Enphase Energy - erster Microinverter IPO (Seite 58)

eröffnet am 18.04.12 23:27:10 von

neuester Beitrag 10.05.24 18:31:58 von

neuester Beitrag 10.05.24 18:31:58 von

Beiträge: 696

ID: 1.173.770

ID: 1.173.770

Aufrufe heute: 2

Gesamt: 104.365

Gesamt: 104.365

Aktive User: 0

ISIN: US29355A1079 · WKN: A1JC82 · Symbol: ENPH

121,23

USD

+8,73 %

+9,73 USD

Letzter Kurs 02:00:00 Nasdaq

Neuigkeiten

| TitelBeiträge |

|---|

22.05.24 · wO Newsflash |

21.05.24 · globenewswire |

15.05.24 · globenewswire |

14.05.24 · wO Newsflash |

Werte aus der Branche Erneuerbare Energien

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,7200 | +33,33 | |

| 251,75 | +18,69 | |

| 22,830 | +17,50 | |

| 22,370 | +17,06 | |

| 28,55 | +17,01 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 11,590 | -11,32 | |

| 1,7500 | -11,62 | |

| 0,9600 | -12,73 | |

| 76,00 | -13,64 | |

| 1,4600 | -21,93 |

Beitrag zu dieser Diskussion schreiben

Hallo Hauswand,ich werde Enphase Energy wenigstens 1-2 Jahre Zeit geben!.Also uns weiter viel Geduld und Erfolg mit Enphase Energy!.Werde bei Aktienkurse um die 5,-Euro versuchen meinen Bestand weiter ausbauen.Ich hoffe, du bleibst mir hier noch eine ganze Weile im Forum erhalten!.Ansonsten würde es hier recht ruhig werden.Ich kaufe mir auch jede Woche den Aktionär. Gruß Lars

N'abend Ihr Tapferen,

hier noch etwas neues über Enphase Energy:

http://investor.enphase.com/releasedetail.cfm?ReleaseID=8073…

Enphase Energie Verliehen Fastest Growing Clean Technology Unternehmen in Nordamerika auf Deloitte 2013 Technology Fast 500 ™

Im Link könnt Ihr den ganzen Bericht lesen, aber ich glaube dem Kurs können nur so Großaufträge wie diese Gärtnerei helfen!

Gute Nacht

hauswand

hier noch etwas neues über Enphase Energy:

http://investor.enphase.com/releasedetail.cfm?ReleaseID=8073…

Enphase Energie Verliehen Fastest Growing Clean Technology Unternehmen in Nordamerika auf Deloitte 2013 Technology Fast 500 ™

Im Link könnt Ihr den ganzen Bericht lesen, aber ich glaube dem Kurs können nur so Großaufträge wie diese Gärtnerei helfen!

Gute Nacht

hauswand

Antwort auf Beitrag Nr.: 45.820.418 von larsuwe am 13.11.13 06:44:59N'abend larsuwe,

erstmal "danke" für die Mühe die Du dir gemacht hast.

Hier ist ein neuer Bericht aus dem letzten Aktionär:

In der vergangenen Woche hat der US Wechselrichter-Hersteller Enphase Energy seine Zahlen für das dritte Quartal 2013 vorgelegt, der Umsatz übertraf mit 62,0 Mio.Dollar leicht die Erwartungen von 60,5 Mio.Dollar, der Verlust fiel mit 0,09 Dollar pro Aktie exakt so hoch aus wie prognostiziert. Die Umsatzprognose für das laufende vierte quartal liegt zwar mit 62-65 Mio. Dollar unter den Erwartungen der Experten von 68 Mio. Dollar, allerdingst wurde vom management eine weitere Erhöhung der Bruttomarge angekündigt.

Die Aktie von Enphase Energy kam nach der Vorlage der Zahlen leicht unter Druck,

bleibt aber weiterhin eine der interessantesten Solar-Investments.

Korrekturen sollten zum Einstieg genutzt werden.

Obwohl diese große Volantilität vom Kurs Nerven kostet,

werde ich noch dabei bleiben!

Gruß

hauswand

erstmal "danke" für die Mühe die Du dir gemacht hast.

Hier ist ein neuer Bericht aus dem letzten Aktionär:

In der vergangenen Woche hat der US Wechselrichter-Hersteller Enphase Energy seine Zahlen für das dritte Quartal 2013 vorgelegt, der Umsatz übertraf mit 62,0 Mio.Dollar leicht die Erwartungen von 60,5 Mio.Dollar, der Verlust fiel mit 0,09 Dollar pro Aktie exakt so hoch aus wie prognostiziert. Die Umsatzprognose für das laufende vierte quartal liegt zwar mit 62-65 Mio. Dollar unter den Erwartungen der Experten von 68 Mio. Dollar, allerdingst wurde vom management eine weitere Erhöhung der Bruttomarge angekündigt.

Die Aktie von Enphase Energy kam nach der Vorlage der Zahlen leicht unter Druck,

bleibt aber weiterhin eine der interessantesten Solar-Investments.

Korrekturen sollten zum Einstieg genutzt werden.

Obwohl diese große Volantilität vom Kurs Nerven kostet,

werde ich noch dabei bleiben!

Gruß

hauswand

We deliver microinverter technology for the solar industry that increases energy production, simplifies design and installation, improves system uptime and reliability, reduces fire safety risk and provides a platform for intelligent energy management. We were founded in March 2006 and have grown rapidly to become the market leader in the microinverter category. Since our first commercial shipment in mid-2008, we have sold over 4,200,000 microinverters as of September 30, 2013. Our sales efforts are focused in the United States, Canada, France, the United Kingdom, Italy, Belgium, Luxembourg, the Netherlands, Switzerland, Greece and Australia.

We sell our microinverter systems primarily to distributors who resell them to solar installers. We also sell directly to large installers and through original equipment manufacturers ("OEMs") and strategic partners. Components of Condensed Consolidated Statements of Operations Net Revenues

We generate revenues from sales of our microinverter systems, which include microinverter units and related accessories, an Envoy communications gateway device, and our Enlighten web-based monitoring service.

Our revenue is affected by changes in the volume and average selling prices of our microinverter systems, driven by supply and demand, sales incentives, and competitive product offerings. Our revenue growth is dependent on our ability to market our products in a manner that increases awareness for microinverter technology, the continual development and introduction of new products to meet the changing technology and performance requirements of our customers, and the expansion of our customer base.

Cost of Revenues and Gross Profit

Cost of revenues is comprised primarily of product costs, warranty, purchasing and production planning personnel and related expenses, logistics costs, depreciation on manufacturing test equipment and hosting services costs. Our product costs are impacted by technological innovations, such as advances in semiconductor integration and new product introductions, economies of scale resulting in lower component costs, and improvements in production processes and automation. Certain costs, primarily personnel and depreciation on manufacturing test equipment, are not directly affected by sales volume.

We outsource our manufacturing to third-party contract manufacturers and generally negotiate product pricing with them on a quarterly basis. In addition, a contract manufacturer also serves as our logistics provider by warehousing and delivering our products. We believe our contract manufacturing partners have sufficient production capacity to meet the growing demand for our products for the foreseeable future. However, shortages in the supply of certain key raw materials could adversely affect our ability to meet customer demand for our products.

Gross profit may vary from quarter to quarter and is primarily affected by our average selling prices, product cost, product mix, warranty costs, changes in estimates to pre-existing warranties and sales volume fluctuations resulting from seasonality.

--------------------------------------------------------------------------------" target="_blank" rel="nofollow ugc noopener">Form 10-Q for ENPHASE ENERGY, INC.

--------------------------------------------------------------------------------

12-Nov-2013

Quarterly Report

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

The following discussion and analysis of our financial condition and results of operations should be read together with our condensed consolidated financial statements and the other financial information appearing elsewhere in this Quarterly Report on Form 10-Q. This discussion contains forward-looking statements reflecting our current expectations and involves risks and uncertainties. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "intend," "potential" or "continue" or the negative of these terms or other comparable terminology. For example, statements regarding our expectations as to future financial performance, expense levels and liquidity sources are forward-looking statements. Our actual results and the timing of events may differ materially from those discussed in our forward-looking statements as a result of various factors, including those discussed below and those discussed in the section entitled "Risk Factors" included in this Quarterly Report on Form 10-Q and our Annual Report on Form 10-K for the year ended December 31, 2012. Overview

We deliver microinverter technology for the solar industry that increases energy production, simplifies design and installation, improves system uptime and reliability, reduces fire safety risk and provides a platform for intelligent energy management. We were founded in March 2006 and have grown rapidly to become the market leader in the microinverter category. Since our first commercial shipment in mid-2008, we have sold over 4,200,000 microinverters as of September 30, 2013. Our sales efforts are focused in the United States, Canada, France, the United Kingdom, Italy, Belgium, Luxembourg, the Netherlands, Switzerland, Greece and Australia.

We sell our microinverter systems primarily to distributors who resell them to solar installers. We also sell directly to large installers and through original equipment manufacturers ("OEMs") and strategic partners. Components of Condensed Consolidated Statements of Operations Net Revenues

We generate revenues from sales of our microinverter systems, which include microinverter units and related accessories, an Envoy communications gateway device, and our Enlighten web-based monitoring service.

Our revenue is affected by changes in the volume and average selling prices of our microinverter systems, driven by supply and demand, sales incentives, and competitive product offerings. Our revenue growth is dependent on our ability to market our products in a manner that increases awareness for microinverter technology, the continual development and introduction of new products to meet the changing technology and performance requirements of our customers, and the expansion of our customer base.

Cost of Revenues and Gross Profit

Cost of revenues is comprised primarily of product costs, warranty, purchasing and production planning personnel and related expenses, logistics costs, depreciation on manufacturing test equipment and hosting services costs. Our product costs are impacted by technological innovations, such as advances in semiconductor integration and new product introductions, economies of scale resulting in lower component costs, and improvements in production processes and automation. Certain costs, primarily personnel and depreciation on manufacturing test equipment, are not directly affected by sales volume.

We outsource our manufacturing to third-party contract manufacturers and generally negotiate product pricing with them on a quarterly basis. In addition, a contract manufacturer also serves as our logistics provider by warehousing and delivering our products. We believe our contract manufacturing partners have sufficient production capacity to meet the growing demand for our products for the foreseeable future. However, shortages in the supply of certain key raw materials could adversely affect our ability to meet customer demand for our products.

Gross profit may vary from quarter to quarter and is primarily affected by our average selling prices, product cost, product mix, warranty costs, changes in estimates to pre-existing warranties and sales volume fluctuations resulting from seasonality.

--------------------------------------------------------------------------------

We sell our microinverter systems primarily to distributors who resell them to solar installers. We also sell directly to large installers and through original equipment manufacturers ("OEMs") and strategic partners. Components of Condensed Consolidated Statements of Operations Net Revenues

We generate revenues from sales of our microinverter systems, which include microinverter units and related accessories, an Envoy communications gateway device, and our Enlighten web-based monitoring service.

Our revenue is affected by changes in the volume and average selling prices of our microinverter systems, driven by supply and demand, sales incentives, and competitive product offerings. Our revenue growth is dependent on our ability to market our products in a manner that increases awareness for microinverter technology, the continual development and introduction of new products to meet the changing technology and performance requirements of our customers, and the expansion of our customer base.

Cost of Revenues and Gross Profit

Cost of revenues is comprised primarily of product costs, warranty, purchasing and production planning personnel and related expenses, logistics costs, depreciation on manufacturing test equipment and hosting services costs. Our product costs are impacted by technological innovations, such as advances in semiconductor integration and new product introductions, economies of scale resulting in lower component costs, and improvements in production processes and automation. Certain costs, primarily personnel and depreciation on manufacturing test equipment, are not directly affected by sales volume.

We outsource our manufacturing to third-party contract manufacturers and generally negotiate product pricing with them on a quarterly basis. In addition, a contract manufacturer also serves as our logistics provider by warehousing and delivering our products. We believe our contract manufacturing partners have sufficient production capacity to meet the growing demand for our products for the foreseeable future. However, shortages in the supply of certain key raw materials could adversely affect our ability to meet customer demand for our products.

Gross profit may vary from quarter to quarter and is primarily affected by our average selling prices, product cost, product mix, warranty costs, changes in estimates to pre-existing warranties and sales volume fluctuations resulting from seasonality.

--------------------------------------------------------------------------------" target="_blank" rel="nofollow ugc noopener">Form 10-Q for ENPHASE ENERGY, INC.

--------------------------------------------------------------------------------

12-Nov-2013

Quarterly Report

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements

The following discussion and analysis of our financial condition and results of operations should be read together with our condensed consolidated financial statements and the other financial information appearing elsewhere in this Quarterly Report on Form 10-Q. This discussion contains forward-looking statements reflecting our current expectations and involves risks and uncertainties. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "intend," "potential" or "continue" or the negative of these terms or other comparable terminology. For example, statements regarding our expectations as to future financial performance, expense levels and liquidity sources are forward-looking statements. Our actual results and the timing of events may differ materially from those discussed in our forward-looking statements as a result of various factors, including those discussed below and those discussed in the section entitled "Risk Factors" included in this Quarterly Report on Form 10-Q and our Annual Report on Form 10-K for the year ended December 31, 2012. Overview

We deliver microinverter technology for the solar industry that increases energy production, simplifies design and installation, improves system uptime and reliability, reduces fire safety risk and provides a platform for intelligent energy management. We were founded in March 2006 and have grown rapidly to become the market leader in the microinverter category. Since our first commercial shipment in mid-2008, we have sold over 4,200,000 microinverters as of September 30, 2013. Our sales efforts are focused in the United States, Canada, France, the United Kingdom, Italy, Belgium, Luxembourg, the Netherlands, Switzerland, Greece and Australia.

We sell our microinverter systems primarily to distributors who resell them to solar installers. We also sell directly to large installers and through original equipment manufacturers ("OEMs") and strategic partners. Components of Condensed Consolidated Statements of Operations Net Revenues

We generate revenues from sales of our microinverter systems, which include microinverter units and related accessories, an Envoy communications gateway device, and our Enlighten web-based monitoring service.

Our revenue is affected by changes in the volume and average selling prices of our microinverter systems, driven by supply and demand, sales incentives, and competitive product offerings. Our revenue growth is dependent on our ability to market our products in a manner that increases awareness for microinverter technology, the continual development and introduction of new products to meet the changing technology and performance requirements of our customers, and the expansion of our customer base.

Cost of Revenues and Gross Profit

Cost of revenues is comprised primarily of product costs, warranty, purchasing and production planning personnel and related expenses, logistics costs, depreciation on manufacturing test equipment and hosting services costs. Our product costs are impacted by technological innovations, such as advances in semiconductor integration and new product introductions, economies of scale resulting in lower component costs, and improvements in production processes and automation. Certain costs, primarily personnel and depreciation on manufacturing test equipment, are not directly affected by sales volume.

We outsource our manufacturing to third-party contract manufacturers and generally negotiate product pricing with them on a quarterly basis. In addition, a contract manufacturer also serves as our logistics provider by warehousing and delivering our products. We believe our contract manufacturing partners have sufficient production capacity to meet the growing demand for our products for the foreseeable future. However, shortages in the supply of certain key raw materials could adversely affect our ability to meet customer demand for our products.

Gross profit may vary from quarter to quarter and is primarily affected by our average selling prices, product cost, product mix, warranty costs, changes in estimates to pre-existing warranties and sales volume fluctuations resulting from seasonality.

--------------------------------------------------------------------------------

Morgen könnte der Aufwärtstrend in Richtung 8,50$ Dollar fortgesetzt werden.Auf eine hoffentlich weiter grüne Woche !.

Schade Tageshöchstkurs von 8,25$ Dollar konnte nicht gehalten werden.Schlußkurs 8,16$ Dollar. Wir kommen einfach nicht so richtig von der Stelle.Langfristig hat das Unternehmen als Nr.1 in den USA auf alle Fälle noch reichlich Potenzial !.Ich hoffe,das wir noch bis ende des Jahres bis in den Bereich von 10,00$ kommen werden. Gruß Lars

Gruß Lars

Gruß Lars

Gruß Lars

Hallo Ephase Energy Fans,

hier noch etwas neues:

Enphase Energy congratulates Joe Kurch , winner of the first Enphase NABCEP Scholarship. Joe will receive from Enphase free online training courses, NABCEP training books and a paid entry-level NABCEP exam. (Photo: Business Wire)

Zuerst noch etwas Werbung für die, die immer noch bei Enphase Energy investiert sind und andere die es noch wollen.

Hier der Link mit dem ganzen Bericht:

http://investor.enphase.com/releasedetail.cfm?ReleaseID=8055…

Irgendwann kommt der Durchbruch! (Nur die harten kommen in den Garten) Das Unternehmen ist gut,

hier zählt das Kostolany-Sytem.

Gruß

hauswand

hier noch etwas neues:

Enphase Energy congratulates Joe Kurch , winner of the first Enphase NABCEP Scholarship. Joe will receive from Enphase free online training courses, NABCEP training books and a paid entry-level NABCEP exam. (Photo: Business Wire)

Zuerst noch etwas Werbung für die, die immer noch bei Enphase Energy investiert sind und andere die es noch wollen.

Hier der Link mit dem ganzen Bericht:

http://investor.enphase.com/releasedetail.cfm?ReleaseID=8055…

Irgendwann kommt der Durchbruch! (Nur die harten kommen in den Garten) Das Unternehmen ist gut,

hier zählt das Kostolany-Sytem.

Gruß

hauswand

N'abend borsalino1965,

N'abend larsuwe,

hier der wichtige Abschnitt vom 2. Quartal:

Business Outlook

"Looking forward, we expect revenue for the third quarter of 2013 to be within a range of $59 million to $63 million," said Kris Sennesael, CFO of Enphase. "We expect the sequential increase in the third quarter revenue to be muted partially due to an anticipated reduction in inventory levels within our distribution channel, as a result of the transition from the third to the fourth generation microinverter system."

Mr. Sennesael continued, "Turning to gross margin, we expect the third quarter gross margin to be within a range of 27 percent to 29 percent. As is the case with each new generation product, the transition to the M250 microinverter system is expected to drive further cost improvements and have a positive margin impact as volume ramps. In the mean time, we will continue to hold the line on our operating expenses and expect the non-GAAP operating expenses for the third quarter of 2013 to be roughly flat compared to the second quarter of 2013."

Hier der wichtige Abschitte vom 3. Quartal:

Third Quarter 2013 Highlights

Record revenue of $62.0 million, up 7% sequentially

Record non-GAAP gross margin of 28.3%, up 140 basis points year-over-year

Non-GAAP operating expenses flat for the fourth consecutive quarter at $20.4 million

Shipped 60,000 units of the fourth-generation microinverter system

Business Outlook

"Looking forward, we expect revenue for the fourth quarter of 2013 to be within a range of $62 million to $65 million," said Kris Sennesael, CFO of Enphase. "We expect fourth quarter gross margin to be within a range of 29 percent to 32 percent, as we continue the transition from our third to fourth-generation microinverter system and drive further product cost improvements. We expect non-GAAP operating expenses for the fourth quarter of 2013 to be roughly flat compared to the third quarter of 2013."

Der Outlook der Einnahmen lag von $59 million to $63 million und ist dann mit erreichten $62 Millionen am oberen Ende.

Hier der Link zum ganzen Bericht:

http://investor.enphase.com/releasedetail.cfm?ReleaseID=8046…

Gute Nacht

hauswand

N'abend larsuwe,

hier der wichtige Abschnitt vom 2. Quartal:

Business Outlook

"Looking forward, we expect revenue for the third quarter of 2013 to be within a range of $59 million to $63 million," said Kris Sennesael, CFO of Enphase. "We expect the sequential increase in the third quarter revenue to be muted partially due to an anticipated reduction in inventory levels within our distribution channel, as a result of the transition from the third to the fourth generation microinverter system."

Mr. Sennesael continued, "Turning to gross margin, we expect the third quarter gross margin to be within a range of 27 percent to 29 percent. As is the case with each new generation product, the transition to the M250 microinverter system is expected to drive further cost improvements and have a positive margin impact as volume ramps. In the mean time, we will continue to hold the line on our operating expenses and expect the non-GAAP operating expenses for the third quarter of 2013 to be roughly flat compared to the second quarter of 2013."

Hier der wichtige Abschitte vom 3. Quartal:

Third Quarter 2013 Highlights

Record revenue of $62.0 million, up 7% sequentially

Record non-GAAP gross margin of 28.3%, up 140 basis points year-over-year

Non-GAAP operating expenses flat for the fourth consecutive quarter at $20.4 million

Shipped 60,000 units of the fourth-generation microinverter system

Business Outlook

"Looking forward, we expect revenue for the fourth quarter of 2013 to be within a range of $62 million to $65 million," said Kris Sennesael, CFO of Enphase. "We expect fourth quarter gross margin to be within a range of 29 percent to 32 percent, as we continue the transition from our third to fourth-generation microinverter system and drive further product cost improvements. We expect non-GAAP operating expenses for the fourth quarter of 2013 to be roughly flat compared to the third quarter of 2013."

Der Outlook der Einnahmen lag von $59 million to $63 million und ist dann mit erreichten $62 Millionen am oberen Ende.

Hier der Link zum ganzen Bericht:

http://investor.enphase.com/releasedetail.cfm?ReleaseID=8046…

Gute Nacht

hauswand

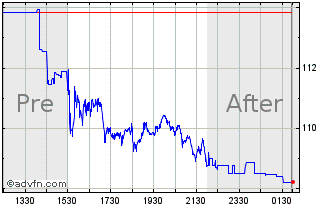

Antwort auf Beitrag Nr.: 45.768.682 von larsuwe am 05.11.13 22:29:34Leider wohl eher nicht, wenn man die nachbörslichen Kurse sieht.

Zahlen sind wohl nicht so gut, aber bald wissen wir mehr.

Zahlen sind wohl nicht so gut, aber bald wissen wir mehr.

22.05.24 · wO Newsflash · Verizon Communications |

14.05.24 · wO Newsflash · Boeing |

10.05.24 · wO Newsflash · American Express |

03.05.24 · wO Newsflash · Amgen |