Baker Hughes (Seite 4)

eröffnet am 27.01.17 18:32:09 von

neuester Beitrag 04.11.23 12:48:23 von

neuester Beitrag 04.11.23 12:48:23 von

Beiträge: 76

ID: 1.245.675

ID: 1.245.675

Aufrufe heute: 0

Gesamt: 4.466

Gesamt: 4.466

Aktive User: 0

ISIN: US05722G1004 · WKN: A2DUAY · Symbol: BKR

32,84

USD

-1,38 %

-0,46 USD

Letzter Kurs 26.04.24 Nasdaq

Neuigkeiten

| Baker Hughes Company Registered (A) Aktien jetzt im kostenlosen Demokonto handeln!Anzeige |

18.03.24 · Accesswire |

16.03.24 · wO Chartvergleich |

19.02.24 · Accesswire |

24.01.24 · wO Newsflash |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4500 | +15,99 | |

| 7,3400 | +15,77 | |

| 9,6400 | +13,95 | |

| 7,9500 | +13,25 | |

| 1,7900 | +11,88 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 325,00 | -9,97 | |

| 0,9400 | -10,48 | |

| 4,3100 | -18,98 | |

| 1,3501 | -20,58 | |

| 9,3500 | -28,02 |

Beitrag zu dieser Diskussion schreiben

Why Baker Hughes' (BKR) Partnership With Horisont Energi ?

https://www.nasdaq.com/articles/why-baker-hughes-bkr-partner…

https://www.nasdaq.com/articles/why-baker-hughes-bkr-partner…

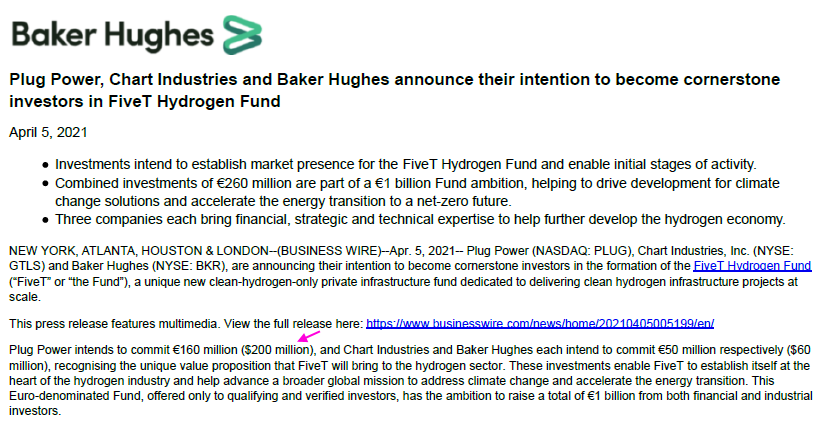

Wer hätte das gedacht: die olle Baker Hughes als Wasserstoff-Play:

https://investors.bakerhughes.com/news-releases/news-release…

...

Jedenfalls danke ich schon mal den Aktionären der Plug Power. Denn daß die eines Tages davon was sehen werden, halte ich für eher unwahrscheinlich.

https://investors.bakerhughes.com/news-releases/news-release…

...

Jedenfalls danke ich schon mal den Aktionären der Plug Power. Denn daß die eines Tages davon was sehen werden, halte ich für eher unwahrscheinlich.

2.3.

Baker Hughes, Akastor merging oil drilling ops, eye IPO

https://finance.yahoo.com/news/baker-hughes-akastor-merging-…

...

Baker Hughes and Norway's Akastor plan to merge their offshore oil drilling equipment units to combine their complementary technologies, with a view to listing the new company longer term, they said on Tuesday.

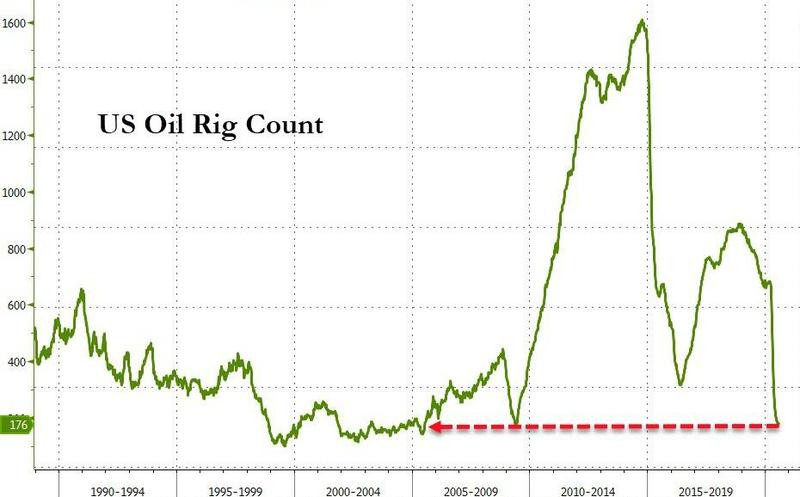

Demand for new drilling equipment has been weak amid the COVID-19 pandemic and last year's plunge in the price of oil, and the companies said proforma revenue for the new unit declined by 16% in 2020 to $713 million.

Combining the drilling technology of Akastor's MHWirth, which sits on top of an oil rig, with seabed pressure control units made by Baker Hughes Subsea Drilling Systems (SDS), will cut costs and create a complete product offering, Akastor told Reuters.

"This is the sort of equipment MHWirth has wanted for many years, but which is difficult to invent from scratch as it's strictly regulated and technically complex," Akastor Chief Financial Officer Oeyvind Paaske said of the SDS products.

Akastor shares hit a 12-month high in early Oslo trade and were up 6.1% by 1338 GMT.

The new company will be owned 50% by each of the parent companies and will have a dual headquarters in Houston, Texas and the southern Norwegian town of Kristiansand, the two companies said.

An initial public offering could come a year or more after the deal closes, Paaske said.

"This transaction makes a stock market listing more realistic," Paaske said, adding that Akastor had considered listing MHWirth previously but didn't feel it had the right set-up to be an independent company.

The new company also plans to expand within onshore oil drilling and in non-oil businesses such as mining at sea and on land.

Annual cost savings from the deal were estimated at between $10 million and $11 million, Akastor said. The company declined to comment on potential job losses.

Baker Hughes will get a cash payout of $120 million from the new firm when the deal closes, and will be owed a further $80 million, while Akastor will receive $100 million in cash and be owed another $20 million.

The deal is subject to regulatory approvals and is expected to close in the second half of 2021.

...

Baker Hughes, Akastor merging oil drilling ops, eye IPO

https://finance.yahoo.com/news/baker-hughes-akastor-merging-…

...

Baker Hughes and Norway's Akastor plan to merge their offshore oil drilling equipment units to combine their complementary technologies, with a view to listing the new company longer term, they said on Tuesday.

Demand for new drilling equipment has been weak amid the COVID-19 pandemic and last year's plunge in the price of oil, and the companies said proforma revenue for the new unit declined by 16% in 2020 to $713 million.

Combining the drilling technology of Akastor's MHWirth, which sits on top of an oil rig, with seabed pressure control units made by Baker Hughes Subsea Drilling Systems (SDS), will cut costs and create a complete product offering, Akastor told Reuters.

"This is the sort of equipment MHWirth has wanted for many years, but which is difficult to invent from scratch as it's strictly regulated and technically complex," Akastor Chief Financial Officer Oeyvind Paaske said of the SDS products.

Akastor shares hit a 12-month high in early Oslo trade and were up 6.1% by 1338 GMT.

The new company will be owned 50% by each of the parent companies and will have a dual headquarters in Houston, Texas and the southern Norwegian town of Kristiansand, the two companies said.

An initial public offering could come a year or more after the deal closes, Paaske said.

"This transaction makes a stock market listing more realistic," Paaske said, adding that Akastor had considered listing MHWirth previously but didn't feel it had the right set-up to be an independent company.

The new company also plans to expand within onshore oil drilling and in non-oil businesses such as mining at sea and on land.

Annual cost savings from the deal were estimated at between $10 million and $11 million, Akastor said. The company declined to comment on potential job losses.

Baker Hughes will get a cash payout of $120 million from the new firm when the deal closes, and will be owed a further $80 million, while Akastor will receive $100 million in cash and be owed another $20 million.

The deal is subject to regulatory approvals and is expected to close in the second half of 2021.

...

Problem:

23.11.2020

American oil and gas companies are asleep at the wheel on methane emissions

https://finance.yahoo.com/news/american-oil-gas-companies-as…

mögliche Lösung:

Low carbon energy solutions

Our industry-leading technology helps the energy industry reduce emissions, conserve energy, and operate more efficiently.

https://www.bakerhughes.com/low-carbon

...

Flaring, venting, and leaks account for more than half of oil and gas industry emissions. Our advanced sensing and control technologies reduce flare emissions, eliminate venting, and pinpoint fugitive emissions with speed and accuracy.

Methane monitoring, management and verification

Solutions for identifying and reducing venting, flaring and fugitive emissions in oil and gas and industrial operations

https://www.bakerhughes.com/methane-monitoring-verification

23.11.2020

American oil and gas companies are asleep at the wheel on methane emissions

https://finance.yahoo.com/news/american-oil-gas-companies-as…

mögliche Lösung:

Low carbon energy solutions

Our industry-leading technology helps the energy industry reduce emissions, conserve energy, and operate more efficiently.

https://www.bakerhughes.com/low-carbon

...

Flaring, venting, and leaks account for more than half of oil and gas industry emissions. Our advanced sensing and control technologies reduce flare emissions, eliminate venting, and pinpoint fugitive emissions with speed and accuracy.

Methane monitoring, management and verification

Solutions for identifying and reducing venting, flaring and fugitive emissions in oil and gas and industrial operations

https://www.bakerhughes.com/methane-monitoring-verification

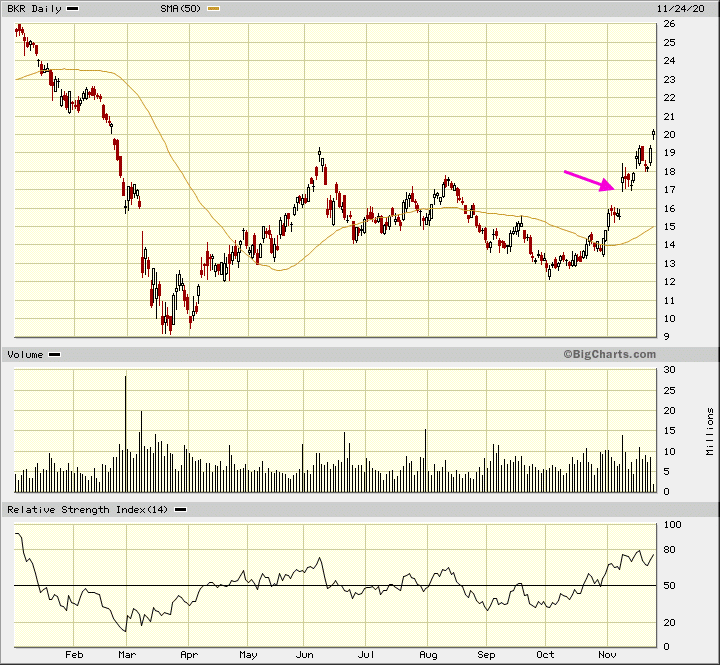

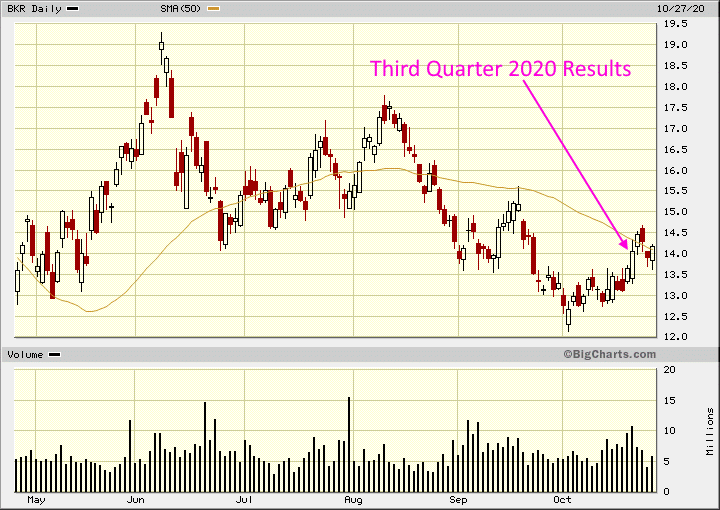

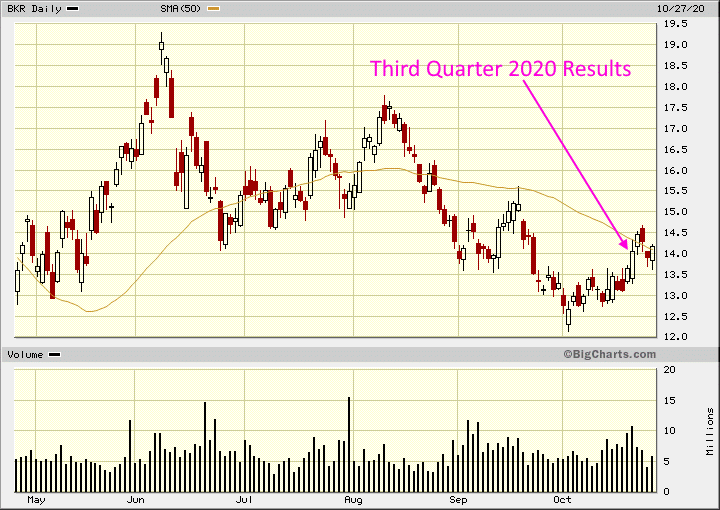

Antwort auf Beitrag Nr.: 65.599.241 von faultcode am 04.11.20 23:25:11...und mit relativer Stärke (RSI), wie viele andere Öl-Werte auch:

Das muss für viele ökobewegte Menschen geradezu traumatisch sein:

• kaum stand Joe Biden als Wahlsieger in den USA einigermaßen fest, gingen viele Ölwerte mit Gap up nach oben

(wie auch die Ölpreise weltweit allgemein nach oben gingen -- aber nicht die US-Gaspreise, die weiter leicht fallen bis heute)

Das muss für viele ökobewegte Menschen geradezu traumatisch sein:

• kaum stand Joe Biden als Wahlsieger in den USA einigermaßen fest, gingen viele Ölwerte mit Gap up nach oben

(wie auch die Ölpreise weltweit allgemein nach oben gingen -- aber nicht die US-Gaspreise, die weiter leicht fallen bis heute)

Antwort auf Beitrag Nr.: 65.515.642 von faultcode am 28.10.20 00:25:12BKR nun auch mit "Öko":

3.11.

Baker Hughes Signs Agreement to Acquire Compact Carbon Capture Technology to Advance Industrial Decarbonization

https://www.wallstreet-online.de/nachricht/13108877-baker-hu…

...

Baker Hughes (NYSE: BKR) announced today it is acquiring Compact Carbon Capture (3C), a pioneering technology development company specializing in carbon capture solutions. The acquisition underpins Baker Hughes’ strategic commitment to lead in the energy transition by providing decarbonization solutions for carbon-intensive industries, including oil and gas and broader industrial operations.

The advancement of carbon capture technology solutions is widely considered critical to delivering the additional CO2 emissions reduction needed to meet global 2050 climate targets. In the energy and industrial sectors, carbon capture technology is among the most viable decarbonization paths for both retrofitting existing assets as well as for greenfield projects. 3C’s technology can address CO2 capture from different emission sources and can contribute significantly to the decarbonization of customers’ operations.

...

3.11.

Baker Hughes Signs Agreement to Acquire Compact Carbon Capture Technology to Advance Industrial Decarbonization

https://www.wallstreet-online.de/nachricht/13108877-baker-hu…

...

Baker Hughes (NYSE: BKR) announced today it is acquiring Compact Carbon Capture (3C), a pioneering technology development company specializing in carbon capture solutions. The acquisition underpins Baker Hughes’ strategic commitment to lead in the energy transition by providing decarbonization solutions for carbon-intensive industries, including oil and gas and broader industrial operations.

The advancement of carbon capture technology solutions is widely considered critical to delivering the additional CO2 emissions reduction needed to meet global 2050 climate targets. In the energy and industrial sectors, carbon capture technology is among the most viable decarbonization paths for both retrofitting existing assets as well as for greenfield projects. 3C’s technology can address CO2 capture from different emission sources and can contribute significantly to the decarbonization of customers’ operations.

...

Antwort auf Beitrag Nr.: 65.251.258 von faultcode am 01.10.20 13:57:32dieser Großauftrag hat Schlimmeres verhindert, aber die 2020Q3-Ergebnisse sind auf Wohlgefallen gestoßen: https://investors.bakerhughes.com/news-releases/news-release…

mir ist der hohe Insider-Kauf des CEO's im September zu $14.12 über ~USD1m aufgefallen; wobei solche US-CEO's schmeißen gerne damit mal herum. Sollte man mMn nicht überbewerten. Ich war nur neugierig.

mir ist der hohe Insider-Kauf des CEO's im September zu $14.12 über ~USD1m aufgefallen; wobei solche US-CEO's schmeißen gerne damit mal herum. Sollte man mMn nicht überbewerten. Ich war nur neugierig.

Antwort auf Beitrag Nr.: 64.704.382 von faultcode am 10.08.20 12:11:1929.9.

Baker Hughes Announces Major LNG Turbomachinery Order from Qatar Petroleum for the North Field East (NFE) Project

https://www.wallstreet-online.de/nachricht/12977353-baker-hu…

...

Baker Hughes (NYSE: BKR) announced an order with longtime partner Qatar Petroleum to supply multiple main refrigerant compressors (MRCs) for Qatar Petroleum’s North Field East (NFE) project, executed by Qatargas. The total award is part of four LNG “mega trains,” representing 33 million tons per annum (MTPA) of additional capacity, which will increase Qatar’s total liquefied natural gas (LNG) production capacity from 77 MTPA to 110 MTPA and help to propel the Gulf nation to global LNG production leadership by 2025.

This order is among the largest LNG deals secured by Baker Hughes in the past five years, for both MTPA and equipment awarded. The order reinforces more than two decades of trust and successful turbomachinery collaboration between Baker Hughes, Qatar Petroleum and Qatargas.

With Qatargas already operating six existing LNG “mega trains” driven by Frame 9E gas turbine refrigerant compressors provided by Baker Hughes, the NFE project underscores the leadership of Baker Hughes LNG technology in the Gulf region and for the world’s most complex LNG projects.

...

Baker Hughes Announces Major LNG Turbomachinery Order from Qatar Petroleum for the North Field East (NFE) Project

https://www.wallstreet-online.de/nachricht/12977353-baker-hu…

...

Baker Hughes (NYSE: BKR) announced an order with longtime partner Qatar Petroleum to supply multiple main refrigerant compressors (MRCs) for Qatar Petroleum’s North Field East (NFE) project, executed by Qatargas. The total award is part of four LNG “mega trains,” representing 33 million tons per annum (MTPA) of additional capacity, which will increase Qatar’s total liquefied natural gas (LNG) production capacity from 77 MTPA to 110 MTPA and help to propel the Gulf nation to global LNG production leadership by 2025.

This order is among the largest LNG deals secured by Baker Hughes in the past five years, for both MTPA and equipment awarded. The order reinforces more than two decades of trust and successful turbomachinery collaboration between Baker Hughes, Qatar Petroleum and Qatargas.

With Qatargas already operating six existing LNG “mega trains” driven by Frame 9E gas turbine refrigerant compressors provided by Baker Hughes, the NFE project underscores the leadership of Baker Hughes LNG technology in the Gulf region and for the world’s most complex LNG projects.

...

aus: ZeroHedge

Antwort auf Beitrag Nr.: 64.512.171 von faultcode am 22.07.20 23:54:0929.7.

GE to sell off its Baker Hughes stake over the next 3 years

https://www.marketwatch.com/story/ge-to-sell-off-its-baker-h…

General Electric Co. said Wednesday, as it reported second-quarter results, that it is launching a program to fully monetize its ownership position in oil services company Baker Hughes Co. over about three years.

GE disclosed Wednesday that it owned 377.4 million shares of Baker Hughes, which based on Tuesday's stock closing price of $15.87 would be valued at $5.99 billion, and a promissory note.

GE has recorded a $1.85 billion gain on its Baker Hughes holdings for the three months ended June 30, but has recorded a loss of $3.87 billion for the six months ended June 30. GE said its monetization plan is designed to allow GE to sell its shares at a price that is approximately the volume-weighted average price of Baker Hughes shares over an extended period of time.

...

GE to sell off its Baker Hughes stake over the next 3 years

https://www.marketwatch.com/story/ge-to-sell-off-its-baker-h…

General Electric Co. said Wednesday, as it reported second-quarter results, that it is launching a program to fully monetize its ownership position in oil services company Baker Hughes Co. over about three years.

GE disclosed Wednesday that it owned 377.4 million shares of Baker Hughes, which based on Tuesday's stock closing price of $15.87 would be valued at $5.99 billion, and a promissory note.

GE has recorded a $1.85 billion gain on its Baker Hughes holdings for the three months ended June 30, but has recorded a loss of $3.87 billion for the six months ended June 30. GE said its monetization plan is designed to allow GE to sell its shares at a price that is approximately the volume-weighted average price of Baker Hughes shares over an extended period of time.

...

16.03.24 · wO Chartvergleich · Adobe |

24.01.24 · wO Newsflash · Abbott Laboratories |

18.11.23 · wO Chartvergleich · ABB |

07.10.23 · wO Chartvergleich · Align Technology |