Exklusivinterview mit Omar Abu Rashed : Union Investment-Aktienexperte: Ölpreis und König könnten Sa (Seite 3) | Diskussion im Forum

eröffnet am 04.12.19 19:37:28 von

neuester Beitrag 27.03.23 12:40:58 von

neuester Beitrag 27.03.23 12:40:58 von

Beiträge: 59

ID: 1.316.459

ID: 1.316.459

Aufrufe heute: 4

Gesamt: 5.127

Gesamt: 5.127

Aktive User: 0

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 64.547.814 von teecee1 am 26.07.20 14:58:58Reliance Overtakes Exxon to Become World’s No. 2 Energy Firm

Debjit Chakraborty, Bloomberg • July 27, 2020

(Bloomberg) -- Reliance Industries Ltd. toppled Exxon Mobil Corp. to become the world’s largest energy company after Saudi Aramco, as investors piled into the conglomerate lured by the Indian firm’s digital and retail forays.

Reliance, which is controlled by Asia’s richest man and manages the world’s biggest oil refinery complex, rose 4.3% in Mumbai on Friday, taking its market value to $189 billion, while Exxon Mobil lost about $1 billion. Aramco, with a market capitalization of $1.75 trillion, is the world’s biggest ...

https://finance.yahoo.com/news/reliance-overtakes-exxon-beco…

..........................................................................................................................................................

July 16, 2020 / 11:40 AM / 11 days ago

Reliance's stake sale talks with Aramco stall over price, sources say

Nidhi Verma, Clara Denina, Saeed Azhar

3 Min Read

NEW DELHI/LONDON/DUBAI (Reuters) - Talks over the sale of a 20% stake in Reliance Industries Ltd’s oil-to-chemical business to Saudi Aramco have stalled over price, four sources familiar with the matter said.

With the energy market hit by falling demand for crude due to COVID-19, Aramco wants the Indian conglomerate to review the $15 billion it agreed to sell the stake for last year, the sources told Reuters.

“Aramco has told Reliance that refining margins are terrible and are expected to remain subdued in Q3 at least, so they can’t pay the price they have agreed pre-COVID,” one of the sources said.

“In reality, Aramco does not have the money.”

A second source said Reliance would wait for the market to recover rather than settling for a “drastic” revaluation of the asset.

Reliance did not respond to Reuters’ emails seeking a response to the sources’ comments, while Aramco ...

https://www.reuters.com/article/us-reliance-aramco/reliances…

..........................................................................................................................................................

This Oil Crisis Will Completely Transform The Industry

By Irina Slav - Jul 26, 2020, 6:00 PM CDT

When JP Morgan's EMEA head of oil and gas research said last month that this crisis was fundamentally no different from previous crises, he was right - at least in a way. But in some ways, he was wrong, because it is not just out of a sense for the dramatic that most observers are calling the current crisis unprecedented.

This crisis will change the industry in ways no other crisis has done.

Oil sands on the path to diversification Canada's oil sands have been among the worst affected segments of the industry, as Wood Mackenzie noted in a June report. One of the reasons for the extent of the damage was that Canada's oil sands producers never got to recover fully from the previous crash before this one struck.

While elsewhere E&Ps picked up where they had left off while the price crisis of 2014 to 2016 unfolded, Canadian oil sands producers struggled ...

https://oilprice.com/Energy/Energy-General/This-Oil-Crisis-W…

Debjit Chakraborty, Bloomberg • July 27, 2020

(Bloomberg) -- Reliance Industries Ltd. toppled Exxon Mobil Corp. to become the world’s largest energy company after Saudi Aramco, as investors piled into the conglomerate lured by the Indian firm’s digital and retail forays.

Reliance, which is controlled by Asia’s richest man and manages the world’s biggest oil refinery complex, rose 4.3% in Mumbai on Friday, taking its market value to $189 billion, while Exxon Mobil lost about $1 billion. Aramco, with a market capitalization of $1.75 trillion, is the world’s biggest ...

https://finance.yahoo.com/news/reliance-overtakes-exxon-beco…

..........................................................................................................................................................

July 16, 2020 / 11:40 AM / 11 days ago

Reliance's stake sale talks with Aramco stall over price, sources say

Nidhi Verma, Clara Denina, Saeed Azhar

3 Min Read

NEW DELHI/LONDON/DUBAI (Reuters) - Talks over the sale of a 20% stake in Reliance Industries Ltd’s oil-to-chemical business to Saudi Aramco have stalled over price, four sources familiar with the matter said.

With the energy market hit by falling demand for crude due to COVID-19, Aramco wants the Indian conglomerate to review the $15 billion it agreed to sell the stake for last year, the sources told Reuters.

“Aramco has told Reliance that refining margins are terrible and are expected to remain subdued in Q3 at least, so they can’t pay the price they have agreed pre-COVID,” one of the sources said.

“In reality, Aramco does not have the money.”

A second source said Reliance would wait for the market to recover rather than settling for a “drastic” revaluation of the asset.

Reliance did not respond to Reuters’ emails seeking a response to the sources’ comments, while Aramco ...

https://www.reuters.com/article/us-reliance-aramco/reliances…

..........................................................................................................................................................

This Oil Crisis Will Completely Transform The Industry

By Irina Slav - Jul 26, 2020, 6:00 PM CDT

When JP Morgan's EMEA head of oil and gas research said last month that this crisis was fundamentally no different from previous crises, he was right - at least in a way. But in some ways, he was wrong, because it is not just out of a sense for the dramatic that most observers are calling the current crisis unprecedented.

This crisis will change the industry in ways no other crisis has done.

Oil sands on the path to diversification Canada's oil sands have been among the worst affected segments of the industry, as Wood Mackenzie noted in a June report. One of the reasons for the extent of the damage was that Canada's oil sands producers never got to recover fully from the previous crash before this one struck.

While elsewhere E&Ps picked up where they had left off while the price crisis of 2014 to 2016 unfolded, Canadian oil sands producers struggled ...

https://oilprice.com/Energy/Energy-General/This-Oil-Crisis-W…

Antwort auf Beitrag Nr.: 64.218.784 von teecee1 am 29.06.20 11:56:49Big Oil Braces For Brutal Earnings Season

By Nick Cunningham - Jul 25, 2020, 6:00 PM CDT

The oil majors are set to unveil their second-quarter earnings in the coming days, and analysts expect the figures to be pretty rough. Despite their size, the integrated oil majors are slated to post huge losses. The problem is that there is almost nowhere to hide. Oil prices were obviously at historically low levels in the second quarter, including a brief trip deep into negative territory. Typically, during downturns, the majors are shielded by their downstream refining assets – low crude prices lower input costs and cheap fuel tends to stoke demand.

... ☕ ... E & Y Friseur ...

However, the pandemic obviously shut everything down, so demand contracted sharply. With hundreds of millions of people confined to their homes, it didn’t matter if fuel was cheap. As a result, refining margins collapsed.

So, too, did petrochemical demand. Chemical units were unlikely to bolster the battered finances of the oil giants. Meanwhile, the global market for LNG has also plummeted. Natural gas has been another segment in which the oil majors are betting their future growth. But Covid-19 has ravaged gas markets as well.

Perhaps the numbers won’t be as bad as expected. On Friday, ...

https://oilprice.com/Energy/Crude-Oil/Big-Oil-Braces-For-Bru…

..........................................................................................................................................................

Rystad’s New Oil Demand Scenario Banks On Second Wave COVID-19

By Julianne Geiger - Jul 25, 2020, 10:30 AM CDT

Rystad Energy is now changing its base-case scenario for oil demand, banking on a second wave of Covid-19.

The new assumption for the base case now incorporates a mild second wave of the coronavirus, which will stall the global oil demand recovery. While Europe reopens parts of its economy, triggering an increase in oil demand, increases in the number of coronavirus cases in other large oil consumers, including the United States, Brazil, and India will offset those European increases, according to Rystad.

Rystad also added a worst-case scenario—one that sees oil demand to be 3.7 million bpd lower for the remainder of 2020, compared to the above base-case scenario, if full lockdowns are reimplemented globally due to increases in the coronavirus.

Rystad notes, ...

https://oilprice.com/Latest-Energy-News/World-News/Rystads-N…

..........................................................................................................................................................

Mexico is moving toward launching the world's largest oil hedge

25th July, 2020

Mexico has asked the largest banks on Wall Street to bid for its massive oil hedging program, while options for trading in crude oil are growing this week ahead of the giant deal. According to Reuters sources

A source with direct knowledge of the matter said that the Ministry of Finance asked banks for quotations, indicating the start of the hedging implementation process

Every year, Mexico buys financial contracts amounting to one billion dollars, which is the largest oil hedging program in the world, to protect its oil revenues.

Bankers and officials on both sides of the deal expect a lower hedge this year because the options used to protect oil profits are more expensive than last ...

https://economy-news.net/content.php?id=21157

By Nick Cunningham - Jul 25, 2020, 6:00 PM CDT

The oil majors are set to unveil their second-quarter earnings in the coming days, and analysts expect the figures to be pretty rough. Despite their size, the integrated oil majors are slated to post huge losses. The problem is that there is almost nowhere to hide. Oil prices were obviously at historically low levels in the second quarter, including a brief trip deep into negative territory. Typically, during downturns, the majors are shielded by their downstream refining assets – low crude prices lower input costs and cheap fuel tends to stoke demand.

... ☕ ... E & Y Friseur ...

However, the pandemic obviously shut everything down, so demand contracted sharply. With hundreds of millions of people confined to their homes, it didn’t matter if fuel was cheap. As a result, refining margins collapsed.

So, too, did petrochemical demand. Chemical units were unlikely to bolster the battered finances of the oil giants. Meanwhile, the global market for LNG has also plummeted. Natural gas has been another segment in which the oil majors are betting their future growth. But Covid-19 has ravaged gas markets as well.

Perhaps the numbers won’t be as bad as expected. On Friday, ...

https://oilprice.com/Energy/Crude-Oil/Big-Oil-Braces-For-Bru…

..........................................................................................................................................................

Rystad’s New Oil Demand Scenario Banks On Second Wave COVID-19

By Julianne Geiger - Jul 25, 2020, 10:30 AM CDT

Rystad Energy is now changing its base-case scenario for oil demand, banking on a second wave of Covid-19.

The new assumption for the base case now incorporates a mild second wave of the coronavirus, which will stall the global oil demand recovery. While Europe reopens parts of its economy, triggering an increase in oil demand, increases in the number of coronavirus cases in other large oil consumers, including the United States, Brazil, and India will offset those European increases, according to Rystad.

Rystad also added a worst-case scenario—one that sees oil demand to be 3.7 million bpd lower for the remainder of 2020, compared to the above base-case scenario, if full lockdowns are reimplemented globally due to increases in the coronavirus.

Rystad notes, ...

https://oilprice.com/Latest-Energy-News/World-News/Rystads-N…

..........................................................................................................................................................

Mexico is moving toward launching the world's largest oil hedge

25th July, 2020

Mexico has asked the largest banks on Wall Street to bid for its massive oil hedging program, while options for trading in crude oil are growing this week ahead of the giant deal. According to Reuters sources

A source with direct knowledge of the matter said that the Ministry of Finance asked banks for quotations, indicating the start of the hedging implementation process

Every year, Mexico buys financial contracts amounting to one billion dollars, which is the largest oil hedging program in the world, to protect its oil revenues.

Bankers and officials on both sides of the deal expect a lower hedge this year because the options used to protect oil profits are more expensive than last ...

https://economy-news.net/content.php?id=21157

Antwort auf Beitrag Nr.: 63.930.260 von teecee1 am 07.06.20 10:22:26June 18, 2020 / 5:15 PM / 11 days ago

Saudi Aramco cuts hundreds of jobs amid oil market downturn, sources say

DUBAI (Reuters) - State oil giant Saudi Aramco (2222.SE) started laying off hundreds of employees this month, two sources familiar with the matter said, as global energy companies reduce their workforces in response to the coronavirus crisis.

Like other top oil firms, ...

https://www.reuters.com/article/us-saudi-aramco-jobs/saudi-a…

..........................................................................................................................................................

Jun 27, 2020

Saudi Aramco's Dividend Math Doesn't Add Up

David Fickling, Bloomberg News

BC-Saudi-Aramco's-Dividend-Math-Doesn't-Add-Up , David Fickling

(Bloomberg Opinion) -- It’s the mother of all payouts.

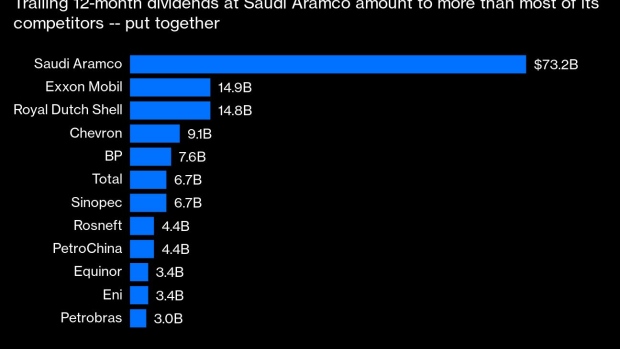

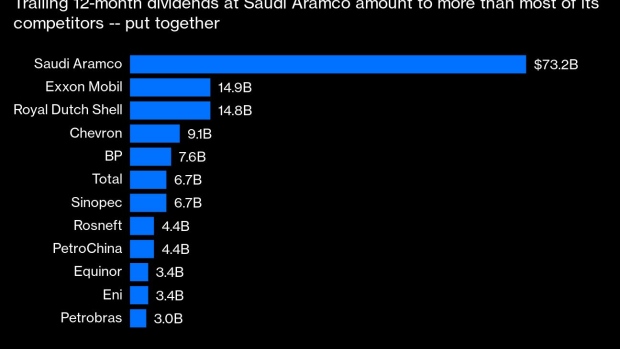

The $75 billion that Saudi Aramco doles out in dividends every year dwarfs what any other listed company gives to shareholders. It’s roughly equivalent to the payouts from Exxon Mobil Corp., Royal Dutch Shell Plc, Chevron Corp., BP Plc, Total SA, PetroChina Co., Eni SpA, Petroleo Brasiliero SA and China Petroleum & Chemical Corp. or Sinopec — put together.

That makes Chief Executive Officer Amin Nasser’s promise to continue that level of returns for the next five years an extraordinary vote of confidence in an oil market awash with uncertainties. Saudi Aramco will be prepared to borrow money to ensure that it meets its commitment this year despite oil prices heading into negative territory, he said this month.

Running up debts to keep the dividend on track is standard practice for energy companies amid the carnage of 2020’s oil market —

https://www.bnnbloomberg.ca/saudi-aramco-s-dividend-math-doe…

..........................................................................................................................................................

BP verkauft Petrochemiegeschäft für fünf Milliarden Dollar

Nachrichtenagentur: dpa-AFX 29.06.2020, 11:08 | 249 | 0 | 0

LONDON (dpa-AFX) - Der Ölkonzern BP verkauft sein Petrochemiegeschäft für insgesamt 5 Milliarden US-Dollar. Käufer ist das britische Chemieunternehmen Ineos, wie BP am Montag in London mitteilte. Dabei erhält der Ölkonzern eine Vorabzahlung von 400 Millionen Dollar, weitere 3,6 Milliarden fließen bei Abschluss der Transaktion, der zum Jahresende erwartet wird. Eine weitere Milliarde Dollar wird in mehreren Tranchen 2021 gezahlt. Mit dem Verkauf schließe BP sein Programm zur Abgabe von Geschäften mit einem Wert von insgesamt 15 Milliarden Dollar ein Jahr früher ab als geplant, ...

BP verkauft Petrochemiegeschäft für fünf Milliarden Dollar | wallstreet-online.de - Vollständiger Artikel unter: https://www.wallstreet-online.de/nachricht/12668677-bp-verka…

..........................................................................................................................................................

Amerikas Öl-Industrie steht vor Pleitewelle: Jetzt schauen alle verzweifelt auf Trump und die Fed

29.06.2020 09:00

Viele Fracking-Unternehmen schreiben hohe Verluste, der Branche droht ein Massensterben. Ein Trumpf aber bleibt: Die Regierung von Präsident Trump wird alles unternehmen, um die strategisch wichtige Branche zu retten.

https://deutsche-wirtschafts-nachrichten.de/504867/Amerikas-…

... 💵 ... Schuldenabbau ... Bankversklavung ...

... 💵 ... Schuldenabbau ... Korruptin etc. ...

... 💵 ... Aufbau ...

..........................................................................................................................................................

Russland warnt die USA vor Regime-Wechsel in Venezuela

28.06.2020 12:00

Moskau hat Venezuela Solidarität im Kampf gegen einen möglichen von der USA betriebenen Regimewechsel in dem Land zugesichert. Doch auch die USA lassen derzeit die Muskeln spielen.

https://deutsche-wirtschafts-nachrichten.de/504923/Russland-…

..........................................................................................................................................................

On V-Day, Russia Vows To Prevent US-Led 'Regime Change' In Venezuela

by Tyler Durden

Wed, 06/24/2020 - 21:25

On Wednesday Russian Foreign Minister Sergey Lavrov used the occasion of Moscow's 75th anniversary V-Day parade commemorating the end of WWII to warn Washington against pushing regime change in Venezuela.

Among other foreign dignitaries, Caracas' top diplomat Jorge Arreaza was in Moscow for the events. Lavrov issued public statements of solidarity expressing support to the socialist country, calling it "a mainstay for countering the attempts to draw the region back into the 19th century and to impose the Monroe Doctrine."

"We strongly support your commitment to combating foreign diktat and any attempts at blatant interference in the domestic affairs of a sovereign state, opposing any attempts at a forced regime change," Lavrov said, as reported in Newsweek. ...

https://www.zerohedge.com/geopolitical/v-day-russia-vows-pre…

..........................................................................................................................................................

18 Million Barrels Of Sanctioned Venezuelan Oil Are Stuck At Sea

By Tsvetana Paraskova - Jun 24, 2020, 11:30 AM CDT

Oil tankers carrying at least 18.1 million barrels of Venezuelan oil are currently idling at sea across the world unable to find buyers – some for as long as six months – as many potential and previous customers of Venezuela’s crude are not taking chances with delivery for fear of incurring secondary U.S. sanctions.

According to Reuters estimates based on shipping data, industry sources, and documents of Venezuela’s state oil firm PDVSA, at least 16 tankers are idling off the coasts of Africa and Southeast Asia because few potential buyers would risk U.S. sanctions for dealing with the regime of Nicolas Maduro.

The 18.1 million barrels of still unsold Venezuelan crude oil is equal to two months of the country’s production at its current rate, according to Reuters.

Over the past months, the U.S. Administration has increasingly stepped up its maximum pressure campaign on Venezuela and its oil industry and exports, seeking to cut off revenues for Maduro’s regime.

Earlier this year, the United States slapped sanctions on Rosneft’s Switzerland-based trading arm and signaled that it was ready to tighten even more the noose around the Venezuelan government.

Last week, the U.S. Department of the Treasury designated three individuals and eight foreign entities, and identified two ...

https://oilprice.com/Latest-Energy-News/World-News/18-Millio…

..........................................................................................................................................................

Schiffe mit Öl aus Venezuela irren auf den Weltmeeren umher

26.06.2020 16:10

Branchendaten zufolge fahren derzeit Tanker mit vielen Millionen Barrel Erdöl auf den Weltmeeren umher, weil sie nach einem Käufer suchen. Denn sie fürchten die USA.

Das "Schwarze Gold" wird zum "Schwarzen Peter": Aus Furcht vor einer Verfolgung durch die US-Behörden wegen möglicher Sanktionsverstöße scheuen Firmen davor zurück, Venezuela Rohöl abzunehmen. Branchendaten zufolge fahren derzeit mindestens 16 Öltanker auf der Suche nach einem Käufer auf den Weltmeeren umher - ...

https://deutsche-wirtschafts-nachrichten.de/504963/Schiffe-m…

... 💣 ... Pechmarie ... 💵 ... de Ölsumpf wird trocken gelegt ,,, Ölsand ...

..........................................................................................................................................................

Owner Of Largest Refinery In India Stops Importing Venezuelan Oil

By Irina Slav - Jun 26, 2020, 9:30 AM CDT

Reliance Industries, the owner of the largest refinery in India and the world, has stopped buying Venezuelan crude, according to unnamed sources in the know who spoke to Bloomberg,

Last year, Reliance bought a quarter of the oil Venezuela exported, but the last time it bought Venezuelan crude this year was in March, Bloomberg reported, citing tanker data, and at a much lower rate than in 2019, at 117,650 bpd.

Reliance is not alone in shunning Venezuelan oil, fearing repercussions from Washington. India’s second-largest refiner, Nayara Energy, has also stopped buying Venezuelan crude, switching to Canadian, Kuwaiti, and Ecuadorian oil, again according to Bloomberg shipping data.

Meanwhile, tankers carrying at least 18.1 million barrels of Venezuelan oil are currently idling at sea across the world unable to find buyers – some for as long as six months – as many potential and previous customers of Venezuela’s crude are not taking chances with delivery for fear of incurring secondary U.S. sanctions.

The latest round of sanction action by Washington against Caracas was to blacklist five Iranian tanker captains and all tankers that have called at Venezuelan ports over the 12 months to June, making many oil traders reconsider their plans. According to shopping brokerage data cited by Reuters earlier this month, there were as many as 77 tankers that have called at Venezuelan ports over the past 12 months, which puts them at risk of being blacklisted.

Despite the sanctions, Venezuela is still exporting some oil, mostly to ...

https://oilprice.com/Latest-Energy-News/World-News/Owner-Of-…

..........................................................................................................................................................

Reliance working to complete Saudi Aramco deal: Mukesh Ambani

1 min read . Updated: 24 Jun 2020, 06:44 AM IST

Written By Nikhil Agarwal

• Reliance and Aramco share a common outlook and vision on evolution of the business in the future, Mukesh Ambani said

• He said the partnership gives the refineries access to a wide portfolio of value accretive crude grades and enhanced feedstock security

NEW DELHI: Having already raised ₹1.15 lakh crore from global tech investors, including Facebook to make the company net debt-free, Reliance Industries chairman Mukesh Ambani said they are now working to complete contours of a $15-billion deal with Saudi Aramco. Announced in the oil-to-telecom conglomerate's last year annual general meeting (AGM), the deal was to be concluded by March 2020 but has been delayed.

Reliance has not yet given a fresh timeline for the completion of the deal.

"In the energy businesses, ...

https://www.livemint.com/companies/news/reliance-working-to-…

Saudi Aramco cuts hundreds of jobs amid oil market downturn, sources say

DUBAI (Reuters) - State oil giant Saudi Aramco (2222.SE) started laying off hundreds of employees this month, two sources familiar with the matter said, as global energy companies reduce their workforces in response to the coronavirus crisis.

Like other top oil firms, ...

https://www.reuters.com/article/us-saudi-aramco-jobs/saudi-a…

..........................................................................................................................................................

Jun 27, 2020

Saudi Aramco's Dividend Math Doesn't Add Up

David Fickling, Bloomberg News

BC-Saudi-Aramco's-Dividend-Math-Doesn't-Add-Up , David Fickling

(Bloomberg Opinion) -- It’s the mother of all payouts.

The $75 billion that Saudi Aramco doles out in dividends every year dwarfs what any other listed company gives to shareholders. It’s roughly equivalent to the payouts from Exxon Mobil Corp., Royal Dutch Shell Plc, Chevron Corp., BP Plc, Total SA, PetroChina Co., Eni SpA, Petroleo Brasiliero SA and China Petroleum & Chemical Corp. or Sinopec — put together.

That makes Chief Executive Officer Amin Nasser’s promise to continue that level of returns for the next five years an extraordinary vote of confidence in an oil market awash with uncertainties. Saudi Aramco will be prepared to borrow money to ensure that it meets its commitment this year despite oil prices heading into negative territory, he said this month.

Running up debts to keep the dividend on track is standard practice for energy companies amid the carnage of 2020’s oil market —

https://www.bnnbloomberg.ca/saudi-aramco-s-dividend-math-doe…

..........................................................................................................................................................

BP verkauft Petrochemiegeschäft für fünf Milliarden Dollar

Nachrichtenagentur: dpa-AFX 29.06.2020, 11:08 | 249 | 0 | 0

LONDON (dpa-AFX) - Der Ölkonzern BP verkauft sein Petrochemiegeschäft für insgesamt 5 Milliarden US-Dollar. Käufer ist das britische Chemieunternehmen Ineos, wie BP am Montag in London mitteilte. Dabei erhält der Ölkonzern eine Vorabzahlung von 400 Millionen Dollar, weitere 3,6 Milliarden fließen bei Abschluss der Transaktion, der zum Jahresende erwartet wird. Eine weitere Milliarde Dollar wird in mehreren Tranchen 2021 gezahlt. Mit dem Verkauf schließe BP sein Programm zur Abgabe von Geschäften mit einem Wert von insgesamt 15 Milliarden Dollar ein Jahr früher ab als geplant, ...

BP verkauft Petrochemiegeschäft für fünf Milliarden Dollar | wallstreet-online.de - Vollständiger Artikel unter: https://www.wallstreet-online.de/nachricht/12668677-bp-verka…

..........................................................................................................................................................

Amerikas Öl-Industrie steht vor Pleitewelle: Jetzt schauen alle verzweifelt auf Trump und die Fed

29.06.2020 09:00

Viele Fracking-Unternehmen schreiben hohe Verluste, der Branche droht ein Massensterben. Ein Trumpf aber bleibt: Die Regierung von Präsident Trump wird alles unternehmen, um die strategisch wichtige Branche zu retten.

https://deutsche-wirtschafts-nachrichten.de/504867/Amerikas-…

... 💵 ... Schuldenabbau ... Bankversklavung ...

... 💵 ... Schuldenabbau ... Korruptin etc. ...

... 💵 ... Aufbau ...

..........................................................................................................................................................

Russland warnt die USA vor Regime-Wechsel in Venezuela

28.06.2020 12:00

Moskau hat Venezuela Solidarität im Kampf gegen einen möglichen von der USA betriebenen Regimewechsel in dem Land zugesichert. Doch auch die USA lassen derzeit die Muskeln spielen.

https://deutsche-wirtschafts-nachrichten.de/504923/Russland-…

..........................................................................................................................................................

On V-Day, Russia Vows To Prevent US-Led 'Regime Change' In Venezuela

by Tyler Durden

Wed, 06/24/2020 - 21:25

On Wednesday Russian Foreign Minister Sergey Lavrov used the occasion of Moscow's 75th anniversary V-Day parade commemorating the end of WWII to warn Washington against pushing regime change in Venezuela.

Among other foreign dignitaries, Caracas' top diplomat Jorge Arreaza was in Moscow for the events. Lavrov issued public statements of solidarity expressing support to the socialist country, calling it "a mainstay for countering the attempts to draw the region back into the 19th century and to impose the Monroe Doctrine."

"We strongly support your commitment to combating foreign diktat and any attempts at blatant interference in the domestic affairs of a sovereign state, opposing any attempts at a forced regime change," Lavrov said, as reported in Newsweek. ...

https://www.zerohedge.com/geopolitical/v-day-russia-vows-pre…

..........................................................................................................................................................

18 Million Barrels Of Sanctioned Venezuelan Oil Are Stuck At Sea

By Tsvetana Paraskova - Jun 24, 2020, 11:30 AM CDT

Oil tankers carrying at least 18.1 million barrels of Venezuelan oil are currently idling at sea across the world unable to find buyers – some for as long as six months – as many potential and previous customers of Venezuela’s crude are not taking chances with delivery for fear of incurring secondary U.S. sanctions.

According to Reuters estimates based on shipping data, industry sources, and documents of Venezuela’s state oil firm PDVSA, at least 16 tankers are idling off the coasts of Africa and Southeast Asia because few potential buyers would risk U.S. sanctions for dealing with the regime of Nicolas Maduro.

The 18.1 million barrels of still unsold Venezuelan crude oil is equal to two months of the country’s production at its current rate, according to Reuters.

Over the past months, the U.S. Administration has increasingly stepped up its maximum pressure campaign on Venezuela and its oil industry and exports, seeking to cut off revenues for Maduro’s regime.

Earlier this year, the United States slapped sanctions on Rosneft’s Switzerland-based trading arm and signaled that it was ready to tighten even more the noose around the Venezuelan government.

Last week, the U.S. Department of the Treasury designated three individuals and eight foreign entities, and identified two ...

https://oilprice.com/Latest-Energy-News/World-News/18-Millio…

..........................................................................................................................................................

Schiffe mit Öl aus Venezuela irren auf den Weltmeeren umher

26.06.2020 16:10

Branchendaten zufolge fahren derzeit Tanker mit vielen Millionen Barrel Erdöl auf den Weltmeeren umher, weil sie nach einem Käufer suchen. Denn sie fürchten die USA.

Das "Schwarze Gold" wird zum "Schwarzen Peter": Aus Furcht vor einer Verfolgung durch die US-Behörden wegen möglicher Sanktionsverstöße scheuen Firmen davor zurück, Venezuela Rohöl abzunehmen. Branchendaten zufolge fahren derzeit mindestens 16 Öltanker auf der Suche nach einem Käufer auf den Weltmeeren umher - ...

https://deutsche-wirtschafts-nachrichten.de/504963/Schiffe-m…

... 💣 ... Pechmarie ... 💵 ... de Ölsumpf wird trocken gelegt ,,, Ölsand ...

..........................................................................................................................................................

Owner Of Largest Refinery In India Stops Importing Venezuelan Oil

By Irina Slav - Jun 26, 2020, 9:30 AM CDT

Reliance Industries, the owner of the largest refinery in India and the world, has stopped buying Venezuelan crude, according to unnamed sources in the know who spoke to Bloomberg,

Last year, Reliance bought a quarter of the oil Venezuela exported, but the last time it bought Venezuelan crude this year was in March, Bloomberg reported, citing tanker data, and at a much lower rate than in 2019, at 117,650 bpd.

Reliance is not alone in shunning Venezuelan oil, fearing repercussions from Washington. India’s second-largest refiner, Nayara Energy, has also stopped buying Venezuelan crude, switching to Canadian, Kuwaiti, and Ecuadorian oil, again according to Bloomberg shipping data.

Meanwhile, tankers carrying at least 18.1 million barrels of Venezuelan oil are currently idling at sea across the world unable to find buyers – some for as long as six months – as many potential and previous customers of Venezuela’s crude are not taking chances with delivery for fear of incurring secondary U.S. sanctions.

The latest round of sanction action by Washington against Caracas was to blacklist five Iranian tanker captains and all tankers that have called at Venezuelan ports over the 12 months to June, making many oil traders reconsider their plans. According to shopping brokerage data cited by Reuters earlier this month, there were as many as 77 tankers that have called at Venezuelan ports over the past 12 months, which puts them at risk of being blacklisted.

Despite the sanctions, Venezuela is still exporting some oil, mostly to ...

https://oilprice.com/Latest-Energy-News/World-News/Owner-Of-…

..........................................................................................................................................................

Reliance working to complete Saudi Aramco deal: Mukesh Ambani

1 min read . Updated: 24 Jun 2020, 06:44 AM IST

Written By Nikhil Agarwal

• Reliance and Aramco share a common outlook and vision on evolution of the business in the future, Mukesh Ambani said

• He said the partnership gives the refineries access to a wide portfolio of value accretive crude grades and enhanced feedstock security

NEW DELHI: Having already raised ₹1.15 lakh crore from global tech investors, including Facebook to make the company net debt-free, Reliance Industries chairman Mukesh Ambani said they are now working to complete contours of a $15-billion deal with Saudi Aramco. Announced in the oil-to-telecom conglomerate's last year annual general meeting (AGM), the deal was to be concluded by March 2020 but has been delayed.

Reliance has not yet given a fresh timeline for the completion of the deal.

"In the energy businesses, ...

https://www.livemint.com/companies/news/reliance-working-to-…

Antwort auf Beitrag Nr.: 63.857.072 von teecee1 am 31.05.20 18:38:19OPEC+ Closes In On Output Cut Extension

By Irina Slav - Jun 05, 2020, 9:30 AM CDT

OPEC+ is reportedly close to agreeing on an extension of the deep production cuts it signed up for in April, after the cartel’s leaders managed to convince Iraq of the continued need for oil production control, Bloomberg’s Javier Blas and Grant Smith write.

There have been doubts about the future of the cuts because earlier reports said that Russia may not be on board with them. Then Iraq came to the fore as a stumbling block.

Bloomberg reported yesterday that Saudi Arabia and Russia were getting increasingly fed up with OPEC’s number-two’s consistent failure to comply with its production quotas.

“Riyadh and Moscow are not kidding about implementing some form of compliance-improvement mechanism,” Rapidan Energy Group founder Bob McNally told Bloomberg. “Without it, they walk.”

According to the Bloomberg report, ...

https://oilprice.com/Latest-Energy-News/World-News/OPEC-Clos…

...........................................................................................................................................................

Opec startet Gespräche über Verlängerung der Förderkürzung

18:25 06.06.2020(aktualisiert 18:26 06.06.2020) https://sptnkne.ws/CBdM

Die Organisation erdölexportierender Länder (OPEC) hat am Samstag Verhandlungen über eine mögliche Verlängerung der aktuellen Drosselung ihrer Ölproduktion begonnen.

Damit wollen die Opec-Mitglieder den Preisverfall in Zeiten der Corona-Krise stoppen. Nach der internen Abstimmung plant das Ölkartell mit seinen Kooperationspartnern, ...

Allerdings will das Kartell die Preise auch nicht zu sehr hochtreiben. Das könnte die US-Konkurrenz wieder stärker ins Spiel bringen, die bei Preisen jenseits der 40 Dollar für ein Barrel (je 159 Liter) wieder kostendeckend produzieren könnte. Mit einem starken Anstieg der Ölpreise würde sich die Opec ihr eigenes Grab schaufeln, ...

https://de.sputniknews.com/wirtschaft/20200606327309192-opec…

...........................................................................................................................................................

OPEC+ Agrees On Extending Record Output Cuts

By Tom Kool - Jun 06, 2020, 2:20 PM CDT

Algeria’s Energy Minister Mohamed Arkab, OPEC’s current President summed up the group’s sentiment by saying that "Despite the progress achieved to date, we cannot afford to rest on our laurels,''.

The last couple of days, the cartel’s de-facto leader Saudi Arabia negotiated with other OPEC members and some non-OPEC countries including Russia, Kazakhstan and Azerbaijan to extend the current 9.7 million bpd output cuts for at least another month.

Most countries partaking in the record production cuts were willing to continue the current deal, ...

https://oilprice.com/Energy/Crude-Oil/OPEC-Agrees-On-Extendi…

..........................................................................................................................................................

CEOs Bank Big Bonuses As Oil Companies Go Bankrupt

By Alex Kimani - Jun 06, 2020, 6:00 PM CDT

When public oil and gas companies are doing relatively well, many are happy to adopt a pay-for-performance model to reward CEOs and executives. However, the tables are quickly turned when things go to the dogs. When these companies go bankrupt, the misery is shared by employees who lose their jobs; retirees see their benefits and pensions go up in smoke, while shareholders and bondholders get wiped out. In sharp contrast, it's very common for blue-chip executives who have run their companies to the ground to receive multi-million dollar golden sendoffs. Indeed, top executives of oil and gas companies going through Chapter 11 frequently receive very fat payouts in the form of cash bonuses, stock grants, and other benefits that often exceed payments during the good times.

It's not any different this time around. ...

https://oilprice.com/Energy/Energy-General/CEOs-Bank-Big-Bon…

..........................................................................................................................................................

Bohrinseln stehen wegen Öl-Crash vor dem Aus

06.06.2020 16:53

Die aktuelle Weltwirtschaftskrise könnte der Offshore-Ölbranche den Todesstoß versetzen. Denn schon vor dem letzten Preis-Crash waren die Ölpreise eigentlich zu niedrig, um die beteiligten Unternehmen tragen zu können.

Deutsche Wirtschaftsnachrichten

Viele Offshore-Projekte haben sich noch nicht einmal von der letzten Krise erholt. (Foto: dpa)

- Welche Rolle Bohrinseln heute spielen und wie die aktuelle Krise sie belastet

- Wo sich derzeit die zahlreichen Problemen die Offshore-Ölbranche zeigen

- Warum Bohrinseln Stück für Stück durch konkurrierende Technologien ersetzt werden

https://deutsche-wirtschafts-nachrichten.de/504421/Bohrinsel…

..........................................................................................................................................................

China Begins Consolidation Of $100+ Billion Oil & Gas Pipeline Industry

By Tsvetana Paraskova - Jun 05, 2020, 1:30 PM CDT

China has required the three biggest state-held oil corporations to transfer the management of half of their liquefied natural gas (LNG) terminals to the newly created state-controlled midstream firm, Caixin Global reported, citing industry insiders.

The transfer of 10 LNG terminals owned by China National Petroleum Corporation (CNPC), Sinopec, and China National Offshore Oil Corporation (CNOOC) is the first step in China’s plan to consolidate the oil and gas pipeline infrastructure into a new giant state-held midstream company.

At the end of last year, ...

https://oilprice.com/Latest-Energy-News/World-News/China-Beg…

... ... QFS-Kontrolle ... Gesara ... etc. ... New China ...

... QFS-Kontrolle ... Gesara ... etc. ... New China ...

By Irina Slav - Jun 05, 2020, 9:30 AM CDT

OPEC+ is reportedly close to agreeing on an extension of the deep production cuts it signed up for in April, after the cartel’s leaders managed to convince Iraq of the continued need for oil production control, Bloomberg’s Javier Blas and Grant Smith write.

There have been doubts about the future of the cuts because earlier reports said that Russia may not be on board with them. Then Iraq came to the fore as a stumbling block.

Bloomberg reported yesterday that Saudi Arabia and Russia were getting increasingly fed up with OPEC’s number-two’s consistent failure to comply with its production quotas.

“Riyadh and Moscow are not kidding about implementing some form of compliance-improvement mechanism,” Rapidan Energy Group founder Bob McNally told Bloomberg. “Without it, they walk.”

According to the Bloomberg report, ...

https://oilprice.com/Latest-Energy-News/World-News/OPEC-Clos…

...........................................................................................................................................................

Opec startet Gespräche über Verlängerung der Förderkürzung

18:25 06.06.2020(aktualisiert 18:26 06.06.2020) https://sptnkne.ws/CBdM

Die Organisation erdölexportierender Länder (OPEC) hat am Samstag Verhandlungen über eine mögliche Verlängerung der aktuellen Drosselung ihrer Ölproduktion begonnen.

Damit wollen die Opec-Mitglieder den Preisverfall in Zeiten der Corona-Krise stoppen. Nach der internen Abstimmung plant das Ölkartell mit seinen Kooperationspartnern, ...

Allerdings will das Kartell die Preise auch nicht zu sehr hochtreiben. Das könnte die US-Konkurrenz wieder stärker ins Spiel bringen, die bei Preisen jenseits der 40 Dollar für ein Barrel (je 159 Liter) wieder kostendeckend produzieren könnte. Mit einem starken Anstieg der Ölpreise würde sich die Opec ihr eigenes Grab schaufeln, ...

https://de.sputniknews.com/wirtschaft/20200606327309192-opec…

...........................................................................................................................................................

OPEC+ Agrees On Extending Record Output Cuts

By Tom Kool - Jun 06, 2020, 2:20 PM CDT

Algeria’s Energy Minister Mohamed Arkab, OPEC’s current President summed up the group’s sentiment by saying that "Despite the progress achieved to date, we cannot afford to rest on our laurels,''.

The last couple of days, the cartel’s de-facto leader Saudi Arabia negotiated with other OPEC members and some non-OPEC countries including Russia, Kazakhstan and Azerbaijan to extend the current 9.7 million bpd output cuts for at least another month.

Most countries partaking in the record production cuts were willing to continue the current deal, ...

https://oilprice.com/Energy/Crude-Oil/OPEC-Agrees-On-Extendi…

..........................................................................................................................................................

CEOs Bank Big Bonuses As Oil Companies Go Bankrupt

By Alex Kimani - Jun 06, 2020, 6:00 PM CDT

When public oil and gas companies are doing relatively well, many are happy to adopt a pay-for-performance model to reward CEOs and executives. However, the tables are quickly turned when things go to the dogs. When these companies go bankrupt, the misery is shared by employees who lose their jobs; retirees see their benefits and pensions go up in smoke, while shareholders and bondholders get wiped out. In sharp contrast, it's very common for blue-chip executives who have run their companies to the ground to receive multi-million dollar golden sendoffs. Indeed, top executives of oil and gas companies going through Chapter 11 frequently receive very fat payouts in the form of cash bonuses, stock grants, and other benefits that often exceed payments during the good times.

It's not any different this time around. ...

https://oilprice.com/Energy/Energy-General/CEOs-Bank-Big-Bon…

..........................................................................................................................................................

Bohrinseln stehen wegen Öl-Crash vor dem Aus

06.06.2020 16:53

Die aktuelle Weltwirtschaftskrise könnte der Offshore-Ölbranche den Todesstoß versetzen. Denn schon vor dem letzten Preis-Crash waren die Ölpreise eigentlich zu niedrig, um die beteiligten Unternehmen tragen zu können.

Deutsche Wirtschaftsnachrichten

Viele Offshore-Projekte haben sich noch nicht einmal von der letzten Krise erholt. (Foto: dpa)

- Welche Rolle Bohrinseln heute spielen und wie die aktuelle Krise sie belastet

- Wo sich derzeit die zahlreichen Problemen die Offshore-Ölbranche zeigen

- Warum Bohrinseln Stück für Stück durch konkurrierende Technologien ersetzt werden

https://deutsche-wirtschafts-nachrichten.de/504421/Bohrinsel…

..........................................................................................................................................................

China Begins Consolidation Of $100+ Billion Oil & Gas Pipeline Industry

By Tsvetana Paraskova - Jun 05, 2020, 1:30 PM CDT

China has required the three biggest state-held oil corporations to transfer the management of half of their liquefied natural gas (LNG) terminals to the newly created state-controlled midstream firm, Caixin Global reported, citing industry insiders.

The transfer of 10 LNG terminals owned by China National Petroleum Corporation (CNPC), Sinopec, and China National Offshore Oil Corporation (CNOOC) is the first step in China’s plan to consolidate the oil and gas pipeline infrastructure into a new giant state-held midstream company.

At the end of last year, ...

https://oilprice.com/Latest-Energy-News/World-News/China-Beg…

...

... QFS-Kontrolle ... Gesara ... etc. ... New China ...

... QFS-Kontrolle ... Gesara ... etc. ... New China ...

Antwort auf Beitrag Nr.: 63.767.920 von teecee1 am 22.05.20 09:23:47Iranian Oil Reaches Crisis-Stricken Venezuela

By Editorial Dept - May 29, 2020, 12:00 PM CDT

- The fourth Iranian fuel tanker has made its way into Venezuelan waters in a direct challenge to US sanctions on both countries. The first three tankers that Iran sent to Venezuela have already arrived and are in the process of unloading. The total deliveries from Iran to Venezuela are expected to be about 1.5 million barrels of gasoline and refining components that are critical to the nation’s oil industry survival. Venezuela has already nearly completely shut down all of its refineries, partly due to years and years of maintenance neglect and partly because it lacks the diluent to refine its ultra-heavy crude oil, which it used to import prior to the sanctions. There are five tankers total in the shipment from Iran. The lack of any response will play poorly against the Trump administration, ...

https://oilprice.com/Energy/Energy-General/Iranian-Oil-Reach…

.........................................................................................................................................................

Venezuela: Staatsmonopol für Treibstoff aufgehoben – 200 Tankstellen privatisiert

Epoch Times31. Mai 2020 Aktualisiert: 31. Mai 2020 17:04

Angesichts der Krise in Venezuela hat die sozialistische Regierung ein Ende des Staatsmonopols für Treibstoff beschlossen. Das verkündete Staatschef Nicolás Maduro in einer Rede.

Angesichts der Krise in Venezuela hat die sozialistische Regierung zum 1. Juni eine Erhöhung der Benzinpreise und ein Ende des Staatsmonopols für Treibstoff beschlossen. „Wir haben entschieden, dass 200 Tankstellen dieses Produkt zum internationalen Preis verkaufen können“, ...

Der internationale Preis für Benzin sei mit 0,50 Dollar (0,45 Euro) festgelegt worden, führte Maduro aus. An wen die Lizenzen für die privat geführten Tankstellen gingen und ob es dazu ein Bieterverfahren gab, teilte der Präsident nicht mit.

Maduro kündigte zugleich ein Subventionssystem für weiterhin günstigeren Treibstoff an. Für ein Privatauto können demnach monatlich 120 Liter Benzin zum Literpreis von 5.000 Bolivar (0,023 Euro) gekauft werden, für Motorräder monatlich 60 Liter. Für den öffentlichen Verkehr soll der Treibstoff zu 100 Prozent subventioniert werden.

Venezuela ist das erdölreichste Land der Welt, ...

... ... wer wird damit ausgeschalten ...

... wer wird damit ausgeschalten ...

https://www.epochtimes.de/politik/welt/venezuela-beendet-sta…

.........................................................................................................................................................

U.S. Regulators Probe Investor Risk Disclosure Of World’s Top Oil ETF

By Tsvetana Paraskova - May 29, 2020, 3:30 PM CDT

The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are investigating the most popular exchange-traded fund tracking crude oil prices, the United States Oil Fund, to ascertain if the fund has managed to properly disclose to investors the risks, Bloomberg reported on Friday, citing three sources familiar with the issue.

The United States Oil Fund LP (NYSEARCA: USO), one of the most popular oil-tracking ETFs for retail investors, was said to be one of the reasons for the historic plunge in May WTI Crude futures on April 20, a day before the May contract expired on April 21.

Many retail investors ...

https://oilprice.com/Latest-Energy-News/World-News/OPEC-Comp…

.........................................................................................................................................................

OPEC Compliance With Output Cuts Was Only 74% In May

By Julianne Geiger - May 29, 2020, 5:30 PM CDT

Not even a full month into OPEC’s deep production cut agreement, rumors have already surfaced that there is a difference of opinion over a possible extension of the oil production cuts—as usual, with Saudi Arabia on one side and Russia on the other.

But those discussions seem premature, given the latest Reuters survey that suggests that the cartel failed to fully comply with its agreed-upon quotas in May.

According to the survey data, Nigeria and Iraq did not live up to their commitments under the massive production cut deal that promised to take 9.7 million barrels of oil production per day out of the oversupplied market.

Overall, the survey showed the group cut just 5.91 million bpd from April levels, producing 24.77 million bpd. This is 4.48 million bpd of the promised reduction, or 74% compliant.

While some have suggested that the reason for OPEC’s failure to bring production down to promised levels is due to contractual obligations with buyers given the short timeframe between the date the agreement was made and its implementation, ...

https://oilprice.com/Latest-Energy-News/World-News/OPEC-Comp…

.........................................................................................................................................................

Russia’s Top Oil Producer Is Struggling With Output Cuts

By Tsvetana Paraskova - May 28, 2020, 4:30 PM CDT

Russia’s largest oil producer, Rosneft, is struggling to supply its long-term buyers with crude oil as it has to cut output due to the OPEC+ deal and will find it hard to keep the current cuts through the end of 2020, as Saudi Arabia is reportedly proposing, Reuters reported on Thursday, quoting sources with knowledge of the matter.

“Rosneft is in pain... They must supply refineries, term buyers. There are simply no resources,” one source with knowledge of the company’s operations told Reuters.

This ‘pain’ for Rosneft may tip the scales in favor of Russia not agreeing to extend the current deep cuts through 2020 –

https://oilprice.com/Latest-Energy-News/World-News/Russias-T…

By Editorial Dept - May 29, 2020, 12:00 PM CDT

- The fourth Iranian fuel tanker has made its way into Venezuelan waters in a direct challenge to US sanctions on both countries. The first three tankers that Iran sent to Venezuela have already arrived and are in the process of unloading. The total deliveries from Iran to Venezuela are expected to be about 1.5 million barrels of gasoline and refining components that are critical to the nation’s oil industry survival. Venezuela has already nearly completely shut down all of its refineries, partly due to years and years of maintenance neglect and partly because it lacks the diluent to refine its ultra-heavy crude oil, which it used to import prior to the sanctions. There are five tankers total in the shipment from Iran. The lack of any response will play poorly against the Trump administration, ...

https://oilprice.com/Energy/Energy-General/Iranian-Oil-Reach…

.........................................................................................................................................................

Venezuela: Staatsmonopol für Treibstoff aufgehoben – 200 Tankstellen privatisiert

Epoch Times31. Mai 2020 Aktualisiert: 31. Mai 2020 17:04

Angesichts der Krise in Venezuela hat die sozialistische Regierung ein Ende des Staatsmonopols für Treibstoff beschlossen. Das verkündete Staatschef Nicolás Maduro in einer Rede.

Angesichts der Krise in Venezuela hat die sozialistische Regierung zum 1. Juni eine Erhöhung der Benzinpreise und ein Ende des Staatsmonopols für Treibstoff beschlossen. „Wir haben entschieden, dass 200 Tankstellen dieses Produkt zum internationalen Preis verkaufen können“, ...

Der internationale Preis für Benzin sei mit 0,50 Dollar (0,45 Euro) festgelegt worden, führte Maduro aus. An wen die Lizenzen für die privat geführten Tankstellen gingen und ob es dazu ein Bieterverfahren gab, teilte der Präsident nicht mit.

Maduro kündigte zugleich ein Subventionssystem für weiterhin günstigeren Treibstoff an. Für ein Privatauto können demnach monatlich 120 Liter Benzin zum Literpreis von 5.000 Bolivar (0,023 Euro) gekauft werden, für Motorräder monatlich 60 Liter. Für den öffentlichen Verkehr soll der Treibstoff zu 100 Prozent subventioniert werden.

Venezuela ist das erdölreichste Land der Welt, ...

...

... wer wird damit ausgeschalten ...

... wer wird damit ausgeschalten ...https://www.epochtimes.de/politik/welt/venezuela-beendet-sta…

.........................................................................................................................................................

U.S. Regulators Probe Investor Risk Disclosure Of World’s Top Oil ETF

By Tsvetana Paraskova - May 29, 2020, 3:30 PM CDT

The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are investigating the most popular exchange-traded fund tracking crude oil prices, the United States Oil Fund, to ascertain if the fund has managed to properly disclose to investors the risks, Bloomberg reported on Friday, citing three sources familiar with the issue.

The United States Oil Fund LP (NYSEARCA: USO), one of the most popular oil-tracking ETFs for retail investors, was said to be one of the reasons for the historic plunge in May WTI Crude futures on April 20, a day before the May contract expired on April 21.

Many retail investors ...

https://oilprice.com/Latest-Energy-News/World-News/OPEC-Comp…

.........................................................................................................................................................

OPEC Compliance With Output Cuts Was Only 74% In May

By Julianne Geiger - May 29, 2020, 5:30 PM CDT

Not even a full month into OPEC’s deep production cut agreement, rumors have already surfaced that there is a difference of opinion over a possible extension of the oil production cuts—as usual, with Saudi Arabia on one side and Russia on the other.

But those discussions seem premature, given the latest Reuters survey that suggests that the cartel failed to fully comply with its agreed-upon quotas in May.

According to the survey data, Nigeria and Iraq did not live up to their commitments under the massive production cut deal that promised to take 9.7 million barrels of oil production per day out of the oversupplied market.

Overall, the survey showed the group cut just 5.91 million bpd from April levels, producing 24.77 million bpd. This is 4.48 million bpd of the promised reduction, or 74% compliant.

While some have suggested that the reason for OPEC’s failure to bring production down to promised levels is due to contractual obligations with buyers given the short timeframe between the date the agreement was made and its implementation, ...

https://oilprice.com/Latest-Energy-News/World-News/OPEC-Comp…

.........................................................................................................................................................

Russia’s Top Oil Producer Is Struggling With Output Cuts

By Tsvetana Paraskova - May 28, 2020, 4:30 PM CDT

Russia’s largest oil producer, Rosneft, is struggling to supply its long-term buyers with crude oil as it has to cut output due to the OPEC+ deal and will find it hard to keep the current cuts through the end of 2020, as Saudi Arabia is reportedly proposing, Reuters reported on Thursday, quoting sources with knowledge of the matter.

“Rosneft is in pain... They must supply refineries, term buyers. There are simply no resources,” one source with knowledge of the company’s operations told Reuters.

This ‘pain’ for Rosneft may tip the scales in favor of Russia not agreeing to extend the current deep cuts through 2020 –

https://oilprice.com/Latest-Energy-News/World-News/Russias-T…

Antwort auf Beitrag Nr.: 63.753.508 von teecee1 am 20.05.20 17:33:53 ...  ... staatlich ... an der Börse ... kann man nichts ... wirklich verstaatlichen ... "Staatsbank"en ... priv. Königreich ... Privatbanken ...

... staatlich ... an der Börse ... kann man nichts ... wirklich verstaatlichen ... "Staatsbank"en ... priv. Königreich ... Privatbanken ...

... ein Staatsunternehmen bleibt im Staat ... Staatsgebiet ... und ... ------ ... nicht in anderen Staats-Unternehmen ein ...

The Oil Price War Has Put A $69 Billion Mega Deal At Risk

By Simon Watkins - May 20, 2020, 7:00 PM CDT

Even before the latest slew of announcements regarding the agreement by Saudi Arabia’s flagship oil and gas company, Aramco, to acquire a 70 percent stake in the Kingdom’s key petrochemicals company, Saudi Basic Industries Corporation (SABIC), for US$69.1 billion, from the country’s sovereign wealth fund, the Public Investment Fund (PIF), the ‘deal’ looked like a meaningless accounting trick that transfers money from one side of the Saudi balance sheet to another. It looked like that because that is what it is but it is much worse than that as well.

Over and above the rhetorical nonsense spouted by the various involved participants about value-enhancing ‘synergies’ between the two entities floats the stark fact that there are none at all. Aramco chief executive officer, Amin Nasser, has often stressed that he wants to position the company less as a straightforward crude oil extraction unit and more as a high-value-added developer of advanced petrochemical products.

However, Aramco buying a majority stake in SABIC, given Aramco’s existing downstream infrastructure, will lead to enormous duplication of resources – people, offices, equipment, research and development, marketing, and capital employed, amongst others. In addition, overlaying SABIC’s existing senior and middle management with those of Aramco, ...

https://oilprice.com/Energy/Energy-General/Oil-War-Puts-Saud…

.........................................................................

Aramco declined to comment.

The Saudi state-owned company has been developing its own gas resources as well as eyeing assets in the United States, Russia, Australia and Africa, the company’s chief executive officer and the Saudi energy minister have said. ...

https://www.hellenicshippingnews.com/saudi-aramcos-bahri-puts-lng-tanker-plan-on-hold-sources/

..........................................................................................................................................................

COVID Crisis Could Unify World’s Largest Oil Companies

By Alex Kimani - May 21, 2020, 7:00 PM CDT

Sir Winston Churchill once admonished leaders to never let a good crisis go to waste. Wall Street banks and other large banks have been paying attention: They were shrewd enough to seize the opportunity presented by the last financial crisis to get hard-nosed government agencies to approve giant M&A deals they would otherwise have frowned upon.

The oil sector should take its cue from the banking sector and try out a little Churchillian wisdom.

Rob Cox, global correspondent for Reuters Breakingviews, seems to feel that is inevitable. He has told Reuters that the Covid-19 crisis could lead to merger mania in sectors like telecoms, auto, consumer goods, and energy.

But unlike the mid-cap energy mergers that had begun to break out before the crisis struck, Rob says tie-ups between giant producers like ExxonMobil (NYSE:XOM), Chevron (NYSE:CVX) and BP(NYSE:BP) among others is now within the realm of possibility.

Cutting Costs

... Giant energy companies could use the cost-cutting gambit to justify mammoth deals that would otherwise fail to pass muster.

Under this backdrop, Exxon and Chevron might bandy together, and even throw in BP for good measure, to form the acronymous “ExChevBrit” whose combined market cap of $425 billion and reserve pool of ~70 billion barrels of oil equivalent would still pale in comparison to Saudi Aramco’s $1.6 trillion value and 270 billion Boe. ...

... ... was machen wir mit unseren Verbindlichkeiten ... unter den Ölteppich kehren ... die wir den Investoren schulden ...

... was machen wir mit unseren Verbindlichkeiten ... unter den Ölteppich kehren ... die wir den Investoren schulden ...

https://oilprice.com/Energy/Energy-General/COVID-Crisis-Coul…

... staatlich ... an der Börse ... kann man nichts ... wirklich verstaatlichen ... "Staatsbank"en ... priv. Königreich ... Privatbanken ...

... staatlich ... an der Börse ... kann man nichts ... wirklich verstaatlichen ... "Staatsbank"en ... priv. Königreich ... Privatbanken ... ... ein Staatsunternehmen bleibt im Staat ... Staatsgebiet ... und ... ------ ... nicht in anderen Staats-Unternehmen ein ...

The Oil Price War Has Put A $69 Billion Mega Deal At Risk

By Simon Watkins - May 20, 2020, 7:00 PM CDT

Even before the latest slew of announcements regarding the agreement by Saudi Arabia’s flagship oil and gas company, Aramco, to acquire a 70 percent stake in the Kingdom’s key petrochemicals company, Saudi Basic Industries Corporation (SABIC), for US$69.1 billion, from the country’s sovereign wealth fund, the Public Investment Fund (PIF), the ‘deal’ looked like a meaningless accounting trick that transfers money from one side of the Saudi balance sheet to another. It looked like that because that is what it is but it is much worse than that as well.

Over and above the rhetorical nonsense spouted by the various involved participants about value-enhancing ‘synergies’ between the two entities floats the stark fact that there are none at all. Aramco chief executive officer, Amin Nasser, has often stressed that he wants to position the company less as a straightforward crude oil extraction unit and more as a high-value-added developer of advanced petrochemical products.

However, Aramco buying a majority stake in SABIC, given Aramco’s existing downstream infrastructure, will lead to enormous duplication of resources – people, offices, equipment, research and development, marketing, and capital employed, amongst others. In addition, overlaying SABIC’s existing senior and middle management with those of Aramco, ...

https://oilprice.com/Energy/Energy-General/Oil-War-Puts-Saud…

.........................................................................

Aramco declined to comment.

The Saudi state-owned company has been developing its own gas resources as well as eyeing assets in the United States, Russia, Australia and Africa, the company’s chief executive officer and the Saudi energy minister have said. ...

https://www.hellenicshippingnews.com/saudi-aramcos-bahri-puts-lng-tanker-plan-on-hold-sources/

..........................................................................................................................................................

COVID Crisis Could Unify World’s Largest Oil Companies

By Alex Kimani - May 21, 2020, 7:00 PM CDT

Sir Winston Churchill once admonished leaders to never let a good crisis go to waste. Wall Street banks and other large banks have been paying attention: They were shrewd enough to seize the opportunity presented by the last financial crisis to get hard-nosed government agencies to approve giant M&A deals they would otherwise have frowned upon.

The oil sector should take its cue from the banking sector and try out a little Churchillian wisdom.

Rob Cox, global correspondent for Reuters Breakingviews, seems to feel that is inevitable. He has told Reuters that the Covid-19 crisis could lead to merger mania in sectors like telecoms, auto, consumer goods, and energy.

But unlike the mid-cap energy mergers that had begun to break out before the crisis struck, Rob says tie-ups between giant producers like ExxonMobil (NYSE:XOM), Chevron (NYSE:CVX) and BP(NYSE:BP) among others is now within the realm of possibility.

Cutting Costs

... Giant energy companies could use the cost-cutting gambit to justify mammoth deals that would otherwise fail to pass muster.

Under this backdrop, Exxon and Chevron might bandy together, and even throw in BP for good measure, to form the acronymous “ExChevBrit” whose combined market cap of $425 billion and reserve pool of ~70 billion barrels of oil equivalent would still pale in comparison to Saudi Aramco’s $1.6 trillion value and 270 billion Boe. ...

...

... was machen wir mit unseren Verbindlichkeiten ... unter den Ölteppich kehren ... die wir den Investoren schulden ...

... was machen wir mit unseren Verbindlichkeiten ... unter den Ölteppich kehren ... die wir den Investoren schulden ...https://oilprice.com/Energy/Energy-General/COVID-Crisis-Coul…

Antwort auf Beitrag Nr.: 63.723.976 von teecee1 am 18.05.20 16:29:37WTI Tumbles Despite Record Drop In Cushing Stocks

by Tyler Durden

Wed, 05/20/2020 - 10:35

After WTI's roll from June to July, oil prices have continued their explosion higher, accelerating this morning after last night's surprise crude draw from API. This is the fifth day higher in a row, with July WTI topping $33.50 despite vaccine expectations falling and little to no positive economic headlines. The market is clearly hope-filled...

“Demand is now clearly on its way back from extremely low levels in April,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “The direction for oil is most likely still higher from here.”

However, as Bloomberg Intelligence Energy Analyst Fernando Valle, warns, while opening of different states and increased traffic point to recovery in gasoline demand; with Latin America’s economic situation worsening, exports will be subdued and contribute to a growing glut in refined products, particularly ...

https://www.zerohedge.com/markets/wti-tumbles-despite-record…

.........................................................................

Saudi Aramco Shares Recover To Level Before Oil Crash

By Tsvetana Paraskova - May 19, 2020, 1:30 PM CDT

Shares in Saudi oil giant Aramco have recovered to levels not seen since Saudi Arabia launched the oil price war in early March, becoming the first major oil firm to regain its market value since oil prices crashed, according to Bloomberg estimates.

Aramco’s stock gained 3.09 percent on Tuesday in Riyadh, but the proportion of its shares trading on the Saudi stock exchange, Tadawul, is much smaller than the volumes and shares of ExxonMobil that change hands every day on the New York Stock Exchange, for example. ...

Earlier this month, Saudi Aramco reported a net income of US$16.66 billion for the first quarter of 2020, down from net earnings of US$22.2 billion for Q1 2019, due to the coronavirus pandemic and ...

https://oilprice.com/Latest-Energy-News/World-News/Saudi-Ara…

... ... noch sind sie Schuldenfrei ... Divid-Ende ... eine Frage der Zeit ... sie treiben den Preis nach oben ... warum ... ??? ...

... noch sind sie Schuldenfrei ... Divid-Ende ... eine Frage der Zeit ... sie treiben den Preis nach oben ... warum ... ??? ...

by Tyler Durden

Wed, 05/20/2020 - 10:35

After WTI's roll from June to July, oil prices have continued their explosion higher, accelerating this morning after last night's surprise crude draw from API. This is the fifth day higher in a row, with July WTI topping $33.50 despite vaccine expectations falling and little to no positive economic headlines. The market is clearly hope-filled...

“Demand is now clearly on its way back from extremely low levels in April,” said Bjarne Schieldrop, chief commodities analyst at SEB AB. “The direction for oil is most likely still higher from here.”

However, as Bloomberg Intelligence Energy Analyst Fernando Valle, warns, while opening of different states and increased traffic point to recovery in gasoline demand; with Latin America’s economic situation worsening, exports will be subdued and contribute to a growing glut in refined products, particularly ...

https://www.zerohedge.com/markets/wti-tumbles-despite-record…

.........................................................................

Saudi Aramco Shares Recover To Level Before Oil Crash

By Tsvetana Paraskova - May 19, 2020, 1:30 PM CDT

Shares in Saudi oil giant Aramco have recovered to levels not seen since Saudi Arabia launched the oil price war in early March, becoming the first major oil firm to regain its market value since oil prices crashed, according to Bloomberg estimates.

Aramco’s stock gained 3.09 percent on Tuesday in Riyadh, but the proportion of its shares trading on the Saudi stock exchange, Tadawul, is much smaller than the volumes and shares of ExxonMobil that change hands every day on the New York Stock Exchange, for example. ...

Earlier this month, Saudi Aramco reported a net income of US$16.66 billion for the first quarter of 2020, down from net earnings of US$22.2 billion for Q1 2019, due to the coronavirus pandemic and ...

https://oilprice.com/Latest-Energy-News/World-News/Saudi-Ara…

...

... noch sind sie Schuldenfrei ... Divid-Ende ... eine Frage der Zeit ... sie treiben den Preis nach oben ... warum ... ??? ...

... noch sind sie Schuldenfrei ... Divid-Ende ... eine Frage der Zeit ... sie treiben den Preis nach oben ... warum ... ??? ...

Antwort auf Beitrag Nr.: 63.701.344 von teecee1 am 15.05.20 20:51:48US Headed For Another 'Tanker War' With Iran - This Time Off Venezuela's Coast

by Tyler Durden

Sun, 05/17/2020 - 21:50

Iranian state TV has announced at least five least five Iranian-flagged tankers are transporting fuel to Venezuela through the Atlantic Ocean and plan to break the American blockade on the Latin American country.

Iran has warned that any US attempt at intercepting its fuel tankers "would have serious repercussions for the Trump administration ahead of the November elections."

State-funded PressTV underscores that "Iran is shipping tons of gasoline to Venezuela in defiance of US sanctions on both countries in a symbolic move guaranteed by Tehran’s missile prowess." ...

State media has further emphasized that the Iranian fuel tankers will not attempt to conceal their presence or mission: "Iran has intentionally hoisted its own flag over the huge tankers which are navigating through the Atlantic before the eyes of the US Navy," according to the report.

Reuters has also reported that US defense officials are planning a potential response: ...

https://www.zerohedge.com/geopolitical/us-headed-another-tan…

............................................................................................................

A Record Fleet Of 117 Tankers Is Bringing Super Cheap Crude To China

by Tyler Durden

Mon, 05/18/2020 - 06:00

Authored by Tsvetana Paraskova via OilPrice.com,

While the rest of the world is tentatively coming out of lockdowns, China is taking advantage of the cheapest crude oil in years to stock up as demand is starting to return in the world’s largest oil importer, Bloomberg reported on Friday, citing tanker-tracking data it has compiled.

At present, a total of 117 very large crude carriers (VLCCs) – each capable of shipping 2 million barrels of oil – are traveling to China for unloading at its ports between the middle of May and the middle of August. If those supertankers transport standard-size crude oil cargoes, it could mean that China expects at least 230 million barrels of oil over the next three months, according to Bloomberg. The fleet en route to China could be the largest number of supertankers traveling to the world’s top oil importer at one time, ever, Bloomberg News’ Firat Kayakiran says. ...

https://www.zerohedge.com/energy/record-fleet-117-tankers-br…

https://www.zerohedge.com/markets/oil-soars-prompt-wti-conta…

by Tyler Durden

Sun, 05/17/2020 - 21:50

Iranian state TV has announced at least five least five Iranian-flagged tankers are transporting fuel to Venezuela through the Atlantic Ocean and plan to break the American blockade on the Latin American country.

Iran has warned that any US attempt at intercepting its fuel tankers "would have serious repercussions for the Trump administration ahead of the November elections."

State-funded PressTV underscores that "Iran is shipping tons of gasoline to Venezuela in defiance of US sanctions on both countries in a symbolic move guaranteed by Tehran’s missile prowess." ...

State media has further emphasized that the Iranian fuel tankers will not attempt to conceal their presence or mission: "Iran has intentionally hoisted its own flag over the huge tankers which are navigating through the Atlantic before the eyes of the US Navy," according to the report.

Reuters has also reported that US defense officials are planning a potential response: ...

https://www.zerohedge.com/geopolitical/us-headed-another-tan…

............................................................................................................

A Record Fleet Of 117 Tankers Is Bringing Super Cheap Crude To China

by Tyler Durden

Mon, 05/18/2020 - 06:00

Authored by Tsvetana Paraskova via OilPrice.com,

While the rest of the world is tentatively coming out of lockdowns, China is taking advantage of the cheapest crude oil in years to stock up as demand is starting to return in the world’s largest oil importer, Bloomberg reported on Friday, citing tanker-tracking data it has compiled.

At present, a total of 117 very large crude carriers (VLCCs) – each capable of shipping 2 million barrels of oil – are traveling to China for unloading at its ports between the middle of May and the middle of August. If those supertankers transport standard-size crude oil cargoes, it could mean that China expects at least 230 million barrels of oil over the next three months, according to Bloomberg. The fleet en route to China could be the largest number of supertankers traveling to the world’s top oil importer at one time, ever, Bloomberg News’ Firat Kayakiran says. ...

https://www.zerohedge.com/energy/record-fleet-117-tankers-br…

https://www.zerohedge.com/markets/oil-soars-prompt-wti-conta…

Antwort auf Beitrag Nr.: 63.689.005 von teecee1 am 15.05.20 08:41:19

Fragile Oil Markets Under Threat From 50 Million Barrels Of Saudi Crude

By Irina Slav - May 15, 2020, 9:00 AM CDT

Some 50 million barrels of Saudi crude oil are approaching U.S. shores just as the Energy Information Administration reported the first inventory decline in months. This, according to Bloomberg, could reverse a tentative recovery in oil prices.

On Wednesday, the EIA reported that commercial crude oil inventories had declined by some 700,000 barrels in the week to May 8. The modest draw gave hope that the oil storage problem may soon begin to resolve itself even if total stockpiles were still above the five-year average for the season.

Now, shipping data from Bloomberg shows more than 50 million barrels of Saudi crude are about to arrive on the Gulf Coast and the West Coast by the end of ...

https://oilprice.com/Energy/Oil-Prices/Fragile-Oil-Markets-U…