Seltene-Erden-Kooperation: Medallion Res. und Rare Earth Salts (Seite 30)

eröffnet am 23.01.18 10:46:16 von

neuester Beitrag 16.05.24 14:35:24 von

neuester Beitrag 16.05.24 14:35:24 von

Beiträge: 1.480

ID: 1.272.382

ID: 1.272.382

Aufrufe heute: 4

Gesamt: 119.193

Gesamt: 119.193

Aktive User: 0

ISIN: CA36269D1015 · WKN: A4016K · Symbol: MRD

0,0415

EUR

-10,75 %

-0,0050 EUR

Letzter Kurs 14.06.24 Frankfurt

Neuigkeiten

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8250 | +25,00 | |

| 0,8906 | +20,35 | |

| 5,6500 | +12,55 | |

| 0,6650 | +9,02 | |

| 1,2500 | +8,70 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 97,50 | -9,13 | |

| 1,0780 | -9,41 | |

| 12,460 | -16,06 | |

| 0,6600 | -24,57 | |

| 46,98 | -97,98 |

Beitrag zu dieser Diskussion schreiben

@ "Die news sind hammer gut!"

Warum fällt dann der Kurs???

Warum fällt dann der Kurs???

Antwort auf Beitrag Nr.: 68.773.757 von JALA am 14.07.21 15:27:01Dabei meinte ich das Lebensalter der Aktionäre ....

Hat da jemand einen Wert was das Monazit kostet? Angeblich soll es ja ein Abfallprodukt sein das in großen Mengen auf Halde liegt. Da wird der Preis sehr niedrig liegen. Die Frage ist natürlich, was es kostet, sobald MDL einen Markt dafür entwickelt hat. Auf der anderen Seite gehen ja auch einige Vorhersagen für einen Preis beim NdPr von an die 100000 $/t aus, das könnte sich dann wieder relativieren.

In jedem Fall scheint mir die Wirtschaftlichkeit solide zu sein und damit die aktuelle MK ein Witz. Da könnte bald eine Neubewertung einsetzen.

Vor allem die Skalierbarkeit und der frei selektierare Standort ist ein Punkt den konventionelle Minen einfach nie bieten werden.

In jedem Fall scheint mir die Wirtschaftlichkeit solide zu sein und damit die aktuelle MK ein Witz. Da könnte bald eine Neubewertung einsetzen.

Vor allem die Skalierbarkeit und der frei selektierare Standort ist ein Punkt den konventionelle Minen einfach nie bieten werden.

Antwort auf Beitrag Nr.: 68.773.688 von married am 14.07.21 15:22:43Married, warum ist für ältere MDL Investoren nicht gut?

Antwort auf Beitrag Nr.: 68.773.370 von Archaon am 14.07.21 15:00:45bzgl. mögl. Denkfehler:

ich glaube, du musst bei deiner gewinnkalkulation noch den Einkaufspreis für das Monazit berücksichtigen

Modelliert werden Betriebskosten von 28 US$ pro kg NdPr in an Cer abgereichertem gemischtem REE-Oxid (ohne Monazit-Lieferkosten; keine Abzinsung für den Nebenproduktwert).

ich glaube, du musst bei deiner gewinnkalkulation noch den Einkaufspreis für das Monazit berücksichtigen

Modelliert werden Betriebskosten von 28 US$ pro kg NdPr in an Cer abgereichertem gemischtem REE-Oxid (ohne Monazit-Lieferkosten; keine Abzinsung für den Nebenproduktwert).

Antwort auf Beitrag Nr.: 68.773.370 von Archaon am 14.07.21 15:00:45Habe ich irgendwo einen Denkfehler???

Hoffentlich !

Solche Berechnungen sind nicht gut für ältere MDL - Investoren.

.

Hoffentlich !

Solche Berechnungen sind nicht gut für ältere MDL - Investoren.

.

Die news sind hammer gut.

Grob überschlagen:

870 t Nd/Pr * 60000-70000 $/t = ca. 60 Mio $ Umsatz

Kostenfaktor 28 $/kg also 28000 $/t = ca. 25 Mio $ Kosten

macht 35 Mio USD Gewinn = 43 mio CAD Gewinn

MK ist aktuell bei 18 Mio CAD

Für ein einfaches KGV von 10 müsste das alleine dafür reichen, dass MDL auf eine MK von um die 400 mio CAD kommt - sprich ein 20 Bagger vom aktuellen Niveau aus

Und die ganze story ist ja voll skalierbar - kann also eine Anlage in Australien, eine in Kanada eine in der EU gebaut werden...

Habe ich irgendwo einen Denkfehler???

Grob überschlagen:

870 t Nd/Pr * 60000-70000 $/t = ca. 60 Mio $ Umsatz

Kostenfaktor 28 $/kg also 28000 $/t = ca. 25 Mio $ Kosten

macht 35 Mio USD Gewinn = 43 mio CAD Gewinn

MK ist aktuell bei 18 Mio CAD

Für ein einfaches KGV von 10 müsste das alleine dafür reichen, dass MDL auf eine MK von um die 400 mio CAD kommt - sprich ein 20 Bagger vom aktuellen Niveau aus

Und die ganze story ist ja voll skalierbar - kann also eine Anlage in Australien, eine in Kanada eine in der EU gebaut werden...

Habe ich irgendwo einen Denkfehler???

Teil2:

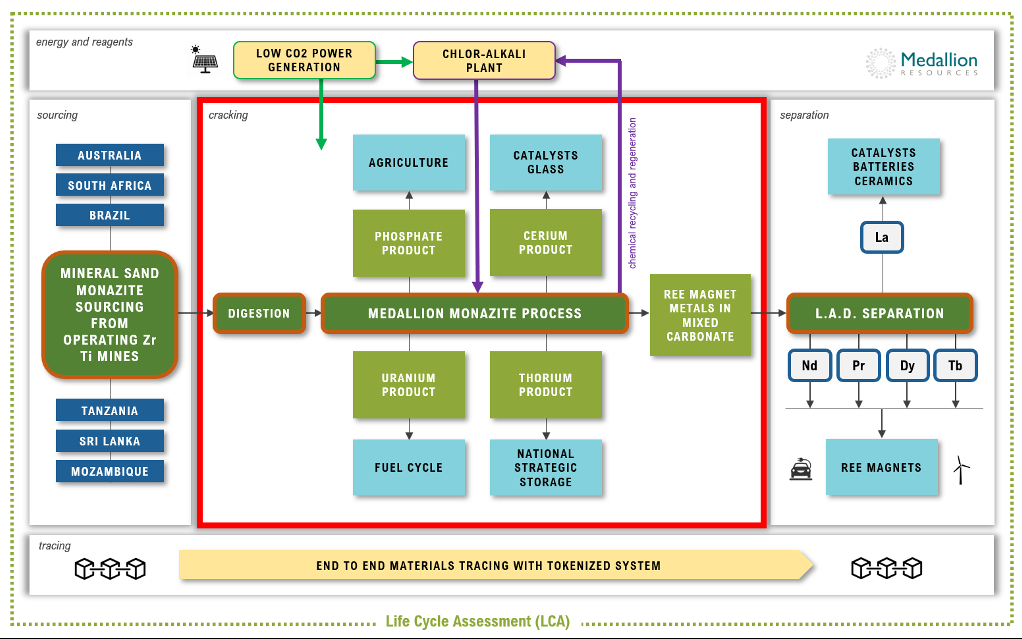

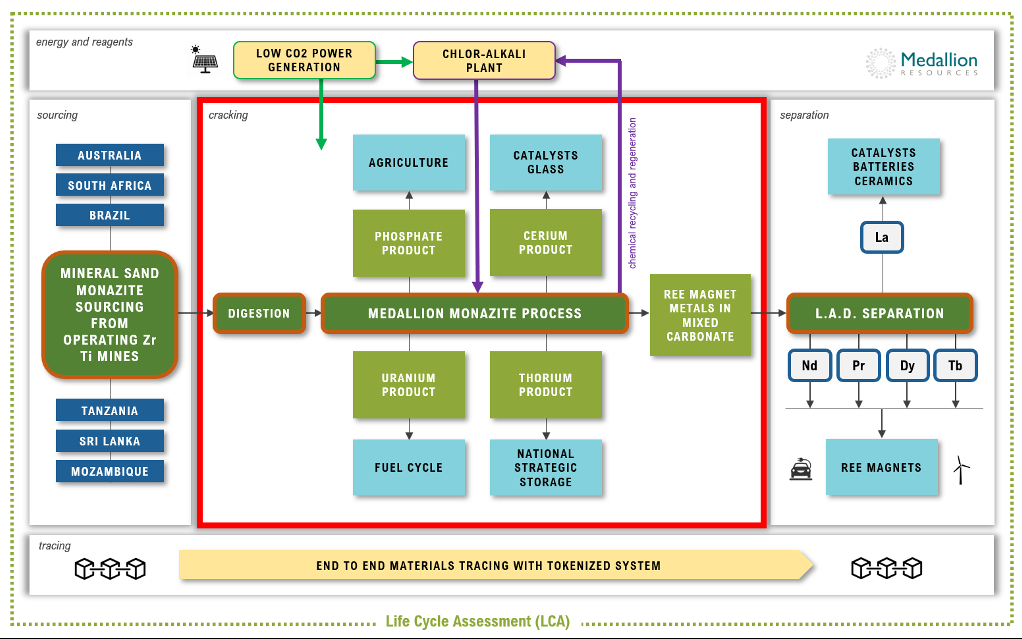

Medallion has completed ten years of research and test work with various service providers to develop a proprietary technology for the extraction of rare earth elements from mineral sand monazite. Medallion’s caustic cracking method was developed with economic and sustainability goals, seeking to minimize process cost while maximizing the resource efficiency of REE production and ensuring waste materials are minimized and captured. More than 90% of the raw material feedstock becomes saleable products within the Medallion Monazite Process.

The developed technology is a modular and transferable method to sustainably produce rare earth elements from a by-product mineral widely available from global operating mineral sand mines. A vast majority of mineral sand mining occurs within the Australia, Africa and Southeast Asian regions. Currently monazite from these operations is either sold to Chinese customers or left on site where it achieves no value. A sustainable and efficient process to extract REEs from mineral sand monazite can deliver REE security without the need for additional mining.

The Medallion Board is reviewing the TEA results to make determinations about Medallion’s further investments toward developing and monetizing the Medallion Monazite Process. Independent financial modelling and market research has indicated a licensing/partnership business approach with parties that have access to mineral sand monazite is likely most appropriate during the current high monazite price environment. As a result, Medallion is actively seeking opportunities for collaboration and technology licensing with mineral sand mining companies within favorable jurisdictions.

Medallion continues to assess acquisition and investment opportunities within the REE and mining sectors.

Figure 1: Envisaged rare earth element monazite to magnet supply chain utilizing the Medallion Monazite Process and Purdue’s LAD Chromatography. Red box outlines the system boundary for the current Techno Economic Assessment.

About Medallion Resources

Medallion Resources (TSX-V: MDL; OTCQB: MLLOF; Frankfurt: MRDN) has developed a proprietary process and related business model to achieve low-cost, near-term, rare-earth element (REE) production by exploiting monazite. Monazite is a rare-earth phosphate mineral that is widely available as a by-product from mineral sand mining operations. Furthermore, Medallion has recently licensed an innovative REE separation technology from Purdue University which can be utilized by Medallion and sub-licensed by Medallion to third party REE producers.

REEs are critical inputs to electric and hybrid vehicles, electronics, imaging systems, wind turbines and strategic defense systems. Medallion is committed to following best practices and accepted international standards in all aspects of mineral transportation, processing and the safe management of waste materials. Medallion utilizes Life Cycle Assessment methodology to support investment and process decision making.

More about Medallion (TSX-V: MDL; OTCQB: MLLOF; Frankfurt: MRDN) can be found at medallionresources.com.

Medallion has completed ten years of research and test work with various service providers to develop a proprietary technology for the extraction of rare earth elements from mineral sand monazite. Medallion’s caustic cracking method was developed with economic and sustainability goals, seeking to minimize process cost while maximizing the resource efficiency of REE production and ensuring waste materials are minimized and captured. More than 90% of the raw material feedstock becomes saleable products within the Medallion Monazite Process.

The developed technology is a modular and transferable method to sustainably produce rare earth elements from a by-product mineral widely available from global operating mineral sand mines. A vast majority of mineral sand mining occurs within the Australia, Africa and Southeast Asian regions. Currently monazite from these operations is either sold to Chinese customers or left on site where it achieves no value. A sustainable and efficient process to extract REEs from mineral sand monazite can deliver REE security without the need for additional mining.

The Medallion Board is reviewing the TEA results to make determinations about Medallion’s further investments toward developing and monetizing the Medallion Monazite Process. Independent financial modelling and market research has indicated a licensing/partnership business approach with parties that have access to mineral sand monazite is likely most appropriate during the current high monazite price environment. As a result, Medallion is actively seeking opportunities for collaboration and technology licensing with mineral sand mining companies within favorable jurisdictions.

Medallion continues to assess acquisition and investment opportunities within the REE and mining sectors.

Figure 1: Envisaged rare earth element monazite to magnet supply chain utilizing the Medallion Monazite Process and Purdue’s LAD Chromatography. Red box outlines the system boundary for the current Techno Economic Assessment.

About Medallion Resources

Medallion Resources (TSX-V: MDL; OTCQB: MLLOF; Frankfurt: MRDN) has developed a proprietary process and related business model to achieve low-cost, near-term, rare-earth element (REE) production by exploiting monazite. Monazite is a rare-earth phosphate mineral that is widely available as a by-product from mineral sand mining operations. Furthermore, Medallion has recently licensed an innovative REE separation technology from Purdue University which can be utilized by Medallion and sub-licensed by Medallion to third party REE producers.

REEs are critical inputs to electric and hybrid vehicles, electronics, imaging systems, wind turbines and strategic defense systems. Medallion is committed to following best practices and accepted international standards in all aspects of mineral transportation, processing and the safe management of waste materials. Medallion utilizes Life Cycle Assessment methodology to support investment and process decision making.

More about Medallion (TSX-V: MDL; OTCQB: MLLOF; Frankfurt: MRDN) can be found at medallionresources.com.

Medallion Announces Completion of Techno Economic Assessment for Extraction of Rare Earth Elements from Mineral Sand Monazite

Vancouver, BC – Medallion Resources Ltd. (TSX-V: MDL; OTCQB: MLLOF; Frankfurt: MRDN) – “Medallion” or the “Company”), is pleased to provide a summary of an independent Techno-Economic Assessment (“TEA”) for Medallion’s proprietary process (the “Medallion Monazite Process”) that enables sustainable extraction of rare earth elements (“REE”) from mineral sand monazite. The TEA was completed by process engineering and simulation specialists Simulus Engineers (Australia).The Medallion Monazite Process is a proprietary method and related business model to achieve low-cost REE production utilizing mineral sand monazite. Monazite is a rare earth phosphate mineral globally available as a by-product from heavy mineral sand mining operations.

The Medallion Monazite Process is a unique commercial offering, developed utilizing process intensification principles. It is a highly optimized and automated design that is transferable to many global locations and scalable in size as REE demand grows. Medallion has recently paired this process with patented REE separation technology developed by Purdue University.

Key Points

Medallion has received from Simulus Engineers comprehensive process flow diagrams, equipment lists, reagent, energy and personnel requirements and energy, heat and mass balances for the Medallion Monazite Process.

Engineering was completed at an assumed 7,000 tonnes per annum scale. The TEA has demonstrated the technical and financial viability of the Medallion Monazite Process at this scale.

Such a facility would deliver approximately 870 tonnes per annum of neodymium (“Nd”) and praseodymium (“Pr”) oxide in cerium-depleted mixed carbonate form.

Nd and Pr oxide are the key inputs for rare earth element permanent magnet production, currently priced at around US$80,000 per tonne.

REE permanent magnets are high growth markets due to their importance for electric mobility and renewable power generation.

Other products from the Medallion Monazite Process include cerium (“Ce”) oxide and trisodium phosphate (“TSP”).

The developed process is zero-liquid waste delivering a high degree of flexibility in the choice of prospective operating locations.

The engineered plant is very modest in land use footprint, energy and transport needs, and is comprised of conventional off-the-shelf plant and equipment, allowing for a short procurement to production lead time.

The engineering data has allowed development of an independent and comprehensive financial model prepared by Denco Strategic Research & Consulting Inc. that can be easily updated for changes to process location and operating assumptions. In the modelled “base case” scenario, a southeastern USA setting was assumed for capital and operating costs, while REE ratios from US-sourced mineral sand monazite was used to model REE outputs.

a capital cost estimate of US$34m was determined from engineered components (not including site specific costs) for an assumed 7,000 tonne monazite per annum process facility. Capital costs can now be scaled for offtake or partner specific supply conditions.

an operating cost of US$12 per kg of cerium-depleted mixed REE oxide (not including monazite supply costs).

an operating cost of US$28 per kg of NdPr in cerium-depleted mixed REE oxide (not including monazite supply costs; no discounting for co-product value) is modelled.

labor is the largest individual operating cost, providing the possibility to markedly lower operating costs by expanding processing capacity and throughput to achieve labor efficiencies.

NdPr is the largest market by value in the REE sector and accounts for approximately 80% of revenue achieved from typical mineral sand monazite feedstock.

Medallion recently invested with Purdue University to gain an exclusive license for proprietary environmentally-friendly REE separation technology (Ligand Assisted Displacement (“LAD”) Chromatography).

This process, while presenting a substantial value add option, has not been modelled in the TEA.

LAD Chromatography provides the opportunity to directly pass a pregnant leach solution from extraction stage to separation stage, maximizing recovery and minimizing cost.

A parallel Life Cycle Assessment (“LCA”) model will be delivered by Minviro Ltd in coming weeks that summarizes the environmental impact of the process and highlights the advantages of utilizing by-product materials.

The TEA integrates and summarizes research completed to date on the Medallion Monazite Process and is a pivotal engineering and financial study. The models used in the TEA are designed to be iterative and can be updated for any global setting/scenario. It is designed to guide the Medallion Board of Directors in the future investment decisions of the Company.

Research and execution plans are being developed internally for both the monazite and LAD processes to guide on-going research.

Based on the operating assumptions of the TEA, results indicate the Medallion Monazite Process is technically viable and presents positive economics for the extraction of REE from mineral sand monazite. The specific process conditions and supporting financial results constitute proprietary information for Medallion that will be shared with partners and prospective licensees under non-disclosure agreements.

“We are very pleased to have reached the TEA milestone, which indicates the technical and financial viability of the Medallion Monazite Process,” commented Mark Saxon, President and CEO. “Over the past decade, Medallion has remained committed to the vision of developing technology to reduce the environmental impact of REE production. The process developed does not require new mining, but utilizes a high-grade relatively low-value by-product from heavy mineral sand mining. We are now discussing opportunities with partners and prospective licensees under NDA’s and developing business models to maximize value from past investment.”

https://medallionresources.com/2021/07/completion-of-techno-…

gut zu wissen

dann spielt es auch keine Rolle,was sie an Ergebnissen veröffentlichen

dann spielt es auch keine Rolle,was sie an Ergebnissen veröffentlichen