Abegeddon - Das Armageddon Japans nach den Abenomics - 500 Beiträge pro Seite

eröffnet am 18.08.13 16:38:46 von

neuester Beitrag 21.01.15 21:50:33 von

neuester Beitrag 21.01.15 21:50:33 von

Beiträge: 72

ID: 1.184.925

ID: 1.184.925

Aufrufe heute: 0

Gesamt: 22.921

Gesamt: 22.921

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| heute 19:46 | 6955 | |

| vor 1 Stunde | 5647 | |

| vor 35 Minuten | 4931 | |

| heute 21:21 | 4540 | |

| vor 1 Stunde | 3184 | |

| heute 19:32 | 2325 | |

| heute 14:53 | 1982 | |

| vor 9 Minuten | 1832 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.182,00 | +0,59 | 217 | |||

| 2. | 3. | 0,1885 | -0,26 | 90 | |||

| 3. | 2. | 1,1800 | -14,49 | 77 | |||

| 4. | 5. | 9,3575 | +0,27 | 60 | |||

| 5. | 4. | 168,60 | -0,93 | 50 | |||

| 6. | Neu! | 0,4400 | +3,53 | 36 | |||

| 7. | Neu! | 4,8025 | +6,45 | 34 | |||

| 8. | Neu! | 11,828 | +13,73 | 31 |

http://www.fuw.ch/article/japanisches-endspiel-in-vier-akten…

Die anstehende Mutter aller Finanzkrisen in Japan bietet ungeahnte Chance. Der kurzfristig bevorstehende starke Anstieg des Nikkei, der Verfall des YEN und die lauernde Herabstufung Japans als solider Schulder bieten dem informierten Investor ungeahnte und exorbitante Gewinnchancen.

Diese Forum verfolgt das Thema.

Die anstehende Mutter aller Finanzkrisen in Japan bietet ungeahnte Chance. Der kurzfristig bevorstehende starke Anstieg des Nikkei, der Verfall des YEN und die lauernde Herabstufung Japans als solider Schulder bieten dem informierten Investor ungeahnte und exorbitante Gewinnchancen.

Diese Forum verfolgt das Thema.

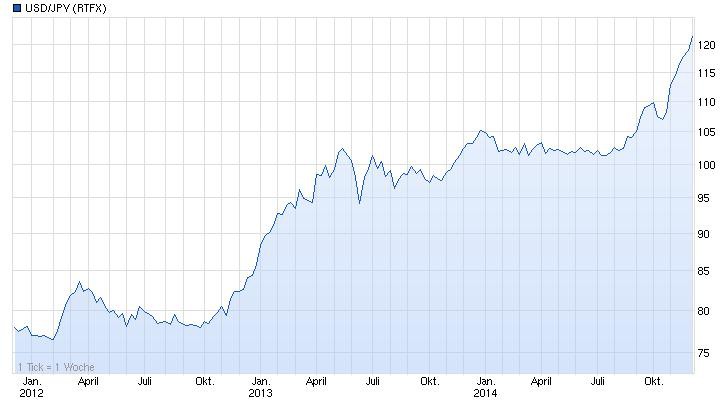

Mit folgenden WKNs kann man z.B. am Abegeddon teilhaben. Ich persönlich gehe für Ende nächstes Jahres von einem USDJPY Kurs mindestens 130 aus. Potential ist bis 200 - auch wenn das zur Zeit übertrieben erscheint.

DE000DX46GF0

DE000DX46GF0

As markets have begun to stabilize and become more comfortable with the possibility that the Fed may taper, aided in large part by Fed assurances that any move to reduce purchases will be data dependent, one of Credit Suisse's preferred trades has come back into play with the yen resuming its weakness against the USD.

In line with this, the yen has resumed its downward trend over recent weeks, once again breaching the psychological 100 level yesterday and it was always likely that 100 would prove a substantial barrier, with little surprise that the rush through the key level in May proved a false dawn.

However, notwithstanding the near-term technical challenge, CS argues that the underlying rational for a weaker yen remains compelling based on the following 4 factors:

1. The Japanese authorities 'need' a weaker yen to kick off the reflationary process. Recall that the current bold experiment is in many ways Japan’s 'last shot in the locker', a fact that is well recognized by both Mr Abe and Mr Koruda - if the yen were to appreciate now the credibility of Abe economics would necessitate further action to weaken the currency.

2. In terms of relative valuation, at current levels the yen remains below the OECD’s estimate of PPP. Indeed the yen would not become 'cheap' on this measure until 120 - which happens to coincide with CS' 12 month forecast.

3. Continued divergence in monetary policy between Japan and the US - Japan is stepping up its easing - should ultimately push the yen lower.

4. The US remains supportive of Japan’s reflationary push and in our view would be happy to tolerate a much lower yen.

All up, CS advises clients to stay core short JPY (long USD/JPY) targeting 120 in 12 months.

In line with this, the yen has resumed its downward trend over recent weeks, once again breaching the psychological 100 level yesterday and it was always likely that 100 would prove a substantial barrier, with little surprise that the rush through the key level in May proved a false dawn.

However, notwithstanding the near-term technical challenge, CS argues that the underlying rational for a weaker yen remains compelling based on the following 4 factors:

1. The Japanese authorities 'need' a weaker yen to kick off the reflationary process. Recall that the current bold experiment is in many ways Japan’s 'last shot in the locker', a fact that is well recognized by both Mr Abe and Mr Koruda - if the yen were to appreciate now the credibility of Abe economics would necessitate further action to weaken the currency.

2. In terms of relative valuation, at current levels the yen remains below the OECD’s estimate of PPP. Indeed the yen would not become 'cheap' on this measure until 120 - which happens to coincide with CS' 12 month forecast.

3. Continued divergence in monetary policy between Japan and the US - Japan is stepping up its easing - should ultimately push the yen lower.

4. The US remains supportive of Japan’s reflationary push and in our view would be happy to tolerate a much lower yen.

All up, CS advises clients to stay core short JPY (long USD/JPY) targeting 120 in 12 months.

http://blogs.wsj.com/moneybeat/2013/08/19/fed-helps-make-yen…

...Given this, the dollar’s recent slide back under 97 yen is unlikely to be repeated in the near term and some forecasters are looking for the U.S. currency to eventually push up as far as Y108 on the assumption that the Bank of Japan will ease monetary policy even further at a time when the Fed is doing just the opposite.

...Given this, the dollar’s recent slide back under 97 yen is unlikely to be repeated in the near term and some forecasters are looking for the U.S. currency to eventually push up as far as Y108 on the assumption that the Bank of Japan will ease monetary policy even further at a time when the Fed is doing just the opposite.

http://www.faz.net/aktuell/wirtschaft/wirtschaftspolitik/abe…

Die Bundesbank zeigt offene Skepsis gegenüber der japanischen Wirtschaftspolitik. Die mit dem Regierungswechsel Ende 2012 begonnene Neuausrichtung dürfte die Wirtschaft des Landes zwar vorübergehend erheblich stimulieren. „Mittelfristig entpuppt sich diese Entwicklung aber als konjunkturelles Strohfeuer, dessen Erlöschen die Wirtschaft ab 2015 tendenziell belastet“, schreibt die Deutsche Bundesbank in ihrem am Montag veröffentlichten Monatsbericht für August. Wesentlich dauerhafter sei die stimulierende Wirkung auf die Inflationsrate.

Zu dieser Einschätzung kommt die Bundesbank auf der Grundlage von Simulationsrechnungen. Danach werden die „Abenomics“ (die nach dem japanischen Regierungschef Shinzo Abe benannte Kombination aus aggressiver Geldpolitik und schuldenfinanzierten Konjunkturhilfen) zwar in diesem Jahr das reale Wachstum zusätzlich um 1,25 Prozent steigern, doch schon im kommenden Jahr verbleibe nur noch ein wesentlich kleinerer Effekt. Da das Auslaufen der wachstumssteigernden Maßnahmen voraussichtlich mit der für April 2014 vorgesehenen ersten Stufe der Erhöhung der Mehrwertsteuer zusammenfalle, könnte die Fiskalpolitik die Konjunkturausschläge verstärken, statt sie zu glätten, warnt die Bundesbank. Umso wichtiger sei ein Erfolg der von Abe im Juni nur vage angekündigten Wachstumsstrategie. Es bleibe abzuwarten, ob durchgreifende Reformschritte kämen. Die Zweifel an der Entschlossenheit Abes, die überfälligen Strukturreformen zu wagen, sind zuletzt auch an den Finanzmärkten stark gewachsen.

Die internationalen Wirkungen der „Abenomics werden nach Ansicht der Bundesbank eher gering bleiben. „Trotz der starken Yen-Abwertung kommt es weder in Deutschland noch in einem anderen bedeutenden Wirtschaftsraum zu einem deutlichen Rückgang der gesamtwirtschaftlichen Produktion.“ Oft stellten sich derzeit sogar positive Effekte ein, durch die anziehende japanische Importnachfrage.

Die neuen Zahlen zur Handelsbilanz, die am Montag in Tokio vorgestellt wurden, bestätigten die Thesen der deutschen Notenbanker. Ein starker Importschub hat das Defizit der japanischen Handelsbilanz im Juli weiter in die Höhe getrieben. Wie das japanische Finanzministerium berichtete, wuchs der Passivsaldo in der Handelsbilanz auf 1,024 Billionen Yen (7,8 Milliarden Euro) an. Die drittgrößte Volkswirtschaft der Welt wies damit den 13. Monat in Folge ein Minus aus. Das ist die längste Defizit-Serie seit 1980. Der wichtigste Grund für den rapiden Anstieg der Importe ist, dass seit der Atomkatastrophe in Fukushima 2011 nahezu alle 50 Atomreaktoren abgeschaltet worden sind. Die Energieunternehmen schließen die Energielücke mit Öl- und Kohleimporten, vor allem aber mit der Einfuhr von Flüssiggas.

Die japanischen Importe legten daher auf Jahressicht um 19,6 Prozent auf 6,986 Billionen Yen zu. Die Kosten für Ölimporte stiegen im Jahresvergleich um 30,2 Prozent, die für Flüssiggas um 16,9 Prozent. Die Exporte stiegen um 12,2 Prozent auf 5,962 Billionen Yen. Der Yen verlor gegenüber Juli 2012 um 24,3 Prozent an Wert. Die Exporte sind damit so stark gestiegen wie seit 2010 nicht mehr, sie stehen aber nur für einen relativ kleinen Teil der japanischen Wirtschaft und machen nur rund 15 Prozent des Bruttoinlandsprodukts aus. Doch sie sind entscheidend für Gewinne und Aktienkurse der Exportunternehmen, die rund die Hälfte zum japanischen Wirtschaftswachstum beitragen.

Die Bundesbank zeigt offene Skepsis gegenüber der japanischen Wirtschaftspolitik. Die mit dem Regierungswechsel Ende 2012 begonnene Neuausrichtung dürfte die Wirtschaft des Landes zwar vorübergehend erheblich stimulieren. „Mittelfristig entpuppt sich diese Entwicklung aber als konjunkturelles Strohfeuer, dessen Erlöschen die Wirtschaft ab 2015 tendenziell belastet“, schreibt die Deutsche Bundesbank in ihrem am Montag veröffentlichten Monatsbericht für August. Wesentlich dauerhafter sei die stimulierende Wirkung auf die Inflationsrate.

Zu dieser Einschätzung kommt die Bundesbank auf der Grundlage von Simulationsrechnungen. Danach werden die „Abenomics“ (die nach dem japanischen Regierungschef Shinzo Abe benannte Kombination aus aggressiver Geldpolitik und schuldenfinanzierten Konjunkturhilfen) zwar in diesem Jahr das reale Wachstum zusätzlich um 1,25 Prozent steigern, doch schon im kommenden Jahr verbleibe nur noch ein wesentlich kleinerer Effekt. Da das Auslaufen der wachstumssteigernden Maßnahmen voraussichtlich mit der für April 2014 vorgesehenen ersten Stufe der Erhöhung der Mehrwertsteuer zusammenfalle, könnte die Fiskalpolitik die Konjunkturausschläge verstärken, statt sie zu glätten, warnt die Bundesbank. Umso wichtiger sei ein Erfolg der von Abe im Juni nur vage angekündigten Wachstumsstrategie. Es bleibe abzuwarten, ob durchgreifende Reformschritte kämen. Die Zweifel an der Entschlossenheit Abes, die überfälligen Strukturreformen zu wagen, sind zuletzt auch an den Finanzmärkten stark gewachsen.

Die internationalen Wirkungen der „Abenomics werden nach Ansicht der Bundesbank eher gering bleiben. „Trotz der starken Yen-Abwertung kommt es weder in Deutschland noch in einem anderen bedeutenden Wirtschaftsraum zu einem deutlichen Rückgang der gesamtwirtschaftlichen Produktion.“ Oft stellten sich derzeit sogar positive Effekte ein, durch die anziehende japanische Importnachfrage.

Die neuen Zahlen zur Handelsbilanz, die am Montag in Tokio vorgestellt wurden, bestätigten die Thesen der deutschen Notenbanker. Ein starker Importschub hat das Defizit der japanischen Handelsbilanz im Juli weiter in die Höhe getrieben. Wie das japanische Finanzministerium berichtete, wuchs der Passivsaldo in der Handelsbilanz auf 1,024 Billionen Yen (7,8 Milliarden Euro) an. Die drittgrößte Volkswirtschaft der Welt wies damit den 13. Monat in Folge ein Minus aus. Das ist die längste Defizit-Serie seit 1980. Der wichtigste Grund für den rapiden Anstieg der Importe ist, dass seit der Atomkatastrophe in Fukushima 2011 nahezu alle 50 Atomreaktoren abgeschaltet worden sind. Die Energieunternehmen schließen die Energielücke mit Öl- und Kohleimporten, vor allem aber mit der Einfuhr von Flüssiggas.

Die japanischen Importe legten daher auf Jahressicht um 19,6 Prozent auf 6,986 Billionen Yen zu. Die Kosten für Ölimporte stiegen im Jahresvergleich um 30,2 Prozent, die für Flüssiggas um 16,9 Prozent. Die Exporte stiegen um 12,2 Prozent auf 5,962 Billionen Yen. Der Yen verlor gegenüber Juli 2012 um 24,3 Prozent an Wert. Die Exporte sind damit so stark gestiegen wie seit 2010 nicht mehr, sie stehen aber nur für einen relativ kleinen Teil der japanischen Wirtschaft und machen nur rund 15 Prozent des Bruttoinlandsprodukts aus. Doch sie sind entscheidend für Gewinne und Aktienkurse der Exportunternehmen, die rund die Hälfte zum japanischen Wirtschaftswachstum beitragen.

http://www.handelsblatt.com/politik/konjunktur/nachrichten/g…

[...]Mit Blick auf den starken Einfluss Abes auf die geldpolitische Ausrichtung der japanischen Notenbank warnt die Bundesbank zugleich vor negativen Langzeiteffekten für die Inflationserwartungen: „Wird die Unabhängigkeit einer Notenbank infrage gestellt, kann das dazu führen, dass sich die bestehenden Erwartungsbildungsprozesse zum Beispiel im Hinblick auf die kommende Inflation grundlegend ändern.” Kritiker sehen Abe wegen der von ihm angestoßenen ultralockeren Geldpolitik der Notenbank als Währungsmanipulator, da die Geldschwemme den Yen-Kurs drückt und japanischen Firmen dadurch im Ausland Wettbewerbsvorteile verschafft.

[...]Mit Blick auf den starken Einfluss Abes auf die geldpolitische Ausrichtung der japanischen Notenbank warnt die Bundesbank zugleich vor negativen Langzeiteffekten für die Inflationserwartungen: „Wird die Unabhängigkeit einer Notenbank infrage gestellt, kann das dazu führen, dass sich die bestehenden Erwartungsbildungsprozesse zum Beispiel im Hinblick auf die kommende Inflation grundlegend ändern.” Kritiker sehen Abe wegen der von ihm angestoßenen ultralockeren Geldpolitik der Notenbank als Währungsmanipulator, da die Geldschwemme den Yen-Kurs drückt und japanischen Firmen dadurch im Ausland Wettbewerbsvorteile verschafft.

Antwort auf Beitrag Nr.: 45.288.469 von Casino_Royal am 20.08.13 19:55:04Die Knockout Schwelle bei diesem Papier ist recht weit vom aktuellem Kurs entfernt und sollte in den nächsten Jahren auf keinen Fall mehr erreicht werden.

Antwort auf Beitrag Nr.: 45.288.469 von Casino_Royal am 20.08.13 19:55:04http://www.boj.or.jp/en/announcements/release_2013/k130808a.…

Basis für diese Investmentidee - aus meiner Sicht eine sichere Investmentchance sind die Erklärungen und Taten der Bank Of Japan. In vorher unbekannter Grössenordnung wird hier ein "QE" durchgeführt. Während die FED sich langsam mit einem "Tapering" beschäftigt, also die Flutung der Märkte mit Dollar einschränkt. In Relation zum BSP betreibt die BOJ ein wesentlich grösseres QE als es die FED je tat.

Basis für diese Investmentidee - aus meiner Sicht eine sichere Investmentchance sind die Erklärungen und Taten der Bank Of Japan. In vorher unbekannter Grössenordnung wird hier ein "QE" durchgeführt. Während die FED sich langsam mit einem "Tapering" beschäftigt, also die Flutung der Märkte mit Dollar einschränkt. In Relation zum BSP betreibt die BOJ ein wesentlich grösseres QE als es die FED je tat.

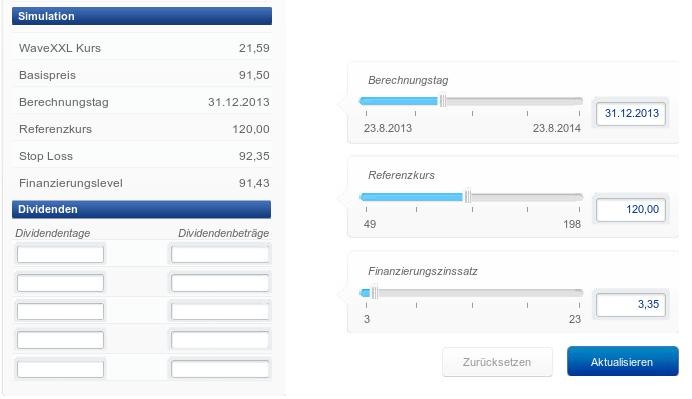

21.59 wäre der Wert dieses Papiers, wenn Credit Suisse recht hätte und der USDJPY Kurs bei 120 läge. Ich rechne ebenso mit einem Kurs von weit über 110 für USDJPY innerhalb der nächsten 6 Monate.

Zitat von sorosinvest: http://www.boj.or.jp/en/announcements/release_2013/k130808a.…

Basis für diese Investmentidee - aus meiner Sicht eine sichere Investmentchance sind die Erklärungen und Taten der Bank Of Japan. In vorher unbekannter Grössenordnung wird hier ein "QE" durchgeführt. Während die FED sich langsam mit einem "Tapering" beschäftigt, also die Flutung der Märkte mit Dollar einschränkt. In Relation zum BSP betreibt die BOJ ein wesentlich grösseres QE als es die FED je tat.

[...]The Bank of Japan will conduct money market operations so that the monetary base will

increase at an annual pace of about 60-70 trillion yen. [...]

Antwort auf Beitrag Nr.: 45.309.121 von sorosinvest am 23.08.13 10:07:39http://forexreportdaily.com/yen-touches-one-month-low-versus…

[..]BOJ officials have really got to maintain what they’ve done,” said Derek Mumford, a director at Rochford Capital, a currency risk-management company in Sydney. “They’ve also got to look to pressure the government as much as they possibly can to fulfill their side of the bargain with structural reform. There’s potential for the yen to weaken in the very near term.[..]

[..]BOJ officials have really got to maintain what they’ve done,” said Derek Mumford, a director at Rochford Capital, a currency risk-management company in Sydney. “They’ve also got to look to pressure the government as much as they possibly can to fulfill their side of the bargain with structural reform. There’s potential for the yen to weaken in the very near term.[..]

Antwort auf Beitrag Nr.: 45.309.061 von sorosinvest am 23.08.13 10:03:15Zur Dokumentation:

am 18.8. (Sonntags) wurde das Papier erstmals erwähnt. Am Montag den 19.8.2013 hatte es einen Kurs von 5.49 EUR.

Heute sind wir bei 6.54 - meine Erwartung, dass dieses Papier im Zeitraum von 6 Monaten zu 20 EUR zu verkaufen ist.

am 18.8. (Sonntags) wurde das Papier erstmals erwähnt. Am Montag den 19.8.2013 hatte es einen Kurs von 5.49 EUR.

Heute sind wir bei 6.54 - meine Erwartung, dass dieses Papier im Zeitraum von 6 Monaten zu 20 EUR zu verkaufen ist.

Interessiert eigentlich jemanden was ich hier schreiben?

Interesse an Abegeddon?

http://ugeist.com/q/g66dnqLXGg

Interesse an Abegeddon?

http://ugeist.com/q/g66dnqLXGg

Antwort auf Beitrag Nr.: 45.311.625 von sorosinvest am 23.08.13 14:51:26End Of Thread!

https://www.xmarkets.db.com/DE/Produkt_Detail/DE000DX46GF0?s…

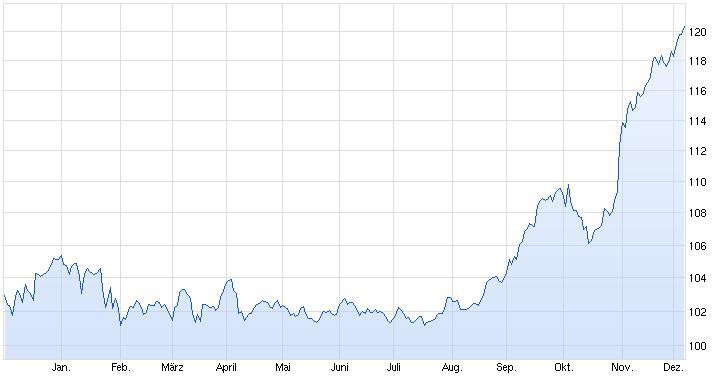

Zur Zeit steht das erwähnte Papier bei 8,32.

Zur Zeit steht das erwähnte Papier bei 8,32.

Zitat von sorosinvest: https://www.xmarkets.db.com/DE/Produkt_Detail/DE000DX46GF0?s…

Zur Zeit steht das erwähnte Papier bei 8,32.

8,51

Ziel 20 Anfang nächstes Jahr.

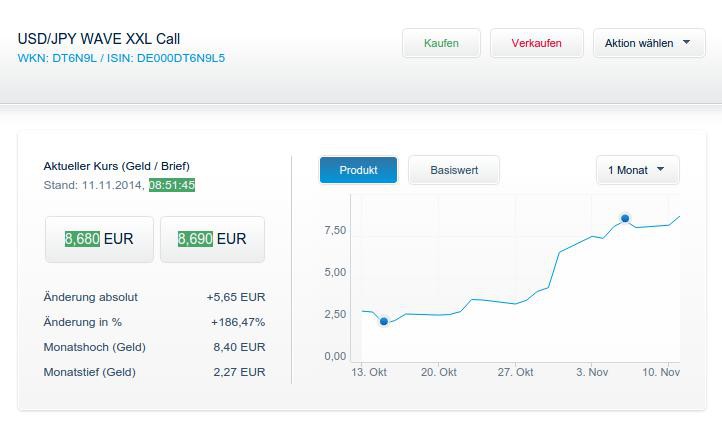

8,70 EUR

(60 % Profit - still counting...)

(60 % Profit - still counting...)

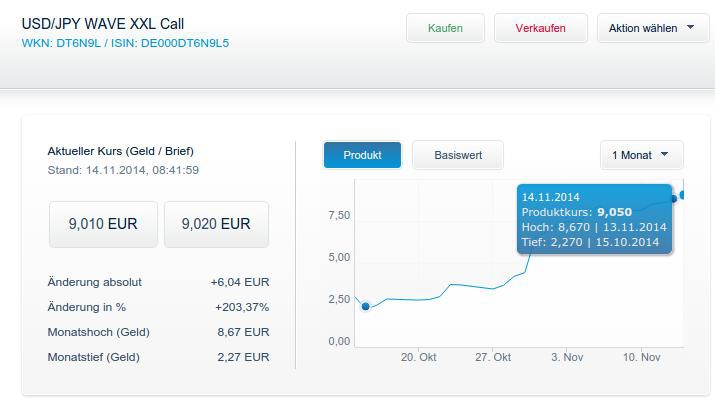

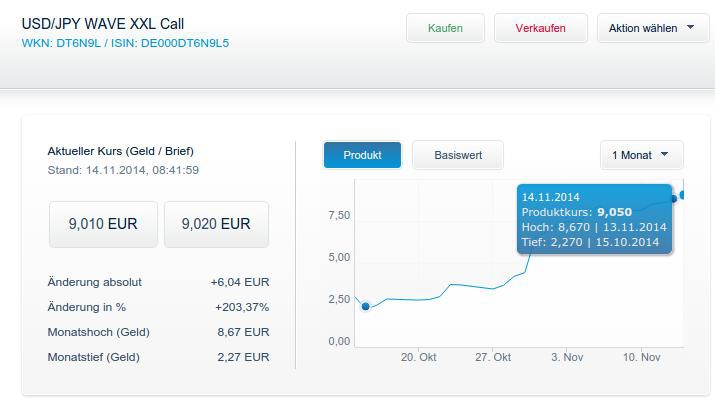

9,1EUR - still counting

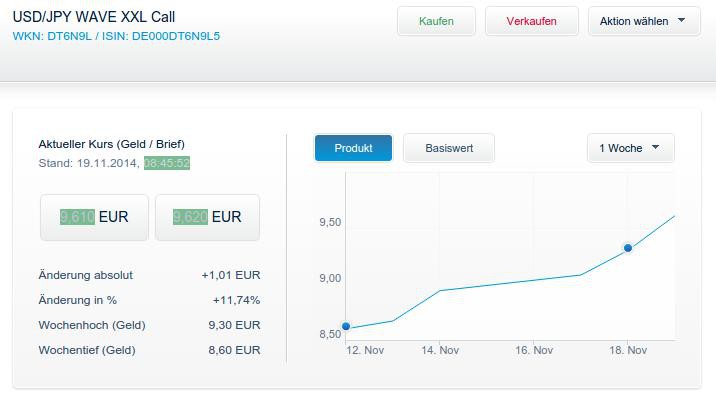

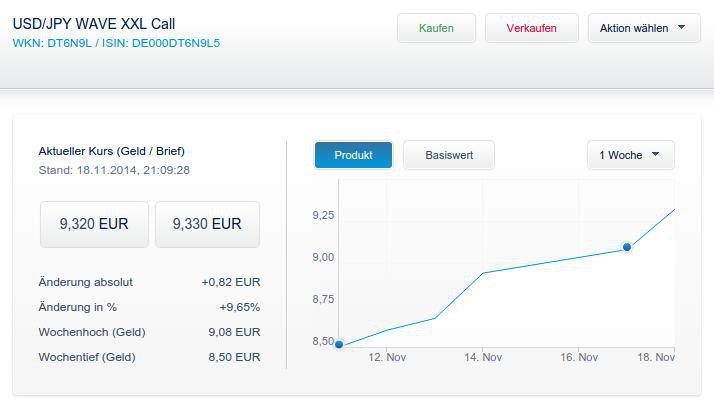

9,6EUR - still counting

USDJPY Trend’s Long Term Drivers Intact

This entrenched long term USDJPY trend has the kind of potent, enduring fundamental support that should make one of the safest trends for long term, risk-averse investors to ride. In particular:

The Fed is slowly but surely tightening its monetary policy for the foreseeable future, which should support a stronger dollar.

The Bank of Japan is headed in the opposite policy direction, and openly admits it wants a weaker Yen.

If the aphorism “don’t fight the Fed” has worked for investors in recent years, it should work even better now that it’s got the BoJ allied with it.

Even better, you don’t even need to trust the central banks intentions. Deeper underlying economic and demographic fundamentals suggest that the US economy should do better over the coming years, and that too implies higher USD interest rates and a continued USDJPY uptrend.

You don’t have to take my word for it. Deutsche Bank sees it hitting 115 in 2014. For over a year Kyle Bass of Hayman Capital has been saying the pair will eventually be above 200. Rock-star pundit John Mauldin sees it going to 300 in the coming 10 years, calling it the “trade of the decade.”

This entrenched long term USDJPY trend has the kind of potent, enduring fundamental support that should make one of the safest trends for long term, risk-averse investors to ride. In particular:

The Fed is slowly but surely tightening its monetary policy for the foreseeable future, which should support a stronger dollar.

The Bank of Japan is headed in the opposite policy direction, and openly admits it wants a weaker Yen.

If the aphorism “don’t fight the Fed” has worked for investors in recent years, it should work even better now that it’s got the BoJ allied with it.

Even better, you don’t even need to trust the central banks intentions. Deeper underlying economic and demographic fundamentals suggest that the US economy should do better over the coming years, and that too implies higher USD interest rates and a continued USDJPY uptrend.

You don’t have to take my word for it. Deutsche Bank sees it hitting 115 in 2014. For over a year Kyle Bass of Hayman Capital has been saying the pair will eventually be above 200. Rock-star pundit John Mauldin sees it going to 300 in the coming 10 years, calling it the “trade of the decade.”

Antwort auf Beitrag Nr.: 46.243.045 von sorosinvest am 16.01.14 19:09:12Hi Deine Wette finde ich nicht schlecht.... macht hier ein Einsteigen noch ein Sinn....?

Wie ist es mit den Risiken Deines USD - Yen Papiers....?

Wieso nicht EUR - Yen?

Kenne mich mit Währungen nicht so aus.... gibt es noch andere Papiere? ....

auf Deine Wette hätte ich besser schon im Sommer 2013 gesetzt....

wie lange will die BoJ noch diese Politik fahren? Könnte die Politik nicht umschwenken wenn der Nutzen der Abenomics in Frage gezogen werden...?

Ich las letztens die Wette USD Yen sei ausgereizt?

Wie ist es mit den Risiken Deines USD - Yen Papiers....?

Wieso nicht EUR - Yen?

Kenne mich mit Währungen nicht so aus.... gibt es noch andere Papiere? ....

auf Deine Wette hätte ich besser schon im Sommer 2013 gesetzt....

wie lange will die BoJ noch diese Politik fahren? Könnte die Politik nicht umschwenken wenn der Nutzen der Abenomics in Frage gezogen werden...?

Ich las letztens die Wette USD Yen sei ausgereizt?

Antwort auf Beitrag Nr.: 46.263.511 von ktulu75 am 20.01.14 20:22:29

Es hat Sinn gemacht, noch einzusteigen. UND ES MACHT IMMER NOCH SINN.

Mehr denn je - der Verfall des JPY nimmt Fahrt auf.

Es hat Sinn gemacht, noch einzusteigen. UND ES MACHT IMMER NOCH SINN.

Mehr denn je - der Verfall des JPY nimmt Fahrt auf.

Hier nochmal der Chart!

Antwort auf Beitrag Nr.: 46.263.511 von ktulu75 am 20.01.14 20:22:29Der YEN wird kollabieren. Wenn die BOJ die Anleihenkäufe aussetzt noch schneller. Begründung:

Wenn die BOJ keine Staatsanleihen im bisherigem Mass käuft werden die Zinsen steigen, der japanische Staat der jetzt schon 50% der Einnahmen für Zinszahlungen auffendet kann dies nicht mehr stemmen. Die Anleger würden dann panikartig aus japanischen Staatsanleihen fliehen. Der Kollaps des YEN ist dann unvermeindlich - aber aus meiner Sicht ist das sogar das, was die Regierung will: Entledigung der Schulden durch Hyperinflation, die auch der Wirtschaft wieder eine Konkurrenzfähigkeit verschafft.

Wenn die BOJ keine Staatsanleihen im bisherigem Mass käuft werden die Zinsen steigen, der japanische Staat der jetzt schon 50% der Einnahmen für Zinszahlungen auffendet kann dies nicht mehr stemmen. Die Anleger würden dann panikartig aus japanischen Staatsanleihen fliehen. Der Kollaps des YEN ist dann unvermeindlich - aber aus meiner Sicht ist das sogar das, was die Regierung will: Entledigung der Schulden durch Hyperinflation, die auch der Wirtschaft wieder eine Konkurrenzfähigkeit verschafft.

Antwort auf Beitrag Nr.: 47.751.939 von sorosinvest am 11.09.14 10:45:30http://www.ariva.de/usd-jpy-us-dollar-japanischer_yen-kurs/c…

Antwort auf Beitrag Nr.: 47.810.298 von sorosinvest am 18.09.14 09:26:28

13,28

DE000DX46GF0

Ein so vorraussagbarer Superdeal.

13,28

DE000DX46GF0

Ein so vorraussagbarer Superdeal.

Die Party beginnt erst - der USDJPY beginnt jetzt richtig abzuwerten!

Die Party beginnt erst - der USDJPY beginnt jetzt richtig abzuwerten!

13,54 btw.

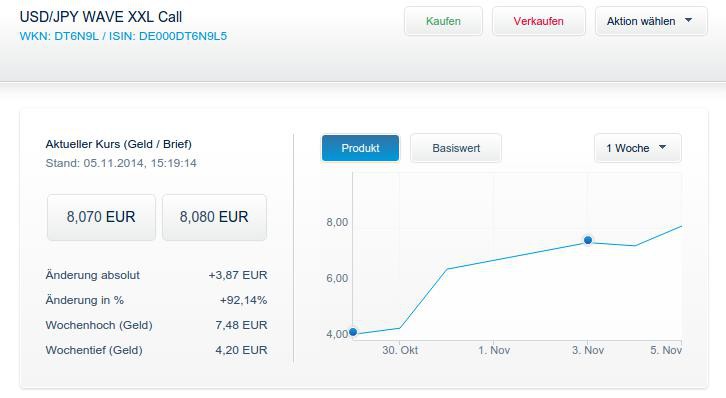

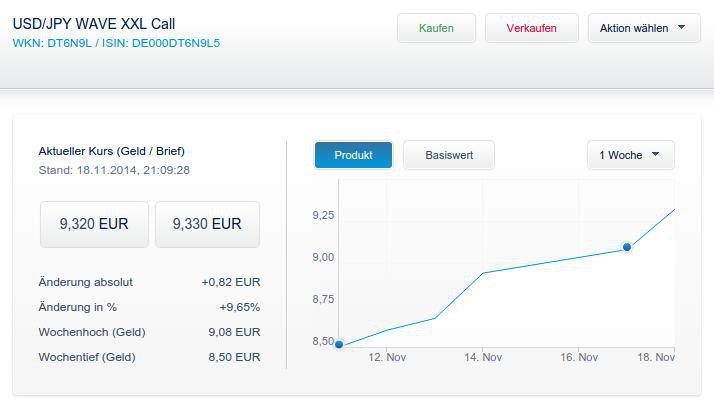

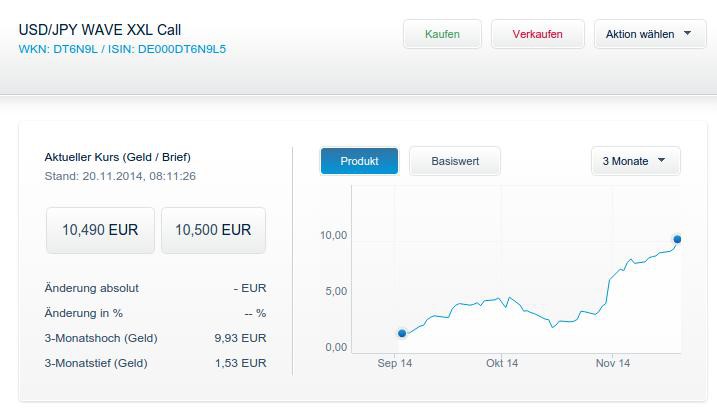

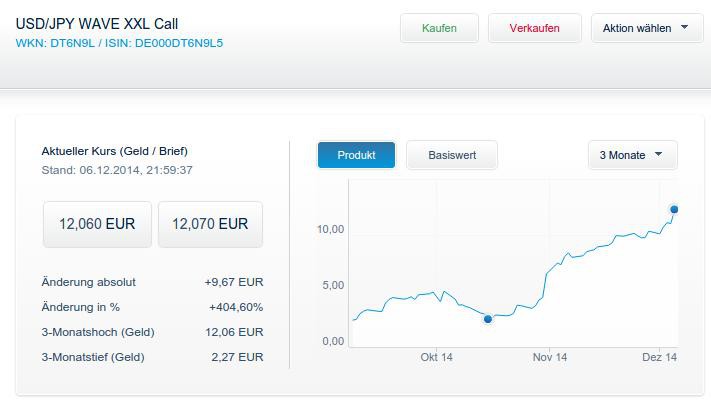

Jetzt aber auf andere Papiere umsteigen mit besserem Hebel:

z.B.: DE000DT6N9L5

Jetzt aber auf andere Papiere umsteigen mit besserem Hebel:

z.B.: DE000DT6N9L5

Antwort auf Beitrag Nr.: 48.200.986 von sorosinvest am 03.11.14 09:01:54

...wie heute morgen gesagt: Die Party geht weiter.

Schade, dass die Gewinne mehrheitlich nur in London und New York gemacht werden

...wie heute morgen gesagt: Die Party geht weiter.

Schade, dass die Gewinne mehrheitlich nur in London und New York gemacht werden

...

Antwort auf Beitrag Nr.: 48.230.506 von sorosinvest am 05.11.14 15:20:00

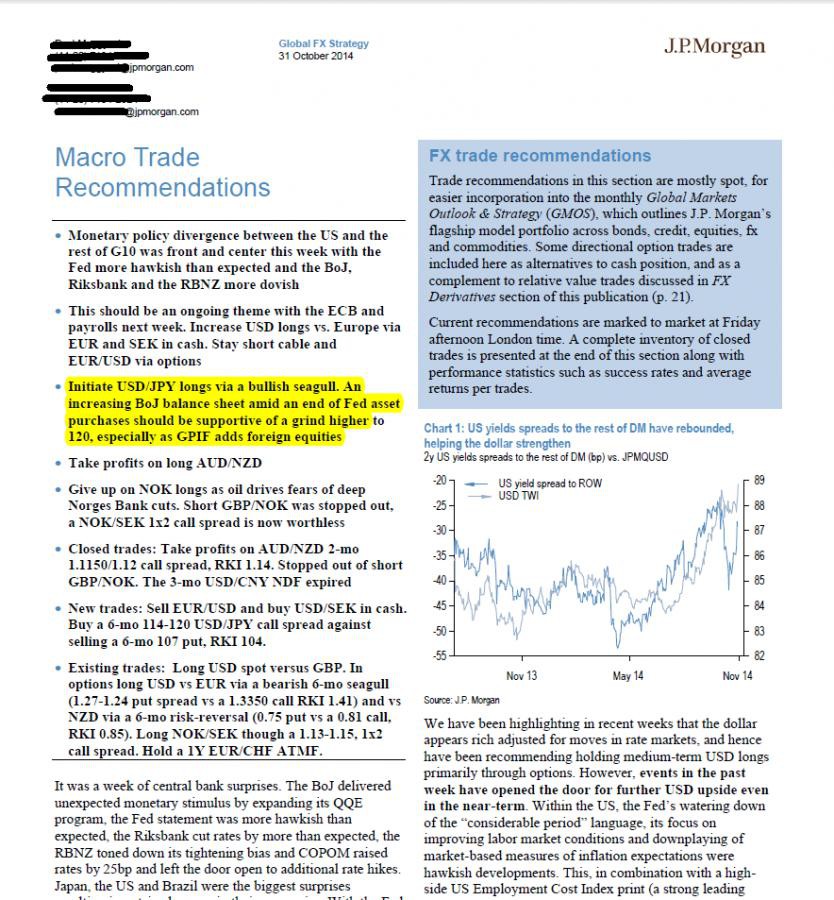

Given the rapid move in USD/JPY and the fact it caught most market participants by surprise, many have asked where it is likely to go from here, particularly given that USD/JPY stalled after the last ‘shock and awe’ easing from the BoJ in April 2013.

In this regard, Goldman Sachs thinks that aside from the technical jargon, there are firmer reasons to continue to expect USD/JPY to rise.

"The first is relative monetary policy, which has been at the crux of our USD/JPY view. The BoJ has committed to open-ended QQE until the 2% price stability target is reached sustainably. On our forecasts, that suggests many years of easing," GS clarifies.

"Second, the rebalancing of the GPIF, particularly if it is mirrored by other asset managers, implies a large pick-up in Japanese buying of foreign assets over the next 3-5 years, which would likely cause Japan’s external balance to deteriorate and be a drag on the Yen," GS adds.

In line with this view, GS has revised its 3-, 6- and 12-month forecasts to 116, 118 and 120 (from 109, 112 and 115), while keeping its long-term forecasts for end-2016 and end-2017 unchanged at 125.

In this regard, Goldman Sachs thinks that aside from the technical jargon, there are firmer reasons to continue to expect USD/JPY to rise.

"The first is relative monetary policy, which has been at the crux of our USD/JPY view. The BoJ has committed to open-ended QQE until the 2% price stability target is reached sustainably. On our forecasts, that suggests many years of easing," GS clarifies.

"Second, the rebalancing of the GPIF, particularly if it is mirrored by other asset managers, implies a large pick-up in Japanese buying of foreign assets over the next 3-5 years, which would likely cause Japan’s external balance to deteriorate and be a drag on the Yen," GS adds.

In line with this view, GS has revised its 3-, 6- and 12-month forecasts to 116, 118 and 120 (from 109, 112 and 115), while keeping its long-term forecasts for end-2016 and end-2017 unchanged at 125.

Wünsche allen einen wunderschönen guten Morgen. Die Investierten haben sicher jetzt schon einen guten Morgen:

Es wir wohl Neuwahlen geben in Japan

http://www.forexlive.com/blog/2014/11/13/usdjpy-to-120-on-po…

USD/JPY to 120 on positive Japanese GDP numbers says Mizuho

5 hours ago | November 13th, 2014 12:07:05 GMT by Ryan Littlestone View Comments

On Sunday (early Monday depending on where you are) we get Japan’s Q3 GDP and Kenji Yoshii at Mizuho Securities says that the data may be the cue for dollar yen to test 118 and even 120. He also said that the market hasn’t fully priced in the potential snap elections and a delay in the next sales tax hike.

We’re looking for a return to growth this quarter after the sales tax slump last quarter and there’s going to be a lot of focus on the consumption and spending numbers to see if Japan has weathered the sales tax hike now. Here’s what’s on the card.

Japan Q3 GDP expectations

Japan Q3 GDP expectations

At the moment it’s hard to find a reason for the yen to rise on the data. If it’s good then 118/120 is a possibility. If it’s bad then any falls will be soaked up on expectations of further BOJ action to support the economy. Like yesterdays BOE inflation report, it’s 2 to 1 in favour that USD/JPY goes up.

USD/JPY to 120 on positive Japanese GDP numbers says Mizuho

5 hours ago | November 13th, 2014 12:07:05 GMT by Ryan Littlestone View Comments

On Sunday (early Monday depending on where you are) we get Japan’s Q3 GDP and Kenji Yoshii at Mizuho Securities says that the data may be the cue for dollar yen to test 118 and even 120. He also said that the market hasn’t fully priced in the potential snap elections and a delay in the next sales tax hike.

We’re looking for a return to growth this quarter after the sales tax slump last quarter and there’s going to be a lot of focus on the consumption and spending numbers to see if Japan has weathered the sales tax hike now. Here’s what’s on the card.

Japan Q3 GDP expectations

Japan Q3 GDP expectations

At the moment it’s hard to find a reason for the yen to rise on the data. If it’s good then 118/120 is a possibility. If it’s bad then any falls will be soaked up on expectations of further BOJ action to support the economy. Like yesterdays BOE inflation report, it’s 2 to 1 in favour that USD/JPY goes up.

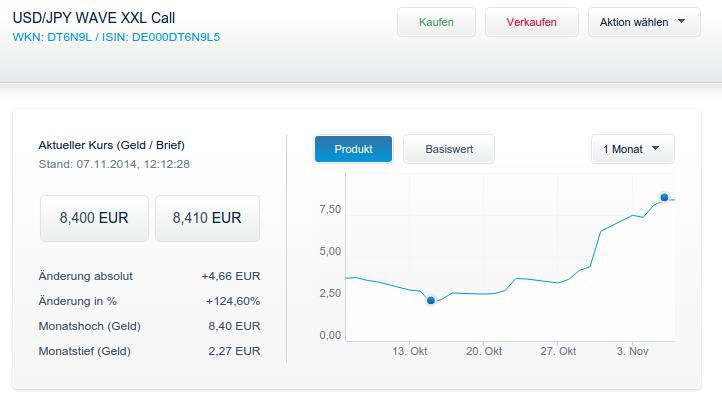

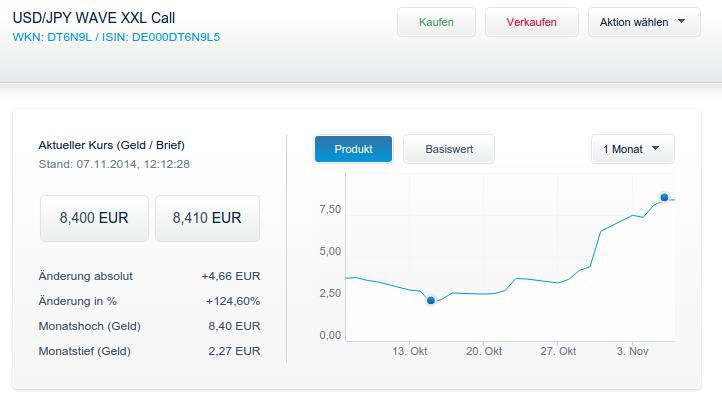

Und weiter geht's:

Wieder einen guten Morgen allen Investierten.

Wieder einen guten Morgen allen Investierten.

Neuwahlen, Verschiebung MwSt. Erhöhung in Japan.

Alles nach wie erwartet. Der eigentliche Crash des YEN kommt noch.

In der Zwischenzeit kann man aber schon gut verdienen:

Alles nach wie erwartet. Der eigentliche Crash des YEN kommt noch.

In der Zwischenzeit kann man aber schon gut verdienen:

3 Monats Chart nochmal. Er ist so schön.

Wer diesem Thread von Anfang an folgt hat den Einsatz etwa versechsfacht.

It carries risks that could seriously affect the global economy, writes William White

In a world of unprecedented expansionary actions by central banks, the Bank of Japan is set to outdo them all. Its plans to expand

significantly the scale of its asset purchases imply that the size of its balance sheet relative to gross domestic product will far

outstrip that of others.

Some suggest such courage is to be emulated, not least by the European Central Bank. Others – rightly – suggest the plan is not so

much courageous as foolhardy. It is not needed and it will not succeed in stimulating growth. Moreover, it carries risks that could

seriously affect the global economy.

First, the reason it is not needed. Japan’s recent slow growth has been largely driven by demographic

trends. Since 2000 growth in GDP per person of working age has been significantly above that in the US.

As for anxieties over persistent deflation, the level of Japanese consumer prices has fallen less than 4 per

cent in the past 15 years. There is no evidence of an accelerating deflationary trend, nor of consumers

delaying spending in anticipation of lower prices. Indeed, the household saving rate has fallen since the

1990s from a traditionally high level to zero.

Second, why it will not work. The underlying intention is to induce businesses to invest and export.

Neither seems likely to happen. Japan’s smaller companies export little and face higher costs of imported

goods and services as a result of a weaker yen. Its bigger ones have long had the advantage of favour-able

financing conditions and large cash balances. They have not responded with more domestic investment.

Why should they do so now in the absence of the significant structural reforms promised by Shinzo Abe,

the prime minister?

The weaker yen has increased corporate profits but exports have responded sluggishly. All this suggests policies aimed at raising

consumer spending would have been more effective.

The BoJ’s policy of announcing a higher inflation target assumes expectations will ratchet up accordingly. Even if it works, the policy

could easily backfire. Indeed, recent weakness in the economy might partially reflect this. Consumers have long faced falling nominal

wages. If they expect this to continue, while believing that inflation will rise, it implies lower real wages and likely lower consumption.

This likelihood will be increased, given terms of trade losses because of a weaker yen and fears of higher sales taxes.

As for capital markets, expectations of faster inflation should normally result in higher nominal interest rates on government debt.

However, holders of government bonds might believe this effect will be offset by central bank purchases of government bonds.

Unfortunately, this belief also points to the associated risks. Rates on government bonds have been very low for a long time but things

might be changing. Low bond rates and a relatively strong yen – which, taken together, equate to a low-risk premium – were initially

supported by high household saving, a strong bias to investing in yen-denominated assets and a large currenAll three of these supports have disappeared. With the yen markedly weaker, any rise in the risk premium for yen-denominated assets

could push bond rates higher. This could trigger a sequence of events leading to higher inflation rates.

Japan’s fiscal deficit is about 8 per cent of GDP and its stock of gross debt about 230 per cent of GDP. Were the average rate on

government bonds to increase to 2 per cent, and should potential nominal growth fail to rise, the deficit would rise above 10 per cent of

GDP. The pace of government bond purchases announced by the BoJ, almost twice the size of the general government deficit, would

then have to rise further. Fears of still more monetisation and sharp price rises would put more upward pressure on bond rates, and

downward pressure on the yen, in a self-fulfilling spiral that could quickly take inflation to very high levels. Such processes have been

seen often in the past 100 years, not least in Latin America.

Nor would this vicious circle be easy to end. Higher central bank rates to support the yen would increase debt service, sending bond

rates even higher. A failure to raise rates would result in the yen weakening further, exacerbating “currency war” tensions. Sales of

foreign exchange reserves to support the yen might be effective but could have serious effects on the markets for US Treasuries and

elsewhere. Confidence everywhere would be seriously affected should it become clear Japan’s authorities were losing control of events.

In a world of unprecedented expansionary actions by central banks, the Bank of Japan is set to outdo them all. Its plans to expand

significantly the scale of its asset purchases imply that the size of its balance sheet relative to gross domestic product will far

outstrip that of others.

Some suggest such courage is to be emulated, not least by the European Central Bank. Others – rightly – suggest the plan is not so

much courageous as foolhardy. It is not needed and it will not succeed in stimulating growth. Moreover, it carries risks that could

seriously affect the global economy.

First, the reason it is not needed. Japan’s recent slow growth has been largely driven by demographic

trends. Since 2000 growth in GDP per person of working age has been significantly above that in the US.

As for anxieties over persistent deflation, the level of Japanese consumer prices has fallen less than 4 per

cent in the past 15 years. There is no evidence of an accelerating deflationary trend, nor of consumers

delaying spending in anticipation of lower prices. Indeed, the household saving rate has fallen since the

1990s from a traditionally high level to zero.

Second, why it will not work. The underlying intention is to induce businesses to invest and export.

Neither seems likely to happen. Japan’s smaller companies export little and face higher costs of imported

goods and services as a result of a weaker yen. Its bigger ones have long had the advantage of favour-able

financing conditions and large cash balances. They have not responded with more domestic investment.

Why should they do so now in the absence of the significant structural reforms promised by Shinzo Abe,

the prime minister?

The weaker yen has increased corporate profits but exports have responded sluggishly. All this suggests policies aimed at raising

consumer spending would have been more effective.

The BoJ’s policy of announcing a higher inflation target assumes expectations will ratchet up accordingly. Even if it works, the policy

could easily backfire. Indeed, recent weakness in the economy might partially reflect this. Consumers have long faced falling nominal

wages. If they expect this to continue, while believing that inflation will rise, it implies lower real wages and likely lower consumption.

This likelihood will be increased, given terms of trade losses because of a weaker yen and fears of higher sales taxes.

As for capital markets, expectations of faster inflation should normally result in higher nominal interest rates on government debt.

However, holders of government bonds might believe this effect will be offset by central bank purchases of government bonds.

Unfortunately, this belief also points to the associated risks. Rates on government bonds have been very low for a long time but things

might be changing. Low bond rates and a relatively strong yen – which, taken together, equate to a low-risk premium – were initially

supported by high household saving, a strong bias to investing in yen-denominated assets and a large currenAll three of these supports have disappeared. With the yen markedly weaker, any rise in the risk premium for yen-denominated assets

could push bond rates higher. This could trigger a sequence of events leading to higher inflation rates.

Japan’s fiscal deficit is about 8 per cent of GDP and its stock of gross debt about 230 per cent of GDP. Were the average rate on

government bonds to increase to 2 per cent, and should potential nominal growth fail to rise, the deficit would rise above 10 per cent of

GDP. The pace of government bond purchases announced by the BoJ, almost twice the size of the general government deficit, would

then have to rise further. Fears of still more monetisation and sharp price rises would put more upward pressure on bond rates, and

downward pressure on the yen, in a self-fulfilling spiral that could quickly take inflation to very high levels. Such processes have been

seen often in the past 100 years, not least in Latin America.

Nor would this vicious circle be easy to end. Higher central bank rates to support the yen would increase debt service, sending bond

rates even higher. A failure to raise rates would result in the yen weakening further, exacerbating “currency war” tensions. Sales of

foreign exchange reserves to support the yen might be effective but could have serious effects on the markets for US Treasuries and

elsewhere. Confidence everywhere would be seriously affected should it become clear Japan’s authorities were losing control of events.

It carries risks that could seriously affect the global economy, writes William White

In a world of unprecedented expansionary actions by central banks, the Bank of Japan is set to outdo them all. Its plans to expand

significantly the scale of its asset purchases imply that the size of its balance sheet relative to gross domestic product will far

outstrip that of others.

Some suggest such courage is to be emulated, not least by the European Central Bank. Others – rightly – suggest the plan is not so

much courageous as foolhardy. It is not needed and it will not succeed in stimulating growth. Moreover, it carries risks that could

seriously affect the global economy.

First, the reason it is not needed. Japan’s recent slow growth has been largely driven by demographic

trends. Since 2000 growth in GDP per person of working age has been significantly above that in the US.

As for anxieties over persistent deflation, the level of Japanese consumer prices has fallen less than 4 per

cent in the past 15 years. There is no evidence of an accelerating deflationary trend, nor of consumers

delaying spending in anticipation of lower prices. Indeed, the household saving rate has fallen since the

1990s from a traditionally high level to zero.

Second, why it will not work. The underlying intention is to induce businesses to invest and export.

Neither seems likely to happen. Japan’s smaller companies export little and face higher costs of imported

goods and services as a result of a weaker yen. Its bigger ones have long had the advantage of favour-able

financing conditions and large cash balances. They have not responded with more domestic investment.

Why should they do so now in the absence of the significant structural reforms promised by Shinzo Abe,

the prime minister?

The weaker yen has increased corporate profits but exports have responded sluggishly. All this suggests policies aimed at raising

consumer spending would have been more effective.

The BoJ’s policy of announcing a higher inflation target assumes expectations will ratchet up accordingly. Even if it works, the policy

could easily backfire. Indeed, recent weakness in the economy might partially reflect this. Consumers have long faced falling nominal

wages. If they expect this to continue, while believing that inflation will rise, it implies lower real wages and likely lower consumption.

This likelihood will be increased, given terms of trade losses because of a weaker yen and fears of higher sales taxes.

As for capital markets, expectations of faster inflation should normally result in higher nominal interest rates on government debt.

However, holders of government bonds might believe this effect will be offset by central bank purchases of government bonds.

Unfortunately, this belief also points to the associated risks. Rates on government bonds have been very low for a long time but things

might be changing. Low bond rates and a relatively strong yen – which, taken together, equate to a low-risk premium – were initially

supported by high household saving, a strong bias to investing in yen-denominated assets and a large currenAll three of these supports have disappeared. With the yen markedly weaker, any rise in the risk premium for yen-denominated assets

could push bond rates higher. This could trigger a sequence of events leading to higher inflation rates.

Japan’s fiscal deficit is about 8 per cent of GDP and its stock of gross debt about 230 per cent of GDP. Were the average rate on

government bonds to increase to 2 per cent, and should potential nominal growth fail to rise, the deficit would rise above 10 per cent of

GDP. The pace of government bond purchases announced by the BoJ, almost twice the size of the general government deficit, would

then have to rise further. Fears of still more monetisation and sharp price rises would put more upward pressure on bond rates, and

downward pressure on the yen, in a self-fulfilling spiral that could quickly take inflation to very high levels. Such processes have been

seen often in the past 100 years, not least in Latin America.

Nor would this vicious circle be easy to end. Higher central bank rates to support the yen would increase debt service, sending bond

rates even higher. A failure to raise rates would result in the yen weakening further, exacerbating “currency war” tensions. Sales of

foreign exchange reserves to support the yen might be effective but could have serious effects on the markets for US Treasuries and

elsewhere. Confidence everywhere would be seriously affected should it become clear Japan’s authorities were losing control of events.

In a world of unprecedented expansionary actions by central banks, the Bank of Japan is set to outdo them all. Its plans to expand

significantly the scale of its asset purchases imply that the size of its balance sheet relative to gross domestic product will far

outstrip that of others.

Some suggest such courage is to be emulated, not least by the European Central Bank. Others – rightly – suggest the plan is not so

much courageous as foolhardy. It is not needed and it will not succeed in stimulating growth. Moreover, it carries risks that could

seriously affect the global economy.

First, the reason it is not needed. Japan’s recent slow growth has been largely driven by demographic

trends. Since 2000 growth in GDP per person of working age has been significantly above that in the US.

As for anxieties over persistent deflation, the level of Japanese consumer prices has fallen less than 4 per

cent in the past 15 years. There is no evidence of an accelerating deflationary trend, nor of consumers

delaying spending in anticipation of lower prices. Indeed, the household saving rate has fallen since the

1990s from a traditionally high level to zero.

Second, why it will not work. The underlying intention is to induce businesses to invest and export.

Neither seems likely to happen. Japan’s smaller companies export little and face higher costs of imported

goods and services as a result of a weaker yen. Its bigger ones have long had the advantage of favour-able

financing conditions and large cash balances. They have not responded with more domestic investment.

Why should they do so now in the absence of the significant structural reforms promised by Shinzo Abe,

the prime minister?

The weaker yen has increased corporate profits but exports have responded sluggishly. All this suggests policies aimed at raising

consumer spending would have been more effective.

The BoJ’s policy of announcing a higher inflation target assumes expectations will ratchet up accordingly. Even if it works, the policy

could easily backfire. Indeed, recent weakness in the economy might partially reflect this. Consumers have long faced falling nominal

wages. If they expect this to continue, while believing that inflation will rise, it implies lower real wages and likely lower consumption.

This likelihood will be increased, given terms of trade losses because of a weaker yen and fears of higher sales taxes.

As for capital markets, expectations of faster inflation should normally result in higher nominal interest rates on government debt.

However, holders of government bonds might believe this effect will be offset by central bank purchases of government bonds.

Unfortunately, this belief also points to the associated risks. Rates on government bonds have been very low for a long time but things

might be changing. Low bond rates and a relatively strong yen – which, taken together, equate to a low-risk premium – were initially

supported by high household saving, a strong bias to investing in yen-denominated assets and a large currenAll three of these supports have disappeared. With the yen markedly weaker, any rise in the risk premium for yen-denominated assets

could push bond rates higher. This could trigger a sequence of events leading to higher inflation rates.

Japan’s fiscal deficit is about 8 per cent of GDP and its stock of gross debt about 230 per cent of GDP. Were the average rate on

government bonds to increase to 2 per cent, and should potential nominal growth fail to rise, the deficit would rise above 10 per cent of

GDP. The pace of government bond purchases announced by the BoJ, almost twice the size of the general government deficit, would

then have to rise further. Fears of still more monetisation and sharp price rises would put more upward pressure on bond rates, and

downward pressure on the yen, in a self-fulfilling spiral that could quickly take inflation to very high levels. Such processes have been

seen often in the past 100 years, not least in Latin America.

Nor would this vicious circle be easy to end. Higher central bank rates to support the yen would increase debt service, sending bond

rates even higher. A failure to raise rates would result in the yen weakening further, exacerbating “currency war” tensions. Sales of

foreign exchange reserves to support the yen might be effective but could have serious effects on the markets for US Treasuries and

elsewhere. Confidence everywhere would be seriously affected should it become clear Japan’s authorities were losing control of events.

http://www.fxstreet.com/news/forex-news/article.aspx?storyid…

“USD/JPY has made a habit out of crashing through our forecasts recently” says Jane Foley, Senior Currency Strategist at Rabobank, as USD/JPY rallies to a 7 year old high overnight just a whisker below 119.00.

Key Quotes

“The sharp deterioration in Japan’s growth and inflation outlook since the 3% hike in the consumption tax hike in April would appear to provide strong justification for a sharply higher value of USD/JPY. That said, according to the OECD’s purchasing power parity estimate, the yen is now undervalued vs. the USD.”

“Going forward, there is the possibility that the Fed will push back against the stronger tone of the USD. This afternoon’s release of US October CPI data is likely to confirm a lack of strong inflationary pressures in the US. The market median for the release stands at a moderate 1.6% y/y.”

“Yesterday’s release of the FOMC minutes did unveil a vigorous debate among Fed officials over the weight that should be given in forward guidance to signals that inflation expectations were slipping. However, as it stands there has been no real push back either by the Fed, corporate America of the US Treasury against the rebound in the value of the USD during the second half of the year.”

“Although there is risk that continued USD strength could push back the timing of the Fed’s first hike and shake out long USD positions, on the assumption that US growth continues to outperform we see further potential for medium-term USD gains. We have revised up our 12 mth USD/JPY forecast to 125.00”

“USD/JPY has made a habit out of crashing through our forecasts recently” says Jane Foley, Senior Currency Strategist at Rabobank, as USD/JPY rallies to a 7 year old high overnight just a whisker below 119.00.

Key Quotes

“The sharp deterioration in Japan’s growth and inflation outlook since the 3% hike in the consumption tax hike in April would appear to provide strong justification for a sharply higher value of USD/JPY. That said, according to the OECD’s purchasing power parity estimate, the yen is now undervalued vs. the USD.”

“Going forward, there is the possibility that the Fed will push back against the stronger tone of the USD. This afternoon’s release of US October CPI data is likely to confirm a lack of strong inflationary pressures in the US. The market median for the release stands at a moderate 1.6% y/y.”

“Yesterday’s release of the FOMC minutes did unveil a vigorous debate among Fed officials over the weight that should be given in forward guidance to signals that inflation expectations were slipping. However, as it stands there has been no real push back either by the Fed, corporate America of the US Treasury against the rebound in the value of the USD during the second half of the year.”

“Although there is risk that continued USD strength could push back the timing of the Fed’s first hike and shake out long USD positions, on the assumption that US growth continues to outperform we see further potential for medium-term USD gains. We have revised up our 12 mth USD/JPY forecast to 125.00”

http://www.reuters.com/article/2014/11/21/us-markets-forex-g…

Goldman Sachs has raised its forecast for the dollar/yen currency pair at the end of 2015 by 10 yen to 130, the investment bank said on Friday, in a week that has seen Japan slip into recession and a snap election called.

The yen has fallen over 10 percent in the past month and skidded to a seven-year low against the dollar at 118.98 JPY= this week after Japan postponed a planned hike in sales tax and braced itself for more policies to combat stubbornly low inflation.

Prime Minister Shinzo Abe dissolved parliament's lower house on Friday for a snap election on Dec. 14, seeking a fresh mandate for his struggling "Abenomics" revival strategy.

On Oct. 31 the Bank of Japan (BoJ) shocked markets with an expansion of its already huge monetary stimulus program.

"The most important lesson we learned recently came on October 31, when the surprise easing by the BoJ underscored the importance of "inflation FX"," Goldman analysts said in a research note.

"After all, had we focused on inflation – rather than BoJ speeches into the meeting – we would have realized that the likelihood of additional easing was high and rising."

Goldman forecast the dollar/yen would be at 135 yen at the end of 2016, and at 140 yen at the end of 2017.

The spectre of deflation also threatens the struggling euro zone economy and is leading to talk of further easing in the 18-nation bloc, prompting Goldman to forecast a lower euro.

"One of our top trade recommendations ... is euro/dollar downside via a $1.20/$1.15 put spread."

Goldman said it expects the euro to trade at $1.15 EUR= by the end of 2015 and then to weaken to parity with the dollar by the end of 2017. It is currently trading at $1.2419.

Goldman Sachs has raised its forecast for the dollar/yen currency pair at the end of 2015 by 10 yen to 130, the investment bank said on Friday, in a week that has seen Japan slip into recession and a snap election called.

The yen has fallen over 10 percent in the past month and skidded to a seven-year low against the dollar at 118.98 JPY= this week after Japan postponed a planned hike in sales tax and braced itself for more policies to combat stubbornly low inflation.

Prime Minister Shinzo Abe dissolved parliament's lower house on Friday for a snap election on Dec. 14, seeking a fresh mandate for his struggling "Abenomics" revival strategy.

On Oct. 31 the Bank of Japan (BoJ) shocked markets with an expansion of its already huge monetary stimulus program.

"The most important lesson we learned recently came on October 31, when the surprise easing by the BoJ underscored the importance of "inflation FX"," Goldman analysts said in a research note.

"After all, had we focused on inflation – rather than BoJ speeches into the meeting – we would have realized that the likelihood of additional easing was high and rising."

Goldman forecast the dollar/yen would be at 135 yen at the end of 2016, and at 140 yen at the end of 2017.

The spectre of deflation also threatens the struggling euro zone economy and is leading to talk of further easing in the 18-nation bloc, prompting Goldman to forecast a lower euro.

"One of our top trade recommendations ... is euro/dollar downside via a $1.20/$1.15 put spread."

Goldman said it expects the euro to trade at $1.15 EUR= by the end of 2015 and then to weaken to parity with the dollar by the end of 2017. It is currently trading at $1.2419.

5. The Dollar Bull Market

Broad-based USD strength …

... particularly against G10.

A multi-year trend in a multi-year US recovery.

USD strength has been a feature of our views in 2014 and its continuation, particularly

against G10, arguably remains our strongest asset market view looking through 2015.

Within that view, continued declines in the EUR/$ rate are the single most important

element, but we expect further meaningful weakness in the JPY as well. We think the

combination of widening 2-year rate differentials, downward pressure on oil prices and

continued resilience in the US growth picture all support that view.

Given that the USD was among the strongest global currencies in 2014, that the view that

USD strength will continue is now quite well-subscribed and that forward markets already

price a significant widening in US policy rates versus many others, the key question is why

it should continue. We think rate differentials have scope to widen further still, even versus

the forward pricing, and if the ECB and BoJ are successful in raising inflationary

expectations, as they are trying to do, real rates may move in the USD’s favour even

without much movement in the nominal structure. We forecast EUR/$ at 1.15 and $/JPY at ovember 19, 2014 Global Viewpoint

Goldman Sachs Global Investment Research 6

130 by end-2015 (moving to parity and 140 in 2017). The bigger story is that we are in a

multi-year phase of USD recovery, as the forces that drove the long period of USD

weakness reverse, and that the market may be underestimating the scope and persistence

of that trend. Relative to a long historical perspective, the USD strength so far looks modest.

Nor does the USD look strong on that basis relative to much of the G10. Given that the

view is more subscribed – and that positioning therefore tends to build – we think it makes

sense to be more ambitious about targets and size and structure positions accordingly.

The USD is also likely to strengthen against much of EM (although not always clearly more

than the forwards). In addition to the scope for rate differentials to widen, we think

currency depreciation will remain (i) an important channel of adjustment in ZAR and BRL,

where current account deficits are still wide, (ii) a means of rebalancing economies towards

non-commodity-producing sectors in the commodity producers (including in RUB and

COP), and (iii) a tool in the battle against very low rates of inflation, including in KRW, ILS

and Central and Eastern Europe (including the HUF, RON, CZK and PLN).

Broad-based USD strength …

... particularly against G10.

A multi-year trend in a multi-year US recovery.

USD strength has been a feature of our views in 2014 and its continuation, particularly

against G10, arguably remains our strongest asset market view looking through 2015.

Within that view, continued declines in the EUR/$ rate are the single most important

element, but we expect further meaningful weakness in the JPY as well. We think the

combination of widening 2-year rate differentials, downward pressure on oil prices and

continued resilience in the US growth picture all support that view.

Given that the USD was among the strongest global currencies in 2014, that the view that

USD strength will continue is now quite well-subscribed and that forward markets already

price a significant widening in US policy rates versus many others, the key question is why

it should continue. We think rate differentials have scope to widen further still, even versus

the forward pricing, and if the ECB and BoJ are successful in raising inflationary

expectations, as they are trying to do, real rates may move in the USD’s favour even

without much movement in the nominal structure. We forecast EUR/$ at 1.15 and $/JPY at ovember 19, 2014 Global Viewpoint

Goldman Sachs Global Investment Research 6

130 by end-2015 (moving to parity and 140 in 2017). The bigger story is that we are in a

multi-year phase of USD recovery, as the forces that drove the long period of USD

weakness reverse, and that the market may be underestimating the scope and persistence

of that trend. Relative to a long historical perspective, the USD strength so far looks modest.

Nor does the USD look strong on that basis relative to much of the G10. Given that the

view is more subscribed – and that positioning therefore tends to build – we think it makes

sense to be more ambitious about targets and size and structure positions accordingly.

The USD is also likely to strengthen against much of EM (although not always clearly more

than the forwards). In addition to the scope for rate differentials to widen, we think

currency depreciation will remain (i) an important channel of adjustment in ZAR and BRL,

where current account deficits are still wide, (ii) a means of rebalancing economies towards

non-commodity-producing sectors in the commodity producers (including in RUB and

COP), and (iii) a tool in the battle against very low rates of inflation, including in KRW, ILS

and Central and Eastern Europe (including the HUF, RON, CZK and PLN).

sorosinvest lass doch mal die ganzen Charts von deinem Wave-Call weg - die sind am Tag danach super langweilig.

Yen steht jetzt auf 120 und wird dort erst mal bleiben. Es sei denn es passiert wirklich was. Und das wäre erst mal kein gutes Zeichen.

Ich denke es sollte sich jetzt lohnen quanto long in jap. Aktien zu gehen - das Spiel ist einigermaßen durchsichtig: Der japan. Staat hat zu viel Schulden. Zinserhöhung => Staatsbankrott. Diese Schulden kauft die Zentralbank auf und neutralisiert sie. Und das hoffentlich bevor der $Y Kurs auf 200 läuft.

Die Aktuere, die ihre Staatsanleihen verkauft haben gehen dann in Aktien.

Yen steht jetzt auf 120 und wird dort erst mal bleiben. Es sei denn es passiert wirklich was. Und das wäre erst mal kein gutes Zeichen.

Ich denke es sollte sich jetzt lohnen quanto long in jap. Aktien zu gehen - das Spiel ist einigermaßen durchsichtig: Der japan. Staat hat zu viel Schulden. Zinserhöhung => Staatsbankrott. Diese Schulden kauft die Zentralbank auf und neutralisiert sie. Und das hoffentlich bevor der $Y Kurs auf 200 läuft.

Die Aktuere, die ihre Staatsanleihen verkauft haben gehen dann in Aktien.

Antwort auf Beitrag Nr.: 48.457.442 von Feuersteinz am 30.11.14 23:20:37

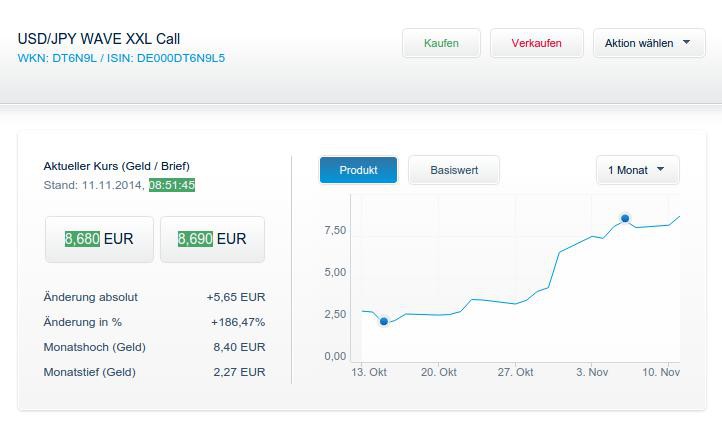

Der Chart macht aber wieder aussergewöhnlich viel Freude. 500% plus im Jahr - dokumentiert in dem Thread - erfreuen mich nunmal grandios.

Teile die Meinung nicht, dass Aktien in J ein gutes Investment sind. Short JGB ( Japanese Government Bonds ) vielleicht - aber bestimmt keine Aktien. Short YEN auf jedenfall. Ist politisch gewollt, dass der YEN sinkt. Don't fight the FED sagte man früher - heute: Don't fight the BOJ

Der Grund warum er weiter schächer werden sollte ist einfach. Die Bank Of Japan druckt einfach JEDEN MONAT 90 Trillion YEN DER YEN MUSS ABWERTEN - WEITER

Zitat von Feuersteinz: sorosinvest lass doch mal die ganzen Charts von deinem Wave-Call weg - die sind am Tag danach super langweilig.

Yen steht jetzt auf 120 und wird dort erst mal bleiben. Es sei denn es passiert wirklich was. Und das wäre erst mal kein gutes Zeichen.

Ich denke es sollte sich jetzt lohnen quanto long in jap. Aktien zu gehen - das Spiel ist einigermaßen durchsichtig: Der japan. Staat hat zu viel Schulden. Zinserhöhung => Staatsbankrott. Diese Schulden kauft die Zentralbank auf und neutralisiert sie. Und das hoffentlich bevor der $Y Kurs auf 200 läuft.

Die Aktuere, die ihre Staatsanleihen verkauft haben gehen dann in Aktien.

Der Chart macht aber wieder aussergewöhnlich viel Freude. 500% plus im Jahr - dokumentiert in dem Thread - erfreuen mich nunmal grandios.

Teile die Meinung nicht, dass Aktien in J ein gutes Investment sind. Short JGB ( Japanese Government Bonds ) vielleicht - aber bestimmt keine Aktien. Short YEN auf jedenfall. Ist politisch gewollt, dass der YEN sinkt. Don't fight the FED sagte man früher - heute: Don't fight the BOJ

Der Grund warum er weiter schächer werden sollte ist einfach. Die Bank Of Japan druckt einfach JEDEN MONAT 90 Trillion YEN DER YEN MUSS ABWERTEN - WEITER

Antwort auf Beitrag Nr.: 48.474.863 von sorosinvest am 02.12.14 17:23:58https://www.moodys.com/research/Moodys-downgrades-Japan-to-A…

http://www.reuters.com/article/2014/12/01/markets-japan-rati…

http://www.reuters.com/article/2014/12/01/markets-japan-rati…

Antwort auf Beitrag Nr.: 48.474.863 von sorosinvest am 02.12.14 17:23:58

Man darf die Situation aus 2008 2009 nicht vergessen: Bei einer Krise holen die Japaner ihr Geld "zurück ins Reich" und die ganzen Carry-Trades werden rückabgewickelt. Da kann der Yen schnell mal 10% steigen - Abenomics hin oder her.

Abwertung

Der Yen muss überhaupt nicht jeden Monat abwerten - schließlich hat er das in 2014 auch nicht ständig gemacht. Man darf die Situation aus 2008 2009 nicht vergessen: Bei einer Krise holen die Japaner ihr Geld "zurück ins Reich" und die ganzen Carry-Trades werden rückabgewickelt. Da kann der Yen schnell mal 10% steigen - Abenomics hin oder her.

Antwort auf Beitrag Nr.: 48.527.948 von sorosinvest am 09.12.14 17:47:07http://www.fuw.ch/article/japanisches-endspiel-in-vier-akten…

- schon älter - aber so wahr; das Endspiel beginnt bald

Die LDP kommt mit einem klaren Wahlsieg an die Macht zurück. Wie könnte ein hypothetisches Szenario für Japan aussehen? Drehbuch und Handlungsempfehlungen für das anstehende Endspiel.

Die Liberaldemokratische Partei (LDP) unter ihrem Anführer Shinzo Abe hat die Parlamentswahlen von gestern Sonntag klar für sich entschieden. Zusammen mit ihrem Koalitionspartner wird die LDP voraussichtlich eine Zweidrittelmehrheit im Unterhaus kontrollieren. Dies, nachdem sie zuvor drei Jahre in der Opposition gestanden hatte. Die Aussicht auf den Sieg Shinzo Abes hat in den vergangenen Wochen bereits zu einer Rally am japanischen Aktienmarkt und zu einer Abschwächung des Yens geführt. Der künftige Premier möchte zur Bekämpfung der Deflation den Yen schwächen und zu diesem Zweck die Bank of Japan (BoJ) verpolitisieren.

Japanisches Drehbuch

Abe könnte mit seiner Politik schlafende Hunde wecken. Zugegeben: Das Ende der Yenhausse und die Zinswende für Staatsanleihen (JGB) wurden schon oft verkündet. Allerdings mehren sich die Anzeichen, dass beide an einem strukturellen Wendepunkt stehen könnten. Es ist deshalb nicht auszuschliessen, dass Abes Absichten den Trendwechsel auslösen.

Wie könnte ein hypothetisches Szenario für Japan aussehen? Am wahrscheinlichsten scheint ein Drama in vier Akten. Anzumerken gilt, dass die Abgrenzung der einzelnen Akte nicht scharf ist, da sich die Phasen überlappen. Auch die zeitliche Dimension kann kaum abgeschätzt werden. Klar ist nur, dass sich Krisen gegen Ende beschleunigen – die ersten Akte können sich aber durchaus über mehrere Jahre hinziehen und durch langwierige Gegenbewegungen unterbrochen werden.

Erster Akt: Yenschwäche

Gemäss Abe trägt die BoJ die Verantwortung für das Verharren in der Deflationsfalle. Deshalb wird er nächsten April BoJ-Chef Masaaki Shirakawa und seine zwei Stellvertreter – alle drei geldpolitische Traditionalisten – durch «Tauben» ersetzen. Zudem plant er eine Inflationsvorgabe von 2 bis 3%, für deren Erreichung er das Präsidium persönlich verantwortlich machen will. Auch wenn Abe politische Kompromisse eingehen muss, dürfte die BoJ nächstes Jahr ein massives Quantitative-Easing-Programm lancieren.

In der Vergangenheit wurden schon einige Versuche unternommen, den Yen abzuwerten. Oft verpufften die Massnahmen wirkungslos. Dieses Mal könnte es aber anders sein, denn es gibt Anzeichen, die für eine strukturelle Wende des Yens auch ohne Eingriffe der BoJ sprechen. Der wichtigste Unterschied zu vergangenen Episoden ist die Handelsbilanz, die letztes Jahr zum ersten Mal seit Ende der Siebzigerjahre nachhaltig ins Minus gedreht hat und aufgrund der geänderten Energiepolitik – höhere Energieimporte als Folge des nach Fukushima beschlossenen Atomausstiegs – dort verharren könnte.

Sofern die Politik der Yenschwäche gelingt, dürfte der Nikkei nächstes Jahr haussieren. Seit dem Jahr 2005 wird der japanische Aktienmarkt hauptsächlich vom Yen getrieben. Einen Vorgeschmack haben Investoren seit der Ansetzung der Neuwahlen bereits erhalten. Zu den Sektoren, die in diesem Umfeld am besten abschneiden werden, gehören mit den Maschinen- und den Autowerten die klassischen Exportchampions.

Zweiter Akt: Zinsanstieg

Über den schwächeren Yen wird die importierte Inflation anziehen. Sollte sich die Weltwirtschaft nächstes Jahr wieder leicht erholen und damit die Konjunktur auch in Japan beflügeln, erhält der Preisauftrieb zusätzliche Schützenhilfe.

zoom

Eine Überwindung der Deflation dürfte vom Aktienmarkt zunächst euphorisch begrüsst werden. Wie Grafik 2 zeigt, erreichen die Aktienmarktbewertungen ihren Höhepunkt bei einer Inflationsrate von 1 bis 3%. Eine Bewertungsexpansion wäre aufgrund der historischen Erfahrung demnach keine Überraschung.

Ein Anziehen von Inflation und Wachstum bringt höhere Zinsen mit sich. Es ist zu erwarten, dass dies vom Aktienmarkt – besonders von den Bankwerten – anfänglich positiv aufgenommen würde. Der Gesamtmarkt dürfte von Umschichtungen aus den enorm überteuerten JGB profitieren, während die Banken dank der höheren Zinsmargen ein Revival erleben.

Dritter Akt: Börsenkorrektur

Die Massnahmen Abes sind angesichts des Schuldenbergs von rund 236% des Bruttoinlandprodukts und eines Budgetdefizits von über 9% des BIP nicht ohne Risiko. Eine Schwächung des Yens wird ausländische Investoren vom Kauf von JGB abhalten. Auf die Ausländer ist Japan aber angewiesen, da den japanischen Privatinvestoren – unter anderem wegen der demografiebedingt sinkenden Sparquote – der Appetit auf JGB vergangen zu sein scheint. Seit 2009 sinkt der JGB-Bestand in den Händen der Privaten – auch das ein struktureller Wandel.

Höhere Zinsen würden angesichts des heute schon beachtlichen Schuldendiensts – die Zinszahlungen beanspruchen trotz rekordtiefer JGB-Renditen rund 25% des Budgets – dereinst Japans Schuldentragfähigkeit in Frage stellen. Das Risiko eines Dominoeffekts steigt – Anleger könnten sich in Scharen von JGB verabschieden, den Zinsauftrieb beschleunigen und die Finanzierungsnot zu einer selbst erfüllenden Prophezeiung machen.

Eine schwere Rezession wäre die Folge. Wie in den Peripheriestaaten Europas würde sie aber nicht von sinkenden, sondern steigenden JGB-Renditen begleitet. In dieser Phase ist von Aktien, Staatsanleihen und Währung abzuraten.

Vierter Akt: Endspiel

Trotzdem ist in Japan kein zweites Griechenlandszenario zu erwarten, denn im Gegensatz zum Euromitglied verfügt das Inselreich über eine eigene Notenpresse, die zur Absorbierung des JGB-Überhangs angeworfen werden dürfte. Die Notenbank wird vollends in den Dienst der Regierung gestellt und die Staatsschuld monetarisiert. Mit anderen Worten: Die BoJ würde der Regierung die Anleihen mit frisch gedrucktem Geld abkaufen und dadurch die Geldmenge massiv ausweiten. Damit verbunden wäre das völlige Entgleiten der Kontrolle über Inflations- und Zinsentwicklung bis hin zur Hyperinflation.

Im Endspiel werden die Eigner von Nominalanlagen über die Geldentwertung enteignet, während Sachanlagen einen gewissen Schutz bieten. Der Nikkei würde in dieser Phase exponentiell steigen, der Yen hingegen abstürzen. Grafik 3 zeigt diese Dynamik am Beispiel der Türkei während der Neunzigerjahre, als sich der Istanbuler Aktienmarkt mehr als verfünftausendfacht, die Lira aber vollständig entwertet hat.

- schon älter - aber so wahr; das Endspiel beginnt bald

Die LDP kommt mit einem klaren Wahlsieg an die Macht zurück. Wie könnte ein hypothetisches Szenario für Japan aussehen? Drehbuch und Handlungsempfehlungen für das anstehende Endspiel.

Die Liberaldemokratische Partei (LDP) unter ihrem Anführer Shinzo Abe hat die Parlamentswahlen von gestern Sonntag klar für sich entschieden. Zusammen mit ihrem Koalitionspartner wird die LDP voraussichtlich eine Zweidrittelmehrheit im Unterhaus kontrollieren. Dies, nachdem sie zuvor drei Jahre in der Opposition gestanden hatte. Die Aussicht auf den Sieg Shinzo Abes hat in den vergangenen Wochen bereits zu einer Rally am japanischen Aktienmarkt und zu einer Abschwächung des Yens geführt. Der künftige Premier möchte zur Bekämpfung der Deflation den Yen schwächen und zu diesem Zweck die Bank of Japan (BoJ) verpolitisieren.

Japanisches Drehbuch

Abe könnte mit seiner Politik schlafende Hunde wecken. Zugegeben: Das Ende der Yenhausse und die Zinswende für Staatsanleihen (JGB) wurden schon oft verkündet. Allerdings mehren sich die Anzeichen, dass beide an einem strukturellen Wendepunkt stehen könnten. Es ist deshalb nicht auszuschliessen, dass Abes Absichten den Trendwechsel auslösen.

Wie könnte ein hypothetisches Szenario für Japan aussehen? Am wahrscheinlichsten scheint ein Drama in vier Akten. Anzumerken gilt, dass die Abgrenzung der einzelnen Akte nicht scharf ist, da sich die Phasen überlappen. Auch die zeitliche Dimension kann kaum abgeschätzt werden. Klar ist nur, dass sich Krisen gegen Ende beschleunigen – die ersten Akte können sich aber durchaus über mehrere Jahre hinziehen und durch langwierige Gegenbewegungen unterbrochen werden.

Erster Akt: Yenschwäche

Gemäss Abe trägt die BoJ die Verantwortung für das Verharren in der Deflationsfalle. Deshalb wird er nächsten April BoJ-Chef Masaaki Shirakawa und seine zwei Stellvertreter – alle drei geldpolitische Traditionalisten – durch «Tauben» ersetzen. Zudem plant er eine Inflationsvorgabe von 2 bis 3%, für deren Erreichung er das Präsidium persönlich verantwortlich machen will. Auch wenn Abe politische Kompromisse eingehen muss, dürfte die BoJ nächstes Jahr ein massives Quantitative-Easing-Programm lancieren.

In der Vergangenheit wurden schon einige Versuche unternommen, den Yen abzuwerten. Oft verpufften die Massnahmen wirkungslos. Dieses Mal könnte es aber anders sein, denn es gibt Anzeichen, die für eine strukturelle Wende des Yens auch ohne Eingriffe der BoJ sprechen. Der wichtigste Unterschied zu vergangenen Episoden ist die Handelsbilanz, die letztes Jahr zum ersten Mal seit Ende der Siebzigerjahre nachhaltig ins Minus gedreht hat und aufgrund der geänderten Energiepolitik – höhere Energieimporte als Folge des nach Fukushima beschlossenen Atomausstiegs – dort verharren könnte.

Sofern die Politik der Yenschwäche gelingt, dürfte der Nikkei nächstes Jahr haussieren. Seit dem Jahr 2005 wird der japanische Aktienmarkt hauptsächlich vom Yen getrieben. Einen Vorgeschmack haben Investoren seit der Ansetzung der Neuwahlen bereits erhalten. Zu den Sektoren, die in diesem Umfeld am besten abschneiden werden, gehören mit den Maschinen- und den Autowerten die klassischen Exportchampions.

Zweiter Akt: Zinsanstieg

Über den schwächeren Yen wird die importierte Inflation anziehen. Sollte sich die Weltwirtschaft nächstes Jahr wieder leicht erholen und damit die Konjunktur auch in Japan beflügeln, erhält der Preisauftrieb zusätzliche Schützenhilfe.

zoom

Eine Überwindung der Deflation dürfte vom Aktienmarkt zunächst euphorisch begrüsst werden. Wie Grafik 2 zeigt, erreichen die Aktienmarktbewertungen ihren Höhepunkt bei einer Inflationsrate von 1 bis 3%. Eine Bewertungsexpansion wäre aufgrund der historischen Erfahrung demnach keine Überraschung.

Ein Anziehen von Inflation und Wachstum bringt höhere Zinsen mit sich. Es ist zu erwarten, dass dies vom Aktienmarkt – besonders von den Bankwerten – anfänglich positiv aufgenommen würde. Der Gesamtmarkt dürfte von Umschichtungen aus den enorm überteuerten JGB profitieren, während die Banken dank der höheren Zinsmargen ein Revival erleben.

Dritter Akt: Börsenkorrektur

Die Massnahmen Abes sind angesichts des Schuldenbergs von rund 236% des Bruttoinlandprodukts und eines Budgetdefizits von über 9% des BIP nicht ohne Risiko. Eine Schwächung des Yens wird ausländische Investoren vom Kauf von JGB abhalten. Auf die Ausländer ist Japan aber angewiesen, da den japanischen Privatinvestoren – unter anderem wegen der demografiebedingt sinkenden Sparquote – der Appetit auf JGB vergangen zu sein scheint. Seit 2009 sinkt der JGB-Bestand in den Händen der Privaten – auch das ein struktureller Wandel.

Höhere Zinsen würden angesichts des heute schon beachtlichen Schuldendiensts – die Zinszahlungen beanspruchen trotz rekordtiefer JGB-Renditen rund 25% des Budgets – dereinst Japans Schuldentragfähigkeit in Frage stellen. Das Risiko eines Dominoeffekts steigt – Anleger könnten sich in Scharen von JGB verabschieden, den Zinsauftrieb beschleunigen und die Finanzierungsnot zu einer selbst erfüllenden Prophezeiung machen.

Eine schwere Rezession wäre die Folge. Wie in den Peripheriestaaten Europas würde sie aber nicht von sinkenden, sondern steigenden JGB-Renditen begleitet. In dieser Phase ist von Aktien, Staatsanleihen und Währung abzuraten.

Vierter Akt: Endspiel

Trotzdem ist in Japan kein zweites Griechenlandszenario zu erwarten, denn im Gegensatz zum Euromitglied verfügt das Inselreich über eine eigene Notenpresse, die zur Absorbierung des JGB-Überhangs angeworfen werden dürfte. Die Notenbank wird vollends in den Dienst der Regierung gestellt und die Staatsschuld monetarisiert. Mit anderen Worten: Die BoJ würde der Regierung die Anleihen mit frisch gedrucktem Geld abkaufen und dadurch die Geldmenge massiv ausweiten. Damit verbunden wäre das völlige Entgleiten der Kontrolle über Inflations- und Zinsentwicklung bis hin zur Hyperinflation.

Im Endspiel werden die Eigner von Nominalanlagen über die Geldentwertung enteignet, während Sachanlagen einen gewissen Schutz bieten. Der Nikkei würde in dieser Phase exponentiell steigen, der Yen hingegen abstürzen. Grafik 3 zeigt diese Dynamik am Beispiel der Türkei während der Neunzigerjahre, als sich der Istanbuler Aktienmarkt mehr als verfünftausendfacht, die Lira aber vollständig entwertet hat.

Schöne Theorie. Scheitert aber gerade. Die Yen Presse läuft sich wund, Statt Inflation wird Deflation produziert.

Japan muss das Defizit einschränken und die Zinsen etwas erhöhen. Dann klappt der Aufschwung.

Japan muss das Defizit einschränken und die Zinsen etwas erhöhen. Dann klappt der Aufschwung.

http://www.zerohedge.com/news/2013-12-05/kyle-bass-warns-whe…

"There are going to be consequences to central bank balance sheet expansion all over the world," Kyle Bass tells Steven Drobny in his new book, The New House of Money Moneyng "It’s a beggar-thy-neighbor policy, but everyone is beggaring thy neighbor." The Texan remains concerned at QE's effects on wealth inequality and worries that "at some point this is going to ignite and set cost pressures off." While Gold-in-JPY is his recommended trade for non-clients, his hugely convex trades on Japan's eventual collapse remain as he explains the endgame for his thesis, "won't buy back until JPY is at 350," and fears "the logical conclusion is war."

Excerpted from Steven Drobny's The New House Of Money,

Drobny: You’re on the tape saying that dollar/yen is going to 200.