PBF Energy

eröffnet am 27.06.19 00:16:24 von

neuester Beitrag 08.09.23 17:43:29 von

neuester Beitrag 08.09.23 17:43:29 von

Beiträge: 44

ID: 1.306.296

ID: 1.306.296

Aufrufe heute: 0

Gesamt: 2.649

Gesamt: 2.649

Aktive User: 0

ISIN: US69318G1067 · WKN: A1J9SG · Symbol: PEN

44,99

EUR

-2,98 %

-1,38 EUR

Letzter Kurs 10.05.24 Tradegate

Neuigkeiten

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,2000 | +29,03 | |

| 246,02 | +21,37 | |

| 1,3200 | +18,92 | |

| 5,6270 | +15,44 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 175,00 | -7,35 | |

| 0,6000 | -9,77 | |

| 0,8850 | -14,90 | |

| 1,0400 | -18,50 | |

| 5,9460 | -75,48 |

Beitrag zu dieser Diskussion schreiben

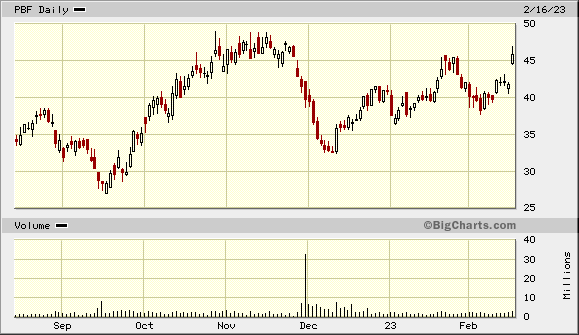

Allzeithoch (keine Nachrichten):

16.2.

UPDATE 2-PBF Energy posts bumper quarterly profit, partners with ENI on biorefinery

https://www.yahoo.com/now/1-refiner-pbf-energy-posts-1201483…

...

PBF Energy Inc posted an upbeat fourth-quarter profit on Thursday and said it sealed a joint venture with Eni Sustainable Mobility, a unit of Italy's energy group Eni, for a renewable diesel project in the United States.

...

As part of the 50-50 venture, Eni will contribute capital totaling $835 million, excluding working capital, plus up to an additional $50 million that is subject to the achievement of project milestones, PBF said in a statement.

The joint venture, St. Bernard Renewables LLC, will own the renewable diesel project currently under construction and co-located with PBF's Chalmette refinery in Louisiana.

...

PBF's gross refining margin, excluding special items, rose to $1.71 billion in the reported quarter, from $998.7 million a year ago.

"The resurgence of demand for our products and our reliable operations allowed PBF to end 2022 in the strongest financial position in our 10-year history as a public company," Chief Executive Officer Tom Nimbley said.

Its total crude oil and feedstocks throughput climbed 8% in the October-December quarter to 86.4 million barrels.

The company expects its full-year 2023 throughput between 935,000 barrels per day (bpd) and 995,000 bpd, and in the current quarter between 845,000 bpd and 905,000 bpd.

The Parsippany, New Jersey-based refiner said its net income attributable to stockholders rose to $637.8 million, or $4.86 per share, in the three-month period ended Dec. 31, from $165.3 million, or $1.36 per share, in the year-ago quarter.

On an adjusted basis, the refiner posted a profit $4.41 per share, missing average analysts' estimate of $4.98 per share, according to Refinitiv data.

...

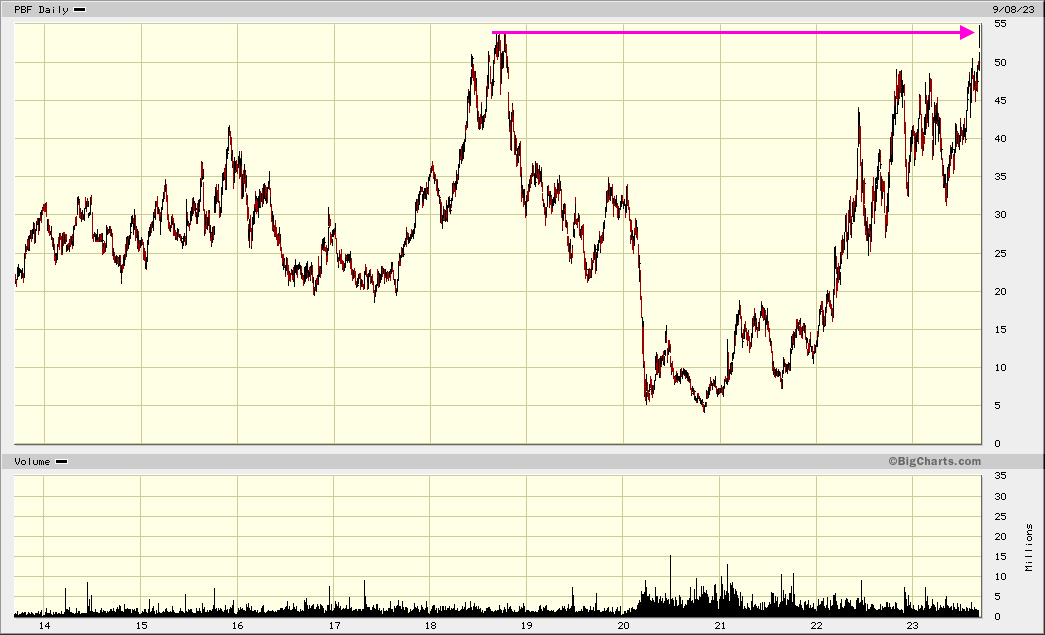

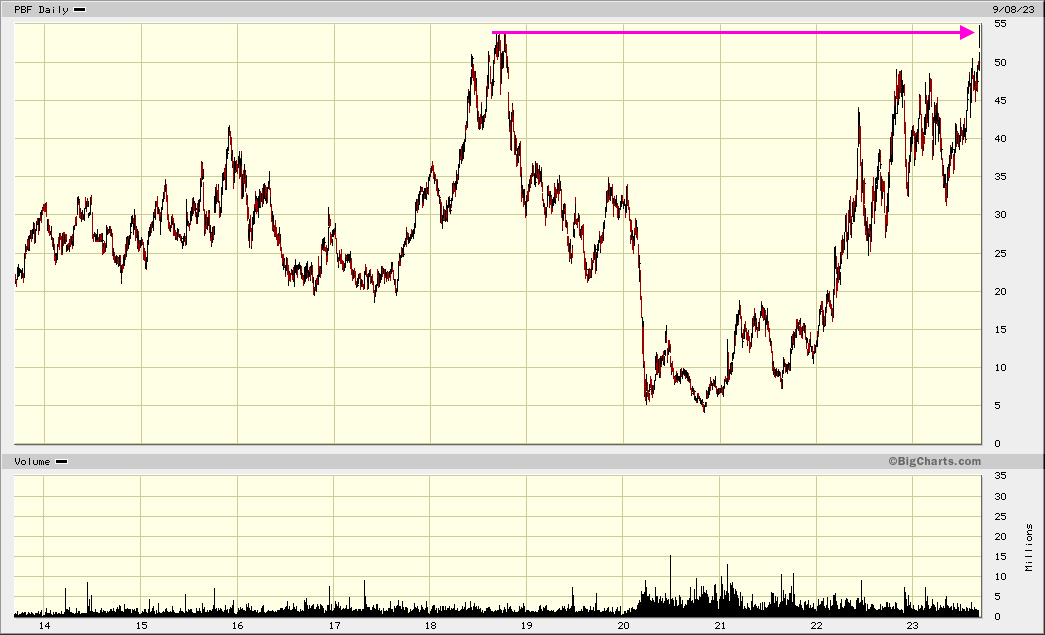

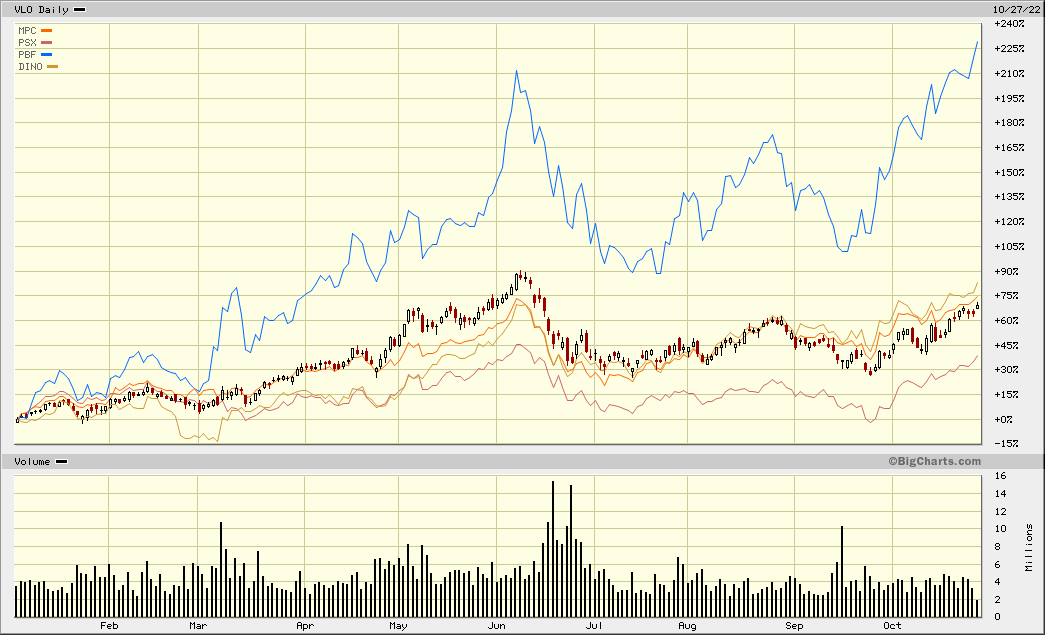

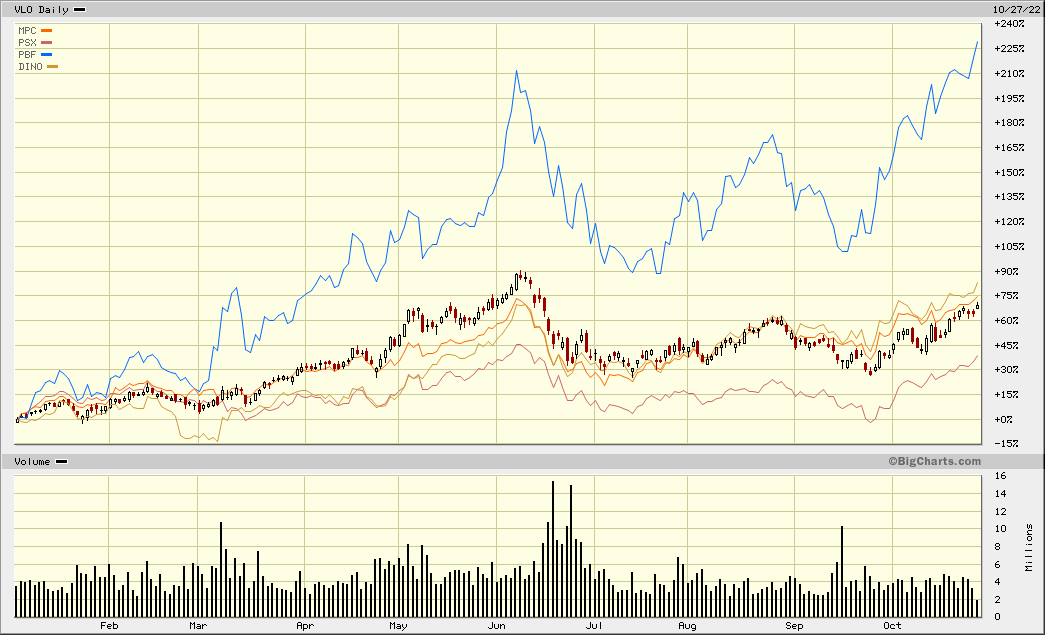

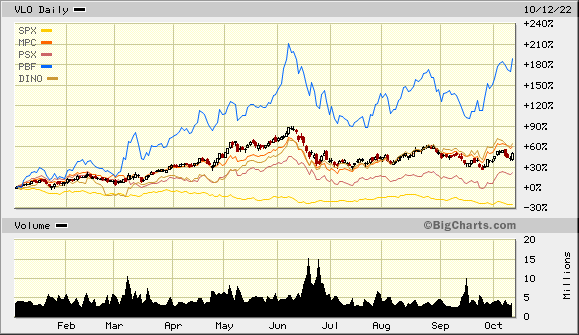

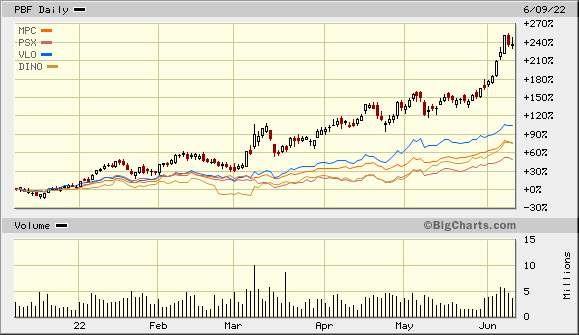

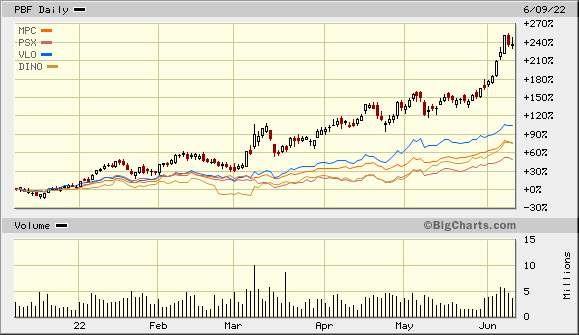

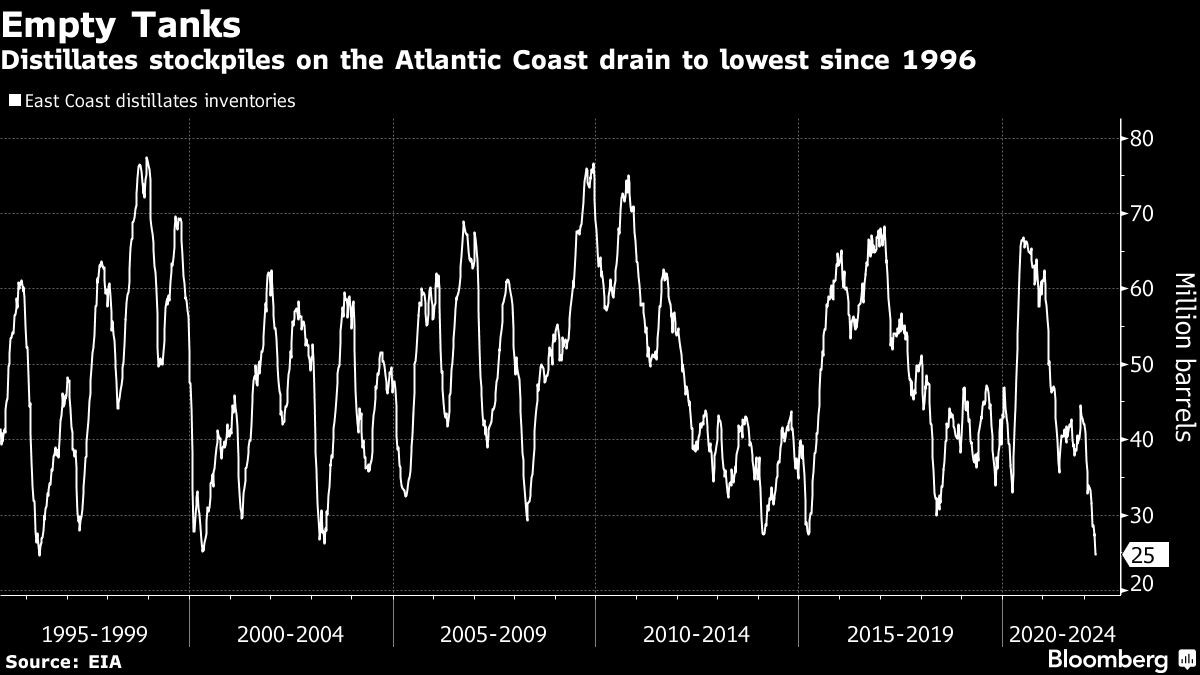

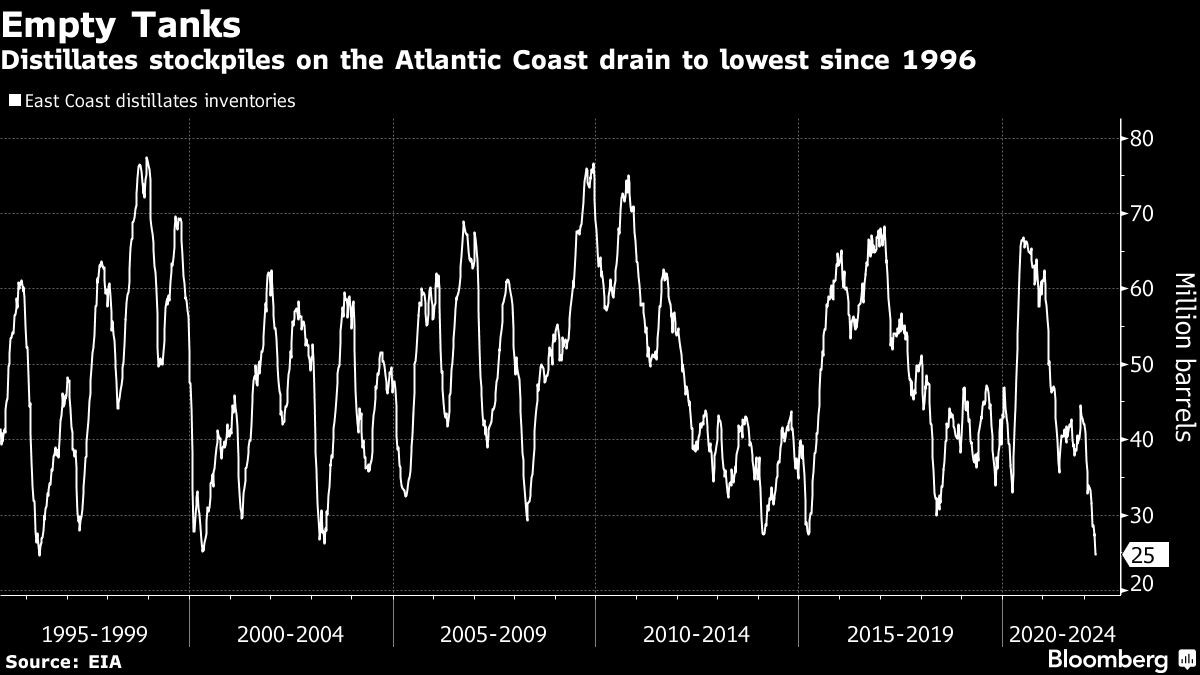

PBF Energy -- der "Diesel-Knaller" von der Ostküste, aber auch die anderen schicken sich an, ihre Hochs vom Juni (Driving season) zu knacken:

PBF Energy ist und bleibt der Knaller in 2022:

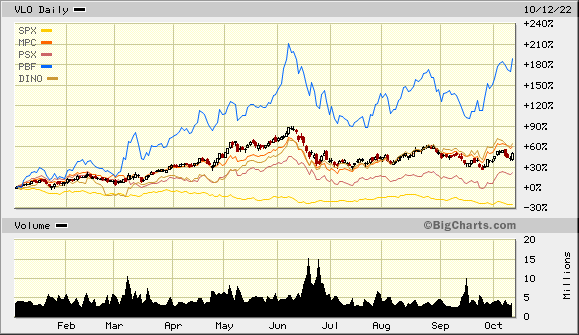

alle ausgewählten Refiner bleiben im Plus bislang (kein Total return).

Das ganz unter ist der SPX = S&P 500 Index

alle ausgewählten Refiner bleiben im Plus bislang (kein Total return).

Das ganz unter ist der SPX = S&P 500 Index

9.6.

PBF Energy Announces Notice of Full Redemption for PBF Holding 9.25% Senior Secured Notes due 2025

https://newsfilter.io/articles/pbf-energy-announces-notice-o…

...

9.6.

Carlos Slim Cashes In on US Oil Refiner’s 600% Pandemic Rebound

The billionaire and his family have sold $358 million of PBF Energy this year.

https://www.bloomberg.com/news/articles/2022-06-09/carlos-sl…

...

Control Empresarial de Capitales, the family’s investment vehicle, has sold about $358 million of PBF Energy Inc. this year, halving its holding in the Parsippany, New Jersey-based company, according to data compiled by Bloomberg. It unloaded $90 million of shares last week, leaving the Slims with a 9.7% stake worth about $500 million.

Slim and his family spent about $60 million buying stock in PBF Energy in 2020, mostly in the aftermath of the covid-19 virus outbreak.

...

=>

PBF Energy Announces Notice of Full Redemption for PBF Holding 9.25% Senior Secured Notes due 2025

https://newsfilter.io/articles/pbf-energy-announces-notice-o…

...

9.6.

Carlos Slim Cashes In on US Oil Refiner’s 600% Pandemic Rebound

The billionaire and his family have sold $358 million of PBF Energy this year.

https://www.bloomberg.com/news/articles/2022-06-09/carlos-sl…

...

Control Empresarial de Capitales, the family’s investment vehicle, has sold about $358 million of PBF Energy Inc. this year, halving its holding in the Parsippany, New Jersey-based company, according to data compiled by Bloomberg. It unloaded $90 million of shares last week, leaving the Slims with a 9.7% stake worth about $500 million.

Slim and his family spent about $60 million buying stock in PBF Energy in 2020, mostly in the aftermath of the covid-19 virus outbreak.

...

=>

...

...

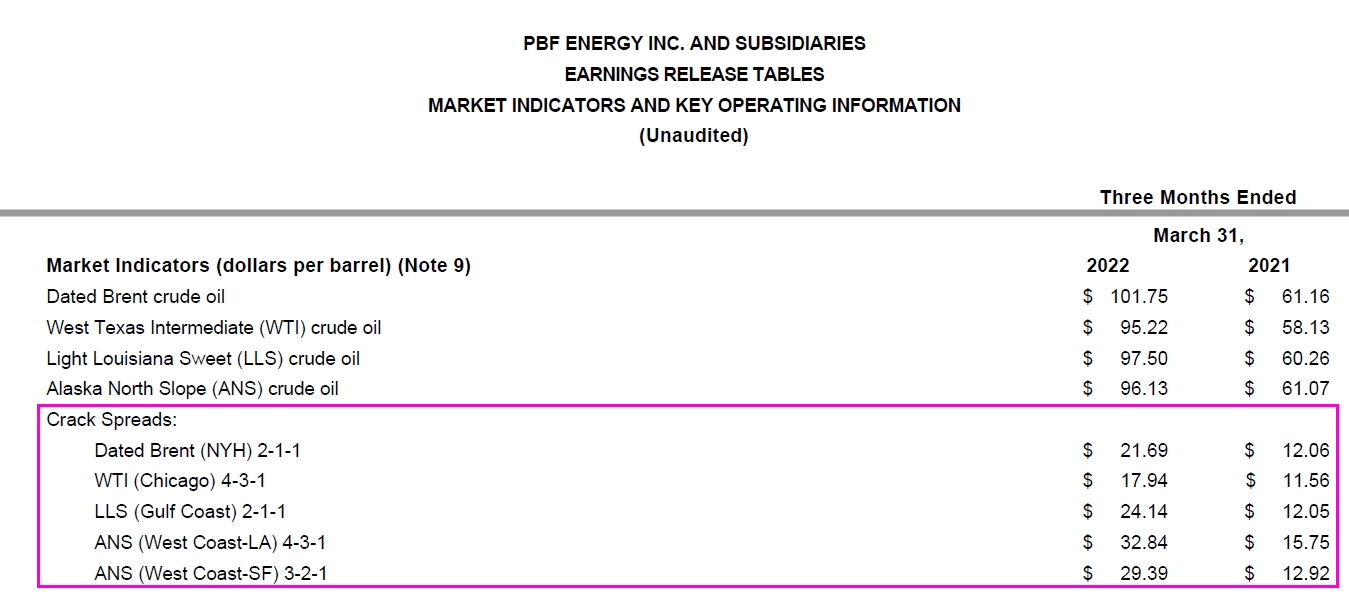

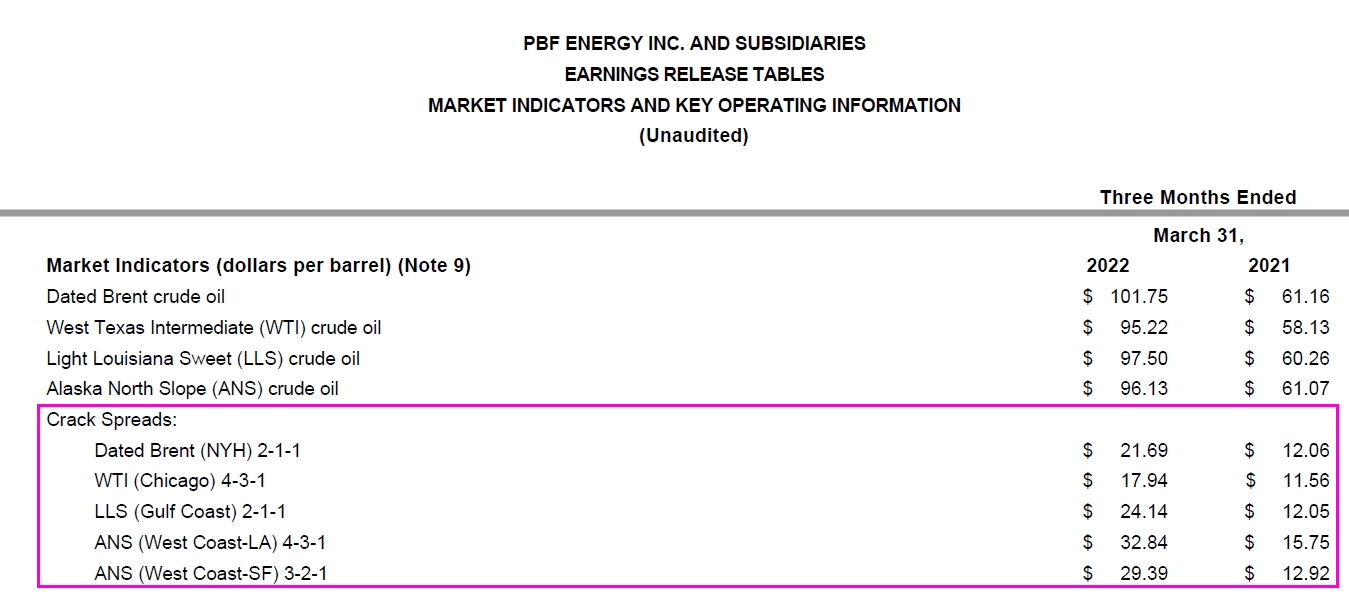

Apr 28, 2022

PBF Energy Announces First Quarter 2022 Results

https://www.prnewswire.com/news-releases/pbf-energy-announce…

...

Apr 28, 2022

PBF Energy Announces First Quarter 2022 Results

https://www.prnewswire.com/news-releases/pbf-energy-announce…

29.4.

Largest U.S. Fuel Pipeline Underused Despite East Coast Shortage (Colonial pipeline)

https://www.bloomberg.com/news/articles/2022-04-29/largest-u…

Largest U.S. Fuel Pipeline Underused Despite East Coast Shortage (Colonial pipeline)

https://www.bloomberg.com/news/articles/2022-04-29/largest-u…

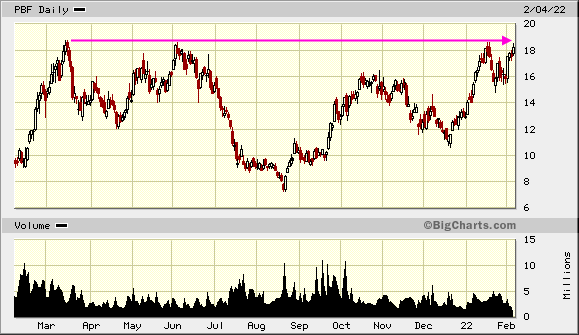

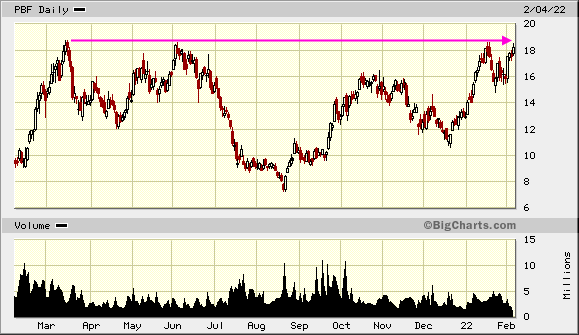

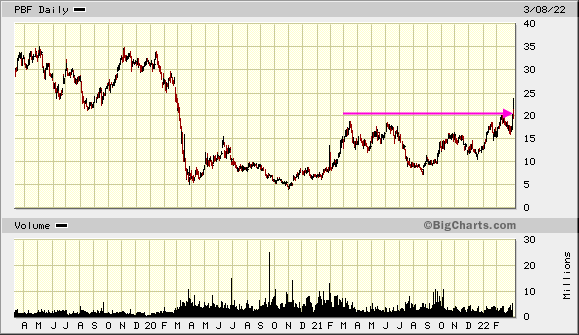

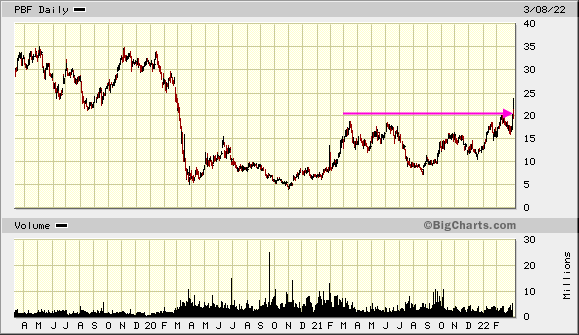

Antwort auf Beitrag Nr.: 70.748.496 von faultcode am 04.02.22 17:14:458.3.

B of A Securities Upgrades PBF Energy to Buy: https://www.benzinga.com/news/22/03/26037610/b-of-a-securiti…

=> PBF zieht durch:

B of A Securities Upgrades PBF Energy to Buy: https://www.benzinga.com/news/22/03/26037610/b-of-a-securiti…

=> PBF zieht durch:

4.3.

Self sanctioning lifts European diesel margins, US refiners stand to benefit

https://seekingalpha.com/news/3809644-self-sanctioning-lifts…

...

With expectations low for European refining, and rising product margins, perhaps the pure-play European refiners provide the best risk-reward; however, US refiners with direct exposure to Europe like Phillips (PSX), or those able to export to Europe like PBF (NYSE:PBF) and Valero (NYSE:VLO) also stand to benefit from higher European refining margins.

...

Self sanctioning lifts European diesel margins, US refiners stand to benefit

https://seekingalpha.com/news/3809644-self-sanctioning-lifts…

...

With expectations low for European refining, and rising product margins, perhaps the pure-play European refiners provide the best risk-reward; however, US refiners with direct exposure to Europe like Phillips (PSX), or those able to export to Europe like PBF (NYSE:PBF) and Valero (NYSE:VLO) also stand to benefit from higher European refining margins.

...

noch ist der Widerstand nicht erreicht, aber PBF Energy könnte einer der besten Hedges darstellen (die ich meine zu kennen) bei einer weiter eskalierenden Ukraine-Krise (was ich nicht hoffe):