Sunrise Energy Metals - Batterie Metalle (Seite 57)

eröffnet am 30.10.17 17:34:33 von

neuester Beitrag 04.06.24 22:31:52 von

neuester Beitrag 04.06.24 22:31:52 von

Beiträge: 578

ID: 1.265.600

ID: 1.265.600

Aufrufe heute: 1

Gesamt: 54.422

Gesamt: 54.422

Aktive User: 0

ISIN: AU0000143729 · WKN: A3CLTW

0,2550

EUR

0,00 %

0,0000 EUR

Letzter Kurs 16.06.24 Lang & Schwarz

Neuigkeiten

| TitelBeiträge |

|---|

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8250 | +25,00 | |

| 0,7437 | +20,93 | |

| 0,8906 | +20,35 | |

| 1,1500 | +15,00 | |

| 8,3200 | +12,74 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,455 | -8,53 | |

| 1,0780 | -9,41 | |

| 12,460 | -16,06 | |

| 0,8300 | -20,38 | |

| 46,98 | -97,98 |

Beitrag zu dieser Diskussion schreiben

Einfaches Einfügen von wallstreetONLINE Charts: So funktionierts.

Hallo Zusammen,

wann stehen hier die nächsten News an? Aktuelle Kaufkurse unter der Voraussetzung das Alu, Nickel und Kobalt weiter steigen?

wann stehen hier die nächsten News an? Aktuelle Kaufkurse unter der Voraussetzung das Alu, Nickel und Kobalt weiter steigen?

Bin hier übrigens raus - und mittlerweile (gottseidank) bei Celsius ... ;-))

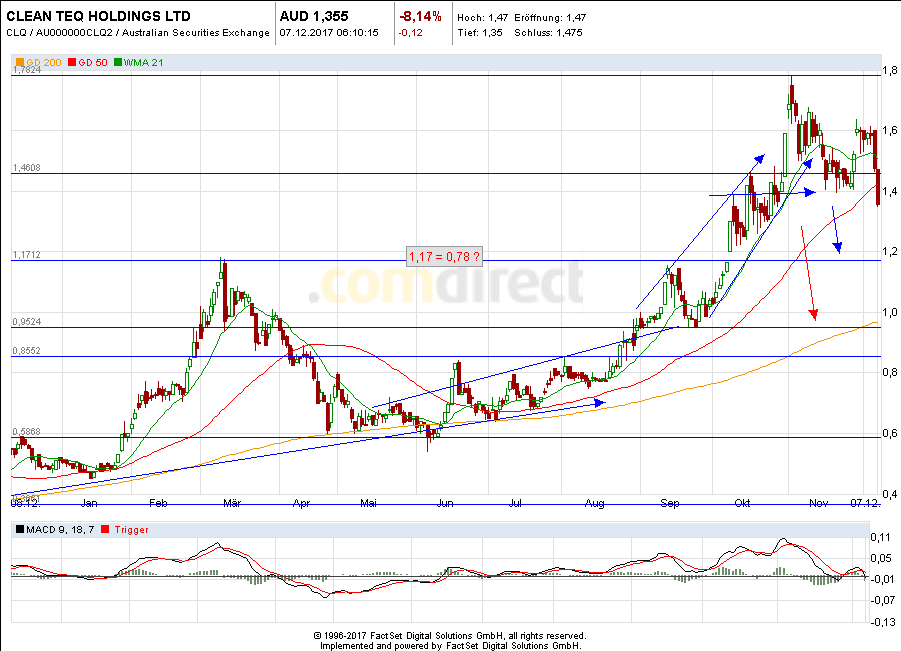

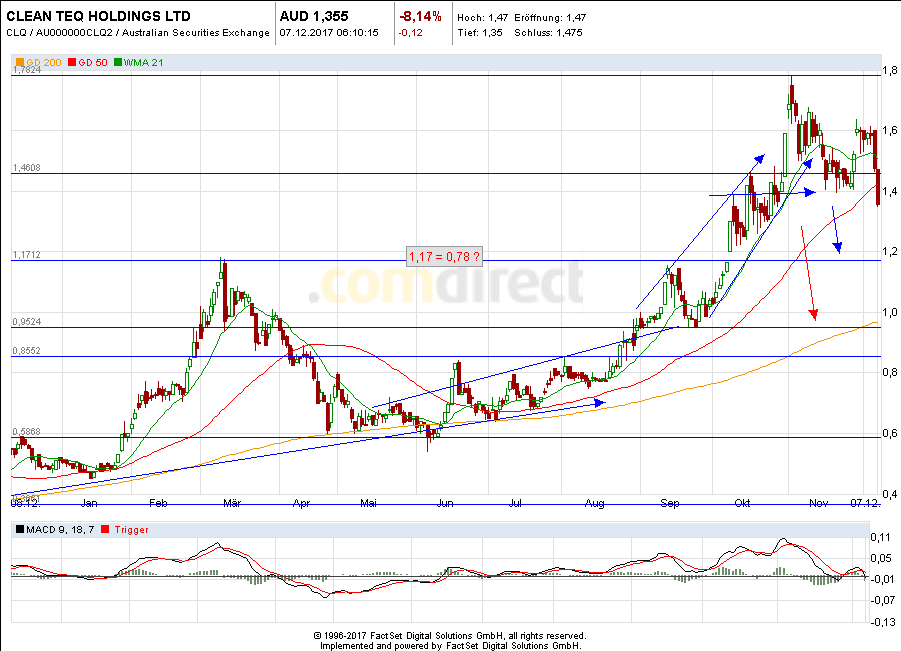

Antwort auf Beitrag Nr.: 56.285.531 von abgemeldet568354 am 27.11.17 14:30:24Durch den fallenden Nickelpreis - Abverkauft gestern und heute - das könnte je nach Nickelpreis noch

tiefer fallen - die 1,17 Aud $ mit schließen der Kurslücke wäre denkbar.

Nur wenn der Nickelpreis noch tiefer fällt - könnte es eine Stufe tiefer gehen. Ist aber eher unwahrscheinlich, weil NUR die Eisenüberproduktion reduziert wird -

tiefer fallen - die 1,17 Aud $ mit schließen der Kurslücke wäre denkbar.

Nur wenn der Nickelpreis noch tiefer fällt - könnte es eine Stufe tiefer gehen. Ist aber eher unwahrscheinlich, weil NUR die Eisenüberproduktion reduziert wird -

Antwort auf Beitrag Nr.: 56.127.794 von hobiewaters am 08.11.17 08:34:02...and Clean TeQ Holdings (CLQ.Australia) has catapulted up 7503%.

https://www.investopedia.com/news/3-electric-car-plays-25-up…

https://www.investopedia.com/news/3-electric-car-plays-25-up…

siehe auch den entspechenden Thread von AUZ:

https://www.wallstreet-online.de/diskussion/1264932-11-20/au…

https://www.wallstreet-online.de/diskussion/1264932-11-20/au…

Hier ein interessanter Artikel auf Hotcopper von heute über AUZ (Australian Mines, das benachbarte Projekt), der auch die beiden Projekte von CLQ und AUZ vergleicht.

Monday was a great, yesterday and today strong consolidation around the A$0.14 mark which is fine for me.

The 200% oversubscription of the CR shows that the institutional investors believe the AUZ story and are continuing to load up (they don’t buy a story without significant due diligence and research) – The BOTS and a few down rappers still in evidence are trying hard to persuade you to sell your shares but on Monday every barrier was chomped through - and with consolidation yesterday and today you can see sales at this price are quickly snapped up

Hold onto your shares they are worth a lot more than you may think - I have not sold one share yet and continue to accumulate. IMHO AUZ is till in its infancy and has a long way to go.

If you have not done so, if so do so again – grab yourself a coffee, nice glass of wine, whiskey or a magnum and print out and Read/Reread the latest AUZ July- Sept quarterly activities report – everything you need to know is there and you can easily see that a lot of the down rampers are simply peddling fake news/ information. Keep it pinned to your study wall.

Only 2 non DRC companies (AUZ and CLQ) that I know about have the capability to supply the cobalt sulphate that the car industry needs by end 2018 / early 2019 when the current already designed and prototyped EV cars, vans and trucks start really rolling off the new EV production lines bid time.

Fortunately or unfortunately I do not invest in Africa, I hope I am wrong but I see future problems in DRC and many countries on the continent, corruption seems endemic, Boarders drawn by colonial powers are continuing to be challenged by tribal / religious issues and the vast oil and mineral wealth never seems to reach the people. This “risk assessment” will be front of all European car manufacturers and it appears that even the Chinese are beginning to take note. Sad but good for AUZ and CLQ in safe and transparent Australia.

Cobalt Sulphate and Nickel Sulphate that both AUZ and CLQ have and is needed for EV batteries is not the same as plain Cobalt and Nickel.

AUZ is in my view the better play though I think both companies will do well. However in my view AUZ is the better play and I sold CLQ 2 weeks ago to put into AUZ as I believe AUZ

- is simply more undervalued CLQ (this is not a CLQ down ramp CLQ will do very well too)

- Sconi will be earliest to production end 2018/early 2019 (JORC resources proven all licenses to mine in place)

- Using simple already proven production methods (CLQ is a planning to use a new pulp in resin method - may ultimately be better but probably will take longer to implement/scale up)

- Low cost mining - Sconi minimal strip open cast mining

- AUZ Sconi resources already proven up + Flemington + Thackaringa will probably be 2.5X plus CLQ Synerston now named Sunrise. (Upside new Sconi tenements increased Sconi X10 from 2 Qtr this year as yet unexplored. –could add significantly more resource

- At least 9 off take EV and Battery manufacturers is discussions with AUZ

- No dominant shareholders (this may change after recent A$20 CR

(CLQ has the complication of a 20% Chinese shareholder co-chairman makes in my opinion causes complications in decision making)

I am holding until at least they start production from Sconi, probably well beyond. As I see conservatively in my view

A$0.25 by Dec 31 2017 or 25 by 25

A$0.50 by June 2018 (Sconi Off-takes signed, BFS Sconi and break ground on Sconi mine and PFS Flemington further JORC report and Thackaringa initial drill results.

A$ 1.00 end 2019 start of Sconi production

Keep the faith – IMHO AUZ is a key part to of the EV/Battery revolution .

aus: Hotcopper, User thaiinvest 107 posts. Date: 08/11/17 Time: 16:39:51 Post #:28613541

Monday was a great, yesterday and today strong consolidation around the A$0.14 mark which is fine for me.

The 200% oversubscription of the CR shows that the institutional investors believe the AUZ story and are continuing to load up (they don’t buy a story without significant due diligence and research) – The BOTS and a few down rappers still in evidence are trying hard to persuade you to sell your shares but on Monday every barrier was chomped through - and with consolidation yesterday and today you can see sales at this price are quickly snapped up

Hold onto your shares they are worth a lot more than you may think - I have not sold one share yet and continue to accumulate. IMHO AUZ is till in its infancy and has a long way to go.

If you have not done so, if so do so again – grab yourself a coffee, nice glass of wine, whiskey or a magnum and print out and Read/Reread the latest AUZ July- Sept quarterly activities report – everything you need to know is there and you can easily see that a lot of the down rampers are simply peddling fake news/ information. Keep it pinned to your study wall.

Only 2 non DRC companies (AUZ and CLQ) that I know about have the capability to supply the cobalt sulphate that the car industry needs by end 2018 / early 2019 when the current already designed and prototyped EV cars, vans and trucks start really rolling off the new EV production lines bid time.

Fortunately or unfortunately I do not invest in Africa, I hope I am wrong but I see future problems in DRC and many countries on the continent, corruption seems endemic, Boarders drawn by colonial powers are continuing to be challenged by tribal / religious issues and the vast oil and mineral wealth never seems to reach the people. This “risk assessment” will be front of all European car manufacturers and it appears that even the Chinese are beginning to take note. Sad but good for AUZ and CLQ in safe and transparent Australia.

Cobalt Sulphate and Nickel Sulphate that both AUZ and CLQ have and is needed for EV batteries is not the same as plain Cobalt and Nickel.

AUZ is in my view the better play though I think both companies will do well. However in my view AUZ is the better play and I sold CLQ 2 weeks ago to put into AUZ as I believe AUZ

- is simply more undervalued CLQ (this is not a CLQ down ramp CLQ will do very well too)

- Sconi will be earliest to production end 2018/early 2019 (JORC resources proven all licenses to mine in place)

- Using simple already proven production methods (CLQ is a planning to use a new pulp in resin method - may ultimately be better but probably will take longer to implement/scale up)

- Low cost mining - Sconi minimal strip open cast mining

- AUZ Sconi resources already proven up + Flemington + Thackaringa will probably be 2.5X plus CLQ Synerston now named Sunrise. (Upside new Sconi tenements increased Sconi X10 from 2 Qtr this year as yet unexplored. –could add significantly more resource

- At least 9 off take EV and Battery manufacturers is discussions with AUZ

- No dominant shareholders (this may change after recent A$20 CR

(CLQ has the complication of a 20% Chinese shareholder co-chairman makes in my opinion causes complications in decision making)

I am holding until at least they start production from Sconi, probably well beyond. As I see conservatively in my view

A$0.25 by Dec 31 2017 or 25 by 25

A$0.50 by June 2018 (Sconi Off-takes signed, BFS Sconi and break ground on Sconi mine and PFS Flemington further JORC report and Thackaringa initial drill results.

A$ 1.00 end 2019 start of Sconi production

Keep the faith – IMHO AUZ is a key part to of the EV/Battery revolution .

aus: Hotcopper, User thaiinvest 107 posts. Date: 08/11/17 Time: 16:39:51 Post #:28613541

Antwort auf Beitrag Nr.: 56.079.125 von hobiewaters am 02.11.17 09:25:46Also wenn die Societe Generale mit bei der Finanzierung dabei ist - ist es TOP