starke, interessante, bombenstarke "Machbarkeitsstudien" - 500 Beiträge pro Seite (Seite 9)

eröffnet am 12.06.14 14:12:18 von

neuester Beitrag 31.05.21 14:26:18 von

neuester Beitrag 31.05.21 14:26:18 von

Beiträge: 10.349

ID: 1.195.350

ID: 1.195.350

Aufrufe heute: 2

Gesamt: 279.116

Gesamt: 279.116

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 11 Minuten | 2887 | |

| 01.05.24, 18:36 | 2173 | |

| vor 28 Minuten | 1897 | |

| gestern 19:24 | 1507 | |

| vor 37 Minuten | 1174 | |

| vor 35 Minuten | 1143 | |

| gestern 18:35 | 1102 | |

| vor 1 Stunde | 923 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.001,60 | +0,59 | 240 | |||

| 2. | 2. | 168,20 | +0,08 | 87 | |||

| 3. | 3. | 9,7000 | +12,27 | 75 | |||

| 4. | 14. | 6,1400 | -1,35 | 69 | |||

| 5. | 11. | 0,1865 | 0,00 | 52 | |||

| 6. | 7. | 0,8750 | -12,50 | 47 | |||

| 7. | 12. | 0,1561 | +2,97 | 38 | |||

| 8. | 6. | 2.302,50 | 0,00 | 36 |

Antwort auf Beitrag Nr.: 57.755.302 von Popeye82 am 14.05.18 16:12:22Yukon’s next AND largest (ever) gold mine

Victoria Gold

http://www.vitgoldcorp.com/news/2018/victoria-gold-provides-…

http://www.cyfn.ca/

http://www.yukonwaterboard.ca/

Victoria Gold

http://www.vitgoldcorp.com/news/2018/victoria-gold-provides-…

http://www.cyfn.ca/

http://www.yukonwaterboard.ca/

Antwort auf Beitrag Nr.: 57.819.116 von Popeye82 am 23.05.18 22:42:52SINGLE biggest regenerational Opportunity in UK, right noooooooooow

Sirius Minerals

http://www.gazettelive.co.uk/news/teesside-news/breakthough-…

http://www.southteesdc.com/

http://www.gazettelive.co.uk/news/teesside-news/significant-…

http://www.gazettelive.co.uk/news/teesside-news/sirius-miner…

http://www.gazettelive.co.uk/business/business-news/2500-sir…

Sirius Minerals

http://www.gazettelive.co.uk/news/teesside-news/breakthough-…

http://www.southteesdc.com/

http://www.gazettelive.co.uk/news/teesside-news/significant-…

http://www.gazettelive.co.uk/news/teesside-news/sirius-miner…

http://www.gazettelive.co.uk/business/business-news/2500-sir…

Antwort auf Beitrag Nr.: 57.828.425 von Popeye82 am 25.05.18 00:17:50Sirius Minerals

- TVCA

Am 18.10.2017 veröffentlicht

South Tees Development Corporation launches the single biggest development opportunity in the UK-

- TVCA

Am 18.10.2017 veröffentlicht

South Tees Development Corporation launches the single biggest development opportunity in the UK-

Antwort auf Beitrag Nr.: 57.789.265 von Popeye82 am 18.05.18 12:08:51Centrex Metals

http://www.asx.com.au/asxpdf/20180525/pdf/43v96pkb7gxnp4.pdf

http://www.asx.com.au/asxpdf/20180525/pdf/43v96pkb7gxnp4.pdf

Antwort auf Beitrag Nr.: 57.627.150 von Popeye82 am 25.04.18 17:59:18Tinka Resources

http://www.tinkaresources.com/news/tinka-drills-32-metres-gr…

http://www.tinkaresources.com/news/tinka-drills-32-metres-gr…

Antwort auf Beitrag Nr.: 57.780.559 von Popeye82 am 17.05.18 12:52:51Kidman Resources

http://www.asx.com.au/documents/research/kidman-resources-lt…

http://www.asx.com.au/documents/research/kidman-resources-lt…

Antwort auf Beitrag Nr.: 57.823.943 von Popeye82 am 24.05.18 15:27:20MGX Minerals

http://www.mgxminerals.com/investors/news/2018/365-mgx-miner…

http://www.nserc-crsng.gc.ca/index_eng.asp

https://uwaterloo.ca/

http://www.ucalgary.ca/

http://www.sfu.ca/

http://www.zincnyx.com/technology/

" MGX Minerals Announces Subsidiary ZincNyx Energy Solutions Joins Research Consortium, to Develop Nanostructured Electrodes for Grid Scale Energy Storage

VANCOUVER, BRITISH COLUMBIA / May 25, 2018 / MGX Minerals Inc. (“MGX” or the “Company”) (CSE: XMG / FKT: 1MG / OTCQB: MGXMF) is pleased to announce that 100% wholly-owned subsidiary ZincNyx Energy Solutions, Inc. (“ZincNyx”) and its research partners will receive a grant from Canada’s Natural Science and Engineering Research Council (“NSERC”) to develop nanostructured material for their next generation Zinc-air energy storage.

The drive toward a renewable energy economy was recently given a big push by NSERC in this year’s Strategic Partnership Grants announcement. ZincNyx, in a consortium with researchers from the Universities of Waterloo, Calgary, and Simon Fraser University, are exploring and developing materials for their next-generation Zinc-air energy storage system. The project, titled Grid-scale Energy Storage Using Zinc-air Fuel Cells with Nanostructured Electrodes, will receive a grant of $580,000 over the next three years to support research. The consortium will be studying the use of graphene-based materials that have shown impressive performance in the lab, and are ready to graduate to commercial applications.

“Graphene is getting a lot of attention for many applications, but is particularly promising for electrochemical reactions since it can perform on par with traditionally used platinum” says project lead Prof. Jeff Gostick of the University of Waterloo. “As engineers and applied scientists, it’s very exciting for us to see our ideas leave the lab and get into the hands of an industrial product, it’s what it’s all about”

“ZincNyx is very pleased with the timing of the grant, which ties in perfectly with our business plan. We are entering early commercialization, but saw a strong need on the horizon to drive down costs to fuel further growth,” points out ZincNyx CEO Suresh Singh. “We are very pleased to be working with this particular group of researchers.”

The Team includes two Canada Research Chairs (Drs. Viola Birss and Erik Kjeang) as well as veteran electrochemical engineer Ted Roberts.

About ZincNyx Energy Solutions

ZincNyx has developed a patented regenerative zinc-air flow battery that efficiently stores energy in the form of zinc particles and contains none of the traditional high cost battery commodities such as lithium, vanadium, or cobalt. The technology allows for low cost mass storage of energy and can be deployed into a wide range of applications.

Unlike conventional batteries, which have a fixed energy/power ratio, ZincNyx’s technology uses a fuel tank system that offers flexible energy/power ratios and scalability. The storage capacity is directly tied to the size of the fuel tank and the quantity of recharged zinc fuel, making scalability a major advantage of the flow battery system. In addition, a further major advantage of the zinc-air flow battery is the ability to charge and discharge simultaneously and at different maximum charge or discharge rates since each of the charge and discharge circuits is separate and independent. Other types of standard and flow batteries are limited to a maximum charge and discharge by the total number of cells as there is no separation of the charge, discharge and storage components.

The ZincNyx mission is to provide the lowest cost, longest duration and most reliable energy storage system for markets involving renewables firming, peak shaving, diesel generator replacement, telecom facility back-up, electrification of ferries and tug boats and electric vehicle charging support.

With a portfolio of 20 granted patents and an experienced management team, ZincNyx is now ready to start commercialization of the product. To watch a short video outlining ZincNyx technology, please visit http://www.zincnyx.com/technology/ "

http://www.mgxminerals.com/investors/news/2018/365-mgx-miner…

http://www.nserc-crsng.gc.ca/index_eng.asp

https://uwaterloo.ca/

http://www.ucalgary.ca/

http://www.sfu.ca/

http://www.zincnyx.com/technology/

" MGX Minerals Announces Subsidiary ZincNyx Energy Solutions Joins Research Consortium, to Develop Nanostructured Electrodes for Grid Scale Energy Storage

VANCOUVER, BRITISH COLUMBIA / May 25, 2018 / MGX Minerals Inc. (“MGX” or the “Company”) (CSE: XMG / FKT: 1MG / OTCQB: MGXMF) is pleased to announce that 100% wholly-owned subsidiary ZincNyx Energy Solutions, Inc. (“ZincNyx”) and its research partners will receive a grant from Canada’s Natural Science and Engineering Research Council (“NSERC”) to develop nanostructured material for their next generation Zinc-air energy storage.

The drive toward a renewable energy economy was recently given a big push by NSERC in this year’s Strategic Partnership Grants announcement. ZincNyx, in a consortium with researchers from the Universities of Waterloo, Calgary, and Simon Fraser University, are exploring and developing materials for their next-generation Zinc-air energy storage system. The project, titled Grid-scale Energy Storage Using Zinc-air Fuel Cells with Nanostructured Electrodes, will receive a grant of $580,000 over the next three years to support research. The consortium will be studying the use of graphene-based materials that have shown impressive performance in the lab, and are ready to graduate to commercial applications.

“Graphene is getting a lot of attention for many applications, but is particularly promising for electrochemical reactions since it can perform on par with traditionally used platinum” says project lead Prof. Jeff Gostick of the University of Waterloo. “As engineers and applied scientists, it’s very exciting for us to see our ideas leave the lab and get into the hands of an industrial product, it’s what it’s all about”

“ZincNyx is very pleased with the timing of the grant, which ties in perfectly with our business plan. We are entering early commercialization, but saw a strong need on the horizon to drive down costs to fuel further growth,” points out ZincNyx CEO Suresh Singh. “We are very pleased to be working with this particular group of researchers.”

The Team includes two Canada Research Chairs (Drs. Viola Birss and Erik Kjeang) as well as veteran electrochemical engineer Ted Roberts.

About ZincNyx Energy Solutions

ZincNyx has developed a patented regenerative zinc-air flow battery that efficiently stores energy in the form of zinc particles and contains none of the traditional high cost battery commodities such as lithium, vanadium, or cobalt. The technology allows for low cost mass storage of energy and can be deployed into a wide range of applications.

Unlike conventional batteries, which have a fixed energy/power ratio, ZincNyx’s technology uses a fuel tank system that offers flexible energy/power ratios and scalability. The storage capacity is directly tied to the size of the fuel tank and the quantity of recharged zinc fuel, making scalability a major advantage of the flow battery system. In addition, a further major advantage of the zinc-air flow battery is the ability to charge and discharge simultaneously and at different maximum charge or discharge rates since each of the charge and discharge circuits is separate and independent. Other types of standard and flow batteries are limited to a maximum charge and discharge by the total number of cells as there is no separation of the charge, discharge and storage components.

The ZincNyx mission is to provide the lowest cost, longest duration and most reliable energy storage system for markets involving renewables firming, peak shaving, diesel generator replacement, telecom facility back-up, electrification of ferries and tug boats and electric vehicle charging support.

With a portfolio of 20 granted patents and an experienced management team, ZincNyx is now ready to start commercialization of the product. To watch a short video outlining ZincNyx technology, please visit http://www.zincnyx.com/technology/ "

Antwort auf Beitrag Nr.: 57.702.711 von Popeye82 am 05.05.18 23:47:30American Pacific Borate + Lithium

http://americanpacificborate.com/wp-content/uploads/ABR-agre…

http://www.greatbasinresources.us/

http://americanpacificborate.com/wp-content/uploads/ABR-agre…

http://www.greatbasinresources.us/

AMONG some of the highest-grade spodumene pegmatites, in the world

zur Resource oben"drauf": "200 identified Pegmatites".

identified Pegmatites".

kann man mal gucken "Was raus kommt".

Sigma Lithium

http://www.newswire.ca/news-releases/sigma-lithium-margaux-c…

http://www.sigmalithiumresources.com/#the-project

http://www.sigmalithiumresources.com/wp-content/uploads/2018…

"Sigma Lithium (Margaux Capital) Obtains Environmental License for Pilot Production Plant and Expects to Finalize Construction June 2018

May 24, 2018, 10:13 ET

MINAS GERAIS, Brazil and VANCOUVER, Canada, May 24, 2018 /CNW/ - Margaux Red Capital Inc. (TSXV-SGMA) and its wholly-owned subsidiary Sigma Lithium Resources Inc. ("Sigma") announce an important step towards completing the feasibility study of Sigma's foothold deposit at its Grota do Cirilo Property in Minas Gerais state, Brazil. Sigma has finalized the environmental licensing process for its Dense Media Separation (DMS) pilot plant and expects to complete its construction in June 2018.

The pilot plant flowsheet was designed after Sigma conducted successful metallurgical tests for over eight months, producing high-quality battery-grade lithium spodumene concentrate above 6% Li2O at SGS laboratories in Canada and Brazil.

The pilot plant will have a capacity to produce up to 12,000 tonnes of lithium spodumene concentrate per year at the rate of 10 tonnes per hour. The pilot plant will consist of a two-stage crushing circuit with a capacity of 30 tonnes per hour, a magnetic separation unit and a DMS unit, which will produce a coarse concentrate of +4mm to -15mm size fraction. Sigma is currently conducting tests of ore sorter technology, which will be later added to the pilot plant.

Sigma's premium lithium spodumene concentrate samples produced by the plant will be sent to prospective clients for validation and certification purposes. "The pilot plant is an important milestone on the path to becoming a fully operational world-class lithium producer by 2020. The metallurgic tests to date have produced a coarse lithium spodumene concentrate above 6% Li2O, using simple DMS processing technology, validating the superior quality of our lithium," says CEO Calvyn Gardner.

"With the advent of electric cars, most of the growth in lithium demand is coming from the chemical producers of lithium hydroxide supplying the battery cathode industry. Sigma is uniquely positioned to cater to this growing demand, due to our ability to produce in-spec 6% lithium concentrate from our high-grade high-purity spodumene ore. Lithium is not rare, but Sigma's differentiation comes from the high quality and purity of our foothold deposit at 1.56% average grade of lithium for our estimated Measured and Indicated Resources," he adds.

Brazil-based Sigma President Itamar Resende says: "The superior metallurgy of our spodumene concentrate was demonstrated by the excellent 73% recoveries obtained, using just the one-stage DMS, for ore sizes crushed at both 6.5 and 9.5mm. As a result, Sigma can build a low-capex DMS commercial processing plant with superior productivity and recoveries. Flotation tests of the middlings from the DMS also produced a fine concentrate with Li2O above 6% with exceptional recoveries of 86%."

Sigma's larger-size spodumene concentrate, especially at 9.5mm particles, is seen to be a premium product because it increases the recovery rates achieved by chemical producers of lithium hydroxide in their calcination process within their kilns.

Itamar adds: "The superior quality of our spodumene lithium concentrate provides Sigma with a competitive advantage when marketing to customers in the chemical industry as they experience excellent recovery rates and higher productivity. As producers of battery grade lithium hydroxide can take up to 12 months to validate a new supplier, our goal is to be qualified well before we start production, which we are targeting to be by the end of 2019."

Sigma plans to implement advanced green and sustainable mining processes at its Minas Gerais operation. The electricity on site is generated by a clean hydroelectric power plant and Sigma will recycle 100% of the water utilized in the plant, while the waste system will stack the mining tailings in dry piles, hence avoiding tailings dams.

ABOUT SIGMA

Sigma is a mineral development company that is advancing into pilot production stage an environmentally focused lithium project in Minas Gerais, Brazil to produce battery grade spodumene concentrate from its high-quality deposits. Sigma corporate purpose is to execute its strategy while embracing environmental, social, and governance ("ESG") principles.

Sigma has 28 mineral rights in four properties spread over 188 km2 and 18,887 hectares -with over 200 lithium bearing pegmatites and 11 former historical lithium mines. The Grota do Cirilo property, Sigma's primary focus, includes 10 mining concessions (mining production authorizations) and is currently undergoing a 20,000m drilling campaign for resource expansion.

Sigma has a National Instrument 43-101 ("NI 43-101") technical report on the Grota do Cicilo property prepared by SGS Canada-Geostat ("SGS"), which includes estimated measured and indicated resources of approximately 12,900,000 tonnes for its main deposit (8,502,000t measured and 4,385,000t indicated), with a high average grade of 1.56% (for approximately 5,000,000t of LCE). The technical report also includes estimated inferred resources of 608,348t and further notes the potential for significant resource expansion.

QUALIFIED Person

The resources estimates in this news release are included in (and the estimated LCE is derived from the resource estimates included in) the technical report titled "Technical Report Northern and Southern Complexes Project, Araçuai and Itinga, Brazil, Sigma Lithium Resources Inc." which has an effective date of January 29, 2018 and was prepared by Marc-Antoine Laporte, P.Geo, M.Sc. of SGS. Mr. Laporte is a qualified person as defined by NI 43-101 and is independent of Sigma. The report is available at www.Sedar.com. "

zur Resource oben"drauf": "200

identified Pegmatites".

identified Pegmatites".kann man mal gucken "Was raus kommt".

Sigma Lithium

http://www.newswire.ca/news-releases/sigma-lithium-margaux-c…

http://www.sigmalithiumresources.com/#the-project

http://www.sigmalithiumresources.com/wp-content/uploads/2018…

"Sigma Lithium (Margaux Capital) Obtains Environmental License for Pilot Production Plant and Expects to Finalize Construction June 2018

May 24, 2018, 10:13 ET

MINAS GERAIS, Brazil and VANCOUVER, Canada, May 24, 2018 /CNW/ - Margaux Red Capital Inc. (TSXV-SGMA) and its wholly-owned subsidiary Sigma Lithium Resources Inc. ("Sigma") announce an important step towards completing the feasibility study of Sigma's foothold deposit at its Grota do Cirilo Property in Minas Gerais state, Brazil. Sigma has finalized the environmental licensing process for its Dense Media Separation (DMS) pilot plant and expects to complete its construction in June 2018.

The pilot plant flowsheet was designed after Sigma conducted successful metallurgical tests for over eight months, producing high-quality battery-grade lithium spodumene concentrate above 6% Li2O at SGS laboratories in Canada and Brazil.

The pilot plant will have a capacity to produce up to 12,000 tonnes of lithium spodumene concentrate per year at the rate of 10 tonnes per hour. The pilot plant will consist of a two-stage crushing circuit with a capacity of 30 tonnes per hour, a magnetic separation unit and a DMS unit, which will produce a coarse concentrate of +4mm to -15mm size fraction. Sigma is currently conducting tests of ore sorter technology, which will be later added to the pilot plant.

Sigma's premium lithium spodumene concentrate samples produced by the plant will be sent to prospective clients for validation and certification purposes. "The pilot plant is an important milestone on the path to becoming a fully operational world-class lithium producer by 2020. The metallurgic tests to date have produced a coarse lithium spodumene concentrate above 6% Li2O, using simple DMS processing technology, validating the superior quality of our lithium," says CEO Calvyn Gardner.

"With the advent of electric cars, most of the growth in lithium demand is coming from the chemical producers of lithium hydroxide supplying the battery cathode industry. Sigma is uniquely positioned to cater to this growing demand, due to our ability to produce in-spec 6% lithium concentrate from our high-grade high-purity spodumene ore. Lithium is not rare, but Sigma's differentiation comes from the high quality and purity of our foothold deposit at 1.56% average grade of lithium for our estimated Measured and Indicated Resources," he adds.

Brazil-based Sigma President Itamar Resende says: "The superior metallurgy of our spodumene concentrate was demonstrated by the excellent 73% recoveries obtained, using just the one-stage DMS, for ore sizes crushed at both 6.5 and 9.5mm. As a result, Sigma can build a low-capex DMS commercial processing plant with superior productivity and recoveries. Flotation tests of the middlings from the DMS also produced a fine concentrate with Li2O above 6% with exceptional recoveries of 86%."

Sigma's larger-size spodumene concentrate, especially at 9.5mm particles, is seen to be a premium product because it increases the recovery rates achieved by chemical producers of lithium hydroxide in their calcination process within their kilns.

Itamar adds: "The superior quality of our spodumene lithium concentrate provides Sigma with a competitive advantage when marketing to customers in the chemical industry as they experience excellent recovery rates and higher productivity. As producers of battery grade lithium hydroxide can take up to 12 months to validate a new supplier, our goal is to be qualified well before we start production, which we are targeting to be by the end of 2019."

Sigma plans to implement advanced green and sustainable mining processes at its Minas Gerais operation. The electricity on site is generated by a clean hydroelectric power plant and Sigma will recycle 100% of the water utilized in the plant, while the waste system will stack the mining tailings in dry piles, hence avoiding tailings dams.

ABOUT SIGMA

Sigma is a mineral development company that is advancing into pilot production stage an environmentally focused lithium project in Minas Gerais, Brazil to produce battery grade spodumene concentrate from its high-quality deposits. Sigma corporate purpose is to execute its strategy while embracing environmental, social, and governance ("ESG") principles.

Sigma has 28 mineral rights in four properties spread over 188 km2 and 18,887 hectares -with over 200 lithium bearing pegmatites and 11 former historical lithium mines. The Grota do Cirilo property, Sigma's primary focus, includes 10 mining concessions (mining production authorizations) and is currently undergoing a 20,000m drilling campaign for resource expansion.

Sigma has a National Instrument 43-101 ("NI 43-101") technical report on the Grota do Cicilo property prepared by SGS Canada-Geostat ("SGS"), which includes estimated measured and indicated resources of approximately 12,900,000 tonnes for its main deposit (8,502,000t measured and 4,385,000t indicated), with a high average grade of 1.56% (for approximately 5,000,000t of LCE). The technical report also includes estimated inferred resources of 608,348t and further notes the potential for significant resource expansion.

QUALIFIED Person

The resources estimates in this news release are included in (and the estimated LCE is derived from the resource estimates included in) the technical report titled "Technical Report Northern and Southern Complexes Project, Araçuai and Itinga, Brazil, Sigma Lithium Resources Inc." which has an effective date of January 29, 2018 and was prepared by Marc-Antoine Laporte, P.Geo, M.Sc. of SGS. Mr. Laporte is a qualified person as defined by NI 43-101 and is independent of Sigma. The report is available at www.Sedar.com. "

Antwort auf Beitrag Nr.: 57.696.867 von Popeye82 am 04.05.18 16:42:29Erin Ventures

http://www.erinventures.com/media/nws_d.php?id=188

http://www.erinventures.com/media/nws_d.php?id=188

Antwort auf Beitrag Nr.: 57.737.506 von Popeye82 am 11.05.18 00:57:49Para Resources

http://www.hallgartenco.com/file.php?path=Mining&filename=Pa…

http://www.hallgartenco.com/file.php?path=Mining&filename=Pa…

Antwort auf Beitrag Nr.: 57.828.509 von Popeye82 am 25.05.18 01:24:35Sirius Minerals

http://smallcaps.com.au/australia-2018-rich-list-highlights-…

http://www.afr.com/leadership/afr-lists/rich-list

http://smallcaps.com.au/australia-2018-rich-list-highlights-…

http://www.afr.com/leadership/afr-lists/rich-list

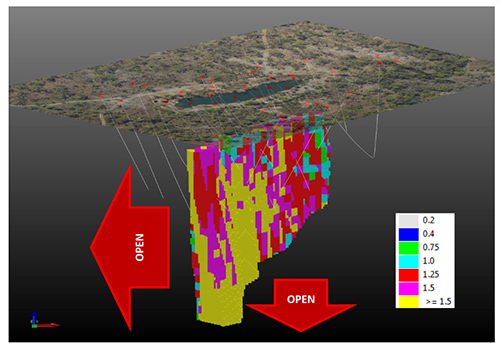

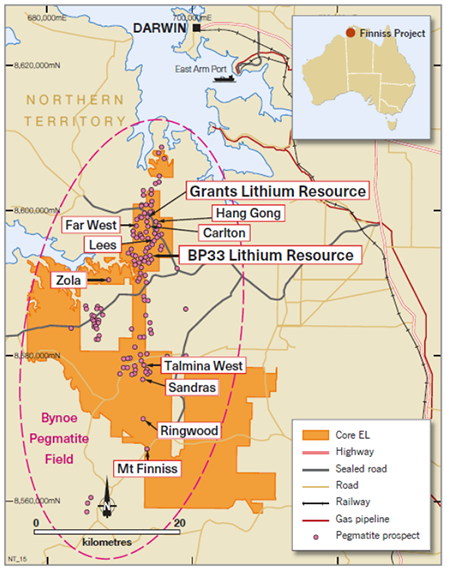

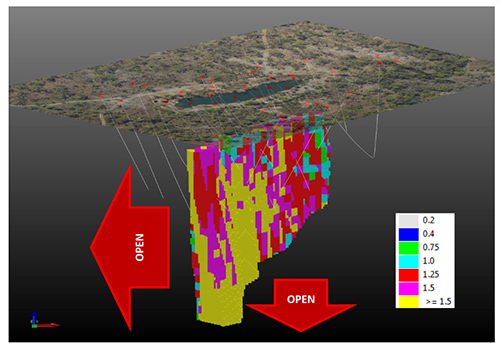

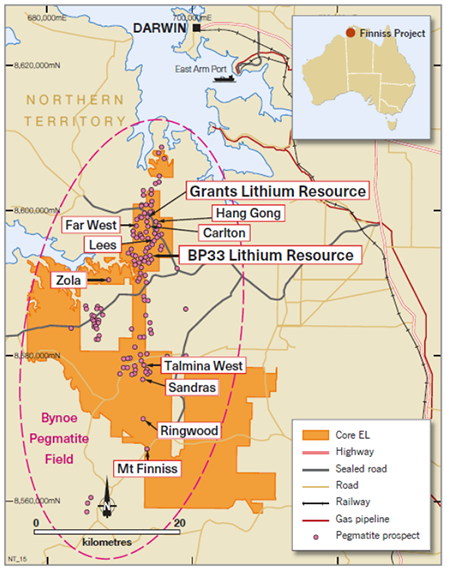

Antwort auf Beitrag Nr.: 57.811.550 von Popeye82 am 23.05.18 03:26:24Core Exploration

http://finfeed.com/small-caps/juniors/core-exploration-annou…

http://finfeed.com/small-caps/juniors/core-exploration-annou…

Antwort auf Beitrag Nr.: 57.759.256 von Popeye82 am 15.05.18 06:10:18TNG

http://www.pv-magazine.de/2018/02/28/schmid-liefert-erste-va…

https://schmid-group.com/business-units/energy-systems/everf…

http://www.pv-magazine.de/2018/02/28/schmid-liefert-erste-va…

https://schmid-group.com/business-units/energy-systems/everf…

Antwort auf Beitrag Nr.: 57.758.155 von Popeye82 am 14.05.18 21:38:26Millennial Lithium

https://www.caesarsreport.com/blog/20617/

https://www.caesarsreport.com/blog/20617/

Antwort auf Beitrag Nr.: 57.800.957 von Rastelly am 21.05.18 09:52:48Re: unglaublich Viele Windeier

ja, richtig - ein wahres Wort.

Aber jeder muss für sich selbst die Erfahrung sammeln.

Erst beobachten, Hintergrund sondieren und dann eventuell die erste Position aufbauen.

Halsbrecherische Aussagen gleich meiden.

____________________________________________________________________

Und Rastelly

Also ohne Jetzt Irgendeine Art Verbal"fight" zu veranstalten, zu Euren Windeiern.

Das haben ja Einige Hier geschrieben.

Mich interessiert Einmal: Was meinst Du/Ihr damit?

Also WAS SIND WELCHE, UND WAS SIND KEINE?????

Ich habe so Eine leichte Ahnung in Welche Richtung Das geht(würde),

und wenn Diese Vermutung richtig ist,

dann habe ich wahrscheinlich nochmal eine DEUTLICH, DEUTLICH Andere Meinung dazu.

ja, richtig - ein wahres Wort.

Aber jeder muss für sich selbst die Erfahrung sammeln.

Erst beobachten, Hintergrund sondieren und dann eventuell die erste Position aufbauen.

Halsbrecherische Aussagen gleich meiden.

____________________________________________________________________

Und Rastelly

Also ohne Jetzt Irgendeine Art Verbal"fight" zu veranstalten, zu Euren Windeiern.

Das haben ja Einige Hier geschrieben.

Mich interessiert Einmal: Was meinst Du/Ihr damit?

Also WAS SIND WELCHE, UND WAS SIND KEINE?????

Ich habe so Eine leichte Ahnung in Welche Richtung Das geht(würde),

und wenn Diese Vermutung richtig ist,

dann habe ich wahrscheinlich nochmal eine DEUTLICH, DEUTLICH Andere Meinung dazu.

Antwort auf Beitrag Nr.: 57.811.001 von Popeye82 am 22.05.18 22:26:47Continental Gold

- Continental Gold is proud to have sponsored a trip where 69 apprentices from the Joint Underground Mining Initiative training program were able to attend the 2017 Mining Fair in Medellín, Colombia. The apprentices form a larger team of 120 who come from communities in the areas of influence in which we operate. This joint training initiative is a cornerstone piece of the Company’s sustainability strategy and would not be possible without the support of the Company, the Buriticá Mayor’s Office through SENA, and the support of the Secretary of Mines of the provincial Government of Antioquia. Continental Gold continues its commitment to the future development and education of the western region of Antioquia. -

http://www.continentalgold.com/en/continental-gold-honours-f…

- Continental Gold is proud to have sponsored a trip where 69 apprentices from the Joint Underground Mining Initiative training program were able to attend the 2017 Mining Fair in Medellín, Colombia. The apprentices form a larger team of 120 who come from communities in the areas of influence in which we operate. This joint training initiative is a cornerstone piece of the Company’s sustainability strategy and would not be possible without the support of the Company, the Buriticá Mayor’s Office through SENA, and the support of the Secretary of Mines of the provincial Government of Antioquia. Continental Gold continues its commitment to the future development and education of the western region of Antioquia. -

http://www.continentalgold.com/en/continental-gold-honours-f…

Antwort auf Beitrag Nr.: 57.805.961 von Popeye82 am 22.05.18 10:35:10Altura Mining

https://alturamining.com/wp-content/uploads/2018/05/1805750-…

http://www.cubeconsulting.com/

https://alturamining.com/wp-content/uploads/2018/05/1805750-…

http://www.cubeconsulting.com/

Antwort auf Beitrag Nr.: 57.751.093 von Popeye82 am 14.05.18 05:21:37New Century Resource

https://wcsecure.weblink.com.au/pdf/NCZ/01985104.pdf

http://sedgman.com/news/sedgman-wins-40m-in-processing-plant…

http://sedgman.com/

http://www.cimic.com.au/

https://wcsecure.weblink.com.au/pdf/NCZ/01985104.pdf

http://sedgman.com/news/sedgman-wins-40m-in-processing-plant…

http://sedgman.com/

http://www.cimic.com.au/

Antwort auf Beitrag Nr.: 57.811.514 von Popeye82 am 23.05.18 02:04:183RD lowest, on the comparative cost curve, for hard rock lithium projects, globally

Birimian

http://birimian.com/pdfs/FurtherGoulaminaCostReductions28May…

https://roskill.com/

Birimian

http://birimian.com/pdfs/FurtherGoulaminaCostReductions28May…

https://roskill.com/

Antwort auf Beitrag Nr.: 57.672.444 von Popeye82 am 01.05.18 21:45:18FIRST major investment, by an international gold mining company into Sudan

Orca Gold

http://www.orcagold.com/news/news-releases/2018/orca-gold-in…

http://www.rml.com.au/

Orca Gold

http://www.orcagold.com/news/news-releases/2018/orca-gold-in…

http://www.rml.com.au/

Antwort auf Beitrag Nr.: 57.815.021 von Popeye82 am 23.05.18 14:25:11Zinc One Resources

http://www.zincone.com/news/2018/zinc-one-concludes-drilling…

http://www.zincone.com/news/2018/zinc-one-concludes-drilling…

Antwort auf Beitrag Nr.: 57.767.038 von Popeye82 am 15.05.18 20:57:00Jangada Mines Plc

http://www.voxmarkets.co.uk/blogs/5-companies-think-will-out…

http://www.voxmarkets.co.uk/blogs/5-companies-think-will-out…

Antwort auf Beitrag Nr.: 57.763.786 von Popeye82 am 15.05.18 15:16:37Galaxy Lithium

http://www.galaxylithium.com/media/announcements/1806100.pdf

http://www.posco.com/

http://www.galaxylithium.com/media/announcements/1806100.pdf

http://www.posco.com/

Antwort auf Beitrag Nr.: 57.801.671 von Popeye82 am 21.05.18 12:30:57Orion Minerals NL

http://www.asx.com.au/asxpdf/20180529/pdf/43vcr5xcm0tpzq.pdf

http://www.asx.com.au/asxpdf/20180529/pdf/43vcr5xcm0tpzq.pdf

Antwort auf Beitrag Nr.: 57.836.591 von Popeye82 am 25.05.18 22:44:54American Pacific Borate + Lithium

http://americanpacificborate.com/wp-content/uploads/ABREnter…

http://www.sinochem.com/en/s/1570-4838-11929.html

http://en.sasac.gov.cn/

http://fortune.com/global500/list/

http://americanpacificborate.com/wp-content/uploads/ABREnter…

http://www.sinochem.com/en/s/1570-4838-11929.html

http://en.sasac.gov.cn/

http://fortune.com/global500/list/

Antwort auf Beitrag Nr.: 57.828.131 von Popeye82 am 24.05.18 22:58:58Victoria Gold

http://www.vitgoldcorp.com/news/2018/victoria-gold-eagle-gol…

http://www.vitgoldcorp.com/news/2018/victoria-gold-eagle-gol…

Antwort auf Beitrag Nr.: 57.811.625 von Popeye82 am 23.05.18 06:27:01ONE of the, most, important lithium +tantalum resources, globally

Pilbara Minerals

http://www.pilbaraminerals.com.au/site/PDF/2148_0/Pilgangoor…

https://www.bloomberg.com/research/stocks/private/snapshot.a…

http://www.australianmining.com.au/news/pilbara-minerals-str…

http://www.mining-journal.com/events-coverage/news/1339175/c…

Pilbara Minerals

http://www.pilbaraminerals.com.au/site/PDF/2148_0/Pilgangoor…

https://www.bloomberg.com/research/stocks/private/snapshot.a…

http://www.australianmining.com.au/news/pilbara-minerals-str…

http://www.mining-journal.com/events-coverage/news/1339175/c…

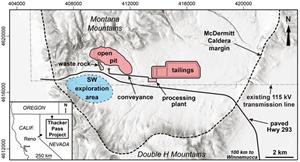

Prophecy Announces Positive Preliminary Economic Assessment Study for the Gibellini Vanadium Project

The PEA Highlights:

Highlights of the PEA (after tax):

Internal rate of return 50.8%

Net present value (NPV) $338.3 million at 7% discount rate

Payback period 1.72 years

Average annual production 9.65 million lbs V2O5

Average V2O5 selling price $12.73 per lb

Operating cash cost $4.77 per lb V2O5

All-in sustaining costs* $6.28 per lb V2O5

Breakeven price** $7.76 per lb V2O5

Initial capital cost including 25% contingency $116.76 million

Average grade 0.26% V2O5

Strip ratio 0.17 waste to leach material

Mining operating rate 3.4 million tons (leach material and waste) per year

Average V2O5 recovery through Direct Heap Leaching 62%

Life of mine 13.5 years

*includes selling costs, royalties, operating cash cost, reclamation, exploration and sustaining capital costs.

**includes selling costs, royalties, operating cash costs, taxes (local, state, and federal), working capital, and sustaining & capital costs.

https://www.minenportal.de/unternehmen_nachrichten.php?mid=1…

The PEA Highlights:

Highlights of the PEA (after tax):

Internal rate of return 50.8%

Net present value (NPV) $338.3 million at 7% discount rate

Payback period 1.72 years

Average annual production 9.65 million lbs V2O5

Average V2O5 selling price $12.73 per lb

Operating cash cost $4.77 per lb V2O5

All-in sustaining costs* $6.28 per lb V2O5

Breakeven price** $7.76 per lb V2O5

Initial capital cost including 25% contingency $116.76 million

Average grade 0.26% V2O5

Strip ratio 0.17 waste to leach material

Mining operating rate 3.4 million tons (leach material and waste) per year

Average V2O5 recovery through Direct Heap Leaching 62%

Life of mine 13.5 years

*includes selling costs, royalties, operating cash cost, reclamation, exploration and sustaining capital costs.

**includes selling costs, royalties, operating cash costs, taxes (local, state, and federal), working capital, and sustaining & capital costs.

https://www.minenportal.de/unternehmen_nachrichten.php?mid=1…

Antwort auf Beitrag Nr.: 57.843.738 von Popeye82 am 28.05.18 06:31:51HISTORIC agreement, a FIRST for the Mining industry

New Century Resources

https://wcsecure.weblink.com.au/pdf/NCZ/01985647.pdf

https://wcsecure.weblink.com.au/pdf/NCZ/01985650.pdf

http://waanyipbc.org/

http://www.downergroup.com/

http://www.nntt.gov.au/searchRegApps/NativeTitleClaims/Pages…

http://www.alassoc.com.au/Services/Cultural-Heritage-Managem…

http://www.legislation.qld.gov.au/view/pdf/inforce/current/a…

http://www.thecompanydetails.com/company/waanyi-enterprises-…

http://www.pmc.gov.au/indigenous-affairs/prime-ministers-ind…

New Century Resources

https://wcsecure.weblink.com.au/pdf/NCZ/01985647.pdf

https://wcsecure.weblink.com.au/pdf/NCZ/01985650.pdf

http://waanyipbc.org/

http://www.downergroup.com/

http://www.nntt.gov.au/searchRegApps/NativeTitleClaims/Pages…

http://www.alassoc.com.au/Services/Cultural-Heritage-Managem…

http://www.legislation.qld.gov.au/view/pdf/inforce/current/a…

http://www.thecompanydetails.com/company/waanyi-enterprises-…

http://www.pmc.gov.au/indigenous-affairs/prime-ministers-ind…

Antwort auf Beitrag Nr.: 57.837.035 von Popeye82 am 26.05.18 03:30:15FULL TRANSformational impact revealed

Interessierte: LESEN.

Sirius Minerals Plc

http://www.thetimes.co.uk/article/sirius-minerals-builds-a-b…

http://siriusminerals.com/latest-news/news-stories/sirius-to…

http://www.gazettelive.co.uk/news/teesside-news/sirius-miner…

https://patentimages.storage.googleapis.com/7a/a0/8c/1c9d34c…

Interessierte: LESEN.

Sirius Minerals Plc

http://www.thetimes.co.uk/article/sirius-minerals-builds-a-b…

http://siriusminerals.com/latest-news/news-stories/sirius-to…

http://www.gazettelive.co.uk/news/teesside-news/sirius-miner…

https://patentimages.storage.googleapis.com/7a/a0/8c/1c9d34c…

Prophecy Development

- Internal rate of return 50.8%

- Net present value (NPV) $338.3 million at 7% discount rate

- Payback period 1.72 years

- Average annual production 9.65 million lbs V2O5

- Average V2O5 selling price $12.73 per lb

- Operating cash cost $4.77 per lb V2O5

- All-in sustaining costs* $6.28 per lb V2O5

- Breakeven price** $7.76 per lb V2O5

- Initial capital cost including 25% contingency $116.76 million

- Average grade 0.26% V2O5

- Strip ratio 0.17 waste to leach material

- Mining operating rate 3.4 million tons (leach material and waste) per year

- Average V2O5 recovery through Direct Heap Leaching 62%

- Life of mine 13.5 years

http://www.juniorminingnetwork.com/junior-miner-news/press-r…

http://www.prophecydev.com/projects/gibellini-vanadium/

- Prophecy Development Corp

Am 03.05.2018 veröffentlicht

Prophecy is on an accelerated, predictable path to advance Gibellini to become the first primary vanadium mine in North America, offering the best quality vanadium pentoxide product that exceeds customer requirements for a variety of applications from traditional re-enforcement bars to high-tech grid-scale batteries and the aerospace industry

Trade Prophecy at links below

US Brokers (OTCQX: PRPCF)

http://www.tdameritrade.com

http://www.etrade.com

http://www.fidelity.com

http://www.merrilledge.com

Canadian Brokers (TSX: PCY)

http://www.Td.com

http://www.rbcdirectinvesting.com

http://www.qtrade.com

http://www.questrade.com

http://www.scotiabank.com/itrade

http://www.bmo.com/investorline

Nick Hodge of Nick's Notebook (https://www.outsiderclub.com/resource...), a private placement and alert service that has raised tens of millions of dollars of investment capital for resource companies, has this to say about Prophecy Development in his March special alert:

"Vanadium is the next great "electric metal" story. Prophecy is developing what aims to be the first primary vanadium mine in North America.

I have been following this story for some time. The more I've learned, the more I realize Prophecy provides great leverage to a vanadium story that's very real.

We are buying Prophecy Development Corp. (TSX-V: PCY)(OTC: PRPCF) below C$3.00." -

- Prophecy Development Corp

Am 26.04.2018 veröffentlicht

The Gibellini Project is located in Eureka County, Nevada, about 25 miles south of the town of Eureka, and is easily accessed by a graded gravel road extending south from US Highway 50. Nevada is featured in the 2016 Fraser Institute survey of mining companies as the fourth most attractive jurisdiction for mining investment globally. -

- Internal rate of return 50.8%

- Net present value (NPV) $338.3 million at 7% discount rate

- Payback period 1.72 years

- Average annual production 9.65 million lbs V2O5

- Average V2O5 selling price $12.73 per lb

- Operating cash cost $4.77 per lb V2O5

- All-in sustaining costs* $6.28 per lb V2O5

- Breakeven price** $7.76 per lb V2O5

- Initial capital cost including 25% contingency $116.76 million

- Average grade 0.26% V2O5

- Strip ratio 0.17 waste to leach material

- Mining operating rate 3.4 million tons (leach material and waste) per year

- Average V2O5 recovery through Direct Heap Leaching 62%

- Life of mine 13.5 years

http://www.juniorminingnetwork.com/junior-miner-news/press-r…

http://www.prophecydev.com/projects/gibellini-vanadium/

- Prophecy Development Corp

Am 03.05.2018 veröffentlicht

Prophecy is on an accelerated, predictable path to advance Gibellini to become the first primary vanadium mine in North America, offering the best quality vanadium pentoxide product that exceeds customer requirements for a variety of applications from traditional re-enforcement bars to high-tech grid-scale batteries and the aerospace industry

Trade Prophecy at links below

US Brokers (OTCQX: PRPCF)

http://www.tdameritrade.com

http://www.etrade.com

http://www.fidelity.com

http://www.merrilledge.com

Canadian Brokers (TSX: PCY)

http://www.Td.com

http://www.rbcdirectinvesting.com

http://www.qtrade.com

http://www.questrade.com

http://www.scotiabank.com/itrade

http://www.bmo.com/investorline

Nick Hodge of Nick's Notebook (https://www.outsiderclub.com/resource...), a private placement and alert service that has raised tens of millions of dollars of investment capital for resource companies, has this to say about Prophecy Development in his March special alert:

"Vanadium is the next great "electric metal" story. Prophecy is developing what aims to be the first primary vanadium mine in North America.

I have been following this story for some time. The more I've learned, the more I realize Prophecy provides great leverage to a vanadium story that's very real.

We are buying Prophecy Development Corp. (TSX-V: PCY)(OTC: PRPCF) below C$3.00." -

- Prophecy Development Corp

Am 26.04.2018 veröffentlicht

The Gibellini Project is located in Eureka County, Nevada, about 25 miles south of the town of Eureka, and is easily accessed by a graded gravel road extending south from US Highway 50. Nevada is featured in the 2016 Fraser Institute survey of mining companies as the fourth most attractive jurisdiction for mining investment globally. -

Antwort auf Beitrag Nr.: 57.811.529 von Popeye82 am 23.05.18 02:28:59Verde Agritech

http://verdeagritech.com/uploads/releases/ac05f7327b4603c191…

http://www.wallstreet-online.de/nachricht/10493874-china-s-f…

http://www.supergreensand.com/

http://verdeagritech.com/uploads/releases/ac05f7327b4603c191…

http://www.wallstreet-online.de/nachricht/10493874-china-s-f…

http://www.supergreensand.com/

Antwort auf Beitrag Nr.: 57.843.609 von Popeye82 am 28.05.18 01:38:26Continental Gold

http://www.continentalgold.com/wp-content/uploads/2018/05/Ca…

http://www.vaneck.com/mutual-fund/gold/inivx/overview/

http://www.continentalgold.com/wp-content/uploads/2018/05/Ca…

http://www.vaneck.com/mutual-fund/gold/inivx/overview/

Antwort auf Beitrag Nr.: 57.718.660 von Popeye82 am 08.05.18 16:35:25Global Atomic

http://www.globalatomiccorp.com/wp-content/uploads/2018/05/G…

http://www.csaglobal.com/

http://www.globalatomiccorp.com/business-acquisition-report/

http://www.globalatomiccorp.com/wp-content/uploads/2018/05/G…

http://www.csaglobal.com/

http://www.globalatomiccorp.com/business-acquisition-report/

Antwort auf Beitrag Nr.: 57.817.955 von Popeye82 am 23.05.18 20:30:49Telson Mining

- InvestmentPitch Media

Am 25.05.2018 veröffentlicht

David Morgan of the Morgan Report interview with Ralph Shearing, President of Telson Mining Corp. (TSXV: TSN) -

http://www.investmentpitch.com/video/0_s2aaskx6/David-Morgan…

- Market One Media Group Inc.

Am 26.03.2018 veröffentlicht

Telson Mining Corporation (TSX.V TSN) is a Canadian based junior resource mining company currently in pre-production at two Mexican gold, silver, and base metal mining projects and is advancing both towards commercial production over the coming months of 2018.

Learn more about the Telson Mining on their website: http://www.telsonmining.com

If you want to learn more about the Market One Minute and how your company can reach millions of investors on BNN, please visit the Market One Minute section of our website here: http://bit.ly/2pBFSqP

Missed an episode of a Market One Minute segment? Here's a playlist to catch up on any you've missed: http://bit.ly/2D4PMqX

» Subscribe to us on YouTube: http://bit.ly/2CYmf2y

Engage with Market One

» Like us on Facebook: https://www.facebook.com/marketonemed...

» Tweet to us on Twitter: https://twitter.com/MarketOneMedia

» Connect with us on LinkedIn: https://www.linkedin.com/company/3489...

» Follow us on Instagram: https://www.instagram.com/marketoneme... -

- Telson Mining Corporation

Am 01.05.2018 veröffentlicht

Multiple trucks leaving the Atocha Mill to deliver Tahuehueto concentrate to Trafigura -

- InvestmentPitch Media

Am 25.05.2018 veröffentlicht

David Morgan of the Morgan Report interview with Ralph Shearing, President of Telson Mining Corp. (TSXV: TSN) -

http://www.investmentpitch.com/video/0_s2aaskx6/David-Morgan…

- Market One Media Group Inc.

Am 26.03.2018 veröffentlicht

Telson Mining Corporation (TSX.V TSN) is a Canadian based junior resource mining company currently in pre-production at two Mexican gold, silver, and base metal mining projects and is advancing both towards commercial production over the coming months of 2018.

Learn more about the Telson Mining on their website: http://www.telsonmining.com

If you want to learn more about the Market One Minute and how your company can reach millions of investors on BNN, please visit the Market One Minute section of our website here: http://bit.ly/2pBFSqP

Missed an episode of a Market One Minute segment? Here's a playlist to catch up on any you've missed: http://bit.ly/2D4PMqX

» Subscribe to us on YouTube: http://bit.ly/2CYmf2y

Engage with Market One

» Like us on Facebook: https://www.facebook.com/marketonemed...

» Tweet to us on Twitter: https://twitter.com/MarketOneMedia

» Connect with us on LinkedIn: https://www.linkedin.com/company/3489...

» Follow us on Instagram: https://www.instagram.com/marketoneme... -

- Telson Mining Corporation

Am 01.05.2018 veröffentlicht

Multiple trucks leaving the Atocha Mill to deliver Tahuehueto concentrate to Trafigura -

Antwort auf Beitrag Nr.: 57.810.380 von Popeye82 am 22.05.18 21:03:44Plateau Energy Metals

http://plateauenergymetals.com/2018/05/29/plateau-energy-met…

http://www.ansto.gov.au/

http://plateauenergymetals.com/2018/05/02/2-may-2018-rfc-amb…

"Plateau Energy Metals reports 90% lithium extraction to sulphate solution from test work undertaken at ANSTO Minerals laboratories, Sydney Australia

May 29, 2018 in News Releases

TORONTO, ONTARIO — (GlobeNewswire – May 29, 2018) – Plateau Energy Metals Inc. (“Plateau” “PLU” or the “Company“)(TSX VENTURE:PLU)(FRANKFURT:QG1)(OTCQB:PLUUF), a lithium and uranium exploration and development company, is pleased to announce results from initial metallurgical test work undertaken at the Australian Nuclear Science and Technology Organisation (“ANSTO Minerals”) mineral processing laboratories in Sydney, Australia. The test work was completed on representative lithium-rich tuff samples collected from outcrop trenches at the Falchani discovery on the Company’s Macusani Plateau lithium/uranium project in southeastern Peru.

The test work forms part of the Company’s continuing efforts to unlock value from the Falchani high-grade lithium discovery and aims to demonstrate ‘proof of concept’ precipitation of lithium carbonate product employing an approach which involves simple atmospheric acid leaching of the lithium-rich tuff material followed by conventional lithium processing steps. Other process options for the up-front extraction of lithium continue to be examined by ANSTO Minerals in parallel with the current program.

ANSTO Minerals Test Work Results

- The leach test work was conducted on bulk trench outcrop samples of the lithium-rich tuff from the Falchani discovery.

- The sample contained 3,336 ppm Li and was milled to a P80 150 micron (µm), with a slurry density of 30 wt%, and leached with a 48 hour residence time at 90-95 °C (similar conditions to the leach test work reported previously completed by TECMMINE in Peru).

- 90% of contained lithium was extracted to leach solution, which compares favourably and improves on the 80% Li extraction from the earlier TECMMINE test work.

- Lithium extraction was reported steady at ~90% recovery level as early as 12 hours into the leach test, indicating shorter leach times should be considered.

- Acid consumption was 153 kg/t of the material processed.

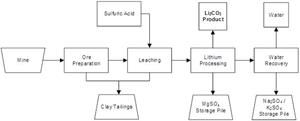

- A preliminary lithium carbonate production flow-sheet using a ‘simple’ up-front sulfuric acid leach has been proposed by ANSTO Minerals (Figure 1 – Preliminary Acid Leach Lithium Carbonate (LC) Flow Sheet for Falchani.jpg, attached) and consists of well understood, conventional lithium processing steps.

- The next phase of the ANSTO Minerals test work will be to produce a battery grade lithium carbonate product via this proposed flow sheet from a larger (15 kg) sample of lithium-rich tuff material. This work should be completed in the next 5-6 weeks.

Ted O’Connor, CEO of Plateau Energy Metals, commented: “These are truly exciting times for Plateau Energy Metals. The recent test work completed at the well-known, and highly respected ‘Lithium-dedicated’ Laboratories at ANSTO Minerals confirms and enhances our previous lithium leaching results. The higher, 90% Li extraction with lower acid consumption reported at 153 kg/t bodes well for future work on this unique lithium mineralization. Sulfuric acid reagent costs represent the main consumable in our proposed lithium carbonate production process, and carries an estimated cost equivalent of US$15/tonne processed based on locally sourced Peruvian acid (<US$100/t, delivered). Acid consumption is expected to reduce during the locked cycle test work phase of planned work that will more accurately reflect proposed operating conditions.

It is also extremely encouraging that the preliminary lithium carbonate production flow sheet proposed by ANSTO Minerals, mirrors existing and conventional ‘off-the-shelf’ lithium processing methodology. We expect to see the first laboratory based battery grade lithium carbonate product being produced from Falchani lithium-rich tuff samples this summer.”

QUALIFIED Persons

Doug Collier (FAusIMM) of ANSTO Minerals, and a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

About ANSTO Minerals

ANSTO Minerals is an international mining consultancy group located in Sydney, Australia, with an experienced team of 60+ engineers, metallurgists, chemists, and scientists who have been providing consulting services and process development services to the mining and minerals processing industries for well over 35 years. ANSTO Minerals has world-leading expertise in uranium ore processing, rare earth processing, zirconium/niobium/hafnium processing, base metals processing, lithium processing (brines and hardrock), and radioactivity control and management.

About Plateau Energy Metals

Plateau Energy Metals Inc. is a Canadian lithium and uranium exploration and development company focused on its properties on the Macusani Plateau in southeastern Peru. The Company controls all reported uranium resources known in Peru, significant and growing lithium resources and mineral concessions covering over 91,000 hectares (910 km2) situated near significant infrastructure. Plateau Energy Metals is listed on the TSX Venture Exchange under the symbol ‘PLU’, quoted on the OTCQB under the symbol “PLUUF” and the Frankfurt Exchange under the symbol ‘QG1’. The Company has 69,496,054 shares issued and outstanding. "

http://plateauenergymetals.com/2018/05/29/plateau-energy-met…

http://www.ansto.gov.au/

http://plateauenergymetals.com/2018/05/02/2-may-2018-rfc-amb…

"Plateau Energy Metals reports 90% lithium extraction to sulphate solution from test work undertaken at ANSTO Minerals laboratories, Sydney Australia

May 29, 2018 in News Releases

TORONTO, ONTARIO — (GlobeNewswire – May 29, 2018) – Plateau Energy Metals Inc. (“Plateau” “PLU” or the “Company“)(TSX VENTURE:PLU)(FRANKFURT:QG1)(OTCQB:PLUUF), a lithium and uranium exploration and development company, is pleased to announce results from initial metallurgical test work undertaken at the Australian Nuclear Science and Technology Organisation (“ANSTO Minerals”) mineral processing laboratories in Sydney, Australia. The test work was completed on representative lithium-rich tuff samples collected from outcrop trenches at the Falchani discovery on the Company’s Macusani Plateau lithium/uranium project in southeastern Peru.

The test work forms part of the Company’s continuing efforts to unlock value from the Falchani high-grade lithium discovery and aims to demonstrate ‘proof of concept’ precipitation of lithium carbonate product employing an approach which involves simple atmospheric acid leaching of the lithium-rich tuff material followed by conventional lithium processing steps. Other process options for the up-front extraction of lithium continue to be examined by ANSTO Minerals in parallel with the current program.

ANSTO Minerals Test Work Results

- The leach test work was conducted on bulk trench outcrop samples of the lithium-rich tuff from the Falchani discovery.

- The sample contained 3,336 ppm Li and was milled to a P80 150 micron (µm), with a slurry density of 30 wt%, and leached with a 48 hour residence time at 90-95 °C (similar conditions to the leach test work reported previously completed by TECMMINE in Peru).

- 90% of contained lithium was extracted to leach solution, which compares favourably and improves on the 80% Li extraction from the earlier TECMMINE test work.

- Lithium extraction was reported steady at ~90% recovery level as early as 12 hours into the leach test, indicating shorter leach times should be considered.

- Acid consumption was 153 kg/t of the material processed.

- A preliminary lithium carbonate production flow-sheet using a ‘simple’ up-front sulfuric acid leach has been proposed by ANSTO Minerals (Figure 1 – Preliminary Acid Leach Lithium Carbonate (LC) Flow Sheet for Falchani.jpg, attached) and consists of well understood, conventional lithium processing steps.

- The next phase of the ANSTO Minerals test work will be to produce a battery grade lithium carbonate product via this proposed flow sheet from a larger (15 kg) sample of lithium-rich tuff material. This work should be completed in the next 5-6 weeks.

Dieses Bild ist nicht SSL-verschlüsselt: [url]http://plateauenergymetals.com/wp-content/uploads/2018/05/Figure_1_-_Preliminary_Acid_Leach_Lithium_Carbonate_LC_Flow_Sheet_for_Falchani.jpg

[/url]Ted O’Connor, CEO of Plateau Energy Metals, commented: “These are truly exciting times for Plateau Energy Metals. The recent test work completed at the well-known, and highly respected ‘Lithium-dedicated’ Laboratories at ANSTO Minerals confirms and enhances our previous lithium leaching results. The higher, 90% Li extraction with lower acid consumption reported at 153 kg/t bodes well for future work on this unique lithium mineralization. Sulfuric acid reagent costs represent the main consumable in our proposed lithium carbonate production process, and carries an estimated cost equivalent of US$15/tonne processed based on locally sourced Peruvian acid (<US$100/t, delivered). Acid consumption is expected to reduce during the locked cycle test work phase of planned work that will more accurately reflect proposed operating conditions.

It is also extremely encouraging that the preliminary lithium carbonate production flow sheet proposed by ANSTO Minerals, mirrors existing and conventional ‘off-the-shelf’ lithium processing methodology. We expect to see the first laboratory based battery grade lithium carbonate product being produced from Falchani lithium-rich tuff samples this summer.”

QUALIFIED Persons

Doug Collier (FAusIMM) of ANSTO Minerals, and a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

About ANSTO Minerals

ANSTO Minerals is an international mining consultancy group located in Sydney, Australia, with an experienced team of 60+ engineers, metallurgists, chemists, and scientists who have been providing consulting services and process development services to the mining and minerals processing industries for well over 35 years. ANSTO Minerals has world-leading expertise in uranium ore processing, rare earth processing, zirconium/niobium/hafnium processing, base metals processing, lithium processing (brines and hardrock), and radioactivity control and management.

About Plateau Energy Metals

Plateau Energy Metals Inc. is a Canadian lithium and uranium exploration and development company focused on its properties on the Macusani Plateau in southeastern Peru. The Company controls all reported uranium resources known in Peru, significant and growing lithium resources and mineral concessions covering over 91,000 hectares (910 km2) situated near significant infrastructure. Plateau Energy Metals is listed on the TSX Venture Exchange under the symbol ‘PLU’, quoted on the OTCQB under the symbol “PLUUF” and the Frankfurt Exchange under the symbol ‘QG1’. The Company has 69,496,054 shares issued and outstanding. "

diese Bumsbude möchte ich;

als Eine der sehr, sehr Wenigen;

hier mal PRE "feasibility" hinzunehmen.

Kobalt/Kupfer/Nickel/Gold, Österreich.

High Grade Metals

http://highgrademetals.com.au/wp-content/uploads/2018/05/HGM…

http://www.asx.com.au/asxpdf/20180405/pdf/43szt9sywzv1j9.pdf

http://highgrademetals.com.au/wp-content/uploads/2018/04/HGM…

als Eine der sehr, sehr Wenigen;

hier mal PRE "feasibility" hinzunehmen.

Kobalt/Kupfer/Nickel/Gold, Österreich.

High Grade Metals

http://highgrademetals.com.au/wp-content/uploads/2018/05/HGM…

http://www.asx.com.au/asxpdf/20180405/pdf/43szt9sywzv1j9.pdf

http://highgrademetals.com.au/wp-content/uploads/2018/04/HGM…

Antwort auf Beitrag Nr.: 57.813.542 von Popeye82 am 23.05.18 11:09:55Fission Uranium

http://resourcestockdigest.com/archives/fission-uranium-tsx-…

http://resourcestockdigest.com/archives/fission-uranium-tsx-…

Antwort auf Beitrag Nr.: 57.837.647 von Popeye82 am 26.05.18 09:18:38TNG

https://stockhead.com.au/resources/vanadium-batteries-are-he…

https://stockhead.com.au/resources/electric-cars-are-the-mos…

" Vanadium batteries are ‘here to stay’ says ASX’s newest tech metal player

Resources

2 hours ago | Angela East

It’s taken a while for investors to realise the potential of vanadium in the battery metals race, but interest is starting to pick up.

The price of vanadium has rocketed 550 per cent in the past three years, outpacing other commodities, including the rival battery metals lithium and cobalt.

There are 35 small cap ASX stocks with exposure to vanadium according to resources data provider MakCorp.

Of these, 27 are ahead over the past 12 months — including King River Copper which is up 1440 per cent. Another half a dozen have made gains of 100 per cent to 384 per cent.

>> Scroll down for a list of ASX stocks with vanadium exposure, courtesy of leading ASX data provider MakCorp

About 90 per cent of global vanadium production is used to make high-strength steel, but future demand stems from its role in vanadium redox flow batteries (VRB), which can store more power and last much longer than lithium-ion batteries.

This makes it highly sought after for industrial and domestic energy storage, though it’s unlikely to be used in electric car batteries.

Chalice Gold enters vanadium market

Chalice Gold Mines (ASX:CHN) is the latest to put its foot on vanadium ground in Australia.

As a gold player, Chalice’s share price has tumbled 44 per cent since October last year.

But the company announced last week it has applied for exploration licences prospective for vanadium and nickel in Queensland and Western Australia.

Chalice executive chairman Tim Goyder told Stockhead investor interest was definitely starting to be realised in the vanadium space.

“Vanadium flow batteries are here to stay, like the lithium batteries are,” he said on the sidelines of the Resources Rising Stars conference in Queensland’s Gold Coast.

The only pure-play producers of vanadium are Toronto’s Largo Resources, which processes 1.4 million tonnes each year from its Vanadio de Maracás Menchen mine in Brazil, and Bushveld Minerals, which processes 2 million tonnes from the Vametco operations in South Africa.

Largo is now a $1 billion producer, while Bushveld has gone from a market cap of £20 million ($35.4 million) to roughly £250 million in just one year.

Bookmark this link for small cap breaking news

Discuss small cap news in our Facebook group

Follow us on Facebook or Twitter

Subscribe to our daily newsletter

Chalice is looking for vanadium hosted in shale rather than the more common magnetite-hosted vanadium because it is much easier to mine.

“Historically around Richmond is the old Julia Creek area – the scene of a lot of work done during the oil crisis for oil shales,” Mr Goyder explained.

“Since then the oil market collapsed and in recent times the vanadium price has risen.

“It’s tripled over the last 12 months from $US6 ($8) a pound to over $US19 a pound, so vanadium is very much in demand, particularly shale-hosted vanadium.”

Chalice’s Flinders River vanadium project in Queensland surrounds the 2.6 billion tonne shale-hosted Richmond vanadium project owned by Intermin Resources (ASX:IRC).

Liontown Resources (ASX:LTR) also has ground in the region as well.

Intermin’s share price has climbed 80 per cent in the past year, while Liontown’s share price has jumped 207 per cent.

Here’s a list of ASX stocks with exposure to tin courtesy of leading ASX data provider MakCorp. (Scroll or swipe for full table)

Ticker Company One-year price change Price May 29 (intraday) Market Cap

Ticker

Company

One-year price change

Price May 29 (intraday)

Market Cap

ACP AUDALIA RESOURCES 40% 0.021 6.0M

AEE AURA ENERGY -12% 0.022 20.7M

ARU ARAFURA RESOURCES 75% 0.098 57.0M

AUR AURIS MINERALS 20% 0.077 29.8M

AVL AUSTRALIAN VANADIUM 167% 0.04 62.5M

AVZ AVZ MINERALS 385% 0.16 298.9M

BAT BATTERY MINERALS -15% 0.056 53.3M

CHN CHALICE GOLD -15% 0.145 37.9M

CZR COZIRON RESOURCES 50% 0.018 32.1M

EME ENERGY METALS 10% 0.11 23.1M

GED GOLDEN DEEPS 47% 0.044 8.1M

IRC INTERMIN 81% 0.17 38.6M

KOR KORAB RESOURCES 100% 0.034 10.3M

KRC KING RIVER COPPER 1440% 0.077 86.7M

LML LINCOLN MINERALS -47% 0.024 13.8M

LTR LIONTOWN RESOURCES 208% 0.04 32.8M

MTB MOUNT BURGESS 50% 0.009 3.8M

MUS MUSTANG RESOURCES -54% 0.019 17.4M

MZN MARINDI METALS 20% 0.012 21.4M

NMT NEOMETALS 28% 0.34 182.1M

PNN PEPINNINI 40% 0.021 11.2M

POW PROTEAN ENERGY 10% 0.034 10.5M

PUR PURSUIT MINERALS -92% 0.105 6.9M

RDS REDSTONE RESOURCES 91% 0.021 8.0M

RTR RUMBLE RESOURCES 191% 0.064 23.0M

SBR SABRE RESOURCES 50% 0.015 5.5M

SI6 SIX SIGMA METALS 0% 0.012 5.5M

SO4 SALTAKE POTASH 23% 0.54 94.5M

SRN SUREFIRE -18% 0.014 5.5M

SXX SOUTHERN CROSS 43% 0.01 10.8M

SYR SYRAH RESOURCES 21% 3.18 945.8M

TMT TECHNOLOGY METALS AUS 102% 0.405 22.9M

TNG TNG 8% 0.14 116.4M

TON TRITON MINERALS 27% 0.071 58.4M

VMC VENUS METALS 70% 0.15 11.5M

Biggest ASX vanadium gainers

The biggest gainers in the vanadium space are King River Copper (ASX:KRC) with a 1440 per cent spike in its share price over the past 12 months, followed by AVZ Minerals (ASX:AVZ), which has witnessed a 385 per cent jump in its share price.

Rumble Resources (ASX:RTR), Australian Vanadium (ASX:AVL) and Technology Metals Australia (ASX:TMT) have all more than doubled their share prices over the same period.

Paul Vollant from TNG (ASX:TNG) says vanadium redox batteries are gaining momentum with strong growth and worldwide commercial deployment.

The market forecast is for compound annual growth of 30.8 per cent between 2015 and 2020.

Mr Vollant says this represents a $US6 billion market opportunity in 2020.

TNG has already proven it can produce high purity, commercial-grade, vanadium electrolyte from its Mount Peake project in the Northern Territory.

Mount Peake is expected to produce 243,000 tonnes of vanadium pentoxide, 10.6 million tonnes of iron oxide and 3.5 million tonnes of titanium dioxide over a 17-year mine-life.

Stockhead is proud to use Mak Corp as a provider of great value, accurate and reliable data on ASX-listed mining stocks. For more information head to Mak Corp’s website. "

https://stockhead.com.au/resources/vanadium-batteries-are-he…

https://stockhead.com.au/resources/electric-cars-are-the-mos…

" Vanadium batteries are ‘here to stay’ says ASX’s newest tech metal player

Resources

2 hours ago | Angela East

It’s taken a while for investors to realise the potential of vanadium in the battery metals race, but interest is starting to pick up.

The price of vanadium has rocketed 550 per cent in the past three years, outpacing other commodities, including the rival battery metals lithium and cobalt.

There are 35 small cap ASX stocks with exposure to vanadium according to resources data provider MakCorp.

Of these, 27 are ahead over the past 12 months — including King River Copper which is up 1440 per cent. Another half a dozen have made gains of 100 per cent to 384 per cent.

>> Scroll down for a list of ASX stocks with vanadium exposure, courtesy of leading ASX data provider MakCorp

About 90 per cent of global vanadium production is used to make high-strength steel, but future demand stems from its role in vanadium redox flow batteries (VRB), which can store more power and last much longer than lithium-ion batteries.

This makes it highly sought after for industrial and domestic energy storage, though it’s unlikely to be used in electric car batteries.

Chalice Gold enters vanadium market

Chalice Gold Mines (ASX:CHN) is the latest to put its foot on vanadium ground in Australia.

As a gold player, Chalice’s share price has tumbled 44 per cent since October last year.

But the company announced last week it has applied for exploration licences prospective for vanadium and nickel in Queensland and Western Australia.

Chalice executive chairman Tim Goyder told Stockhead investor interest was definitely starting to be realised in the vanadium space.

“Vanadium flow batteries are here to stay, like the lithium batteries are,” he said on the sidelines of the Resources Rising Stars conference in Queensland’s Gold Coast.

The only pure-play producers of vanadium are Toronto’s Largo Resources, which processes 1.4 million tonnes each year from its Vanadio de Maracás Menchen mine in Brazil, and Bushveld Minerals, which processes 2 million tonnes from the Vametco operations in South Africa.

Largo is now a $1 billion producer, while Bushveld has gone from a market cap of £20 million ($35.4 million) to roughly £250 million in just one year.

Bookmark this link for small cap breaking news

Discuss small cap news in our Facebook group

Follow us on Facebook or Twitter

Subscribe to our daily newsletter

Chalice is looking for vanadium hosted in shale rather than the more common magnetite-hosted vanadium because it is much easier to mine.

“Historically around Richmond is the old Julia Creek area – the scene of a lot of work done during the oil crisis for oil shales,” Mr Goyder explained.

“Since then the oil market collapsed and in recent times the vanadium price has risen.

“It’s tripled over the last 12 months from $US6 ($8) a pound to over $US19 a pound, so vanadium is very much in demand, particularly shale-hosted vanadium.”

Chalice’s Flinders River vanadium project in Queensland surrounds the 2.6 billion tonne shale-hosted Richmond vanadium project owned by Intermin Resources (ASX:IRC).

Liontown Resources (ASX:LTR) also has ground in the region as well.

Intermin’s share price has climbed 80 per cent in the past year, while Liontown’s share price has jumped 207 per cent.

Here’s a list of ASX stocks with exposure to tin courtesy of leading ASX data provider MakCorp. (Scroll or swipe for full table)

Ticker Company One-year price change Price May 29 (intraday) Market Cap

Ticker

Company

One-year price change

Price May 29 (intraday)

Market Cap

ACP AUDALIA RESOURCES 40% 0.021 6.0M

AEE AURA ENERGY -12% 0.022 20.7M

ARU ARAFURA RESOURCES 75% 0.098 57.0M

AUR AURIS MINERALS 20% 0.077 29.8M

AVL AUSTRALIAN VANADIUM 167% 0.04 62.5M

AVZ AVZ MINERALS 385% 0.16 298.9M

BAT BATTERY MINERALS -15% 0.056 53.3M

CHN CHALICE GOLD -15% 0.145 37.9M

CZR COZIRON RESOURCES 50% 0.018 32.1M

EME ENERGY METALS 10% 0.11 23.1M

GED GOLDEN DEEPS 47% 0.044 8.1M

IRC INTERMIN 81% 0.17 38.6M

KOR KORAB RESOURCES 100% 0.034 10.3M

KRC KING RIVER COPPER 1440% 0.077 86.7M

LML LINCOLN MINERALS -47% 0.024 13.8M

LTR LIONTOWN RESOURCES 208% 0.04 32.8M

MTB MOUNT BURGESS 50% 0.009 3.8M

MUS MUSTANG RESOURCES -54% 0.019 17.4M

MZN MARINDI METALS 20% 0.012 21.4M

NMT NEOMETALS 28% 0.34 182.1M

PNN PEPINNINI 40% 0.021 11.2M

POW PROTEAN ENERGY 10% 0.034 10.5M

PUR PURSUIT MINERALS -92% 0.105 6.9M

RDS REDSTONE RESOURCES 91% 0.021 8.0M

RTR RUMBLE RESOURCES 191% 0.064 23.0M

SBR SABRE RESOURCES 50% 0.015 5.5M

SI6 SIX SIGMA METALS 0% 0.012 5.5M

SO4 SALTAKE POTASH 23% 0.54 94.5M

SRN SUREFIRE -18% 0.014 5.5M

SXX SOUTHERN CROSS 43% 0.01 10.8M

SYR SYRAH RESOURCES 21% 3.18 945.8M

TMT TECHNOLOGY METALS AUS 102% 0.405 22.9M

TNG TNG 8% 0.14 116.4M

TON TRITON MINERALS 27% 0.071 58.4M

VMC VENUS METALS 70% 0.15 11.5M

Biggest ASX vanadium gainers

The biggest gainers in the vanadium space are King River Copper (ASX:KRC) with a 1440 per cent spike in its share price over the past 12 months, followed by AVZ Minerals (ASX:AVZ), which has witnessed a 385 per cent jump in its share price.

Rumble Resources (ASX:RTR), Australian Vanadium (ASX:AVL) and Technology Metals Australia (ASX:TMT) have all more than doubled their share prices over the same period.

Paul Vollant from TNG (ASX:TNG) says vanadium redox batteries are gaining momentum with strong growth and worldwide commercial deployment.

The market forecast is for compound annual growth of 30.8 per cent between 2015 and 2020.

Mr Vollant says this represents a $US6 billion market opportunity in 2020.

TNG has already proven it can produce high purity, commercial-grade, vanadium electrolyte from its Mount Peake project in the Northern Territory.

Mount Peake is expected to produce 243,000 tonnes of vanadium pentoxide, 10.6 million tonnes of iron oxide and 3.5 million tonnes of titanium dioxide over a 17-year mine-life.

Stockhead is proud to use Mak Corp as a provider of great value, accurate and reliable data on ASX-listed mining stocks. For more information head to Mak Corp’s website. "

Antwort auf Beitrag Nr.: 57.800.300 von Popeye82 am 21.05.18 02:55:11AVZ Minerals

https://static1.squarespace.com/static/5934d2ae6b8f5beeb5ba2…

https://de.linkedin.com/company/jns-capital-corp-

http://www.alsglobal.com/locations/asia-pacific/pacific/aust…

https://static1.squarespace.com/static/5934d2ae6b8f5beeb5ba2…

https://de.linkedin.com/company/jns-capital-corp-

http://www.alsglobal.com/locations/asia-pacific/pacific/aust…

Antwort auf Beitrag Nr.: 57.804.716 von Popeye82 am 22.05.18 07:59:54Havilah Resources

http://www.havilah-resources.com.au/wp-content/uploads/2018/…

http://minerals.statedevelopment.sa.gov.au/geoscience/drill_…

http://www.havilah-resources.com.au/wp-content/uploads/2018/…

http://minerals.statedevelopment.sa.gov.au/geoscience/drill_…

Antwort auf Beitrag Nr.: 57.689.517 von Popeye82 am 03.05.18 20:04:24Trilogy Metals

https://trilogymetals.com/news/2018/trilogy-metals-provides-…

https://trilogymetals.com/news/2018/trilogy-metals-announces…

http://www.south32.net/

http://www.aidea.org/

https://eplanning.blm.gov/epl-front-office/eplanning/planAnd…

http://www.epa.gov/nepa/national-environmental-policy-act-ep…

http://www.nps.gov/state/ak/index.htm

http://www.nps.gov/locations/alaska/upload/ANILCA-Electronic…

https://trilogymetals.com/news/2018/trilogy-metals-provides-…

https://trilogymetals.com/news/2018/trilogy-metals-announces…

http://www.south32.net/

http://www.aidea.org/

https://eplanning.blm.gov/epl-front-office/eplanning/planAnd…

http://www.epa.gov/nepa/national-environmental-policy-act-ep…

http://www.nps.gov/state/ak/index.htm

http://www.nps.gov/locations/alaska/upload/ANILCA-Electronic…

Antwort auf Beitrag Nr.: 57.857.682 von Popeye82 am 29.05.18 16:12:22spannende Firma.

____________

American Pacific Borate + Lithium

http://americanpacificborate.com/wp-content/uploads/ABREnter…

http://www.chinafiber.com/

http://www.sinomach.com.cn/en/

http://fortune.com/global500/list/

____________

American Pacific Borate + Lithium

http://americanpacificborate.com/wp-content/uploads/ABREnter…

http://www.chinafiber.com/

http://www.sinomach.com.cn/en/

http://fortune.com/global500/list/

Antwort auf Beitrag Nr.: 57.670.929 von Popeye82 am 01.05.18 18:02:02Pure Gold Mining

http://puregoldmining.ca/news/pure-gold-fully-funded-rapidly…

http://puregoldmining.ca/news/pure-gold-fully-funded-rapidly…

Antwort auf Beitrag Nr.: 57.859.608 von Popeye82 am 29.05.18 19:27:49Prophecy Development

http://www.mining-journal.com/feasibility/news/1339250/%E2%8…

http://www.mining-journal.com/feasibility/news/1339250/%E2%8…

Antwort auf Beitrag Nr.: 57.837.002 von Popeye82 am 26.05.18 02:05:46Para Resources

http://pararesourcesinc.com/para-resources-announces-el-limo…

http://pararesourcesinc.com/para-resources-announces-6400000…

http://pararesourcesinc.com/para-appoints-javier-cordova-und…

http://pararesourcesinc.com/para-resources-announces-el-limo…

http://pararesourcesinc.com/para-resources-announces-6400000…

http://pararesourcesinc.com/para-appoints-javier-cordova-und…

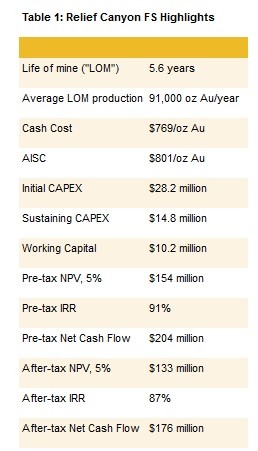

Antwort auf Beitrag Nr.: 55.082.098 von rolleg am 05.06.17 16:27:48Pershing Gold Announces Positive Feasibility Study for Relief Canyon

http://www.pershinggold.com/file/Index?KeyFile=393692201

Ich kann da auf den schnellen Blick keine "großartige" Veränderung zur PFS/PEA feststellen. Minenleben z.B. hat sich nicht verbessert...

http://www.pershinggold.com/file/Index?KeyFile=2000883737

http://www.pershinggold.com/file/Index?KeyFile=393692201

Ich kann da auf den schnellen Blick keine "großartige" Veränderung zur PFS/PEA feststellen. Minenleben z.B. hat sich nicht verbessert...

http://www.pershinggold.com/file/Index?KeyFile=2000883737

Antwort auf Beitrag Nr.: 57.552.480 von Popeye82 am 16.04.18 12:28:17Nzuri Copper

http://www.asx.com.au/asxpdf/20180530/pdf/43vdq5bz0gq7fb.pdf

http://www.tembocapital.com/

http://en.huayou.com/

http://www.canaccordgenuity.com/

http://www.asx.com.au/asxpdf/20180530/pdf/43vdq5bz0gq7fb.pdf

http://www.tembocapital.com/

http://en.huayou.com/

http://www.canaccordgenuity.com/

Antwort auf Beitrag Nr.: 57.765.571 von Popeye82 am 15.05.18 18:01:34Bluestone Resources

http://www.bluestoneresources.ca/_resources/news/nr_20180530…

http://www.bluestoneresources.ca/_resources/news/nr_20180530…

Antwort auf Beitrag Nr.: 57.800.495 von Tirolesi am 21.05.18 07:55:09ja wer hätte das Gedacht,

Sand is running out,

wofür er (Sand) Alles GEBRAUCHT wird?

_____________________________

Dazu möchte ich nochmal ein bisschen Was raussuchen.

Und Warum Das; so Wies aussieht; so ist, auch.

Sand is running out,

wofür er (Sand) Alles GEBRAUCHT wird?

_____________________________

Dazu möchte ich nochmal ein bisschen Was raussuchen.

Und Warum Das; so Wies aussieht; so ist, auch.

Antwort auf Beitrag Nr.: 57.859.125 von Popeye82 am 29.05.18 18:34:51New Century Resources

https://wcsecure.weblink.com.au/pdf/NCZ/01986492.pdf

https://wcsecure.weblink.com.au/pdf/NCZ/01986492.pdf

Antwort auf Beitrag Nr.: 57.690.969 von Popeye82 am 03.05.18 23:27:16Armadale Capital Plc

https://polaris.brighterir.com/public/armadale_capital/news/…

https://polaris.brighterir.com/public/armadale_capital/news/…

Antwort auf Beitrag Nr.: 57.862.131 von Popeye82 am 30.05.18 01:27:17TNG

http://tngltd.com.au/investor_centre/media_articles.phtml

http://tngltd.com.au/investor_centre/media_articles.phtml

Antwort auf Beitrag Nr.: 57.782.002 von Popeye82 am 17.05.18 15:40:20Filo Mining

http://www.filo-mining.com/news/2018/filo-mining-drills-130-…

http://www.filo-mining.com/news/2018/filo-mining-drills-130-…

Antwort auf Beitrag Nr.: 57.862.236 von Popeye82 am 30.05.18 05:33:27American Pacific Borate + Lithium