Lithium, Graphit & Co das Batteriemetall Forum, News, Fakten und möglichen Auswirkungen (Seite 100)

eröffnet am 29.01.22 16:21:43 von

neuester Beitrag 09.06.24 12:34:08 von

neuester Beitrag 09.06.24 12:34:08 von

Beiträge: 3.206

ID: 1.356.985

ID: 1.356.985

Aufrufe heute: 0

Gesamt: 112.260

Gesamt: 112.260

Aktive User: 0

ISIN: AU000000ASN8 · WKN: A2AC6W · Symbol: 9MY

0,0665

EUR

0,00 %

0,0000 EUR

Letzter Kurs 14.06.24 Tradegate

Neuigkeiten

| TitelBeiträge |

|---|

08.05.24 · wO Chartvergleich |

01.05.24 · Accesswire |

13.03.24 · wO Chartvergleich |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8250 | +25,00 | |

| 0,7437 | +20,93 | |

| 0,8906 | +20,35 | |

| 1,1500 | +15,00 | |

| 8,3200 | +12,74 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,455 | -8,53 | |

| 97,50 | -9,13 | |

| 1,0780 | -9,41 | |

| 12,460 | -16,06 | |

| 46,98 | -97,98 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 73.309.532 von Dicker69 am 16.02.23 18:52:44Dazu auch dies:

BP to buy TravelCenters of America for $1.3 billion

BP to buy TravelCenters of America for $1.3 billion

Zitat von Oginvest: Feb 16 (Reuters) - TravelCenters of America Inc (TA.O) said on Thursday it would be acquired by BP Plc (BP.L) for about $1.3 billion in cash, as the British energy giant looks to expand its travel convenience and fuel supply footprint in the United States.

BP has offered $86 per TravelCenters share held, which represents a 74% premium to the stock's last close on Wednesday.

...

https://www.reuters.com/markets/deals/bp-buy-travelcenters-a…

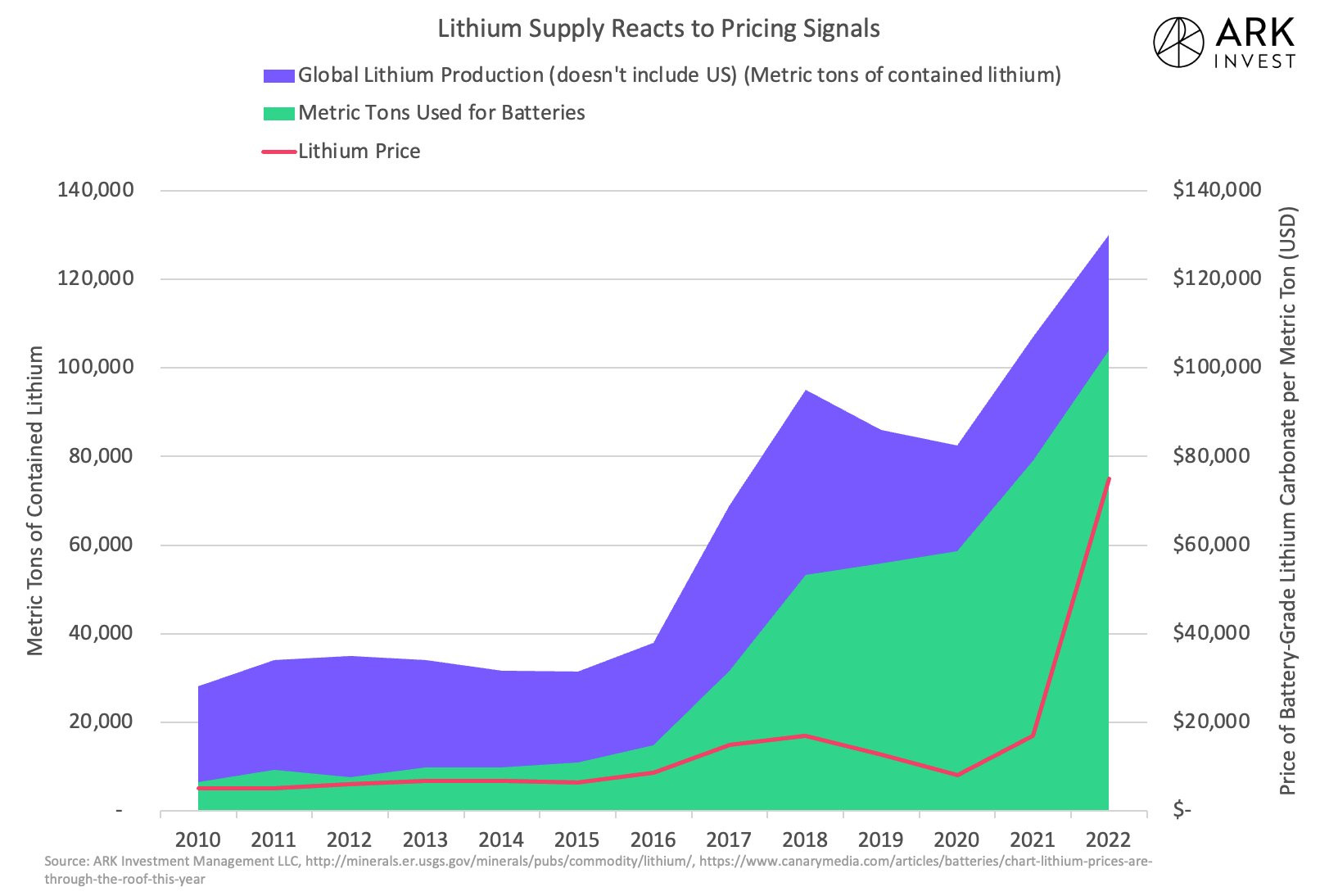

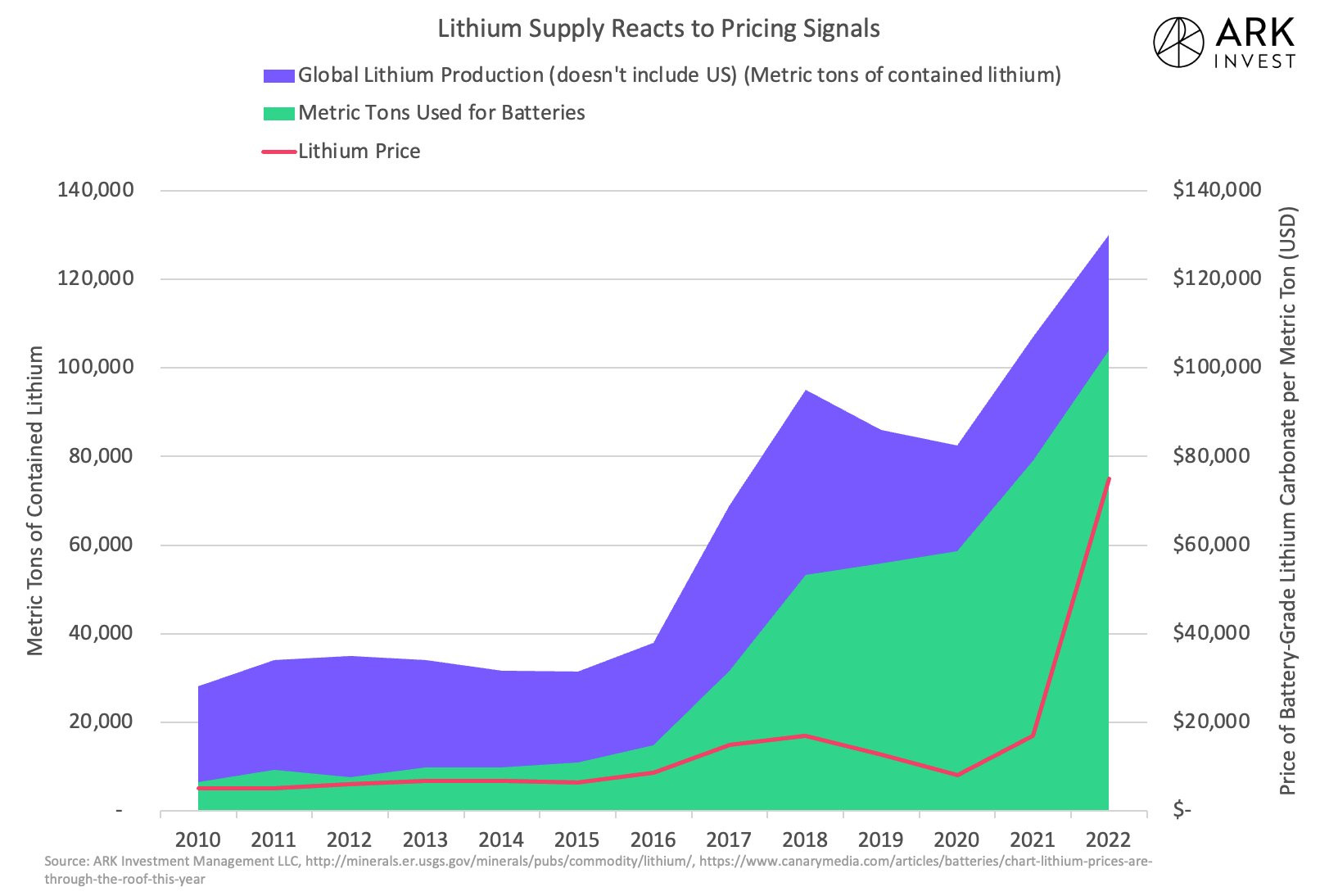

Das Lithiumangebot reagiert auf Preissignale, und der Preis ist ein Signal.

Der Lithiumpreis verdoppelte sich 2017 ungefähr auf 15.000 $ pro Tonne, und das Angebot reagierte. Jetzt liegt Lithium bei ~70.000 $ pro Tonne

https://twitter.com/skorusARK/status/1625615787086979095/pho…

DYOR Dicker

Der Lithiumpreis verdoppelte sich 2017 ungefähr auf 15.000 $ pro Tonne, und das Angebot reagierte. Jetzt liegt Lithium bei ~70.000 $ pro Tonne

https://twitter.com/skorusARK/status/1625615787086979095/pho…

DYOR Dicker

Tweet Biden

Mit Hilfe von @SecGranholm und @SecretaryPetehabe ich mir zum Ziel gesetzt, bis 2030 ein Made-in-America-Ladenetz für Elektrofahrzeuge mit 500.000 Ladegeräten auf Autobahnen und in Gemeinden aufzubauen. Die heutigen Maßnahmen bringen uns dem Abschluss der Arbeit und der Eroberung des globalen EV-Marktes näher.

https://twitter.com/POTUS/status/1625911326802423825

DYOR Dicker

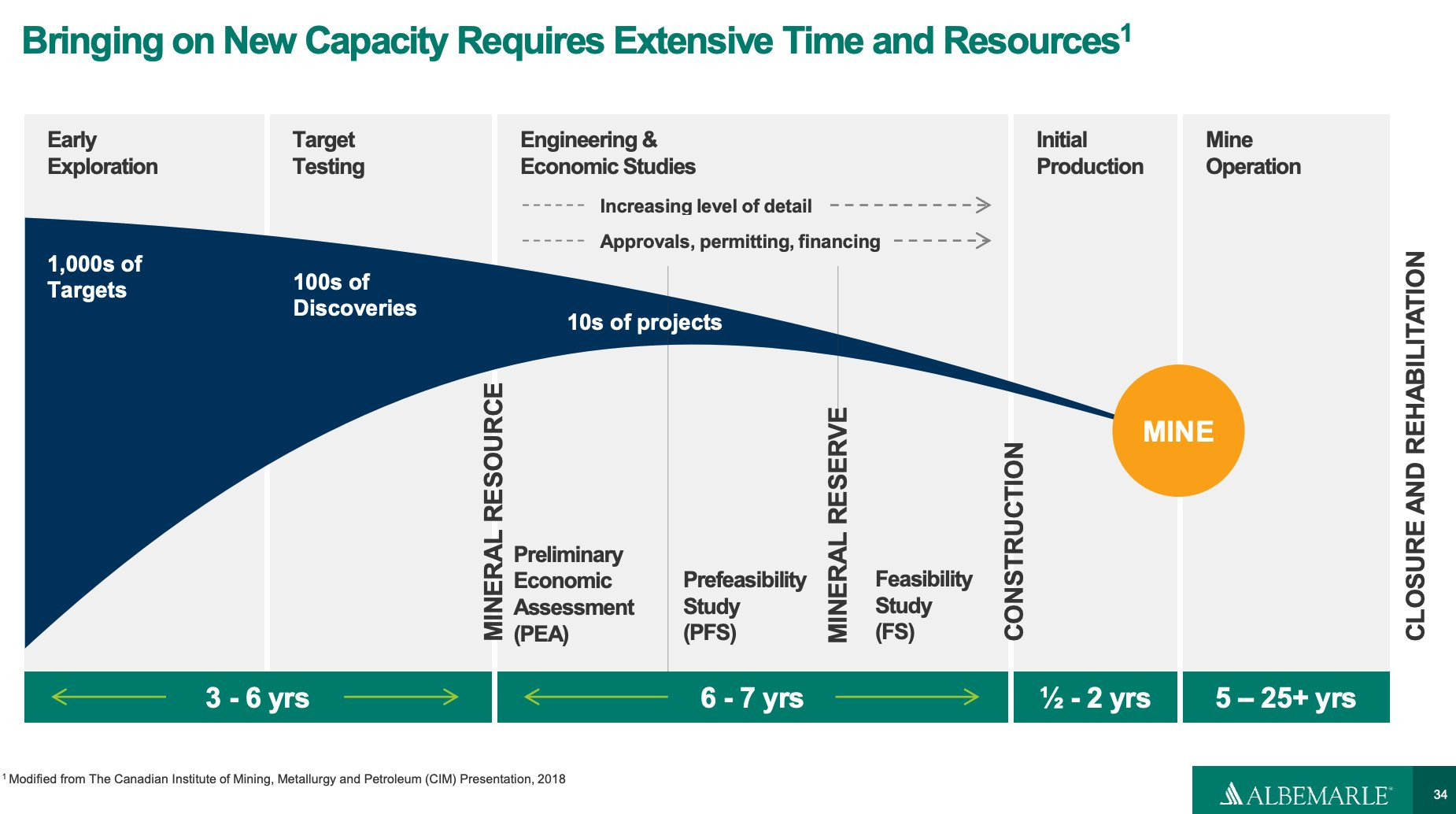

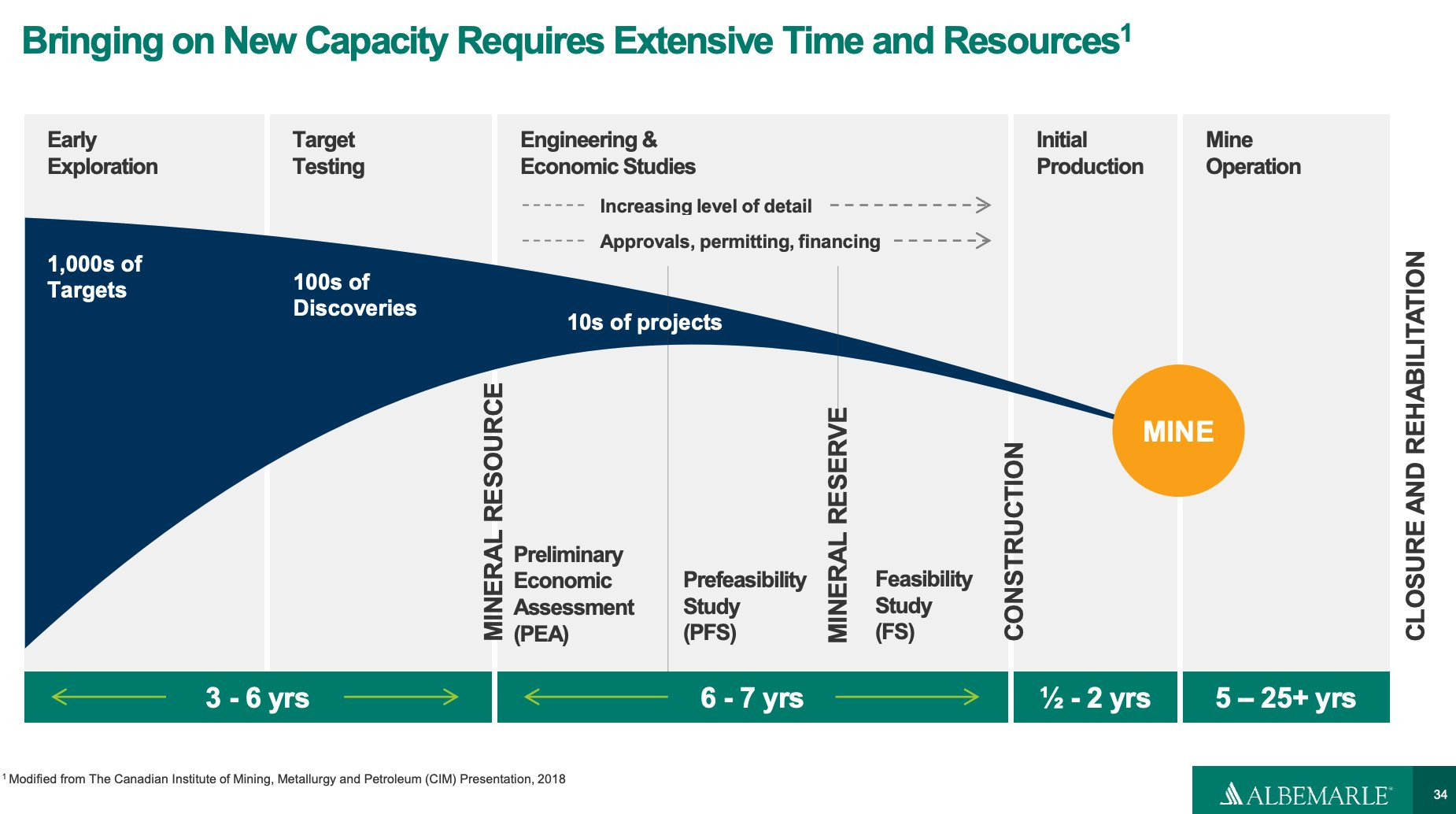

In der jüngeren Geschichte wollten Orte keinen Bergbau, was es schwierig machte, durch das Genehmigungsverfahren zu kommen.

Jetzt wird die Entwicklung der Batterielieferkette von der Regierung gefördert. Das ist eine große Veränderung. ...ganz zu schweigen davon, wenn diese großen Autolobbyisten hinter der Sache stehen.

https://twitter.com/skorusARK/status/1625615793164525595/pho…

DYOR Dicker

Jetzt wird die Entwicklung der Batterielieferkette von der Regierung gefördert. Das ist eine große Veränderung. ...ganz zu schweigen davon, wenn diese großen Autolobbyisten hinter der Sache stehen.

https://twitter.com/skorusARK/status/1625615793164525595/pho…

DYOR Dicker

Antwort auf Beitrag Nr.: 73.309.241 von Oginvest am 16.02.23 18:24:09Moin und Danke für Dein Einsatz hier.....

Wir haben alle die Werbespots gesehen. China ist in Elektrofahrzeuge verliebt. Wie lange dauert es, bis der Markt für Elektrofahrzeuge in den USA Fuß fasst? Antwort: NICHT SEHR LANGE.

Lithiumriese Albemarle Corp (ALB. N) erwartet, dass Chinas Markt für Elektrofahrzeuge (EV) in diesem Jahr um 40% oder mindestens um 3 Millionen Fahrzeuge wachsen wird, was die Nachfrage nach dem Batteriemetall auf dem größten Automobilmarkt der Welt ankurbeln wird.

https://www.reuters.com/markets/commodities/albemarle-expect…

DYOR Dicker

Wir haben alle die Werbespots gesehen. China ist in Elektrofahrzeuge verliebt. Wie lange dauert es, bis der Markt für Elektrofahrzeuge in den USA Fuß fasst? Antwort: NICHT SEHR LANGE.

Lithiumriese Albemarle Corp (ALB. N) erwartet, dass Chinas Markt für Elektrofahrzeuge (EV) in diesem Jahr um 40% oder mindestens um 3 Millionen Fahrzeuge wachsen wird, was die Nachfrage nach dem Batteriemetall auf dem größten Automobilmarkt der Welt ankurbeln wird.

https://www.reuters.com/markets/commodities/albemarle-expect…

DYOR Dicker

Congo demands $17 bln more in infrastructure investments from China deal

Feb 16 (Reuters) -Congo's state auditor has demanded an additional $17 billion of investments from a 2008 infrastructure-for-minerals deal with Chinese investors that is currently being renegotiated, documents seen by Reuters on Thursday showed.

President Felix Tshisekedi's government has been revisiting the deal struck by his predecessor Joseph Kabila under which Sinohydro Corp SINOH.UL and China Railway Group Limited agreed to build roads and hospitals in exchange for a 68% stake in Sicomines, a cobalt and copper joint venture with Congo's state mining company Gecamines.

Under the Sicomines deal, the Chinese investors committed to spending $3 billion on infrastructure projects, but the state auditor - Inspection Generale des Finances (IGF) - demanded that commitment be increased to $20 billion, to reflect the value of the mining concessions that Gecamines contributed to the deal.

...

https://www.xm.com/research/markets/allNews/reuters/congo-de…

Feb 16 (Reuters) -Congo's state auditor has demanded an additional $17 billion of investments from a 2008 infrastructure-for-minerals deal with Chinese investors that is currently being renegotiated, documents seen by Reuters on Thursday showed.

President Felix Tshisekedi's government has been revisiting the deal struck by his predecessor Joseph Kabila under which Sinohydro Corp SINOH.UL and China Railway Group Limited agreed to build roads and hospitals in exchange for a 68% stake in Sicomines, a cobalt and copper joint venture with Congo's state mining company Gecamines.

Under the Sicomines deal, the Chinese investors committed to spending $3 billion on infrastructure projects, but the state auditor - Inspection Generale des Finances (IGF) - demanded that commitment be increased to $20 billion, to reflect the value of the mining concessions that Gecamines contributed to the deal.

...

https://www.xm.com/research/markets/allNews/reuters/congo-de…

Australia's South32 sees China manganese demand up as half-year profit falls

South32 Ltd pointed on Thursday to signs of rising Chinese demand for steel-making material manganese, while reporting a 44% drop in first-half underlying earnings driven by inflation and falls in prices for its key commodities.The result slightly beat analysts’ expectations.

Sign Up for the Australasia Digest

The company, the world’s biggest producer of manganese, said the steel market in China had just begun to warm up following the end of pandemic controls there late last year. A pick-up in property-related steel demand from China would underpin higher manganese prices in coming months, chief executive Graham Kerr told Reuters.

“Real estate is probably still the sluggish market at the moment. That hasn’t quite taken off yet compared to the industrial side,” he said.

However, fresh buying of steel from that sector should erode stockpiles and help lift manganese prices to around $6.20 per dry metric tonne over the next three months from around $5.90 currently, he said. As more supply from South Africa appeared, prices would fall back towards $5.20 to $5.30, he said.

...

>> https://www.mining.com/web/south32-sees-china-manganese-dema…

Freyr Battery, Finnish Minerals Group plan cathode material JV

Freyr Battery and Finnish Minerals Group said on Thursday they had signed an agreement for a possible joint venture to produce cathode material based on lithium, iron and phosphate in Finland.The cathode material is needed in batteries used for large-scale energy storage.

Sign Up for the Battery Metals Digest

“The potential joint plant aims to be a spearhead project for the production of LFP cathode material in Europe,” the companies said.

Freyr, at present, is building its first battery cell factory in Norway.

Finnish Minerals Group, which has a state mandate to develop the mining and battery industry in Finland, said it had completed a preliminary study of its Sokli deposit in northern Finland.

“The results of the scoping study show the Sokli deposit in Savukoski could produce not only phosphate and iron, but also various rare earth elements, which are essential in the transition to using renewable energy,” Finnish Minerals Group added.

Sokli could fulfill more than 20% of Europe’s annual demand for phosphate, in addition to producing other minerals, the company said.

“The mine would strengthen the autonomy of European industry and reduce our dependence on exported minerals,” Finnish Minerals Group Chief Executive Matti Hietanen said.

https://www.mining.com/web/freyr-battery-finnish-minerals-gr…

Air Liquide sees historic opportunity to invest in clean energy

Industrial gases firm Air Liquide pledged on Thursday to take advantage of an historic opportunity to invest in clean energy, helped by the U.S. Inflation Reduction Act (IRA), as it beat 2022 earnings estimates and forecast more growth this year.

U.S. President Joe Biden signed the $430 billion IRA last August, promising huge incentives for companies to invest in the shift away from fossil fuels.

"We have never had historically such an opportunity of investment," Air Liquide Chief Executive Francois Jackow said in a press call, adding that in recent months the investment dynamic had become stronger in the United States than in Europe.

Air Liquide is one of the largest hydrogen producers in the world, and last year made almost 4 billion euros ($4.3 billion) of investment decisions, a company record.

The firm, which in 2022 launched its ADVANCE plan to invest 16 billion euros by 2025, said its 12-month investment opportunities totalled 3.3 billion euros, with more than 40% linked to the energy transition.

Air Liquide reported recurring operating income of 4.86 billion euros for 2022, up 16.9% year-on-year, above the 4.79 billion average forecast in a company-provided consensus.

Sales rose 7% on a comparable basis to 29.9 billion euros, with demand from the Americas and Asia Pacific, and from industrial merchant and electronics clients, driving growth in its main gas and services business.

At 1200, Air Liquide shares were up 1.6% at 148.16 euros.

For this year, the company forecast a further increase its operating margin and recurring net profit growth at constant exchange rates, unchanged from its guidance for last year

It proposed a dividend of 2.95 euro per share, up 12.2% year on year.

https://kalkinemedia.com/news/world-news/air-liquide-sees-hi…

Industrial gases firm Air Liquide pledged on Thursday to take advantage of an historic opportunity to invest in clean energy, helped by the U.S. Inflation Reduction Act (IRA), as it beat 2022 earnings estimates and forecast more growth this year.

U.S. President Joe Biden signed the $430 billion IRA last August, promising huge incentives for companies to invest in the shift away from fossil fuels.

"We have never had historically such an opportunity of investment," Air Liquide Chief Executive Francois Jackow said in a press call, adding that in recent months the investment dynamic had become stronger in the United States than in Europe.

Air Liquide is one of the largest hydrogen producers in the world, and last year made almost 4 billion euros ($4.3 billion) of investment decisions, a company record.

The firm, which in 2022 launched its ADVANCE plan to invest 16 billion euros by 2025, said its 12-month investment opportunities totalled 3.3 billion euros, with more than 40% linked to the energy transition.

Air Liquide reported recurring operating income of 4.86 billion euros for 2022, up 16.9% year-on-year, above the 4.79 billion average forecast in a company-provided consensus.

Sales rose 7% on a comparable basis to 29.9 billion euros, with demand from the Americas and Asia Pacific, and from industrial merchant and electronics clients, driving growth in its main gas and services business.

At 1200, Air Liquide shares were up 1.6% at 148.16 euros.

For this year, the company forecast a further increase its operating margin and recurring net profit growth at constant exchange rates, unchanged from its guidance for last year

It proposed a dividend of 2.95 euro per share, up 12.2% year on year.

https://kalkinemedia.com/news/world-news/air-liquide-sees-hi…

Antwort auf Beitrag Nr.: 73.308.572 von Oginvest am 16.02.23 17:01:30

Rules on Tuesday will require that by 2035 carmakers must achieve a 100% cut in CO2 emissions from new cars sold, which would make it impossible to sell new fossil fuel-powered vehicles in the 27-country bloc.

That plan has gone down badly in Italy, homes to brands including Fiat and Alfa Romeo, where the car industry is still largely focused on combustion engine technology.

"We all care about water, air quality and a cleaner environment ... but that does not mean laying off millions of workers and shutting down thousands of businesses," said Transport Minister Matteo Salvini, who leads the rightist League party.

"The ideological fundamentalism of electricity alone is suicide and a gift to China," he added.

Salvini, who is also deputy prime minister, said more time and more funding was needed to ensure a smooth transition.

Foreign Minister Antonio Tajani earlier indicated that Rome would seek to dilute the target.

"Italy will put forward its own counter-proposal: to limit the reduction to 90%, giving industries the chance to adapt," Tajani was quoted as saying by daily Corriere della Sera.

The domestic automotive industry employs over 270,000 workers directly or indirectly and accounts for more than 5% of the country's gross domestic product, according to data from automotive association ANFIA.

Sales of fully-electric cars fell 27% last year in Italy, accounting for just 3.7% of total new car registrations, according to ANFIA.

EU countries agreed the deal on banning thermal engine cars in October last year, but still need to formally rubber stamp the rules before they can take effect. Final approval is expected in March.

https://www.msn.com/en-us/news/world/italy-condemns-eu-plan-…

Italy condemns EU plan to outlaw fossil fuel cars

ROME (Reuters) -Italy stepped up its opposition on Thursday to European plans to outlaw the sale of new petrol and diesel cars in 12 years, with the transport minister calling a rapid switch to electric vehicles "suicide" and a "gift" to Chinese industry.Rules on Tuesday will require that by 2035 carmakers must achieve a 100% cut in CO2 emissions from new cars sold, which would make it impossible to sell new fossil fuel-powered vehicles in the 27-country bloc.

That plan has gone down badly in Italy, homes to brands including Fiat and Alfa Romeo, where the car industry is still largely focused on combustion engine technology.

"We all care about water, air quality and a cleaner environment ... but that does not mean laying off millions of workers and shutting down thousands of businesses," said Transport Minister Matteo Salvini, who leads the rightist League party.

"The ideological fundamentalism of electricity alone is suicide and a gift to China," he added.

Salvini, who is also deputy prime minister, said more time and more funding was needed to ensure a smooth transition.

Foreign Minister Antonio Tajani earlier indicated that Rome would seek to dilute the target.

"Italy will put forward its own counter-proposal: to limit the reduction to 90%, giving industries the chance to adapt," Tajani was quoted as saying by daily Corriere della Sera.

The domestic automotive industry employs over 270,000 workers directly or indirectly and accounts for more than 5% of the country's gross domestic product, according to data from automotive association ANFIA.

Sales of fully-electric cars fell 27% last year in Italy, accounting for just 3.7% of total new car registrations, according to ANFIA.

EU countries agreed the deal on banning thermal engine cars in October last year, but still need to formally rubber stamp the rules before they can take effect. Final approval is expected in March.

https://www.msn.com/en-us/news/world/italy-condemns-eu-plan-…

08.05.24 · wO Chartvergleich · Plug Power |

13.03.24 · wO Chartvergleich · British American Tobacco |

28.02.24 · wO Chartvergleich · Bayer |

29.11.23 · wO Chartvergleich · Borussia Dortmund |

08.11.23 · wO Chartvergleich · Bayer |

11.10.23 · wO Chartvergleich · Argosy Minerals |

04.10.23 · wO Chartvergleich · Bayer |

13.09.23 · wO Chartvergleich · Morphosys |

23.08.23 · wO Chartvergleich · NVIDIA |

| Zeit | Titel |

|---|---|

| 15.06.24 |