starke, interessante, bombenstarke "Machbarkeitsstudien" - 500 Beiträge pro Seite (Seite 7)

eröffnet am 12.06.14 14:12:18 von

neuester Beitrag 31.05.21 14:26:18 von

neuester Beitrag 31.05.21 14:26:18 von

Beiträge: 10.349

ID: 1.195.350

ID: 1.195.350

Aufrufe heute: 1

Gesamt: 279.091

Gesamt: 279.091

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 865 | |

| vor 1 Stunde | 851 | |

| vor 1 Stunde | 806 | |

| vor 40 Minuten | 792 | |

| gestern 21:21 | 721 | |

| vor 55 Minuten | 519 | |

| vor 47 Minuten | 483 | |

| vor 32 Minuten | 399 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.161,01 | +1,36 | 217 | |||

| 2. | 3. | 0,1885 | -0,26 | 90 | |||

| 3. | 2. | 1,1800 | -14,49 | 77 | |||

| 4. | 5. | 9,3500 | +1,14 | 60 | |||

| 5. | 4. | 157,24 | -0,91 | 50 | |||

| 6. | Neu! | 0,3044 | +4,32 | 36 | |||

| 7. | Neu! | 4,7950 | +6,91 | 34 | |||

| 8. | Neu! | 11,905 | +14,97 | 31 |

gold, in "wilder" Ecke.

schon recht grosses deposit, recht fettes; pot.; outputding.

kann man MAL GUCKEN WIES WEITERGEHT.

ein grosser Negativpunkt ist dass Diese deposits sehr, sehr "zer"sprengt sind.

Chaarat Gold Holdings

http://www.mining-journal.com/leadership/news/1315473/chaara…

http://www.chaarat.com/wp-content/uploads/2018/02/Chaarat_Pr…

http://www.chaarat.com/wp-content/uploads/2017/08/Ministry-o…

http://www.chaarat.com/investors/rns/

http://www.chaarat.com/project/kyzyltash/

http://www.chaarat.com/project/development/

http://www.chaarat.com/project/

schon recht grosses deposit, recht fettes; pot.; outputding.

kann man MAL GUCKEN WIES WEITERGEHT.

ein grosser Negativpunkt ist dass Diese deposits sehr, sehr "zer"sprengt sind.

Chaarat Gold Holdings

http://www.mining-journal.com/leadership/news/1315473/chaara…

http://www.chaarat.com/wp-content/uploads/2018/02/Chaarat_Pr…

http://www.chaarat.com/wp-content/uploads/2017/08/Ministry-o…

http://www.chaarat.com/investors/rns/

http://www.chaarat.com/project/kyzyltash/

http://www.chaarat.com/project/development/

http://www.chaarat.com/project/

Antwort auf Beitrag Nr.: 57.028.257 von Popeye82 am 14.02.18 22:34:33sehr interessanter wachstumsplan... voll genehmigt.

an kompaktheit fehlt es etwas, stimmt schon

mal davon abgsehen von der bewertung den eckdaten, dem plan... so in derart stell ich mir das gerne vor. kyrgyzstan ist schon etwas schwierig von den leuten her (siehe centerra oder highland)

china gold buddelt wohl in der nähe.

von der bewertung her ist das auch ganz nett... weiss nur nicht wegen KE, debt oder wie sie da vorgehen. wenn sie das mit wenig verwässerung so hinbekommen, na dann...

an kompaktheit fehlt es etwas, stimmt schon

mal davon abgsehen von der bewertung den eckdaten, dem plan... so in derart stell ich mir das gerne vor. kyrgyzstan ist schon etwas schwierig von den leuten her (siehe centerra oder highland)

china gold buddelt wohl in der nähe.

von der bewertung her ist das auch ganz nett... weiss nur nicht wegen KE, debt oder wie sie da vorgehen. wenn sie das mit wenig verwässerung so hinbekommen, na dann...

Antwort auf Beitrag Nr.: 56.929.793 von Popeye82 am 05.02.18 07:25:32Cardinal Resources

Cardinal OUT, to outperform peers; Dual-listed Cardinal Resources (ASX:CDV; TSX:CDV) is aiming high in 2018 as its experienced management team continues to de-risk its flagship, large-scale Namdini openpit gold project in Ghana

http://www.mining-journal.com/resourcestocks-company-profile…

"Managing director and CEO Archie Koimtsidis said Cardinal provided investors with exposure to potentially a world-class development gold asset, with the company de-risking and advancing the project towards development with a management team with extensive in-country experience.

"The company expects to continue to generate positive news flow from its infill drill campaign, metallurgical optimisation work, greenfield exploration assets and preliminary economic assessment due in the first quarter of 2018," he told Mining Journal.

"Given the recently completed drill programme at Namdini, growing mineral resources and expected positive PEA, the company believes it should outperform its peer group during 2018."

Namdini's indicated mineral resource has increased to 120 million tonnes grading 1.1g/t gold for 4.3 million ounces with an inferred mineral resource of 84Mt grading 1.2g/t for 3.1Moz at a 0.5g/t cutoff.

Infill drilling has continued to point to the scope of the resource with recently produced high-grade gold results including 13m at 4.9g/t from surface and 9m at 4.1g/t from 414m.

alt='Infill drilling has produced high-grade gold results'

Infill drilling has produced high-grade gold results

"Recent grade control starter pit drilling results have been extremely positive and suggest a higher grade, low strip scenario could dramatically reduce the payback period for this large-scale development project," Koimtsidis said.

Along with achieving the PEA this quarter, Cardinal will continue to release results from its ongoing infill drill programme that will lead to an updated mineral resource estimate.

"The company anticipates an upgrade in mineral resources and a well-defined starter pit, when the update is released," Koimtsidis said.

Cardinal has already reached significant milestones - it has a mining licence in hand for Namdini and filed an Environmental Impact Statement in August.

Koimtsidis said the EIS was tracking well and he anticipated permitting approvals by mid-year.

"As for production, it's a bit early for us to place a timeframe on that but we can say that we will be very active in seeking out funding options once our PEA is reported to the market during Q1-2018," he said.

Namdini is located in the Nangodi Greenstone Belt (NGB), where the main lithology in the belt are volcanic-sediment sequences of Birimian age (interbedded basic to intermediate flows, felsic tuffs and fine-grained sediments) overlying earlier sedimentary basins (greywackes and phyllites) of the Tarkwaian formation.

Locally, the NGB trends north-northeast to south-southwest over 30km and diverts to an east-northeast to south-southwest trend in the south of the area around Namdini.

In all rock types, mineralisation is associated with disseminated sulphides of pyrite and minor arsenopyrite, in both the veins and wall rocks. The mineralised zones are visually distinctive due to the presence of millimetre to centimetre wide quartz-carbonate veins that are commonly folded and contain yellow-brown sericite-carbonate selvedges.

Cardinal likes the lay of the land and recently extended its portfolio by agreeing to acquire two prospecting licences in northeast Ghana from a Kinross Gold Corp subsidiary.

alt='The company expects a positive PEA for Namdini this quarter'

The company expects a positive PEA for Namdini this quarter

The Kinross tenements are located along the Nangodi shear, and contain the historic Nangodi gold mine, which produced 18,620oz at 24.54g/t during the 1930s, Koimtsidis explained.

"The consolidation of the acquired land package with Cardinal's large scale Ndongo tenement, which is located on the same regional shear zone as the Namdini deposit, will allow Cardinal to progress its regional exploration programme," he said.

"Early mapping and sampling shows similarities with Namdini, particularly in relation to alteration."

Cardinal is busy implementing geophysical, structural, and large-scale soil sampling programmes on its greenfields properties in Ghana.

Preliminary work at Kungongo, about 45km west of Namdini, has identified a large-scale gold-in-soil anomaly measuring roughly 4.5km long by 300m wide.

The company believes there is potential to delineate a resource from this indicative anomaly.

Cardinal's two additional exploration properties located close to the Namdini deposit, Ndongo and Bongo, take the total land package in the Bolgatanga district to over 900km2.

Cardinal had ongoing soil sampling and geophysics programmes running at Ndongo at the time of going to press.

On top of expanding its landholding and exploration activity, the company has broadened its investor base, adding a TSX listing in July 2017.

Six months on, Koimtsidis said the dual listing provided a broader awareness of the significant gold discovery that Namdini represents.

"The TSX listing has enhanced the company's support by the North American and Australian investment communities," he said.

"It was timely given the substantial amount of activity being conducted to complete our PEA.

"Further, North American investors have a very good understanding of the West African mining scene and, with the listing on the TSX, it has provided the opportunity for the company to be compared with its North American peers also operating in West Africa."

A clear indication of the support Cardinal is attracting is the C$12 million (US$9.6 million) bought deal financing announced in October, which will add to the near A$20 million (US$16 million) the company had in cash at the end of September.

Koimtsidis said there were several key reasons for attracting such strong support - namely the attractive jurisdiction, Cardinal management's extensive in-country and mining experience and the project's location advantages.

He said Ghana was home to several junior, intermediate and senior mining companies and had a long history of mining, plus a stable political system.

"Ghana has an established mining and tax regime in place that provides a clear framework for advancing projects," he said.

"The company is led by a strong management and development team who have extensive experience in Ghana and other African countries."

alt='Cardinal Resources MD and CEO Archie Koimtsidis'

Cardinal Resources MD and CEO Archie Koimtsidis

Koimtsidis splits his time between Ghana and the company's head office in Perth, Western Australia, and the board members represent further in-country expertise, finance and mine discovery and development experience.

"The Namdini project location has a lot of attractive advantages from a development and infrastructure point of view, being located near water, power and sealed roads to air and sea ports," Koimtsidis added.

"Ghana also provides skilled labour through its extensive history of mining and the large number of operating mines in country."

As 2018 begins to unfold, Koimtsidis said investors could expect to see positive news flow from Cardinal's ongoing drill campaign, metallurgical optimisation work, greenfield exploration results, a PEA and mineral resource update.

"More detailed studies will continue through 2018 with expected releases of exploration results, detailed metallurgy, engineering design work and PFS results," he concluded."

Cardinal OUT, to outperform peers; Dual-listed Cardinal Resources (ASX:CDV; TSX:CDV) is aiming high in 2018 as its experienced management team continues to de-risk its flagship, large-scale Namdini openpit gold project in Ghana

http://www.mining-journal.com/resourcestocks-company-profile…

"Managing director and CEO Archie Koimtsidis said Cardinal provided investors with exposure to potentially a world-class development gold asset, with the company de-risking and advancing the project towards development with a management team with extensive in-country experience.

"The company expects to continue to generate positive news flow from its infill drill campaign, metallurgical optimisation work, greenfield exploration assets and preliminary economic assessment due in the first quarter of 2018," he told Mining Journal.

"Given the recently completed drill programme at Namdini, growing mineral resources and expected positive PEA, the company believes it should outperform its peer group during 2018."

Namdini's indicated mineral resource has increased to 120 million tonnes grading 1.1g/t gold for 4.3 million ounces with an inferred mineral resource of 84Mt grading 1.2g/t for 3.1Moz at a 0.5g/t cutoff.

Infill drilling has continued to point to the scope of the resource with recently produced high-grade gold results including 13m at 4.9g/t from surface and 9m at 4.1g/t from 414m.

alt='Infill drilling has produced high-grade gold results'

Infill drilling has produced high-grade gold results

"Recent grade control starter pit drilling results have been extremely positive and suggest a higher grade, low strip scenario could dramatically reduce the payback period for this large-scale development project," Koimtsidis said.

Along with achieving the PEA this quarter, Cardinal will continue to release results from its ongoing infill drill programme that will lead to an updated mineral resource estimate.

"The company anticipates an upgrade in mineral resources and a well-defined starter pit, when the update is released," Koimtsidis said.

Cardinal has already reached significant milestones - it has a mining licence in hand for Namdini and filed an Environmental Impact Statement in August.

Koimtsidis said the EIS was tracking well and he anticipated permitting approvals by mid-year.

"As for production, it's a bit early for us to place a timeframe on that but we can say that we will be very active in seeking out funding options once our PEA is reported to the market during Q1-2018," he said.

Namdini is located in the Nangodi Greenstone Belt (NGB), where the main lithology in the belt are volcanic-sediment sequences of Birimian age (interbedded basic to intermediate flows, felsic tuffs and fine-grained sediments) overlying earlier sedimentary basins (greywackes and phyllites) of the Tarkwaian formation.

Locally, the NGB trends north-northeast to south-southwest over 30km and diverts to an east-northeast to south-southwest trend in the south of the area around Namdini.

In all rock types, mineralisation is associated with disseminated sulphides of pyrite and minor arsenopyrite, in both the veins and wall rocks. The mineralised zones are visually distinctive due to the presence of millimetre to centimetre wide quartz-carbonate veins that are commonly folded and contain yellow-brown sericite-carbonate selvedges.

Cardinal likes the lay of the land and recently extended its portfolio by agreeing to acquire two prospecting licences in northeast Ghana from a Kinross Gold Corp subsidiary.

alt='The company expects a positive PEA for Namdini this quarter'

The company expects a positive PEA for Namdini this quarter

The Kinross tenements are located along the Nangodi shear, and contain the historic Nangodi gold mine, which produced 18,620oz at 24.54g/t during the 1930s, Koimtsidis explained.

"The consolidation of the acquired land package with Cardinal's large scale Ndongo tenement, which is located on the same regional shear zone as the Namdini deposit, will allow Cardinal to progress its regional exploration programme," he said.

"Early mapping and sampling shows similarities with Namdini, particularly in relation to alteration."

Cardinal is busy implementing geophysical, structural, and large-scale soil sampling programmes on its greenfields properties in Ghana.

Preliminary work at Kungongo, about 45km west of Namdini, has identified a large-scale gold-in-soil anomaly measuring roughly 4.5km long by 300m wide.

The company believes there is potential to delineate a resource from this indicative anomaly.

Cardinal's two additional exploration properties located close to the Namdini deposit, Ndongo and Bongo, take the total land package in the Bolgatanga district to over 900km2.

Cardinal had ongoing soil sampling and geophysics programmes running at Ndongo at the time of going to press.

On top of expanding its landholding and exploration activity, the company has broadened its investor base, adding a TSX listing in July 2017.

Six months on, Koimtsidis said the dual listing provided a broader awareness of the significant gold discovery that Namdini represents.

"The TSX listing has enhanced the company's support by the North American and Australian investment communities," he said.

"It was timely given the substantial amount of activity being conducted to complete our PEA.

"Further, North American investors have a very good understanding of the West African mining scene and, with the listing on the TSX, it has provided the opportunity for the company to be compared with its North American peers also operating in West Africa."

A clear indication of the support Cardinal is attracting is the C$12 million (US$9.6 million) bought deal financing announced in October, which will add to the near A$20 million (US$16 million) the company had in cash at the end of September.

Koimtsidis said there were several key reasons for attracting such strong support - namely the attractive jurisdiction, Cardinal management's extensive in-country and mining experience and the project's location advantages.

He said Ghana was home to several junior, intermediate and senior mining companies and had a long history of mining, plus a stable political system.

"Ghana has an established mining and tax regime in place that provides a clear framework for advancing projects," he said.

"The company is led by a strong management and development team who have extensive experience in Ghana and other African countries."

alt='Cardinal Resources MD and CEO Archie Koimtsidis'

Cardinal Resources MD and CEO Archie Koimtsidis

Koimtsidis splits his time between Ghana and the company's head office in Perth, Western Australia, and the board members represent further in-country expertise, finance and mine discovery and development experience.

"The Namdini project location has a lot of attractive advantages from a development and infrastructure point of view, being located near water, power and sealed roads to air and sea ports," Koimtsidis added.

"Ghana also provides skilled labour through its extensive history of mining and the large number of operating mines in country."

As 2018 begins to unfold, Koimtsidis said investors could expect to see positive news flow from Cardinal's ongoing drill campaign, metallurgical optimisation work, greenfield exploration results, a PEA and mineral resource update.

"More detailed studies will continue through 2018 with expected releases of exploration results, detailed metallurgy, engineering design work and PFS results," he concluded."

Antwort auf Beitrag Nr.: 56.857.001 von Popeye82 am 29.01.18 04:21:15Sayona Mining

http://www.asx.com.au/asxpdf/20180215/pdf/43rllbv09mqb2s.pdf

http://www.sgs.ca/

http://www.asx.com.au/asxpdf/20180215/pdf/43rllbv09mqb2s.pdf

http://www.sgs.ca/

Antwort auf Beitrag Nr.: 56.942.816 von Popeye82 am 06.02.18 05:59:18Tawana Resources (NL)(/"AMAL")

http://spcagent.co/tawana/wp-content/uploads/sites/37/2018/0…

http://www.primero.com.au/

http://spcagent.co/tawana/wp-content/uploads/sites/37/2018/0…

http://www.primero.com.au/

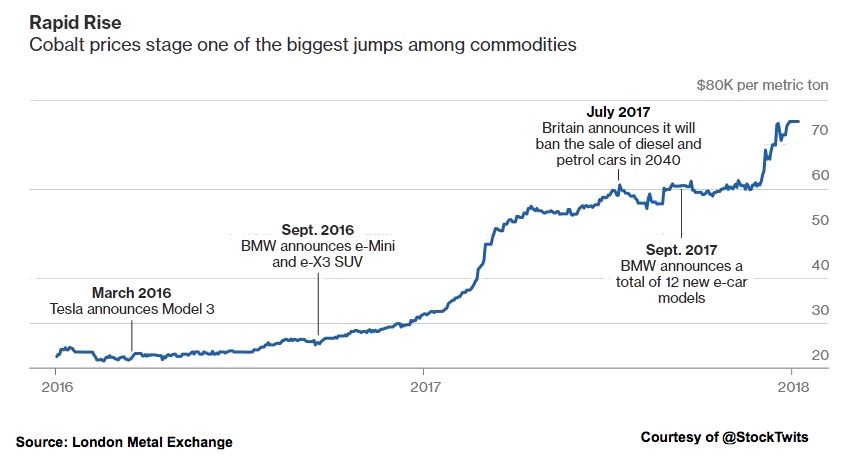

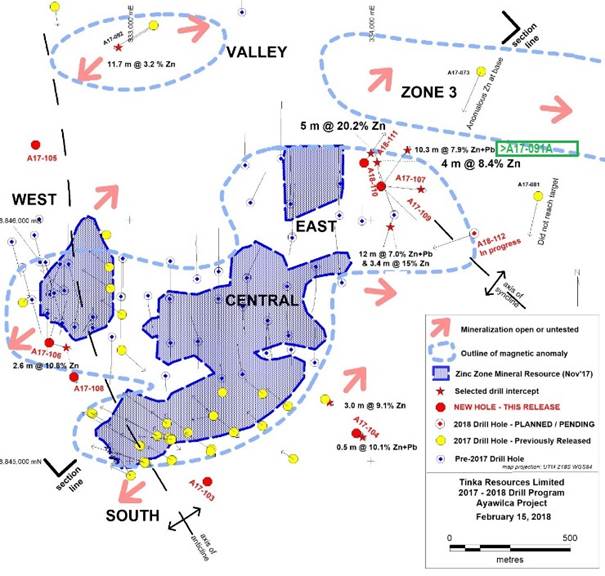

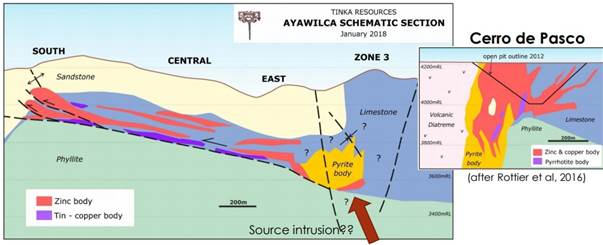

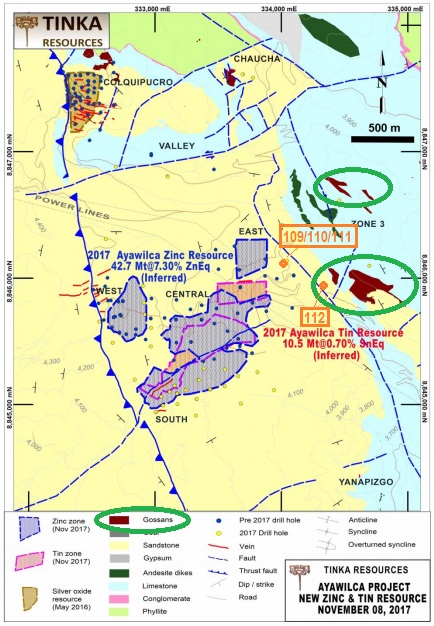

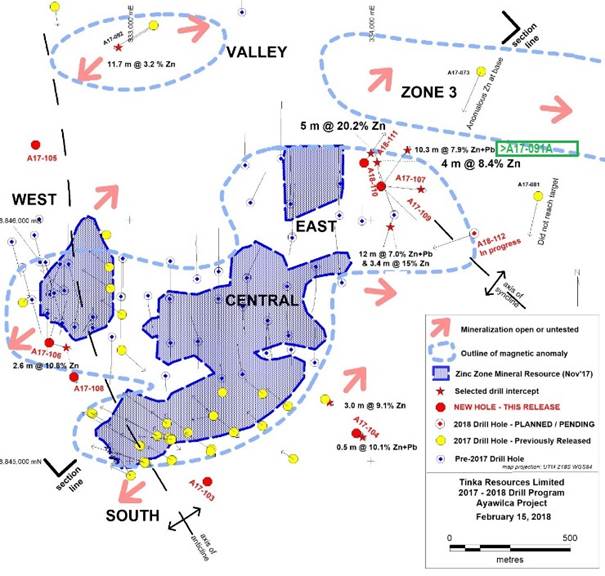

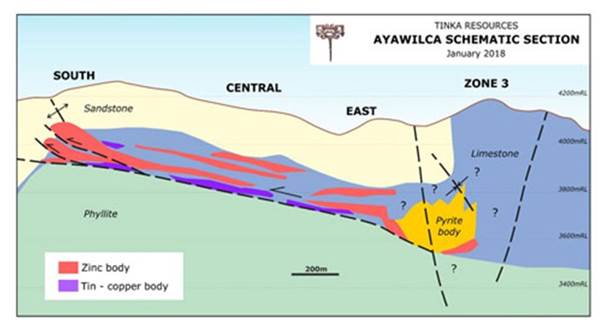

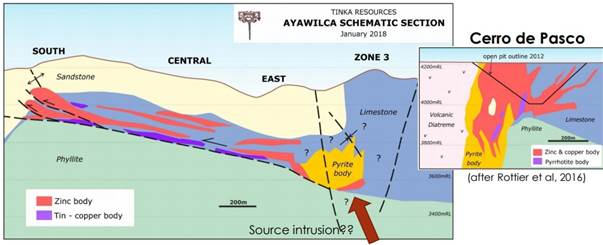

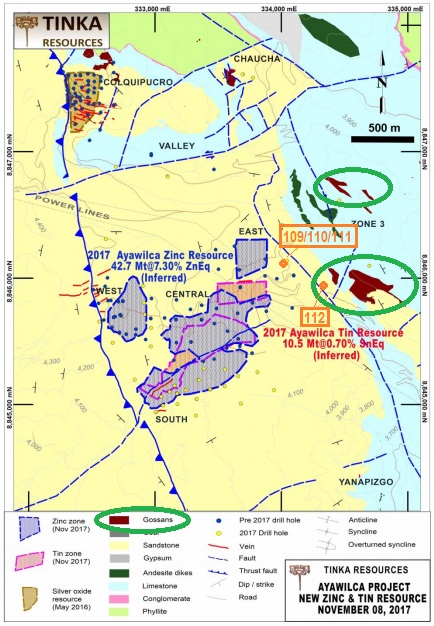

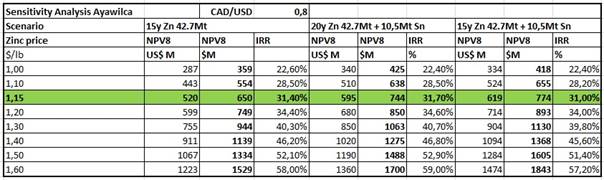

Antwort auf Beitrag Nr.: 56.819.854 von Popeye82 am 24.01.18 23:55:44Tinka Resources

http://www.tinkaresources.com/news/tinka-appoints-chairman-t…

http://www.tinkaresources.com/news/tinka-appoints-chairman-t…

Antwort auf Beitrag Nr.: 56.665.685 von Popeye82 am 09.01.18 19:37:27Egan Street Resources

http://www.asx.com.au/asxpdf/20180215/pdf/43rlgx104sqxt2.pdf

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.asx.com.au/asxpdf/20180215/pdf/43rlgx104sqxt2.pdf

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.eganstreetresources.com.au/wp-content/uploads/201…

http://www.eganstreetresources.com.au/wp-content/uploads/201…

Antwort auf Beitrag Nr.: 57.030.036 von Popeye82 am 15.02.18 08:52:15Tinka Resources

http://www.tinkaresources.com/news/tinka-drills-5-metres-gra…

http://www.tinkaresources.com/news/tinka-drills-5-metres-gra…

Antwort auf Beitrag Nr.: 56.912.333 von Popeye82 am 02.02.18 13:56:24KÖNNTE Hier noch relevant werden.

weiterer Lithiumer.

SÜdamerika.

______________________

das wird langsam ziemlich gross.

und da dürfte noch Einiges, Einiges möglich sein.

LSC Lithium

http://www.lsclithium.com/news-and-media/news-releases/press…

weiterer Lithiumer.

SÜdamerika.

______________________

das wird langsam ziemlich gross.

und da dürfte noch Einiges, Einiges möglich sein.

LSC Lithium

http://www.lsclithium.com/news-and-media/news-releases/press…

Antwort auf Beitrag Nr.: 56.454.170 von Popeye82 am 14.12.17 22:26:26ich werde weiter investigativ reporten.

wir werden die Wahrheit RAUSkriegen.

_________________________________________________________________

Ardea Resources

https://ardearesources.com.au/downloads/announcements/arl_20…

https://ardearesources.com.au/downloads/reports/arl_qa201712…

wir werden die Wahrheit RAUSkriegen.

_________________________________________________________________

Ardea Resources

https://ardearesources.com.au/downloads/announcements/arl_20…

https://ardearesources.com.au/downloads/reports/arl_qa201712…

Antwort auf Beitrag Nr.: 56.998.407 von Popeye82 am 11.02.18 17:05:30Jangada Mines Plc(/Ivanhoe Mines)

Platinum market set for another surplus in 2018 —Johnson Matthey

http://www.mining.com/web/platinum-market-set-another-surplu…

"The platinum market is set for another surplus this year after recording oversupply of 110,000 ounces in 2017, Johnson Matthey said in a report on Wednesday, although its sister metal palladium is tipped to see another deficit.

Platinum demand fell nearly 7 percent last year, with sharp falls seen in Japanese investment and Chinese jewellery buying as well as a slowdown in consumption by carmakers, who use the metal in catalytic converters, the company said.

Chinese jewellery buying was forecast to fall for a fifth year in 2018, it said, while autocatalyst demand was expected to keep shrinking. But it said a rise in industrial demand was likely to lead to a slight increase in overall demand.

"Before accounting for investment, we expect global platinum consumption to rise slightly," said Johnson Matthey, a leading manufacturer of vehicle catalysts.

"However, this will be matched by a modest increase in combined primary and secondary supplies, mainly due to rising recoveries from autocatalyst scrap," it said.

"Assuming that investment demand in 2018 is similar to last year, the market is likely to remain in modest surplus," it added.

The palladium market was expected to remain in deficit, it said. Automotive demand, which rose 6 percent last year to 8.424 million ounces, was expected to hit another record high next year, in line with a rise in gasoline vehicle output.

Supply, which declined 2 percent last year, was expected to rise slightly, but the market was set to remain in deficit after recording a shortfall of 629,000 ounces last year.

"The market will almost certainly remain in deficit, but the size of the shortfall will be determined primarily by the investment sector, where demand has been negative for the last three years," Johnson Matthey said.

Palladium-backed exchange-traded funds have seen "heavy and prolonged" selling since their holdings peaked in late 2014, the company said. Investors had taken advantage of a sharp rise in prices to take profits, it said.

Palladium was the best performer among major precious metals last year, surging 56 percent to post its biggest annual rise since 2010. The metal extended gains in January to hit a record $1,138 an ounce, but has since retreated.

Platinum in contrast edged up less than 3 percent as concerns over diesel's shrinking market share weighed on prices. That lifted palladium into a premium over platinum for the first time since 2001, reaching more than $150 an ounce late last year.

(Reporting by Jan Harvey; Editing by Edmund Blair)"

Platinum market set for another surplus in 2018 —Johnson Matthey

http://www.mining.com/web/platinum-market-set-another-surplu…

"The platinum market is set for another surplus this year after recording oversupply of 110,000 ounces in 2017, Johnson Matthey said in a report on Wednesday, although its sister metal palladium is tipped to see another deficit.

Platinum demand fell nearly 7 percent last year, with sharp falls seen in Japanese investment and Chinese jewellery buying as well as a slowdown in consumption by carmakers, who use the metal in catalytic converters, the company said.

Chinese jewellery buying was forecast to fall for a fifth year in 2018, it said, while autocatalyst demand was expected to keep shrinking. But it said a rise in industrial demand was likely to lead to a slight increase in overall demand.

"Before accounting for investment, we expect global platinum consumption to rise slightly," said Johnson Matthey, a leading manufacturer of vehicle catalysts.

"However, this will be matched by a modest increase in combined primary and secondary supplies, mainly due to rising recoveries from autocatalyst scrap," it said.

"Assuming that investment demand in 2018 is similar to last year, the market is likely to remain in modest surplus," it added.

The palladium market was expected to remain in deficit, it said. Automotive demand, which rose 6 percent last year to 8.424 million ounces, was expected to hit another record high next year, in line with a rise in gasoline vehicle output.

Supply, which declined 2 percent last year, was expected to rise slightly, but the market was set to remain in deficit after recording a shortfall of 629,000 ounces last year.

"The market will almost certainly remain in deficit, but the size of the shortfall will be determined primarily by the investment sector, where demand has been negative for the last three years," Johnson Matthey said.

Palladium-backed exchange-traded funds have seen "heavy and prolonged" selling since their holdings peaked in late 2014, the company said. Investors had taken advantage of a sharp rise in prices to take profits, it said.

Palladium was the best performer among major precious metals last year, surging 56 percent to post its biggest annual rise since 2010. The metal extended gains in January to hit a record $1,138 an ounce, but has since retreated.

Platinum in contrast edged up less than 3 percent as concerns over diesel's shrinking market share weighed on prices. That lifted palladium into a premium over platinum for the first time since 2001, reaching more than $150 an ounce late last year.

(Reporting by Jan Harvey; Editing by Edmund Blair)"

Antwort auf Beitrag Nr.: 57.023.160 von Popeye82 am 14.02.18 14:21:48TNG

http://tngltd.com.au/investor_centre/media_articles.phtml

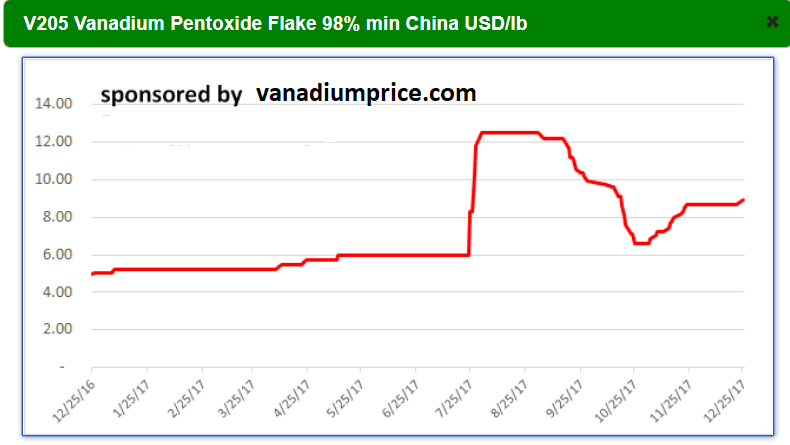

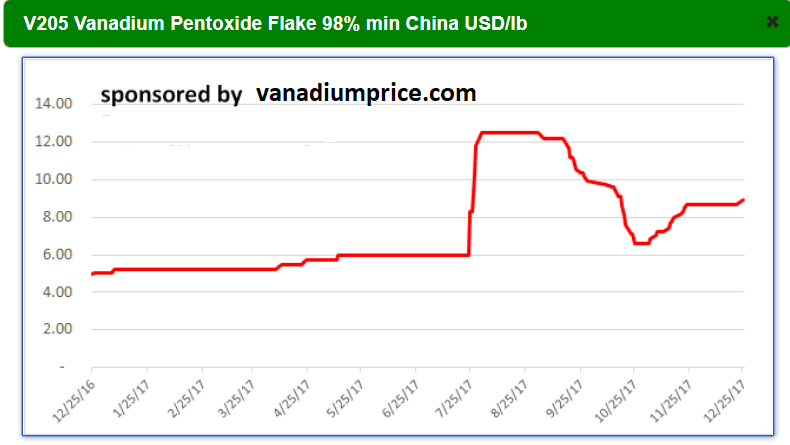

" Metal Bulletin reports that vanadium markets in Europe and USA are strengthening further due to stronger demand and continued supply concerns. V2O5 prices are now firm above US$13/lb, 6% higher than last month.

"People are very short on material right now, especially traders" a US-based supplier source said.

In China, vanadium market is slower with fewer exports quotations ahead of the Chinese New Year’s holidays.

However, a sources reckons that "the current tight supply in V2O5 is expected to persist in the next months, and the sharp demand growth (in China) may happen in the second half of the year if no additional production fills the gap"."

http://tngltd.com.au/investor_centre/media_articles.phtml

" Metal Bulletin reports that vanadium markets in Europe and USA are strengthening further due to stronger demand and continued supply concerns. V2O5 prices are now firm above US$13/lb, 6% higher than last month.

"People are very short on material right now, especially traders" a US-based supplier source said.

In China, vanadium market is slower with fewer exports quotations ahead of the Chinese New Year’s holidays.

However, a sources reckons that "the current tight supply in V2O5 is expected to persist in the next months, and the sharp demand growth (in China) may happen in the second half of the year if no additional production fills the gap"."

Antwort auf Beitrag Nr.: 57.000.192 von Popeye82 am 12.02.18 00:22:20Allegiance Coal

http://www.allegiancecoal.com.au//irm/showdownloaddoc.aspx?A…

http://www.allegiancecoal.com.au//irm/showdownloaddoc.aspx?A…

Antwort auf Beitrag Nr.: 56.722.587 von Popeye82 am 15.01.18 19:37:06Aguia Resources

http://www.asx.com.au/asxpdf/20180215/pdf/43rlsjm2n0rhc2.pdf

http://www.asx.com.au/asxpdf/20180215/pdf/43rlsjm2n0rhc2.pdf

Antwort auf Beitrag Nr.: 56.901.167 von Popeye82 am 01.02.18 16:37:21HISTORIC PNG day

schon auch interessantes DIng. überlege sich da evt mal ein paar; spekulativ; reinzuschaufeln. die Strategie ist äusserst interessant, Etwas wirklich Spezielles. m.E. ein "VERDAMMTES impact Ding". (für Das (operating) LAND) aber ich würde mal sagen (bis Jetzt) nicht "übergut kalkulierbar".

____________________________________________________________________

Mayur Resources

http://www.investi.com.au/api/announcements/mrl/ab247a9b-eb2…

http://mayurresources.com/industrial-sands/

schon auch interessantes DIng. überlege sich da evt mal ein paar; spekulativ; reinzuschaufeln. die Strategie ist äusserst interessant, Etwas wirklich Spezielles. m.E. ein "VERDAMMTES impact Ding". (für Das (operating) LAND) aber ich würde mal sagen (bis Jetzt) nicht "übergut kalkulierbar".

____________________________________________________________________

Mayur Resources

http://www.investi.com.au/api/announcements/mrl/ab247a9b-eb2…

http://mayurresources.com/industrial-sands/

Antwort auf Beitrag Nr.: 57.008.070 von Popeye82 am 12.02.18 21:51:47Telson Resources

http://www.telsonresources.com/images/NewsReleases/2018_News…

http://www.telsonresources.com/images/NewsReleases/2018_News…

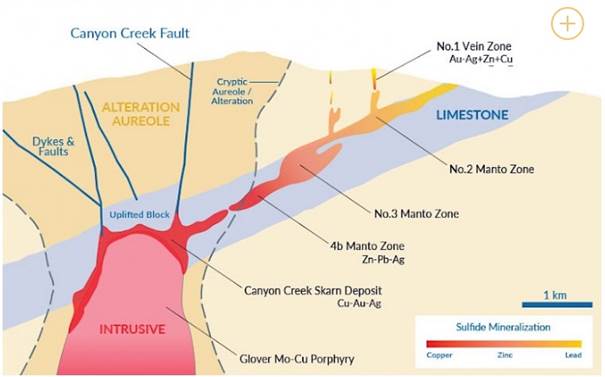

Antwort auf Beitrag Nr.: 56.864.633 von Popeye82 am 29.01.18 18:00:36Callinex Mines

https://callinex.ca/callinex-intersects-11-8m-3-9-zinc-equiv…

https://callinex.ca/callinex-announces-flow-financing-advanc…

https://callinex.ca/callinex-intersects-11-8m-3-9-zinc-equiv…

https://callinex.ca/callinex-announces-flow-financing-advanc…

Antwort auf Beitrag Nr.: 57.000.510 von Popeye82 am 12.02.18 07:17:21Triton Minerals

http://www.asx.com.au/asxpdf/20180215/pdf/43rlmjz92sglk5.pdf

http://www.argonautfinancial.com.au/

http://www.asx.com.au/asxpdf/20180214/pdf/43rktm6v1nt2zm.pdf

http://adpgroup.com/lycopodium-adp/

http://www.asx.com.au/asxpdf/20180215/pdf/43rlmjz92sglk5.pdf

http://www.argonautfinancial.com.au/

http://www.asx.com.au/asxpdf/20180214/pdf/43rktm6v1nt2zm.pdf

http://adpgroup.com/lycopodium-adp/

Antwort auf Beitrag Nr.: 56.881.514 von Popeye82 am 31.01.18 08:11:59Metalicity

http://www.asx.com.au/asxpdf/20180216/pdf/43rn524w7q5z1c.pdf

http://www.optiro.com/

http://www.asx.com.au/asxpdf/20180205/pdf/43rc0m7h6yz6jh.pdf

http://www.asx.com.au/asxpdf/20180205/pdf/43rc0v0r6mrhyk.pdf

http://www.asx.com.au/asxpdf/20180201/pdf/43r80b3tsnqjkg.pdf

http://www.asx.com.au/asxpdf/20180205/pdf/43rc0v0r6mrhyk.pdf

http://www.asx.com.au/asxpdf/20180216/pdf/43rn524w7q5z1c.pdf

http://www.optiro.com/

http://www.asx.com.au/asxpdf/20180205/pdf/43rc0m7h6yz6jh.pdf

http://www.asx.com.au/asxpdf/20180205/pdf/43rc0v0r6mrhyk.pdf

http://www.asx.com.au/asxpdf/20180201/pdf/43r80b3tsnqjkg.pdf

http://www.asx.com.au/asxpdf/20180205/pdf/43rc0v0r6mrhyk.pdf

Antwort auf Beitrag Nr.: 56.979.941 von Popeye82 am 09.02.18 05:43:44Niocorp Developments

http://www.niocorp.com/index.php/press-releases/381-niocorp-…

http://www.whitehouse.gov/

http://www.federalregister.gov/documents/2018/02/16/2018-032…

http://www.niocorp.com/images/Letter-to-Interior-Defense-Com…

http://www.whitehouse.gov/presidential-actions/presidential-…

https://governor.nebraska.gov/

https://bacon.house.gov/

https://adriansmith.house.gov/

http://www.niocorp.com/index.php/press-releases/381-niocorp-…

http://www.whitehouse.gov/

http://www.federalregister.gov/documents/2018/02/16/2018-032…

http://www.niocorp.com/images/Letter-to-Interior-Defense-Com…

http://www.whitehouse.gov/presidential-actions/presidential-…

https://governor.nebraska.gov/

https://bacon.house.gov/

https://adriansmith.house.gov/

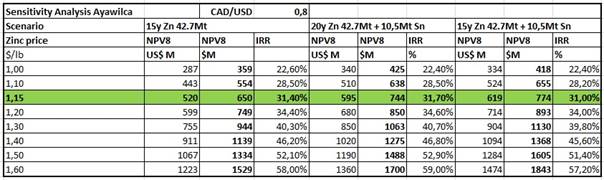

Antwort auf Beitrag Nr.: 57.034.362 von Popeye82 am 15.02.18 16:01:57Tinka Resources

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

Antwort auf Beitrag Nr.: 57.023.859 von Popeye82 am 14.02.18 15:21:13Kutcho Copper

http://www.kutcho.ca/investors/news-releases/2018/kutcho-cop…

http://energyandgold.com/2018/02/14/kutcho-copper-restarts-b…

http://www.kutcho.ca/investors/news-releases/2018/kutcho-cop…

http://energyandgold.com/2018/02/14/kutcho-copper-restarts-b…

Antwort auf Beitrag Nr.: 56.997.894 von Popeye82 am 11.02.18 15:01:46kenne Das Projekt seit Mehreren Jahren bisschen,

bin interessiert.

künftiger buy nicht ausgeschlossen,

aber bis dato nicht klar.

mal sehen ob Der KAHN ABSÄUFT.

___________________________

habe Die Fährte (wieder)aufgenommen:

Ergebnis noch nicht so ganz klar.

wird wohl schon noch 2-3 Wasser den Bach(runter) dauern. brauchen.

Manhattan(/Trans-Tasman Resources)

http://www.stuff.co.nz/business/100928922/iron-sand-miner-tt…

http://www.stuff.co.nz/business/industries/95546761/ttr-iron…

http://www.stuff.co.nz/business/96365775/four-appeals-lodged…

"Iron sand miner to fast track South Taranaki mining plans if appeals against project fail

MIKE WATSON

Last updated 18:14, January 26 2018

Protestors voice their concern over consent given to TTR to dredge the seabed for ironsand

A proposed new company that will hold the rights to mine iron sand off the coast of Taranaki plans to fast track the mining project if appeals against it fail.

Trans-Tasman Resources this week announced its plans to merge with Perth-based Manhattan Corporation, a company part owned by TTR directors Alan Eggers and John Seton, Manhattan Corporation reported.

Should the merger go ahead Manhattan will acquire all of TTR assets in return for 706 million ordinary shares and 706 million performance shares valued at $36.4m, based on Manhattan's latest traded share price of 26c a share.

TTR's plans to dredge the seabed off the Taranaki coast for ironsand is being appealed.

In August New Zealand's Environmental Protection Authority granted TTR marine and discharge consents to annually mine 50 million tonnes of iron sand over 35 years in the South Taranaki Bight.

READ MORE:

* Seven appeals lodged in High Court to fight Taranaki ironsand mining plan

* Controversial plan to mine seabed for iron ore approved in split decision

A remote controlled dredge will vacuum sand from the sea bed between depths of 20 metres and 42m, at a rate of 8000 tonnes an hour, to a processing ship. The dredging is earmarked in an area 22 kilometres to 36km off the coastline from Patea.

The proposal was widely opposed and the EPA decison has been appealed to the High Court by environment groups, including Kiwis Against Seabed Mining, Forest and Bird, and Greenpeace, as well as Taranaki iwi.

The hearing is scheduled to be held in Wellington between April 16-19 with a decision expected around July or August.

Should those appeals fail the company said it would fast track the Taranaki project and raise more capital.

So far TTR had spent $80m in preparation to dredge in the South Taranaki Bight.

Ad Feedback

If the appeals are successful the company could reapply to the EPA for consent and use funds raised towards their West Coast project.

TTR also have permission to dredge heavy mineral sands between 1km and 12km off the West Coast from Hokitika to Karamea, an area spanning 4440sqkm.

The area contains potential heavy mineral sands and precious metal deposits on the seabed at between 20m to 80m deep.

Manhattan have a mining stake in West Australia with an uranium project situated 200km north east of Kalgoorlie.

However the project is on hold, for at least four years, due to a state government decree not to approve new uranium mines.

The newly merged company would be called TTR Corporation and will be publicly listed on the Australian Stock Exchange.

Much of the iron sand mined off the South Taranaki coast would be sent to China, which imported more than 1 billion tonnes of iron ore in 2016 for steel making.

The EPA was split on the controversial seabed mining application lodged by TTR with two members of its four-person decision-making committee issuing a "strongly dissenting opinion".

But chairman Alick Shaw, made the casting vote to approve the application.

- Stuff "

bin interessiert.

künftiger buy nicht ausgeschlossen,

aber bis dato nicht klar.

mal sehen ob Der KAHN ABSÄUFT.

___________________________

habe Die Fährte (wieder)aufgenommen:

Ergebnis noch nicht so ganz klar.

wird wohl schon noch 2-3 Wasser den Bach(runter) dauern. brauchen.

Manhattan(/Trans-Tasman Resources)

http://www.stuff.co.nz/business/100928922/iron-sand-miner-tt…

http://www.stuff.co.nz/business/industries/95546761/ttr-iron…

http://www.stuff.co.nz/business/96365775/four-appeals-lodged…

"Iron sand miner to fast track South Taranaki mining plans if appeals against project fail

MIKE WATSON

Last updated 18:14, January 26 2018

Protestors voice their concern over consent given to TTR to dredge the seabed for ironsand

A proposed new company that will hold the rights to mine iron sand off the coast of Taranaki plans to fast track the mining project if appeals against it fail.

Trans-Tasman Resources this week announced its plans to merge with Perth-based Manhattan Corporation, a company part owned by TTR directors Alan Eggers and John Seton, Manhattan Corporation reported.

Should the merger go ahead Manhattan will acquire all of TTR assets in return for 706 million ordinary shares and 706 million performance shares valued at $36.4m, based on Manhattan's latest traded share price of 26c a share.

TTR's plans to dredge the seabed off the Taranaki coast for ironsand is being appealed.

In August New Zealand's Environmental Protection Authority granted TTR marine and discharge consents to annually mine 50 million tonnes of iron sand over 35 years in the South Taranaki Bight.

READ MORE:

* Seven appeals lodged in High Court to fight Taranaki ironsand mining plan

* Controversial plan to mine seabed for iron ore approved in split decision

A remote controlled dredge will vacuum sand from the sea bed between depths of 20 metres and 42m, at a rate of 8000 tonnes an hour, to a processing ship. The dredging is earmarked in an area 22 kilometres to 36km off the coastline from Patea.

The proposal was widely opposed and the EPA decison has been appealed to the High Court by environment groups, including Kiwis Against Seabed Mining, Forest and Bird, and Greenpeace, as well as Taranaki iwi.

The hearing is scheduled to be held in Wellington between April 16-19 with a decision expected around July or August.

Should those appeals fail the company said it would fast track the Taranaki project and raise more capital.

So far TTR had spent $80m in preparation to dredge in the South Taranaki Bight.

Ad Feedback

If the appeals are successful the company could reapply to the EPA for consent and use funds raised towards their West Coast project.

TTR also have permission to dredge heavy mineral sands between 1km and 12km off the West Coast from Hokitika to Karamea, an area spanning 4440sqkm.

The area contains potential heavy mineral sands and precious metal deposits on the seabed at between 20m to 80m deep.

Manhattan have a mining stake in West Australia with an uranium project situated 200km north east of Kalgoorlie.

However the project is on hold, for at least four years, due to a state government decree not to approve new uranium mines.

The newly merged company would be called TTR Corporation and will be publicly listed on the Australian Stock Exchange.

Much of the iron sand mined off the South Taranaki coast would be sent to China, which imported more than 1 billion tonnes of iron ore in 2016 for steel making.

The EPA was split on the controversial seabed mining application lodged by TTR with two members of its four-person decision-making committee issuing a "strongly dissenting opinion".

But chairman Alick Shaw, made the casting vote to approve the application.

- Stuff "

Antwort auf Beitrag Nr.: 56.966.789 von Popeye82 am 07.02.18 22:02:43ScoZinc Mining

http://www.miningmagazine.com/services/contracting/scozinc-r…

http://www.dynonobel.com/

http://www.dexter.ca/

http://www.miningmagazine.com/services/contracting/scozinc-r…

http://www.dynonobel.com/

http://www.dexter.ca/

Antwort auf Beitrag Nr.: 57.023.160 von Popeye82 am 14.02.18 14:21:48bin da evt. noch an Einem "side" play interessiert.

TNG auch nicht uninteressant für Mich.

TNG

http://www.energy-storage.news/news/chinese-governments-stra…

http://www.spartonres.ca/wp-content/uploads/2017/10/Guidance…

"Chinese government’s strategic push for energy storage to yield large flow battery projects

Published: 6 Nov 2017, 12:45

By:

Andy Colthorpe

Pu Neng flow batteries. The company, formerly known as Prudent Energy, received investment from Canadian company High Power Exploration (HPX), earlier this year. Image: Pu Neng.

A project demonstrating the integration of energy storage onto grid networks in Hubei, China, will see the first phase of a 10MW / 40MWh project built by Pu Neng, a vanadium flow battery manufacturer.

The first phase of the Hubei Zaoyang Storage Integration Demonstration Project will be a 3MW / 12MWh vanadium redox flow battery (VRB) in Zaoyang, Hubei Province. The battery storage system will be used to assist the integration of power from large-scale photovoltaics (PV) locally.

While the project sounds fairly significantly sized compared to other flow battery systems around the world, according to Pu Neng, the 40MWh project itself is going to soon be superseded in size in Hubei by a mammoth 100MW / 500MWh energy storage system that is expected to “be the cornerstone of a new smart energy grid” in the province, where it will fulfil the role of a peaking power plant, stabilising the local network.

Pu Neng signed a deal to develop the first phase of that project with Hubei Pingfan Vanadium Energy Storage Technology Company, a subsidiary of Hubei Pingfan, a mining and industrial metals and minerals company which is growing its interest in vanadium for energy storage. Pingfan apparently has more than one million tonnes of vanadium at one of its own reserves.

Perhaps more significantly, Hubei Pingfan was listed in the Chinese government’s 12th five-year plan of national strategy, issued in 2011, as a national pilot enterprise for vanadium. For the Hubei Zaoyang project, Pu Neng and Pingfan will develop vanadium electrolytes from local sources, which the project partners said will also help establish supply chains for the metal for future projects. The first phase of the project begins this month, for completion early next year.

National policy document calls for huge vanadium storage kick-start

Another more recently issued central government policy document, September’s “Guidance on the Promotion of Energy Storage Technology and Industry Development”, published by the China National Development and Reform Commission (NDRC), calls for more investment in energy storage, including flow batteries.

The NDRC has actually called for several vast flow battery systems, of over 100MW per system, to be deployed as trials and demonstrators. In fact, a 200MW / 800MWh vanadium energy storage project is being built already in Dalian, a city in the southern province of Liaoning, by Chinese system manufacturer Rongke Power and UniEnergy Technologies (UET).

Pu Neng chairman Robert Friedland described vanadium as a “miracle metal” which could “fundamentally transform” China’s power grid, adding that the country has the world’s “largest and highest-grade” vanadium resources.

“With massive amounts of renewable energy and storage coming online, China will create the most modern, clean and efficient grid in the world. Earlier this year, Chairman Xie and I discussed the opportunity to utilize Hubei's abundant vanadium resources and Pu Neng's next generation technology to set a new benchmark for the global energy storage industry. This is just the first step of what will be many projects working together,” Friedland said.

According to Robert Friedland, NDRC’s policy statement, which calls for demonstrators to be built by 2020, “will result in vanadium flow batteries revolutionizing modern electricity grids in the way that lithium-ion batteries are enabling the global transition to electric vehicles.”

Flow batteries are often used in circumstances where their scalability and ability to hold longer durations of energy storage for aggressive cycling perform more favourably than cheaper lithium-ion batteries, which tend to perform better in high-power, short duration applications."

TNG auch nicht uninteressant für Mich.

TNG

http://www.energy-storage.news/news/chinese-governments-stra…

http://www.spartonres.ca/wp-content/uploads/2017/10/Guidance…

"Chinese government’s strategic push for energy storage to yield large flow battery projects

Published: 6 Nov 2017, 12:45

By:

Andy Colthorpe

Pu Neng flow batteries. The company, formerly known as Prudent Energy, received investment from Canadian company High Power Exploration (HPX), earlier this year. Image: Pu Neng.

A project demonstrating the integration of energy storage onto grid networks in Hubei, China, will see the first phase of a 10MW / 40MWh project built by Pu Neng, a vanadium flow battery manufacturer.

The first phase of the Hubei Zaoyang Storage Integration Demonstration Project will be a 3MW / 12MWh vanadium redox flow battery (VRB) in Zaoyang, Hubei Province. The battery storage system will be used to assist the integration of power from large-scale photovoltaics (PV) locally.

While the project sounds fairly significantly sized compared to other flow battery systems around the world, according to Pu Neng, the 40MWh project itself is going to soon be superseded in size in Hubei by a mammoth 100MW / 500MWh energy storage system that is expected to “be the cornerstone of a new smart energy grid” in the province, where it will fulfil the role of a peaking power plant, stabilising the local network.

Pu Neng signed a deal to develop the first phase of that project with Hubei Pingfan Vanadium Energy Storage Technology Company, a subsidiary of Hubei Pingfan, a mining and industrial metals and minerals company which is growing its interest in vanadium for energy storage. Pingfan apparently has more than one million tonnes of vanadium at one of its own reserves.

Perhaps more significantly, Hubei Pingfan was listed in the Chinese government’s 12th five-year plan of national strategy, issued in 2011, as a national pilot enterprise for vanadium. For the Hubei Zaoyang project, Pu Neng and Pingfan will develop vanadium electrolytes from local sources, which the project partners said will also help establish supply chains for the metal for future projects. The first phase of the project begins this month, for completion early next year.

National policy document calls for huge vanadium storage kick-start

Another more recently issued central government policy document, September’s “Guidance on the Promotion of Energy Storage Technology and Industry Development”, published by the China National Development and Reform Commission (NDRC), calls for more investment in energy storage, including flow batteries.

The NDRC has actually called for several vast flow battery systems, of over 100MW per system, to be deployed as trials and demonstrators. In fact, a 200MW / 800MWh vanadium energy storage project is being built already in Dalian, a city in the southern province of Liaoning, by Chinese system manufacturer Rongke Power and UniEnergy Technologies (UET).

Pu Neng chairman Robert Friedland described vanadium as a “miracle metal” which could “fundamentally transform” China’s power grid, adding that the country has the world’s “largest and highest-grade” vanadium resources.

“With massive amounts of renewable energy and storage coming online, China will create the most modern, clean and efficient grid in the world. Earlier this year, Chairman Xie and I discussed the opportunity to utilize Hubei's abundant vanadium resources and Pu Neng's next generation technology to set a new benchmark for the global energy storage industry. This is just the first step of what will be many projects working together,” Friedland said.

According to Robert Friedland, NDRC’s policy statement, which calls for demonstrators to be built by 2020, “will result in vanadium flow batteries revolutionizing modern electricity grids in the way that lithium-ion batteries are enabling the global transition to electric vehicles.”

Flow batteries are often used in circumstances where their scalability and ability to hold longer durations of energy storage for aggressive cycling perform more favourably than cheaper lithium-ion batteries, which tend to perform better in high-power, short duration applications."

Antwort auf Beitrag Nr.: 57.052.025 von Popeye82 am 17.02.18 17:40:58AMBITIOUS

; subtitle: it's big AND long

TNG(/PengPengEnergy(/Vanadium(/Greenrotze)))

http://www.valuewalk.com/2018/01/energy-storage-vanadium-soa…

http://www.newegg.com/?nm_mc=AFC-C8Junction&cm_mmc=AFC-C8Jun…

https://cleantechnica.com/2017/12/07/us-energy-storage-incre…

http://www.greentechmedia.com/research/subscription/u-s-ener…

http://www.forbes.com/sites/trevornace/2017/08/01/california…

https://content.sierraclub.org/press-releases/2017/07/califo…

https://news.wgbh.org/2017/09/19/local-news/bill-would-commi…

https://malegislature.gov/Bills/190/S1849

https://malegislature.gov/Bills/190/H3395

http://www.greentechmedia.com/articles/read/hawaiian-electri…

https://s3.amazonaws.com/dive_static/paychek/Docket_No._2014…

http://www.thegardenisland.com/2017/11/12/hawaii-news/clean-…

http://www.hawaiianelectric.com/clean-energy-hawaii/producin…

https://about.bnef.com/blog/global-storage-market-double-six…

https://en.wikipedia.org/wiki/Tesla_Model_3

https://about.bnef.com/new-energy-outlook/

https://about.bnef.com/

https://electrek.co/2017/12/21/worlds-largest-battery-200mw-…

http://www.rongkepower.com/Product/show/catid/175/id/103/lan…

https://spectrum.ieee.org/green-tech/fuel-cells/its-big-and-…

https://globenewswire.com/news-release/2017/11/01/1172376/0/…

http://www.greentechmedia.com/articles/read/the-grim-details…

http://www.lazard.com/perspective/levelized-cost-of-storage-…

http://www.forbes.com/sites/jamesconca/2016/12/13/vanadium-f…

http://www.uetechnologies.com/

http://onlinelibrary.wiley.com/doi/10.1002/aenm.201100008/ab…

https://energy.gov/sites/prod/files/VRB.pdf

http://www.whitehouse.gov/presidential-actions/presidential-…

https://pubs.er.usgs.gov/publication/pp1802U

https://pubs.usgs.gov/pp/1802/u/pp1802u.pdf

http://www.greentechmedia.com/articles/read/were-still-under…

https://globenewswire.com/news-release/2017/11/01/1172376/0/…

http://www.computerworld.com/article/3182369/sustainable-it/…

"U.S. Energy Storage Surges 2017, World’s Largest Battery Is Being Built In Vanadium

January 3, 2018 1:14 pm by John Lee CFA

- US energy storage increases 46% In 3rd quarter. Hawaii, California, Massachusetts aim to be powered by 100% renewable energy by 2045.

- Global storage market to double six times by 2030 to a total of 305 GWh. China reportedly started construction of world’s biggest 800 MWh battery (equivalent of 16,000 Tesla model 3 batteries), and it’s made in vanadium

- Lithium batteries’ parasitic load factor and scalability may hamper future growth. Vanadium batteries could start dominating the utility energy storage sector in 2018 due to their proven reliability and longer battery life.

- With fierce competition amongst vanadium battery makers without clear winner, investing in vanadium mining company may be best way to participate in the rise of vanadium usage in batteries.

- The considerable upside of vanadium mining company valuation can be seen when compared with uranium mining company valuation.

US energy storage increases 46% in 3rd Quarter. Hawaii, California, Massachusetts aim to be powered by 100% renewable energy by 2045.

The article “US Energy Storage Increases 46% in 3rd Quarter” by Joshua Hill, published on December 7, 2017, revealed latest US Energy Storage Monitorreport by GreenTechMedia (“GTM”) Research showed a total of 41.8 MW (megawatts) worth of new energy storage capacity was deployed in the third quarter of 2017, representing an increase of 46% year-over-year and 10% quarter-over-quarter.

Texas led the way in the utility-scale segment with its 30 MW project, followed by Massachusetts, California, and Hawaii. GTM Research also highlighted the increasing role that energy storage is having in utilities’ Integrated Resource Planning (IRP), with utilities across 14 states including nearly 2 GW (gigawatts) worth of storage into their IRP thinking.

Article “California To Meet 2030 Renewable Energy Targets By 2020” by Joshua Hill dated November 21, 2017 indicates California state’s major utilities have already met and should soon exceed the state’s 2020 renewable energy target of 33% and will likely meet the 2030 target of 50% by 2020.

California’s investor-owned utilities have already surpassed their interim targets and, according to the CPUC, “have sufficient resources under development to exceed the 33% by 2020 RPS requirement.”

Pacific Gas and Electric Company: 32.9%

Southern California Edison: 28.2%

San Diego Gas & Electric: 43.2%

According to the Forbes article “California Goes All In — 100% Renewable Energy by 2045” by Trevor Nace (August, 2017), an ambitious plan set forth by Senate President Kevin de León (D) would set in place a goal of producing within California’s electricity grid 60% renewable energy by 2030 and 100% renewable energy by 2045.

California has the largest GDP ($2.6 trillion) of any state in the United States—roughly 14% of the entire nation’s GDP. California’s GDP is larger than that of all but 5 nations. It greater than those of France and Brazil.

Similarly, a “Bill would Commit Massachusetts To 100 Percent Renewable Energy” (to quote the title of a September 19, 2017 article by Craig Lemoult). Actually, it’s two bills:

“Massachusetts would get 100 percent of its electricity from renewable sources by 2035 under a plan heard by lawmakers Tuesday. The bills would also require the state to renewably power all of its heating and transportation by 2050. The bills (S. 1849, H. 3395) aim to move the state beyond its current clean energy commitment, which has focused primarily on electricity generation.”

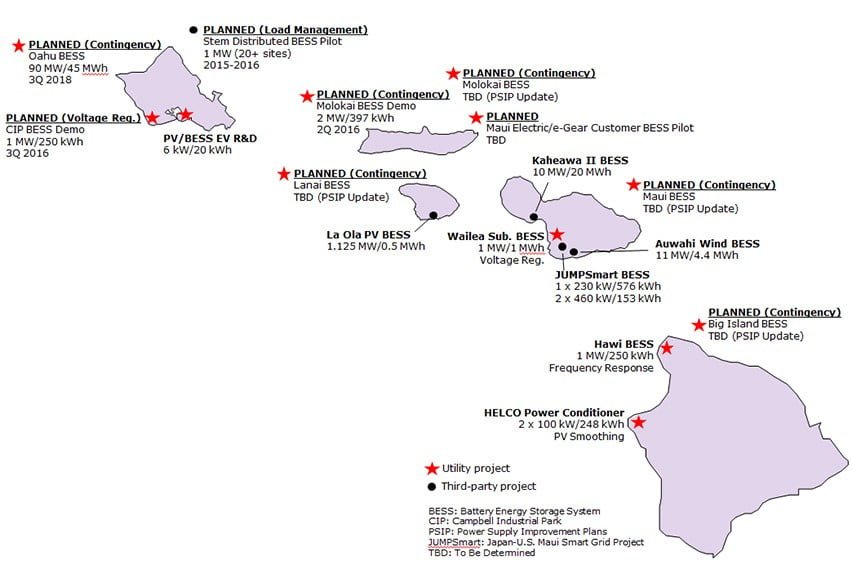

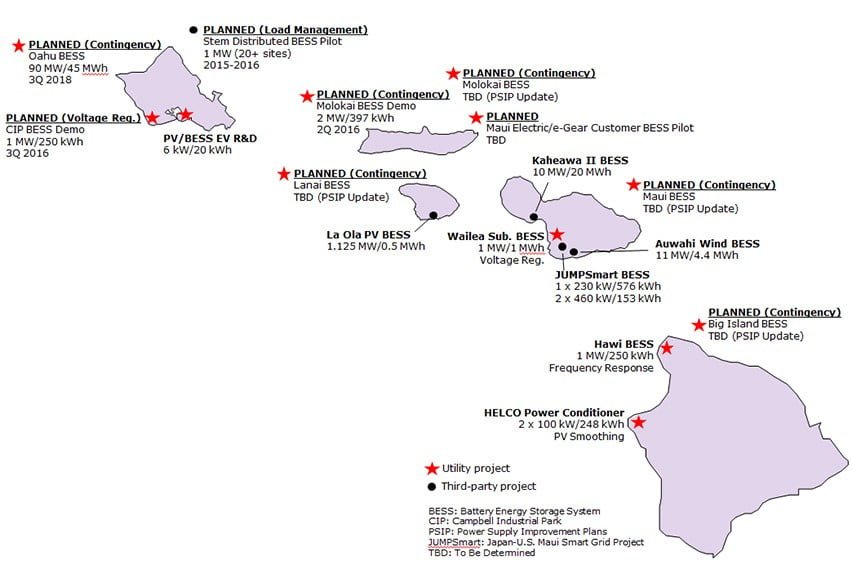

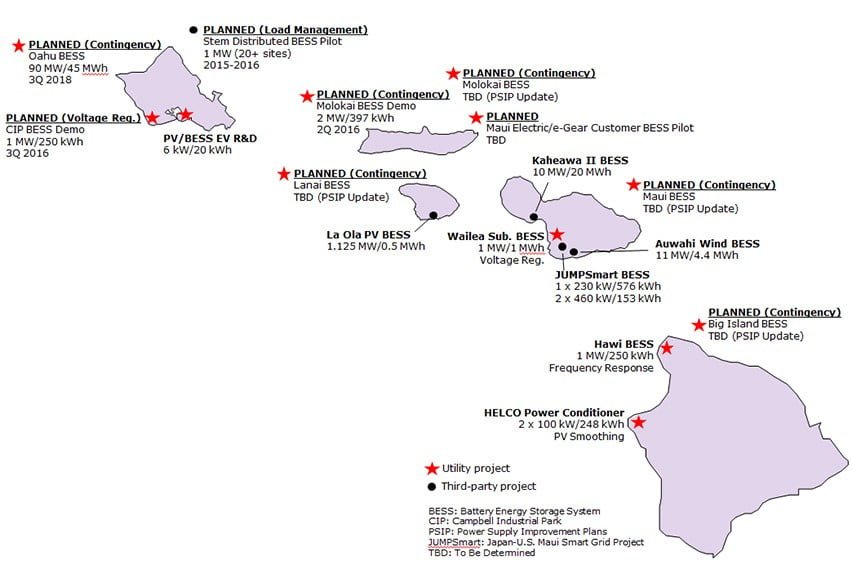

Titled “Hawaii Utility’s 100% Renewable Energy Plan Got the Green Light,” in a GreenTechMedia article dated July 18, 2017 by Jeff John, Hawaii Public Utilities Commission approved (PDF) the utility’s Power Supply Improvement Plan (PSIP), a sprawling document that contains the recipe for hitting the state’s 100 percent renewables mandate by 2040, five years ahead of schedule.

According to the article by Jessica Else, “Clean energy puts Kauai, Hawaii” (November 12, 2017), more than 40 percent of electricity generated on Kauai comes from renewable resources. That’s up from 2009, when 5 percent of the island’s electricity came from renewable resources. Solar is a big contributor to power generation on the island, and on sunny days around 90 percent of daytime energy needs are met by solar, the Kauai Island Utility Cooperative says.

According to Hawaiian Electric Companies, more than 17 energy storage projects for providing grid service or exploring this technology are either underway or planned. The goal is to support the use of more renewable energy and maintain reliable service for customers.

Global storage market to double six times by 2030 to a total of 305 GWh, China reportedly started construction of world’s biggest 800 MWh battery (equivalent of 16,000 Tesla model 3 batteries), and it’s made in vanadium

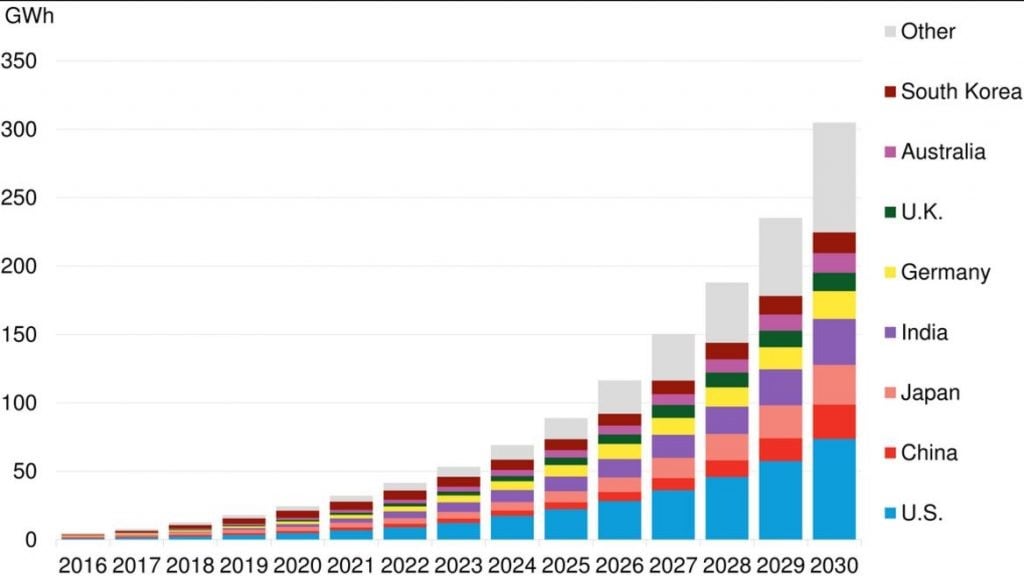

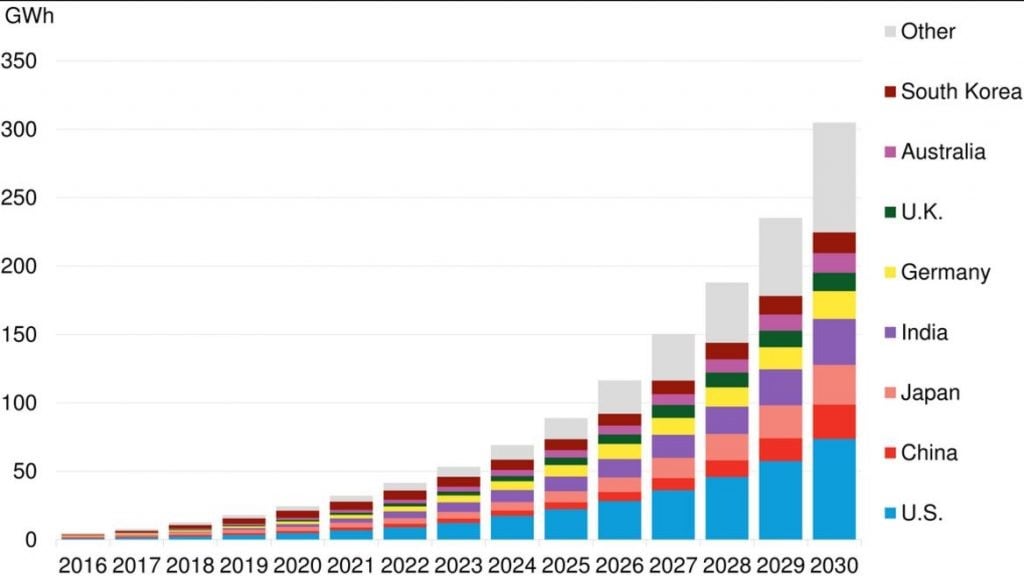

“Global Storage Market to Double Six Times by 2030,” rising to a total of 125 gigawatts/305 gigawatt-hours, according to an article published by Bloomberg New Energy Finance (November 20, 2017).

305 gigawatt hours is equivalent in battery capacity to 6 million Tesla model 3 cars (each at 50kWh, according to Wikipedia). Currently there are approximately 2 million electric vehicles on the road. The article forecasts one-fourth of deployments to be in the U.S. and $103 billion to be invested in energy storage over the period

Source: Bloomberg New Energy Finance

This is a similar trajectory to that of the remarkable expansion that the solar industry from 2000 to 2015, in which the share of photovoltaics as a percentage of total generation doubled seven times. Eight countries will lead the market, with 70 percent of capacity to be installed in the U.S., China, Japan, India, Germany, the U.K., Australia, and South Korea.

Bloomberg New Energy Finance’s (BNEF) New Energy Outlook data further reported that “Renewable energy sources are set to represent almost three quarters of the $10.2 trillion the world will invest in new power generating technology until 2040, thanks to rapidly falling costs for solar and wind power, and a growing role for batteries, including electric vehicle batteries, in balancing supply and demand.”

Utility-scale battery systems are expected to fall from about $700 per kilowatt-hour in 2016 to less than $300 per kilowatt-hour in 2030.

Economic tipping points mean renewable energy will account for over half of electricity generation by the mid-2020s in the UK and Germany.

As early as 2030, “there will be whole weeks where wind and solar power generation exceed total demand at some point every day,” analysts state (in the actual energy report, available only by subscription). This will be a very difficult experience for base load nuclear and coal-fired power plants. But it will be an opportunity for flexible power technologies such as energy storage and gas generators, or demand response such as flexible electric-vehicle charging and variable industrial loads that can respond quickly to conditions on the grid.

Vanadium batteries appear to be China’s way of coping with surging renewable energy capacities, according to the electrek article by John Fitzgerald Weaver, “World’s largest battery: 200MW/800MWh Vanadium Flow Battery—Site Work Ongoing” (December 21, 2017).

A vanadium/mining industry PR firm has visited the site of an in development 200MW/800MWh vanadium flow battery (VFB) in Dalian, China and noted that site work is ongoing. They also stated that most of the product that will fill the site—the vanadium batteries—is already built in the manufacturer’s nearby factory.

This battery is currently the largest planned chemical battery in the world, and part of Chinese government investment meant to spur the technology.

The battery’s purposes are to provide power during peak hours of demand, enhance grid stability, and deliver juice during black-start conditions, in emergencies. The system is expected to peak-shave about 8% of Dalian’s load when it comes online in 2020.

The vertically-integrated battery manufacturer has deployed almost 30 similar projects, some attached to operating wind farms in the Liaoning province of China. The Rongke Giga Factory opened in early 2017 with a phase 1 capacity of 300MW/year. Phases 2 and 3 have goals of 1 and 3 GW/year of production.

The battery is part of a push from the China National Development and Reform Commission to develop and deploy energy storage technology.

The most recent program from the commission awarded competitor Pu Neng, among others, more vanadium battery projects.

Pu Neng, the leading provider of vanadium flow battery technology in the world, has been awarded a contract for a 3-megawatt (MW) 12-megawatt-hour (MWh) VRB as Phase 1 of the Hubei Zaoyang 10MW 40MWh Storage Integration Demonstration Project. This first phase will be installed in Zaoyang, Hubei and integrate a large solar photovoltaic system into the grid. Following this 10MW 40MWh project, there will be a larger, 100MW 500MWh, energy storage project that will be the cornerstone of a new smart-energy grid in Hubei Province.

Electrek said vanadium flow batteries already cost well below $500/kWh – and some hope to see $150/kWh by 2020. That’s a competitive product. And if utilities like it better because it scales easier and has a longer lifetime, renewables will benefit.

Indeed, grid scale vanadium battery deployment is making global inroads. Utility scaled batteries are in operation in the US (in the states of California, Washington, Hawaii), China, Singapore, and Japan. The last of these countries has had a 60 MWh vanadium battery in operation since 2015.

Lithium batteries’ parasitic load factor and scalability may hamper future growth. Vanadium batteries could start dominating the utility energy storage sector in 2018 due to their proven reliability and longer battery life.

While lithium and vanadium grid batteries are popular choices for large-scale energy storage applications, a GreeTechMedia article by Jason Deign (November 30, 2017) highlighted a potentially major problem for the lithium-ion battery industry.

Lazard’s latest levelized cost of storage (LCOS) report downgraded its estimates for lithium-ion round-trip efficiency to account for parasitic losses, GTM has discovered.

“The round-trip efficiencies for the electrical energy storage systems have been calculated as between 83 percent and 86 percent, falling to between 41 percent and 69 percent where parasitic loads are included,” the study concluded.”

Parasitic load refers to the cooling requirement for lithium batteries to operate efficiently and safely under the sun, in high temperatures.

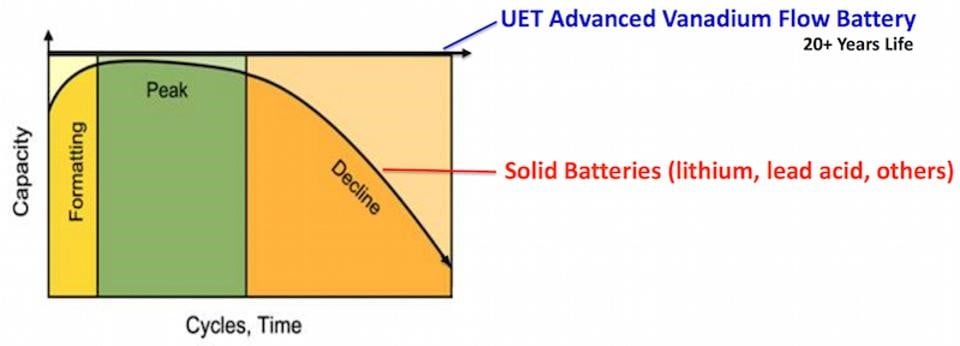

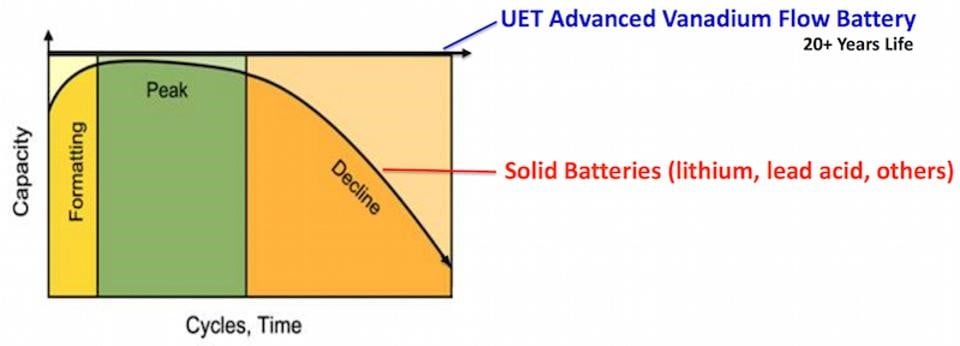

Indeed, there are problems with lithium batteries other than the parasitic load factor. Lithium-ion or lead-acid also begin degrading after a couple of years. Their life is exhausted after about 1,000 charges. Those batteries become environmental hazard with little residual value. This is hardly compatible with the lifecycle of a wind farm, which can last 10 to 20 years. Scalability is also an issue as batteries require a delicate maintenance circuitry and must be daisy chained to grow beyond 50 MWh

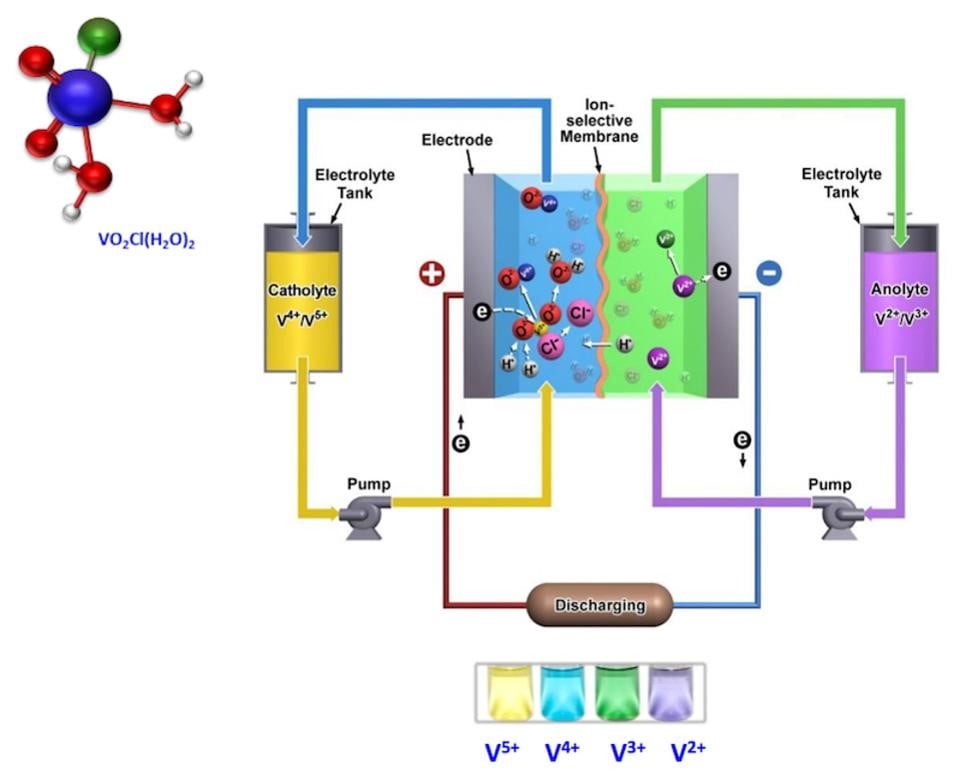

James Conca described vanadium battery well in a Forbes article (December 13, 2016). The latest, greatest utility-scale battery storage technology to emerge on the commercial market is the vanadium redox battery, also known as the vanadium flow battery.

Vanadium flow batteries are nonflammable, compact, fully containerizable. They are reusable over semi-infinite cycles, discharge 100% of the stored energy, and do not degrade for more than 20 years.

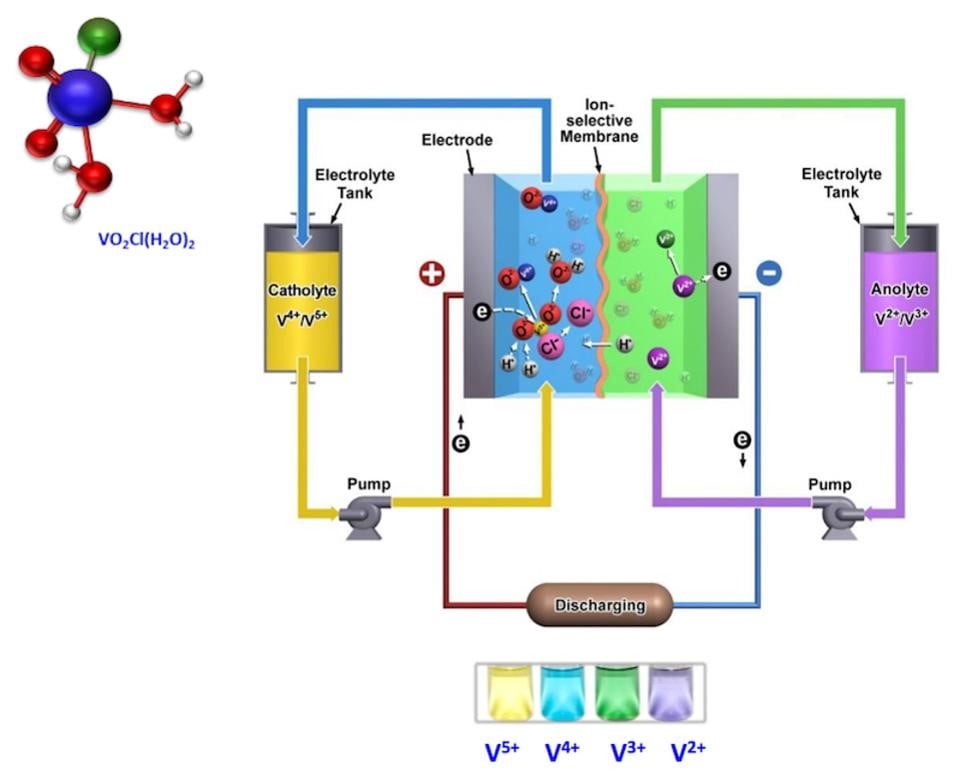

Vanadium flow batteries use the multiple valence states of vanadium to store and release charges. Energy is stored by providing electrons making V(2+,3+), and energy is released by losing electrons to form V(4+,5+). Source: UET

Flow batteries consist of two tanks of liquid, which simply sit there until needed. When pumped into a reactor, the two solutions flow adjacent to each other past a membrane and generate a charge by moving electrons back and forth during charging and discharging.

This type of battery can offer almost unlimited energy capacity simply by using larger electrolyte storage tanks. It can be left completely discharged for long periods with no ill effects, making maintenance simpler than with other batteries. Because of these unique properties, the new V-flow batteries reduce the cost of storage to about 5¢/kWh. For utility-scale applications, V-flow battery outcompetes Li-ion and any other solid battery. They’re safer, more scalable, longer-lasting, and cheaper — less than half the per kWh cost.

Unlike solid batteries, like lithium-ion or lead-acid, which begin to degrade after a couple of years, V-flow batteries are fully reusable over semi-infinite cycles and do not degrade. This gives them a very, very long life.

The specifications of the latest generation of vanadium battery electrolyte from Pacific Northwest National Laboratory introduce hydrochloric acid into the electrolyte solution, which almost doubles the storage capacity and makes the system work over a far greater range of temperatures, from –40°C to 50°C (–40°F to 122°F). The latter removes the large previous cost of maintaining temperature control.

With fierce competition amongst vanadium battery makers without a clear winner, investing in a vanadium mining company may be the best way to participate in the rise of vanadium use in batteries.

Today there are many vanadium battery suppliers in China (PuNeng, Rongke), UK, Europe, USA (Vionx, UET), Thailand, and Japan. Each claims its own superiority in performance, reliability, and cost. Investing in vanadium mining company may be best way to participate the rise of vanadium usage in batteries. Think of vanadium mining as bitcoin mining, which comes with relatively fixed unit cost and is unhindered upside by a rising vanadium price.

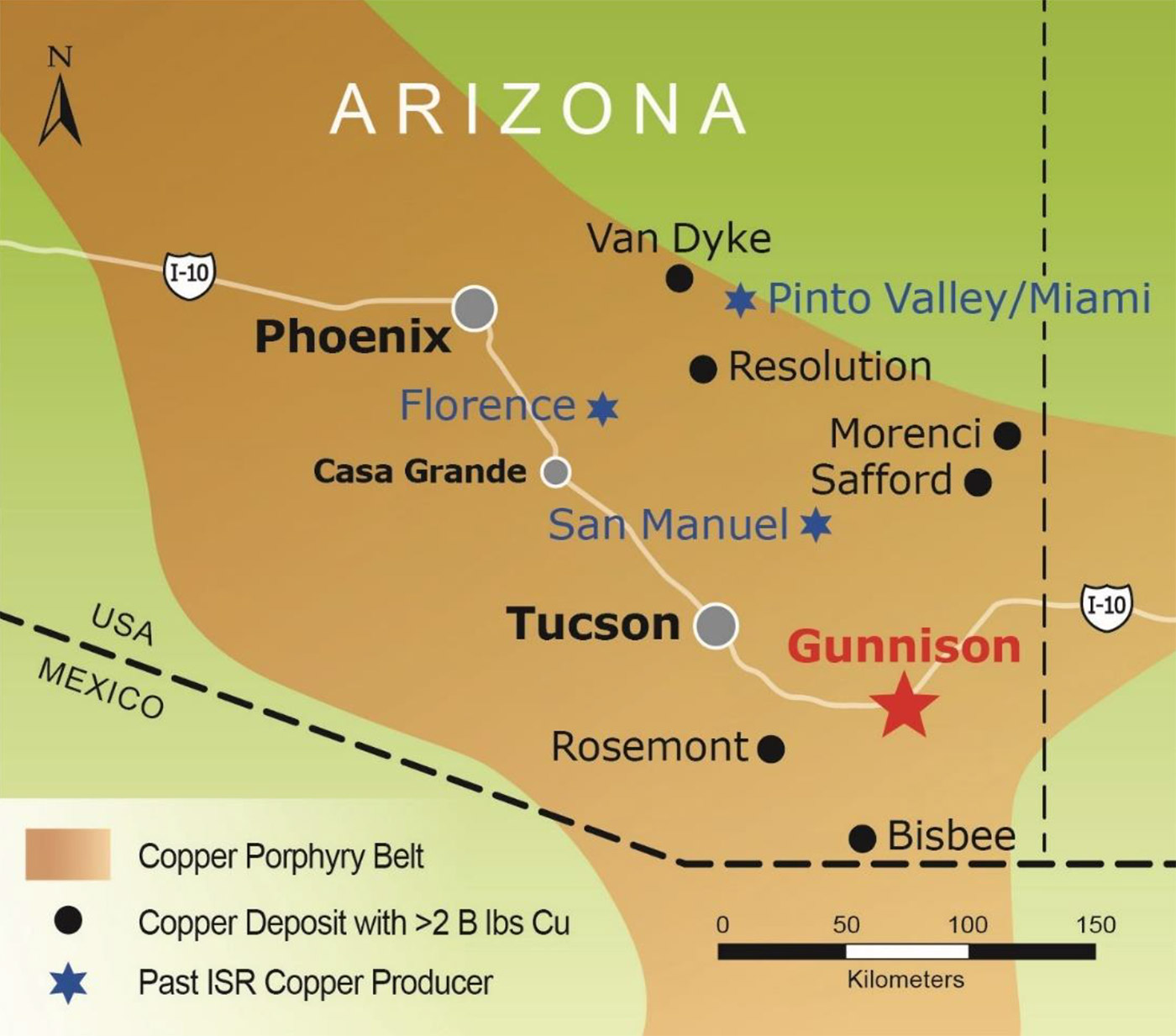

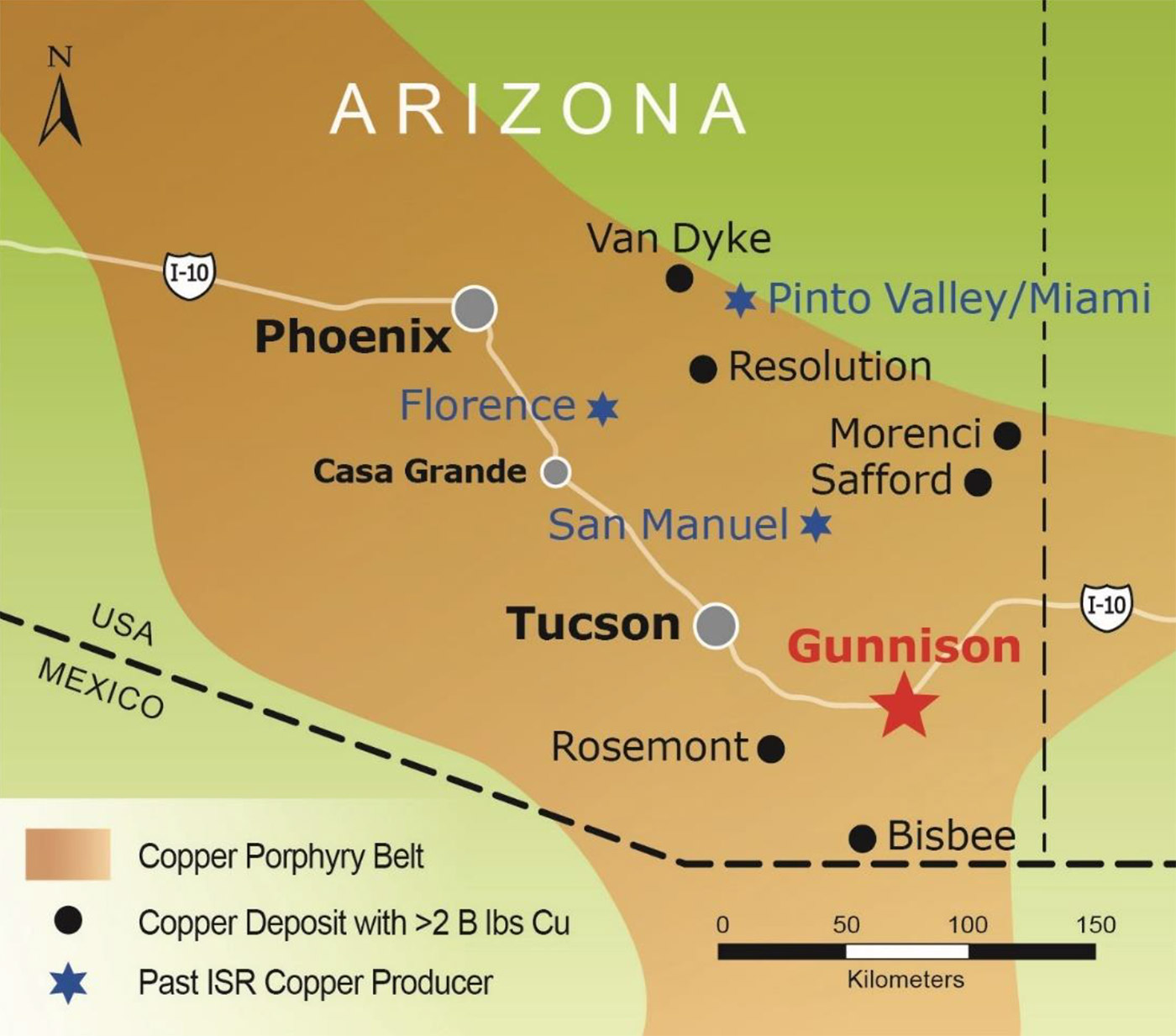

The spotlight for possibly the most advanced permitting stage vanadium project in North America is the Gibellini primary vanadium project, operated by Prophecy Development Corp (TSX: PCY, OTC: PRPCF, Frankfurt: 1P2N). Gibellini is located in mining friendly state of Nevada, where the majority of gold production in the United States takes place.

In the last 10 years, Gibellini received approximately $20 million in investment in drilling, engineering, feasibility, and permitting.

Prophecy received an independent technical report on the Gibellini project titled “Gibellini Vanadium Project Nevada, USA NI 43-101 Technical Report” with an effective date of November 10, 2017 (the “Report,” prepared by Amec Foster Wheeler E&C Services Inc., or AMEC). The Report disclosed an estimated for the Gibellini deposit 49.62 million pounds of vanadium pentoxide in the measured category and 79.67 million pounds of vanadium pentoxide in the indicated category. As vanadium currently trades at over $9 a pound, the resource base translates to a lot of dollar value in the ground in a mining friendly jurisdiction.

*(1) The Qualified Person for the estimate is Mr. E.J.C. Orbock III, RM SME, an Amec Foster Wheeler employee. The mineral resource estimate has an effective date of 10 November, 2017.

(2) Mineral resources are reported at various cut-off grades for oxide, transition, and reduced material.

(3) Mineral resources are reported within a conceptual pit shell that uses the following assumptions: mineral resource V2O5 price: $10.81/lb; mining cost: $2.21/ton mined; process cost: $13.14/ton processed; general and administrative (G&A) cost: $0.99/ton processed; metallurgical recovery assumptions of 60% for oxide material, 70% for transition material, and 52% for reduced material; tonnage factors of 16.86 ft3/ton for oxide material, 16.35 ft3/ton for transition material, and 14.18 ft3/ton for reduced material; royalty: 2.5% net smelter return (NSR); shipping and conversion costs: $0.37/lb. An overall 40º pit slope angle assumption was used.

(4) Rounding as required by reporting guidelines may result in apparent summation differences between tons, grade, and contained metal content. Tonnage and grade measurements are in US units. Grades are reported in percentages.

On December 20, 2017, the US president, Donald Trump, signed the executive order “Recognizing Strategic Importance of Minerals Mining to Domestic Economy, National Security, Infrastructure.” Among other things, he called on U.S. government agencies to identify ways to both (1) streamline the permitting processes (expediting exploration, production, processing, reprocessing, recycling, and domestic refining of critical minerals) and (2) ensure that miners and producers have electronic access to the most advanced topographic, geologic, and geophysical data within U.S. territory.

On the same day, the U.S. Geological Survey listed vanadium as one of 23 critical mineral resources of the United States; yet there is not a primary vanadium mine currently in the country.

Prophecy’s goals are to develop Gibellini into the first primary vanadium mine in the United States and to offer the best leverage and a direct investment vehicle, one that reflects vanadium prices.

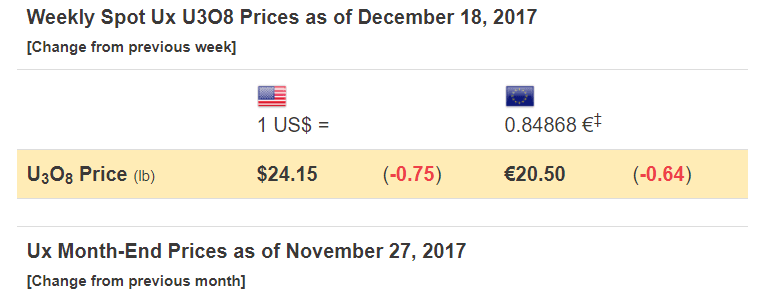

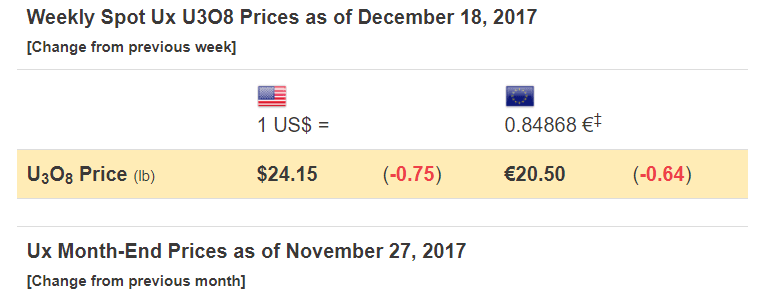

The considerable upside of vanadium mining company valuation can be seen when compared with uranium mining company valuation.

Here I have made a valuation comparison of three preproduction-stage mining companies: Prophecy (vanadium), Fission (uranium), and NextGen (uranium). I chose Fission and NextGen because most vanadium is produced in China and there are no primary vanadium mines in North America to compare Gibellini with.

Company Name NexGen Energy Ltd Fission Uranium Corp Prophecy Dev Corp

Symbol NXE.to FCU.to PCY.to

Market Cap C$1,080 million C$ 388 million C$ 32 million

Deposit Name Arrow, Rook I Patterson Lake S. Gibellini

Resource (lbs) 0.0M lb Measured,

179.5M lb Indicated

0.0M lb Measured,

81.1M lb Indicated

49.6M lb Measured,

79.7M lb Indicated

Price Assumption* $65/lb U3O8 $65/lb U3O8 $10.8/lb V2O5

Current Price $24.2/lb U3O8 $24.2/lb U3O8 $9.2/lb V2O5

*Price assumption used in the respective technical study

https://www.stockwatch.com/Quote/Fundamentals.aspx?symbol=NX…

https://www.stockwatch.com/Quote/Fundamentals.aspx?symbol=FC…

https://www.stockwatch.com/Quote/Fundamentals.aspx?symbol=PC…

http://www.nexgenenergy.ca/_resources/reports/Rook-1-Technic…

https://fissionuranium.com/_resources/reports/RPA_Fission_U_…

http://www.prophecydev.com/files/Gibellini_10Nov2017_final.p…

https://www.uxc.com/p/prices/uxcprices.aspx

source: vanadiumprice.com

Can we see a 1,000% increase in Prophecy valuation to catch up to Fission’s valuation?

Source: stockcharts.com

Recall in the previous uranium bull market, Cameco went from $5 in 2003 to eventually $50.

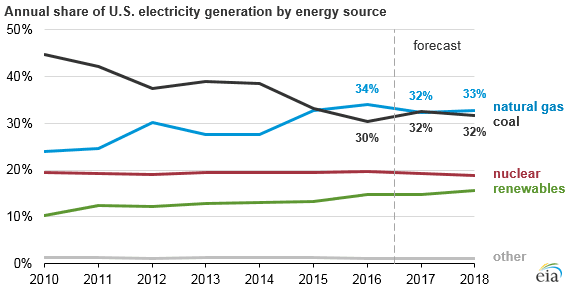

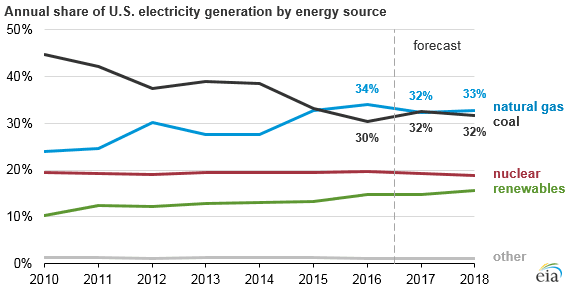

Before you dismiss the vanadium vs uranium comparison, Consider the following chart from EIA

Nuclear power generation has been on the decline in the US since 2010, while renewable generation has almost doubled in the same period. The chart would not be much different on a global basis.

Energy storage is an indispensable part of renewable energy. Therefore, linking vanadium (the key ingredient in vanadium batteries) to renewables is as applicable and relevant as linking uranium to nuclear power. And unquestionably, the cheaper and cleaner renewable power holds the future.

Lastly, I leave you with quotes and sights:

“Cost-effective, reliable, and longer-lived energy storage is necessary to truly modernize the grid,” said Dr. Imre Gyuk, energy storage program manager for Department of Energy’s Office of Electricity Delivery and Energy Reliability. December 2016

If the cost savings from reducing climate change and hazardous air pollution — most importantly lower healthcare costs — are also taken into account, California would save an average of $7,395 per person by 2050, Jacobson found. About 12,500 fewer people would die each year as a result of air pollution. “It’s a no-brainer,” Mark Jacobson, a Stanford University engineering professor. February 20, 2017

Flow batteries scale more easily because all that’s needed to grow capacity is more liquid; the hardware remains the same, Li-ion batteries require an entirely separate unit to be daisy-chained in, according to Dean Frankel, an associate at Lux Research.

That means flow batteries have the potential to be less expensive than Li-ion. They also last longer, according to Frankel. At full discharge, Li-ion batteries last only four hours. To double that charge time, another complete battery unit must be added, Frankel said. March 2017

“Even U.S. utilities have announced extremely low prices for solar in relatively small quantities, and the price of storage continues to come down rapidly,” said Jon Wellinghoff, renowned energy law attorney and former chairman of the Federal Energy Regulatory Commission. “It is very clear that solar-plus-storage is now, or in the near future will be, less expensive to build than any traditional ‘baseload’ coal, nuclear or gas facilities. And we are seeing solar with advanced inverters successfully perform most of the functions of traditional power plants,” he added. November 2017

“Energy storage deployments are increasing rapidly, as more policymakers and grid planners are recognizing the many benefits of storage,” said Kelly Speakes-Backman, CEO of the Energy Storage Association. “Coupled with policies that provide a clear signal to markets, and regulatory reforms that compensate storage for the full value it offers, we see this trend continuing toward 35 gigawatts by 2025.”

December, 2017

Chairman of Hubei Pingfan Xie Guangguo, said, “We selected a vanadium flow battery because they have superior safety, reliability and lifecycle economics compared to lithium-ion and other battery types.” November 1, 2017

On September 22, 2017, the China National Development and Reform Commission (NDRC) released Document 1701, “Guidance on the Promotion of Energy Storage Technology and Industry Development.” It is aimed at accelerating the deployment of energy storage. The policy calls for the launch of pilot projects, including deploying multiple 100MW-scale vanadium flow batteries by the end of 2020, with the aim of large-scale deployment over the ensuing five years.

Robert Friedland, Chairman of Pu Neng, commented, “China has the largest and highest-grade vanadium resources in the world and is poised to use this miracle metal to fundamentally transform its electricity grid. With massive amounts of renewable energy and storage coming online, China will create the most modern, clean and efficient grid in the world.”

On the newly released NDRC policy, Mr. Friedland commented, “This new policy will result in vanadium flow batteries revolutionizing modern electricity grids in the way that lithium-ion batteries are enabling the global transition to electric vehicles.”

The 550-megawatt Desert Sunlight solar farm in Riverside County, California.

QUALIFIED Persons

The resource information contained in this article was reviewed and approved by Christopher M. Kravits, CPG, LPG, who is a Qualified Person within the meaning of NI 43-101. Mr. Kravits is a consultant to Prophecy and is not independent of the Company in that most of his income is derived from the Company. Mr. Kravits serves as its Qualified Person and General Mining Manager.

Article by John Lee, CFA"

; subtitle: it's big AND long

TNG(/PengPengEnergy(/Vanadium(/Greenrotze)))

http://www.valuewalk.com/2018/01/energy-storage-vanadium-soa…

http://www.newegg.com/?nm_mc=AFC-C8Junction&cm_mmc=AFC-C8Jun…

https://cleantechnica.com/2017/12/07/us-energy-storage-incre…

http://www.greentechmedia.com/research/subscription/u-s-ener…

http://www.forbes.com/sites/trevornace/2017/08/01/california…

https://content.sierraclub.org/press-releases/2017/07/califo…

https://news.wgbh.org/2017/09/19/local-news/bill-would-commi…

https://malegislature.gov/Bills/190/S1849

https://malegislature.gov/Bills/190/H3395

http://www.greentechmedia.com/articles/read/hawaiian-electri…

https://s3.amazonaws.com/dive_static/paychek/Docket_No._2014…

http://www.thegardenisland.com/2017/11/12/hawaii-news/clean-…

http://www.hawaiianelectric.com/clean-energy-hawaii/producin…

https://about.bnef.com/blog/global-storage-market-double-six…

https://en.wikipedia.org/wiki/Tesla_Model_3

https://about.bnef.com/new-energy-outlook/

https://about.bnef.com/

https://electrek.co/2017/12/21/worlds-largest-battery-200mw-…

http://www.rongkepower.com/Product/show/catid/175/id/103/lan…

https://spectrum.ieee.org/green-tech/fuel-cells/its-big-and-…

https://globenewswire.com/news-release/2017/11/01/1172376/0/…

http://www.greentechmedia.com/articles/read/the-grim-details…

http://www.lazard.com/perspective/levelized-cost-of-storage-…

http://www.forbes.com/sites/jamesconca/2016/12/13/vanadium-f…

http://www.uetechnologies.com/

http://onlinelibrary.wiley.com/doi/10.1002/aenm.201100008/ab…

https://energy.gov/sites/prod/files/VRB.pdf

http://www.whitehouse.gov/presidential-actions/presidential-…

https://pubs.er.usgs.gov/publication/pp1802U

https://pubs.usgs.gov/pp/1802/u/pp1802u.pdf

http://www.greentechmedia.com/articles/read/were-still-under…

https://globenewswire.com/news-release/2017/11/01/1172376/0/…

http://www.computerworld.com/article/3182369/sustainable-it/…

"U.S. Energy Storage Surges 2017, World’s Largest Battery Is Being Built In Vanadium

January 3, 2018 1:14 pm by John Lee CFA