LYNAS - Faktenthread, Analysen, Querverweise u. Meldungen zum Unternehmen (Seite 160)

eröffnet am 25.04.07 13:15:18 von

neuester Beitrag 03.05.24 18:38:38 von

neuester Beitrag 03.05.24 18:38:38 von

Beiträge: 3.531

ID: 1.126.458

ID: 1.126.458

Aufrufe heute: 1

Gesamt: 785.127

Gesamt: 785.127

Aktive User: 0

ISIN: AU000000LYC6 · WKN: 871899 · Symbol: LYI

4,0100

EUR

+1,34 %

+0,0530 EUR

Letzter Kurs 03.05.24 Tradegate

Neuigkeiten

18.04.24 · Der Aktionär TV |

23.01.24 · kapitalerhoehungen.de |

22.01.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,8360 | +17,66 | |

| 1,0950 | +16,00 | |

| 2,4000 | +14,83 | |

| 552,55 | +13,76 | |

| 33,17 | +13,52 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 185,00 | -9,76 | |

| 0,6700 | -14,92 | |

| 43,97 | -16,90 | |

| 12,000 | -25,00 | |

| 46,24 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 42.331.399 von JoJo49 am 10.11.11 14:26:59Um es kurz zu machen, ob und wann das mit dem Malawiprojekt klappt und ob Lynas es in Malawi mal zu einer Proktion bringt ist IMHO noch offen und zu jetzigen Zeitpunkt relativ unwichtig.

Im äußersten Fall muss Lynas auf Schadenersatz klagen und u.a. die 4mill.$ zurückfordern.

Da sieht es mit der folgenden Empfehlung schon wesentlich anders auf:

http://www.macquarie.com.au/dafiles/Internet/mgl/au/apps/ret…

Lynas Corporation

Breaking the stranglehold

Outperform, A$2.30 price target

We initiate coverage with an Outperform recommendation.

New supply alternative to China

Lynas is close to first production from its Mount Weld Rare Earth Project.

Commissioning of the Concentration Plant in Western Australia is on track,

Lynas is now stockpiling concentrate onsite in preparation for start-up of the

Lynas Advanced Materials Plant (LAMP). Construction of the LAMP in Malaysia

is slightly behind schedule but nearing completion. The main hurdle now is the

permit required to begin operations in Malaysia. While the decision for the permit

will have a binary impact on the project, Macquarie believes it is unlikely it will be

denied, as Lynas has satisfied international safety requirements, which were

brought into question resulting in a review of the plant. The company expects to

begin commercial production during 2HFY12, we forecast modest production in

FY12 of 825 t rare earth oxide (REO).

Valuation upside – highly leveraged

We value the Mount Weld Rare Earth Project including Phase 1 output of

11,000 t/a and the Phase 2 expansion to 22,000 t/a REO at A$2.42/sh, using a

long-term REO basket price of US$40.58/kg and a conservative operating cost

of US$15.00/kg. Using the spot basket price from the 07/11/11 of US$125.34/kg

and exchange rate of US$1.04/A$ in perpetuity results in a NPV of A$7.70/sh.

Market is focused on approvals – IAEA standards met

Following the review of the LAMP by the International Atomic Energy Agency

(IAEA), Lynas has submitted the documentation to the Malaysian Atomic Energy

Licensing Board (AELB) required for the approval of the LAMP pre-operational

license. As it stands, the Malaysian Government has stated that no preoperational

license will be issued to Lynas and Lynas will not be allowed to

import raw materials for the plant from Australia until it is satisfied the

recommendations have been implemented. Macquarie views the risk as potential

further delay to start-up rather than not receiving a license at all. The IAEA

reported that Lynas had met all radiation safety standards imposed on them at

the plant by the regulatory authorities and these standards meet internationally

recognised IAEA safety standards.

China remains dominant – partnerships key for Lynas

As with the majority of commodity markets, China’s role is key. However,

compared to the better understood markets such as copper, coal or iron ore,

where Chinese consumption is a significant driver of demand, the rare earth

market is heavily dominated by China on both the supply and demand side.

China’s dominance in all areas of the rare earth market presents risk to any new

market entrant. Lynas’ off-take agreements and alliances put the company in a

good position in this context, with a spread of non-Chinese end users likely to

support diversification of supply. Changes to China’s rare earth export policy will

continue to impact the global market and pricing.

For more information please refer to our full report, Lynas Corporation: Breaking the

stranglehold, available at www.macquarie.com/research.

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

Grüsse JoJo

Im äußersten Fall muss Lynas auf Schadenersatz klagen und u.a. die 4mill.$ zurückfordern.

Da sieht es mit der folgenden Empfehlung schon wesentlich anders auf:

http://www.macquarie.com.au/dafiles/Internet/mgl/au/apps/ret…

Lynas Corporation

Breaking the stranglehold

Outperform, A$2.30 price target

We initiate coverage with an Outperform recommendation.

New supply alternative to China

Lynas is close to first production from its Mount Weld Rare Earth Project.

Commissioning of the Concentration Plant in Western Australia is on track,

Lynas is now stockpiling concentrate onsite in preparation for start-up of the

Lynas Advanced Materials Plant (LAMP). Construction of the LAMP in Malaysia

is slightly behind schedule but nearing completion. The main hurdle now is the

permit required to begin operations in Malaysia. While the decision for the permit

will have a binary impact on the project, Macquarie believes it is unlikely it will be

denied, as Lynas has satisfied international safety requirements, which were

brought into question resulting in a review of the plant. The company expects to

begin commercial production during 2HFY12, we forecast modest production in

FY12 of 825 t rare earth oxide (REO).

Valuation upside – highly leveraged

We value the Mount Weld Rare Earth Project including Phase 1 output of

11,000 t/a and the Phase 2 expansion to 22,000 t/a REO at A$2.42/sh, using a

long-term REO basket price of US$40.58/kg and a conservative operating cost

of US$15.00/kg. Using the spot basket price from the 07/11/11 of US$125.34/kg

and exchange rate of US$1.04/A$ in perpetuity results in a NPV of A$7.70/sh.

Market is focused on approvals – IAEA standards met

Following the review of the LAMP by the International Atomic Energy Agency

(IAEA), Lynas has submitted the documentation to the Malaysian Atomic Energy

Licensing Board (AELB) required for the approval of the LAMP pre-operational

license. As it stands, the Malaysian Government has stated that no preoperational

license will be issued to Lynas and Lynas will not be allowed to

import raw materials for the plant from Australia until it is satisfied the

recommendations have been implemented. Macquarie views the risk as potential

further delay to start-up rather than not receiving a license at all. The IAEA

reported that Lynas had met all radiation safety standards imposed on them at

the plant by the regulatory authorities and these standards meet internationally

recognised IAEA safety standards.

China remains dominant – partnerships key for Lynas

As with the majority of commodity markets, China’s role is key. However,

compared to the better understood markets such as copper, coal or iron ore,

where Chinese consumption is a significant driver of demand, the rare earth

market is heavily dominated by China on both the supply and demand side.

China’s dominance in all areas of the rare earth market presents risk to any new

market entrant. Lynas’ off-take agreements and alliances put the company in a

good position in this context, with a spread of non-Chinese end users likely to

support diversification of supply. Changes to China’s rare earth export policy will

continue to impact the global market and pricing.

For more information please refer to our full report, Lynas Corporation: Breaking the

stranglehold, available at www.macquarie.com/research.

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

Grüsse JoJo

Antwort auf Beitrag Nr.: 42.329.017 von JoJo49 am 10.11.11 07:48:37http://www.theage.com.au/business/lynas-in-midst-of-malawi-c…

Lynas in midst of Malawi crisis

November 10, 2011 - 11:47AM.

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

Grüsse JoJo

Lynas in midst of Malawi crisis

November 10, 2011 - 11:47AM.

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

Grüsse JoJo

LYC Lynas Corporation Limited

November 2011

10th Malawi Update

http://www.stocknessmonster.com/news-item?S=LYC&E=ASX&N=6562…

November 2011

Malawi Update

As Lynas Corporation Limited (“Lynas”) (ASX:LYC, OTC:LYSDY) announced on 22 December 2010, Lynas received approval from the Government of Malawi to complete the acquisition of the Kangankunde Carbonatite Complex (“KGK”) in Malawi, Africa. As part of that Malawi Government approval process, the Malawi Minister of Natural Resources, Energy and Environment formally approved and certified the transfer of the mining licence for the KGK tenements (“Mining Licence”), to a wholly owned subsidiary of Lynas. As a consequence, a wholly owned subsidiary of Lynas is the registered legal owner of the Mining Licence. Lynas also received formal approval of the KGK project proposal from the Malawi Investment Promotion Agency.

Lynas announced its completion of the KGK acquisition on 7 March 2011 and work continues on this project.

Lynas has recently received correspondence on behalf of a party claiming that, in 2003, the Government of Malawi acted incorrectly in not renewing that party’s exploration licence over the area of the KGK tenements. Lynas understands that the party has made various claims in proceedings against the Government of Malawi in relation to this matter and in particular, in relation to the Mining Licence. Lynas is not currently a party to any proceedings concerning this matter.

Lynas will keep the market informed should there be further relevant developments in relation to this matter.

For further information please contact Alistair Reid or Liz Whiteway on +61 2 8259 7100 or

visit www.lynascorp.com

For all media enquires please contact Michael Vaughan from FTI Consulting on +61 2 8298 6100

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

Grüsse JoJo

November 2011

10th Malawi Update

http://www.stocknessmonster.com/news-item?S=LYC&E=ASX&N=6562…

November 2011

Malawi Update

As Lynas Corporation Limited (“Lynas”) (ASX:LYC, OTC:LYSDY) announced on 22 December 2010, Lynas received approval from the Government of Malawi to complete the acquisition of the Kangankunde Carbonatite Complex (“KGK”) in Malawi, Africa. As part of that Malawi Government approval process, the Malawi Minister of Natural Resources, Energy and Environment formally approved and certified the transfer of the mining licence for the KGK tenements (“Mining Licence”), to a wholly owned subsidiary of Lynas. As a consequence, a wholly owned subsidiary of Lynas is the registered legal owner of the Mining Licence. Lynas also received formal approval of the KGK project proposal from the Malawi Investment Promotion Agency.

Lynas announced its completion of the KGK acquisition on 7 March 2011 and work continues on this project.

Lynas has recently received correspondence on behalf of a party claiming that, in 2003, the Government of Malawi acted incorrectly in not renewing that party’s exploration licence over the area of the KGK tenements. Lynas understands that the party has made various claims in proceedings against the Government of Malawi in relation to this matter and in particular, in relation to the Mining Licence. Lynas is not currently a party to any proceedings concerning this matter.

Lynas will keep the market informed should there be further relevant developments in relation to this matter.

For further information please contact Alistair Reid or Liz Whiteway on +61 2 8259 7100 or

visit www.lynascorp.com

For all media enquires please contact Michael Vaughan from FTI Consulting on +61 2 8298 6100

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

Grüsse JoJo

http://www.themalaysianinsider.com/malaysia/article/three-bi…" target="_blank" rel="nofollow ugc noopener">http://www.themalaysianinsider.com/malaysia/article/three-bi…

Three bids later, AELB says Lynas still non-compliant

By Shannon Teoh

November 09, 2011

Raza Aziz says his board will not compromise on safety. — Picture by Jack Ooi

...

Abdul Aziz revealed today that the September 19 request was for a fourth draft, which was only handed in last week.

Having shed more than half its value on the Australian Securities Exchange over the past six months, Lynas was reported last week to be expecting a pre-operating licence “by the end of the year and it could come before analysts make a planned visit to the plant this month.”

“‘Slight delays’ at its controversial Malaysian refinery will not affect its plans to supply rare earths to customers by the first half of next year,” Australian daily Sydney Morning Herald said on November 1.

Lynas has refuted claims of potential radiation pollution, assuring Kuantan residents they would face “zero exposure” unlike an earlier Japanese rare earth refinery near Ipoh that was still conducting a clean-up nearly 20 years after it was shut down.

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

Grüsse JoJo

Three bids later, AELB says Lynas still non-compliant

By Shannon Teoh

November 09, 2011

Raza Aziz says his board will not compromise on safety. — Picture by Jack Ooi

...

Abdul Aziz revealed today that the September 19 request was for a fourth draft, which was only handed in last week.

Having shed more than half its value on the Australian Securities Exchange over the past six months, Lynas was reported last week to be expecting a pre-operating licence “by the end of the year and it could come before analysts make a planned visit to the plant this month.”

“‘Slight delays’ at its controversial Malaysian refinery will not affect its plans to supply rare earths to customers by the first half of next year,” Australian daily Sydney Morning Herald said on November 1.

Lynas has refuted claims of potential radiation pollution, assuring Kuantan residents they would face “zero exposure” unlike an earlier Japanese rare earth refinery near Ipoh that was still conducting a clean-up nearly 20 years after it was shut down.

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

Grüsse JoJo

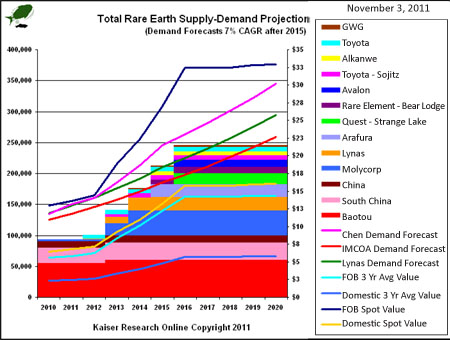

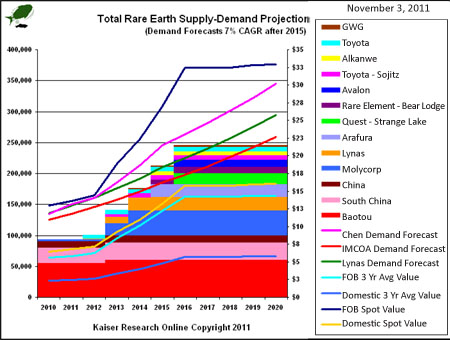

http://www.theaureport.com/pub/na/11550

John Kaiser: Rare Earth Companies Poised for Comeback

Source: JT Long of The Critical Metals Report (11/8/11)

The companies in a race to produce critical heavy rare earth elements by 2016 are already way ahead of their smaller competitors. In this exclusive interview with The Critical Metals Report, Kaiser Research Online editor John Kaiser handicaps the players on the end-user, producer and investor side—believe it or not, China may have the largest stake in developing sources outside its borders.

Companies Mentioned: Avalon Rare Metals Inc. - Commerce Resources Corp.- Lynas Corp. - Molycorp Minerals - Quest Rare Minerals Ltd.- Rare Element Resources Ltd.- Tasman Metals Ltd.

...

...

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

Grüsse JoJo

John Kaiser: Rare Earth Companies Poised for Comeback

Source: JT Long of The Critical Metals Report (11/8/11)

The companies in a race to produce critical heavy rare earth elements by 2016 are already way ahead of their smaller competitors. In this exclusive interview with The Critical Metals Report, Kaiser Research Online editor John Kaiser handicaps the players on the end-user, producer and investor side—believe it or not, China may have the largest stake in developing sources outside its borders.

Companies Mentioned: Avalon Rare Metals Inc. - Commerce Resources Corp.- Lynas Corp. - Molycorp Minerals - Quest Rare Minerals Ltd.- Rare Element Resources Ltd.- Tasman Metals Ltd.

...

...

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

Grüsse JoJo

Einige User aus dem HC-Forum gehen davon aus das einige Teilnehmer aus dieser Konferenz wie Broker, Analysten usw. eingeladen werden wie auch Kunden und Partner mit LYC-Verträgen für eine geführte Tour durch die LAMP am darauffolgendem Wochenende.

Grüsse JoJo

http://www.metalevents.com/events/7th-international-rare-ear…

7th International Rare Earths Conference

Kowloon Shangri-La Hotel, Hong Kong

November 15-17 2011

This event is now sold out with over 350 delegates registered. Please contact sales$metalevents.com (please replace the $ with @ if it is a genuine e-mail) to join the waiting list or to check for cancellations.

Metal Events Ltd and Roskill Information Services Ltd are once again returning to Hong Kong to hold their 7th International Rare Earths Conference.

This has become the international event for the global rare earths industry and last year attracted a record number of participants representing all the major global producers, end-users, traders, investors and funds.

This year’s programme will focus chiefly on end-use markets for rare earths and consumption trends, while reviewing supply-side developments.

New for 2011 – Exhibition Space – SOLD OUT

We are pleased to announce that space has been made at this year’s event to enable companies to promote their projects on a one to one basis to other delegates for the duration of the conference.

PLEASE NOTE THAT THIS CONFERENCE WILL BE CONDUCTED IN ENGLISH ONLY

Programme

Tuesday 15 November

16:00 – 19:00 Registration

18:00 – 20:00 Welcome Reception kindly sponsored by Great Western Minerals Group

Wednesday 16 November

08:00 – 09:00 Registration desk re-opens

Session 1 – Rare earths sector overview

09:00 Opening by Judith Chegwidden, Director, Roskill Information Services Ltd., United Kingdom;

09:15 “Rare earth markets and supply/demand dynamics: Stormy seas, fog and shoals”. Constantine Karayannopoulos, President & CEO, Neo Material Technologies Inc., Canada;

09:45 ”China’s rare earth market”, by Zhang Zhong, General Manager, Inner Mongolia Baotou Steel Rare Earth Hi-Tech Co., Ltd

10:15 Coffee break

Session 2 – Outlook for future supply

11:15 “New sources of supply – Lynas”, by Nick Curtis, Executive Chairman, Lynas Corporation Ltd., Australia;

11:40 “The next rare earth era: Global diversity in

rare earth manufacturing”, by Mark Smith, CEO, Molycorp Inc., USA;

12:05 “Rare earths resources in Russia”, by Pavel Detkov, Managing Director, Polyfer Handels/Solikamsk Works, Austria;

12:30 “The outlook for Jiangxi rare earths production”, by Zhong Xiao Yun, General Manager, Jiangxi Rare Earth & Rare Metals Tungsten Group, China;

12:55 Q & A

13:00 – 14:30 Luncheon kindly sponsored by Avalon Rare Metals Inc

Session 3- Efficient processing for rare earths

14:30 ”What rare earth producers and processors have to do to manage their waste products”, by Horst Monken-Fernandes, Division of Nuclear Fuel Cycle & Waste Technology, IAEA, Austria;

14:55 “Processing options for rare earths: from ore to mixed rare earth product”, by Karin Soldenhoff, Manager – Process Development Research, ANSTO – Minerals, Australia;

15:20 “Processing and utilisation of rare earth solid wastes”, by Tao Xu, VP Baotou Research Institute of Rare Earths, PR China;

15:45 Q&A

16:00 Tea

Thursday 17 November

Session 4 – Rare earths consumption

09.30 “Rare earths for the phosphors market”, by Jean-Guy Le Helloco, Electronics BU Director, Rhodia, France;

09:55 “Trends in the use of rare earths in polishing powders and dielectric ceramics”, by Jai Subramanian, Global Business Manager, Ferro Corp., USA;

10:20 “Latest research and development trends in magnetic functional materials,” by Dr. Yu Dunbo, Grirem Advanced Materials Co., Ltd., China;

10:45 Q&A

11:00 Coffee

Session 5 – Recycling and challenges for rare earths

11:45 “Downstream developments in Sichuan’s rare earths industry”, by Prof. Liu Zifu, Senior Consultant, Sichuan Province Engineering Consultancy & Reserach Institute, China;

12:10 “Rare earths recycling”, by Allan Walton, Research Fellow Metallurgy & Materials, Birmingham University, United Kingdom;

12:35 “Opportunities & challenges for rare earths in green technologies”, by Suzanne Shaw, Senior Analyst, Roskill Information Services, United Kingdom;

13:00 Q&A

13:15 Close and luncheon kindly sponsored by Avalon Rare Metals Inc

...

...

Googleübersetzt: http://translate.google.de/translate?hl=de&sl=en&u=http://ww…

Grüsse JoJo

http://www.metalevents.com/events/7th-international-rare-ear…

7th International Rare Earths Conference

Kowloon Shangri-La Hotel, Hong Kong

November 15-17 2011

This event is now sold out with over 350 delegates registered. Please contact sales$metalevents.com (please replace the $ with @ if it is a genuine e-mail) to join the waiting list or to check for cancellations.

Metal Events Ltd and Roskill Information Services Ltd are once again returning to Hong Kong to hold their 7th International Rare Earths Conference.

This has become the international event for the global rare earths industry and last year attracted a record number of participants representing all the major global producers, end-users, traders, investors and funds.

This year’s programme will focus chiefly on end-use markets for rare earths and consumption trends, while reviewing supply-side developments.

New for 2011 – Exhibition Space – SOLD OUT

We are pleased to announce that space has been made at this year’s event to enable companies to promote their projects on a one to one basis to other delegates for the duration of the conference.

PLEASE NOTE THAT THIS CONFERENCE WILL BE CONDUCTED IN ENGLISH ONLY

Programme

Tuesday 15 November

16:00 – 19:00 Registration

18:00 – 20:00 Welcome Reception kindly sponsored by Great Western Minerals Group

Wednesday 16 November

08:00 – 09:00 Registration desk re-opens

Session 1 – Rare earths sector overview

09:00 Opening by Judith Chegwidden, Director, Roskill Information Services Ltd., United Kingdom;

09:15 “Rare earth markets and supply/demand dynamics: Stormy seas, fog and shoals”. Constantine Karayannopoulos, President & CEO, Neo Material Technologies Inc., Canada;

09:45 ”China’s rare earth market”, by Zhang Zhong, General Manager, Inner Mongolia Baotou Steel Rare Earth Hi-Tech Co., Ltd

10:15 Coffee break

Session 2 – Outlook for future supply

11:15 “New sources of supply – Lynas”, by Nick Curtis, Executive Chairman, Lynas Corporation Ltd., Australia;

11:40 “The next rare earth era: Global diversity in

rare earth manufacturing”, by Mark Smith, CEO, Molycorp Inc., USA;

12:05 “Rare earths resources in Russia”, by Pavel Detkov, Managing Director, Polyfer Handels/Solikamsk Works, Austria;

12:30 “The outlook for Jiangxi rare earths production”, by Zhong Xiao Yun, General Manager, Jiangxi Rare Earth & Rare Metals Tungsten Group, China;

12:55 Q & A

13:00 – 14:30 Luncheon kindly sponsored by Avalon Rare Metals Inc

Session 3- Efficient processing for rare earths

14:30 ”What rare earth producers and processors have to do to manage their waste products”, by Horst Monken-Fernandes, Division of Nuclear Fuel Cycle & Waste Technology, IAEA, Austria;

14:55 “Processing options for rare earths: from ore to mixed rare earth product”, by Karin Soldenhoff, Manager – Process Development Research, ANSTO – Minerals, Australia;

15:20 “Processing and utilisation of rare earth solid wastes”, by Tao Xu, VP Baotou Research Institute of Rare Earths, PR China;

15:45 Q&A

16:00 Tea

Thursday 17 November

Session 4 – Rare earths consumption

09.30 “Rare earths for the phosphors market”, by Jean-Guy Le Helloco, Electronics BU Director, Rhodia, France;

09:55 “Trends in the use of rare earths in polishing powders and dielectric ceramics”, by Jai Subramanian, Global Business Manager, Ferro Corp., USA;

10:20 “Latest research and development trends in magnetic functional materials,” by Dr. Yu Dunbo, Grirem Advanced Materials Co., Ltd., China;

10:45 Q&A

11:00 Coffee

Session 5 – Recycling and challenges for rare earths

11:45 “Downstream developments in Sichuan’s rare earths industry”, by Prof. Liu Zifu, Senior Consultant, Sichuan Province Engineering Consultancy & Reserach Institute, China;

12:10 “Rare earths recycling”, by Allan Walton, Research Fellow Metallurgy & Materials, Birmingham University, United Kingdom;

12:35 “Opportunities & challenges for rare earths in green technologies”, by Suzanne Shaw, Senior Analyst, Roskill Information Services, United Kingdom;

13:00 Q&A

13:15 Close and luncheon kindly sponsored by Avalon Rare Metals Inc

...

...

Googleübersetzt: http://translate.google.de/translate?hl=de&sl=en&u=http://ww…

Antwort auf Beitrag Nr.: 42.320.620 von Optimist_ am 08.11.11 18:29:55Ein durchaus nachvollziehbares Szenario.

Hätte IMHO mehr als eine Daumen verdient!

Wer sich Sorgen um die REE-Preisentwicklung macht sollte folgeden Artikel vollständig lesen:

http://au.ibtimes.com/articles/245844/20111109/doubling-dema…

Doubling Demand for Rare Earths Seen Pushing Prices Up in 2012

By Christine Gaylican | November 9, 2011 3:52 PM EST

Die verschiedenen und umfangreichen Einsatz von Permanentmagneten in elektronischen Geräten, Radar-, Hybrid-Autos, energieeffiziente Sonnenkollektoren und Windturbinen kontinuierlich drücken Sie die Nachfrage und Preis für Seltene Erden im Jahr 2012.

(Foto: Reuters / David Gray)

Workers wearing face masks load discarded piles of sacks onto a truck at a rare earth smelting plant located on the outskirts of the city of Baotou in China's Inner Mongolia Autonomous Region October 31, 2010. Arbeiter tragen Gesichtsmasken Last verworfen Stapel von Säcken auf einen LKW zu einem seltenen Erden Schmelzwerk am Rande der Stadt Baotou in der Inneren Mongolei Chinas Autonomer Region 31. Oktober 2010 befindet.

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

http://translate.googleusercontent.com/translate_c?hl=de&ie=…

Grüsse JoJo

Hätte IMHO mehr als eine Daumen verdient!

Wer sich Sorgen um die REE-Preisentwicklung macht sollte folgeden Artikel vollständig lesen:

http://au.ibtimes.com/articles/245844/20111109/doubling-dema…

Doubling Demand for Rare Earths Seen Pushing Prices Up in 2012

By Christine Gaylican | November 9, 2011 3:52 PM EST

Die verschiedenen und umfangreichen Einsatz von Permanentmagneten in elektronischen Geräten, Radar-, Hybrid-Autos, energieeffiziente Sonnenkollektoren und Windturbinen kontinuierlich drücken Sie die Nachfrage und Preis für Seltene Erden im Jahr 2012.

(Foto: Reuters / David Gray)

Workers wearing face masks load discarded piles of sacks onto a truck at a rare earth smelting plant located on the outskirts of the city of Baotou in China's Inner Mongolia Autonomous Region October 31, 2010. Arbeiter tragen Gesichtsmasken Last verworfen Stapel von Säcken auf einen LKW zu einem seltenen Erden Schmelzwerk am Rande der Stadt Baotou in der Inneren Mongolei Chinas Autonomer Region 31. Oktober 2010 befindet.

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

http://translate.googleusercontent.com/translate_c?hl=de&ie=…

Grüsse JoJo

Zitat von JoJo49: IMHO wird die Betriebsgenehmigung durch die AELB Anfang Dezember erfolgen denn damit hätten beide Seiten ihr Gesicht gewahrt.

Das soll und kann allerdings nicht heißen das damit sofort die zu diesem Zeitpunkt geplante volle Produktionsmarge von 11.000pta startet sondern erst nach dem Eintreffen vom Konzentat aus der Mine der Probeanlauf erfolgen kann.

Nicht vergessen darf man die Fertigstellung der Anlage, evt. erfolgt die Genehmigung nur mit Auflagen (sogar wahrscheinlich, auch des zukünftigen Friedens wegen) und damit nochmaligen Verzögerungen durch techn./baul. Anpassungen.

1.Genehmigung

2.Anlage fetiggestellt (Stand aktuell: 80%, siehe letzter Activity report)

3.REO in Malaysia eingetroffen

...

4.Validierung des Prozesses (verbunden mit der Auflage radioaktive Messungen durchzuführen)

5.cycle time/Durchlaufzeit des REO-Konzentrats bis zum Endprodukt

6.ramp-up bis auf 11.000 t/a

Mit Gewinn und voller Kapazität ist sicher nicht vor 2013 zu rechnen, aber das ist reine Spekulation.

Wichtig ist, dass Lynas jetzt in jedem Schritt professionell arbeitet und kommuniziert. Die Aufbereitung im LAMP ist kein Selbstläufer, das ist (fast) Pionierarbeit und sollte von keinem Investor unterschätzt werden.

IMHO wird die Betriebsgenehmigung durch die AELB Anfang Dezember erfolgen denn damit hätten beide Seiten ihr Gesicht gewahrt.

Das soll und kann allerdings nicht heißen das damit sofort die zu diesem Zeitpunkt geplante volle Produktionsmarge von 11.000pta startet sondern erst nach dem Eintreffen vom Konzentat aus der Mine der Probeanlauf erfolgen kann.

http://www.raremetalblog.com/2011/11/brokers-assess-lynas-mo…

Saturday, November 05, 2011

Brokers assess Lynas, Molycorp, Peak, Namibia RE, Tertiary

There is a growing number of brokers following the rare earths and rare metals space. From London, Libertas Partners seem to be well across the subject.

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

http://www.deraktionaer.de/aktien-deutschland/die-besten-akt…

08.11.2011 07:56 Uhr

Die besten Aktien der Welt

Simon Bardt

...

u.a.:

- welche Seltene-Erden-Produzenten, die nicht in China tätig sind, gerade jetzt wieder für Investoren spannend werden.

...

http://www.rohstoff-welt.de/news/artikel.php?sid=31279

Tradium-Chef Rüth: Rohstofflagerhaltung der Chinesen ein riskantes Spiel

08.11.2011 | 7:41 Uhr | DAF

...

...

Grüsse JoJo

Das soll und kann allerdings nicht heißen das damit sofort die zu diesem Zeitpunkt geplante volle Produktionsmarge von 11.000pta startet sondern erst nach dem Eintreffen vom Konzentat aus der Mine der Probeanlauf erfolgen kann.

http://www.raremetalblog.com/2011/11/brokers-assess-lynas-mo…

Saturday, November 05, 2011

Brokers assess Lynas, Molycorp, Peak, Namibia RE, Tertiary

There is a growing number of brokers following the rare earths and rare metals space. From London, Libertas Partners seem to be well across the subject.

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

http://www.deraktionaer.de/aktien-deutschland/die-besten-akt…

08.11.2011 07:56 Uhr

Die besten Aktien der Welt

Simon Bardt

...

u.a.:

- welche Seltene-Erden-Produzenten, die nicht in China tätig sind, gerade jetzt wieder für Investoren spannend werden.

...

http://www.rohstoff-welt.de/news/artikel.php?sid=31279

Tradium-Chef Rüth: Rohstofflagerhaltung der Chinesen ein riskantes Spiel

08.11.2011 | 7:41 Uhr | DAF

...

...

Grüsse JoJo

IMHO sind all die Bemühungen von Lynas, der AELB und den malayischen Behörden die SMSL bei Ihren Informationen mit Einladungen einzubeziehen um das ganze auf eine faktenberuhende sachliche Ebene zu bringen vergebliche Mühe.

IMHO müßte die ALEB, Lynas und die zuständige malayischen Behörden gegen die SMSL auf Richtigstellung und Schadenersatzt klagen, denn auch in Malaysia sind nachweislich wiederholte Falschdarstellungen zum Schaden Dritter unter hohe Strafe gestellt.

Grüsse JoJo

http://www.freemalaysiatoday.com/2011/11/08/miti-aelb-and-sm…

Miti, AELB and SMSL to visit Lynas site

Stephanie Sta Maria | November 8, 2011

Miti will also attempt to strike a middle ground between civil society's interests and those of the nation.

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

http://www.freemalaysiatoday.com/2011/11/08/miti-on-lynas-pl…

Miti on Lynas plant: Safety is top priority

Stephanie Sta Maria | November 8, 2011

Lynas will not be allowed to operate its plant until it meets IAEA conditions.

...

...

Googleübersetzt: http://translate.googleusercontent.com/translate_c?hl=de&ie=…

IMHO müßte die ALEB, Lynas und die zuständige malayischen Behörden gegen die SMSL auf Richtigstellung und Schadenersatzt klagen, denn auch in Malaysia sind nachweislich wiederholte Falschdarstellungen zum Schaden Dritter unter hohe Strafe gestellt.

Grüsse JoJo

http://www.freemalaysiatoday.com/2011/11/08/miti-aelb-and-sm…

Miti, AELB and SMSL to visit Lynas site

Stephanie Sta Maria | November 8, 2011

Miti will also attempt to strike a middle ground between civil society's interests and those of the nation.

...

...

Googleübersetzt: http://translate.google.de/translate?sl=en&tl=de&js=n&prev=_…

http://www.freemalaysiatoday.com/2011/11/08/miti-on-lynas-pl…

Miti on Lynas plant: Safety is top priority

Stephanie Sta Maria | November 8, 2011

Lynas will not be allowed to operate its plant until it meets IAEA conditions.

...

...

Googleübersetzt: http://translate.googleusercontent.com/translate_c?hl=de&ie=…

23.01.24 · kapitalerhoehungen.de · BASF |

22.01.24 · wallstreetONLINE Redaktion · Lynas Rare Earths |

08.08.23 · nebenwerte ONLINE · Lynas Rare Earths |

21.06.23 · Konstantin Oldenburger · Lynas Rare Earths |

09.05.23 · ESG Aktien · Lynas Rare Earths |

| Zeit | Titel |

|---|---|

| 03.05.24 |