Vår Energi - norwegische Tochter der Eni (Seite 3)

eröffnet am 20.03.22 00:20:44 von

neuester Beitrag 09.05.24 23:36:05 von

neuester Beitrag 09.05.24 23:36:05 von

Beiträge: 56

ID: 1.358.574

ID: 1.358.574

Aufrufe heute: 4

Gesamt: 6.964

Gesamt: 6.964

Aktive User: 0

ISIN: NO0011202772 · WKN: A3DEH5 · Symbol: J4V

2,9630

EUR

-1,53 %

-0,0460 EUR

Letzter Kurs 20:01:18 Tradegate

Neuigkeiten

| TitelBeiträge |

|---|

16.02.24 · Markus Weingran |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,0775 | +40,13 | |

| 12,730 | +19,53 | |

| 25,00 | +19,05 | |

| 0,9790 | +12,79 | |

| 3,1000 | +8,77 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 21,520 | -10,07 | |

| 4,2918 | -10,59 | |

| 0,9554 | -10,71 | |

| 19,630 | -15,10 | |

| 2,5300 | -16,78 |

Beitrag zu dieser Diskussion schreiben

25.8.

Vår Energi strengthens its executive management team to reaffirm its strategic ambitions

https://investors.varenergi.no/news/news-details/2023/Vr-Ene…

...

The Company’s recent acquisition of Neptune Energy Norge will accelerate the Company’s position as a leading E&P independent in Norway. The Company is currently the third largest operator on the Norwegian Continental Shelf and the acquisition will further scale, diversify and strengthen its growth and value creation. In response to these new opportunities, the board has decided to make certain adjustments to the management group and bring on more resources.

"We are very pleased to announce that Nick Walker will be joining Vår as CEO and also that our current CEO, Torger Rød, transfers to the new role as COO”, says Thorhild Widvey, chair of the board.

...

Vår Energi strengthens its executive management team to reaffirm its strategic ambitions

https://investors.varenergi.no/news/news-details/2023/Vr-Ene…

...

The Company’s recent acquisition of Neptune Energy Norge will accelerate the Company’s position as a leading E&P independent in Norway. The Company is currently the third largest operator on the Norwegian Continental Shelf and the acquisition will further scale, diversify and strengthen its growth and value creation. In response to these new opportunities, the board has decided to make certain adjustments to the management group and bring on more resources.

"We are very pleased to announce that Nick Walker will be joining Vår as CEO and also that our current CEO, Torger Rød, transfers to the new role as COO”, says Thorhild Widvey, chair of the board.

...

25 July 2023: Chief Executive Officer, Torger Rød in Vår Energi has bought 10 000 shares in the company at a price of NOK 30.34 per share.

https://investors.varenergi.no/news/news-details/2023/Vr-Ene…

https://investors.varenergi.no/news/news-details/2023/Vr-Ene…

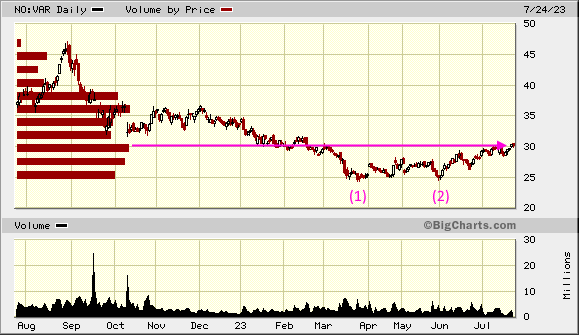

Vår Energi scheint langsam aus dem Loch herauszukommen:

June 23, 2023

Vår Energi to acquire Neptune Energy’s Norwegian oil and gas assets to accelerate growth and value creation on the NCS

https://investors.varenergi.no/news/news-details/2023/Vr-Ene…

...

Vår Energi ASA (OSE: VAR) (“Vår Energi” or the “Company”) has today entered into an agreement with Neptune Energy Group Holdings Limited to acquire 100% of the shares of Neptune Energy Norge AS (“Neptune Norway”) for a cash consideration based on an agreed enterprise value of USD 2.275 billion (the “Transaction”) to accelerate growth and value creation as a leading E&P independent on the Norwegian Continental Shelf (NCS).

In conjunction with the Transaction, Eni S.p.A (“Eni”) has agreed to acquire the remaining assets of Neptune group outside of Norway and Germany in a separate transaction. Completion of both transactions is inter-conditional.

The Transaction will add scale, diversification and further longevity to Vår Energi’s portfolio. It is in line with the plan for growth and value creation, path to ESG leadership and attractive distributions presented at the 2023 Capital Markets Update. The acquired assets are complementary to Vår Energi’s current portfolio and highly cash generative with low production cost and limited near-term investments.

The Transaction will strengthen the Company’s position in all existing hub areas and combine two strong organisations with extensive NCS experience. It will be financed through available liquidity and credit facilities and is expected to strengthen future dividend capacity.

...

Vår Energi to acquire Neptune Energy’s Norwegian oil and gas assets to accelerate growth and value creation on the NCS

https://investors.varenergi.no/news/news-details/2023/Vr-Ene…

...

Vår Energi ASA (OSE: VAR) (“Vår Energi” or the “Company”) has today entered into an agreement with Neptune Energy Group Holdings Limited to acquire 100% of the shares of Neptune Energy Norge AS (“Neptune Norway”) for a cash consideration based on an agreed enterprise value of USD 2.275 billion (the “Transaction”) to accelerate growth and value creation as a leading E&P independent on the Norwegian Continental Shelf (NCS).

In conjunction with the Transaction, Eni S.p.A (“Eni”) has agreed to acquire the remaining assets of Neptune group outside of Norway and Germany in a separate transaction. Completion of both transactions is inter-conditional.

The Transaction will add scale, diversification and further longevity to Vår Energi’s portfolio. It is in line with the plan for growth and value creation, path to ESG leadership and attractive distributions presented at the 2023 Capital Markets Update. The acquired assets are complementary to Vår Energi’s current portfolio and highly cash generative with low production cost and limited near-term investments.

The Transaction will strengthen the Company’s position in all existing hub areas and combine two strong organisations with extensive NCS experience. It will be financed through available liquidity and credit facilities and is expected to strengthen future dividend capacity.

...

Vår Energi scheint nach einiger Zeit wieder etwas mehr in die Gänge zu kommen:

24.4.

Vår Energi reports first quarter 2023 results

https://investors.varenergi.no/news/news-details/2023/Vr-Ene…

...

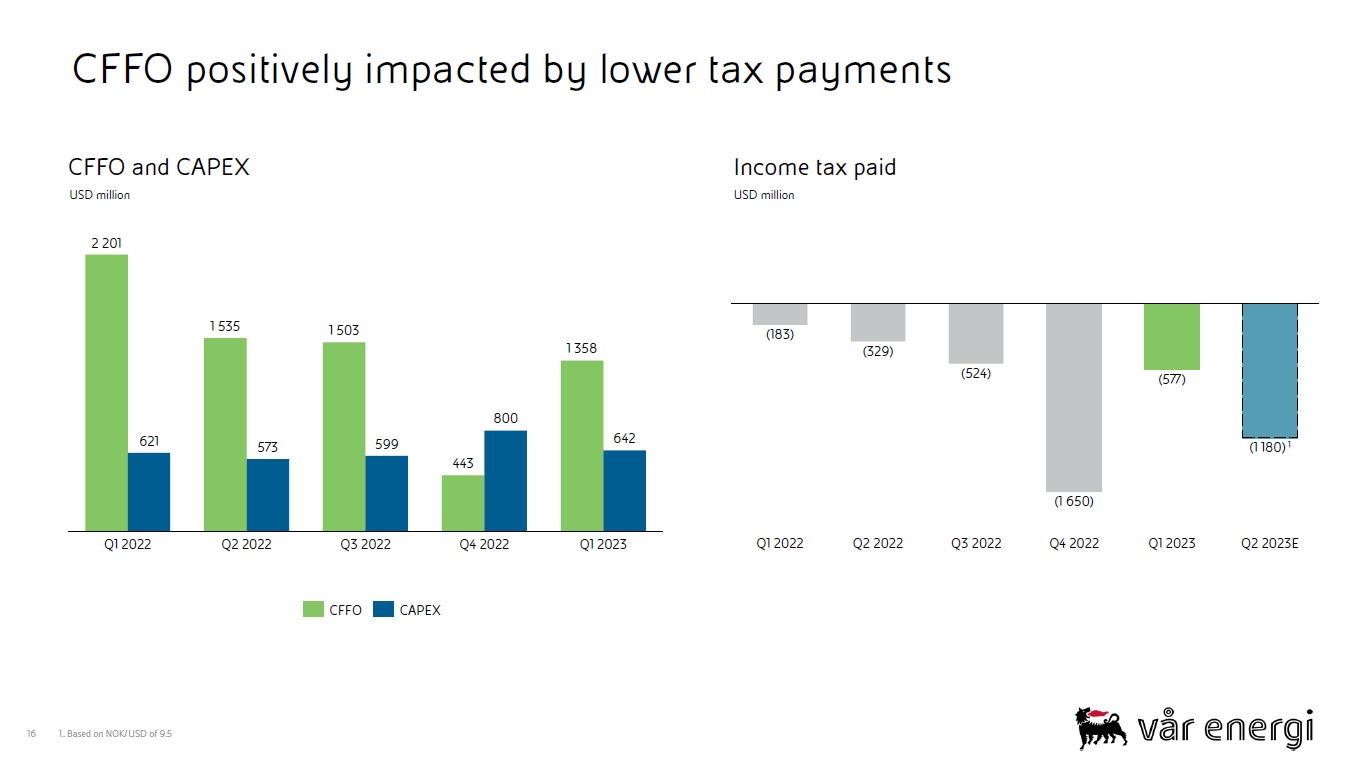

<CFFO = Cash flow from operations >

...

=> die Norweger sitzen auf Ölquellen

Vår Energi reports first quarter 2023 results

https://investors.varenergi.no/news/news-details/2023/Vr-Ene…

...

<CFFO = Cash flow from operations >

...

=> die Norweger sitzen auf Ölquellen

2.3.

Vår Energi ASA: Confirms oil discovery near Goliat in the Barents Sea

https://investors.varenergi.no/news/news-details/2023/Vr-Ene…

...

Vår Energi ASA (OSE: VAR) confirms discovery of oil in the operated 7122/8-1S Countach well in production licence PL229 (Goliat), northwest of Hammerfest, including updated volume estimates. The well was drilled in one of the segments that form the Countach prospect.

Preliminary estimates place the size of the discovery in the tested segment between 0,5 – 2,1 million Sm3 (3-13 million bbls) of total recoverable oil equivalents. The potential of the Countach prospect, in the undrilled segments, is estimated at up to 3,7 million Sm3 (23 million bbls) of total recoverable oil equivalents.

The well will now be permanently plugged and abandoned, and the licensees will evaluate drilling an appraisal well in the future.

...

Vår Energi ASA: Confirms oil discovery near Goliat in the Barents Sea

https://investors.varenergi.no/news/news-details/2023/Vr-Ene…

...

Vår Energi ASA (OSE: VAR) confirms discovery of oil in the operated 7122/8-1S Countach well in production licence PL229 (Goliat), northwest of Hammerfest, including updated volume estimates. The well was drilled in one of the segments that form the Countach prospect.

Preliminary estimates place the size of the discovery in the tested segment between 0,5 – 2,1 million Sm3 (3-13 million bbls) of total recoverable oil equivalents. The potential of the Countach prospect, in the undrilled segments, is estimated at up to 3,7 million Sm3 (23 million bbls) of total recoverable oil equivalents.

The well will now be permanently plugged and abandoned, and the licensees will evaluate drilling an appraisal well in the future.

...

Anbei ein Auszug zum Steuersatz dem Varenergi leider unterliegt.

Petroleum companies are subject to both ordinary corporate taxation and special

taxation pursuant to the Petroleum Tax Act of 13 June 1975.

The formal corporate tax rate is 22%, whereas the special tax rate is 71.8%. However,

since the corporate tax may be deducted in the special tax base, the effective

corporate tax is only 6.204%. Thus, the overall combined tax rate remains stable at

78% (from 2022 increasing somewhat to 78.004%)

---------------------------------------------------

Konkret bleiben daher im Q4/2022 von einem Gewinn von 1,7 Mrd. vor Steuern noch 488 Mio nach Steuern übrig. Da kann man als Investor nur in Tränen ausbrechen.

Petroleum companies are subject to both ordinary corporate taxation and special

taxation pursuant to the Petroleum Tax Act of 13 June 1975.

The formal corporate tax rate is 22%, whereas the special tax rate is 71.8%. However,

since the corporate tax may be deducted in the special tax base, the effective

corporate tax is only 6.204%. Thus, the overall combined tax rate remains stable at

78% (from 2022 increasing somewhat to 78.004%)

---------------------------------------------------

Konkret bleiben daher im Q4/2022 von einem Gewinn von 1,7 Mrd. vor Steuern noch 488 Mio nach Steuern übrig. Da kann man als Investor nur in Tränen ausbrechen.

Vår Energi - norwegische Tochter der Eni