China Crash (Seite 9)

eröffnet am 26.10.18 15:59:51 von

neuester Beitrag 08.02.24 12:18:20 von

neuester Beitrag 08.02.24 12:18:20 von

Beiträge: 314

ID: 1.291.324

ID: 1.291.324

Aufrufe heute: 0

Gesamt: 40.185

Gesamt: 40.185

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 30 Minuten | 6247 | |

| vor 35 Minuten | 5007 | |

| vor 38 Minuten | 4148 | |

| vor 44 Minuten | 3758 | |

| vor 30 Minuten | 2585 | |

| heute 14:53 | 1943 | |

| heute 15:18 | 1918 | |

| heute 13:07 | 1476 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.177,80 | +1,38 | 235 | |||

| 2. | 2. | 1,1100 | -19,57 | 118 | |||

| 3. | 3. | 0,1905 | +0,79 | 97 | |||

| 4. | 5. | 9,3450 | +1,08 | 63 | |||

| 5. | 4. | 171,56 | +0,81 | 54 | |||

| 6. | Neu! | 0,4250 | -1,16 | 39 | |||

| 7. | Neu! | 11,905 | +14,97 | 36 | |||

| 8. | Neu! | 4,7750 | +6,47 | 35 |

Beitrag zu dieser Diskussion schreiben

1.8.

China’s Economy Deteriorated Further in July, Beige Book Says

https://www.bnnbloomberg.ca/china-s-economy-deteriorated-fur…

...

China’s economy weakened further in July amid a resurgence in Covid outbreaks, China Beige Book International said, warning that market optimism about a rebound is misplaced.

Factory output and new orders slowed to a pace not seen since the middle of 2020, and retail sector employment was the worst in more than two years, according to the latest survey from CBBI, a provider of independent economic data. Revenue growth for manufacturers and retailers deteriorated, curbing profits, it said.

After a reprieve in June, when Covid restrictions in places like Shanghai and elsewhere were eased, virus cases flared up again in multiple regions, a threat to the economy’s fragile recovery. Factory activity unexpectedly contracted in July and property sales continued to shrink, data published Sunday showed. Top leaders have signaled a softening on this year’s official growth target of around 5.5% as they stick to the Covid Zero strategy.

“Beware the July rebound narrative. Markets are convinced that easing lockdowns mean the worst is over, but July data show that firms are still largely refusing to invest, borrow and especially now, hire,” Leland Miller, chief executive officer of CBBI, said in the statement. “This is likely because companies simply do not believe that their Covid Zero nightmare is over.”

...

China’s Economy Deteriorated Further in July, Beige Book Says

https://www.bnnbloomberg.ca/china-s-economy-deteriorated-fur…

...

China’s economy weakened further in July amid a resurgence in Covid outbreaks, China Beige Book International said, warning that market optimism about a rebound is misplaced.

Factory output and new orders slowed to a pace not seen since the middle of 2020, and retail sector employment was the worst in more than two years, according to the latest survey from CBBI, a provider of independent economic data. Revenue growth for manufacturers and retailers deteriorated, curbing profits, it said.

After a reprieve in June, when Covid restrictions in places like Shanghai and elsewhere were eased, virus cases flared up again in multiple regions, a threat to the economy’s fragile recovery. Factory activity unexpectedly contracted in July and property sales continued to shrink, data published Sunday showed. Top leaders have signaled a softening on this year’s official growth target of around 5.5% as they stick to the Covid Zero strategy.

“Beware the July rebound narrative. Markets are convinced that easing lockdowns mean the worst is over, but July data show that firms are still largely refusing to invest, borrow and especially now, hire,” Leland Miller, chief executive officer of CBBI, said in the statement. “This is likely because companies simply do not believe that their Covid Zero nightmare is over.”

...

29.7.

UK plc is cutting ties to China, says CBI boss

New alliances will be needed in post-Brexit Europe to offset souring trading links with Beijing, warns Tony Danker

https://www.ft.com/content/cd93dd29-7069-4e2e-baa8-7081b385c…

...

Thousands of British companies are cutting economic ties with China en masse, threatening to heap more pressure on the cost of living, the head of the CBI business group has warned.

Tony Danker, the CBI director-general, said chief executives were increasingly switching business links from China to other countries in anticipation of a further deterioration in relations between Beijing and the West.

Danker said the UK would need to find new trade partners and rekindle old ones — for example in the EU — if the West severed its China links. “If the political experts and security experts are right, we are all going to need to be good friends again,” he said.

“Every company that I speak to at the moment is engaged in rethinking their supply chains,” he said. “Because they anticipate that our politicians will inevitably accelerate towards a decoupled world from China.”

...

UK plc is cutting ties to China, says CBI boss

New alliances will be needed in post-Brexit Europe to offset souring trading links with Beijing, warns Tony Danker

https://www.ft.com/content/cd93dd29-7069-4e2e-baa8-7081b385c…

...

Thousands of British companies are cutting economic ties with China en masse, threatening to heap more pressure on the cost of living, the head of the CBI business group has warned.

Tony Danker, the CBI director-general, said chief executives were increasingly switching business links from China to other countries in anticipation of a further deterioration in relations between Beijing and the West.

Danker said the UK would need to find new trade partners and rekindle old ones — for example in the EU — if the West severed its China links. “If the political experts and security experts are right, we are all going to need to be good friends again,” he said.

“Every company that I speak to at the moment is engaged in rethinking their supply chains,” he said. “Because they anticipate that our politicians will inevitably accelerate towards a decoupled world from China.”

...

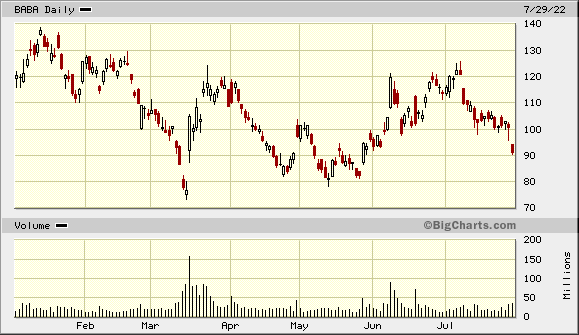

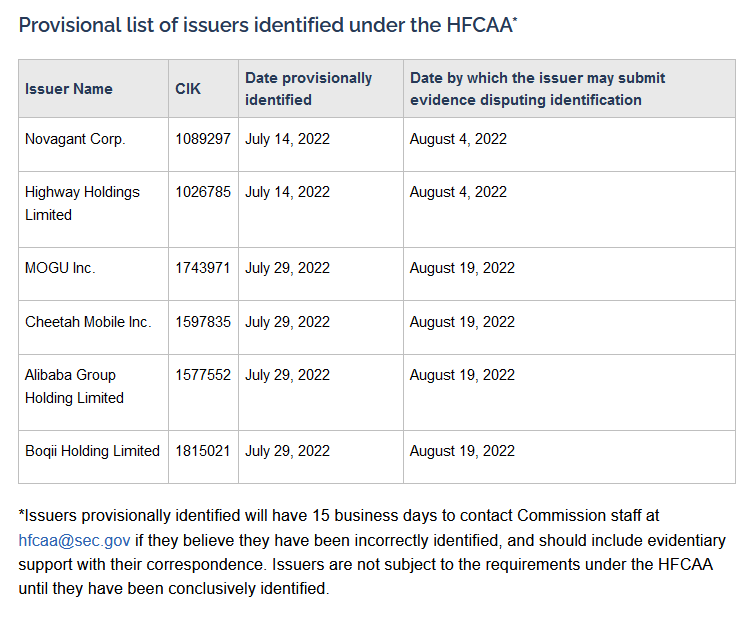

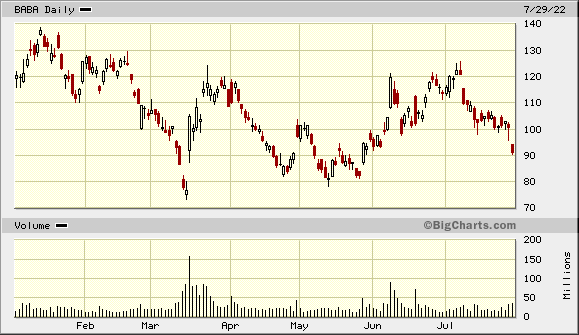

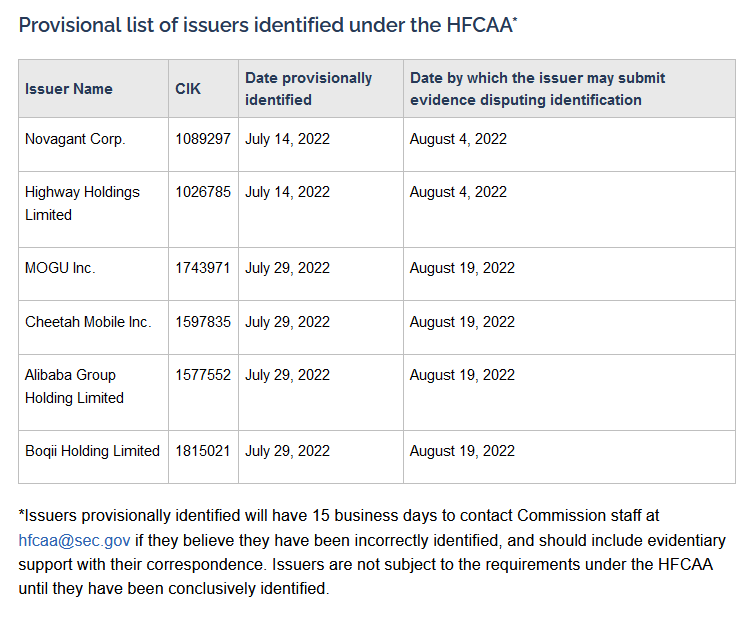

Holding Foreign Companies Accountable Act ("HFCAA"):

https://www.cnbc.com/2022/05/05/sec-expands-list-of-firms-fa…

=> $BABA ist auch dabei:

https://www.sec.gov/hfcaa

https://www.cnbc.com/2022/05/05/sec-expands-list-of-firms-fa…

=> $BABA ist auch dabei:

https://www.sec.gov/hfcaa

Antwort auf Beitrag Nr.: 71.666.697 von faultcode am 27.05.22 12:56:3923.7.

CEO und CFO von Evergrande treten zurück

Der mit 300 Milliarden Dollar verschuldete chinesische Immobilienriese Evergrande gilt als insolvent. Nun sind der Vorstandschef und Finanzchef zurückgetreten. Ermittler werfen ihnen irreguläre Geschäfte vor.

https://www.manager-magazin.de/finanzen/immobilien/evergrand…

...

Der Vorstandschef und der Finanzvorstand von China Evergrande treten nach einer Untersuchung der Dienstleistungssparte des angeschlagenen Immobilienkonzerns zurück. Eine vorläufige Ermittlung hat ergeben, dass CEO Xia Haijun und CFO Pan Darong an der Umleitung von Krediten beteiligt waren, teilte Evergrande am Freitagabend (MEZ) mit.

Sie hätten 13,4 Milliarden Yuan (1,99 Milliarden Dollar), die der Sparte Evergrande Property Services gehörten, als Kreditgarantien verwendet. Die Manager hätten die Kredite "über Dritte an Evergrande Group zurückübertragen und für allgemeine Geschäftstätigkeiten verwendet". Die Garantien seien allerdings von Banken beschlagnahmt worden, was die Liquidität der Evergrande-Tochter gefährdet habe.

Der Konzern habe seinen bisherigen geschäftsführenden Direktor Siu Shawn zum neuen Vorstandschef und den Vizepräsidenten Qian Cheng zum Finanzvorstand ernannt, hieß es weiter. Evergrande Group sei auch in Gesprächen mit Evergrande Property Services über einen Rückzahlungsplan.

Investoren befürchten schon lange, dass die Cashflow-Probleme des chinesischen Bauriesen zu seinem totalen Zusammenbruch führen und die Entwicklung der zweitgrößten Volkswirtschaft der Welt verlangsamen könnte.

Evergrande ist mit mehr als 300 Milliarden Dollar verschuldet und hat mehrfach Zinszahlungen sowohl für Inlands- als auch für Auslandsanleihen nicht bedient. Der Immobilienriese gilt damit als pleite, auch wenn er offiziell noch nicht für bankrott erklärt wurde. Längst zieht Peking hinter den Kulissen die Fäden bei dem Konzern und versucht eine Kettenreaktion für Geschäftspartner und Banken zu verhindern, die ein offizieller Bankrott nach sich ziehen würde. Evergrande ist dabei kein Einzelfall, auch andere Immobilienkonzerne in China sind hoch verschuldet, indem sie mit immer mehr eingegangenen Risiken versuchten, von dem jahrelangen Bauboom in China zu profitieren.

...

CEO und CFO von Evergrande treten zurück

Der mit 300 Milliarden Dollar verschuldete chinesische Immobilienriese Evergrande gilt als insolvent. Nun sind der Vorstandschef und Finanzchef zurückgetreten. Ermittler werfen ihnen irreguläre Geschäfte vor.

https://www.manager-magazin.de/finanzen/immobilien/evergrand…

...

Der Vorstandschef und der Finanzvorstand von China Evergrande treten nach einer Untersuchung der Dienstleistungssparte des angeschlagenen Immobilienkonzerns zurück. Eine vorläufige Ermittlung hat ergeben, dass CEO Xia Haijun und CFO Pan Darong an der Umleitung von Krediten beteiligt waren, teilte Evergrande am Freitagabend (MEZ) mit.

Sie hätten 13,4 Milliarden Yuan (1,99 Milliarden Dollar), die der Sparte Evergrande Property Services gehörten, als Kreditgarantien verwendet. Die Manager hätten die Kredite "über Dritte an Evergrande Group zurückübertragen und für allgemeine Geschäftstätigkeiten verwendet". Die Garantien seien allerdings von Banken beschlagnahmt worden, was die Liquidität der Evergrande-Tochter gefährdet habe.

Der Konzern habe seinen bisherigen geschäftsführenden Direktor Siu Shawn zum neuen Vorstandschef und den Vizepräsidenten Qian Cheng zum Finanzvorstand ernannt, hieß es weiter. Evergrande Group sei auch in Gesprächen mit Evergrande Property Services über einen Rückzahlungsplan.

Investoren befürchten schon lange, dass die Cashflow-Probleme des chinesischen Bauriesen zu seinem totalen Zusammenbruch führen und die Entwicklung der zweitgrößten Volkswirtschaft der Welt verlangsamen könnte.

Evergrande ist mit mehr als 300 Milliarden Dollar verschuldet und hat mehrfach Zinszahlungen sowohl für Inlands- als auch für Auslandsanleihen nicht bedient. Der Immobilienriese gilt damit als pleite, auch wenn er offiziell noch nicht für bankrott erklärt wurde. Längst zieht Peking hinter den Kulissen die Fäden bei dem Konzern und versucht eine Kettenreaktion für Geschäftspartner und Banken zu verhindern, die ein offizieller Bankrott nach sich ziehen würde. Evergrande ist dabei kein Einzelfall, auch andere Immobilienkonzerne in China sind hoch verschuldet, indem sie mit immer mehr eingegangenen Risiken versuchten, von dem jahrelangen Bauboom in China zu profitieren.

...

so sah es noch 2019 aus -- auf dem Papier:

<property developer in the PRC>

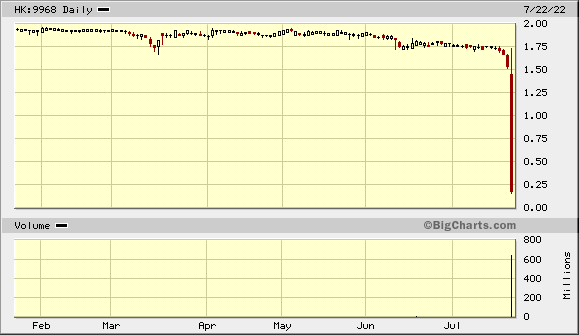

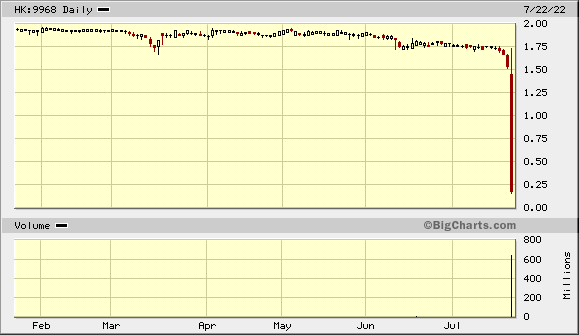

und heute das hier:

Huijing Holdings Co. Ltd. (HKG)

22.7.

TRADING HALT

At the request of Huijing Holdings Company Limited (the “Company”), trading in the shares of the Company on The Stock Exchange of Hong Kong Limited has been halted with effect from 11:49 a.m. on Friday, 22 July 2022, pending the release of an announcement in relation to inside information of the Company.

http://investor.huijingholdings.com/en/global/home.php

Incorporated in the Cayman Islands with limited liability

OVERVIEW (aus oben -- GLOBAL OFFERING)

We are an established integrated residential and commercial property developer in the PRC, focusing in the Guangdong and Hunan provinces. Started with property projects in Dongguan, we have gradually spread to Heyuan, the Yangtze River Delta Urban Cluster (which includes Anhui Province, Jiangsu Province and Zhejiang Province) and the Yangtze Mid-stream Urban Cluster (which includes Hubei Province, Hunan Province and Jiangxi Province).

In 2018, the total contracted sales of our Group, together with our joint venture, achieved a 97.7% year-on-year growth and amounted to RMB2,562.4 million.

According to JLL, in terms of contracted sales among the top 100 local property developers, our Group, together with our joint venture, ranked 28th in Dongguan (with market share of 0.6%), 63rd in Changsha (with market share of 0.4%) and 39th in Hefei (with market share of 0.6%), and accounted for 1.3% and 0.8% of the market share in Heyuan and Hengyang respectively. Having been recognized by the market, we are dedicated to offering quality integrated properties to our customers.

We also offer properties promoting specific industry(ies) encouraged by local government authorities.

Our history can be traced back to 2004 when Dongguan Huijing Real Estate, the predecessor of our major subsidiary, Huijing Group, was established and when Dongguan Huijing Real Estate obtained the pre-sale permits for Huijing Villa (First Phase) (滙景豪庭第一期). Leveraging on our ability to provide

quality residential properties to our customers, we commenced the construction of our first integrated development Huijing City (滙景城) in 2011 in Dongguan.

We and our property projects have been awarded various accolades from different organizations including the ‘‘Exquisite Taste Luxury Home Award’’ (頂級品味豪宅獎) awarded by Wen Wei Po (文匯 報), the Hong Kong Institute of Architects, and the Hong Kong Institute of Designers in 2010, ‘‘Dongguan’s Most Influential Brand Real Estate Enterprises’’ (東莞最具影響力品牌房企) by Sohu (搜 狐網) in 2014, and ‘‘Anhui Top-10 City Complex Annual Award’’ (安徽年度十佳城市綜合體) by the Graduate School of Real Estate of Hefei University (合肥學院房地產研究所) in 2016.

We believe that our strong brand recognition, in particular in Dongguan, together with our land sourcing strategy and cost control measures, have contributed to our growth.

...

<property developer in the PRC>

und heute das hier:

Huijing Holdings Co. Ltd. (HKG)

22.7.

TRADING HALT

At the request of Huijing Holdings Company Limited (the “Company”), trading in the shares of the Company on The Stock Exchange of Hong Kong Limited has been halted with effect from 11:49 a.m. on Friday, 22 July 2022, pending the release of an announcement in relation to inside information of the Company.

http://investor.huijingholdings.com/en/global/home.php

Incorporated in the Cayman Islands with limited liability

OVERVIEW (aus oben -- GLOBAL OFFERING)

We are an established integrated residential and commercial property developer in the PRC, focusing in the Guangdong and Hunan provinces. Started with property projects in Dongguan, we have gradually spread to Heyuan, the Yangtze River Delta Urban Cluster (which includes Anhui Province, Jiangsu Province and Zhejiang Province) and the Yangtze Mid-stream Urban Cluster (which includes Hubei Province, Hunan Province and Jiangxi Province).

In 2018, the total contracted sales of our Group, together with our joint venture, achieved a 97.7% year-on-year growth and amounted to RMB2,562.4 million.

According to JLL, in terms of contracted sales among the top 100 local property developers, our Group, together with our joint venture, ranked 28th in Dongguan (with market share of 0.6%), 63rd in Changsha (with market share of 0.4%) and 39th in Hefei (with market share of 0.6%), and accounted for 1.3% and 0.8% of the market share in Heyuan and Hengyang respectively. Having been recognized by the market, we are dedicated to offering quality integrated properties to our customers.

We also offer properties promoting specific industry(ies) encouraged by local government authorities.

Our history can be traced back to 2004 when Dongguan Huijing Real Estate, the predecessor of our major subsidiary, Huijing Group, was established and when Dongguan Huijing Real Estate obtained the pre-sale permits for Huijing Villa (First Phase) (滙景豪庭第一期). Leveraging on our ability to provide

quality residential properties to our customers, we commenced the construction of our first integrated development Huijing City (滙景城) in 2011 in Dongguan.

We and our property projects have been awarded various accolades from different organizations including the ‘‘Exquisite Taste Luxury Home Award’’ (頂級品味豪宅獎) awarded by Wen Wei Po (文匯 報), the Hong Kong Institute of Architects, and the Hong Kong Institute of Designers in 2010, ‘‘Dongguan’s Most Influential Brand Real Estate Enterprises’’ (東莞最具影響力品牌房企) by Sohu (搜 狐網) in 2014, and ‘‘Anhui Top-10 City Complex Annual Award’’ (安徽年度十佳城市綜合體) by the Graduate School of Real Estate of Hefei University (合肥學院房地產研究所) in 2016.

We believe that our strong brand recognition, in particular in Dongguan, together with our land sourcing strategy and cost control measures, have contributed to our growth.

...

!

Dieser Beitrag wurde von FairMOD moderiert. Grund: auf eigenen Wunsch des Users

17.7.

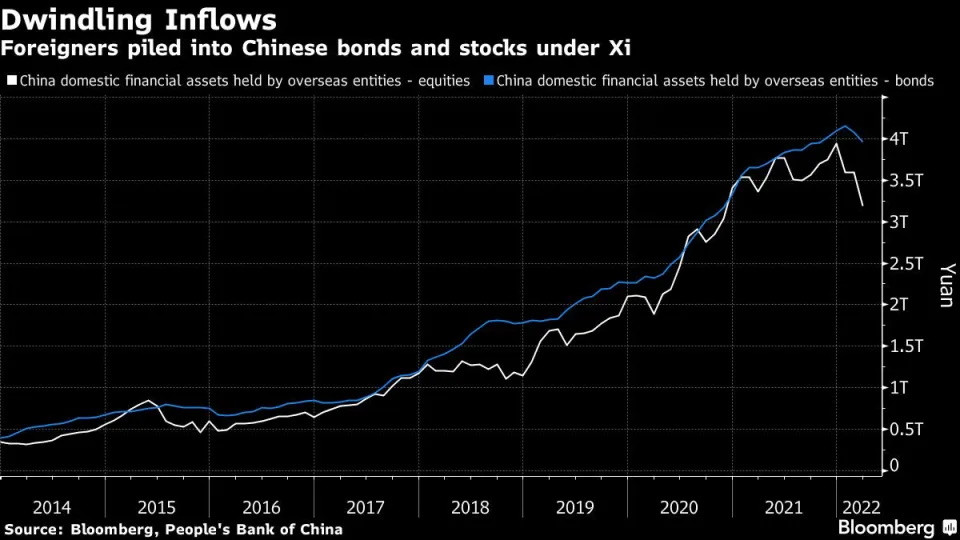

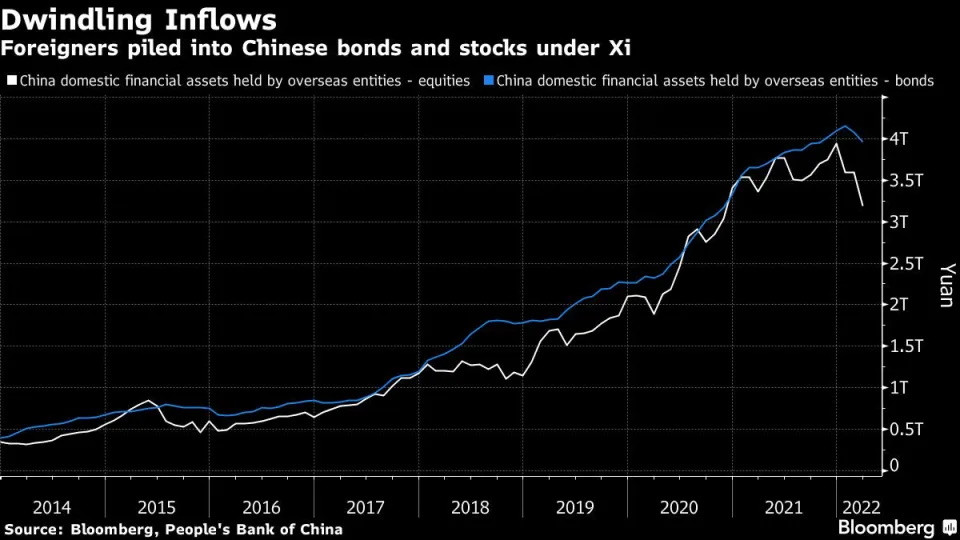

China Is Pariah for Global Investors as Xi’s Policies Backfire

https://finance.yahoo.com/news/china-pariah-global-investors…

...

After drawing foreign capital into China’s markets for years, President Xi Jinping is now facing the risk of a nasty period of financial de-globalization. Investors point to one main reason why: Xi’s own policies.

Money managers once enticed by China’s juicy yields and huge tech companies now say reasons to avoid the country outweigh incentives to buy. They cite everything from unpredictable regulatory campaigns to economic damage caused by strict Covid-19 policies, not to mention growing risks stemming from a wobbly real-estate market and even Xi’s coziness with Russia’s Vladimir Putin.

It all marks a dramatic about-face for a market that had been developing into a magnet for investors from around the globe, a role that seemed to be China’s destiny as the second-largest economy.

“The supertanker of Western capital is starting to turn away from China,” said Matt Smith of Ruffer LLP, a $31 billion investment firm that recently shut its Hong Kong office after more than a decade because of shrinking demand for on-the-ground equity research.

“It’s just easier to put China aside for now when you see no end in sight from Covid Zero and the return of geopolitical risk.”

...

China Is Pariah for Global Investors as Xi’s Policies Backfire

https://finance.yahoo.com/news/china-pariah-global-investors…

...

After drawing foreign capital into China’s markets for years, President Xi Jinping is now facing the risk of a nasty period of financial de-globalization. Investors point to one main reason why: Xi’s own policies.

Money managers once enticed by China’s juicy yields and huge tech companies now say reasons to avoid the country outweigh incentives to buy. They cite everything from unpredictable regulatory campaigns to economic damage caused by strict Covid-19 policies, not to mention growing risks stemming from a wobbly real-estate market and even Xi’s coziness with Russia’s Vladimir Putin.

It all marks a dramatic about-face for a market that had been developing into a magnet for investors from around the globe, a role that seemed to be China’s destiny as the second-largest economy.

“The supertanker of Western capital is starting to turn away from China,” said Matt Smith of Ruffer LLP, a $31 billion investment firm that recently shut its Hong Kong office after more than a decade because of shrinking demand for on-the-ground equity research.

“It’s just easier to put China aside for now when you see no end in sight from Covid Zero and the return of geopolitical risk.”

...

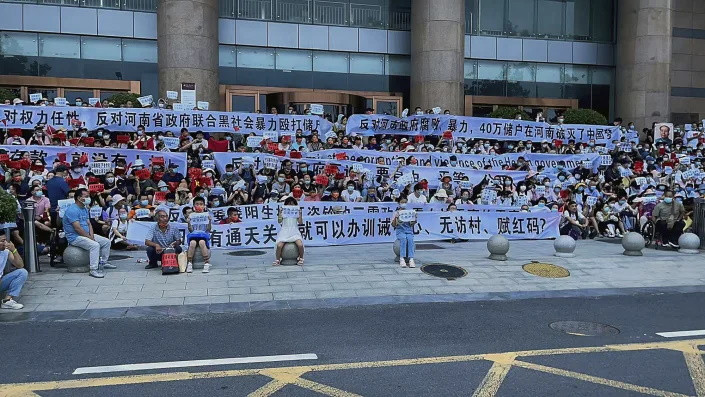

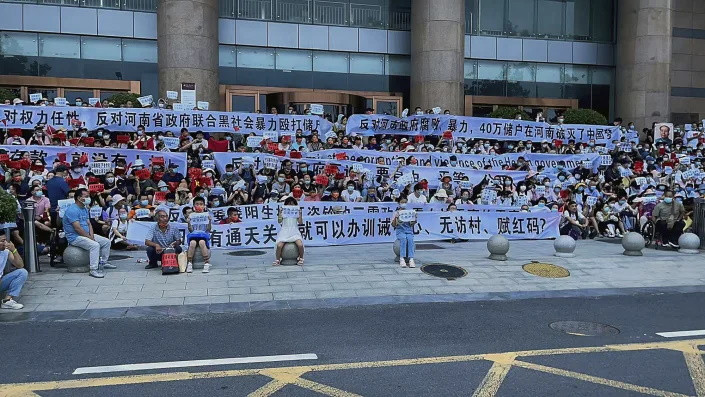

Antwort auf Beitrag Nr.: 71.806.813 von faultcode am 18.06.22 00:42:38bank run --> Proteste:

10.7.

Chinese bank depositors face police in angry protest

https://news.yahoo.com/chinese-bank-depositors-face-police-1…

...

A large crowd of angry Chinese bank depositors faced off with police Sunday, some roughed up as they were taken away, in a case that has drawn attention because of earlier attempts to use a COVID-19 tracking app to prevent them from mobilizing.

Hundreds of people held up banners and chanted slogans on the wide steps of the entrance to a branch of China's central bank in the city of Zhengzhou in Henan province, about 620 kilometers (380 miles) southwest of Beijing. Video taken by a protester shows plainclothes security teams being pelted with water bottles and other objects as they charge the crowd.

Later videos posted on social media show an unclear number of protesters being shoved forward individually and down stairs by security teams dressed in plain white or black T-shirts. Phone calls to Zhengzhou city and Henan province police rang unanswered.

The protesters are among thousands of customers who opened accounts at six rural banks in Henan and neighboring Anhui province that offered higher interest rates. They later found they could not withdraw their funds after media reports that the head of the banks' parent company was on the run and wanted for financial crimes.

“We came today and wanted to get our savings back, because I have elderly people and children at home, and the inability to withdraw savings has seriously affected my life,” said a woman from Shandong province, who only gave her last name, Zhang, out of fear of retribution.

What had been a local scandal became a national incident last month because of the misuse of the COVID-19 tracking app. Many who set out for Zhengzhou to demand action from regulators found that their health status on the app had turned red, preventing them from traveling. Some reported being questioned by police after checking into their hotel about why they had come to the city. Five Zhengzhou officials were later punished.

...

10.7.

Chinese bank depositors face police in angry protest

https://news.yahoo.com/chinese-bank-depositors-face-police-1…

...

A large crowd of angry Chinese bank depositors faced off with police Sunday, some roughed up as they were taken away, in a case that has drawn attention because of earlier attempts to use a COVID-19 tracking app to prevent them from mobilizing.

Hundreds of people held up banners and chanted slogans on the wide steps of the entrance to a branch of China's central bank in the city of Zhengzhou in Henan province, about 620 kilometers (380 miles) southwest of Beijing. Video taken by a protester shows plainclothes security teams being pelted with water bottles and other objects as they charge the crowd.

Later videos posted on social media show an unclear number of protesters being shoved forward individually and down stairs by security teams dressed in plain white or black T-shirts. Phone calls to Zhengzhou city and Henan province police rang unanswered.

The protesters are among thousands of customers who opened accounts at six rural banks in Henan and neighboring Anhui province that offered higher interest rates. They later found they could not withdraw their funds after media reports that the head of the banks' parent company was on the run and wanted for financial crimes.

“We came today and wanted to get our savings back, because I have elderly people and children at home, and the inability to withdraw savings has seriously affected my life,” said a woman from Shandong province, who only gave her last name, Zhang, out of fear of retribution.

What had been a local scandal became a national incident last month because of the misuse of the COVID-19 tracking app. Many who set out for Zhengzhou to demand action from regulators found that their health status on the app had turned red, preventing them from traveling. Some reported being questioned by police after checking into their hotel about why they had come to the city. Five Zhengzhou officials were later punished.

...

5.7.

Tencent zensiert: Wer auf WeChat NFT, Bitcoin & Co. erwähnt, riskiert eine Kontosperre

https://www.finanzen.net/nachricht/devisen/wechat-und-weixin…

...

Der chinesische Tech-Konzern Tencent verbietet auf seinen Messenger-Apps WeChat und Weixin jegliche Gespräche über ausländische Kryptowährungen und NFTs - eine Begründung für diesen Schritt wurde nicht genannt. Dies berichtet das Informationsportal t3n.

Das neue Verbot sei Mitte Juni in den WeChat-Nutzungsbedingungen aufgetaucht. Wer sich seither auf WeChat oder Weixin über NFTs oder Bitcoin, Ethereum & Co. austauscht, werde zunächst verwarnt. Zudem könne Tencent die Funktionen des entsprechenden Kontos einschränken. Halte sich die Nutzerin oder der Nutzer auch nach der Verwarnung nicht an die neue Regelung, werde das Konto endgültig gesperrt.

Während es keine offizielle Begründung zu den geänderten Nutzungsbedingungen gibt, lässt sich dieser Schritt doch in den politischen Kontext einordnen: Im Herbst vergangenen Jahres hatte China das Mining von Kryptowährungen verboten und alle Transaktionen in Verbindung mit Bitcoin, Ethereum und Co. für illegal erklärt.

...

Im März war bereits bekannt geworden, dass Tencent WeChat-Konten mit Verbindungen zum NFT-Handeln gesperrt hat. Laut CNBC hat das Unternehmen dieses Vorgehen damit begründet, keine Spekulationen in digitale Währungen ankurbeln zu wollen. Tatsächlich sind Kryptowährungen auf WeChat nicht gänzlich verboten: Wie t3n berichtet, wurde die einzige in China erlaubte Kryptowährung, der digitale Yuan, auf der Messenger-App kürzlich als Zahlungsoption eingeführt.

...

Von WeChat oder Weixin gesperrt zu werden kann insofern eine schwere Sanktion bedeuten, da es in China weder Facebook noch WhatsApp oder Twitter gibt.

Mit über einer Milliarde Nutzerinnen und Nutzern ist WeChat t3n vorliegenden Daten zufolge nationaler Marktführer. heise zitiert Sarah Cook, Senior Research Analystin bei der Forschungsgruppe Freedom House dazu wie folgt: "Es ist wirklich schwer, in der modernen chinesischen Gesellschaft zu funktionieren, ohne WeChat zu verwenden." Über die App kann man sich nicht nur mit Kontakten vernetzen, sondern zudem Spiele spielen, Essen bestellen oder ein Taxi rufen. heise berichtet auch, dass WeChat bereits in der Vergangenheit bestimmte Inhalte nur Sekunden nach ihrer Veröffentlichung oder sogar in Echtzeit gelöscht hat, darunter bestimmte Bilder oder Textnachrichten zwischen einzelnen Nutzerinnen und Nutzern.

...

=> man kann mMn davon ausgehen, daß in China allgemein (und wieder) ein großer Schwarzhandel für Güter und Dienstleistungen aller Art blüht

Aber eine moderne Volkswirtschaft sieht so nicht aus.

Tencent zensiert: Wer auf WeChat NFT, Bitcoin & Co. erwähnt, riskiert eine Kontosperre

https://www.finanzen.net/nachricht/devisen/wechat-und-weixin…

...

Der chinesische Tech-Konzern Tencent verbietet auf seinen Messenger-Apps WeChat und Weixin jegliche Gespräche über ausländische Kryptowährungen und NFTs - eine Begründung für diesen Schritt wurde nicht genannt. Dies berichtet das Informationsportal t3n.

Das neue Verbot sei Mitte Juni in den WeChat-Nutzungsbedingungen aufgetaucht. Wer sich seither auf WeChat oder Weixin über NFTs oder Bitcoin, Ethereum & Co. austauscht, werde zunächst verwarnt. Zudem könne Tencent die Funktionen des entsprechenden Kontos einschränken. Halte sich die Nutzerin oder der Nutzer auch nach der Verwarnung nicht an die neue Regelung, werde das Konto endgültig gesperrt.

Während es keine offizielle Begründung zu den geänderten Nutzungsbedingungen gibt, lässt sich dieser Schritt doch in den politischen Kontext einordnen: Im Herbst vergangenen Jahres hatte China das Mining von Kryptowährungen verboten und alle Transaktionen in Verbindung mit Bitcoin, Ethereum und Co. für illegal erklärt.

...

Im März war bereits bekannt geworden, dass Tencent WeChat-Konten mit Verbindungen zum NFT-Handeln gesperrt hat. Laut CNBC hat das Unternehmen dieses Vorgehen damit begründet, keine Spekulationen in digitale Währungen ankurbeln zu wollen. Tatsächlich sind Kryptowährungen auf WeChat nicht gänzlich verboten: Wie t3n berichtet, wurde die einzige in China erlaubte Kryptowährung, der digitale Yuan, auf der Messenger-App kürzlich als Zahlungsoption eingeführt.

...

Von WeChat oder Weixin gesperrt zu werden kann insofern eine schwere Sanktion bedeuten, da es in China weder Facebook noch WhatsApp oder Twitter gibt.

Mit über einer Milliarde Nutzerinnen und Nutzern ist WeChat t3n vorliegenden Daten zufolge nationaler Marktführer. heise zitiert Sarah Cook, Senior Research Analystin bei der Forschungsgruppe Freedom House dazu wie folgt: "Es ist wirklich schwer, in der modernen chinesischen Gesellschaft zu funktionieren, ohne WeChat zu verwenden." Über die App kann man sich nicht nur mit Kontakten vernetzen, sondern zudem Spiele spielen, Essen bestellen oder ein Taxi rufen. heise berichtet auch, dass WeChat bereits in der Vergangenheit bestimmte Inhalte nur Sekunden nach ihrer Veröffentlichung oder sogar in Echtzeit gelöscht hat, darunter bestimmte Bilder oder Textnachrichten zwischen einzelnen Nutzerinnen und Nutzern.

...

=> man kann mMn davon ausgehen, daß in China allgemein (und wieder) ein großer Schwarzhandel für Güter und Dienstleistungen aller Art blüht

Aber eine moderne Volkswirtschaft sieht so nicht aus.

China unter Xi ist ein dümmlicher Staat dritter Klasse geworden:

7.7.

Hong Kong Dumps Hundreds of Taiwan’s Mangos on Improbable Covid Risk

https://ampvideo.bnnbloomberg.ca/hong-kong-dumps-hundreds-of…

...

Hong Kong ordered hundreds of mangoes imported from Taiwan tossed out after finding traces of coronavirus on the skin of just one of the orange-hued fruits.

The move is part of the once vibrant Asian financial hub’s efforts to reduce the risk of imported infections as it tries to contain a growing Covid-19 outbreak, despite the lack of scientific evidence that such products are a serious danger to people. It mirrors similar action taken in China, which has rejected food and other goods from around the world after testing turned up signs of the virus.

Hong Kong’s Centre for Food Safety instructed the distributor to dispose of the fruit after getting results from surveillance testing the 200-kilogram (441 pounds) shipment, the agency said in a statement Wednesday. It seemed to acknowledge the rarity of the risk, saying in the same statement that Covid-19 is predominantly transmitted through droplets and cannot multiply in food or food packaging.

Taiwan’s Council of Agriculture hit back, saying the measure isn’t scientific and calling on the city to adopt measures in line with international norms.

Nearby gambling hub Macau, which is experiencing its worst outbreak of the pandemic, destroyed two batches of Taiwan’s mangoes in the past week after similar testing results. The cities and mainland China, which takes a zero-tolerance approach to the virus, are the only places in the world that treat environmental samples from food or other objects as legitimate sources of infection.

Taiwan’s Ministry of Foreign Affairs mocked Macau in a tweet, questioning how the city’s authorities carried out testing on the fruit.

The recalls add to a challenging year for mango growers in Taiwan, who are facing an expected 47% fall in production to the lowest level since 1997 due to uneven flowering, low temperatures, rainfall and disease, according to Taiwan’s Council of Agriculture.

The World Health Organization and overseas food safety authorities say it’s unlikely the virus can be transmitted to humans via food consumption.

...

7.7.

Hong Kong Dumps Hundreds of Taiwan’s Mangos on Improbable Covid Risk

https://ampvideo.bnnbloomberg.ca/hong-kong-dumps-hundreds-of…

...

Hong Kong ordered hundreds of mangoes imported from Taiwan tossed out after finding traces of coronavirus on the skin of just one of the orange-hued fruits.

The move is part of the once vibrant Asian financial hub’s efforts to reduce the risk of imported infections as it tries to contain a growing Covid-19 outbreak, despite the lack of scientific evidence that such products are a serious danger to people. It mirrors similar action taken in China, which has rejected food and other goods from around the world after testing turned up signs of the virus.

Hong Kong’s Centre for Food Safety instructed the distributor to dispose of the fruit after getting results from surveillance testing the 200-kilogram (441 pounds) shipment, the agency said in a statement Wednesday. It seemed to acknowledge the rarity of the risk, saying in the same statement that Covid-19 is predominantly transmitted through droplets and cannot multiply in food or food packaging.

Taiwan’s Council of Agriculture hit back, saying the measure isn’t scientific and calling on the city to adopt measures in line with international norms.

Nearby gambling hub Macau, which is experiencing its worst outbreak of the pandemic, destroyed two batches of Taiwan’s mangoes in the past week after similar testing results. The cities and mainland China, which takes a zero-tolerance approach to the virus, are the only places in the world that treat environmental samples from food or other objects as legitimate sources of infection.

Taiwan’s Ministry of Foreign Affairs mocked Macau in a tweet, questioning how the city’s authorities carried out testing on the fruit.

The recalls add to a challenging year for mango growers in Taiwan, who are facing an expected 47% fall in production to the lowest level since 1997 due to uneven flowering, low temperatures, rainfall and disease, according to Taiwan’s Council of Agriculture.

The World Health Organization and overseas food safety authorities say it’s unlikely the virus can be transmitted to humans via food consumption.

...