BlackRock Capital Investment Corp. -- Mezzanine-Kapital für mittelgrosse (US-)Unternehmen (Seite 3)

eröffnet am 13.01.18 22:52:56 von

neuester Beitrag 08.09.23 22:20:24 von

neuester Beitrag 08.09.23 22:20:24 von

Beiträge: 56

ID: 1.271.702

ID: 1.271.702

Aufrufe heute: 0

Gesamt: 3.309

Gesamt: 3.309

Aktive User: 0

ISIN: US0925331086 · WKN: A0M452 · Symbol: BKCC

3,6800

USD

+0,27 %

+0,0100 USD

Letzter Kurs 19.03.24 UTP Consolidated

Neuigkeiten

18.03.24 · Business Wire (engl.) |

07.03.24 · Business Wire (engl.) |

05.03.24 · Business Wire (engl.) |

26.01.24 · Business Wire (engl.) |

08.11.23 · Business Wire (engl.) |

Werte aus der Branche Finanzdienstleistungen

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,9000 | +20,00 | |

| 2,1875 | +19,37 | |

| 4,5000 | +15,38 | |

| 6,3000 | +14,55 | |

| 0,5700 | +14,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,3500 | -10,60 | |

| 7,16 | -12,04 | |

| 10,799 | -12,20 | |

| 12,90 | -20,07 | |

| 1,5000 | -40,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 64.460.165 von Nudossi73 am 18.07.20 15:22:24

Hallo Nudossi,

bin bei Onvista, Dividende und Bonusaktien waren am gleichen Tag gebucht,

schau mal in Deinen Bestand rein...

Zitat von Nudossi73: Hallo Kollegen

Ich hätte da mal eine Frage bezüglich der Dividende.Die letzte Dividende wurde ja 20 % in bar und 80 % als Stockdividende als Stammaktien bezahlt.

Nun die 20 % bar sind geflossen....aber was ist mit den Aktien ? Wann bekommt man diese gut-geschrieben ?

Weiß zufällig jemand darüber bescheid ?

Danke im Voraus

Hallo Nudossi,

bin bei Onvista, Dividende und Bonusaktien waren am gleichen Tag gebucht,

schau mal in Deinen Bestand rein...

Und was BDC `s im allgemeinen betrifft:

Die Anlageform finde ich gut und ja sicher in der aktuellen Situation sind hier viele Risiken. Aber diese Risiken werden zum teil belohnt in Form von üppigen Dividenden.

Worauf man aktuell achten sollte das man wenn man investiert sich genau informiert über das Unternehmen und man sollte eine Differenz zum NAV haben um die 30% um das Risiko etwas zu minimieren. Im übrigen gibt es BDC seit 40 Jahren. In den 40 Jahren ist noch kein einziger BDC Pleitegegangen. Die Regularien für diese Form sind meiner Meinung nach ausreichend.

Wer mut hat wird auch belohnt.

Viele grüße

Die Anlageform finde ich gut und ja sicher in der aktuellen Situation sind hier viele Risiken. Aber diese Risiken werden zum teil belohnt in Form von üppigen Dividenden.

Worauf man aktuell achten sollte das man wenn man investiert sich genau informiert über das Unternehmen und man sollte eine Differenz zum NAV haben um die 30% um das Risiko etwas zu minimieren. Im übrigen gibt es BDC seit 40 Jahren. In den 40 Jahren ist noch kein einziger BDC Pleitegegangen. Die Regularien für diese Form sind meiner Meinung nach ausreichend.

Wer mut hat wird auch belohnt.

Viele grüße

Hallo Kollegen

Ich hätte da mal eine Frage bezüglich der Dividende.Die letzte Dividende wurde ja 20 % in bar und 80 % als Stockdividende als Stammaktien bezahlt.

Nun die 20 % bar sind geflossen....aber was ist mit den Aktien ? Wann bekommt man diese gut-geschrieben ?

Weiß zufällig jemand darüber bescheid ?

Danke im Voraus

Ich hätte da mal eine Frage bezüglich der Dividende.Die letzte Dividende wurde ja 20 % in bar und 80 % als Stockdividende als Stammaktien bezahlt.

Nun die 20 % bar sind geflossen....aber was ist mit den Aktien ? Wann bekommt man diese gut-geschrieben ?

Weiß zufällig jemand darüber bescheid ?

Danke im Voraus

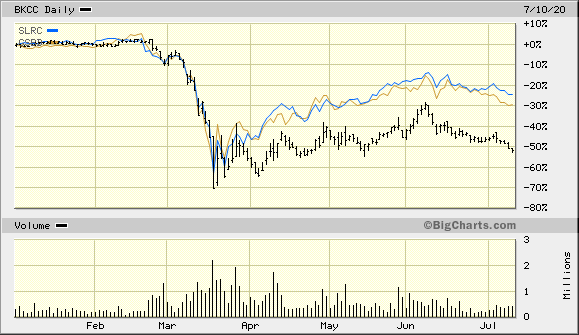

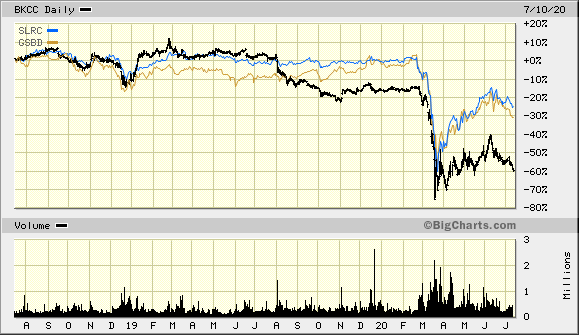

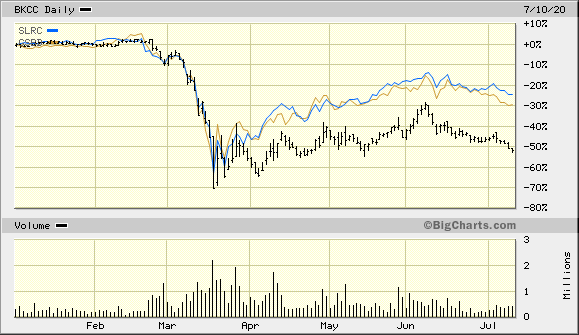

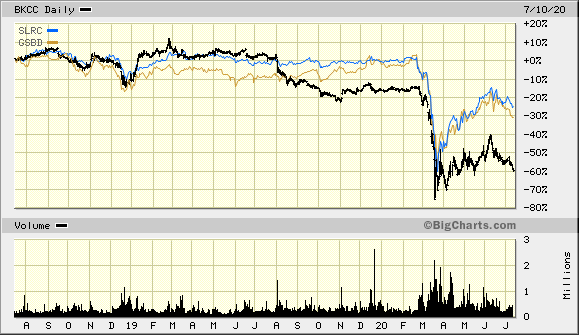

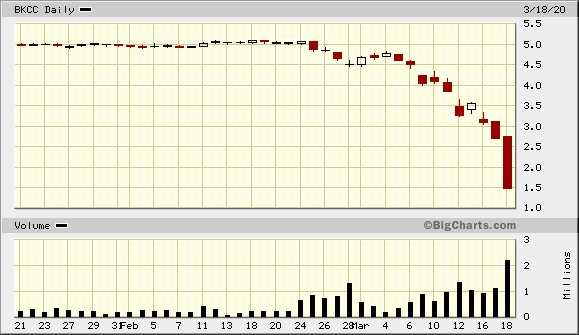

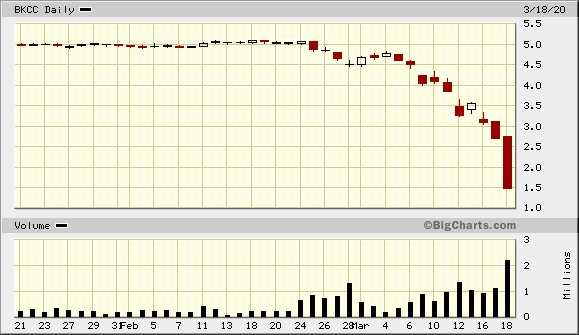

Antwort auf Beitrag Nr.: 56.735.217 von faultcode am 16.01.18 20:48:33BKCC hat es in dieser BDC-Gruppe (non-total return) offenbar am härtesten getroffen:

https://bigcharts.marketwatch.com/advchart/frames/frames.asp…

https://bigcharts.marketwatch.com/advchart/frames/frames.asp…

Vielen Dank faultcode für das Einstellen des Berichtes,

das deckt sich auch mit meiner Einschätzung, es wird zu einer Kreditausfallrate

von 5% bis 15% für die BDC´s in den nächsten Jahren kommen

und dementsprechend wird es zu einer Durststrecke von 2 bis 4 Jahren

bein den BDC´s kommen, eine Neuinvestment drängt sich nicht mehr auf.

das deckt sich auch mit meiner Einschätzung, es wird zu einer Kreditausfallrate

von 5% bis 15% für die BDC´s in den nächsten Jahren kommen

und dementsprechend wird es zu einer Durststrecke von 2 bis 4 Jahren

bein den BDC´s kommen, eine Neuinvestment drängt sich nicht mehr auf.

noch vom Juni aus dem WSJ:

5.6.

Payment Problems Rise in Fast-Growing Private-Debt Market; Default rates rise sharply for loans popular with heavily indebted private-equity-backed companies

8:55 am ET June 5, 2020 (Dow Jones) Editor's Picks Print

By Paul J. Davies

Debt-repayment problems are increasing among borrowers in the rapidly growing market for private credit, where specialist funds make loans directly to smaller companies often without banks involved.

Data on the performance of such loans are hard to come by because they are arranged privately and usually only held by a single fund, or a small club of lenders. But U.S. law firm Proskauer Rose LLP , which has been tracking deals it helped arrange over recent years, said defaults jumped at the end of the first quarter of this year as the Covid-19 pandemic prompted widespread economic shutdowns.

Default rates for such loans in the U.S. hit 5.9% at the end of the quarter, according to Proskauer, after less than a month of the economic restrictions brought on by Covid-19.

"For weaker companies it kind of tipped them over the edge," said Peter Antoszyk, co-head of Proskauer's private-credit restructuring group.

Loans in the private-credit market have become a popular tool for private-equity firms to pile debt on companies they own. Borrowers tend to be smaller companies than in the better-known leveraged-loan market, which has also seen rapid growth in recent years. Popular sectors include health care, software and retail.

Total assets under management in private-debt and direct-lending funds had grown to more than $740 billion by the end of September last year from about $125 billion in 2006, according to Preqin, a research firm.

Investors—which include hedge funds, pension funds, insurance companies, private family offices and specialist debt funds—have been encouraged into private credit and the larger leveraged loan markets by a hunt for higher yields. They became more popular after the last financial crisis when banks stepped back from some riskier lending.

Investors and analysts expect default rates in leveraged loan and private-credit markets to rise sharply over coming months. Andrew Jackson , head of fixed-income investing at Federated Hermes, expects default rates to rise above 10% for both kinds of higher-risk loan. "The question is not will we get there, but how long will we stay in that territory?" he said.

Funds dedicated to private debt and direct lending raise capital commitments from investors and put the money to work over time, like private-equity funds. The market also includes listed business development companies .

Share prices of large BDCs such as FS KKR Capital Corp . and BlackRock Capital Investment Corp . tumbled in March and April but have recovered some of those losses since. In its first-quarter conference call, FS KKR Capital said its portfolio had lost nearly 11% in value in the first quarter, though only 1.8 percentage points of that was realized losses. Its biggest loss was $54 million on loans to Art Van Furniture , which filed for bankruptcy in early March with plans to close most of its 169 stores.

Defaults among private borrowers roughly doubled in the first quarter from the final quarter of last year, Mr. Antoszyk said, although Proskauer hasn't published its figures previously. The firm arranges loans for companies with earnings before interest, taxes, depreciation and amortization of between $10 million and $250 million. There are nearly 600 outstanding loans that constitute Proskauer's index, worth $95 billion.

Default rates were higher among smaller companies, Mr. Antoszyk said. Among companies with Ebitda greater than $50 million, the default rate was 4.4%; of those with less than $25 million, the rate was 7%.

This is partly because loans to smaller companies include stronger protections for lenders, known as covenants. Larger loans in the private-debt market have increasingly adopted the looser, covenant-lite standards that reduce the ability of lenders to ask the company to make changes when its business deteriorates.

Traditionally, lenders to small and medium-size companies in general have much more influence over their management, which has helped make the process toward default slower while ensuring a higher level of recoveries when borrowers do default, Mr. Jackson said.

"We could see worse recoveries this time around," he added. "Direct lenders can't always get in to talk to companies about restructuring because covenant lite loans have become so prevalent."

Private-debt funds have a lot of uninvested capital—known as dry powder—coming into this crisis. This might allow them to be more flexible and financially more supportive of companies in trouble.

"I think a lot of these workouts will occur in the conference room rather than the courtroom," Mr. Antoszyk said.

Write to Paul J. Davies at paul.davies@wsj.com

https://www.wsj.com/articles/payment-problems-rise-in-fast-g…

07/01/20

BlackRock Capital Investment Corporation to Report Second Quarter 2020 Earnings on July 29, 2020 -- https://www.blackrockbkcc.com/news-releases/news-release-det…

5.6.

Payment Problems Rise in Fast-Growing Private-Debt Market; Default rates rise sharply for loans popular with heavily indebted private-equity-backed companies

8:55 am ET June 5, 2020 (Dow Jones) Editor's Picks Print

By Paul J. Davies

Debt-repayment problems are increasing among borrowers in the rapidly growing market for private credit, where specialist funds make loans directly to smaller companies often without banks involved.

Data on the performance of such loans are hard to come by because they are arranged privately and usually only held by a single fund, or a small club of lenders. But U.S. law firm Proskauer Rose LLP , which has been tracking deals it helped arrange over recent years, said defaults jumped at the end of the first quarter of this year as the Covid-19 pandemic prompted widespread economic shutdowns.

Default rates for such loans in the U.S. hit 5.9% at the end of the quarter, according to Proskauer, after less than a month of the economic restrictions brought on by Covid-19.

"For weaker companies it kind of tipped them over the edge," said Peter Antoszyk, co-head of Proskauer's private-credit restructuring group.

Loans in the private-credit market have become a popular tool for private-equity firms to pile debt on companies they own. Borrowers tend to be smaller companies than in the better-known leveraged-loan market, which has also seen rapid growth in recent years. Popular sectors include health care, software and retail.

Total assets under management in private-debt and direct-lending funds had grown to more than $740 billion by the end of September last year from about $125 billion in 2006, according to Preqin, a research firm.

Investors—which include hedge funds, pension funds, insurance companies, private family offices and specialist debt funds—have been encouraged into private credit and the larger leveraged loan markets by a hunt for higher yields. They became more popular after the last financial crisis when banks stepped back from some riskier lending.

Investors and analysts expect default rates in leveraged loan and private-credit markets to rise sharply over coming months. Andrew Jackson , head of fixed-income investing at Federated Hermes, expects default rates to rise above 10% for both kinds of higher-risk loan. "The question is not will we get there, but how long will we stay in that territory?" he said.

Funds dedicated to private debt and direct lending raise capital commitments from investors and put the money to work over time, like private-equity funds. The market also includes listed business development companies .

Share prices of large BDCs such as FS KKR Capital Corp . and BlackRock Capital Investment Corp . tumbled in March and April but have recovered some of those losses since. In its first-quarter conference call, FS KKR Capital said its portfolio had lost nearly 11% in value in the first quarter, though only 1.8 percentage points of that was realized losses. Its biggest loss was $54 million on loans to Art Van Furniture , which filed for bankruptcy in early March with plans to close most of its 169 stores.

Defaults among private borrowers roughly doubled in the first quarter from the final quarter of last year, Mr. Antoszyk said, although Proskauer hasn't published its figures previously. The firm arranges loans for companies with earnings before interest, taxes, depreciation and amortization of between $10 million and $250 million. There are nearly 600 outstanding loans that constitute Proskauer's index, worth $95 billion.

Default rates were higher among smaller companies, Mr. Antoszyk said. Among companies with Ebitda greater than $50 million, the default rate was 4.4%; of those with less than $25 million, the rate was 7%.

This is partly because loans to smaller companies include stronger protections for lenders, known as covenants. Larger loans in the private-debt market have increasingly adopted the looser, covenant-lite standards that reduce the ability of lenders to ask the company to make changes when its business deteriorates.

Traditionally, lenders to small and medium-size companies in general have much more influence over their management, which has helped make the process toward default slower while ensuring a higher level of recoveries when borrowers do default, Mr. Jackson said.

"We could see worse recoveries this time around," he added. "Direct lenders can't always get in to talk to companies about restructuring because covenant lite loans have become so prevalent."

Private-debt funds have a lot of uninvested capital—known as dry powder—coming into this crisis. This might allow them to be more flexible and financially more supportive of companies in trouble.

"I think a lot of these workouts will occur in the conference room rather than the courtroom," Mr. Antoszyk said.

Write to Paul J. Davies at paul.davies@wsj.com

https://www.wsj.com/articles/payment-problems-rise-in-fast-g…

07/01/20

BlackRock Capital Investment Corporation to Report Second Quarter 2020 Earnings on July 29, 2020 -- https://www.blackrockbkcc.com/news-releases/news-release-det…

Hallo Faultcode,

da wir ja hier die einzigsten Akteure sind, aufgrund der Geldschwemme

gehe ich nicht von einer Pleite von BlackRock BDC aus, aktuell sind wir bei 30% Dividende

sind dies Kaufkurse oder Finger weg?

Wie hoch ist eigentlich der Anteil der Mutter Company an BlackRock, auf beiden Websites findet

man leider nichts.

danke

da wir ja hier die einzigsten Akteure sind, aufgrund der Geldschwemme

gehe ich nicht von einer Pleite von BlackRock BDC aus, aktuell sind wir bei 30% Dividende

sind dies Kaufkurse oder Finger weg?

Wie hoch ist eigentlich der Anteil der Mutter Company an BlackRock, auf beiden Websites findet

man leider nichts.

danke

ich weiß nicht was los war, aber gesund ist das nicht mMn:

tagsüber so:

After hours so:

--> Volumen: 223

Irgendwie fehlt es dem System in den Nischen vollkommen an Liquidität zur Zeit

Letzte Meldung vom 4.3. war eine Dividende von USD0.14

Für's Quartal.

Eigentlich kann ich mir das nur mit sehr vielen Margin Calls erklären, die nun durch's System fegen

tagsüber so:

After hours so:

--> Volumen: 223

Irgendwie fehlt es dem System in den Nischen vollkommen an Liquidität zur Zeit

Letzte Meldung vom 4.3. war eine Dividende von USD0.14

Für's Quartal.

Eigentlich kann ich mir das nur mit sehr vielen Margin Calls erklären, die nun durch's System fegen

Antwort auf Beitrag Nr.: 61.792.006 von faultcode am 29.10.19 18:49:53“During the third quarter, we continued to achieve progress on our strategic priorities of (i) stabilizing NAV by exiting non-core legacy investments in a prudent manner and (ii) deploying more capital into diversified and secured income-producing investments, as the core of our portfolio.

The non-core legacy portfolio was 18% of the total portfolio by fair market value at September 30, 2019, compared to 28% and 33% at June 30, 2019 and December 31, 2018, respectively.

The quarter over quarter reduction was driven by a successful exit of the second lien and equity position in Vertellus Holdings and related companies during the third quarter. Vertellus was previously the largest position in the non-core portion of the portfolio. The exit of these two positions, along with a partial exit of Vertellus first lien position resulted in $32 million of proceeds, which was $2.2 million below the prior quarter mark.

We continue to focus on prudent exits or reductions of the remaining non-core legacy positions which have been a source of NAV volatility,” commented James E. Keenan, Chairman and Interim CEO of the Company.

...

“On October 29, 2019, the Company’s Board of Directors approved the application to the Company of the 150% minimum asset coverage requirement, as detailed further in this earnings release. As a result, the applicable minimum asset coverage ratio will be reduced from 200% to 150%, effective October 29, 2020 (unless the Company receives earlier stockholder approval).

Our goal is to prudently increase leverage from current levels as further non-core exits occur, with a target leverage range of 1.00-1.25x once the reduced asset coverage requirement becomes effective. We believe that the added flexibility will allow the Company to pursue its goal of improving return on equity, while creating a more diversified portfolio of secured income-producing investments.”

https://www.marketwatch.com/press-release/blackrock-capital-…

The non-core legacy portfolio was 18% of the total portfolio by fair market value at September 30, 2019, compared to 28% and 33% at June 30, 2019 and December 31, 2018, respectively.

The quarter over quarter reduction was driven by a successful exit of the second lien and equity position in Vertellus Holdings and related companies during the third quarter. Vertellus was previously the largest position in the non-core portion of the portfolio. The exit of these two positions, along with a partial exit of Vertellus first lien position resulted in $32 million of proceeds, which was $2.2 million below the prior quarter mark.

We continue to focus on prudent exits or reductions of the remaining non-core legacy positions which have been a source of NAV volatility,” commented James E. Keenan, Chairman and Interim CEO of the Company.

...

“On October 29, 2019, the Company’s Board of Directors approved the application to the Company of the 150% minimum asset coverage requirement, as detailed further in this earnings release. As a result, the applicable minimum asset coverage ratio will be reduced from 200% to 150%, effective October 29, 2020 (unless the Company receives earlier stockholder approval).

Our goal is to prudently increase leverage from current levels as further non-core exits occur, with a target leverage range of 1.00-1.25x once the reduced asset coverage requirement becomes effective. We believe that the added flexibility will allow the Company to pursue its goal of improving return on equity, while creating a more diversified portfolio of secured income-producing investments.”

https://www.marketwatch.com/press-release/blackrock-capital-…

NEW YORK--(BUSINESS WIRE)--Oct. 1, 2019-- BlackRock Capital Investment Corporation (NASDAQ:BKCC) ("BlackRock Capital Investment" or the "Company") announced today that it will report earnings for the third quarter 2019 on Wednesday, October 30, 2019 after the close of the financial markets.

https://www.blackrockbkcc.com/news-releases/news-release-det…

https://www.blackrockbkcc.com/news-releases/news-release-det…