European Uranium Resources Ltd. ehem.TOURNIGAN ENERGY - 500 Beiträge pro Seite (Seite 85)

eröffnet am 24.10.03 13:49:51 von

neuester Beitrag 20.10.16 13:54:51 von

neuester Beitrag 20.10.16 13:54:51 von

Beiträge: 42.309

ID: 789.294

ID: 789.294

Aufrufe heute: 5

Gesamt: 4.041.325

Gesamt: 4.041.325

Aktive User: 0

ISIN: CA05478A1093 · WKN: A2AKWX · Symbol: AZR

0,0100

CAD

0,00 %

0,0000 CAD

Letzter Kurs 26.06.23 TSX Venture

Neuigkeiten

27.09.23 · Accesswire |

18.07.23 · Accesswire |

27.06.23 · Accesswire |

23.06.23 · Accesswire |

05.06.23 · Accesswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +809,09 | |

| 8,0000 | +45,45 | |

| 11,000 | +19,57 | |

| 1,6640 | +16,04 | |

| 527,60 | +15,68 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 6,6800 | -8,94 | |

| 0,7000 | -10,26 | |

| 324,70 | -10,30 | |

| 8,1000 | -20,59 | |

| 0,6601 | -26,22 |

Interview mit dem CEO:

http://www.proactiveinvestors.com/companies/ceo_focus/249/eu…

http://www.proactiveinvestors.com/companies/ceo_focus/249/eu…

Antwort auf Beitrag Nr.: 42.862.283 von Last_Man_Standing am 07.03.12 08:30:48Bzw. gleich so:

Miningscout 07/03/2012

Uran: Branche wird optimistischer

Ein Jahr nach der Atomkatastrophe von Fukushima wird die Uranbranche wieder optimistischer. Noch immer sind die Auswirkungen der verheerenden Naturkatastrophen spürbar. Der Uranmarkt hat sich noch nicht von den Tiefs des Vorjahrs erholt, er ist jedoch wieder auf dem Weg der Besserung. Große Uranaktien haben seit Jahresanfang um bis zu 20 Prozent zugelegt. Einzig der Preis für Uran hat seit Fukushima keine großen Sprünge gemacht. Er sackte damals von 70 Dollar je Pfund auf 49 Dollar ab. Aktuell steht er bei 52 Dollar. Kurzfristig rechnen Beobachter auch nicht mit einem deutlichen Anstieg. Die fehlende Urannachfrage aus Japan und Deutschland macht sich bemerkbar. Es fehlt der Nachfragedruck, Angebot und Nachfrage halten sich derzeit in etwa die Waage.

Doch dies könnte sich bald ändern. Momentan liegt die Nachfrage jährlich bei rund 178 Millionen Pfund Uran. Minen produzieren jährlich 140 Millionen Pfund, hinzu kommt wieder gewonnenes Uran, unter anderem aus alten russischen Waffensystemen. Doch Russland wird diese Art des Recyclings im kommenden Jahr aufgeben. Das verschärft die Situation. Zudem wurden einige Projekte nach Fukushima eingestellt oder verschoben. Damit ist die Angebotslage künftig beeinträchtigt. Durchaus möglich ist zudem, dass künftig wieder mehr japanische Reaktoren angeschaltet werden, dies würde die Nachfrage antreiben. Zudem wird die Nachfrage von den weltweit im Bau befindlichen rund 60 Reaktoren profitieren. Kanadische Experten glauben daher, dass die Nachfrage nach Uran bald wieder klar anziehen wird. So sollten 265 Millionen Pfund jährlich keine Überraschung sein. Das wäre ein Plus von fast 50 Prozent im Vergleich zur aktuellen Situation. Für Uranunternehmen wäre dies eine gute Perspektive.

http://www.miningscout.de/Rohstoffblog/Uran_Branche_wird_opt…

Uran: Branche wird optimistischer

Ein Jahr nach der Atomkatastrophe von Fukushima wird die Uranbranche wieder optimistischer. Noch immer sind die Auswirkungen der verheerenden Naturkatastrophen spürbar. Der Uranmarkt hat sich noch nicht von den Tiefs des Vorjahrs erholt, er ist jedoch wieder auf dem Weg der Besserung. Große Uranaktien haben seit Jahresanfang um bis zu 20 Prozent zugelegt. Einzig der Preis für Uran hat seit Fukushima keine großen Sprünge gemacht. Er sackte damals von 70 Dollar je Pfund auf 49 Dollar ab. Aktuell steht er bei 52 Dollar. Kurzfristig rechnen Beobachter auch nicht mit einem deutlichen Anstieg. Die fehlende Urannachfrage aus Japan und Deutschland macht sich bemerkbar. Es fehlt der Nachfragedruck, Angebot und Nachfrage halten sich derzeit in etwa die Waage.

Doch dies könnte sich bald ändern. Momentan liegt die Nachfrage jährlich bei rund 178 Millionen Pfund Uran. Minen produzieren jährlich 140 Millionen Pfund, hinzu kommt wieder gewonnenes Uran, unter anderem aus alten russischen Waffensystemen. Doch Russland wird diese Art des Recyclings im kommenden Jahr aufgeben. Das verschärft die Situation. Zudem wurden einige Projekte nach Fukushima eingestellt oder verschoben. Damit ist die Angebotslage künftig beeinträchtigt. Durchaus möglich ist zudem, dass künftig wieder mehr japanische Reaktoren angeschaltet werden, dies würde die Nachfrage antreiben. Zudem wird die Nachfrage von den weltweit im Bau befindlichen rund 60 Reaktoren profitieren. Kanadische Experten glauben daher, dass die Nachfrage nach Uran bald wieder klar anziehen wird. So sollten 265 Millionen Pfund jährlich keine Überraschung sein. Das wäre ein Plus von fast 50 Prozent im Vergleich zur aktuellen Situation. Für Uranunternehmen wäre dies eine gute Perspektive.

http://www.miningscout.de/Rohstoffblog/Uran_Branche_wird_opt…

Das glaube ich auch, solange die Alternativen vom Staat unterstützt werden müssen.

vorbörse 40.5 cadcent

umgerechnet 8 cent vor dem split

..

.. ..

..

umgerechnet 8 cent vor dem split

..

.. ..

..

und noch 3 k im 37er bid...

die achterbahnfahrt nach unten nimmt weiter seinen lauf

die achterbahnfahrt nach unten nimmt weiter seinen lauf

Reversesplits, noch dazu mit Namensänderung, sind natürlich immer Enteignungen (und Betrug) der Altaktionäre. Schade, dass TVC so gar nichts auf die Reihe brachte um nun trotz angeblichen Aktionärsschutzes zu solch miesen Tricks greifen muss.

Wie ergings mir mit Bayswater? - Die splitteten 10:1 und am ersten Handelstag gab der 'Superjunior' gleich 50% ab und seitdem ist er im steten Abwärtstrend. Der Junior hat n Schwesterchen;-)

Wie ergings mir mit Bayswater? - Die splitteten 10:1 und am ersten Handelstag gab der 'Superjunior' gleich 50% ab und seitdem ist er im steten Abwärtstrend. Der Junior hat n Schwesterchen;-)

@greywolf

so isses leider....

siehe auch mein posting 42814182

so isses leider....

siehe auch mein posting 42814182

Zitat von ivanbaerlin: sicher wird der kurs angepaßt....

aber wer sich schon ein bisschen länger mit explorer beschäftigt,

der kennt sicherlich den immer wieder kehrenden gleichen ablauf.

95% der der explorer schaffen es bekanntlich nicht zum produzenten.

aber sie bestehen viele jahre und das kostet geld.

gehälter, exploration, sonstiges. dieses geld muss ja immer wieder neu generiert werden und dies läuft oftmals nach dem gleichen muster.

ständige ausgabe neuer aktien (auch mitarbeiter und freundes sonder konditionens-ausgaben). das ganze geht solange bis eine grosse anzahl aktien erreicht sind und der kurs gleichzeitig im untersten bereich angekommen ist. ein nenneswertes kapital ist meist nicht mehr vorhanden.

dann erfolgt ein schnitt wie z.B. hier 5 alte gegen 1 neue.

der kurs geht von 9 auf 45cent und statt 250 mio gibt es 50 mio aktien.

der kurs ist natürlich super um wieder neue kapitalmaßnahmen durchzuführen

und so wird die aktienanzahl wieder hochgetrieben und da aber gleichzeitig die wertigkeit nicht zunimmt fällt der kurs der aktie.

ist das geld eines tages wieder aufgebraucht die aktienanzahl wieder oben und der kurs unten geht das ganze spiel von neuen los.

leider checken es die meisten erst wenn sie nach jahren ihren einstiegspreis mit dem istpreis vergleichen und feststellen das sie quasi die "ganze zeche" bezahlt haben.

die akute schnittstelle/gefahr sehe ich nach dem tausch > wenn der kurs unter den x 5 eröffnugskurs fällt.

zudem ist bei 40-50 cadcent seit jahren ein sehr grosser technischer widerstand...

tja was sollen wir kleinanleger uns für kurs hoffnungen machen

wenn die grossen player dicke pakete (sie unten 88.5 k neu = 442 k alt),

für 37 cent neu = 7,4 cent alt händeln....

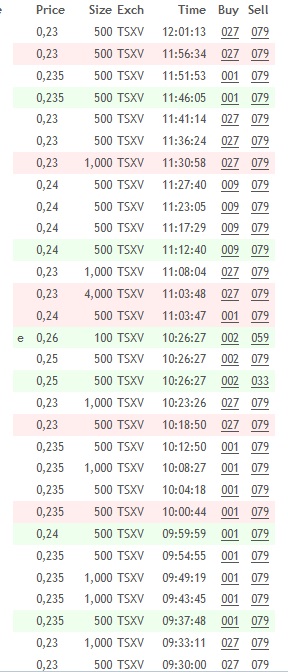

Recent Trades - Last 10 of 38

Time ET Ex Price Change Volume Buyer Seller Markers

11:27:58 V 0.37 -0.005 88,500 79 CIBC 2 RBC K

11:27:58 V 0.365 -0.01 2,000 79 CIBC 14 ITG K

11:21:16 V 0.36 -0.015 3,000 85 Scotia 9 BMO Nesbitt K

10:31:16 V 0.37 -0.01 300 7 TD Sec 59 PI E

10:04:17 V 0.365 -0.01 5,000 81 HSBC 1 Anonymous K

10:04:02 V 0.37 -0.005 4,500 1 Anonymous 2 RBC K

10:04:00 V 0.37 -0.005 4,500 1 Anonymous 2 RBC K

10:03:58 V 0.37 -0.005 4,500 89 Raymond James 2 RBC K

10:03:33 V 0.37 -0.005 4,500 1 Anonymous 2 RBC K

10:03:18 V 0.37 -0.005 3,500 1 Anonymous 2 RBC K

wenn die grossen player dicke pakete (sie unten 88.5 k neu = 442 k alt),

für 37 cent neu = 7,4 cent alt händeln....

Recent Trades - Last 10 of 38

Time ET Ex Price Change Volume Buyer Seller Markers

11:27:58 V 0.37 -0.005 88,500 79 CIBC 2 RBC K

11:27:58 V 0.365 -0.01 2,000 79 CIBC 14 ITG K

11:21:16 V 0.36 -0.015 3,000 85 Scotia 9 BMO Nesbitt K

10:31:16 V 0.37 -0.01 300 7 TD Sec 59 PI E

10:04:17 V 0.365 -0.01 5,000 81 HSBC 1 Anonymous K

10:04:02 V 0.37 -0.005 4,500 1 Anonymous 2 RBC K

10:04:00 V 0.37 -0.005 4,500 1 Anonymous 2 RBC K

10:03:58 V 0.37 -0.005 4,500 89 Raymond James 2 RBC K

10:03:33 V 0.37 -0.005 4,500 1 Anonymous 2 RBC K

10:03:18 V 0.37 -0.005 3,500 1 Anonymous 2 RBC K

European Uranium Files Technical Report for Kuriskova Preliminary Feasibility Study

http://www.stockhouse.com/FinancialTools/sn_newsreleases.asp…

http://www.stockhouse.com/FinancialTools/sn_newsreleases.asp…

LINKE gewinnen Wahl in der Slowakei

http://de.reuters.com/article/topNews/idDEBEE82903W20120311

damit dürften die chancen auf eine abbaugenehmigung weiter sinken...

http://de.reuters.com/article/topNews/idDEBEE82903W20120311

damit dürften die chancen auf eine abbaugenehmigung weiter sinken...

und 35 = 7 cent alt

Recent Trades - Last 10 of 59

Time ET Ex Price Change Volume Buyer Seller Markers

15:56:39 V 0.35 -0.025 6,500 58 Qtrade 7 TD Sec K

15:56:39 V 0.36 -0.015 1,000 1 Anonymous 7 TD Sec K

15:53:01 V 0.365 -0.01 10,000 1 Anonymous 7 TD Sec K

15:19:26 V 0.35 -0.025 7,500 62 Haywood 7 TD Sec K

15:19:26 V 0.355 -0.02 1,000 2 RBC 7 TD Sec K

15:19:26 V 0.355 -0.02 1,500 7 TD Sec 7 TD Sec K

15:06:46 V 0.355 -0.02 3,500 7 TD Sec 9 BMO Nesbitt K

15:06:46 V 0.355 -0.02 1,000 85 Scotia 9 BMO Nesbitt K

15:06:46 V 0.36 -0.015 500 2 RBC 9 BMO Nesbitt K

15:06:46 V 0.36 -0.015 1,000 9 BMO Nesbitt 9 BMO Nesbitt K

Recent Trades - Last 10 of 59

Time ET Ex Price Change Volume Buyer Seller Markers

15:56:39 V 0.35 -0.025 6,500 58 Qtrade 7 TD Sec K

15:56:39 V 0.36 -0.015 1,000 1 Anonymous 7 TD Sec K

15:53:01 V 0.365 -0.01 10,000 1 Anonymous 7 TD Sec K

15:19:26 V 0.35 -0.025 7,500 62 Haywood 7 TD Sec K

15:19:26 V 0.355 -0.02 1,000 2 RBC 7 TD Sec K

15:19:26 V 0.355 -0.02 1,500 7 TD Sec 7 TD Sec K

15:06:46 V 0.355 -0.02 3,500 7 TD Sec 9 BMO Nesbitt K

15:06:46 V 0.355 -0.02 1,000 85 Scotia 9 BMO Nesbitt K

15:06:46 V 0.36 -0.015 500 2 RBC 9 BMO Nesbitt K

15:06:46 V 0.36 -0.015 1,000 9 BMO Nesbitt 9 BMO Nesbitt K

Antwort auf Beitrag Nr.: 42.896.977 von ivanbaerlin am 13.03.12 22:28:07macht echt Freude, den Optimismus, den du hier verbreitest. Bist du noch investiert?

Wenn nicht, kannste das ja vielleicht einfach mal sein lassen...

Wenn nicht, kannste das ja vielleicht einfach mal sein lassen...

!

Dieser Beitrag wurde von akummermehr moderiert. Grund: Behauptung ohne BelegZitat von soalex: macht echt Freude, den Optimismus, den du hier verbreitest. Bist du noch investiert?

Wenn nicht, kannste das ja vielleicht einfach mal sein lassen...

muss dich leider entäuschen...

bin investiert (vor 2008)

und werde auch weiterhin ggf. kritisch posten

es gibt hier eine ignore funktion,

trag mich doch darin ein und du brauchst die zurzeit traurigen realität

(in meinen beiträgen) nicht mehr ins auge schaun..

Antwort auf Beitrag Nr.: 42.901.150 von ivanbaerlin am 14.03.12 16:50:06man nehme ein t...

European Uranium Retains Renmark Financial Communications Inc.

Vancouver, British Columbia CANADA, March 14, 2012 /FSC/ - European Uranium Resources Ltd. (EUU - TSX Venture, TGPN - FWB)(the "Company") is pleased to announce that it has retained the services of Renmark Financial Communications Inc. ("Renmark") to provide investor relations services to the Company.

"We are pleased to announce that we have selected Renmark to reinforce and raise European Uranium's profile in the financial community and enhance the visibility of our project portfolio. We chose Renmark because its standards and methodologies fit best with the message we wish to communicate to the investing public, focusing specifically on retail brokers," noted Dorian (Dusty) Nicol, President and CEO of European Uranium.

The Company has retained Renmark for a minimum of six months at a monthly retainer of $5,000 and a month to month basis thereafter.

Renmark does not have any interest, directly or indirectly, in European Uranium or its securities, or any right or intent to acquire such an interest.

http://tmx.quotemedia.com/article.php?newsid=49354740&qm_sym…

Vancouver, British Columbia CANADA, March 14, 2012 /FSC/ - European Uranium Resources Ltd. (EUU - TSX Venture, TGPN - FWB)(the "Company") is pleased to announce that it has retained the services of Renmark Financial Communications Inc. ("Renmark") to provide investor relations services to the Company.

"We are pleased to announce that we have selected Renmark to reinforce and raise European Uranium's profile in the financial community and enhance the visibility of our project portfolio. We chose Renmark because its standards and methodologies fit best with the message we wish to communicate to the investing public, focusing specifically on retail brokers," noted Dorian (Dusty) Nicol, President and CEO of European Uranium.

The Company has retained Renmark for a minimum of six months at a monthly retainer of $5,000 and a month to month basis thereafter.

Renmark does not have any interest, directly or indirectly, in European Uranium or its securities, or any right or intent to acquire such an interest.

http://tmx.quotemedia.com/article.php?newsid=49354740&qm_sym…

Antwort auf Beitrag Nr.: 42.901.953 von Last_Man_Standing am 14.03.12 18:54:36(the "Company") is pleased to announce that it has retained the services of Renmark Financial Communications Inc

....................................................................

soso... sie freuen sich also weiterhin jeden monat $ 5.000 zu zahlen...

die frage ist nur...was hat es bisher gebracht?..genutzt?

der kurs ist abolut unten und hatte sogar neue AT lows gesetzt..

....................................................................

soso... sie freuen sich also weiterhin jeden monat $ 5.000 zu zahlen...

die frage ist nur...was hat es bisher gebracht?..genutzt?

der kurs ist abolut unten und hatte sogar neue AT lows gesetzt..

und kurs fällt weiter...

auf aktuell 33,5 cent neu = entspricht 6,7 cent alt

Recent Trades - today

Time ET Ex Price Change Volume Buyer Seller Markers

10:58:14 V 0.335 -0.01 8,000 85 Scotia 89 Raymond James K

10:58:14 V 0.335 -0.01 1,500 2 RBC 89 Raymond James K

auf aktuell 33,5 cent neu = entspricht 6,7 cent alt

Recent Trades - today

Time ET Ex Price Change Volume Buyer Seller Markers

10:58:14 V 0.335 -0.01 8,000 85 Scotia 89 Raymond James K

10:58:14 V 0.335 -0.01 1,500 2 RBC 89 Raymond James K

... wundert dich das? Du hast doch selbst gut erklärt, wie das ist, wenn Firmen reverse-splitten und die MCap schrumpfen!

Altaktionäre werden soviel wie enteignet, dann werden massenhaft neue Aktien begeben, mit ein paar 'News' der Kurs geschönt und die neuen Aktien dann wieder verklopft - das ganze wiederholt sich, die Direktoren leben gut.

(Irgendwas wird der Mod schon wieder finden, um den Beitrag zu löschen - mir egal!)

Gruß!

Altaktionäre werden soviel wie enteignet, dann werden massenhaft neue Aktien begeben, mit ein paar 'News' der Kurs geschönt und die neuen Aktien dann wieder verklopft - das ganze wiederholt sich, die Direktoren leben gut.

(Irgendwas wird der Mod schon wieder finden, um den Beitrag zu löschen - mir egal!)

Gruß!

Zitat von greywolfe: ... wundert dich das? Du hast doch selbst gut erklärt, wie das ist, wenn Firmen reverse-splitten und die MCap schrumpfen!

Altaktionäre werden soviel wie enteignet, dann werden massenhaft neue Aktien begeben, mit ein paar 'News' der Kurs geschönt und die neuen Aktien dann wieder verklopft - das ganze wiederholt sich, die Direktoren leben gut.

(Irgendwas wird der Mod schon wieder finden, um den Beitrag zu löschen - mir egal!)

Gruß!

hallo,

nein wundert mich nicht.

könnte mir zudem auch vorstellen das man ein nierdrigeres kursniveau "wünscht" und nutzen könnte, um mitarbeiter optionen auszugeben

respektive privat placierungen an ausgewählte interessenten.

seis drum, irgendwann wird der kurs auch wieder hochgezogen

mein KZ > 2,00cad (entspricht der alten widerstandszone von 40cent).

ich hab zeit und geduld.....

ja ein posting von mir wurde auch gemeldet und gelöscht. die mods sind hier bei aber ganz okay!

habe den eindruck, dass hier ein gewisses klientel gerne mal beiträge meldet die nicht ihren vorstellungen entsprechen.

bin ja schon 6 jahre hier im thread aber soetwas gab es hier noch nie.

naja eintagsfliegen kommen und gehen...

gruß!

note,

das posting beinhaltet ausschließlich meine persönliche meinung

und stellt keine kauf oder verkaufsempfehlung dar.

... ja, von den alten Kumpels gibts kaum einen mehr, obwohl sich hie und da einer verirrt (bilde mir ein, neulich sogar ne Wortspende von canal1 gelesen zu haben). Auch die Ruhe hier verwundert mich nicht, es gibt ja defacto nichts zu berichten, das irgendwann nen Erfolg versprechen würde. Und so ziehen halt Projekte vorbei wie Curr., Krem., USA, ... - momentan sind halt Kurs. u. Nov. dran und in einiger Zeit spielen sie dann in Skandinavien ihre Spielchen (weils da ja viel leichter ist als in der Slowakei;-)

Mit .40 (alt) hast du dir ein hohes Kursziel gesetzt, ich bin mit .20 zufrieden. Erleb ichs nochmal, werde ich Tourni meiden. Nun sind sie sogar schon zu faul zum Zocken;-)

Ich hab in meiner Kurzzusammenfassung vorhin natürlich vergessen, dass ramponiertes Renomee gelegentlich mit nem neuen Namen versucht wird zu kaschieren. Offenbar muss es wirklich 'Investoren' geben, die sich nicht mal die Mühe machen, die History zu lesen.

Nicht verzagen - kenne deinen MK nicht, aber lmeiner liegt nach wie vor bei 12 Cents. Bin immer noch zuversichtlich, obwohls im Augenblick wirklich aussieht, dass wir trotz Splits zu den alten Werten schrumpfen.

(Ich hab 2-3 Leichen im Depot mit 99% Verlust - ich lass sie dort als stete Mahnung;-)

N8! Gruß!

Mit .40 (alt) hast du dir ein hohes Kursziel gesetzt, ich bin mit .20 zufrieden. Erleb ichs nochmal, werde ich Tourni meiden. Nun sind sie sogar schon zu faul zum Zocken;-)

Ich hab in meiner Kurzzusammenfassung vorhin natürlich vergessen, dass ramponiertes Renomee gelegentlich mit nem neuen Namen versucht wird zu kaschieren. Offenbar muss es wirklich 'Investoren' geben, die sich nicht mal die Mühe machen, die History zu lesen.

Nicht verzagen - kenne deinen MK nicht, aber lmeiner liegt nach wie vor bei 12 Cents. Bin immer noch zuversichtlich, obwohls im Augenblick wirklich aussieht, dass wir trotz Splits zu den alten Werten schrumpfen.

(Ich hab 2-3 Leichen im Depot mit 99% Verlust - ich lass sie dort als stete Mahnung;-)

N8! Gruß!

Antwort auf Beitrag Nr.: 42.910.321 von greywolfe am 15.03.12 22:49:45... ne, nicht kanal1 sondern oscar1 und BeWu;-) n8

Antwort auf Beitrag Nr.: 42.910.321 von greywolfe am 15.03.12 22:49:45Deine Leichen geben die Antwort von selbt.

Antwort auf Beitrag Nr.: 42.912.898 von N424671 am 16.03.12 11:58:43... schau mal, dass du in 40 Jahren weniger zusammenbringst und dann rede ich mit dir Schlaumeier vielleicht weiter!

Zitat von greywolfe: ... schau mal, dass du in 40 Jahren weniger zusammenbringst und dann rede ich mit dir Schlaumeier vielleicht weiter!

das du die leichen zur anschauung im depot läßt ist stark!

denn der mensch vergißt schnell mal das negative -

das du es zudem öffentlich zugibst und schreibst - zeugt für deine stärke und erfahrung!

95% der explorer schaffen es nicht zum produzenten

ähnlich ist es mit den anlegern bei diesen titeln.

sie zeichen sich oftmals durch hohle sprüche und unkenntnis aus

und sind nach relativ kurzer zeit wieder verschwunden.

"häuptling 37 tage WO " könnte in diese kategorie passen.

das tourni in skandinavien eingestiegen ist,

ist wohl auch strategisch gewollt. man will wohl ein zweites standbein und vom alleinigen fokus

(möglicherweise keine) abbau genehmigung slowakei ablenken.

ja bis dato hatte ich glück und habe meine kursabstürze aussitzen können..toi..toi..toi..

(zuletzt jahrelang -30 k bei rysmf ;-) auch alles vor 2008 ;-)

bei tourni habe ich jetzt nur noch meine bestände vor 2008 -

muss gestehen weiss gar nicht auf anhieb den schnitt, vielleicht 17-20 cent.

200 k neukäufe hatte ich zu ca. 10,5er schnitt noch vor dem split mit gewinn abgegeben.

hatte mir das kurs trauerspiel kurz vor und nach dem split schon gedacht.

und was sollts, ich hab damals zwischen 2-4 dollar in mehreren tranchen verkauft (ek 0,15) und einen richtig schönen steuerfreien deal gemacht. ;-)

da kann ich für den fall der fälle ggf. auch mal was abgeben...

gruss!

note,

das posting beinhaltet ausschließlich meine persönliche meinung

und stellt keine kauf oder verkaufsempfehlung dar

Antwort auf Beitrag Nr.: 42.916.167 von ivanbaerlin am 16.03.12 20:00:39Hast Du eigentlich auch eine Info, wie bei den 95% gezählt wurde? Ich meine damit welche Zeiträume (gab man den Explorern dabei auch genug Zeit?) und ob da auch die Explorer mitgezählt wurden die ihre Funde dann für teures Geld an Produzenten verkaufen bzw. nur noch über ein JV beteiligt bleiben?

Frage nur weil zu dem was meiner persönlichen Erfahrung entspricht, ganze Welten dazwischen liegen. Liegt aber vermutlich nur an meiner Auswahl. Manche Dinge lassen sich ja doch schon vorher erkennen.

Soll aber keine Kaufempfehlung für EUU sein! EUU ist bei mir einer von derzeit ca. 40 Rohstoffwerten und macht nur 1,2 % aus meinem Depot aus. Andererseits gilt für mich immer der Grundsatz, wenn ich nicht an die Erfolgsmöglichkeit glaube, dann verkaufe ich auch notfalls mit Verlust. An so einem Wert dann festzuhalten ist dann inkonsequent und schlichtweg Irrsinn.

Schade ist aber in der tat, dass viele Anleger bei Explorer immer nur an Tenbagger denken, aber selten daran, dass die hohen Gewinnchancen auch seinen Preis in Form eines wohlmöglichen Totalverlustes haben. Was mir auch oft auffällt ist die fehlende Geduld vieler Anleger. Der Weg zum Produzenten ist oft sehr langwierig und mit vielen Steinen im Weg, selbst als Juniorproduzent lauern noch viele Gefahren. Viele vergessen das in ihrer Geldgier und sind in dem Segment als Anleger dann einfach fehl am Platz.

Es heisst nicht umsonst Gier frisst Hirn...

Frage nur weil zu dem was meiner persönlichen Erfahrung entspricht, ganze Welten dazwischen liegen. Liegt aber vermutlich nur an meiner Auswahl. Manche Dinge lassen sich ja doch schon vorher erkennen.

Soll aber keine Kaufempfehlung für EUU sein! EUU ist bei mir einer von derzeit ca. 40 Rohstoffwerten und macht nur 1,2 % aus meinem Depot aus. Andererseits gilt für mich immer der Grundsatz, wenn ich nicht an die Erfolgsmöglichkeit glaube, dann verkaufe ich auch notfalls mit Verlust. An so einem Wert dann festzuhalten ist dann inkonsequent und schlichtweg Irrsinn.

Schade ist aber in der tat, dass viele Anleger bei Explorer immer nur an Tenbagger denken, aber selten daran, dass die hohen Gewinnchancen auch seinen Preis in Form eines wohlmöglichen Totalverlustes haben. Was mir auch oft auffällt ist die fehlende Geduld vieler Anleger. Der Weg zum Produzenten ist oft sehr langwierig und mit vielen Steinen im Weg, selbst als Juniorproduzent lauern noch viele Gefahren. Viele vergessen das in ihrer Geldgier und sind in dem Segment als Anleger dann einfach fehl am Platz.

Es heisst nicht umsonst Gier frisst Hirn...

hallo,

deine fragen zu den "95%" kann ich attock leider nicht beantworten,

denn ich habe den link zu der gelesenen studie nicht zur hand.

aber ein anderer interessanter artikel zum thema explorer hier mal als link:

http://aktien-blog.com/checkliste-rohstoff-explorer.html

deine aktiendepot mit 40 titeln ist ja bestens abgesichert.

die 1,2% EUU anteil bereiten dir bestimmt keine schlaflosen nächte.

dein risiko management ist proffessionell und konsequent.

denke mal du gibst das beste beispiel dafür wie man es mach kann und sollte.

ich bin um längen noch nicht soweit..

schön dass wir hier mit dir einen sehr kompetenten mitleser und schreiber haben.

gruss!

deine fragen zu den "95%" kann ich attock leider nicht beantworten,

denn ich habe den link zu der gelesenen studie nicht zur hand.

aber ein anderer interessanter artikel zum thema explorer hier mal als link:

http://aktien-blog.com/checkliste-rohstoff-explorer.html

deine aktiendepot mit 40 titeln ist ja bestens abgesichert.

die 1,2% EUU anteil bereiten dir bestimmt keine schlaflosen nächte.

dein risiko management ist proffessionell und konsequent.

denke mal du gibst das beste beispiel dafür wie man es mach kann und sollte.

ich bin um längen noch nicht soweit..

schön dass wir hier mit dir einen sehr kompetenten mitleser und schreiber haben.

gruss!

Antwort auf Beitrag Nr.: 42.931.250 von ivanbaerlin am 20.03.12 19:45:44Hallo ivanbaerlin,

vielen Dank für die netten Worte. Fragte nur weil man sowas sowohl im Positiven wie Negativen immer hinterfragen sollte, um sich eine realistische Meinung bilden zu können (getreu dem Sprichwort: Traue nie einer Statistik, die du nicht selbst gefälscht hast). Inwieweit die 95% stimmen, werden wir nur schwer nachprüfen können. Aber es ist sicher ein guter Augenöffner, damit sich manch einer, der sich dem Risiko bei einem Explorerinvest nicht bewusst ist, mal Gedanken macht.

Der Artikel aus Deinem Link ist sehr gut und treffend beschrieben. Die Bewertung von 5% der Resourcen sollte man auch auf keinen Fall als echte Richtgröße verwenden (derzeit trifft das auf fast alle zu). Zuviele Faktoren spielen bei der Richtgröße eine Rolle.

Mit am wichtigsten ist Punkt 2 bei der Fragestellung. Obwohl ich auch zugeben muss, dass ich mich wahrlich nicht immer daran halte, wenn die ein gutes Projekt bzw. gute Aussichten haben. Liegt aber auch daran, dass es zwar viele erfahrene Manager gibt, aber davon auch nur ganz ganz wenige, denen man fast blind (wenn man es überhaupt so sagen kann) sein Geld anvertrauen kann. Soll aber auch nicht heissen, dass man nur mit diesen Erfolg haben kann.

Ich selbst habe mir auch angewöhnt, im Erfolgsfalle nach den ersten 100% (manchmal auch später, je nach Bewertung) die Hälfte meiner Shares zu verkaufen und damit meinen Einsatz vor Steuern zu sichern. Hilft neben einer guten Streuung auch die Geduld mit den Einzeltiteln zu bewahren (man kann ja dann quasi an dem Titel nichts mehr verlieren). Und bei keinem anderen Segment am Aktienmarkt braucht es soviel Geduld wie bei den Explorern.

Aber einem erfahrenen Tournigan-Hasen muss ich das ja nicht sagen. Und letztlich gilt ja für uns alle als Investoren:

Wer glaubt, alles verstanden zu haben, der zeigt nur, dass er noch nichts verstanden hat. Man lernt nie aus...

Gruß Manfred

vielen Dank für die netten Worte. Fragte nur weil man sowas sowohl im Positiven wie Negativen immer hinterfragen sollte, um sich eine realistische Meinung bilden zu können (getreu dem Sprichwort: Traue nie einer Statistik, die du nicht selbst gefälscht hast). Inwieweit die 95% stimmen, werden wir nur schwer nachprüfen können. Aber es ist sicher ein guter Augenöffner, damit sich manch einer, der sich dem Risiko bei einem Explorerinvest nicht bewusst ist, mal Gedanken macht.

Der Artikel aus Deinem Link ist sehr gut und treffend beschrieben. Die Bewertung von 5% der Resourcen sollte man auch auf keinen Fall als echte Richtgröße verwenden (derzeit trifft das auf fast alle zu). Zuviele Faktoren spielen bei der Richtgröße eine Rolle.

Mit am wichtigsten ist Punkt 2 bei der Fragestellung. Obwohl ich auch zugeben muss, dass ich mich wahrlich nicht immer daran halte, wenn die ein gutes Projekt bzw. gute Aussichten haben. Liegt aber auch daran, dass es zwar viele erfahrene Manager gibt, aber davon auch nur ganz ganz wenige, denen man fast blind (wenn man es überhaupt so sagen kann) sein Geld anvertrauen kann. Soll aber auch nicht heissen, dass man nur mit diesen Erfolg haben kann.

Ich selbst habe mir auch angewöhnt, im Erfolgsfalle nach den ersten 100% (manchmal auch später, je nach Bewertung) die Hälfte meiner Shares zu verkaufen und damit meinen Einsatz vor Steuern zu sichern. Hilft neben einer guten Streuung auch die Geduld mit den Einzeltiteln zu bewahren (man kann ja dann quasi an dem Titel nichts mehr verlieren). Und bei keinem anderen Segment am Aktienmarkt braucht es soviel Geduld wie bei den Explorern.

Aber einem erfahrenen Tournigan-Hasen muss ich das ja nicht sagen. Und letztlich gilt ja für uns alle als Investoren:

Wer glaubt, alles verstanden zu haben, der zeigt nur, dass er noch nichts verstanden hat. Man lernt nie aus...

Gruß Manfred

Hoffen wir mal, es nützt was:

Atomenergie

Sorgen um eine Uranknappheit wachsen wieder

23. März 2012

Die Atomenergiebranche rechnet mit einem Aufschwung. Bei Energieversorgern wächst bereits wieder die Sorge über eine Uranknappheit.

Etwas mehr als ein Jahr nach der Naturkatastrophe in Japan mit den fatalen Folgen für das Atomkraftwerk Fukushima rechnet der französische Konzern Areva (WKN: A1H9Y2) mit einer Erholung des Marktes. Als Folge der Ereignisse in Japan hat Deutschland den Ausstieg aus der Atomstromproduktion beschlossen, haben sich weltweit Projekte verzögert. Vom Ende der Atomkraft ist aber heute international nicht mehr die Rede. Im Gegenteil: Weltweit sind viele Atomkraftwerke in Bau oder in Planung. Vor allem Asiens neue Wirtschaftsmächte China und Indien setzen auf die Atomenergie - und sie haben auch wahrscheinlich kaum eine andere Chance, wenn sie den wachsenden Energiehunger der eigenen Volkswirtschaften befriedigen wollen.

Mit einem Aufschwung der Atomenergiebranche dürften auch weitere Unsicherheiten bei den Aktien der Uranförderer weichen. Stattdessen könnten Sorgen wieder wachsen, ob ausreichend Uran zur Verfügung steht - das könnte die Preise für den radioaktiven Rohstoff steigern. Areva selbst berichtet von steigender Nervosität bei Betreibern von Atomkraftwerken in Sachen Rohstoffversorgung.

http://www.goldinvest.de/index.php/sorgen-um-eine-uranknapph…

Atomenergie

Sorgen um eine Uranknappheit wachsen wieder

23. März 2012

Die Atomenergiebranche rechnet mit einem Aufschwung. Bei Energieversorgern wächst bereits wieder die Sorge über eine Uranknappheit.

Etwas mehr als ein Jahr nach der Naturkatastrophe in Japan mit den fatalen Folgen für das Atomkraftwerk Fukushima rechnet der französische Konzern Areva (WKN: A1H9Y2) mit einer Erholung des Marktes. Als Folge der Ereignisse in Japan hat Deutschland den Ausstieg aus der Atomstromproduktion beschlossen, haben sich weltweit Projekte verzögert. Vom Ende der Atomkraft ist aber heute international nicht mehr die Rede. Im Gegenteil: Weltweit sind viele Atomkraftwerke in Bau oder in Planung. Vor allem Asiens neue Wirtschaftsmächte China und Indien setzen auf die Atomenergie - und sie haben auch wahrscheinlich kaum eine andere Chance, wenn sie den wachsenden Energiehunger der eigenen Volkswirtschaften befriedigen wollen.

Mit einem Aufschwung der Atomenergiebranche dürften auch weitere Unsicherheiten bei den Aktien der Uranförderer weichen. Stattdessen könnten Sorgen wieder wachsen, ob ausreichend Uran zur Verfügung steht - das könnte die Preise für den radioaktiven Rohstoff steigern. Areva selbst berichtet von steigender Nervosität bei Betreibern von Atomkraftwerken in Sachen Rohstoffversorgung.

http://www.goldinvest.de/index.php/sorgen-um-eine-uranknapph…

Post-Fukushima uranium demand much the same, miners much cheaper

13 March 2012

http://www.tradingfloor.com/posts/post-fukushima-uranium-dem…

13 March 2012

http://www.tradingfloor.com/posts/post-fukushima-uranium-dem…

Antwort auf Beitrag Nr.: 42.947.639 von Last_Man_Standing am 23.03.12 15:46:44Ich habe gelesen, dass in Japan nur noch ein Atomkraftwerk läuft und die Oel- und Gaskraftwerke ev. Andere auch hochgefahren wurden.

Vor 10 Jahre habe ich gelesen, dass die Atomtechnologie total verändert wurde und 99,99% ungefährlich geworden ist. (Technische Erneuerungen)

Dass Japan ohne Atomstrom produzieren kann ist schon erstaunlich, aber die Kosten steigen auch für deren Produkte.

Der Yen hat zwischenzeitlich ca. 8.5% zu allen Währungen nachgegeben.

Ich sehe die Katastrophe nicht in Europa kommen, aber im Osten schon.

Vor 10 Jahre habe ich gelesen, dass die Atomtechnologie total verändert wurde und 99,99% ungefährlich geworden ist. (Technische Erneuerungen)

Dass Japan ohne Atomstrom produzieren kann ist schon erstaunlich, aber die Kosten steigen auch für deren Produkte.

Der Yen hat zwischenzeitlich ca. 8.5% zu allen Währungen nachgegeben.

Ich sehe die Katastrophe nicht in Europa kommen, aber im Osten schon.

Neue Website:

www.euresources.com

www.euresources.com

Energy Metals Bonanza: Chris Berry

TICKERS: EFR, EUU; TGP, FMS, LI, NGC; NGPHF, RCK; RCKTF; RJIA, SGH, STM; STHJF, TLH, WLC; WLCDF

Source: Brian Sylvester of The Energy Report (3/27/12)

Auszug:

Another uranium company I've just started following is European Uranium Resources Ltd. (EUU:TSX.V; TGP:Fkft). It used to be called Tournigan Energy Ltd. This company can be thought of as both a "pure" play and an "area" play. Its sole focus is on developing uranium assets in Europe (Slovakia, Sweden and Finland). With over 160 operating nuclear reactors in Europe today, this seems to me to be a sound strategy irrespective of what some European countries have said about a long-term move away from nuclear power. European Uranium has a sound technical team in place and a strategic investor in AREVA (AREVA:EPA), which provides a huge stamp of credibility for the company. It has recently released a prefeasibility study, which demonstrated that the company could potentially be one of the lowest-cost producers of uranium globally with a life-of-mine cost of $23/lb. Going forward, the catalysts are additional drilling on its centerpiece deposit in Slovakia, called Kuriskova, and a full feasibility study that will provide additional clarity on the economics of this property.

siehe: http://www.theenergyreport.com/pub/na/12928

TICKERS: EFR, EUU; TGP, FMS, LI, NGC; NGPHF, RCK; RCKTF; RJIA, SGH, STM; STHJF, TLH, WLC; WLCDF

Source: Brian Sylvester of The Energy Report (3/27/12)

Auszug:

Another uranium company I've just started following is European Uranium Resources Ltd. (EUU:TSX.V; TGP:Fkft). It used to be called Tournigan Energy Ltd. This company can be thought of as both a "pure" play and an "area" play. Its sole focus is on developing uranium assets in Europe (Slovakia, Sweden and Finland). With over 160 operating nuclear reactors in Europe today, this seems to me to be a sound strategy irrespective of what some European countries have said about a long-term move away from nuclear power. European Uranium has a sound technical team in place and a strategic investor in AREVA (AREVA:EPA), which provides a huge stamp of credibility for the company. It has recently released a prefeasibility study, which demonstrated that the company could potentially be one of the lowest-cost producers of uranium globally with a life-of-mine cost of $23/lb. Going forward, the catalysts are additional drilling on its centerpiece deposit in Slovakia, called Kuriskova, and a full feasibility study that will provide additional clarity on the economics of this property.

siehe: http://www.theenergyreport.com/pub/na/12928

Antwort auf Beitrag Nr.: 42.995.271 von N424671 am 03.04.12 14:56:22Wolltest Du dazu etwas fragen oder schreiben (wegen Wiederholung des Links aus Beitrag 42036)?

Antwort auf Beitrag Nr.: 42.997.407 von Last_Man_Standing am 03.04.12 20:37:33Nein, in diesem Bericht steht eigentlich alles, was man braucht. Ich glaubte, ich könnte die deutsche Übersetung hineinbringen

hmm...obs was bringts? der kurs zuckt nicht mal...

European Uranium Resources: Firmenprofil auf explorercheck.de veröffentlicht 11.04.2012 - 09:36 - Kategorie: Bergbau und Rohstoffförderung

http://www.ptext.net/nachrichten/european-uranium-resources-…" target="_blank" rel="nofollow ugc noopener">http://www.ptext.net/nachrichten/european-uranium-resources-…

http://www.explorercheck.de/pdf/EuropeanUraniumResources_EUU…

European Uranium Resources: Firmenprofil auf explorercheck.de veröffentlicht 11.04.2012 - 09:36 - Kategorie: Bergbau und Rohstoffförderung

http://www.ptext.net/nachrichten/european-uranium-resources-…" target="_blank" rel="nofollow ugc noopener">http://www.ptext.net/nachrichten/european-uranium-resources-…

http://www.explorercheck.de/pdf/EuropeanUraniumResources_EUU…

Antwort auf Beitrag Nr.: 43.026.442 von ivanbaerlin am 11.04.12 20:03:50Danke für diesen Bericht, ich bleibe auf der Suchliste dabei

Wo ist eigentlich das Gold in Belfast geblieben???'

Antwort auf Beitrag Nr.: 43.030.389 von N424671 am 12.04.12 15:10:42... hab mir zuerst überlegt, ob ich dir überhaupt antworte, aber es soll sein!

http://www.thefreelibrary.com/Tournigan+Sells+Curraghinalt+G…

http://www.thefreelibrary.com/Tournigan+Sells+Curraghinalt+G…

Antwort auf Beitrag Nr.: 43.031.478 von greywolfe am 12.04.12 17:48:22Danke, bin schon sehr lange dabei und darum habe ich gefragt. Mit Tournigan konnten wir sehr viel Geld machen.

Jetzt hat sich die Situation geändert: Frankreich will die Uran- und die Oelförderung beherrschen für die Europäer.

Ich habe die Uranförderung besucht in der näche von Agadez und am 24. April wird der König wieder gewählt werden. Dann geht es mit dieser Aktie nicht weiter, weil Deutschland ja nicht mehr mit Uran Strom erzeugen will.

Jetzt hat sich die Situation geändert: Frankreich will die Uran- und die Oelförderung beherrschen für die Europäer.

Ich habe die Uranförderung besucht in der näche von Agadez und am 24. April wird der König wieder gewählt werden. Dann geht es mit dieser Aktie nicht weiter, weil Deutschland ja nicht mehr mit Uran Strom erzeugen will.

Antwort auf Beitrag Nr.: 43.031.628 von N424671 am 12.04.12 18:12:52ja klar der könig ist tod lang lebe der könig

und nimm mal noch nen zug aus deiner pfeife...

und nimm mal noch nen zug aus deiner pfeife...

Zitat von N424671: Jetzt hat sich die Situation geändert: Frankreich will die Uran- und die Oelförderung beherrschen für die Europäer.

Aus dem Grund ists auch nicht verkehrt, dass Areva zu den größeren Aktionären von EUU zählt und man mit Areva zusammenarbeitet.

http://www.irw-press.com/news_14409.html

Antwort auf Beitrag Nr.: 43.033.116 von ivanbaerlin am 12.04.12 23:02:25und nen kräftigen Schluck Feuerwasser dazu... nur um sicher zu sein

European Uranium Resources: Firmenprofil auf explorercheck.de veröffentlicht

Auf den Seiten von explorercheck.de wurde ein Firmprofil zu European Uranium Resources (TSX: EUU / WKN: A1JUR7) veröffentlicht

Unter folgender Adresse kann das Firmenprofil abgerufen werden:

http://www.explorercheck.de/pdf/EuropeanUraniumResources_EUU…

European Uranium Resources Ltd. (vormals Tournigan Energy Ltd.) konzentriert sich auf die Exploration und Erschließung von Uran in Europa und verfügt über Projekte in der Slowakei, Schweden und Finnland, die sich in verschiedenen Explorations- und Erschließungsphasen befinden. European Uranium sieht sich selbst hervorragend positioniert, um die Rolle eines wesentlichen Uranexplorations- und Erschließungsunternehmen in Europa einzunehmen. Europa verzeichnet mit 160 Atomkraftreaktoren (sowie weiteren in Planung und im Bau befindlichen) den größten Pro-Kopf-Uranverbrauch weltweit, obwohl auf dem Kontinent derzeit lediglich eine Uranmine in Betrieb ist. Das unternehmenseigene Projekt Kuriskova in der Slowakei könnte einer der weltweit kostengünstigsten Uranproduzenten werden.

11.04.2012

Aussender:

www.explorercheck.de

Auf den Seiten von explorercheck.de wurde ein Firmprofil zu European Uranium Resources (TSX: EUU / WKN: A1JUR7) veröffentlicht

Unter folgender Adresse kann das Firmenprofil abgerufen werden:

http://www.explorercheck.de/pdf/EuropeanUraniumResources_EUU…

European Uranium Resources Ltd. (vormals Tournigan Energy Ltd.) konzentriert sich auf die Exploration und Erschließung von Uran in Europa und verfügt über Projekte in der Slowakei, Schweden und Finnland, die sich in verschiedenen Explorations- und Erschließungsphasen befinden. European Uranium sieht sich selbst hervorragend positioniert, um die Rolle eines wesentlichen Uranexplorations- und Erschließungsunternehmen in Europa einzunehmen. Europa verzeichnet mit 160 Atomkraftreaktoren (sowie weiteren in Planung und im Bau befindlichen) den größten Pro-Kopf-Uranverbrauch weltweit, obwohl auf dem Kontinent derzeit lediglich eine Uranmine in Betrieb ist. Das unternehmenseigene Projekt Kuriskova in der Slowakei könnte einer der weltweit kostengünstigsten Uranproduzenten werden.

11.04.2012

Aussender:

www.explorercheck.de

aktuell 25 cadcent für eine neue also 5 alten,

entspricht 3,8 eurocent für eine alte tourni...

würd mich nicht wundern wenn auf diesem oder noch niedrigeren niveau

mitarbeiter/freundes optionen, privatplacierungen generiert werden ....

entspricht 3,8 eurocent für eine alte tourni...

würd mich nicht wundern wenn auf diesem oder noch niedrigeren niveau

mitarbeiter/freundes optionen, privatplacierungen generiert werden ....

Antwort auf Beitrag Nr.: 43.062.683 von ivanbaerlin am 19.04.12 20:04:10heute gehts ja fett runter! bei 20 CAD-Cent aufgesetzt bei hohem Volumen...

hmm...kommen da schlechte News oder was ist da los?

hmm...kommen da schlechte News oder was ist da los?

European Uranium Comments on Market Activity

European Uranium Resources Ltd. (EUU: TSX-V; TGPN: Frankfurt) (the “Company”) confirms in response to queries about recent trading activity that there is no material news pending.

As disclosed most recently on February 29, 2012, pursuant to a project acquisition, the Company issued 10,727,969 shares of the Company to Mawson Resources Ltd. (TSX:MAW). Pursuant to a shareholder and court approved plan of arrangement and pending the approval of the TSX Venture Exchange, Mawson will distribute these 10,727,969 shares of the Company to its shareholders on a pro-rata basis before April 30, 2012. A significant proportion of these shares will be distributed to Mawson shareholders who are also shareholders of the Company and it is expected that these mutual shareholders will not immediately sell the shares they receive on distribution.

The Company has assembled a portfolio of outstanding uranium projects in Slovakia, Sweden and Finland at all stages of the exploration / development pipeline. The flagship property is the high-grade Kuriskova project in Slovakia. A recently completed prefeasibility study demonstrates that Kuriskova could be one of the lowest cost uranium producers in the world. European Uranium Resources Ltd. has a strong base of supportive shareholders, including AREVA, ranked first in the global nuclear power industry and a key player in uranium mining. The company is well-funded, with $8.5 million cash at December 31, 2011.

Over the next twelve to eighteen months the Company expects to:

- Advance the feasibility study and associated environmental impact studies at the Kuriskova project;

- Based on the outstanding results of the Kuriskova prefeasibility study, explore the possibility of arranging a production off-take agreement or joint venture to fund completion of the feasibility study;

- Define the structure which allows uranium production from Kuriskova to be developed for the benefit of Slovakia’s energy future. This could be a production off-take arrangement with Slovakia or a partnership with a Slovak entity;

- Conduct exploration drilling on the Kuriskova project;

- Conduct exploration programs on the other Slovak uranium prospects; and

- Advance exploration on the newly acquired Swedish and Finland prospects.

The development of the Kuriskova project can potentially provide Slovakia, which is among the world’s highest per capita consumers of nuclear power, a secure source of uranium for thirty years. There are multiple exploration targets within the Kuriskova license area which have the potential to expand the resource. In addition to Kuriskova, European Uranium also has the Novoveska Huta deposit on which a resource has been defined plus several exploration targets on other licenses in Slovakia.

European Uranium acquired seven uranium properties located in Sweden and Finland from Mawson Resources Ltd. on February 29 2012: the Hotagen, Duobblon, Kapell and Aronsjö projects in Sweden and the Riutta, Asento and Nuottijärvi projects in Finland. The potential of this portfolio of projects is demonstrated by the results at the Riutta project announced by Mawson on September 20, 2011. Mawson reported that best result from a 10 hole diamond drill program at the Riutta project totaling 1,065 metres comes from drill hole AREVA DH 1 which intersected 11.3 m at 0.68% uranium oxide ("U3O8") including 3.7 metres at 1.53% U3O8 from 28.3 metres. The true thickness of the interval is estimed to be 8.6 m. Mawson reported that this is the best uranium drill result in Finland's history and demonstrates the potential for high grade and near surface uranium at the Riutta project. High grade uranium mineralization has now been drilled over 450 m of strike within a larger 3.6 km trend. The Riutta project is fully permitted for exploration; mineralization remains open along strike and down dip, and European Uranium looks forward to further testing the project's potential.

http://tmx.quotemedia.com/article.php?newsid=50474245&qm_sym…

European Uranium Resources Ltd. (EUU: TSX-V; TGPN: Frankfurt) (the “Company”) confirms in response to queries about recent trading activity that there is no material news pending.

As disclosed most recently on February 29, 2012, pursuant to a project acquisition, the Company issued 10,727,969 shares of the Company to Mawson Resources Ltd. (TSX:MAW). Pursuant to a shareholder and court approved plan of arrangement and pending the approval of the TSX Venture Exchange, Mawson will distribute these 10,727,969 shares of the Company to its shareholders on a pro-rata basis before April 30, 2012. A significant proportion of these shares will be distributed to Mawson shareholders who are also shareholders of the Company and it is expected that these mutual shareholders will not immediately sell the shares they receive on distribution.

The Company has assembled a portfolio of outstanding uranium projects in Slovakia, Sweden and Finland at all stages of the exploration / development pipeline. The flagship property is the high-grade Kuriskova project in Slovakia. A recently completed prefeasibility study demonstrates that Kuriskova could be one of the lowest cost uranium producers in the world. European Uranium Resources Ltd. has a strong base of supportive shareholders, including AREVA, ranked first in the global nuclear power industry and a key player in uranium mining. The company is well-funded, with $8.5 million cash at December 31, 2011.

Over the next twelve to eighteen months the Company expects to:

- Advance the feasibility study and associated environmental impact studies at the Kuriskova project;

- Based on the outstanding results of the Kuriskova prefeasibility study, explore the possibility of arranging a production off-take agreement or joint venture to fund completion of the feasibility study;

- Define the structure which allows uranium production from Kuriskova to be developed for the benefit of Slovakia’s energy future. This could be a production off-take arrangement with Slovakia or a partnership with a Slovak entity;

- Conduct exploration drilling on the Kuriskova project;

- Conduct exploration programs on the other Slovak uranium prospects; and

- Advance exploration on the newly acquired Swedish and Finland prospects.

The development of the Kuriskova project can potentially provide Slovakia, which is among the world’s highest per capita consumers of nuclear power, a secure source of uranium for thirty years. There are multiple exploration targets within the Kuriskova license area which have the potential to expand the resource. In addition to Kuriskova, European Uranium also has the Novoveska Huta deposit on which a resource has been defined plus several exploration targets on other licenses in Slovakia.

European Uranium acquired seven uranium properties located in Sweden and Finland from Mawson Resources Ltd. on February 29 2012: the Hotagen, Duobblon, Kapell and Aronsjö projects in Sweden and the Riutta, Asento and Nuottijärvi projects in Finland. The potential of this portfolio of projects is demonstrated by the results at the Riutta project announced by Mawson on September 20, 2011. Mawson reported that best result from a 10 hole diamond drill program at the Riutta project totaling 1,065 metres comes from drill hole AREVA DH 1 which intersected 11.3 m at 0.68% uranium oxide ("U3O8") including 3.7 metres at 1.53% U3O8 from 28.3 metres. The true thickness of the interval is estimed to be 8.6 m. Mawson reported that this is the best uranium drill result in Finland's history and demonstrates the potential for high grade and near surface uranium at the Riutta project. High grade uranium mineralization has now been drilled over 450 m of strike within a larger 3.6 km trend. The Riutta project is fully permitted for exploration; mineralization remains open along strike and down dip, and European Uranium looks forward to further testing the project's potential.

http://tmx.quotemedia.com/article.php?newsid=50474245&qm_sym…

Zitat von inthiscase: heute gehts ja fett runter! bei 20 CAD-Cent aufgesetzt bei hohem Volumen...

hmm...kommen da schlechte News oder was ist da los?

heute wurden ca. 1.3 mio aktien umgesetzt also fast 7 mio alte...

-50% seit dem split - sorry, aber es ist zum kotzen...

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aEUU-19486…

European Uranium does not say why trading is down

2012-04-19 16:39 ET - News Release

This item is part of Stockwatch's value added news feed and is only available to Stockwatch subscribers.

Here is a sample of this item:

Mr. Dorian Nicol reports

EUROPEAN URANIUM COMMENTS ON MARKET ACTIVITY

European Uranium Resources Ltd. confirms in response to queries about recent trading activity that there is no material news pending.

As disclosed most recently on Feb. 29, 2012, pursuant to a project acquisition, the company issued 10,727,969 shares of the company to Mawson Resources Ltd. Pursuant to a shareholder and court-approved plan of arrangement and pending the approval of the TSX Venture Exchange, Mawson will distribute these 10,727,969 shares of the company to its shareholders on a pro rata basis before April 30, 2012. A significant proportion of these shares will be distributed to Mawson shareholders who are also shareholders of the company and it is expected that these mutual shareholders will not immediately sell the shares they receive on distribution.

The remainder is available to Stockwatch subscribers. Click the yellow link above for a free trial subscription.

Antwort auf Beitrag Nr.: 43.063.574 von Last_Man_Standing am 19.04.12 23:33:11Wenn der Kursverfall so weitergeht, ist die MK bald geringer als der Cashbestand von EUU...

MK heute 52.331.542 Shares * 0,23 CAD = 12.036.254,66 CAD

Vermutlich halten mich alle für total bescheuert, aber ich werd hier wohl bald nochmal nachkaufen...

MK heute 52.331.542 Shares * 0,23 CAD = 12.036.254,66 CAD

Vermutlich halten mich alle für total bescheuert, aber ich werd hier wohl bald nochmal nachkaufen...

Antwort auf Beitrag Nr.: 43.063.574 von Last_Man_Standing am 19.04.12 23:33:11Nochmal übersetzt:

European Uranium berichtet über Marktaktivitäten

http://www.irw-press.com/news_15691.html

European Uranium berichtet über Marktaktivitäten

http://www.irw-press.com/news_15691.html

Antwort auf Beitrag Nr.: 43.063.585 von Last_Man_Standing am 19.04.12 23:40:37Diese Firma kann das ohne die Zukunftsprognosen in Europa einbezogen zu kaum schaffen.

Natürlich möchte jeder Strom haben aber 3 Länder in Europa werden die Atomstromwende herbeiführen können. Und der König von Frankreich wird mit aller Klarheit wiedergewählt werden müssen und darnach werden alle Europäer von Frankreich her Oel/Gas für die Stromerzeugung kaufen können.

Europa wird sich nicht auf Atomstrom wiederbeleben lassen, sagt der Zukunfsforscher:

Natürlich möchte jeder Strom haben aber 3 Länder in Europa werden die Atomstromwende herbeiführen können. Und der König von Frankreich wird mit aller Klarheit wiedergewählt werden müssen und darnach werden alle Europäer von Frankreich her Oel/Gas für die Stromerzeugung kaufen können.

Europa wird sich nicht auf Atomstrom wiederbeleben lassen, sagt der Zukunfsforscher:

Antwort auf Beitrag Nr.: 43.063.585 von Last_Man_Standing am 19.04.12 23:40:37http://www.cash.ch/video/20895

heute wieder ganz schön dicke einzelumsätze  (x 5 = alte aktienanzahl)

(x 5 = alte aktienanzahl)

Recent Trades - Last 10 of 67

Time ET Ex Price Change Volume Buyer Seller Markers

14:19:48 V 0.24 0.01 3,500 1 Anonymous 1 Anonymous K

14:19:15 V 0.24 0.01 6,000 33 Canaccord 1 Anonymous K

14:19:15 V 0.24 0.01 51,000 1 Anonymous 1 Anonymous K

14:18:13 V 0.24 0.01 12,000 1 Anonymous 85 Scotia K

14:17:00 V 0.24 0.01 10,000 1 Anonymous 1 Anonymous K

14:16:51 V 0.24 0.01 3,000 78 Salman 80 National Bank K

14:16:51 V 0.24 0.01 12,000 1 Anonymous 80 National Bank K

13:53:06 V 0.24 0.01 50,000 1 Anonymous 68 Leede K

13:52:48 V 0.24 0.01 30,000 1 Anonymous 1 Anonymous K

13:52:42 V 0.24 0.01 50,000 1 Anonymous 1 Anonymous K

(x 5 = alte aktienanzahl)

(x 5 = alte aktienanzahl)Recent Trades - Last 10 of 67

Time ET Ex Price Change Volume Buyer Seller Markers

14:19:48 V 0.24 0.01 3,500 1 Anonymous 1 Anonymous K

14:19:15 V 0.24 0.01 6,000 33 Canaccord 1 Anonymous K

14:19:15 V 0.24 0.01 51,000 1 Anonymous 1 Anonymous K

14:18:13 V 0.24 0.01 12,000 1 Anonymous 85 Scotia K

14:17:00 V 0.24 0.01 10,000 1 Anonymous 1 Anonymous K

14:16:51 V 0.24 0.01 3,000 78 Salman 80 National Bank K

14:16:51 V 0.24 0.01 12,000 1 Anonymous 80 National Bank K

13:53:06 V 0.24 0.01 50,000 1 Anonymous 68 Leede K

13:52:48 V 0.24 0.01 30,000 1 Anonymous 1 Anonymous K

13:52:42 V 0.24 0.01 50,000 1 Anonymous 1 Anonymous K

Na ja, geht wohl wieder mal Richtung 5 Cent!

Wenn Hollande gewählt werden sollte dann bekommt diese Aktie wieder eine ganz kleine Chance

Zitat von Last_Man_Standing: Wenn der Kursverfall so weitergeht, ist die MK bald geringer als der Cashbestand von EUU...

MK heute 52.331.542 Shares * 0,23 CAD = 12.036.254,66 CAD

Vermutlich halten mich alle für total bescheuert, aber ich werd hier wohl bald nochmal nachkaufen...

hallo manfred,

habe deine "bescheuerte idee"

aufgegriffen

aufgegriffenund zwei tage zu 22,5 eingesammelt....

schaun wer mal..

gruss

juergen

Antwort auf Beitrag Nr.: 43.083.768 von ivanbaerlin am 25.04.12 00:20:03Hallo Jürgen,

dann können wir uns wenigstens am Ende gegenseitig Bemitleiden, wenns doch wieder auf die 0,05 CAD runter geht

Glaubs aber nicht.

Hab jetzt übrigens (nur Zwecks der Offenheit) mein Depot mit den ensprechenden Kürzeln der Kanada bzw. Aussi-Börse auf meiner User-Info eingstellt. Hatte es von der Stückzahl etwas eingedampft (u.a. auch zugunsten von EUU). Sind aber immernoch 30 Einzelwerte

Aktuelle Aktien-Invests (30) - Kanada (23): AA / AST / CEV / CZY / CSL / CFM / EGZ / EUU / MIN / FIS / FMS / FDC / KSK / LAM / LMR / MCK / MNV / PP / RRS / SGH / STM / ZC / ZNR - Australien (7): AXE / BAU / HDG / MGY / NSL / PNN / UTO

Sind also neben EUU noch 5 andere Uranwerte dabei (Fission, Forum, Strathmore, Laramide und U308 Ltd.). Bin da long sehr optimstisch...

http://www.wallstreet-online.de/userinfo/456992.html

Gruß

Manni

dann können wir uns wenigstens am Ende gegenseitig Bemitleiden, wenns doch wieder auf die 0,05 CAD runter geht

Glaubs aber nicht.

Hab jetzt übrigens (nur Zwecks der Offenheit) mein Depot mit den ensprechenden Kürzeln der Kanada bzw. Aussi-Börse auf meiner User-Info eingstellt. Hatte es von der Stückzahl etwas eingedampft (u.a. auch zugunsten von EUU). Sind aber immernoch 30 Einzelwerte

Aktuelle Aktien-Invests (30) - Kanada (23): AA / AST / CEV / CZY / CSL / CFM / EGZ / EUU / MIN / FIS / FMS / FDC / KSK / LAM / LMR / MCK / MNV / PP / RRS / SGH / STM / ZC / ZNR - Australien (7): AXE / BAU / HDG / MGY / NSL / PNN / UTO

Sind also neben EUU noch 5 andere Uranwerte dabei (Fission, Forum, Strathmore, Laramide und U308 Ltd.). Bin da long sehr optimstisch...

http://www.wallstreet-online.de/userinfo/456992.html

Gruß

Manni

Mal eine (fast) aktuelle Karte mit den Atomreaktoren in Europa:

Tournigan’s uranium resource estimate gets major boost, feasibility study is next

By Resource Intelligence · May 16, 2012

Tournigan Energy Ltd (TSXV:TVC) is an exploration and development company that has built a portfolio of highly prospective uranium projects in Slovakia. By the first quarter of 2012 Tournigan will complete its re-launch as an advanced stage pure-play uranium company called European Uranium Resources Ltd with projects in Slovakia, Sweden and Finland. Europe has 186 nuclear power plants in operation and 19 new plants under construction and there is only one operating uranium mine within the European Union, in the Czech Republic. Clearly, Europe, a region with the world’s largest per capita consumption of uranium, has an urgent need to develop uranium production.

Resource Intelligence: Kuriskova in East Central Slovakia is your flagship property. Could you update us on the latest resource estimates?

Dusty Nicol: The June 2011 estimate, compared to the earlier resource estimate, added 39% to the Indicated Resource (increasing it to 28.5 million lbs of U3O8 at a grade of 0.555% U3O8). With the additional 12.7 million lbs of U3O8 in inferred Resource at a grade of 0.185% U3O8, this estimate increased the overall resource at Kuriskova by 3.1 million lbs of U3O8 and ongoing metallurgical test work has confirmed uranium recoveries of 93-94%.

RI: Could you give investors a sense of how significant this uranium deposit is?

DN: Kuriskova is one of the highest grade undeveloped uranium deposits in the world. By comparison, Strathmore’s Roca Honda project in New Mexico that is being developed in joint venture with Sumitomo Corp, has measured and indicated resources of 3.7 million tonnes at an average grade of 0.23% containing 17.5 million lbs of U3O8. Kuriskova could supply all of Slovakia’s domestic consumption of 300 tonnes of uranium metal per year, with the remainder available for export. The fact that Slovakia depends on nuclear energy for close to 50% of its power makes Kuriskova a very significant and strategically important deposit for Slovakia.

RI: What stage is the Kuriskova project at now and what are your priorities for the project in 2012?

DN: We will begin the Feasibility Study which will take between 18 to 24 months to finish and we will drill test some of the exciting exploration targets that have been identified within the Kuriskova project area. There is significant growth potential beyond the current defined mineral resources.

RI: Aside from increasing the resource estimate at Kuriskova, what other milestones did the Company achieve last year?

DN: The Company completed an initial resource estimate at the Novaveska Huta project also located in East Central Slovakia in October 2011, adding pounds of U3O8 to our resource inventory and the project is open to the east and north.

A very significant milestone happened in December 2011 when we formed a strategic alliance with AREVA and welcomed them as a shareholder. Andreas Mittler, Vice President, Expertise and Projects Department of AREVA Mines joined our board of directors. Tournigan has entered into a technical services agreement with AREVA to perform a work program comprising metallurgical and environmental test work to be part of the Kuriskova feasibility study. AREVA’s public alliance and their technical expertise should also assist Tournigan in the permitting process for the project.

RI: It will be a year this March since the Fukushima nuclear accident and it has affected share prices of uranium companies including Tournigan’s. Do you see this as a short-term problem?

DN: The Fukushima accident affected all uranium equities, including ours. Fortunately we were well funded and we have not sought to raise equity financing since that accident. Tournigan will continue to build on the fundamental value of its projects to position it for a market revaluation upon an improvement in uranium prices.

RI: What would you tell investors who might be discouraged from investing in uranium exploration companies because of Fukushima?

DN: I think that the effects of Fukushima will be mitigated by the mid- to longer-term outlook and demand for uranium. Despite some countries making what must be viewed as a politically driven decision to abandon – or stated intention to abandon – nuclear power, the annual consumption of those countries is insignificant when compared to China and India. Currently China is constructing 26 nuclear reactors, which are 42% of global construction. There is no real substitute for nuclear energy in the fast-growing Chinese economy. Russia and India continue construction of reactors and it is said that Russia will halt exports of uranium in 2013, which will decrease supply that can’t currently be made up elsewhere. It is hard to imagine an energy mix for the world that does not include a significant nuclear component.

RI: What can investors expect from Tournigan over the next 12 to 18 months?

DN: We will advance the Feasibility Study at Kuriskova and continue to add to our uranium resource inventory in Slovakia, Sweden and Finland. There is often an excessive lag in the valuations of some companies between preliminary feasibility studies and bankable feasibility studies that provides investment openings because resource inventories often continue to grow between the two studies. We hope that is the case with Tournigan as well.

RI: What would differentiate Tournigan from other players in the field of uranium exploration? Is there anything else you’d like to tell investors?

DN: European Uranium Resources Ltd will be an advanced stage pure-play uranium company focused in Europe, well placed to benefit from an increase in the price of uranium.

Investor Highlights

- Pure uranium play

- Solid fundamental value – high-grade uranium resource nearing development

- Strong supportive shareholders including

- AREVA which is ranked first in the global nuclear power industry and a key player

- in uranium mining

http://www.resourceintelligence.net/tournigan-energy-major-b…

By Resource Intelligence · May 16, 2012

Tournigan Energy Ltd (TSXV:TVC) is an exploration and development company that has built a portfolio of highly prospective uranium projects in Slovakia. By the first quarter of 2012 Tournigan will complete its re-launch as an advanced stage pure-play uranium company called European Uranium Resources Ltd with projects in Slovakia, Sweden and Finland. Europe has 186 nuclear power plants in operation and 19 new plants under construction and there is only one operating uranium mine within the European Union, in the Czech Republic. Clearly, Europe, a region with the world’s largest per capita consumption of uranium, has an urgent need to develop uranium production.

Resource Intelligence: Kuriskova in East Central Slovakia is your flagship property. Could you update us on the latest resource estimates?

Dusty Nicol: The June 2011 estimate, compared to the earlier resource estimate, added 39% to the Indicated Resource (increasing it to 28.5 million lbs of U3O8 at a grade of 0.555% U3O8). With the additional 12.7 million lbs of U3O8 in inferred Resource at a grade of 0.185% U3O8, this estimate increased the overall resource at Kuriskova by 3.1 million lbs of U3O8 and ongoing metallurgical test work has confirmed uranium recoveries of 93-94%.

RI: Could you give investors a sense of how significant this uranium deposit is?

DN: Kuriskova is one of the highest grade undeveloped uranium deposits in the world. By comparison, Strathmore’s Roca Honda project in New Mexico that is being developed in joint venture with Sumitomo Corp, has measured and indicated resources of 3.7 million tonnes at an average grade of 0.23% containing 17.5 million lbs of U3O8. Kuriskova could supply all of Slovakia’s domestic consumption of 300 tonnes of uranium metal per year, with the remainder available for export. The fact that Slovakia depends on nuclear energy for close to 50% of its power makes Kuriskova a very significant and strategically important deposit for Slovakia.

RI: What stage is the Kuriskova project at now and what are your priorities for the project in 2012?

DN: We will begin the Feasibility Study which will take between 18 to 24 months to finish and we will drill test some of the exciting exploration targets that have been identified within the Kuriskova project area. There is significant growth potential beyond the current defined mineral resources.

RI: Aside from increasing the resource estimate at Kuriskova, what other milestones did the Company achieve last year?

DN: The Company completed an initial resource estimate at the Novaveska Huta project also located in East Central Slovakia in October 2011, adding pounds of U3O8 to our resource inventory and the project is open to the east and north.

A very significant milestone happened in December 2011 when we formed a strategic alliance with AREVA and welcomed them as a shareholder. Andreas Mittler, Vice President, Expertise and Projects Department of AREVA Mines joined our board of directors. Tournigan has entered into a technical services agreement with AREVA to perform a work program comprising metallurgical and environmental test work to be part of the Kuriskova feasibility study. AREVA’s public alliance and their technical expertise should also assist Tournigan in the permitting process for the project.

RI: It will be a year this March since the Fukushima nuclear accident and it has affected share prices of uranium companies including Tournigan’s. Do you see this as a short-term problem?

DN: The Fukushima accident affected all uranium equities, including ours. Fortunately we were well funded and we have not sought to raise equity financing since that accident. Tournigan will continue to build on the fundamental value of its projects to position it for a market revaluation upon an improvement in uranium prices.

RI: What would you tell investors who might be discouraged from investing in uranium exploration companies because of Fukushima?

DN: I think that the effects of Fukushima will be mitigated by the mid- to longer-term outlook and demand for uranium. Despite some countries making what must be viewed as a politically driven decision to abandon – or stated intention to abandon – nuclear power, the annual consumption of those countries is insignificant when compared to China and India. Currently China is constructing 26 nuclear reactors, which are 42% of global construction. There is no real substitute for nuclear energy in the fast-growing Chinese economy. Russia and India continue construction of reactors and it is said that Russia will halt exports of uranium in 2013, which will decrease supply that can’t currently be made up elsewhere. It is hard to imagine an energy mix for the world that does not include a significant nuclear component.

RI: What can investors expect from Tournigan over the next 12 to 18 months?

DN: We will advance the Feasibility Study at Kuriskova and continue to add to our uranium resource inventory in Slovakia, Sweden and Finland. There is often an excessive lag in the valuations of some companies between preliminary feasibility studies and bankable feasibility studies that provides investment openings because resource inventories often continue to grow between the two studies. We hope that is the case with Tournigan as well.

RI: What would differentiate Tournigan from other players in the field of uranium exploration? Is there anything else you’d like to tell investors?

DN: European Uranium Resources Ltd will be an advanced stage pure-play uranium company focused in Europe, well placed to benefit from an increase in the price of uranium.

Investor Highlights

- Pure uranium play

- Solid fundamental value – high-grade uranium resource nearing development

- Strong supportive shareholders including

- AREVA which is ranked first in the global nuclear power industry and a key player

- in uranium mining

http://www.resourceintelligence.net/tournigan-energy-major-b…

May 17, 2012

URANIUM REACTION

u.a.:

- LOCAL JAPANESE TOWN ASSEMBLY VOTES TO RESTART TWO IDLED REACTORS

- TALK OF REACTOR BUILD HEATS UP IN CENTRAL EUROPE

http://www.versantpartners.com/pdfFiles/20120517Uranium.pdf

URANIUM REACTION

u.a.:

- LOCAL JAPANESE TOWN ASSEMBLY VOTES TO RESTART TWO IDLED REACTORS

- TALK OF REACTOR BUILD HEATS UP IN CENTRAL EUROPE

http://www.versantpartners.com/pdfFiles/20120517Uranium.pdf

England will weiterhin Atomkraftwerke betreiben und ausbauen wegen den CO2.

Ausbau der Kernenergie

Chinesen drängen auf britischen Atommarkt

http://www.ftd.de/unternehmen/industrie/:ausbau-der-kernener…

Chinesen drängen auf britischen Atommarkt

http://www.ftd.de/unternehmen/industrie/:ausbau-der-kernener…

25.05.12 | 14:17 Uhr | 7 mal gelesenEuropean Uranium Resources Ltd