt die These, dass Marktgleichgewicht über unterlassene Investitionen herzustellen ist

Antwort auf Beitrag Nr.: 48.193.552 von R-BgO am 01.11.14 11:11:33Apropos Ölpreis: Schon mal was von "Hemisphere Energy" gehört?

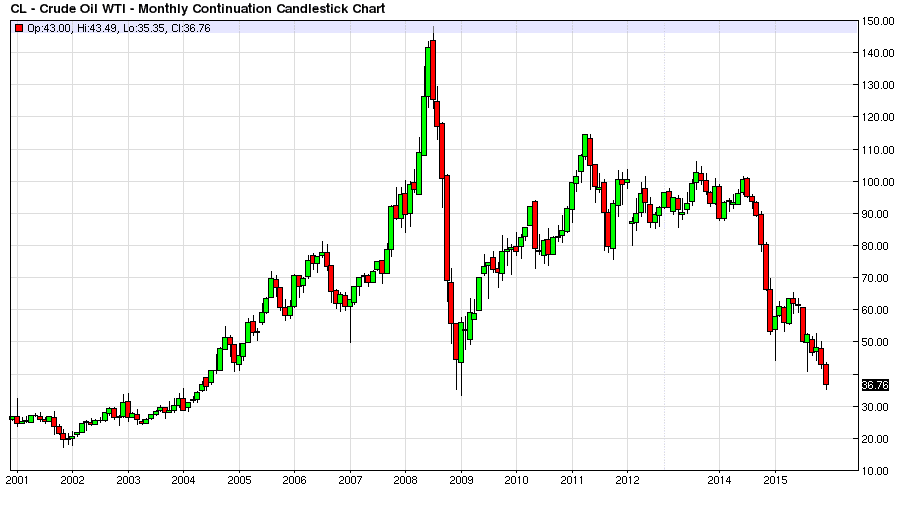

WTI gestern $76,70

Antwort auf Beitrag Nr.: 48.173.359 von R-BgO am 30.10.14 13:27:55

Das stimmt zwar alles, ist meiner bescheidenen Meinung nach aber nur die halbe Miete.

Der Ölpreis ist so wenig ein reiner Marktpreis wie die Ölförderer reine gewinnorientierte Unternehmen sind.

Zwar nicht der größte Teil der Ölförderung, aber immer noch ein entscheidend großer ist in der Hand der Saudis und ihnen nahestehenden sunnitischen Arabern. deswegen tragen sie im amerikanischen die Bezeichnung "swing state" oder "swing producer".

Meine These lautet dementsprechend, dass die Saudis letztlich den Preis bestimmen. Das hatten einige vergessen, und zwar nicht nur us-amerikanische Fracker, sondern vor allem undisziplinierte OPEC-Kartellbrüder. Die Iraner, Venezuelander, Nigerianer etc. sind weder politisch noch religiös mit den Saudis verbündet. Eher im Gegenteil. Sie haben in den letzten Jahren einfach drauf los gepumpt, um ihre Haushalte durch Öleinnahmen zu finanzieren. Das nicht-OPEC Land Rußland im Prinzip ebenso.

Diese Staaten trifft es jetzt auch am härtesten. Die independent oil companies können in der Tat auch mit niedrigeren Ölpreisen weiter profitabel fördern. sie kürzen eben entsprechend stark bei den Investitionen und verdienen weniger.

Was aber soll Venezuela machen? Deren verstaatlichte Ölindustrie kann keine Investitionen kürzen, weil die noch nicht einmal die dringend notwendigen Wartungsarbeiten schaffen. Die sind schon kaputt gespart. Gleichzeitig ist Venezuela nahe der Zahlungsunfähigkeit und das sozialisitische Regime kann auch kaum Sozialausgaben kürzen, ohne eine Rebellion zu riskieren.

Was soll der Iran machen? Durch die Sanktionen haben die nichts mehr außer der Ölindustrie. ihr überdimensionierter Militärapparat verschlingt laufende Kosten, die sie sich nicht leisten können und außerdem gibt der Iran viel Geld für außenpolitische Abentuer aus, z. B. Unterstützung der Hisbollah.

Was soll Putin machen? Auch Rußlands Ölindustrie müßte investieren. Der Staatshaushalt ist aber auf der Basis eines Ölpreises von $100 kalkuliert. Bei $70 fehlen die Milliarden hinten und vorne. Politisch müssen die Krim, andere ukrainische Separatisten sowie weitere Vasallenstaaten alimentiert werden. Alles teure Kostgänger. Der russische Militärapparat dürfte auch sehr teuer sein und die Bevölkerung wird Putin kaum kürzungen der Sozialausgaben verzeihen - solange er durch die sanktionen unnötig hohe preise verursacht.

Was soll Nigeria machen? Dieser Staat ist durch und durch korrupt und wird nur durch die Öleinnahmen notdürftig zusammen gehalten. Dieser Staat ist so herunter gewirtschaftet, dass die sich weder gegen Ebola noch gegen Boko Haram wehren können. Wie groß muß der Frust in der Bevölkerung sein, dass islamistische Terroristen 300 Mädchen entführen können und damit durchkommen?

Diese Staaten haben eben um ihre Ausgaben finanzieren zu können einfach gepumpt, was möglich war und müssen jetzt lernen, dass sie trotzdem sparen müssen.

Zitat von R-BgO: 5) da die cash-costs SEHR viel niedriger (#10, #11) zu sein scheinen, als die break-even costs (was plausibel ist, angesichts der gigantischen CapEx) bedeutet das, dass die Anpassung primär über unterlassene Produktionsausweitung (=gestrichene Investitionen) erfolgen muss; gemildert werden kann das über stärker als erwartet steigende Nachfrage

Das stimmt zwar alles, ist meiner bescheidenen Meinung nach aber nur die halbe Miete.

Der Ölpreis ist so wenig ein reiner Marktpreis wie die Ölförderer reine gewinnorientierte Unternehmen sind.

Zwar nicht der größte Teil der Ölförderung, aber immer noch ein entscheidend großer ist in der Hand der Saudis und ihnen nahestehenden sunnitischen Arabern. deswegen tragen sie im amerikanischen die Bezeichnung "swing state" oder "swing producer".

Meine These lautet dementsprechend, dass die Saudis letztlich den Preis bestimmen. Das hatten einige vergessen, und zwar nicht nur us-amerikanische Fracker, sondern vor allem undisziplinierte OPEC-Kartellbrüder. Die Iraner, Venezuelander, Nigerianer etc. sind weder politisch noch religiös mit den Saudis verbündet. Eher im Gegenteil. Sie haben in den letzten Jahren einfach drauf los gepumpt, um ihre Haushalte durch Öleinnahmen zu finanzieren. Das nicht-OPEC Land Rußland im Prinzip ebenso.

Diese Staaten trifft es jetzt auch am härtesten. Die independent oil companies können in der Tat auch mit niedrigeren Ölpreisen weiter profitabel fördern. sie kürzen eben entsprechend stark bei den Investitionen und verdienen weniger.

Was aber soll Venezuela machen? Deren verstaatlichte Ölindustrie kann keine Investitionen kürzen, weil die noch nicht einmal die dringend notwendigen Wartungsarbeiten schaffen. Die sind schon kaputt gespart. Gleichzeitig ist Venezuela nahe der Zahlungsunfähigkeit und das sozialisitische Regime kann auch kaum Sozialausgaben kürzen, ohne eine Rebellion zu riskieren.

Was soll der Iran machen? Durch die Sanktionen haben die nichts mehr außer der Ölindustrie. ihr überdimensionierter Militärapparat verschlingt laufende Kosten, die sie sich nicht leisten können und außerdem gibt der Iran viel Geld für außenpolitische Abentuer aus, z. B. Unterstützung der Hisbollah.

Was soll Putin machen? Auch Rußlands Ölindustrie müßte investieren. Der Staatshaushalt ist aber auf der Basis eines Ölpreises von $100 kalkuliert. Bei $70 fehlen die Milliarden hinten und vorne. Politisch müssen die Krim, andere ukrainische Separatisten sowie weitere Vasallenstaaten alimentiert werden. Alles teure Kostgänger. Der russische Militärapparat dürfte auch sehr teuer sein und die Bevölkerung wird Putin kaum kürzungen der Sozialausgaben verzeihen - solange er durch die sanktionen unnötig hohe preise verursacht.

Was soll Nigeria machen? Dieser Staat ist durch und durch korrupt und wird nur durch die Öleinnahmen notdürftig zusammen gehalten. Dieser Staat ist so herunter gewirtschaftet, dass die sich weder gegen Ebola noch gegen Boko Haram wehren können. Wie groß muß der Frust in der Bevölkerung sein, dass islamistische Terroristen 300 Mädchen entführen können und damit durchkommen?

Diese Staaten haben eben um ihre Ausgaben finanzieren zu können einfach gepumpt, was möglich war und müssen jetzt lernen, dass sie trotzdem sparen müssen.

Antwort auf Beitrag Nr.: 48.220.186 von DJHLS am 04.11.14 18:40:59Hallo DJHLS,

zuerst einmal danke dafür, dass Du diesen Thread besuchst. Ich denke er wird dadurch besser werden.

Zu Deinem Posting:

Ich widerspreche keiner Deiner Aussagen, frage mich aber was das konkret für Prognosen bedeutet.

In der Tendenz verstehe ich Deine Punkte so, dass seitens Venezuela, Iran, Russland, Nigeria et al. ein enormer Druck besteht, so viel Cash wie möglich zu generieren.

=> d.h. bei den vermuteten geringen cash-Kosten maximale Förderung

=> da die meisten wohl sowieso keinen großen Slack mehr haben, bedeutet das "so viel wie bisher"

=> das wiederum würde ceteris paribus -falls meine obigen Überlegungen stimmen- dazu führen, dass die Einnahmendefizite ggü. den Planungen dieser Länder bereits jetzt gigantisch sind und im Falle eines weiteren Rückgangs auf vielleicht sogar 60$ noch weitaus dramatischer werden könnten; das dürfte dann länderspezifische politische und wirtschaftliche Folgen haben (von denen mir persönlich einige eher gefallen würden)

Besonders interessant wäre aber eine Abschätzung dazu, wie sich die von Dir beschriebenen Investitionsdefizite auswirken, insbesondere wenn sie durch fehlende Einnahmen verschärft werden. Ab wann führen sie zu welchen Rückgängen der Förderkapazität?

zuerst einmal danke dafür, dass Du diesen Thread besuchst. Ich denke er wird dadurch besser werden.

Zu Deinem Posting:

Ich widerspreche keiner Deiner Aussagen, frage mich aber was das konkret für Prognosen bedeutet.

In der Tendenz verstehe ich Deine Punkte so, dass seitens Venezuela, Iran, Russland, Nigeria et al. ein enormer Druck besteht, so viel Cash wie möglich zu generieren.

=> d.h. bei den vermuteten geringen cash-Kosten maximale Förderung

=> da die meisten wohl sowieso keinen großen Slack mehr haben, bedeutet das "so viel wie bisher"

=> das wiederum würde ceteris paribus -falls meine obigen Überlegungen stimmen- dazu führen, dass die Einnahmendefizite ggü. den Planungen dieser Länder bereits jetzt gigantisch sind und im Falle eines weiteren Rückgangs auf vielleicht sogar 60$ noch weitaus dramatischer werden könnten; das dürfte dann länderspezifische politische und wirtschaftliche Folgen haben (von denen mir persönlich einige eher gefallen würden)

Besonders interessant wäre aber eine Abschätzung dazu, wie sich die von Dir beschriebenen Investitionsdefizite auswirken, insbesondere wenn sie durch fehlende Einnahmen verschärft werden. Ab wann führen sie zu welchen Rückgängen der Förderkapazität?

Antwort auf Beitrag Nr.: 48.228.040 von R-BgO am 05.11.14 12:18:35

Erst einmal vielen Dank für den freundlichen Empfang.

Die Förderkosten der Staaten bzw. staatlichen und halbstaatlichen Förderunternehmen sind nicht so transparent wie bei den börsennotierten, privatwirtschaftlichen Unternehmen. Oft wird auch hinzu genommen, was diese Staaten für einen Ölpreis brauchen, um einen ausgeglichenen Haushalt zu erreichen.

Im Falle Nigerias und Venezuelas würde ich von gar nicht mal so niedrigen Cash Costs ausgehen. Mit Rußland und dem Iran teilen sie veraltete Förderanlagen.

Alle diese Länder haben zudem entweder durch Korruption, Krankheiten, sozialistische Bürokratie, Handelsembargo oder Restriktionen den Nachteil, dass ausländische Unternehmen der Öl-Zulieferindustrie entweder nicht liefern dürfen oder Preisaufschläge nehmen.

Was bedeutet das nun?

Ihre Förderung werden die wohl mittelfristig aufrecht erhalten können, aber dann kommt unweigerlich die Klippe. Es ist m. E. weniger ein linearer Abstieg als vielmehr ein starkes Abknicken. Wäre aber Zufall, wenn sich das in Rußland, Iran, Venezuela, Nigeria gleichzeitig ereignen würde. Davon gehe ich nicht aus.

Die Fähigkeit Einnahmeausfälle zu verkraften, dürfte recht unterschiedlich ausgeprägt sein. Für manche dieser Staaten ist dann China die letzte Hoffnung, aber da müssen sie dann ihre Ölprodutkion verpfänden. Außerdem bekommen die Chinesen derzeit das Öl ja auch auf dem Weltmarkt recht billig.

Ich vermute, dass diese Länder nunmehr - wo die Saudis klare Kante gezeigt haben - die ersten sind, die wieder zu Förderdisziplin zurückkehren wollen und Besserung geloben werden. Da sie ihre Förderung erstmal sowieso nicht ausweiten können bzw. eine Schrumpfung nur Frage der Zeit ist, werden sie für engere Quoten plädieren.

Ich könnte mir vorstellen, dass Saudi-Arabien aus disziplinarischen Gründen der Ölhahn erstmal noch weiter aufdreht und den Preis drückt, bis der Schmeerzlevel für Rußland, Iran, Venezuela, Nigeria groß genug ist, damit sie förmlich kapitulieren.

Zitat von R-BgO: Hallo DJHLS,

zuerst einmal danke dafür, dass Du diesen Thread besuchst. Ich denke er wird dadurch besser werden.

Zu Deinem Posting:

Ich widerspreche keiner Deiner Aussagen, frage mich aber was das konkret für Prognosen bedeutet.

In der Tendenz verstehe ich Deine Punkte so, dass seitens Venezuela, Iran, Russland, Nigeria et al. ein enormer Druck besteht, so viel Cash wie möglich zu generieren.

=> d.h. bei den vermuteten geringen cash-Kosten maximale Förderung

=> da die meisten wohl sowieso keinen großen Slack mehr haben, bedeutet das "so viel wie bisher"

=> das wiederum würde ceteris paribus -falls meine obigen Überlegungen stimmen- dazu führen, dass die Einnahmendefizite ggü. den Planungen dieser Länder bereits jetzt gigantisch sind und im Falle eines weiteren Rückgangs auf vielleicht sogar 60$ noch weitaus dramatischer werden könnten; das dürfte dann länderspezifische politische und wirtschaftliche Folgen haben (von denen mir persönlich einige eher gefallen würden)

Besonders interessant wäre aber eine Abschätzung dazu, wie sich die von Dir beschriebenen Investitionsdefizite auswirken, insbesondere wenn sie durch fehlende Einnahmen verschärft werden. Ab wann führen sie zu welchen Rückgängen der Förderkapazität?

Erst einmal vielen Dank für den freundlichen Empfang.

Die Förderkosten der Staaten bzw. staatlichen und halbstaatlichen Förderunternehmen sind nicht so transparent wie bei den börsennotierten, privatwirtschaftlichen Unternehmen. Oft wird auch hinzu genommen, was diese Staaten für einen Ölpreis brauchen, um einen ausgeglichenen Haushalt zu erreichen.

Im Falle Nigerias und Venezuelas würde ich von gar nicht mal so niedrigen Cash Costs ausgehen. Mit Rußland und dem Iran teilen sie veraltete Förderanlagen.

Alle diese Länder haben zudem entweder durch Korruption, Krankheiten, sozialistische Bürokratie, Handelsembargo oder Restriktionen den Nachteil, dass ausländische Unternehmen der Öl-Zulieferindustrie entweder nicht liefern dürfen oder Preisaufschläge nehmen.

Was bedeutet das nun?

Ihre Förderung werden die wohl mittelfristig aufrecht erhalten können, aber dann kommt unweigerlich die Klippe. Es ist m. E. weniger ein linearer Abstieg als vielmehr ein starkes Abknicken. Wäre aber Zufall, wenn sich das in Rußland, Iran, Venezuela, Nigeria gleichzeitig ereignen würde. Davon gehe ich nicht aus.

Die Fähigkeit Einnahmeausfälle zu verkraften, dürfte recht unterschiedlich ausgeprägt sein. Für manche dieser Staaten ist dann China die letzte Hoffnung, aber da müssen sie dann ihre Ölprodutkion verpfänden. Außerdem bekommen die Chinesen derzeit das Öl ja auch auf dem Weltmarkt recht billig.

Ich vermute, dass diese Länder nunmehr - wo die Saudis klare Kante gezeigt haben - die ersten sind, die wieder zu Förderdisziplin zurückkehren wollen und Besserung geloben werden. Da sie ihre Förderung erstmal sowieso nicht ausweiten können bzw. eine Schrumpfung nur Frage der Zeit ist, werden sie für engere Quoten plädieren.

Ich könnte mir vorstellen, dass Saudi-Arabien aus disziplinarischen Gründen der Ölhahn erstmal noch weiter aufdreht und den Preis drückt, bis der Schmeerzlevel für Rußland, Iran, Venezuela, Nigeria groß genug ist, damit sie förmlich kapitulieren.

NA Shale scheint wirklich einer der entscheidenden Faktoren in der globalen Balance zu sein; hier ein bisschen background vom WSJ (schade, dass nix zu cash-Kosten gesagt wird):

Kippt der Fracking-Boom in den USA?

Von RUSSELL GOLD, ERIN AILWORTH und BENOÎT FAUCON VERBINDEN

Donnerstag, 30. Oktober 2014, 19:40 Uhr

Ölbohrungen in der Eagle-Ford-Formation in Texas. Analysten glauben, dass hier ab Preisen zwischen 53 und 65 Dollar wirtschaftlich gearbeitet werden kann. Eddie Seal

Der Einbruch der Ölpreise dürfte dem Förder-Boom in den USA vorerst nichts anhaben. Auch nach dem Einbruch der vergangenen Monate müssten die Preise noch mindestens um 20 Dollar je Barrel fallen, ehe sich die Produktion abkühlt, sagen Branchenexperten. Einige kleinere Förderer könnten allerdings bereits bei einem leichteren Rückgang in ernsthafte Probleme geraten.

Hinter dem rasanten Anstieg der Ölproduktion in den USA, die laut staatlichen Statistiken im Oktober 8,97 Millionen Barrel am Tag erreichte, stehen kleine und mittelgroße Unternehmen – nicht die globalen Energieriesen. Einige dieser Förderfirmen haben sich eine Menge Schulden aufgeladen. Vor wenigen Monaten, als der Ölpreis noch klar über 100 Dollar lag, war das noch leichter zu rechtfertigen.

Am Mittwoch kostete ein Barrel der US-Ölsorte WTI zum Handelsschluss 82,20 Dollar. In einigen Teilen der Vereinigten Staaten, in den wenige Pipelines vorhanden sind, um das Öl zu den Raffinerien zu transportieren, liegen die Preise noch deutlich tiefer. Niedrigere Preise bedeuten für die Förderfirmen, dass sie weniger Geld haben, um ihre Schulden zu bedienen – vor allem dann, wenn die Preise weiter absacken sollten.

Bisher haben die US-Firmen nicht auf den jüngsten Preisrutsch am Ölmarkt reagiert. Die Zahl der Bohrtürme für die Suche nach Öl auf amerikanischem Boden ist seit dem 20. Juni, als die Ölpreise ihren Höhepunkt erreichten, sogar leicht gestiegen.

Die Organisation Erdöl exportierender Staaten (Opec) scheint darauf zu wetten, dass sich das bald ändert. Abdalla Salem el-Badri, Generalsekretär des Ölkartells, prognostizierte am Mittwoch, dass die Hälfte des amerikanischen Öls, das aus Schieferformationen gefrackt wird, auf dem aktuellen Preisniveau unwirtschaftlich sei. Entsprechend erwartet er, dass die Firmen ihre Produktion stoppen werden.

Diese Sichtweise widerspricht den Erwartungen der meisten Analysten in den USA. Diese gehen davon aus, dass die Ölproduktion bei den gegenwärtigen Preisen stabil bleiben kann, da die Firmen effizientere Förderwege gefunden und so die Kosten gesenkt hätten. So hat sich die Menge, die aus jeder neuen Quelle in Südtexas gezapft werden kann, seit 2012 nahezu verdoppelt, wie US-Statistiken zeigen.

80 Prozent der Firmen verdienen bei 80 Dollar Geld

Marianne Kah, Chefvolkswirtin bei Conoco Philipps, sagt, die Ölpreise müssten bis auf 50 Dollar je Barrel fallen um der Ölproduktion in den US-Schieferbecken “wirklich zu schaden”. Laut ihr arbeiten 80 Prozent der Firmen in der US-Schieferbranche – in der Conoco Philips einer der größeren Anbieter ist – bei Preisen zwischen 40 und 80 Dollar je Barrel WTI profitabel.

Jason Bordoff, Direktor am Zentrum für globale Energiepolitik der Columbia Universität, glaubt, dass die Preise noch viel weiter fallen müssten, um ernsthaft Druck auf die boomende Energiebranche auszuüben. “Ich bin nicht sicher, ob 80 Dollar genug sind”, sagt er. „Für einen echten Stresstest bräuchte es wohl Preise von 60 oder 65 Dollar.”

Der Vorstandschef von Occidental Petroleum erklärte vergangene Woche, dass er auch zu den aktuellen Preisen reichlich Fördergelegenheiten im Permian-Becken in West-Texas sehe. “Wir denken, dass es bei 75 Dollar eine Menge wirtschaftlich rentablen Öls gibt”, sagte Steve Chazen in einer Telefonkonferenz mit Analysten. „Ob ich denke, dass es auch bei 50 Dollar viel wirtschaftlich rentables Öl gibt? Nein, denke ich nicht”, fügte er hinzu.

Im Permian-Becken wird so heftig gefördert wie nirgendwo sonst in den USA. Laut einer Studie von Robert W. Bard & Co rechnet sich die Produktion für Firmen dort ab WTI-Preisen von 57 bis 75 Dollar je Barrel. Unternehmen wie Chevron, Apache oder Pioneer Natural Resources dürften ihre Förderung in Permian daher fortsetzen.

Im Bereich der Eagle Ford Formation – einem Fördergebiet weiter im Süden von Texas, wo Marathon Oil, Anadarko Petroleum und EOG Resources bohren – wäre die Produktion laut Baird sogar bei niedrigeren Preisen profitabel. Die Grenze sehen die Analysten hier bei 53 bis 65 Dollar. In der Bakken-Formation in North Dakota liegt der Grenzpreis demnach bei 61 bis 75 Dollar je Barrel. Zu den Unternehmen, die hier Öl fördern, zählen Continental Resources, Whiting Petroleum und Hess.

...

http://www.wsj.de/nachrichten/SB1191213138250241451900458024…

Kippt der Fracking-Boom in den USA?

Von RUSSELL GOLD, ERIN AILWORTH und BENOÎT FAUCON VERBINDEN

Donnerstag, 30. Oktober 2014, 19:40 Uhr

Ölbohrungen in der Eagle-Ford-Formation in Texas. Analysten glauben, dass hier ab Preisen zwischen 53 und 65 Dollar wirtschaftlich gearbeitet werden kann. Eddie Seal

Der Einbruch der Ölpreise dürfte dem Förder-Boom in den USA vorerst nichts anhaben. Auch nach dem Einbruch der vergangenen Monate müssten die Preise noch mindestens um 20 Dollar je Barrel fallen, ehe sich die Produktion abkühlt, sagen Branchenexperten. Einige kleinere Förderer könnten allerdings bereits bei einem leichteren Rückgang in ernsthafte Probleme geraten.

Hinter dem rasanten Anstieg der Ölproduktion in den USA, die laut staatlichen Statistiken im Oktober 8,97 Millionen Barrel am Tag erreichte, stehen kleine und mittelgroße Unternehmen – nicht die globalen Energieriesen. Einige dieser Förderfirmen haben sich eine Menge Schulden aufgeladen. Vor wenigen Monaten, als der Ölpreis noch klar über 100 Dollar lag, war das noch leichter zu rechtfertigen.

Am Mittwoch kostete ein Barrel der US-Ölsorte WTI zum Handelsschluss 82,20 Dollar. In einigen Teilen der Vereinigten Staaten, in den wenige Pipelines vorhanden sind, um das Öl zu den Raffinerien zu transportieren, liegen die Preise noch deutlich tiefer. Niedrigere Preise bedeuten für die Förderfirmen, dass sie weniger Geld haben, um ihre Schulden zu bedienen – vor allem dann, wenn die Preise weiter absacken sollten.

Bisher haben die US-Firmen nicht auf den jüngsten Preisrutsch am Ölmarkt reagiert. Die Zahl der Bohrtürme für die Suche nach Öl auf amerikanischem Boden ist seit dem 20. Juni, als die Ölpreise ihren Höhepunkt erreichten, sogar leicht gestiegen.

Die Organisation Erdöl exportierender Staaten (Opec) scheint darauf zu wetten, dass sich das bald ändert. Abdalla Salem el-Badri, Generalsekretär des Ölkartells, prognostizierte am Mittwoch, dass die Hälfte des amerikanischen Öls, das aus Schieferformationen gefrackt wird, auf dem aktuellen Preisniveau unwirtschaftlich sei. Entsprechend erwartet er, dass die Firmen ihre Produktion stoppen werden.

Diese Sichtweise widerspricht den Erwartungen der meisten Analysten in den USA. Diese gehen davon aus, dass die Ölproduktion bei den gegenwärtigen Preisen stabil bleiben kann, da die Firmen effizientere Förderwege gefunden und so die Kosten gesenkt hätten. So hat sich die Menge, die aus jeder neuen Quelle in Südtexas gezapft werden kann, seit 2012 nahezu verdoppelt, wie US-Statistiken zeigen.

80 Prozent der Firmen verdienen bei 80 Dollar Geld

Marianne Kah, Chefvolkswirtin bei Conoco Philipps, sagt, die Ölpreise müssten bis auf 50 Dollar je Barrel fallen um der Ölproduktion in den US-Schieferbecken “wirklich zu schaden”. Laut ihr arbeiten 80 Prozent der Firmen in der US-Schieferbranche – in der Conoco Philips einer der größeren Anbieter ist – bei Preisen zwischen 40 und 80 Dollar je Barrel WTI profitabel.

Jason Bordoff, Direktor am Zentrum für globale Energiepolitik der Columbia Universität, glaubt, dass die Preise noch viel weiter fallen müssten, um ernsthaft Druck auf die boomende Energiebranche auszuüben. “Ich bin nicht sicher, ob 80 Dollar genug sind”, sagt er. „Für einen echten Stresstest bräuchte es wohl Preise von 60 oder 65 Dollar.”

Der Vorstandschef von Occidental Petroleum erklärte vergangene Woche, dass er auch zu den aktuellen Preisen reichlich Fördergelegenheiten im Permian-Becken in West-Texas sehe. “Wir denken, dass es bei 75 Dollar eine Menge wirtschaftlich rentablen Öls gibt”, sagte Steve Chazen in einer Telefonkonferenz mit Analysten. „Ob ich denke, dass es auch bei 50 Dollar viel wirtschaftlich rentables Öl gibt? Nein, denke ich nicht”, fügte er hinzu.

Im Permian-Becken wird so heftig gefördert wie nirgendwo sonst in den USA. Laut einer Studie von Robert W. Bard & Co rechnet sich die Produktion für Firmen dort ab WTI-Preisen von 57 bis 75 Dollar je Barrel. Unternehmen wie Chevron, Apache oder Pioneer Natural Resources dürften ihre Förderung in Permian daher fortsetzen.

Im Bereich der Eagle Ford Formation – einem Fördergebiet weiter im Süden von Texas, wo Marathon Oil, Anadarko Petroleum und EOG Resources bohren – wäre die Produktion laut Baird sogar bei niedrigeren Preisen profitabel. Die Grenze sehen die Analysten hier bei 53 bis 65 Dollar. In der Bakken-Formation in North Dakota liegt der Grenzpreis demnach bei 61 bis 75 Dollar je Barrel. Zu den Unternehmen, die hier Öl fördern, zählen Continental Resources, Whiting Petroleum und Hess.

...

http://www.wsj.de/nachrichten/SB1191213138250241451900458024…

Antwort auf Beitrag Nr.: 48.242.299 von R-BgO am 06.11.14 13:47:11

Auf Seite 6 findet sich eine interessante Darstellung zur Wirtschaftlichkeit der verschiedenen Basins. Einerseits wird die "after-tax-rate-of-return" (=ATROR) bei einem Preis von $80/bbl angegeben, andererseits der Preis bei dem man noch 10% ATROR schafft.

Demnach liegen wohl alle ihre Plays so, dass dass auch noch mit 50$ klappt und rund die Hälfte sogar bis unter 40$.

Die Renditen bei 80$ möge sich jeder selber ansehen; fange echt an, mich zu fragen, ob das deepwater-offshore nicht richtig weh tun kann.

weiterer Datenpunkt zu NA-Profitabilität

EOG scheint einer der profitabelsten NA-unconventional Player zu sein; sie hatten sehr gute Zahlen gestern und hielten diese Präsentation: http://www.eogresources.com/investors/slides/InvPres_1114.pd…Auf Seite 6 findet sich eine interessante Darstellung zur Wirtschaftlichkeit der verschiedenen Basins. Einerseits wird die "after-tax-rate-of-return" (=ATROR) bei einem Preis von $80/bbl angegeben, andererseits der Preis bei dem man noch 10% ATROR schafft.

Demnach liegen wohl alle ihre Plays so, dass dass auch noch mit 50$ klappt und rund die Hälfte sogar bis unter 40$.

Die Renditen bei 80$ möge sich jeder selber ansehen; fange echt an, mich zu fragen, ob das deepwater-offshore nicht richtig weh tun kann.

und hier noch was von Old Simmons,

das war der Typ, von dem ich 2006 "Twilight in the Desert" gelesen habe, was mein Interesse an der ganzen peak-oil Problematik erst geweckt hat;ist schon was älter und ich werde eine Weile brauchen, bis ich mich durchgekämpft habe, aber bereits auf den ersten Seiten befinden sich Diagramme zu "treshold-economics" für die verschiedenen Fördergebiete, die GROB zu den anderen Punkten passen.

Quelle: http://multibriefs.com/briefs/aesc/WellEconomicsReport.pdf

Antwort auf Beitrag Nr.: 48.265.753 von R-BgO am 09.11.14 10:06:21

With many domestic producers citing profitability down to prices as low as $60, we believe the downside is too great for OPEC to try to force significant production out of the market. The IEA has stated that just 4% of U.S. shale output needs prices above the $80 level to be profitable."

Zitat aus der Quelle:

"Marginal cost support. With many domestic producers citing profitability down to prices as low as $60, we believe the downside is too great for OPEC to try to force significant production out of the market. The IEA has stated that just 4% of U.S. shale output needs prices above the $80 level to be profitable."

SHALE REMAINS ECONOMICAL WITH LOWER PRICES

November 07, 2014Despite a drop in oil prices over the last month, major U.S. shale plays will continue to be profitable on condition that WTI price levels stay above 65 USD/bbl, concludes Rystad Energy through their latest research.

“A key parameter to assess sustainability of the shale oil revolution is breakeven pricing. We find profitable core areas in shale plays like Eagle Ford, Niobrabra and Bakken, with a WTI breakeven oil price of under 50 USD/bbl”, says Espen Erlingsen, Senior Analyst at Rystad Energy.

Eagle Ford (Oil & Condensate), Niobrara (Wattenberg) and Bakken (ND) contribute to about 50% of total North American shale liquid production, and make up a 60 BUSD in yearly investment.

Rystad Energy research estimates the average breakeven price for more than 1,500 different acreage positions. Key inputs are well costs and liquid content reported by companies and well performances reported by state authorities.

http://www.rystadenergy.com/AboutUs/NewsCenter/PressReleases…

=>sie sind etwas skeptischer als die IEA

Wenn ich die ganzen Angaben zu break-even Preisen lese, frage ich mich mit welchen Annahmen die jeweils gerechnet sind:

-Kapitalkosten?

-Output je Quelle und zeitlicher Verlauf?

-Kostenentwicklung über den Zeitraum der Ausbeutung einer Quelle?

Ich denke, dass man durch Verschieben dieser Annahmen recht unterschiedliche break-even Preise für ein und dieselbe Quelle ermitteln kann...

Hat mal jemand so eine break-even Kostenermittlung en detail gesehen/gefunden?

-Kapitalkosten?

-Output je Quelle und zeitlicher Verlauf?

-Kostenentwicklung über den Zeitraum der Ausbeutung einer Quelle?

Ich denke, dass man durch Verschieben dieser Annahmen recht unterschiedliche break-even Preise für ein und dieselbe Quelle ermitteln kann...

Hat mal jemand so eine break-even Kostenermittlung en detail gesehen/gefunden?

Falling Crude Prices to Slow Midcontinent Production Growth

Midcontinent production is still rising, but lower prices will greatly reduce next year's growth.New York, NY (PRWEB) November 11, 2014

NYC-based PIRA Energy Group believes that falling crude prices will slow midcontinent production growth. In the U.S., the stock excess versus last year increased and with a significant draw last year, the commercial excess should grow even more for the week of November 7. In Japan, crude runs fell, imports rose and stocks built. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

Falling Crude Prices to Slow Midcontinent Production Growth

Crude prices plunged in October, with Brent falling nearly $10/Bbl and WTI ending the month below $80. Midcontinent differentials were little changed, except for those in the Permian Basin, where new pipeline capacity allowed prices to rebound from deep third quarter discounts. Midcontinent production is still rising, but lower prices will greatly reduce next year's growth.

Creeping Excess Storage

A look back at the most recent month of DOE weekly data shows a significantly smaller stock draw, compared to the same month last year, in spite of demand being up, year-on-year. A 630 MB/D difference in U.S. commercial stock change is a reflection of a global imbalance of supply over demand, this year compared to last year, of over 1 MMB/D. Far from being a mystery, this imbalance is apparent in stocks around the world. For winter, we expect the surplus to manifest itself in smaller draws, which will be reflected in a creeping stock excess. Come the spring, this surplus will appear as higher outright inventory levels. For this week, the stock excess versus last year increased to 15.4 million barrels, and with a significant draw last year, the commercial excess should grow even more for the week of November 7.

Japanese Crude Runs Fall, Imports Rise, Stocks Build

Crude runs eased to their lowest level since early July. Crude imports rose such that stocks built. Gasoline and gasoil demands were modestly changed and both product stocks drew, with the biggest draw being for gasoil. Kerosene demand was relatively strong and stocks posted their first seasonal draw. Refining margins are better with all the major product cracks firming.

Medium-Term Crude and Gas Price Outlooks Revised Down

Many of the bearish guideposts for our low case have emerged in the past six months. In the absence of new supply disruptions, we are likely to see prices at or below current levels for the next several years. We still believe that demand growth will return to a trend of 1.2 MMB/D, and combined with high-cost project cuts, this will lead to strengthening prices later in the decade. In the case of North American natural gas, the extremely strong growth in supply, even at sub-$4 prices and declining rig counts, suggests that prices are likely to stay lower for longer. Those changes, coupled with a weaker outlook for global gas demand growth, have led to reductions in the European and Asian gas outlooks as well.

U.S. LPG Stocks Remain Stubbornly High

Last week, U.S. propane inventories posted their second draw this heating season. The relatively small draw was influenced by a decline in both imports and in apparent demand. Inventories ended the week at 77.7 MMB, while the surplus expanded to 18.4 million barrels as the year ago withdrawal of 2.5 MMB stood much higher than the recent one. High U.S. stocks will ultimately need to clear by export. National LPG stocks are now well poised to both supply the harshest of winters and an increasing export market. Weaker prices relative to export destinations will be necessary for exports to increase.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

mal 'ne kleine Übersicht zu Informations-Quellen

z.B. Researchfirmen

http://www.rystadenergy.com/AboutUs/NewsCenter/press-release…

http://www.pira.com/news-press/pira-energy-news

http://www.hartenergy.com/News/

Reports/Studien

http://www.postcarbon.org/wp-content/uploads/2014/10/Drillin…

http://multibriefs.com/briefs/aesc/WellEconomicsReport.pdf

How $80 oil postpones the floater recovery

(neu von Rystad: http://www.rystadenergy.com/AboutUs/NewsCenter/Newsletters/O…)The outlook for the floater market, before the substantial oil price drop, reflects a short-term oversupply due to a massive fleet increase combined with lowered demand growth rates. In September 2014 we saw market fundamentals suggesting a recovery for the floater market by late 2016, shown by the implied utilization increase post-2016 (Figure 1).

With the past month’s oil price fall to around 80 USD/bbl, a key question remains pivotal for the industry; how will this drop affect the market balance ahead, and what happens to the anticipated market recovery?

- The September demand and supply scenario with a Brent price of 105 USD/bbl – Late 2016 Recovery

The floater demand has seen an average annual growth rate of 9% from 2010-2013. However, due to existing market conditions with E&P companies delaying and cancelling projects, we expect a slowdown in the floater demand growth to 4% from 2013-2016. On the supply side we do not see the same slowdown as numerous floater newbuild deliveries are expected during the same period. The result is a period, where implied gross utilization decreases (Figure 1) and we see challenging market conditions for drillers with limited contract coverage. Reaching late 2016 however, fundamentals point towards a market recovery with average annual demand growth rates again reaching 9% towards 2020. The rig demand growth recovery is supported by the necessity of offshore drilling to bring new volumes into an economy which still grows its oil consumption, and where offshore is still an important contributor.

- The Sustained $80 Oil Price Scenario – Oversupply Could Lead to Attrition

If the oil price stabilizes at 80 USD/bbl, we anticipate halved short- and long-term average annual demand growth rates compared to the September scenario; 2% during 2013-2016, and 4% for 2016-2020 respectively. In the sustained $80 Oil Price Scenario, the short term effects will be related to an immediate drop /sustained low level of exploration drilling. Medium- to long- term we anticipate high breakeven projects (those with breakeven prices above 80 USD/bbl) to be delayed or cancelled, of which 50% of the floater demand at risk is located in deepwater areas of Brazil and West Africa. The effects of the above mentioned development in floater demand will create further downwards pressure on implied gross utilization: from an anticipated utilization of around 80-90% in our September view, to a utilization level of around 70-75% (Figure 2). Adding to this, and as a direct reaction to falling utilization levels, we could see increased fleet attrition. This would in turn help the recovery of the market and reduce the negative effects of the lower oil price on utilization levels. However, little doubt remains that a sustained $80 oil price will have significant negative effects on the markets, and that drillers will have to be even more patient in their wait for better days.

Antwort auf Beitrag Nr.: 48.318.727 von R-BgO am 14.11.14 10:44:15Die 64.000 Euro-Frage ist, wieviel vom zweiten Szenario bereits in den aktuellen Preisen von Seadrill & Co. eingearbeitet ist...

100%?

50%?

oder sogar 200%?

100%?

50%?

oder sogar 200%?

Shale Drillers Idle Rigs From Texas to Utah as Oil Rout Deepens

http://washpost.bloomberg.com/Story?docId=1376-NENCZ46TTDSI0…Lynn DoanNov 07, 2014 8:00 pm ET

Nov. 8 (Bloomberg) -- The shale-oil drilling boom in the U.S. is showing early signs of cracking.

Rigs targeting oil sank by 14 to 1,568 this week, the lowest since Aug. 22, Baker Hughes Inc. said yesterday. The Eagle Ford shale formation in south Texas lost the most, dropping nine to 197. The nation’s oil rig count is down from a peak of 1,609 on Oct. 10.

Drillers are slowing down as crude prices tumbled 24 percent in the past four months. Transocean Ltd. said yesterday that its earnings would take a hit by a drop in fees and demand for its rigs. The slide threatens to curb a production boom in U.S. shale formations that has helped bring prices at the pump below $3 a gallon for the first time since 2010 and shrink the nation’s dependence on foreign oil imports.

“We are officially seeing the slowdown in oil drilling,” James Williams, president of energy consulting company WTRG Economics, said by telephone from London, Arkansas, yesterday. “There’s no doubt about it now. We’re already down 49 rigs since the peak in October. It’ll have fallen by more than 100 rigs by the end of year.”

...

Chesapeake, EOG

Executives at several large U.S. shale producers, including Chesapeake Energy Corp. and EOG Resources Inc., have vowed to maintain or even raise production as they reported earnings this week. They say their success in bringing down costs means they can make money even if prices slump further.

The oil rig count will drop to 1,325 by the middle of next year amid lower prices, Genscape Inc., an energy data company based in Louisville, Kentucky, said in a report Nov. 6.

Drillers from Apache Corp. to Continental Resources Inc. have said this week that they’re laying down rigs in some oil plays.

Transocean, owner of the biggest fleet of deep-water drilling rigs, is delaying the release of its third-quarter results after saying its earnings would be hit by $2.76 billion in charges from a decline in the value of its contracts drilling business and a drop in rig-use fees. The company had been scheduled to report earnings yesterday.

Transocean’s competitors will probably have to take similar measures as “this is going to be an industry wide phenomenon,” Goldman Sachs Group Inc. said in a research note yesterday.

Self-sufficient

While the drop in oil prices limits spending in shale plays, production will continue to boom next year and North America may become self-sufficient in oil by 2016, Per Magnus Nysveen, head of analysis for Oslo-based consulting company Rystad Energy AS, said by e-mail yesterday. Liquid output from North American shale will rise to 6.5 million barrels a day in December and to 12 million barrels by 2020, he said.

U.S. oil production climbed 2,000 barrels a day in the week ended Oct. 31 to 8.972 million, the highest level in at least three decades, Energy Information Administration data show.

WTI futures are still a “long way off” from rebounding, said Mike Wittner, the head of oil market research at Societe Generale SA.

“The market needs to see much more significant reductions in the rig count on a steady, sustained basis for it to have any impact on production and prices,” he said by telephone from New York yesterday. “Growth is so strong now that it’s going to take a long time and many months for it to actually peter out and turn into negative growth.”

...

Was die breakeven cost für die shale plays angeht, sind sich die analysten offenbar sehr uneinig und es bestehen zwischen den einzelnen Regionen sehr große Unterschiede:

http://www.reuters.com/article/2014/10/23/idUSL3N0SH5N220141…

http://www.reuters.com/article/2014/10/23/idUSL3N0SH5N220141…

Und noch mehr Lesestoff: http://snbchf.com/global-macro/shale-oil-oil-sands/

Ich habe hier nicht alles mitgelesen.

Hat schon jemand die Möglichkeit aufgezeigt, dass es sich hier um eine politisch gesteuerte Preisbildung handeln könnte.

Ende der 80er haben die USA den Ölpreis als politische Waffe eingesetzt.

Die Russische Wirtschaft ist damals bei Preisen von ca. 10 $/Fass zusasmmengebrochen.

Nachträglich wurde eine politische Einflussnahme auf einige Förderländer (u.a. Saudi-Arabien) eingeräumt.

Der aktuell kritische Punkt für die russische Wirtschaft soll bei ca. 70 $ liegen.

Hat schon jemand die Möglichkeit aufgezeigt, dass es sich hier um eine politisch gesteuerte Preisbildung handeln könnte.

Ende der 80er haben die USA den Ölpreis als politische Waffe eingesetzt.

Die Russische Wirtschaft ist damals bei Preisen von ca. 10 $/Fass zusasmmengebrochen.

Nachträglich wurde eine politische Einflussnahme auf einige Förderländer (u.a. Saudi-Arabien) eingeräumt.

Der aktuell kritische Punkt für die russische Wirtschaft soll bei ca. 70 $ liegen.

Antwort auf Beitrag Nr.: 48.320.479 von Gataulin am 14.11.14 13:03:46an die Theorie glaube ich persönlich eher nicht;

wenn überhaupt, dann könnte es m.E. nur dadurch versucht werden, dass man Saudi Arabien davon abhält, seine Förderung zu senken und so Nachfrage und Angebot ins Gleichgewicht zu bringen;

gleichzeitig würde aber genau damit all die geschädigt, die ohne eine solche Intervention profitabel investieren wollten/würden

wenn das also von amerikanischen Politikern betrieben würde, dann würden die in großem Umfang ihre eigenen Konstituenten schädigen...

plausibler scheinen mir da Überlegungen, dass die Saudis ihren Marktanteil halten wollen, oder ganz schnöde einfach Geld brauchen und deswegen nicht senken;

jedenfalls wird -wenn keiner aus anderen Gründen zurückzieht- das Gleichgewicht im Markt am Ende schön kapitalistisch dadurch hergestellt, dass alle rausfliegen die sich das Mitspielen nicht mehr leisten können; Schweinezyklus pur

(und wenn dabei ein paar Russen oder Iraner oder Venezolaner auf der Strecke bleiben, umso besser; ist für mich persönlich ein Bonusstückchen)

wenn überhaupt, dann könnte es m.E. nur dadurch versucht werden, dass man Saudi Arabien davon abhält, seine Förderung zu senken und so Nachfrage und Angebot ins Gleichgewicht zu bringen;

gleichzeitig würde aber genau damit all die geschädigt, die ohne eine solche Intervention profitabel investieren wollten/würden

wenn das also von amerikanischen Politikern betrieben würde, dann würden die in großem Umfang ihre eigenen Konstituenten schädigen...

plausibler scheinen mir da Überlegungen, dass die Saudis ihren Marktanteil halten wollen, oder ganz schnöde einfach Geld brauchen und deswegen nicht senken;

jedenfalls wird -wenn keiner aus anderen Gründen zurückzieht- das Gleichgewicht im Markt am Ende schön kapitalistisch dadurch hergestellt, dass alle rausfliegen die sich das Mitspielen nicht mehr leisten können; Schweinezyklus pur

(und wenn dabei ein paar Russen oder Iraner oder Venezolaner auf der Strecke bleiben, umso besser; ist für mich persönlich ein Bonusstückchen)

Antwort auf Beitrag Nr.: 48.320.611 von R-BgO am 14.11.14 13:15:34

Russland soll ganz einfach die Einnahmeseite gekappt werden.

Als zusätzliche Sanktion.

Putin kann nur von der eigenen Bevölkerung aus dem Wege geräumt werden.

Und die reagiert nur, wenn sich die Lebensverhältnisse verschlechtern.

Solange das strukturelle russische Staatsdefizit mit Öl-und Gaseinnahmen ausgeglichen wird, finden die Russen ihren großmannssüchtigen Cheffe klasse.

Rein politisch motivierter Angriff

M.E spielen hier wirtschaftliche Interessen eine untergeordnete Rolle.Russland soll ganz einfach die Einnahmeseite gekappt werden.

Als zusätzliche Sanktion.

Putin kann nur von der eigenen Bevölkerung aus dem Wege geräumt werden.

Und die reagiert nur, wenn sich die Lebensverhältnisse verschlechtern.

Solange das strukturelle russische Staatsdefizit mit Öl-und Gaseinnahmen ausgeglichen wird, finden die Russen ihren großmannssüchtigen Cheffe klasse.

re #33, #34:

interessante Links, leider aber auch immer nur mit Informationen zu Gesamtkostenmittelfristig sind die auch entscheidend, aber kurzfristig zählen cash-costs

Was für mich aber auf den Infos aufbauend neu auf den Zettel kommt, sind

-die Transportkosten (wer hätte gedacht, dass Brasilien-offshore 6x "näher" an den Endmärkten liegt, als Dakota oder Texas?

-hedging Einflüsse

Antwort auf Beitrag Nr.: 48.320.479 von Gataulin am 14.11.14 13:03:46

Glaube ich weniger, aber es könnte ein gern gesehener Nebeneffekt sein. Denn als erstes denkt jede Öl fördernde Nation an sich selbst und seine eigene Wirtschaft.

Und handelt danach...

Der jetzige Ölpreis bringt Nachteile für alle Förderer, die hauptsächlich ihr Produkt verkaufen, keine Frage.

Aber diejenigen Nationen, die ihr zu diesen Preisen gefördertes Öl selbst verbrauchen, für die wirkt dieser niedrige Preis sich quasi als ein Konjunktur Programm aus. Dieser Fakt wird m.M. eigentlich sehr selten in den vielen Presse Artikeln erwähnt.

Zitat von Gataulin: Hat schon jemand die Möglichkeit aufgezeigt, dass es sich hier um eine politisch gesteuerte Preisbildung handeln könnte...

Glaube ich weniger, aber es könnte ein gern gesehener Nebeneffekt sein. Denn als erstes denkt jede Öl fördernde Nation an sich selbst und seine eigene Wirtschaft.

Und handelt danach...

Der jetzige Ölpreis bringt Nachteile für alle Förderer, die hauptsächlich ihr Produkt verkaufen, keine Frage.

Aber diejenigen Nationen, die ihr zu diesen Preisen gefördertes Öl selbst verbrauchen, für die wirkt dieser niedrige Preis sich quasi als ein Konjunktur Programm aus. Dieser Fakt wird m.M. eigentlich sehr selten in den vielen Presse Artikeln erwähnt.

Antwort auf Beitrag Nr.: 48.320.764 von Gataulin am 14.11.14 13:29:26

...und was kommt NACH Putin......ultra konservative bzw. ultra linke Parteien ...die nur ein Ziel haben ....dem Westen das Maul stopfen und den USA die Großmacht demonstrieren ....in Kombi mit einem neuen russischen Großmachtstreben unter Einbeziehung der ehmaligen Sowjetstaaten ...

Tolle Aussichten ..echt ...also weg mit Putin ...back to Historie ...

Ich muss wieder kotzen wenn ich sehe wie der Westen auch Russland zwangsdemokratisieren will ....

Zitat von Gataulin: M.E spielen hier wirtschaftliche Interessen eine untergeordnete Rolle.

Russland soll ganz einfach die Einnahmeseite gekappt werden.

Als zusätzliche Sanktion.

Putin kann nur von der eigenen Bevölkerung aus dem Wege geräumt werden.

Und die reagiert nur, wenn sich die Lebensverhältnisse verschlechtern.

Solange das strukturelle russische Staatsdefizit mit Öl-und Gaseinnahmen ausgeglichen wird, finden die Russen ihren großmannssüchtigen Cheffe klasse.

...und was kommt NACH Putin......ultra konservative bzw. ultra linke Parteien ...die nur ein Ziel haben ....dem Westen das Maul stopfen und den USA die Großmacht demonstrieren ....in Kombi mit einem neuen russischen Großmachtstreben unter Einbeziehung der ehmaligen Sowjetstaaten ...

Tolle Aussichten ..echt ...also weg mit Putin ...back to Historie ...

Ich muss wieder kotzen wenn ich sehe wie der Westen auch Russland zwangsdemokratisieren will ....

Stimmt

Man weiß, was man hat, nicht aber was kommt.Ich will Putin auch gar nicht verteufeln.

Platzek hat schon recht, wenn er sagt, man kann die Schuld für den Ukraine-konflikt nicht nur bei Putin suchen.

Fakt ist aber, dass EU und USA genau das tun.

Daher bin ich auch mehr und mehr überzeugt, dass alle zur Verfügung stehenden Mittel genutzt werden.

Allem voran die Ölpreiswaffe, weil man so die Russen schwächen und gleichzeitig die Konjunktur der G7 anfeuern kann.

Antwort auf Beitrag Nr.: 48.369.098 von Gataulin am 20.11.14 12:52:09

Hier fände ich eine Beschränkung auf direkt ölbezogene Themen besser.

Wer sich politisch austauschen will, findet z.B.

hier Thread: Peak Oil und die Folgen oder

hier Thread: Ukraine-Konflikt und die EU oder

hier http://www.wallstreet-online.de/community/letzte-antworten.h…

eine große Spielwiese...

Vielen Dank im voraus.

Vorschlag/Bitte

könnten die politischen Diskussionen vielleicht anderswo geführt werden?Hier fände ich eine Beschränkung auf direkt ölbezogene Themen besser.

Wer sich politisch austauschen will, findet z.B.

hier Thread: Peak Oil und die Folgen oder

hier Thread: Ukraine-Konflikt und die EU oder

hier http://www.wallstreet-online.de/community/letzte-antworten.h…

eine große Spielwiese...

Vielen Dank im voraus.

und wieder zum Thema:

http://www.rystadenergy.com/AboutUs/NewsCenter/PressReleases…US SHALE BOOM CONFIRMED DESPITE FALLING OIL PRICES

November 17, 2014

Underestimation of future oil supply from North America may have large implications for global markets and policy makers. Opinions differ between leading government agencies and independent data providers. Rystad Energy reaffirms its medium-term outlook for North American (NAm) shale oil output of ~8 MMbbld in 2020, or ~12 MMbbld when including NGL. These NAm shale numbers for 2020 are 2-4 MMbbld higher than most other industry forecasts. Rystad Energy also differs from leading agencies in their supply projections for other large producing regions such as Russia, Kazakhstan, Mexico, non-OPEC Africa and OECD Europe.

However, Rystad Energy’s view on forward-looking oil market imbalances does not differ too much from other agencies. “Our call-on-OPEC crude, for example, bottoms at 28.3 MMbbld in 2017 before rising towards the 2014-levels in 2020,“ says Bjornar Tonhaugen, VP Oil and Gas Markets. “We share the view that the oil market is structurally over-supplied in at least the coming three years, barring any major and lasting supply disruptions.”

The composition of medium term oil supply differs widely between Rystad Energy and prevailing industry references. “If we are right on NAm shale, as we have been until now, and simultaneously underestimate supply growth outside of the US, the oil market would become even more over-supplied towards 2020 than we currently believe,” says Tonhaugen. “The oil market cannot rely solely on OPEC decisions to rebalance in the medium term. In addition, we will see reduced supply growth from many sources as marginal activities become unprofitable across the board, which again lays the foundation for the next up-cycle down the road.”

Antwort auf Beitrag Nr.: 48.369.584 von R-BgO am 20.11.14 13:40:59

Aber gut, wer glaubt, dass der Ölpreis von Angebot und Nachfrage abhängt, dem ist nicht zu helfen.

Die Thread-Überschrift

lautet "Gründe für den Absturz des Ölpreises".Aber gut, wer glaubt, dass der Ölpreis von Angebot und Nachfrage abhängt, dem ist nicht zu helfen.

Schon ein bisschen älter, aber mit ein paar Datenpunkten zu Bohrkosten

http://mobile.businessweek.com/articles/2013-10-10/u-dot-s-d…Auszug:

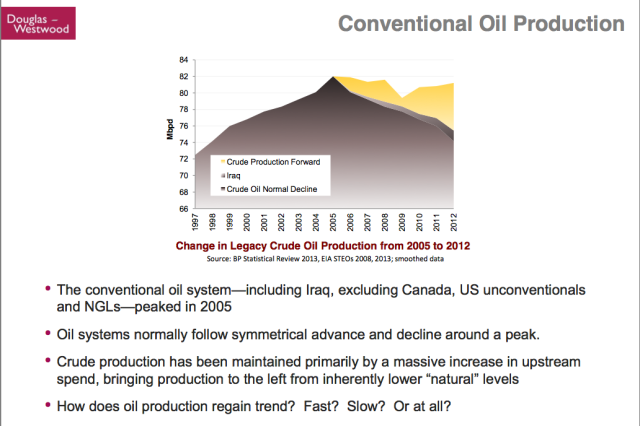

Global Sustainability’s Hughes estimates the U.S. needs to drill 6,000 new wells per year at a cost of $35 billion to maintain current production. His research also shows that the newest wells aren’t as productive as those drilled in the first years of the boom, a sign that oil companies have already tapped the best spots, making it that much harder to keep breaking records. Hughes has predicted that production will peak in 2017 and fall to 2012 levels within two years.

“The hype about U.S. energy independence and ‘Saudi America’ is deafening if you look at the mainstream media,” Hughes says. “We need to have a much more in-depth and intelligent discussion about this.” On Oct. 7, Abdalla Salem el-Badri, OPEC’s secretary general, said at a conference in Kuwait that U.S. shale producers are “running out of sweet spots” and that output will peak in 2018.

If the boom goes bust, it will profoundly affect the fortunes of states such as Oklahoma, which from 1907 to 1923 was the biggest oil-producing state in the U.S. Its production has increased more than 80 percent since Chesapeake drilled the Serenity well near the Kansas border, propelled by oil prices that have averaged more than $85 a barrel since the start of 2009. Drills are targeting the Woodford shale, the Mississippi Chat, and the Mississippi lime, hardened deposits left by a shallow sea that covered Oklahoma 350 million years ago.

The cost of drilling a horizontal shale well ranges from $3.5 million in the Mississippi lime to $9 million or more in the Bakken. That’s far more than the cost of a similar vertical well, which goes from $400,000 to $600,000, according to Drillinginfo.

In September, Steve Slawson, vice president for Slawson Exploration, sat in a trailer about 35 miles north of Oklahoma City, watching monitors as his crew shattered the Mississippi lime thousands of feet below. The well, known as Begonia 1-30H, will cost about $3.7 million.

One-third of that is the cost of fracking: First, thin pipes loaded with explosives are threaded into the hole to blast the ancient reef. Then, at a cost of about $80,000, the Begonia will consume 50,000 gallons of hydrochloric acid to dissolve the limestone; another $68,000 will pay for 1,000 gallons of antibacterial solution to kill microorganisms that chew up the pipes; $110,000 goes for a soapy surfactant to reduce friction; $10,000 covers a scale inhibitor to prevent lime buildup; and $230,000 purchases 2 million pounds of sand to prop the fractures open so the oil and gas can flow into the well. Then there’s $300,000 in pumping charges, plus the cost of equipment rental, pipe, and water, which brings the price tag for fracking the well to $1.2 million. A host of other things, from cement to Porta Potty rentals, accounts for the rest of the cost.

There’s little doubt Begonia will produce oil, Slawson says. The question is whether it will be enough to cover the cost of drilling and how quickly. Slawson Exploration’s first Mississippi lime horizontal well, the nearby Wolf 1-29H, produced the equivalent of almost 1,185 barrels a day when it started flowing last year and has paid for itself twice over, Slawson says. After the Wolf, a third of his wells were “dogs,” and only a third have come even close to it.

mal etwas aus einer ganz anderen Perspektive gesehen

Ben Hunt zur "over-determination" der Ölpreise: http://www.salientpartners.com/epsilontheory/post/2014/11/24…macht (mich) echt nachdenklich - und demütig-

The 2014 Oil Price Crash Explained

ganzer Artikel zu finden unter: http://euanmearns.com/the-2014-oil-price-crash-explained/Auszüge:

Posted on November 24, 2014 by Euan Mearns

In February 2009 Phil Hart published on The Oil Drum a simple supply demand model that explained then the action in the oil price. In this post I update Phil’s model to July 2014 using monthly oil supply (crude+condensate) and price data from the Energy Information Agency (EIA).

This model explains how a drop in demand for oil of only 1 million barrels per day can account for the fall in price from $110 to below $80 per barrel.

The future price will be determined by demand, production capacity and OPEC production constraint. A further fall in demand of the order 1 Mbpd may see the price fall below $60. Conversely, at current demand, an OPEC production cut of the order 1 Mbpd may send the oil price back up towards $100. It seems that volatility has returned to the oil market.

...

...

The Recent Past and the Future

Old hands will know that it is virtually impossible to forecast the oil price. The anomalous recent price stability of $110±10 I believe reflects great skill on the part of Saudi Arabia balancing the market at a price high enough to keep Saudi Arabia solvent and low enough to keep the world economy afloat. The reason Saudi Arabia has not cut production now, when faced with weak global demand for oil, probably comes down to their desire to maintain market share which means hobbling the N American LTO bonanza. Alternatively, they could be conspiring with the USA to wreck the Russian economy? But Saudi Arabia is not the only member of OPEC and the economies of many of the member countries will be suffering badly at these prices and that ultimately leads to elevated risk of civil unrest. It is not possible to predict the actions of the main players but it is easier to predict what the outcome may be of certain actions.

1) If demand for oil weakens by about a further 1 Mbpd this may send the price down below $60 / bbl.

2) If OPEC cuts supply by about 1 Mbpd at constant demand this may send the price back up towards $100 / bbl.

3) Prolonged low price may see LTO production fall in N America and other non-OPEC projects shelved resulting in attrition of non-OPEC capacity. This may take one to two years to work through but with constant demand, this will inevitably send prices higher again.

4) Prolonged low price may see many specialist LTO producers default on loans, risking a new credit crunch and reduced LTO production. This would likely lead to a major consolidation of operators in the LTO patch where the larger companies (the IOCs) pick up the best assets at knock down prices. That is the way it has always been.

5) Black Swans and elephants in the room – with conflict escalation in Ukraine and / or Syria-Iraq and a new credit crunch, all bets will be off.

Antwort auf Beitrag Nr.: 48.419.814 von R-BgO am 26.11.14 14:20:33He ihr Öl Junkies, euer Thema live aus Wien ...

http://www.opec.org/opec_web/en/multimedia/349.htm

http://www.opec.org/opec_web/en/multimedia/349.htm

OPEC 166th Meeting concludes No 7/2014

(in Auszügen)Vienna, Austria

27 Nov 2014

The 166th Meeting of the Conference of the Organization of the Petroleum Exporting Countries (OPEC) was held in Vienna, Austria, on Thursday, 27th November 2014 ...

...

The Conference reviewed the oil market outlook, as presented by the Secretary General, in particular supply/demand projections for the first, second, third and fourth quarters of 2015, with emphasis on the first half of the year.

The Conference also considered forecasts for the world economic outlook and noted that the global economic recovery was continuing, albeit very slowly and unevenly spread, with growth forecast at 3.2% for 2014 and 3.6% for 2015.

The Conference also noted, importantly, that, although world oil demand is forecast to increase during the year 2015, this will, yet again, be offset by the projected increase of 1.36 mb/d in non-OPEC supply.

The increase in oil and product stock levels in OECD countries, where days of forward cover are comfortably above the five-year average, coupled with the on-going rise in non-OECD inventories, are indications of an extremely well-supplied market.

Recording its concern over the rapid decline in oil prices in recent months, the Conference concurred that stable oil prices – at a level which did not affect global economic growth but which, at the same time, allowed producers to receive a decent income and to invest to meet future demand – were vital for world economic wellbeing.

Accordingly, in the interest of restoring market equilibrium, the Conference decided to maintain the production level of 30.0 mb/d, as was agreed in December 2011. As always, in taking this decision, Member Countries confirmed their readiness to respond to developments which could have an adverse impact on the maintenance of an orderly and balanced oil market.

Agreeing on the need to be vigilant given the uncertainties and risks associated with future developments in the world economy, the Conference directed the Secretariat to continue its close monitoring of developments in supply and demand, as well as non-fundamental factors such as speculative activity, keeping Member Countries fully briefed on developments.

...

The Conference resolved that its next Ordinary Meeting will convene in Vienna, Austria, on Friday, 5th June 2015, immediately after the OPEC International Seminar on “Petroleum: An Engine for Development” which will take place at the Vienna Hofburg Palace on 3rd and 4th June 2015.

wie man durch "maintain" etwas "restored" wird wohl ihr Geheimnis bleiben...

allgemein und politisch zu Brent - Öl gehts in dem Forum weiter.......hier könnt ihr euch die Köpfe heiß reden..Brent Politik..Weltuntergang und all das.

Ein Blogeintrag von Finite World

http://ourfiniteworld.com/2014/11/05/oil-price-slide-no-good…Auszüge daraus:

A large share of oil sellers need the revenue from oil sales. They have to continue producing, regardless of how low oil prices go unless they are stopped by bankruptcy, revolution, or something else that gives them a very clear signal to stop. Producers of oil from US shale are in this category, as are most oil exporters, including many of the OPEC countries and Russia.

Some large oil companies, such as Shell and ExxonMobil, decided even before the recent drop in prices that they couldn’t make money by developing available producible resources at then-available prices, likely around $100 barrel. See my post, Beginning of the End? Oil Companies Cut Back on Spending. These large companies are in the process of trying to sell off acreage, if they can find someone to buy it. Their actions will eventually lead to a drop in oil production, but not very quickly–maybe in a couple of years.

...

...

If oil prices are too low, subsidies for food and oil will need to be cut, as will spending on programs to provide jobs and new infrastructure such as desalination plants. If the cuts are too great, there is the possibility of revolution and rapid decline of oil production. Virtually none of the OPEC countries can get along with oil prices in the $80 per barrel range (Figure 7).

Eine Grafik von Goldman Sachs

gefunden bei: http://energypolicy.columbia.edu/sites/default/files/energy/… auf Seite 45

ist vermutlich schon von 2013...

Antwort auf Beitrag Nr.: 48.450.168 von R-BgO am 29.11.14 11:52:06

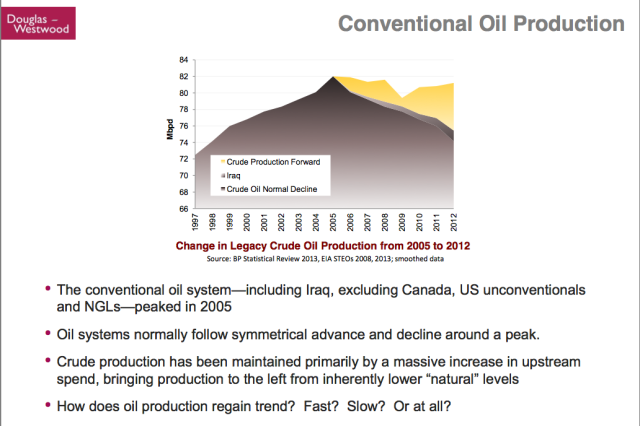

die gelbe Fläche soll ein Investitionsvolumen von 2,5 Billionen Dollars erfordert haben...

aus der gleichen Quelle:

die gelbe Fläche soll ein Investitionsvolumen von 2,5 Billionen Dollars erfordert haben...

Stray Reflections von Jawad Mian