PBF Energy (Seite 2)

eröffnet am 27.06.19 00:16:24 von

neuester Beitrag 08.09.23 17:43:29 von

neuester Beitrag 08.09.23 17:43:29 von

Beiträge: 44

ID: 1.306.296

ID: 1.306.296

Aufrufe heute: 0

Gesamt: 2.649

Gesamt: 2.649

Aktive User: 0

ISIN: US69318G1067 · WKN: A1J9SG · Symbol: PEN

44,78

EUR

-3,43 %

-1,59 EUR

Letzter Kurs 20:40:02 Tradegate

Neuigkeiten

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,2000 | +29,03 | |

| 1,0400 | +18,18 | |

| 5,6270 | +15,44 | |

| 14,990 | +15,31 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,0000 | -6,83 | |

| 2,8850 | -7,23 | |

| 175,00 | -7,35 | |

| 2,0500 | -9,69 | |

| 1,0340 | -18,97 |

Beitrag zu dieser Diskussion schreiben

28.1.

New Jersey Refinery Set to Restart Some Idled Fuel Production

https://finance.yahoo.com/news/jersey-refinery-set-restart-i…

...

PBF Energy Inc. plans to restore production of some transportation fuels at its Paulsboro, N.J., facility after halting output of refined products in late 2020 when oil consumption was decimated by Covid.

It will take several months to repair equipment needed to restart production units, people familiar with operations say. Among the first units to be restarted as soon as this summer may be the continuous catalytic reformer. Reformers convert low-octane naphtha from crude units into high-octane blendstocks for gasoline.

Higher fuel output is welcome news for consumers in the Northeast, which has become reliant on imports because of a dearth of local production. More than 1 million barrels of production have disappeared from North American since 2020 due to plant closures and conversions to renewable fuels plants.

The region lost its largest local supply of fuel when the Philadelphia Energy Solutions refinery exploded in a 2019. Meanwhile, gasoline and diesel prices have surged as demand has rebounded since the worst days of the pandemic.

“The market is a lot more balanced than it used to be, and the U.S. East Coast, which is import dependent, now looks more attractive than it was, say, a few years ago,” Robert Campbell, an analyst at Energy Aspects, said by phone. “The prospect of more refinery closures in Europe amid a push for decarbonization could further tighten supplies and improve margins for coastal refineries such as Paulsboro.”

...

New Jersey Refinery Set to Restart Some Idled Fuel Production

https://finance.yahoo.com/news/jersey-refinery-set-restart-i…

...

PBF Energy Inc. plans to restore production of some transportation fuels at its Paulsboro, N.J., facility after halting output of refined products in late 2020 when oil consumption was decimated by Covid.

It will take several months to repair equipment needed to restart production units, people familiar with operations say. Among the first units to be restarted as soon as this summer may be the continuous catalytic reformer. Reformers convert low-octane naphtha from crude units into high-octane blendstocks for gasoline.

Higher fuel output is welcome news for consumers in the Northeast, which has become reliant on imports because of a dearth of local production. More than 1 million barrels of production have disappeared from North American since 2020 due to plant closures and conversions to renewable fuels plants.

The region lost its largest local supply of fuel when the Philadelphia Energy Solutions refinery exploded in a 2019. Meanwhile, gasoline and diesel prices have surged as demand has rebounded since the worst days of the pandemic.

“The market is a lot more balanced than it used to be, and the U.S. East Coast, which is import dependent, now looks more attractive than it was, say, a few years ago,” Robert Campbell, an analyst at Energy Aspects, said by phone. “The prospect of more refinery closures in Europe amid a push for decarbonization could further tighten supplies and improve margins for coastal refineries such as Paulsboro.”

...

21.10.

Oil Refining Renaissance Under Threat From Natural Gas Crisis

https://www.bnnbloomberg.ca/oil-refining-renaissance-under-t…

...

Surging prices for natural gas are threatening to eat up the profit some oil refiners are making on their fuels, forcing them to cut processing rates and even altering normal crude-buying patterns.

Natural gas -- specifically methane -- is central to making the hydrogen that oil refineries rely on for diesel-producing machines called hydrocrackers and hydrotreaters, which help to eliminate sulfur.

The natural gas price surge has added up to $6 per barrel to the cost of processing more sulfurous crudes -- as much as a tenfold increase compared with two years ago -- according to the International Energy Agency.

As well as creating uncertainty about what a revival in refining margins, it yet another example of how the energy crisis is sprawling across markets and industries.

...

Oil Refining Renaissance Under Threat From Natural Gas Crisis

https://www.bnnbloomberg.ca/oil-refining-renaissance-under-t…

...

Surging prices for natural gas are threatening to eat up the profit some oil refiners are making on their fuels, forcing them to cut processing rates and even altering normal crude-buying patterns.

Natural gas -- specifically methane -- is central to making the hydrogen that oil refineries rely on for diesel-producing machines called hydrocrackers and hydrotreaters, which help to eliminate sulfur.

The natural gas price surge has added up to $6 per barrel to the cost of processing more sulfurous crudes -- as much as a tenfold increase compared with two years ago -- according to the International Energy Agency.

As well as creating uncertainty about what a revival in refining margins, it yet another example of how the energy crisis is sprawling across markets and industries.

...

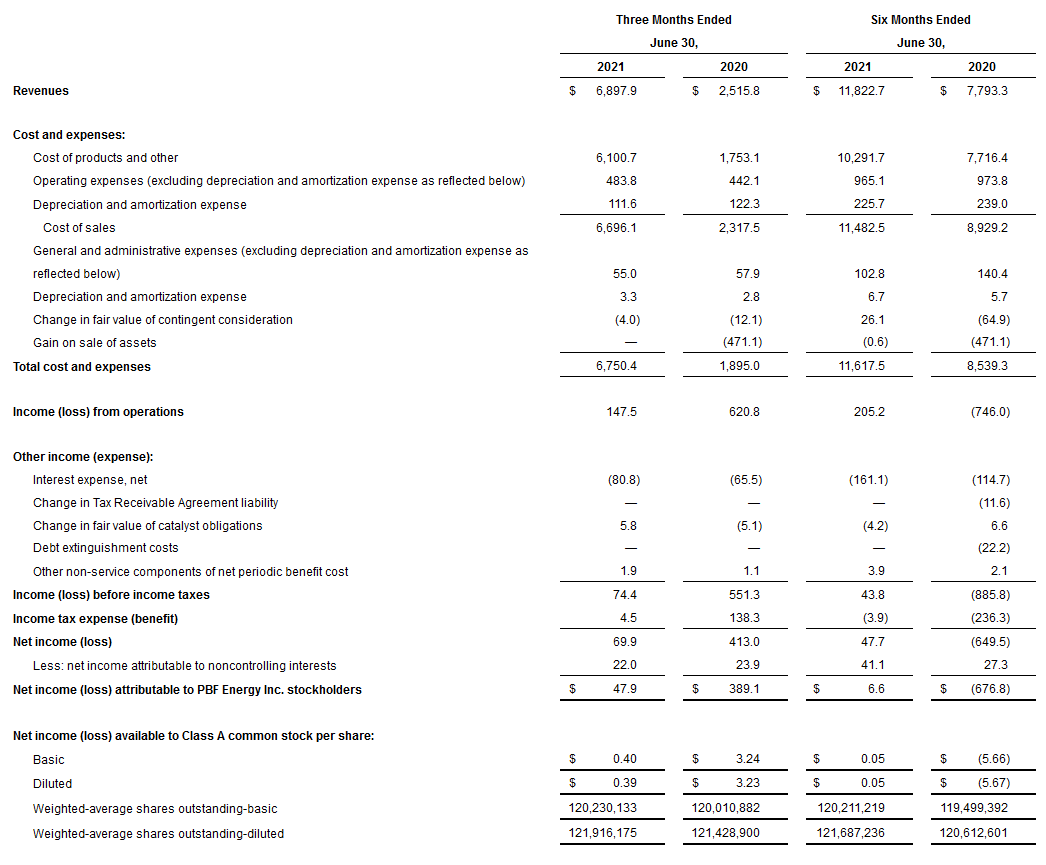

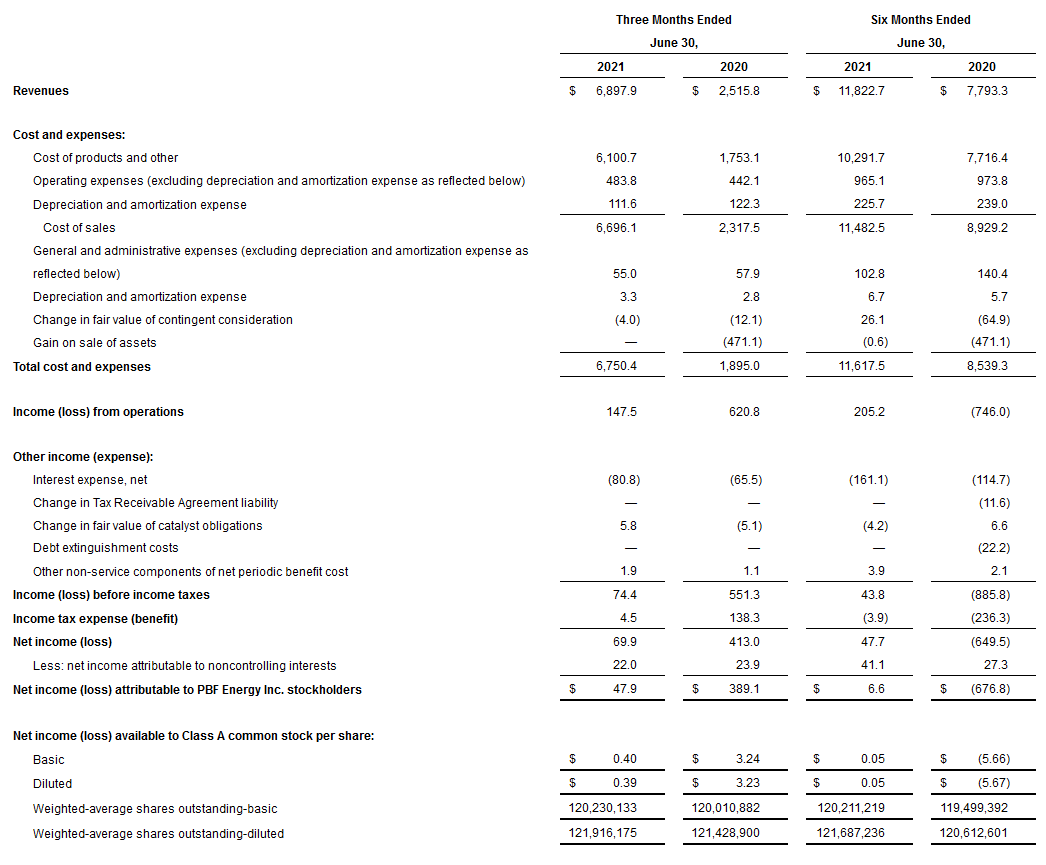

2021Q2:

29.7.

...

Tom Nimbley, PBF Energy's Chairman and CEO, said, "PBF's second quarter results reflect the improving demand environment. We operated our refineries at rates which were the highest since the onset of the pandemic." Mr. Nimbley continued, "Demand continued its gradual improvement but is still not at pre-pandemic levels. We expect, as demand incrementally improves, that we could see additional crude supply enter the market which could directionally shift current headwinds to tailwinds in the commodities market.

As we anticipate this potential positive momentum shift, the independent refining sector continues to face headwinds as a result of escalating compliance costs under the RFS program. The Environmental Protection Agency needs to address the program because the RIN-bank will be fully depleted by early 2022 at current rates."

Mr. Nimbley concluded, "Despite these recent challenges, we are confident that we have the operations, team and resources to overcome the current hurdles. We exited the second quarter with ample liquidity, including approximately $1.4 billion in cash, that we believe will support our business as market conditions improve."

...

...

https://www.prnewswire.com/news-releases/pbf-energy-announce…

29.7.

...

Tom Nimbley, PBF Energy's Chairman and CEO, said, "PBF's second quarter results reflect the improving demand environment. We operated our refineries at rates which were the highest since the onset of the pandemic." Mr. Nimbley continued, "Demand continued its gradual improvement but is still not at pre-pandemic levels. We expect, as demand incrementally improves, that we could see additional crude supply enter the market which could directionally shift current headwinds to tailwinds in the commodities market.

As we anticipate this potential positive momentum shift, the independent refining sector continues to face headwinds as a result of escalating compliance costs under the RFS program. The Environmental Protection Agency needs to address the program because the RIN-bank will be fully depleted by early 2022 at current rates."

Mr. Nimbley concluded, "Despite these recent challenges, we are confident that we have the operations, team and resources to overcome the current hurdles. We exited the second quarter with ample liquidity, including approximately $1.4 billion in cash, that we believe will support our business as market conditions improve."

...

...

https://www.prnewswire.com/news-releases/pbf-energy-announce…

Antwort auf Beitrag Nr.: 68.544.726 von faultcode am 18.06.21 00:09:21

abwarten.

Jedenfalls müssen sie nun nachrüsten. Ein bischen jedenfalls

22.7.

PBF Energy Comments on Bay Area Air Quality Management District Decision

https://finance.yahoo.com/news/pbf-energy-comments-bay-area-…

...

PBF Energy Inc. (NYSE:PBF) today commented on the Bay Area Air Quality Management District (BAAQMD) Board members' decision to adopt Proposed Amended Rule (PAR) 6-5 related to particulate emissions from refinery Fluid Catalytic Cracking (FCC) units in the Bay Area.

Paul Davis, President of PBF Energy's Western Region, stated, "We have been working closely throughout the rule-making process with BAAQMD staff and anticipated today's outcome. Importantly, the rule-making requires refineries to meet a specific emissions standard by 2026, without requiring the installation of a wet gas scrubber or any other specific technology."

Mr. Davis concluded, "PBF has previously planned projects that will be implemented over the coming months that will allow our Martinez refinery to achieve emissions reductions significantly closer to the desired level in the first quarter of 2022. We will continue to work with the BAAQMD to arrive at our mutually desired goal of improving air quality and continuing to provide our vital products to one of the largest fuel markets in the world."

...

ansonsten für die Earnings nächste Woche, 29.7.:

https://finance.yahoo.com/quote/PBF?p=PBF

Martinez, CA

Zitat von faultcode: ...

One refining company, PBF, warned that the cost would likely cause it to shut its facility.

...

abwarten.

Jedenfalls müssen sie nun nachrüsten. Ein bischen jedenfalls

22.7.

PBF Energy Comments on Bay Area Air Quality Management District Decision

https://finance.yahoo.com/news/pbf-energy-comments-bay-area-…

...

PBF Energy Inc. (NYSE:PBF) today commented on the Bay Area Air Quality Management District (BAAQMD) Board members' decision to adopt Proposed Amended Rule (PAR) 6-5 related to particulate emissions from refinery Fluid Catalytic Cracking (FCC) units in the Bay Area.

Paul Davis, President of PBF Energy's Western Region, stated, "We have been working closely throughout the rule-making process with BAAQMD staff and anticipated today's outcome. Importantly, the rule-making requires refineries to meet a specific emissions standard by 2026, without requiring the installation of a wet gas scrubber or any other specific technology."

Mr. Davis concluded, "PBF has previously planned projects that will be implemented over the coming months that will allow our Martinez refinery to achieve emissions reductions significantly closer to the desired level in the first quarter of 2022. We will continue to work with the BAAQMD to arrive at our mutually desired goal of improving air quality and continuing to provide our vital products to one of the largest fuel markets in the world."

...

ansonsten für die Earnings nächste Woche, 29.7.:

https://finance.yahoo.com/quote/PBF?p=PBF

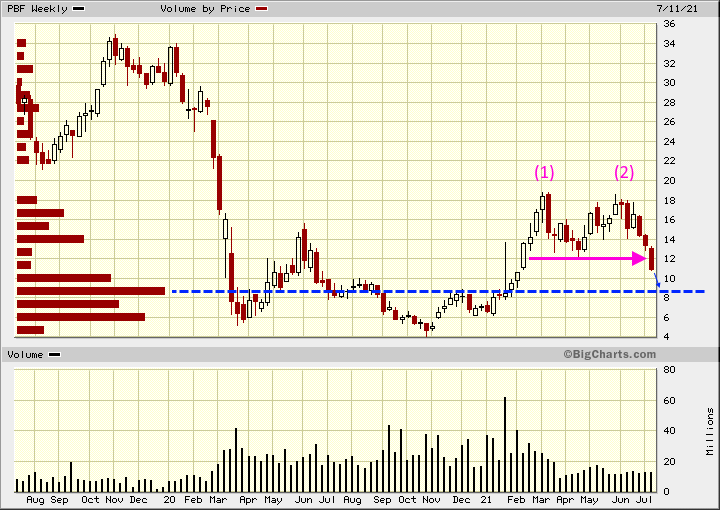

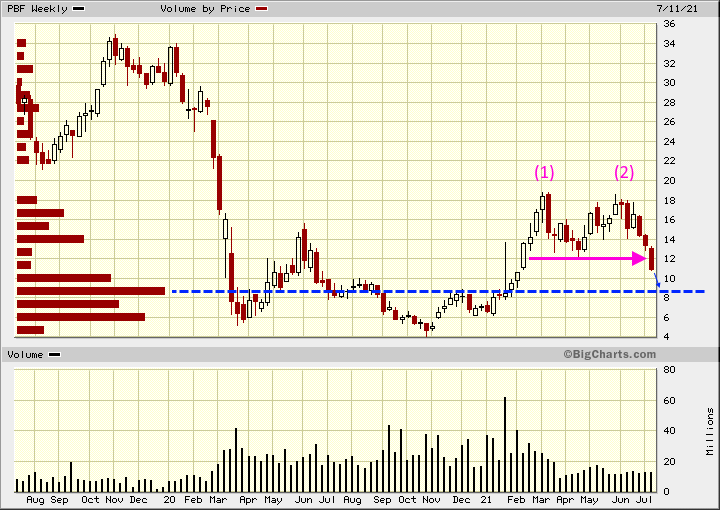

heute wurde das Doppelhoch bestätigt, und wie das so ist, wenn die Sache (für die Algos) klar ist --- rasant:

<Wochenkerzen>

Refiner hatten heute allgemein einen schlechten Tag; trotzdem.

Charttechnisches Kursziel sind damit die ~USD8.

<Wochenkerzen>

Refiner hatten heute allgemein einen schlechten Tag; trotzdem.

Charttechnisches Kursziel sind damit die ~USD8.

15.6.

San Francisco nearing vote to drastically cut refinery pollution with new tech

https://www.nasdaq.com/articles/san-francisco-nearing-vote-t…

...

California air quality regulators will likely vote in July on a plan that would require two San Francisco-area refineries to install technology to curb pollution that exacerbates health problems, officials said on Tuesday.

Exposure to soot and fine particulate matter has been linked to health issues ranging from asthma to heart attacks. Recent studies have shown fine particulate matter has a disproportionate impact on communities of color and low-income neighborhoods that are often found near industrial plants.

The two refineries are urging the Bay Area Air Quality Management District (BAAQMD) to adopt a less stringent standard that would not require them to install wet gas scrubbers, which would cost hundreds of millions of dollars. Dozens of refineries have already invested in the technology, including the nearby Valero Benicia refinery.

One refining company, PBF, warned that the cost would likely cause it to shut its facility.

The Bay Area is falling short of state and national air quality standards for particulate matter, requiring the region to further reduce emissions. The refineries in the Bay Area, including the 245,000 barrel-per-day (bpd) Chevron Richmond and the 157,000-bpd PBF Martinez, emitted 800 tons of particulate matter last year, according to the district.

Last week the U.S. Environmental Protection Agency said it would re-examine federal standards for particulate matter to protect public health.

Air particulate matter has been linked to increased risk of cancer as well as heart, lung and nervous system damage. Residents of Richmond, California, have one of the highest asthma rates in the state, according to county data.

A virtual meeting on the issue in early June drew more than 200 participants for more than five hours of testimony. Environmental activists want the more stringent rule, while union members said tougher measures would cause the PBF refinery to shut, resulting in job losses.

BAAQMD estimated that installing wet scrubbers would cost Chevron about $241 million and PBF $255 million. Chevron and PBF say it will cost them $1.5 billion and $800 million, respectively.

Refineries emit particulate matter when they operate their fluid catalytic cracking units (cat crackers) to turn crude oil into gasoline and high-octane products, as well as burn off petroleum coke.

Under the more stringent rule, the refineries would need to limit annual emissions of particulate matter to 0.01 grain per dry standard cubic foot by 2026, in line with standards applied to new sources of pollution. The requirement would lower PBF and Chevron's particulate matter emissions by half or 400 tons per year, BAAQMD estimates.

The district said the refineries could consider cutting labor costs (FC: ) or increasing gas prices for consumers by 2 cents per gallon to offset the cost.

) or increasing gas prices for consumers by 2 cents per gallon to offset the cost.

...

San Francisco nearing vote to drastically cut refinery pollution with new tech

https://www.nasdaq.com/articles/san-francisco-nearing-vote-t…

...

California air quality regulators will likely vote in July on a plan that would require two San Francisco-area refineries to install technology to curb pollution that exacerbates health problems, officials said on Tuesday.

Exposure to soot and fine particulate matter has been linked to health issues ranging from asthma to heart attacks. Recent studies have shown fine particulate matter has a disproportionate impact on communities of color and low-income neighborhoods that are often found near industrial plants.

The two refineries are urging the Bay Area Air Quality Management District (BAAQMD) to adopt a less stringent standard that would not require them to install wet gas scrubbers, which would cost hundreds of millions of dollars. Dozens of refineries have already invested in the technology, including the nearby Valero Benicia refinery.

One refining company, PBF, warned that the cost would likely cause it to shut its facility.

The Bay Area is falling short of state and national air quality standards for particulate matter, requiring the region to further reduce emissions. The refineries in the Bay Area, including the 245,000 barrel-per-day (bpd) Chevron Richmond and the 157,000-bpd PBF Martinez, emitted 800 tons of particulate matter last year, according to the district.

Last week the U.S. Environmental Protection Agency said it would re-examine federal standards for particulate matter to protect public health.

Air particulate matter has been linked to increased risk of cancer as well as heart, lung and nervous system damage. Residents of Richmond, California, have one of the highest asthma rates in the state, according to county data.

A virtual meeting on the issue in early June drew more than 200 participants for more than five hours of testimony. Environmental activists want the more stringent rule, while union members said tougher measures would cause the PBF refinery to shut, resulting in job losses.

BAAQMD estimated that installing wet scrubbers would cost Chevron about $241 million and PBF $255 million. Chevron and PBF say it will cost them $1.5 billion and $800 million, respectively.

Refineries emit particulate matter when they operate their fluid catalytic cracking units (cat crackers) to turn crude oil into gasoline and high-octane products, as well as burn off petroleum coke.

Under the more stringent rule, the refineries would need to limit annual emissions of particulate matter to 0.01 grain per dry standard cubic foot by 2026, in line with standards applied to new sources of pollution. The requirement would lower PBF and Chevron's particulate matter emissions by half or 400 tons per year, BAAQMD estimates.

The district said the refineries could consider cutting labor costs (FC:

) or increasing gas prices for consumers by 2 cents per gallon to offset the cost.

) or increasing gas prices for consumers by 2 cents per gallon to offset the cost....

17.6.

U.S. refiners amass over $1 bln biofuel liability as Biden admin mulls relief

https://finance.yahoo.com/news/u-refiners-amass-over-1-19334…

...

U.S. merchant refiners have amassed up to a $1.6 billion shortfall in the credits they will need to comply with U.S. biofuel laws, according to a Reuters review of corporate disclosures, an apparent bet that the Biden administration could let them off the hook or that credit prices will fall.

The big liability among companies including PBF Energy Inc , CVR Energy Inc, Par Pacific Holdings and Delta Airlines comes as the administration of President Joe Biden considers granting oil refiners relief from their biofuel mandates amid soaring credit costs and economic turmoil from the coronavirus pandemic that has hurt the fuel industry.

"There is a sense among refiners that they have to do something right now," said Robert Campbell, head of oil products research at Energy Aspects, referring to the decision among some companies to carry a shortfall in the biofuel credits. "They feel that the point of obligation is extremely challenging for them."

Under the U.S. Renewable Fuel Standard program, refiners must blend billions of gallons of biofuels like ethanol into their fuel or buy compliance credits, known as RINs, from those that do. Merchant refiners have long opposed the policy because of its cost.

PBF posted outstanding biofuel and emissions credit obligations for the first quarter of 2021 amounting to $848.3 million, up from $118.4 million for the same quarter a year ago, according to the Reuters review. The company did not say how much of the $848.3 million was related to outstanding compliance obligations.

...

U.S. refiners amass over $1 bln biofuel liability as Biden admin mulls relief

https://finance.yahoo.com/news/u-refiners-amass-over-1-19334…

...

U.S. merchant refiners have amassed up to a $1.6 billion shortfall in the credits they will need to comply with U.S. biofuel laws, according to a Reuters review of corporate disclosures, an apparent bet that the Biden administration could let them off the hook or that credit prices will fall.

The big liability among companies including PBF Energy Inc , CVR Energy Inc, Par Pacific Holdings and Delta Airlines comes as the administration of President Joe Biden considers granting oil refiners relief from their biofuel mandates amid soaring credit costs and economic turmoil from the coronavirus pandemic that has hurt the fuel industry.

"There is a sense among refiners that they have to do something right now," said Robert Campbell, head of oil products research at Energy Aspects, referring to the decision among some companies to carry a shortfall in the biofuel credits. "They feel that the point of obligation is extremely challenging for them."

Under the U.S. Renewable Fuel Standard program, refiners must blend billions of gallons of biofuels like ethanol into their fuel or buy compliance credits, known as RINs, from those that do. Merchant refiners have long opposed the policy because of its cost.

PBF posted outstanding biofuel and emissions credit obligations for the first quarter of 2021 amounting to $848.3 million, up from $118.4 million for the same quarter a year ago, according to the Reuters review. The company did not say how much of the $848.3 million was related to outstanding compliance obligations.

...

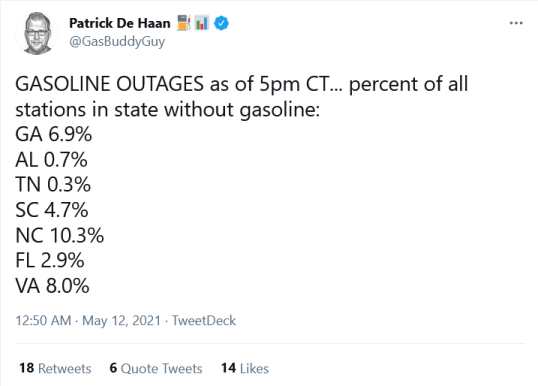

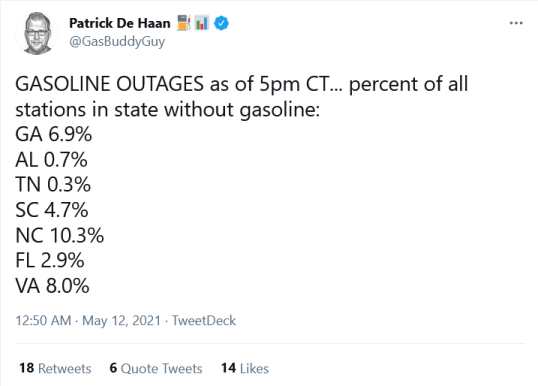

Antwort auf Beitrag Nr.: 68.154.121 von faultcode am 11.05.21 22:17:04

https://twitter.com/GasBuddyGuy/status/1392250845207670785

https://twitter.com/GasBuddyGuy/status/1392250845207670785

Antwort auf Beitrag Nr.: 68.153.779 von faultcode am 11.05.21 21:50:44man kann nur sagen, daß in dieser Peer group PBF am wenigsten heute fiel:

• VLO -2.45%

• MPC -1.96%

• PSX -2.29%

• PBF -0.31%

• VLO -2.45%

• MPC -1.96%

• PSX -2.29%

• PBF -0.31%