New Gold, dank Merger mit sehr großer Zukunft! (Seite 5)

eröffnet am 01.04.08 13:40:03 von

neuester Beitrag 10.05.24 11:07:40 von

neuester Beitrag 10.05.24 11:07:40 von

Beiträge: 556

ID: 1.140.021

ID: 1.140.021

Aufrufe heute: 4

Gesamt: 71.722

Gesamt: 71.722

Aktive User: 0

ISIN: CA6445351068 · WKN: A0ERPH · Symbol: 32N

1,9095

EUR

+1,49 %

+0,0280 EUR

Letzter Kurs 17:42:59 Tradegate

Neuigkeiten

| TitelBeiträge |

|---|

13.05.24 · globenewswire |

16.06.23 · Jörg Schulte Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,8000 | +566,67 | |

| 1,0000 | +32,63 | |

| 21,800 | +16,27 | |

| 0,5100 | +15,38 | |

| 238,32 | +14,63 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,1100 | -6,61 | |

| 6,5500 | -7,09 | |

| 14,843 | -8,77 | |

| 177,10 | -21,98 | |

| 46,71 | -98,00 |

Beitrag zu dieser Diskussion schreiben

..."As our operations return to pre-COVID levels and we complete all non-recurring capital projects at Rainy River, we can now take a longer-term perspective.

New Gold's future will be supported by profitable operations, a stronger balance sheet, and as our current hedges expire at year end, we will be fully exposed to the strengthened gold price.

We are excited to enter the next stage as we create a Canadian-focused, diversified company that prioritizes profitability and free cash flow generation...

Renaud Adams, CEO

14.7.

New Gold Reports Second Quarter Operational Results

https://finance.yahoo.com/news/gold-reports-second-quarter-o…

...

...

=> ich hoffe nur, daß Adams das " COVID-19"-Quartal zum Mülleimer-Quartal gemacht hat und das kein Trend bei Rainy River ist

New Gold's future will be supported by profitable operations, a stronger balance sheet, and as our current hedges expire at year end, we will be fully exposed to the strengthened gold price.

We are excited to enter the next stage as we create a Canadian-focused, diversified company that prioritizes profitability and free cash flow generation...

Renaud Adams, CEO

14.7.

New Gold Reports Second Quarter Operational Results

https://finance.yahoo.com/news/gold-reports-second-quarter-o…

...

...

=> ich hoffe nur, daß Adams das " COVID-19"-Quartal zum Mülleimer-Quartal gemacht hat und das kein Trend bei Rainy River ist

New Gold says Q2 production below plan

New Gold (NYSEMKT:NGD) -1.5% pre-market after reporting Q2 preliminary production of ~98.1K gold equiv. oz., including 64,294 oz. gold, 34,282 oz. silver and ~16.9M lbs. copper.https://seekingalpha.com/news/3590950-new-gold-says-q2-prod…

New Gold gibt die Rückzahlung der in 2020 fälligen Schuldverschreibung in Höhe von 400 Mio. USD bekannt

Die Rückzahlung der Anleihe wurde durch die Erlöse aus einer 400 Mio. USD Anleiheemission mit Laufzeit 2027 finanziert.https://www.newgold.com/investors/news-releases/news-details…

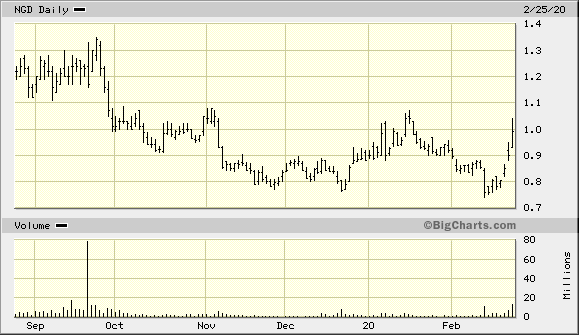

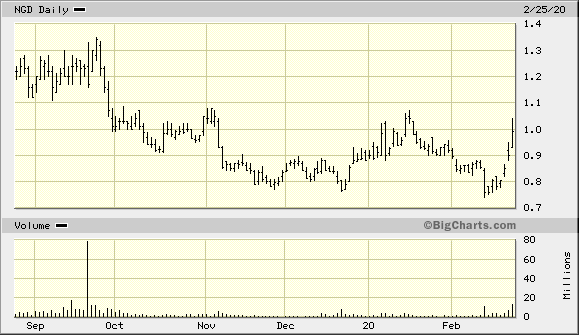

scheint aber erst nochmal abzutauchen ...

der deal bringt aber wohl gute 30cent wert pro aktie ...

ziel 1,66US$.

bin dabei.

der deal bringt aber wohl gute 30cent wert pro aktie ...

ziel 1,66US$.

bin dabei.

Antwort auf Beitrag Nr.: 63.977.580 von faultcode am 10.06.20 22:38:49momentan gibt's noch ne kleine technische Hürde auf dem weiteren Weg nach oben:

..danach stehen die ~USD2.2 an, und als Fernziel die alte VaP-Unterstützung bei ~USD2.8, die allerdings ein Brett ist.

Heute spielt natürlich auch (wieder) Artemis/Blackwater eine Rolle: https://www.wallstreet-online.de/diskussion/1326009-1-10/art…

..danach stehen die ~USD2.2 an, und als Fernziel die alte VaP-Unterstützung bei ~USD2.8, die allerdings ein Brett ist.

Heute spielt natürlich auch (wieder) Artemis/Blackwater eine Rolle: https://www.wallstreet-online.de/diskussion/1326009-1-10/art…

Antwort auf Beitrag Nr.: 63.959.247 von faultcode am 09.06.20 17:10:39Tag 2 -- zur Abwechslung mal mit Expansion Breakout (unbestätigt):

10.6

New Gold Announces Launch of $400 million Senior Notes Offering to Fund Redemption of Outstanding 6.25% Senior Notes

https://finance.yahoo.com/news/gold-announces-launch-400-mil…

10.6

New Gold Announces Launch of $400 million Senior Notes Offering to Fund Redemption of Outstanding 6.25% Senior Notes

https://finance.yahoo.com/news/gold-announces-launch-400-mil…

Antwort auf Beitrag Nr.: 59.878.423 von faultcode am 14.02.19 21:56:13

--> q.e.d.

9.6

New Gold to Divest Blackwater to Artemis Gold for C$190 Million in Cash and Retained Exposure via an 8% Gold Stream and Equity Stake in Artemis

https://www.wallstreet-online.de/nachricht/12608181-new-gold…

...New Gold Inc. (“New Gold” or the “Company”) (TSX and NYSE American: NGD) is pleased to announce that it has entered into a definitive agreement (the “Agreement”) with Artemis Gold Inc. (“Artemis”) to divest its Blackwater Project (“Blackwater”) located in British Columbia, Canada (the “Transaction”). Under the terms of the Agreement, New Gold will receive consideration comprised of the following:

C$190 million in cash comprised of C$140 million in cash upon closing of the Transaction and C$50 million in cash payable twelve months following closing of the Transaction (the “Second Instalment”);

A gold stream on 8% gold produced from Blackwater, reducing to 4% of gold production once approximately 280,000 ounces of gold have been delivered to New Gold. The stream is subject to a transfer price equal to 35% of the spot gold price; In the event that agreed upon production targets at Blackwater are not achieved by the 7th, 8th, or 9th anniversary of closing of the Transaction, New Gold will be entitled to receive additional cash payments of C$28 million on each of those dates;

and C$20 million in Artemis shares upon closing of the Transaction, subject to New Gold not acquiring more than 9.9% of Artemis’ issued and outstanding common shares, in which case the difference between C$20 million and the value of the shares issued to New Gold shall be added to the Second Instalment.

...

Blackwater

14.02.19 Zitat von faultcode: ...=> eine (weitere) Zerlegung in die Einzelteile (nach dem Verkauf von Mesquite) würde mich nicht wundern

--> Adams hat schließlich die Richmont Mines an Alamos Gold verkauft (2017); das ging "am Stück", was ich hier stark bezweifle

--> als nächstes ist daher mMn Blackwater fällig...

=> ich gehe davon aus, daß das noch in 2019 passieren wird. Die Zeit drängt zwar noch nicht; das würde aber (mMn) 2020 passieren...

--> q.e.d.

9.6

New Gold to Divest Blackwater to Artemis Gold for C$190 Million in Cash and Retained Exposure via an 8% Gold Stream and Equity Stake in Artemis

https://www.wallstreet-online.de/nachricht/12608181-new-gold…

...New Gold Inc. (“New Gold” or the “Company”) (TSX and NYSE American: NGD) is pleased to announce that it has entered into a definitive agreement (the “Agreement”) with Artemis Gold Inc. (“Artemis”) to divest its Blackwater Project (“Blackwater”) located in British Columbia, Canada (the “Transaction”). Under the terms of the Agreement, New Gold will receive consideration comprised of the following:

C$190 million in cash comprised of C$140 million in cash upon closing of the Transaction and C$50 million in cash payable twelve months following closing of the Transaction (the “Second Instalment”);

A gold stream on 8% gold produced from Blackwater, reducing to 4% of gold production once approximately 280,000 ounces of gold have been delivered to New Gold. The stream is subject to a transfer price equal to 35% of the spot gold price; In the event that agreed upon production targets at Blackwater are not achieved by the 7th, 8th, or 9th anniversary of closing of the Transaction, New Gold will be entitled to receive additional cash payments of C$28 million on each of those dates;

and C$20 million in Artemis shares upon closing of the Transaction, subject to New Gold not acquiring more than 9.9% of Artemis’ issued and outstanding common shares, in which case the difference between C$20 million and the value of the shares issued to New Gold shall be added to the Second Instalment.

...

So wird nun also das Problem gelöst -- immerhin wird es vom Markt mit Erleichterung aufgenommen: +10%

12.08.19

--> ich gehe davon aus, daß dieser Deal die (fundamentale) Analyse dieses Miners kompliziert(er) macht, und damit die Gefahr besteht, daß dann doch irgendwie ein Deckel auf dem Aktienkurs drauf ist, auch bei weiter steigenden Goldpreisen

=> auf der anderen Seite:

• wenn ich einfach annehme, daß die New Afton Mine 100% self-funding ist und bleibt, und ein möglicher, späterer Blackwater-Verkauf (BC) auch der weiteren Reduzierung der Schulden dient, dann ergibt sich der grobe Wert von New Gold (für mich) nur noch aus den Reserven von Rainy River und der dortigen operativen Performance (in der derzeitigen Goldpreisumgebung mit > USD1,500)

--> Renaud Adams, der Erklärbär-CEO unter den Goldminern, mit diesem Eigenlob:

"Ontario Teachers’ is known to conduct in-depth due diligence and partner with high quality management teams that share its values of integrity and operational excellence..."

12.08.19

Zitat von faultcode: ...Die 800 Millionen U.S. dollar Schulden hier hängen wie ein Mühlstein um den Hals dieses Unternehmens. Man kann nur beten, daß der Goldpreis da oben bleibt...

--> ich gehe davon aus, daß dieser Deal die (fundamentale) Analyse dieses Miners kompliziert(er) macht, und damit die Gefahr besteht, daß dann doch irgendwie ein Deckel auf dem Aktienkurs drauf ist, auch bei weiter steigenden Goldpreisen

=> auf der anderen Seite:

• wenn ich einfach annehme, daß die New Afton Mine 100% self-funding ist und bleibt, und ein möglicher, späterer Blackwater-Verkauf (BC) auch der weiteren Reduzierung der Schulden dient, dann ergibt sich der grobe Wert von New Gold (für mich) nur noch aus den Reserven von Rainy River und der dortigen operativen Performance (in der derzeitigen Goldpreisumgebung mit > USD1,500)

--> Renaud Adams, der Erklärbär-CEO unter den Goldminern, mit diesem Eigenlob:

"Ontario Teachers’ is known to conduct in-depth due diligence and partner with high quality management teams that share its values of integrity and operational excellence..."

New Gold Announces $300 Million Partnership With Ontario Teachers’ Pension Plan at the New Afton Mine Adding Significant Financial Flexibility

New Gold Inc. (“New Gold” or the “Company”) (TSX and NYSE American: NGD) is pleased to announce that it has entered into a strategic partnership with Ontario Teachers’ Pension Plan (“Ontario Teachers’”). Under the terms of the strategic partnership, Ontario Teachers’ has agreed to acquire a 46.0% free cash flow interest in the New Afton mine (“New Afton”) with an option to convert the interest into a 46.0% joint venture interest in four years, or have their interest remain as a free cash flow interest at a reduced rate of 42.5%, for upfront cash proceeds of $300 million payable upon closing of the transaction (the “Transaction”). The proceeds from the Transaction will be used to improve New Gold’s financial flexibility and to reduce net indebtedness.

Key Transaction Highlights

Provides New Gold with immediate cash proceeds of $300 million at an attractive cost of capital, materially reducing New Gold’s net indebtedness and increasing financial flexibility.

New Gold retains full operating control over New Afton during development of the C-Zone as the mine transitions to expand its operating mine life.

Ontario Teachers’ is a world-class financial sponsor whose support of New Afton serves to increase New Gold’s visibility and its vision of creating value for all stakeholders.

Overriding buyback option provides New Gold with the flexibility to potentially re-acquire 100% of New Afton in the future.

New Gold will retain 100% of the exploration claims outside of the New Afton mining permit area and has granted Ontario Teachers’ an option to acquire its proportionate share of these claims upon conversion into the joint venture interest.

Summary Transaction Terms

Ontario Teachers’ will initially acquire a 46.0% free cash flow interest in the New Afton mining claim area with a four-year term (“Interim Interest”) for $300 million in upfront proceeds and New Gold will retain 100% ownership of New Afton.

After four years, Ontario Teachers’ has an option (“JV Interest Option”) to convert the Interim Interest into a 46.0% partnership interest in New Afton (“JV Interest”) with New Gold holding the remaining 54.0% partnership interest in a limited partnership New Gold and Ontario Teachers’ will form at the time of conversion.

If Ontario Teachers’ does not exercise the JV Interest Option, Ontario Teachers’ will continue to hold a free cash flow interest in New Afton, but at a reduced rate of 42.5% (“Reduced Interest”).

New Gold will hold (i) an overriding buyback option to re-purchase and cancel the Interim Interest (the “Buyback Option”) during the JV Interest Option exercise period and (ii) a right of first offer for the life of the agreements.

“We are pleased to be partnering with Ontario Teachers’, one of the world’s preeminent and most well-respected investors, in this transformational transaction that provides us with up front cash allowing us to restructure our balance sheet and lower our level of net indebtedness via a true shared risk and upside partnership focused on free cash flow. This transaction provides New Gold with an attractive cost of capital, further strengthens our financial position, allows us to benefit from the full exploration potential elsewhere on the New Afton land package and provides the opportunity to re-acquire 100% of New Afton,” said Renaud Adams, President and Chief Executive Officer of New Gold. “Ontario Teachers’ is known to conduct in-depth due diligence and partner with high quality management teams that share its values of integrity and operational excellence. We look forward to our partnership with Ontario Teachers’ as we continue our mission to turn New Gold into Canada’s leading intermediate diversified gold producer.”

“We are delighted to partner with New Gold, a leading Canadian mining company, in this distinctive transaction. We gain access to a free cash flow interest from a top quality asset in a stable and well-established mining area, with the ability to convert to a JV interest in four years. Ontario Teachers' Natural Resources group has a global mandate to pursue investments that provide attractive returns and inflation protection through exposure to a basket of key commodities,” said Dale Burgess, Senior Managing Director, Infrastructure & Natural Resources of Ontario Teachers’.

New Gold Inc. (“New Gold” or the “Company”) (TSX and NYSE American: NGD) is pleased to announce that it has entered into a strategic partnership with Ontario Teachers’ Pension Plan (“Ontario Teachers’”). Under the terms of the strategic partnership, Ontario Teachers’ has agreed to acquire a 46.0% free cash flow interest in the New Afton mine (“New Afton”) with an option to convert the interest into a 46.0% joint venture interest in four years, or have their interest remain as a free cash flow interest at a reduced rate of 42.5%, for upfront cash proceeds of $300 million payable upon closing of the transaction (the “Transaction”). The proceeds from the Transaction will be used to improve New Gold’s financial flexibility and to reduce net indebtedness.

Key Transaction Highlights

Provides New Gold with immediate cash proceeds of $300 million at an attractive cost of capital, materially reducing New Gold’s net indebtedness and increasing financial flexibility.

New Gold retains full operating control over New Afton during development of the C-Zone as the mine transitions to expand its operating mine life.

Ontario Teachers’ is a world-class financial sponsor whose support of New Afton serves to increase New Gold’s visibility and its vision of creating value for all stakeholders.

Overriding buyback option provides New Gold with the flexibility to potentially re-acquire 100% of New Afton in the future.

New Gold will retain 100% of the exploration claims outside of the New Afton mining permit area and has granted Ontario Teachers’ an option to acquire its proportionate share of these claims upon conversion into the joint venture interest.

Summary Transaction Terms

Ontario Teachers’ will initially acquire a 46.0% free cash flow interest in the New Afton mining claim area with a four-year term (“Interim Interest”) for $300 million in upfront proceeds and New Gold will retain 100% ownership of New Afton.

After four years, Ontario Teachers’ has an option (“JV Interest Option”) to convert the Interim Interest into a 46.0% partnership interest in New Afton (“JV Interest”) with New Gold holding the remaining 54.0% partnership interest in a limited partnership New Gold and Ontario Teachers’ will form at the time of conversion.

If Ontario Teachers’ does not exercise the JV Interest Option, Ontario Teachers’ will continue to hold a free cash flow interest in New Afton, but at a reduced rate of 42.5% (“Reduced Interest”).

New Gold will hold (i) an overriding buyback option to re-purchase and cancel the Interim Interest (the “Buyback Option”) during the JV Interest Option exercise period and (ii) a right of first offer for the life of the agreements.

“We are pleased to be partnering with Ontario Teachers’, one of the world’s preeminent and most well-respected investors, in this transformational transaction that provides us with up front cash allowing us to restructure our balance sheet and lower our level of net indebtedness via a true shared risk and upside partnership focused on free cash flow. This transaction provides New Gold with an attractive cost of capital, further strengthens our financial position, allows us to benefit from the full exploration potential elsewhere on the New Afton land package and provides the opportunity to re-acquire 100% of New Afton,” said Renaud Adams, President and Chief Executive Officer of New Gold. “Ontario Teachers’ is known to conduct in-depth due diligence and partner with high quality management teams that share its values of integrity and operational excellence. We look forward to our partnership with Ontario Teachers’ as we continue our mission to turn New Gold into Canada’s leading intermediate diversified gold producer.”

“We are delighted to partner with New Gold, a leading Canadian mining company, in this distinctive transaction. We gain access to a free cash flow interest from a top quality asset in a stable and well-established mining area, with the ability to convert to a JV interest in four years. Ontario Teachers' Natural Resources group has a global mandate to pursue investments that provide attractive returns and inflation protection through exposure to a basket of key commodities,” said Dale Burgess, Senior Managing Director, Infrastructure & Natural Resources of Ontario Teachers’.