The Big 5 of today - and then, 1972: Nifty Fifty - Älteste Beiträge zuerst (Seite 6)

eröffnet am 05.05.17 22:55:02 von

neuester Beitrag 02.02.24 01:01:33 von

neuester Beitrag 02.02.24 01:01:33 von

Beiträge: 68

ID: 1.252.270

ID: 1.252.270

Aufrufe heute: 0

Gesamt: 5.131

Gesamt: 5.131

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 59 Minuten | 1749 | |

| 26.04.24, 14:53 | 990 | |

| vor 1 Stunde | 523 | |

| gestern 23:32 | 510 | |

| vor 57 Minuten | 471 | |

| vor 1 Stunde | 407 | |

| vor 57 Minuten | 320 | |

| gestern 22:18 | 316 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.146,19 | +0,10 | 213 | |||

| 2. | 2. | 181,26 | +0,17 | 120 | |||

| 3. | 5. | 10,800 | +36,71 | 78 | |||

| 4. | 3. | 2.320,74 | -0,87 | 59 | |||

| 5. | 4. | 65,40 | +0,54 | 57 | |||

| 6. | 6. | 0,9650 | +16,27 | 41 | |||

| 7. | 7. | 15,146 | +0,03 | 40 | |||

| 8. | 9. | 2,3510 | -0,17 | 30 |

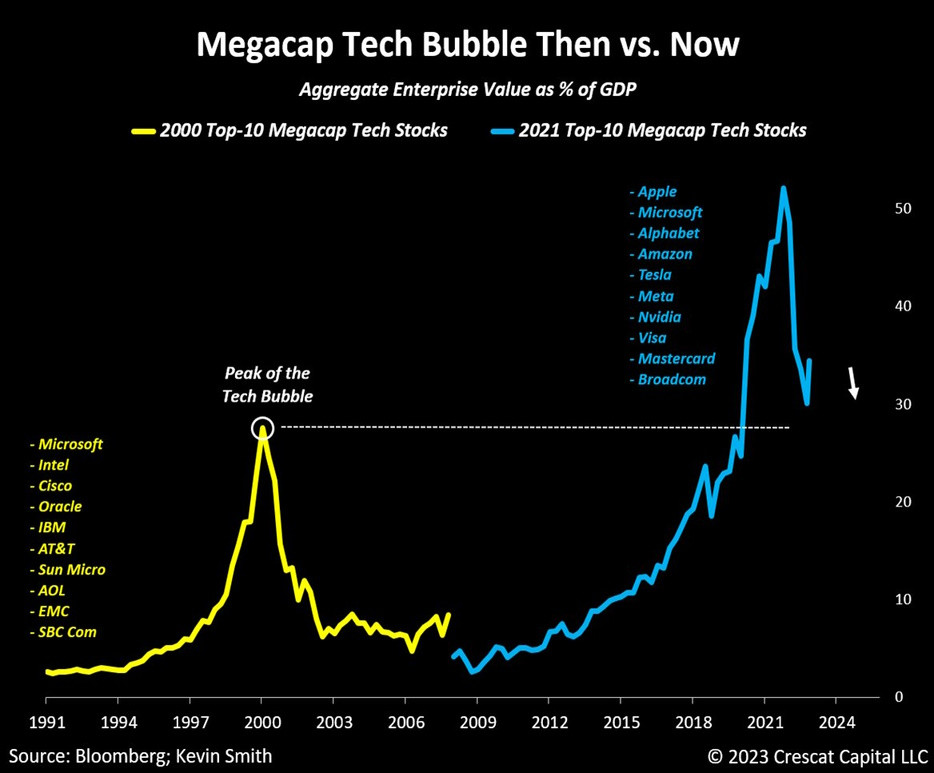

der US-Markt in 2021:

https://twitter.com/zerohedge/status/1466840656115077125

=> 3 dieser 5 Werte sind aus den Big 5

https://twitter.com/zerohedge/status/1466840656115077125

=> 3 dieser 5 Werte sind aus den Big 5

14.12.

Apple, Google have ‘vice-like grip’ over mobile devices, U.K. regulator says

https://www.marketwatch.com/story/apple-google-have-vice-lik…

...

The U.K. competition regulator said Tuesday that its interim report has found that a duopoly of Apple Inc. and Alphabet Inc.’s Google limits competition and choice, and that the firms are “exercising a vice-like grip” over mobile devices.

The Competition and Markets Authority said its report into mobile ecosystems suggests users are losing out because of the companies’ control. It had launched a probe in June over concerns that Apple and Google have too much power over the iOS and Android operating systems, respectively, along with their app stores and web browsers.

The antitrust watchdog said it is concerned that this control is leading to less competition and meaningful choice for customers, as people appear to be missing out on innovative new products and services, along with higher prices.

“Apple and Google have developed a vice-like grip over how we use mobile phones and we’re concerned that it’s causing millions of people across the U.K. to lose out,” CMA Chief Executive Andrea Coscelli said.

The CMA said the best way for it to tackle the firms’ substantial market power was through a digital market unit once it receives powers from the government.

The report also set out a range of actions to address the issues, including making it easier for customers to switch ecosystems without losing functionality or data and making it easier to install apps through other methods than default app stores.

The CMA is consulting on its initial findings and said it will welcome responses by Feb. 7.

Representatives from Apple and Google weren’t immediately available for comment.

...

vice-like grip =~ schraubstockartiger Griff (UK; Amer.: vise = Schraubstock)

Apple, Google have ‘vice-like grip’ over mobile devices, U.K. regulator says

https://www.marketwatch.com/story/apple-google-have-vice-lik…

...

The U.K. competition regulator said Tuesday that its interim report has found that a duopoly of Apple Inc. and Alphabet Inc.’s Google limits competition and choice, and that the firms are “exercising a vice-like grip” over mobile devices.

The Competition and Markets Authority said its report into mobile ecosystems suggests users are losing out because of the companies’ control. It had launched a probe in June over concerns that Apple and Google have too much power over the iOS and Android operating systems, respectively, along with their app stores and web browsers.

The antitrust watchdog said it is concerned that this control is leading to less competition and meaningful choice for customers, as people appear to be missing out on innovative new products and services, along with higher prices.

“Apple and Google have developed a vice-like grip over how we use mobile phones and we’re concerned that it’s causing millions of people across the U.K. to lose out,” CMA Chief Executive Andrea Coscelli said.

The CMA said the best way for it to tackle the firms’ substantial market power was through a digital market unit once it receives powers from the government.

The report also set out a range of actions to address the issues, including making it easier for customers to switch ecosystems without losing functionality or data and making it easier to install apps through other methods than default app stores.

The CMA is consulting on its initial findings and said it will welcome responses by Feb. 7.

Representatives from Apple and Google weren’t immediately available for comment.

...

vice-like grip =~ schraubstockartiger Griff (UK; Amer.: vise = Schraubstock)

von den Big 5 konnten sich heute 3 Werte ganz gut halten, v.a. Apple; 2 nicht ("Nasdaq worst week since 2020"):

• AAPL -1.28%

• MSFT -1.85%

• GOOG -2.56%

• AMZN -5.95%

• FB -4.23%

Benchmark: QQQ -2.77%

<sortiert nach Market cap absteigend>

=> meine Annahme: Amazon und Facebook (Meta Platforms) stehen aus (US)-regulatorischen Gründen (Antitrust laws) unter besonderem Druck --> Insider leaks von Washington, D.C. zur Wall Street, so meine zweite Annahme

• AAPL -1.28%

• MSFT -1.85%

• GOOG -2.56%

• AMZN -5.95%

• FB -4.23%

Benchmark: QQQ -2.77%

<sortiert nach Market cap absteigend>

=> meine Annahme: Amazon und Facebook (Meta Platforms) stehen aus (US)-regulatorischen Gründen (Antitrust laws) unter besonderem Druck --> Insider leaks von Washington, D.C. zur Wall Street, so meine zweite Annahme

Antwort auf Beitrag Nr.: 62.761.529 von faultcode am 23.02.20 13:15:47

nur noch Apple hat eine Market Cap von über $2,000,000,000,000. Die anderen der Big 5 liegen schon drunter:

$MSFT: $1,774,381,175,144

$AAPL: $2,417,522,804,794

$GOOG: $1,292,438,441,438

$AMZN: $1,159,139,426,564

$META: $377,358,624,522

wobei "Facebook" schon länger aus diesem Club herausgefallen ist.

<Zahlen nach google.com/finance/ -- müssen also nicht genau sein>

Zitat von faultcode: Kontraindikator?

...

nur noch Apple hat eine Market Cap von über $2,000,000,000,000. Die anderen der Big 5 liegen schon drunter:

$MSFT: $1,774,381,175,144

$AAPL: $2,417,522,804,794

$GOOG: $1,292,438,441,438

$AMZN: $1,159,139,426,564

$META: $377,358,624,522

wobei "Facebook" schon länger aus diesem Club herausgefallen ist.

<Zahlen nach google.com/finance/ -- müssen also nicht genau sein>

13.11.

Big Tech Loses Sway as S&P 500 Becomes More Exxon, Less Amazon

https://www.bnnbloomberg.ca/big-tech-loses-sway-as-s-p-500-b…

...

The power the world’s technology giants wielded over the US stock market for years as it surged to record highs has been greatly diminished by the bust of 2022.

Even after last week’s rally, Apple Inc., Microsoft Corp., Amazon.com Inc., Alphabet Inc. and Meta Platforms Inc. have lost more than $3 trillion in market value this year as slowing revenue growth and rising interest rates battered valuations. That’s cut their weighting in the S&P 500 Index to about 19% from a record of more than 24% in September 2020.

The shift shows how much the contours of the stock market have shifted since the Federal Reserve made a sharp break from the easy money policies that set off a speculative frenzy. As the tech sector’s sway diminishes, more traditional sectors such as energy and banking are accounting for a greater share of the S&P 500, with companies like Exxon Mobil Corp. and Wells Fargo & Co. benefiting from high oil prices or rising interest rates.

The reversal of fortunes means that investors who piled into the S&P 500 back when tech stocks were surging are now far less exposed to the sector -- and its potential rebound -- than they were before. By the end of 2021, there was about $7 trillion invested in funds that are tied to the index.

“The average investor doesn’t have a clue about this stuff,” said Michael Mullaney, director of global market research at Boston Partners. “This is going to be something that plays out not just this year but into next year and longer.”

The technology sector got some relief from data on Thursday that showed inflation slowed more than expected in October, fueling optimism that the Fed could soon pause its most aggressive cycle of interest-rate hikes in decades. That sent the Nasdaq 100 Index up 9.4% on Thursday and Friday for its best two-day performance since 2008.

...

Apple, Microsoft, Alphabet, Amazon and Meta Platforms have been responsible for about half of the S&P 500 Index’s drop this year, according to data compiled by Bloomberg. If all the companies in the benchmark are weighted equally -- instead of by market value, which is how the index is actually constructed -- its drop would have been cut by six percentage points this year.

...

“Big technology stocks in particular have benefited from the almost endless liquidity and cheap money financed by the immense pace of growth,” said Dirk Friczewsky, market analyst for ActivTrades. “Now a different wind is blowing on the financial markets and investors don’t want to suddenly be without a chair when the music stops playing.”

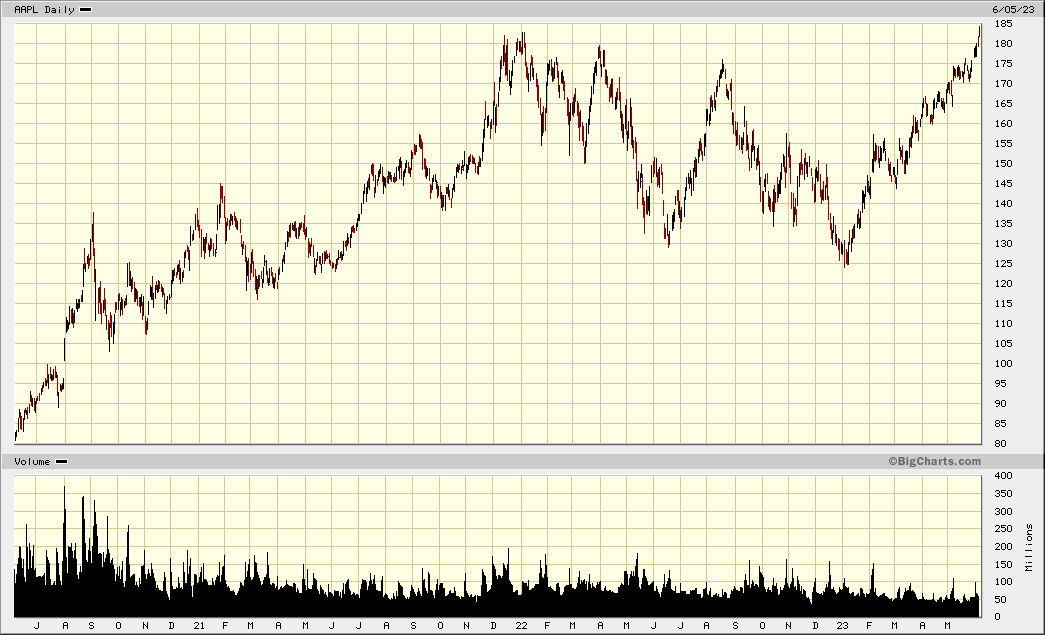

Apple mit neuem Alltime High:

Beitrag zu dieser Diskussion schreiben

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 206 | ||

| 119 | ||

| 59 | ||

| 54 | ||

| 48 | ||

| 39 | ||

| 38 | ||

| 30 | ||

| 30 | ||

| 28 |

| Wertpapier | Beiträge | |

|---|---|---|

| 27 | ||

| 19 | ||

| 19 | ||

| 18 | ||

| 16 | ||

| 15 | ||

| 15 | ||

| 15 | ||

| 15 | ||

| 15 |