Africa Oil Corp. - World-Class East Africa Oil Exploration (Seite 302)

eröffnet am 23.06.11 21:04:25 von

neuester Beitrag 28.04.24 15:36:08 von

neuester Beitrag 28.04.24 15:36:08 von

Beiträge: 4.121

ID: 1.167.139

ID: 1.167.139

Aufrufe heute: 2

Gesamt: 628.834

Gesamt: 628.834

Aktive User: 0

ISIN: CA00829Q1019 · WKN: A0MZJC · Symbol: AOI

1,6550

EUR

+0,73 %

+0,0120 EUR

Letzter Kurs 14.05.24 Tradegate

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 40,36 | +18,80 | |

| 15,000 | +15,38 | |

| 2,7600 | +11,29 | |

| 8,0000 | +10,34 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,1050 | -6,75 | |

| 300,01 | -7,69 | |

| 1,0000 | -13,04 | |

| 21,000 | -23,64 | |

| 5,9460 | -75,48 |

Beitrag zu dieser Diskussion schreiben

Ich erinnere, dass der Montag in Nordamerika und Kanada Bank Holiday ist, wenn ein gesetzlicher Feiertag auf ein Wochenende fällt - daher hast Du vermutlich recht, gabbo62...

Heute ist kein Feiertag in Kanada, es war gestern am 01.07.12 der Feiertag.

Antwort auf Beitrag Nr.: 43.341.736 von gimo211 am 02.07.12 08:17:32Hi gimo211, wegen Börsenfeiertag in Kanada schließe ich heute eine NR von Africa Oil aus.

Ich rechne nach diesen Presse-Releases nun heute mit einem Operational Update. Ich bin sehr gespannt, was die Logs zu den primary targets im lower Lokhone sandstone sagen und wie groß man dort eine zusätzliche pay zone einschätzt.

Das sie offenbar früher Basement erreicht haben, überrascht mich nicht; bislang haben sie die gesamte Geologie etwa 300m früher als ursprünglich erwartet angetroffen.

Hier noch ein genereller Artikel zur zukünftigen Bedeutung von East Africa - Man möge sich einmal vorstellen, wo AOI in 5 Jahren stehen kann, wenn alles positiv bleibt....

http://www.telegraph.co.uk/finance/newsbysector/energy/oilan…

Oil and gas are the new African queens

By Emily Gosden

5:27PM BST 01 Jul 2012

When Royal Dutch Shell proposed a 195p-a-share, £992m offer for Mozambique-focused oil and gas explorer Cove Energy in February, many in the City regarded it as a “full” offer.

“The valuation looks stretched,” wrote one analyst. “The proposed offer is unlikely to face a challenge,” said another. More than four months on, Thailand’s PTT now leads a bidding war with a 240p-a-share agreed bid.

The City now expects Shell – which has so far raised its offer to 220p – to come back and at least match PTT, potentially even upping its bid to above 300p. Cove’s prized asset is its 8.5pc stake in the Rovuma 1 block off the Mozambique coast, where giant gas reserves have been discovered.

The fact that interest in the company has so greatly exceeded expectations is, in large part, due to the astonishing run of further gas discoveries in the block since February. But the bidding war also highlights the importance with which East Africa is regarded by the world’s biggest oil and gas companies – and the premium they are willing to pay .

“In the space of a few years, East Africa has become a feeding ground for most of the world’s oil majors, which have sniffed our resources of oil and gas on a truly gargantuan scale,” wrote Malcolm Graham-Wood, oil analyst at VSA Capital, in a recent note. And in the world of oil and gas where, as he puts it, “if you find it, they will come”, those gargantuan reserves are the key.

“It’s been known there’s oil here for 100 years,” Laurie Hunter, chief executive of explorer Madagascar Oil says. “It actually seeps out on the surface in places.”

But with exploratory drilling consistently exceeding expectations, the geology of East Africa is proving to be even better than once thought.

FTSE 100 explorer Tullow Oil began drilling by Lake Albert in Uganda in 2006 – the first well there since 1938. It has drilled 45 wells to date; 43 of them have hit hydrocarbons. The company says it believes the Lake Albert rift basin is a “a major hydrocarbon province in its own right”, with resources as high as 1.1bn barrels. French oil major Total and Chinese CNOOC have paid $2.9bn to buy into Tullow’s stakes.

In March, Tullow struck oil in its first exploration well in Kenya, the country’s first ever discovery. After further success, Tullow has already suggested Kenya’s reserves could exceed those in Uganda.

But while the oil discoveries look transformational – for all involved – it is gas that is causing the most excitement. In the balmy waters of the Indian Ocean, off the coasts of Tanzania and Mozambique, gas discoveries are estimated to stand at more than 100 trillion cubic feet (tcf). Potential resources are significantly higher. By way of context, the UK’s entire annual natural gas consumption in 2010 was 3.3tcf.

The discoveries have made Ophir Energy the darling of the UK stock market. Since listing in July 2011 at 250p a share, the explorer has more than doubled in value, closing last week at 580p.

In May Ophir and partner BG Group announced their fifth consecutive gas discovery off Tanzania, taking their estimated reserves there to more than 10tcf. Ophir says its “unusually high success rate” is aided by the fact the basins’ geology is “ideal” for producing 3D seismic data, reducing the exploration risk.

Other major players off the coast of Tanzania include Norway’s Statoil and US giant ExxonMobil, who together have already discovered about 9tcf this year.

Further south, Mozambique’s Prosperidade gas complex in the Rovuma block is thought to contain recoverable reserves of 17tcf to 30tcf of gas – the discovery that brought Shell and PTT to the table for Cove. America’s Anadarko and Italian company ENI have also made giant Mozambique finds.

To date, Mr Graham-Wood says, Mozambique is “undoubtedly the biggest success story in East Africa”.

But it’s not just the geology that makes East Africa so exciting – it’s also the geography. “Conveniently,” Mr Graham-Wood notes, East Africa’s gas “faces the lucrative markets of India and the Far East and is now a truly valuable commodity”.

The gas will be cooled into liquefied natural gas (LNG) so it can be shipped to Asia. Gas consumption jumped 21.5pc in China and 11.6pc in Japan in 2011, according to BP data.

“We believe there is enough gas offshore Tanzania in total for an LNG export project,” says Martin Houston, chief operating officer of BG Group. “Looking at global gas demand growth between 2010 to 2020, supply will actually need to grow by more than 9pc per year – this is roughly equivalent to bringing onstream '20 Norways’ by the end of the decade. LNG is set to increase from just under 10pc of the gas supply mix today to around 14pc in 2025 with Asian demand the engine of this growth.”

“Gas is cheaper than oil, it’s easier to find big supply sources, and it’s cleaner,” explains analyst Stuart Joyner of Investec. “The Japanese nuclear industry has basically shut down, the UK has gone from being a net exporter of gas to a net importer. The growth in the gas market globally is phenomenal. The returns on LNG right now are much much better than they are for oil.”

Exploiting the reserves in East Africa is not without its challenges, as Mr Joyner notes from a recent visit to Mozambique. “There are no roads and you have to fly everywhere on dodgy twin-props.”

There are political challenges, too. Tullow was forced to defend itself against unfounded corruption allegations in Uganda, and has been embroiled in a tax dispute with former partner Heritage Oil.

Madagascar Oil’s shares had to be temporarily suspended in 2010, a month after listing on AIM, amid a tax dispute with the island’s government, now resolved. And Shell’s plans to explore in four “exciting” offshore deepwater blocks have been delayed for a decade by a stand-off between Tanzania and semi-autonomous Zanzibar over production sharing rights.

Yet challenging environments are part and parcel of frontier oil and gas exploration. There is little doubt that East Africa is well on its way to becoming a major new oil and gas exporting province.

No wonder, then, that analysts believe the bidding race for Cove has a long way to go - and is unlikely to be the last.

Shell last week extended its 220p offer, despite having been outbid. Mr Graham-Wood suggests that could be a “cunning ruse to buy time on another deal” – to buy a stake from one of the other partners in Rovuma. Even in February Shell had said it was assessing potential opportunities to build a higher stake in the block.

Mr Joyner agrees that the supermajors are circling. “Ophir is the obvious next target, but I think you could also see consolidation of some of the smaller stakes in the Mozambique projects and ultimately Anadarko and possibly ENI cashing in,” he says. “At the moment, you have a mix of independents and medium-sized companies. Fast-forward five years, you will see a very different picture.”

Das sie offenbar früher Basement erreicht haben, überrascht mich nicht; bislang haben sie die gesamte Geologie etwa 300m früher als ursprünglich erwartet angetroffen.

Hier noch ein genereller Artikel zur zukünftigen Bedeutung von East Africa - Man möge sich einmal vorstellen, wo AOI in 5 Jahren stehen kann, wenn alles positiv bleibt....

http://www.telegraph.co.uk/finance/newsbysector/energy/oilan…

Oil and gas are the new African queens

By Emily Gosden

5:27PM BST 01 Jul 2012

When Royal Dutch Shell proposed a 195p-a-share, £992m offer for Mozambique-focused oil and gas explorer Cove Energy in February, many in the City regarded it as a “full” offer.

“The valuation looks stretched,” wrote one analyst. “The proposed offer is unlikely to face a challenge,” said another. More than four months on, Thailand’s PTT now leads a bidding war with a 240p-a-share agreed bid.

The City now expects Shell – which has so far raised its offer to 220p – to come back and at least match PTT, potentially even upping its bid to above 300p. Cove’s prized asset is its 8.5pc stake in the Rovuma 1 block off the Mozambique coast, where giant gas reserves have been discovered.

The fact that interest in the company has so greatly exceeded expectations is, in large part, due to the astonishing run of further gas discoveries in the block since February. But the bidding war also highlights the importance with which East Africa is regarded by the world’s biggest oil and gas companies – and the premium they are willing to pay .

“In the space of a few years, East Africa has become a feeding ground for most of the world’s oil majors, which have sniffed our resources of oil and gas on a truly gargantuan scale,” wrote Malcolm Graham-Wood, oil analyst at VSA Capital, in a recent note. And in the world of oil and gas where, as he puts it, “if you find it, they will come”, those gargantuan reserves are the key.

“It’s been known there’s oil here for 100 years,” Laurie Hunter, chief executive of explorer Madagascar Oil says. “It actually seeps out on the surface in places.”

But with exploratory drilling consistently exceeding expectations, the geology of East Africa is proving to be even better than once thought.

FTSE 100 explorer Tullow Oil began drilling by Lake Albert in Uganda in 2006 – the first well there since 1938. It has drilled 45 wells to date; 43 of them have hit hydrocarbons. The company says it believes the Lake Albert rift basin is a “a major hydrocarbon province in its own right”, with resources as high as 1.1bn barrels. French oil major Total and Chinese CNOOC have paid $2.9bn to buy into Tullow’s stakes.

In March, Tullow struck oil in its first exploration well in Kenya, the country’s first ever discovery. After further success, Tullow has already suggested Kenya’s reserves could exceed those in Uganda.

But while the oil discoveries look transformational – for all involved – it is gas that is causing the most excitement. In the balmy waters of the Indian Ocean, off the coasts of Tanzania and Mozambique, gas discoveries are estimated to stand at more than 100 trillion cubic feet (tcf). Potential resources are significantly higher. By way of context, the UK’s entire annual natural gas consumption in 2010 was 3.3tcf.

The discoveries have made Ophir Energy the darling of the UK stock market. Since listing in July 2011 at 250p a share, the explorer has more than doubled in value, closing last week at 580p.

In May Ophir and partner BG Group announced their fifth consecutive gas discovery off Tanzania, taking their estimated reserves there to more than 10tcf. Ophir says its “unusually high success rate” is aided by the fact the basins’ geology is “ideal” for producing 3D seismic data, reducing the exploration risk.

Other major players off the coast of Tanzania include Norway’s Statoil and US giant ExxonMobil, who together have already discovered about 9tcf this year.

Further south, Mozambique’s Prosperidade gas complex in the Rovuma block is thought to contain recoverable reserves of 17tcf to 30tcf of gas – the discovery that brought Shell and PTT to the table for Cove. America’s Anadarko and Italian company ENI have also made giant Mozambique finds.

To date, Mr Graham-Wood says, Mozambique is “undoubtedly the biggest success story in East Africa”.

But it’s not just the geology that makes East Africa so exciting – it’s also the geography. “Conveniently,” Mr Graham-Wood notes, East Africa’s gas “faces the lucrative markets of India and the Far East and is now a truly valuable commodity”.

The gas will be cooled into liquefied natural gas (LNG) so it can be shipped to Asia. Gas consumption jumped 21.5pc in China and 11.6pc in Japan in 2011, according to BP data.

“We believe there is enough gas offshore Tanzania in total for an LNG export project,” says Martin Houston, chief operating officer of BG Group. “Looking at global gas demand growth between 2010 to 2020, supply will actually need to grow by more than 9pc per year – this is roughly equivalent to bringing onstream '20 Norways’ by the end of the decade. LNG is set to increase from just under 10pc of the gas supply mix today to around 14pc in 2025 with Asian demand the engine of this growth.”

“Gas is cheaper than oil, it’s easier to find big supply sources, and it’s cleaner,” explains analyst Stuart Joyner of Investec. “The Japanese nuclear industry has basically shut down, the UK has gone from being a net exporter of gas to a net importer. The growth in the gas market globally is phenomenal. The returns on LNG right now are much much better than they are for oil.”

Exploiting the reserves in East Africa is not without its challenges, as Mr Joyner notes from a recent visit to Mozambique. “There are no roads and you have to fly everywhere on dodgy twin-props.”

There are political challenges, too. Tullow was forced to defend itself against unfounded corruption allegations in Uganda, and has been embroiled in a tax dispute with former partner Heritage Oil.

Madagascar Oil’s shares had to be temporarily suspended in 2010, a month after listing on AIM, amid a tax dispute with the island’s government, now resolved. And Shell’s plans to explore in four “exciting” offshore deepwater blocks have been delayed for a decade by a stand-off between Tanzania and semi-autonomous Zanzibar over production sharing rights.

Yet challenging environments are part and parcel of frontier oil and gas exploration. There is little doubt that East Africa is well on its way to becoming a major new oil and gas exporting province.

No wonder, then, that analysts believe the bidding race for Cove has a long way to go - and is unlikely to be the last.

Shell last week extended its 220p offer, despite having been outbid. Mr Graham-Wood suggests that could be a “cunning ruse to buy time on another deal” – to buy a stake from one of the other partners in Rovuma. Even in February Shell had said it was assessing potential opportunities to build a higher stake in the block.

Mr Joyner agrees that the supermajors are circling. “Ophir is the obvious next target, but I think you could also see consolidation of some of the smaller stakes in the Mozambique projects and ultimately Anadarko and possibly ENI cashing in,” he says. “At the moment, you have a mix of independents and medium-sized companies. Fast-forward five years, you will see a very different picture.”

Sorry gimo.

Du warst zu schnell, ich war wohl gerade noch am Bearbeiten.

Schönen Start in die (hoffentlich super-dooper-AOI) Woche!

Du warst zu schnell, ich war wohl gerade noch am Bearbeiten.

Schönen Start in die (hoffentlich super-dooper-AOI) Woche!

Antwort auf Beitrag Nr.: 43.340.757 von gimo211 am 01.07.12 17:34:14Cheers gimo. Sounds promising, would be very pleased indeed  ...

...

Auf meiner abendlichen Tour habe ich noch folgenden Artikel gefunden, ich stufe ihn zunächst als RUMOUR ein - klingt imho in Teilen aber durchaus plausibel.

Many thanks to RionsRun from Stockhouse!

--------------

“If Ngamia was bad, the rig would have been taken to Paipai. Moving to Twiga, which is larger and higher a risk, is a confirmation that Ngamia is good. Twiga is analogous to Ngamia,” said an industry expert.

Tullow Oil moves to new drilling site as Ngamia-1 results awaited

Posted Sunday, July 1 2012 at 16:31

Tullow plans to shift its drilling rig to Twiga-1, also in Turkana, located in Block 13T, some 31 kilometres north-west of Ngamia-1. The company is also mobilising a second rig to accelerate drilling in Paipai in Block 10A in Marsabit County. Photo/FILE

Tullow Oil has concluded drilling for oil in the Ngamia-1 well after reaching a depth 400 metres, short of the targeted 2,700 metres.

The firm said it was not possible to strike additional oil beyond the current depth of 2,340 metres and was now moving to the next drilling location.

“The 2,700 was a preliminary target. We were looking for hydro-carbons at certain depths. We are currently testing the well to see the flow of oil,” said Martin Mbogo, general manager for Tullow Oil Kenya.

The findings could be released in two weeks but it is still too early to ascertain if the total oil deposit in Ngamia-1 was enough to put the country in the elite list of global producers.

Conclusive findings on commercial viability will take close to two years.

“The excitement was timely after we picked up samples of oil. As a listed company, we also have certain disclosure requirements,” said Mr Mbogo in a telephone interview.

Now, Tullow plans to shift its drilling rig to Twiga-1, also in Turkana, located in Block 13T, some 31 kilometres north-west of Ngamia-1.

The company is also mobilising a second rig to accelerate drilling in Paipai in Block 10A in Marsabit County.

Martin Heya, the Energy ministry’s Commissioner for Petroleum said drilling had been halted because the oil column had come to an end and the drilling was costly.

“The more we drill, we are overloaded with data which we must pay for. We are not plugging or abandoning. We are now testing the well to come back later,” Mr Heya said.

“Tullow and the government have agreed to stop there after Tullow hit the basement rock earlier than expected. The prospects for more oil below it are zero and there is no justification or benefits of drilling further,” he added.

Geology experts said seismic mapping before the drilling that started on January 24 may have been erroneous when the primary target was set.

“If Ngamia was bad, the rig would have been taken to Paipai. Moving to Twiga, which is larger and higher a risk, is a confirmation that Ngamia is good. Twiga is analogous to Ngamia,” said an industry expert.

Tullow has previously said that there are five other prospects within the basin.

It is understood that Tullow Oil has sunk close to $58 million (Sh4.7 billion) into the project. Ownership of Ngamia-1 drilling project is split fifty-fifty between Tullow and Africa Oil.

In a statement , Africa Oil confirmed that drilling has been completed while the two additional wells — Twiga-1 in Block 13T and the Paipai-1 in Block 10A --will be drilled.

http://www.businessdailyafrica.com/Tullow+Oil+moves+to+new+d…

...

...Auf meiner abendlichen Tour habe ich noch folgenden Artikel gefunden, ich stufe ihn zunächst als RUMOUR ein - klingt imho in Teilen aber durchaus plausibel.

Many thanks to RionsRun from Stockhouse!

--------------

“If Ngamia was bad, the rig would have been taken to Paipai. Moving to Twiga, which is larger and higher a risk, is a confirmation that Ngamia is good. Twiga is analogous to Ngamia,” said an industry expert.

Tullow Oil moves to new drilling site as Ngamia-1 results awaited

Posted Sunday, July 1 2012 at 16:31

Tullow plans to shift its drilling rig to Twiga-1, also in Turkana, located in Block 13T, some 31 kilometres north-west of Ngamia-1. The company is also mobilising a second rig to accelerate drilling in Paipai in Block 10A in Marsabit County. Photo/FILE

Tullow Oil has concluded drilling for oil in the Ngamia-1 well after reaching a depth 400 metres, short of the targeted 2,700 metres.

The firm said it was not possible to strike additional oil beyond the current depth of 2,340 metres and was now moving to the next drilling location.

“The 2,700 was a preliminary target. We were looking for hydro-carbons at certain depths. We are currently testing the well to see the flow of oil,” said Martin Mbogo, general manager for Tullow Oil Kenya.

The findings could be released in two weeks but it is still too early to ascertain if the total oil deposit in Ngamia-1 was enough to put the country in the elite list of global producers.

Conclusive findings on commercial viability will take close to two years.

“The excitement was timely after we picked up samples of oil. As a listed company, we also have certain disclosure requirements,” said Mr Mbogo in a telephone interview.

Now, Tullow plans to shift its drilling rig to Twiga-1, also in Turkana, located in Block 13T, some 31 kilometres north-west of Ngamia-1.

The company is also mobilising a second rig to accelerate drilling in Paipai in Block 10A in Marsabit County.

Martin Heya, the Energy ministry’s Commissioner for Petroleum said drilling had been halted because the oil column had come to an end and the drilling was costly.

“The more we drill, we are overloaded with data which we must pay for. We are not plugging or abandoning. We are now testing the well to come back later,” Mr Heya said.

“Tullow and the government have agreed to stop there after Tullow hit the basement rock earlier than expected. The prospects for more oil below it are zero and there is no justification or benefits of drilling further,” he added.

Geology experts said seismic mapping before the drilling that started on January 24 may have been erroneous when the primary target was set.

“If Ngamia was bad, the rig would have been taken to Paipai. Moving to Twiga, which is larger and higher a risk, is a confirmation that Ngamia is good. Twiga is analogous to Ngamia,” said an industry expert.

Tullow has previously said that there are five other prospects within the basin.

It is understood that Tullow Oil has sunk close to $58 million (Sh4.7 billion) into the project. Ownership of Ngamia-1 drilling project is split fifty-fifty between Tullow and Africa Oil.

In a statement , Africa Oil confirmed that drilling has been completed while the two additional wells — Twiga-1 in Block 13T and the Paipai-1 in Block 10A --will be drilled.

http://www.businessdailyafrica.com/Tullow+Oil+moves+to+new+d…

http://www.businessdailyafrica.com/Tullow+Oil+moves+to+new+d…

Tullow Oil moves to new drilling site as Ngamia-1 results awaited

Tullow plans to shift its drilling rig to Twiga-1, also in Turkana, located in Block 13T, some 31 kilometres north-west of Ngamia-1. The company is also mobilising a second rig to accelerate drilling in Paipai in Block 10A in Marsabit

Posted Sunday, July 1 2012 at 16:31

Tullow Oil has concluded drilling for oil in the Ngamia-1 well after reaching a depth 400 metres, short of the targeted 2,700 metres

Tullow Oil moves to new drilling site as Ngamia-1 results awaited

The firm said it was not possible to strike additional oil beyond the current depth of 2,340 metres and was now moving to the next drilling location.

“The 2,700 was a preliminary target. We were looking for hydro-carbons at certain depths. We are currently testing the well to see the flow of oil,” said Martin Mbogo, general manager for Tullow Oil Kenya.

The findings could be released in two weeks but it is still too early to ascertain if the total oil deposit in Ngamia-1 was enough to put the country in the elite list of global producers.

Conclusive findings on commercial viability will take close to two years.

“The excitement was timely after we picked up samples of oil. As a listed company, we also have certain disclosure requirements,” said Mr Mbogo in a telephone interview.

Now, Tullow plans to shift its drilling rig to Twiga-1, also in Turkana, located in Block 13T, some 31 kilometres north-west of Ngamia-1.

The company is also mobilising a second rig to accelerate drilling in Paipai in Block 10A in Marsabit County.

Martin Heya, the Energy ministry’s Commissioner for Petroleum said drilling had been halted because the oil column had come to an end and the drilling was costly.

“The more we drill, we are overloaded with data which we must pay for. We are not plugging or abandoning. We are now testing the well to come back later,” Mr Heya said.

“Tullow and the government have agreed to stop there after Tullow hit the basement rock earlier than expected. The prospects for more oil below it are zero and there is no justification or benefits of drilling further,” he added.

Geology experts said seismic mapping before the drilling that started on January 24 may have been erroneous when the primary target was set.

“If Ngamia was bad, the rig would have been taken to Paipai. Moving to Twiga, which is larger and higher a risk, is a confirmation that Ngamia is good. Twiga is analogous to Ngamia,” said an industry expert.

Tullow has previously said that there are five other prospects within the basin.

It is understood that Tullow Oil has sunk close to $58 million (Sh4.7 billion) into the project. Ownership of Ngamia-1 drilling project is split fifty-fifty between Tullow and Africa Oil.

In a statement , Africa Oil confirmed that drilling has been completed while the two additional wells — Twiga-1 in Block 13T and the Paipai-1 in Block 10A --will be drilled.

Tullow Oil moves to new drilling site as Ngamia-1 results awaited

Tullow plans to shift its drilling rig to Twiga-1, also in Turkana, located in Block 13T, some 31 kilometres north-west of Ngamia-1. The company is also mobilising a second rig to accelerate drilling in Paipai in Block 10A in Marsabit

Posted Sunday, July 1 2012 at 16:31

Tullow Oil has concluded drilling for oil in the Ngamia-1 well after reaching a depth 400 metres, short of the targeted 2,700 metres

Tullow Oil moves to new drilling site as Ngamia-1 results awaited

The firm said it was not possible to strike additional oil beyond the current depth of 2,340 metres and was now moving to the next drilling location.

“The 2,700 was a preliminary target. We were looking for hydro-carbons at certain depths. We are currently testing the well to see the flow of oil,” said Martin Mbogo, general manager for Tullow Oil Kenya.

The findings could be released in two weeks but it is still too early to ascertain if the total oil deposit in Ngamia-1 was enough to put the country in the elite list of global producers.

Conclusive findings on commercial viability will take close to two years.

“The excitement was timely after we picked up samples of oil. As a listed company, we also have certain disclosure requirements,” said Mr Mbogo in a telephone interview.

Now, Tullow plans to shift its drilling rig to Twiga-1, also in Turkana, located in Block 13T, some 31 kilometres north-west of Ngamia-1.

The company is also mobilising a second rig to accelerate drilling in Paipai in Block 10A in Marsabit County.

Martin Heya, the Energy ministry’s Commissioner for Petroleum said drilling had been halted because the oil column had come to an end and the drilling was costly.

“The more we drill, we are overloaded with data which we must pay for. We are not plugging or abandoning. We are now testing the well to come back later,” Mr Heya said.

“Tullow and the government have agreed to stop there after Tullow hit the basement rock earlier than expected. The prospects for more oil below it are zero and there is no justification or benefits of drilling further,” he added.

Geology experts said seismic mapping before the drilling that started on January 24 may have been erroneous when the primary target was set.

“If Ngamia was bad, the rig would have been taken to Paipai. Moving to Twiga, which is larger and higher a risk, is a confirmation that Ngamia is good. Twiga is analogous to Ngamia,” said an industry expert.

Tullow has previously said that there are five other prospects within the basin.

It is understood that Tullow Oil has sunk close to $58 million (Sh4.7 billion) into the project. Ownership of Ngamia-1 drilling project is split fifty-fifty between Tullow and Africa Oil.

In a statement , Africa Oil confirmed that drilling has been completed while the two additional wells — Twiga-1 in Block 13T and the Paipai-1 in Block 10A --will be drilled.

Zitat von motz1: Auf die paar Tage sollte es nun auch nicht mehr ankommen, das Warten im Moment ist deutlich angenehmer als noch im vergangenen Oktober

Wie wahr, Motz1 - einmal mehr (wie schon bei PCL) erweist sich ein gutes - aber insbesondere frühes - Näschen und die in diesem Business notwendige Geduld als wirklich "wealth" stiftend....

Bei AOI ist nun Fun angesagt...

Ich werde in dem nächsten Tagen (sobald ich einmal ein wenig Zeit habe, um die wichtigsten Infos zusammen zustellen) auf w : o einen neuen Thread zu einem bislang hier nicht diskutierten Wert eröffnen - just for friends

Motz1, vielen Dank für Deine immer interessanten und guten Beiträge hier!!

Schon etwa eine Woche alt, aber dennoch interessant. Die Herren aus der Lundin-Riege wissen, wie man an Geld kommt - auch in diesen Zeiten

Lundin Petroleum secures US$2.5 billion financing

25 Jun 2012

Lundin Petroleum has entered into a fully committed 7-year senior secured revolving credit facility of USD 2.5 billion. This senior secured facility is revolving in order to adjust to Lundin Petroleum group financing needs. This facility will provide the necessary financial flexibility to carry out Lundin Petroleum's development and exploration projects in Norway.

Ashley Heppenstall, President and CEO of Lundin Petroleum comments: 'At a moment when financial markets are extremely uncertain and volatile and when banks are increasingly selective, we are very pleased to close this financing with such a high profile group of 25 international banks, combining existing and new lenders to Lundin Petroleum. This USD 2.5 billion fully committed credit facility, together with our healthy operational cash-flows, will allow us to fully fund our Edvard Grieg and Brynhild developments as well as on-going projects and our exploration programme over the next several years. We will also have significant spare financial capacity to potentially seize new opportunities or carry out additional developments.'

http://www.lundin-petroleum.com/Press/pr_corp_25-06-12_e.htm…

Lundin Petroleum secures US$2.5 billion financing

25 Jun 2012

Lundin Petroleum has entered into a fully committed 7-year senior secured revolving credit facility of USD 2.5 billion. This senior secured facility is revolving in order to adjust to Lundin Petroleum group financing needs. This facility will provide the necessary financial flexibility to carry out Lundin Petroleum's development and exploration projects in Norway.

Ashley Heppenstall, President and CEO of Lundin Petroleum comments: 'At a moment when financial markets are extremely uncertain and volatile and when banks are increasingly selective, we are very pleased to close this financing with such a high profile group of 25 international banks, combining existing and new lenders to Lundin Petroleum. This USD 2.5 billion fully committed credit facility, together with our healthy operational cash-flows, will allow us to fully fund our Edvard Grieg and Brynhild developments as well as on-going projects and our exploration programme over the next several years. We will also have significant spare financial capacity to potentially seize new opportunities or carry out additional developments.'

http://www.lundin-petroleum.com/Press/pr_corp_25-06-12_e.htm…

Um die Wartezeit zu überbrücken:

Falls noch jemand Interesse an Infos zum East-African-Rift-System hat, gibt es hier noch ein paar (Einstiegs-)Links zu den geologischen Hintergründen.

Many thanks to user manfrombrussels on iii!

---------------

East Africa's Great Rift Valley: A Complex Rift System

by James Wood and Alex Guth - Michigan Technological University

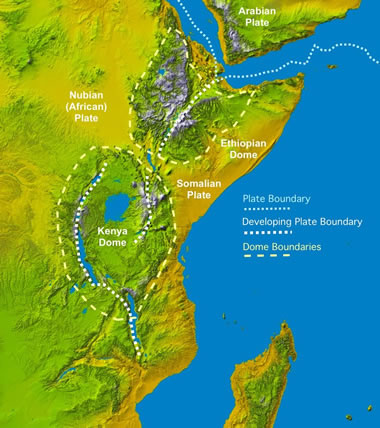

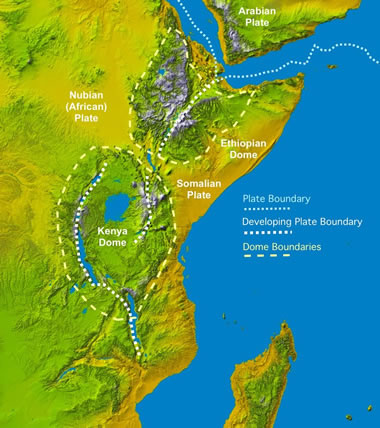

Part I. The East African Rift System

The East African Rift System (EARS) is one the geologic wonders of the world, a place where the earth's tectonic forces are presently trying to create new plates by splitting apart old ones. In simple terms, a rift can be thought of as a fracture in the earth's surface that widens over time, or more technically, as an elongate basin bounded by opposed steeply dipping normal faults. Geologists are still debating exactly how rifting comes about, but the process is so well displayed in East Africa (Ethiopia-Kenya-Uganda-Tanzania) that geologists have attached a name to the new plate-to-be; the Nubian Plate makes up most of Africa, while the smaller plate that is pulling away has been named the Somalian Plate (Figure 1). These two plates are moving away form each other and also away from the Arabian plate to the north. The point where these three plates meet in the Afar region of Ethiopia forms what is called a triple-junction. However, all the rifting in East Africa is not confined to the Horn of Africa; there is a lot of rifting activity further south as well, extending into Kenya and Tanzania and Great Lakes region of Africa. The purpose of this paper is to discuss the general geology of these rifts are and highlight the geologic processes involved in their formation.

Figure 1: Colored Digital Elevation Model showing tectonic plate boundaries, outlines of the elevation highs demonstrating the thermal bulges and large lakes of East Africa. Click Image to Enlarge. The basemap is a Space Shuttle radar topography image by NASA.

[...]

http://geology.com/articles/east-africa-rift.shtml

The East African Rift System – A View from Space

Author Michael Hall and John Diggens; Astrium Geo-Information Services

Remote sensing data has given a unique perspective on the East African Rift System, allowing both large regional structures and more subtle features to be identified and placed in context

Geological interpretation overview of the East African Rift System, illustrating surface structure and stratigraphy completed using Earth Observation data. Source: Astrium/ArcGlobe

East Africa, overlooked in terms of its hydrocarbon potential for many years, is increasingly viewed as an exploration hot spot, with recent discoveries in the Albertine Rift and offshore Tanzania leading to a resurgence in interest. Dominated by the East Africa Rift System (EARS), the region has a complex geological history and provides the potential to bring together modern techniques to aid geological understanding and to help efficiently target hydrocarbon exploration.

[...]

http://www.geoexpro.com/article/The_East_African_Rift_System…

Tellus™

East African Rifts

The tectonic evolution of the sedimentary basins within this region is influenced by major regional rifting episodes.

A region of increasing importance

The East African Rifts basins lie along the length of the Great

Rift Valley from southern Ethiopia (5.5ºN) to Malawi (15.5ºS).

The region extends through southern Ethiopia, southern Sudan,

western Uganda, eastern Democratic Republic of Congo, western

Rwanda, western Burundi, Tanzania, western Kenya, Zambia,

Malawi and northwest Mozambique.

[...]

http://www.fugro-robertson.com/TellusFRLData/DataCoveragePDF…

Falls noch jemand Interesse an Infos zum East-African-Rift-System hat, gibt es hier noch ein paar (Einstiegs-)Links zu den geologischen Hintergründen.

Many thanks to user manfrombrussels on iii!

---------------

East Africa's Great Rift Valley: A Complex Rift System

by James Wood and Alex Guth - Michigan Technological University

Part I. The East African Rift System

The East African Rift System (EARS) is one the geologic wonders of the world, a place where the earth's tectonic forces are presently trying to create new plates by splitting apart old ones. In simple terms, a rift can be thought of as a fracture in the earth's surface that widens over time, or more technically, as an elongate basin bounded by opposed steeply dipping normal faults. Geologists are still debating exactly how rifting comes about, but the process is so well displayed in East Africa (Ethiopia-Kenya-Uganda-Tanzania) that geologists have attached a name to the new plate-to-be; the Nubian Plate makes up most of Africa, while the smaller plate that is pulling away has been named the Somalian Plate (Figure 1). These two plates are moving away form each other and also away from the Arabian plate to the north. The point where these three plates meet in the Afar region of Ethiopia forms what is called a triple-junction. However, all the rifting in East Africa is not confined to the Horn of Africa; there is a lot of rifting activity further south as well, extending into Kenya and Tanzania and Great Lakes region of Africa. The purpose of this paper is to discuss the general geology of these rifts are and highlight the geologic processes involved in their formation.

Figure 1: Colored Digital Elevation Model showing tectonic plate boundaries, outlines of the elevation highs demonstrating the thermal bulges and large lakes of East Africa. Click Image to Enlarge. The basemap is a Space Shuttle radar topography image by NASA.

[...]

http://geology.com/articles/east-africa-rift.shtml

The East African Rift System – A View from Space

Author Michael Hall and John Diggens; Astrium Geo-Information Services

Remote sensing data has given a unique perspective on the East African Rift System, allowing both large regional structures and more subtle features to be identified and placed in context

Geological interpretation overview of the East African Rift System, illustrating surface structure and stratigraphy completed using Earth Observation data. Source: Astrium/ArcGlobe

East Africa, overlooked in terms of its hydrocarbon potential for many years, is increasingly viewed as an exploration hot spot, with recent discoveries in the Albertine Rift and offshore Tanzania leading to a resurgence in interest. Dominated by the East Africa Rift System (EARS), the region has a complex geological history and provides the potential to bring together modern techniques to aid geological understanding and to help efficiently target hydrocarbon exploration.

[...]

http://www.geoexpro.com/article/The_East_African_Rift_System…

Tellus™

East African Rifts

The tectonic evolution of the sedimentary basins within this region is influenced by major regional rifting episodes.

A region of increasing importance

The East African Rifts basins lie along the length of the Great

Rift Valley from southern Ethiopia (5.5ºN) to Malawi (15.5ºS).

The region extends through southern Ethiopia, southern Sudan,

western Uganda, eastern Democratic Republic of Congo, western

Rwanda, western Burundi, Tanzania, western Kenya, Zambia,

Malawi and northwest Mozambique.

[...]

http://www.fugro-robertson.com/TellusFRLData/DataCoveragePDF…