Baker Hughes

eröffnet am 27.01.17 18:32:09 von

neuester Beitrag 04.11.23 12:48:23 von

neuester Beitrag 04.11.23 12:48:23 von

Beiträge: 76

ID: 1.245.675

ID: 1.245.675

Aufrufe heute: 0

Gesamt: 4.466

Gesamt: 4.466

Aktive User: 0

ISIN: US05722G1004 · WKN: A2DUAY · Symbol: BKR

32,84

USD

-1,38 %

-0,46 USD

Letzter Kurs 26.04.24 Nasdaq

Neuigkeiten

| Baker Hughes Company Registered (A) Aktien jetzt im kostenlosen Demokonto handeln!Anzeige |

18.03.24 · Accesswire |

16.03.24 · wO Chartvergleich |

19.02.24 · Accesswire |

24.01.24 · wO Newsflash |

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,4500 | +15,99 | |

| 7,3400 | +15,77 | |

| 9,6400 | +13,95 | |

| 7,9500 | +13,25 | |

| 1,7900 | +11,88 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 325,00 | -9,97 | |

| 0,9400 | -10,48 | |

| 4,3100 | -18,98 | |

| 1,3501 | -20,58 | |

| 9,3500 | -28,02 |

Beitrag zu dieser Diskussion schreiben

die Ölausrüster hatten heute einen sauguten Tag (nun in der Summer Break 2023 spätestens ab letzter Woche und teilweise bis Anfang September laufend): Schlumberger + Halliburton auf Platz 1 + 2, Baker Hughes auf Platz 4 im S&P 500:

16.6.

Baker Hughes Awarded Major Subsea Contract from Eni in Ivory Coast

Baker Hughes to deploy innovative deepwater technology for continuous operations

https://investors.bakerhughes.com/news-releases/news-release…

...

Baker Hughes (NASDAQ: BKR), an energy technology company, has been awarded a major contract by Eni and its partner Petroci for the Baleine Phase 2 project in Ivory Coast, Africa’s first Scope 1 and 2 net-zero emissions development.

This award, which includes eight deep water trees, three Aptara™ manifolds, the relevant subsea production control system, and flexible risers and jumpers, strengthens Baker Hughes’ presence in West Africa and unlocks considerable growth potential in the country.

Baker Hughes will deliver a configured-to-order product portfolio across subsea production and flexible pipe systems, designed for optimum cost effectiveness, installation and life-of-field value. These deepwater trees and manifolds, supplemented with subsea production controls and flexible pipe systems, provide efficiency and cost-effectiveness under demanding conditions.

Their modular design aids in reducing lead times, vital for the economic feasibility of such projects. This contract reflects Baker Hughes’ value proposition of advanced technology, exceptional execution and value, holistic solutions and operational efficiency.

...

Baker Hughes Awarded Major Subsea Contract from Eni in Ivory Coast

Baker Hughes to deploy innovative deepwater technology for continuous operations

https://investors.bakerhughes.com/news-releases/news-release…

...

Baker Hughes (NASDAQ: BKR), an energy technology company, has been awarded a major contract by Eni and its partner Petroci for the Baleine Phase 2 project in Ivory Coast, Africa’s first Scope 1 and 2 net-zero emissions development.

This award, which includes eight deep water trees, three Aptara™ manifolds, the relevant subsea production control system, and flexible risers and jumpers, strengthens Baker Hughes’ presence in West Africa and unlocks considerable growth potential in the country.

Baker Hughes will deliver a configured-to-order product portfolio across subsea production and flexible pipe systems, designed for optimum cost effectiveness, installation and life-of-field value. These deepwater trees and manifolds, supplemented with subsea production controls and flexible pipe systems, provide efficiency and cost-effectiveness under demanding conditions.

Their modular design aids in reducing lead times, vital for the economic feasibility of such projects. This contract reflects Baker Hughes’ value proposition of advanced technology, exceptional execution and value, holistic solutions and operational efficiency.

...

22.5.

ATOME Energy says Baker Hughes investment is a vote of confidence as it advances Villeta project

https://finance.yahoo.com/news/atome-energy-says-baker-hughe…

...

ATOME Energy PLC CEO Olivier Mussat joins Proactive's Stephen Gunnion with details of Baker Hughes' acquisition of a strategic 6.6% stake in the company as it plays a more important role in the hydrogen economy. Mussat said the investment demonstrates the confidence of the $27 billion dollar company in ATOME's strategy and projects.

ATOME Energy says Baker Hughes investment is a vote of confidence as it advances Villeta project

https://finance.yahoo.com/news/atome-energy-says-baker-hughe…

...

ATOME Energy PLC CEO Olivier Mussat joins Proactive's Stephen Gunnion with details of Baker Hughes' acquisition of a strategic 6.6% stake in the company as it plays a more important role in the hydrogen economy. Mussat said the investment demonstrates the confidence of the $27 billion dollar company in ATOME's strategy and projects.

16.5.

WSJ: Baker Hughes CFO Aims to Boost Dividends, Be More Judicious With Buybacks

Six months into the role, Nancy Buese is leading a pivot in how the oil-field services company returns cash to shareholders

https://www.wsj.com/articles/baker-hughes-cfo-aims-to-boost-…

...

Baker Hughes’s new finance chief wants to prioritize raising dividends over share buybacks, a philosophical shift for the oil-field-services company as it nears the end of a restructuring aimed at lifting profit margins and reducing costs.

The Houston-based company is planning to evaluate this summer the pace and rate it would like to increase the dividend over time, with the intention of making a recommendation to the board later this year, said Chief Financial Officer Nancy Buese, who has served in the role for roughly six months.

“We should be able to improve and increase the dividend,” she said. “To me, that’s the biggest mark that management can provide in terms of confidence in the future.”

The company generally aims to return 60% to 80% of its free cash flow to shareholders. Those rewards in recent years have included buybacks, dividends and distributions to General Electric, which recently sold its remaining stake in the company. GE, until this year, was entitled to receive distributions on an equal per-share amount of any dividend paid by Baker Hughes.

...

WSJ: Baker Hughes CFO Aims to Boost Dividends, Be More Judicious With Buybacks

Six months into the role, Nancy Buese is leading a pivot in how the oil-field services company returns cash to shareholders

https://www.wsj.com/articles/baker-hughes-cfo-aims-to-boost-…

...

Baker Hughes’s new finance chief wants to prioritize raising dividends over share buybacks, a philosophical shift for the oil-field-services company as it nears the end of a restructuring aimed at lifting profit margins and reducing costs.

The Houston-based company is planning to evaluate this summer the pace and rate it would like to increase the dividend over time, with the intention of making a recommendation to the board later this year, said Chief Financial Officer Nancy Buese, who has served in the role for roughly six months.

“We should be able to improve and increase the dividend,” she said. “To me, that’s the biggest mark that management can provide in terms of confidence in the future.”

The company generally aims to return 60% to 80% of its free cash flow to shareholders. Those rewards in recent years have included buybacks, dividends and distributions to General Electric, which recently sold its remaining stake in the company. GE, until this year, was entitled to receive distributions on an equal per-share amount of any dividend paid by Baker Hughes.

...

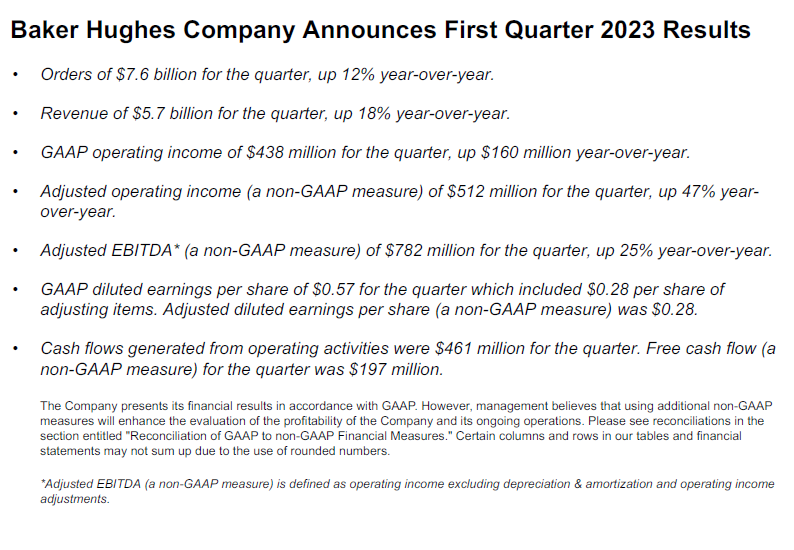

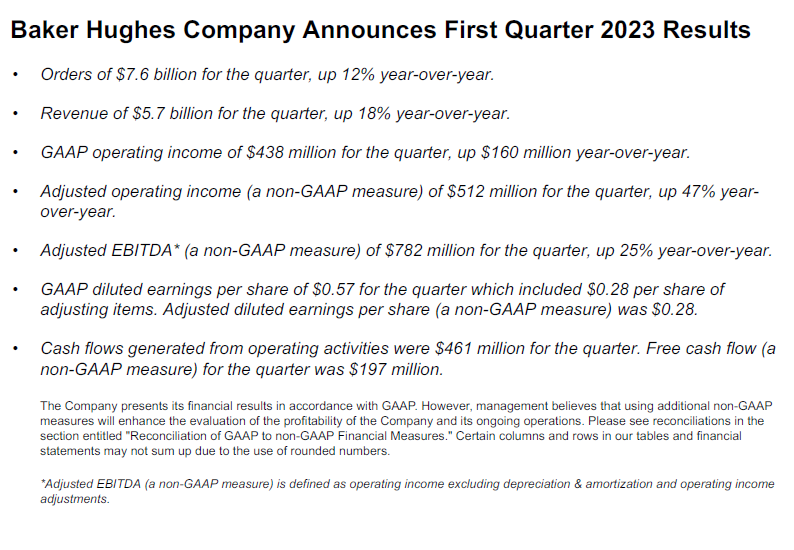

Q1: https://investors.bakerhughes.com/news-releases/news-release…

...

"up", "up", "up", ...

...

“We were pleased with our first quarter results and remain optimistic on the outlook for 2023. We maintained our strong order momentum in IET and SSPS. We also delivered solid operating results at the high end of our guidance in both business segments, booked almost $300 million of New Energy orders and generated approximately $200 million of free cash flow,” said Lorenzo Simonelli, Baker Hughes chairman and chief executive officer.

“While 2023 has already started off with some macro volatility, we remain optimistic on the outlook for energy services and Baker Hughes.

Our diverse portfolio features long cycle and short cycle businesses that position us well to navigate any periods of variability that may occur across the energy sector.”

“We continue to believe that the current environment remains unique, with a spending cycle that is more durable and less sensitive to commodity price swings, relative to prior cycles. Another notable characteristic of this cycle is the continued shift towards the development of natural gas and LNG. As the world increasingly recognizes the crucial role natural gas will play in the energy transition, serving as both a transition and destination fuel, the case for a multi-decade growth opportunity in gas is steadily improving as both a transition and destination fuel.”

“In addition to capitalizing on the commercial opportunities presented by this favorable macro backdrop, Baker Hughes remains committed in 2023 to transforming the Company operationally and positioning it for growth in the energy and industrial markets. I want to thank our shareholders, customers, and our employees for their continued hard work to deliver against our strategic goals,” concluded Simonelli.

...

...

"up", "up", "up", ...

...

“We were pleased with our first quarter results and remain optimistic on the outlook for 2023. We maintained our strong order momentum in IET and SSPS. We also delivered solid operating results at the high end of our guidance in both business segments, booked almost $300 million of New Energy orders and generated approximately $200 million of free cash flow,” said Lorenzo Simonelli, Baker Hughes chairman and chief executive officer.

“While 2023 has already started off with some macro volatility, we remain optimistic on the outlook for energy services and Baker Hughes.

Our diverse portfolio features long cycle and short cycle businesses that position us well to navigate any periods of variability that may occur across the energy sector.”

“We continue to believe that the current environment remains unique, with a spending cycle that is more durable and less sensitive to commodity price swings, relative to prior cycles. Another notable characteristic of this cycle is the continued shift towards the development of natural gas and LNG. As the world increasingly recognizes the crucial role natural gas will play in the energy transition, serving as both a transition and destination fuel, the case for a multi-decade growth opportunity in gas is steadily improving as both a transition and destination fuel.”

“In addition to capitalizing on the commercial opportunities presented by this favorable macro backdrop, Baker Hughes remains committed in 2023 to transforming the Company operationally and positioning it for growth in the energy and industrial markets. I want to thank our shareholders, customers, and our employees for their continued hard work to deliver against our strategic goals,” concluded Simonelli.

...

7.3.

Baker Hughes Plans for Multiple Years of Growth: CERAWeek Update

https://www.bloomberg.com/news/articles/2023-03-06/chevron-c…

...

Baker Hughes Co., the world’s No. 3 oil field-services provider, is gearing up for years of expansion to make up for underinvestment from clients.

“We do see a hunger and a need for more oil,” Chief Executive Officer Lorenzo Simonelli said in a Bloombert TV interview. He added that while growth is leveling off in North America, it’s a different story overseas, where demand is outstripping supply.

...

cf. https://www.msn.com/en-us/money/news/baker-hughes-ceo-on-rec…

Baker Hughes Plans for Multiple Years of Growth: CERAWeek Update

https://www.bloomberg.com/news/articles/2023-03-06/chevron-c…

...

Baker Hughes Co., the world’s No. 3 oil field-services provider, is gearing up for years of expansion to make up for underinvestment from clients.

“We do see a hunger and a need for more oil,” Chief Executive Officer Lorenzo Simonelli said in a Bloombert TV interview. He added that while growth is leveling off in North America, it’s a different story overseas, where demand is outstripping supply.

...

cf. https://www.msn.com/en-us/money/news/baker-hughes-ceo-on-rec…

Earnings:

https://investors.bakerhughes.com/news-releases/news-release…

...

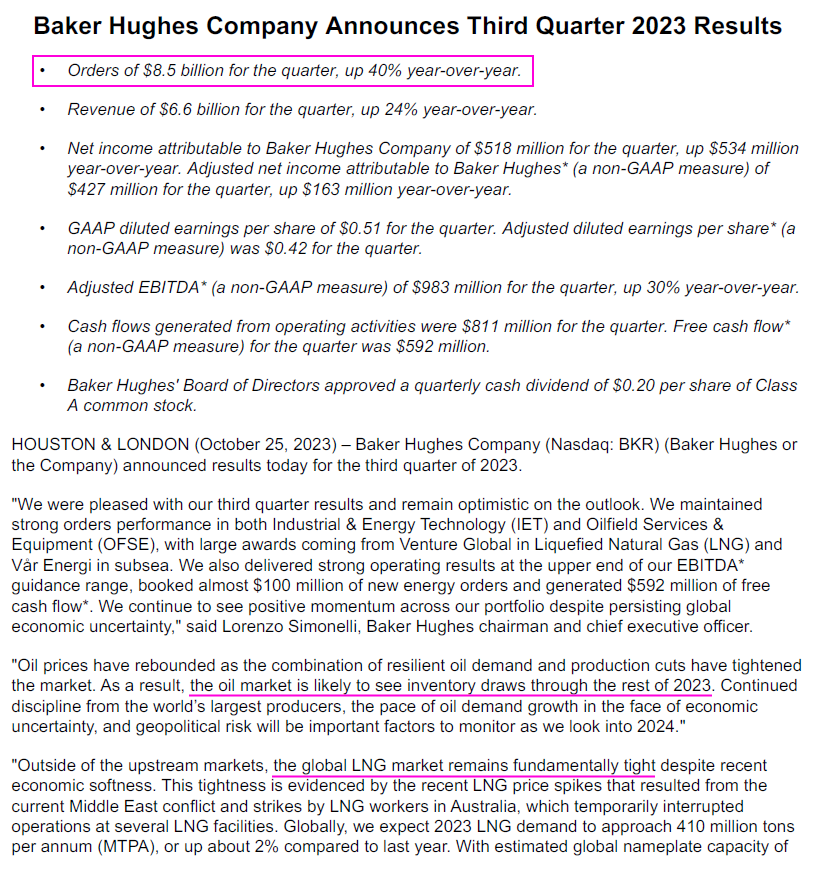

• Record orders of $8.0 billion for the quarter, up 32% sequentially and up 20% year-over-year

• Revenue of $5.9 billion for the quarter, up 10% sequentially and up 8% year-over-year

• GAAP operating income of $663 million for the quarter, up $394 million sequentially and up 15% year-over-year

Adjusted operating income (a non-GAAP measure) of $692 million for the quarter, up 38% sequentially and up 21% year-over-year

• Adjusted EBITDA* (a non-GAAP measure) of $947 million for the quarter, up 25% sequentially and up 12% year-over-year

• GAAP earnings per share of $0.18 for the quarter which included $0.20 per share of adjusting items. Adjusted earnings per share (a non-GAAP measure) was $0.38.

• Cash flows generated from operating activities were $898 million for the quarter. Free cash flow (a non-GAAP measure) for the quarter was $657 million.

...

Lorenzo Simonelli, Baker Hughes chairman and chief executive officer: ...

“In 2023, the global economy is expected to experience some challenges under the weight of inflationary pressures and tightening monetary conditions.

Despite recessionary pressures in some of the world’s largest economies, we maintain a positive outlook for the energy sector, given supply shortages appear likely to persist. With years of under investment now being amplified by recent geopolitical factors, global spare capacity for oil and gas has deteriorated and will likely require years of investment growth to meet forecasted future demand.”

“Given this macro backdrop, Baker Hughes is intensely focused on four key areas in 2023 in order to drive future value for shareholders. First, we are well positioned to capitalize on the significant growth opportunities that are building across both business segments.

Second, we remain focused on optimizing our corporate structure and transforming the Baker Hughes organization to drive improvements in our margin and returns profile.

Third, we continue to develop our portfolio of new energy technologies.

Fourth, we will continue to focus on all these initiatives and generating strong free cash flow and returning 60 to 80% of this free cash flow to shareholders through a combination of dividends and opportunistic share buybacks,” concluded Simonelli.

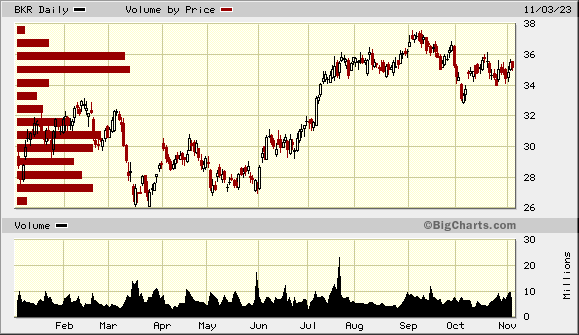

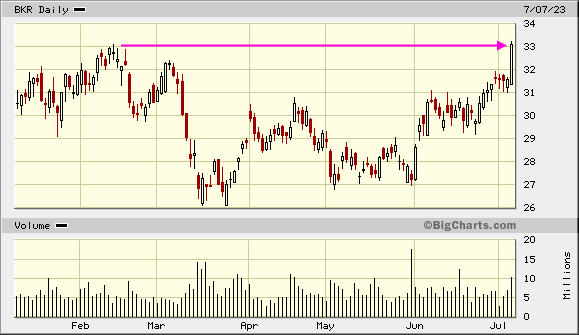

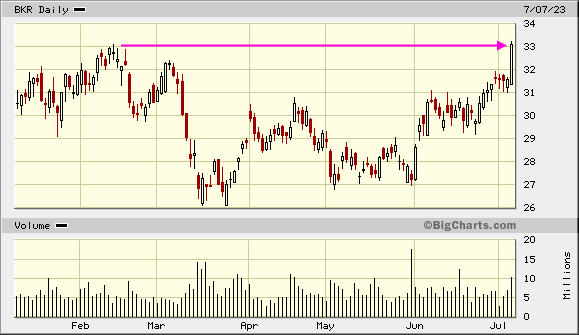

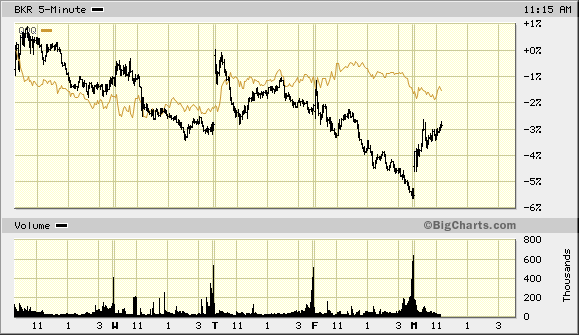

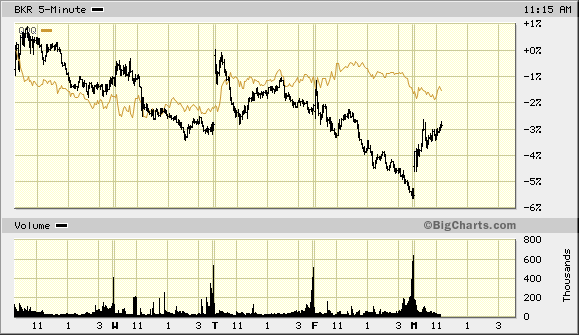

=> das kam bislang eher nicht so gut an (an einem guten Börsentag):

https://investors.bakerhughes.com/news-releases/news-release…

...

• Record orders of $8.0 billion for the quarter, up 32% sequentially and up 20% year-over-year

• Revenue of $5.9 billion for the quarter, up 10% sequentially and up 8% year-over-year

• GAAP operating income of $663 million for the quarter, up $394 million sequentially and up 15% year-over-year

Adjusted operating income (a non-GAAP measure) of $692 million for the quarter, up 38% sequentially and up 21% year-over-year

• Adjusted EBITDA* (a non-GAAP measure) of $947 million for the quarter, up 25% sequentially and up 12% year-over-year

• GAAP earnings per share of $0.18 for the quarter which included $0.20 per share of adjusting items. Adjusted earnings per share (a non-GAAP measure) was $0.38.

• Cash flows generated from operating activities were $898 million for the quarter. Free cash flow (a non-GAAP measure) for the quarter was $657 million.

...

Lorenzo Simonelli, Baker Hughes chairman and chief executive officer: ...

“In 2023, the global economy is expected to experience some challenges under the weight of inflationary pressures and tightening monetary conditions.

Despite recessionary pressures in some of the world’s largest economies, we maintain a positive outlook for the energy sector, given supply shortages appear likely to persist. With years of under investment now being amplified by recent geopolitical factors, global spare capacity for oil and gas has deteriorated and will likely require years of investment growth to meet forecasted future demand.”

“Given this macro backdrop, Baker Hughes is intensely focused on four key areas in 2023 in order to drive future value for shareholders. First, we are well positioned to capitalize on the significant growth opportunities that are building across both business segments.

Second, we remain focused on optimizing our corporate structure and transforming the Baker Hughes organization to drive improvements in our margin and returns profile.

Third, we continue to develop our portfolio of new energy technologies.

Fourth, we will continue to focus on all these initiatives and generating strong free cash flow and returning 60 to 80% of this free cash flow to shareholders through a combination of dividends and opportunistic share buybacks,” concluded Simonelli.

=> das kam bislang eher nicht so gut an (an einem guten Börsentag):

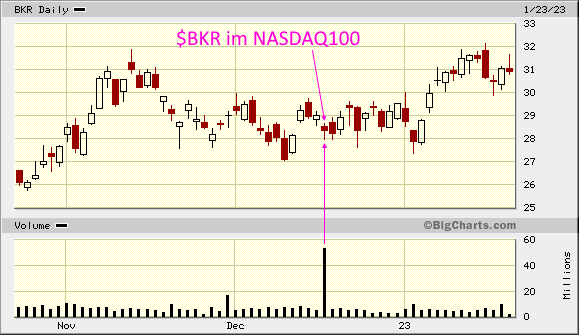

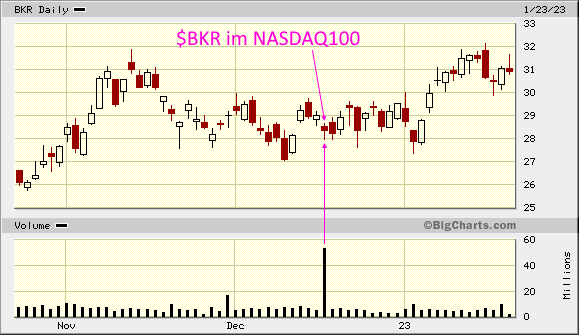

Baker Hughes in den NASDAQ100-Index am Freitag: https://www.wallstreet-online.de/nachricht/16315987-achtung-…

=>

=>

Baker Hughes Acquires Power Generation Division of BRUSH Group to Enhance its Electric Machinery Portfolio

https://www.globenewswire.com/en/news-release/2022/08/08/249…

...

• Acquisition expands Baker Hughes’ turbomachinery portfolio with proven electric-power technology for industrial and energy customers

• Integration of BRUSH will enhance Baker Hughes’ electrification offering and supports strategic commitment to provide cleaner energy solutions

HOUSTON and LONDON, Aug. 08, 2022 (GLOBE NEWSWIRE) -- Baker Hughes (Nasdaq: BKR) announced it has agreed to acquire the Power Generation division of BRUSH Group (“BRUSH”) from One Equity Partners. BRUSH is an established equipment manufacturer that specializes in electric power generation and management for the industrial and energy sectors. This acquisition supports Baker Hughes’ strategic commitment to lead in providing decarbonization solutions for the natural gas industry and historically hard-to-abate sectors.

The addition of BRUSH will enhance Baker Hughes’ core turbomachinery portfolio with electromechanical equipment, including electric generators, synchronous condensers, electric motors, and associated control power management systems. Already in use across a wide range of industries, BRUSH’s technology complements Baker Hughes’ existing e-LNG offering. Through the acquisition, Baker Hughes also plans to optimize its supply chain by leveraging BRUSH Power Generation’s manufacturing base and expanding its scope on customer projects in both the industrial and energy sectors.

“We are delighted to bring the BRUSH Power Generation division, already a long-established and trusted supplier, into the Baker Hughes family,” said Rod Christie, executive vice president of Turbomachinery & Process Solutions at Baker Hughes. “The need for electrification in the hard-to-abate and natural gas sectors plays an increasingly critical role in accelerating the path to net-zero. Through this acquisition, we will expand our core electrification capabilities and scope, further enhance our supply chain, and reach new industrial customers who can benefit from our broader turbomachinery and climate technology solutions offerings.”

...

https://www.globenewswire.com/en/news-release/2022/08/08/249…

...

• Acquisition expands Baker Hughes’ turbomachinery portfolio with proven electric-power technology for industrial and energy customers

• Integration of BRUSH will enhance Baker Hughes’ electrification offering and supports strategic commitment to provide cleaner energy solutions

HOUSTON and LONDON, Aug. 08, 2022 (GLOBE NEWSWIRE) -- Baker Hughes (Nasdaq: BKR) announced it has agreed to acquire the Power Generation division of BRUSH Group (“BRUSH”) from One Equity Partners. BRUSH is an established equipment manufacturer that specializes in electric power generation and management for the industrial and energy sectors. This acquisition supports Baker Hughes’ strategic commitment to lead in providing decarbonization solutions for the natural gas industry and historically hard-to-abate sectors.

The addition of BRUSH will enhance Baker Hughes’ core turbomachinery portfolio with electromechanical equipment, including electric generators, synchronous condensers, electric motors, and associated control power management systems. Already in use across a wide range of industries, BRUSH’s technology complements Baker Hughes’ existing e-LNG offering. Through the acquisition, Baker Hughes also plans to optimize its supply chain by leveraging BRUSH Power Generation’s manufacturing base and expanding its scope on customer projects in both the industrial and energy sectors.

“We are delighted to bring the BRUSH Power Generation division, already a long-established and trusted supplier, into the Baker Hughes family,” said Rod Christie, executive vice president of Turbomachinery & Process Solutions at Baker Hughes. “The need for electrification in the hard-to-abate and natural gas sectors plays an increasingly critical role in accelerating the path to net-zero. Through this acquisition, we will expand our core electrification capabilities and scope, further enhance our supply chain, and reach new industrial customers who can benefit from our broader turbomachinery and climate technology solutions offerings.”

...

16.03.24 · wO Chartvergleich · Adobe |

24.01.24 · wO Newsflash · Abbott Laboratories |

18.11.23 · wO Chartvergleich · ABB |

07.10.23 · wO Chartvergleich · Align Technology |