Roxgold - High Grade Gold in Burkina Faso - 500 Beiträge pro Seite

eröffnet am 10.07.12 14:45:26 von

neuester Beitrag 26.06.21 17:16:55 von

neuester Beitrag 26.06.21 17:16:55 von

Beiträge: 420

ID: 1.175.444

ID: 1.175.444

Aufrufe heute: 0

Gesamt: 39.152

Gesamt: 39.152

Aktive User: 0

ISIN: CA7798992029 · WKN: A1CWW3

1,2980

EUR

-0,31 %

-0,0040 EUR

Letzter Kurs 06.07.21 L&S Exchange

Neuigkeiten

Werte aus der Branche Stahl und Bergbau

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0200 | +13,33 | |

| 21,000 | +10,53 | |

| 40,81 | +10,30 | |

| 2,8300 | +10,12 | |

| 2.500,00 | +8,70 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 27,00 | -6,90 | |

| 1.435,10 | -7,29 | |

| 0,5650 | -11,77 | |

| 264,05 | -13,14 | |

| 8,2501 | -13,16 |

Homepage:

http://www.roxgold.com/s/Home.asp

Juni 2012 Präsentation:

http://www.roxgold.com/i/pdf/Roxgold_PPT.pdf

Nach dem Abverkauf der letzten Monate, den hochgradigen BE's, anstehendem NI 43-101, und erstklassigen Nachbarn Semafo gings nach gestriger News mit hohem Vol. 33% up:

http://finance.yahoo.com/news/roxgold-inc-announces-postpone…

Insiderhandel:

http://canadianinsider.com/node/7?menu_tickersearch=ROG+|+Ro…

Sharestructure:

http://www.roxgold.com/s/ShareStructure.asp

MK: 81 CAD Mio

HIGHLIGHTS:

156.16 gpt Au over 3.0 meters from YRM-11-DDH-041 (35 Zone)

101.65 gpt Au over 4.2 meters from YRM-11-DDH-028 (55 Zone)

30.14 gpt Au over 8 meters from YRM-11-DDH-042 (35 Zone)

Phase 2 drilling at Yaramoko Underway

55 Zone Results:

DDH-026 reported 1.70 gpt Au over 4.07 meters from 72.6m to 76.67m

DDH-027 reported 6.18 gpt Au over 12.4 meters from 97.8m to 110.2m

including 15.67 gpt Au over 2.0 meters from 108.2 to 110.2m

DDH-028 reported 101.65 gpt Au over 4.2 meters from 109.1m to 113.3m

35 Zones Results;

DDH-040 reported 18.26 gpt Au over 2.0 meters from 48.85m to 50.85m

and 1.41 gpt Au over 2.15 meters from 82.95m to 85.1m

DDH-041 reported 156.16 gpt Au over 3.0 meters from 40.7m to 43.7m

and 5.35 gpt Au over 1.25 meters from 49.35 to 50.6m

and 2.46 gpt Au over 3.5 meters from 74.6m to 78.1m

DDH-042 reported 30.14 gpt Au over 8.0 meters from 52.0m to 60.0m

including 56.65 gpt Au over 4.0 meters from 55.0m to 59.0m

and 2.37 gpt Au over 2.9 meters from 93.4m to 96.3m

DDH-043 reported 1.7 gpt Au over 2.0 meters from 26.15m to 28.16m

DDH-044 reported 0.74 gpt Au over 2.0 meters from 14.3m to 16.3m

and 2.57 gpt Au over 2.0 meters from 28.0m to 30.0m

MfG.

STT

Ist mal auf Watch - bin noch nicht investiert...

Ist auf jetztigem Preisniveau für mich aber sehr verlockend...

Warte mal ab ob der gestrige Ausbruch nachhaltig war.

STT

Ist auf jetztigem Preisniveau für mich aber sehr verlockend...

Warte mal ab ob der gestrige Ausbruch nachhaltig war.

STT

Sieht so aus als ob das gestrige Niveau nicht gehalten werden kann...

Recent Trades - Last 10 of 189

Time ET Ex Price Change Volume Buyer Seller Markers

11:03:45 V 0.69 -0.06 500 79 CIBC 99 Jitney K

11:03:45 V 0.69 -0.06 500 79 CIBC 99 Jitney K

10:38:49 V 0.69 -0.06 500 99 Jitney 7 TD Sec K

10:38:23 V 0.68 -0.07 500 73 Cormark 79 CIBC K

10:38:23 V 0.68 -0.07 1,500 101 Newedge 62 Haywood K

10:38:23 V 0.68 -0.07 13,000 73 Cormark 62 Haywood K

10:38:23 V 0.68 -0.07 3,000 99 Jitney 62 Haywood K

10:38:23 V 0.68 -0.07 4,000 33 Canaccord 62 Haywood K

10:38:23 V 0.68 -0.07 5,000 124 Questrade 62 Haywood K

10:38:00 V 0.69 -0.06 500 99 Jitney 9 BMO Nesbitt K

das heisst für mich weiter warten, evt. sehen wir die 0.50 CAD wieder...

Recent Trades - Last 10 of 189

Time ET Ex Price Change Volume Buyer Seller Markers

11:03:45 V 0.69 -0.06 500 79 CIBC 99 Jitney K

11:03:45 V 0.69 -0.06 500 79 CIBC 99 Jitney K

10:38:49 V 0.69 -0.06 500 99 Jitney 7 TD Sec K

10:38:23 V 0.68 -0.07 500 73 Cormark 79 CIBC K

10:38:23 V 0.68 -0.07 1,500 101 Newedge 62 Haywood K

10:38:23 V 0.68 -0.07 13,000 73 Cormark 62 Haywood K

10:38:23 V 0.68 -0.07 3,000 99 Jitney 62 Haywood K

10:38:23 V 0.68 -0.07 4,000 33 Canaccord 62 Haywood K

10:38:23 V 0.68 -0.07 5,000 124 Questrade 62 Haywood K

10:38:00 V 0.69 -0.06 500 99 Jitney 9 BMO Nesbitt K

das heisst für mich weiter warten, evt. sehen wir die 0.50 CAD wieder...

Antwort auf Beitrag Nr.: 43.465.565 von MONSIEURCB am 07.08.12 14:45:34Resourcenschätzung nach NI 43-101 sollte bald kommen...

schaun mer mal...

schaun mer mal...

Zahlen sind da ...

http://finance.yahoo.com/news/roxgold-announces-initial-esti…

.. und der Handel ist wieder aufgenommen!

http://finance.yahoo.com/news/roxgold-announces-initial-esti…

.. und der Handel ist wieder aufgenommen!

Antwort auf Beitrag Nr.: 43.466.404 von MONSIEURCB am 07.08.12 17:12:06Da hatte ich auch etwas mehr erwartet...

In der Resourcenschätzung ist jedoch nuf zone 55 drin - Yaramoko wird also noch weitere

Oz enthalten...

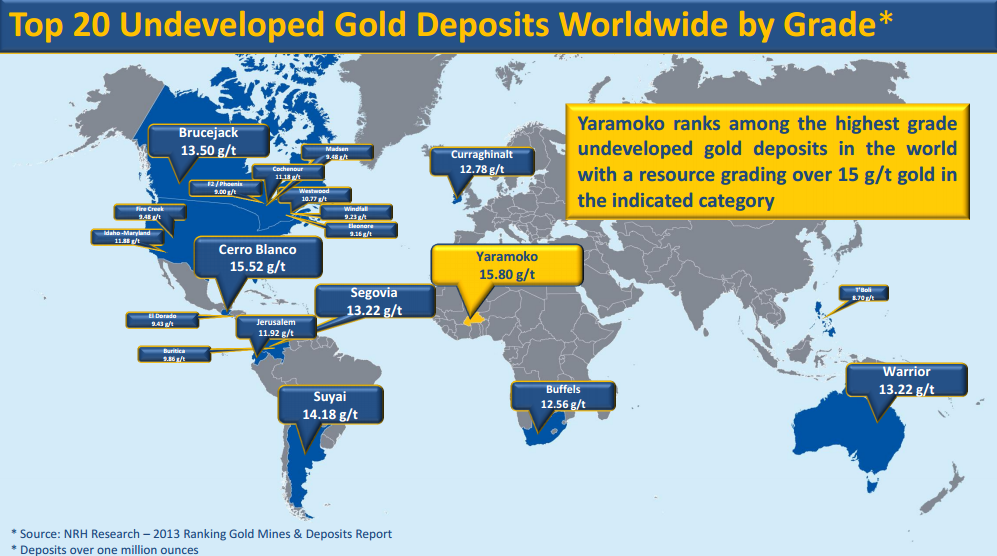

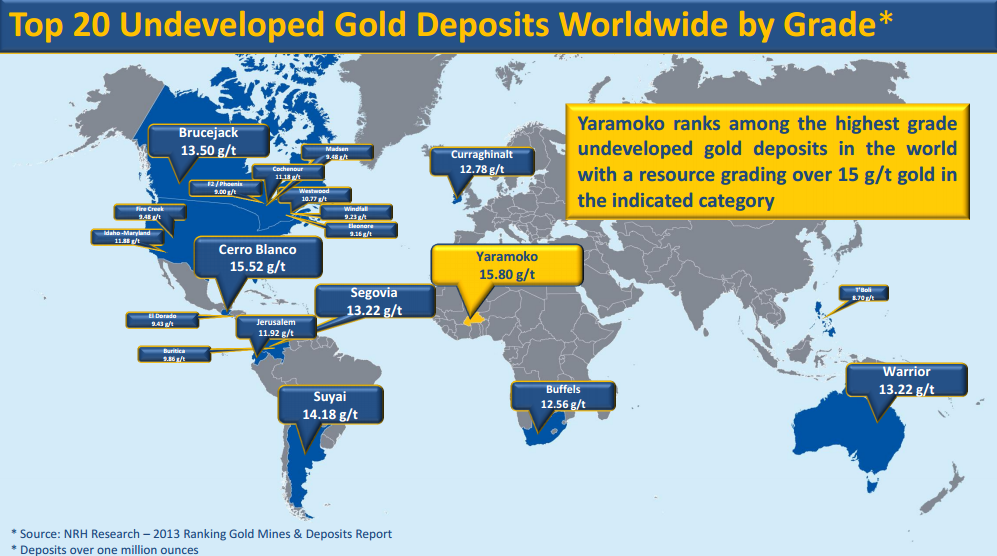

Die Grades (g/t) sind allerdings absolute Spitzenklasse.

Ich werde mit meinem Einstieg weiter warten - denke wir sehen noch tiefere Kurse.

Halte Roxgold jedoch weiterhin für sehr interessant...

Wer bereits investiert ist braucht auf jedenfall GEDULD!!!

MfG. STT

In der Resourcenschätzung ist jedoch nuf zone 55 drin - Yaramoko wird also noch weitere

Oz enthalten...

Die Grades (g/t) sind allerdings absolute Spitzenklasse.

Ich werde mit meinem Einstieg weiter warten - denke wir sehen noch tiefere Kurse.

Halte Roxgold jedoch weiterhin für sehr interessant...

Wer bereits investiert ist braucht auf jedenfall GEDULD!!!

MfG. STT

Heute +10% in CA mit - bis jetzt - 700.000 Umsatz ... wenn man sich das Langfrist-Chart ansieht, könnte das der Auftakt zum nächsten Kursgipfel sein ...

Wow - jetzt geht die Post ab.

Wenn's klappt, dürfte der Kurs ab 26. September abheben ...

http://finance.yahoo.com/news/oliver-lennox-king-files-lette…

Wenn's klappt, dürfte der Kurs ab 26. September abheben ...

http://finance.yahoo.com/news/oliver-lennox-king-files-lette…

Antwort auf Beitrag Nr.: 43.567.015 von MONSIEURCB am 04.09.12 15:08:59Danke Monsieurcb fürs einstellen der Links...

Habe mir gestern eine erste Position in CAN geholt - leider etwas teurer als

gedacht. war vor ein paar Wochen wohl zu geizig... halte aber cash zum Nachkauf.

Die ganzen Uneinigkeiten und Streitereien bezüglich Managment und Shareholder Value deuten auf ein erstklassiges Goldvorkommen hin - jeder will was vom Kuchen.

Ist jetzt viel Spannung im Spiel - auch dank steigendem Goldpreis, US-Wahljahr kann es

ein interessanter Herbst werden.

MfG.

STT

Habe mir gestern eine erste Position in CAN geholt - leider etwas teurer als

gedacht. war vor ein paar Wochen wohl zu geizig... halte aber cash zum Nachkauf.

Die ganzen Uneinigkeiten und Streitereien bezüglich Managment und Shareholder Value deuten auf ein erstklassiges Goldvorkommen hin - jeder will was vom Kuchen.

Ist jetzt viel Spannung im Spiel - auch dank steigendem Goldpreis, US-Wahljahr kann es

ein interessanter Herbst werden.

MfG.

STT

Antwort auf Beitrag Nr.: 43.603.894 von SayTheTruth am 14.09.12 09:02:05ein Insider hat sich gestern mal 34'000 Stk. geschnappt...

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

MONSIEURCB,

Wie stehst du zu dem Deal mit Lennox King?

Für mich ist das ganze etwas undurchsichtig...

MfG.

STT

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

MONSIEURCB,

Wie stehst du zu dem Deal mit Lennox King?

Für mich ist das ganze etwas undurchsichtig...

MfG.

STT

Ehrlich gesagt, erscheint mir die ganze Geschichte inzwischen auch nicht mehr so eindeutig klar wie zu Beginn - als ich noch dachte, dass jetzt wirklich ein BESSERES Team die "Macht" übernimmt ... es geht nun mal um eine Menge Knete, und da werden die Fäden im Hintergrund gesponnen. Bleiben wir dran - es bleibt spannend ...

Schön das es nun auch ein Forum in Deutsch gibt. Ich war bisher immer nur bei Bullboards. Leider erst heute endeckt

Bin hier schon länger dabei.........meine erste Posi gut im Minus, meine zweite im Plus.

Heute ein großer Insiderkauf..... 183.500 Stück......stimmt mich positiv.

Keiner hat 138.135 Can/$ zu verschenken.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Bin hier schon länger dabei.........meine erste Posi gut im Minus, meine zweite im Plus.

Heute ein großer Insiderkauf..... 183.500 Stück......stimmt mich positiv.

Keiner hat 138.135 Can/$ zu verschenken.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Am 25.September ist Hauptversammlung........bin gespannt was da

kommt.

r Lennox-King has rejected the new Roxgold Inc. (TSXV:ROG4) team’s offer of compromise. The Special Committee of Roxgold authorized new CEO Brett Richards to reach out to Mr. Lennox-King with a proposed compromise solution to be considered by shareholders at the annual general meeting on September 25, 2012.

As quoted in the press release:

In light of this shareholder feedback, last week the Special Committee of Roxgold authorized Mr. Richards to reach out to Mr. Lennox-King with a proposed compromise solution to be considered by shareholders at the annual general meeting to be held on September 25, 2012 (the Meeting). The full text of the letter sent from Mr. Richards to Mr. Lennox-King on September 13, 2012 is reproduced below, however the key terms of the proposal were:

• a new slate of seven (7) directors comprised as follows:

? three (3) nominees chosen by Mr. Lennox-King;

? three (3) nominees from the proposed Roxgold slate, being Peter R. Jones, Gordon Pridham and John Knowles;

? Brett Richards nominated as the seventh director and named CEO;

• Peter R. Jones be nominated to act as chair; and

• Roxgold reimburse up to a maximum of CDN$200,000 of the fees incurred by Mr. Lennox-King in connection with the proxy contest.

Unfortunately, Mr. Lennox-King refused this generous offer put forward by Mr. Richards.

“While our support to date has exceeded our expectations, I have always said that this is not my fight and I simply want what is best for Roxgold and its shareholders,” said Brett Richards, proposed CEO, “I have fervently worked towards the fairest solution to this proxy dispute and am disappointed that it was rejected.”

Regardless of how many shares held, Roxgold urges shareholders to vote in line with Glass Lewis and ISS’s recommendation to vote their GOLD proxy in favour of the new Roxgold team as soon as possible. The cut-off for receipt of proxies is 2:00 p.m. (Vancouver time) on Friday, September 21, 2012. We thank shareholders for their continued support.

kommt.

r Lennox-King has rejected the new Roxgold Inc. (TSXV:ROG4) team’s offer of compromise. The Special Committee of Roxgold authorized new CEO Brett Richards to reach out to Mr. Lennox-King with a proposed compromise solution to be considered by shareholders at the annual general meeting on September 25, 2012.

As quoted in the press release:

In light of this shareholder feedback, last week the Special Committee of Roxgold authorized Mr. Richards to reach out to Mr. Lennox-King with a proposed compromise solution to be considered by shareholders at the annual general meeting to be held on September 25, 2012 (the Meeting). The full text of the letter sent from Mr. Richards to Mr. Lennox-King on September 13, 2012 is reproduced below, however the key terms of the proposal were:

• a new slate of seven (7) directors comprised as follows:

? three (3) nominees chosen by Mr. Lennox-King;

? three (3) nominees from the proposed Roxgold slate, being Peter R. Jones, Gordon Pridham and John Knowles;

? Brett Richards nominated as the seventh director and named CEO;

• Peter R. Jones be nominated to act as chair; and

• Roxgold reimburse up to a maximum of CDN$200,000 of the fees incurred by Mr. Lennox-King in connection with the proxy contest.

Unfortunately, Mr. Lennox-King refused this generous offer put forward by Mr. Richards.

“While our support to date has exceeded our expectations, I have always said that this is not my fight and I simply want what is best for Roxgold and its shareholders,” said Brett Richards, proposed CEO, “I have fervently worked towards the fairest solution to this proxy dispute and am disappointed that it was rejected.”

Regardless of how many shares held, Roxgold urges shareholders to vote in line with Glass Lewis and ISS’s recommendation to vote their GOLD proxy in favour of the new Roxgold team as soon as possible. The cut-off for receipt of proxies is 2:00 p.m. (Vancouver time) on Friday, September 21, 2012. We thank shareholders for their continued support.

Wer Kauft hier solche Pakete........mir solls recht sein, die Insider sollten Informationen haben die wir nicht haben.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Roxgold Announces Settlement Agreement and New Proposed Board

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Sept. 25, 2012) - Roxgold Inc. ("Roxgold" or "the Company") (ROG.V) today announced that the Company and Oliver Lennox-King ("OLK") have entered into a Settlement Agreement that terminates their proxy dispute on mutually agreeable terms. The settlement is expected to be implemented at today's Annual General Shareholders Meeting (the "AGM"). Both Roxgold and OLK believe this settlement is in the best interests of all shareholders and allows the Company to continue with the development of its exploration concessions in Burkina Faso, West Africa.

http://finance.yahoo.com/news/roxgold-announces-settlement-a…

Jetzt kann es endlich weiter gehen... Mal schauen was Oliver Lennox-King

mit seinen Kontakten bewirken kann...

MfG.

STT

VANCOUVER, BRITISH COLUMBIA--(Marketwire - Sept. 25, 2012) - Roxgold Inc. ("Roxgold" or "the Company") (ROG.V) today announced that the Company and Oliver Lennox-King ("OLK") have entered into a Settlement Agreement that terminates their proxy dispute on mutually agreeable terms. The settlement is expected to be implemented at today's Annual General Shareholders Meeting (the "AGM"). Both Roxgold and OLK believe this settlement is in the best interests of all shareholders and allows the Company to continue with the development of its exploration concessions in Burkina Faso, West Africa.

http://finance.yahoo.com/news/roxgold-announces-settlement-a…

Jetzt kann es endlich weiter gehen... Mal schauen was Oliver Lennox-King

mit seinen Kontakten bewirken kann...

MfG.

STT

Auch hier der komplette link:

http://finance.yahoo.com/news/roxgold-announces-settlement-a…

.. eigentlich kann's jetzt nur bergauf gehen - bin gespannt, wie Kanada heute reagiert!

http://finance.yahoo.com/news/roxgold-announces-settlement-a…

.. eigentlich kann's jetzt nur bergauf gehen - bin gespannt, wie Kanada heute reagiert!

Insiderkauf auch heute zwar nur 10k........aber ich denke nach dem Settlement muss hier was gehen

Bin am Überlegen evt. noch aufzustocken........das Länderrisiko ist leider

bei einen afrikanischen Staat da.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Bin am Überlegen evt. noch aufzustocken........das Länderrisiko ist leider

bei einen afrikanischen Staat da.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Kurs explotiert bei sehr hohen Volumen.

Antwort auf Beitrag Nr.: 43.658.972 von Aktiengeier_1 am 28.09.12 19:45:19Ja,schöne Kursentwicklung seit OLK im Board sitzt...

Freue mich bereits auf die neue Präsentation und BE's...

Freue mich bereits auf die neue Präsentation und BE's...

Roxgold hat eben den Dollar geknackt .. Schampus! ;-)

Antwort auf Beitrag Nr.: 43.679.524 von MONSIEURCB am 04.10.12 19:35:40Leider nur kurz........aber wird schon

Werd weiter sammeln bei Rücksetzer.

Werd weiter sammeln bei Rücksetzer.

Wenn Direktoren und Manager gute Arbeit abliefern sollen sie die Optionen haben.

Ich hab vorhin nochmals 3200 Stück in Stuttgart nachgekauft........hoffentlich gehts weiter nach oben.......der Goldpreis spielt hier natürlich stark mit.

Ich hab vorhin nochmals 3200 Stück in Stuttgart nachgekauft........hoffentlich gehts weiter nach oben.......der Goldpreis spielt hier natürlich stark mit.

Charttechnisch sieht Roxgold gut aus.....super wäre wenn die gelbe 200 Tagelinie nachhaltig genommen würde. Kurze Korektur ist möglich da der Kurs die Bollinger Bänder nach oben verlassen hat.

Ist immer schwierig Explorer mit Charttechnik einzustufen......aber es ist hier im Moment bullisch.

http://www.tradesignalonline.com/charts/chart.aspx?op=open&i…

Ist immer schwierig Explorer mit Charttechnik einzustufen......aber es ist hier im Moment bullisch.

http://www.tradesignalonline.com/charts/chart.aspx?op=open&i…

Gestern war kein so guter Tag für Roxgold......das hat ein Insider ausgenutzt und gleich 92500 Stück gekauft.

Achtung der nachfolgende Link zeigt den Kauf nur heute.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Achtung der nachfolgende Link zeigt den Kauf nur heute.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Wie bei allen EM Explorern.......auch hier wieder ein Rücksetzer.....wann

kommt endlich der Befreiungsschlag für die Explorer?

kommt endlich der Befreiungsschlag für die Explorer?

Antwort auf Beitrag Nr.: 43.731.322 von Aktiengeier_1 am 19.10.12 16:01:20Habe mich am Mittwoch von Roxgold getrennt (VK: 0.82 CAD) + 32%

Der Gewinn war am wegschmeltzen - also habe ich mal mitgenommen. Gewinne einstreichen

ist bei solchen Werten wichtig... Die Informationspolitik vom Team rund um King hat mich bis hierher auch entäuscht.

Werde Roxgold jedoch genaustens weiter verfolgen....

MfG.

STT

Der Gewinn war am wegschmeltzen - also habe ich mal mitgenommen. Gewinne einstreichen

ist bei solchen Werten wichtig... Die Informationspolitik vom Team rund um King hat mich bis hierher auch entäuscht.

Werde Roxgold jedoch genaustens weiter verfolgen....

MfG.

STT

Das politische Risiko in Burkina Faso scheint kalkulierbar zu sein, wenn man bedenkt, dass dort bereits 48 ausländische Firmen einen Mine betreiben, darunter auch Iamgold.

Gewinnmitnahmen haben noch nicht geschadet......ich habs ähnlich bei Rio Alto gemacht.

Bei Roxgold werd ich noch bleiben......läuft doch noch besser als die meisten EM Explorer.

Bei Roxgold werd ich noch bleiben......läuft doch noch besser als die meisten EM Explorer.

Toll Cross Securities Inc. ist ein sehr starker Käufer heute mit derzeit 55k.......stimmt mich positiv.

Kurs muss noch halten.

Kurs muss noch halten.

Antwort auf Beitrag Nr.: 43.750.452 von MONSIEURCB am 25.10.12 12:23:45Ja, sehr schöne Grades - aber immer relativ kurze Intervalle...

Mal sehen was die CAN's heute damit machen.....

Ich bin heute leider nur Zuschauer.

Mal sehen was die CAN's heute damit machen.....

Ich bin heute leider nur Zuschauer.

Antwort auf Beitrag Nr.: 43.750.452 von MONSIEURCB am 25.10.12 12:23:45Der Kurs und der Umsatz würdigen die Bohrergebnisse.......bin gespannt wo wir heute schließen.......sehe in der Aktie enormes Potenial wenn der Goldpreis un West Afrika halbwegs stabil bleibt.

Wieder kleiner Insiderkauf von 6500 Stück.....ist wohl einer durch die

Bohrergebnisse motiviert worden.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Bohrergebnisse motiviert worden.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

In CA +10% mit über einer halben Mio. Umsatz ... die News scheinen in den Köpfen angekommen zu sein. Denke, wir werden noch VIEL Freude haben mit diesem Wert - den in Deutschland offenbar kein Schwein kennt ... außer uns glücklichen Gold-Ebern ... ;-)

Wenns dann sein muss halten wir zu zweit das Forum aufrecht......läuft doch

bis jetzt nicht schlecht.......oder

bis jetzt nicht schlecht.......oder

Pssssssssstttt ... muss ja keiner kennen & wissen ... ;-)

Noch wer da hier im Forum?

Grüß Euch,

Ja das Gold liegt tief.......aber es ist da

Kurs endlich wieder schön nach oben und noch eine großer Insiderkauf

von 180000 Stück...... und ein kleiner Verkauf von 21200 Stück.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Ja das Gold liegt tief.......aber es ist da

Kurs endlich wieder schön nach oben und noch eine großer Insiderkauf

von 180000 Stück...... und ein kleiner Verkauf von 21200 Stück.

http://www.tmxmoney.com/HttpController?GetPage=SearchInsider…

Dicker Insiderkauf von 430200 Stück......der Goldpreis müsste noch mitspielen.

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Seite wird leider täglich geändert!

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Seite wird leider täglich geändert!

Wieder ein dicker Insiderkauf von 199500 Stück.

Ich hoffe die Insider wissen mehr.

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Der Link ändert sich täglich.....das heisst der Insiderkauf ist nur heute sichtbar.

Ich hoffe die Insider wissen mehr.

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Der Link ändert sich täglich.....das heisst der Insiderkauf ist nur heute sichtbar.

Antwort auf Beitrag Nr.: 43.999.206 von Aktiengeier_1 am 09.01.13 12:29:42Roxgold Reports Deepest High Grade Intercept on 55 Zone to Date and Confirms Mineralization to 900 Meters

http://finance.yahoo.com/news/roxgold-reports-deepest-high-g…

die guten Grade liegen wieder sehr tief!

und bzgl. Insider-Aktivitäten kann ich die Seite empfehlen:

http://www.canadianinsider.com/node/7?menu_tickersearch=Roxg…

Bei Marker ist der Kauf von gestern drin!

http://finance.yahoo.com/news/roxgold-reports-deepest-high-g…

die guten Grade liegen wieder sehr tief!

und bzgl. Insider-Aktivitäten kann ich die Seite empfehlen:

http://www.canadianinsider.com/node/7?menu_tickersearch=Roxg…

Bei Marker ist der Kauf von gestern drin!

Wird mir bald umheimlich......heute schon wieder ein Insiderkauf von 304000 Stück.

Werden wir hier eine Mine sehen oder vorher eine Übernahme?

Meinungen?

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Werden wir hier eine Mine sehen oder vorher eine Übernahme?

Meinungen?

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Sieht ja zur Zeit nicht rosig aus ...

http://www.barchart.com/opinions/stocks/ROG.VN

... Afrika gilt zunehmend als Risiko-Erdteil ...

http://www.barchart.com/opinions/stocks/ROG.VN

... Afrika gilt zunehmend als Risiko-Erdteil ...

Wenigstens HIER sieht's neutral aus ...

http://www.stockta.com/cgi-bin/analysis.pl?symb=ROG.C&cobran…

http://www.stockta.com/cgi-bin/analysis.pl?symb=ROG.C&cobran…

Antwort auf Beitrag Nr.: 44.074.226 von MONSIEURCB am 28.01.13 19:56:32wieso? Hast heute auch Schlachtfest im Depot?

Wow! Da glaubt jemand an den Erfolg ... das macht Mut:

http://finance.yahoo.com/news/roxgold-inc-announces-10-milli…

http://finance.yahoo.com/news/roxgold-inc-announces-10-milli…

Antwort auf Beitrag Nr.: 44.077.011 von MONSIEURCB am 29.01.13 14:06:01Geduld ist hier gefragt......Gold hat heute nach oben gedreht

Grüß Euch,

Wieder ein Insiderkauf von 100k.

Wenn man die vielen Insiderkäufe der letzten Zeit ansieht kanns nur

nach oben gehen.

Leider wird das Gold immer wieder von den Amis gedeckelt, meisten so zwischen 14 Uhr und 16 Uhr deutscher Zeit.

Insiderkauf sichtbar wenn man auf Marker geht.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

Wieder ein Insiderkauf von 100k.

Wenn man die vielen Insiderkäufe der letzten Zeit ansieht kanns nur

nach oben gehen.

Leider wird das Gold immer wieder von den Amis gedeckelt, meisten so zwischen 14 Uhr und 16 Uhr deutscher Zeit.

Insiderkauf sichtbar wenn man auf Marker geht.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

Wieder ein Insiderkauf gestern von 192000 Stück.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

Roxgold Inc. Announces Closing of $10 Million Private Placement

TORONTO, ONTARIO--(Marketwire - Feb. 11, 2013) -

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

Roxgold Inc. (TSX VENTURE:ROG) (the "Company") announced that it has closed its previously announced brokered private placement (the "Offering") at a price of $0.70 per Common Share. The Company issued 14,973,214 common shares ("Common Shares") for gross proceeds of $10,481,250. The Offering was made through a syndicate of agents co-led by Toll Cross Securities Inc. and Jennings Capital Inc. that included GMP Securities L.P. and Raymond James Ltd. (together, the "Agents"). Under the Agency Agreement between the Company and the Agents, the Agents were granted the option to increase the original 14,286,000 Common Shares to be issued under the Offering by an additional 15%, which the Agents partially exercised to place an additional 687,214 Common Shares. In connection with the Offering, the Agents received a commission equal to 6.0% of the gross proceeds of the offering excluding $1,263,050 of president's list orders.

The net proceeds of the Offering will be used for continued exploration of the Company's Burkina Faso properties and for general working capital purposes.

The Common Shares issued in connection with the Offering are subject to a four-month hold period.

The securities offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") and may not be offered or sold in the United States or to, or for the benefit of, U.S. persons (as defined in Regulation S under the U.S. Securities Act) absent U.S. registration or an applicable exemption from the U.S. registration requirements. This release does not constitute an offer for sale of securities in the United States.

TORONTO, ONTARIO--(Marketwire - Feb. 11, 2013) -

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES

Roxgold Inc. (TSX VENTURE:ROG) (the "Company") announced that it has closed its previously announced brokered private placement (the "Offering") at a price of $0.70 per Common Share. The Company issued 14,973,214 common shares ("Common Shares") for gross proceeds of $10,481,250. The Offering was made through a syndicate of agents co-led by Toll Cross Securities Inc. and Jennings Capital Inc. that included GMP Securities L.P. and Raymond James Ltd. (together, the "Agents"). Under the Agency Agreement between the Company and the Agents, the Agents were granted the option to increase the original 14,286,000 Common Shares to be issued under the Offering by an additional 15%, which the Agents partially exercised to place an additional 687,214 Common Shares. In connection with the Offering, the Agents received a commission equal to 6.0% of the gross proceeds of the offering excluding $1,263,050 of president's list orders.

The net proceeds of the Offering will be used for continued exploration of the Company's Burkina Faso properties and for general working capital purposes.

The Common Shares issued in connection with the Offering are subject to a four-month hold period.

The securities offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") and may not be offered or sold in the United States or to, or for the benefit of, U.S. persons (as defined in Regulation S under the U.S. Securities Act) absent U.S. registration or an applicable exemption from the U.S. registration requirements. This release does not constitute an offer for sale of securities in the United States.

Keiner mehr hier?

Wir haben Trading stop seit heute. Wer weiß was?

Wir haben Trading stop seit heute. Wer weiß was?

Aus Stockhouse

Roxgold Announces an Updated Mineral Resource Estimate for the 55 Zone

TORONTO, ONTARIO--(Marketwire - March 4, 2013) - Roxgold Inc. (TSX

VENTURE:ROG) ("Roxgold" or the "Company") is pleased to announce an updated

resource estimate for the 55 Zone deposit on its 100% owned Yaramoko

concession located on the Hounde Greenstone Belt in Burkina Faso. The estimate

was undertaken by AGP Mining Consultants Inc. ("AGP") and is based on 81,105

meters of drilling and has been prepared in accordance with National

Instrument 43-101 ("43-101") Standards for Disclosure of Mineral Properties.

Roxgold is continuing to execute its infill drilling program between 400 and

750 meters vertical depth to expand the 55 Zone.

HIGHLIGHTS

-- 94% increase in ounces of gold ("Au") in Indicated Resource category at

a 3 gram per tonne ("gpt") cut-off to 679,000 ounces.

-- The mineral resource estimate represents a high conversion rate of

inferred to indicated at higher grades than estimated in the initial

resource estimate dated September 24, 2012.

Table 1. Q1 2013 resource estimate summary

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

Roxgold Announces an Updated Mineral Resource Estimate for the 55 Zone

TORONTO, ONTARIO--(Marketwire - March 4, 2013) - Roxgold Inc. (TSX

VENTURE:ROG) ("Roxgold" or the "Company") is pleased to announce an updated

resource estimate for the 55 Zone deposit on its 100% owned Yaramoko

concession located on the Hounde Greenstone Belt in Burkina Faso. The estimate

was undertaken by AGP Mining Consultants Inc. ("AGP") and is based on 81,105

meters of drilling and has been prepared in accordance with National

Instrument 43-101 ("43-101") Standards for Disclosure of Mineral Properties.

Roxgold is continuing to execute its infill drilling program between 400 and

750 meters vertical depth to expand the 55 Zone.

HIGHLIGHTS

-- 94% increase in ounces of gold ("Au") in Indicated Resource category at

a 3 gram per tonne ("gpt") cut-off to 679,000 ounces.

-- The mineral resource estimate represents a high conversion rate of

inferred to indicated at higher grades than estimated in the initial

resource estimate dated September 24, 2012.

Table 1. Q1 2013 resource estimate summary

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

Wieder ein dicker Insiderkauf von 297k Stück.

So viele Insiderkäufe ist wirklich nicht normal........wer kanns

erklären. Normal sollten Insider mehr über die Zukunft der Firma wissen

darum bin ich weiterhin optimistisch.

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Symbol

Company Name

Insider Buys Volume

Insider Sells Volume

Net Buys Volume

ROG

Roxgold Inc.

297,500

0

297,500

So viele Insiderkäufe ist wirklich nicht normal........wer kanns

erklären. Normal sollten Insider mehr über die Zukunft der Firma wissen

darum bin ich weiterhin optimistisch.

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Symbol

Company Name

Insider Buys Volume

Insider Sells Volume

Net Buys Volume

ROG

Roxgold Inc.

297,500

0

297,500

Wieder 100k Insiderekauf.....mir solls recht sein. Einfach auf Marker

in der Kopfzeile gehen dann sind die 100k sichtbar.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG

in der Kopfzeile gehen dann sind die 100k sichtbar.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG

Grüß Euch,

Aktivitäten in Deutschland bei Roxgold sehr gering...... was ich nicht verstehe. Aber ich denke wir werden hier unseren Weg gehen....der Kurs

geht nach oben und keiner merkt was.

Raymond James analyst Gary Baschuk initiated coverage on Roxgold Inc., which is focused on developing the Yaramoko project in Burkina Faso, with an “outperform” rating.

He views the company’s initial resource base as strong, and believes the property has significant potential for additional discoveries.

Target: Mr. Baschuk set a price target of $1.40. The average target is $1.23.

http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

Aktivitäten in Deutschland bei Roxgold sehr gering...... was ich nicht verstehe. Aber ich denke wir werden hier unseren Weg gehen....der Kurs

geht nach oben und keiner merkt was.

Raymond James analyst Gary Baschuk initiated coverage on Roxgold Inc., which is focused on developing the Yaramoko project in Burkina Faso, with an “outperform” rating.

He views the company’s initial resource base as strong, and believes the property has significant potential for additional discoveries.

Target: Mr. Baschuk set a price target of $1.40. The average target is $1.23.

http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

Ist noch wer investiert aus mir in Deutschland??????

Interessant Seite 19 der Präsentation was in Q1/2013

noch ansteht.....da müsste bald einiges kommen.

http://www.roxgold.com/i/pdf/Roxgold_PPT.pdf

noch ansteht.....da müsste bald einiges kommen.

http://www.roxgold.com/i/pdf/Roxgold_PPT.pdf

Guten Morgen,

wieder ein Insiderkauf von 95k........einfach beim Link auf Marker gehen.

http://www.canadianinsider.com/node/7?menu_tickersearch=Roxg…

wieder ein Insiderkauf von 95k........einfach beim Link auf Marker gehen.

http://www.canadianinsider.com/node/7?menu_tickersearch=Roxg…

Schöner Anstieg heute.......... mittlerweile sind meine Nachkäufe schon gut im Plus.

Bin gespannt auf die ersten News die sollten ja bald kommen.

Bin gespannt auf die ersten News die sollten ja bald kommen.

Wieder ein Insiderkauf gestern von 98,5k

http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

Antwort auf Beitrag Nr.: 44.344.133 von Aktiengeier_1 am 02.04.13 11:56:57Achtung! Marker ist nicht gleich ein Insiderkauf!

Siehe hier:

http://canadianinsider.com/node/7?menu_tickersearch=Roxgold+…

Die Angabe im Marker hat erstmal gar nix zu sagen.

Wirkliche Insiderkäufe tauchen letztendlich bei canadianinsider in den entsprechenden Kategorien auf!

Und hier sieht man, dass zuletzt lediglich zahlreiche Optionen ausgegeben wurden!

Die letzten wirkliche Insiderkäufe gab es Anfang/Mitte März!

Siehe hier:

http://canadianinsider.com/node/7?menu_tickersearch=Roxgold+…

Die Angabe im Marker hat erstmal gar nix zu sagen.

Wirkliche Insiderkäufe tauchen letztendlich bei canadianinsider in den entsprechenden Kategorien auf!

Und hier sieht man, dass zuletzt lediglich zahlreiche Optionen ausgegeben wurden!

Die letzten wirkliche Insiderkäufe gab es Anfang/Mitte März!

Antwort auf Beitrag Nr.: 44.344.401 von Kongo-Otto am 02.04.13 12:25:18Grüß Dich,

Nein glaub ich nicht.......man sieht den Insiderkauf auch hier.....leider nur heute.

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Nein glaub ich nicht.......man sieht den Insiderkauf auch hier.....leider nur heute.

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Der Goldpreis macht uns zu schaffen im Moment......aber es kommen auch wieder besser Tage.

Kaum ein EM Explorer bleibt verschont..............Mist.

Mein Depo schreit nach Erholung.

Kaum ein EM Explorer bleibt verschont..............Mist.

Mein Depo schreit nach Erholung.

Ich warte auf die Goldpreisanhebung durch den Westen!

http://der-klare-blick.com/2013/04/goldpreisanhebung-durch-d…

http://der-klare-blick.com/2013/04/goldpreisanhebung-durch-d…

Neue schöne Bohrergebnisse......Gold ist ja reichlich vorhanden....weiter so!

http://web.tmxmoney.com/article.php?newsid=59298113&qm_symbo…

http://web.tmxmoney.com/article.php?newsid=59298113&qm_symbo…

Wieder ein Insiderkauf von 100k.......nur wieder heute sichtbar dann erfolgt wieder ein Update.

Mir werden die Insiderkäufe wirklich unheimlich...... aber mir solls recht sein.

Die letzten Bohrergebnisse sind wirklich gut.....alle warten auf den Goldpreisanstieg.

Wie ich die letzten Monate verfolgt habe hängt die Aktie außergewöhnlich stark am Goldpreis.

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Mir werden die Insiderkäufe wirklich unheimlich...... aber mir solls recht sein.

Die letzten Bohrergebnisse sind wirklich gut.....alle warten auf den Goldpreisanstieg.

Wie ich die letzten Monate verfolgt habe hängt die Aktie außergewöhnlich stark am Goldpreis.

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

nochmal, das sind keine wirklichen Insider-Käufe!

Wirkliche Insider-Käufe sind bei canadianinsider bzw. SEDAR gelistet!

Dort tauchen aber z.B. auch die zuletzt von dir genannten Käufe nicht aus!

Siehe hier: http://canadianinsider.com/node/7?menu_tickersearch=Roxgold+…

eine Erläuterung findest du z.B. bei der Definition von Insider-Trades:

http://www.tmxmoney.com/en/market_activity/itm_important_inf…

oder kurzgefasst hier:

Wirkliche Insider-Käufe sind bei canadianinsider bzw. SEDAR gelistet!

Dort tauchen aber z.B. auch die zuletzt von dir genannten Käufe nicht aus!

Siehe hier: http://canadianinsider.com/node/7?menu_tickersearch=Roxgold+…

eine Erläuterung findest du z.B. bei der Definition von Insider-Trades:

http://www.tmxmoney.com/en/market_activity/itm_important_inf…

oder kurzgefasst hier:

Zitat von Francky57: ...vom Stockhouse

How often must this be explained?

TSX insider markers are not reliable.

Every trade i make, i can flag as insider. This flag is what TSX shows.

But what counts, are the SEDI/SEDAR filings canadiansider shows which must be reported no later than 5 five calendar days later.

This doesn't mean that insiders will never flag his transactions in his software, but he has no obligation to do so.

For example, if someone wants to manipulate the stock price, he could use this flagging to mark his trades as insider trades and afterwards maybe even mention the TSX indication in forums...

Be more careful, this is a world of sharks.

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&…

Antwort auf Beitrag Nr.: 44.415.749 von Kongo-Otto am 12.04.13 09:30:37Danke!

ich glaub jetzt wirklich es sind keine Insiderkäufe.....aber manchen

tauchen bei beiden links auf ander nicht. Für mich nicht ganz nachvollziehbar.

So viel Insiderkäufe wären wirklich komisch......zumindest waren es Käufe.

Werde versuchen nur noch die wirklichen Insiderkäufe zu posten.

ich glaub jetzt wirklich es sind keine Insiderkäufe.....aber manchen

tauchen bei beiden links auf ander nicht. Für mich nicht ganz nachvollziehbar.

So viel Insiderkäufe wären wirklich komisch......zumindest waren es Käufe.

Werde versuchen nur noch die wirklichen Insiderkäufe zu posten.

Antwort auf Beitrag Nr.: 44.417.227 von Aktiengeier_1 am 12.04.13 12:07:27Insiderkäufe sind zwar nett und irgendwo auch ein Vertrauensbeweis des Managements in die stärke des eigenen Unternehmens, aber letztendlich haben sie keine Aussagekraft.

Denn wenn ich mir anschaue, zu welchen Kursen die Insider bei so manchem Wert gekauft haben....

Denn wenn ich mir anschaue, zu welchen Kursen die Insider bei so manchem Wert gekauft haben....

Zum Kot... die Goldkurse!!! Ich denke das sollte es gewesen sein

mit der Korrektur.....was hat sich an Europa geändert die letzten

zwei Tage?

mit der Korrektur.....was hat sich an Europa geändert die letzten

zwei Tage?

Gold ist reichlich vorhanden.....die hohen Grade werden immer wichtiger

bei einen Goldpreis um 1470 USD.

May 2, 2013 - 9:29 AM EDT

Roxgold Announces Results for Metallurgical Testwork Drilling

TORONTO, ONTARIO--(Marketwired - May 2, 2013) - Roxgold Inc. (TSX VENTURE:ROG) ("Roxgold" or the "Company") is pleased to announce results from metallurgical drilling at its 100% owned Yaramoko Permit in Burkina Faso.

HIGHLIGHTS:

29.73 grams per tonne ("gpt") gold over 28.8 meters in metallurgical test hole, YRM-13-MET-01

27.62 gpt gold over 7.3 meters in metallurgical test hole, YRM-13-MET-05

http://app.quotemedia.com/quotetools/newsStoryPopup.go?story…

bei einen Goldpreis um 1470 USD.

May 2, 2013 - 9:29 AM EDT

Roxgold Announces Results for Metallurgical Testwork Drilling

TORONTO, ONTARIO--(Marketwired - May 2, 2013) - Roxgold Inc. (TSX VENTURE:ROG) ("Roxgold" or the "Company") is pleased to announce results from metallurgical drilling at its 100% owned Yaramoko Permit in Burkina Faso.

HIGHLIGHTS:

29.73 grams per tonne ("gpt") gold over 28.8 meters in metallurgical test hole, YRM-13-MET-01

27.62 gpt gold over 7.3 meters in metallurgical test hole, YRM-13-MET-05

http://app.quotemedia.com/quotetools/newsStoryPopup.go?story…

Roxgold Intersects 22.1 gpt Gold Over 3.96 Meters in 55 Zone Infill Drilling

http://finance.yahoo.com/news/roxgold-intersects-22-1-gpt-14…

Antwort auf Beitrag Nr.: 44.583.707 von Kongo-Otto am 07.05.13 17:00:40Bist du hier schon investiert......oder ist dir der Goldpeis noch zu niederig?

Habe kürzlich bei Rye Patch Gold nochmals aufgestockt. Am 13.05. erstes hearing mit Coeur...mal schauen.

Habe kürzlich bei Rye Patch Gold nochmals aufgestockt. Am 13.05. erstes hearing mit Coeur...mal schauen.

Antwort auf Beitrag Nr.: 44.616.127 von Aktiengeier_1 am 12.05.13 18:05:08ich bin hier nicht investiert.

Halte aktuell weitesgehenst die Füße still. Zudem müsste ich mich nochmal mit ROG beschäftigen.

Bin allgemein nicht so der Fan von Afrika-Investments, wegen des Länderrisikos.

Und da die höheren Grade recht tief liegen, der Cut-Off recht hoch ist, wollte ich auch erstmal die PEA sehen!

Halte aktuell weitesgehenst die Füße still. Zudem müsste ich mich nochmal mit ROG beschäftigen.

Bin allgemein nicht so der Fan von Afrika-Investments, wegen des Länderrisikos.

Und da die höheren Grade recht tief liegen, der Cut-Off recht hoch ist, wollte ich auch erstmal die PEA sehen!

Roxgold in aller Munde!

http://ceo.ca/quinton-hennigh-audio-may-13-2013/

We also asked Quinton to name a few resource companies that deserve more attention from today’s market (20:36). He hesitated, but offered Roxgold, Dalradian, and Pretium Resources as suggestions of companies he’s interested in. Investors who really want to know what Quinton’s thinking should subscribe to Exploration Insights ($140 per month here).

http://ceo.ca/quinton-hennigh-audio-may-13-2013/

We also asked Quinton to name a few resource companies that deserve more attention from today’s market (20:36). He hesitated, but offered Roxgold, Dalradian, and Pretium Resources as suggestions of companies he’s interested in. Investors who really want to know what Quinton’s thinking should subscribe to Exploration Insights ($140 per month here).

Wir brauchen einen besseren Goldpreis........

Nix mehr los.........ich bin immer noch dabei. Ihr werdet sehen wenn

der Goldpreis zurückkommt dann ghets hier überproportional ab.

der Goldpreis zurückkommt dann ghets hier überproportional ab.

Wer liest noch mit? Bald werden wir die Talsohle überwunden haben.

Antwort auf Beitrag Nr.: 44.919.521 von Aktiengeier_1 am 25.06.13 18:37:11Hallo,

ich bin dabei

curacanne

ich bin dabei

curacanne

Roxgold Intercepts 41.7 gpt Gold Over 4.4 Metres in Regional Exploration Drilling at Bagassi South

http://finance.yahoo.com/news/roxgold-intercepts-41-7-gpt-11…

Antwort auf Beitrag Nr.: 44.920.719 von curacanne am 25.06.13 21:08:26Hi Cura,

schön wieder einer der dabei ist Kongo Otto liegt auch auf der Lauer.....

Kongo Otto liegt auch auf der Lauer.....

Wir brauchen einen guten Goldkurs.....dann klappts mit schnellen 50%.

Aktie hängt sehr stark am Goldkurs.

schön wieder einer der dabei ist

Kongo Otto liegt auch auf der Lauer.....

Kongo Otto liegt auch auf der Lauer.....

Wir brauchen einen guten Goldkurs.....dann klappts mit schnellen 50%.

Aktie hängt sehr stark am Goldkurs.

Keiner mehr da......dann muss ich alleine weiterhoffen

Antwort auf Beitrag Nr.: 45.230.771 von Aktiengeier_1 am 12.08.13 14:27:10Ich Habe meinen Ausstieg (Beitrag NR. 37) schon vor längerem bekannt gegeben - war ja auch die richtige Entscheidung...

Beobachten tue ich Roxgold weiterhin.

Bei steigendem Goldpreis sicherlich ein top Pick im Goldsektor.

Wünsche allen Investierten viel Erfolg

Grüsse STT

Beobachten tue ich Roxgold weiterhin.

Bei steigendem Goldpreis sicherlich ein top Pick im Goldsektor.

Wünsche allen Investierten viel Erfolg

Grüsse STT

Wird Zeit das du wieder einsteigst............wenn Gold weiter steigt werden

wir heier eine Überraschung erleben.

Nur meine Meinung weiter Long.

wir heier eine Überraschung erleben.

Nur meine Meinung weiter Long.

Aug 9/13 Aug 2/13 Dorward, John Andrew Direct Ownership Common Shares 11 - Acquisition carried out privately 250,000 $0.400

Aug 4/13 Aug 1/13 Colterjohn, Richard Mark Direct Ownership Common Shares 16 - Acquisition under a prospectus exemption 1,000,000 $0.400

Aug 1/13 Aug 1/13 Lennox-King, Oliver Direct Ownership Common Shares 10 - Acquisition in the public market 1,000,000 $0.400

Aug 2/13 Jul 30/13 Rubenstein, Jonathan A. Direct Ownership Common Shares 11 - Acquisition carried out privately 100,000 $0.400

Trading Date Ticker Insider Volume Average

Buy Price Average

Sell Price

Buy Sell Net

Aug 28/13 ROG 261,500 261,500 $0.703

Aug 4/13 Aug 1/13 Colterjohn, Richard Mark Direct Ownership Common Shares 16 - Acquisition under a prospectus exemption 1,000,000 $0.400

Aug 1/13 Aug 1/13 Lennox-King, Oliver Direct Ownership Common Shares 10 - Acquisition in the public market 1,000,000 $0.400

Aug 2/13 Jul 30/13 Rubenstein, Jonathan A. Direct Ownership Common Shares 11 - Acquisition carried out privately 100,000 $0.400

Trading Date Ticker Insider Volume Average

Buy Price Average

Sell Price

Buy Sell Net

Aug 28/13 ROG 261,500 261,500 $0.703

Schöne Käufe hier..........die Aktie macht sich. Gold muss mitspielen dann

gibts wennig Aktien die so performen.

Weiter so!

gibts wennig Aktien die so performen.

Weiter so!

Roxgold announces an after-tax IRR of 47.7% in its Preliminary Economic Assessment on the Yaramoko Gold Project

http://finance.yahoo.com/news/roxgold-announces-tax-irr-47-1…

Base case is stated assuming 100% basis and a gold price of $1,300/oz

• Pre-tax IRR of 59.2% with a 1.2 year payback on initial capital

• After-tax IRR of 47.7% with a 1.4 year payback on initial capital

• Pre-tax NPV5% of $250 million

• After-tax NPV5% of $192 million

• Estimated average annual gold production of 98,300 ounces for the first five years

• Current study mine life of 10 years

• Average metallurgical recoveries of 96% gold

• Average total cash costs of $455/oz (including royalties) for the first 5 years of production

• Average total cash costs of $530/oz (including royalties) for Life of Mine ("LOM")

• Estimated all-in sustaining costs of $681/oz for first 5 years

• Pre-Production capital of $93.8 million

http://finance.yahoo.com/news/roxgold-announces-tax-irr-47-1…

Base case is stated assuming 100% basis and a gold price of $1,300/oz

• Pre-tax IRR of 59.2% with a 1.2 year payback on initial capital

• After-tax IRR of 47.7% with a 1.4 year payback on initial capital

• Pre-tax NPV5% of $250 million

• After-tax NPV5% of $192 million

• Estimated average annual gold production of 98,300 ounces for the first five years

• Current study mine life of 10 years

• Average metallurgical recoveries of 96% gold

• Average total cash costs of $455/oz (including royalties) for the first 5 years of production

• Average total cash costs of $530/oz (including royalties) for Life of Mine ("LOM")

• Estimated all-in sustaining costs of $681/oz for first 5 years

• Pre-Production capital of $93.8 million

Antwort auf Beitrag Nr.: 45.459.651 von Kongo-Otto am 16.09.13 18:59:42Hab`s auch gerade gesehen - sieht gut aus!

Gruß

reini81

Gruß

reini81

Antwort auf Beitrag Nr.: 45.460.093 von reini81 am 16.09.13 20:00:48also ich bin wirklich positiv überrascht!

So gut hätte ich es nicht erwartet!

Auch die CAPEX wirkt moderat.

Ob das alles eine fd MK von über 100M$ rechtfertigt sei mal dahingestellt, aber die Meldung ist jedenfalls top!

So gut hätte ich es nicht erwartet!

Auch die CAPEX wirkt moderat.

Ob das alles eine fd MK von über 100M$ rechtfertigt sei mal dahingestellt, aber die Meldung ist jedenfalls top!

Antwort auf Beitrag Nr.: 45.460.143 von Kongo-Otto am 16.09.13 20:07:21Find ich auch! Bin ganz deiner Meinung!

NPV,IRR,Capex,recovery,cash cost.... einwandfrei.

P&L

SEPPi

NPV,IRR,Capex,recovery,cash cost.... einwandfrei.

P&L

SEPPi

Antwort auf Beitrag Nr.: 45.460.143 von Kongo-Otto am 16.09.13 20:07:21Hallo Kongo-Otto,

PEA ist nicht schlecht.......denk mal der CAPEX ist in Afrika

ohnehin ein bisschen billiger.

Gold müsste mal steigen.......

PEA ist nicht schlecht.......denk mal der CAPEX ist in Afrika

ohnehin ein bisschen billiger.

Gold müsste mal steigen.......

roxgold aktuell 0,55 cad

mk 71 mio. dollar

mk 71 mio. dollar

Nix mehr los im Forum von Roxgold......ich habe noch alle Aktien.....und

warte auf einen besseren Goldkurs......durchhalten ist angesagt.

warte auf einen besseren Goldkurs......durchhalten ist angesagt.

Roxgold aktuell 0,44 cad

seht ihr in roxgold auch ein pot. Übernahmeziel?

seht ihr in roxgold auch ein pot. Übernahmeziel?

Antwort auf Beitrag Nr.: 46.137.233 von Global-Player83 am 31.12.13 21:39:50Wenn es eine gut Übernahme ist hab ich nichts dagegen. Der Goldpreis

muss mitspielen.

muss mitspielen.

Roxgold Inc. übernimmt die XDM Royalty Corp.

http://www.rohstoff-welt.de/news/artikel.php?sid=46768

http://www.rohstoff-welt.de/news/artikel.php?sid=46768

Antwort auf Beitrag Nr.: 46.168.699 von fmhbolero am 06.01.14 21:44:44Danke für die Info...............bin immer noch voll investiert.......

die Zeit für Roxgold wird kommen.

Keiner mehr investiert?

die Zeit für Roxgold wird kommen.

Keiner mehr investiert?

Antwort auf Beitrag Nr.: 46.279.715 von Aktiengeier_1 am 22.01.14 17:21:51Kein Intresse, weder hier noch in CAN.

Vorgestern Kapitalerhöhung:

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aROG-21520…

Der Kurs ist davon ganz unbeeindruckt

http://www.stockwatch.com/News/Item.aspx?bid=Z-C%3aROG-21520…

Der Kurs ist davon ganz unbeeindruckt

Ein Insider hat 477,500 Stück gekauft.....ganz schön viel!

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeM…

Schon wieder ein Insiderkauf bei Roxgold von 104500 Stück...........was ist hier los......jetzt sollte mal der Kurs wieder steigen.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

Und noch ein Kauf......von 58000 Stück......auf der Internetseite auf im

unteren Reiter auf Marker gehen.....dann sieht man den Insiderkauf.

Ganz schön viel Käufe.......hoffentlich macht das Ebola Virus keine Problem

welches sich in der Gegend um Guinea in Afrika ausbreitet.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

unteren Reiter auf Marker gehen.....dann sieht man den Insiderkauf.

Ganz schön viel Käufe.......hoffentlich macht das Ebola Virus keine Problem

welches sich in der Gegend um Guinea in Afrika ausbreitet.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

Ich werde hier mal prüfen was Insiderkäufe wirklich bringen. In den letzten Handelstagen wurden fast 900.000 Aktien gekauft. Heute auch wieder ein Insiderkaufvon 120.000 Stück. Bin gespannt ob hier was positives kommt

die nächsten Wochen.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

die nächsten Wochen.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

Zwar schon ein bisschen älter aber jetzt kann Roxgold wieder in Ruhe

der Exploration nachgehen, da die Kasse wieder gefüllt ist.

Roxgold Inc. meldete gestern den Abschluss des zuvor angekündigten öffentlichen Angebots von 49.680.000 Stammaktien. Der Verkauf lief gemäß dem Kurzprospekt vom 17. März 2014 ab und erzielte einen Bruttoertrag von 28.814.400 CAD. Die Emissionsmittler erwarben alle 6.480.000 Stammaktien,

die zur Ausgabe verfügbar waren im Sinne der Ausübung ihrer Mehrzuteilungsoption, zusätzlich zu den 43.200.000 Stammaktien, zu deren Erwerb sich die Emissionsmittler bereits verpflichtet hatten. Das Unternehmen verfügt derzeit über 235.782.698 ausgegebene und ausstehende Stammaktien.

Der Nettoerlös des Angebots soll für den Ausbau des Yaramoko-Goldprojekts und die weitere Exploration der Liegenschaft genutzt werden sowie für allgemeine Betriebskapitalzwecke.

© Redaktion MinenPortal.de

Redaktion, 26.03.14 - 10:10 Uhr

der Exploration nachgehen, da die Kasse wieder gefüllt ist.

Roxgold Inc. meldete gestern den Abschluss des zuvor angekündigten öffentlichen Angebots von 49.680.000 Stammaktien. Der Verkauf lief gemäß dem Kurzprospekt vom 17. März 2014 ab und erzielte einen Bruttoertrag von 28.814.400 CAD. Die Emissionsmittler erwarben alle 6.480.000 Stammaktien,

die zur Ausgabe verfügbar waren im Sinne der Ausübung ihrer Mehrzuteilungsoption, zusätzlich zu den 43.200.000 Stammaktien, zu deren Erwerb sich die Emissionsmittler bereits verpflichtet hatten. Das Unternehmen verfügt derzeit über 235.782.698 ausgegebene und ausstehende Stammaktien.

Der Nettoerlös des Angebots soll für den Ausbau des Yaramoko-Goldprojekts und die weitere Exploration der Liegenschaft genutzt werden sowie für allgemeine Betriebskapitalzwecke.

© Redaktion MinenPortal.de

Redaktion, 26.03.14 - 10:10 Uhr

Immer wieder Insiderkäufe heute wieder 82500 Stück....schon bemerkenswert!

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG

Wieder ein fetter Insiderkauf von 1474588 Stück. Der Kurs geht langsam

nach oben.....ich hoffe das hält an.

nach oben.....ich hoffe das hält an.

Antwort auf Beitrag Nr.: 46.870.170 von Aktiengeier_1 am 24.04.14 18:20:25Quelle zum Insiderkauf http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

Hier mal die Jahreszahlen von Roxgold wie fandet ihr die Machbarkeitstudie??

Roxgold Inc. veröffentlicht Jahresergebnisse für 2013

Roxgold Inc. Roxgold Inc. gab heute die Ergebnisse für das am 31. Dezember 2013 geendete Finanzjahr bekannt.

Der Nettoverlust des Unternehmens belief sich auf 5,3 Mio. USD bzw. 0,03 USD je Aktie, ein deutlicher Rückgang gegenüber 30,6 Mio. USD (0,26 USD je Aktie) innerhalb der 14 Monate bis zum 31. Dezember 2012.

Zum 31. Dezember 2013 verfügte das Unternehmen über Barmittel und Barmitteläquivalente in Höhe von 17,7 Mio. USD und damit mehr als doppelt soviel wie ein Jahr zuvor (8,6 Mio. USD).

Am 31. Dezember 2013 schloss Roxgold Inc. die Übernahme von XMD Royalty Corporation ab.

Roxgold Inc. veröffentlicht Jahresergebnisse für 2013

Roxgold Inc. Roxgold Inc. gab heute die Ergebnisse für das am 31. Dezember 2013 geendete Finanzjahr bekannt.

Der Nettoverlust des Unternehmens belief sich auf 5,3 Mio. USD bzw. 0,03 USD je Aktie, ein deutlicher Rückgang gegenüber 30,6 Mio. USD (0,26 USD je Aktie) innerhalb der 14 Monate bis zum 31. Dezember 2012.

Zum 31. Dezember 2013 verfügte das Unternehmen über Barmittel und Barmitteläquivalente in Höhe von 17,7 Mio. USD und damit mehr als doppelt soviel wie ein Jahr zuvor (8,6 Mio. USD).

Am 31. Dezember 2013 schloss Roxgold Inc. die Übernahme von XMD Royalty Corporation ab.

Antwort auf Beitrag Nr.: 46.870.192 von Aktiengeier_1 am 24.04.14 18:23:27

Name

Shares Held

Position Value

% of Outsanding

1832 Asset ...

32.0M

$17,236,114

13.6%

Lion Manager Pty ...

24.3M

$16,369,047

10.3%

Appian Natural ...

23.9M

$13,823,794

10.1%

ANRH SARL

23.9M

$13,161,508

10.1%

Sprott Asset ...

8.4M

$3,505,695

3.6%

na und,

die kaufen aus der neuen KE

Name

Shares Held

Position Value

% of Outsanding

1832 Asset ...

32.0M

$17,236,114

13.6%

Lion Manager Pty ...

24.3M

$16,369,047

10.3%

Appian Natural ...

23.9M

$13,823,794

10.1%

ANRH SARL

23.9M

$13,161,508

10.1%

Sprott Asset ...

8.4M

$3,505,695

3.6%

na und,

die kaufen aus der neuen KE

Share Structure

Share Structure

Basic Shares Issued and Outstanding: (as at Feb. 28, 2014) 235,782,698

Fully Diluted: 247,245,910

Market Capitalization: ~$151 million

Current Share Price: $0.64 (Mar. 31, 2014)

52-week high -- 52-week low: C$0.76 -- $0.36

Board & Management Holdings: 6%

Share Structure

Basic Shares Issued and Outstanding: (as at Feb. 28, 2014) 235,782,698

Fully Diluted: 247,245,910

Market Capitalization: ~$151 million

Current Share Price: $0.64 (Mar. 31, 2014)

52-week high -- 52-week low: C$0.76 -- $0.36

Board & Management Holdings: 6%

Roxgold Inc. Wie der kanadische Goldexplorer Roxgold Inc. am Freitag mitteilte, wurden seinen Mitarbeitern Anreiz-Aktienoptionen gewährt, welche zum Erwerb von insgesamt 150.000 Stammaktien berechtigen. Ausübbar sind die Optionen bis zum 25. April 2019 zu einem festgesetzten Preis von 0,67 $ je Aktie.

Das Unternehmen hatte in der vergangenen Woche zudem die Ergebnisse des Gesamtjahres 2013 veröffentlicht. Während dieses Zeitraumes wurde dabei ein Nettoverlust von 5,3 Mio. $ bzw. 0,03 $ je Aktie verzeichnet.

© Redaktion MinenPortal.de

Das Unternehmen hatte in der vergangenen Woche zudem die Ergebnisse des Gesamtjahres 2013 veröffentlicht. Während dieses Zeitraumes wurde dabei ein Nettoverlust von 5,3 Mio. $ bzw. 0,03 $ je Aktie verzeichnet.

© Redaktion MinenPortal.de

Noch was gefunden......

Nettobarwert von 250 Mio. Dollar

Dollar Roxgold präsentiert positive Machbarkeitsstudie

Geschrieben von Björn Junker • 23. April 2014 • Druckversion

Die kanadische Roxgold (WKN A1CWW3) hat eine Machbarkeitsstudie für ihr Yaramoko-Projekt in Burkina Faso veröffentlicht, die davon ausgeht, dass die Mine über eine Lebensdauer von sieben Jahren durchschnittlich 99.500 Unzen Gold pro Jahr produzieren wird. Die durchschnittlichen „all-in sustaining costs" werden auf 590 USD pro Unze geschätzt.

Der interne Zinsfuß nach Steuern wird mit 48,4% angegeben und die Amortisierungsdauer auf 1,6 Jahre geschätzt. Darüber hinaus wird in der nun veröffentlichten Machbarkeitsstudie ein Nettobarwert nach Steuern von 250 Mio. Dollar für Yaramoko angesetzt. CEO John Dorward beschreibt Yaramoko zudem als Projekt mit hohen Margen und vergleichsweise niedrigem Investitionsbedarf vor Produktionsbeginn. In der Studie werden diese Kosten mit 106,4 Mio. Dollar angesetzt. Roxgold legt bei seinen Berechnungen einen Goldpreis von 1.300 USD pro Unze zugrunde.

Nettobarwert von 250 Mio. Dollar

Dollar Roxgold präsentiert positive Machbarkeitsstudie

Geschrieben von Björn Junker • 23. April 2014 • Druckversion

Die kanadische Roxgold (WKN A1CWW3) hat eine Machbarkeitsstudie für ihr Yaramoko-Projekt in Burkina Faso veröffentlicht, die davon ausgeht, dass die Mine über eine Lebensdauer von sieben Jahren durchschnittlich 99.500 Unzen Gold pro Jahr produzieren wird. Die durchschnittlichen „all-in sustaining costs" werden auf 590 USD pro Unze geschätzt.

Der interne Zinsfuß nach Steuern wird mit 48,4% angegeben und die Amortisierungsdauer auf 1,6 Jahre geschätzt. Darüber hinaus wird in der nun veröffentlichten Machbarkeitsstudie ein Nettobarwert nach Steuern von 250 Mio. Dollar für Yaramoko angesetzt. CEO John Dorward beschreibt Yaramoko zudem als Projekt mit hohen Margen und vergleichsweise niedrigem Investitionsbedarf vor Produktionsbeginn. In der Studie werden diese Kosten mit 106,4 Mio. Dollar angesetzt. Roxgold legt bei seinen Berechnungen einen Goldpreis von 1.300 USD pro Unze zugrunde.

Das ist mal wieder ein Hausnummer, kann nicht mehr lange dauern, bis der Kurs anzieht.

Roxgold Intercepts 226.76 Grams Per Tonne Gold Over 3.1 Metres (2.7 Metres True Width) In Drilling At Bagassi South

http://www.roxgold.com/s/NewsReleases.asp?ReportID=651346&_T…

Roxgold Intercepts 226.76 Grams Per Tonne Gold Over 3.1 Metres (2.7 Metres True Width) In Drilling At Bagassi South

http://www.roxgold.com/s/NewsReleases.asp?ReportID=651346&_T…

Antwort auf Beitrag Nr.: 46.930.100 von CFalko am 06.05.14 16:57:44Ja endlich könnte hier der Befreiungsschlag kommen.....weiter so.

Wieder ein dicker Insiderkauf von 300k........der Kurs zieht auch nach

oben.

oben.

Antwort auf Beitrag Nr.: 46.987.556 von Aktiengeier_1 am 15.05.14 13:58:37Hier der Link dazu

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

Wieder ein riesiger Insiderkauf von 1 Mio............

Der Kurs schiebt sich nach oben. Das Yaramoko Peojekt könnte wirklich

eine Mine werden wenn das Management die Finanzierung hinbekommt.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

Der Kurs schiebt sich nach oben. Das Yaramoko Peojekt könnte wirklich

eine Mine werden wenn das Management die Finanzierung hinbekommt.

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG+…

Roxgold hatte am Freitag wieder einen dicken Insiderkauf

von 2.271.500 Stück.........wer kauft schon so viel Aktien?

Wir werden sehen ob der Kurs weiter nach oben geht!

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG

Einfach im im unteren Reiter auf Marker gehen dann sieht man

die Insiderkäufe.

von 2.271.500 Stück.........wer kauft schon so viel Aktien?

Wir werden sehen ob der Kurs weiter nach oben geht!

http://www.canadianinsider.com/node/7?menu_tickersearch=ROG

Einfach im im unteren Reiter auf Marker gehen dann sieht man

die Insiderkäufe.

Nicht viel dabei hier bei der Goldperle.....der Chart sieht super aus ein neues hoch heute.

Antwort auf Beitrag Nr.: 47.400.336 von Aktiengeier_1 am 30.07.14 16:54:48Absolut kein Interesse bei uns, naja vielleicht ab 2 EUR dann

Ist Roxgold weiterhin ein Kauf ??

Brent Cook meinte das sie ein gutes Deposit haben.

Brent Cook meinte das sie ein gutes Deposit haben.

Antwort auf Beitrag Nr.: 47.775.177 von Szween am 14.09.14 00:50:59Ich beobachte Roxgold schon sehr lange und bin auch investiert. Roxgold für

mich einer der stärksten Gold Explorer die ich im Depo habe.

Wenn Gold mitspielt werden wir hier andere Kurse sehen.

Nur meine Meinung

mich einer der stärksten Gold Explorer die ich im Depo habe.

Wenn Gold mitspielt werden wir hier andere Kurse sehen.

Nur meine Meinung

Nicht viel los hier im Forum......der Kurs hat zwar einen Rücksetzer erfahren wie auch die meisten anderen Werte im Goldsektor........aber die 1190 USD bei Gold wurden erfolgreich verteitigt..........es könnte die Wende einleiten.

Insiderkauf von heute von 1,54 Millionen Aktien könnte damit zusammenhängen bin mir aber nicht sicher.

https://www.canadianinsider.com/node/7?menu_tickersearch=Rox…

Roxgold Inc. Announces C$30 Million Bought Deal Financing

Nachrichtenquelle: Marketwired | 14.10.2014, 14:15

TORONTO, ONTARIO--(Marketwired - Oct. 14, 2014) -

Roxgold Inc. (TSX VENTURE:ROG) ("Roxgold" or the "Company") is pleased to announce that it has entered into an agreement with a syndicate of investment dealers co-led by Cormark Securities Inc. and BMO Capital Markets and including Macquarie Capital Markets Canada Ltd., GMP Securities L.P., RBC Capital Markets, Haywood Securities Inc., Canaccord Genuity Corp. and Raymond James Ltd. (the "Underwriters"), which have agreed to purchase, on a bought deal basis, 46.2 million units of Roxgold (the "Units") at a purchase price of $0.65 per Unit (the "Offering Price"), for aggregate gross proceeds in the amount of approximately $30 million. Each Unit will consist of one common share of Roxgold (a "Unit Share") and one-half of one common share purchase warrant (each full warrant, a "Warrant"), each full Warrant being exercisable to acquire one common share of Roxgold at a purchase price of $0.90 for a period of 15 months following the closing date.

In addition, the Company has granted the Underwriters an option to purchase up to an additional 6.93 million Units at the Offering Price exercisable within 30 days after the closing of the offering for additional gross proceeds in the amount of up to approximately $4.5 million.

The offering is scheduled to close on or about November 4, 2014 and is subject to certain conditions including, but not limited to, the receipt of all necessary approvals including the approval of the TSX Venture Exchange and the securities regulatory authorities.

The net proceeds from the offering will be used to advance development of the Yaramoko Gold Project and for general corporate purposes.

These securities offered have not been registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

This press release shall not constitute an offer to sell or solicitation of an offer to buy the securities in any jurisdiction. The common shares will not be and have not been registered under the United States Securities Act of 1933 and may not be offered or sold in the United States absent registration or applicable exemption from the registration requirements.

https://www.canadianinsider.com/node/7?menu_tickersearch=Rox…

Roxgold Inc. Announces C$30 Million Bought Deal Financing

Nachrichtenquelle: Marketwired | 14.10.2014, 14:15

TORONTO, ONTARIO--(Marketwired - Oct. 14, 2014) -

Roxgold Inc. (TSX VENTURE:ROG) ("Roxgold" or the "Company") is pleased to announce that it has entered into an agreement with a syndicate of investment dealers co-led by Cormark Securities Inc. and BMO Capital Markets and including Macquarie Capital Markets Canada Ltd., GMP Securities L.P., RBC Capital Markets, Haywood Securities Inc., Canaccord Genuity Corp. and Raymond James Ltd. (the "Underwriters"), which have agreed to purchase, on a bought deal basis, 46.2 million units of Roxgold (the "Units") at a purchase price of $0.65 per Unit (the "Offering Price"), for aggregate gross proceeds in the amount of approximately $30 million. Each Unit will consist of one common share of Roxgold (a "Unit Share") and one-half of one common share purchase warrant (each full warrant, a "Warrant"), each full Warrant being exercisable to acquire one common share of Roxgold at a purchase price of $0.90 for a period of 15 months following the closing date.

In addition, the Company has granted the Underwriters an option to purchase up to an additional 6.93 million Units at the Offering Price exercisable within 30 days after the closing of the offering for additional gross proceeds in the amount of up to approximately $4.5 million.

The offering is scheduled to close on or about November 4, 2014 and is subject to certain conditions including, but not limited to, the receipt of all necessary approvals including the approval of the TSX Venture Exchange and the securities regulatory authorities.

The net proceeds from the offering will be used to advance development of the Yaramoko Gold Project and for general corporate purposes.

These securities offered have not been registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

This press release shall not constitute an offer to sell or solicitation of an offer to buy the securities in any jurisdiction. The common shares will not be and have not been registered under the United States Securities Act of 1933 and may not be offered or sold in the United States absent registration or applicable exemption from the registration requirements.

eigentlich tolle zahlen, wenn nicht die bewertung schon so derbe wäre.

werde mir mal die rox auf die watch legen.

werde mir mal die rox auf die watch legen.

Der Sturz der Regierung in Burkina Faso geht auch an Roxgold nicht

ohne Spuren vorbei...obwohl das Roxgold Personal nicht betroffen sein soll.

Echt ärgerlich!

Der Miese Goldpreis noch dazu......wir sehen auch wieder bessere Zeiten.

Trotzdem hat eine Insider gekauft am Freitag 33500 Stück gekauft.

https://www.canadianinsider.com/node/7?menu_tickersearch=ROG…

ohne Spuren vorbei...obwohl das Roxgold Personal nicht betroffen sein soll.

Echt ärgerlich!

Der Miese Goldpreis noch dazu......wir sehen auch wieder bessere Zeiten.

Trotzdem hat eine Insider gekauft am Freitag 33500 Stück gekauft.

https://www.canadianinsider.com/node/7?menu_tickersearch=ROG…

Nov 4 (Reuters) - Roxgold Inc ROG.V :

* Announces closing of C$30 million bought deal financing and approval of the yaramoko exploitation permit

* Says burkina faso council of ministers approved the issuance of the yaramoko exploitation permit

* Says approval will allow Roxgold to progress the development of the yaramoko gold project

* Announces closing of C$30 million bought deal financing and approval of the yaramoko exploitation permit

* Says burkina faso council of ministers approved the issuance of the yaramoko exploitation permit

* Says approval will allow Roxgold to progress the development of the yaramoko gold project

Roxgold provides financing and project development update

TORONTO, Dec. 29, 2014 /PRNewswire/ - Roxgold Inc. (TSX.V:ROG) ("Roxgold" or the "Company") is pleased to announce that it has signed an updated mandate and commitment arrangement with Societe Generale Corporate and Investment Banking ("Societe Generale") to replace the commitment letter announced on September 30, 2014 which expired on December 25, 2014. Under the revised arrangement, Societe Generale has reconfirmed, subject to the conditions described below, its commitment to provide US$37.5 million of project finance and to act as sole Mandated Lead Arranger ("MLA") for the balance under the US$75 million facility. The commitment has been extended on the same terms as those outlined in the September 30, 2014 press release.

Credit Suisse AG has elected not to extend its previously announced commitment to provide US$37.5 million of project finance debt. Roxgold and Societe Generale are in discussions with a number of experienced project finance banks and are working toward closing the updated debt facility in Q1 2015 utilizing the extensive due diligence and documentation work already completed in 2014. As the availability of the financing facility is subject to a number of conditions precedent, including the receipt by Roxgold of the mining decree for the previously approved mining permit at Yaramoko and other standard conditions precedent for facilities of this nature including completion of due diligence by any new lender and finalization of documentation, there can be no assurance that the debt facility transaction will complete. The Societe Generale reconfirmed commitment of US$37.5 million is also subject to it arranging the balance of the US$75 million facility.

Roxgold remains well financed to pursue early works at the Yaramoko Gold Project with approximately US$42 million in cash. In addition, the Company has the ability to issue up to US$15 million in equity to its underground mining contractor, African Underground Mining Services, once underground development commences.

Project Development

Notwithstanding the recent events in Burkina Faso, Roxgold has continued to make significant progress on developing the Yaramoko Gold Project. Recent highlights include the following:

* Detailed Design and Engineering has been completed;

* SAG mill being manufactured by Outotec is on schedule and is 60% complete;

* Armtec tunnel for underground mine access is now complete and awaiting shipment; and

* Design of the powerline to access the grid is complete and long lead item procurement, including tower steel and transformer, is approximately 40% complete.

In addition, the Company has made a key appointment, with Mr. Iain Cox joining Roxgold as Yaramoko's General Manager Operations.

Iain Cox is a mining engineer with significant experience in West Africa and the start-up of underground mining operations. Iain has directly relevant experience from roles performed in Ghana, Egypt, Vietnam, the Philippines, Turkey, Indonesia and Australia for companies including Newmont/Normandy, Centamin and Crew Gold. Over the last 19 years he has held senior leadership roles in development and operational phases at many underground mining projects.

Mr. Cox holds a Bachelor of Engineering from the University of Queensland as well as an MBA from Latrobe University.

Paul Criddle, Roxgold's Chief Operating Officer, commented: "We are delighted to welcome Iain to Roxgold, as he is a high caliber professional who brings a great deal of experience to the project. We are confident that he will contribute to Yaramoko's success as we continue to move forward with our development strategy."

Key early works contracts have been advanced and, pending receipt of the formal mining decree, Roxgold is in a strong position to initiate site works at Yaramoko. The Company has agreed the terms for key items of infrastructure, including the permanent camp and bulk earthworks, which will commence shortly after the award of the mining decree. Given progress on critical path items such as detailed design and engineering and the SAG mill, Roxgold remains confident that Yaramoko will be in production just over a year following the award of the mining decree.

"Despite recent challenges in Burkina Faso, Roxgold is in excellent shape for the commencement of development at Yaramoko," commented John Dorward, President and CEO. "We have a strong treasury, excellent partners in the form of AUMS and Societe Generale, and we have continued to attract experienced and motivated people to our company."

Roxgold announces graduation to Tier 1 of the TSX Venture Exchange

TORONTO, Dec. 31, 2014 /PRNewswireRoxgold Inc. (TSX.V:ROG) ("Roxgold" or the "Company") is pleased to announce that it has been approved for graduation from Tier 2 Issuer status to Tier 1 Issuer status by the TSX Venture Exchange.

Roxgold will commence trading as a Tier 1 Issuer on the TSX Venture Exchange on Friday, January 2, 2015.

Tier 1 is the Exchange's premier tier and is reserved for the Exchange's most advanced Issuers with the most significant financial resources. Tier 1 Issuers benefit from decreased filing requirements and improved service standards.

PRNewswire

Antwort auf Beitrag Nr.: 48.674.492 von fmhbolero am 31.12.14 20:05:44Danke für deine Beiträge ich dacht schon ich bin allein im Forum

Bist du in Roxgold investiert oder beobachtest du den Goldwert nur?

Ich bin schon lange investiert immer mal wieder ein Trading aber die

Hauptposition bleibt stehen.

Für mich ein guter Goldwert.....wir werden uns freuen wenn der Goldpreis

bzw. der HUI mitspielt.

Bist du in Roxgold investiert oder beobachtest du den Goldwert nur?

Ich bin schon lange investiert immer mal wieder ein Trading aber die

Hauptposition bleibt stehen.

Für mich ein guter Goldwert.....wir werden uns freuen wenn der Goldpreis

bzw. der HUI mitspielt.

Antwort auf Beitrag Nr.: 48.679.250 von Aktiengeier_1 am 02.01.15 11:22:05Moin, Du bist hier nicht alleine.

Ich halte eine kleine Position von 4500 Stück und warte die weitere Entwicklung in Burkina Faso erstmal ab.

Ich halte eine kleine Position von 4500 Stück und warte die weitere Entwicklung in Burkina Faso erstmal ab.

Gold macht sich gut........wie auch der Goldminenindex HUI.

Roxgold zurück zu alter Form

Roxgold zurück zu alter Form

"Baugenehmigung" ist da ...

Roxgold recieves approval for Yaramoko gold project from Burkina Faso15:05 (30/01) - Source: RTRS

Jan 30 (Reuters) - Roxgold Inc ROG.V :

* Says has received its final permitting approval for the yaramoko gold project from the government of burkina faso

* Says expects to commence initial site works in the coming weeks

>> KLICK <<

Antwort auf Beitrag Nr.: 48.939.164 von fmhbolero am 30.01.15 21:00:49Findet ihr Roxgold oder True Gold lukrativer?