Nano One Materials ...Lithiumplayer mit großem Potential? (Seite 44)

eröffnet am 13.11.15 11:14:18 von

neuester Beitrag 10.05.24 20:00:11 von

neuester Beitrag 10.05.24 20:00:11 von

Beiträge: 2.165

ID: 1.221.450

ID: 1.221.450

Aufrufe heute: 2

Gesamt: 260.468

Gesamt: 260.468

Aktive User: 0

ISIN: CA63010A1030 · WKN: A14QDY · Symbol: NANO

1,8900

CAD

-1,05 %

-0,0200 CAD

Letzter Kurs 17.05.24 Toronto

Neuigkeiten

16.05.24 · Shareribs Anzeige |

15.05.24 · IRW Press |

15.05.24 · Accesswire |

14.05.24 · Shareribs Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7400 | +20,01 | |

| 16,270 | +16,71 | |

| 1,2800 | +14,29 | |

| 0,8450 | +14,19 | |

| 2,9000 | +13,28 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 240,00 | -7,69 | |

| 2,6100 | -9,06 | |

| 11,320 | -10,51 | |

| 0,5500 | -26,67 | |

| 48,40 | -97,97 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 74.142.278 von unterhorst am 12.07.23 12:52:45

Mindestens 10K nächstes Jahr…😀👍

Zitat von unterhorst: hab mir auch mal 1K gegönnt,gucken was draus wird

Mindestens 10K nächstes Jahr…😀👍

hab mir auch mal 1K gegönnt,gucken was draus wird

Batterien zukünftig nachhaltiger produziert

EU ebnet den Weg zur nachhaltigen Produktion von Batterien mit einer neuen Verordnung ab 2024. Hört sich an, wie für Nano One gemacht 😎Link: https://de.finance.yahoo.com/nachrichten/eu-mitgliedstaaten-…

Antwort auf Beitrag Nr.: 74.128.631 von lilu-bit am 10.07.23 00:14:11Moin, danke auch dir fûr dein Statement/Sichtweise in Bezug Rio Tinto.

Auch wenn ich das falsch in Erinnerung hatte,

sind eure Sichtweisen Perspektiven, wie ihr das seht, erklärend sehr hilfreich.

Vielen Dank euch allen noch einmal.

Lg

Auch wenn ich das falsch in Erinnerung hatte,

Zitat von AEVR: Ok

https://www.irw-press.com/de/news/nano-one-gibt-abschluss-ei…

Das war damals die Meldung, 12m war ein Stillhalteabkommen zu und Sperrfrist für wertpapierveräusserungen. Hatte ich verkehrt in. Erinnerung, sry.

sind eure Sichtweisen Perspektiven, wie ihr das seht, erklärend sehr hilfreich.

Vielen Dank euch allen noch einmal.

Lg

Antwort auf Beitrag Nr.: 74.128.340 von contrapunctus am 09.07.23 21:26:13Die Story mit Saint-Gobain und Nano, die hier beschrieben wird, ist in weiten Teilen bekannt und stammt aus den Jahren 2018 / 2019. Der neue Player Addionics ist neu für mich. Klingt erst mal spannend und in der beschriebenen Art schlüssig.

Hast Du @contrapunctus schon mal was von einer Konstellation mit Addionics gehört?

Im Zusammenhang mit Nano ist Addionics jedenfalls noch nicht aufgetaucht. Die News auf Addionics WEB-Präsenz vermittelt mir den Eindruck, sie sind noch in der Entwicklungs-Phase und weiter von der Kommerzialisierung entfernt als Nano. Denn Nano One hat schon eine Reihe von Meilensteinen in seiner Entwicklung geschafft und kann auf viele Geschäftspartner zurückgreifen. Das vermisse ich bei Addionics noch.

Schau'n wir mal, wie sich das in Zukunft entwickelt. Manchmal werden Wünsche wahr.

Hast Du @contrapunctus schon mal was von einer Konstellation mit Addionics gehört?

Im Zusammenhang mit Nano ist Addionics jedenfalls noch nicht aufgetaucht. Die News auf Addionics WEB-Präsenz vermittelt mir den Eindruck, sie sind noch in der Entwicklungs-Phase und weiter von der Kommerzialisierung entfernt als Nano. Denn Nano One hat schon eine Reihe von Meilensteinen in seiner Entwicklung geschafft und kann auf viele Geschäftspartner zurückgreifen. Das vermisse ich bei Addionics noch.

Schau'n wir mal, wie sich das in Zukunft entwickelt. Manchmal werden Wünsche wahr.

DREAM TEAM: Nano One Materials & Saint Gobain & Addionics

Sofern man den Weg des Unternehmens schon etwas länger mitverfolgt, klingt das für mich sehr, sehr plausibel! Sehr unwahrscheinlich, das sie bei den noch bestehenden Kontakten zu Saint Gobain, deren Entwicklung zusammen mit Addionics bzw. diese nicht im Blick haben oder sogar, wie hier angenommen mit involviert sind!Hier das Orginal: https://stockhouse.com/companies/bullboard/t.nano/nano-one-m…

DREAM TEAM: Nano One Materials & Saint Gobain & Addionics

Why? A few thoughts on this.

Part 1: Nano One Materials & Saint Gobain

1) December 18, 2018: Nano One Signs a Joint Development Agreement with Saint-Gobain

https://nanoone.ca/news/news-releases/nano-one-signs-a-joint…

"The goal of the collaboration is to enhance high temperature processing of Nano One's lithium ion battery materials. ... commercial terms remain confidential.”

"Their materials are complementary to our processing technology and this agreement adds to our current efforts with other strategic interests in the lithium ion battery supply chain."

Ms. Ben Bassat, Nano One's VP of Business Development

"Saint-Gobain also wants to be joining Nano One's demonstration pilot project, as a consortium member with the support of the Government of Canada through Sustainable Development Technology Canada."

“Innovation for a sustainable future is at the core of both companies and our combined know-how has the potential to put us at the forefront of transformative energy storage solutions. We look forward to working in close collaboration with Nano One.”

Mr. Natesh Krishnan, Worldwide Commercial Director Saint Gobain

2) May 31, 2019: Nano One Approved for $5 Million Funding from Sustainable Development Technology Canada

https://nanoone.ca/news/news-releases/nano-one-approved-for-…

“As communicated previously,” Mr. Blondal added, “Nano One is engaged with Pulead Technology and Saint-Gobain and we are pleased to announce that Volkswagen Group Research will join our consortium as a project contributor. Details on the other two project contributors remain confidential. We are inspired to be working with such accomplished global leaders and look forward to accelerating our activities with the support of SDTC.”

Addendum: VW & Saint Gobain are still Consortium Partners today

https://nanoone.ca/about/partners/

3) August 4, 2021: Nano One Provides Update on Joint Projects with Saint-Gobain (PROJECTS!)

https://nanoone.ca/news/news-releases/nano-one-provides-upda…

“This project has provided valuable insight on thermal processing conditions for various cathode materials and furnace materials. We have developed thermal processing expertise to optimize the performance of cathode materials and throughout the project, we have shared a collaborative and open relationship with our colleagues at Saint-Gobain. Potential future work will build on those outcomes, add manufacturing know-how and enhance the value of our process technology and business offerings."

Stephen Campbell, Nano One’s Chief Technology Officer.

"Saint-Gobain remains a consortium member within Nano One’s “Scaling Advanced Battery Materials” project supported by Sustainable Development Technology Canada (“SDTC”) and the British Columbia Innovative Clean Energy (“ICE”) fund."

"The partnership with Nano One has been important to Saint-Gobain through advancing our understanding of the cathode material firing process to allow an enhanced product offering to better serve this market.”

Mr. Natesh Krishan, General Manager of Engineered Ceramics of Saint-Gobain

"Having built a positive working relationship over the past 2 years, Nano One and Saint-Gobain are discussing the scope of work for additional joint projects and will continue to explore future business and co-development opportunities."

Final assessment: ALL GOALS of these joint PROJECTS were apparently achieved more than satisfactorily for both sides!

Part 2: Saint-Gobain & Addionics

1) April 21, 2021: Announcement of the collaboration

https://batteriesnews.com/saint-gobain-addionics-high-power-…

a) Saint Gobain

"Saint-Gobain and addionics to develop high-power, high-capacity solid-state batteries for long-range, fast-charging EV. The partnership aims to offer major improvements in EV battery performance, such as longer driving range, fast charging, enhanced safety and lower production costs. Saint-Gobain’s initial technological breakthrough with its novel solid-state battery components enables safer battery operation and low-cost manufacturing by simplifying the production flow and eliminating intermediate processes."

>> Haven't you heard everything like this before?

b) Addionics

And what does Addionics bring to the collaboration? A LOT, namely another optimization!

aa) https://www.addionics.com/post/3d-electrodes-the-new-standar…

"By using dry coating instead, where the active material on the current collector is already dry, this would remove or at least minimize the need for a drying process."

"Ready-for-production technology is designed to be seamlessly integrated into existing manufacturing lines, regardless of the chemistry, new or existing. Indeed, the industry is adopting this new 3D metal architecture for cell design as by being a drop-in solution, it’s cheaper and easier"

"Additionally, it can improve any kind of battery technology and chemistry, including li-ion, silicon, solid state and more."

>> DRY COATING? Who would like to use this or is interested in it? Tesla, VW... Others?

bb) https://www.addionics.com/post/is-the-us-on-the-way-to-becom…

"By reducing the amount of inactive materials and increasing electrode loading, Addionics 3D structures allow LFP batteries to deliver more power and store more energy. Indeed, as more active material is loaded with Addionics’ technology, higher energy density is achieved to allow a longer driving range. Furthermore, the 3D electrode structure contributes to reducing the internal resistance of LFP batteries to achieve faster charging times and allowing them to operate at high currents."

"For these reasons, Addionics is collaborating with a number of major OEMs to develop high performing LFP batteries that will enable car makers to use this safe, cost-effective technology to power current and future EVs and fleets."

>> LFP? Multiple OEMs? Like Nano One Materials! The perfect match? Or LMFP?

"As #LMFP batteries enter the early stage of mass production, it's no wonder that Volkswagen and other industry leaders are taking notice. With its advanced capabilities and performance, LMFP has the potential to be one of the leading EV battery chemistries in the next few years. Combining LMFP with advanced 3D current collectors can improve adhesion and increase the active content of LMFP, enabling a higher energy density. Exciting times lie ahead for the future of batteries!"

https://www.linkedin.com/posts/addionics_chinas-ev-battery-s…

It all sounds very good!

)

)cc) https://www.addionics.com/post/addionics-unveils-the-world-s…

On February 14, 23 Addionics unveils the world's first 3D electrode manufacturing pilot line for EV batteries.

"With Addionics' partners' support, the company will expand its technological developments primarily for the automotive industry, which includes global leading automakers and tier 1 suppliers."

- https://www.eetimes.com/how-smart-3d-electrodes-will-power-n…

"Addionics has started building in its pilot stage in Israel the components required by companies in the United States and Europe. Later, taking advantage of the Inflation Reduction ACT (IRA) incentives, Addionics plans to extend to the US, building a production site to serve the American automotive market."

- https://www.forbes.com/sites/johnfrazer1/2023/04/03/ev-autom…

"No new facilities need to be built. What we offer is a drop-in solution that requires no additional capital expenditure. Additionally, the solution is chemistry-agnostic. It doesn’t matter if the battery is nickel-manganese-cobalt, lithium-iron-phosphate or even emerging chemistries such as silicon and solid-state. Costs are reduced as a result, and the kicker is that so are emissions; we have a more efficient manufacturing and drying process that consumes less and creates less waste.”

Couldn't that fit Nano One Materials schedule?

dd) More information about Addionics on Linkedin: https://www.linkedin.com/company/addionics/posts/?feedView=a…

Part 3: Conclusion

The work between Saint-Gobain and Nano One Materials has now been completed for almost 2 years. Over time, however, the collaboration between Saint Gobain and Addionics has developed rapidly. Both Nano One Materials and Addionics are right now at the beginning of their commercialization, the link here is Saint Gobain in my opinion.

In this cooperation, everything would fit together technologically (ONE POT/M2CAMS & Solid State & Smart 3D electrodes/dry coating) and surprisingly also in terms of time. This solution would be independent of different battery chemicals, could be easily integrated into existing production processes and could be used worldwide as a complete solution!!!

IN SHORT: This interaction would combine all the advantages that the batteries of the next generation should have: environmental compatibility, long range, fast charging time, durability, cost savings!

For me, Nano One Materials (Active Material) & Saint Gobain (Solid-state battery components) & Addionics (Smart 3D electrode technology/dry coating) would be:

THE DREAM TEAM FOR THE NEXT GENERATION OF GREEN LITHIUM BATTERIES!

https://nanoone.ca/news/news-releases/nano-one-patented-cath…

https://www.addionics.com/post/addionics-to-collaborate-with…

But it is very likely that it will only be >> ONE << of many possible collaborations alongside the many others (Rio Tinto, BASF, Umicore, Euro Manganese, ONE ... and all the unpublished projects that are unfortunately under NDA) that are certainly running in the background.

Exciting times! We will see! Stay informed!

Zum Starsearcher80

… ehrlich,was für ein übertrieben verfasstes Exemplar.Ich mag und schätze andere Meinungen/Ansichten.Aber dieses Geschwafel ist echt krass.Hätte Buchautor /Poet werden sollen

… ehrlich,was für ein übertrieben verfasstes Exemplar.Ich mag und schätze andere Meinungen/Ansichten.Aber dieses Geschwafel ist echt krass.Hätte Buchautor /Poet werden sollen

Antwort auf Beitrag Nr.: 74.084.602 von AEVR am 30.06.23 08:46:18

Nein, von einer Übernahme durch Rio Tinto stand da nichts im Kooperationsvertrag. Die Option 1 Mio. Aktien bis 16.06.23 von Nano One für 4 CAD zu kaufen, hat Rio, glaube ich wertlos verfallen lassen bei einem damaligen Preis von 2,18 USD pro Aktie.

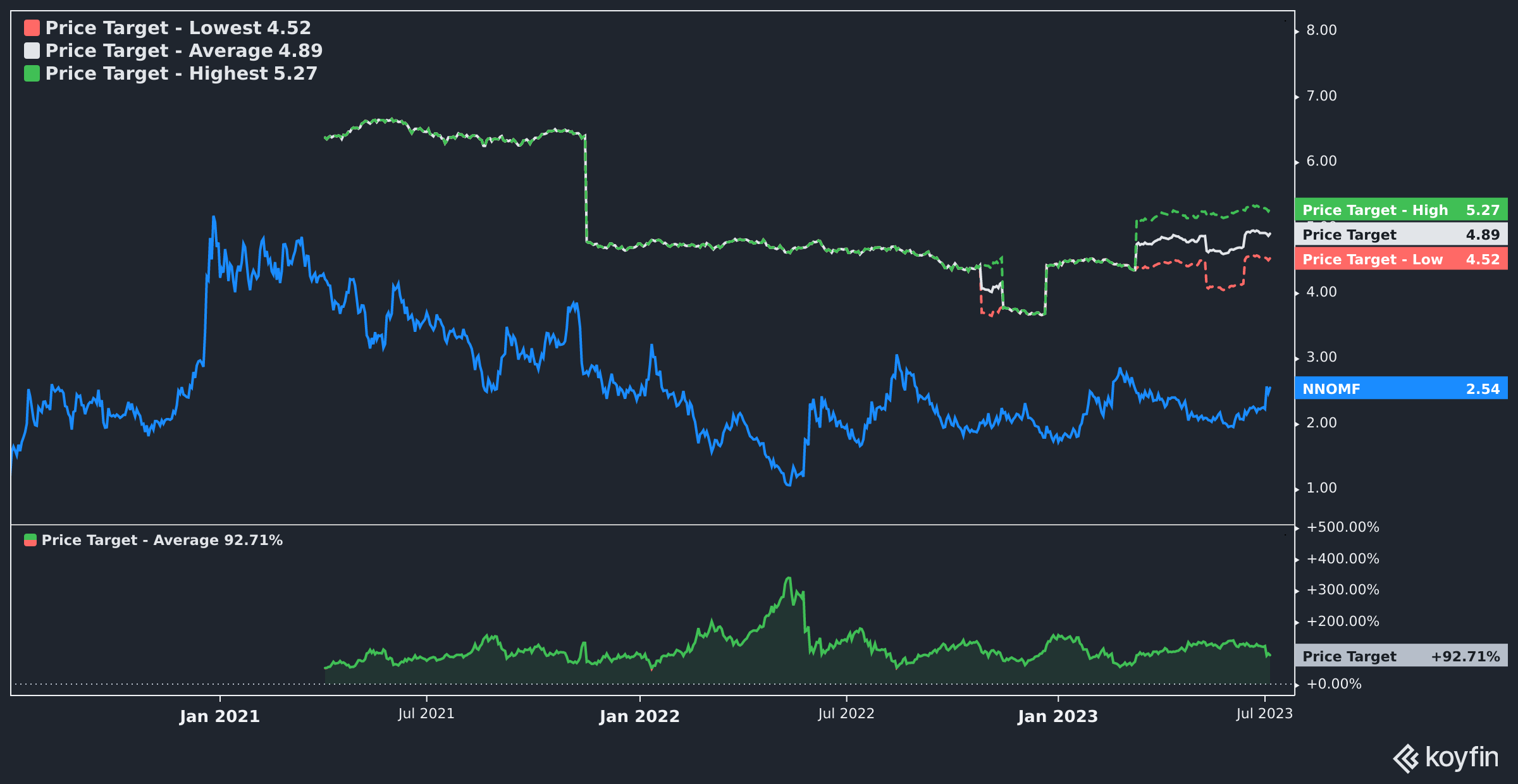

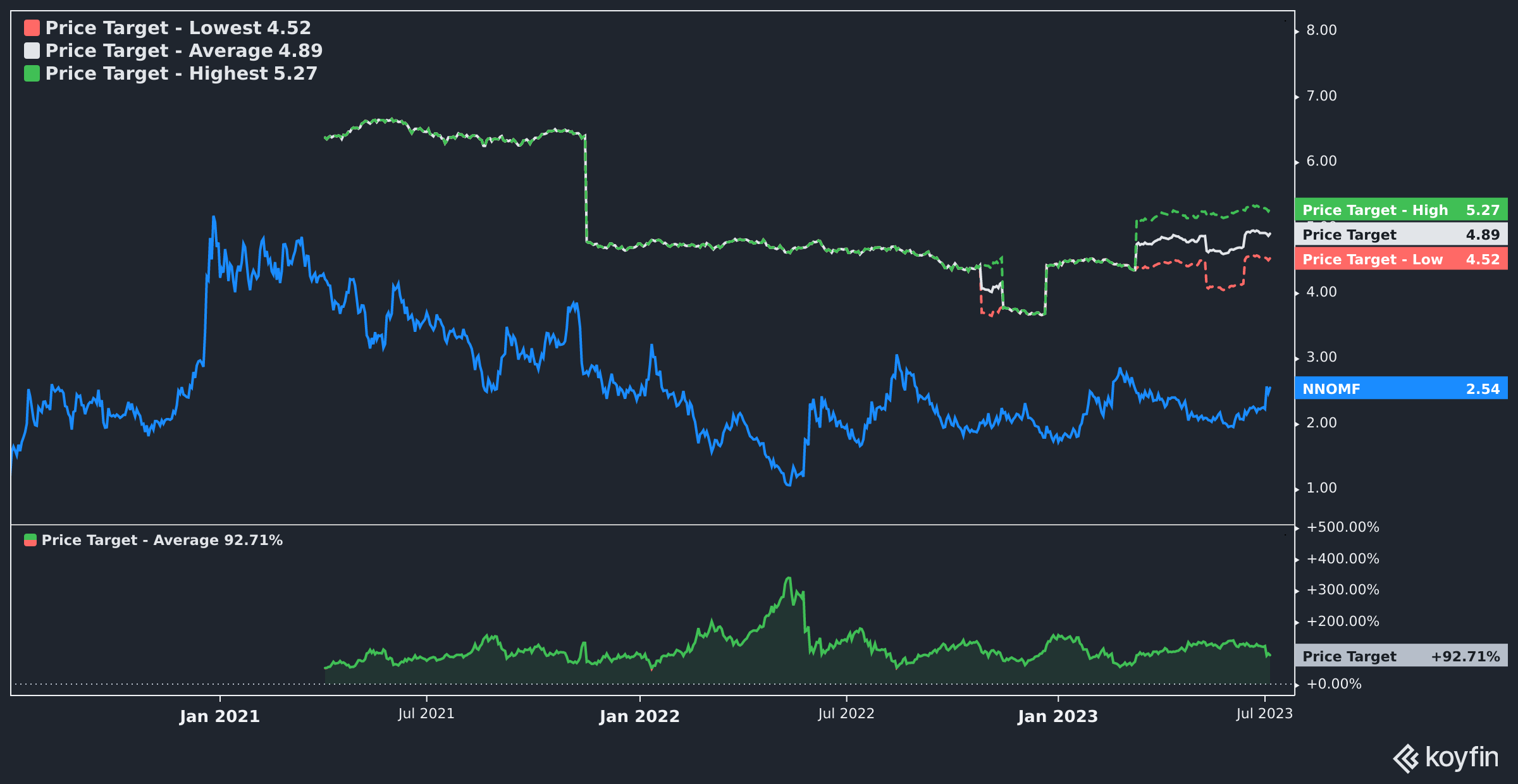

Die Marktkapitalisierung von Nano One liegt derzeit bei ca. 265 Mio. USD. Analysten schätzen die Preisentwicklung bis Jahresende auf ca. 5 USD.

Bei einer feindlichen Übernahme müsste ein Käufer mindestens 521 Mio. USD auf den Tisch legen.

Welchen Vorteil hätte Rio Tinto mit der Übernahme von Nano One?

Nano wird sich alleine abstrampeln, um genug Kunden für sein Kathoden-Material zu akquirieren. Als aufstrebendes Unternehmen ist man da agiler und flexibler.

Rio Tinto ist ein Milliarden schwerer Bergbaukonzern mit weltweiter Wertschöpfungskette. Warum sollte er Ressourcen dafür vergeuden, die in keinem Verhältnis zum Nutzen für ihn stehen. Selbst eine Milliarde zusätzliche Einnahmen wären bei einem Gewinn vor Steuern von 18,6 Mrd. USD uninteressant.

Nano One ist für Rio der Partner, der die Kathodenmaterial-Produktion vorantreibt. So macht jeder, was er am besten kann und Rio verdient dabei zweimal.

Will Rio Tinto Nano One übernehmen?

Sorry @AEVR für die verzögerte Antwort, ich musste erst mal ein paar Zahlen checken.Nein, von einer Übernahme durch Rio Tinto stand da nichts im Kooperationsvertrag. Die Option 1 Mio. Aktien bis 16.06.23 von Nano One für 4 CAD zu kaufen, hat Rio, glaube ich wertlos verfallen lassen bei einem damaligen Preis von 2,18 USD pro Aktie.

Die Marktkapitalisierung von Nano One liegt derzeit bei ca. 265 Mio. USD. Analysten schätzen die Preisentwicklung bis Jahresende auf ca. 5 USD.

Bei einer feindlichen Übernahme müsste ein Käufer mindestens 521 Mio. USD auf den Tisch legen.

Welchen Vorteil hätte Rio Tinto mit der Übernahme von Nano One?

Nano wird sich alleine abstrampeln, um genug Kunden für sein Kathoden-Material zu akquirieren. Als aufstrebendes Unternehmen ist man da agiler und flexibler.

Rio Tinto ist ein Milliarden schwerer Bergbaukonzern mit weltweiter Wertschöpfungskette. Warum sollte er Ressourcen dafür vergeuden, die in keinem Verhältnis zum Nutzen für ihn stehen. Selbst eine Milliarde zusätzliche Einnahmen wären bei einem Gewinn vor Steuern von 18,6 Mrd. USD uninteressant.

Nano One ist für Rio der Partner, der die Kathodenmaterial-Produktion vorantreibt. So macht jeder, was er am besten kann und Rio verdient dabei zweimal.

Neuer Post von Starsearcher80…

Wenn man das liest, könnte man meinen, dass der Kurs hier in maximal 2 Jahren bei 50 Euro steht. Sehr optimistisch geschrieben, aber in meinen Augen auch nicht falsch. Da ist schon viel dran an dem, was Starsearcher80 schreibt. Beurteilt selbst:Post by Starsearcher80on Jul 09, 2023 12:32am

198 Views Post# 3553246

THE BIRTH OF A UNICORN STOCK

The Unicorn stock. We've all heard of one. We've all dreamed of being a part of one. But the reality is that many of us will spend a lifetime and rarely see a true Unicorn stock, let alone have the good fortune to catch the stock early. For myself, in close to 35 years in the market, I think I've come across three true unicorn stocks. Only one of them did I catch early, and although I made a lot of money on the stock, I also left a lot on the table. The other two I came to much later, mostly to watch and learn.

Unicorns stocks are of course rare. I've seen any number of companies come close to this Unicorn status, but there are just SO many conditions that have to time perfectly for the birth of a true unicorn stock to materialize. Of course the gazillion dollar question is are we seeing the birth of a Unicorn stock with Nano? The answer could in fact be "yes". So let's go through these conditions:

1) The field of the company must be new/emerging:

The field of rechargeable batteries is not new per se. Lithium battery technology is close to 40 years old now. But what IS hugely new is the MASSIVE race to ungrade the technology to produce longer lasting batteries at huge volumes and progressively lower costs. Of course this is driven by the burgeoning EV industry, but also the battery storage facilities being built to help cities deal with over-burdened grid useage.

As it pertains to these new massive industries, it can be simplied as a race to build faster, cheaper, greener batteries at scale. It is the very nature of the competitive market to drive this need. Now, if it were just a race to build at scale, really, that would be solveable fairly easily. Just build more and bigger factories. But put the compatitive nature of free market will have these massive factories tripping over each other to acheive these competitive goals.

I want to highlight these competitive market words again.Keep these words close: Cheaper, faster, greener, longer lasting. The battery makers who achieve these goals will thrive. Those who don't will ultimately fail.

2) The Unicorn company has to have something that is not only truly unique but have "game changer" capability:

For Unicorn status, this is what first intrigued me so much with Nano. Current processing technology is extremely dirty, slow, costly, and the battery degrades. In my thinking, solving ANY one of these four competitive goals would give Nano a home run opportunity. But Nano is not just solving one of these problems. They are solving ALL FOUR. Via the One Pot processes, the process is cheaper, faster, greenerinfinitely greener, and battery degredation is greatly improved. That Nano is solving all four issues is not just a home run. It's an abolute out-of-the-park home run. And even these words are putting it far far too mildly. Nano is fitting RIGHT into the competitive need of these massive factories being built, and again the words are right there. Cheaper, faster, greener, longer lasting. Unicorn potential? Absolutely. Game-changing technology? Absolutely.

3) The Unicorn stock must be ahead of the competion:

For all intensive purposes, Nano does not currently have any competition, and if there is any competition out there, Nano is literally years ahead of them. I've spent a LOT of time searching for that competition, as have others, and to the best of our collective knowlege, Nano currently stands alone. That's kind of competitive advantage takes your breath away. It is also a condition for Unicorn status, and in this regard, Nano qualifies. Not just "kind-of" qualifies. FULLY qualifies.

4) Governments must support the emerging technology:

There are any number of examples of companies that have legislation that ultimately impeeds their growth. Most of these companies were independent, without any Government support, that forged their own Unicorn-like path, only to then get road-blocks put up by Governement. Tech is littered with examples of this.

But as it pertains to the super-charged growth of the battery industry, I don't think I've EVER seen governments collectively trip over each other to financially support a new industry. There are now MASSIVE infusions of Governement dollars into battery tech, and at every level of Government, absolutely super-charging this race. Much of this support is actually driven by the geo-political move to on-shore cirtical industries. We saw this happen first with chip-makers, and now with EV battery need. With 95% of the processing currently being done in China, North America now feels understandably vulnerable if China were to ever "shut the taps off" so to speak. It is a VERY understandable concern, especially as the relationship with China is now strained at best, with the potential now for worse now unfortunately coming in to view. Enter Government to solve this problem, and as quickly as possible. In the U.S. it's the Inflation Reduction Act (IRA). Onshoring is now happening at a stunning speed, and we're aloready seeing the first glimpses of this, which are already staggering in size and scope. And there will be more. Much MUCH more.

That this on-shoring is happening now is near perfect timing for Nano. Nano has also benefited directly by Government support, and there is every expectation that this will not only continue but will also be much larger. For the Canadian Goverment, Nano is already a VERY well known company in this space, and something that the Government can put up as a a huge Canadian success story.

That there is MASSIVE government support in this space, in both the U.S. and Canada, and that Nano is already a very well known company in this space, is HUGELY exciting. I have NO doubt that Nano's future will also be turbo-charged by this support. The timing of this Government support of this new industry again absolutely lays fertile groundwork for possible Unicorn status with Nano. Truly, in this area it just couldn't get any better.

5) The Unicorn company has to have the right Management at every stage of its growth:

Does Nano have the right management? I think they do. Nano has done a stunning job of anticipating this market. They have made excellent inroads with Government, and are showing signs of starting to flex without being overstated. They are actively making industry connections far bigger and far faster than what any otherwise currently small company would ever be able to do.

Nano is going to be entering a period of rapid expansion on just about every front imaginable, and this is going to present challenges that are present to any company going through similar rapid growth. Is current management up to this challenge? As much as I'd like to say yes, this is a question that can only be answered in the future, as as such, can only be put in the category of "remains to be seen". What I can say though is management has shown themselves as both prudent and adept, which is a rare combination in and of itself. This bodes well for the future, and I am willing to trust they'll meet those growth challenges with the same careful planning that they've shown so far.

Unicorn status? The potential is there. With so many of the Unicorn boxes checked, it would be a shame not to check this management box as well, as it is actually well within the company's control to "get it right".

So back to the Headline of this post:

Are we witnessing the birth of a true Unicorn stock with Nano?? All in, the potential is absolutely there, and then some.

It's an eye-opening, breath-taking proposition. And it's just SO rare that when I come across a company such as Nano with THAT much potential, with something that is THAT game-changing and unique, and the timing is THAT good with the need in the market.....well, it all stops me right in my tracks. While I can't beleive what is right there before my eyes... there it is.

So I take a breath, and smile ear to ear at the prospect. The birth of a Unicorn stock, and I'm there at the beginning. The profit potential here is jaw-dropping.

Antwort auf Beitrag Nr.: 74.092.060 von Grafinado am 01.07.23 21:44:50

Link: https://www.volkswagen-newsroom.com/de/pressemitteilungen/vo…

Was ist der Knackpunkt?

Ford und Tesla wollen vom chinesischen Batteriehersteller CATL ihre Batterien kaufen und in ihren Fahrzeugen verbauen. Dafür wollen sie den IRA geschickt umgehen, um sich die Subventionen für ihre Fahrzeuge zu sichern.

Wie soll das ablaufen?

BloombergNEF hat bereits im Januar in ihrem "Top 10 Energiespeicher-Trends im Jahr 2023" bereits darüber geschrieben.

Zitat BloombergNEF vom 11.01.2023 - automatisch übersetzt

"Gerüchten zufolge erwägen Ford und CATL den Bau einer Batterieproduktionsanlage in Michigan, USA, in einer komplexen

Vereinbarung, die es der Einrichtung ermöglichen würde, Steuervorteile zu erzielen und gleichzeitig die gesetzlichen Bestimmungen einzuhalten. (Ford wäre Eigentümer der Anlage, während CATL sie betreiben würde.) Solche kreativen Workarounds werden bei chinesischen Unternehmen immer wahrscheinlicher, insbesondere bei denen, die an einer Expansion in die USA interessiert sind."

Link: https://about.bnef.com/blog/top-10-energy-storage-trends-in-…

Welche Auswirkung hat das auf unser Investment?

Nano One kann nur mit ökonomischen und ökologischen Fakten punkten. Doch letztlich entscheidet der Preis, ob ein Kunde das Auto kauft oder nicht. Die Kosten der EV-Batterie ist dabei das entscheidende Kriterium. Der Preis muss günstig und die Herstellung muss hoch profitabel sein. Da kann Nano One den Hebel ansetzen.

Mit starken Partnern überzeugen!

PowerCo von VW, Umicore und das Startup Our Next Energy (ONE) könne dabei im Industriemaßstab Zeichen setzen, wie profitabel Nano's Fertigungs-Ansatz ist. VW spricht dabei von erheblichen Einsparungen.

Zitat Volkswagen Newsroom vom 16.06.23

"Der neue Prozess hat nach PowerCo Berechnungen das Potential, rund 30 Prozent Energie, rund 15 Prozent Fabrikfläche und damit hunderte Millionen Euro Fertigungskosten pro Jahr zu sparen. Frank Blome, CEO der PowerCo SE: „Die Trockenbeschichtung ist für die Produktion das, was die Feststoffzelle für das Produkt ist – ein echter Game-Changer, der uns bei erfolgreicher Skalierung in Großserie eine klare Alleinstellung und damit klare Wettbewerbsvorteile verschafft.“"

Link: https://www.volkswagen-newsroom.com/de/pressemitteilungen/na…

Profitabilität ist ein scharfes Schwert in den künftigen Rabatt-Schlachten, wenn sich EV-Fahrzeugbauer um die Kunden prügeln. Tesla hat es in der Vergangenheit schon gezeigt. Umsatz war Elon Musk wichtiger als Profitabilität.

Mache ich mir Sorgen?

Nein.

Hoffen wir auf das Beste und rechnen mit dem Schlimmsten

Wir können nur hoffen, dass sich Dan Blondal von Nano One mit Unterstützung der kanadischen Regierung für die verschärfte Auslegung der Subventionen des IRA durchsetzt. Obwohl VW ab der Seite von Nano steht und kanadische Interessen teilt (siehe Link), ist zu befürchten, dass die US-Fahrzeug-Lobby die Kriterien zu ihren Gunsten verwässert.Link: https://www.volkswagen-newsroom.com/de/pressemitteilungen/vo…

Was ist der Knackpunkt?

Ford und Tesla wollen vom chinesischen Batteriehersteller CATL ihre Batterien kaufen und in ihren Fahrzeugen verbauen. Dafür wollen sie den IRA geschickt umgehen, um sich die Subventionen für ihre Fahrzeuge zu sichern.

Wie soll das ablaufen?

BloombergNEF hat bereits im Januar in ihrem "Top 10 Energiespeicher-Trends im Jahr 2023" bereits darüber geschrieben.

Zitat BloombergNEF vom 11.01.2023 - automatisch übersetzt

"Gerüchten zufolge erwägen Ford und CATL den Bau einer Batterieproduktionsanlage in Michigan, USA, in einer komplexen

Vereinbarung, die es der Einrichtung ermöglichen würde, Steuervorteile zu erzielen und gleichzeitig die gesetzlichen Bestimmungen einzuhalten. (Ford wäre Eigentümer der Anlage, während CATL sie betreiben würde.) Solche kreativen Workarounds werden bei chinesischen Unternehmen immer wahrscheinlicher, insbesondere bei denen, die an einer Expansion in die USA interessiert sind."

Link: https://about.bnef.com/blog/top-10-energy-storage-trends-in-…

Welche Auswirkung hat das auf unser Investment?

Nano One kann nur mit ökonomischen und ökologischen Fakten punkten. Doch letztlich entscheidet der Preis, ob ein Kunde das Auto kauft oder nicht. Die Kosten der EV-Batterie ist dabei das entscheidende Kriterium. Der Preis muss günstig und die Herstellung muss hoch profitabel sein. Da kann Nano One den Hebel ansetzen.

Mit starken Partnern überzeugen!

PowerCo von VW, Umicore und das Startup Our Next Energy (ONE) könne dabei im Industriemaßstab Zeichen setzen, wie profitabel Nano's Fertigungs-Ansatz ist. VW spricht dabei von erheblichen Einsparungen.

Zitat Volkswagen Newsroom vom 16.06.23

"Der neue Prozess hat nach PowerCo Berechnungen das Potential, rund 30 Prozent Energie, rund 15 Prozent Fabrikfläche und damit hunderte Millionen Euro Fertigungskosten pro Jahr zu sparen. Frank Blome, CEO der PowerCo SE: „Die Trockenbeschichtung ist für die Produktion das, was die Feststoffzelle für das Produkt ist – ein echter Game-Changer, der uns bei erfolgreicher Skalierung in Großserie eine klare Alleinstellung und damit klare Wettbewerbsvorteile verschafft.“"

Link: https://www.volkswagen-newsroom.com/de/pressemitteilungen/na…

Profitabilität ist ein scharfes Schwert in den künftigen Rabatt-Schlachten, wenn sich EV-Fahrzeugbauer um die Kunden prügeln. Tesla hat es in der Vergangenheit schon gezeigt. Umsatz war Elon Musk wichtiger als Profitabilität.

Mache ich mir Sorgen?

Nein.

Nano One Materials ...Lithiumplayer mit großem Potential?