Ölpreise stark gestiegen - Brent auf höchstem Stand seit knapp 4 Jahren (Seite 17) | Diskussion im Forum

eröffnet am 25.09.18 16:17:49 von

neuester Beitrag 08.01.24 13:02:37 von

neuester Beitrag 08.01.24 13:02:37 von

Beiträge: 539

ID: 1.289.261

ID: 1.289.261

Aufrufe heute: 2

Gesamt: 87.280

Gesamt: 87.280

Aktive User: 0

ISIN: XC0009677409 · WKN: 967740

82,73

USD

0,00 %

0,00 USD

Letzter Kurs 13:00:49 Lang & Schwarz

Neuigkeiten

10.05.24 · wallstreetONLINE Redaktion |

10.05.24 · dpa-AFX |

10.05.24 · dpa-AFX |

10.05.24 · Shareribs Anzeige |

10.05.24 · BNP Paribas Anzeige |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,2000 | +29,03 | |

| 246,02 | +21,37 | |

| 13,000 | +10,26 | |

| 4,5500 | +9,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,510 | -12,21 | |

| 0,8850 | -14,90 | |

| 0,960 | -15,04 | |

| 12,14 | -16,28 | |

| 5,9460 | -75,48 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 67.685.773 von faultcode am 01.04.21 20:11:3714.4.

Oil Prices Jump As EIA Reports A Crude Draw

https://oilprice.com/Energy/Energy-General/Oil-Prices-Jump-A…

...

Crude oil prices climbed on Wednesday morning after the Energy Information Administration reported crude oil inventories had shed 5.9 million barrels in the week to April 9.

This compared with an inventory draw of 3.5 million barrels for the previous week.

The EIA’s inventory estimate comes a day after the American Petroleum Institute reported a 3.6-million-barrel inventory draw in crude oil for the same period but a 5.565-million-barrel build in gasoline stocks, which prevented oil prices from swinging significantly up or down.

For gasoline, the EIA estimated a modest inventory build of 300,000 barrels for the week to April 9, with production averaging 9.6 million bpd. This compared with a stock build of 4 million barrels for the previous week and an average production rate of 9.3 million bpd.

In middle distillates, the authority estimated an inventory decline of 2.1 million barrels for the week to April 9, with production averaging 4.6 million bpd, virtually unchanged from the week before last, with inventories adding 1.5 million barrels.

...

Oil Prices Jump As EIA Reports A Crude Draw

https://oilprice.com/Energy/Energy-General/Oil-Prices-Jump-A…

...

Crude oil prices climbed on Wednesday morning after the Energy Information Administration reported crude oil inventories had shed 5.9 million barrels in the week to April 9.

This compared with an inventory draw of 3.5 million barrels for the previous week.

The EIA’s inventory estimate comes a day after the American Petroleum Institute reported a 3.6-million-barrel inventory draw in crude oil for the same period but a 5.565-million-barrel build in gasoline stocks, which prevented oil prices from swinging significantly up or down.

For gasoline, the EIA estimated a modest inventory build of 300,000 barrels for the week to April 9, with production averaging 9.6 million bpd. This compared with a stock build of 4 million barrels for the previous week and an average production rate of 9.3 million bpd.

In middle distillates, the authority estimated an inventory decline of 2.1 million barrels for the week to April 9, with production averaging 4.6 million bpd, virtually unchanged from the week before last, with inventories adding 1.5 million barrels.

...

Antwort auf Beitrag Nr.: 67.581.201 von faultcode am 24.03.21 12:29:031.4.

Here are the details of the OPEC+ decision to raise oil production

Saudi Arabia also plans to roll back its own voluntary cut

https://www.marketwatch.com/story/here-are-the-details-of-th…

...

The Organization of the Petroleum Exporting Countries and their allies, together known as OPEC+, announced Thursday that they will gradually raise production from May through July by easing the size of their earlier output reductions.

Saudi Arabia will also rollback its voluntary cuts during the three-month period.

“The agreement is supportive of oil prices, yet should also help avoid a sharp spike upward as oil demand picks up,” said Ann-Louise Hittle, Wood Mackenzie’s vice president, Macro Oils, in emailed commentary.

Wood Mackenzie forecasts a “strong recovery in oil demand by the third quarter for the U.S.” and expects total global oil demand to gain 6.2 million barrel per day year on year in 2021, she said.

During a press conference, Saudi Arabia’s Minister of Energy Prince Abdulaziz bin Salman said OPEC+ will raise daily oil production by 350,000 barrels in May, 350,000 barrels in June and by 441,000 barrels in July.

OPEC+ was holding back roughly 8 million barrels a day of output, 1 million of which represented a voluntary cut by Saudi Arabia.

However, Prince Abdulaziz also said Saudi Arabia will gradually roll back that voluntary cut, which it announced at the January meeting. It will ease the per-day reduction by 250,000 barrels in May, by 350,000 barrels in June and by 400,000 barrels in July. That means the Saudis would essentially stop their voluntary cut in July.

The group will continue to assess oil market conditions monthly, and decide on whether to adjust production, up or down, for the following month by no more than 500,000 barrels per day.

OPEC+ also extended the amount of time countries have to make up for producing above their quotas to the end of September.

...

Here are the details of the OPEC+ decision to raise oil production

Saudi Arabia also plans to roll back its own voluntary cut

https://www.marketwatch.com/story/here-are-the-details-of-th…

...

The Organization of the Petroleum Exporting Countries and their allies, together known as OPEC+, announced Thursday that they will gradually raise production from May through July by easing the size of their earlier output reductions.

Saudi Arabia will also rollback its voluntary cuts during the three-month period.

“The agreement is supportive of oil prices, yet should also help avoid a sharp spike upward as oil demand picks up,” said Ann-Louise Hittle, Wood Mackenzie’s vice president, Macro Oils, in emailed commentary.

Wood Mackenzie forecasts a “strong recovery in oil demand by the third quarter for the U.S.” and expects total global oil demand to gain 6.2 million barrel per day year on year in 2021, she said.

During a press conference, Saudi Arabia’s Minister of Energy Prince Abdulaziz bin Salman said OPEC+ will raise daily oil production by 350,000 barrels in May, 350,000 barrels in June and by 441,000 barrels in July.

OPEC+ was holding back roughly 8 million barrels a day of output, 1 million of which represented a voluntary cut by Saudi Arabia.

However, Prince Abdulaziz also said Saudi Arabia will gradually roll back that voluntary cut, which it announced at the January meeting. It will ease the per-day reduction by 250,000 barrels in May, by 350,000 barrels in June and by 400,000 barrels in July. That means the Saudis would essentially stop their voluntary cut in July.

The group will continue to assess oil market conditions monthly, and decide on whether to adjust production, up or down, for the following month by no more than 500,000 barrels per day.

OPEC+ also extended the amount of time countries have to make up for producing above their quotas to the end of September.

...

Antwort auf Beitrag Nr.: 67.453.433 von faultcode am 14.03.21 18:11:1124.3.

Suez Canal Blockage May Ripple Through Global Energy Market

• European refiners reliant on Mideast oil may seek alternatives

• Grounded vessel is expected to be cleared over next few days

https://www.bloomberg.com/news/articles/2021-03-24/suez-cana…

...

European and U.S. refiners that rely on the vital waterway for cargoes of Middle Eastern oil may be forced to look for replacement supplies should the blockage persist, potentially boosting prices of alternative grades. At the same time, flows of crude from North Sea fields destined for Asia will be held up.

...

The critical trade route has been thrown into turmoil after the container ship ran aground on Tuesday, blocking traffic in both directions. While the vessel is only likely to remain stuck for a couple of days, that’ll be long enough to scramble some energy flows, creating an extra headache for refiners, traders and producers already coping with the pandemic’s fallout. Local pipeline networks, however, should help to alleviate some of the disruption.

“There are plenty of alternative trades for European importers to avoid the Suez Canal,” said Ralph Leszczynski, head of research at shipbroker Banchero Costa & Co.

Buyers in Europe and the U.S. may now look to other regions, including the U.S. Gulf, North Sea, Russia and West Africa, according to shipbrokers. Varieties including Mars Blend from the U.S. Gulf, Urals from Russia, and even Asian and Russian Far East grades are likely to get a boost as a result of any increased demand, an analyst and one of the shipbrokers said.

...

"..is expected.."

Suez Canal Blockage May Ripple Through Global Energy Market

• European refiners reliant on Mideast oil may seek alternatives

• Grounded vessel is expected to be cleared over next few days

https://www.bloomberg.com/news/articles/2021-03-24/suez-cana…

...

European and U.S. refiners that rely on the vital waterway for cargoes of Middle Eastern oil may be forced to look for replacement supplies should the blockage persist, potentially boosting prices of alternative grades. At the same time, flows of crude from North Sea fields destined for Asia will be held up.

...

The critical trade route has been thrown into turmoil after the container ship ran aground on Tuesday, blocking traffic in both directions. While the vessel is only likely to remain stuck for a couple of days, that’ll be long enough to scramble some energy flows, creating an extra headache for refiners, traders and producers already coping with the pandemic’s fallout. Local pipeline networks, however, should help to alleviate some of the disruption.

“There are plenty of alternative trades for European importers to avoid the Suez Canal,” said Ralph Leszczynski, head of research at shipbroker Banchero Costa & Co.

Buyers in Europe and the U.S. may now look to other regions, including the U.S. Gulf, North Sea, Russia and West Africa, according to shipbrokers. Varieties including Mars Blend from the U.S. Gulf, Urals from Russia, and even Asian and Russian Far East grades are likely to get a boost as a result of any increased demand, an analyst and one of the shipbrokers said.

...

"..is expected.."

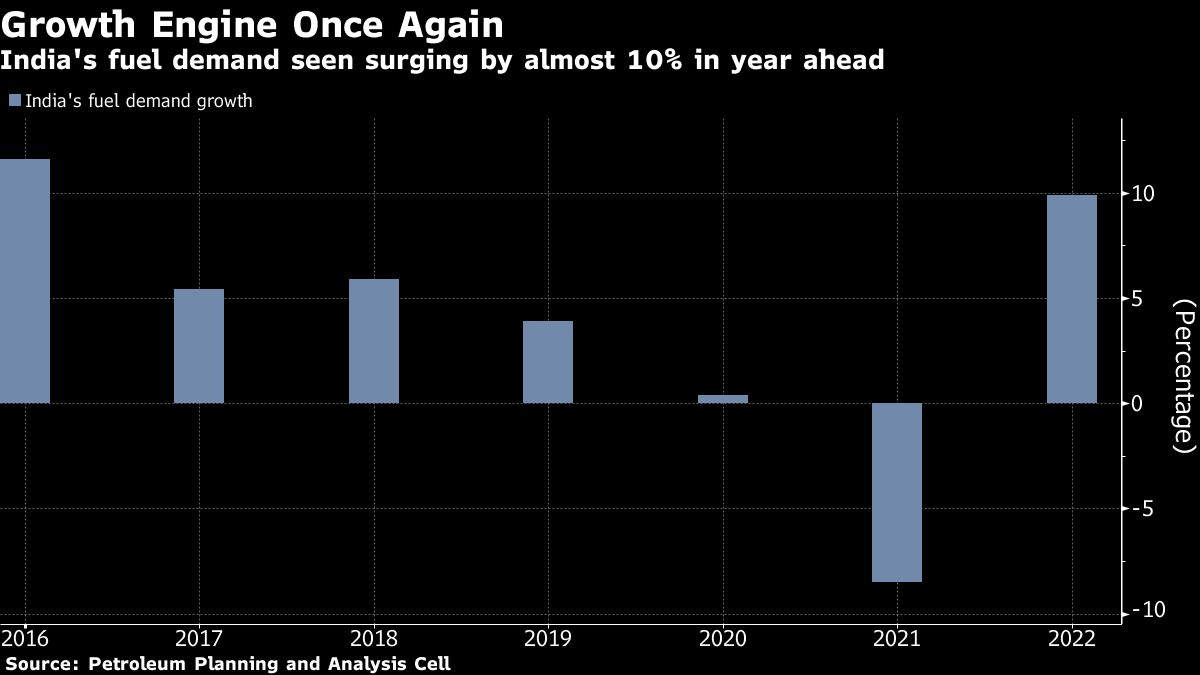

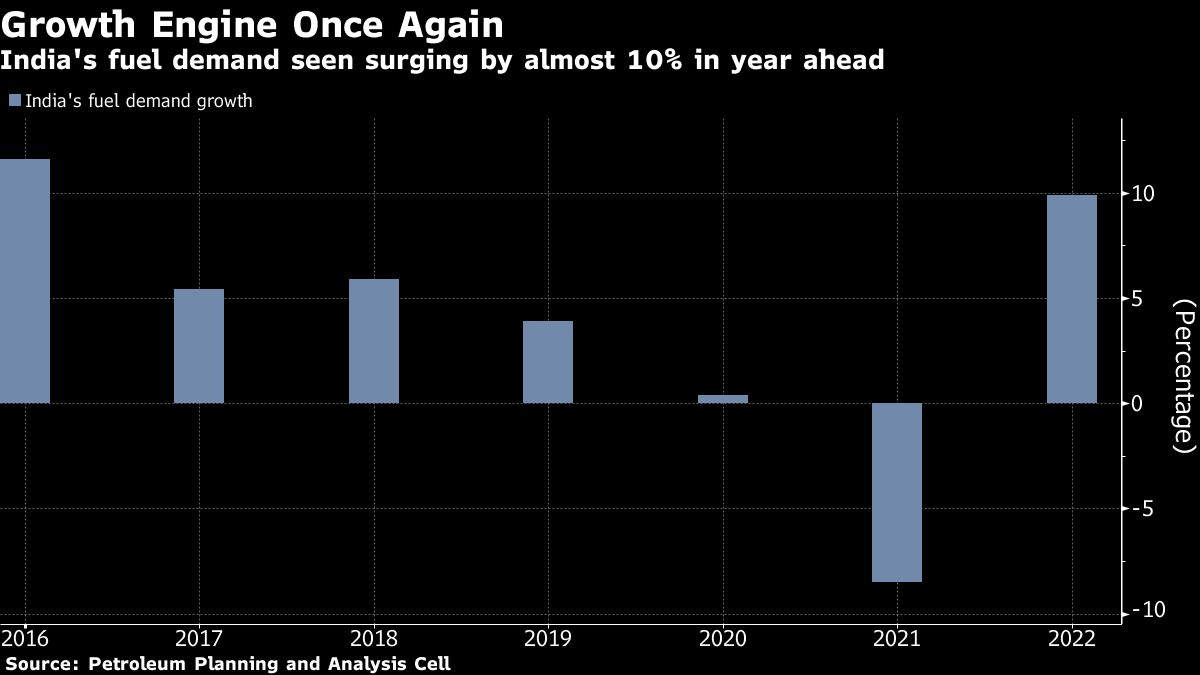

Antwort auf Beitrag Nr.: 67.309.380 von faultcode am 04.03.21 17:08:55Oil India -- globaler Importeur #3

..und die Suche nach billigem Öl:

9.3.

Saudi Oil Hawkishness Speeds Indian Plan to Seek Alternatives

https://www.msn.com/en-us/money/markets/saudi-oil-hawkishnes…

...

Saudi Arabia’s push to restrain oil supply to buoy prices is spurring India to speed up plans to diversify its crude sources and pursue alternative energy, the chairman of one of the nation’s biggest refiners said.

The world’s third-biggest oil importer was already trying to cut its dependence on Middle Eastern crude, with American oil rising from 0.5% of total purchases to 6% over the past five years, Mukesh Kumar Surana, chairman of state-owned Hindustan Petroleum Corp., said in a Bloomberg Television interview.

Indian Oil Minister Dharmendra Pradhan has repeatedly called for OPEC+ to pump more crude to stop prices from rising too high. However, his pleas fell on deaf ears in Riyadh when the alliance, which is dominated by Saudi Arabia and Russia, decided to hold output steady last week. The decision and an attack on an export terminal in the kingdom pushed Brent above $71 a barrel on Monday.

“Higher prices make the future of oil as a commodity in the energy basket more detrimental,” Surana said. “It pushes people to look for more alternative resources in the energy basket,” he said, adding that India would prefer an oil price in the $50 to $60 a barrel range.

Around 86% of Indian oil imports last year were from OPEC+ members, with 19% coming from Saudi Arabia, according to government data. Indian refiners are watching Iran’s possible re-entry into the oil market closely, Surana said.

...

..und die Suche nach billigem Öl:

9.3.

Saudi Oil Hawkishness Speeds Indian Plan to Seek Alternatives

https://www.msn.com/en-us/money/markets/saudi-oil-hawkishnes…

...

Saudi Arabia’s push to restrain oil supply to buoy prices is spurring India to speed up plans to diversify its crude sources and pursue alternative energy, the chairman of one of the nation’s biggest refiners said.

The world’s third-biggest oil importer was already trying to cut its dependence on Middle Eastern crude, with American oil rising from 0.5% of total purchases to 6% over the past five years, Mukesh Kumar Surana, chairman of state-owned Hindustan Petroleum Corp., said in a Bloomberg Television interview.

Indian Oil Minister Dharmendra Pradhan has repeatedly called for OPEC+ to pump more crude to stop prices from rising too high. However, his pleas fell on deaf ears in Riyadh when the alliance, which is dominated by Saudi Arabia and Russia, decided to hold output steady last week. The decision and an attack on an export terminal in the kingdom pushed Brent above $71 a barrel on Monday.

“Higher prices make the future of oil as a commodity in the energy basket more detrimental,” Surana said. “It pushes people to look for more alternative resources in the energy basket,” he said, adding that India would prefer an oil price in the $50 to $60 a barrel range.

Around 86% of Indian oil imports last year were from OPEC+ members, with 19% coming from Saudi Arabia, according to government data. Indian refiners are watching Iran’s possible re-entry into the oil market closely, Surana said.

...

Ich hatte im Depot noch ein sehr altes 15er Hebel Zertifikat was quasi nix mehr Wert war und selbst das ist jetzt wieder auf null... Hätte zwar ein fetter Gewinn sein können, aber wenigstens kein Verlust

Alter Schwede was ist da heut los, da soll sich nochmal einer auskennen, gute 3 Dollar an einem Tag. Aber da jetzt noch einsteigen, ob da Sinn macht?

Antwort auf Beitrag Nr.: 67.283.265 von faultcode am 03.03.21 13:26:02Thu, March 4, 2021, 5:02 PM

Oil Surges After OPEC+ Agrees to Keep Oil Output Unchanged

https://finance.yahoo.com/news/oil-market-counts-down-critic…

Oil Surges After OPEC+ Agrees to Keep Oil Output Unchanged

https://finance.yahoo.com/news/oil-market-counts-down-critic…

Man könnte fast denken, dass die Gamestop boys auf Öl umsteigen 😂

Brent ist zurzeit nicht mehr berechenbar 🤮

10.05.24 · dpa-AFX · Öl (Brent) |

10.05.24 · wallstreetONLINE Redaktion · Öl (Brent) |

10.05.24 · dpa-AFX · Öl (Brent) |

10.05.24 · dpa-AFX · Öl (Brent) |

09.05.24 · dpa-AFX · Öl (Brent) |

09.05.24 · dpa-AFX · Öl (Brent) |

09.05.24 · dpa-AFX · Öl (Brent) |

09.05.24 · dpa-AFX · Öl (Brent) |

| Zeit | Titel |

|---|---|

| 09.05.24 | |

| 16.04.24 | |

| 07.04.24 | |

| 16.10.23 | |

| 14.10.23 | |

| 23.09.23 | |

| 16.09.23 | |

| 04.09.23 | |

| 04.09.23 | |

| 01.09.23 |