Gulf Resources (GFRE) - Brom, Salze und Chemikalien für China - 500 Beiträge pro Seite

eröffnet am 01.07.09 22:48:51 von

neuester Beitrag 13.05.11 20:48:05 von

neuester Beitrag 13.05.11 20:48:05 von

Beiträge: 61

ID: 1.151.525

ID: 1.151.525

Aufrufe heute: 0

Gesamt: 5.111

Gesamt: 5.111

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 01.05.24, 18:36 | 303 | |

| gestern 20:16 | 185 | |

| gestern 22:56 | 178 | |

| vor 1 Stunde | 128 | |

| gestern 19:40 | 116 | |

| vor 1 Stunde | 111 | |

| gestern 23:11 | 90 | |

| heute 00:58 | 90 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.001,60 | +0,59 | 240 | |||

| 2. | 2. | 181,19 | +0,66 | 87 | |||

| 3. | 3. | 9,7000 | +12,27 | 75 | |||

| 4. | 14. | 6,1400 | -1,35 | 69 | |||

| 5. | 11. | 0,1865 | 0,00 | 52 | |||

| 6. | 7. | 0,8750 | -12,50 | 47 | |||

| 7. | 12. | 0,1561 | +2,97 | 38 | |||

| 8. | 6. | 2.302,50 | 0,00 | 36 |

Hallo zusammen!

Bitte nicht wieder die Hände über dem Kopf zusammenschlagen, ich weiß, hab wieder was komisches ausgegraben:

Es handelt sich um Gulf Resources (GFRE: OB), einem kleinen chinesischen Chemie-Zulieferer und nach eigenen Angaben Chinas größtem Brom-Produzenten.

Bevor ihr alle wegklickt, erstmal die Kennzahlen:

Anzahl Aktien 122,2 Mio

Kurs 0,55 USD

MKap 67,21 Mio

Cash 30 Mio

KGV08 3,00, KGV09(e) 2,48

KBV 0,83

KUV 0,77, KUV09(e) 0,68

KCV 2,69

Nettomarge = 25%

2009 wird noch ein wenig besser, hier der Gewinn und Umsatz der letzten Jahre und die Schätzung für 09, von Schwäche bisher keine Spur:

Hier die Hintergründe:

GFRE ist mit einem Anteil von über 20% Chinas größter Brom-Produzent und stellt neben verschiedenen Salzen auch Chemikalien her. Man sieht sich als Chemie-Zulieferer für den chinesischen Markt (Öl+Gas, Papier, Landwirtschaft, Feuerschutz,..), die Nachfrage im Inland übersteigt das Angebot weshalb zusätzlich noch importiert wird, trotz einer Verdreifachung des Preises in den letzten 8 Jahren (Wachstum 12% p.a., Produktion 10% p.a.) Brom wird weltweit praktisch nur in den USA, Israel und China produziert (ICL, Chemtura, Albermarle, 21% Rest/China), wobei der Anteil in China zu über 90% aus Shandong, südlich von Peking kommt. Was GFRE so interessant macht, ist der riesengroße Graben, den es spendiert bekommen hat: Vor 2006 gab es in China über 200 verschiedene kleine Produzenten, welche aber durch die Regierung auf 6 Lizenzen beschränkt wurde. GFRE hat eine davon und kauft nun fleißig wie die Konkurrenz die Überreste der kleinen Produzenten auf, in den letzten 2 Jahren für ca 46 Mio 6 Stück, 30 Mio sind momentan noch in der Kriegskasse.

Bei einer Kapitalerhöhung zu fast dem doppelten Kurs (1$) wurden alle langfristige Verbindlichkeiten von 18,3 Mio getilgt.

Leider ist GFRE nur an der OTC gelistet, auf einen Wechsel wird aber schon seit einiger Zeit hingearbeitet. Die Neubesetzung des Boards wurde erst kürzlich abgeschlossen, die Voraussetzung von mehreren unabhängigen Direktoren wird nun erfüllt. Bleibt leider noch der Kurs, der allem Anschein nach durch ein Reverse-Split gelöst werden soll. Hier werden auch die Kritiker am lautesten, denn ein Reverse-Split ist meistens die absolut letzte Möglichkeit um ein praktisch totes Unternehmen für kurze Zeit wieder aus dem Penny-Bereich zu befördern.

Links:

Homepage:http://www.gulfresourcesinc.cn

Präsentation Mai 2009:http://www.gulfresourcesinc.cn/images/pdf/5_12_2009_gfre_ppt…

Profil:http://www.gulfresourcesinc.cn/images/pdf/5_12_2009_gfre_cor…

MSN:http://moneycentral.msn.com/investor/research/newsnap.asp?Sy…

Morningstar:http://quicktake.morningstar.com/StockNet/Snapshot.aspx?Coun…

Yahoo:http://finance.yahoo.com/q?s=GFRE.OB

Businessweek:http://investing.businessweek.com/businessweek/research/stoc…

Bitte nicht wieder die Hände über dem Kopf zusammenschlagen, ich weiß, hab wieder was komisches ausgegraben:

Es handelt sich um Gulf Resources (GFRE: OB), einem kleinen chinesischen Chemie-Zulieferer und nach eigenen Angaben Chinas größtem Brom-Produzenten.

Bevor ihr alle wegklickt, erstmal die Kennzahlen:

Anzahl Aktien 122,2 Mio

Kurs 0,55 USD

MKap 67,21 Mio

Cash 30 Mio

KGV08 3,00, KGV09(e) 2,48

KBV 0,83

KUV 0,77, KUV09(e) 0,68

KCV 2,69

Nettomarge = 25%

2009 wird noch ein wenig besser, hier der Gewinn und Umsatz der letzten Jahre und die Schätzung für 09, von Schwäche bisher keine Spur:

Hier die Hintergründe:

GFRE ist mit einem Anteil von über 20% Chinas größter Brom-Produzent und stellt neben verschiedenen Salzen auch Chemikalien her. Man sieht sich als Chemie-Zulieferer für den chinesischen Markt (Öl+Gas, Papier, Landwirtschaft, Feuerschutz,..), die Nachfrage im Inland übersteigt das Angebot weshalb zusätzlich noch importiert wird, trotz einer Verdreifachung des Preises in den letzten 8 Jahren (Wachstum 12% p.a., Produktion 10% p.a.) Brom wird weltweit praktisch nur in den USA, Israel und China produziert (ICL, Chemtura, Albermarle, 21% Rest/China), wobei der Anteil in China zu über 90% aus Shandong, südlich von Peking kommt. Was GFRE so interessant macht, ist der riesengroße Graben, den es spendiert bekommen hat: Vor 2006 gab es in China über 200 verschiedene kleine Produzenten, welche aber durch die Regierung auf 6 Lizenzen beschränkt wurde. GFRE hat eine davon und kauft nun fleißig wie die Konkurrenz die Überreste der kleinen Produzenten auf, in den letzten 2 Jahren für ca 46 Mio 6 Stück, 30 Mio sind momentan noch in der Kriegskasse.

Bei einer Kapitalerhöhung zu fast dem doppelten Kurs (1$) wurden alle langfristige Verbindlichkeiten von 18,3 Mio getilgt.

Leider ist GFRE nur an der OTC gelistet, auf einen Wechsel wird aber schon seit einiger Zeit hingearbeitet. Die Neubesetzung des Boards wurde erst kürzlich abgeschlossen, die Voraussetzung von mehreren unabhängigen Direktoren wird nun erfüllt. Bleibt leider noch der Kurs, der allem Anschein nach durch ein Reverse-Split gelöst werden soll. Hier werden auch die Kritiker am lautesten, denn ein Reverse-Split ist meistens die absolut letzte Möglichkeit um ein praktisch totes Unternehmen für kurze Zeit wieder aus dem Penny-Bereich zu befördern.

Links:

Homepage:http://www.gulfresourcesinc.cn

Präsentation Mai 2009:http://www.gulfresourcesinc.cn/images/pdf/5_12_2009_gfre_ppt…

Profil:http://www.gulfresourcesinc.cn/images/pdf/5_12_2009_gfre_cor…

MSN:http://moneycentral.msn.com/investor/research/newsnap.asp?Sy…

Morningstar:http://quicktake.morningstar.com/StockNet/Snapshot.aspx?Coun…

Yahoo:http://finance.yahoo.com/q?s=GFRE.OB

Businessweek:http://investing.businessweek.com/businessweek/research/stoc…

Danke für deinen Beitrag. Finde den Wert sehr interessant, vorallem die Kennzahlen sehen richtig gut aus. 30 Mio Cash. KGV von unter 3.

Im Chart geht der Trend eindeutig nach oben, stetig.

Ich glaub ich teste das mal an.

Wie hast du das eigentlich entdeckt, wie gehst du vor wenn du auf die Pirsch nach solchen Aktien gehst? Hast du auch einen Tipp bekommen wie ich jetzt von dir, oder benutzt du einen Scanner?

Im Chart geht der Trend eindeutig nach oben, stetig.

Ich glaub ich teste das mal an.

Wie hast du das eigentlich entdeckt, wie gehst du vor wenn du auf die Pirsch nach solchen Aktien gehst? Hast du auch einen Tipp bekommen wie ich jetzt von dir, oder benutzt du einen Scanner?

Hallo RayNar,

Hört sich erstmal nicht uninteressant an -hast Du mal geguckt, ob auch die zeitnahe Entwicklung der Brompreise die Geschäftszahlen(+Prognose) rechtfertigen würde?

Gruß,

Popeye

Hört sich erstmal nicht uninteressant an -hast Du mal geguckt, ob auch die zeitnahe Entwicklung der Brompreise die Geschäftszahlen(+Prognose) rechtfertigen würde?

Gruß,

Popeye

interssanter wert , wir aber nicht in deutschland gehandelt

Viel Erfolg!

MfG.

s.

Komme jetzt erst endlich dazu, euch zu antworten:

@paulite

Ja, der Trend gefällt mir auch sehr gut, trotz Krise scheint hier alles intakt zu sein und sollte China weiter den Ton angeben, dürfte man hier sehr gut positioniert sein.

Ich selber bekomme leider keine Geheimtipps, ich habe die Aktie auch über ein paar Ecken zufällig entdeckt. Es ist ja nicht so, dass das gleich die erste gewesen wäre, hab mich schon durch viel Mist vorher arbeiten müssen

@latinl

Nein, leider nicht. Orderkosten sind nicht ohne, aber wollte den Wert nicht einfach vorbeiziehen lassen.

Sollte ein Listing an der Amex klappen könnte ja auch ein Handel in Deutschland kommen, wer weiß?

@Popeye82

Mir sind leider keine Brompreise bekannt, es gibt auch (zum Glück) keinen Spot-Preis oder dergleichen. Da die Prognose erst vom Mai stammt werde ich die erstmal so akzeptieren, soweit ich das bis jetzt beurteilen kann wurden vorherige Prognosen, Margen und Wachstumsraten gut eingehalten.

In der Präsentation ist zu sehen, daß sich der Brompreis wohl auf dem hohen Niveau stabilisiert oder vielleicht minimal fällt.

Das wäre aber auch nicht so das große Problem, denn das Salzgeschäft hat noch höhere Margen und hat sich von einem Umatzbeitrag der Sparte von 1% 2007 auf 9% 2008 verbessert und federt hoffentlich Rückgänge ein wenig ab. Der Kurs scheint auf dem Gebiet sowieso einiges eingepreist zu haben.

@stupidgame

Bezüglich dem "Ringelrein" in der Direktorenrunde lässt sich sagen, daß diese aufgrund der Listingbestimmungen der Amex durchgeführt wurden. In der letzten Mitteilung hiess es, daß jetzt die vorgeschriebene Anzahl an unabhängigen Direktoren erreicht ist und ein Listing weiter angestrebt wird.

Im letzten Wechsel ist dem Unternehmen auch niemand verloren gegangen, der CFO "musste" seinen zusätzlichen Sitz wohl aufgeben.

ABER einen Fall gab es leider, bei dem ein Direktor nach ein paar Monaten wieder das Weite gesucht hat. Das sehe ich auch erstmal grundsätzlich negativ, das sollte man im Auge behalten. Gerüchte sind aber nicht auszumachen, das hatte hoffentlich nur persönliche Gründe.

@paulite

Ja, der Trend gefällt mir auch sehr gut, trotz Krise scheint hier alles intakt zu sein und sollte China weiter den Ton angeben, dürfte man hier sehr gut positioniert sein.

Ich selber bekomme leider keine Geheimtipps, ich habe die Aktie auch über ein paar Ecken zufällig entdeckt. Es ist ja nicht so, dass das gleich die erste gewesen wäre, hab mich schon durch viel Mist vorher arbeiten müssen

@latinl

Nein, leider nicht. Orderkosten sind nicht ohne, aber wollte den Wert nicht einfach vorbeiziehen lassen.

Sollte ein Listing an der Amex klappen könnte ja auch ein Handel in Deutschland kommen, wer weiß?

@Popeye82

Mir sind leider keine Brompreise bekannt, es gibt auch (zum Glück) keinen Spot-Preis oder dergleichen. Da die Prognose erst vom Mai stammt werde ich die erstmal so akzeptieren, soweit ich das bis jetzt beurteilen kann wurden vorherige Prognosen, Margen und Wachstumsraten gut eingehalten.

In der Präsentation ist zu sehen, daß sich der Brompreis wohl auf dem hohen Niveau stabilisiert oder vielleicht minimal fällt.

Das wäre aber auch nicht so das große Problem, denn das Salzgeschäft hat noch höhere Margen und hat sich von einem Umatzbeitrag der Sparte von 1% 2007 auf 9% 2008 verbessert und federt hoffentlich Rückgänge ein wenig ab. Der Kurs scheint auf dem Gebiet sowieso einiges eingepreist zu haben.

@stupidgame

Bezüglich dem "Ringelrein" in der Direktorenrunde lässt sich sagen, daß diese aufgrund der Listingbestimmungen der Amex durchgeführt wurden. In der letzten Mitteilung hiess es, daß jetzt die vorgeschriebene Anzahl an unabhängigen Direktoren erreicht ist und ein Listing weiter angestrebt wird.

Im letzten Wechsel ist dem Unternehmen auch niemand verloren gegangen, der CFO "musste" seinen zusätzlichen Sitz wohl aufgeben.

ABER einen Fall gab es leider, bei dem ein Direktor nach ein paar Monaten wieder das Weite gesucht hat. Das sehe ich auch erstmal grundsätzlich negativ, das sollte man im Auge behalten. Gerüchte sind aber nicht auszumachen, das hatte hoffentlich nur persönliche Gründe.

Imageshack hat anscheinend das schöne Bildchen unterschlagen:

Antwort auf Beitrag Nr.: 37.505.515 von stupidgame am 02.07.09 10:17:53

Hallo Stupidgame,

Also ich würde hier wahrs. so oder so(seriös oder nicht) nichts reinstecken, einfach(nur) weil ich genug eigenes Zeug verfolge.

Aber trotzdem mal die Frage, wie ist denn der Smiley zu verstehen -irgendwie in Richtung Abzocke??

Grüße,

Popeye

Hallo Stupidgame,

Also ich würde hier wahrs. so oder so(seriös oder nicht) nichts reinstecken, einfach(nur) weil ich genug eigenes Zeug verfolge.

Aber trotzdem mal die Frage, wie ist denn der Smiley zu verstehen -irgendwie in Richtung Abzocke??

Grüße,

Popeye

Höre mir gerade den Jahresbericht an.

Brompreise sind zwischenzeitig von 1900 $/t bis auf 1400 $/t eingebrochen, sind aber inzwischen wieder auf 1920 $/t angestiegen. Man rechnet grob mit konstanten oder minimal fallenden Preisen.

Brompreise sind zwischenzeitig von 1900 $/t bis auf 1400 $/t eingebrochen, sind aber inzwischen wieder auf 1920 $/t angestiegen. Man rechnet grob mit konstanten oder minimal fallenden Preisen.

Die Guidance im letzten Jahr wurde übertroffen (80 Mio->87 Mio) und auch die vom ersten Quartal wurde übertroffen (Gewinn 0,5->0,6). Erst danach wurde die Guidance für das ganze Jahr ausgegeben.

Bis jetzt keine nennenswerte Rückgänge in der Nachfrage zu sehen, Margen weiterhin sehr hoch.

Bis jetzt keine nennenswerte Rückgänge in der Nachfrage zu sehen, Margen weiterhin sehr hoch.

Antwort auf Beitrag Nr.: 37.517.473 von Popeye82 am 04.07.09 00:39:03wie ist denn der Smiley zu verstehen -irgendwie in Richtung Abzocke??

Nein. Auf keinen Fall. RayNar macht hier `nen guten Job. Hätte ich irgendwelche ernsthaften Einwände, dann hätte ich das geschrieben.

Wo ich etwas vorsichtig wäre, das ist das Timing für den Einstieg. Dran denken, wir haben Ferienzeit, und das ist ein Smallcap. die laufen saisonal in der Regel zu dieser Zeit schlechter.

Dazu kommt, dass die Charttechnik momentan, sowohl im täglichen, als auch im wöchentlichen Chart auf "Sell" gedreht hat.

http://stockcharts.com/charts/gallery.html?gfre

Auch den Gesamtmarkt sollte man IMO in dem Zusammenhang im Auge behalten. Hier wackelt es zumindest erneut.

Nach meiner bescheidenen Meinung ist ein Einstieg Anfang August wahrscheinlich günstiger. Die Q2 Zahlen sind in den letzten 3 Jahren zwischen 10.8. und 14.8. veröffentlicht worden.

Ich halte das bei anderen, ähnlichen Aktien übrigens genauso.

Gruß

s.

Nein. Auf keinen Fall. RayNar macht hier `nen guten Job. Hätte ich irgendwelche ernsthaften Einwände, dann hätte ich das geschrieben.

Wo ich etwas vorsichtig wäre, das ist das Timing für den Einstieg. Dran denken, wir haben Ferienzeit, und das ist ein Smallcap. die laufen saisonal in der Regel zu dieser Zeit schlechter.

Dazu kommt, dass die Charttechnik momentan, sowohl im täglichen, als auch im wöchentlichen Chart auf "Sell" gedreht hat.

http://stockcharts.com/charts/gallery.html?gfre

Auch den Gesamtmarkt sollte man IMO in dem Zusammenhang im Auge behalten. Hier wackelt es zumindest erneut.

Nach meiner bescheidenen Meinung ist ein Einstieg Anfang August wahrscheinlich günstiger. Die Q2 Zahlen sind in den letzten 3 Jahren zwischen 10.8. und 14.8. veröffentlicht worden.

Ich halte das bei anderen, ähnlichen Aktien übrigens genauso.

Gruß

s.

Antwort auf Beitrag Nr.: 37.518.091 von stupidgame am 04.07.09 12:05:48Investiere auch viel in Small-Caps und vermute, dass jetzt eine schwache Phase kommt, aber so richtig überzeugt bin ich davon nicht, wenn die Finanzmedien das schon berichten, muss es anders kommen?

Jedenfalls hab ich das Problem für mich so gelöst, dass ich nur mit kleinen Positionen und SL anteste, im schlimmsten Fall verbrenn ich viel an Gebühren, im besten laufen ein zwei Werte richtig gut.

Jedenfalls hab ich das Problem für mich so gelöst, dass ich nur mit kleinen Positionen und SL anteste, im schlimmsten Fall verbrenn ich viel an Gebühren, im besten laufen ein zwei Werte richtig gut.

Seit ein paar Tagen in Frankfurt gelistet?! Nicht schlecht:

GFRE bestätigt das kleine Kaufsignal des MACD und steigt intraday an, jedoch wie in den letzten Tagen unter niedrigem Volumen:

GFRE hat einen neuen COO.

Wie ich bei einigen anderen chinesischen Unternehmen gesehen habe, scheinen Forderungen generell etwas heikel zu sein, weshalb es nur gut sein kann, wenn da jemand ein Auge drauf wirft.

22.07.2009 22:01

Gulf Resources Promotes Nai Hui Miao to Chief Operating Officer]/b]

Gulf Resources, Inc. (OTCBB: GFRE) (”Gulf Resources” or the ”Company”), a leading manufacturer of bromine, crude salt and specialty chemical products in China, today announced that the Company’s board of directors has appointed Mr. Nai Hui Miao to serve as the Company’s chief operating officer, effective July 16, 2009. His responsibilities will include overseeing the Company’s daily operations, sales and material procurement, in addition to monitoring account receivables.

Mr. Miao has rich experience from working for Gulf Resources’ two operating subsidiaries Shouguang City Haoyuan Chemical Company Limited (”SCHC”) and Shouguang City Yuxin Chemical Company Limited (”SYCI”). Since January 2006, he served as vice president of SCHC, where he was responsible for sales, human resources and general business management. Since January 2006, he has also served as director secretary of Gulf Resources’ Board of Directors. From 2005 to 2006, Mr. Miao served as vice president and deputy general manager of SYCI, where he developed the sales market of Talimu oil field. From 1991 to 2005, Mr. Miao worked for of Shouguang City Commercial Trading Center Company Limited where he started off as manager and was later promoted to vice president. During his tenure, Shouguang City Commercial Trading Center Company Limited transformed from a state-owned enterprise into a privately held company. Previously, and since 1986, he was the director of Shouguang Business Trade Center. Mr. Miao has an associate degree in business administration from the Weifang College in Shandong province, China.

”We are delighted to recognize Mr. Miao’s years of hard work and dedication by promoting him to the newly established position of chief operating officer. His breadth of experience will be a strong asset in his new role,” said Xiaobin Liu, Chief Executive Officer of Gulf Resources. ”His deep knowledge of both the bromine and chemical industries will play an important role as we develop opportunities in existing markets and new vertical markets.”

Wie ich bei einigen anderen chinesischen Unternehmen gesehen habe, scheinen Forderungen generell etwas heikel zu sein, weshalb es nur gut sein kann, wenn da jemand ein Auge drauf wirft.

22.07.2009 22:01

Gulf Resources Promotes Nai Hui Miao to Chief Operating Officer]/b]

Gulf Resources, Inc. (OTCBB: GFRE) (”Gulf Resources” or the ”Company”), a leading manufacturer of bromine, crude salt and specialty chemical products in China, today announced that the Company’s board of directors has appointed Mr. Nai Hui Miao to serve as the Company’s chief operating officer, effective July 16, 2009. His responsibilities will include overseeing the Company’s daily operations, sales and material procurement, in addition to monitoring account receivables.

Mr. Miao has rich experience from working for Gulf Resources’ two operating subsidiaries Shouguang City Haoyuan Chemical Company Limited (”SCHC”) and Shouguang City Yuxin Chemical Company Limited (”SYCI”). Since January 2006, he served as vice president of SCHC, where he was responsible for sales, human resources and general business management. Since January 2006, he has also served as director secretary of Gulf Resources’ Board of Directors. From 2005 to 2006, Mr. Miao served as vice president and deputy general manager of SYCI, where he developed the sales market of Talimu oil field. From 1991 to 2005, Mr. Miao worked for of Shouguang City Commercial Trading Center Company Limited where he started off as manager and was later promoted to vice president. During his tenure, Shouguang City Commercial Trading Center Company Limited transformed from a state-owned enterprise into a privately held company. Previously, and since 1986, he was the director of Shouguang Business Trade Center. Mr. Miao has an associate degree in business administration from the Weifang College in Shandong province, China.

”We are delighted to recognize Mr. Miao’s years of hard work and dedication by promoting him to the newly established position of chief operating officer. His breadth of experience will be a strong asset in his new role,” said Xiaobin Liu, Chief Executive Officer of Gulf Resources. ”His deep knowledge of both the bromine and chemical industries will play an important role as we develop opportunities in existing markets and new vertical markets.”

GFRE hat "PRE-14C" eingereicht.

Das bedeutet, daß ein Reverse-Split zwischen 1:4 und 1:9 vorbereitet wird, um ein Listing an der NASDAQ anzustreben. Das alles dauert wohl noch ein wenig, wie man sieht wird aber daran schon fleissig gearbeitet

To the Stockholders of Gulf Resources, Inc.:

This Notice and the accompanying Information Statement are being furnished to the stockholders of Gulf Resources, Inc., a Delaware corporation (the “Company”), in connection with action taken by the holders of a majority of the issued and outstanding voting securities of the Company, approving, by written consent dated July 29, 2009, the amendment of the Company's Amended and Restated Certificate of Incorporation to effect a reverse split of the Company’s common stock, par value $0.0005 per share (the “Common Stock”) within a range of 1 for 4 to 1 for 9, so that every four (4) to nine (9) outstanding shares of Common Stock before the reverse stock split shall represent one share of Common Stock after the reverse stock split. The actions to be taken pursuant to the written consent shall be taken at such future date as determined by the Board of Directors, as evidenced by the filing of the Amendment with the Secretary of State of the State of Delaware, but in no event earlier than the 20th day after this Information Statement is so mailed or furnished.

Das bedeutet, daß ein Reverse-Split zwischen 1:4 und 1:9 vorbereitet wird, um ein Listing an der NASDAQ anzustreben. Das alles dauert wohl noch ein wenig, wie man sieht wird aber daran schon fleissig gearbeitet

To the Stockholders of Gulf Resources, Inc.:

This Notice and the accompanying Information Statement are being furnished to the stockholders of Gulf Resources, Inc., a Delaware corporation (the “Company”), in connection with action taken by the holders of a majority of the issued and outstanding voting securities of the Company, approving, by written consent dated July 29, 2009, the amendment of the Company's Amended and Restated Certificate of Incorporation to effect a reverse split of the Company’s common stock, par value $0.0005 per share (the “Common Stock”) within a range of 1 for 4 to 1 for 9, so that every four (4) to nine (9) outstanding shares of Common Stock before the reverse stock split shall represent one share of Common Stock after the reverse stock split. The actions to be taken pursuant to the written consent shall be taken at such future date as determined by the Board of Directors, as evidenced by the filing of the Amendment with the Secretary of State of the State of Delaware, but in no event earlier than the 20th day after this Information Statement is so mailed or furnished.

Und weiter gehts..

David Wong ist neuer Vize-Präsident im Bereich Finanzen.

Er soll neben den Finanzberichten auch als Ansprechpartner für Investoren herhalten, da er dem Englischen mächtig ist

NEW YORK and SHANDONG, China, July 31 GFRE-VP-Finance

NEW YORK and SHANDONG, China, July 31 /PRNewswire-Asia-FirstCall/ -- Gulf

Resources, Inc. (OTC Bulletin Board: GFRE) ("Gulf Resources" or the "Company"),

a leading manufacturer of bromine, crude salt and specialty chemical products

in China, today announced that the Company appointed Mr. David Wong to serve

as Vice President of Finance, effective August 1, 2009. His responsibilities

will include corporate consolidated financial reporting with U.S GAAP

compliance and reconciliation, financial planning and analysis, and strategic

communication with the investment community. Mr. Wong will be the Company's

primary investor relations contact and will also be involved in business

development.

Mr. Wong has rich experience in corporate risk control and financial

planning and analysis. Since January 2007, he served as finance manager of

the Asia Pacific headquarters of a NYSE-listed, Fortune 500 diversified global

manufacturing and technology company, where he was primarily responsible for

Sarbannes Oxley compliance, system audits and risk management, internal

controls over risks as well as consolidated financial reporting. Prior to

that, he was regional finance manager of the South China Manufacturing

division of the same Fortune 500 company, where he was tasked with

strengthening the internal control system, applying corporate accounting

principles and practices, financial forecasting and budgeting. From June 2000

to December 2004, Mr. Wong served as finance senior supervisor and finance

assistant manager of the South China Manufacturing division of a NASDAQ-listed

electronics manufacturing services provider based in Singapore. He graduated

from Hunan University with a major in International Accounting and he holds

the following certifications: Certified Management Accountant (USA), Certified

Production & Inventory Management (USA), and China Certified Accountant. Mr.

Wong is fluent in both Mandarin and English.

"We are pleased to welcome David to our team as we seek to strengthen our

financial reporting, disclosure and planning," said Xiaobin Liu, Chief

Executive Officer of Gulf Resources. "Not only are we are benefiting from his

extensive experience in financial planning and analysis, internal risk

assessment and disclosure at positions with leading multinational companies,

but also from his outstanding bilingual communication skills that will further

enhance Gulf Resources' transparency in the capital markets."

David Wong ist neuer Vize-Präsident im Bereich Finanzen.

Er soll neben den Finanzberichten auch als Ansprechpartner für Investoren herhalten, da er dem Englischen mächtig ist

NEW YORK and SHANDONG, China, July 31 GFRE-VP-Finance

NEW YORK and SHANDONG, China, July 31 /PRNewswire-Asia-FirstCall/ -- Gulf

Resources, Inc. (OTC Bulletin Board: GFRE) ("Gulf Resources" or the "Company"),

a leading manufacturer of bromine, crude salt and specialty chemical products

in China, today announced that the Company appointed Mr. David Wong to serve

as Vice President of Finance, effective August 1, 2009. His responsibilities

will include corporate consolidated financial reporting with U.S GAAP

compliance and reconciliation, financial planning and analysis, and strategic

communication with the investment community. Mr. Wong will be the Company's

primary investor relations contact and will also be involved in business

development.

Mr. Wong has rich experience in corporate risk control and financial

planning and analysis. Since January 2007, he served as finance manager of

the Asia Pacific headquarters of a NYSE-listed, Fortune 500 diversified global

manufacturing and technology company, where he was primarily responsible for

Sarbannes Oxley compliance, system audits and risk management, internal

controls over risks as well as consolidated financial reporting. Prior to

that, he was regional finance manager of the South China Manufacturing

division of the same Fortune 500 company, where he was tasked with

strengthening the internal control system, applying corporate accounting

principles and practices, financial forecasting and budgeting. From June 2000

to December 2004, Mr. Wong served as finance senior supervisor and finance

assistant manager of the South China Manufacturing division of a NASDAQ-listed

electronics manufacturing services provider based in Singapore. He graduated

from Hunan University with a major in International Accounting and he holds

the following certifications: Certified Management Accountant (USA), Certified

Production & Inventory Management (USA), and China Certified Accountant. Mr.

Wong is fluent in both Mandarin and English.

"We are pleased to welcome David to our team as we seek to strengthen our

financial reporting, disclosure and planning," said Xiaobin Liu, Chief

Executive Officer of Gulf Resources. "Not only are we are benefiting from his

extensive experience in financial planning and analysis, internal risk

assessment and disclosure at positions with leading multinational companies,

but also from his outstanding bilingual communication skills that will further

enhance Gulf Resources' transparency in the capital markets."

Meine Glaskugel hat Recht behalten

NEW YORK and SHANDONG PROVINCE, China, Aug. 3 GFRE-Announces-Plans

NEW YORK and SHANDONG PROVINCE, China, Aug. 3

/PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (OTC Bulletin Board: GFRE)

("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude

salt and specialty chemical products in China, announced today that on July 28,

2009 its Board of Directors adopted resolutions approving a reverse split of

the Company's Common Stock on within a range of 1 for 4 to 1 for 9, so that

every four (4) to nine (9) outstanding shares of Common Stock before the

reverse stock split shall represent one share of Common Stock after the

reverse stock split. The resolution was subsequently adopted by the written

consent of the Company's stockholders entitled to vote a majority of the

shares of Common Stock on July 29, 2009. Stockholders holding in the aggregate

67,638,898 shares of Common Stock or 55.4% of the Common Stock outstanding

approved the reverse split. The reverse split is part of the Company's

strategy to uplist its shares to a senior US stock market.

Currently, Gulf Resources has approximately 122.2 million shares of common

stock outstanding. After a four to one reverse split, the Company would have

approximately 30.5 million and after a nine to one reverse split, the Company

would have approximately 13.6 million shares outstanding. The exact ratio of

reverse stock split and effective date of the reverse split is subject to

approval from the Company's Board of Directors, but is expected to occur by

mid-September.

"By effecting a reverse split our common stock, we believe that we now

meet all of the criteria required to list our shares on a senior stock market

in the US," said Mr. Xiaobin Liu, Chief Executive Officer of Gulf Resources.

"We feel that this action is in the long-term interest of our Company and our

shareholders as it will help us attracting investor interest in our stock,

improve our liquidity and provide greater access to the US financial markets

as we execute our growth strategy."

The Company filed an information statement with the US Securities and

Exchange Commission on Schedule 14-C on July 30, 2009 detailing the terms of

the reverse split.

About Gulf Resources, Inc.

Gulf Resources, Inc. operates through two wholly-owned subsidiaries,

Shouguang City Haoyuan Chemical Company Limited ("SCHC") and Shouguang Yuxin

Chemical Industry Co., Limited ("SYCI"). The Company believes that it is one

of the largest producers of bromine in China. Elemental Bromine is used to

manufacture a wide variety of compounds utilized in industry and agriculture.

Through SYCI, the Company manufactures chemical products utilized in a variety

of applications, including oil & gas field explorations and as papermaking

chemical agents. For more information about the Company, please visit

http://www.gulfresourcesinc.cn

NEW YORK and SHANDONG PROVINCE, China, Aug. 3 GFRE-Announces-Plans

NEW YORK and SHANDONG PROVINCE, China, Aug. 3

/PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (OTC Bulletin Board: GFRE)

("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude

salt and specialty chemical products in China, announced today that on July 28,

2009 its Board of Directors adopted resolutions approving a reverse split of

the Company's Common Stock on within a range of 1 for 4 to 1 for 9, so that

every four (4) to nine (9) outstanding shares of Common Stock before the

reverse stock split shall represent one share of Common Stock after the

reverse stock split. The resolution was subsequently adopted by the written

consent of the Company's stockholders entitled to vote a majority of the

shares of Common Stock on July 29, 2009. Stockholders holding in the aggregate

67,638,898 shares of Common Stock or 55.4% of the Common Stock outstanding

approved the reverse split. The reverse split is part of the Company's

strategy to uplist its shares to a senior US stock market.

Currently, Gulf Resources has approximately 122.2 million shares of common

stock outstanding. After a four to one reverse split, the Company would have

approximately 30.5 million and after a nine to one reverse split, the Company

would have approximately 13.6 million shares outstanding. The exact ratio of

reverse stock split and effective date of the reverse split is subject to

approval from the Company's Board of Directors, but is expected to occur by

mid-September.

"By effecting a reverse split our common stock, we believe that we now

meet all of the criteria required to list our shares on a senior stock market

in the US," said Mr. Xiaobin Liu, Chief Executive Officer of Gulf Resources.

"We feel that this action is in the long-term interest of our Company and our

shareholders as it will help us attracting investor interest in our stock,

improve our liquidity and provide greater access to the US financial markets

as we execute our growth strategy."

The Company filed an information statement with the US Securities and

Exchange Commission on Schedule 14-C on July 30, 2009 detailing the terms of

the reverse split.

About Gulf Resources, Inc.

Gulf Resources, Inc. operates through two wholly-owned subsidiaries,

Shouguang City Haoyuan Chemical Company Limited ("SCHC") and Shouguang Yuxin

Chemical Industry Co., Limited ("SYCI"). The Company believes that it is one

of the largest producers of bromine in China. Elemental Bromine is used to

manufacture a wide variety of compounds utilized in industry and agriculture.

Through SYCI, the Company manufactures chemical products utilized in a variety

of applications, including oil & gas field explorations and as papermaking

chemical agents. For more information about the Company, please visit

http://www.gulfresourcesinc.cn

Hi Raynar

Danke für die Infos. Ich bin vor ca. 6 Wochen ebenfalls in den Wert eingestiegen, habe aber wegen einer relativ kleinen Position den Wert nur beiläufig beobachtet. Ist der starke Kursanstieg der letzten Tage auf die beabsichtigte US-Listung zurückzuführen oder gibt es noch andere Gründe ?

Danke für die Infos. Ich bin vor ca. 6 Wochen ebenfalls in den Wert eingestiegen, habe aber wegen einer relativ kleinen Position den Wert nur beiläufig beobachtet. Ist der starke Kursanstieg der letzten Tage auf die beabsichtigte US-Listung zurückzuführen oder gibt es noch andere Gründe ?

Hallo SimplyRed,

ja der Wert ist wirklich schön gestiegen . Der geplante Börsenplatzwechsel dürfte zu einem großen Teil dafür verantwortlich sein. Es ist anscheinend so, daß bei einer Bekanntgabe des Uplistings das Unternehmen hinter vorgehaltener Hand schon akzeptiert wurde. Der englischsprachige COO zeigt das auch noch Mal ganz deutlich.

. Der geplante Börsenplatzwechsel dürfte zu einem großen Teil dafür verantwortlich sein. Es ist anscheinend so, daß bei einer Bekanntgabe des Uplistings das Unternehmen hinter vorgehaltener Hand schon akzeptiert wurde. Der englischsprachige COO zeigt das auch noch Mal ganz deutlich.

Die bald kommenden Quartalszahlen (war glaube ich der 12. oder 13. August) haben auch noch mal das Interesse von einigen geweckt, dazu kommt noch,daß Smallcaps generell in letzter Zeit ganz gut abgeschnitten haben.

Ich befürchte aber auch hier, daß es nach den Zahlen evtl. zu Sell-on-good-News kommen könnte, wir werden sehen.

ja der Wert ist wirklich schön gestiegen

. Der geplante Börsenplatzwechsel dürfte zu einem großen Teil dafür verantwortlich sein. Es ist anscheinend so, daß bei einer Bekanntgabe des Uplistings das Unternehmen hinter vorgehaltener Hand schon akzeptiert wurde. Der englischsprachige COO zeigt das auch noch Mal ganz deutlich.

. Der geplante Börsenplatzwechsel dürfte zu einem großen Teil dafür verantwortlich sein. Es ist anscheinend so, daß bei einer Bekanntgabe des Uplistings das Unternehmen hinter vorgehaltener Hand schon akzeptiert wurde. Der englischsprachige COO zeigt das auch noch Mal ganz deutlich.Die bald kommenden Quartalszahlen (war glaube ich der 12. oder 13. August) haben auch noch mal das Interesse von einigen geweckt, dazu kommt noch,daß Smallcaps generell in letzter Zeit ganz gut abgeschnitten haben.

Ich befürchte aber auch hier, daß es nach den Zahlen evtl. zu Sell-on-good-News kommen könnte, wir werden sehen.

Gulf Resources Reports Second Quarter 2009 Results

Second Quarter Highlights

-- Net revenue was $29.6 million, a year-over-year increase of 24.5%

-- Gross profit was $13.1 million, a year-over-year increase of 35.5%

-- Gross Margin was 44.4%, compared to 40.8% in second quarter of 2008

-- Net income was $9.0 million, or $0.07 per diluted share, compared to

$6.3 million, or $0.06 per diluted share a year ago

-- Cash totaled $38.0 million as of June 30, 2009

-- Appointed a majority of independent Board of Directors

http://www.stockhouse.com/News/USReleasesDetail.aspx?n=74131…

Gruß

s.

Second Quarter Highlights

-- Net revenue was $29.6 million, a year-over-year increase of 24.5%

-- Gross profit was $13.1 million, a year-over-year increase of 35.5%

-- Gross Margin was 44.4%, compared to 40.8% in second quarter of 2008

-- Net income was $9.0 million, or $0.07 per diluted share, compared to

$6.3 million, or $0.06 per diluted share a year ago

-- Cash totaled $38.0 million as of June 30, 2009

-- Appointed a majority of independent Board of Directors

http://www.stockhouse.com/News/USReleasesDetail.aspx?n=74131…

Gruß

s.

Wahnsinns-Zahlen! Freu mich richtig auf die Telefonkonferenz, mal sehen was dort angesprochen wird.

Kurz von meiner Seite, stupidgame hat ja das Wichtigste schon geschrieben:

- CASH!

- Margen rauf

- weniger abhängig von Brom: Crude Salt rauf, Chemie-Sparte mit richtig guten Wachstumszahlen (quasi das interne Juwel..)

- Zum Halbjahr schon 15,5 Mio verdient bei Jahresschätzung von 27-29 Mio

- Ausblick positiv

Kurz von meiner Seite, stupidgame hat ja das Wichtigste schon geschrieben:

- CASH!

- Margen rauf

- weniger abhängig von Brom: Crude Salt rauf, Chemie-Sparte mit richtig guten Wachstumszahlen (quasi das interne Juwel..)

- Zum Halbjahr schon 15,5 Mio verdient bei Jahresschätzung von 27-29 Mio

- Ausblick positiv

Hab gestern Abend endlich die Telefonkonferenz angehört, welche meine (rosarote) Meinung soweit bestätigt. Lustig waren die Aussagen zur Prognose, welche nicht angehoben wurden, da man konservativ bleiben möchte, aber angemerkt wurde, daß man weit über den Planungen liegt und mit leicht steigenden Preisen rechnet. Außerdem ist die letzte Akquisition nicht komplett in den Zahlen enthalten, was noch etwas Luft nach oben lässt. Die Chemiesparte ist auch um über 50% organisch gewachsen und könnte der Juwel von GFRE werden.

Bei den nächsten Quartalszahlen gibt sich vielleicht eine interessante Situation: Bis dahin ist GFRE hoffentlich an der AMEX/NASDAQ gelistet und wird hoffentlich nochmals bessere Zahlen vorlegen. Im Vergleichsquartal im letzten Jahr musste aufgrund der olympischen Spiele die Produktion allgemein gebremst werden, weshalb die entsprechenden Steigerungsraten jenseits von Gut und Böse aussehen sollten. Das letzte Quartal war bereits ein sichtbarer Ausreisser nach oben, vielleicht poste ich ja mal eine kleine Excel-Grafik.

Es werden aber auch ein paar neue Aktien kommen, da ausgegebene Warrants im Geld liegen.

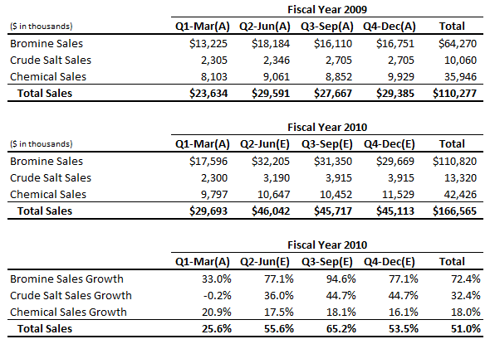

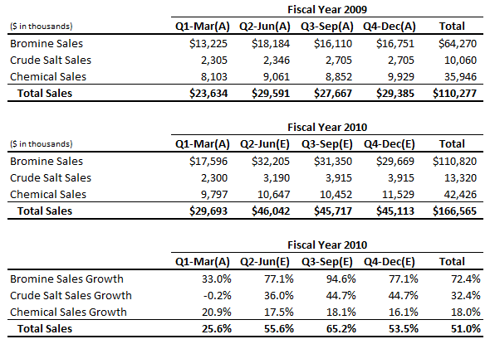

Die letzten Quartale in einer Übersicht:

Bei den nächsten Quartalszahlen gibt sich vielleicht eine interessante Situation: Bis dahin ist GFRE hoffentlich an der AMEX/NASDAQ gelistet und wird hoffentlich nochmals bessere Zahlen vorlegen. Im Vergleichsquartal im letzten Jahr musste aufgrund der olympischen Spiele die Produktion allgemein gebremst werden, weshalb die entsprechenden Steigerungsraten jenseits von Gut und Böse aussehen sollten. Das letzte Quartal war bereits ein sichtbarer Ausreisser nach oben, vielleicht poste ich ja mal eine kleine Excel-Grafik.

Es werden aber auch ein paar neue Aktien kommen, da ausgegebene Warrants im Geld liegen.

Die letzten Quartale in einer Übersicht:

Damit der Thread nicht einschläft, bis in ein paar Tagen die Präsentation in Amerika ist.

What $1.18 of GFRE gets you... 2-Sep-09 03:23 pm

31 Cents in cash and cash equivalents.

50 cents in plant and equipment.

73 cents in stock holder equity.

30 cents in 2009 earnings (projected).

650% sales increase - 2009/2006.

3000% profit increase - 2009/2006.

Forward PE of 4 and Trailing PE of 5 with good growth prospects in future.

What $1.18 of GFRE gets you... 2-Sep-09 03:23 pm

31 Cents in cash and cash equivalents.

50 cents in plant and equipment.

73 cents in stock holder equity.

30 cents in 2009 earnings (projected).

650% sales increase - 2009/2006.

3000% profit increase - 2009/2006.

Forward PE of 4 and Trailing PE of 5 with good growth prospects in future.

GFRE ist ein weiterer Zukauf geglückt

http://www.streetinsider.com/Press+Releases/Gulf+Resources+A…

Gulf Resources Acquires Bromine and Crude Salt Manufacturing Assets

September 9, 2009 8:00 AM EDT

NEW YORK and SHANDONG, China, Sept. 9 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (OTC Bulletin Board: GFRE) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in the People's Republic of China, today announced that one of its wholly- owned subsidiaries Shouguang City Haoyuan Chemical Company Limited ("SCHC") has signed an agreement with three individual residents of the People's Republic of China, Fenqiu Yuan, Han Wang and Qing Yang (the "Sellers"), to acquire manufacturing assets involved in bromine and crude salt production and to lease private land use rights located in Shouguang City Yingli Township Beishan Village ("Leased Property"). Consideration being paid by the Company for the manufacturing assets and the value of the rights to the Leased Property includes RMB112 million (approximately $16.4) million in cash and the issuance of 4,229,366 shares of common stock equal to RMB33.6 million (approximately $4.9 million). The price per share is $1.163. After the transaction, the Company will have approximately 126.4 million shares of common stock outstanding.

Upon the closing of the transaction by September 30, 2009, SCHC will acquire the bromine and crude salt assets including buildings, equipment, wells, pipelines, power circuits and inventory owned by the Sellers, and any warranties associated therewith. The assets have been non-operative since January 2009. The filing process for the Company to obtain 50-year 11.02km2 land use rights for the Leased Property is currently underway. SCHC has no relationship with the Sellers or the original operations of the assets being purchased.

Following the successful closing of the acquisition, the Company expects to start production utilizing the newly purchased assets in November 2009. The Company estimates the manufacturing assets will add 4,000 metric tons to its annual bromine production capacity and 150,000 metric tons to its annual crude salt production capacity.

"The acquisition is expected to bring SCHC's annual production capacity to 38,700 metric tons of bromine and 450,000 metric tons of crude salt. Based on current market prices for bromine and crude salt, we expect the added manufacturing assets to contribute $2.6 million of revenue for the fourth quarter of 2009 and $11.3 million of revenue for fiscal year 2010, with an expected gross margin of approximately 43%," stated Xiaobin Liu, CEO of Gulf Resources. "This acquisition will further expand our market share and strengthen our competitive position as suppliers of bromine and crude salt, which should enhance our pricing power. We intend to continue assessing additional bromine and crude salt asset acquisition opportunities given our strong cash position as we believe these projects offer a healthy return on investment."

The closing of the transaction is subject to certain closing conditions, including a final assessment of the condition of the assets. Further details on the terms of this transaction can be found in the Company's 8-K which is expected to be filed with the U.S. Securities and Exchange Commission by September 15, 2009.

http://www.streetinsider.com/Press+Releases/Gulf+Resources+A…

Gulf Resources Acquires Bromine and Crude Salt Manufacturing Assets

September 9, 2009 8:00 AM EDT

NEW YORK and SHANDONG, China, Sept. 9 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (OTC Bulletin Board: GFRE) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in the People's Republic of China, today announced that one of its wholly- owned subsidiaries Shouguang City Haoyuan Chemical Company Limited ("SCHC") has signed an agreement with three individual residents of the People's Republic of China, Fenqiu Yuan, Han Wang and Qing Yang (the "Sellers"), to acquire manufacturing assets involved in bromine and crude salt production and to lease private land use rights located in Shouguang City Yingli Township Beishan Village ("Leased Property"). Consideration being paid by the Company for the manufacturing assets and the value of the rights to the Leased Property includes RMB112 million (approximately $16.4) million in cash and the issuance of 4,229,366 shares of common stock equal to RMB33.6 million (approximately $4.9 million). The price per share is $1.163. After the transaction, the Company will have approximately 126.4 million shares of common stock outstanding.

Upon the closing of the transaction by September 30, 2009, SCHC will acquire the bromine and crude salt assets including buildings, equipment, wells, pipelines, power circuits and inventory owned by the Sellers, and any warranties associated therewith. The assets have been non-operative since January 2009. The filing process for the Company to obtain 50-year 11.02km2 land use rights for the Leased Property is currently underway. SCHC has no relationship with the Sellers or the original operations of the assets being purchased.

Following the successful closing of the acquisition, the Company expects to start production utilizing the newly purchased assets in November 2009. The Company estimates the manufacturing assets will add 4,000 metric tons to its annual bromine production capacity and 150,000 metric tons to its annual crude salt production capacity.

"The acquisition is expected to bring SCHC's annual production capacity to 38,700 metric tons of bromine and 450,000 metric tons of crude salt. Based on current market prices for bromine and crude salt, we expect the added manufacturing assets to contribute $2.6 million of revenue for the fourth quarter of 2009 and $11.3 million of revenue for fiscal year 2010, with an expected gross margin of approximately 43%," stated Xiaobin Liu, CEO of Gulf Resources. "This acquisition will further expand our market share and strengthen our competitive position as suppliers of bromine and crude salt, which should enhance our pricing power. We intend to continue assessing additional bromine and crude salt asset acquisition opportunities given our strong cash position as we believe these projects offer a healthy return on investment."

The closing of the transaction is subject to certain closing conditions, including a final assessment of the condition of the assets. Further details on the terms of this transaction can be found in the Company's 8-K which is expected to be filed with the U.S. Securities and Exchange Commission by September 15, 2009.

Laut Gulf Resources beträgt der Preis pro Tonne Brom knapp 2000$ bei konstantem Angebot und steigender Nachfrage. Deswegen dürften die nächsten Zahlen nochmal besser als erwartet aussehen

21.09.2009 14:01

Gulf Resources Provides Outlook on Bromine Prices

NEW YORK and WEIFANG, China, Sept. 21 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (BULLETIN BOARD: GFRE) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in the People's Republic of China, today provided an update on year-to-date bromine prices in China and discussed the outlook for bromine prices for the remainder of 2009.

Bromine prices have rebounded significantly in 2009 after the slump caused by an overall decrease in raw material prices and a reduction in manufacturing activity in the beginning of the year due to the slowdown of the global economy. In September 2009, bromine prices reached $1,980 per metric ton, demonstrating an 18% increase from the lowest price of $1,680 per metric ton recorded at the beginning of 2009.

"We are observing several trends indicating further increases in China's bromine prices during the remainder of 2009. First, industries utilizing bromine demonstrate strong demand, while supply remains flat. Second, as the domestically produced share of all bromine consumed in China increases, domestic producers have more pricing power. Finally, lower bromine inventory levels of domestic suppliers mean less pressure to discount prices," stated Xiaobin Liu, CEO of Gulf Resources. "According to a report by one Chinese chemical website ( http://www.chinachemnet.com/ ), published on September 14, 2009, bromine prices are expected to reach a record high level in the fourth quarter of 2009." It is believed that these favorable factors will contribute to the net profit of the Company.

21.09.2009 14:01

Gulf Resources Provides Outlook on Bromine Prices

NEW YORK and WEIFANG, China, Sept. 21 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (BULLETIN BOARD: GFRE) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in the People's Republic of China, today provided an update on year-to-date bromine prices in China and discussed the outlook for bromine prices for the remainder of 2009.

Bromine prices have rebounded significantly in 2009 after the slump caused by an overall decrease in raw material prices and a reduction in manufacturing activity in the beginning of the year due to the slowdown of the global economy. In September 2009, bromine prices reached $1,980 per metric ton, demonstrating an 18% increase from the lowest price of $1,680 per metric ton recorded at the beginning of 2009.

"We are observing several trends indicating further increases in China's bromine prices during the remainder of 2009. First, industries utilizing bromine demonstrate strong demand, while supply remains flat. Second, as the domestically produced share of all bromine consumed in China increases, domestic producers have more pricing power. Finally, lower bromine inventory levels of domestic suppliers mean less pressure to discount prices," stated Xiaobin Liu, CEO of Gulf Resources. "According to a report by one Chinese chemical website ( http://www.chinachemnet.com/ ), published on September 14, 2009, bromine prices are expected to reach a record high level in the fourth quarter of 2009." It is believed that these favorable factors will contribute to the net profit of the Company.

Gulf mit den ersten Planzahlen der neuen Akquisition:

25.09.2009 14:06

Gulf Resources Provides Expected Net Income Contribution of Acquired Manufacturing Assets

NEW YORK and SHANDONG, China, Sept. 25 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (BULLETIN BOARD: GFRE) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in the People's Republic of China, today announced that it expects the bromine and crude salt manufacturing assets, for which it entered into an asset purchase agreement on September 7, 2009, to contribute approximately $3.3 million in net income for 2010. This reflects a projected net profit margin of 29% given $11.3 million in expected revenue contribution of the assets for 2010. The company expects the acquired assets to become operational at the end of November 2009.

Consideration being paid by the Company for the manufacturing assets and the value of the rights to the leased property includes RMB 78.4 million (approximately $11.5) million in cash and the issuance of 4,229,366 shares of common stock equal to RMB33.6 million (approximately $4.9 million). The Company has so far paid approximately 30% of the total cash amount and expects to pay the remaining 70% of the cash consideration and the share consideration upon the closing of the transaction on September 30, 2009.

Gulf Resources has completed the audit and transition of the manufacturing assets. The technology preparations, staff employment and equipment maintenance are scheduled as planned and the Company expects to start production utilizing the newly purchased assets by the end of November 2009. In line with the earlier announcement, the Company estimates the manufacturing assets will add 4,000 metric tons to its annual bromine production capacity and 150,000 metric tons to its annual crude salt production capacity.

"Our latest acquisition is proceeding on schedule and will close by the end of the quarter," stated Xiaobin Liu, CEO of Gulf Resources. "The additional production capacity will further expand our domestic market share and help satisfy domestic demand for bromine and crude salt, while the increased access to limited bromine reserves should further enhance our pricing power in the industry."

25.09.2009 14:06

Gulf Resources Provides Expected Net Income Contribution of Acquired Manufacturing Assets

NEW YORK and SHANDONG, China, Sept. 25 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (BULLETIN BOARD: GFRE) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in the People's Republic of China, today announced that it expects the bromine and crude salt manufacturing assets, for which it entered into an asset purchase agreement on September 7, 2009, to contribute approximately $3.3 million in net income for 2010. This reflects a projected net profit margin of 29% given $11.3 million in expected revenue contribution of the assets for 2010. The company expects the acquired assets to become operational at the end of November 2009.

Consideration being paid by the Company for the manufacturing assets and the value of the rights to the leased property includes RMB 78.4 million (approximately $11.5) million in cash and the issuance of 4,229,366 shares of common stock equal to RMB33.6 million (approximately $4.9 million). The Company has so far paid approximately 30% of the total cash amount and expects to pay the remaining 70% of the cash consideration and the share consideration upon the closing of the transaction on September 30, 2009.

Gulf Resources has completed the audit and transition of the manufacturing assets. The technology preparations, staff employment and equipment maintenance are scheduled as planned and the Company expects to start production utilizing the newly purchased assets by the end of November 2009. In line with the earlier announcement, the Company estimates the manufacturing assets will add 4,000 metric tons to its annual bromine production capacity and 150,000 metric tons to its annual crude salt production capacity.

"Our latest acquisition is proceeding on schedule and will close by the end of the quarter," stated Xiaobin Liu, CEO of Gulf Resources. "The additional production capacity will further expand our domestic market share and help satisfy domestic demand for bromine and crude salt, while the increased access to limited bromine reserves should further enhance our pricing power in the industry."

Antwort auf Beitrag Nr.: 37.699.618 von RayNar am 03.08.09 15:26:35Gulf hat heute den reverse-Aktiensplit veröffentlicht. Vor 2 Monaten gab es die erste Meldung, daß sie zwischen 4:1 und 9:1 splitten werden, 4:1 ist es geworden, nachdem der Kurs sich positiv entwickelt hat.

Man beachte den Kommentar vom CEO, es geht direkt an die NASDAQ!

09.10.2009 14:03

Gulf Resources Effects a One-For-Four Reverse Stock Split

NEW YORK and WEIFANG, China, Oct. 9 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (BULLETIN BOARD: GFRE, GRUS) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in China, announced today that the Company will effect a one-for-four reverse split of the Company's common stock and trade on the Over the Counter Bulletin Board under the new ticker symbol "GRUS.OB" effective at the open of the market on October 12, 2009, so that every four shares of common stock before the reverse stock split shall represent one share of common stock after the reverse stock split. As a result of the reverse split, the Company will have approximately 30,542,211 shares of common stock issued and outstanding.

"The reverse stock split is an important step in order to meet the minimum share price requirements for uplisting our shares to NASDAQ. We believe listing our shares on NASDAQ will better reflect the true value of our Company and also provide our stock with increased liquidity, as more institutions are able to invest in companies trading on a senior stock market," said Mr. Xiaobin Liu, Chief Executive Officer of Gulf Resources. "Therefore, we strongly believe that these actions are in the best interest of the Company and our shareholders."

About Gulf Resources, Inc.

Gulf Resources, Inc. operates through two wholly-owned subsidiaries, Shouguang City Haoyuan Chemical Company Limited ("SCHC") and Shouguang Yuxin Chemical Industry Co., Limited ("SYCI"). The Company believes that it is one of the largest producers of bromine in China. Elemental Bromine is used to manufacture a wide variety of compounds utilized in industry and agriculture. Through SYCI, the Company manufactures chemical products utilized in a variety of applications, including oil&gas field explorations and as papermaking chemical agents. For more information about the Company, please visit http://www.gulfresourcesinc.cn/

Man beachte den Kommentar vom CEO, es geht direkt an die NASDAQ!

09.10.2009 14:03

Gulf Resources Effects a One-For-Four Reverse Stock Split

NEW YORK and WEIFANG, China, Oct. 9 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (BULLETIN BOARD: GFRE, GRUS) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in China, announced today that the Company will effect a one-for-four reverse split of the Company's common stock and trade on the Over the Counter Bulletin Board under the new ticker symbol "GRUS.OB" effective at the open of the market on October 12, 2009, so that every four shares of common stock before the reverse stock split shall represent one share of common stock after the reverse stock split. As a result of the reverse split, the Company will have approximately 30,542,211 shares of common stock issued and outstanding.

"The reverse stock split is an important step in order to meet the minimum share price requirements for uplisting our shares to NASDAQ. We believe listing our shares on NASDAQ will better reflect the true value of our Company and also provide our stock with increased liquidity, as more institutions are able to invest in companies trading on a senior stock market," said Mr. Xiaobin Liu, Chief Executive Officer of Gulf Resources. "Therefore, we strongly believe that these actions are in the best interest of the Company and our shareholders."

About Gulf Resources, Inc.

Gulf Resources, Inc. operates through two wholly-owned subsidiaries, Shouguang City Haoyuan Chemical Company Limited ("SCHC") and Shouguang Yuxin Chemical Industry Co., Limited ("SYCI"). The Company believes that it is one of the largest producers of bromine in China. Elemental Bromine is used to manufacture a wide variety of compounds utilized in industry and agriculture. Through SYCI, the Company manufactures chemical products utilized in a variety of applications, including oil&gas field explorations and as papermaking chemical agents. For more information about the Company, please visit http://www.gulfresourcesinc.cn/

Da der Chart im Eingangsposting nicht mehr geht, gibt's hier einen Neuen (auch nur solange, bis es an die NASDAQ geht  ):

):

):

):

Das Rad dreht sich sehr schnell:

Gestern Nacht wurde das Formular 8-A12B eingereicht

http://www.sec.gov/Archives/edgar/data/885462/00011938050900… das mehr oder weniger die Aufnahme zur NASDAQ bestätigt!

Es wird also bald eine offizielle Nachricht geben und schätzungsweise innerhalb von einer Woche zur Nasdaq gehen.

Gestern Nacht wurde das Formular 8-A12B eingereicht

http://www.sec.gov/Archives/edgar/data/885462/00011938050900… das mehr oder weniger die Aufnahme zur NASDAQ bestätigt!

Es wird also bald eine offizielle Nachricht geben und schätzungsweise innerhalb von einer Woche zur Nasdaq gehen.

Antwort auf Beitrag Nr.: 38.220.498 von RayNar am 21.10.09 11:07:18Und da ist sie schon, NASDAQ wir kommen:

21.10.2009 14:01

Gulf Resources Approved to List on the NASDAQ Global Select Market

NEW YORK and SHANDONG, China, Oct. 21 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (BULLETIN BOARD: GRUS) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in China, today announced it has received approval to list its common stock on the NASDAQ Global Select Market. The Company will trade on NASDAQ under the ticker symbol "GFRE." Until such time, the Company's common stock will continue to trade on the Over the Counter Bulletin Board under the ticker symbol "GRUS." The Company will provide additional information regarding the trading start shortly.

"We are very proud to be approved to list on the NASDAQ Global Select Market. As a high-growth company, Gulf Resources is a good match for this prestigious stock market," said Mr. Liu. "Moving from the OTC BB to NASDAQ is a major milestone for Gulf Resources. It is an important endorsement of our integrity as a public company and helps us build credibility with our customers, partners, and investors."

21.10.2009 14:01

Gulf Resources Approved to List on the NASDAQ Global Select Market

NEW YORK and SHANDONG, China, Oct. 21 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (BULLETIN BOARD: GRUS) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in China, today announced it has received approval to list its common stock on the NASDAQ Global Select Market. The Company will trade on NASDAQ under the ticker symbol "GFRE." Until such time, the Company's common stock will continue to trade on the Over the Counter Bulletin Board under the ticker symbol "GRUS." The Company will provide additional information regarding the trading start shortly.

"We are very proud to be approved to list on the NASDAQ Global Select Market. As a high-growth company, Gulf Resources is a good match for this prestigious stock market," said Mr. Liu. "Moving from the OTC BB to NASDAQ is a major milestone for Gulf Resources. It is an important endorsement of our integrity as a public company and helps us build credibility with our customers, partners, and investors."

Gibt schon wieder gute Nachrichten zu Gulf Resources zu vermelden.

Mit 13 Kunden, die etwa 75% vom Umsatz (Brom+Salz, ohne Chemie) ausmachen, wurden monatliche Verträge der Brompreise geschlossen. Der Preis wurde erneut um 8% angehoben, seit Jahresbeginn stieg er um 28%!

23.10.2009 14:02

Gulf Resources Provides Update on Contractual Bromine Prices

NEW YORK&SHANDONG, China, Oct. 23 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (BULLETIN BOARD: GRUS) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in China, today provided an update on bromine prices in October and reaffirmed the positive outlook on bromine prices for the rest of 2009.

Due to the continuous demand for bromine, Gulf Resources has raised its price per metric ton and signed monthly contractual agreements with 13 existing customers. According to the new contracts, the price per metric ton is $2,140, representing an 8% increase from $1,980 per metric ton in September and a 28% increase from $1,680 per metric ton in the beginning of 2009. These 13 customers represent approximately 75% of the Company's bromine and crude salt revenue. The Company has also increased its contractual bromine prices with all of its other customers as well.

The rebound in bromine prices is mainly due to increased demand from producers of flame retardants and oil drilling chemicals and Gulf Resources believes the demand outlook will remain positive for the rest of 2009. The Company intends to continue adjusting contractual bromine prices based on market developments.

"We expect a positive impact on both our top and bottom line performance for the fourth quarter from the increase in bromine prices as the rate of the price increases has exceeded our expectations," said Mr. Xiaobin Liu, Chief Executive Officer of Gulf Resources. "As an indication of China's expanding manufacturing and industrial activities, the country's purchasing managers' index (PMI) has increased to 54.3 in September from 54.0 in August, representing the seventh consecutive month for this macroeconomic indicator exceeding 50.0, which is the level signifying economic expansion. We believe the outlook for chemical manufacturing will remain positive for the remainder of the year, thus signifying continued healthy demand for bromine products."

Mit 13 Kunden, die etwa 75% vom Umsatz (Brom+Salz, ohne Chemie) ausmachen, wurden monatliche Verträge der Brompreise geschlossen. Der Preis wurde erneut um 8% angehoben, seit Jahresbeginn stieg er um 28%!

23.10.2009 14:02

Gulf Resources Provides Update on Contractual Bromine Prices

NEW YORK&SHANDONG, China, Oct. 23 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. (BULLETIN BOARD: GRUS) ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in China, today provided an update on bromine prices in October and reaffirmed the positive outlook on bromine prices for the rest of 2009.

Due to the continuous demand for bromine, Gulf Resources has raised its price per metric ton and signed monthly contractual agreements with 13 existing customers. According to the new contracts, the price per metric ton is $2,140, representing an 8% increase from $1,980 per metric ton in September and a 28% increase from $1,680 per metric ton in the beginning of 2009. These 13 customers represent approximately 75% of the Company's bromine and crude salt revenue. The Company has also increased its contractual bromine prices with all of its other customers as well.

The rebound in bromine prices is mainly due to increased demand from producers of flame retardants and oil drilling chemicals and Gulf Resources believes the demand outlook will remain positive for the rest of 2009. The Company intends to continue adjusting contractual bromine prices based on market developments.

"We expect a positive impact on both our top and bottom line performance for the fourth quarter from the increase in bromine prices as the rate of the price increases has exceeded our expectations," said Mr. Xiaobin Liu, Chief Executive Officer of Gulf Resources. "As an indication of China's expanding manufacturing and industrial activities, the country's purchasing managers' index (PMI) has increased to 54.3 in September from 54.0 in August, representing the seventh consecutive month for this macroeconomic indicator exceeding 50.0, which is the level signifying economic expansion. We believe the outlook for chemical manufacturing will remain positive for the remainder of the year, thus signifying continued healthy demand for bromine products."

Viel blabla um Gulf Resources momentan. Gab eine Pressemitteilung bezüglich Festivitäten der NASDAQ-Aufnahme. Interessant hierbei ist nur, daß man wohl die Politik auf seiner Seite hat:

"Gulf Resources is the first company from Shouguang city to be listed on NASDAQ Global Select Market. On behalf of the Shouguang municipal government and its population, I want to congratulate Gulf Resources for reaching this milestone," said the Mayor of Shouguang City, Shandong Province. "We are very supportive of Gulf Resources and its role in consolidating the bromine industry in China. We have a positive outlook on Gulf's ability to increase its market share in the industry. With the support of the local government and NASDAQ, Gulf Resources will solidify its leadership and develop more innovative products in the bromine, crude salt and specialty chemical segments."

Wichtig ist noch zu beachten, daß die Zahlen am 9.11 kommen sollten. Eine Telefonkonferenz steht auch an. Hierbei möchte ich nochmal auf einen alten Beitrag von mir vom 14.8 hinweisen, der sich allen Anschein nach bewahrheiten wird:

Bei den nächsten Quartalszahlen gibt sich vielleicht eine interessante Situation: Bis dahin ist GFRE hoffentlich an der AMEX/NASDAQ gelistet und wird hoffentlich nochmals bessere Zahlen vorlegen. Im Vergleichsquartal im letzten Jahr musste aufgrund der olympischen Spiele die Produktion allgemein gebremst werden, weshalb die entsprechenden Steigerungsraten jenseits von Gut und Böse aussehen sollten. Das letzte Quartal war bereits ein sichtbarer Ausreisser nach oben, ...

"Gulf Resources is the first company from Shouguang city to be listed on NASDAQ Global Select Market. On behalf of the Shouguang municipal government and its population, I want to congratulate Gulf Resources for reaching this milestone," said the Mayor of Shouguang City, Shandong Province. "We are very supportive of Gulf Resources and its role in consolidating the bromine industry in China. We have a positive outlook on Gulf's ability to increase its market share in the industry. With the support of the local government and NASDAQ, Gulf Resources will solidify its leadership and develop more innovative products in the bromine, crude salt and specialty chemical segments."

Wichtig ist noch zu beachten, daß die Zahlen am 9.11 kommen sollten. Eine Telefonkonferenz steht auch an. Hierbei möchte ich nochmal auf einen alten Beitrag von mir vom 14.8 hinweisen, der sich allen Anschein nach bewahrheiten wird:

Bei den nächsten Quartalszahlen gibt sich vielleicht eine interessante Situation: Bis dahin ist GFRE hoffentlich an der AMEX/NASDAQ gelistet und wird hoffentlich nochmals bessere Zahlen vorlegen. Im Vergleichsquartal im letzten Jahr musste aufgrund der olympischen Spiele die Produktion allgemein gebremst werden, weshalb die entsprechenden Steigerungsraten jenseits von Gut und Böse aussehen sollten. Das letzte Quartal war bereits ein sichtbarer Ausreisser nach oben, ...

http://www.finanznachrichten.de/nachrichten-2009-11/15424377…

09.11.2009 21:25

Gulf Resources Reports Third Quarter 2009 Results, Increases 2009 Revenue and Net Income Guidance

NEW YORK&SHANDONG PROVINCE, China, Nov. 9 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in China, today announced its financial results for the three and nine months ended September 30, 2009.

Third Quarter 2009 Highlights and Recent Events

-- Net revenue was $27.7 million, a year-over-year increase of 57.6%

-- Gross profit was $12.1 million, a year-over-year increase of 96.8%

-- Gross margin was 43.9%, compared to 35.1% in the third quarter of 2008

-- Net income was $8.3 million, or $0.27 per basic and diluted share, up

122.9% from $3.7 million, or $0.15 per basic and diluted share, a year

ago

-- Cash totaled $19.3 million as of September 30, 2009

-- Appointed Mr. Nai Hui Miao as chief operating officer

-- Completed seventh acquisition of bromine and crude salt manufacturing

assets, adding 4,000 metric tons (MT) of bromine and 150,000 MT of

crude salt annual production capacity

-- Began trading on the NASDAQ Global Select Market on October 27, 2009;

management celebrated the event by ringing the closing bell that same

day

[..]

09.11.2009 21:25

Gulf Resources Reports Third Quarter 2009 Results, Increases 2009 Revenue and Net Income Guidance

NEW YORK&SHANDONG PROVINCE, China, Nov. 9 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in China, today announced its financial results for the three and nine months ended September 30, 2009.

Third Quarter 2009 Highlights and Recent Events

-- Net revenue was $27.7 million, a year-over-year increase of 57.6%

-- Gross profit was $12.1 million, a year-over-year increase of 96.8%

-- Gross margin was 43.9%, compared to 35.1% in the third quarter of 2008

-- Net income was $8.3 million, or $0.27 per basic and diluted share, up

122.9% from $3.7 million, or $0.15 per basic and diluted share, a year

ago

-- Cash totaled $19.3 million as of September 30, 2009

-- Appointed Mr. Nai Hui Miao as chief operating officer

-- Completed seventh acquisition of bromine and crude salt manufacturing

assets, adding 4,000 metric tons (MT) of bromine and 150,000 MT of

crude salt annual production capacity

-- Began trading on the NASDAQ Global Select Market on October 27, 2009;

management celebrated the event by ringing the closing bell that same

day

[..]

Die prozentualen Zugewinne schauen wie erwartet sehr gut aus, beim Gewinn sage und schreibe 122,9% zum Vorjahr! Das war aber allgemein bekannt, weshalb es leider keinen großen Kurssprung gab. Man musste sogar im Vergleich zum Vorquartal minimal fallende Umsätze einstecken, was auf vorgezogene Käufe auf Vorrat zurückzuführen ist (sein soll.). Weiterhin 1A, KGV aber inzwischen bei 9.

GFRE gibt eine KE bekannt.

Knapp 3 Mio Aktien zu 8,50$ = 25 Mio für neue Akquistionen

http://www.finanznachrichten.de/nachrichten-2009-12/15686032…

Knapp 3 Mio Aktien zu 8,50$ = 25 Mio für neue Akquistionen

http://www.finanznachrichten.de/nachrichten-2009-12/15686032…

Ab heute ist die zuletzt erworbene Brom-Anlage voll funktionsfähig und man hofft auf weitere Übernahmen.

14.12.2009 14:03

Gulf Resources Begins Formal Production of New Bromine and Crude Salt Assets

NEW YORK and SHANDONG, China, Dec. 14 /PRNewswire-Asia-FirstCall/ -- Gulf Resources, Inc. ("Gulf Resources" or the "Company"), a leading manufacturer of bromine, crude salt and specialty chemical products in China, today provided an update on the integration of manufacturing assets that the Company acquired in September 2009. The Company started formal production using the assets on December 14, 2009.

Gulf Resources completed the transfer of ownership of bromine and crude salt manufacturing assets on September 30, 2009. With support from the sellers of the assets and the local government, the Company signed a land lease agreement with local authorities and obtained the required land use rights for the property. The Company has recently finished the maintenance and modification of the assets. After having completed successful trial production, the company expects the newly acquired assets will result in a daily bromine and crude salt production of 10 and 370 metric tons, respectively.

"We were able to start timely production using the newly acquired assets because of the support of the local government, assistance from the sellers of the assets, and the efforts of the management team," said Mr. Xiaobin Liu, Chief Executive Officer of Gulf Resources. "With bromine prices higher compared with September levels, the additional production capacity will keep us well positioned for achieving our financial goals for the current fiscal year. Looking ahead at 2010, we expect China's strong economy and the government's continued efforts to regulate small, unlicensed bromine producers to help Gulf Resources meet its goal of expanding production capacity. This should allow for continued growth in our top and bottom lines."

About Gulf Resources, Inc.