Diskussion zu Signal Gold [Anaconda Gold] - 500 Beiträge pro Seite (Seite 71)

eröffnet am 20.09.06 16:45:25 von

neuester Beitrag 10.05.24 19:28:53 von

neuester Beitrag 10.05.24 19:28:53 von

Beiträge: 36.202

ID: 1.083.231

ID: 1.083.231

Aufrufe heute: 0

Gesamt: 2.161.479

Gesamt: 2.161.479

Aktive User: 0

ISIN: CA82664T1012 · WKN: A3DK3Q · Symbol: SGNL

0,1000

CAD

-4,76 %

-0,0050 CAD

Letzter Kurs 10.05.24 Toronto

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +809,09 | |

| 8,0000 | +45,45 | |

| 11,000 | +19,57 | |

| 1,2000 | +18,05 | |

| 527,60 | +15,68 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 324,70 | -10,30 | |

| 9,8500 | -10,54 | |

| 0,6166 | -19,12 | |

| 0,6601 | -26,22 | |

| 47,33 | -97,99 |

Antwort auf Beitrag Nr.: 53.798.196 von IQ4U am 30.11.16 10:17:29Hallo IQ4U,

das ist die Frage aller Fragen bei Anaconda; wie will Dustin Angelo die Produktion realistisch auf 30.000 Unzen (später 100.000) realisieren. Mit dem laufendem Cash-Flow sind im Moment sicher keine großen Invests möglich.

Trotzdem bin ich sicher, dass Anaconda unter der verantwortungsvollen Unternehmensleitung langfristig deutlich wertvoller sein wird. Kapitalerhöhung und Finanzierungsdeal waren sicher sehr wichtige Bausteine und wurden jedenfalls von Angelo zur rechten Zeit getätigt.

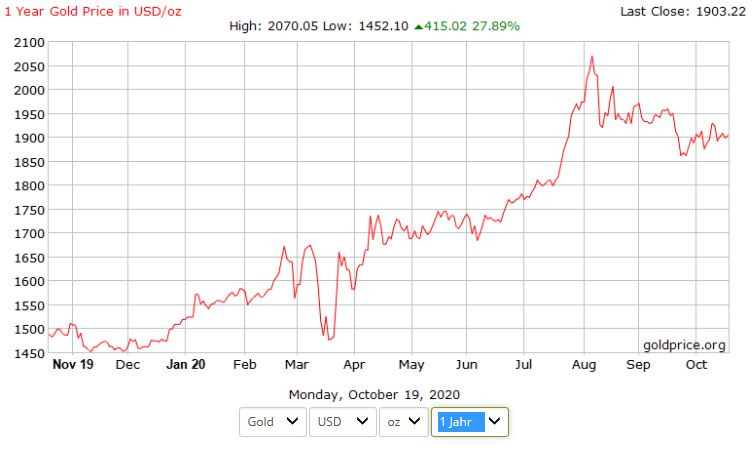

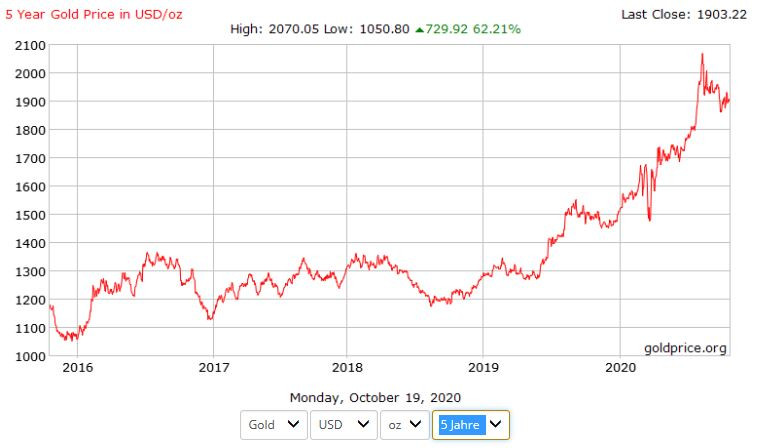

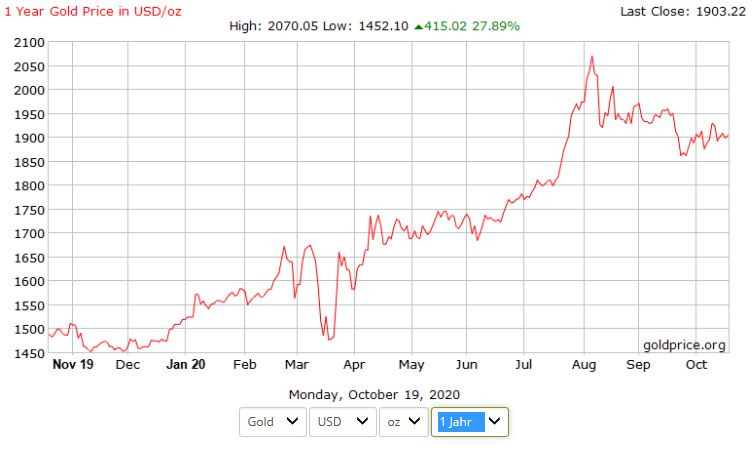

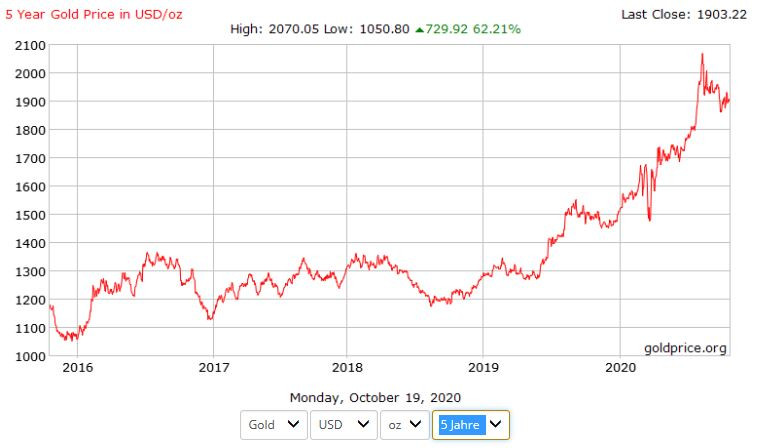

Der derzeitige Aktienkurs ist eh nur eine Momentaufnahme ohne größere Bedeutung. Mit der nötigen Geduld wird sich dein Invest in Anaconda wahrscheinlich als gute Entscheidung herausstellen. Meiner Meinung nach sollte Gold nach der Trumpomanie spätestens im Januar wieder Richtung höherer Notierung tendieren.

Die EU manövriert sich weltpolitisch ins totale Abseits und ist mental und politisch in sehr schlechter Verfassung und erscheint mittlerweile nicht nur den Nichteuropäern als orientierungslos. (Hier verweise ich auch auf Dustins Kommentar in einer Mail von ihm - frei übersetzt "Europa allgemein hat zuletzt aufrührerische Zeiten durchlebt.") Insofern kann ein Goldminer oder Gold nicht so verkehrt sein!!! Geschichte beweist in jedem Fall, dass mittel- und langfristig jede Währung an Wert/Kaufkraft verliert und Gold und andere werthaltige Güter (begrenzt, knapp) zumindest einen Vermögenserhalt bezogen auf die Kaufkraft gewährleisten können.

Wünsche Dir und Allen eine schöne Vorweihnachtszeit

Harry

das ist die Frage aller Fragen bei Anaconda; wie will Dustin Angelo die Produktion realistisch auf 30.000 Unzen (später 100.000) realisieren. Mit dem laufendem Cash-Flow sind im Moment sicher keine großen Invests möglich.

Trotzdem bin ich sicher, dass Anaconda unter der verantwortungsvollen Unternehmensleitung langfristig deutlich wertvoller sein wird. Kapitalerhöhung und Finanzierungsdeal waren sicher sehr wichtige Bausteine und wurden jedenfalls von Angelo zur rechten Zeit getätigt.

Der derzeitige Aktienkurs ist eh nur eine Momentaufnahme ohne größere Bedeutung. Mit der nötigen Geduld wird sich dein Invest in Anaconda wahrscheinlich als gute Entscheidung herausstellen. Meiner Meinung nach sollte Gold nach der Trumpomanie spätestens im Januar wieder Richtung höherer Notierung tendieren.

Die EU manövriert sich weltpolitisch ins totale Abseits und ist mental und politisch in sehr schlechter Verfassung und erscheint mittlerweile nicht nur den Nichteuropäern als orientierungslos. (Hier verweise ich auch auf Dustins Kommentar in einer Mail von ihm - frei übersetzt "Europa allgemein hat zuletzt aufrührerische Zeiten durchlebt.") Insofern kann ein Goldminer oder Gold nicht so verkehrt sein!!! Geschichte beweist in jedem Fall, dass mittel- und langfristig jede Währung an Wert/Kaufkraft verliert und Gold und andere werthaltige Güter (begrenzt, knapp) zumindest einen Vermögenserhalt bezogen auf die Kaufkraft gewährleisten können.

Wünsche Dir und Allen eine schöne Vorweihnachtszeit

Harry

Antwort auf Beitrag Nr.: 53.821.581 von harry_limes am 03.12.16 12:07:28

Danke Harry, für Deine Sichtweise und Einschätzung der Lage!

Ich werde morgen erst einmal nach Dubai fliegen und mir dort ein Bild davon machen wie die ölaufgepumpte arabische Welt der Scheichs derzeit vor Ort aussieht.

Bin gespannt was wieder dazu gebaut wurde und wie weit dort der auf Pump finanzierte Bauboom fortgeschritten ist. Spätestens mit der nächsten weltweiten Finanzkrise schätze ich, dass es die Entwicklung dort wieder um einige Jahre zurückwerfen wird... aber nur meins.

Auch ich wünsche allerseits erst einmal eine schöne zweite Adventswoche!

IQ

Danke Harry, für Deine Sichtweise und Einschätzung der Lage!

Ich werde morgen erst einmal nach Dubai fliegen und mir dort ein Bild davon machen wie die ölaufgepumpte arabische Welt der Scheichs derzeit vor Ort aussieht.

Bin gespannt was wieder dazu gebaut wurde und wie weit dort der auf Pump finanzierte Bauboom fortgeschritten ist. Spätestens mit der nächsten weltweiten Finanzkrise schätze ich, dass es die Entwicklung dort wieder um einige Jahre zurückwerfen wird... aber nur meins.

Auch ich wünsche allerseits erst einmal eine schöne zweite Adventswoche!

IQ

Anaconda Mining sells 4,388 oz Au in fiscal Q2

2016-12-07 07:24 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING SELLS NEARLY 4,400 OUNCES OF GOLD AND GENERATES OVER $7.4M IN GOLD SALES REVENUE IN Q2 FY2017

Anaconda Mining Inc. has released financial and operating results from the three- and six-month period ended Nov. 30, 2016. During the second quarter of fiscal 2017, the company sold 4,388 ounces of gold and generated $7,411,279 in revenue at an average sales price of $1,689 per ounce. Anaconda also earned approximately $400,000 in revenue from the sale of its waste rock from the recently announced aggregates project. The company expects to file its full financial statements by Jan. 13, 2016.

President and chief executive officer Dustin Angelo stated: "During the second quarter of fiscal 2017, the Pine Cove mill set a new throughput record running at an average of 1,302 tonnes per operating day, which we see as the new normal. The entire team did a great job rebounding from the first quarter of fiscal 2017, delivering a strong quarter operationally. In relation to the first quarter, tonnes processed and grade increased 9 per cent and 18 per cent, respectively, and gold sales volume was up approximately 50 per cent. We expect cash cost per ounce sold for the second quarter to be lower than the first quarter of fiscal 2017. Also during the quarter, we earned our first $400,000 of revenue from our aggregates project. The mining operation has benefited from the aggregates project because it reduces hauling distance, lowers operating costs and mitigates asset retirement obligations, while generating additional cash flow."

Fiscal second quarter 2017 operations overview

The Pine Cove mill operated for 83 days during the second quarter of fiscal 2017 at an availability rate of 91 per cent, a three-percentage-point increase over the availability in the second quarter of fiscal 2016. The mill achieved an average run rate of 1,302 tonnes per operating day compared with 1,181 tonnes per operating day in the second quarter of fiscal 2016, a 10-per-cent increase. The Pine Cove mill processed 108,045 dry tonnes of ore during the quarter compared with 95,629 dry tonnes of ore in the similar period of fiscal 2016, a 13-per-cent increase. Overall mill recovery was 85 per cent compared with 87 per cent in the second quarter of fiscal 2016. Average feed grade during the quarter was 1.38 grams per tonne (g/t), lower than the second quarter of fiscal 2016 but 18 per cent higher than the first quarter of fiscal 2017 and in line with expectations for the remainder of the year.

The mining operation at the Point Rousse project operated for 74 days in the second quarter in the Pine Cove pit. Total production was 129,078 tonnes of ore and 595,668 tonnes of waste for a strip ratio of 4.6:1, waste to ore. Total tonnes mined at the Pine Cove pit was 14 per cent higher compared with the second quarter of fiscal 2016. The increased levels of production through the second quarter of fiscal 2017 resulted in completion of rock placement of phase 1 of tailings storage facility II. Tonnes mined and strip ratio decreased, relative to the first quarter of fiscal 2017, 27 per cent and 44 per cent, respectively, and are expected to further reduce during the second half of fiscal 2017.

Anaconda earned approximately $400,000 of revenue from 11 shipments of waste rock totalling 660,000 tonnes.

The associated table summarizes the key operating statistics for the three and six months ended Nov. 30, 2016, and Nov. 30, 2015.

OPERATING STATISTICS

For the three months ended For the six months ended

Nov. 30, 2016 Nov. 30, 2015 Nov. 30, 2016 Nov. 30, 2015

Mill

Operating days 83 81 171 167

Availability 91% 88% 93% 91%

Dry tonnes processed 108,045 95,629 207,486 192,161

Tonnes per 24-hour period 1,302 1,181 1,213 1,151

Grade (grams per tonne) 1.38 1.66 1.28 1.64

Overall mill recovery 85% 87% 85% 87%

Gold sales volume (troy oz) 4,388 4,605 7,307 8,561

Mine -- total

Operating days 74 73 157 151

Ore production (tonnes) 129,078 117,133 237,383 221,411

Waste production (tonnes) 595,668 559,961 1,485,788 1,202,789

Total production (tonnes) 724,746 667,094 1,723,171 1,424,200

Waste: ore ratio 4.6 4.8 6.3 5.4

Mine -- Pine Cove pit

Operating days 74 64 157 142

Ore production (tonnes) 129,078 105,947 237,383 210,225

Waste production (tonnes) 595,668 529,718 1,485,788 1,172,546

Total production (tonnes) 724,746 635,665 1,723,171 1,382,771

Waste: ore ratio 4.6 5.0 6.3 5.6

Mine -- Stog'er Tight

Operating days - 9 - 9

Ore production (tonnes) - 11,186 - 11,186

Waste production (tonnes) - 30,243 - 30,243

Total production (tonnes) - 41,429 - 41,429

Waste: ore ratio - 2.7 - 2.7

Note

Operating statistics exclude changes in in-circuit inventory.

ABOUT ANACONDA

Anaconda Mining is a growth-oriented, gold mining and exploration company with a producing project called the Point Rousse project and an exploration/development project called the Viking project in Newfoundland.

The Point Rousse project is approximately 6,300 hectares of property on the Ming's Bight peninsula located in the Baie Verte mining district in Newfoundland, Canada.

Anaconda also controls the Viking project, which has approximately 6,225 hectares of property in White Bay, Newfoundland, approximately 100 kilometres by water (180 kilometres via road) from the Pine Cove mill.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

2016-12-07 07:24 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING SELLS NEARLY 4,400 OUNCES OF GOLD AND GENERATES OVER $7.4M IN GOLD SALES REVENUE IN Q2 FY2017

Anaconda Mining Inc. has released financial and operating results from the three- and six-month period ended Nov. 30, 2016. During the second quarter of fiscal 2017, the company sold 4,388 ounces of gold and generated $7,411,279 in revenue at an average sales price of $1,689 per ounce. Anaconda also earned approximately $400,000 in revenue from the sale of its waste rock from the recently announced aggregates project. The company expects to file its full financial statements by Jan. 13, 2016.

President and chief executive officer Dustin Angelo stated: "During the second quarter of fiscal 2017, the Pine Cove mill set a new throughput record running at an average of 1,302 tonnes per operating day, which we see as the new normal. The entire team did a great job rebounding from the first quarter of fiscal 2017, delivering a strong quarter operationally. In relation to the first quarter, tonnes processed and grade increased 9 per cent and 18 per cent, respectively, and gold sales volume was up approximately 50 per cent. We expect cash cost per ounce sold for the second quarter to be lower than the first quarter of fiscal 2017. Also during the quarter, we earned our first $400,000 of revenue from our aggregates project. The mining operation has benefited from the aggregates project because it reduces hauling distance, lowers operating costs and mitigates asset retirement obligations, while generating additional cash flow."

Fiscal second quarter 2017 operations overview

The Pine Cove mill operated for 83 days during the second quarter of fiscal 2017 at an availability rate of 91 per cent, a three-percentage-point increase over the availability in the second quarter of fiscal 2016. The mill achieved an average run rate of 1,302 tonnes per operating day compared with 1,181 tonnes per operating day in the second quarter of fiscal 2016, a 10-per-cent increase. The Pine Cove mill processed 108,045 dry tonnes of ore during the quarter compared with 95,629 dry tonnes of ore in the similar period of fiscal 2016, a 13-per-cent increase. Overall mill recovery was 85 per cent compared with 87 per cent in the second quarter of fiscal 2016. Average feed grade during the quarter was 1.38 grams per tonne (g/t), lower than the second quarter of fiscal 2016 but 18 per cent higher than the first quarter of fiscal 2017 and in line with expectations for the remainder of the year.

The mining operation at the Point Rousse project operated for 74 days in the second quarter in the Pine Cove pit. Total production was 129,078 tonnes of ore and 595,668 tonnes of waste for a strip ratio of 4.6:1, waste to ore. Total tonnes mined at the Pine Cove pit was 14 per cent higher compared with the second quarter of fiscal 2016. The increased levels of production through the second quarter of fiscal 2017 resulted in completion of rock placement of phase 1 of tailings storage facility II. Tonnes mined and strip ratio decreased, relative to the first quarter of fiscal 2017, 27 per cent and 44 per cent, respectively, and are expected to further reduce during the second half of fiscal 2017.

Anaconda earned approximately $400,000 of revenue from 11 shipments of waste rock totalling 660,000 tonnes.

The associated table summarizes the key operating statistics for the three and six months ended Nov. 30, 2016, and Nov. 30, 2015.

OPERATING STATISTICS

For the three months ended For the six months ended

Nov. 30, 2016 Nov. 30, 2015 Nov. 30, 2016 Nov. 30, 2015

Mill

Operating days 83 81 171 167

Availability 91% 88% 93% 91%

Dry tonnes processed 108,045 95,629 207,486 192,161

Tonnes per 24-hour period 1,302 1,181 1,213 1,151

Grade (grams per tonne) 1.38 1.66 1.28 1.64

Overall mill recovery 85% 87% 85% 87%

Gold sales volume (troy oz) 4,388 4,605 7,307 8,561

Mine -- total

Operating days 74 73 157 151

Ore production (tonnes) 129,078 117,133 237,383 221,411

Waste production (tonnes) 595,668 559,961 1,485,788 1,202,789

Total production (tonnes) 724,746 667,094 1,723,171 1,424,200

Waste: ore ratio 4.6 4.8 6.3 5.4

Mine -- Pine Cove pit

Operating days 74 64 157 142

Ore production (tonnes) 129,078 105,947 237,383 210,225

Waste production (tonnes) 595,668 529,718 1,485,788 1,172,546

Total production (tonnes) 724,746 635,665 1,723,171 1,382,771

Waste: ore ratio 4.6 5.0 6.3 5.6

Mine -- Stog'er Tight

Operating days - 9 - 9

Ore production (tonnes) - 11,186 - 11,186

Waste production (tonnes) - 30,243 - 30,243

Total production (tonnes) - 41,429 - 41,429

Waste: ore ratio - 2.7 - 2.7

Note

Operating statistics exclude changes in in-circuit inventory.

ABOUT ANACONDA

Anaconda Mining is a growth-oriented, gold mining and exploration company with a producing project called the Point Rousse project and an exploration/development project called the Viking project in Newfoundland.

The Point Rousse project is approximately 6,300 hectares of property on the Ming's Bight peninsula located in the Baie Verte mining district in Newfoundland, Canada.

Anaconda also controls the Viking project, which has approximately 6,225 hectares of property in White Bay, Newfoundland, approximately 100 kilometres by water (180 kilometres via road) from the Pine Cove mill.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

Da hat unser geliebter Waste-Rocker leider wieder durchwachsene Zahlen geliefert. Erzielter Goldpreis mit etwas mehr als 1270US$ für die Monate September, Oktober und November eigentlich etwas zu niedrig. Produziertes und verkauftes Gold in onces leider ca. 5% unter Vorjahresquartal.

Es wurde mehr Erz und Waste verarbeitet aber die Gehalte bleiben leider zu niedrig, da helfen die Abfallgebühren auch nur marginal. Leider wurde das Blending aus dem Vorjahr mit Material von Stog´er Tight nicht wiederholt. Genau auf diesen Ansatz hatte ich gesetzt, dass man mindestens bei hohen Goldpreisen effizient "mixt". Das Material von Stog´er Tight hatte im vergangen Jahr in etwa den doppelten Goldgehalt.

Der Waste-Deal ist zwar besser als nichts, aber wie will Dustin auf 30.000 onces kommen? Anaconda ist sicher unterbewertet, aber bei den Zahlen wird das wahrscheinlich zunächst so bleiben. Goldpreis muss rauf oder/und Dustin erklärt plausibel wie Produktion erhöht wird und damit auch die AISC reduziert werden. Dann erreicht Anaconda die Profitabilität und dann kommt auch Fahrt in die Unternehmensbewertung.

Das wird schon - ich bleibe optimistisch bei unserem Waste-Rocker.

Grüße / Harry

Es wurde mehr Erz und Waste verarbeitet aber die Gehalte bleiben leider zu niedrig, da helfen die Abfallgebühren auch nur marginal. Leider wurde das Blending aus dem Vorjahr mit Material von Stog´er Tight nicht wiederholt. Genau auf diesen Ansatz hatte ich gesetzt, dass man mindestens bei hohen Goldpreisen effizient "mixt". Das Material von Stog´er Tight hatte im vergangen Jahr in etwa den doppelten Goldgehalt.

Der Waste-Deal ist zwar besser als nichts, aber wie will Dustin auf 30.000 onces kommen? Anaconda ist sicher unterbewertet, aber bei den Zahlen wird das wahrscheinlich zunächst so bleiben. Goldpreis muss rauf oder/und Dustin erklärt plausibel wie Produktion erhöht wird und damit auch die AISC reduziert werden. Dann erreicht Anaconda die Profitabilität und dann kommt auch Fahrt in die Unternehmensbewertung.

Das wird schon - ich bleibe optimistisch bei unserem Waste-Rocker.

Grüße / Harry

Antwort auf Beitrag Nr.: 53.858.276 von harry_limes am 08.12.16 20:41:17RE:On target as far as their plan goes...

The certified idiot, lberard, returns.... He hasn't noticed the 50,000,000 shares of dilution being unloaded on long term shareholders right now.... or the fact that management dilutes their shareholders and then donates big chunks of money to charity. Or how about the fact the share price is in the lowest range it has ever been in yet management makes HUGE salaries. Maybe he forgot that when the share price was sitting at 10 cents that management does a financing to a select individual at 5.5 cents. How's that for protecting the interests of the common shareholder? The idiot, lberard, sees the gold production but fails to see that it's not enough to fund capital projects. This is a disaster as an investment and the management of this company should be voted out. However, those individuals that get financings at half the going share price are likely to keep voting them in. After all, it's a good deal to pay half the going rate......

Read more at http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

zur Zeit ist die Fantasie nur, das sie höhere Grade beim Explorieren finden

The certified idiot, lberard, returns.... He hasn't noticed the 50,000,000 shares of dilution being unloaded on long term shareholders right now.... or the fact that management dilutes their shareholders and then donates big chunks of money to charity. Or how about the fact the share price is in the lowest range it has ever been in yet management makes HUGE salaries. Maybe he forgot that when the share price was sitting at 10 cents that management does a financing to a select individual at 5.5 cents. How's that for protecting the interests of the common shareholder? The idiot, lberard, sees the gold production but fails to see that it's not enough to fund capital projects. This is a disaster as an investment and the management of this company should be voted out. However, those individuals that get financings at half the going share price are likely to keep voting them in. After all, it's a good deal to pay half the going rate......

Read more at http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

zur Zeit ist die Fantasie nur, das sie höhere Grade beim Explorieren finden

Antwort auf Beitrag Nr.: 53.869.273 von supideti am 10.12.16 11:54:38Etwas extrem formuliert, aber im Ansatz die wesentlichen kritischen Punkte angesprochen.

Trotzdem ist dieser Frust übertrieben und ungerecht (der Schreiberling hat die falsche Aktie im Depot), weil:

Wer Aktien von Anaconda Mining unter Dustin Angelo erwirbt und/oder hält sollte eigentlich wissen, dass er/sie nicht in den profitabelsten Goldproduzenten der Welt oder Kanadas investiert. Die Rahmenbedingungen für die Goldproduktion in Neufundland sicher nicht optimal sind. Anaconda legt Wert auf eine harmonische und einvernehmliche Koexistenz von umweltschädlicher Goldförderung und Mehrwert für die Gesellschaft in dieser Region. In sofern ist die Waste-Vereinbarung auch ein sehr positives Puzzleteil.

Weiterhin musste Dustin Angelo bei der Kapitalerhöhung Zugeständnisse machen, da die Nachfrage nicht exorbitant war. Bei der Kapitalerhöhung hat Anaconda de facto 0,07CAD$ pro share erhalten.

"It’s complicated and very specific to Canadian tax law. In the end, Anaconda sold all 29 million units at $0.07."

Aus meiner Sicht investiert man bei Anaconda in einen verantwortungsvollen Goldproduzenten und Dustin Angelo geht halt auch keine großen Investitionsrisiken ein und das ist gut! Denn im schlimmsten Fall hinterlässt er für einige Familien und die Region einen großen Schaden.

Der CEO und Anaconda brauchen einfach das nötige Glück indem sie bessere Gehalte identifizieren und der Goldpreis mitspielt.

Wenn ich derzeit einen Goldproduzenten mit hohem moralischen Anspruch identifizieren müsste, so wäre meine Entscheidung eindeutig - der Sieger ist Anaconda Mining.

Enttäuschend ist wahrscheinlich die Zahl der Anaconda-Aktionäre in Neufundland!!!

Schönes Wochenende / Harry

Trotzdem ist dieser Frust übertrieben und ungerecht (der Schreiberling hat die falsche Aktie im Depot), weil:

Wer Aktien von Anaconda Mining unter Dustin Angelo erwirbt und/oder hält sollte eigentlich wissen, dass er/sie nicht in den profitabelsten Goldproduzenten der Welt oder Kanadas investiert. Die Rahmenbedingungen für die Goldproduktion in Neufundland sicher nicht optimal sind. Anaconda legt Wert auf eine harmonische und einvernehmliche Koexistenz von umweltschädlicher Goldförderung und Mehrwert für die Gesellschaft in dieser Region. In sofern ist die Waste-Vereinbarung auch ein sehr positives Puzzleteil.

Weiterhin musste Dustin Angelo bei der Kapitalerhöhung Zugeständnisse machen, da die Nachfrage nicht exorbitant war. Bei der Kapitalerhöhung hat Anaconda de facto 0,07CAD$ pro share erhalten.

"It’s complicated and very specific to Canadian tax law. In the end, Anaconda sold all 29 million units at $0.07."

Aus meiner Sicht investiert man bei Anaconda in einen verantwortungsvollen Goldproduzenten und Dustin Angelo geht halt auch keine großen Investitionsrisiken ein und das ist gut! Denn im schlimmsten Fall hinterlässt er für einige Familien und die Region einen großen Schaden.

Der CEO und Anaconda brauchen einfach das nötige Glück indem sie bessere Gehalte identifizieren und der Goldpreis mitspielt.

Wenn ich derzeit einen Goldproduzenten mit hohem moralischen Anspruch identifizieren müsste, so wäre meine Entscheidung eindeutig - der Sieger ist Anaconda Mining.

Enttäuschend ist wahrscheinlich die Zahl der Anaconda-Aktionäre in Neufundland!!!

Schönes Wochenende / Harry

Antwort auf Beitrag Nr.: 53.870.317 von harry_limes am 10.12.16 16:14:36schauen wir mal

In dem post steckt ziemlich viel Emotion

Ich würde sagen, war oder ist noch investiert

Wahrscheinlich zu deutlich höheren Kursen

Dann mal schönes WE

In dem post steckt ziemlich viel Emotion

Ich würde sagen, war oder ist noch investiert

Wahrscheinlich zu deutlich höheren Kursen

Dann mal schönes WE

Anaconda starts 2,000 m drill program at Point Rousse

2016-12-13 07:26 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING COMMENCES SECOND PHASE OF DRILLING AT ARGYLE

Anaconda Mining Inc. has initiated a second phase of diamond drilling at the Argyle prospect of the Point Rousse project. The purpose of the Phase 2 Exploration Program is to follow up on significant mineralization encountered during the Phase 1 exploration program at Argyle (see press release dated October 12, 2016). The known gold mineralization system at Argyle extends 410 metres along strike and 100 metres down-dip to the north, and is present 42 metres vertically below surface. The mineralized zone is open along strike and down-dip.

The Phase 2 Exploration Program will consist of approximately 2,000 metres of diamond drilling to determine if there are farther strike and dip extensions to mineralization within the consistent level of mineralized stratigraphy referred to as the Argyle gabbro (Exhibit A), and to determine the broad shape of the thicker and higher-grade portions of mineralization. Furthermore, the results of a recent detailed ground magnetic and induced-polarization ("IP") geophysical surveys conducted in the area over and surrounding Argyle, in concert with other key geological characteristics, have identified several other target areas which appear to be hosted within Argyle gabbro. Specific targets within these broader areas of interest will be tested during the Phase 2 Exploration Program.

President and CEO, Dustin Angelo, states, "We believe that Argyle has the potential to form a new deposit at the Point Rousse Project and to play a significant role in extending and increasing gold production. At the current exploration stage, our goals are to outline the geometry of the mineralization and to determine if there are other similar zones adjacent to Argyle to contribute to resource growth within Point Rousse."

The Phase 2 Exploration Program at Argyle is expected to be complete by January of 2017 with final results and interpretation expected later in the winter.

Viking Drilling

The Company has also recently completed a second phase of drilling at its Viking Project to test several exploration targets including the Viking Trend, Thor South and the Whiskey Jack showing within the Asgard Trend (Exhibit B). The program consisted of 1,151 metres of diamond drilling in 6 drill holes. Samples from this program have been submitted for assay and the results are expected in January.

Goldenville Exploration Program

The Company would also like to provide an update on the recent diamond drilling campaign at the Goldenville Horizon, an exploration target at the Point Rousse Project approximately five to seven kilometres from the Pine Cove Mill. The Goldenville Horizon consists of an ironstone formation and is known to be the same geological unit as the Nugget Pond Horizon, which is approximately 60 kilometres east of the Point Rousse Project and host to the former, high-grade Nugget Pond gold mine. The drill program was designed to test specific areas of the ironstone in search of Nugget Pond-style mineralization. The Company completed 1,686 metres of diamond drilling at Goldenville in 14 drill holes. While intersecting several areas with characteristics like Nugget Pond, the program did not result in intersections of significant gold mineralization.

President and CEO, Dustin Angelo, states, "The gold deposit type we are searching for, typified by the historic Nugget Pond deposit, is expected to have a relatively small footprint. During the recent program, we tested approximately ten percent of the prospective length of the Goldenville Horizon and observed that, locally, the processes involved in forming deposits are active within the area. Building on knowledge gained through this program we have refined our exploration model for this type of mineralization. Future work along the Goldenville Horizon will make use of this knowledge and focus on other areas of interest associated with the Goldenville Horizon. We still believe there is the potential to find a high-grade deposit like Nugget Pond."

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

All samples are collected using QA/QC protocols including the regular insertion of duplicates, standards and blanks within the sample batch for analysis. All samples quoted in this release were analyzed at Eastern Analytical Ltd. in Springdale, NL, for Au by fire assay (30g) with an AA finish.

ABOUT ANACONDA MINING

Anaconda Mining is a growth-oriented, gold mining and exploration company with a producing project called the Point Rousse Project and two exploration/development projects called the Viking and Great Northern Projects in Newfoundland.

The Point Rousse Project is approximately 6,300 hectares of property on the Ming's Bight Peninsula located in the Baie Verte Mining District in Newfoundland, Canada. Since 2012, Anaconda has increased its property control by ten-fold on the peninsula and gold production to nearly 16,000 ounces per year. In an effort to expand production, it is currently exploring three primary, prospective gold trends, which have approximately 20 km of cumulative strike length and include five deposits and numerous prospects and showings, all within 8 km of the Pine Cove Mill. A second property called the Tilt Cove Property, consisting of 350 hectares, is located approximately 60 kilometres by road from the Pine Cove Mill but is also within the Baie Verte Mining District and underlain by similar geology to the Point Rousse Project.

Anaconda also controls the Viking and Great Northern Projects, which have approximately 6,225 and 6,375 hectares of property (respectively) in White Bay, Newfoundland, approximately 100 kilometres by water (180 kilometres via road) from the Pine Cove Mill. The Viking Project contains the Thor Deposit and other gold prospects and showings and the Great Northern Project includes numerous prospects and showings within a similar geological setting as the Viking Project. The Company's plan is to discover and develop more resources within these project areas and substantially increase annual production at the Pine Cove Mill from its current rate of nearly 16,000 ounces.

As the only pure play gold producer in Atlantic Canada, Anaconda Mining is turning the rock we live on into a growing and profitable resource. With a young and motivated workforce, innovative technology and the support of local suppliers, Anaconda is investing in the people of Newfoundland & Labrador and giving back to the communities in which we operate - building a better future for all our stakeholders, from the ground up.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

2016-12-13 07:26 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING COMMENCES SECOND PHASE OF DRILLING AT ARGYLE

Anaconda Mining Inc. has initiated a second phase of diamond drilling at the Argyle prospect of the Point Rousse project. The purpose of the Phase 2 Exploration Program is to follow up on significant mineralization encountered during the Phase 1 exploration program at Argyle (see press release dated October 12, 2016). The known gold mineralization system at Argyle extends 410 metres along strike and 100 metres down-dip to the north, and is present 42 metres vertically below surface. The mineralized zone is open along strike and down-dip.

The Phase 2 Exploration Program will consist of approximately 2,000 metres of diamond drilling to determine if there are farther strike and dip extensions to mineralization within the consistent level of mineralized stratigraphy referred to as the Argyle gabbro (Exhibit A), and to determine the broad shape of the thicker and higher-grade portions of mineralization. Furthermore, the results of a recent detailed ground magnetic and induced-polarization ("IP") geophysical surveys conducted in the area over and surrounding Argyle, in concert with other key geological characteristics, have identified several other target areas which appear to be hosted within Argyle gabbro. Specific targets within these broader areas of interest will be tested during the Phase 2 Exploration Program.

President and CEO, Dustin Angelo, states, "We believe that Argyle has the potential to form a new deposit at the Point Rousse Project and to play a significant role in extending and increasing gold production. At the current exploration stage, our goals are to outline the geometry of the mineralization and to determine if there are other similar zones adjacent to Argyle to contribute to resource growth within Point Rousse."

The Phase 2 Exploration Program at Argyle is expected to be complete by January of 2017 with final results and interpretation expected later in the winter.

Viking Drilling

The Company has also recently completed a second phase of drilling at its Viking Project to test several exploration targets including the Viking Trend, Thor South and the Whiskey Jack showing within the Asgard Trend (Exhibit B). The program consisted of 1,151 metres of diamond drilling in 6 drill holes. Samples from this program have been submitted for assay and the results are expected in January.

Goldenville Exploration Program

The Company would also like to provide an update on the recent diamond drilling campaign at the Goldenville Horizon, an exploration target at the Point Rousse Project approximately five to seven kilometres from the Pine Cove Mill. The Goldenville Horizon consists of an ironstone formation and is known to be the same geological unit as the Nugget Pond Horizon, which is approximately 60 kilometres east of the Point Rousse Project and host to the former, high-grade Nugget Pond gold mine. The drill program was designed to test specific areas of the ironstone in search of Nugget Pond-style mineralization. The Company completed 1,686 metres of diamond drilling at Goldenville in 14 drill holes. While intersecting several areas with characteristics like Nugget Pond, the program did not result in intersections of significant gold mineralization.

President and CEO, Dustin Angelo, states, "The gold deposit type we are searching for, typified by the historic Nugget Pond deposit, is expected to have a relatively small footprint. During the recent program, we tested approximately ten percent of the prospective length of the Goldenville Horizon and observed that, locally, the processes involved in forming deposits are active within the area. Building on knowledge gained through this program we have refined our exploration model for this type of mineralization. Future work along the Goldenville Horizon will make use of this knowledge and focus on other areas of interest associated with the Goldenville Horizon. We still believe there is the potential to find a high-grade deposit like Nugget Pond."

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects.

All samples are collected using QA/QC protocols including the regular insertion of duplicates, standards and blanks within the sample batch for analysis. All samples quoted in this release were analyzed at Eastern Analytical Ltd. in Springdale, NL, for Au by fire assay (30g) with an AA finish.

ABOUT ANACONDA MINING

Anaconda Mining is a growth-oriented, gold mining and exploration company with a producing project called the Point Rousse Project and two exploration/development projects called the Viking and Great Northern Projects in Newfoundland.

The Point Rousse Project is approximately 6,300 hectares of property on the Ming's Bight Peninsula located in the Baie Verte Mining District in Newfoundland, Canada. Since 2012, Anaconda has increased its property control by ten-fold on the peninsula and gold production to nearly 16,000 ounces per year. In an effort to expand production, it is currently exploring three primary, prospective gold trends, which have approximately 20 km of cumulative strike length and include five deposits and numerous prospects and showings, all within 8 km of the Pine Cove Mill. A second property called the Tilt Cove Property, consisting of 350 hectares, is located approximately 60 kilometres by road from the Pine Cove Mill but is also within the Baie Verte Mining District and underlain by similar geology to the Point Rousse Project.

Anaconda also controls the Viking and Great Northern Projects, which have approximately 6,225 and 6,375 hectares of property (respectively) in White Bay, Newfoundland, approximately 100 kilometres by water (180 kilometres via road) from the Pine Cove Mill. The Viking Project contains the Thor Deposit and other gold prospects and showings and the Great Northern Project includes numerous prospects and showings within a similar geological setting as the Viking Project. The Company's plan is to discover and develop more resources within these project areas and substantially increase annual production at the Pine Cove Mill from its current rate of nearly 16,000 ounces.

As the only pure play gold producer in Atlantic Canada, Anaconda Mining is turning the rock we live on into a growing and profitable resource. With a young and motivated workforce, innovative technology and the support of local suppliers, Anaconda is investing in the people of Newfoundland & Labrador and giving back to the communities in which we operate - building a better future for all our stakeholders, from the ground up.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

Liebe Schlangenbeschwörer,

ich wünsche Euch allen Frohe Weihnachten im Kreise Eurer Familien!

ich wünsche Euch allen Frohe Weihnachten im Kreise Eurer Familien!

Und ich wünsche euch allen ein gutes neues Jahr 2017.

Gesundheit und Glück.

Mal schauen was Anaconda in 2017 zu bieten hat.

Gesundheit und Glück.

Mal schauen was Anaconda in 2017 zu bieten hat.

Ich wünsche allen Schlangenbeschwörern ein gutes und gesundes neues Jahr!!!

Wollen wir mal sehen wo der Goldpreis unsere Ana hinträgt in 2017...

Wollen wir mal sehen wo der Goldpreis unsere Ana hinträgt in 2017...

Anaconda's Farr quits as CFO

2017-01-03 08:11 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING ANNOUNCES RESIGNATION OF CHIEF FINANCIAL OFFICER

Anaconda Mining Inc.'s chief financial officer, Errol Farr, has informed the company that he shall resign, effective March 31, 2017, to pursue other opportunities. Until the resignation date, Mr. Farr will remain with the company to assist with a smooth transition to the successor chief financial officer. Anaconda has already begun a process to identify a full-time replacement.

President and chief executive officer, Dustin Angelo, stated: "On behalf of the board of directors and the entire work force at Anaconda, I would like to thank Errol for his contribution to the company during his tenure. We wish him well in his future endeavours."

About Anaconda Mining

Anaconda Mining is a growth-oriented, gold-mining and exploration company with a producing project called the Point Rousse project and an exploration/development project called the Viking project in Newfoundland. The Point Rousse project is approximately 6,300 hectares of property on the Ming's Bight peninsula located in the Baie Verte mining district in Newfoundland, Canada. Anaconda also controls the Viking project, which has approximately 6,225 hectares of property in White Bay, Newfoundland, approximately 100 kilometres by water (180 kilometres via road) from the Pine Cove mill.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

2017-01-03 08:11 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING ANNOUNCES RESIGNATION OF CHIEF FINANCIAL OFFICER

Anaconda Mining Inc.'s chief financial officer, Errol Farr, has informed the company that he shall resign, effective March 31, 2017, to pursue other opportunities. Until the resignation date, Mr. Farr will remain with the company to assist with a smooth transition to the successor chief financial officer. Anaconda has already begun a process to identify a full-time replacement.

President and chief executive officer, Dustin Angelo, stated: "On behalf of the board of directors and the entire work force at Anaconda, I would like to thank Errol for his contribution to the company during his tenure. We wish him well in his future endeavours."

About Anaconda Mining

Anaconda Mining is a growth-oriented, gold-mining and exploration company with a producing project called the Point Rousse project and an exploration/development project called the Viking project in Newfoundland. The Point Rousse project is approximately 6,300 hectares of property on the Ming's Bight peninsula located in the Baie Verte mining district in Newfoundland, Canada. Anaconda also controls the Viking project, which has approximately 6,225 hectares of property in White Bay, Newfoundland, approximately 100 kilometres by water (180 kilometres via road) from the Pine Cove mill.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

Anaconda Mining has all Point Rousse aggregate permits

2017-01-05 07:39 ET - News Release

Mr. Dustin Angelo reports

THRIVING AGGREGATES VENTURE AT ANACONDA'S POINT ROUSSE PROJECT; 1,000,000 TONNES SHIPPED AND OVER 70 NEW JOBS

Anaconda Mining Inc. is providing an update on the aggregates venture at the Point Rousse project's Port Rousse port facility recently announced on Oct. 27, 2016. As previously disclosed, the Company is working with Shore Line Aggregates, a subsidiary of its contract miner, Guy J. Bailey Ltd., and Phoenix Bulk Carriers (BVI) Ltd. to supply 3.5 million tonnes of construction aggregate, using Anaconda's waste rock from its gold mining operation, to a construction project on the eastern seaboard of the United States. On December 22, 2016, the Canadian Environmental Assessment Agency issued its environmental assessment determination regarding the Port Rousse Port Facility Project (the "Port Rousse Project") deciding no further environmental assessment is required. As such, all necessary permits to construct facilities and operate the Aggregates Venture at Port Rousse have been received.

To date, the Aggregates Venture has shipped approximately 1,000,000 tonnes of aggregate. The Baie Verte Harbour is one of the deepest harbours in Atlantic Canada which makes it suitable for the type of ships required to move such a large quantity of material. Ships on this route measure 199 metres and can carry 60,000 tonnes of aggregate per trip.

"With water export access at Port Rousse, our waste rock is now a competitive product in the seaborne aggregates market, resulting in an additional revenue stream for Anaconda while also reducing mining costs. The aggregate that will be shipped under this project would otherwise require approximately 100,000 tri-axle tractor trailer loads if transported over land. The marine shipping option makes this a safe, green, and competitive means to move vast amounts of product. The companies involved continue to explore other market opportunities. The establishment of Port Rousse also opens up new economic diversification opportunities for Anaconda and the Baie Verte region. Water access now positions Anaconda to explore other export and import ventures, including potentially importing gold ore for processing at the Pine Cove Mill."

Dustin Angelo, President & CEO, Anaconda Mining

"We take pride in innovation at Anaconda. We took an obstacle and turned it into an opportunity both for Anaconda and the broader community. Over 70 new direct jobs have been created, with 60 people hired by Shore Line for on-shore operations and an additional 12 employed by Sealand Shipping Services Ltd. as tug operators, harbour pilots, and hand-lining services. Over half of these people are under 35 years of age."

Allan Cramm, VP & General Manager, Anaconda Mining

"You can feel the renewed energy that this project has created in the Baie Verte Region. Businesses throughout the region are feeling the benefits as direct vendors as well as in spin off industries."

Clar Brown, Mayor, Town of Baie Verte

"After conducting ship-loading activities for many vessels over Q-4 of 2016, Phoenix is substantially impressed with the operational efficiencies and high caliber of professionalism at Port Rousse. All vessels are loaded 24/7/365 at an average rate of at least 20,000 metric tonnes per day. We could not ask for better partners in the Baie Verte community who, we are confident, will continue to support our mutual success!"

Peter Koken, Phoenix Bulk Carriers

ABOUT ANACONDA MINING

Anaconda Mining is a growth-oriented, gold mining and exploration company with a producing project called the Point Rousse Project and three exploration/development projects called the Viking and Great Northern Projects and the Tilt Cove Property in Newfoundland.

The Point Rousse Project is approximately 6,300 hectares of property on the Ming's Bight Peninsula located in the Baie Verte Mining District in Newfoundland, Canada. Since 2012, Anaconda has increased its property control by ten-fold on the peninsula and gold production to nearly 16,000 ounces per year. In an effort to expand production, it is currently exploring three primary, prospective gold trends, which have approximately 20 km of cumulative strike length and include five deposits and numerous prospects and showings, all within 8 km of the Pine Cove Mill. A second project called the Tilt Cove Property, consisting of 350 hectares, is located approximately 60 kilometres by road from the Pine Cove Mill but is also within the Baie Verte Mining District and underlain by similar geology to the Point Rousse Project.

Anaconda also controls the Viking and Great Northern Projects, which have approximately 6,225 and 6,375 hectares of property, respectively, in White Bay, Newfoundland, approximately 100 kilometres by water (180 kilometres via road) from the Pine Cove Mill. The Viking Project contains the Thor Deposit and other gold prospects and showings and the Great Northern Project includes numerous prospects and showings within a similar geological setting as the Viking Project. The Company's plan is to discover and develop more resources within these project areas and substantially increase annual production at the Pine Cove Mill from its current rate of nearly 16,000 ounces.

As the only pure play gold producer in Atlantic Canada, Anaconda Mining is turning the rock we live on into a growing and profitable resource. With a young and motivated workforce, innovative technology and the support of local suppliers, Anaconda is investing in the people of Newfoundland & Labrador and giving back to the communities in which we operate - building a better future for all our stakeholders, from the ground up.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

2017-01-05 07:39 ET - News Release

Mr. Dustin Angelo reports

THRIVING AGGREGATES VENTURE AT ANACONDA'S POINT ROUSSE PROJECT; 1,000,000 TONNES SHIPPED AND OVER 70 NEW JOBS

Anaconda Mining Inc. is providing an update on the aggregates venture at the Point Rousse project's Port Rousse port facility recently announced on Oct. 27, 2016. As previously disclosed, the Company is working with Shore Line Aggregates, a subsidiary of its contract miner, Guy J. Bailey Ltd., and Phoenix Bulk Carriers (BVI) Ltd. to supply 3.5 million tonnes of construction aggregate, using Anaconda's waste rock from its gold mining operation, to a construction project on the eastern seaboard of the United States. On December 22, 2016, the Canadian Environmental Assessment Agency issued its environmental assessment determination regarding the Port Rousse Port Facility Project (the "Port Rousse Project") deciding no further environmental assessment is required. As such, all necessary permits to construct facilities and operate the Aggregates Venture at Port Rousse have been received.

To date, the Aggregates Venture has shipped approximately 1,000,000 tonnes of aggregate. The Baie Verte Harbour is one of the deepest harbours in Atlantic Canada which makes it suitable for the type of ships required to move such a large quantity of material. Ships on this route measure 199 metres and can carry 60,000 tonnes of aggregate per trip.

"With water export access at Port Rousse, our waste rock is now a competitive product in the seaborne aggregates market, resulting in an additional revenue stream for Anaconda while also reducing mining costs. The aggregate that will be shipped under this project would otherwise require approximately 100,000 tri-axle tractor trailer loads if transported over land. The marine shipping option makes this a safe, green, and competitive means to move vast amounts of product. The companies involved continue to explore other market opportunities. The establishment of Port Rousse also opens up new economic diversification opportunities for Anaconda and the Baie Verte region. Water access now positions Anaconda to explore other export and import ventures, including potentially importing gold ore for processing at the Pine Cove Mill."

Dustin Angelo, President & CEO, Anaconda Mining

"We take pride in innovation at Anaconda. We took an obstacle and turned it into an opportunity both for Anaconda and the broader community. Over 70 new direct jobs have been created, with 60 people hired by Shore Line for on-shore operations and an additional 12 employed by Sealand Shipping Services Ltd. as tug operators, harbour pilots, and hand-lining services. Over half of these people are under 35 years of age."

Allan Cramm, VP & General Manager, Anaconda Mining

"You can feel the renewed energy that this project has created in the Baie Verte Region. Businesses throughout the region are feeling the benefits as direct vendors as well as in spin off industries."

Clar Brown, Mayor, Town of Baie Verte

"After conducting ship-loading activities for many vessels over Q-4 of 2016, Phoenix is substantially impressed with the operational efficiencies and high caliber of professionalism at Port Rousse. All vessels are loaded 24/7/365 at an average rate of at least 20,000 metric tonnes per day. We could not ask for better partners in the Baie Verte community who, we are confident, will continue to support our mutual success!"

Peter Koken, Phoenix Bulk Carriers

ABOUT ANACONDA MINING

Anaconda Mining is a growth-oriented, gold mining and exploration company with a producing project called the Point Rousse Project and three exploration/development projects called the Viking and Great Northern Projects and the Tilt Cove Property in Newfoundland.

The Point Rousse Project is approximately 6,300 hectares of property on the Ming's Bight Peninsula located in the Baie Verte Mining District in Newfoundland, Canada. Since 2012, Anaconda has increased its property control by ten-fold on the peninsula and gold production to nearly 16,000 ounces per year. In an effort to expand production, it is currently exploring three primary, prospective gold trends, which have approximately 20 km of cumulative strike length and include five deposits and numerous prospects and showings, all within 8 km of the Pine Cove Mill. A second project called the Tilt Cove Property, consisting of 350 hectares, is located approximately 60 kilometres by road from the Pine Cove Mill but is also within the Baie Verte Mining District and underlain by similar geology to the Point Rousse Project.

Anaconda also controls the Viking and Great Northern Projects, which have approximately 6,225 and 6,375 hectares of property, respectively, in White Bay, Newfoundland, approximately 100 kilometres by water (180 kilometres via road) from the Pine Cove Mill. The Viking Project contains the Thor Deposit and other gold prospects and showings and the Great Northern Project includes numerous prospects and showings within a similar geological setting as the Viking Project. The Company's plan is to discover and develop more resources within these project areas and substantially increase annual production at the Pine Cove Mill from its current rate of nearly 16,000 ounces.

As the only pure play gold producer in Atlantic Canada, Anaconda Mining is turning the rock we live on into a growing and profitable resource. With a young and motivated workforce, innovative technology and the support of local suppliers, Anaconda is investing in the people of Newfoundland & Labrador and giving back to the communities in which we operate - building a better future for all our stakeholders, from the ground up.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

Anaconda Mining receives $551,304 (U.S.) from Auramet

2017-01-11 09:05 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING RAISES USD$551,000 THROUGH PREPAYMENT ARRANGEMENT

Anaconda Mining Inc. entered into an agreement on Jan. 9, 2017, with Auramet International LLC, through which Auramet has paid $551,304 (U.S.), less fees, to Anaconda in exchange for 468 ounces of gold ($1,178 (U.S.) per ounce). After fees and conversion to Canadian dollars, the company received a net amount of $660,990. Anaconda will deliver these ounces to Auramet in 12 semi-monthly deliveries of 39 ounces each from January to June 2017. The Net Proceeds will be used for general working capital purposes. All dollar amounts are in Canadian dollars unless otherwise noted.

President and CEO, Dustin Angelo, stated, "We are pleased to be able to enter into this short-term financing with Auramet, who has been a great partner to Anaconda for many years. The Prepayment Arrangement will allow us to fortify our cash position for the next few months. Operating cash flow has been tight this fiscal year because of the slow start in the first quarter. Operationally, we were much improved in the second quarter and forecast our expenses to continue to decrease in the second half of the year. The Prepayment Arrangement affords us greater flexibility and cushion as we come out of the difficult period earlier in the year."

As part of the Agreement, Anaconda granted to Auramet European-style call options to purchase from the Company gold bullion as follows:

OuncesStrike PriceExpiration Date

400 USD$1,300 December 27, 2017

400 USD$1,300 August 29, 2018

ABOUT ANACONDA MINING

Anaconda Mining is a growth-oriented, gold mining and exploration company with a producing project called the Point Rousse Project and three exploration/development projects called the Viking and Great Northern Projects and the Tilt Cove Property in Newfoundland.

The Point Rousse Project is approximately 6,300 hectares of property on the Ming's Bight Peninsula located in the Baie Verte Mining District in Newfoundland, Canada. Since 2012, Anaconda has increased its property control by ten-fold on the peninsula and gold production to nearly 16,000 ounces per year. In an effort to expand production, it is currently exploring three primary, prospective gold trends, which have approximately 20 km of cumulative strike length and include five deposits and numerous prospects and showings, all within 8 km of the Pine Cove Mill. A second project called the Tilt Cove Property, consisting of 350 hectares, is located approximately 60 kilometres by road from the Pine Cove Mill but is also within the Baie Verte Mining District and underlain by similar geology to the Point Rousse Project.

Anaconda also controls the Viking and Great Northern Projects, which have approximately 6,225 and 6,375 hectares of property, respectively, in White Bay, Newfoundland, approximately 100 kilometres by water (180 kilometres via road) from the Pine Cove Mill. The Viking Project contains the Thor Deposit and other gold prospects and showings and the Great Northern Project includes numerous prospects and showings within a similar geological setting as the Viking Project. The Company's plan is to discover and develop more resources within these project areas and substantially increase annual production at the Pine Cove Mill from its current rate of nearly 16,000 ounces.

As the only pure play gold producer in Atlantic Canada, Anaconda Mining is turning the rock we live on into a growing and profitable resource. With a young and motivated workforce, innovative technology and the support of local suppliers, Anaconda is investing in the people of Newfoundland & Labrador and giving back to the communities in which we operate - building a better future for all our stakeholders, from the ground up.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

2017-01-11 09:05 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING RAISES USD$551,000 THROUGH PREPAYMENT ARRANGEMENT

Anaconda Mining Inc. entered into an agreement on Jan. 9, 2017, with Auramet International LLC, through which Auramet has paid $551,304 (U.S.), less fees, to Anaconda in exchange for 468 ounces of gold ($1,178 (U.S.) per ounce). After fees and conversion to Canadian dollars, the company received a net amount of $660,990. Anaconda will deliver these ounces to Auramet in 12 semi-monthly deliveries of 39 ounces each from January to June 2017. The Net Proceeds will be used for general working capital purposes. All dollar amounts are in Canadian dollars unless otherwise noted.

President and CEO, Dustin Angelo, stated, "We are pleased to be able to enter into this short-term financing with Auramet, who has been a great partner to Anaconda for many years. The Prepayment Arrangement will allow us to fortify our cash position for the next few months. Operating cash flow has been tight this fiscal year because of the slow start in the first quarter. Operationally, we were much improved in the second quarter and forecast our expenses to continue to decrease in the second half of the year. The Prepayment Arrangement affords us greater flexibility and cushion as we come out of the difficult period earlier in the year."

As part of the Agreement, Anaconda granted to Auramet European-style call options to purchase from the Company gold bullion as follows:

OuncesStrike PriceExpiration Date

400 USD$1,300 December 27, 2017

400 USD$1,300 August 29, 2018

ABOUT ANACONDA MINING

Anaconda Mining is a growth-oriented, gold mining and exploration company with a producing project called the Point Rousse Project and three exploration/development projects called the Viking and Great Northern Projects and the Tilt Cove Property in Newfoundland.

The Point Rousse Project is approximately 6,300 hectares of property on the Ming's Bight Peninsula located in the Baie Verte Mining District in Newfoundland, Canada. Since 2012, Anaconda has increased its property control by ten-fold on the peninsula and gold production to nearly 16,000 ounces per year. In an effort to expand production, it is currently exploring three primary, prospective gold trends, which have approximately 20 km of cumulative strike length and include five deposits and numerous prospects and showings, all within 8 km of the Pine Cove Mill. A second project called the Tilt Cove Property, consisting of 350 hectares, is located approximately 60 kilometres by road from the Pine Cove Mill but is also within the Baie Verte Mining District and underlain by similar geology to the Point Rousse Project.

Anaconda also controls the Viking and Great Northern Projects, which have approximately 6,225 and 6,375 hectares of property, respectively, in White Bay, Newfoundland, approximately 100 kilometres by water (180 kilometres via road) from the Pine Cove Mill. The Viking Project contains the Thor Deposit and other gold prospects and showings and the Great Northern Project includes numerous prospects and showings within a similar geological setting as the Viking Project. The Company's plan is to discover and develop more resources within these project areas and substantially increase annual production at the Pine Cove Mill from its current rate of nearly 16,000 ounces.

As the only pure play gold producer in Atlantic Canada, Anaconda Mining is turning the rock we live on into a growing and profitable resource. With a young and motivated workforce, innovative technology and the support of local suppliers, Anaconda is investing in the people of Newfoundland & Labrador and giving back to the communities in which we operate - building a better future for all our stakeholders, from the ground up.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

Antwort auf Beitrag Nr.: 54.059.740 von bigyawn am 11.01.17 15:14:46Marketcap entspricht der Güteklasse dieser News. 39 ounces

Anaconda Mining samples up to 24.5 g/t Au at Jackson's

2017-01-12 07:41 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING DEMONSTRATES EXPLORATION POTENTIAL OF THE GREAT NORTHERN PROJECT; ASSAYS UP TO 24.5 G/T AU FROM GRAB SAMPLES AT JACKSON'S ARM

Anaconda Mining Inc. has completed a preliminary work program at the 100-per-cent-held Jackson's Arm property, part of the Great Northern project, located approximately 20 kilometres north of Anaconda's Viking project. The work program was successful in defining areas of prospectivity within the property by determining key geological controls associated with known surface mineralization.

Key exploration highlights

Completed 15 line kilometres of geological mapping, including detailed mapping of 10 trenches;

Outlined a continuous zone of gold mineralization and alteration that is 1.7 kilometres long by 40 to 400 metres wide;

Defined four kilometres of exploration potential to the north (one kilometre) and east (three kilometres);

Rock samples assayed 24.5 grams per tonne (g/t) gold and 0.03 g/t gold (Boot N' Hammer prospect), 11.7 g/t gold (Stocker prospect) and 3.35 g/t gold (trench JT1);

Determined that gold mineralization and alteration are associated with a series of fault zones that are splays off the Doucer's Valley fault, a similar setting to the Pine Cove deposit at the Point Rousse project.

President and chief executive officer Dustin Angelo stated: "Our recent work has shown that the main gold occurrences at Jackson's Arm are hosted along a series of secondary fault zones linked to the regional-scale Doucer's Valley fault system. This relationship further highlights the potential to host gold along and adjacent to multiple property-scale faults that cross the area. We are pleased with the size and continuity of the alteration zone and now feel that we have the pertinent geological information upon which to build more advanced exploration. The continuation and repetition of the host structures to the immediate north and east demonstrates the potential for future discovery on this property. Having another potentially gold-bearing project similar in setting to the Pine Cove pit, near water and relatively close to the Pine Cove mill, is a great asset for the Anaconda exploration portfolio."

Geological mapping

During the late fall of 2016, Anaconda completed a total of 15 line kilometres of grid, geological mapping and mapped 10 trenches in detail. Mapping outlined a 1.7-kilometre-long-by-40-to-400-metre-wide continuous alteration zone that is host to the main gold prospects at Jackson's Arm on the west side of the property. The alteration is controlled by a fault zone that is interpreted to extend immediately to the north along strike beyond the current, known zone of alteration. The company has also discovered similar repeating faults to the east. Consequently, Anaconda believes the potential strike of the alteration system could extend an additional four kilometres, both north and east.

Overview of geology

Alteration and gold mineralization are hosted within the Ordovician-aged granites of the Coney Head complex. The alteration zone and host granites are in thrust-faulted contact with younger Silurian volcanic and sedimentary rocks along the southwestern margin. This steeply east-northeast-dipping and north-northwest-striking fault zone and associated splays are interpreted to represent significant control on the localization of hydrothermal alteration and gold mineralization on the property, where the host granite forms a favourable mechanical host to gold mineralization. The fault zone is interpreted as a secondary splay off the Doucer's Valley fault system. The host environment to gold mineralization at Jackson's Arm has been observed by Anaconda geologists at the nearby Thor and Rattling Brook deposits, and also at the Pine Cove mine where gold mineralization is hosted adjacent to secondary thrust fault systems.

Great Northern project overview

The Great Northern project is located near the community of Jackson's Arm, Nfld., and is centred along the Doucer's Valley fault, a regional splay off the Long Range fault. The Doucer's Valley fault is a significant geological control on and host to several gold deposits, including Anaconda's Thor deposit (83,000 ounces indicated and 31,000 ounces inferred resources*) and the Rattling Brook deposit (495,000 ounces inferred resources**).

The Great Northern project boasts several gold prospects and showings, including the Shrik, Stocker, Boot N' Hammer, 954 prospects and the Incinerator Trail zone. Surface grab samples assaying up to 24.5 g/t gold and 1,232.0 g/t silver at the Boot N' Hammer prospect; up to 56.7 g/t gold and 2.75 ounces per tonne silver at the Stocker prospect; up to 7.2 g/t gold at the Shrik prospect; and 13.6 g/t gold at the 954 prospect. The Incinerator Trail zone has been tested by four reconnaissance-style diamond drill holes in the 1980s and returned gold assays of 1.78 g/t gold over four metres (hole RB-35) and 2.30 g/t gold over 4.05 metres (hole RB-41).

Notes

* Resource taken from the National Instrument 43-101 report for the Viking project entitled "NI 43-101 technical report and mineral resource estimate on the Thor deposit, Viking project, White Bay area, Newfoundland and Labrador, Canada," with an effective date of Aug. 29, 2016.

** Resource taken from the NI 43-101 report for the Jackson's Arm project entitled "Technical report on mineral resource estimate for Jackson's Arm gold project, White Bay area, Newfoundland and Labrador, latitude 49 degrees 53 minutes 2.65 seconds north, longitude 56 degrees 50 minutes 7.09 seconds west," with an effective date of April 20, 2009. Prepared for: Kermode Resources Ltd. by Mercator Geological Services Ltd.

This news release has been reviewed and approved by Paul McNeill, PGeo, vice-president, exploration, with Anaconda Mining, a qualified person, under National Instrument 43-101 standard for disclosure for mineral projects.

About Anaconda Mining

Anaconda Mining's Point Rousse project is approximately 6,300 hectares of property on the Ming's Bight peninsula located in the Baie Verte mining district in Newfoundland, Canada. A second project, called the Tilt Cove property, consisting of 350 hectares, is located approximately 60 kilometres by road from the Pine Cove mill.

Anaconda also controls the Viking and Great Northern projects, which have approximately 6,225 hectares and 6,375 hectares of property, respectively, in White Bay, Newfoundland. The company's plan is to discover and develop more resources within these project areas and substantially increase annual production at the Pine Cove mill from its current rate of nearly 16,000 ounces.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

2017-01-12 07:41 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING DEMONSTRATES EXPLORATION POTENTIAL OF THE GREAT NORTHERN PROJECT; ASSAYS UP TO 24.5 G/T AU FROM GRAB SAMPLES AT JACKSON'S ARM

Anaconda Mining Inc. has completed a preliminary work program at the 100-per-cent-held Jackson's Arm property, part of the Great Northern project, located approximately 20 kilometres north of Anaconda's Viking project. The work program was successful in defining areas of prospectivity within the property by determining key geological controls associated with known surface mineralization.

Key exploration highlights

Completed 15 line kilometres of geological mapping, including detailed mapping of 10 trenches;

Outlined a continuous zone of gold mineralization and alteration that is 1.7 kilometres long by 40 to 400 metres wide;

Defined four kilometres of exploration potential to the north (one kilometre) and east (three kilometres);

Rock samples assayed 24.5 grams per tonne (g/t) gold and 0.03 g/t gold (Boot N' Hammer prospect), 11.7 g/t gold (Stocker prospect) and 3.35 g/t gold (trench JT1);

Determined that gold mineralization and alteration are associated with a series of fault zones that are splays off the Doucer's Valley fault, a similar setting to the Pine Cove deposit at the Point Rousse project.

President and chief executive officer Dustin Angelo stated: "Our recent work has shown that the main gold occurrences at Jackson's Arm are hosted along a series of secondary fault zones linked to the regional-scale Doucer's Valley fault system. This relationship further highlights the potential to host gold along and adjacent to multiple property-scale faults that cross the area. We are pleased with the size and continuity of the alteration zone and now feel that we have the pertinent geological information upon which to build more advanced exploration. The continuation and repetition of the host structures to the immediate north and east demonstrates the potential for future discovery on this property. Having another potentially gold-bearing project similar in setting to the Pine Cove pit, near water and relatively close to the Pine Cove mill, is a great asset for the Anaconda exploration portfolio."

Geological mapping

During the late fall of 2016, Anaconda completed a total of 15 line kilometres of grid, geological mapping and mapped 10 trenches in detail. Mapping outlined a 1.7-kilometre-long-by-40-to-400-metre-wide continuous alteration zone that is host to the main gold prospects at Jackson's Arm on the west side of the property. The alteration is controlled by a fault zone that is interpreted to extend immediately to the north along strike beyond the current, known zone of alteration. The company has also discovered similar repeating faults to the east. Consequently, Anaconda believes the potential strike of the alteration system could extend an additional four kilometres, both north and east.

Overview of geology

Alteration and gold mineralization are hosted within the Ordovician-aged granites of the Coney Head complex. The alteration zone and host granites are in thrust-faulted contact with younger Silurian volcanic and sedimentary rocks along the southwestern margin. This steeply east-northeast-dipping and north-northwest-striking fault zone and associated splays are interpreted to represent significant control on the localization of hydrothermal alteration and gold mineralization on the property, where the host granite forms a favourable mechanical host to gold mineralization. The fault zone is interpreted as a secondary splay off the Doucer's Valley fault system. The host environment to gold mineralization at Jackson's Arm has been observed by Anaconda geologists at the nearby Thor and Rattling Brook deposits, and also at the Pine Cove mine where gold mineralization is hosted adjacent to secondary thrust fault systems.

Great Northern project overview

The Great Northern project is located near the community of Jackson's Arm, Nfld., and is centred along the Doucer's Valley fault, a regional splay off the Long Range fault. The Doucer's Valley fault is a significant geological control on and host to several gold deposits, including Anaconda's Thor deposit (83,000 ounces indicated and 31,000 ounces inferred resources*) and the Rattling Brook deposit (495,000 ounces inferred resources**).

The Great Northern project boasts several gold prospects and showings, including the Shrik, Stocker, Boot N' Hammer, 954 prospects and the Incinerator Trail zone. Surface grab samples assaying up to 24.5 g/t gold and 1,232.0 g/t silver at the Boot N' Hammer prospect; up to 56.7 g/t gold and 2.75 ounces per tonne silver at the Stocker prospect; up to 7.2 g/t gold at the Shrik prospect; and 13.6 g/t gold at the 954 prospect. The Incinerator Trail zone has been tested by four reconnaissance-style diamond drill holes in the 1980s and returned gold assays of 1.78 g/t gold over four metres (hole RB-35) and 2.30 g/t gold over 4.05 metres (hole RB-41).

Notes

* Resource taken from the National Instrument 43-101 report for the Viking project entitled "NI 43-101 technical report and mineral resource estimate on the Thor deposit, Viking project, White Bay area, Newfoundland and Labrador, Canada," with an effective date of Aug. 29, 2016.

** Resource taken from the NI 43-101 report for the Jackson's Arm project entitled "Technical report on mineral resource estimate for Jackson's Arm gold project, White Bay area, Newfoundland and Labrador, latitude 49 degrees 53 minutes 2.65 seconds north, longitude 56 degrees 50 minutes 7.09 seconds west," with an effective date of April 20, 2009. Prepared for: Kermode Resources Ltd. by Mercator Geological Services Ltd.

This news release has been reviewed and approved by Paul McNeill, PGeo, vice-president, exploration, with Anaconda Mining, a qualified person, under National Instrument 43-101 standard for disclosure for mineral projects.

About Anaconda Mining

Anaconda Mining's Point Rousse project is approximately 6,300 hectares of property on the Ming's Bight peninsula located in the Baie Verte mining district in Newfoundland, Canada. A second project, called the Tilt Cove property, consisting of 350 hectares, is located approximately 60 kilometres by road from the Pine Cove mill.

Anaconda also controls the Viking and Great Northern projects, which have approximately 6,225 hectares and 6,375 hectares of property, respectively, in White Bay, Newfoundland. The company's plan is to discover and develop more resources within these project areas and substantially increase annual production at the Pine Cove mill from its current rate of nearly 16,000 ounces.

We seek Safe Harbor.

© 2017 Canjex Publishing Ltd. All rights reserved.

TORONTO, Jan. 13, 2017 /CNW/ - Anaconda Mining Inc. ("Anaconda" or the "Company") – (TSX:ANX) is pleased to report its financial and operating results for the three months ended November 30, 2016 (the "Quarter"). The Company sold 4,388 ounces of gold resulting in $7,411,279 in revenue at an average sales price of $1,689 (USD$1,273) per ounce. Cash cost per ounce sold at the Point Rousse Project for the three months ended November 30, 2016 was $1,036 (USD$781). The Company generated positive earnings before interest, taxes, depreciation and amortization and other non-cash expenses ("EBITDA") of $3,029,080 at the Point Rousse Project. Net income for the three months ended November 30, 2016 was $723,181. As at November 30, 2016, the Company had cash and cash equivalents of $480,210 and net working capital of $1,752,360.

Read more at http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

Read more at http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

Anaconda earns $723,181 in Q2 fiscal 2017

2017-01-13 17:42 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING SELLS 4,388 OUNCES AND GENERATES $3.0M OF EBITDA AT THE POINT ROUSSE PROJECT FOR Q2 FISCAL 2017

Anaconda Mining Inc. has released its financial and operating results for the three months ended Nov. 30, 2016. The company sold 4,388 ounces of gold resulting in $7,411,279 in revenue at an average sales price of $1,689 ($1,273 (U.S.)) per ounce. Cash cost per ounce sold at the Point Rousse project for the three months ended Nov. 30, 2016, was $1,036 ($781 (U.S.)). The company generated positive earnings before interest, taxes, depreciation and amortization, and other non-cash expenses of $3,029,080 at the Point Rousse project. Net income for the three months ended Nov. 30, 2016, was $723,181. As at Nov. 30, 2016, the company had cash and cash equivalents of $480,210 and net working capital of $1,752,360.

President and chief executive officer, Dustin Angelo, stated: "Operationally, Anaconda rebounded well in the second quarter of fiscal 2017, producing and selling 4,388 ounces of gold, a 50-per-cent increase from the first quarter. Most notably, the Pine Cove mill reached a new record level of throughput at over 1,300 tonnes per operating day. On the cost side, our cash operating cost per ounce for the second quarter of $1,036 per ounce was well below our trailing eight quarters of $1,086 per ounce largely due to a reduced strip ratio and increased gold production. All-in cash cost of $1,625 per ounce for the second quarter was also much improved, 33 per cent lower than the first quarter of fiscal 2017. In the second half of fiscal 2017, we are forecasting better gold production because of expected higher grade and lower all-in sustaining cash cost per ounce due to a further reduction in strip ratio and lower capital and exploration expenditures."

Highlights for the three and six months ended Nov. 30, 2016:

As at Nov. 30, 2016, the company had cash and cash equivalents of $480,210 and net working capital of $1,752,360.

For the three months ended Nov. 30, 2016, the company sold 4,388 ounces of gold and generated $7,411,279 in revenue at an average sales price of $1,689 ($1,273 (U.S.)) per ounce.