Biotech Depot 2009 - 500 Beiträge pro Seite

eröffnet am 11.01.09 15:53:11 von

neuester Beitrag 03.01.10 16:55:57 von

neuester Beitrag 03.01.10 16:55:57 von

Beiträge: 85

ID: 1.147.459

ID: 1.147.459

Aufrufe heute: 0

Gesamt: 11.891

Gesamt: 11.891

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 8 Minuten | 1449 | |

| vor 10 Minuten | 1221 | |

| vor 49 Minuten | 1086 | |

| vor 9 Minuten | 855 | |

| heute 06:46 | 735 | |

| vor 33 Minuten | 598 | |

| 20.04.24, 12:11 | 489 | |

| vor 20 Minuten | 486 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.026,14 | +0,54 | 243 | |||

| 2. | 2. | 1,2700 | -7,97 | 98 | |||

| 3. | 3. | 0,1905 | +0,79 | 89 | |||

| 4. | 4. | 161,50 | +1,78 | 80 | |||

| 5. | 5. | 9,3600 | +1,24 | 75 | |||

| 6. | 6. | 7,0220 | +0,34 | 47 | |||

| 7. | 8. | 0,0160 | -24,17 | 38 | |||

| 8. | 7. | 22,220 | +0,77 | 37 |

Hallo!

Infolge der Finanzkrise war die Entwicklung meines Biotech-Depots im letzten Jahr (Thread: Biotech Depot 2008)) ebenfalls recht mau. Naja, mal schauen, was dieses Jahr bringt... zwei schwere Krisen in nichtmal 10 Jahren - ich hoffe ja nicht, dass man jetzt damit in regelmäßigen Abständen zu rechnen hat. Nun heißt es wieder... neues Jahr, neues Glück!

Das Depot hat sich zum letzten Jahr nicht wesentlich geändert... nur eine Position Seattle Genetics (SGEN) ist dazu gekommen. Wichtigste Position ist nachwievor Genmab, gefolgt von Onyx, Cubist und Regeneron. Damit sieht es aktuell so aus:

19,0% Genmab http://finance.yahoo.com/q?s=GEN.CO

11,0% Onyx http://finance.yahoo.com/q?s=ONXX

7,9% Cubist http://finance.yahoo.com/q?s=CBST

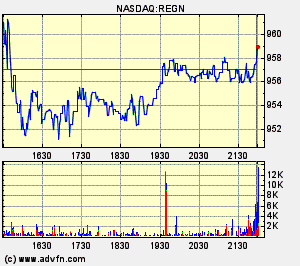

7,7% Regeneron http://finance.yahoo.com/q?s=REGN

5,5% Evotec http://finance.yahoo.com/q?s=EVT.DE

5,2% Isis http://finance.yahoo.com/q?s=ISIS

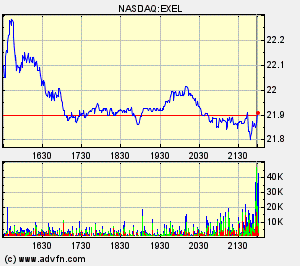

5,2% Exelixis http://finance.yahoo.com/q?s=EXEL

4,9% Medigene http://finance.yahoo.com/q?s=MDG.DE

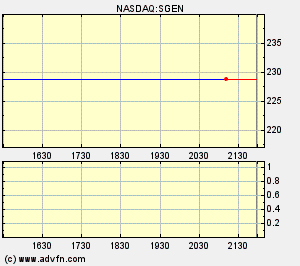

4,3% Seattle Genetics http://finance.yahoo.com/q?s=SGEN

4,1% ViroPharma http://finance.yahoo.com/q?s=VPHM

3,9% Micromet http://finance.yahoo.com/q?s=MITI

3,7% Addex http://finance.yahoo.com/q?s=ADXN.SW

3,4% Progenics http://finance.yahoo.com/q?s=PGNX

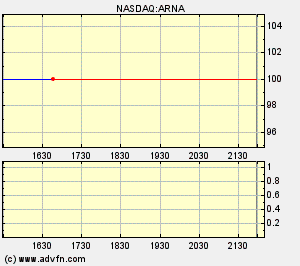

3,0% Arena http://finance.yahoo.com/q?s=ARNA

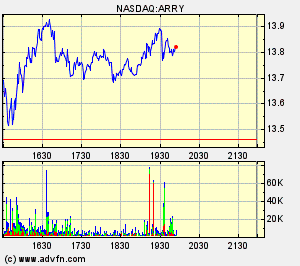

2,9% Array http://finance.yahoo.com/q?s=ARRY

2,8% NicOx http://finance.yahoo.com/q?s=COX.PA

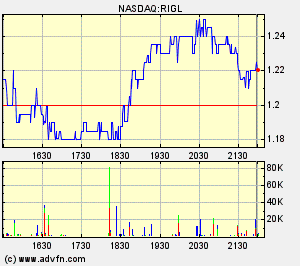

2,5% Rigel http://finance.yahoo.com/q?s=RIGL

1,6% Sucampo http://finance.yahoo.com/q?s=SCMP

1,3% Incyte http://finance.yahoo.com/q?s=INCY

Onyx könnte etwas reduziert werden, NicOx und Sucampo werde ich wohl nicht länger halten, ebenso ist Evotec im Moment eigentlich zu hoch gewichtet. Rigel würde ich zusammen mit Incyte etwas aufstocken. Interessant finde ich Neurosearch, vielleicht noch Basilea.

Ich orientiere mich ein wenig am Nasdaq Biotech Index (NBI)... ein Überblick seiner Werte findet sich hier: Thread: Nasdaq Biotech Index [NBI] - Charts aller enthaltenen Werte

Ein interessantes Biotech-Depot mit gutes Infos ist meiner Meinung nach http://www.hammerstockblog.com/

Nun also allen ein gutes und erfolgreiches Jahr 2009!

mfg ipollit

Infolge der Finanzkrise war die Entwicklung meines Biotech-Depots im letzten Jahr (Thread: Biotech Depot 2008)) ebenfalls recht mau. Naja, mal schauen, was dieses Jahr bringt... zwei schwere Krisen in nichtmal 10 Jahren - ich hoffe ja nicht, dass man jetzt damit in regelmäßigen Abständen zu rechnen hat. Nun heißt es wieder... neues Jahr, neues Glück!

Das Depot hat sich zum letzten Jahr nicht wesentlich geändert... nur eine Position Seattle Genetics (SGEN) ist dazu gekommen. Wichtigste Position ist nachwievor Genmab, gefolgt von Onyx, Cubist und Regeneron. Damit sieht es aktuell so aus:

19,0% Genmab http://finance.yahoo.com/q?s=GEN.CO

11,0% Onyx http://finance.yahoo.com/q?s=ONXX

7,9% Cubist http://finance.yahoo.com/q?s=CBST

7,7% Regeneron http://finance.yahoo.com/q?s=REGN

5,5% Evotec http://finance.yahoo.com/q?s=EVT.DE

5,2% Isis http://finance.yahoo.com/q?s=ISIS

5,2% Exelixis http://finance.yahoo.com/q?s=EXEL

4,9% Medigene http://finance.yahoo.com/q?s=MDG.DE

4,3% Seattle Genetics http://finance.yahoo.com/q?s=SGEN

4,1% ViroPharma http://finance.yahoo.com/q?s=VPHM

3,9% Micromet http://finance.yahoo.com/q?s=MITI

3,7% Addex http://finance.yahoo.com/q?s=ADXN.SW

3,4% Progenics http://finance.yahoo.com/q?s=PGNX

3,0% Arena http://finance.yahoo.com/q?s=ARNA

2,9% Array http://finance.yahoo.com/q?s=ARRY

2,8% NicOx http://finance.yahoo.com/q?s=COX.PA

2,5% Rigel http://finance.yahoo.com/q?s=RIGL

1,6% Sucampo http://finance.yahoo.com/q?s=SCMP

1,3% Incyte http://finance.yahoo.com/q?s=INCY

Onyx könnte etwas reduziert werden, NicOx und Sucampo werde ich wohl nicht länger halten, ebenso ist Evotec im Moment eigentlich zu hoch gewichtet. Rigel würde ich zusammen mit Incyte etwas aufstocken. Interessant finde ich Neurosearch, vielleicht noch Basilea.

Ich orientiere mich ein wenig am Nasdaq Biotech Index (NBI)... ein Überblick seiner Werte findet sich hier: Thread: Nasdaq Biotech Index [NBI] - Charts aller enthaltenen Werte

Ein interessantes Biotech-Depot mit gutes Infos ist meiner Meinung nach http://www.hammerstockblog.com/

Nun also allen ein gutes und erfolgreiches Jahr 2009!

mfg ipollit

die einzelnen Charts...

Genmab http://www.genmab.com/

Onyx http://www.onyx-pharm.com/

Cubist http://www.cubist.com/

Regeneron http://www.regeneron.com/

Evotec http://www.evotec.com/

Isis

Exelixis http://www.exelixis.com/

Medigene http://www.medigene.de/

Seattle Genetics http://www.seagen.com/

ViroPharma http://www.viropharma.com/

Micromet http://www.micromet.de/

Addex http://www.addexpharma.com/

Progenics http://www.progenics.com/

Arena http://www.arenapharm.com/

Array http://www.arraybiopharma.com/

NicOx http://www.nicox.com/

Rigel http://www.rigel.com/

Sucampo http://www.sucampo.com/

Incyte http://www.incyte.com/

mfg ipollit" target="_blank" rel="nofollow ugc noopener">http://www.isispharm.com/

Exelixis http://www.exelixis.com/

Medigene http://www.medigene.de/

Seattle Genetics http://www.seagen.com/

ViroPharma http://www.viropharma.com/

Micromet http://www.micromet.de/

Addex http://www.addexpharma.com/

Progenics http://www.progenics.com/

Arena http://www.arenapharm.com/

Array http://www.arraybiopharma.com/

NicOx http://www.nicox.com/

Rigel http://www.rigel.com/

Sucampo http://www.sucampo.com/

Incyte http://www.incyte.com/

mfg ipollit" target="_blank" rel="nofollow ugc noopener">

Exelixis http://www.exelixis.com/

Medigene http://www.medigene.de/

Seattle Genetics http://www.seagen.com/

ViroPharma http://www.viropharma.com/

Micromet http://www.micromet.de/

Addex http://www.addexpharma.com/

Progenics http://www.progenics.com/

Arena http://www.arenapharm.com/

Array http://www.arraybiopharma.com/

NicOx http://www.nicox.com/

Rigel http://www.rigel.com/

Sucampo http://www.sucampo.com/

Incyte http://www.incyte.com/

mfg ipollit" target="_blank" rel="nofollow ugc noopener">http://www.isispharm.com/

Exelixis http://www.exelixis.com/

Medigene http://www.medigene.de/

Seattle Genetics http://www.seagen.com/

ViroPharma http://www.viropharma.com/

Micromet http://www.micromet.de/

Addex http://www.addexpharma.com/

Progenics http://www.progenics.com/

Arena http://www.arenapharm.com/

Array http://www.arraybiopharma.com/

NicOx http://www.nicox.com/

Rigel http://www.rigel.com/

Sucampo http://www.sucampo.com/

Incyte http://www.incyte.com/

mfg ipollit

Genmab http://www.genmab.com/

Onyx http://www.onyx-pharm.com/

Cubist http://www.cubist.com/

Regeneron http://www.regeneron.com/

Evotec http://www.evotec.com/

Isis

Exelixis http://www.exelixis.com/

Medigene http://www.medigene.de/

Seattle Genetics http://www.seagen.com/

ViroPharma http://www.viropharma.com/

Micromet http://www.micromet.de/

Addex http://www.addexpharma.com/

Progenics http://www.progenics.com/

Arena http://www.arenapharm.com/

Array http://www.arraybiopharma.com/

NicOx http://www.nicox.com/

Rigel http://www.rigel.com/

Sucampo http://www.sucampo.com/

Incyte http://www.incyte.com/

mfg ipollit" target="_blank" rel="nofollow ugc noopener">http://www.isispharm.com/

Exelixis http://www.exelixis.com/

Medigene http://www.medigene.de/

Seattle Genetics http://www.seagen.com/

ViroPharma http://www.viropharma.com/

Micromet http://www.micromet.de/

Addex http://www.addexpharma.com/

Progenics http://www.progenics.com/

Arena http://www.arenapharm.com/

Array http://www.arraybiopharma.com/

NicOx http://www.nicox.com/

Rigel http://www.rigel.com/

Sucampo http://www.sucampo.com/

Incyte http://www.incyte.com/

mfg ipollit" target="_blank" rel="nofollow ugc noopener">

Exelixis http://www.exelixis.com/

Medigene http://www.medigene.de/

Seattle Genetics http://www.seagen.com/

ViroPharma http://www.viropharma.com/

Micromet http://www.micromet.de/

Addex http://www.addexpharma.com/

Progenics http://www.progenics.com/

Arena http://www.arenapharm.com/

Array http://www.arraybiopharma.com/

NicOx http://www.nicox.com/

Rigel http://www.rigel.com/

Sucampo http://www.sucampo.com/

Incyte http://www.incyte.com/

mfg ipollit" target="_blank" rel="nofollow ugc noopener">http://www.isispharm.com/

Exelixis http://www.exelixis.com/

Medigene http://www.medigene.de/

Seattle Genetics http://www.seagen.com/

ViroPharma http://www.viropharma.com/

Micromet http://www.micromet.de/

Addex http://www.addexpharma.com/

Progenics http://www.progenics.com/

Arena http://www.arenapharm.com/

Array http://www.arraybiopharma.com/

NicOx http://www.nicox.com/

Rigel http://www.rigel.com/

Sucampo http://www.sucampo.com/

Incyte http://www.incyte.com/

mfg ipollit

Antwort auf Beitrag Nr.: 36.350.858 von ipollit am 11.01.09 15:53:11Kauf doch mal Xoma + Paion

Nimm noch MorphoSys mit rein und das Depot ist absolut top! Du brauchst jedenfalls keinen Biotech-Fonds, denn Du hast ja fast schon deinen eigenen. Auch über Celgene und Genzyme würde ich noch nachdenken...

Genmab wurde zuletzt etwas belastet durch die Zwischenergebnisse der PIII-Zulassungstudie von Zalutumumab gegen Krebs im Bereich von Kopf und Hals. Die Studie wird nun bis zum Ende weitergeführt und nicht vorzeitig abgebrochen, weil bereits vor Ende der Studie eine klare Wirksamkeit von Zalutumumab belegbar wäre. Dies heißt also nicht, dass Zalutumumab, das ein direkter Konkurrent zu Imclone's Erbitux sein soll, nicht wirksam ist, sondern nur, dass es nicht zu einer vorzeitigen Zulassung kommt. Die Endgültigen Ergebnisse könnten nun Ende des Jahres kommen und ein Partnerschaftsdeal+Zulassung in 2010.

Dafür sieht es mit Arzerra (Konkurrent von Rituxan) immer noch sehr gut aus... in Kürze sollte zusammen mit GSK der erste Zulassungantrag (CLL) gestellt werden und dann entsprechend die Zulassung im Sommer erfolgen. Genmab wird etwa 25% Royalties für Arzerra von GSK erhalten. In 2010 könnte es eine weitere Zulassung gegen NHL geben... angeblich kommen PIII-Ergebnisse bereits in diesem Quartal.

Goldman Sachs erwartet für Genmab 2008 einen Umsatz von ca. 125 Mio USD, für 2009 250 Mio USD und für 2010 500 Mio USD... entsprechend soll der Cash bis 2010 auf 500 Mio USD steigen (aktuelle MK ca. 1,75 Mrd USD bei ca. 300 Mio USD Cash). Das Ergebnis soll 2009 bei 4 DKK und 2010 bei 35 DKK pro Aktie liegen (Kurs aktuell bei 220 DKK).

**********

Genmab Shares Slide on Interim Zalutumumab Data

By Cormac Sheridan

BioWorld International Correspondent

Shares in Genmab A/S were off by more than 7 percent during trading Tuesday following an interim update on a Phase III pivotal study of zalutumumab (HuMax-EGFr) in head and neck cancer.

The Copenhagen, Denmark-based company said the data it received at the halfway point did not fulfill criteria for an early halt on grounds of exceptional efficacy. That was sufficient to prompt a slide, as the share price had been boosted "by a growing expectation during the last three to six months that the study would be stopped at the interim stage," analyst Mark Clark of ING Wholesale in London, told BioWorld International.

"Had it met the stop criteria at the interim stage, there would have been the possibility of doing a partnership deal this year," he said. "We're now back to the original timeline, which is late 2009."

The stock (COPENHAGEN:GEN) was changing hands at DKK213.25 (US$38.38) early afternoon Tuesday, down DKK17.50 on the previous day's close of DKK230.75. It hit a low of DKK211.50 earlier in the day.

"Obviously the criteria for stopping it were pretty tough," Clark said. However, analysts interpreted the company's "obvious enthusiasm" for the molecule during its third quarter analyst call last year as an indication that the drug appeared to be performing well.

Patients in the trial - who were randomized to the treatment and control arms on a 2:1 basis - were surviving beyond six months, when best supported care historically delivered about 4.5 months of survival. "You can argue whether or not the company allowed those expectations to run," he said.

The company reiterated its enthusiasm for the program Monday. "Anecdotally, we hear from some of the sites that they are very pleased with how the trial is going," Genmab CEO Lisa Drakeman told analysts on a conference call Monday.

"We've got very good feedback," Chief Scientific Officer Jan van de Winkel said on the call. "I'm fairly optimistic about the outcome. I think it will be fine."

An independent data monitoring committee did conclude that the benefit-risk profile of zalutumumab, which inhibits epidermal growth factor receptor, is acceptable. However, it is not releasing any efficacy data at this point, Drakeman said, in order to avoid the danger of introducing bias. Enrollment of up to 273 patients with squamous cell carcinoma of the head and neck, who are refractory to or intolerant of standard platinum-based chemotherapy, will continue.

The trial, which has received fast-track designation from the FDA, has enrolled 212 subjects so far. Participants are being randomized into one of two treatment groups: zalutumumab in combination with best supportive care or best supportive care alone. The primary endpoint is survival from randomization until death. A final analysis will be performed once 231 deaths have occurred.

Genmab expects to report the data by the year-end, and to file for a BLA in early 2010. The company does not plan to finalize a partnering deal in advance. "I think we need to stick with our plan, which is to wait for data," Drakeman said.

A Phase III study of zalutumumab in combination with radiotherapy in 600 previously untreated head and neck cancer patients, which is being conducted in cooperation with the Danish Head and Neck Cancer Study Group, is ongoing.

Published January 7, 2009

mfg ipollit

Dafür sieht es mit Arzerra (Konkurrent von Rituxan) immer noch sehr gut aus... in Kürze sollte zusammen mit GSK der erste Zulassungantrag (CLL) gestellt werden und dann entsprechend die Zulassung im Sommer erfolgen. Genmab wird etwa 25% Royalties für Arzerra von GSK erhalten. In 2010 könnte es eine weitere Zulassung gegen NHL geben... angeblich kommen PIII-Ergebnisse bereits in diesem Quartal.

Goldman Sachs erwartet für Genmab 2008 einen Umsatz von ca. 125 Mio USD, für 2009 250 Mio USD und für 2010 500 Mio USD... entsprechend soll der Cash bis 2010 auf 500 Mio USD steigen (aktuelle MK ca. 1,75 Mrd USD bei ca. 300 Mio USD Cash). Das Ergebnis soll 2009 bei 4 DKK und 2010 bei 35 DKK pro Aktie liegen (Kurs aktuell bei 220 DKK).

**********

Genmab Shares Slide on Interim Zalutumumab Data

By Cormac Sheridan

BioWorld International Correspondent

Shares in Genmab A/S were off by more than 7 percent during trading Tuesday following an interim update on a Phase III pivotal study of zalutumumab (HuMax-EGFr) in head and neck cancer.

The Copenhagen, Denmark-based company said the data it received at the halfway point did not fulfill criteria for an early halt on grounds of exceptional efficacy. That was sufficient to prompt a slide, as the share price had been boosted "by a growing expectation during the last three to six months that the study would be stopped at the interim stage," analyst Mark Clark of ING Wholesale in London, told BioWorld International.

"Had it met the stop criteria at the interim stage, there would have been the possibility of doing a partnership deal this year," he said. "We're now back to the original timeline, which is late 2009."

The stock (COPENHAGEN:GEN) was changing hands at DKK213.25 (US$38.38) early afternoon Tuesday, down DKK17.50 on the previous day's close of DKK230.75. It hit a low of DKK211.50 earlier in the day.

"Obviously the criteria for stopping it were pretty tough," Clark said. However, analysts interpreted the company's "obvious enthusiasm" for the molecule during its third quarter analyst call last year as an indication that the drug appeared to be performing well.

Patients in the trial - who were randomized to the treatment and control arms on a 2:1 basis - were surviving beyond six months, when best supported care historically delivered about 4.5 months of survival. "You can argue whether or not the company allowed those expectations to run," he said.

The company reiterated its enthusiasm for the program Monday. "Anecdotally, we hear from some of the sites that they are very pleased with how the trial is going," Genmab CEO Lisa Drakeman told analysts on a conference call Monday.

"We've got very good feedback," Chief Scientific Officer Jan van de Winkel said on the call. "I'm fairly optimistic about the outcome. I think it will be fine."

An independent data monitoring committee did conclude that the benefit-risk profile of zalutumumab, which inhibits epidermal growth factor receptor, is acceptable. However, it is not releasing any efficacy data at this point, Drakeman said, in order to avoid the danger of introducing bias. Enrollment of up to 273 patients with squamous cell carcinoma of the head and neck, who are refractory to or intolerant of standard platinum-based chemotherapy, will continue.

The trial, which has received fast-track designation from the FDA, has enrolled 212 subjects so far. Participants are being randomized into one of two treatment groups: zalutumumab in combination with best supportive care or best supportive care alone. The primary endpoint is survival from randomization until death. A final analysis will be performed once 231 deaths have occurred.

Genmab expects to report the data by the year-end, and to file for a BLA in early 2010. The company does not plan to finalize a partnering deal in advance. "I think we need to stick with our plan, which is to wait for data," Drakeman said.

A Phase III study of zalutumumab in combination with radiotherapy in 600 previously untreated head and neck cancer patients, which is being conducted in cooperation with the Danish Head and Neck Cancer Study Group, is ongoing.

Published January 7, 2009

mfg ipollit

Cubist (CBST) entwickelt sich meiner Meinung nach auch recht gut. Cubicine ist sehr erfolgreich. Die aktuellen Schätzungen sind laut yahoo ein Umsatz von 434 Mio USD für 2008 und 574 Mio USD für 2009... und ein Ergebnis von 1,28 bzw 1,74 USD pro Aktie. Bei einem Kurs von 24,56 USD entspricht dies einem KGV08e von 19 und KGV09e von 14. Cubist hat für Cubicine mittelfristig einen Umsatz von 750 Mio USD angepeilt.

Letztes Jahr wurde Ecallantide (DX-88) gegen Blutverlust in PII von Dyax einlizensiert... meiner Meinung nach eine Indikation mit Potential (Dyax könnte bald für DX-88 bereits eine FDA-Zulassung gegen HAE erhalten als Konkurrent von Jerini's Icatibant).

Nun hat Cubist einen weiteren Kandidaten einlizensiert... der am weitesten fortgeschrittene RNAi-Kandidat von Alnylam, ALN-RSV01 in PII...

http://www.tmcnet.com/usubmit/2009/01/09/3902909.htm

[January 09, 2009]

Cubist, Alnylam Partner in $102.5M RNAi Drugs Deal

(BioWorld Today Via Acquire Media NewsEdge) Massachusetts firms Cubist Pharmaceuticals Inc. and Alnylam Pharmaceuticals Inc. have formed a 50-50 North American partnership to develop and commercialize Alnylam's respiratory syncytial virus (RSV)-specific RNAi therapeutics.

But Wall Street apparently was not so keen on the deal, sending both firms' shares down slightly Friday. Shares of Lexington, Mass.-based Cubist (NASDAQ:CBST) closed at $24.56, a loss of 63 cents, while shares of Cambridge, Mass.-based Alnylam (NASDAQ:ALNY) fell 88 cents, to close at $23.12.

Under the agreement, Alnylam will receive $20 million up front and could bank an additional $82.5 million based on certain development and sales milestones.

The company also could gain double-digit royalties on net sales outside of North America and Asia.

The partnership gives Cubist sole commercialization rights of the ALN-RSV program worldwide outside of Asia, where the rights are held by Japanese firm Kyowa Hakko Kirin Co. Ltd. under a $93 million deal signed with Alnylam last June. (See BioWorld Today, June 20, 2008.)

Cubist and Alnylam will share equally development responsibilities and profits in North America. After achieving certain development milestones, Alnylam could opt to convert the North American co-development and profit share to a royalty-bearing license with development and sales milestones.

The RSV-specific RNAi therapeutic program includes Alnylam's ALN-RSV01, which currently is being studied in a double-blind, randomized, placebo-controlled Phase II trial to assess the drug's safety and tolerability in adult lung transplant patients naturally infected with RSV, said Jason Rhodes, Alnylam's vice president of business development.

The trial also will evaluate the antiviral activity of ALN-RSV01 in patients with a naturally acquired RSV lower respiratory tract infection.

The firm expects to have data from the trial by the second half of this year, Rhodes told BioWorld Today. Following the completion of that trial, Alnylam expects to begin a trial of ALN-RSV01 in pediatric patients with RSV, he noted.

Results reported by Alnylam of a double-blind, randomized, placebo-controlled Phase II trial, known as GEMINI, showed that intranasally administered ALN-RSV01 demonstrated statistically significant antiviral efficacy with about a 40 percent relative reduction in RSV infection rate and a 95 percent increase in the number of infection-free patients compared with placebo.

The company's RSV-specific RNAi program also includes other potent and specific second-generation RNAi-based RSV inhibitors in preclinical development.

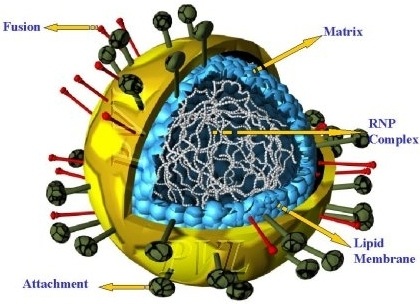

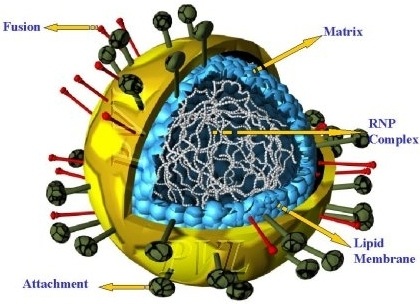

RSV is a common, highly contagious virus that causes infections in both the upper- and lower respiratory tract in children and adults, Rhodes explained.

There are about 18 million infections reported annually in most developed countries, resulting in about 1 million hospitalizations, he said.

In the U.S. alone, there are about 125,000 pediatric and 175,000 adult hospitalizations annually attributed to RSV, Rhodes said.

While RSV infection typically results in cold-like symptoms, it can lead to more serious respiratory illnesses such as croup, pneumonia and bronchiolitis, and in some cases, be deadly.

RSV infection in infants also has been linked to the development of childhood asthma.

There currently are no treatments that are broadly used to successfully treat RSV, Rhodes noted.

Pediatric patients especially, said Steven Gilman, Cubists' chief scientific officer, are "in dire need" of an effective treatment for the infection.

"RSV is an important disease for children, and there is a very large unmet medical need," he told BioWorld Today.

Given the RSV program's potential to be used in a fairly broad outpatient population, Rhodes said, it was always Alnylam's strategy to partner it.

"At this stage, we don't plan to build a broad outpatient commercial organization at this point in the company's development," he said.

Alnylam had a "broad range" of discussions with several pharmaceutical companies ranging from large multinational pharma companies to local biopharmaceutical firms.

Rhodes said his firm chose Cubist to partner on the RSV RNAi program because of its expertise in acute care and infectious disease products.

He noted Cubist's success in commercializing Cubicin (daptomycin for injection), the first antibiotic in a new class of anti-infectives called lipopeptides.

Cubist also has an agreement with London-based AstraZeneca plc to handle U.S. hospital sales for its intravenous antibiotic Merrem (meropenem for injection).

Cubist's product pipeline also includes ecallantide, a recombinant human protein in Phase II clinical trials for the prevention of blood loss during cardiothoracic surgery, and two development programs for drugs to treat Gram-negative infections and Clostridium difficile-associated diarrhea.

In addition, Rhodes said, Cubist is located just "15 minutes west" of Alnylam.

"So if you are going to have a partner where they are in a true 50-50 deal where you have to be working together to co-develop the product, it's obviously helpful to have them be local," he said.

Beyond the location, Rhodes said, the firms have a "culture similarity" that makes them "very compatible."

"Cubist is a superb partner," he added.

The deal "sits well" with Cubist's strategy to build its pipeline, Gilman said.

"We are very excited about the progress of RNAi therapeutics. This is a new area of science and new technology. The science together with the medical need for RSV will be a very dramatic, potentially exciting and rewarding program for us," he noted.

Analyst Thomas Russo, of R.W. Baird & Co., called Alnylam's partnership with Cubist "another disciplined deal" for the RSV RNAi program.

"We like it," he said.

But Piper Jaffray analyst Edward A. Tenthoff called the deal's terms "disappointing."

"In comparison, Kyowa paid $15 million up front plus $78 million in potential milestones last June for Asian rights, indicating that the value of the RSV program has declined," he said in a research note.

**************

http://seekingalpha.com/article/114245-cubist-and-alnylam-an…

Cubist and Alnylam, An Odd Partnership

by: Eben Tessari January 11, 2009 | about stocks: ALNY / CBST

Cubist (CBST) and Alnylam (ALNY) have formed a strategic collaboration to develop and commercialize Alnylam’s ALN-RSV program. The RSV-specific RNAi therapeutic program includes ALN-RSV01, which is currently in Phase II clinical development for the treatment of respiratory syncytial virus (RSV) infection in adult lung transplant patients, as well as several other potent and specific second-generation RNAi-based RSV inhibitors in pre-clinical studies.

Deal Terms

————————-

- $20M upfront

- $82.5M in potential sales and milestone payments

- 50/50 Co-development and profit sharing agreement in US

- Cubist has full commercialization rights EX-US and Asia

- Alnylam receives double digit royalties EX-US and Asia

Cubist? Really? It’s not that I don’t have respect for Cubist, I do. It just strikes me as an odd partnership choice. Why couldn’t Alnylam land another one of those megadeals it’s known for; one of those that In Vivo appoints its deal of the year? Might it be because all of the big pharma players said no? The GEMINI study (small phase IIa with ALN-RSV01) published about a year ago was supposedly the proof that RNAi could work in humans. Well, if so, where is the obscene upfront?

The trial in question was small and mostly artificial. The patients were infected and treated with RSV in their nose… not their lungs like it would be in actual patients. When Alnylam can get the drug to the lower lung and have it reduce viral load and improved clinical symptoms, I’ll be impressed. In addition, to be approved this drug must show some benefit regarding a reduction of days in the hospital or reduction in symptoms, two topics GEMINI didn’t even begin to address.

I could be wrong here, but my guess is that these issues are why Alnylam partnered this drug with Cubist and not with big pharma. Overall, the deal is probably fairly valued, though not by recent Alnylam standards; ALNY is trading down 6% on the day as I write this so it seems that the market was a bit disappointed.

The street better get used to it; I’ve said it before and I’ll say it again: I don’t believe in RNAi as a human therapy for a wide range of diseases (if any). Now, that doesn’t mean I don’t want to see it succeed or want the companies to fizzle out and die; cutting edge research is essential to both medicine and the economy… just don’t ask me to invest in Alnylam.

*************

http://triangle.bizjournals.com/triangle/othercities/boston/…

Monday, January 5, 2009, 3:52pm EST | Modified: Wednesday, January 7, 2009, 1:32pm

Cubist receives $90M credit

Cubist Pharmaceuticals, the Lexington, Mass.-based biotechnology company, has opened a $90 million revolving line of credit with the Royal Bank of Scotland. The money is to be used for general corporate expenses, according to a document filed with the Securities and Exchange Commission.

Cubist (Nasdaq: CBST) has also filed two Investigational New Drug applications with the Food and Drug Administration, indicating its plans to begin clinical trials on the drug targets. The company has one drug, an intravenous antibiotic called Cubicin, already on the market. The company focuses on research, development and commercialization of acute care pharmaceutical products.

The company’s 2007 revenue was $294.6 million. Cubist’s shares were trading at $25.08 in late Monday afternoon trading. The previous close was $25.05. The company’s stock has traded between $16.25 and $28.74 over the past year.

***********

http://www.canadianbusiness.com/markets/market_news/article.…

From The Associated Press, December 8, 2008 - 3:40 PM

Cubist slides following second downgrade in 2 days; analyst cites Cubicin patent risk

NEW YORK (AP) - Shares of Cubist Pharmaceuticals Inc. sank Monday as concerns swirled about the patent protection for its antibiotic Cubicin, which provides almost all of the company's revenue.

Leerink Swann analyst Howard Liang lowered his rating to "Underperform" from "Market Perform" because of his view that investors are overlooking the risk that a generic drug maker will challenge the patents protecting Cubicin. He said Cubist shares might be worth $10 if the patents were successfully challenged.

Shares of the Lexington, Mass., company fell $2.34, or 8.7 percent, to $24.64 in afternoon trading.

Cubicin is vulnerable to generic competition because the Food and Drug Administration approved it more than five years ago, in September 2003. The patents on the drug are set to expire in 2016 and 2019, but generic drug companies could challenge those patents earlier by saying they are not valid or don't apply to their version of the drug.

If such a challenge were successful, Liang estimated Cubist shares would be worth $10.

Cubist said it has not been notified of any patent challenges for Cubicin.

With competing stocks slumping and Cubist shares trading at their highest levels in almost seven years, he said, investors are no longer accounting for that risk, which is particularly important to Cubist because Cubicin is its only marketed drug.

Cubist reported $112.4 million in revenue in the third quarter. Sales of Cubicin accounted for $110.6 million of that total.

The analyst described Cubicin as the most "successful intravenous antibiotic U.S. launch in history," and said demand for Cubicin to treat antibiotic-resistant infections has grown significantly. But Cubist's other drugs are in preclinical testing, and he said there is little excitement about its blood loss drug DX-88.

Liang was the second analyst in two days to cut his rating on the stock, following an Oppenheimer downgrade Friday. Kevin DeGeeter cited the weak patent protection for Cubicin as one of the reasons for his downgrade.

mfg ipollit

Letztes Jahr wurde Ecallantide (DX-88) gegen Blutverlust in PII von Dyax einlizensiert... meiner Meinung nach eine Indikation mit Potential (Dyax könnte bald für DX-88 bereits eine FDA-Zulassung gegen HAE erhalten als Konkurrent von Jerini's Icatibant).

Nun hat Cubist einen weiteren Kandidaten einlizensiert... der am weitesten fortgeschrittene RNAi-Kandidat von Alnylam, ALN-RSV01 in PII...

http://www.tmcnet.com/usubmit/2009/01/09/3902909.htm

[January 09, 2009]

Cubist, Alnylam Partner in $102.5M RNAi Drugs Deal

(BioWorld Today Via Acquire Media NewsEdge) Massachusetts firms Cubist Pharmaceuticals Inc. and Alnylam Pharmaceuticals Inc. have formed a 50-50 North American partnership to develop and commercialize Alnylam's respiratory syncytial virus (RSV)-specific RNAi therapeutics.

But Wall Street apparently was not so keen on the deal, sending both firms' shares down slightly Friday. Shares of Lexington, Mass.-based Cubist (NASDAQ:CBST) closed at $24.56, a loss of 63 cents, while shares of Cambridge, Mass.-based Alnylam (NASDAQ:ALNY) fell 88 cents, to close at $23.12.

Under the agreement, Alnylam will receive $20 million up front and could bank an additional $82.5 million based on certain development and sales milestones.

The company also could gain double-digit royalties on net sales outside of North America and Asia.

The partnership gives Cubist sole commercialization rights of the ALN-RSV program worldwide outside of Asia, where the rights are held by Japanese firm Kyowa Hakko Kirin Co. Ltd. under a $93 million deal signed with Alnylam last June. (See BioWorld Today, June 20, 2008.)

Cubist and Alnylam will share equally development responsibilities and profits in North America. After achieving certain development milestones, Alnylam could opt to convert the North American co-development and profit share to a royalty-bearing license with development and sales milestones.

The RSV-specific RNAi therapeutic program includes Alnylam's ALN-RSV01, which currently is being studied in a double-blind, randomized, placebo-controlled Phase II trial to assess the drug's safety and tolerability in adult lung transplant patients naturally infected with RSV, said Jason Rhodes, Alnylam's vice president of business development.

The trial also will evaluate the antiviral activity of ALN-RSV01 in patients with a naturally acquired RSV lower respiratory tract infection.

The firm expects to have data from the trial by the second half of this year, Rhodes told BioWorld Today. Following the completion of that trial, Alnylam expects to begin a trial of ALN-RSV01 in pediatric patients with RSV, he noted.

Results reported by Alnylam of a double-blind, randomized, placebo-controlled Phase II trial, known as GEMINI, showed that intranasally administered ALN-RSV01 demonstrated statistically significant antiviral efficacy with about a 40 percent relative reduction in RSV infection rate and a 95 percent increase in the number of infection-free patients compared with placebo.

The company's RSV-specific RNAi program also includes other potent and specific second-generation RNAi-based RSV inhibitors in preclinical development.

RSV is a common, highly contagious virus that causes infections in both the upper- and lower respiratory tract in children and adults, Rhodes explained.

There are about 18 million infections reported annually in most developed countries, resulting in about 1 million hospitalizations, he said.

In the U.S. alone, there are about 125,000 pediatric and 175,000 adult hospitalizations annually attributed to RSV, Rhodes said.

While RSV infection typically results in cold-like symptoms, it can lead to more serious respiratory illnesses such as croup, pneumonia and bronchiolitis, and in some cases, be deadly.

RSV infection in infants also has been linked to the development of childhood asthma.

There currently are no treatments that are broadly used to successfully treat RSV, Rhodes noted.

Pediatric patients especially, said Steven Gilman, Cubists' chief scientific officer, are "in dire need" of an effective treatment for the infection.

"RSV is an important disease for children, and there is a very large unmet medical need," he told BioWorld Today.

Given the RSV program's potential to be used in a fairly broad outpatient population, Rhodes said, it was always Alnylam's strategy to partner it.

"At this stage, we don't plan to build a broad outpatient commercial organization at this point in the company's development," he said.

Alnylam had a "broad range" of discussions with several pharmaceutical companies ranging from large multinational pharma companies to local biopharmaceutical firms.

Rhodes said his firm chose Cubist to partner on the RSV RNAi program because of its expertise in acute care and infectious disease products.

He noted Cubist's success in commercializing Cubicin (daptomycin for injection), the first antibiotic in a new class of anti-infectives called lipopeptides.

Cubist also has an agreement with London-based AstraZeneca plc to handle U.S. hospital sales for its intravenous antibiotic Merrem (meropenem for injection).

Cubist's product pipeline also includes ecallantide, a recombinant human protein in Phase II clinical trials for the prevention of blood loss during cardiothoracic surgery, and two development programs for drugs to treat Gram-negative infections and Clostridium difficile-associated diarrhea.

In addition, Rhodes said, Cubist is located just "15 minutes west" of Alnylam.

"So if you are going to have a partner where they are in a true 50-50 deal where you have to be working together to co-develop the product, it's obviously helpful to have them be local," he said.

Beyond the location, Rhodes said, the firms have a "culture similarity" that makes them "very compatible."

"Cubist is a superb partner," he added.

The deal "sits well" with Cubist's strategy to build its pipeline, Gilman said.

"We are very excited about the progress of RNAi therapeutics. This is a new area of science and new technology. The science together with the medical need for RSV will be a very dramatic, potentially exciting and rewarding program for us," he noted.

Analyst Thomas Russo, of R.W. Baird & Co., called Alnylam's partnership with Cubist "another disciplined deal" for the RSV RNAi program.

"We like it," he said.

But Piper Jaffray analyst Edward A. Tenthoff called the deal's terms "disappointing."

"In comparison, Kyowa paid $15 million up front plus $78 million in potential milestones last June for Asian rights, indicating that the value of the RSV program has declined," he said in a research note.

**************

http://seekingalpha.com/article/114245-cubist-and-alnylam-an…

Cubist and Alnylam, An Odd Partnership

by: Eben Tessari January 11, 2009 | about stocks: ALNY / CBST

Cubist (CBST) and Alnylam (ALNY) have formed a strategic collaboration to develop and commercialize Alnylam’s ALN-RSV program. The RSV-specific RNAi therapeutic program includes ALN-RSV01, which is currently in Phase II clinical development for the treatment of respiratory syncytial virus (RSV) infection in adult lung transplant patients, as well as several other potent and specific second-generation RNAi-based RSV inhibitors in pre-clinical studies.

Deal Terms

————————-

- $20M upfront

- $82.5M in potential sales and milestone payments

- 50/50 Co-development and profit sharing agreement in US

- Cubist has full commercialization rights EX-US and Asia

- Alnylam receives double digit royalties EX-US and Asia

Cubist? Really? It’s not that I don’t have respect for Cubist, I do. It just strikes me as an odd partnership choice. Why couldn’t Alnylam land another one of those megadeals it’s known for; one of those that In Vivo appoints its deal of the year? Might it be because all of the big pharma players said no? The GEMINI study (small phase IIa with ALN-RSV01) published about a year ago was supposedly the proof that RNAi could work in humans. Well, if so, where is the obscene upfront?

The trial in question was small and mostly artificial. The patients were infected and treated with RSV in their nose… not their lungs like it would be in actual patients. When Alnylam can get the drug to the lower lung and have it reduce viral load and improved clinical symptoms, I’ll be impressed. In addition, to be approved this drug must show some benefit regarding a reduction of days in the hospital or reduction in symptoms, two topics GEMINI didn’t even begin to address.

I could be wrong here, but my guess is that these issues are why Alnylam partnered this drug with Cubist and not with big pharma. Overall, the deal is probably fairly valued, though not by recent Alnylam standards; ALNY is trading down 6% on the day as I write this so it seems that the market was a bit disappointed.

The street better get used to it; I’ve said it before and I’ll say it again: I don’t believe in RNAi as a human therapy for a wide range of diseases (if any). Now, that doesn’t mean I don’t want to see it succeed or want the companies to fizzle out and die; cutting edge research is essential to both medicine and the economy… just don’t ask me to invest in Alnylam.

*************

http://triangle.bizjournals.com/triangle/othercities/boston/…

Monday, January 5, 2009, 3:52pm EST | Modified: Wednesday, January 7, 2009, 1:32pm

Cubist receives $90M credit

Cubist Pharmaceuticals, the Lexington, Mass.-based biotechnology company, has opened a $90 million revolving line of credit with the Royal Bank of Scotland. The money is to be used for general corporate expenses, according to a document filed with the Securities and Exchange Commission.

Cubist (Nasdaq: CBST) has also filed two Investigational New Drug applications with the Food and Drug Administration, indicating its plans to begin clinical trials on the drug targets. The company has one drug, an intravenous antibiotic called Cubicin, already on the market. The company focuses on research, development and commercialization of acute care pharmaceutical products.

The company’s 2007 revenue was $294.6 million. Cubist’s shares were trading at $25.08 in late Monday afternoon trading. The previous close was $25.05. The company’s stock has traded between $16.25 and $28.74 over the past year.

***********

http://www.canadianbusiness.com/markets/market_news/article.…

From The Associated Press, December 8, 2008 - 3:40 PM

Cubist slides following second downgrade in 2 days; analyst cites Cubicin patent risk

NEW YORK (AP) - Shares of Cubist Pharmaceuticals Inc. sank Monday as concerns swirled about the patent protection for its antibiotic Cubicin, which provides almost all of the company's revenue.

Leerink Swann analyst Howard Liang lowered his rating to "Underperform" from "Market Perform" because of his view that investors are overlooking the risk that a generic drug maker will challenge the patents protecting Cubicin. He said Cubist shares might be worth $10 if the patents were successfully challenged.

Shares of the Lexington, Mass., company fell $2.34, or 8.7 percent, to $24.64 in afternoon trading.

Cubicin is vulnerable to generic competition because the Food and Drug Administration approved it more than five years ago, in September 2003. The patents on the drug are set to expire in 2016 and 2019, but generic drug companies could challenge those patents earlier by saying they are not valid or don't apply to their version of the drug.

If such a challenge were successful, Liang estimated Cubist shares would be worth $10.

Cubist said it has not been notified of any patent challenges for Cubicin.

With competing stocks slumping and Cubist shares trading at their highest levels in almost seven years, he said, investors are no longer accounting for that risk, which is particularly important to Cubist because Cubicin is its only marketed drug.

Cubist reported $112.4 million in revenue in the third quarter. Sales of Cubicin accounted for $110.6 million of that total.

The analyst described Cubicin as the most "successful intravenous antibiotic U.S. launch in history," and said demand for Cubicin to treat antibiotic-resistant infections has grown significantly. But Cubist's other drugs are in preclinical testing, and he said there is little excitement about its blood loss drug DX-88.

Liang was the second analyst in two days to cut his rating on the stock, following an Oppenheimer downgrade Friday. Kevin DeGeeter cited the weak patent protection for Cubicin as one of the reasons for his downgrade.

mfg ipollit

Zu Rigel und R788, dem oralen Syk Kinase Hemmer gegen RA in PII... hier ist die Frage, wie am Ende das Nebenwirkungsprofil aussieht. Jedenfalls scheint das Management in den nächsten Monaten einen Partnerschafts-Deal für R788 erreichen zu wollen.

http://www.hammerstockblog.com/biotech-portfolio-updates-rig…

Assuming this trend continues in 2009, it is crucial to identify small and medium companies with candidates whose activity has already been proven in clinical trials. One of the most interesting companies that fall into this category is Rigel Pharmaceutical (RIGL). The company is currently developing a validated drug with blockbuster potential, and is expected to announce major collaboration deal during the first quarter.

Despite the imminent nature of the deal, investors should be aware of the risk factors that naturally come along with negotiations of this type. In addition, there are specific issues with Rigel that might affect the exact terms of the deals, let alone the ability to finalize it. Nevertheless, when all aspects are taken into account, it seems that at current price levels, Rigel represents an attractive investment opportunity.

In contrast to other companies that try to be as vague as possible about the timing of future deals, Rigel is going out of its way to reassure investors that it will have a deal in place by the end of the first quarter. Rigel’s lead drug, R788, is currently being evaluated in two comparative trials in patients with rheumatoid arthritis (RA), a $14 billion indication. During most of 2008, R788 was considered to be one the most promising drugs in the biotech industry, but an update at last year’s ACR meeting raised doubts regarding the safety profile of R788, as reviewed in my recent article on Rigel. According to the company, the safety data from the ACR meeting did not affect its negotiation leverage, as the potential partners had access to the data before it was published, so nothing came as a surprise to them. Trying to be as explicit as possible, Rigel managers state that none of the companies with whom it was in advanced discussions dropped out of the race as a result of the safety issues.

The safety issue most investors are worried about is the increase in blood pressure R788 seems to induce. With current regulatory climate, and considering that RA patients are more prone to develop high blood pressure, this safety signal will probably be closely watched in future trials. Nevertheless, for the same reason, future trials will probably demonstrate that there is no material risk because in the vast majority of cases, the slight blood pressure increase will be manageable by hypertension drugs. Even in cases where the elevation in blood pressure is not manageable, the patient can be taken off the drug and the blood pressure returns to its normal levels. Evidently, if R788 gets approved, it is plausible that some patients will be more sensitive to this side effect and show a too steep of an increase in blood pressure. These patients will have to be taken of the drug but they still represent a small portion of the overall market.

In order to become a successful drug, R788 does not have to outperform the currently approved drugs for RA, instead, it should just offer patients a more convenient treatment with comparable efficacy. The mainstay treatment in RA is TNF-inhibitors, which are injectable biologics. As an oral agent, R788 could be preferred by patients who will have to pick between a monthly injection and a twice-a-day pill. Having an oral drug in the market will certainly help Rigel and its partner to squeeze R788 before the injectable agents, and become a standard first line treatment. This is in contrast to recently approved agents for RA such as Orencia and Rituxan, which are usually given to patients who do not derive sufficient benefit from TNF inhibitors.

According to Rigel, the deal will include a profit sharing arrangement in the U.S, royalties on sales outside of the U.S and a generous upfront payment. Therefore, Rigel will have to fund some of the development costs as well as establish a dedicated sales force in the U.S in return to the co-promotion rights. Building a sales infrastructure in some parts of the U.S typically requires substantial investment, but from Rigel’s perspective, this move makes a lot of sense given the unique nature of the RA market. In terms of incidence, RA occurs in a relatively small number of patients every year, however, because RA is an incurable chronic disease, patients receive treatment for years and decades. Therefore, this multi-billion market can be served by a relatively small sales force, one that can be built by a small company like Rigel.

Judging by the depressed share price, the market is skeptic with respect to the amount of money Rigel can get for R788. Ironically, the company’s current market cap is close to its market cap during 2007, before R788 demonstrated such a potent activity in RA. In my opinion, there are several factors including the impressive efficacy in a randomized trial, the blockbuster potential of R788, and the fact that it is an oral agent, which turn it into a very attractive drug for large pharmas, especially those who already have a RA franchise.

mfg ipollit

http://www.hammerstockblog.com/biotech-portfolio-updates-rig…

Assuming this trend continues in 2009, it is crucial to identify small and medium companies with candidates whose activity has already been proven in clinical trials. One of the most interesting companies that fall into this category is Rigel Pharmaceutical (RIGL). The company is currently developing a validated drug with blockbuster potential, and is expected to announce major collaboration deal during the first quarter.

Despite the imminent nature of the deal, investors should be aware of the risk factors that naturally come along with negotiations of this type. In addition, there are specific issues with Rigel that might affect the exact terms of the deals, let alone the ability to finalize it. Nevertheless, when all aspects are taken into account, it seems that at current price levels, Rigel represents an attractive investment opportunity.

In contrast to other companies that try to be as vague as possible about the timing of future deals, Rigel is going out of its way to reassure investors that it will have a deal in place by the end of the first quarter. Rigel’s lead drug, R788, is currently being evaluated in two comparative trials in patients with rheumatoid arthritis (RA), a $14 billion indication. During most of 2008, R788 was considered to be one the most promising drugs in the biotech industry, but an update at last year’s ACR meeting raised doubts regarding the safety profile of R788, as reviewed in my recent article on Rigel. According to the company, the safety data from the ACR meeting did not affect its negotiation leverage, as the potential partners had access to the data before it was published, so nothing came as a surprise to them. Trying to be as explicit as possible, Rigel managers state that none of the companies with whom it was in advanced discussions dropped out of the race as a result of the safety issues.

The safety issue most investors are worried about is the increase in blood pressure R788 seems to induce. With current regulatory climate, and considering that RA patients are more prone to develop high blood pressure, this safety signal will probably be closely watched in future trials. Nevertheless, for the same reason, future trials will probably demonstrate that there is no material risk because in the vast majority of cases, the slight blood pressure increase will be manageable by hypertension drugs. Even in cases where the elevation in blood pressure is not manageable, the patient can be taken off the drug and the blood pressure returns to its normal levels. Evidently, if R788 gets approved, it is plausible that some patients will be more sensitive to this side effect and show a too steep of an increase in blood pressure. These patients will have to be taken of the drug but they still represent a small portion of the overall market.

In order to become a successful drug, R788 does not have to outperform the currently approved drugs for RA, instead, it should just offer patients a more convenient treatment with comparable efficacy. The mainstay treatment in RA is TNF-inhibitors, which are injectable biologics. As an oral agent, R788 could be preferred by patients who will have to pick between a monthly injection and a twice-a-day pill. Having an oral drug in the market will certainly help Rigel and its partner to squeeze R788 before the injectable agents, and become a standard first line treatment. This is in contrast to recently approved agents for RA such as Orencia and Rituxan, which are usually given to patients who do not derive sufficient benefit from TNF inhibitors.

According to Rigel, the deal will include a profit sharing arrangement in the U.S, royalties on sales outside of the U.S and a generous upfront payment. Therefore, Rigel will have to fund some of the development costs as well as establish a dedicated sales force in the U.S in return to the co-promotion rights. Building a sales infrastructure in some parts of the U.S typically requires substantial investment, but from Rigel’s perspective, this move makes a lot of sense given the unique nature of the RA market. In terms of incidence, RA occurs in a relatively small number of patients every year, however, because RA is an incurable chronic disease, patients receive treatment for years and decades. Therefore, this multi-billion market can be served by a relatively small sales force, one that can be built by a small company like Rigel.

Judging by the depressed share price, the market is skeptic with respect to the amount of money Rigel can get for R788. Ironically, the company’s current market cap is close to its market cap during 2007, before R788 demonstrated such a potent activity in RA. In my opinion, there are several factors including the impressive efficacy in a randomized trial, the blockbuster potential of R788, and the fact that it is an oral agent, which turn it into a very attractive drug for large pharmas, especially those who already have a RA franchise.

mfg ipollit

Viropharma...

http://www.rttnews.com/ArticleView.aspx?Id=811877&SMap=1

ViroPharma - Nothing To Sneeze At

12/29/2008 5:59 AM ET

(RTTNews) - Shares of biotech company ViroPharma Inc. (VPHM: News ) appear to be bucking the market downturn, and have gained nearly 55% over the past year. In contrast, the Amex Biotechnology Index (^BTK), the benchmark index for the biotechnology sector, has tumbled 20% during the same time period.

ViroPharma's stock traded as high as $111.62 on March 6, 2000. The disappointing initial trial results of the company's investigational drug Picovir (pleconaril) against viral meningitis and cold, released in April 2000, sent the stock into a tailspin. Since then, it has been a rollercoaster ride for the stock.

In the last twelve months, ViroPharma stock has traded in the range of $7.94 - $15.16. As on December 26, the company had a market cap of $1.02 billion based on the stock's closing price of $13.

Company Overview

ViroPharma, based in the State of Delaware was founded in 1994 by Claude Nash and Mark McKinlay. The company focuses its drug development activities on viral diseases including cytomegalovirus and hepatitis C.

ViroPharma went public on November 19, 1996 offering 2.25 million shares at $7 each. Up till now, the company has been deriving all its sales from its only marketed drug -- Vancocin, which is used to treat deadly bacterial infections. The recent acquisition of Lev Pharmaceuticals Inc. offers an opportunity for ViroPharma to diversify its sales base. With the FDA approving Lev Pharma's Cinryze, a drug to treat hereditary angioedema as recently as October, ViroPharma will no longer be a one-trick pony

Vancocin - A Financial Lifesaver

ViroPharma, which was counting on its experimental common-cold drug Picovir as a source of revenue, met with disappointment following the FDA's rejection of the drug over safety concerns in June 2002.

In November 2004, ViroPharma acquired the American rights to antibiotic Vancocin from Eli Lilly & Co. (LLY), which had developed the drug, for $116 million. Vancocin is the oral capsule formulation of antibiotic Vancomycin hydrochloride. (Vancomycin is available as a powder for injection and as capsules or solution for oral use).

ViroPharma began marketing its flagship product, Vancocin in 2004. Eli Lilly sells the drug outside of the United States. ViroPharma also pays 35% of the net sales of Vancocin to Eli Lilly.

As on date, Vancocin is the only FDA-approved product to treat severe Clostridium difficile infection, also referred to as CDI. Clostridium difficile infection is one of the most common and devastating hospital-acquired infections. The bacterial infection occurs when patients are treated with antibiotics for other diseases. A prolonged treatment with antibiotics has a negative impact on beneficial bacteria that live in gastrointestinal tract, making the patients prone to bacterial infection. Closteridium difficile can cause diarrhea, ranging from a mild disturbance to a very severe illness with ulceration and bleeding from the colon. In severe conditions, the bacterium can cause perforation of the intestine leading to peritonitis, which can be fatal.

The Clostridium difficile infection is one of the most serious problems facing the U.S. healthcare system. The most commonly used drug to treat Clostridium difficile infection is the generic antibiotic Metronidazole. However, if the infection is severe, Vancocin is the only approved treatment.

Since its commercialization, sales of Vancocin have had an impressive growth. The patent covering Vancocin expired long back in 1996.

So .....Why doesn't the drug have an approved generic yet?

Vancocin works by targeting the Clostridium difficile bacterium in the gastrointestinal tract. Because of the complexities in the way the drug works, in order for a generic copy of Vancocin to be approved by the FDA, it has to prove itself to be truly bioequivalent to Vancocin in comparative clinical trials.

Usually generic drugs do not have to go through clinical trials and they are approved based on the bioequivalence data from the laboratory. No generic drug company has come forward to conduct clinical trials for generic Vancocin to establish the bioequivalence because of the huge expenses involved in conducting clinical trials.

According to experts, "an ineffective generic version of Vancocin will prove fatal because patients treated with ineffective generic Vancocin will have no second chances if it fails".

FDA's Changing Stance

In March 2006, the FDA's Office of Generic Drugs, or OGD revised the standard for the approval of generic copies of Vancocin. The OGD claimed that Vancocin is eligible for a BCS-based (Biopharmaceutics Classification System) biowaiver and that a clinical trial for generic Vancomycin is not necessary if it exhibits rapid dissolution in 'in vitro' test (lab setting). Rapid dissolution in 'in vitro' testing is one of the criteria for granting BCS-based biowaiver.

Since then, speculation has been rife that the FDA might approve a generic Vancocin based on the in vitro dissolution testing. On March 17, 2006 ViroPharma filed its citizen petition, asking the FDA to stay approval of generic Vancocin based solely on in vitro bioequivalence testing.

The BCS, a tool for classifying drugs based upon their aqueous solubility and intestinal permeability, is used by regulatory agencies to grant waivers from in vivo bioavailability and/or bioequivalence studies.

ViroPharma came to know of the new bioequivalence standard for generic Vancocin through a report issued by a trading firm Infinium Capital. Though ViroPharma eventually received verbal confirmation from the OGD about the change in standards, the FDA refused to supply ViroPharma with copies of FDA's correspondence with Infinium or anyone else related to the revised standards.

In its SEC filing dated May 31, 2006, ViroPharma stated that a press agency conducted an email interview with the FDA, in which the FDA sent an email to the press agency on March 17, 2006 stating that "[OGD] has recently revised the bioequivalence recommendations for oral Vancomycin from a clinical trial with bioequivalence endpoints to an in vitro method involving dissolution testing"

After ViroPharma's request to the FDA for records relating to the regulatory agency's decision on the bioequivalence standards for generic copies of Vancocin went unanswered, the company appealed to the Department of Health and Human Services, or HHS in November 2007. This time too, the HHS acknowledged receipt of ViroPharma's administrative appeal, but never responded.

As recently as December 15, 2008 the FDA revealed its draft guidance for establishing bioequivalence to Vancocin. Under the proposed draft guidance, apart from dissolution testing in a lab setting, a generic version of Vancocin should significantly contain the same inactive ingredients (Qualitative sameness - Q1) in substantially the same quantities (Quantitative sameness - Q2 ) as branded Vancocin.

According to the FDA's new guidance, if the generic versions do not have 'qualitative sameness' and 'quantitative sameness' as that of Vancocin, they need to prove their 'bioequivalence to Vancocin' in comparative clinical trials. The proposed draft guidance is open for public comment.

Meanwhile, on December 18, ViroPharma filed a suit against the Department of Health and Human Services and the FDA under the Freedom of Information Act, seeking administrative records related to the FDA's decision in March 2006 revised bioequivalence standard for generic Vancocin. The company has also requested the FDA for the administrative record relating to the regulatory agency's Vancocin bioequivalence guidance of December 15, 2008.

Thomas Doyle, ViroPharma's vice president, strategic initiatives is of the view that the FDA's Vancocin bioequivalence guidance of December 15, 2008, represents a deviation from the proposed OGD's (Office of Generic Drugs) March 2006 guidance.

.....How? All along, the OGD has asserted that Vancocin capsules are highly soluble and rapidly dissolving, and hence eligible for a BCS-based biowaiver. However, according to ViroPharma, Vancocin is not a BCS drug. The information released by the FDA as recently as December 15, also confirms that Vancocin is not rapidly dissolving. The confirmation was based on a Vancocin dissolution study completed by the FDA in February 2008.

With the new study not supporting OGD's March 2006 bioequivalence approach, the FDA has now proposed that a generic copy of Vancocin does not need to demonstrate rapid dissolution and that it requires "comparable" dissolution and Q1/Q2 sameness with respect to inactive ingredients.

The draft guidance has a 60 day public comment period to review. So a clear picture about generic competition for Vancocin will emerge once the draft guidance is finalized.

Last year, Vancocin's sales totaled $203.7 million, up 22% over 2006. For the first nine months of 2008, the drug raked in sales of $182.3 million, reflecting an increase of 17% from the comparable year-ago period. For full year of 2008, ViroPharma expects Vancocin sales to range between $235 million and $245 million. Analysts estimate sales of $233.3 million.

Shedding The One-Trick Pony Image

Seeking to diversify its sales base, in July 2008, ViroPharma agreed to acquire Lev Pharmaceuticals for $442.9 million. Under the terms of the agreement, ViroPharma paid $2.25 in cash plus $0.50 in stock for each Lev share. The purchase price represented a premium of 49% over Lev's share price prior to the deal announcement. On achievement of certain regulatory and commercial milestones, Lev shareholders will also receive an additional $1.00 per share. Including the additional payments, the deal has a potential value of $617.5 million.

Lev Pharmaceuticals is a little-known drug company, which was trading on the Over the Counter Bulletin Board Exchange when the deal was announced. Following the announcement of the deal on July 15, ViroPharma stock fell 15% to $10.62 as investors felt the acquisition was pricey and bid down the stock.

However, the acquisition seems to be paying off for ViroPharma. In October, the FDA approved Lev Pharma's Cinryze as a prophylactic (preventive) treatment for hereditary angioedema, or HAE, a rare and potentially life-threatening genetic disease. Lev Pharma had sought FDA approval of Cinryze, both as prophylactic and acute treatments of HAE attack. But the FDA approved Cinryze only as a prophylactic treatment and sought additional data to approve the drug in acute treatment of HAE.

Cinryze is the first product to be approved in the U.S. for HAE, which affects about 6,000 to 10,000 Americans. HAE is characterized by rapid swelling of the hands, feet, limbs, face, intestinal tract or airway.

Being an orphan drug, Cinryze will get seven years of marketing exclusivity. Cowen and Co. analyst Rachel McMinn estimates Cinryze to cost $3,400 per dose, or about $350,000 per year. Susquehanna analysts project annual sales of Cinryze to peak at about $127 million. According to analysts, an HAE drug approved as a prophylactic treatment brings in more revenue per patient, compared to an acute treatment setting.

ViroPharma, which has acquired Lev Pharma, has sought an expanded label indication for Cinryze for acute treatment of HAE. However, in the market for acute treatment of HAE, Cinryze has a number of possible contenders like CSL Behring's Berinert, Dyax Corp's DX-88 and Jerini AG's Firazyr.

While CSL Behring's Berinert is already under review by the FDA, Dyax Corp. completed the submission of Biologics License Application for DX-88 on September 24. DX-88 is expected to be approved by the FDA for acute HAE around mid-2009. The German company Jerini was issued a not approvable letter for Firazyr in April by the FDA. (A not approvable letter lists the deficiencies in the application and explains why the application cannot be approved).

However, for the prevention of HAE, ViroPharma's Cinryze remains the only FDA-approved drug till date.

Product Pipeline

The most promising candidate in ViroPharma's pipeline is Camvia (maribavir), a Phase 3 antiviral compound for the prevention of CMV (cytomegalovirus) disease in stem cell and solid organ transplant patients. ViroPharma expects to file a New Drug Application for Camvia with the FDA next year.

ViroPharma acquired worldwide rights (excluding Japan) to Camvia from GlaxoSmithKline in August 2003 for an up-front cash payment of $3.5 million, and will make additional milestone payments upon regulatory clearance.

The approved drugs for CMV disease, which are currently in the market carry black box warnings and have associated toxicities. Roche's Valganciclovir, the market leader for prevention of CMV disease, is associated with serious adverse effects and the drug's labeling carries a black box warning. In phase III trials, ViroPharma's Camvia has been found to be safe and well tolerated.

Camvia was granted orphan drug status in February 2007. According to ViroPharma, peak global sales of Camvia could be between $400 million and $500 million annually. The patents covering Camvia expire in 2015.

The Drugs That Never Made It To Market

Picovir

After data from clinical trials that evaluated Picovir (pleconaril) against meningitis proved unimpressive, ViroPharma began testing the drug for respiratory infections. But those results also turned out negative. It was only then that ViroPharma started trying Picovir against common cold. The compound used in Picovir was licensed by ViroPharma from Sanofi-Synthelabo, known as Sanofi-Aventis since 2004.

According to ViroPharma, Picovir in clinical trials, shortened the duration of cold to 6.3 days from 7.3 days. The company submitted its new drug application for Picovir in July 2001. However, in June 2002, an FDA panel unanimously rejected the drug, saying the potential risks far outweighed the small beneficial effect.

After Picovir was rejected by the FDA, ViroPharma re-licensed the drug to Schering Plough in 2003. Schering Plough is developing pleconaril in an intranasal formulation for common cold and asthma exacerbations and the drug has completed phase II trials.

HCV-796

HCV-796, a drug co-developed by Wyeth and ViroPharma was in a phase II trial when the companies abandoned the development of the drug in April 2008 due to safety concerns. In August 2007, the companies halted the trial as some patients treated with HCV-796 developed elevated liver enzymes, indicating liver damage.

Financials

The company has been profitable since 2005. Prior to the 2004 acquisition of Vancocin, the company incurred losses.

Net income for the third-quarter ended September 30, 2008 increased to $27.07 million or $0.33 per share from $21.28 million or $0.26 per share in the year-ago quarter. Quarterly revenue climbed to $65.9 million, up from $50.9 million in the comparable quarter a year before. Thus far, the company has posted 15 consecutive quarters of positive cash flow and profitability.

Free cash flow at the end of the recent third quarter was $75.53 million. Net debt at the end of the quarter was $250 million.

Upward Revision Of Estimates

Analysts are bullish on the company's earnings growth prospects and over the last 90 days, they have revised their estimates for 2008 by 10 cents to $0.99 per share.

Stock Performance

After trading in a range for almost a year, the stock broke out of the range and gained almost 50% in middle of 2008, and has managed to remain above its 200-day MA. The stock has some resistance around the $15 level.

Closing Thoughts

The threat of generic competition has continued to remain an overhang on ViroPharma, ever since the Office of Generic Drugs revealed the revised bioequivalence standard for generic Vancocin in 2006. The FDA's recent proposed draft guidance for establishing bioequivalence to Vancocin only strengthens the generic risk.

In addition to generic competition, Vancocin also faces a threat from Optimer Pharmaceuticals' (OPTR) OPT-80, which is currently under late-stage testing. In a phase III study, OPT-80 was found to have higher cure and lower relapse rates than Vancocin in the treatment of Closteridium difficile infection.

But that said, unlike in the past, ViroPharma has new sources of revenue to offset decline in Vancocin sales. The long-term growth potential of the company now rests on the success of Cinryze, which was recently approved by the FDA, and Camvia, which is expected to reach the market around 2010 or early 2011.

by RTT Staff Writer[/i]

mfg ipollit

http://www.rttnews.com/ArticleView.aspx?Id=811877&SMap=1

ViroPharma - Nothing To Sneeze At

12/29/2008 5:59 AM ET

(RTTNews) - Shares of biotech company ViroPharma Inc. (VPHM: News ) appear to be bucking the market downturn, and have gained nearly 55% over the past year. In contrast, the Amex Biotechnology Index (^BTK), the benchmark index for the biotechnology sector, has tumbled 20% during the same time period.

ViroPharma's stock traded as high as $111.62 on March 6, 2000. The disappointing initial trial results of the company's investigational drug Picovir (pleconaril) against viral meningitis and cold, released in April 2000, sent the stock into a tailspin. Since then, it has been a rollercoaster ride for the stock.

In the last twelve months, ViroPharma stock has traded in the range of $7.94 - $15.16. As on December 26, the company had a market cap of $1.02 billion based on the stock's closing price of $13.

Company Overview

ViroPharma, based in the State of Delaware was founded in 1994 by Claude Nash and Mark McKinlay. The company focuses its drug development activities on viral diseases including cytomegalovirus and hepatitis C.

ViroPharma went public on November 19, 1996 offering 2.25 million shares at $7 each. Up till now, the company has been deriving all its sales from its only marketed drug -- Vancocin, which is used to treat deadly bacterial infections. The recent acquisition of Lev Pharmaceuticals Inc. offers an opportunity for ViroPharma to diversify its sales base. With the FDA approving Lev Pharma's Cinryze, a drug to treat hereditary angioedema as recently as October, ViroPharma will no longer be a one-trick pony

Vancocin - A Financial Lifesaver

ViroPharma, which was counting on its experimental common-cold drug Picovir as a source of revenue, met with disappointment following the FDA's rejection of the drug over safety concerns in June 2002.

In November 2004, ViroPharma acquired the American rights to antibiotic Vancocin from Eli Lilly & Co. (LLY), which had developed the drug, for $116 million. Vancocin is the oral capsule formulation of antibiotic Vancomycin hydrochloride. (Vancomycin is available as a powder for injection and as capsules or solution for oral use).

ViroPharma began marketing its flagship product, Vancocin in 2004. Eli Lilly sells the drug outside of the United States. ViroPharma also pays 35% of the net sales of Vancocin to Eli Lilly.

As on date, Vancocin is the only FDA-approved product to treat severe Clostridium difficile infection, also referred to as CDI. Clostridium difficile infection is one of the most common and devastating hospital-acquired infections. The bacterial infection occurs when patients are treated with antibiotics for other diseases. A prolonged treatment with antibiotics has a negative impact on beneficial bacteria that live in gastrointestinal tract, making the patients prone to bacterial infection. Closteridium difficile can cause diarrhea, ranging from a mild disturbance to a very severe illness with ulceration and bleeding from the colon. In severe conditions, the bacterium can cause perforation of the intestine leading to peritonitis, which can be fatal.

The Clostridium difficile infection is one of the most serious problems facing the U.S. healthcare system. The most commonly used drug to treat Clostridium difficile infection is the generic antibiotic Metronidazole. However, if the infection is severe, Vancocin is the only approved treatment.

Since its commercialization, sales of Vancocin have had an impressive growth. The patent covering Vancocin expired long back in 1996.

So .....Why doesn't the drug have an approved generic yet?

Vancocin works by targeting the Clostridium difficile bacterium in the gastrointestinal tract. Because of the complexities in the way the drug works, in order for a generic copy of Vancocin to be approved by the FDA, it has to prove itself to be truly bioequivalent to Vancocin in comparative clinical trials.

Usually generic drugs do not have to go through clinical trials and they are approved based on the bioequivalence data from the laboratory. No generic drug company has come forward to conduct clinical trials for generic Vancocin to establish the bioequivalence because of the huge expenses involved in conducting clinical trials.

According to experts, "an ineffective generic version of Vancocin will prove fatal because patients treated with ineffective generic Vancocin will have no second chances if it fails".

FDA's Changing Stance

In March 2006, the FDA's Office of Generic Drugs, or OGD revised the standard for the approval of generic copies of Vancocin. The OGD claimed that Vancocin is eligible for a BCS-based (Biopharmaceutics Classification System) biowaiver and that a clinical trial for generic Vancomycin is not necessary if it exhibits rapid dissolution in 'in vitro' test (lab setting). Rapid dissolution in 'in vitro' testing is one of the criteria for granting BCS-based biowaiver.

Since then, speculation has been rife that the FDA might approve a generic Vancocin based on the in vitro dissolution testing. On March 17, 2006 ViroPharma filed its citizen petition, asking the FDA to stay approval of generic Vancocin based solely on in vitro bioequivalence testing.

The BCS, a tool for classifying drugs based upon their aqueous solubility and intestinal permeability, is used by regulatory agencies to grant waivers from in vivo bioavailability and/or bioequivalence studies.

ViroPharma came to know of the new bioequivalence standard for generic Vancocin through a report issued by a trading firm Infinium Capital. Though ViroPharma eventually received verbal confirmation from the OGD about the change in standards, the FDA refused to supply ViroPharma with copies of FDA's correspondence with Infinium or anyone else related to the revised standards.