Red-Banks - 500 Beiträge pro Seite

eröffnet am 24.07.09 13:40:15 von

neuester Beitrag 26.06.11 18:31:42 von

neuester Beitrag 26.06.11 18:31:42 von

Beiträge: 46

ID: 1.151.954

ID: 1.151.954

Aufrufe heute: 0

Gesamt: 3.510

Gesamt: 3.510

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 26.04.24, 14:53 | 662 | |

| gestern 23:32 | 257 | |

| heute 04:11 | 233 | |

| gestern 18:36 | 214 | |

| heute 00:14 | 210 | |

| heute 00:33 | 209 | |

| gestern 22:06 | 197 | |

| gestern 22:18 | 128 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.159,50 | -0,16 | 207 | |||

| 2. | 2. | 194,05 | +15,31 | 119 | |||

| 3. | 3. | 2.328,04 | -0,29 | 59 | |||

| 4. | 4. | 65,95 | -2,66 | 50 | |||

| 5. | 5. | 7,9000 | +7,48 | 46 | |||

| 6. | 6. | 0,8300 | -29,66 | 39 | |||

| 7. | 7. | 15,116 | -5,73 | 38 | |||

| 8. | 8. | 0,1785 | -7,03 | 30 |

Als die FED die Neue Bankenwelt schuf:

12:59PM Report: Treasury injects $203 billion to 649 firms by Ronald D. Orol

WASHINGTON (MarketWatch) - Treasury has allocated more than $203 billion in capital to 649 financial institutions as part of its capital injection program as of June 30, according to a report released Monday by the government's Financial Stability Oversight Board. The FSOB is made up of government officials, including as Treasury Secretary Timothy Geithner and Federal Reserve Chairman Ben Bernanke. The FSOB also reported that, as of June 30, the government has made more than $23.9 billion in loans under the Term Asset-Backed Securities Loan Facility, or TALF, a program to support consumer and business lending, according to the report. The allocations have been made as part of the Treasury's $700 billion Troubled Asset Relief Program

12:59PM Report: Treasury injects $203 billion to 649 firms by Ronald D. Orol

WASHINGTON (MarketWatch) - Treasury has allocated more than $203 billion in capital to 649 financial institutions as part of its capital injection program as of June 30, according to a report released Monday by the government's Financial Stability Oversight Board. The FSOB is made up of government officials, including as Treasury Secretary Timothy Geithner and Federal Reserve Chairman Ben Bernanke. The FSOB also reported that, as of June 30, the government has made more than $23.9 billion in loans under the Term Asset-Backed Securities Loan Facility, or TALF, a program to support consumer and business lending, according to the report. The allocations have been made as part of the Treasury's $700 billion Troubled Asset Relief Program

und was die Pharisäer dazu sagen:

10:49AM Regional bank earnings may disappoint: strategist by John Spence

BOSTON (MarketWatch) -- Investors have been encouraged by better-than-expected second-quarter results at banking giants such as Goldman Sachs Group Inc. (GS) Bank of America Corp. (BAC), but may end up disappointed by upcoming earnings reports from smaller banks. "While last week's numbers from some financial giants were well received, a large number of smaller regional banks may have a harder time impressing markets given their exposure to the still-weakening commercial real estate sector," said David Kelly, chief market strategist at JPMorgan Funds, on Monday. U.S. banks have been charging off distressed commercial loans at the fastest clip in nearly two decades, The Wall Street Journal reported Monday.

10:49AM Regional bank earnings may disappoint: strategist by John Spence

BOSTON (MarketWatch) -- Investors have been encouraged by better-than-expected second-quarter results at banking giants such as Goldman Sachs Group Inc. (GS) Bank of America Corp. (BAC), but may end up disappointed by upcoming earnings reports from smaller banks. "While last week's numbers from some financial giants were well received, a large number of smaller regional banks may have a harder time impressing markets given their exposure to the still-weakening commercial real estate sector," said David Kelly, chief market strategist at JPMorgan Funds, on Monday. U.S. banks have been charging off distressed commercial loans at the fastest clip in nearly two decades, The Wall Street Journal reported Monday.

und nun ab in die Tempel,

die Kanzel ruft.

die Kanzel ruft.

Comerica swings to loss as provisions grow (CMA) by Steve Goldstein

LONDON (MarketWatch) -- Dallas-based bank Comerica (CMA) said it swung to a second-quarter loss of $16 million, or 10 cents a share, after paying preferred dividends of $34 million to the U.S. Treasury during the quarter. Provisions for loan losses grew to $312 million, up from $170 million in the year-earlier quarter and $203 million in the first quarter of 2009. Analysts polled by FactSet had forecast a loss of 39 cents a share. It expects third-quarter net interest margin to be "relatively unchanged" from the second quarter's 2.73%, net credit-related charge-offs in the third quarter 2009 to be similar to second quarter's 2.08% and to improve modestly in the fourth quarter, additional gains from selling mortgage-backed government agency securities, and a mid- to high-single digit decrease in 2009 noninterest expense.

LONDON (MarketWatch) -- Dallas-based bank Comerica (CMA) said it swung to a second-quarter loss of $16 million, or 10 cents a share, after paying preferred dividends of $34 million to the U.S. Treasury during the quarter. Provisions for loan losses grew to $312 million, up from $170 million in the year-earlier quarter and $203 million in the first quarter of 2009. Analysts polled by FactSet had forecast a loss of 39 cents a share. It expects third-quarter net interest margin to be "relatively unchanged" from the second quarter's 2.73%, net credit-related charge-offs in the third quarter 2009 to be similar to second quarter's 2.08% and to improve modestly in the fourth quarter, additional gains from selling mortgage-backed government agency securities, and a mid- to high-single digit decrease in 2009 noninterest expense.

State Street swings to loss on conduit charges (STT) by John Spence

BOSTON (MarketWatch) -- State Street Corp. (STT) on Tuesday reported a second-quarter net loss of $3.31 billion, or $7.12 a share, compared with profit of $548 million, or $1.35 a share, in the year-ago period. The Boston-based financial-services giant said the latest quarter's results included a loss of $7.91 a share to move troubled investment vehicles known as conduits that issued asset-backed commercial paper onto its balance sheet. The company also booked a charge of 23 cents a share related to paying back funds it borrowed under the government's financial bailout.

Dat is ja mehr als die Goldmänner gewonnen haben, au,au

BOSTON (MarketWatch) -- State Street Corp. (STT) on Tuesday reported a second-quarter net loss of $3.31 billion, or $7.12 a share, compared with profit of $548 million, or $1.35 a share, in the year-ago period. The Boston-based financial-services giant said the latest quarter's results included a loss of $7.91 a share to move troubled investment vehicles known as conduits that issued asset-backed commercial paper onto its balance sheet. The company also booked a charge of 23 cents a share related to paying back funds it borrowed under the government's financial bailout.

Dat is ja mehr als die Goldmänner gewonnen haben, au,au

Regions swings to loss (RF) by Greg Morcroft

NEW YORK (MarketWatch) -- Regions Financial Corp.(RF) on Tuesday posted a loss of $188 million, or 28 cents a share, compared with a year-earlier profit of $206 million, or 30 cents a share. A survey of analysts by Thomson Reuters predicted a 22-cent loss. Loan-loss provisions surged to $912 million from $309 million a year earlier.

NEW YORK (MarketWatch) -- Regions Financial Corp.(RF) on Tuesday posted a loss of $188 million, or 28 cents a share, compared with a year-earlier profit of $206 million, or 30 cents a share. A survey of analysts by Thomson Reuters predicted a 22-cent loss. Loan-loss provisions surged to $912 million from $309 million a year earlier.

SLM reports quarterly net loss of $123 mln (SLM) by Alistair Barr

SAN FRANCISCO (MarketWatch) -- SLM Corp. (SLM) late Tuesday reported a second-quarter net loss of $123 million, or 23 cents a share, as the student loan giant recorded $484 million in unrealized losses on derivatives and hedging activities while setting aside $278 million in provisions for loan losses. A year earlier, SLM said it generated net income of $266 million, or 50 cents a share. SLM also reports "core" results, which don't adhere to generally accepted accounting principles. On that basis, SLM said it made a second-quarter profit of $170 million, or 31 cents a share, versus a profit of $156 million, or 27 cents a share, in the year-ago quarter. SLM shares fell 2.8% to $9.24 in after-hours action.

SAN FRANCISCO (MarketWatch) -- SLM Corp. (SLM) late Tuesday reported a second-quarter net loss of $123 million, or 23 cents a share, as the student loan giant recorded $484 million in unrealized losses on derivatives and hedging activities while setting aside $278 million in provisions for loan losses. A year earlier, SLM said it generated net income of $266 million, or 50 cents a share. SLM also reports "core" results, which don't adhere to generally accepted accounting principles. On that basis, SLM said it made a second-quarter profit of $170 million, or 31 cents a share, versus a profit of $156 million, or 27 cents a share, in the year-ago quarter. SLM shares fell 2.8% to $9.24 in after-hours action.

SunTrust Banks swings to $183.5 million loss (STI) by Steve Goldstein

LONDON (MarketWatch) -- SunTrust Banks (STI) said it swung to a second-quarter loss of $183.5 million, or 41 cents a share, after loan-loss provisions of $962.2 million and the year-earlier sale of Coca-Cola shares. The Atlanta bank earned $530 million, or $1.52 in the year-earlier period. Revenue fell 16% to $2.19 billion. Analysts polled by FactSet Research had forecast a loss of 49 cents a share.

LONDON (MarketWatch) -- SunTrust Banks (STI) said it swung to a second-quarter loss of $183.5 million, or 41 cents a share, after loan-loss provisions of $962.2 million and the year-earlier sale of Coca-Cola shares. The Atlanta bank earned $530 million, or $1.52 in the year-earlier period. Revenue fell 16% to $2.19 billion. Analysts polled by FactSet Research had forecast a loss of 49 cents a share.

KeyCorp loss narrows, provisions increased (KEY) by Simon Kennedy

LONDON (MarketWatch) -- KeyCorp (KEY) said Wednesday that its second-quarter net loss narrowed to $226 million, or 68 cents a share, from a loss of $1.13 billion, or $2.70 a share, a year earlier. The loss from continuing operations was 69 cents a share. The results are after the 28-cents-a-share impact of a cash dividend paid to the U.S. Treasury Department and a noncash deemed dividend related to the exchange of common shares as part of its efforts to raise $1.8 billion of Tier 1 common equity. The group said the loss for the current quarter is largely the result of an increase in the provision for loan losses. As of the end of the quarter, KeyCorp's allowance for loan losses was $2.5 billion, up from $1.4 billion a year earlier. Analysts polled by Thomson Reuters had expected a loss of 41 cents a share.

LONDON (MarketWatch) -- KeyCorp (KEY) said Wednesday that its second-quarter net loss narrowed to $226 million, or 68 cents a share, from a loss of $1.13 billion, or $2.70 a share, a year earlier. The loss from continuing operations was 69 cents a share. The results are after the 28-cents-a-share impact of a cash dividend paid to the U.S. Treasury Department and a noncash deemed dividend related to the exchange of common shares as part of its efforts to raise $1.8 billion of Tier 1 common equity. The group said the loss for the current quarter is largely the result of an increase in the provision for loan losses. As of the end of the quarter, KeyCorp's allowance for loan losses was $2.5 billion, up from $1.4 billion a year earlier. Analysts polled by Thomson Reuters had expected a loss of 41 cents a share.

Huntington Bancshares reports slimmer loss (HBAN) by John Spence

BOSTON (MarketWatch) -- Huntington Bancshares Inc. (HBAN) on Thursday reported a second-quarter net loss of $125.1 million, or 40 cents a share, compared with a loss of $2.43 billion, or $6.79 a share, in the year-earlier period. The Ohio-based bank said provision for credit losses was $413.7 million in the second quarter as it continues to wrestle with exposure to troubled real estate loans. "Though we saw increases in net charge-offs and delinquencies in our residential mortgage portfolio, this was in line with expectations given the market environment," said Chief Executive Stephen Steinour. "In light of our commercial loan portfolio review, it was prudent to continue to build reserves," he added.

BOSTON (MarketWatch) -- Huntington Bancshares Inc. (HBAN) on Thursday reported a second-quarter net loss of $125.1 million, or 40 cents a share, compared with a loss of $2.43 billion, or $6.79 a share, in the year-earlier period. The Ohio-based bank said provision for credit losses was $413.7 million in the second quarter as it continues to wrestle with exposure to troubled real estate loans. "Though we saw increases in net charge-offs and delinquencies in our residential mortgage portfolio, this was in line with expectations given the market environment," said Chief Executive Stephen Steinour. "In light of our commercial loan portfolio review, it was prudent to continue to build reserves," he added.

Fifth Third chargeoffs almost doubled in Q2 (FITB) by Greg Morcroft

NEW YORK (MarketWatch) -- Ohio-based Fifth Third Bancorp (FITB) said on Thursday that its net chargeoffs as a percentage of loans almost doubled in the second quarter, driven by a surge in chargeoffs for commercial loans. Total net chargeoffs in the quarter rose to 3.08% of outstanding loans. The rate for commercial loans was 2.81%, up from 1.41% a year ago. Consumer chargeoffs as a percentage of total loans rose to 3.48% from 2.04%. In dollar amounts, the bank charged off $626 million of loans in the quarter, compared to $344 million a year ago. "Loss experience overall continues to be driven by commercial and residential real estate loans in Michigan and Florida, the company said in a press release. " In aggregate, Florida and Michigan represented approximately 45 percent of total losses during the quarter and 28 percent of total loans and leases." The company said within its commercial portfolio, "Michigan and Florida account(ed) for 54% of commercial construction losses."

NEW YORK (MarketWatch) -- Ohio-based Fifth Third Bancorp (FITB) said on Thursday that its net chargeoffs as a percentage of loans almost doubled in the second quarter, driven by a surge in chargeoffs for commercial loans. Total net chargeoffs in the quarter rose to 3.08% of outstanding loans. The rate for commercial loans was 2.81%, up from 1.41% a year ago. Consumer chargeoffs as a percentage of total loans rose to 3.48% from 2.04%. In dollar amounts, the bank charged off $626 million of loans in the quarter, compared to $344 million a year ago. "Loss experience overall continues to be driven by commercial and residential real estate loans in Michigan and Florida, the company said in a press release. " In aggregate, Florida and Michigan represented approximately 45 percent of total losses during the quarter and 28 percent of total loans and leases." The company said within its commercial portfolio, "Michigan and Florida account(ed) for 54% of commercial construction losses."

Capital One reports quarterly loss of $276 mln (COF) by Alistair Barr

SAN FRANCISCO (MarketWatch) -- Capital One Financial (COF) reported a second-quarter loss of $276 million, or 65 cents a share. That compares to a profit of $453 million, or $1.21 a share, a year earlier. The quarterly loss included $461.7 million that Capital One paid to redeem a government preferred investment from the Troubled Asset Relief Program and a $38 million dividend payment on those securities. Excluding those payments, Capital One said it made a second-quarter profit of $224.2 million, or 53 cents per common share. Capital One was expected to lose 73 cents a share, according to the average estimate of 23 analysts polled by Thomson Reuters.

SAN FRANCISCO (MarketWatch) -- Capital One Financial (COF) reported a second-quarter loss of $276 million, or 65 cents a share. That compares to a profit of $453 million, or $1.21 a share, a year earlier. The quarterly loss included $461.7 million that Capital One paid to redeem a government preferred investment from the Troubled Asset Relief Program and a $38 million dividend payment on those securities. Excluding those payments, Capital One said it made a second-quarter profit of $224.2 million, or 53 cents per common share. Capital One was expected to lose 73 cents a share, according to the average estimate of 23 analysts polled by Thomson Reuters.

Wilmington Trust loses 20 cents a share (WL) by John Ittner

NEW YORK (MarketWatch) -- Wilmington Trust Corp. (WL) said Friday that it lost $9 million, or 20 cents a share, in the second quarter. This was caused primarily by securities losses of $23 million on pooled trust-preferred investment securities. On an after-tax-basis, this impairment reduced earnings by approximately 26 cents a share. In the same period a year ago it lost $20 million, or 29 cents a share. Analysts polled by FactSet Research estimated, on average, a loss per share of 11 cents.

NEW YORK (MarketWatch) -- Wilmington Trust Corp. (WL) said Friday that it lost $9 million, or 20 cents a share, in the second quarter. This was caused primarily by securities losses of $23 million on pooled trust-preferred investment securities. On an after-tax-basis, this impairment reduced earnings by approximately 26 cents a share. In the same period a year ago it lost $20 million, or 29 cents a share. Analysts polled by FactSet Research estimated, on average, a loss per share of 11 cents.

so, erstmal Cafe-pAUSE

UND DANN LOCKEN DIE gRINGOS MICH:

UND DANN LOCKEN DIE gRINGOS MICH:

Spiel mir das Lied vom Tod:

West Coast Bancorp Reports 2009 Second Quarter Results

--- Second quarter 2009 operating loss*, which excludes an industry-wide special FDIC assessment charge of $.8 million after tax, was $5.5 million or $.36 per diluted share compared to operating income per diluted share of $.17 in the same quarter 2008. --- West Coast Bank's total risk based capital ratio increased to 10.81% at June 30, 2009 from 10.70% at June 30, 2008.

West Coast Bancorp Reports 2009 Second Quarter Results

--- Second quarter 2009 operating loss*, which excludes an industry-wide special FDIC assessment charge of $.8 million after tax, was $5.5 million or $.36 per diluted share compared to operating income per diluted share of $.17 in the same quarter 2008. --- West Coast Bank's total risk based capital ratio increased to 10.81% at June 30, 2009 from 10.70% at June 30, 2008.

California-Voodoo-Land

Heritage Commerce Corp Reports Financial Results for Second Quarter 2009

SAN JOSE, Calif., Jul 23, 2009 (GlobeNewswire via COMTEX) -- Heritage Commerce Corp /quotes/comstock/15*!htbk/quotes/nls/htbk (HTBK 3.04, +0.04, +1.33%) , parent company of Heritage Bank of Commerce, today reported a second quarter 2009 net loss available to common shareholders of $6.0 million, or $(0.51) per diluted common share, which included a $10.7 million provision for loan losses and $591,000 in dividends and discount accretion on preferred stock. In the second quarter a year ago, the net loss available to common shareholders was $3.1 million, or $(0.26) per diluted common share, which included a $7.8 million provision for loan losses and no preferred dividends.

Heritage Commerce Corp Reports Financial Results for Second Quarter 2009

SAN JOSE, Calif., Jul 23, 2009 (GlobeNewswire via COMTEX) -- Heritage Commerce Corp /quotes/comstock/15*!htbk/quotes/nls/htbk (HTBK 3.04, +0.04, +1.33%) , parent company of Heritage Bank of Commerce, today reported a second quarter 2009 net loss available to common shareholders of $6.0 million, or $(0.51) per diluted common share, which included a $10.7 million provision for loan losses and $591,000 in dividends and discount accretion on preferred stock. In the second quarter a year ago, the net loss available to common shareholders was $3.1 million, or $(0.26) per diluted common share, which included a $7.8 million provision for loan losses and no preferred dividends.

uiii, das ging aber schnell,

man ist nicht begeistert über diese Threads.

Warum denn , liebe Bänker,

KJontrolle kann doch nicht schaden.

man ist nicht begeistert über diese Threads.

Warum denn , liebe Bänker,

KJontrolle kann doch nicht schaden.

National Penn Bancshares, Inc. Reports Second Quarter Financial Results - Successfully Raises $52.2 Million in Additional Capital During Quarter

BOYERTOWN, Pa., July 23, 2009 /PRNewswire-FirstCall via COMTEX/ -- National Penn Bancshares, Inc. /quotes/comstock/15*!npbc/quotes/nls/npbc (NPBC 4.15, +0.02, +0.48%) reported a net loss of $7.90 million for the first half of 2009. This loss, after payment of dividends on preferred stock issued to the U.S. Treasury under its Capital Purchase Program, represents a loss of $0.09 per diluted common share. For the second quarter 2009, National Penn's net loss attributable to common shareholders, after dividends on the preferred stock issued to the U.S. Treasury, amounted to $9.64 million, or a loss of $0.11 per diluted common share.

BOYERTOWN, Pa., July 23, 2009 /PRNewswire-FirstCall via COMTEX/ -- National Penn Bancshares, Inc. /quotes/comstock/15*!npbc/quotes/nls/npbc (NPBC 4.15, +0.02, +0.48%) reported a net loss of $7.90 million for the first half of 2009. This loss, after payment of dividends on preferred stock issued to the U.S. Treasury under its Capital Purchase Program, represents a loss of $0.09 per diluted common share. For the second quarter 2009, National Penn's net loss attributable to common shareholders, after dividends on the preferred stock issued to the U.S. Treasury, amounted to $9.64 million, or a loss of $0.11 per diluted common share.

First Place Financial Corp. Reports Fourth Quarter Net Loss of $12.7 Million; Board of Directors Approves Quarterly Dividend

Jul 23, 2009 (GlobeNewswire via COMTEX) -- Highlights

* Net loss for the fourth quarter of fiscal 2009 was $12.7 million,

primarily driven by a higher provision for loan losses, real

estate owned expense and a one-time FDIC special assessment,

partially offset by mortgage banking gains;

The Board of Directors declared the Company's 42nd consecutive

quarterly common cash dividend. The dividend of $0.01 per share is

the same as the prior quarter.

ihr ganzer Stolz

Jul 23, 2009 (GlobeNewswire via COMTEX) -- Highlights

* Net loss for the fourth quarter of fiscal 2009 was $12.7 million,

primarily driven by a higher provision for loan losses, real

estate owned expense and a one-time FDIC special assessment,

partially offset by mortgage banking gains;

The Board of Directors declared the Company's 42nd consecutive

quarterly common cash dividend. The dividend of $0.01 per share is

the same as the prior quarter.

ihr ganzer Stolz

Including the $29.8 million provision for loan losses and an income tax benefit of $10.0 million, Center Financial posted a net loss of $12.8 million, equal to $0.81 per share, for the 2009 second quarter. This compares with a net loss of $2.7 million, or $0.19 per share, for the 2009 first quarter, after a provision for loan losses of $14.5 million and an income tax benefit of $2.2 million. In the 2008 second quarter, the company posted net income of $5.3 million, equal to $0.32 per diluted share, after a provision for loan losses of $2.0 million and an income tax provision of $3.3 million.

Center Financial Reports 2009 Second Quarter Results; Takes Assertive Stance on Credit with $29.8MM Provision, $14.4MM in Net Charge-Offs

Center Financial Reports 2009 Second Quarter Results; Takes Assertive Stance on Credit with $29.8MM Provision, $14.4MM in Net Charge-Offs

Six Georgia bank subsidiaries closed by John Letzing

SAN FRANCISCO (MarketWatch) -- Six subsidiaries of Macon, Ga.-based Security Bank Corp. were closed by regulators Friday, bringing the number of U.S. bank failures in 2009 to 64. The Federal Deposit Insurance Corp. said Pinehurst, Ga.-based State Bank and Trust Co. has agreed to assume the six failed banks' deposits. The six banks, with a total of 20 branches, had about $2.4 billion in deposits as of March 31, the FDIC said.

5:51PM Waterford Village Bank 58th bank failure of 2009 (EVBN) by Wallace Witkowski

SAN FRANCISCO (MarketWatch) -- Waterford Village Bank of Clarence, N.Y. became the 58th bank to fail in 2009, and the first in New York this year, according to the Federal Deposit Insurance Corp. Friday. Evans Bancorp Inc. (EVBN) will assume all deposits and purchase all assets. As of March 31, Waterford had assets of $61.4 million and deposits of about $58 million. The failure also marks the 83rd bank to fail during the recession.

SAN FRANCISCO (MarketWatch) -- Six subsidiaries of Macon, Ga.-based Security Bank Corp. were closed by regulators Friday, bringing the number of U.S. bank failures in 2009 to 64. The Federal Deposit Insurance Corp. said Pinehurst, Ga.-based State Bank and Trust Co. has agreed to assume the six failed banks' deposits. The six banks, with a total of 20 branches, had about $2.4 billion in deposits as of March 31, the FDIC said.

5:51PM Waterford Village Bank 58th bank failure of 2009 (EVBN) by Wallace Witkowski

SAN FRANCISCO (MarketWatch) -- Waterford Village Bank of Clarence, N.Y. became the 58th bank to fail in 2009, and the first in New York this year, according to the Federal Deposit Insurance Corp. Friday. Evans Bancorp Inc. (EVBN) will assume all deposits and purchase all assets. As of March 31, Waterford had assets of $61.4 million and deposits of about $58 million. The failure also marks the 83rd bank to fail during the recession.

8:23PM Illinois bank is 5th failure Friday, 69th of year by John Letzing

SAN FRANCISCO (MarketWatch) -- Harvey, Ill.-based Mutual Bank was closed by regulators Friday, the 69th U.S. bank to fail this year amid the ongoing credit crunch. Mutual Bank had $1.6 billion in assets and $1.6 billion in deposits as of July 16, the Federal Deposit Insurance Corp. said, and its failure will cost the federal deposit insurance fund $696 million. Garland, Tex.-based United Central Bank has agreed to assume the failed bank's deposits, the FDIC said.

SAN FRANCISCO (MarketWatch) -- Harvey, Ill.-based Mutual Bank was closed by regulators Friday, the 69th U.S. bank to fail this year amid the ongoing credit crunch. Mutual Bank had $1.6 billion in assets and $1.6 billion in deposits as of July 16, the Federal Deposit Insurance Corp. said, and its failure will cost the federal deposit insurance fund $696 million. Garland, Tex.-based United Central Bank has agreed to assume the failed bank's deposits, the FDIC said.

Antwort auf Beitrag Nr.: 37.643.175 von Gulliver am 24.07.09 18:51:37yep,

aber diesmal hat er den Mut gehabt dafür nen eigenen Tread

zu meistern.

aber diesmal hat er den Mut gehabt dafür nen eigenen Tread

zu meistern.

Four more failed banks brings year's tally to 68 by Wallace Witkowski

SAN FRANCISCO (MarketWatch) -- Four more banks failed according to the Federal Deposit Insurance Corp. on Friday, bringing the year's total to 68, and to 93 failed banks since the beginning of the recession. First BankAmericano of Elizabeth, N.J., will have its deposits transferred to Crown Bank, Brick, N.J.; Peoples Community Bank of West Chester, Ohio, will have deposits sent to First Financial Bank of Hamilton, Ohio; Integrity Bank of Jupiter, Fla., will transfer deposits to Stonegate Bank of Fort Lauderdale, Fla.; and First State Bank of Altus in Altus, Okla. will transfer deposits to Herring Bank of Amarillo, Texas.

sämtliche Sparkässle oder Bürgermeisterbanken gehen hops.

SAN FRANCISCO (MarketWatch) -- Four more banks failed according to the Federal Deposit Insurance Corp. on Friday, bringing the year's total to 68, and to 93 failed banks since the beginning of the recession. First BankAmericano of Elizabeth, N.J., will have its deposits transferred to Crown Bank, Brick, N.J.; Peoples Community Bank of West Chester, Ohio, will have deposits sent to First Financial Bank of Hamilton, Ohio; Integrity Bank of Jupiter, Fla., will transfer deposits to Stonegate Bank of Fort Lauderdale, Fla.; and First State Bank of Altus in Altus, Okla. will transfer deposits to Herring Bank of Amarillo, Texas.

sämtliche Sparkässle oder Bürgermeisterbanken gehen hops.

Neue Bankpleite

US-Finanzkrise findet kein Ende

Schon die 77. Insolvenz: Mit der Colonial Bank wird das in diesem Jahr bislang größte US-Kreditinstitut dichtgemacht.

Der Rivale BB&T profitiert durch die Übernahme der meisten Vermögenswerte - und steigt zur achtgrößten US-Bank auf.

Mit der Colonial Bank aus Montgomery im Bundesstaat Alabama ist am Freita die größte US-Bank in diesem Jahr in die Pleite gegangen.

Der Einlagensicherungsfonds FDIC schloss das Institut und betonte zugleich, für die Kunden entstünden keine Nachteile.

Die Colonial Bank hatte eine Bilanzsumme von 25 Mrd. $ und 346 Filialen in fünf US-Bundesstaaten.

Ihr Zusammenbruch zeigt, dass trotz der augenscheinlichen Erholung einiger Branchenführer - die Großbanken zahlten zuletzt die Milliarden-Staatshilfen zurück - im amerikanischen Bankensystem noch vieles im Argen liegt.

Branchenexperten hatten gewarnt, dass in den kommenden Jahren bis zu 1000 US-Banken aufgeben könnten.

Der Konkurrent BB&T aus Winston-Salem in North Carolina übernimmt die meisten Vermögenswerte der Colonial Bank im Wert von rund 22 Mrd. $.

Für die BB&T ist es die größte Übernahme in ihrer 137-jährigen Geschichte.

Nach Einlagen entsteht damit die achtgrößte Bank der USA.

Im Juni hatte die BB&T staatliche Hilfsgelder in Höhe von 3,1 Mrd. $ zurückgezahlt.

Die Bankenaufsicht hatte festgestellt, das Institut sei gut kapitalisiert.

Die Bilanzsumme der BB&T belief sich im Juni auf 152,4 Mrd. $.

Sie hat 1505 Filialen in elf Bundesstaaten und in Washington D.C.

Die Pleite von Colonial werde den Sicherungsfonds 2,8 Mrd. $ kosten, hieß es. Zuletzt waren in den USA Zweifel daran laut geworden, ob der Einlagensicherungsfonds gut gefüllt ist.

Schon Ende März lag er noch bei 13 Mrd. $ und seitdem musste die FDIC mehrfach bei Bankenpleiten einspringen.

Die teuerste Rettungsaktion für die Behörde war bisher die Pleite des Immobilienfinanzierers IndyMac im vergangenen Jahr, die die FDIC mehr als 10 Mrd. $ kostete.

Die US-Bankenaufsicht schloss am Freitag eine Reihe weiterer Banken. So mussten auch die Community Bank of Arizona, die Community Bank of Nevada und die Union Bank, National Association dichtmachen.

Damit erhöhte sich die Zahl der Bankenpleiten in diesem Jahr in den USA auf 77.

Die mit Abstand größte Pleite legte im vergangenen Jahr die US-Sparkasse Washington Mutual mit einer Bilanzsumme von 307 Mrd. $ hin.

US-Finanzkrise findet kein Ende

Schon die 77. Insolvenz: Mit der Colonial Bank wird das in diesem Jahr bislang größte US-Kreditinstitut dichtgemacht.

Der Rivale BB&T profitiert durch die Übernahme der meisten Vermögenswerte - und steigt zur achtgrößten US-Bank auf.

Mit der Colonial Bank aus Montgomery im Bundesstaat Alabama ist am Freita die größte US-Bank in diesem Jahr in die Pleite gegangen.

Der Einlagensicherungsfonds FDIC schloss das Institut und betonte zugleich, für die Kunden entstünden keine Nachteile.

Die Colonial Bank hatte eine Bilanzsumme von 25 Mrd. $ und 346 Filialen in fünf US-Bundesstaaten.

Ihr Zusammenbruch zeigt, dass trotz der augenscheinlichen Erholung einiger Branchenführer - die Großbanken zahlten zuletzt die Milliarden-Staatshilfen zurück - im amerikanischen Bankensystem noch vieles im Argen liegt.

Branchenexperten hatten gewarnt, dass in den kommenden Jahren bis zu 1000 US-Banken aufgeben könnten.

Der Konkurrent BB&T aus Winston-Salem in North Carolina übernimmt die meisten Vermögenswerte der Colonial Bank im Wert von rund 22 Mrd. $.

Für die BB&T ist es die größte Übernahme in ihrer 137-jährigen Geschichte.

Nach Einlagen entsteht damit die achtgrößte Bank der USA.

Im Juni hatte die BB&T staatliche Hilfsgelder in Höhe von 3,1 Mrd. $ zurückgezahlt.

Die Bankenaufsicht hatte festgestellt, das Institut sei gut kapitalisiert.

Die Bilanzsumme der BB&T belief sich im Juni auf 152,4 Mrd. $.

Sie hat 1505 Filialen in elf Bundesstaaten und in Washington D.C.

Die Pleite von Colonial werde den Sicherungsfonds 2,8 Mrd. $ kosten, hieß es. Zuletzt waren in den USA Zweifel daran laut geworden, ob der Einlagensicherungsfonds gut gefüllt ist.

Schon Ende März lag er noch bei 13 Mrd. $ und seitdem musste die FDIC mehrfach bei Bankenpleiten einspringen.

Die teuerste Rettungsaktion für die Behörde war bisher die Pleite des Immobilienfinanzierers IndyMac im vergangenen Jahr, die die FDIC mehr als 10 Mrd. $ kostete.

Die US-Bankenaufsicht schloss am Freitag eine Reihe weiterer Banken. So mussten auch die Community Bank of Arizona, die Community Bank of Nevada und die Union Bank, National Association dichtmachen.

Damit erhöhte sich die Zahl der Bankenpleiten in diesem Jahr in den USA auf 77.

Die mit Abstand größte Pleite legte im vergangenen Jahr die US-Sparkasse Washington Mutual mit einer Bilanzsumme von 307 Mrd. $ hin.

yep,

dog eat dog,

oder hier geht an big fish an einen anderen big fish.

Wo ist der größere big fish, der auch den schluckt?

Die spielen kein Halma, die spielen Domino.

dog eat dog,

oder hier geht an big fish an einen anderen big fish.

Wo ist der größere big fish, der auch den schluckt?

Die spielen kein Halma, die spielen Domino.

WHO WILL BE THE NEXT IN LINE.

CBON Community Bancorp 0.36 -0.5415

-60.07% 6,212,496 2,236,499

CORS Corus Bankshares Inc 0.37 -0.115

-23.71% 8,276,947 3,062,470

GFG Guaranty Financial G... 0.40 -0.09

-18.37% 18,554,101 7,421,640

CPF Central Pacific Fina... 2.62 -0.39

-12.96% 1,708,337

WNC Wabash National Corp... 1.44 -0.21

-12.73% 513,128

DRL Doral Finl Corp 2.98 -0.42

-12.35% 506,964

CBON Community Bancorp 0.36 -0.5415

-60.07% 6,212,496 2,236,499

CORS Corus Bankshares Inc 0.37 -0.115

-23.71% 8,276,947 3,062,470

GFG Guaranty Financial G... 0.40 -0.09

-18.37% 18,554,101 7,421,640

CPF Central Pacific Fina... 2.62 -0.39

-12.96% 1,708,337

WNC Wabash National Corp... 1.44 -0.21

-12.73% 513,128

DRL Doral Finl Corp 2.98 -0.42

-12.35% 506,964

7:25PM Guaranty Bank of Austin, 81st bank failure of '09 by Benjamin Pimentel

SAN FRANCISCO (MarketWatch) - Guaranty Bank of Austin, Tex. became the 81st bank failure of 2009 after it was closed by Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corp. as receiver, the federal agency said late Friday. The FDIC said it has entered into a "purchase and assumption agreement" with BBVA Compass of Birmingham, Ala. As of June 30, Guaranty Bank had total assets about $13 billion and total deposits of about $12 billion.

6:34PM CapitalSouth Bank, Ala. 80th bank failure of 2009 by Benjamin Pimentel

SAN FRANCISCO (MarketWatch) - CapitalSouth Bank of Birmingham, Ala. became the 80th bank failure of 2009 after it was closed by the Alabama State Banking Dept. which appointed the Federal Deposit Insurance Corp. as receiver, the federal agency said Friday. The FDIC said it has entered into "a purchase and assumption agreement with Iberiabank, Lafayette, La. to assume all of the deposits of CapitalSouth Bank, excluding those from brokers."

SAN FRANCISCO (MarketWatch) - Guaranty Bank of Austin, Tex. became the 81st bank failure of 2009 after it was closed by Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corp. as receiver, the federal agency said late Friday. The FDIC said it has entered into a "purchase and assumption agreement" with BBVA Compass of Birmingham, Ala. As of June 30, Guaranty Bank had total assets about $13 billion and total deposits of about $12 billion.

6:34PM CapitalSouth Bank, Ala. 80th bank failure of 2009 by Benjamin Pimentel

SAN FRANCISCO (MarketWatch) - CapitalSouth Bank of Birmingham, Ala. became the 80th bank failure of 2009 after it was closed by the Alabama State Banking Dept. which appointed the Federal Deposit Insurance Corp. as receiver, the federal agency said Friday. The FDIC said it has entered into "a purchase and assumption agreement with Iberiabank, Lafayette, La. to assume all of the deposits of CapitalSouth Bank, excluding those from brokers."

10:24AM FDIC: Number of troubled banks rises to 416 by Wallace Witkowski

SAN FRANCISCO (MarketWatch) -- The Federal Deposit Insurance Corp. said Thursday that the number of troubled banks rose to 416 at the end of June from 305 at the end of March. FDIC said this is the largest number of banks on its "problem list" since June 30, 1994, when 434 banks were on the list. Assets at troubled banks totaled $299.8 billion, the highest level since Dec. 31, 1993, the agency said. Banks insured by the FDIC swung to a total quarterly loss of $3.7 billion from last year when they reported a total profit of $4.8 billion. Total reserves of the Deposit Insurance Fund stood at $42 billion, with the contingent loss reserve falling to $10.4 billion from $13 billion over the second quarter

SAN FRANCISCO (MarketWatch) -- The Federal Deposit Insurance Corp. said Thursday that the number of troubled banks rose to 416 at the end of June from 305 at the end of March. FDIC said this is the largest number of banks on its "problem list" since June 30, 1994, when 434 banks were on the list. Assets at troubled banks totaled $299.8 billion, the highest level since Dec. 31, 1993, the agency said. Banks insured by the FDIC swung to a total quarterly loss of $3.7 billion from last year when they reported a total profit of $4.8 billion. Total reserves of the Deposit Insurance Fund stood at $42 billion, with the contingent loss reserve falling to $10.4 billion from $13 billion over the second quarter

7:20PM Iowa, Illinois banks bring '09 failure tally to 87 by John Letzing

SAN FRANCISCO (MarketWatch) -- Sioux City, Iowa-based Vantus Bank and Oak Forest, Ill.-based InBank were closed by regulators Friday, bringing the number of U.S. bank failures this year to 87. Vantus Bank had roughly $368 million in deposits as of Aug. 28, the Federal Deposit Insurance Corp. said, while InBank had $199 million in deposits as of Aug. 3. The combined bank failures will cost the federal deposit insurance fund $234 million, the FDIC said.

6:24PM Missouri bank is 85th U.S. failure of 2009 by John Letzing

SAN FRANCISCO (MarketWatch) -- Kansas City, Mo.-based First Bank of Kansas City was closed by regulators Friday, marking the 85th U.S. bank failure of the year. The Federal Deposit Insurance Corp. said De Soto, Kan.-based Great American Bank has agreed to assume the failed bank's deposits. First Bank of Kansas City had roughly $15 million in deposits as of June 30, the FDIC said, and its failure will cost the deposit insurance fund $6 million.

SAN FRANCISCO (MarketWatch) -- Sioux City, Iowa-based Vantus Bank and Oak Forest, Ill.-based InBank were closed by regulators Friday, bringing the number of U.S. bank failures this year to 87. Vantus Bank had roughly $368 million in deposits as of Aug. 28, the Federal Deposit Insurance Corp. said, while InBank had $199 million in deposits as of Aug. 3. The combined bank failures will cost the federal deposit insurance fund $234 million, the FDIC said.

6:24PM Missouri bank is 85th U.S. failure of 2009 by John Letzing

SAN FRANCISCO (MarketWatch) -- Kansas City, Mo.-based First Bank of Kansas City was closed by regulators Friday, marking the 85th U.S. bank failure of the year. The Federal Deposit Insurance Corp. said De Soto, Kan.-based Great American Bank has agreed to assume the failed bank's deposits. First Bank of Kansas City had roughly $15 million in deposits as of June 30, the FDIC said, and its failure will cost the deposit insurance fund $6 million.

USA-Hilfe

Wie Deutschland Amerika retten kann

Foto: picture-alliance/dpa

Einfach und effektiv: Übernehmen Sie die Patenschaft für eine kleine Investmentbank!

Ermöglichen Sie dem süßen Racker mit Ihrem Geld den Schulbesuch, damit er nicht nur das Abschreiben von Milliarden, sondern auch endlich Rechnen lernt!

Aber mit dem Schulbesuch ist es natürlich nicht getan. Unterstützen Sie aufstrebende Broker mit der Finanzierung von berufsqualifizierenden Weiterbildungsmaßnahmen oder von...

... Profis aus dem Inkassobereich - damit das Geld endlich wieder eingetrieben wird.

Mit Ihren Spenden können Sie auch dafür sorgen, dass erfahrene Berater aus Deutschland und Liechtenstein die amerikanische Finanzkrise mit ein paar Steuertipps wieder in den Griff kriegen.

Hr. Zumwinkel und sein Anwalt.

Einfacher ist natürlich tatkräftiges Anpacken beim Beseitigen von Krisen-Immobilien.

Zum Glück gibt es bereits hiesige Unternehmen, die unbürokratische Hilfe leisten wollen.

Die Deutsche Bank beispielsweise hat vor, den amerikanischen Kollegen einen Großteil ihres für solche Notfälle bereitstehenden Jürgen-Schneider-Gedächtnisfonds zur Verfügung zu stellen.

Was ist noch möglich?

Kein Problem: Mit nicht mehr benötigten Kleidungsstücken (Bildhintergrund) kann man den notleidenden Amerikanern eine Freude machen.

Ähnliches gilt für...

... Luftbrücken...

... oder ausgemusterte Rosinenbomber.

Aber leider...

Foto: DDP

...sind viele Deutsche der Überzeugung, bereits genug für den amerikanischen Wahlkampf und den Schwarzen Freitag getan zu haben.

Dennoch: Hilfe geht viel simpler, als man denkt.

Unser Rat: Bezahlen Sie einfach mal Steuern!

Ob Sie wollen oder nicht, werden Sie damit sicher Banker in Not unterstützen.

Wie Deutschland Amerika retten kann

Foto: picture-alliance/dpa

Einfach und effektiv: Übernehmen Sie die Patenschaft für eine kleine Investmentbank!

Ermöglichen Sie dem süßen Racker mit Ihrem Geld den Schulbesuch, damit er nicht nur das Abschreiben von Milliarden, sondern auch endlich Rechnen lernt!

Aber mit dem Schulbesuch ist es natürlich nicht getan. Unterstützen Sie aufstrebende Broker mit der Finanzierung von berufsqualifizierenden Weiterbildungsmaßnahmen oder von...

... Profis aus dem Inkassobereich - damit das Geld endlich wieder eingetrieben wird.

Mit Ihren Spenden können Sie auch dafür sorgen, dass erfahrene Berater aus Deutschland und Liechtenstein die amerikanische Finanzkrise mit ein paar Steuertipps wieder in den Griff kriegen.

Hr. Zumwinkel und sein Anwalt.

Einfacher ist natürlich tatkräftiges Anpacken beim Beseitigen von Krisen-Immobilien.

Zum Glück gibt es bereits hiesige Unternehmen, die unbürokratische Hilfe leisten wollen.

Die Deutsche Bank beispielsweise hat vor, den amerikanischen Kollegen einen Großteil ihres für solche Notfälle bereitstehenden Jürgen-Schneider-Gedächtnisfonds zur Verfügung zu stellen.

Was ist noch möglich?

Kein Problem: Mit nicht mehr benötigten Kleidungsstücken (Bildhintergrund) kann man den notleidenden Amerikanern eine Freude machen.

Ähnliches gilt für...

... Luftbrücken...

... oder ausgemusterte Rosinenbomber.

Aber leider...

Foto: DDP

...sind viele Deutsche der Überzeugung, bereits genug für den amerikanischen Wahlkampf und den Schwarzen Freitag getan zu haben.

Dennoch: Hilfe geht viel simpler, als man denkt.

Unser Rat: Bezahlen Sie einfach mal Steuern!

Ob Sie wollen oder nicht, werden Sie damit sicher Banker in Not unterstützen.

In den USA geht bald die hundertste Bank pleite

(51)

20. September 2009, 11:36 Uhr

In den USA vergeht keine Woche, ohne dass eine Bank zusammenbricht. Und die Marke von hundert Pleiten in diesem Jahr rückt immer näher. Mit zwei weiteren Schließungen stieg die Zahl am Wochenende auf 94. Einspringen muss meist der amerikanische Einlagensicherungsfonds, doch dessen Mittel schrumpfen.

(51)

20. September 2009, 11:36 Uhr

In den USA vergeht keine Woche, ohne dass eine Bank zusammenbricht. Und die Marke von hundert Pleiten in diesem Jahr rückt immer näher. Mit zwei weiteren Schließungen stieg die Zahl am Wochenende auf 94. Einspringen muss meist der amerikanische Einlagensicherungsfonds, doch dessen Mittel schrumpfen.

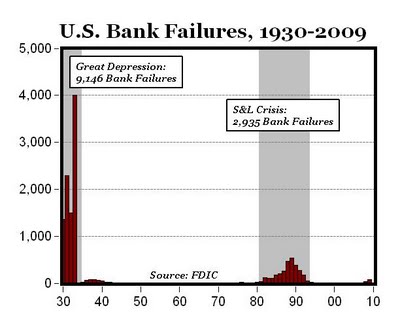

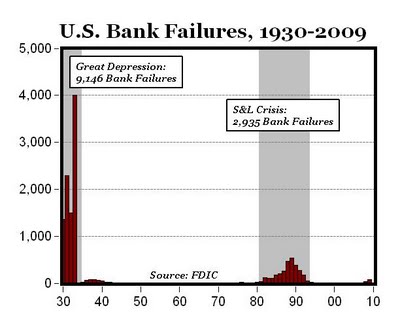

Antwort auf Beitrag Nr.: 38.035.770 von Groupier am 23.09.09 00:30:59Alles relativ - wenn man rein die Anzahl der Pleiten historisch vergleicht...

Und das Bankensterben in der USA geht weiter. Ob wir den Stand vom letzten Jahr, dort starben 140 Banken, wieder erreichen werden ?

USA: Banken vom aussterben bedroht

05.05.2010 15:54 Uhr von Michael Mross

In den USA sind die Banken vom aussterben bedroht. Nach Ansicht von Beobachtern hat sich die Dynamik des Bankensterbens in den USA in letzter Zeit verstärkt. Am Wochenende mussten sieben Banken geschlossen werden nachdem dieses Jahr bereits 64 in die Pleite geschlittert sind.

Geht das Bankensterben in den USA los?

Drei davon in Puerto Rico, zwei in Missouri und jeweils eine in Michigan und Washington. Allein für diese sieben Fälle muss der US-Einlagensicherungsfonds FDIC mit 5,9 Milliarden geradestehen, da diesmal vor allem die großen Institute betroffen sind.

Die größten Pleiten wurden auf der Karibikinsel Puerto Rico verzeichnet, die zwar nicht direkt zu den USA gehört aber zum US-Protektorat zählt.

http://www.gevestor.de/ index .php?id=84&tx_ttnews[tt_news]=69128&cHash=e42b9e8da1

USA: Banken vom aussterben bedroht

05.05.2010 15:54 Uhr von Michael Mross

In den USA sind die Banken vom aussterben bedroht. Nach Ansicht von Beobachtern hat sich die Dynamik des Bankensterbens in den USA in letzter Zeit verstärkt. Am Wochenende mussten sieben Banken geschlossen werden nachdem dieses Jahr bereits 64 in die Pleite geschlittert sind.

Geht das Bankensterben in den USA los?

Drei davon in Puerto Rico, zwei in Missouri und jeweils eine in Michigan und Washington. Allein für diese sieben Fälle muss der US-Einlagensicherungsfonds FDIC mit 5,9 Milliarden geradestehen, da diesmal vor allem die großen Institute betroffen sind.

Die größten Pleiten wurden auf der Karibikinsel Puerto Rico verzeichnet, die zwar nicht direkt zu den USA gehört aber zum US-Protektorat zählt.

http://www.gevestor.de/ index .php?id=84&tx_ttnews[tt_news]=69128&cHash=e42b9e8da1

go ahead Joe

Three Florida bank failures take 2010 tally to 76 (BOFL) by Carla Mozee

LOS ANGELES (MarketWatch) -- Three affiliated banks in Florida were closed Friday, according to the Federal Deposit Insurance Corp., raising the tally of bank failures in 2010 to 76. The Bank of Florida - Southeast in Fort Lauderdale; the Bank of Florida - Southwest in Naples; and the Bank of Florida - Tampa Bay in Tampa were shut down. EverBank in Jacksonville, Fla., has acquired their banking operations. Bank of Florida Corp. (BOFL), which owned the three banks, isn't part of the transaction, the FDIC said in a statement. Bank of Florida - Southeast had total assets of $595.3 million and total deposits of $531.7 million as of March 31. Bank of Florida - Southwest had total assets of $640.9 million and total deposits of $559.9 million, and Bank of Florida - Tampa Bay had total assets of $245.2 million and total deposits of $224 million. The failed banks will reopen Tuesday as branches of EverBan

LOS ANGELES (MarketWatch) -- Sun West Bank in Las Vegas, Nev. was shut down late Friday, according to the Federal Deposit Insurance Corp., pushing up the total of U.S. bank closures in 2010 to 78. City National Bank, a subsidiary of City National Corp. (CYN), will assume all of Sun West's deposits. Sun West Bank had $360.7 million in total assets and $353.9 million in total deposits as of March 31. The closure will cost the deposit-insurance fund an estimated $96.7 million, the FDIC said in a statement. The seven branches of the failed bank will reopen on Tuesday as branches of City National Bank. (Corrects stock ticker for City National Corp.)

8:30PM California bank failure lifts 2010 tally to 77 (TCBK) by Carla Mozee

LOS ANGELES (MarketWatch) -- Granite Community Bank N.A. in Granite Bay, Calif., was closed on Friday, according to the Federal Deposit Insurance Corp., bringing the number of U.S. bank closures in 2010 to 77. Chico, Calif.-based Tri Counties Bank, whose parent company is TriCo Bancshares (TCBK), will assume all of Granite Community's deposits. The three branches of the failed bank will reopen on Tuesday as branches of Tri Countries Bank. Granite Community had about $102.9 million in total assets and $94.2 million in total deposits as of March 31. Tri Counties didn't pay

and wanz (en) more

Nevada bank failure pushes 2010 tally to 78 (CYN) by Carla Mozee

LOS ANGELES (MarketWatch) -- Sun West Bank in Las Vegas, Nev. was shut down late Friday, according to the Federal Deposit Insurance Corp., pushing up the total of U.S. bank closures in 2010 to 78. City National Bank, a subsidiary of City National Corp. (CYN), will assume all of Sun West's deposits. Sun West Bank had $360.7 million in total assets and $353.9 million in total deposits as of March 31. The closure will cost the deposit-insurance fund an estimated $96.7 million, the FDIC said in a statement. The seven branches of the failed bank will reopen on Tuesday as branches of City National Bank. (Corrects stock ticker for City National Corp.)

Three Florida bank failures take 2010 tally to 76 (BOFL) by Carla Mozee

LOS ANGELES (MarketWatch) -- Three affiliated banks in Florida were closed Friday, according to the Federal Deposit Insurance Corp., raising the tally of bank failures in 2010 to 76. The Bank of Florida - Southeast in Fort Lauderdale; the Bank of Florida - Southwest in Naples; and the Bank of Florida - Tampa Bay in Tampa were shut down. EverBank in Jacksonville, Fla., has acquired their banking operations. Bank of Florida Corp. (BOFL), which owned the three banks, isn't part of the transaction, the FDIC said in a statement. Bank of Florida - Southeast had total assets of $595.3 million and total deposits of $531.7 million as of March 31. Bank of Florida - Southwest had total assets of $640.9 million and total deposits of $559.9 million, and Bank of Florida - Tampa Bay had total assets of $245.2 million and total deposits of $224 million. The failed banks will reopen Tuesday as branches of EverBan

LOS ANGELES (MarketWatch) -- Sun West Bank in Las Vegas, Nev. was shut down late Friday, according to the Federal Deposit Insurance Corp., pushing up the total of U.S. bank closures in 2010 to 78. City National Bank, a subsidiary of City National Corp. (CYN), will assume all of Sun West's deposits. Sun West Bank had $360.7 million in total assets and $353.9 million in total deposits as of March 31. The closure will cost the deposit-insurance fund an estimated $96.7 million, the FDIC said in a statement. The seven branches of the failed bank will reopen on Tuesday as branches of City National Bank. (Corrects stock ticker for City National Corp.)

8:30PM California bank failure lifts 2010 tally to 77 (TCBK) by Carla Mozee

LOS ANGELES (MarketWatch) -- Granite Community Bank N.A. in Granite Bay, Calif., was closed on Friday, according to the Federal Deposit Insurance Corp., bringing the number of U.S. bank closures in 2010 to 77. Chico, Calif.-based Tri Counties Bank, whose parent company is TriCo Bancshares (TCBK), will assume all of Granite Community's deposits. The three branches of the failed bank will reopen on Tuesday as branches of Tri Countries Bank. Granite Community had about $102.9 million in total assets and $94.2 million in total deposits as of March 31. Tri Counties didn't pay

and wanz (en) more

Nevada bank failure pushes 2010 tally to 78 (CYN) by Carla Mozee

LOS ANGELES (MarketWatch) -- Sun West Bank in Las Vegas, Nev. was shut down late Friday, according to the Federal Deposit Insurance Corp., pushing up the total of U.S. bank closures in 2010 to 78. City National Bank, a subsidiary of City National Corp. (CYN), will assume all of Sun West's deposits. Sun West Bank had $360.7 million in total assets and $353.9 million in total deposits as of March 31. The closure will cost the deposit-insurance fund an estimated $96.7 million, the FDIC said in a statement. The seven branches of the failed bank will reopen on Tuesday as branches of City National Bank. (Corrects stock ticker for City National Corp.)

So das macht jetzt nen Durchschnit von

15 Banken,

die monatlich in den USA hops gehen.

15 Banken,

die monatlich in den USA hops gehen.

Antwort auf Beitrag Nr.: 38.070.725 von arima am 28.09.09 17:15:25stimmt,

die Banken der USA sind relativ.

oder doch vielleicht

Schwarze Löcher

die Banken der USA sind relativ.

oder doch vielleicht

Schwarze Löcher

7 US-Banken geschlossen, darunter eine Milliarden-Pleite

Der Freitag bescherte den USA erneut sieben Bankenpleiten.

In diesem Jahr musste die amerikanische Einlagensicherung FDIC damit bereits 103 Institute abwickeln.

Die größte Banken-Pleite des Wochenendes wurde im Bundesstaat Georgia gemeldet.

Die Crescent Bank and Trust Company mit Aktiva im Umfang von 1,01 Milliarden Dollar und Einlagen von 965,7 Millionen Dollar schloss ihre Pforten.

Die Kundeneinlagen wurden von der Renasant Bank in Tupelo übernommen.

Die weiteren Schließungen:

Sterling Bank in Florida

($ 407,9 Mio. Aktiva, $ 372,4 Mio. Einlagen)

Home Valley Bank in Oregon

($ 251,8 Mio. Aktiva, $ 229,6 Mio. Einlagen)

SouthwestUSA Bank in Nevada

($ 214 Mio. Aktiva, $ 186,7 Mio. Einlagen)

Williamsburg First National Bank in South Carolina

($ 139,3 Mio. Aktiva, $ 134,3 Mio. Einlagen)

Community Security Bank in Minnesota

( 108 Mio. Aktiva, $ 99,7 Mio. Einlagen)

Thunder Bank in Kansas

($ 32,6 Mio. Aktiva, $ 28,5 Mio. Einlagen)

Die Anzahl der amerikanischen Banken, die in diesem Jahr pleitegingen, steigt damit auf 103.

2009 gingen insgesamt 140 bankrott.

Bis zum gleichen Zeitpunkt waren seinerzeit aber erst 64 Häuser geschlossen worden.

Auch die Liste der als "problembehaftet" angesehenen Banken wurde nun von 702 auf 775 Einträge verlängert.

Goldreporter.de

Der Freitag bescherte den USA erneut sieben Bankenpleiten.

In diesem Jahr musste die amerikanische Einlagensicherung FDIC damit bereits 103 Institute abwickeln.

Die größte Banken-Pleite des Wochenendes wurde im Bundesstaat Georgia gemeldet.

Die Crescent Bank and Trust Company mit Aktiva im Umfang von 1,01 Milliarden Dollar und Einlagen von 965,7 Millionen Dollar schloss ihre Pforten.

Die Kundeneinlagen wurden von der Renasant Bank in Tupelo übernommen.

Die weiteren Schließungen:

Sterling Bank in Florida

($ 407,9 Mio. Aktiva, $ 372,4 Mio. Einlagen)

Home Valley Bank in Oregon

($ 251,8 Mio. Aktiva, $ 229,6 Mio. Einlagen)

SouthwestUSA Bank in Nevada

($ 214 Mio. Aktiva, $ 186,7 Mio. Einlagen)

Williamsburg First National Bank in South Carolina

($ 139,3 Mio. Aktiva, $ 134,3 Mio. Einlagen)

Community Security Bank in Minnesota

( 108 Mio. Aktiva, $ 99,7 Mio. Einlagen)

Thunder Bank in Kansas

($ 32,6 Mio. Aktiva, $ 28,5 Mio. Einlagen)

Die Anzahl der amerikanischen Banken, die in diesem Jahr pleitegingen, steigt damit auf 103.

2009 gingen insgesamt 140 bankrott.

Bis zum gleichen Zeitpunkt waren seinerzeit aber erst 64 Häuser geschlossen worden.

Auch die Liste der als "problembehaftet" angesehenen Banken wurde nun von 702 auf 775 Einträge verlängert.

Goldreporter.de

Mit Herzinfarkt darnieder

CTBK-City Bank kam mal von 35 $

CTBK-City Bank kam mal von 35 $

10:16AM FDIC: 829 'problem' banks in second quarter by Steve Goldstein

WASHINGTON (MarketWatch) -- The number of problem banks reached 829 during the second quarter while the income of insured institutions reached $21.6 billion, the Federal Deposit Insurance Corp. said Tuesday. The FDIC still expects bank failures in 2010 to exceed 2009 levels of 140, as 118 institutions have failed year-to-date. "Particularly given economic uncertainties we believe that all banks should continue to exercise caution and maintain strong reserves. The high level of troubled loans reflects the ongoing challenges that many banks face," said Chairman Sheila Bai

WASHINGTON (MarketWatch) -- The number of problem banks reached 829 during the second quarter while the income of insured institutions reached $21.6 billion, the Federal Deposit Insurance Corp. said Tuesday. The FDIC still expects bank failures in 2010 to exceed 2009 levels of 140, as 118 institutions have failed year-to-date. "Particularly given economic uncertainties we believe that all banks should continue to exercise caution and maintain strong reserves. The high level of troubled loans reflects the ongoing challenges that many banks face," said Chairman Sheila Bai

R.I.P.

Nr.1 )

First Commercial Bank of Florida

Orlando 07.01.2011

Nr.2 )

Legacy Bank

Scottsdale 07.01.2011

Nr.1 )

First Commercial Bank of Florida

Orlando 07.01.2011

Nr.2 )

Legacy Bank

Scottsdale 07.01.2011

Failed Bank List

The FDIC is often appointed as receiver for failed banks. This page contains useful information for the customers and vendors of these banks. This includes information on the acquiring bank (if applicable), how your accounts and loans are affected, and how vendors can file claims against the receivership. Failed Financial Institution Contact Search displays point of contact information related to failed banks.

This list includes banks which have failed since October 1, 2000. To search for banks that failed prior to those on this page, visit this link: Failures and Assistance Transactions

Failed Bank List - CSV file (Updated on Mondays. Also opens in Excel - Excel Help)

Click arrows next to headers to sort in Ascending or Descending order.

_________________________________________________________

Bank Name

City

State

CERT #

Acquiring Institution

Closing Date

Updated Date

Mountain Heritage Bank Clayton GA 57593 First American Bank and Trust Company June 24, 2011 June 24, 2011

First Commercial Bank of Tampa Bay Tampa FL 27583 Stonegate Bank June 17, 2011 June 22, 2011

McIntosh State Bank Jackson GA 19237 Hamilton State Bank June 17, 2011 June 22, 2011

Atlantic Bank and Trust Charleston SC 58420 First Citizens Bank and Trust Company, Inc. June 3, 2011 June 8, 2011

First Heritage Bank Snohomish WA 23626 Columbia State Bank May 27, 2011 June 3, 2011

Summit Bank Burlington WA 513 Columbia State Bank May 20, 2011 May 24, 2011

First Georgia Banking Company Franklin GA 57647 CertusBank, National Association May 20, 2011 May 24, 2011

Atlantic Southern Bank Macon GA 57213 CertusBank, National Association May 20, 2011 May 24, 2011

Coastal Bank Cocoa Beach FL 34898 Florida Community Bank, a division of Premier American Bank, N.A. May 6, 2011 May 11, 2011

Community Central Bank Mount Clemens MI 34234 Talmer Bank & Trust April 29, 2011 May 4, 2011

The Park Avenue Bank Valdosta GA 19797 Bank of the Ozarks April 29, 2011 May 23, 2011

First Choice Community Bank Dallas GA 58539 Bank of the Ozarks April 29, 2011 May 17, 2011

Cortez Community Bank Brooksville FL 57625 Florida Community Bank, a division of Premier American Bank, N.A. April 29, 2011 May 4, 2011

First National Bank of Central Florida Winter Park FL 26297 Florida Community Bank, a division of Premier American Bank, N.A. April 29, 2011 May 4, 2011

Heritage Banking Group Carthage MS 14273 Trustmark National Bank April 15, 2011 April 20, 2011

Rosemount National Bank Rosemount MN 24099 Central Bank April 15, 2011 May 17, 2011

Superior Bank Birmingham AL 17750 Superior Bank, National Association April 15, 2011 April 20, 2011

Nexity Bank Birmingham AL 19794 AloStar Bank of Commerce April 15, 2011 April 20, 2011

New Horizons Bank East Ellijay GA 57705 Citizens South Bank April 15, 2011 April 20, 2011

Bartow County Bank Cartersville GA 21495 Hamilton State Bank April 15, 2011 April 20, 2011

Nevada Commerce Bank Las Vegas NV 35418 City National Bank April 8, 2011 April 15, 2011

Western Springs National Bank and Trust Western Springs IL 10086 Heartland Bank and Trust Company April 8, 2011 May 17, 2011

The Bank of Commerce Wood Dale IL 34292 Advantage National Bank Group March 25, 2011 April 27, 2011

Legacy Bank Milwaukee WI 34818 Seaway Bank and Trust Company March 11, 2011 April 27, 2011

First National Bank of Davis Davis OK 4077 The Pauls Valley National Bank March 11, 2011 April 27, 2011

Valley Community Bank St. Charles IL 34187 First State Bank February 25, 2011 April 27, 2011

San Luis Trust Bank, FSB San Luis Obispo CA 34783 First California Bank February 18, 2011 April 27, 2011

Charter Oak Bank Napa CA 57855 Bank of Marin February 18, 2011 April 27, 2011

Citizens Bank of Effingham Springfield GA 34601 Heritage Bank of the South February 18, 2011 April 27, 2011

Habersham Bank Clarkesville GA 151 SCBT National Association February 18, 2011 April 27, 2011

Canyon National Bank Palm Springs CA 34692 Pacific Premier Bank February 11, 2011 April 27, 2011

Badger State Bank Cassville WI 13272 Royal Bank February 11, 2011 April 27, 2011

Peoples State Bank Hamtramck MI 14939 First Michigan Bank February 11, 2011 April 27, 2011

Sunshine State Community Bank Port Orange FL 35478 Premier American Bank, N.A. February 11, 2011 April 27, 2011

Community First Bank Chicago Chicago IL 57948 Northbrook Bank & Trust Company February 4, 2011 April 27, 2011

North Georgia Bank Watkinsville GA 35242 BankSouth February 4, 2011 April 27, 2011

American Trust Bank Roswell GA 57432 Renasant Bank February 4, 2011 April 27, 2011

First Community Bank Taos NM 12261 U.S. Bank, N.A. January 28, 2011 April 27, 2011

FirsTier Bank Louisville CO 57646 No Acquirer January 28, 2011 May 5, 2011

Evergreen State Bank Stoughton WI 5328 McFarland State Bank January 28, 2011 April 27, 2011

The First State Bank Camargo OK 2303 Bank 7 January 28, 2011 April 27, 2011

United Western Bank Denver CO 31293 First-Citizens Bank & Trust Company January 21, 2011 April 27, 2011

The Bank of Asheville Asheville NC 34516 First Bank January 21, 2011 April 27, 2011

CommunitySouth Bank & Trust Easley SC 57868 CertusBank, National Association January 21, 2011 April 27, 2011

Enterprise Banking Company McDonough GA 19758 No Acquirer January 21, 2011 April 27, 2011

Oglethorpe Bank Brunswick GA 57440 Bank of the Ozarks January 14, 2011 April 27, 2011

Legacy Bank Scottsdale AZ 57820 Enterprise Bank & Trust January 7, 2011 April 27, 2011

First Commercial Bank of Florida Orlando FL 34965 First Southern Bank January 7, 2011 April 27, 2011

Community National Bank Lino Lakes MN 23306 Farmers & Merchants Savings Bank December 17, 2010 March 8, 2011

First Southern Bank Batesville AR 58052 Southern Bank December 17, 2010 March 8, 2011

United Americas Bank, N.A. Atlanta GA 35065 State Bank and Trust Company December 17, 2010 March 8, 2011

Appalachian Community Bank, FSB McCaysville GA 58495 Peoples Bank of East Tennessee December 17, 2010 March 8, 2011

Chestatee State Bank Dawsonville GA 34578 Bank of the Ozarks December 17, 2010 March 8, 2011

The Bank of Miami,N.A. Coral Gables FL 19040 1st United Bank December 17, 2010 March 8, 2011

Earthstar Bank Southampton PA 35561 Polonia Bank December 10, 2010 March 8, 2011

Paramount Bank Farmington Hills MI 34673 Level One Bank December 10, 2010 March 8, 2011

First Banking Center Burlington WI 5287 First Michigan Bank November 19, 2010 March 8, 2011

Allegiance Bank of North America Bala Cynwyd PA 35078 VIST Bank November 19, 2010 March 8, 2011

Gulf State Community Bank Carrabelle FL 20340 Centennial Bank November 19, 2010 March 8, 2011

Copper Star Bank Scottsdale AZ 35463 Stearns Bank, N.A. November 12, 2010 March 8, 2011

Darby Bank & Trust Co. Vidalia GA 14580 Ameris Bank November 12, 2010 March 8, 2011

Tifton Banking Company Tifton GA 57831 Ameris Bank November 12, 2010 March 8, 2011

First Vietnamese American Bank

In Vietnamese Westminster CA 57885 Grandpoint Bank November 5, 2010 March 8, 2011

Pierce Commercial Bank Tacoma WA 34411 Heritage Bank November 5, 2010 March 8, 2011

Western Commercial Bank Woodland Hills CA 58087 First California Bank November 5, 2010 March 8, 2011

K Bank Randallstown MD 31263 Manufacturers and Traders Trust Company (M&T Bank) November 5, 2010 March 8, 2011

First Arizona Savings, A FSB Scottsdale AZ 32582 No Acquirer October 22, 2010 March 8, 2011

Hillcrest Bank Overland Park KS 22173 Hillcrest Bank, N.A. October 22, 2010 March 8, 2011

First Suburban National Bank Maywood IL 16089 Seaway Bank and Trust Company October 22, 2010 March 8, 2011

The First National Bank of Barnesville Barnesville GA 2119 United Bank October 22, 2010 March 8, 2011

The Gordon Bank Gordon GA 33904 Morris Bank October 22, 2010 March 8, 2011

Progress Bank of Florida Tampa FL 32251 Bay Cities Bank October 22, 2010 March 8, 2011

First Bank of Jacksonville Jacksonville FL 27573 Ameris Bank October 22, 2010 March 8, 2011

Premier Bank Jefferson City MO 34016 Providence Bank October 15, 2010 March 8, 2011

WestBridge Bank and Trust Company Chesterfield MO 58205 Midland States Bank October 15, 2010 March 8, 2011

Security Savings Bank, F.S.B. Olathe KS 30898 Simmons First National Bank October 15, 2010 March 8, 2011

Shoreline Bank Shoreline WA 35250 GBC International Bank October 1, 2010 March 8, 2011

Wakulla Bank Crawfordville FL 21777 Centennial Bank October 1, 2010 March 8, 2011

North County Bank Arlington WA 35053 Whidbey Island Bank September 24, 2010 March 8, 2011

Haven Trust Bank Florida Ponte Vedra Beach FL 58308 First Southern Bank September 24, 2010 March 8, 2011

Maritime Savings Bank West Allis WI 28612 North Shore Bank, FSB September 17, 2010 March 8, 2011

Bramble Savings Bank Milford OH 27808 Foundation Bank September 17, 2010 March 8, 2011

The Peoples Bank Winder GA 182 Community & Southern Bank September 17, 2010 March 8, 2011

First Commerce Community Bank Douglasville GA 57448 Community & Southern Bank September 17, 2010 March 8, 2011

Bank of Ellijay Ellijay GA 58197 Community & Southern Bank September 17, 2010 March 8, 2011

ISN Bank Cherry Hill NJ 57107 Customers Bank September 17, 2010 March 8, 2011

Horizon Bank Bradenton FL 35061 Bank of the Ozarks September 10, 2010 March 8, 2011

Sonoma Valley Bank Sonoma CA 27259 Westamerica Bank August 20, 2010 March 8, 2011

Los Padres Bank Solvang CA 32165 Pacific Western Bank August 20, 2010 March 16, 2011

Butte Community Bank Chico CA 33219 Rabobank, N.A. August 20, 2010 March 8, 2011

Pacific State Bank Stockton CA 27090 Rabobank, N.A. August 20, 2010 March 8, 2011

ShoreBank Chicago IL 15640 Urban Partnership Bank August 20, 2010 March 7, 2011

Imperial Savings and Loan Association Martinsville VA 31623 River Community Bank, N.A. August 20, 2010 March 7, 2011

Independent National Bank Ocala FL 27344 CenterState Bank of Florida, N.A. August 20, 2010 March 7, 2011

Community National Bank at Bartow Bartow FL 25266 CenterState Bank of Florida, N.A. August 20, 2010 March 7, 2011

Palos Bank and Trust Company Palos Heights IL 17599 First Midwest Bank August 13, 2010 March 7, 2011

Ravenswood Bank Chicago IL 34231 Northbrook Bank & Trust Company August 6, 2010 March 7, 2011

LibertyBank Eugene OR 31964 Home Federal Bank July 30, 2010 March 7, 2011

The Cowlitz Bank Longview WA 22643 Heritage Bank July 30, 2010 March 7, 2011

Coastal Community Bank Panama City Beach FL 9619 Centennial Bank July 30, 2010 March 7, 2011

Bayside Savings Bank Port Saint Joe FL 57669 Centennial Bank July 30, 2010 March 7, 2011

Northwest Bank & Trust Acworth GA 57658 State Bank and Trust Company July 30, 2010 March 7, 2011

Home Valley Bank Cave Junction OR 23181 South Valley Bank & Trust July 23, 2010 March 7, 2011

SouthwestUSA Bank Las Vegas NV 35434 Plaza Bank July 23, 2010 March 7, 2011

Community Security Bank New Prague MN 34486 Roundbank July 23, 2010 March 7, 2011

Thunder Bank Sylvan Grove KS 10506 The Bennington State Bank July 23, 2010 March 7, 2011

Williamsburg First National Bank Kingstree SC 17837 First Citizens Bank and Trust Company, Inc. July 23, 2010 March 7, 2011

Crescent Bank and Trust Company Jasper GA 27559 Renasant Bank July 23, 2010 March 7, 2011

Sterling Bank Lantana FL 32536 IBERIABANK July 23, 2010 March 7, 2011

Mainstreet Savings Bank, FSB Hastings MI 28136 Commercial Bank July 16, 2010 March 7, 2011

Olde Cypress Community Bank Clewiston FL 28864 CenterState Bank of Florida, N.A. July 16, 2010 March 7, 2011

Turnberry Bank Aventura FL 32280 NAFH National Bank July 16, 2010 March 7, 2011

Metro Bank of Dade County Miami FL 25172 NAFH National Bank July 16, 2010 March 7, 2011

First National Bank of the South Spartanburg SC 35383 NAFH National Bank July 16, 2010 March 7, 2011

Woodlands Bank Bluffton SC 32571 Bank of the Ozarks July 16, 2010 March 7, 2011

Home National Bank Blackwell OK 11636 RCB Bank July 9, 2010 March 16, 2011

USA Bank Port Chester NY 58072 New Century Bank July 9, 2010 March 7, 2011

Ideal Federal Savings Bank Baltimore MD 32456 No Acquirer July 9, 2010 March 7, 2011

Bay National Bank Baltimore MD 35462 Bay Bank, FSB July 9, 2010 March 7, 2011

High Desert State Bank Albuquerque NM 35279 First American Bank June 25, 2010 November 1, 2010

First National Bank Savannah GA 34152 The Savannah Bank, N.A. June 25, 2010 October 21, 2010

Peninsula Bank Englewood FL 26563 Premier American Bank, N.A. June 25, 2010 September 22, 2010

Nevada Security Bank Reno NV 57110 Umpqua Bank June 18, 2010 October 22, 2010

Washington First International Bank Seattle WA 32955 East West Bank June 11, 2010 November 30, 2010

TierOne Bank Lincoln NE 29341 Great Western Bank June 4, 2010 March 24, 2010

Arcola Homestead Savings Bank Arcola IL 31813 No Acquirer June 4, 2010 August 26, 2010

First National Bank Rosedale MS 15814 The Jefferson Bank June 4, 2010 August 26, 2010

Sun West Bank Las Vegas NV 34785 City National Bank May 28, 2010 November 1, 2010

Granite Community Bank, NA Granite Bay CA 57315 Tri Counties Bank May 28, 2010 November 1, 2010

Bank of Florida - Tampa Tampa FL 57814 EverBank May 28, 2010 August 26, 2010

Bank of Florida - Southwest Naples FL 35106 EverBank May 28, 2010 August 26, 2010

Bank of Florida - Southeast Fort Lauderdale FL 57360 EverBank May 28, 2010 August 26, 2010

Pinehurst Bank Saint Paul MN 57735 Coulee Bank May 21, 2010 August 26, 2010

Midwest Bank and Trust Company Elmwood Park IL 18117 FirstMerit Bank, N.A. May 14, 2010 August 26, 2010

Southwest Community Bank Springfield MO 34255 Simmons First National Bank May 14, 2010 October 28, 2010

New Liberty Bank Plymouth MI 35586 Bank of Ann Arbor May 14, 2010 August 26, 2010

Satilla Community Bank Saint Marys GA 35114 Ameris Bank May 14, 2010 August 26, 2010

1st Pacific Bank of California San Diego CA 35517 City National Bank May 7, 2010 August 26, 2010

Towne Bank of Arizona Mesa AZ 57697 Commerce Bank of Arizona May 7, 2010 August 26, 2010

Access Bank Champlin MN 16476 PrinsBank May 7, 2010 August 26, 2010

The Bank of Bonifay Bonifay FL 14246 First Federal Bank of Florida May 7, 2010 August 26, 2010

Frontier Bank Everett WA 22710 Union Bank, N.A. April 30, 2010 August 26, 2010

BC National Banks Butler MO 17792 Community First Bank April 30, 2010 November 4, 2010

Champion Bank Creve Coeur MO 58362 BankLiberty April 30, 2010 August 26, 2010

CF Bancorp Port Huron MI 30005 First Michigan Bank April 30, 2010 March 24, 2010

Westernbank Puerto Rico

En Español Mayaguez PR 31027 Banco Popular de Puerto Rico April 30, 2010 August 26, 2010

R-G Premier Bank of Puerto Rico

En Español Hato Rey PR 32185 Scotiabank de Puerto Rico April 30, 2010 August 26, 2010

Eurobank

En Español San Juan PR 27150 Oriental Bank and Trust April 30, 2010 March 16, 2010

Wheatland Bank Naperville IL 58429 Wheaton Bank & Trust April 23, 2010 August 26, 2010

Peotone Bank and Trust Company Peotone IL 10888 First Midwest Bank April 23, 2010 August 26, 2010

Lincoln Park Savings Bank Chicago IL 30600 Northbrook Bank & Trust Company April 23, 2010 August 26, 2010

New Century Bank Chicago IL 34821 MB Financial Bank, N.A. April 23, 2010 August 26, 2010

Citizens Bank and Trust Company of Chicago Chicago IL 34658 Republic Bank of Chicago April 23, 2010 November 4, 2010

Broadway Bank Chicago IL 22853 MB Financial Bank, N.A. April 23, 2010 November 3, 2010

Amcore Bank, National Association Rockford IL 3735 Harris N.A. April 23, 2010 March 10, 2011

City Bank Lynnwood WA 21521 Whidbey Island Bank April 16, 2010 November 29, 2010

Tamalpais Bank San Rafael CA 33493 Union Bank, N.A. April 16, 2010 August 26, 2010

Innovative Bank Oakland CA 23876 Center Bank April 16, 2010 August 26, 2010

Butler Bank Lowell MA 26619 People's United Bank April 16, 2010 November 4, 2010

Riverside National Bank of Florida Fort Pierce FL 24067 TD Bank, N.A. April 16, 2010 August 26, 2010

AmericanFirst Bank Clermont FL 57724 TD Bank, N.A. April 16, 2010 November 8, 2010

First Federal Bank of North Florida Palatka FL 28886 TD Bank, N.A. April 16, 2010 August 27, 2010

Lakeside Community Bank Sterling Heights MI 34878 No Acquirer April 16, 2010 August 27, 2010

Beach First National Bank Myrtle Beach SC 34242 Bank of North Carolina April 9, 2010 August 27, 2010

Desert Hills Bank Phoenix AZ 57060 New York Community Bank March 26, 2010 August 27, 2010

Unity National Bank Cartersville GA 34678 Bank of the Ozarks March 26, 2010 August 27, 2010

Key West Bank Key West FL 34684 Centennial Bank March 26, 2010 November 3, 2010

McIntosh Commercial Bank Carrollton GA 57399 CharterBank March 26, 2010 August 27, 2010

State Bank of Aurora Aurora MN 8221 Northern State Bank March 19, 2010 August 27, 2010

First Lowndes Bank Fort Deposit AL 24957 First Citizens Bank March 19, 2010 November 3, 2010

Bank of Hiawassee Hiawassee GA 10054 Citizens South Bank March 19, 2010 August 27, 2010

Appalachian Community Bank Ellijay GA 33989 Community & Southern Bank March 19, 2010 August 27, 2010

Advanta Bank Corp. Draper UT 33535 No Acquirer March 19, 2010 September 16, 2010

Century Security Bank Duluth GA 58104 Bank of Upson March 19, 2010 August 27, 2010

American National Bank Parma OH 18806 The National Bank and Trust Company March 19, 2010 November 4, 2010

Statewide Bank Covington LA 29561 Home Bank March 12, 2010 August 27, 2010

Old Southern Bank Orlando FL 58182 Centennial Bank March 12, 2010 August 27, 2010

The Park Avenue Bank New York NY 27096 Valley National Bank March 12, 2010 August 27, 2010

LibertyPointe Bank New York NY 58071 Valley National Bank March 11, 2010 August 27, 2010

Centennial Bank Ogden UT 34430 No Acquirer March 5, 2010 August 27, 2010

Waterfield Bank Germantown MD 34976 No Acquirer March 5, 2010 August 27, 2010

Bank of Illinois Normal IL 9268 Heartland Bank and Trust Company March 5, 2010 August 27, 2010

Sun American Bank Boca Raton FL 27126 First-Citizens Bank & Trust Company March 5, 2010 August 27, 2010

Rainier Pacific Bank Tacoma WA 38129 Umpqua Bank February 26, 2010 August 27, 2010

Carson River Community Bank Carson City NV 58352 Heritage Bank of Nevada February 26, 2010 August 27, 2010

La Jolla Bank, FSB La Jolla CA 32423 OneWest Bank, FSB February 19, 2010 August 27, 2010

George Washington Savings Bank Orland Park IL 29952 FirstMerit Bank, N.A. February 19, 2010 August 27, 2010

The La Coste National Bank La Coste TX 3287 Community National Bank February 19, 2010 November 3, 2010

Marco Community Bank Marco Island FL 57586 Mutual of Omaha Bank February 19, 2010 August 27, 2010

1st American State Bank of Minnesota Hancock MN 15448 Community Development Bank, FSB February 5, 2010 November 8, 2010

American Marine Bank Bainbridge Island WA 16730 Columbia State Bank January 29, 2010 August 26, 2010

First Regional Bank Los Angeles CA 23011 First-Citizens Bank & Trust Company January 29, 2010 August 26, 2010

Community Bank and Trust Cornelia GA 5702 SCBT National Association January 29, 2010 August 26, 2010

Marshall Bank, N.A. Hallock MN 16133 United Valley Bank January 29, 2010 August 26, 2010

Florida Community Bank Immokalee FL 5672 Premier American Bank, N.A. January 29, 2010 March 24, 2010

First National Bank of Georgia Carrollton GA 16480 Community & Southern Bank January 29, 2010 November 3, 2010

Columbia River Bank The Dalles OR 22469 Columbia State Bank January 22, 2010 November 2, 2010

Evergreen Bank Seattle WA 20501 Umpqua Bank January 22, 2010 August 26, 2010

Charter Bank Santa Fe NM 32498 Charter Bank January 22, 2010 August 26, 2010

Bank of Leeton Leeton MO 8265 Sunflower Bank, N.A. January 22, 2010 August 26, 2010