CHART und FAKTENTHREAD für UNIVERSAL POWER CORP - 500 Beiträge pro Seite

eröffnet am 25.02.10 14:44:06 von

neuester Beitrag 11.04.11 13:15:18 von

neuester Beitrag 11.04.11 13:15:18 von

Beiträge: 44

ID: 1.156.196

ID: 1.156.196

Aufrufe heute: 0

Gesamt: 12.218

Gesamt: 12.218

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 9 Minuten | 5245 | |

| vor 12 Minuten | 4369 | |

| vor 17 Minuten | 3591 | |

| heute 13:40 | 3024 | |

| vor 1 Stunde | 2284 | |

| vor 59 Minuten | 1901 | |

| vor 34 Minuten | 1638 | |

| heute 13:07 | 1348 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.139,01 | +1,17 | 240 | |||

| 2. | 3. | 0,1905 | +0,79 | 113 | |||

| 3. | 2. | 1,1000 | -20,29 | 107 | |||

| 4. | 5. | 9,3800 | +1,46 | 73 | |||

| 5. | 4. | 170,82 | +0,38 | 57 | |||

| 6. | 12. | 2.339,93 | +0,34 | 39 | |||

| 7. | Neu! | 11,905 | +14,97 | 37 | |||

| 8. | Neu! | 4,8470 | +8,07 | 36 |

Hallo @ALL,

Ich eröffne mal einen CHART und FAKTENTHREAD für UNIVERSAL POWER CORP damit man eine bessere Übersicht der Fakten, News und Berichte behält!!!

Wenn einer Berichte, News, Infos und Charts dazu Stellen will, herzlich Willkommen!!!!

ABER eine wichtige BITTE:

Diskutieren sollten wir aber weiterhin im Hauptthread http://www.wallstreet-online.de/diskussion/1134215-1-10/http… dieser Thread soll nur zur Sammlung der Information dienen!!!

Also, viel Spaß beim sammeln und lesen hier!!!!!!

UNIVERSAL POWER CORP. REGISTERED SHARES O.N.HILFE UND INFOS - Aktie

WKN: A0M2R5 | ISIN: CA91378M1041 | 3U2A

Symbol North America, TSXV: UNX

Europe, Frankfurt:3U2A

USA, Pinksheets: UPWRF

Share Price $1.85

Shares Issued & Outstanding 77,693,000

Market Capitalization $143,732,050

Fully Diluted 89,807,000

Cash on Hand $5 Million

Head Office Vancouver, BC

Transfer Agent Pacific Corporate Trust Company, Vancouver, BC

Legal Counsel Clark Wilson, Vancouver, BC

Auditor Morgan & Company, Vancouver, BC

Homepage: http://www.universalpowercorp.com/index.php

Präsentation: http://www.universalpowercorp.com/PDF/English-UNX_Powerpoint…

Projekte: http://www.universalpowercorp.com/projects/projects.php?page…

http://www.stockta.com/cgi-bin/analysis.pl?symb=UNX.C&num1=5…

Stockhouse

http://www.stockhouse.com/tools/?page=/FinancialTools/sn_ove…

FFM

Sehr gute Seiten zu Charts.....

barchart http://www.barchart.com/

bullchart http://www.bullchart.de/rechner/index.php

Candelstick http://www.fxmarkets.de/chart/candle.htm

LiveCharts http://www.livecharts.co.uk/MarketCharts/gold.php" target="_blank" rel="nofollow ugc noopener">http://www.livecharts.co.uk/MarketCharts/gold.php

Stundencharthttp://cxa.marketwatch.com/TSX/en/Market/intchart.aspx?symb=…

Viele Erklärungen zu Charts....

http://www.fxmarkets.de/chart/index.htm

Gruß

TimLuca

Ich eröffne mal einen CHART und FAKTENTHREAD für UNIVERSAL POWER CORP damit man eine bessere Übersicht der Fakten, News und Berichte behält!!!

Wenn einer Berichte, News, Infos und Charts dazu Stellen will, herzlich Willkommen!!!!

ABER eine wichtige BITTE:

Diskutieren sollten wir aber weiterhin im Hauptthread http://www.wallstreet-online.de/diskussion/1134215-1-10/http… dieser Thread soll nur zur Sammlung der Information dienen!!!

Also, viel Spaß beim sammeln und lesen hier!!!!!!

UNIVERSAL POWER CORP. REGISTERED SHARES O.N.HILFE UND INFOS - Aktie

WKN: A0M2R5 | ISIN: CA91378M1041 | 3U2A

Symbol North America, TSXV: UNX

Europe, Frankfurt:3U2A

USA, Pinksheets: UPWRF

Share Price $1.85

Shares Issued & Outstanding 77,693,000

Market Capitalization $143,732,050

Fully Diluted 89,807,000

Cash on Hand $5 Million

Head Office Vancouver, BC

Transfer Agent Pacific Corporate Trust Company, Vancouver, BC

Legal Counsel Clark Wilson, Vancouver, BC

Auditor Morgan & Company, Vancouver, BC

Homepage: http://www.universalpowercorp.com/index.php

Präsentation: http://www.universalpowercorp.com/PDF/English-UNX_Powerpoint…

Projekte: http://www.universalpowercorp.com/projects/projects.php?page…

http://www.stockta.com/cgi-bin/analysis.pl?symb=UNX.C&num1=5…

Stockhouse

http://www.stockhouse.com/tools/?page=/FinancialTools/sn_ove…

FFM

Sehr gute Seiten zu Charts.....

barchart http://www.barchart.com/

bullchart http://www.bullchart.de/rechner/index.php

Candelstick http://www.fxmarkets.de/chart/candle.htm

LiveCharts http://www.livecharts.co.uk/MarketCharts/gold.php" target="_blank" rel="nofollow ugc noopener">http://www.livecharts.co.uk/MarketCharts/gold.php

Stundencharthttp://cxa.marketwatch.com/TSX/en/Market/intchart.aspx?symb=…

Viele Erklärungen zu Charts....

http://www.fxmarkets.de/chart/index.htm

Gruß

TimLuca

Hiermit möchte ich erst einmal "TimLuca" einen großen Dank aussprechen, der sich die Arbeit & Mühe gemacht hat, einen Chart- und Faktenthread für UNX zu eröffnen. Hierzu bin ich leider zu doof (allerdings gebe ich es auch zu).

Der Chart- und Faktenthread sollte für alle Teilnehmer eine enorme Erleichterung darstellen, da so das ewige Blättern im Hauptthread entfällt.

„TimLuca, hab Dank!“

1.) Unternehmensanalyse:

Die beste Analyse zu UNX mit entsprechenden Aktualisierungen gibt es auf sharewise.com vom User Proxy.

„Proxy, auch Dir Dank für Deine Spitzenarbeit!“

Quelle: http://www.de.sharewise.com/aktien/CA91378M1041-universal-po…

2.) Die letzten NEWS vom 24.02.2010:

Universal Power acquires 60% of Namibia Industrial

2010-02-24 16:34 ET - Acquisition

The TSX Venture Exchange has accepted for filing documentation of an agreement dated July 7, 2009, between Universal Power Corp. and Limpet Investments (Pty.) Ltd. (Knowledge Katti) whereby the company may acquire 60 per cent of the issued and outstanding common shares of Namibia Industrial Development Group (Pty.) Ltd. (NIDG). NIDG has an oil and gas exploration licence to explore block number 2815 situated directly east of the Kudu gas field and north of Orange basin, offshore Namibia.

The total consideration payable to the Vendor is $1,000,000 cash and 3,000,000 common shares of the Company. In addition, the Company is to keep the license in good standing.

Insider / Pro Group Participation:

Insider=Y /Name ProGroup=P # of Shares

Knowledge Katti Y 3,000,000

For further information, please refer to the Company's news releases dated July 7, 2009 and December 31, 2009.

Quelle: http://www.stockwatch.com/newsit/newsit_newsit.aspx?bid=Z-C:…

3.) Aktuelle Marktkapitalisierung:

Bei 77,693 Mio. Aktien und einem Kurs von 2,35 CAD ~ 182,58 Mio. CAD.

Hinzu kommen dann bestimmt noch die 3 Mio. Stück für die o.g. Finanzierung (???).

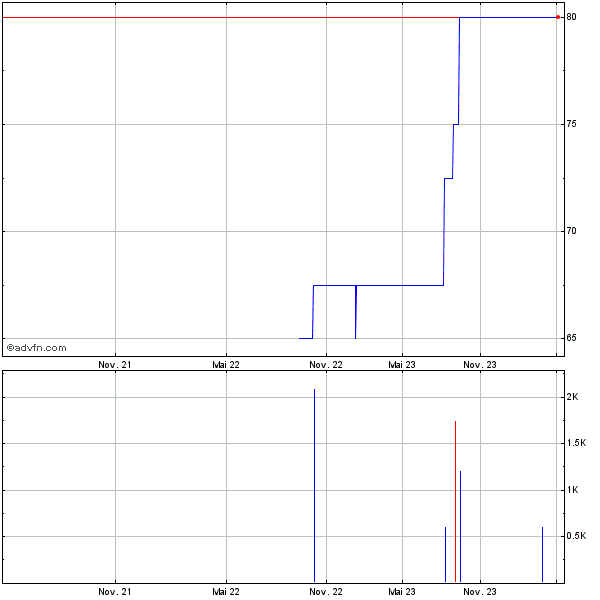

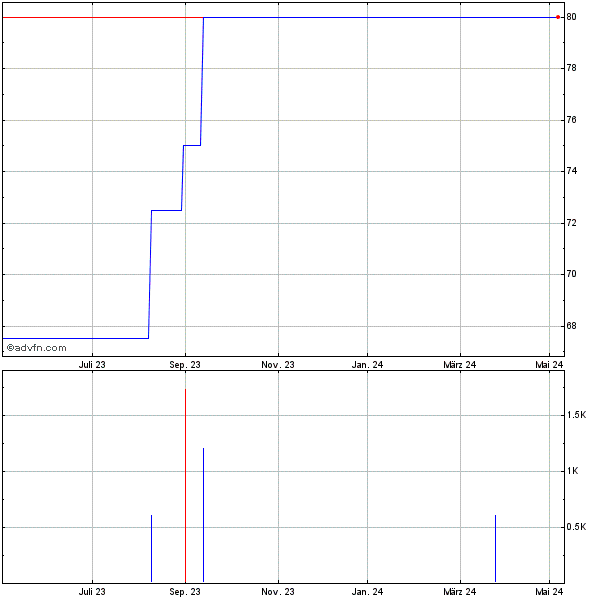

4.) UNX-Chartanalyse auf stockcharts:

Quelle: http://stockcharts.com/charts/gallery.html?UNX.V

5.) Wechselkurs CAD – EUR:

Quelle: http://www.wallstreet-online.de/devisen/100785/chart.html?tr…

Der Chart- und Faktenthread sollte für alle Teilnehmer eine enorme Erleichterung darstellen, da so das ewige Blättern im Hauptthread entfällt.

„TimLuca, hab Dank!“

1.) Unternehmensanalyse:

Die beste Analyse zu UNX mit entsprechenden Aktualisierungen gibt es auf sharewise.com vom User Proxy.

„Proxy, auch Dir Dank für Deine Spitzenarbeit!“

Quelle: http://www.de.sharewise.com/aktien/CA91378M1041-universal-po…

2.) Die letzten NEWS vom 24.02.2010:

Universal Power acquires 60% of Namibia Industrial

2010-02-24 16:34 ET - Acquisition

The TSX Venture Exchange has accepted for filing documentation of an agreement dated July 7, 2009, between Universal Power Corp. and Limpet Investments (Pty.) Ltd. (Knowledge Katti) whereby the company may acquire 60 per cent of the issued and outstanding common shares of Namibia Industrial Development Group (Pty.) Ltd. (NIDG). NIDG has an oil and gas exploration licence to explore block number 2815 situated directly east of the Kudu gas field and north of Orange basin, offshore Namibia.

The total consideration payable to the Vendor is $1,000,000 cash and 3,000,000 common shares of the Company. In addition, the Company is to keep the license in good standing.

Insider / Pro Group Participation:

Insider=Y /Name ProGroup=P # of Shares

Knowledge Katti Y 3,000,000

For further information, please refer to the Company's news releases dated July 7, 2009 and December 31, 2009.

Quelle: http://www.stockwatch.com/newsit/newsit_newsit.aspx?bid=Z-C:…

3.) Aktuelle Marktkapitalisierung:

Bei 77,693 Mio. Aktien und einem Kurs von 2,35 CAD ~ 182,58 Mio. CAD.

Hinzu kommen dann bestimmt noch die 3 Mio. Stück für die o.g. Finanzierung (???).

4.) UNX-Chartanalyse auf stockcharts:

Quelle: http://stockcharts.com/charts/gallery.html?UNX.V

5.) Wechselkurs CAD – EUR:

Quelle: http://www.wallstreet-online.de/devisen/100785/chart.html?tr…

Die "Paritätschlacht" geht weiter, gut für uns Aktionäre (natürlich in Bezug auf den CAD)!

_____

Geheimes Treffen: Hedge-Fonds nehmen Euro ins Visier

Gleich mehrere große Hedge-Fonds wollen offenbar Wetten gegen den Euro abschließen. Das Kalkül: Der Euro fällt auf Parität zum Dollar – für Fonds-Manager die Gelegenheit, noch einmal richtig Kasse zu machen. Parallelen zur US-Finanzkrise drängen sich auf.

Quelle: http://www.handelsblatt.com/finanzen/fondsnachrichten/geheim…

_____

Geheimes Treffen: Hedge-Fonds nehmen Euro ins Visier

Gleich mehrere große Hedge-Fonds wollen offenbar Wetten gegen den Euro abschließen. Das Kalkül: Der Euro fällt auf Parität zum Dollar – für Fonds-Manager die Gelegenheit, noch einmal richtig Kasse zu machen. Parallelen zur US-Finanzkrise drängen sich auf.

Quelle: http://www.handelsblatt.com/finanzen/fondsnachrichten/geheim…

Großer Chart:

Vor einem richtig, richtig fetten Hype kommen meist nervöse und volatile Konsolidierungen mit teilweise bis zu 50% vom Höchstkurs, die über Monate andauern können.

Anbei ein paar Beispiele:

Forsys Metals:

http://aktien.wallstreet-online.de/Forsys-Metals-Aktie/chart…

Energulf:

http://aktien.wallstreet-online.de/Energulf-Resources-Aktie/…

Falcon Oil & Gas:

http://aktien.wallstreet-online.de/Falcon-Oil-Gas-Aktie/char…

Xemplar Energy:

http://aktien.wallstreet-online.de/Xemplar-Energy-Aktie/char…

THOMPSON CREEK:

http://aktien.wallstreet-online.de/Thompson-Creek-Aktie/char…

Anbei ein paar Beispiele:

Forsys Metals:

http://aktien.wallstreet-online.de/Forsys-Metals-Aktie/chart…

Energulf:

http://aktien.wallstreet-online.de/Energulf-Resources-Aktie/…

Falcon Oil & Gas:

http://aktien.wallstreet-online.de/Falcon-Oil-Gas-Aktie/char…

Xemplar Energy:

http://aktien.wallstreet-online.de/Xemplar-Energy-Aktie/char…

THOMPSON CREEK:

http://aktien.wallstreet-online.de/Thompson-Creek-Aktie/char…

Could Namibia Be Ten Times Better Than Brazil for Oil?

Feb 26th, 2010 | By Byron King

I logged 9,814 air miles. Took four different flights. Spent a total of 54 hours traveling. All to meet with a man they call “Mr. GO Deep…”

“Mr. GO Deep” is the go to guy in offshore oil development. Oil companies pay him HUGE consulting fees in hopes to identify the next deep or ultra deep offshore oil deposits.

Yet in my recent trip down to Brazil, “Mr. GO Deep” sat at a table with me — just me — for two solid hours, explaining what he’s doing in the energy world. And why, while offshore Brazilian oil is good, there’s another deep sea play with even better oil prospects. Then he handed me off to several of his able staff, who were equally generous with their time and perspective. A first-class act, in every respect.

Here’s what I’ve found, along with a few ideas of how you can take advantage of the secrets he shared…

Meet “Mr. GO Deep” – The GO TO Man in Deep Oil Discoveries

The man I’m talking about is Marcio Mello — the always-ebullient Brazilian geochemist and CEO of Brazil’s HRT Petroleum Co. I first met Marcio back at last year’s American Association of Petroleum Geologists (AAPG) convention. He wowed the crowd with a discussion of the oil potential of the South Atlantic.

“The Namibian offshore is analogous to that of Brazil,” Marcio stated, with slides and hard data to back it up. Then he showed his proprietary research into natural offshore oil seeps off Namibia, and the geochemistry that demonstrates immense hydrocarbon potential. As for the reservoirs, he showed a slide of proprietary seismic data. “And look at this turbidite stuff,” he yelled, as a couple hundred seasoned geologists in the room both gasped and chuckled.

Indeed, Namibia is destined for oil riches. “But Namibia,” said Marcio, “is way underexplored. So you can put down a little money for the concessions and get very rich.”

Any mention of “very rich” makes my ears perk up. When I questioned Marcio further about the offshore Namibia deposits, he was gracious enough to invite me down to see his facilities in Brazil.

Here’s What I Found About Namibia…

I looked at seismic. I saw geochemistry. I saw satellite data. I saw gravity and magnetic maps. If there’s a frontier spot on earth where you can say that drilling risk is low for wildcat development, it’s offshore Namibia. (You just have to be sure to drill in the right place.)

Nothing is easy, of course. There aren’t a lot of wells offshore Namibia. Just a handful. But we know there’s a giant natural gas field at Kudu in the south, immediately north of the Namibian territorial line with South Africa. So there’s a hydrocarbon system out there. Now we know there’s gas, so where’s the rest of it? As Marcio says, “If I see a little baby, I look for its mama.”

After a week in Brazil, I can say something significant. It’s that right now, some people (guess who) know more about the deep regions offshore Namibia than Petrobras knew about the deep Campos Basin off Brazil before it drilled the Tupi discovery and found 12 billion barrels of oil.

The Secret Finding Namibia’s Oil

To understand what Marcio brings to the table – and his secret for finding deep oil plays — you first have to understand how big oil companies think about exploration…

There are a couple of different exploration philosophies among big oil companies. One philosophy is that the oil company gains an offshore concession and works the heck out of that concession. It puts big bucks into seismic, seismic and more seismic. Then it drills the biggest structure on the concession and MAYBE finds oil.

Or maybe not. Maybe the oil company drills a dry hole, because there’s a big structure with no oil. There are all sorts of geological reasons why this might happen. The bottom line is, “You have a wine bottle, but there’s no wine in it,” as Marcio says.

Another exploration philosophy is that an oil company gains an offshore concession and looks across the entire region for evidence of a petroleum system. Where did the oil and gas originate? Where’s the “oil kitchen”? What are the migration pathways? Where could that oil be now? After a lot of work at the REGIONAL level, then the company hones in on its concession and drills — and it’s not necessarily the big structure. Maybe it drills lower down, like in the oil kitchen.

I’m telling you things that people have spent BILLIONS of dollars learning the hard way. This is information that took Petrobras years to develop. Marcio had an uphill fight at Petrobras for a long time, working to replace “turbidite” thinking (a prolific kind of oil-bearing formation) with “petroleum systems” thinking.

Today, this “petroleum systems approach” is the kind of thinking that Marcio brings to the table.

Why Namibia’s Oil Is Even More Promising Than Brazil’s

If you’re a long time Whiskey reader, you already know I’m very bullish on Brazilian oil opportunities. But there are some things that make the Namibian oil plays even better. Allow me to explain…

Brazil is about to pass a set of new petroleum laws that will put its entire pre-salt region under the jurisdiction of a new national oil company (NOC), meaning NOT Petrobras, which is publicly owned. Future pre-salt deals will be along the lines of production sharing arrangements (PSAs) with the NOC, which private oil companies HATE because they can’t book the reserves and impress Wall Street.

There are all sorts of issues about how much interest Petrobras will get in future Brazil offshore concessions (30% is the current number). And how Petrobras will be the operator, on behalf of the NOC, of all future pre-salt plays off Brazil. It’s going to be complicated, if not hairy!

The bottom line is that if an international oil company wants to look for big oil fields, like pre-salt plays and find and book those huge volumes of oil, it has to go somewhere else.

Where else? Why… Namibia, of course! Offshore Namibia, you can get 10 times the acreage for 1/10th the price. For now..

There are many ways for you to take advantage of this discovery. First, if you’re looking for a home run opportunity, try searching some of the smaller oil companies with concessions in Namibia. You’ll want to look mainly at ones that are pure plays, though. A second, less exciting but safer way to play it would be to look at some of the big oil service companies that provide the drill bits, rigs, and hardware for general deep sea oil discoveries.

Quelle: http://whiskeyandgunpowder.com/could-namibia-be-ten-times-be…

Feb 26th, 2010 | By Byron King

I logged 9,814 air miles. Took four different flights. Spent a total of 54 hours traveling. All to meet with a man they call “Mr. GO Deep…”

“Mr. GO Deep” is the go to guy in offshore oil development. Oil companies pay him HUGE consulting fees in hopes to identify the next deep or ultra deep offshore oil deposits.

Yet in my recent trip down to Brazil, “Mr. GO Deep” sat at a table with me — just me — for two solid hours, explaining what he’s doing in the energy world. And why, while offshore Brazilian oil is good, there’s another deep sea play with even better oil prospects. Then he handed me off to several of his able staff, who were equally generous with their time and perspective. A first-class act, in every respect.

Here’s what I’ve found, along with a few ideas of how you can take advantage of the secrets he shared…

Meet “Mr. GO Deep” – The GO TO Man in Deep Oil Discoveries

The man I’m talking about is Marcio Mello — the always-ebullient Brazilian geochemist and CEO of Brazil’s HRT Petroleum Co. I first met Marcio back at last year’s American Association of Petroleum Geologists (AAPG) convention. He wowed the crowd with a discussion of the oil potential of the South Atlantic.

“The Namibian offshore is analogous to that of Brazil,” Marcio stated, with slides and hard data to back it up. Then he showed his proprietary research into natural offshore oil seeps off Namibia, and the geochemistry that demonstrates immense hydrocarbon potential. As for the reservoirs, he showed a slide of proprietary seismic data. “And look at this turbidite stuff,” he yelled, as a couple hundred seasoned geologists in the room both gasped and chuckled.

Indeed, Namibia is destined for oil riches. “But Namibia,” said Marcio, “is way underexplored. So you can put down a little money for the concessions and get very rich.”

Any mention of “very rich” makes my ears perk up. When I questioned Marcio further about the offshore Namibia deposits, he was gracious enough to invite me down to see his facilities in Brazil.

Here’s What I Found About Namibia…

I looked at seismic. I saw geochemistry. I saw satellite data. I saw gravity and magnetic maps. If there’s a frontier spot on earth where you can say that drilling risk is low for wildcat development, it’s offshore Namibia. (You just have to be sure to drill in the right place.)

Nothing is easy, of course. There aren’t a lot of wells offshore Namibia. Just a handful. But we know there’s a giant natural gas field at Kudu in the south, immediately north of the Namibian territorial line with South Africa. So there’s a hydrocarbon system out there. Now we know there’s gas, so where’s the rest of it? As Marcio says, “If I see a little baby, I look for its mama.”

After a week in Brazil, I can say something significant. It’s that right now, some people (guess who) know more about the deep regions offshore Namibia than Petrobras knew about the deep Campos Basin off Brazil before it drilled the Tupi discovery and found 12 billion barrels of oil.

The Secret Finding Namibia’s Oil

To understand what Marcio brings to the table – and his secret for finding deep oil plays — you first have to understand how big oil companies think about exploration…

There are a couple of different exploration philosophies among big oil companies. One philosophy is that the oil company gains an offshore concession and works the heck out of that concession. It puts big bucks into seismic, seismic and more seismic. Then it drills the biggest structure on the concession and MAYBE finds oil.

Or maybe not. Maybe the oil company drills a dry hole, because there’s a big structure with no oil. There are all sorts of geological reasons why this might happen. The bottom line is, “You have a wine bottle, but there’s no wine in it,” as Marcio says.

Another exploration philosophy is that an oil company gains an offshore concession and looks across the entire region for evidence of a petroleum system. Where did the oil and gas originate? Where’s the “oil kitchen”? What are the migration pathways? Where could that oil be now? After a lot of work at the REGIONAL level, then the company hones in on its concession and drills — and it’s not necessarily the big structure. Maybe it drills lower down, like in the oil kitchen.

I’m telling you things that people have spent BILLIONS of dollars learning the hard way. This is information that took Petrobras years to develop. Marcio had an uphill fight at Petrobras for a long time, working to replace “turbidite” thinking (a prolific kind of oil-bearing formation) with “petroleum systems” thinking.

Today, this “petroleum systems approach” is the kind of thinking that Marcio brings to the table.

Why Namibia’s Oil Is Even More Promising Than Brazil’s

If you’re a long time Whiskey reader, you already know I’m very bullish on Brazilian oil opportunities. But there are some things that make the Namibian oil plays even better. Allow me to explain…

Brazil is about to pass a set of new petroleum laws that will put its entire pre-salt region under the jurisdiction of a new national oil company (NOC), meaning NOT Petrobras, which is publicly owned. Future pre-salt deals will be along the lines of production sharing arrangements (PSAs) with the NOC, which private oil companies HATE because they can’t book the reserves and impress Wall Street.

There are all sorts of issues about how much interest Petrobras will get in future Brazil offshore concessions (30% is the current number). And how Petrobras will be the operator, on behalf of the NOC, of all future pre-salt plays off Brazil. It’s going to be complicated, if not hairy!

The bottom line is that if an international oil company wants to look for big oil fields, like pre-salt plays and find and book those huge volumes of oil, it has to go somewhere else.

Where else? Why… Namibia, of course! Offshore Namibia, you can get 10 times the acreage for 1/10th the price. For now..

There are many ways for you to take advantage of this discovery. First, if you’re looking for a home run opportunity, try searching some of the smaller oil companies with concessions in Namibia. You’ll want to look mainly at ones that are pure plays, though. A second, less exciting but safer way to play it would be to look at some of the big oil service companies that provide the drill bits, rigs, and hardware for general deep sea oil discoveries.

Quelle: http://whiskeyandgunpowder.com/could-namibia-be-ten-times-be…

Hier kann sich jeder User noch einmal das "göttliche" Interview mit Duane Parnham aus 06/2009 `reinziehen:

_____

Interview - Duane Parnham - Universal Power Corp.

Sonntag, 28 Juni 2009

Namibia – das neue Öldorado

Was haben die Küstenregionen in Südamerikas Osten und Afrikas Westen gemein?

Vor mehr als 100 Mio. Jahren brach der Kontinent Gondwana auseinander, Afrika driftete in Richtung Osten, während sich Südamerika nach Westen bewegte, es entstand er Atlantische Ozean.

Dadurch, dass beide Küstenregionen einmal direkt zusammenlagen, weisen diese auch sehr ähnliche geologische Strukturen, inklusive darin vorhandener Rohstoffe auf. Während in den Seegebieten Brasiliens bereits große Mengen an Öl und Erdgas aufgefunden wurden, steckt die Explorationsarbeit auf der gegenüberliegenden Seite, also vor der Küste Namibias noch am Anfang. Doch auch dort konnte bereits das Vorhandensein potentieller Öl- und Gas-Anomalien bewiesen werden.

Die kanadische Explorationsgesellschaft Universal Power Corp. , deren Management ein hohes Ansehen in Namibia genießt, ist eine der wenigen Firmen, die dieses Potential bereits erkannt haben und die Erlaubnis zur Erforschung der Hoheitsgewässer Namibias besitzen. Wir sprachen mit Universal Power Corps. Chairman Duane Parnham über die enormen Chancen, die Namibias Küstengewässer im Bereich Öl- und Gasförderung bieten.

Quelle: http://www.dyor.de/universal-power-corp/interview-duane-parn…

_____

Interview - Duane Parnham - Universal Power Corp.

Sonntag, 28 Juni 2009

Namibia – das neue Öldorado

Was haben die Küstenregionen in Südamerikas Osten und Afrikas Westen gemein?

Vor mehr als 100 Mio. Jahren brach der Kontinent Gondwana auseinander, Afrika driftete in Richtung Osten, während sich Südamerika nach Westen bewegte, es entstand er Atlantische Ozean.

Dadurch, dass beide Küstenregionen einmal direkt zusammenlagen, weisen diese auch sehr ähnliche geologische Strukturen, inklusive darin vorhandener Rohstoffe auf. Während in den Seegebieten Brasiliens bereits große Mengen an Öl und Erdgas aufgefunden wurden, steckt die Explorationsarbeit auf der gegenüberliegenden Seite, also vor der Küste Namibias noch am Anfang. Doch auch dort konnte bereits das Vorhandensein potentieller Öl- und Gas-Anomalien bewiesen werden.

Die kanadische Explorationsgesellschaft Universal Power Corp. , deren Management ein hohes Ansehen in Namibia genießt, ist eine der wenigen Firmen, die dieses Potential bereits erkannt haben und die Erlaubnis zur Erforschung der Hoheitsgewässer Namibias besitzen. Wir sprachen mit Universal Power Corps. Chairman Duane Parnham über die enormen Chancen, die Namibias Küstengewässer im Bereich Öl- und Gasförderung bieten.

Quelle: http://www.dyor.de/universal-power-corp/interview-duane-parn…

Gazprom signs up for Kudu

Russian giant Gazprom and Namibian state oil company Namcor have agreed to establish a special purpose company to take a majority stake in the Kudu gas field to accelerate its progress to first production in 2014.

Quelle: http://www.upstreamonline.com/live/article208127.ece

Russian giant Gazprom and Namibian state oil company Namcor have agreed to establish a special purpose company to take a majority stake in the Kudu gas field to accelerate its progress to first production in 2014.

Quelle: http://www.upstreamonline.com/live/article208127.ece

Spezial Report Öl

International Research: „Too fast, too furious... now time for a break.“

Inhalt:

Kursavancen „zu weit, zu schnell“,

Upside begrenzt

Shale Gas als „Game changer“ im

Energiesektor und attraktive

Investmentopportunität

Liquiditätsschwemme und

gestiegener Risikoappetit als

primärer Grund für Ölpreisanstieg

Aktuell Überversorgung am Ölsektor,

Lagerbestände als Archilles-Ferse

Ölpreisentwicklung aus Sicht der

Österreichischen Schule der

Nationalökonomie

Ein chinesischer „Black Swan“?

Prognose 2010: 1. HJ: Fortsetzung

des Aufwärtstrends bis USD 90-100,

2. Halbjahr Trendumkehr zu erwarten

Durchschnittskurs 2010:

USD 72/Barrel

Quelle: http://www.rohstoff-welt.de/news/artikel.php?sid=17950

International Research: „Too fast, too furious... now time for a break.“

Inhalt:

Kursavancen „zu weit, zu schnell“,

Upside begrenzt

Shale Gas als „Game changer“ im

Energiesektor und attraktive

Investmentopportunität

Liquiditätsschwemme und

gestiegener Risikoappetit als

primärer Grund für Ölpreisanstieg

Aktuell Überversorgung am Ölsektor,

Lagerbestände als Archilles-Ferse

Ölpreisentwicklung aus Sicht der

Österreichischen Schule der

Nationalökonomie

Ein chinesischer „Black Swan“?

Prognose 2010: 1. HJ: Fortsetzung

des Aufwärtstrends bis USD 90-100,

2. Halbjahr Trendumkehr zu erwarten

Durchschnittskurs 2010:

USD 72/Barrel

Quelle: http://www.rohstoff-welt.de/news/artikel.php?sid=17950

11.03.10

Tullow Oil loses control over Kudu

RUSSIAN gas giant Gazprom and Namcor have partnered up to muscle out Tullow Oil as the main shareholder in the Kudu gas field, securing 54 per cent of the interest in the multibillion-dollar offshore energy project.

Quelle: http://www.namibian.com.na/news/full-story/archive/2010/marc…

Tullow Oil loses control over Kudu

RUSSIAN gas giant Gazprom and Namcor have partnered up to muscle out Tullow Oil as the main shareholder in the Kudu gas field, securing 54 per cent of the interest in the multibillion-dollar offshore energy project.

Quelle: http://www.namibian.com.na/news/full-story/archive/2010/marc…

Wenigstens klappt die PR bei UNX

Universal Power Retains Leading Investor Relations Firm

3/18/2010 9:00 AM - Canada NewsWire

CALGARY, Mar 18, 2010 (Canada NewsWire via COMTEX News Network) --

Universal Power Corp. (TSX-V:UNX), an oil and gas company focused on exploration in Namibia, Africa, today announced that it has retained The Equicom Group Inc. to provide strategic investor relations and financial communications services for the Company.

Under the terms of the agreement, Universal Power will pay Equicom a monthly retainer fee of $6,000 for select strategic communications services. The initial contract term is for 12 months and commences immediately.

Neither Equicom nor any of its principals have an ownership interest, directly or indirectly, in Universal Power or its securities, and Universal Power has not granted Equicom or its principals any right to acquire such an interest.

About Universal Power Corp.

Universal Power Corp. is an oil and gas company focused on building a portfolio of high impact exploration targets in offshore Namibia, Africa. The company has more than 32,000 square kilometres of concessions along the prolific South Atlantic Margin. The management team and the company's directors have established relationships with the Namibian Government, its state-run energy entity, NAMCOR, and the country's Black Economic Empowerment partners.

About Equicom Group

Equicom, a wholly-owned subsidiary of TMX Group Inc., is a leading Canadian provider of investor relations and strategic corporate communications services. With proven expertise in developing and executing highly effective strategic communications programs, and an extensive network of investment community contacts, Equicom specializes in helping clients achieve their capital markets objectives. Equicom offers a comprehensive suite of services including: investor relations, media relations, annual report production, multimedia and web design, web casting, live event management and corporate branding. Equicom is headquartered in Toronto, with offices in Montreal and Calgary. For further information, please visit www.equicomgroup.com or follow Equicom on Twitter at http://twitter.com/Equicom.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

%SEDAR: 00016276E

SOURCE: Universal Power Corp.

Investor Relations: David Feick, (403) 218-2839, dfeick@equicomgroup.com; Or Heidi Christensen Brown, (403) 218-2833, hchristensenbrown@equicomgroup.com

Copyright (C) 2010 CNW Group. All rights reserved.

Gruß

Fliege

ich glaube beim ersten mal ist was schief gegangen.

Jetzt noch mal

Universal Power Retains Leading Investor Relations Firm

3/18/2010 9:00 AM - Canada NewsWire

CALGARY, Mar 18, 2010 (Canada NewsWire via COMTEX News Network) --

Universal Power Corp. (TSX-V:UNX), an oil and gas company focused on exploration in Namibia, Africa, today announced that it has retained The Equicom Group Inc. to provide strategic investor relations and financial communications services for the Company.

Under the terms of the agreement, Universal Power will pay Equicom a monthly retainer fee of $6,000 for select strategic communications services. The initial contract term is for 12 months and commences immediately.

Neither Equicom nor any of its principals have an ownership interest, directly or indirectly, in Universal Power or its securities, and Universal Power has not granted Equicom or its principals any right to acquire such an interest.

About Universal Power Corp.

Universal Power Corp. is an oil and gas company focused on building a portfolio of high impact exploration targets in offshore Namibia, Africa. The company has more than 32,000 square kilometres of concessions along the prolific South Atlantic Margin. The management team and the company's directors have established relationships with the Namibian Government, its state-run energy entity, NAMCOR, and the country's Black Economic Empowerment partners.

About Equicom Group

Equicom, a wholly-owned subsidiary of TMX Group Inc., is a leading Canadian provider of investor relations and strategic corporate communications services. With proven expertise in developing and executing highly effective strategic communications programs, and an extensive network of investment community contacts, Equicom specializes in helping clients achieve their capital markets objectives. Equicom offers a comprehensive suite of services including: investor relations, media relations, annual report production, multimedia and web design, web casting, live event management and corporate branding. Equicom is headquartered in Toronto, with offices in Montreal and Calgary. For further information, please visit www.equicomgroup.com or follow Equicom on Twitter at http://twitter.com/Equicom.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

%SEDAR: 00016276E

SOURCE: Universal Power Corp.

Investor Relations: David Feick, (403) 218-2839, dfeick@equicomgroup.com; Or Heidi Christensen Brown, (403) 218-2833, hchristensenbrown@equicomgroup.com

Copyright (C) 2010 CNW Group. All rights reserved.

05.04.2010

Universal Power Confirms Namibian License Renewal

Universal Power reported that the renewal for Petroleum Exploration License Block 1711 was granted by the Ministry of Mines and Energy for the Republic of Namibia, for an additional two-year period. The renewal notice dated April 1, 2010 confirms UNX will maintain a carried interest throughout the next phase of the property's evaluation.

"Preliminary results presented to-date for Kunene No. 1 well located within Block 1711 clearly suggest the regional presence of a large hydrocarbon-charged reservoir. The two year renewal period will provide sufficient time for the block's participation group to perform the planned work program in following up on the very encouraging results achieved to-date on the concession," said Mr. Gabriel Ollivier, CEO of Universal Power.

Ownership in Block 1711 is distributed between Nakor Investments, an affiliate of the Sintez Group (70% working interest), EnerGulf Resources (10% working interest), PetroSA (10% working interest), NAMCOR (7% carried interest) and Kunene Energy (3% carried interest). Universal owns 90% of Kunene Energy.

Quelle: http://www.rigzone.com/news/article.asp?a_id=90511

Universal Power Confirms Namibian License Renewal

Universal Power reported that the renewal for Petroleum Exploration License Block 1711 was granted by the Ministry of Mines and Energy for the Republic of Namibia, for an additional two-year period. The renewal notice dated April 1, 2010 confirms UNX will maintain a carried interest throughout the next phase of the property's evaluation.

"Preliminary results presented to-date for Kunene No. 1 well located within Block 1711 clearly suggest the regional presence of a large hydrocarbon-charged reservoir. The two year renewal period will provide sufficient time for the block's participation group to perform the planned work program in following up on the very encouraging results achieved to-date on the concession," said Mr. Gabriel Ollivier, CEO of Universal Power.

Ownership in Block 1711 is distributed between Nakor Investments, an affiliate of the Sintez Group (70% working interest), EnerGulf Resources (10% working interest), PetroSA (10% working interest), NAMCOR (7% carried interest) and Kunene Energy (3% carried interest). Universal owns 90% of Kunene Energy.

Quelle: http://www.rigzone.com/news/article.asp?a_id=90511

Die Geschichte geht weiter.

Man holt sich noch einen Experten ins Boot!

Universal Power appoints Maria Elliott as Vice President, Finance, and Chief Financial OfficerUniversal Power Corp UNX 4/15/2010 7:00:00 AMCALGARY, Apr 15, 2010 (Canada NewsWire via COMTEX News Network) --

<< "UNX" TSX-V "3U2A" Frankfurt Shares Outstanding: 80,002,871 >>

Universal Power Corp. ("Universal" or the "Company") announced today that Ms. Maria Elliott has been appointed as the Company's Vice-President, Finance and Chief Financial Officer. Mr. Barry Swanson, Universal's current Chief Financial Officer and Director, has resigned in both capacities and will remain with the Company until April 30, 2010, to help ease the transition of responsibilities.

"Universal continues to build its management team with seasoned professionals while in the process of moving its headquarters from Vancouver to Calgary. As Canada's oil and gas hub, Calgary offers world class access to geo-science, engineering, and financial expertise specific to the industry. The hiring of Ms. Elliott is an excellent example of the city's talent pool, as her background and understanding meets every skill set and experience we had hoped for as we sought to replace Mr. Swanson. In particular, her professional experiences at Sherritt International were key attributes to her hiring, as the company evolved from exploration to becoming a major producer in Cuba and early stage producer in other countries," said Mr. Gabriel Ollivier, CEO of Universal.

Universal's Chairman, Mr. Duane Parnham stated, "We want to thank Mr. Swanson for his many contributions over the past three years, in helping to build Universal's dynamic portfolio of growth opportunities. Mr. Swanson has indicated his interest in returning to the fund management industry and we respect his decision to step down from the Board to avoid any potential conflicts of interest. We wish him all the best in his future endeavors."

Ms. Elliott is a Certified General Accountant with over 17 years of oil and gas financial and reporting experience, of which 15 years are specific to international operations. Prior to joining the Company, Ms. Elliott was the CFO and Controller of Action Energy Inc. She also held the respective positions of Chief Internal Auditor and Controller at Sherritt International. Ms. Elliott has set up international offices, negotiated with government officials, implemented and monitored internal controls locally and internationally, including compliance and risk management, and has been a leader in all areas of financial reporting.

Universal also wishes to announce that it has granted incentive stock options to certain consultants and officers for the purchase of a total of 500,000 common shares of the Company at a price of $2.27 each valid until April 14, 2015. The options are being granted pursuant to the terms of the Company's stock option plan.

About Universal Power Corp.

Universal Power Corp. is an oil and gas company focused on building a portfolio of high impact exploration targets in offshore Namibia, Africa. The Company has more than 32,000 square kilometers of concessions along the prolific South Atlantic Margin. The Company has a newly expanded managerial and technical team supported by strong Namibian partnerships, and is thus well positioned to make a significant contribution to the exploration and development of Namibia's offshore oil concessions.

<< On Behalf of the Board of Directors of Universal Power Corp. Duane Parnham Chairman For further information visit our website at www.universalpowercorp.com Sedar Profile No. 00016276 Forward Looking Information --------------------------- >>

This news release contains certain forward-looking statements that reflect the current views and/or expectations of Universal Power Corp. with respect to its performance, business and future events. Investors are cautioned that all forward-looking statements involve risks and uncertainties including, without limitation, those relating to changes in the market, potential downturns in economic conditions, foreign exchange fluctuations, changes in business strategy, regulatory requirements, demand for our resources, competition and dependence on key personnel. These risks, as well as others, could cause actual results and events to vary significantly. Universal Power Corp. does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Universal Power Corp.

David Feick, Investor Relations, Telephone: (403) 218-2839, Email: dfeick@equicomgroup.com; Heidi Christensen Brown, Investor Relations, Telephone: (403) 218-2833, Email: hchristensenbrown@equicomgroup.com

Copyright (C) 2010 CNW Group. All rights reserved.

Man holt sich noch einen Experten ins Boot!

Universal Power appoints Maria Elliott as Vice President, Finance, and Chief Financial OfficerUniversal Power Corp UNX 4/15/2010 7:00:00 AMCALGARY, Apr 15, 2010 (Canada NewsWire via COMTEX News Network) --

<< "UNX" TSX-V "3U2A" Frankfurt Shares Outstanding: 80,002,871 >>

Universal Power Corp. ("Universal" or the "Company") announced today that Ms. Maria Elliott has been appointed as the Company's Vice-President, Finance and Chief Financial Officer. Mr. Barry Swanson, Universal's current Chief Financial Officer and Director, has resigned in both capacities and will remain with the Company until April 30, 2010, to help ease the transition of responsibilities.

"Universal continues to build its management team with seasoned professionals while in the process of moving its headquarters from Vancouver to Calgary. As Canada's oil and gas hub, Calgary offers world class access to geo-science, engineering, and financial expertise specific to the industry. The hiring of Ms. Elliott is an excellent example of the city's talent pool, as her background and understanding meets every skill set and experience we had hoped for as we sought to replace Mr. Swanson. In particular, her professional experiences at Sherritt International were key attributes to her hiring, as the company evolved from exploration to becoming a major producer in Cuba and early stage producer in other countries," said Mr. Gabriel Ollivier, CEO of Universal.

Universal's Chairman, Mr. Duane Parnham stated, "We want to thank Mr. Swanson for his many contributions over the past three years, in helping to build Universal's dynamic portfolio of growth opportunities. Mr. Swanson has indicated his interest in returning to the fund management industry and we respect his decision to step down from the Board to avoid any potential conflicts of interest. We wish him all the best in his future endeavors."

Ms. Elliott is a Certified General Accountant with over 17 years of oil and gas financial and reporting experience, of which 15 years are specific to international operations. Prior to joining the Company, Ms. Elliott was the CFO and Controller of Action Energy Inc. She also held the respective positions of Chief Internal Auditor and Controller at Sherritt International. Ms. Elliott has set up international offices, negotiated with government officials, implemented and monitored internal controls locally and internationally, including compliance and risk management, and has been a leader in all areas of financial reporting.

Universal also wishes to announce that it has granted incentive stock options to certain consultants and officers for the purchase of a total of 500,000 common shares of the Company at a price of $2.27 each valid until April 14, 2015. The options are being granted pursuant to the terms of the Company's stock option plan.

About Universal Power Corp.

Universal Power Corp. is an oil and gas company focused on building a portfolio of high impact exploration targets in offshore Namibia, Africa. The Company has more than 32,000 square kilometers of concessions along the prolific South Atlantic Margin. The Company has a newly expanded managerial and technical team supported by strong Namibian partnerships, and is thus well positioned to make a significant contribution to the exploration and development of Namibia's offshore oil concessions.

<< On Behalf of the Board of Directors of Universal Power Corp. Duane Parnham Chairman For further information visit our website at www.universalpowercorp.com Sedar Profile No. 00016276 Forward Looking Information --------------------------- >>

This news release contains certain forward-looking statements that reflect the current views and/or expectations of Universal Power Corp. with respect to its performance, business and future events. Investors are cautioned that all forward-looking statements involve risks and uncertainties including, without limitation, those relating to changes in the market, potential downturns in economic conditions, foreign exchange fluctuations, changes in business strategy, regulatory requirements, demand for our resources, competition and dependence on key personnel. These risks, as well as others, could cause actual results and events to vary significantly. Universal Power Corp. does not undertake any obligations to release publicly any revisions for updating any voluntary forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Universal Power Corp.

David Feick, Investor Relations, Telephone: (403) 218-2839, Email: dfeick@equicomgroup.com; Heidi Christensen Brown, Investor Relations, Telephone: (403) 218-2833, Email: hchristensenbrown@equicomgroup.com

Copyright (C) 2010 CNW Group. All rights reserved.

Aktualisiertes Fact-Sheet (Stand April 2010):

Quelle: http://www.universalpowercorp.com/PDF/UNX_factsheet.pdf

Quelle: http://www.universalpowercorp.com/PDF/UNX_factsheet.pdf

17.05.2010

Universal Awarded Additional Blocks in Offshore Namibia

CALGARY, May 17 /CNW/ - Universal Power Corp. ("Universal" or the "Company") announced today that it has been awarded a Petroleum Exploration Licence ("PEL") for the offshore Namibian blocks 2813A, 2814B, and 2914A by the Ministry of Mines and Energy ("MME") of the Republic of Namibia. Universal will have a 40% working interest in the blocks; HRT O&G Exploração e Produção de Petróleo Ltd. ("HRT O&G") will have a 40% working interest, and Acarus Investments (Proprietary) Ltd., will have a 20% participating interest. The designated operator of the blocks is HRT O&G.

"This award adds three strategically important blocks to our portfolio and is being done in partnership with HRT O&G, the world's premier experts along the offshore South Atlantic margins," said Mr. Gabriel Ollivier, President and CEO of Universal. "Given the extensive field work we have conducted in assessing the regional and lease-specific prospectivity of the Orange basin, securing blocks 2813A, 2814B, and 2914A is key to our regional land position, which now stands at over 42,000 square kilometers of contiguous acreage."

Mr. Duane Parnham, Universal's Chairman said, "These blocks add to our growing asset base with an agreement that enables us to partner with the company that predicted some of the world's largest pre-salt oil discoveries. HRT O&G's experience and expertise in techniques that maximize the probabilities of success materially adds to the likelihood that we will succeed in finding Namibia's large offshore oil pools. In addition to mitigating exploration risk, Universal's partnership with HRT O&G will significantly reduce our net risked capital exposure by sharing costs associated with the data acquisition and scientific work that will precede the drilling of any wells. HRT O&G also brings strategic relationships with many of the world's major oil and gas companies that could lead to further partnering opportunities."

About Blocks 2813A, 2814B, and 2914A

The blocks collectively span an area of 15,382 square kilometers (1,538,200 hectares, or 3,789,094 acres). The three blocks are contiguous, and are positioned immediately west and diagonally southwest of the large Kudu gas discovery, located in the southern portion of the Namibian offshore leases in what is geologically known as the Orange basin. In addition, the three blocks link to Universal's 90%-owned 2713A and 2713B blocks to the north, and 90%-owned 2815 to the east.

The PEL for blocks 2813A, 2814B, and 2914A has three phases, with the agreement effective May 14, 2010. Phase 1 spans four years, with work program commitments focused on assembly, interpretation, and mapping of existing 2D and 3D seismic data followed by new acquisition of seismic data. Additional techniques may also be employed that will add to detailed satellite oil slick detection, geotechnical, and geochemical field work that has already been done by or on behalf of Universal in the Orange basin. The estimated gross cost of the first four-year phase is US$8,500,000. Phases 2 and 3 are each renewable for a two year period, and carry a commitment to drill one well during each phase.

About HRT O&G

HRT O&G is an oil and gas company based in Rio de Janeiro, Brazil, and is a wholly-owned subsidiary of HRT Participações em Petróleo S.A. ("HRTP"). The HRT O&G team is led by Dr. Marcio Mello, who founded HRT Petroleum in 2004 after a very successful 24-year career at Petrobras, which included a 17-year span running the technical centre of excellence of Petrobras-CEGEQ. From 2004 until mid-2009, Dr. Marcio Mello was the CEO of HRT Petroleum, which was strictly a geologic consultancy company with the biggest geoscientific lab in the southern hemisphere. Over the years, the HRT team has gained global recognition for their expertise in building fully-integrated 3-D compositional petroleum system basin models, putting full use of investigative techniques based on geochemistry, biostratigraphy, seismic interpretation, structural geology, oceanography, and biology, in their efforts to reduce exploration risk. The HRT team is credited, among their many accomplishments, with predicting hydrocarbon presence in the pre-salt of Brazil's Santos basin, which led to the giant Carioca and Tupi oil discoveries. The services offered by HRT Petroleum continue to exist through Integrated Petroleum Expertise Co. ("IPEX"), which is now another wholly-owned subsidiary of HRTP. Universal has a Services Agreement with IPEX on blocks 2713A and 2815 and expects the work contained in the agreement to be completed in June, 2010.

About Universal Power Corp.

Universal Power Corp. is an oil and gas company focused on building a portfolio of high impact exploration targets in offshore Namibia, Africa. The Company has more than 51,000 gross square kilometers of Namibian offshore concessions along the prolific South Atlantic Margin. The Company has a newly expanded managerial and technical team supported by strong Namibian partnerships, and is thus well positioned to make a significant contribution to the exploration and development of Namibia's offshore oil and gas concessions.

Quelle: http://www.stockhouse.com/bullboards/MessageDetail.aspx?p=0&…

Universal Awarded Additional Blocks in Offshore Namibia

CALGARY, May 17 /CNW/ - Universal Power Corp. ("Universal" or the "Company") announced today that it has been awarded a Petroleum Exploration Licence ("PEL") for the offshore Namibian blocks 2813A, 2814B, and 2914A by the Ministry of Mines and Energy ("MME") of the Republic of Namibia. Universal will have a 40% working interest in the blocks; HRT O&G Exploração e Produção de Petróleo Ltd. ("HRT O&G") will have a 40% working interest, and Acarus Investments (Proprietary) Ltd., will have a 20% participating interest. The designated operator of the blocks is HRT O&G.

"This award adds three strategically important blocks to our portfolio and is being done in partnership with HRT O&G, the world's premier experts along the offshore South Atlantic margins," said Mr. Gabriel Ollivier, President and CEO of Universal. "Given the extensive field work we have conducted in assessing the regional and lease-specific prospectivity of the Orange basin, securing blocks 2813A, 2814B, and 2914A is key to our regional land position, which now stands at over 42,000 square kilometers of contiguous acreage."

Mr. Duane Parnham, Universal's Chairman said, "These blocks add to our growing asset base with an agreement that enables us to partner with the company that predicted some of the world's largest pre-salt oil discoveries. HRT O&G's experience and expertise in techniques that maximize the probabilities of success materially adds to the likelihood that we will succeed in finding Namibia's large offshore oil pools. In addition to mitigating exploration risk, Universal's partnership with HRT O&G will significantly reduce our net risked capital exposure by sharing costs associated with the data acquisition and scientific work that will precede the drilling of any wells. HRT O&G also brings strategic relationships with many of the world's major oil and gas companies that could lead to further partnering opportunities."

About Blocks 2813A, 2814B, and 2914A

The blocks collectively span an area of 15,382 square kilometers (1,538,200 hectares, or 3,789,094 acres). The three blocks are contiguous, and are positioned immediately west and diagonally southwest of the large Kudu gas discovery, located in the southern portion of the Namibian offshore leases in what is geologically known as the Orange basin. In addition, the three blocks link to Universal's 90%-owned 2713A and 2713B blocks to the north, and 90%-owned 2815 to the east.

The PEL for blocks 2813A, 2814B, and 2914A has three phases, with the agreement effective May 14, 2010. Phase 1 spans four years, with work program commitments focused on assembly, interpretation, and mapping of existing 2D and 3D seismic data followed by new acquisition of seismic data. Additional techniques may also be employed that will add to detailed satellite oil slick detection, geotechnical, and geochemical field work that has already been done by or on behalf of Universal in the Orange basin. The estimated gross cost of the first four-year phase is US$8,500,000. Phases 2 and 3 are each renewable for a two year period, and carry a commitment to drill one well during each phase.

About HRT O&G

HRT O&G is an oil and gas company based in Rio de Janeiro, Brazil, and is a wholly-owned subsidiary of HRT Participações em Petróleo S.A. ("HRTP"). The HRT O&G team is led by Dr. Marcio Mello, who founded HRT Petroleum in 2004 after a very successful 24-year career at Petrobras, which included a 17-year span running the technical centre of excellence of Petrobras-CEGEQ. From 2004 until mid-2009, Dr. Marcio Mello was the CEO of HRT Petroleum, which was strictly a geologic consultancy company with the biggest geoscientific lab in the southern hemisphere. Over the years, the HRT team has gained global recognition for their expertise in building fully-integrated 3-D compositional petroleum system basin models, putting full use of investigative techniques based on geochemistry, biostratigraphy, seismic interpretation, structural geology, oceanography, and biology, in their efforts to reduce exploration risk. The HRT team is credited, among their many accomplishments, with predicting hydrocarbon presence in the pre-salt of Brazil's Santos basin, which led to the giant Carioca and Tupi oil discoveries. The services offered by HRT Petroleum continue to exist through Integrated Petroleum Expertise Co. ("IPEX"), which is now another wholly-owned subsidiary of HRTP. Universal has a Services Agreement with IPEX on blocks 2713A and 2815 and expects the work contained in the agreement to be completed in June, 2010.

About Universal Power Corp.

Universal Power Corp. is an oil and gas company focused on building a portfolio of high impact exploration targets in offshore Namibia, Africa. The Company has more than 51,000 gross square kilometers of Namibian offshore concessions along the prolific South Atlantic Margin. The Company has a newly expanded managerial and technical team supported by strong Namibian partnerships, and is thus well positioned to make a significant contribution to the exploration and development of Namibia's offshore oil and gas concessions.

Quelle: http://www.stockhouse.com/bullboards/MessageDetail.aspx?p=0&…

25.05.2010

Universal strengthens its board through appointment of independent directors

TORONTO, May 25 /CNW/ - Universal Power Corp. ("Universal" or the "Company") today announced the appointment of Mr. Michael Black and Mr. Keith Turnbull to the Company's Board of Directors (the "Board"). Both Mr. Black and Mr.Turnbull will be acting as independent directors.

Mr. Michael Black is the Managing Partner of Heenan Blaikie LLP's Calgary energy-focused office, and is also a member of the firm's seven-member national Executive Committee. Mr. Black has extensive legal experience in the energy sector, ranging from the negotiation and drafting of both domestic and international joint operating and joint venture agreements, the negotiation and execution of resource-based transactions, and other legal and commercial matters specific to the conduct of business in international jurisdictions. Mr. Black has recently acted as the lead counsel on several multi-billon dollar international energy merger and acquisition (M&A) transactions. In the past five years, he has led over 50 M&A deals. Mr. Black received his law degree (LLB) from the University of British Columbia in 1984.

Mr. Keith Turnbull recently retired from KPMG where he was a member of the accounting firm's 12-member national executive management team, and most recently the Office Managing Partner of the practice's Calgary office. Mr. Turnbull's distinguished 38-year career in public practice included significant involvement with emerging international energy companies, and covered a broad spectrum of activities, including financial reporting, taxation planning, corporate governance, internal controls, auditing, public disclosure, and other assignments specific to oil and gas companies. Mr. Turnbull received his Chartered Accountancy (CA) designation in 1974.

"Mr. Black and Mr. Turnbull are both strategic thinkers. They bring a wealth of experience that will ensure expert planning and execution of our growth initiatives" said Mr. Gabriel Ollivier, President and CEO of Universal. "Their appointments have strengthened Universal's ability to manage both challenges and opportunities, and their independence further supports our commitment to best practices in corporate governance."

Consequential to the above-mentioned appointments, the Company also wishes to announce that it has granted incentive stock options to certain directors for the purchase of a total of 600,000 common shares of the Company at a price of $2.00 each valid until May 25, 2015. The options are being granted pursuant to the terms of the Company's stock option plan.

In accordance with the Company's articles of incorporation, the Company has increased the required membership of its Board from six to eight members. The directors of the Company will hold office until the next annual general meeting of the Company where they may stand for re-election by the shareholders.

About Universal Power Corp.

Universal Power Corp. is an oil and gas company focused on building a portfolio of high impact exploration targets in offshore Namibia, Africa. The Company has more than 51,000 gross square kilometers of Namibian offshore concessions along the prolific South Atlantic Margin. The Company has a newly expanded managerial and technical team supported by strong Namibian partnerships, and is thus well positioned to make a significant contribution to the exploration and development of Namibia's offshore oil and gas concessions.

http://ca.news.finance.yahoo.com/s/25052010/30/link-f-cnw-un…

Universal strengthens its board through appointment of independent directors

TORONTO, May 25 /CNW/ - Universal Power Corp. ("Universal" or the "Company") today announced the appointment of Mr. Michael Black and Mr. Keith Turnbull to the Company's Board of Directors (the "Board"). Both Mr. Black and Mr.Turnbull will be acting as independent directors.

Mr. Michael Black is the Managing Partner of Heenan Blaikie LLP's Calgary energy-focused office, and is also a member of the firm's seven-member national Executive Committee. Mr. Black has extensive legal experience in the energy sector, ranging from the negotiation and drafting of both domestic and international joint operating and joint venture agreements, the negotiation and execution of resource-based transactions, and other legal and commercial matters specific to the conduct of business in international jurisdictions. Mr. Black has recently acted as the lead counsel on several multi-billon dollar international energy merger and acquisition (M&A) transactions. In the past five years, he has led over 50 M&A deals. Mr. Black received his law degree (LLB) from the University of British Columbia in 1984.

Mr. Keith Turnbull recently retired from KPMG where he was a member of the accounting firm's 12-member national executive management team, and most recently the Office Managing Partner of the practice's Calgary office. Mr. Turnbull's distinguished 38-year career in public practice included significant involvement with emerging international energy companies, and covered a broad spectrum of activities, including financial reporting, taxation planning, corporate governance, internal controls, auditing, public disclosure, and other assignments specific to oil and gas companies. Mr. Turnbull received his Chartered Accountancy (CA) designation in 1974.

"Mr. Black and Mr. Turnbull are both strategic thinkers. They bring a wealth of experience that will ensure expert planning and execution of our growth initiatives" said Mr. Gabriel Ollivier, President and CEO of Universal. "Their appointments have strengthened Universal's ability to manage both challenges and opportunities, and their independence further supports our commitment to best practices in corporate governance."

Consequential to the above-mentioned appointments, the Company also wishes to announce that it has granted incentive stock options to certain directors for the purchase of a total of 600,000 common shares of the Company at a price of $2.00 each valid until May 25, 2015. The options are being granted pursuant to the terms of the Company's stock option plan.

In accordance with the Company's articles of incorporation, the Company has increased the required membership of its Board from six to eight members. The directors of the Company will hold office until the next annual general meeting of the Company where they may stand for re-election by the shareholders.

About Universal Power Corp.

Universal Power Corp. is an oil and gas company focused on building a portfolio of high impact exploration targets in offshore Namibia, Africa. The Company has more than 51,000 gross square kilometers of Namibian offshore concessions along the prolific South Atlantic Margin. The Company has a newly expanded managerial and technical team supported by strong Namibian partnerships, and is thus well positioned to make a significant contribution to the exploration and development of Namibia's offshore oil and gas concessions.

http://ca.news.finance.yahoo.com/s/25052010/30/link-f-cnw-un…

Universal announces prospective crude oil resources in offshore Namibia's Block 2713A

1:45 PM ET, June 9, 2010

CALGARY, Jun 9, 2010 (Canada NewsWire via COMTEX) --

"UNX" TSX-V "3U2A" Frankfurt Shares Outstanding: 85,667,157

Universal Power Corp. ("Universal" or the "Company") today announced prospective resource estimates for the Company's 90% owned 2713A Exploration Licence, representing approximately 16% of Universal's net land position in offshore Namibia. The property is located on the boundary between the Luderitz and the Orange Basin in the southern portion of Namibia. The prospective resource estimates were provided by a third party independent report (the "2713A Evaluation") supplied by DeGolyer and MacNaughton ("D&M") of Dallas, Texas. The D&M Prospective Resource Evaluation Report for Block 2713A, effective April 1, 2010, was prepared in accordance with National Instrument 51-101 ("NI 51-101"), Sections 5.9 and 5.10 standards for review and assessment of prospective resources. Overall, D&M has reported an unrisked mean oil-equivalent prospective resource at Block 2713A of 2.39 billion BOE (converting gas to oil at 6:1), and a risked mean prospective resource of 567 million BOE.

"The 2713A Evaluation provides an independent resource evaluation and is an important step forward in Universal's exploration program," said Mr. Gabriel Ollivier, CEO of Universal Power. "The calculated probability of success of 23% for the Block makes for robust risked economics and supports our belief that there is significant crude oil to be found in offshore Namibia. We feel that collectively the defined prospective resource of Block 2713A, related scientific findings and the large structural features already mapped will be of significant interest to the world's major oil and gas companies."

Summary of Block 2713A Evaluation

Gross Unrisked and Risked Recoverable Resource Estimates for Namibian Block 2713A, as of April 1, 2010, Citing the Statistical Aggregate Outcome:

-------------------------------------------------------------------------

P90 P50 P10

Description (Low Est.) (Best Est.) (High Est.) Mean Est.

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Unrisked Recov. Oil

(10(3) bbl) 1,444,765 2,104,579 3,065,903 2,197,245

-------------------------------------------------------------------------

Unrisked Recov.

Solution Gas (BCF) 370.0 911.3 2,244.5 1,167.0

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Risked Recov. Oil

(10(3) bbl) 342,577 499,029 726,974 521,002

-------------------------------------------------------------------------

Risked Recov. Solution

Gas (BCF) 88.4 217.6 536.0 278.7

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Gross Unrisked BOE

(10(3) Gas at 6:1) 1,506,435 2,256,456 3,439,986 2,391,742

-------------------------------------------------------------------------

Gross Risked BOE

(10(3) Gas at 6:1) 357,305 535,301 816,314 567,452

-------------------------------------------------------------------------

Of note, only a portion of Block 2713A has been mapped, leading to the identification of two oil prospects and two leads, all of which were reviewed by D&M for purposes of the resource report. The most significant prospect, Chimay, is a sub-salt equivalent play similar in age and geologic setting to the large Tupi and Jupiter discoveries made in the Santos Basin in offshore Brazil.

The 2713A Evaluation is authored by D&M independent consultant, Thomas C. Pence, P.E., registered in the State of Texas. The report has been prepared in accordance with Sections 5.9 and 5.10 of NI 51-101, and is based upon the authors' review of technical data including geology, geophysics and reservoir parameters.

The full 2713A Evaluation Report is available on the Company's website at www.universalpowercorp.com and is filed on SEDAR at www.sedar.com. Universal recommends that readers refer to the 2713A Evaluation in its entirety as it details the process for determining the resource estimate, the assumptions underpinning the modeling, and defines all of the technical terms used.

The resources described in the 2713A Evaluation and in this release are "undiscovered resources" as defined in the Canadian Oil and Gas Evaluation ("COGE") Handbook. Undiscovered resources are defined as those quantities of oil and gas estimates on a given date to be contained in accumulations yet to be discovered. The estimate of the potentially recoverable portions of undiscovered resources are classified as prospective resources. Prospective resources are defined as those quantities of oil and gas estimated on a given date to be potentially recoverable from undiscovered accumulations technically viable and economic to recover.

In accordance with Section 5.9 of NI 51-101, the Company declares that there is no certainty that any portion of these resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources.

Summary of the Block 2713A

The Company's 90% owned subsidiary Kunene Energy (Proprietary) Limited holds the interest in the permit and the exploration concession, issued on August 30, 2007, by the Republic of Namibia, Ministry of Mines and Energy. The 2713A Block totals 5,481 square kilometers.

Exploration Risk

The 2713A Evaluation provides a discussion assessing the probability of geological success in undertaking a test well program on the 2713A prospect. The risk factors in assessing the probability are associated with source rock risk, migration risk, reservoir risk, closure risk, and containment risk, each of which are discussed in the 2713A Evaluation. A negative outcome from any one of, or a combination of, these risk factors has the potential for failure to discover economic concentrations of hydrocarbons.

3D Seismic Plan at Block 2713A

Universal is currently in the first exploration period which consists of four years of technical work. The Company plans on completing a 3D seismic program over the prospective areas that Universal currently has access to. The acquisition of seismic should be complete by March 31, 2011.

Other Information

About BOE

BOEs may be misleading, particularly if used in isolation. A BOE conversion ratio of 6 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

About the Authors of the Evaluation

DeGolyer and MacNaughton is an international petroleum consulting firm with offices in the United States of America, Canada and Russia, who specialize in evaluation of reserves and resources for major oil and gas companies, governments, financial institutions and the investment industry. DeGolyer and MacNaughton have conducted assessments of and for the largest petroleum and financial companies in the world. During seven decades, the firm has successfully performed studies on hundreds of thousands of petroleum properties in more than 100 countries.

About Universal Power Corp.

Universal Power Corp. is an oil and gas company focused on building a portfolio of high impact exploration targets in offshore Namibia, Africa. The Company has more than 51,000 gross square kilometers of Namibian offshore concessions along the prolific South Atlantic Margin. The Company has a newly expanded managerial and technical team supported by strong Namibian partnerships, and is thus well positioned to make a significant contribution to the exploration and development of Namibia's offshore oil and gas concessions.

On Behalf of the Board of Directors

of Universal Power Corp.

Duane Parnham

Chairman

1:45 PM ET, June 9, 2010

CALGARY, Jun 9, 2010 (Canada NewsWire via COMTEX) --

"UNX" TSX-V "3U2A" Frankfurt Shares Outstanding: 85,667,157

Universal Power Corp. ("Universal" or the "Company") today announced prospective resource estimates for the Company's 90% owned 2713A Exploration Licence, representing approximately 16% of Universal's net land position in offshore Namibia. The property is located on the boundary between the Luderitz and the Orange Basin in the southern portion of Namibia. The prospective resource estimates were provided by a third party independent report (the "2713A Evaluation") supplied by DeGolyer and MacNaughton ("D&M") of Dallas, Texas. The D&M Prospective Resource Evaluation Report for Block 2713A, effective April 1, 2010, was prepared in accordance with National Instrument 51-101 ("NI 51-101"), Sections 5.9 and 5.10 standards for review and assessment of prospective resources. Overall, D&M has reported an unrisked mean oil-equivalent prospective resource at Block 2713A of 2.39 billion BOE (converting gas to oil at 6:1), and a risked mean prospective resource of 567 million BOE.

"The 2713A Evaluation provides an independent resource evaluation and is an important step forward in Universal's exploration program," said Mr. Gabriel Ollivier, CEO of Universal Power. "The calculated probability of success of 23% for the Block makes for robust risked economics and supports our belief that there is significant crude oil to be found in offshore Namibia. We feel that collectively the defined prospective resource of Block 2713A, related scientific findings and the large structural features already mapped will be of significant interest to the world's major oil and gas companies."

Summary of Block 2713A Evaluation

Gross Unrisked and Risked Recoverable Resource Estimates for Namibian Block 2713A, as of April 1, 2010, Citing the Statistical Aggregate Outcome:

-------------------------------------------------------------------------

P90 P50 P10

Description (Low Est.) (Best Est.) (High Est.) Mean Est.

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Unrisked Recov. Oil

(10(3) bbl) 1,444,765 2,104,579 3,065,903 2,197,245

-------------------------------------------------------------------------

Unrisked Recov.

Solution Gas (BCF) 370.0 911.3 2,244.5 1,167.0

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Risked Recov. Oil

(10(3) bbl) 342,577 499,029 726,974 521,002

-------------------------------------------------------------------------

Risked Recov. Solution

Gas (BCF) 88.4 217.6 536.0 278.7

-------------------------------------------------------------------------

-------------------------------------------------------------------------

Gross Unrisked BOE

(10(3) Gas at 6:1) 1,506,435 2,256,456 3,439,986 2,391,742

-------------------------------------------------------------------------

Gross Risked BOE

(10(3) Gas at 6:1) 357,305 535,301 816,314 567,452

-------------------------------------------------------------------------

Of note, only a portion of Block 2713A has been mapped, leading to the identification of two oil prospects and two leads, all of which were reviewed by D&M for purposes of the resource report. The most significant prospect, Chimay, is a sub-salt equivalent play similar in age and geologic setting to the large Tupi and Jupiter discoveries made in the Santos Basin in offshore Brazil.

The 2713A Evaluation is authored by D&M independent consultant, Thomas C. Pence, P.E., registered in the State of Texas. The report has been prepared in accordance with Sections 5.9 and 5.10 of NI 51-101, and is based upon the authors' review of technical data including geology, geophysics and reservoir parameters.

The full 2713A Evaluation Report is available on the Company's website at www.universalpowercorp.com and is filed on SEDAR at www.sedar.com. Universal recommends that readers refer to the 2713A Evaluation in its entirety as it details the process for determining the resource estimate, the assumptions underpinning the modeling, and defines all of the technical terms used.