Glencore International AG Europas größter Börsengang (Seite 23)

eröffnet am 14.04.11 11:26:26 von

neuester Beitrag 02.04.24 08:12:49 von

neuester Beitrag 02.04.24 08:12:49 von

Beiträge: 936

ID: 1.165.552

ID: 1.165.552

Aufrufe heute: 12

Gesamt: 147.133

Gesamt: 147.133

Aktive User: 0

ISIN: JE00B4T3BW64 · WKN: A1JAGV · Symbol: 8GC

5,5080

EUR

+0,51 %

+0,0280 EUR

Letzter Kurs 26.04.24 Tradegate

Neuigkeiten

16.04.24 · dpa-AFX Analysen |

08.04.24 · dpa-AFX |

02.04.24 · kapitalerhoehungen.de |

31.03.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,6900 | +23,96 | |

| 5,1500 | +21,75 | |

| 15,890 | +21,67 | |

| 0,8900 | +17,11 | |

| 0,9000 | +16,13 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,5200 | -6,61 | |

| 1,1200 | -6,67 | |

| 10,040 | -7,89 | |

| 0,5700 | -8,06 | |

| 46,98 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Deutsche Bank erhöht KZ auf 420 pence (c. 4,9 EUR)

https://www.modernreaders.com/news/2021/05/28/glencore-longl…

https://www.modernreaders.com/news/2021/05/28/glencore-longl…

Antwort auf Beitrag Nr.: 68.204.368 von Pacific1 am 16.05.21 09:41:48

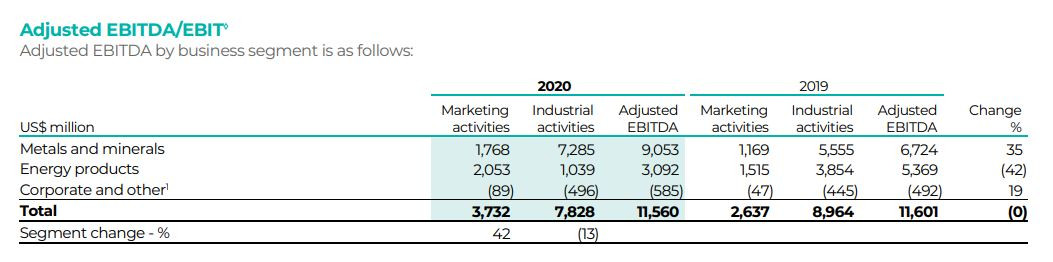

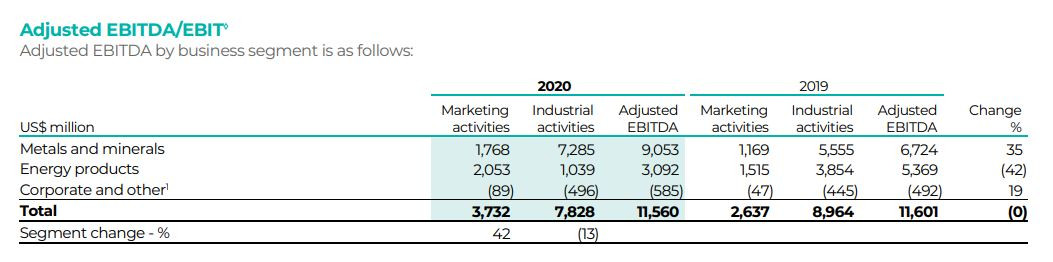

Die Analyse bzgl. Glencore sehe ich etwas differenzierter. Und seit wann entscheidet man über ein Investment, abhängig von Frauenquote? Verstehe diesen Kommentar nicht. Dann die Abschreibungen in 2020 war außerordentlich und nicht cash wirksam (also kein cash Verlust). D.h. diese Impairments / Abschreibungen führt man für die Zukunft nicht unbedingt fort, einiges davon ist Covid bedingt, andere assets wurde verkauft etc. Die Bewertung der Firma basiert auf der Zukunft. Weiterhin bezieht er sich auf Umsatz aus Energy und Metals, wobei doch ein Großteil aus Energy stammen würde. Viel wichtiger ist jedoch, was an EBITDA / EBIT per Segment beigesteuert wird. Und da kommen fast 75% aus "nicht" energy. Siehe Bild

Zu den Impairments heißt es im JA wie folgt (da kann sich jeder ein Bild machen, was davon wohlmöglich wiederkehrend ist. Meines Erachtens nicht viel)

2020 Impairments

Property, plant and equipment and intangible assets

• Volcan is a listed zinc / silver mining entity in Peru, in which the Group acquired a 63% controlling (23% economic) interest at the end of 2017 (Industrial activities segment). The operations primarily comprise two cash-generating units (Yauli and Chungar) and at the time of the acquisition, approximately one third of the value was ascribed to realising the future potential of various projects / resources. Due to the impact Covid-19 has had on the long-term outlook of the global economy, a comprehensive review of the life of mine plan and related expansion projects was carried out in Q2 2020 where it was determined that the related risk / confidence levels in deploying capital to longer-term greenfield projects and the probability of approving development and realisation of these projects had reduced. This, along with the shift in long-term zinc pricing, lead to an impairment of $2,347 million (related deferred tax obligations of $716 million were released) to its estimated recoverable amount of $1,503 million. The valuation assumes long-term zinc and silver prices of $2,400/t and $20.00/lb, respectively and an operation specific discount rate of 9.2%. Should the zinc and silver price assumptions fall by 10% (across the curve), a further impairment of $450 million would be recognised. A 10% reduction in estimated annual production over the life of mine could result in an additional impairment of

$540 million.

• As a result of persistent operational challenges, further technical analysis resulting in a reduced life of mine forecast, delays in key development projects and cost increases owing to inflation, tax and other regulatory pressures, a decision was made, in Q2 2020, to place the Mopani copper operations in Zambia (Industrial activities segment) on extended care and maintenance subject to government approval. In January 2021, an agreement was reached to sell Mopani to ZCCM (see note 15). At year end, the carrying value was determined with reference to the estimated fair value of the consideration receivable from the sale transaction noted above. The Mopani operations were therefore impaired by $1,041 million, to $861 million, reflecting the estimated fair value of the agreed sales terms. The valuation remains sensitive to price and production volumes and a deterioration in these assumptions could result in additional impairments. The operation specific discount rate used in the valuation was 10.5%. The short to longterm copper price assumptions were $7,900/mt – 6,300/mt. Should the copper price assumptions fall by 10% (across the curve), considering historical production performance, production volumes decline by 20%, a further $150 million and $235 million, respectively, of impairment would be recognised.

• During H1 2020, pressure on the API2 European coal market (primary price reference market for our Colombian coal operations) increased as European economies continue to progress their decarbonisation trajectory, exacerbated by the significant drop in oil and gas prices (supply and demand factors). A review of Prodeco’s operations determined that, in addition to a deteriorating market environment, there were increasing challenges with respect to obtaining several key approvals from government agencies and other key stakeholders. In Q2 2020, an application was therefore made to place Prodeco on extended care and maintenance until these conditions improve. In Q4, the application was rejected and it was subsequently decided to relinquish the mining licenses.

Consequently, the full carrying value of the mining operations related to such licenses ($835 million) (Industrial activities segment) were fully impaired (property, plant and equipment - $789 million and non-current advances and loans - $46 million).

• As noted above, oil prices were significantly impacted by demand destruction from Covid-19, the lack of timely effective supply response from OPEC+ and the longer term outlook for oil prices also deteriorated due to updated expectations surrounding decarbonisation. In addition, Covid-19 disrupted and restricted international mobility, which had a particularly significant impact

on our workforce arrangements in Chad, resulting in these fields being placed on care and maintenance in March. As a result, in Q2 2020, the Chad oil operations (Industrial activities segment) were impaired by $673 million to their estimated recoverable amount of $145 million. The valuation remains sensitive to Covid-19 related disruptions on international mobility and a timely restart of the operations in a safe and economic manner. Should such restart be prolonged by an extended period of time, an additional future impairment of the balance of the carrying amount could result.

• In June 2020, it was determined to keep the Lydenburg chrome smelter (Industrial activities segment) on care and maintenance, reflecting the challenging operating and market environment across the South African ferrochrome industry, including unsustainably increasing electricity tariffs / supply interruption and other sources of real cost inflation. These macro factors outweigh the significant efforts made over the past years to make the operation more competitive, rendering its estimated fair value as negative. As a result, the entire carrying value of the Lydenburg smelter ($116 million) was impaired.

• The global macro-economic impact of Covid-19 on refined petroleum product demand and resulting global refinery overcapacity has had a negative effect on refining margins. As a result, Astron (Industrial activities segment) has lowered its long term throughthe-cycle outlook on refining margins by approximately 30%. As a result, the Astron oil refinery was impaired by $480 million to its

estimated recoverable amount of $1,015 million, including its related downstream supply business. The operation specific discount rate used in the valuation was a pre-tax nominal discount rate of 12.3%. The valuation remains most sensitive to refining margins and a deterioration in these assumptions could result in additional impairments. Should the margin assumptions fall by $1/bbl

(across the curve), a further $243 million of impairment would be recognised. Should the discount rate increase by 1%, a further $88 million of impairment would be recognised.

• The balance of the impairment charges on property, plant and equipment (none of which were individually material) relate to specific assets where utilisation is no longer required or to projects no longer progressed due to changes in production and development plans. As a result, the full carrying amount of these assets/projects was impaired, with $62 million recognised in our Industrial activities segment.

Zitat von Pacific1: Das Format Echtgeld TV hat auch einige Rohstofftitel besprochen.

Christian W. Röhl hat sich nicht ganz so positiv zur Glencore geäußert. U.a. wegen der Recht umfangreichen Energieaktivitäten (insbesondere Kohle).

Hier ist der Beitrag aufrufbar:

Die Analyse bzgl. Glencore sehe ich etwas differenzierter. Und seit wann entscheidet man über ein Investment, abhängig von Frauenquote? Verstehe diesen Kommentar nicht. Dann die Abschreibungen in 2020 war außerordentlich und nicht cash wirksam (also kein cash Verlust). D.h. diese Impairments / Abschreibungen führt man für die Zukunft nicht unbedingt fort, einiges davon ist Covid bedingt, andere assets wurde verkauft etc. Die Bewertung der Firma basiert auf der Zukunft. Weiterhin bezieht er sich auf Umsatz aus Energy und Metals, wobei doch ein Großteil aus Energy stammen würde. Viel wichtiger ist jedoch, was an EBITDA / EBIT per Segment beigesteuert wird. Und da kommen fast 75% aus "nicht" energy. Siehe Bild

Zu den Impairments heißt es im JA wie folgt (da kann sich jeder ein Bild machen, was davon wohlmöglich wiederkehrend ist. Meines Erachtens nicht viel)

2020 Impairments

Property, plant and equipment and intangible assets

• Volcan is a listed zinc / silver mining entity in Peru, in which the Group acquired a 63% controlling (23% economic) interest at the end of 2017 (Industrial activities segment). The operations primarily comprise two cash-generating units (Yauli and Chungar) and at the time of the acquisition, approximately one third of the value was ascribed to realising the future potential of various projects / resources. Due to the impact Covid-19 has had on the long-term outlook of the global economy, a comprehensive review of the life of mine plan and related expansion projects was carried out in Q2 2020 where it was determined that the related risk / confidence levels in deploying capital to longer-term greenfield projects and the probability of approving development and realisation of these projects had reduced. This, along with the shift in long-term zinc pricing, lead to an impairment of $2,347 million (related deferred tax obligations of $716 million were released) to its estimated recoverable amount of $1,503 million. The valuation assumes long-term zinc and silver prices of $2,400/t and $20.00/lb, respectively and an operation specific discount rate of 9.2%. Should the zinc and silver price assumptions fall by 10% (across the curve), a further impairment of $450 million would be recognised. A 10% reduction in estimated annual production over the life of mine could result in an additional impairment of

$540 million.

• As a result of persistent operational challenges, further technical analysis resulting in a reduced life of mine forecast, delays in key development projects and cost increases owing to inflation, tax and other regulatory pressures, a decision was made, in Q2 2020, to place the Mopani copper operations in Zambia (Industrial activities segment) on extended care and maintenance subject to government approval. In January 2021, an agreement was reached to sell Mopani to ZCCM (see note 15). At year end, the carrying value was determined with reference to the estimated fair value of the consideration receivable from the sale transaction noted above. The Mopani operations were therefore impaired by $1,041 million, to $861 million, reflecting the estimated fair value of the agreed sales terms. The valuation remains sensitive to price and production volumes and a deterioration in these assumptions could result in additional impairments. The operation specific discount rate used in the valuation was 10.5%. The short to longterm copper price assumptions were $7,900/mt – 6,300/mt. Should the copper price assumptions fall by 10% (across the curve), considering historical production performance, production volumes decline by 20%, a further $150 million and $235 million, respectively, of impairment would be recognised.

• During H1 2020, pressure on the API2 European coal market (primary price reference market for our Colombian coal operations) increased as European economies continue to progress their decarbonisation trajectory, exacerbated by the significant drop in oil and gas prices (supply and demand factors). A review of Prodeco’s operations determined that, in addition to a deteriorating market environment, there were increasing challenges with respect to obtaining several key approvals from government agencies and other key stakeholders. In Q2 2020, an application was therefore made to place Prodeco on extended care and maintenance until these conditions improve. In Q4, the application was rejected and it was subsequently decided to relinquish the mining licenses.

Consequently, the full carrying value of the mining operations related to such licenses ($835 million) (Industrial activities segment) were fully impaired (property, plant and equipment - $789 million and non-current advances and loans - $46 million).

• As noted above, oil prices were significantly impacted by demand destruction from Covid-19, the lack of timely effective supply response from OPEC+ and the longer term outlook for oil prices also deteriorated due to updated expectations surrounding decarbonisation. In addition, Covid-19 disrupted and restricted international mobility, which had a particularly significant impact

on our workforce arrangements in Chad, resulting in these fields being placed on care and maintenance in March. As a result, in Q2 2020, the Chad oil operations (Industrial activities segment) were impaired by $673 million to their estimated recoverable amount of $145 million. The valuation remains sensitive to Covid-19 related disruptions on international mobility and a timely restart of the operations in a safe and economic manner. Should such restart be prolonged by an extended period of time, an additional future impairment of the balance of the carrying amount could result.

• In June 2020, it was determined to keep the Lydenburg chrome smelter (Industrial activities segment) on care and maintenance, reflecting the challenging operating and market environment across the South African ferrochrome industry, including unsustainably increasing electricity tariffs / supply interruption and other sources of real cost inflation. These macro factors outweigh the significant efforts made over the past years to make the operation more competitive, rendering its estimated fair value as negative. As a result, the entire carrying value of the Lydenburg smelter ($116 million) was impaired.

• The global macro-economic impact of Covid-19 on refined petroleum product demand and resulting global refinery overcapacity has had a negative effect on refining margins. As a result, Astron (Industrial activities segment) has lowered its long term throughthe-cycle outlook on refining margins by approximately 30%. As a result, the Astron oil refinery was impaired by $480 million to its

estimated recoverable amount of $1,015 million, including its related downstream supply business. The operation specific discount rate used in the valuation was a pre-tax nominal discount rate of 12.3%. The valuation remains most sensitive to refining margins and a deterioration in these assumptions could result in additional impairments. Should the margin assumptions fall by $1/bbl

(across the curve), a further $243 million of impairment would be recognised. Should the discount rate increase by 1%, a further $88 million of impairment would be recognised.

• The balance of the impairment charges on property, plant and equipment (none of which were individually material) relate to specific assets where utilisation is no longer required or to projects no longer progressed due to changes in production and development plans. As a result, the full carrying amount of these assets/projects was impaired, with $62 million recognised in our Industrial activities segment.

Das Format Echtgeld TV hat auch einige Rohstofftitel besprochen.

Christian W. Röhl hat sich nicht ganz so positiv zur Glencore geäußert. U.a. wegen der Recht umfangreichen Energieaktivitäten (insbesondere Kohle).

Hier ist der Beitrag aufrufbar:

Christian W. Röhl hat sich nicht ganz so positiv zur Glencore geäußert. U.a. wegen der Recht umfangreichen Energieaktivitäten (insbesondere Kohle).

Hier ist der Beitrag aufrufbar:

THE PROBLEMS WITH COPPER SUPPLY

“I have switched from being a structural copper bear to a structural copper bull.” Leigh Goehring, Barron’s Commodity column May 2001.

Copper has emerged as a leader in this commodity bull market. We are strong believers that copper prices are heading significantly higher. After bottoming at $1.95 per pound in early 2016, copper prices have more than doubled. Copper equities (as measured by the COPX ETF) have done even better, rallying over 200% — more than twice the increase of the S&P 500.

https://f.hubspotusercontent40.net/hubfs/4043042/Commentarie…

“I have switched from being a structural copper bear to a structural copper bull.” Leigh Goehring, Barron’s Commodity column May 2001.

Copper has emerged as a leader in this commodity bull market. We are strong believers that copper prices are heading significantly higher. After bottoming at $1.95 per pound in early 2016, copper prices have more than doubled. Copper equities (as measured by the COPX ETF) have done even better, rallying over 200% — more than twice the increase of the S&P 500.

https://f.hubspotusercontent40.net/hubfs/4043042/Commentarie…

Wie schon ausgeführt, wenn es wirklich so kommt, wie die meisten Analysten vorhersagen "commodity supercycle", dann gehört Glencore ins Portfolio. Da Börse keine Einbahnstraße ist, werden wir hier nicht schnurstracks unendliche Höhen erreichen. D.h. auf und ab und konsos werden kommen. Mittel bis langfristig kann es aber gut steigen, wenn die Preise für commodities auch weiter steigen.

Hab noch eine kleine Position 1000 Stück im Depot die ich vor mehreren Jahren für 3,98 Euro gekauft hatte, scheint ja damit noch etwas zu werden

Antwort auf Beitrag Nr.: 68.139.079 von JBelfort am 11.05.21 08:29:27

Spannend, bin mit einer reinen Trading Position leider etwas spät eingestiegen, eine Verdoppelung käme gelegen

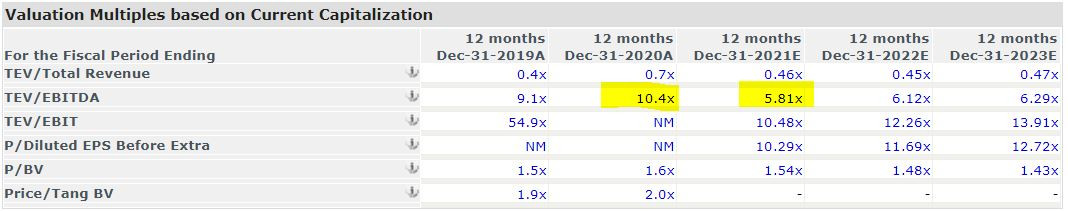

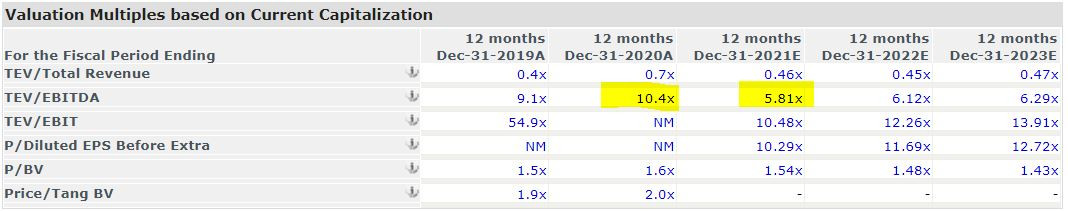

Zitat von JBelfort: Ich rechne mit einer Verdoppelung der Kurses. Im letzten Jahr war Unternehmenswert in Relation zum Gewinn vor Abschreibungen, Zinsen und Steuern fast doppelt so hoch.

Spannend, bin mit einer reinen Trading Position leider etwas spät eingestiegen, eine Verdoppelung käme gelegen

Antwort auf Beitrag Nr.: 67.882.382 von Shizogenie am 20.04.21 14:20:50

Läuft oder? Hoffe du hattes die Geduld. Ich sehe im Chart wenig Widerstände nach oben hin.

Zitat von Shizogenie: So richtig partizipiert man hier aber noch nicht, von steigenden Kupferkursen.

Läuft oder? Hoffe du hattes die Geduld. Ich sehe im Chart wenig Widerstände nach oben hin.

Ich rechne mit einer Verdoppelung der Kurses. Im letzten Jahr war Unternehmenswert in Relation zum Gewinn vor Abschreibungen, Zinsen und Steuern fast doppelt so hoch.

How the Green Economy Will Be a Gold Mine for Copper

https://www-barrons-com.cdn.ampproject.org/c/s/www.barrons.c…

https://www-barrons-com.cdn.ampproject.org/c/s/www.barrons.c…

Glencore International AG Europas größter Börsengang