Aixtron - Die Perle im Technologiebereich (Seite 4619)

eröffnet am 14.07.04 15:26:35 von

neuester Beitrag 10.05.24 14:03:52 von

neuester Beitrag 10.05.24 14:03:52 von

Beiträge: 50.786

ID: 880.385

ID: 880.385

Aufrufe heute: 382

Gesamt: 4.168.933

Gesamt: 4.168.933

Aktive User: 1

ISIN: DE000A0WMPJ6 · WKN: A0WMPJ · Symbol: AIXA

21,810

EUR

-2,20 %

-0,490 EUR

Letzter Kurs 16:48:26 Tradegate

Neuigkeiten

| AIXTRON Aktien ab 5,80 Euro handeln - Ohne versteckte Kosten!Anzeige |

09.05.24 · dpa-AFX |

09.05.24 · dpa-AFX |

09.05.24 · dpa-AFX |

Werte aus der Branche Halbleiter

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 24,450 | +45,71 | |

| 7,7500 | +15,67 | |

| 7,6000 | +14,29 | |

| 19,900 | +10,56 | |

| 12,323 | +10,29 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,0380 | -11,92 | |

| 4,1200 | -12,15 | |

| 6,9750 | -12,81 | |

| 27,30 | -33,48 | |

| 1.000,00 | -50,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 25.573.420 von der4jaehrige am 21.11.06 20:24:59Bin kein Freund von offenen Gaps ... also hoffentlich wird das gleich morgen wieder geschlossen und dann solls im Laufe des Tages kräftig hoch gehen.

Wirthi

Wirthi

in Frankfrurt wollts einer genauch wissen

Antwort auf Beitrag Nr.: 25.569.198 von WAlexandro am 21.11.06 18:02:55Das glaub ich auch!

NUR in der düsse ist zuwenig treibstoff NUR wenn die kräftig duchgeschüttelt wird , wird die RAKETE hochexblosiv

NUR wenn die kräftig duchgeschüttelt wird , wird die RAKETE hochexblosiv die TAGE werden aber kürzer dafür exblosiver

die TAGE werden aber kürzer dafür exblosiver

gruss der4

NUR in der düsse ist zuwenig treibstoff

NUR wenn die kräftig duchgeschüttelt wird , wird die RAKETE hochexblosiv

NUR wenn die kräftig duchgeschüttelt wird , wird die RAKETE hochexblosiv die TAGE werden aber kürzer dafür exblosiver

die TAGE werden aber kürzer dafür exblosiver

gruss der4

was interessant ist: das orderbuch hat erstmals ,seit langem, mal wieder mit einem nachfrageüberhang geschlossen hat. verhältnis 1 zu 0,6 ist ordentlich

es grüsst ricki

es grüsst ricki

There are now [4] new stories posted on our member site. Please sign in to read real-time news updates.

A broader Aixtron: Q&A with deposition specialist Aixtron AG

Printer friendly

Related stories

Chris Hall, DigiTimes.com [Tuesday 21 November 2006]

Aixtron AG has specialized in MOCVD technology since 1983, but the Europe-based company is now brandishing its latest acquisition, the California-based Genus, which supplies both a CVD and ALD capability to complement Aixtron’s traditional emphasis on MOCVD as well as its more recently developed AVD technology.

That all adds up to a formidably broad range of technology options, leaving the company well positioned for the technology shifts that lie ahead. Small or seismic, those technology shifts will now cover a huge range of potential applications, from consumer multimedia players through to displays and area lighting.

DigiTimes.com had the opportunity to talk with Paul Hyland, President and CEO of Aixtron, and Dr. William (“Bill”) Elder, Executive Vice President at Aixtron with responsibility for their silicon interests, about the prospects for the combined company, now that it has completed the integration of Genus, which was acquired 18 months ago, and the business challenges and technology scenarios that lie ahead. This at-length, in-depth interview also includes contributions from Christian (“Chris”) Geng, Aixtron general manager for Greater China.

This is Part I of a five-part interview. Part II follows on November 22.

Q: Aixtron has traditionally been a leading supplier of MOCVD equipment, and my understanding is that there has been a recent up-tick in demand for MOCVD equipment, led, I assume, by growth in LED manufacturing. How is Aixtron positioned, now, in MOCVD equipment supply? Have you seen growth in this area?

PH: We still are the largest producer of MOCVD equipment. And as you suggest, for the last two or three quarters we have seen quite a substantial increase in orders, with equipment order intake totaling €81.2 million in the first six months of 2006. Asia remains our biggest MOCVD market and we have received a large number of system orders from the region, and together these generated 71% of our first six months, 2006 revenues. There are a number of factors involved here, one of which has been the introduction of new products by Aixtron. Over the last two or three years we’ve developed a more modular technology platform, including the introduction of our “Yield-Plus” package, which allows customers to achieve both increased yields and a reduced cost of ownership. In addition, we’ve introduced new high-capacity Aixtron MOCVD systems. All of this has been very favorably received by our customers.

Since the end of last year, we’ve been able to offer customers both a 42x2 inches planetary system, and a 30x2 inches showerhead system, and these are significant tools, ones that can help the industry reduce its cost of ownership and increase throughput, going forward. Cost of ownership (CoO) and new applications are the key to the more recent demand for systems, which marks the arrival of a second major LED application, namely LED backlighting. LEDs for mobile phones in particular, have kept the industry very well occupied for the past two or three years, but the arrival of LED backlighting, as the next major application, will ensure a further level of growth in the industry.

The last two quarters have been particularly healthy for Aixtron, and although we can’t talk about the third quarter until 2 November when we publish our results, the demand that we saw in the second quarter of 2006 was very encouraging. (Equipment order intake in the second quarter of 2006 totaled €49.4 million.)

The systems that have been coming into Taiwan are not only for our existing customers, but also for one or two new people appearing on the scene, including for example ProMOS Technologies and their recently announced joint venture with Hermes-Epitek. It’s a healthy indication, perhaps, that there are companies in Taiwan who see this next application, LED backlighting, as an opportunity to enter the LED market.

BE: It’s interesting for us because ProMOS is already a very long-term silicon customer for Aixtron, through Genus, for memory applications. The relationship we have with ProMOS will lend itself well to this joint venture with Hermes in the LED market. We know all of the key management people we need to be working with as they embark on this new venture within ProMOS.

Q: I had the impression that the introduction of LED backlighting could be delayed by cost factors, but in fact this is an area where costs have been leveling out?

PH: I think your interpretation is right. If you had asked us 12 or 18 months ago, we’d have said the same thing, that there was still a very large cost delta between traditional CCFL backlighting and LED as a backlighting technology, but I think the past 18 months have seen not only an improvement in performance and consistency but also an improved CoO. There is still a gap, without any question, and part of the investment that’s being made by the industry is not only the re-qualification of their existing processes, but also a migration of those processes to new, larger capacity systems.

That is an essential step in getting the CoO down. They’ve not only got to migrate their internal processes, they have to re-qualify the processes on new systems, on additional systems, and then I believe the industry will rapidly drive down the cost. If you look at what the industry has done in the past three or four years, I think it’s a reasonably safe bet that they will achieve that reduced CoO.

Q: Can you give any facts and figures about increased purchases for MOCVD, particularly if you’ve made any significant entry into the China market?

PH: The Chinese market is a market we’ve been actively involved in for quite some considerable time, but needless to say, there isn’t the same degree of infrastructure or expertise in place yet as you might see elsewhere, but there’s been a fairly steady investment in China over the last few years. Chris [Geng] is actually responsible for the mainland China market, and it’s true to say he is seeing the emergence of new commercial companies trying to establish themselves in China. It has moved on from the early days where there was government encouragement of cooperation between academic institutions and industry partners. Businesses have now moved on to the next stage, where we are seeing new companies specifically focused on LED production.

Chris Geng: Well, initially it was always universities working with companies with very ambitious plans, and we have seen a very significant increase in orders from China, this year, compared to last year.

PH: And the other factor is the improved commercial relationships between Taiwan companies and Chinese businesses. There are many examples of Taiwan companies acting as facilitators within projects in Mainland China.

Q: In some general sense, you see some improvement in relations between Taiwan and China?

Chris Geng: On an engineering level, very much so. You see a lot of Taiwan engineers going to China.

Q: And is that a case of Taiwan manufacturing going directly to China? Or are they working with China partners?

PH: We’ve most recently sold 300mm systems, for silicon applications, in mainland China. In that particular case, it was a Korean company in a JV with a European company within China. That JV is seen as both a strategic investment and an opportunity to make an early entry into what is clearly an emerging market. We may need to be patient and wait for the mainland China market to fully develop, but I think you will see other Asian countries assisting in that process.

BE: And I think what you’re seeing, especially from Korean and European companies, is the desire to penetrate the Chinese end-market. The way to do that is to get up and running with your own fab in China, and then most of that production satisfies the needs of the local Chinese market, and there’s no import or export of products. I think what we’re seeing in the case of Korea is a tremendous investment on the part of the Korean companies, in order to make sure that production comes on line fast. So if you’re asking, “Are there Taiwan engineers going to China?” the answer is “yes,” but there are also Korean engineers going to China to try and sell their technology. And clearly whoever is first to market with advanced DRAMs will play a significant role in the China marketplace.

Q: So the Korea industry is really moving, trying to develop a synergy with China?

BE: Yes, they are very active.

Q: In practice, are the Koreans doing well or not?

BE: The Koreans are making focused investments that ensure they overcome any initial cultural barriers and that they transfer the technology efficiently. I am confident that they will succeed with this approach, but they are not alone in seeing the potential of this market.

Q: Are there any particular regions or cities where this type of activity is occurring? Is it a case of more in the South, say in Dongguan, or further north, in Shanghai, for example?

Chris Geng: I think it depends on the technology. Coming back to compound MOCVD applications, China has established five different centers for solid-state lighting (DaLian, NanChan, Shanghai, Shenzen, XiaMen), for example.

BE: What I was referring to there was purely related to silicon. I think what Chris is referring to is a much broader investment across China, compared to what we see in the silicon area. Most of the silicon investment on the part of the foreign companies is going into Shanghai and the surrounding area. I think compound is a little different.

PH: Most of the investments, compound- or silicon-related, are taking place around the bigger cities. The Chinese are understandably very interested in the area of solid-state lighting, for quite natural reasons. I say that because the industry is not just about the production of LED chips. When the CoO key markers are met, it’s going to involve the packaging of the device as well. China’s not alone in this, but I think they are certainly interested in the potential of solid-state lighting.

Any time I go into the local hardware super-store in Germany, I’m always interested to see where the LED lighting products start and finish. Even today, you can see what I would call growing niche consumer products. It’s true they are relatively highly priced compared to conventional lighting, so there’s still a way to go. Personally, I believe solid-state lighting will need at least another three to five years of the development cycle before it actually becomes a viable commercial product, but its use as a lighting source is undoubtedly increasing each year.

Q: And in terms of technology, you’re talking only about LEDs, right now?

PH: Yes I am. In the short to medium term our, and the industry’s, focus is on solid-state LED lighting.

However, if we switch technologies, for a moment, to OLEDs, only a few days ago there was a ceremony to mark the official opening of a European Commission sponsored development program, in which we are participating in the long-term development of OLED lighting as another longer term alternative to conventional lighting

One company we’ve been regularly involved with directly is Philips, a company that is clearly interested in carrying out both LED and OLED joint and long-term development projects, and we are already playing a role in those. Both are viable technology approaches, but OLED is still clearly in its early days of development in comparison to LEDs, and I don’t think we should underestimate the time it takes for these technologies to become fully developed and commercialized. It takes time and focus to succeed in these new fields.

In addition to lighting, OLEDs potentially address the large display markets as well, but if we look around at what is a highly competitive display industry today, we can see a continual technical and cost improvement in TFT-LCD and plasma technologies, and the arrival of new display technologies such as SED. OLED is undoubtedly a very interesting and promising technology, but it may take a bit longer than first envisaged to move on from small displays to large displays.

Paul Hyland, President and CEO, Aixtron: “What we have today is great challenges and great opportunities – in equal measure. I wouldn’t want it any other way.”

Photo: Company

Dr. William (“Bill”) Elder, Executive Vice President, Aixtron: “We talk about acquiring technology, but at night our technology pretty much walks out the door. Making sure that you keep the people to ensure the success of the technology is critical.”

Photo: Company

Aixtron’s Lynx-iXP 300mm CVD System (front)

Photo: Company

Aixtron’s Lynx-iXP 300mm CVD System (back)

Photo: Company

Tricent AVD Deposition System for Advanced Metals and Dielectrics

Photo: Company

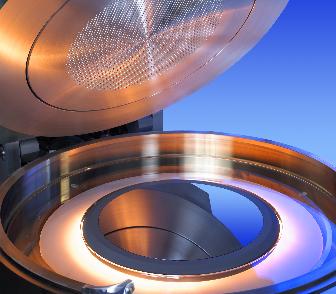

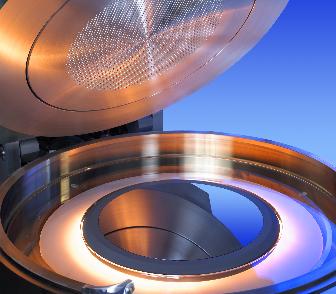

Tricent AVD 300mm Reactor Chamber

Photo: Company

AIX 2800G4 HT (42x2") for high through-put and high yield manufacturing of GaN based LEDs

Photo: Company

Irgendwann gebt die Rakete ab.

Gruß

WAlex

A broader Aixtron: Q&A with deposition specialist Aixtron AG

Printer friendly

Related stories

Chris Hall, DigiTimes.com [Tuesday 21 November 2006]

Aixtron AG has specialized in MOCVD technology since 1983, but the Europe-based company is now brandishing its latest acquisition, the California-based Genus, which supplies both a CVD and ALD capability to complement Aixtron’s traditional emphasis on MOCVD as well as its more recently developed AVD technology.

That all adds up to a formidably broad range of technology options, leaving the company well positioned for the technology shifts that lie ahead. Small or seismic, those technology shifts will now cover a huge range of potential applications, from consumer multimedia players through to displays and area lighting.

DigiTimes.com had the opportunity to talk with Paul Hyland, President and CEO of Aixtron, and Dr. William (“Bill”) Elder, Executive Vice President at Aixtron with responsibility for their silicon interests, about the prospects for the combined company, now that it has completed the integration of Genus, which was acquired 18 months ago, and the business challenges and technology scenarios that lie ahead. This at-length, in-depth interview also includes contributions from Christian (“Chris”) Geng, Aixtron general manager for Greater China.

This is Part I of a five-part interview. Part II follows on November 22.

Q: Aixtron has traditionally been a leading supplier of MOCVD equipment, and my understanding is that there has been a recent up-tick in demand for MOCVD equipment, led, I assume, by growth in LED manufacturing. How is Aixtron positioned, now, in MOCVD equipment supply? Have you seen growth in this area?

PH: We still are the largest producer of MOCVD equipment. And as you suggest, for the last two or three quarters we have seen quite a substantial increase in orders, with equipment order intake totaling €81.2 million in the first six months of 2006. Asia remains our biggest MOCVD market and we have received a large number of system orders from the region, and together these generated 71% of our first six months, 2006 revenues. There are a number of factors involved here, one of which has been the introduction of new products by Aixtron. Over the last two or three years we’ve developed a more modular technology platform, including the introduction of our “Yield-Plus” package, which allows customers to achieve both increased yields and a reduced cost of ownership. In addition, we’ve introduced new high-capacity Aixtron MOCVD systems. All of this has been very favorably received by our customers.

Since the end of last year, we’ve been able to offer customers both a 42x2 inches planetary system, and a 30x2 inches showerhead system, and these are significant tools, ones that can help the industry reduce its cost of ownership and increase throughput, going forward. Cost of ownership (CoO) and new applications are the key to the more recent demand for systems, which marks the arrival of a second major LED application, namely LED backlighting. LEDs for mobile phones in particular, have kept the industry very well occupied for the past two or three years, but the arrival of LED backlighting, as the next major application, will ensure a further level of growth in the industry.

The last two quarters have been particularly healthy for Aixtron, and although we can’t talk about the third quarter until 2 November when we publish our results, the demand that we saw in the second quarter of 2006 was very encouraging. (Equipment order intake in the second quarter of 2006 totaled €49.4 million.)

The systems that have been coming into Taiwan are not only for our existing customers, but also for one or two new people appearing on the scene, including for example ProMOS Technologies and their recently announced joint venture with Hermes-Epitek. It’s a healthy indication, perhaps, that there are companies in Taiwan who see this next application, LED backlighting, as an opportunity to enter the LED market.

BE: It’s interesting for us because ProMOS is already a very long-term silicon customer for Aixtron, through Genus, for memory applications. The relationship we have with ProMOS will lend itself well to this joint venture with Hermes in the LED market. We know all of the key management people we need to be working with as they embark on this new venture within ProMOS.

Q: I had the impression that the introduction of LED backlighting could be delayed by cost factors, but in fact this is an area where costs have been leveling out?

PH: I think your interpretation is right. If you had asked us 12 or 18 months ago, we’d have said the same thing, that there was still a very large cost delta between traditional CCFL backlighting and LED as a backlighting technology, but I think the past 18 months have seen not only an improvement in performance and consistency but also an improved CoO. There is still a gap, without any question, and part of the investment that’s being made by the industry is not only the re-qualification of their existing processes, but also a migration of those processes to new, larger capacity systems.

That is an essential step in getting the CoO down. They’ve not only got to migrate their internal processes, they have to re-qualify the processes on new systems, on additional systems, and then I believe the industry will rapidly drive down the cost. If you look at what the industry has done in the past three or four years, I think it’s a reasonably safe bet that they will achieve that reduced CoO.

Q: Can you give any facts and figures about increased purchases for MOCVD, particularly if you’ve made any significant entry into the China market?

PH: The Chinese market is a market we’ve been actively involved in for quite some considerable time, but needless to say, there isn’t the same degree of infrastructure or expertise in place yet as you might see elsewhere, but there’s been a fairly steady investment in China over the last few years. Chris [Geng] is actually responsible for the mainland China market, and it’s true to say he is seeing the emergence of new commercial companies trying to establish themselves in China. It has moved on from the early days where there was government encouragement of cooperation between academic institutions and industry partners. Businesses have now moved on to the next stage, where we are seeing new companies specifically focused on LED production.

Chris Geng: Well, initially it was always universities working with companies with very ambitious plans, and we have seen a very significant increase in orders from China, this year, compared to last year.

PH: And the other factor is the improved commercial relationships between Taiwan companies and Chinese businesses. There are many examples of Taiwan companies acting as facilitators within projects in Mainland China.

Q: In some general sense, you see some improvement in relations between Taiwan and China?

Chris Geng: On an engineering level, very much so. You see a lot of Taiwan engineers going to China.

Q: And is that a case of Taiwan manufacturing going directly to China? Or are they working with China partners?

PH: We’ve most recently sold 300mm systems, for silicon applications, in mainland China. In that particular case, it was a Korean company in a JV with a European company within China. That JV is seen as both a strategic investment and an opportunity to make an early entry into what is clearly an emerging market. We may need to be patient and wait for the mainland China market to fully develop, but I think you will see other Asian countries assisting in that process.

BE: And I think what you’re seeing, especially from Korean and European companies, is the desire to penetrate the Chinese end-market. The way to do that is to get up and running with your own fab in China, and then most of that production satisfies the needs of the local Chinese market, and there’s no import or export of products. I think what we’re seeing in the case of Korea is a tremendous investment on the part of the Korean companies, in order to make sure that production comes on line fast. So if you’re asking, “Are there Taiwan engineers going to China?” the answer is “yes,” but there are also Korean engineers going to China to try and sell their technology. And clearly whoever is first to market with advanced DRAMs will play a significant role in the China marketplace.

Q: So the Korea industry is really moving, trying to develop a synergy with China?

BE: Yes, they are very active.

Q: In practice, are the Koreans doing well or not?

BE: The Koreans are making focused investments that ensure they overcome any initial cultural barriers and that they transfer the technology efficiently. I am confident that they will succeed with this approach, but they are not alone in seeing the potential of this market.

Q: Are there any particular regions or cities where this type of activity is occurring? Is it a case of more in the South, say in Dongguan, or further north, in Shanghai, for example?

Chris Geng: I think it depends on the technology. Coming back to compound MOCVD applications, China has established five different centers for solid-state lighting (DaLian, NanChan, Shanghai, Shenzen, XiaMen), for example.

BE: What I was referring to there was purely related to silicon. I think what Chris is referring to is a much broader investment across China, compared to what we see in the silicon area. Most of the silicon investment on the part of the foreign companies is going into Shanghai and the surrounding area. I think compound is a little different.

PH: Most of the investments, compound- or silicon-related, are taking place around the bigger cities. The Chinese are understandably very interested in the area of solid-state lighting, for quite natural reasons. I say that because the industry is not just about the production of LED chips. When the CoO key markers are met, it’s going to involve the packaging of the device as well. China’s not alone in this, but I think they are certainly interested in the potential of solid-state lighting.

Any time I go into the local hardware super-store in Germany, I’m always interested to see where the LED lighting products start and finish. Even today, you can see what I would call growing niche consumer products. It’s true they are relatively highly priced compared to conventional lighting, so there’s still a way to go. Personally, I believe solid-state lighting will need at least another three to five years of the development cycle before it actually becomes a viable commercial product, but its use as a lighting source is undoubtedly increasing each year.

Q: And in terms of technology, you’re talking only about LEDs, right now?

PH: Yes I am. In the short to medium term our, and the industry’s, focus is on solid-state LED lighting.

However, if we switch technologies, for a moment, to OLEDs, only a few days ago there was a ceremony to mark the official opening of a European Commission sponsored development program, in which we are participating in the long-term development of OLED lighting as another longer term alternative to conventional lighting

One company we’ve been regularly involved with directly is Philips, a company that is clearly interested in carrying out both LED and OLED joint and long-term development projects, and we are already playing a role in those. Both are viable technology approaches, but OLED is still clearly in its early days of development in comparison to LEDs, and I don’t think we should underestimate the time it takes for these technologies to become fully developed and commercialized. It takes time and focus to succeed in these new fields.

In addition to lighting, OLEDs potentially address the large display markets as well, but if we look around at what is a highly competitive display industry today, we can see a continual technical and cost improvement in TFT-LCD and plasma technologies, and the arrival of new display technologies such as SED. OLED is undoubtedly a very interesting and promising technology, but it may take a bit longer than first envisaged to move on from small displays to large displays.

Paul Hyland, President and CEO, Aixtron: “What we have today is great challenges and great opportunities – in equal measure. I wouldn’t want it any other way.”

Photo: Company

Dr. William (“Bill”) Elder, Executive Vice President, Aixtron: “We talk about acquiring technology, but at night our technology pretty much walks out the door. Making sure that you keep the people to ensure the success of the technology is critical.”

Photo: Company

Aixtron’s Lynx-iXP 300mm CVD System (front)

Photo: Company

Aixtron’s Lynx-iXP 300mm CVD System (back)

Photo: Company

Tricent AVD Deposition System for Advanced Metals and Dielectrics

Photo: Company

Tricent AVD 300mm Reactor Chamber

Photo: Company

AIX 2800G4 HT (42x2") for high through-put and high yield manufacturing of GaN based LEDs

Photo: Company

Irgendwann gebt die Rakete ab.

Gruß

WAlex

Antwort auf Beitrag Nr.: 25.567.772 von der4jaehrige am 21.11.06 17:12:25DOCH Wacker Chemie hat mit Silizium zutun

Dialog Semiconductor hat glaub mit Halbleiter zutun und das andere firmen sagen mir weniger was

Dialog Semiconductor hat glaub mit Halbleiter zutun und das andere firmen sagen mir weniger was

Antwort auf Beitrag Nr.: 25.567.522 von rickmann am 21.11.06 17:03:32? mach halt den link auf

vielleicht verstehst du dann

vielleicht verstehst du dann

Antwort auf Beitrag Nr.: 25.567.130 von Tepui am 21.11.06 16:45:46tepui, das sind keine aixtron verkäufe. die einzigen insider trades, die bei aixtron in den letzten wochen gelaufen sind, waren eine paar käufe durch den aufsichtsrat und dessen frau. waren aber nur ein paar tausend.

es grüsst ricki

es grüsst ricki

Antwort auf Beitrag Nr.: 25.567.522 von rickmann am 21.11.06 17:03:32DER hat sich bestimmt an der tür verirrt

oder will Tepui uns was anderes sagen was er mit den verkäufen anderen firmen meint ich verstehs auch nicht

oder will Tepui uns was anderes sagen was er mit den verkäufen anderen firmen meint ich verstehs auch nicht

Antwort auf Beitrag Nr.: 25.567.130 von Tepui am 21.11.06 16:45:46????? ich verstehe dich nicht

es güsst ricki

es güsst ricki

09.05.24 · dpa-AFX · Allianz |

09.05.24 · dpa-AFX · Infineon Technologies |

09.05.24 · dpa-AFX · Infineon Technologies |

08.05.24 · wO Chartvergleich · Plug Power |

07.05.24 · dpa-AFX · AIXTRON |

02.05.24 · Aktienwelt360 · Steico |

30.04.24 · wO Newsflash · AIXTRON |