Aura Minerals - Goldproduzent in Honduras und Brasilien (Seite 2)

eröffnet am 12.05.16 00:54:05 von

neuester Beitrag 14.01.23 13:04:33 von

neuester Beitrag 14.01.23 13:04:33 von

Beiträge: 64

ID: 1.231.632

ID: 1.231.632

Aufrufe heute: 0

Gesamt: 6.541

Gesamt: 6.541

Aktive User: 0

ISIN: VGG069731120 · WKN: A2PBMB

8,6250

EUR

0,00 %

0,0000 EUR

Letzter Kurs 16.06.24 Lang & Schwarz

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8250 | +25,00 | |

| 0,7437 | +20,93 | |

| 0,8906 | +20,35 | |

| 1,1500 | +15,00 | |

| 8,3200 | +12,74 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,455 | -8,53 | |

| 1,0780 | -9,41 | |

| 12,460 | -16,06 | |

| 0,8300 | -20,38 | |

| 46,98 | -97,98 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 67.266.468 von faultcode am 02.03.21 14:18:249.4.

...

Aura Minerals (TSX: ORA) (B3: AURA33) reported that it has reached quarterly production of 66,782 gold equivalent ounces ("GEO") in Q1 2021, which is 68% more compared to consolidated production of 39,735 GEO in Q1 2020.

The company said that Q1 2021 results represent the second highest consolidated production (measured in GEO) in the company's history for a single quarter, just behind the 68,964 GEO reported in Q4 2020, where temporary access to high grades from the Ernesto mine at the Company's EPP project contributed to record results.

President and CEO Rodrigo Barbosa noted, "Under our consolidated operational plan, we expected the first two quarters of 2021 to have the lowest grades and production. Despite this, we achieved the company's second highest quarterly consolidated production, just behind Q4 2020. Aranzazu reached production of 100,000 tons at the mine in March and is moving towards full capacity of 100,000 tons at the plant. Moreover, the company expects to reach higher grades at the Ernesto mine at EPP during Q3 2021, with continued access to higher grades expected in Q4 2021."

...

Aura boosts gold equivalent production 68% in Q1 2021

https://www.kitco.com/news/2021-04-09/Aura-boosts-gold-equiv…

...

Aura Minerals (TSX: ORA) (B3: AURA33) reported that it has reached quarterly production of 66,782 gold equivalent ounces ("GEO") in Q1 2021, which is 68% more compared to consolidated production of 39,735 GEO in Q1 2020.

The company said that Q1 2021 results represent the second highest consolidated production (measured in GEO) in the company's history for a single quarter, just behind the 68,964 GEO reported in Q4 2020, where temporary access to high grades from the Ernesto mine at the Company's EPP project contributed to record results.

President and CEO Rodrigo Barbosa noted, "Under our consolidated operational plan, we expected the first two quarters of 2021 to have the lowest grades and production. Despite this, we achieved the company's second highest quarterly consolidated production, just behind Q4 2020. Aranzazu reached production of 100,000 tons at the mine in March and is moving towards full capacity of 100,000 tons at the plant. Moreover, the company expects to reach higher grades at the Ernesto mine at EPP during Q3 2021, with continued access to higher grades expected in Q4 2021."

...

Aura boosts gold equivalent production 68% in Q1 2021

https://www.kitco.com/news/2021-04-09/Aura-boosts-gold-equiv…

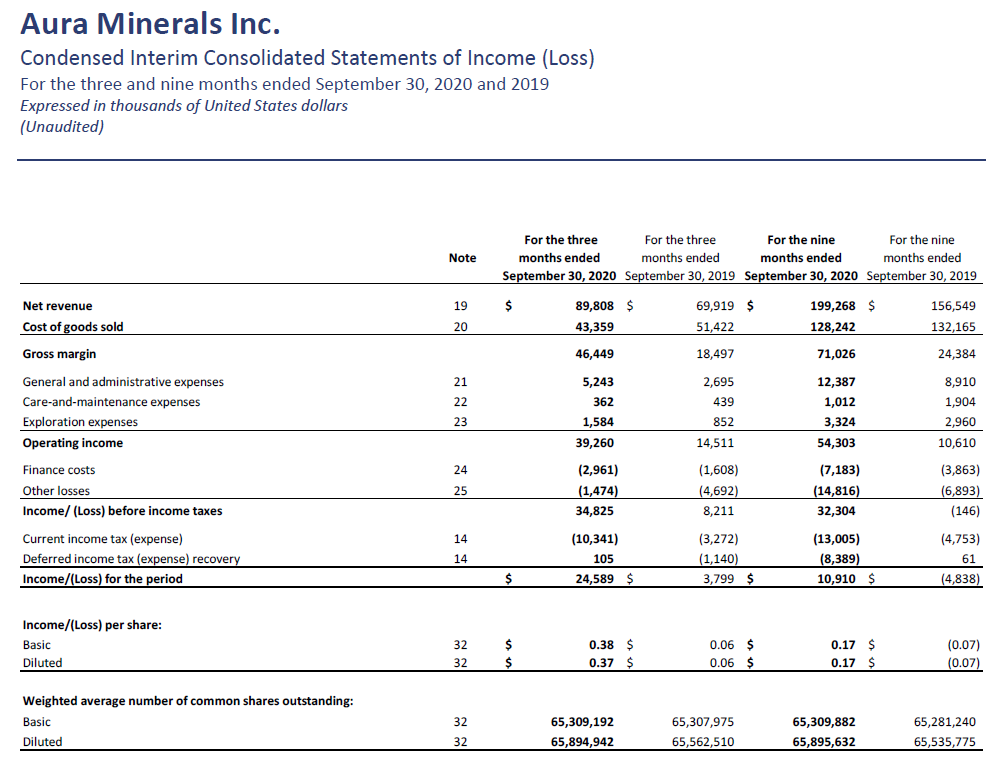

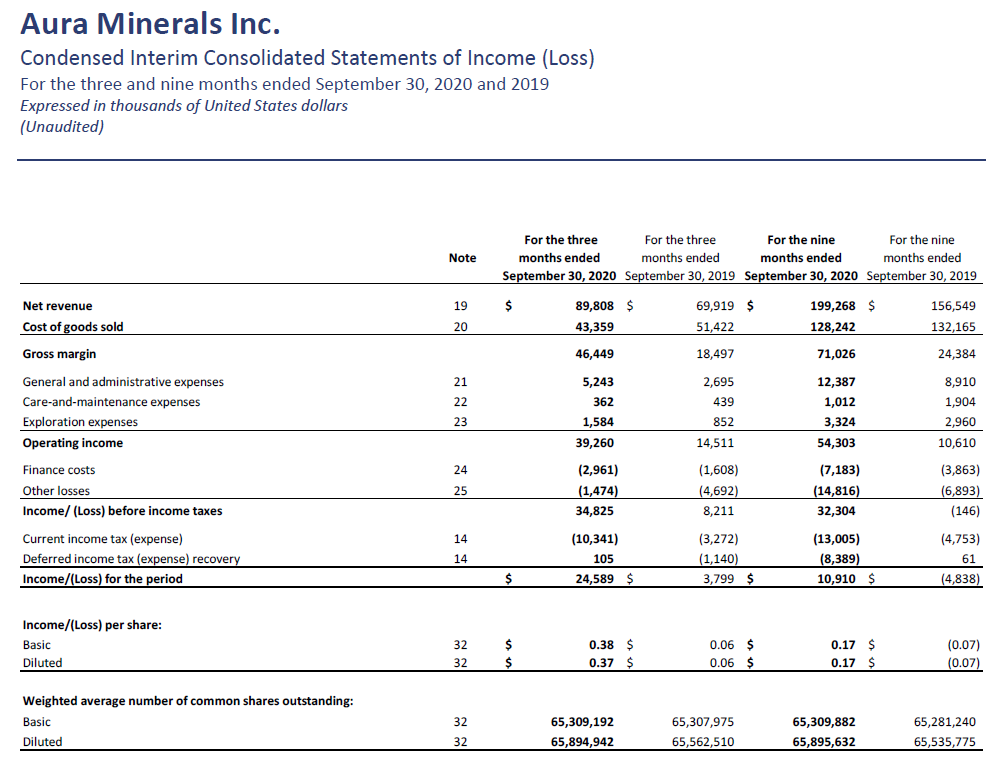

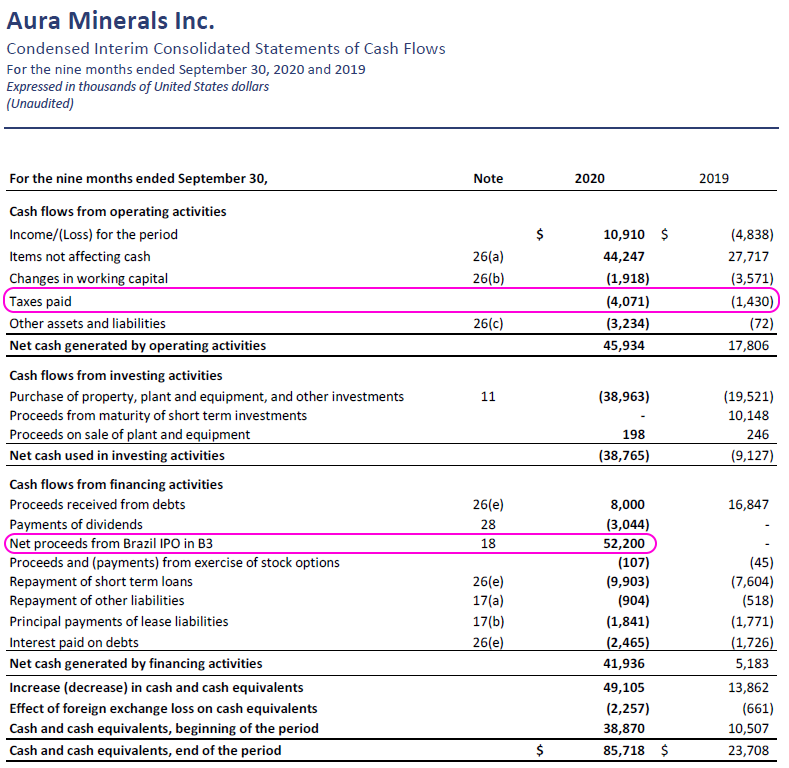

2020-Ergebnisse:

1.3.

https://www.juniorminingnetwork.com/junior-miner-news/press-…

...

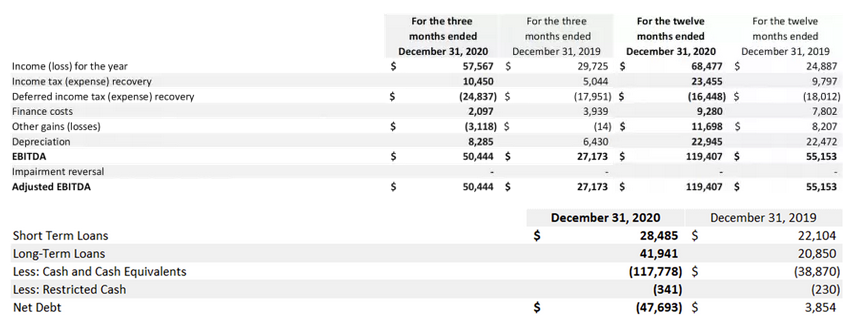

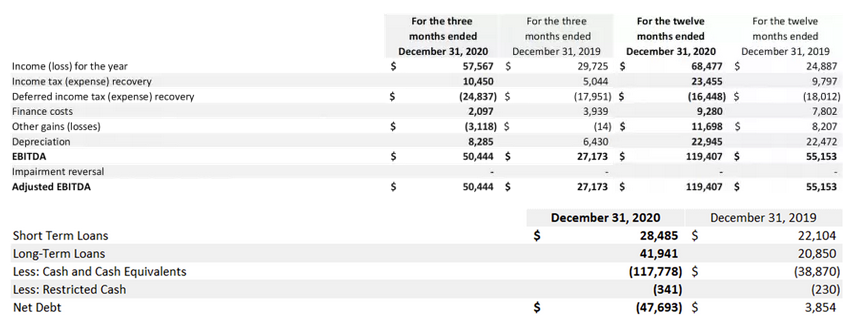

Rodrigo Barbosa, CEO of Aura, comments: “On behalf of Aura, I am proud to announce another quarter of exceptional results for the Company. During the fourth quarter of 2020, Aura recorded EBITDA of US$50 million. Equally important, we were able to achieve these results with zero lost time accidents during the fourth quarter of 2020.

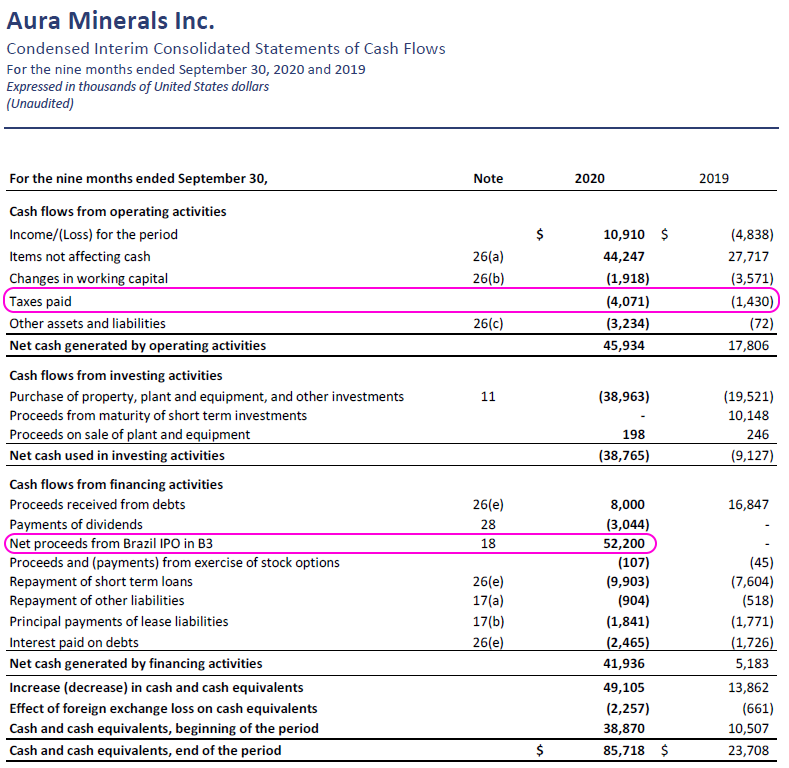

In the year ended December 31, 2020, EBITDA reached US$119 million, of which US$94 million was generated in the third and fourth quarters. The Company ended 2020 with a solid balance sheet, including US$118 million in cash and negative net debt of US$48 million.

We believe our financial position will fully fund our ambitious growth plan, under which management has targeted over 400,000 ounces of annual gold production by 2024, while continuing to generate cash flows from operations.”

...

...

1.3.

https://www.juniorminingnetwork.com/junior-miner-news/press-…

...

Rodrigo Barbosa, CEO of Aura, comments: “On behalf of Aura, I am proud to announce another quarter of exceptional results for the Company. During the fourth quarter of 2020, Aura recorded EBITDA of US$50 million. Equally important, we were able to achieve these results with zero lost time accidents during the fourth quarter of 2020.

In the year ended December 31, 2020, EBITDA reached US$119 million, of which US$94 million was generated in the third and fourth quarters. The Company ended 2020 with a solid balance sheet, including US$118 million in cash and negative net debt of US$48 million.

We believe our financial position will fully fund our ambitious growth plan, under which management has targeted over 400,000 ounces of annual gold production by 2024, while continuing to generate cash flows from operations.”

...

...

Antwort auf Beitrag Nr.: 66.089.029 von faultcode am 16.12.20 15:52:37Strong buy, Gold kommt und Firma ist TOP

Strong buy

Strong buy

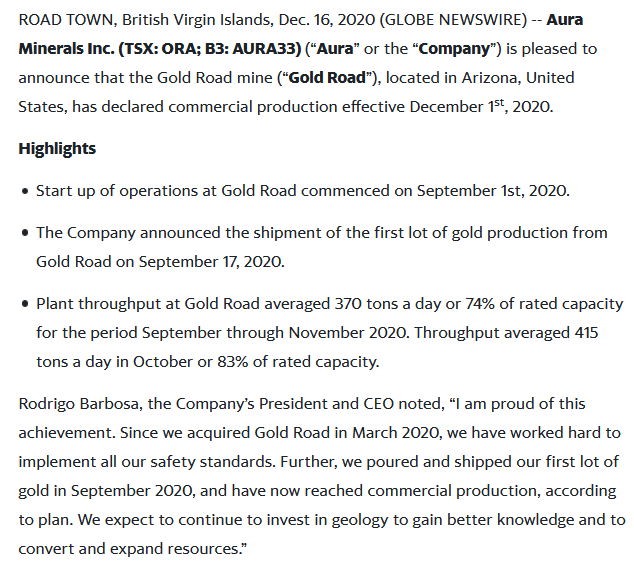

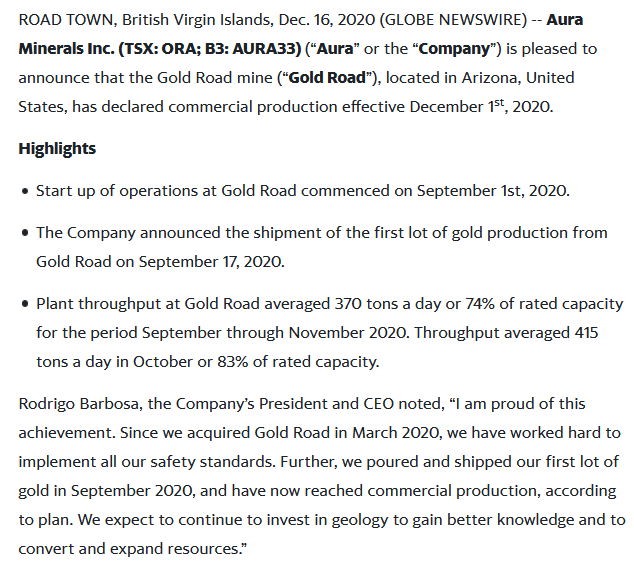

Antwort auf Beitrag Nr.: 65.776.692 von faultcode am 20.11.20 00:36:58Aura Minerals Announces Commercial Production at Gold Road

https://finance.yahoo.com/news/aura-announces-commercial-pro…

...

https://finance.yahoo.com/news/aura-announces-commercial-pro…

...

Antwort auf Beitrag Nr.: 65.720.772 von faultcode am 16.11.20 13:12:4219.11.

Aura Announces New and Improved Offtake Agreement with Trafigura starting in 2022

https://finance.yahoo.com/news/aura-announces-improved-offta…

...

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (the “Company” or “Aura”) announces that its wholly-owned subsidiary, Aranzazu Holding S.A. de C.V. (“Aranzazu”) has recently completed a competitive bidding process for a new offtake agreement with respect to the copper and gold concentrate produced at the Company’s Aranzazu mine.

In connection with the completion of the bidding process, Aranzazu has entered into an offtake agreement (the “New Agreement”) with Trafigura México, S.A. de C.V. (“Trafigura”), pursuant to which Trafigura has agreed to purchase 100% of the copper and gold concentrate produced at Aranzazu during the term of the New Agreement. The New Agreement is effective as of the beginning of 2022 and continues until the end of 2024. The current offtake agreement in place with IXM Metals (the “Existing Agreement”) will remain in force until the end of 2021.

As result of a strong competitive process and improved market conditions for copper, Aura expects Aranzazu to achieve material savings under the New Agreement, improving gross margins by 4 percentage points compared to the terms of the Existing Agreement.

Rodrigo Barbosa, the Company’s President and CEO noted:

“In 2018 our priority was to restart Aranzazu under a detailed and sustainable production plan. Since we restarted the project last year, we have been investing in geology and exploration in order to increase the life of mine as well, besides optimizing operational efficiencies. As result, we have been able to exceed initial expectations set in the Feasibility Study for certain KPIs, such as recoveries and dilution. Now, we were able to improve the conditions of our offtake agreement, taking advantage of a competitive process and favorable market conditions”.

=> +11% heute

__

ein indirekter, aber mMn wichtiger Vorteil dabei:

• Aura sollte nun hinreichend Erfahrung mit refraktärem, deutlich arsenhaltigem Erz bzw. Konzentrat zum Verkauf gesammelt haben (als meine Hoffnung)

Die Bedeutung solcher Lagerstätten wird in Zukunft immer weiter zunehmen, da das einfach zu erschließende Erz in Tendenz immer weniger wird.

Aura Announces New and Improved Offtake Agreement with Trafigura starting in 2022

https://finance.yahoo.com/news/aura-announces-improved-offta…

...

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (the “Company” or “Aura”) announces that its wholly-owned subsidiary, Aranzazu Holding S.A. de C.V. (“Aranzazu”) has recently completed a competitive bidding process for a new offtake agreement with respect to the copper and gold concentrate produced at the Company’s Aranzazu mine.

In connection with the completion of the bidding process, Aranzazu has entered into an offtake agreement (the “New Agreement”) with Trafigura México, S.A. de C.V. (“Trafigura”), pursuant to which Trafigura has agreed to purchase 100% of the copper and gold concentrate produced at Aranzazu during the term of the New Agreement. The New Agreement is effective as of the beginning of 2022 and continues until the end of 2024. The current offtake agreement in place with IXM Metals (the “Existing Agreement”) will remain in force until the end of 2021.

As result of a strong competitive process and improved market conditions for copper, Aura expects Aranzazu to achieve material savings under the New Agreement, improving gross margins by 4 percentage points compared to the terms of the Existing Agreement.

Rodrigo Barbosa, the Company’s President and CEO noted:

“In 2018 our priority was to restart Aranzazu under a detailed and sustainable production plan. Since we restarted the project last year, we have been investing in geology and exploration in order to increase the life of mine as well, besides optimizing operational efficiencies. As result, we have been able to exceed initial expectations set in the Feasibility Study for certain KPIs, such as recoveries and dilution. Now, we were able to improve the conditions of our offtake agreement, taking advantage of a competitive process and favorable market conditions”.

=> +11% heute

__

ein indirekter, aber mMn wichtiger Vorteil dabei:

• Aura sollte nun hinreichend Erfahrung mit refraktärem, deutlich arsenhaltigem Erz bzw. Konzentrat zum Verkauf gesammelt haben (als meine Hoffnung)

Die Bedeutung solcher Lagerstätten wird in Zukunft immer weiter zunehmen, da das einfach zu erschließende Erz in Tendenz immer weniger wird.

Antwort auf Beitrag Nr.: 65.705.223 von faultcode am 13.11.20 23:42:06Aura Minerals hat die guten Nachrichten Freitag Nacht versteckt

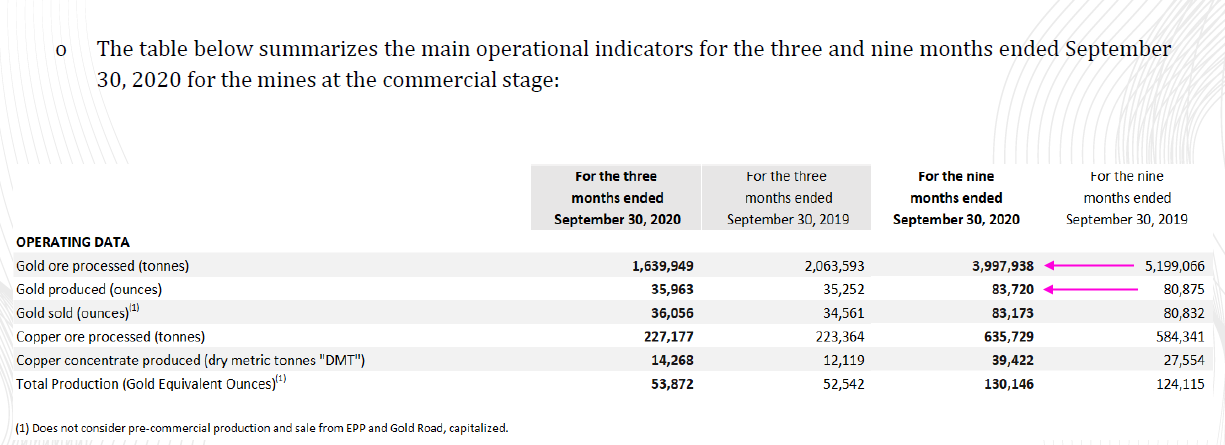

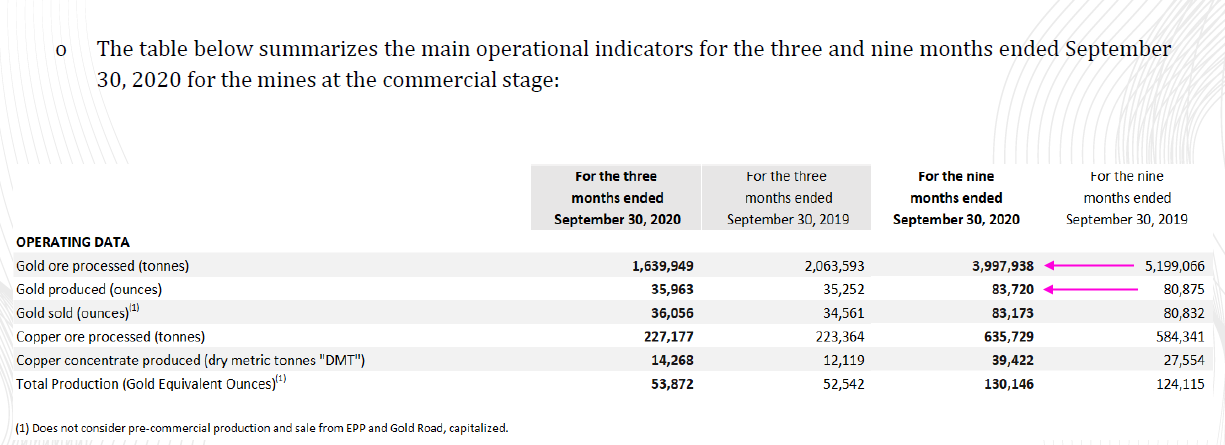

Für mehr Gold konnte weniger Erz verarbeitet werden:

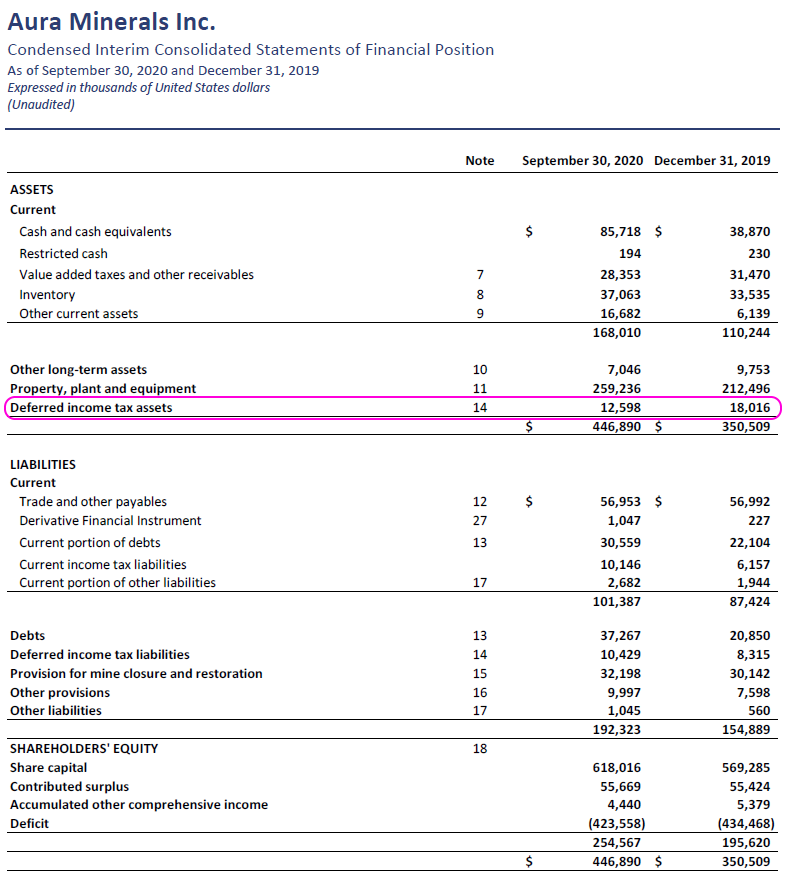

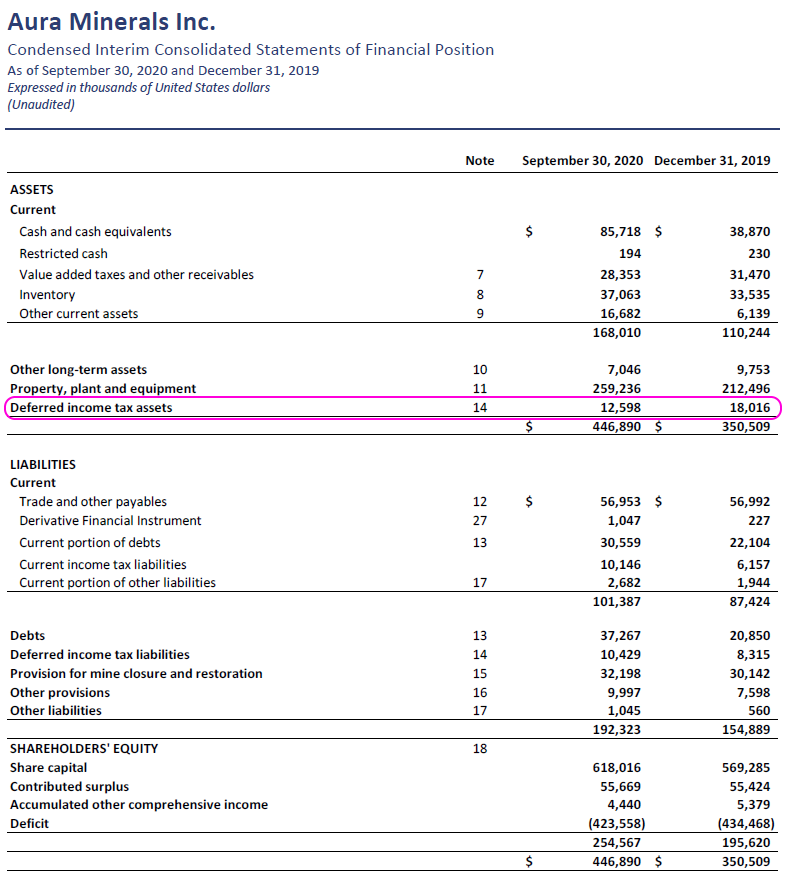

Eigentlich sollte Aura noch eine Menge Verlustvorträge haben:

..aber die schwinden nun auch:

Aura ist schon seit einiger Zeit (eben seit dem Merger mit Rio Novo Gold) ein kompliziertes Unternehmen geworden mit oper. Sitz in Miami/FL/USA, aber Steuer- und Rechtssitz auf den British Virgin Islands und eben mit diversen oper. Liegenschaften in BRA, MEX, USA, HND.

Da spielen Wechselkurseffekte auch eine große Rolle.

Für mehr Gold konnte weniger Erz verarbeitet werden:

Eigentlich sollte Aura noch eine Menge Verlustvorträge haben:

..aber die schwinden nun auch:

Aura ist schon seit einiger Zeit (eben seit dem Merger mit Rio Novo Gold) ein kompliziertes Unternehmen geworden mit oper. Sitz in Miami/FL/USA, aber Steuer- und Rechtssitz auf den British Virgin Islands und eben mit diversen oper. Liegenschaften in BRA, MEX, USA, HND.

Da spielen Wechselkurseffekte auch eine große Rolle.

Antwort auf Beitrag Nr.: 65.705.049 von faultcode am 13.11.20 22:56:49der Webcast am Montag ist in Portuguese und wird simultan ins Englische übersetzt:

https://ir.auraminerals.com/?lang=en

--> ich habe den Eindruck, Aura Minerals soll als so eine Art "brasilianische Barrick Gold" etabliert werden (mit solchen und anderen Maßnahmen), natürlich erstmal in ganz klein

https://ir.auraminerals.com/?lang=en

--> ich habe den Eindruck, Aura Minerals soll als so eine Art "brasilianische Barrick Gold" etabliert werden (mit solchen und anderen Maßnahmen), natürlich erstmal in ganz klein

Antwort auf Beitrag Nr.: 64.895.015 von faultcode am 26.08.20 22:36:4913.11,

Aura Minerals boosts gold production in Brazil

https://resourceworld.com/aura-minerals-boosts-gold-producti…

Aura Minerals Inc. [ORA-TSX; AURA32-B3] has declared commercial production at its Ernesto open-pit gold mine in Mato Grosso, Brazil.

The Ernesto mine is part of the Ernesto/Pau-a-Pique (EPP) mine complex, which consists of a processing plant that is fed by the Lavrinha, Japones, Rio Alegre and now Ernesto open pit mines, as well as the Pau-a-Pique underground deposits. Last year, the EPP complex produced 55,933 oz gold at an operating cash cost of US$963/oz.

In October, 2020, the Ernesto mine alone produced 2,507 oz gold. As a result of the contribution from the Ernesto mine in October, 2020, EPP achieved its highest production since the 2016 start-up, with 8,233 oz gold produced.

At Ernesto, the company expects an increase in production in the fourth quarter of 2020, after which Aura plans to push back in the mine to access high-grade ore by the fourth quarter of 2021, which the company then expects to access through to the end of 2022.

“In January, 2019, we started to develop the Ernesto mine (pre-stripping),” said Aura President and CEO Rodrigo Barbosa.

The Ernesto mine is expected to produce approximately 125,000 oz averaging 3.0 g/t gold for the life of the mine.

Aura is a mid-tier gold and copper production company. Its producing assets include the San Andres gold mine in Honduras, the EPP gold mine complex in Brazil, the Aranzazu copper-gold-silver mine in Mexico, and the Gold Road (pre-operational) gold mine in the U.S.

The company has two additional gold projects in Brazil (Almas and Matup) and one gold project in Colombia (Tolda Fria).

Total production from all the company’s operations in Q3 2020 was 56,472 gold equivalent ounces, indicating a strong production recovery from the COVID-19 pandemic in Q1 and Q2 2020.

Production in Q3 included 18,802 oz from the San Andres mine and 18,231 oz from the EPP mines. The Aranzau operation produced 17,909 oz in Q3. Aura shipped its first gold from the Gold Road project in September. The company expects to declare commercial production at Gold Road, Arizona, by December, 2020.

...

Aura Minerals boosts gold production in Brazil

https://resourceworld.com/aura-minerals-boosts-gold-producti…

Aura Minerals Inc. [ORA-TSX; AURA32-B3] has declared commercial production at its Ernesto open-pit gold mine in Mato Grosso, Brazil.

The Ernesto mine is part of the Ernesto/Pau-a-Pique (EPP) mine complex, which consists of a processing plant that is fed by the Lavrinha, Japones, Rio Alegre and now Ernesto open pit mines, as well as the Pau-a-Pique underground deposits. Last year, the EPP complex produced 55,933 oz gold at an operating cash cost of US$963/oz.

In October, 2020, the Ernesto mine alone produced 2,507 oz gold. As a result of the contribution from the Ernesto mine in October, 2020, EPP achieved its highest production since the 2016 start-up, with 8,233 oz gold produced.

At Ernesto, the company expects an increase in production in the fourth quarter of 2020, after which Aura plans to push back in the mine to access high-grade ore by the fourth quarter of 2021, which the company then expects to access through to the end of 2022.

“In January, 2019, we started to develop the Ernesto mine (pre-stripping),” said Aura President and CEO Rodrigo Barbosa.

The Ernesto mine is expected to produce approximately 125,000 oz averaging 3.0 g/t gold for the life of the mine.

Aura is a mid-tier gold and copper production company. Its producing assets include the San Andres gold mine in Honduras, the EPP gold mine complex in Brazil, the Aranzazu copper-gold-silver mine in Mexico, and the Gold Road (pre-operational) gold mine in the U.S.

The company has two additional gold projects in Brazil (Almas and Matup) and one gold project in Colombia (Tolda Fria).

Total production from all the company’s operations in Q3 2020 was 56,472 gold equivalent ounces, indicating a strong production recovery from the COVID-19 pandemic in Q1 and Q2 2020.

Production in Q3 included 18,802 oz from the San Andres mine and 18,231 oz from the EPP mines. The Aranzau operation produced 17,909 oz in Q3. Aura shipped its first gold from the Gold Road project in September. The company expects to declare commercial production at Gold Road, Arizona, by December, 2020.

...

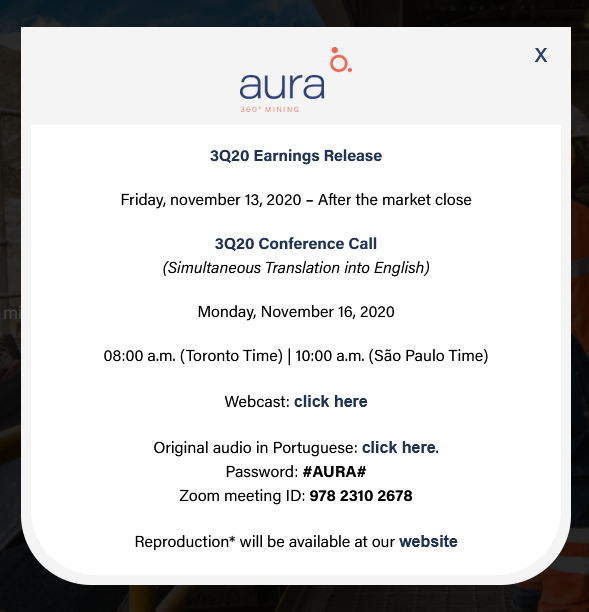

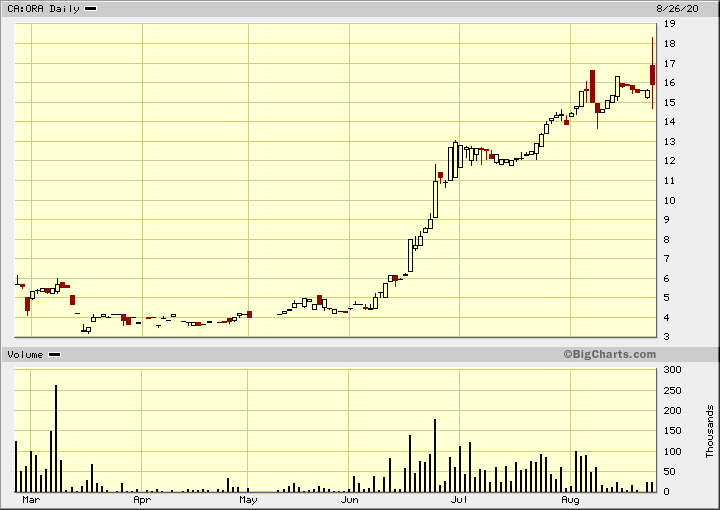

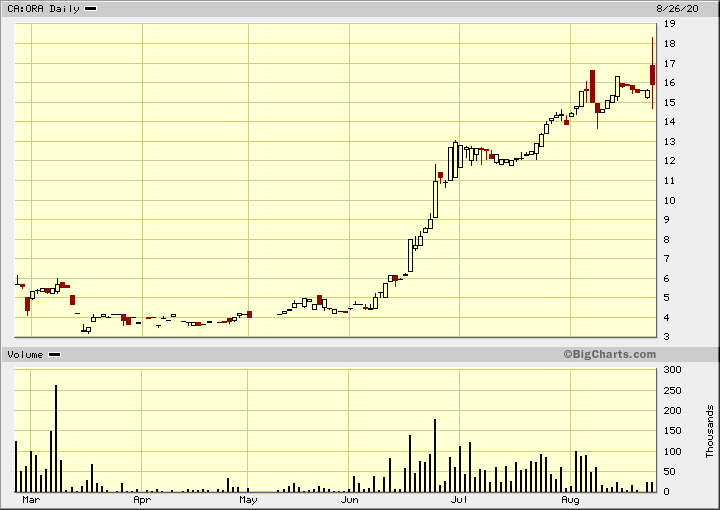

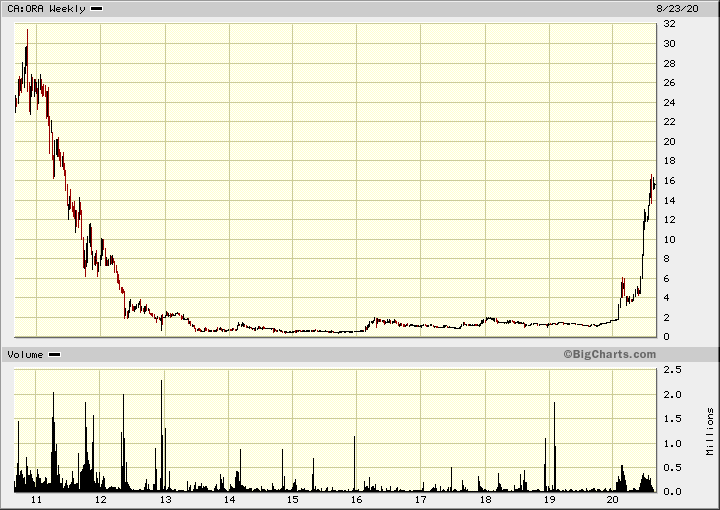

Antwort auf Beitrag Nr.: 64.232.305 von faultcode am 30.06.20 10:33:13Stock split (1:15) ist vollzogen und sorgte für etwas Unruhe:

Aber neues 8-Jahreshoch intraday:

Aber neues 8-Jahreshoch intraday:

Antwort auf Beitrag Nr.: 64.066.971 von faultcode am 18.06.20 15:01:2624.6.

http://auraminerals.com/aura-minerals-inc-press-release/

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (the “Company” or “Aura”) today announces that the Company is launching an initial primary and secondary public offering with restricted placement efforts of Brazilian depositary receipts (certificados de depósito de ações, or “BDRs“), sponsored level II, to be issued by Itaú Unibanco S.A., as depositary institution, with each BDR representing one share of the Company (each, a “Share”) (the “Offering”). The BDRs being offered in the Offering have been approved for listing on the B3 S.A. – Brasil, Bolsa, Balcão (the “B3”). The launch of the Offering follows the Company’s announcement on June 1, 2020 of its resumption of the process commenced in the first quarter of 2020 to explore a possible initial public offering in Brazil, which plans the Company previously suspended in light of the global COVID-19 pandemic.

The Offering will consist of (i) a primary public offering with restricted efforts of, initially, 331,033 BDRs (the “Primary Offering” and the “Primary Offering BDRs”), representing 331,033 Shares, and a secondary public offering with restricted efforts of, initially, 626,090 BDRs by a certain shareholder of the Company (the “Base Offering Selling Shareholder”) (the “Secondary Offering BDRs” and, together with the Primary Offering BDRs, the “Base Offering BDRs”), representing 626,090 Shares, on the non-organized over-the-counter market, exclusively to professional investors (as defined in article 9-A of Brazilian Securities Commission (Comissão de Valores Mobiliários, or the “CVM”) Instruction No. 539, dated November 13, 2013, as amended (“CVM Instruction 539”)) located in Brazil (“Local Professional Investors”), to be placed by a syndicate of underwriters (the “Brazilian Underwriters”), pursuant to Brazilian Law No. 6,385, dated December 7, 1976, as amended (the “Brazilian Capital Markets Law”), CVM Instruction No. 332, dated April 4, 2000, as amended, CVM Instruction No. 476, dated January 16, 2009, as amended (“CVM Instruction 476”), the ANBIMA Code of Regulation and Best Practices for Structuring, Coordination and Distribution of Public Offers for Securities and Public Offers for the Acquisition of Securities (Código ANBIMA de Regulação e Melhores Práticas para Estruturação, Coordenação e Distribuição de Ofertas Públicas de Valores Mobiliários e Ofertas Públicas de Aquisição de Valores Mobiliários) and other applicable legal and regulatory provisions; and (ii) placement efforts of the BDRs to (a) certain qualified institutional buyers (QIBs, as defined in Rule 144A promulgated under the United States Securities Act of 1933, as amended (the “Securities Act”)) in the United States, in transactions exempt from the registration requirements of the Securities Act; (b) certain accredited investors (as defined under applicable Canadian securities laws) in Canada on a private placement basis; and (c) investors elsewhere outside the United States, Canada and Brazil that are not U.S. persons (as defined in Regulation S promulgated under the Securities Act) in accordance with the applicable laws of such jurisdictions (the “Foreign Investors” and, together with the Local Professional Investors, the “Professional Investors”), and, in all cases, provided that they invest in Brazil in accordance with the investment mechanisms regulated by the Brazilian National Monetary Council, the Central Bank of Brazil and/or the CVM, by a syndicate of placement agents (the “International Placement Agents”).

Until the date of completion of the bookbuilding procedure, the number of Base Offering BDRs may be increased by up to 2.69%, corresponding to up to 25,719 BDRs to be offered by a certain individual shareholder of the Company (the “Additional BDRs Selling Shareholder” and, together with the Base Offering Selling Shareholder, the “Selling Shareholders”), under the same conditions and at the same price of the Base Offering BDRs (the “Additional BDRs”).

In addition to the Additional BDRs, the number of Base Offering BDRs may be increased by up to 15%, corresponding to up to 143,568 BDRs, of which 49,655 BDRs are to be offered by the Company (the “Primary Over-Allotment BDRs”) and 93,913 BDRs are to be offered by the Base Offering Selling Shareholder (the “Secondary Over-Allotment BDRs” and, together with the Primary Over-Allotment BDRs, the “Over-Allotment BDRs”), under the same conditions and at the same price of the Base Offering BDRs, pursuant to an option to be granted by the Company and the Base Offering Selling Shareholder to the Brazilian Underwriter that will act as stabilization agent, for the purposes of the services of stabilization of the price of the BDRs in connection with the Offering.

The price per BDR is expected to be between R$820.00 and R$990.00 (or C$214.59 and C$259.08, based on the daily average rate of exchange published by the Bank of Canada on June 23, 2020) (the “Indicative Price Range”), however, it may be set above or below the Indicative Price Range (the “Price per BDR”).

The Company expects to use the net proceeds of the Offering to fund (i) continuous development, maintenance and expansion of the Company’s producing assets; (ii) exploration and development of projects that are not yet in commercial production; and (iii) reinforcement of the Company’s capital structure.

The Company expects the determination of the Price per BDR to occur on July 2, 2020, settlement of the Base Offering BDRs and, if applicable, the Additional BDRs to occur on July 7, 2020, and completion of the Offering to occur on or before August 11, 2020.

The Company is a BVI Business Company registered under the laws of the British Virgin Islands and it is not required to grant a preemptive right or priority right to current shareholders when it issues new shares. Thus, considering that the Company is not subject to Brazilian Law No. 6,404, dated December 15, 1976, as amended, and, consequently, is not subject to the provisions of article 9-A of CVM Instruction 476, no preference or priority will be granted to the current shareholders of the Company in connection with the Primary Offering.

Pursuant to CVM Instruction 476, trading of the BDRs on secondary market on the B3 shall be limited among “qualified investors” (as defined in article 9-B of CVM Instruction 539) until the earlier of (i) a public offering of BDRs registered with the CVM, in which case the Company shall change the BDR program registered with the CVM from sponsored level II to sponsored level III; or (ii) the elapse of 18 months following the date on which the BDRs are admitted for trading on the B3.

...

Toronto Stock Exchange

http://auraminerals.com/aura-minerals-inc-press-release/

Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (the “Company” or “Aura”) today announces that the Company is launching an initial primary and secondary public offering with restricted placement efforts of Brazilian depositary receipts (certificados de depósito de ações, or “BDRs“), sponsored level II, to be issued by Itaú Unibanco S.A., as depositary institution, with each BDR representing one share of the Company (each, a “Share”) (the “Offering”). The BDRs being offered in the Offering have been approved for listing on the B3 S.A. – Brasil, Bolsa, Balcão (the “B3”). The launch of the Offering follows the Company’s announcement on June 1, 2020 of its resumption of the process commenced in the first quarter of 2020 to explore a possible initial public offering in Brazil, which plans the Company previously suspended in light of the global COVID-19 pandemic.

The Offering will consist of (i) a primary public offering with restricted efforts of, initially, 331,033 BDRs (the “Primary Offering” and the “Primary Offering BDRs”), representing 331,033 Shares, and a secondary public offering with restricted efforts of, initially, 626,090 BDRs by a certain shareholder of the Company (the “Base Offering Selling Shareholder”) (the “Secondary Offering BDRs” and, together with the Primary Offering BDRs, the “Base Offering BDRs”), representing 626,090 Shares, on the non-organized over-the-counter market, exclusively to professional investors (as defined in article 9-A of Brazilian Securities Commission (Comissão de Valores Mobiliários, or the “CVM”) Instruction No. 539, dated November 13, 2013, as amended (“CVM Instruction 539”)) located in Brazil (“Local Professional Investors”), to be placed by a syndicate of underwriters (the “Brazilian Underwriters”), pursuant to Brazilian Law No. 6,385, dated December 7, 1976, as amended (the “Brazilian Capital Markets Law”), CVM Instruction No. 332, dated April 4, 2000, as amended, CVM Instruction No. 476, dated January 16, 2009, as amended (“CVM Instruction 476”), the ANBIMA Code of Regulation and Best Practices for Structuring, Coordination and Distribution of Public Offers for Securities and Public Offers for the Acquisition of Securities (Código ANBIMA de Regulação e Melhores Práticas para Estruturação, Coordenação e Distribuição de Ofertas Públicas de Valores Mobiliários e Ofertas Públicas de Aquisição de Valores Mobiliários) and other applicable legal and regulatory provisions; and (ii) placement efforts of the BDRs to (a) certain qualified institutional buyers (QIBs, as defined in Rule 144A promulgated under the United States Securities Act of 1933, as amended (the “Securities Act”)) in the United States, in transactions exempt from the registration requirements of the Securities Act; (b) certain accredited investors (as defined under applicable Canadian securities laws) in Canada on a private placement basis; and (c) investors elsewhere outside the United States, Canada and Brazil that are not U.S. persons (as defined in Regulation S promulgated under the Securities Act) in accordance with the applicable laws of such jurisdictions (the “Foreign Investors” and, together with the Local Professional Investors, the “Professional Investors”), and, in all cases, provided that they invest in Brazil in accordance with the investment mechanisms regulated by the Brazilian National Monetary Council, the Central Bank of Brazil and/or the CVM, by a syndicate of placement agents (the “International Placement Agents”).

Until the date of completion of the bookbuilding procedure, the number of Base Offering BDRs may be increased by up to 2.69%, corresponding to up to 25,719 BDRs to be offered by a certain individual shareholder of the Company (the “Additional BDRs Selling Shareholder” and, together with the Base Offering Selling Shareholder, the “Selling Shareholders”), under the same conditions and at the same price of the Base Offering BDRs (the “Additional BDRs”).

In addition to the Additional BDRs, the number of Base Offering BDRs may be increased by up to 15%, corresponding to up to 143,568 BDRs, of which 49,655 BDRs are to be offered by the Company (the “Primary Over-Allotment BDRs”) and 93,913 BDRs are to be offered by the Base Offering Selling Shareholder (the “Secondary Over-Allotment BDRs” and, together with the Primary Over-Allotment BDRs, the “Over-Allotment BDRs”), under the same conditions and at the same price of the Base Offering BDRs, pursuant to an option to be granted by the Company and the Base Offering Selling Shareholder to the Brazilian Underwriter that will act as stabilization agent, for the purposes of the services of stabilization of the price of the BDRs in connection with the Offering.

The price per BDR is expected to be between R$820.00 and R$990.00 (or C$214.59 and C$259.08, based on the daily average rate of exchange published by the Bank of Canada on June 23, 2020) (the “Indicative Price Range”), however, it may be set above or below the Indicative Price Range (the “Price per BDR”).

The Company expects to use the net proceeds of the Offering to fund (i) continuous development, maintenance and expansion of the Company’s producing assets; (ii) exploration and development of projects that are not yet in commercial production; and (iii) reinforcement of the Company’s capital structure.

The Company expects the determination of the Price per BDR to occur on July 2, 2020, settlement of the Base Offering BDRs and, if applicable, the Additional BDRs to occur on July 7, 2020, and completion of the Offering to occur on or before August 11, 2020.

The Company is a BVI Business Company registered under the laws of the British Virgin Islands and it is not required to grant a preemptive right or priority right to current shareholders when it issues new shares. Thus, considering that the Company is not subject to Brazilian Law No. 6,404, dated December 15, 1976, as amended, and, consequently, is not subject to the provisions of article 9-A of CVM Instruction 476, no preference or priority will be granted to the current shareholders of the Company in connection with the Primary Offering.

Pursuant to CVM Instruction 476, trading of the BDRs on secondary market on the B3 shall be limited among “qualified investors” (as defined in article 9-B of CVM Instruction 539) until the earlier of (i) a public offering of BDRs registered with the CVM, in which case the Company shall change the BDR program registered with the CVM from sponsored level II to sponsored level III; or (ii) the elapse of 18 months following the date on which the BDRs are admitted for trading on the B3.

...

Toronto Stock Exchange